1. Introduction

Today, numerous policies about green development and asset utilization have been formulated by several governments [

1]. It is well known that the use of new energy sources can straightforwardly control fossil vitality utilization and carbon emanations [

2]. Compared with traditional fuel vehicles, new energy vehicles use advanced technology [

3] and unconventional fuels as power sources [

4], which can achieve almost zero exhaust emissions [

5], reduce emissions, and alleviate the greenhouse effect. Therefore, changing the structure of vehicle energy consumption and promoting the development of new energy business play noteworthy parts in environmental protection.

However, a new energy vehicle business, as a high-tech business, faces several issues, like the high cost of research and development and market expansion. To solve those problems, the government may offer subsidies to motivate new energy vehicle businesses to move forward. For instance, Turkey has reduced greenhouse gas emissions by introducing emissions taxes in fuel pricing, determining the worth of the excise tax rates associated with the energy potency of vehicles and their instrumentality, and charging for any excess beyond the established emission standards [

6]. In the U.S., every electric vehicle obtained in 2010 or afterward qualifies for government subsidies, in the form of taxation credits of up to

$7500. In addition, some states in the U.S. have also adopted subsidy incentives. For example, California provides subsidies of up to

$5000 per consumer [

7]. In 2009, the Chinese government began providing subsidies to customers who are shopping for new energy vehicles. Furthermore, in 2014, the General Office of the State Council proposed that subsidies should also be offered to enterprises with a large scale of promotion and application.

This paper focuses on two government subsidy policies: the unit production subsidy and the green technology investment subsidy. Both subsidies are commonly used [

8,

9]. The unit production subsidy is a government subsidy for each unit of production or consumption of a product. For example, Beijing has issued measures to grant a subsidy of up to 10,000 yuan per vehicle to eligible “trade-in” new energy vehicles. Among the facilities related to new energy vehicles, Chongqing provides a one-time subsidy of 150 yuan/kW or 200 yuan/kW for newly built direct current charging piles within and outside of its central urban range. Besides the unit production subsidy, the government also directly offers firms a certain percentage of R&D cost subsidies (i.e., a green technology investment subsidy). For example, Chongqing provides subsidies for R&D of different models. According to the production, sales volume, and cruising range of the new models, different R&D cost subsidies will be provided, up to 5 million yuan. Note that under the unit production subsidy, beneficiaries can be firms [

10], or consumers [

11], and its essence is to empower buyers to purchase products. In order to better understand the pros and cons of the two forms of subsidies, we focus on the case of the government providing subsidies to firms. Technological eco-innovation is an important method of solving environmental problems [

12]. In this paper, we use the level of eco-innovation to measure innovation performance. The purpose of the government subsidy is to incentivize firms to increase eco-innovation levels and social welfare. At present, three core technologies of new energy vehicles (the battery, motor, and electronic control systems) are not yet mature, and technology is still a key factor affecting the competitiveness of enterprises. On the one hand, different technologies owned by firms lead to different innovation capabilities; that is, there is a technology gap between firms. For example, Tesla stands at the forefront of the technological innovation environment [

13]. Firms with different initial innovation capabilities obtain differing returns from investing in eco-innovation. Therefore, firms respond differently to government subsidies. On the other hand, because a technology spillover effect can lead to free-riding behavior, one firm can make use of another firm’s eco-innovation investments. Thus, both the technology gap and the spillover effect will lead to a more complicated behaviour of firms.

The above discussion motivates the following research questions: For a given subsidy type (no subsidy, unit production subsidy, and green technology investment subsidy), what are the effects of the technology gap and the spillover effect on firms’ eco-innovation levels, their profits, and the social welfare? How do government subsidies affect firms’ decisions and social welfare? How should the government choose subsidy policies? To answer these questions, we develop a stylized demonstration with two competitive supply chains, each consisting of a manufacturer and a retailer. The government acts as a Stankelberg leader and decides whether or not to offer subsidies to manufacturers and what types of subsidies to offer. Two manufacturers sell products to their retailers and determine eco-innovation levels and wholesale prices. Then, both retailers simultaneously decide their retail prices. We derive the subgame perfect equilibrium by backward induction.

1.1. Summary of Main Finding

Our analysis first shows that, for a given subsidy policy, as the technology gap increases, the technology leader’s (i.e., manufacturer 1’s) eco-innovation level and profit increase, whereas the technology follower’s (i.e., manufacturer 2’s) eco-innovation level is decreases. However, how the spillover effect impacts the manufacturers’ profits and eco-innovation levels depends on the type of subsidy and the technology gap.

Second, we compare the profitability and eco-innovation levels of manufacturers and the social welfare under subsidies and without subsidy. We find that, under a centralized supply chain, the technology leader’s eco-innovation level is maximized under the unit production subsidy, while the technology follower’s eco-innovation level is maximized under the green technology investment subsidy. Furthermore, the leader obtains the highest profit under the green technology investment subsidy, whereas the follower obtains the highest profit without subsidy.

Third, we amplify the investigation to a decentralized supply chain. We find that the key insights under the decentralized setting are same as those under the centralized setting. Intuitively, the eco-innovation level of the leaders and the social welfare are greater under the centralized setting than the decentralized setting.

1.2. Originality and Map of the Paper

There are many reasons why our work differs from other research. First, unlike most studies in the literature [

14], we consider the effects of government subsidies on firms’ decisions in the framework of supply chain competition. Second, under three government subsidy policies (no subsidy, unit production subsidy, green technology investment subsidy), we study how both the technology gap and the spillover effect affect firms’ eco-innovation levels, profits, and supply chains’ social welfare. Furthermore, we determine the conditions under which a subsidy policy is better from the views of manufacturers’ profitability, eco-innovation levels and social welfare. Third, to explore the applicability, we extend the discussion to a decentralized setting. We shed light on how firms and governments would respond to different supply chain structures in terms of their eco-innovation levels, profits, and subsidy policies. The structure of this paper is as follows: Related previous literature is discussed in

Section 2.

Section 3 describes the model building and symbolic representation. We then study centralized and decentralized supply chains in

Section 4 and

Section 5, respectively. We summarize the paper and describe the future outlook in

Section 6.

3. Model

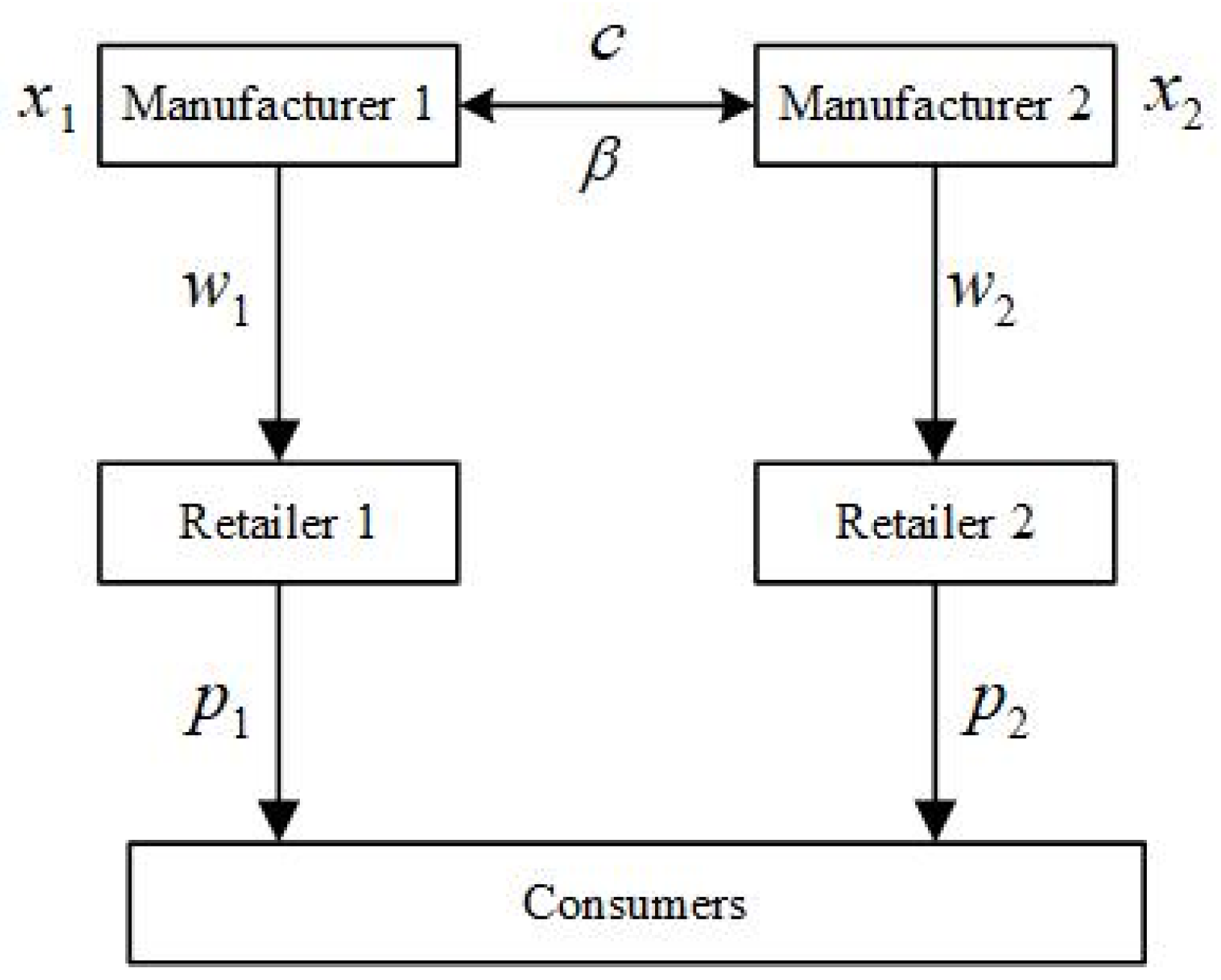

Two competing supply chains are considered in this paper, which are indexed by

. Each includes an upstream manufacturer and a downstream, consumer-facing retailer. The retailer in supply chain

offers products purchased from manufacturer

at the wholesale price

and offers the products to customers at the unit price

. We sum up our model notations in

Table 1.

Manufacturers have different pollution treatment capabilities. We assume that manufacturer 1 and manufacturer 2 are the technology leader and follower, respectively, regarding their pollution treatment capability. Therefore, in the following, we additionally use “leader” and “follower” to denote manufacturer 1 and manufacturer 2, separately. In order to concentrate on the eco-innovation levels and profitability of the companies in the supply chains, as well as the performance of the supply chains as affected by the technology gap and spillover effect, we assume that the two manufacturers offer their products at the same level of quality. In terms of pollution treatment capacity, the higher the technology, the lower the unit cost of environmental protection. Thus, the technology leader has lower environmental protection costs than the follower, denoted by and , respectively. Accordingly, we utilize to denote the technology gap between the leader and the follower. To make our model more concise and straightforward, we assume that is 0; therefore, the technology gap is .

In order to cut down on environmental protection costs, manufacturers may be inclined to invest in eco-innovation R&D to enhance their technological capabilities. The cost to be invested for the level of eco-innovation corresponds to

is

[

37,

38]. Similar to [

39], we take the spillover effect

into consideration, and the effective eco-innovation levels of the leader and the follower are

and

, respectively. In other words, the amount of the unit cost reduction from investing in eco-innovative R&D for manufacturer 1 is

if manufacturer 1’s and manufacturer 2’s eco-innovation levels are

and

, respectively. Consequently, the unit costs of the leader and follower are

and

, respectively.

There are two subsidy types: the unit production cost subsidy and the green technology investment subsidy. Under the unit production cost, the government subsidies to the leader and the follower are

and

[

40], respectively. Under the green technology investment subsidy, the government subsidizes a manufacturer

i fraction of its investment cost [

41].

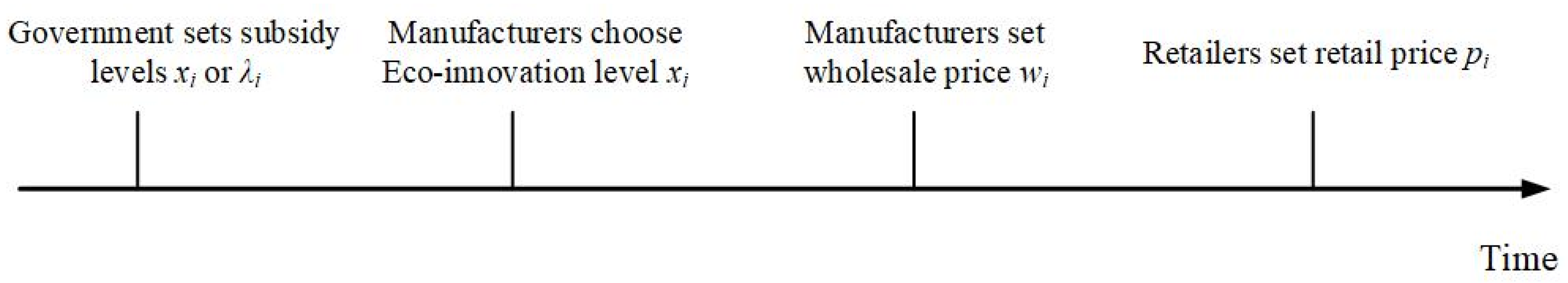

We construct a Stackelberg game model [

42] to analyze the social welfare and the manufacturers’ profits and eco-innovation levels under three government subsidy policies. The decision sequence of the supply chain members is illustrated in

Figure 1. First, the government sets subsidy levels

(under the unit production subsidy) or

(under the green technology investment subsidy). Both manufacturers then decide simultaneously their eco-innovation levels and wholesale prices. Last, both retailers set their retail prices. The equilibrium solutions of the firms’ decisions in the supply chain can be obtained by backward induction [

43] (

Figure 2).

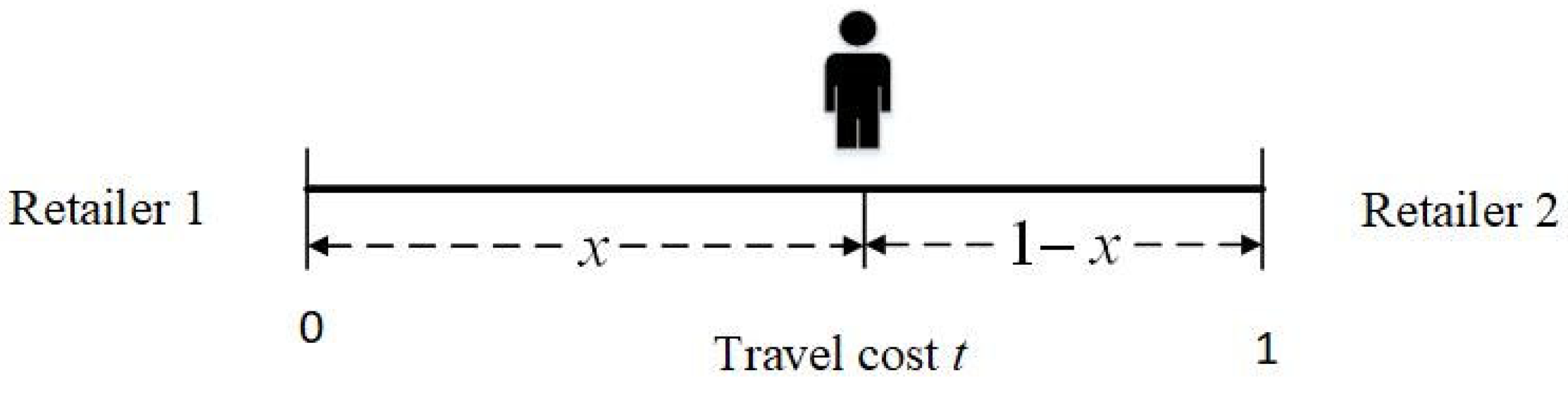

We use the Hotelling model to gain the demand function

for the products of the two retailers [

44] (

Figure 3). Products produced by the two manufacturers are of the same quality, but not identical, so they compete with one another. Consumers are uniformly distributed in [0, 1] interval, the distribution density is 1, which is common information to the manufacturers and retailers. A customer whose position is

is

away from retailer 1 and at a distance

from retailer 2. The travel cost is

, and customers are willing to pay

per unit of product. One consumer gets a utility of

if he or she buys from retailer 1 and receives

if he or she purchases from retailer 2. The two retailers decide prices

separately, and their demand

can be acquired by solving the mathematical formula below.

.

Hence, we have that and . The retailers’ market shares are affected by the prices and unit travel cost .

In this paper, the superscript contains information about the supply chain structure and the subsidy type, representing the corresponding equilibrium solutions. The subscript is used to specify the supply chain participants. For example, denotes the equilibrium profits of firm under supply chain structure l and subsidy type h, where , represent the manufacturer and the retailer, respectively, denote the centralized and decentralized settings, respectively, and represent no subsidy, the unit production subsidy, and the green technology investment subsidy, respectively.

4. Centralized Supply Chain

In this section, we analyse the performance of centralized supply chains, that is, the supply chains that are vertically integrated in the sense that the manufacturers also are the retailers. First, we investigate a base model where the government does not offer subsidy to manufacturers. We then investigate the equilibrium solutions for the unit production subsidy and the green technology investment subsidy. Last, we compare the three subsidy policies (no subsidy, unit production subsidy, and green technology investment subsidy) from the perspective of social welfare and the firms’ profits and eco-innovation levels.

4.1. No Subsidy in Centralized Supply Chains

The government does not provide any subsidy to the manufacturers in this base model. Manufacturer

i sets its retail price

and eco-innovation level

to maximize its profit:

The manufacturers’ profits consist of two parts. The first part is the income from the sale of products, and the second part is their eco-innovation investment costs. Based on the consumer’s utility function, the consumer surplus is presented as follows:

Furthermore, we can define the social welfares as follows.

CS is the consumer surplus, and

and

are the profits for manufacturer 1 and manufacturer 2, respectively. We can obtain the equilibrium eco-innovation levels, the retail prices, and manufacturers’ profits, which are summarized as Proposition 1, and the proofs can be seen in

Appendix A. In this section, to ensure that eco-innovation levels are larger than zero, we assume that

Proposition 1. Without a subsidy in the centralized supply chains, the equilibrium eco-innovation levels, the firms’ profits, and the social welfare are as follows.

- (i)

Manufacturer 1′s and manufacturer 2′s equilibrium eco-innovation levels areand, respectively. In addition,.

- (ii)

Manufacturer 1’s and manufacturer 2’s equilibrium profits areandrespectively. In addition,.

- (iii)

The social welfare is.

As shown in Proposition 1, manufacturer 1’s eco-innovation level is always superior to the level of manufacturer 2. The technology leader is willing to exert more eco-innovation effort to cut down the environmental protection cost. Therefore, manufacturer 1 has a price advantage over manufacturer 2, i.e., . Note that a lower price means a greater market demand, so manufacturer 1 can get a higher sales revenue. In addition, due to the technology gap, the profit of manufacturer 1 is intuitively larger than the profit of manufacturer 2.

Next, we investigate the impact of the technology gap and spillover effect on the manufacturers’ eco-innovation levels and profits.

Corollary 1. Without subsidy, we have the following.

- (i)

The leader’s eco-innovation leveldecreases in the spillover effect; the follower’s eco-innovation levelincreases inonly when the technology gapis relatively large (i.e.,).

- (ii)

Asincreases,increases whiledecreases (i.e., ).

- (iii)

The leader’s profitincreases inonly whenis small (i.e., ); the follower’s profit increases in .

- (iv)

Asincreases,increases whiledecreases.

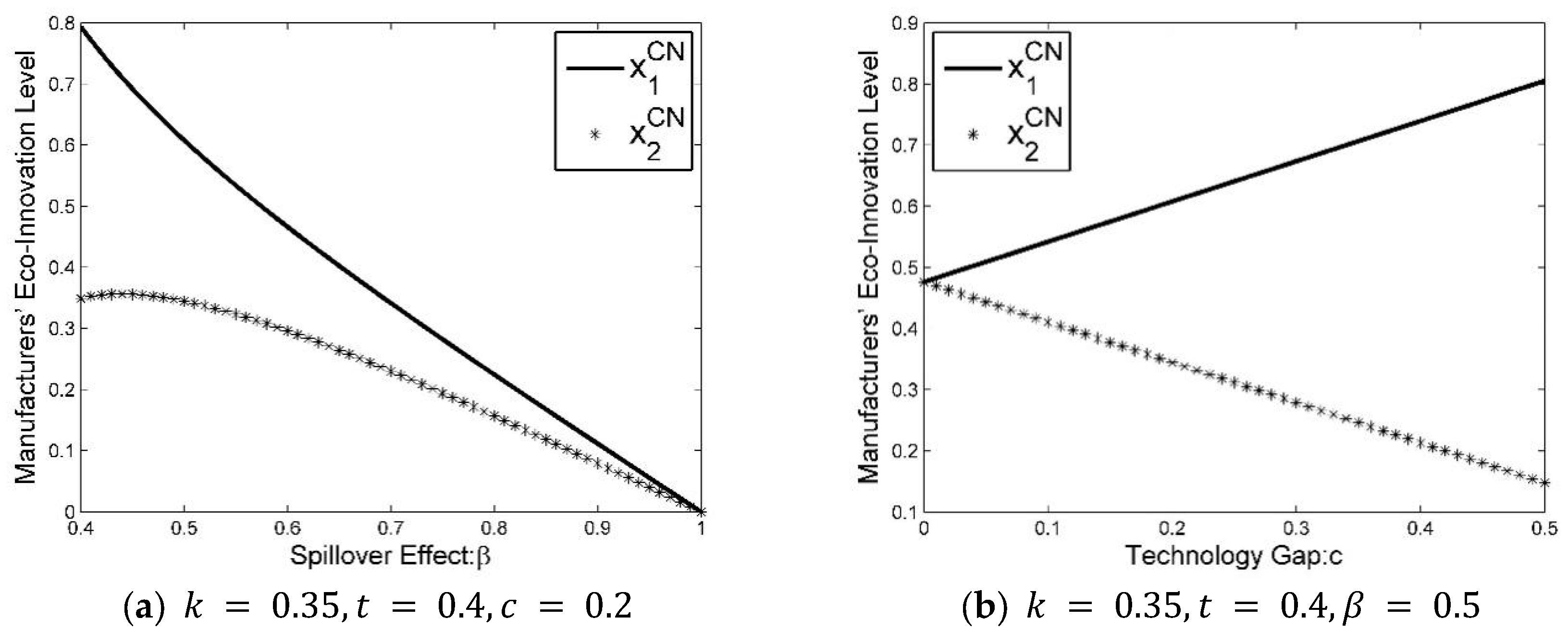

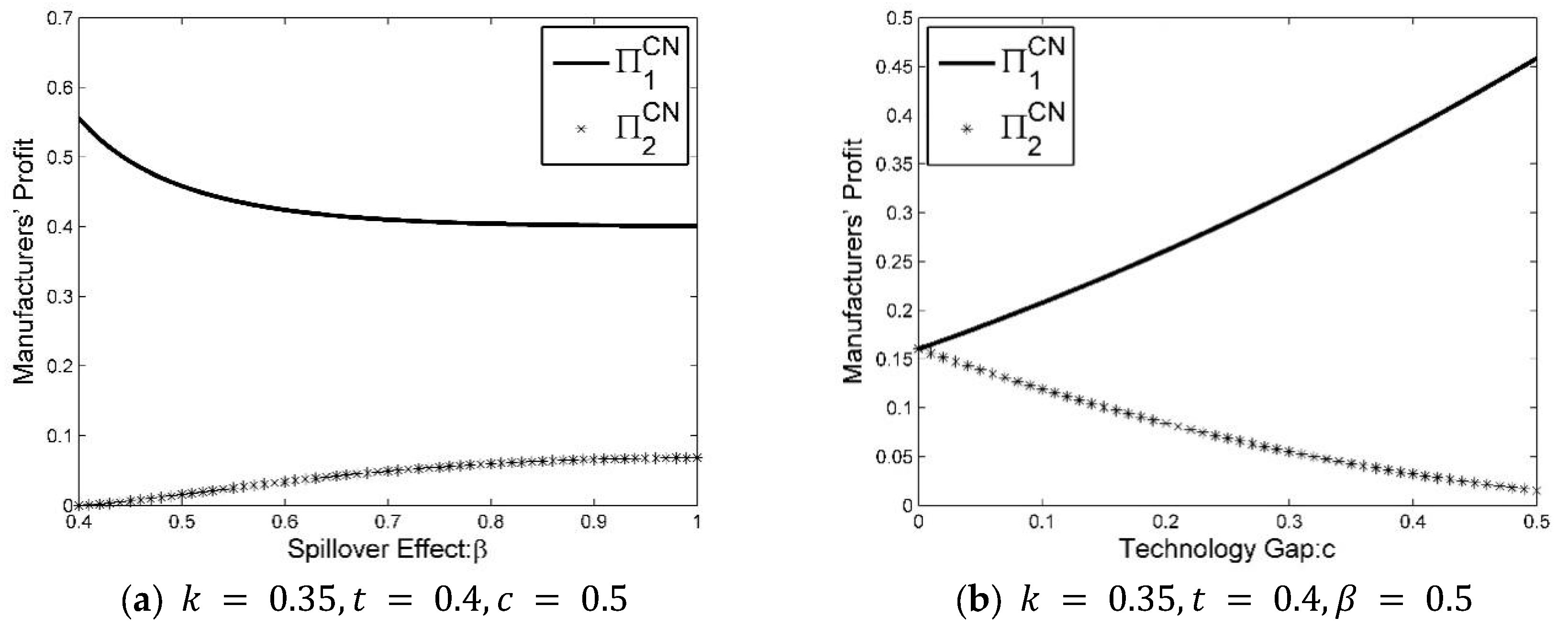

Corollary 1(i) and

Figure 4a show that the spillover effect

has a negative effect on the leader’s eco-innovation level

. Note that a large

leads to a high level of effective eco-innovation. As

increases, the free-riding effect increases, and manufacturer 1 does not have enough impetus to improve its eco-innovation level. Furthermore, due to the high investment costs resulting from larger levels of eco-innovation, the eco-innovation level of the leader decreases in the spillover effect. Interestingly, whether manufacturer 2’s eco-innovation level decreases in

depends on the technology gap

. When

is large (i.e.,

), the competition between the manufacturers is low and manufacturer 2 has more incentive to improve its eco-innovation level as

increases. Otherwise, manufacturer 2’s eco-innovation level decreases in

.

Corollary 1(ii) and

Figure 4b show that, as

increases,

increases, while

decreases. Note that the greater

, the greater the environmental protection cost of manufacturer 2. The benefit to the manufacturers from reduced environmental protection costs decreases in c. Thus, manufacturer 2’s eco-innovation level decreases. In contrast, the greater the technological gap, the greater the competitiveness and technological superiority of manufacturer 1, and the more the benefits of the higher

. Consequently, as

increases, manufacturer 2 ought to set a higher eco-innovation level. Furthermore, the eco-innovation levels of both manufacturers are equal when

is equal to 0; the greater the

, the greater the gap between the manufacturers’ eco-innovation levels.

Recall that manufacturer 1’s eco-innovation level

decreases in

. When

is large (i.e.,

), the competition between the manufacturers is low. In this situation, as

increases, the investment cost reduction from the reduction of

is smaller than the generation taken a toll decrease from the spillover effect; thus, manufacturer 1’s profit decreases (see

Figure 5a). Manufacturer 1’s profit increases as

increases only if the technology gap c is small (i.e.,

). However, manufacturer 2’s profit is always increasing in

. This is because of the benefit from free riding due to the increasing

; thus, manufacturer 2 will get more profit as

increases, as shown in Corollary 1(iii).

From Corollary 1(ii) and

Figure 5b, we have seen that, as the technology gap

increases, manufacturer 1’s eco-innovation level increases, while manufacturer 2’s eco-innovation level decreases. Additionally, manufacturer 1’s profit increases in

, and manufacturer 2’s profit decreases in

as shown Corollary 1(iv).

To encourage the manufacturers to improve their eco-innovation levels, the government provides subsidies to manufacturers who produce energy vehicles. This paper considers two subsidy types (the unit production subsidy and the green technology investment subsidy) which are common in practice and in the literature.

4.2. Unit Production Subsidy in Centralized Supply Chains

In this subsection, we study the case where the government offers the unit production subsidy to the manufacturers. We assume that the government subsidies offered to the leader and the follower are

and

for a unit product, respectively. Compared with the no subsidy case, manufacturer 1’s and manufacturer 2’s profits both have an additional government subsidy, which are

and

, respectively. Thus, under the unit production subsidy, both manufacturers’ profits are as follows.

Furthermore, the social welfare under the unit production subsidy is as follows.

where

denotes the government’s entire subsidy payment to the manufacturers, which is equal to

. We derive the equilibrium eco-innovation levels by backward induction, manufacturers’ profits, and subsidy levels. Similarly, to ensure that the eco-innovation level is larger than zero, we assume that

Proposition 2. Under the unit production subsidy in the centralized supply chains, the equilibrium subsidy levels, the eco-innovation levels, the firms’ profits, and the social welfare are as follows.

- (i)

The equilibrium subsidy levels satisfy the following relationship:.

- (ii)

The equilibrium eco-innovation levels of the leader and follower areand, respectively. In addition,.

- (iii)

The equilibrium profits of the leader and follower areandrespectively. In addition,.

- (iv)

The social welfare is.

In general, people may expect that the government should subsidize more for the follower (i.e., manufacturer 2) than for the leader (i.e., manufacturer 1). Surprisingly, this is not true. As shown in Proposition 2(i), manufacturer 1’s subsidy is always higher than that of manufacturer 2. As a technology leader, manufacturer 1 has more capacity to increase the eco-innovation level. Thus, with the same subsidy, manufacturer 1 can increase their eco-innovation level, and thus the effective eco-innovation level, more. Consequently, the government should offer more subsidies to manufacturer 1.

Similarly to Proposition 1, both manufacturer 1’s profit and its eco-innovation level are always larger than manufacturer 2’s profit and eco-innovation level, respectively, as shown in Proposition 2(ii,iii).

Corollary 2. With the unit production subsidy, we have the following.

- (i)

The eco-innovation level of the leaderdecreases in the spillover effect; the follower’s eco-innovation levelincreases inonly when the technology gapis large (i.e.,).

- (ii)

Asincreases, eco-innovation level of the leaderincreases while the eco-innovation level of the followerdecreases (i.e.,).

- (iii)

The leader’s profitincreases inonly whenis relatively small (i.e.,). The follower’s profitincreases in.

- (iv)

Asincreases, the profit of the leaderincreases, while the follower’s profitdecreases.

From Corollary 2, the impacts of the technology gap and spillover effect on the firms’ profits and eco-innovation levels are similar to those with no subsidy; i.e., the government’s unit production subsidy policy does not change qualitative outcomes. Next, we discuss the performance of the supply chain under the green technology investment subsidy.

4.3. Green Technology Investment Subsidy in Centralized Supply Chains

In this section, we study the case in which the government offers the green technology investment subsidy to the manufacturers. We assume that the investment subsidy subsidizes the manufacturer

a portion of its investment cost

, i.e., the government subsidies to manufacturer 1 and manufacturer 2 are

and

, respectively. Similarly, both manufacturers’ profits are as follows.

Social welfare under the green technology investment subsidy and the unit production subsidy is the same, except that, under the green technology investment subsidy, the total subsidy payment of the government is . The government pursues maximum social welfare by deciding and . We will confine our analysis to , so that the manufacturers’ subsidy ratios are non-negative.

Proposition 3. Under the green technology investment subsidy in the centralized supply chains, the equilibrium subsidy levels, the eco-innovation levels, the firms’ profits, and the social welfare are as follows.

- (i)

The equilibrium subsidy levels areand. In addition,.

- (ii)

The equilibrium eco-innovation levels of the leader and follower areand. In addition,.

- (iii)

The equilibrium profits of the leader and follower areand.

- (iv)

The social welfare is.

From Proposition 3, we see that the government subsidizes more to manufacturer 1, and manufacturer 1’s eco-innovation level is always larger than manufacturer 2’s. Those results are the same as under the unit production subsidy. In addition, Proposition 3(iii) shows that, when the investment cost coefficient of the manufacturers is small, the green technology investment subsidy policy is more favorable to manufacturer 2.

Next, we study how the spillover effect and technology gap affect the firms’ profits and eco-innovation levels under the green technology investment subsidy.

Corollary 3. Under the green technology investment subsidy:

- (i)

Both manufacturers’ eco-innovation levelsandincrease in the spillover effect;

- (ii)

Asincreases, the eco-innovation level of the leaderincreases, while the follower’s eco-innovation leveldecreases (i.e.,).

- (iii)

The leader’s profitdecreases inif and only ifand c are relatively large (i.e.,). The follower’s profitdecreases inwhenand.

- (iv)

Asincreases, the leader’s profitincreases, while the follower’s profitincreases when.

As shown in Corollary 3, the effects of the technology gap and the spillover effect on the equilibrium solutions of manufacturers’ profits and eco-innovation levels are similar to those under the unit production cost subsidy. However, under the green technology investment subsidy, the eco-innovation levels increase in the spillover effect which is the opposite of their behavior under the unit production cost subsidy. The government subsidizes manufacturers’ green technology investments directly. Higher levels of eco-innovation require relatively large investments and lead to higher subsidies. Manufacturers are inclined to increase the eco-innovation levels to obtain more subsidies and cost deductions when the spillover effect increases. Finally, Corollary 3(iv) shows that the insights remain the same in terms of the qualitative results as in previous research.

4.4. Without Subsidy vs. with Subsidy under Centralized Supply Chain

This section compares the equilibrium solutions under the three subsidy types in a centralized setting.

Proposition 4. In the centralized supply chain:

- (i)

The eco-innovation level of manufacturer 1 gets the highest under the unit production subsidy and is the lowest with no subsidy, i.e.,.

- (ii)

Manufacturer 2’s eco-innovation level is the highest under the green technology investment subsidy and is the lowest under the unit production subsidy, i.e.,.

- (iii)

Manufacturer 1’s equilibrium profit is the highest under the green technology investment subsidy, while the lowest with no subsidy, i.e.,.

- (iv)

Manufacturer 2’s equilibrium profit is the highest under the unit product subsidy and the smallest with no subsidy, i.e.,.

- (v)

The social welfare under the unit production subsidy is superior to that under the green technology investment subsidy if and only if the technology gap is large (i.e.,).

Proposition 4(i) shows the eco-innovation level of the leader is larger under subsidies than without subsidy. This is because the government subsidy can incentivize manufacturer 1 to improve the eco-innovation level. Furthermore, manufacturer 1’s eco-innovation level is higher with the unit production subsidy than that with the green technology investment subsidy. Proposition 2(i) shows that the subsidy of manufacturer 1 is always larger than that of manufacturer 2, which, along with the technology gap, results in a greater production cost advantage and quantity of sales for manufacturer 1, and that the subsidy of manufacturer 1 under the unit production subsidy is directly related to the sales volume. To take full advantage of this, manufacturer 1 is willing to increase its eco-innovation level and obtains the highest level under the unit production subsidy.

Interestingly, the eco-innovation level of the follower (i.e., manufacturer 2) is not necessarily larger under with subsidy than that without subsidy, especially for the unit production subsidy. Note that, from Proposition 2(i), we have that the government offers more subsidies to manufacturer 1. Thus, under the unit production subsidy, the competitiveness for manufacturer 2 is lower than with no subsidy. Consequently, manufacturer 2 has less incentive to incur more costs to improve its eco-innovation level, which is lower under the unit production subsidy, as shown in Proposition 4(ii).

Recall that from Propositions 2 and 3, we have that the government offers fewer subsidies to manufacturer 2 under both subsidy types. Thus, both subsidy types enhance the leaders’ advantages, making them more competitive than the followers. Consequently, manufacturer 1 can get more profit from subsidies, whereas manufacturer 2 will suffer a loss from subsidies, as shown in Proposition 4(iii,v).

Nevertheless, Proposition 4(iii,v) further show that both manufacturers obtain more profits under the green technology investment subsidy. Note that, due to the spillover effect, the cost reduction from the reduced investment is greater than the gain from the reduced production cost. Thus, both manufacturers prefer the green technology investment subsidy to the unit production subsidy.

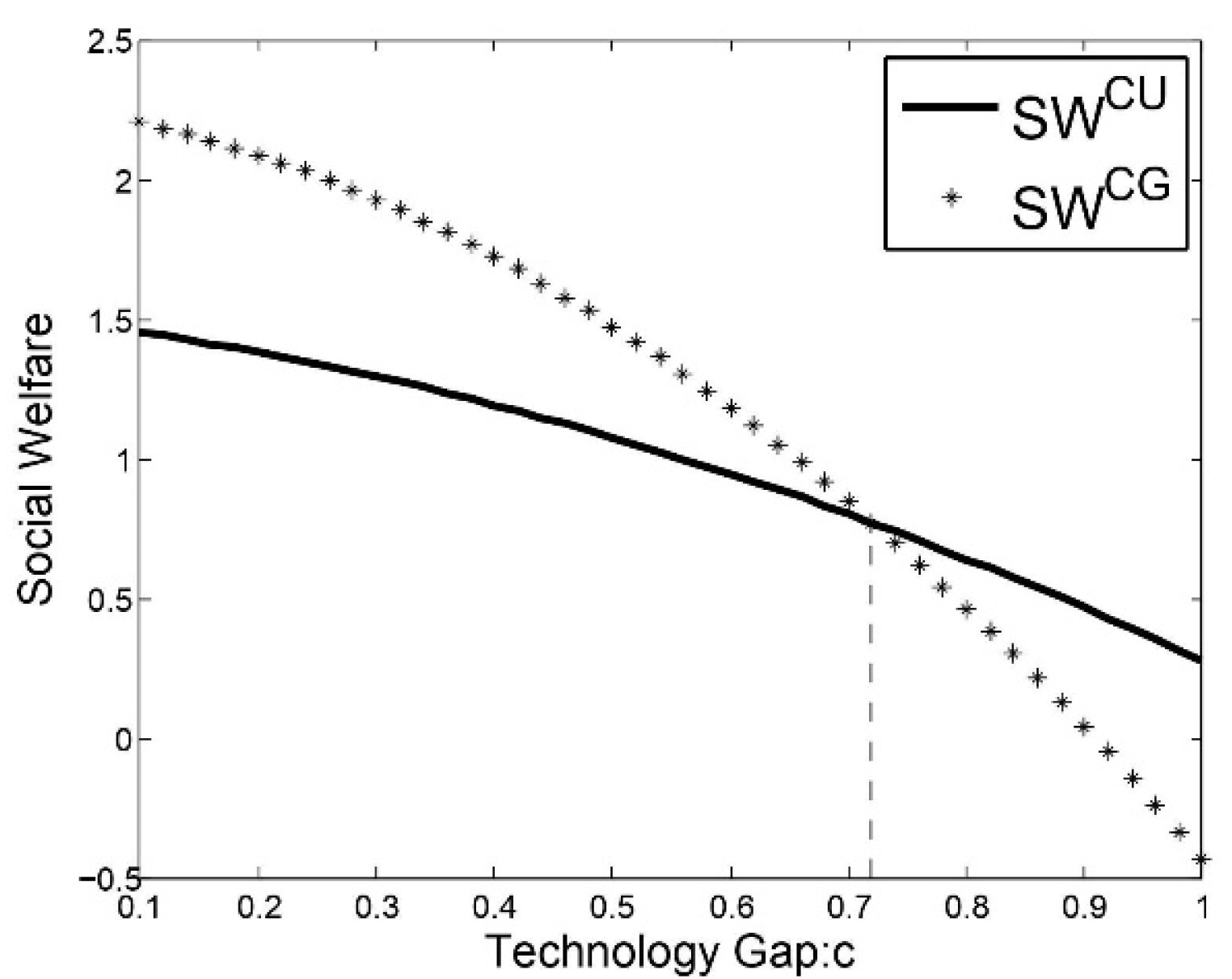

As Proposition 4(v) shows, the government subsidy can increase the total social welfare, which is consistent with reasoning by which many countries (e.g., China, Germany, USA) provide subsidies to firms. Furthermore, Proposition 4(v) and

Figure 6 show that the subsidy (green investment subsidy or unit production subsidy) under which greater social welfare is achieved depends on the technology gap

. When

is large, the competitiveness between both manufacturers is small, and manufacturer 2 has less incentive to increase its eco-innovation level. Under such circumstances, the government ought to choose the unit production subsidy policy to motivate manufacturers to increase their eco-innovation levels. Consequently, the government should offer the unit production subsidy to both manufacturers when there is a large technology gap. Otherwise, the government ought to provide the green technology investment subsidy to the manufacturers.

5. Decentralized Supply Chains

This section examines the decentralized supply chain described in

Section 4.

5.1. No Subsidy in Decentralized Supply Chains

Throughout this subsection, we will confine our analysis to

so that the manufacturers’ eco-innovation levels are non-negative. Without subsidies, the manufacturers’ profits, the retailers’ profits, and the social welfare are as follows.

In this model, we first infer the equilibrium solution for the retail price at a given level of eco-innovation and wholesale price according to the inverse induction method. Then, we analyze the manufacturers’ equilibrium wholesale price and eco-innovation level decisions. The following equilibrium outcomes can be derived.

Proposition 5. Without subsidy in the decentralized setting, the equilibrium eco-innovation levels and profits of the firms and the supply chains’ social welfare are as follows.

- (i)

The equilibrium eco-innovation levels of the leader and the follower areand, respectively. In addition,.

- (ii)

The equilibrium profits of the leader and the follower areand, respectively. In addition,.

- (iii)

The retailers’ equilibrium profits areandrespectively. In addition,.

- (iv)

The social welfare and the consumer surplus are.

Similar to Proposition 1, Proposition 5 shows that manufacturer 1’s profit and eco-innovation level are greater than those of manufacturer 2. Furthermore, retailer 1 gets more profit than retailer 2. This is because manufacturer 1 with a lower unit production cost will offer a small wholesale price for retailer 1, leading to retailer 1’s profit being higher.

Proposition 5 further indicates that, in the decentralized setting, the total profit of supply chain 1 is also higher than supply chain 2. This is the same as in the centralized setting, in which the total profit of the supply chain consists only of the manufacturer’s profit.

5.2. Unit Production Subsidy in Decentralized Supply Chains

As in

Section 4.2, throughout this section, we study the case in which the government subsidizes

and

to manufacturer 1 and manufacturer 2, respectively, under the unit production subsidy policy. Similarly to the centralized setting, we can get the equilibrium solutions and the effect of the technology gap and the spillover effect on the equilibrium solutions in the following Proposition and Corollary, respectively. Also, we will confine our analysis to

so that the manufacturers’ eco-innovation levels are non-negative.

Proposition 6. Under the unit production subsidy in the decentralized supply chain, the equilibrium subsidy levels, the eco-innovation levels, the firms’ profits, and the social welfare are as follows.

- (i)

The equilibrium subsidy levels satisfy the following relationship:.

- (ii)

The equilibrium eco-innovation levels of the leader and the follower areand, respectively. In addition,.

- (iii)

The equilibrium eco-innovation profits of the leader and the follower areandrespectively. In addition,.

- (iv)

The retailers’ equilibrium profits areandrespectively. In addition,.

- (v)

The social welfare is.

In the decentralized setting, Proposition 6 shows that the leader obtains more profit and a higher eco-innovation level than the follower under the unit production subsidy. The supply chain under the unit production subsidy in the centralized setting has the same results. Similarly, retailer 1 is more profitable than retailer 2, as shown in Proposition 6(iv).

5.3. Green Technology Investment Subsidy in Decentralized Supply Chains

Similarly to in

Section 4.3, we explore a green technology investment subsidy policy where the government subsidizes a portion of its investment cost,

, to the manufacturers. The profit functions of the manufacturers and retailers are similar to those under the unit production subsidy. Again, we will confine our analysis to

. Similarly, the solutions we can derive are as follows.

Proposition 7. Under the green technology investment subsidy in the decentralized setting, the equilibrium subsidy levels, eco-innovation levels, and profits of the firms, as well as the social welfare, are as follows.

- (i)

The equilibrium subsidy levels areand. In addition,.

- (ii)

The equilibrium eco-innovation levels of the leader and the follower areand. In addition,.

- (iii)

The equilibrium profits of the leader and the follower areand. In addition,.

- (iv)

The retailers’ equilibrium profits areand. In addition,.

- (v)

The social welfare is.

As Proposition 7 shows, under the green technology investment subsidy in the decentralized setting, the eco-innovation level and profit of the follower and its retailer’s profit are smaller than those of the leader. This result is similar to that obtained under the unit production subsidy. Next, we explore the impact of the technology gap and the spillover effect on the equilibrium solutions in the decentralized setting under the three types of subsidy policies.

Corollary 4. Under the three subsidy policies in the decentralized supply chain:

- (i)

The leader’s eco-innovation level,increases in the spillover effectunder the three subsidy policies. The follower’s eco-innovation level, with no subsidy and under the unit production subsidy increases inifis small (i.e.,) andis large (i.e.,respectively. Furthermore, the eco-innovation level of the follower increases inunder the green technology investment subsidy.

- (ii)

Asincreases, the eco-innovation level of the leaderincreases, while the follower’s eco-innovation leveldecreases (i.e.,).

- (iii)

With subsidies, the leader’s and the follower’s profitsandincrease in. Retailer 1’s profitdecreases in, while retailer 2’s profitincreases in.

- (iv)

Under the three types of subsidy policies, asincreases, the leader’s and its retailer’s profits increase, while the follower’s and its retailer’s profits decrease.

Corollary 4 presents how both the spillover effect and the technology gap affect the equilibrium solutions in a decentralized supply chain.

Corollary 4(i) shows that, for a given government subsidy, the eco-innovation level of the leader increases with the spillover effect , which is not necessarily true for the follower’s eco-innovation level. Nevertheless, as shown in the Corollary 4(ii), the eco-innovation level of the follower is a decreasing function of the technology gap , while the eco-innovation level of the leader is the opposite. Those results are similar to those obtained under the centralized setting.

Corollary 4(iii) shows that, if the government offers subsidies to the manufacturers, both manufacturers’ profits increase in the spillover effect. However, retailer 1’s profit will decrease in ; i.e., the spillover effect has opposite effects on retailer 1 and manufacturer 1. Note that, from Corollary 4(i), we obtain that the eco-innovation level of the leader increases in , and thus leads to a cost reduction. Therefore, both the wholesale and the retail prices decrease. Consequently, retailer 1’s revenue from the higher demand is less than its loss from the lower price. As a result, retailer 1’s profit decreases in .

Corollary 4(iv) shows that, for each subsidy policy, the profit of the leader increases in whereas the profit of the follower decreases in . This result is the same as that obtained under the centralized setting.

5.4. Without Subsidy vs. with Subsidy under Decentralized Supply Chains

Proposition 8. In the decentralized supply chain:

- (i)

The eco-innovation level of manufacture 1 is always larger with subsidies than without subsidies (i.e.,;). Furthermore,.

- (ii)

Manufacturer 2’s eco-innovation level is the highest under the green technology investment subsidy, while it is the smallest under the unit production subsidy; i.e.,.

- (iii)

Manufacturer 1 has the largest profit under the unit production subsidy; Manufacturer 2 has the largest profit without subsidies.

Proposition 8(i) shows that, with subsidies, manufacturer 1’s eco-innovation level is invariably larger. This result is the same as in the centralized setting. Nevertheless, different from in the centralized setting, manufacturer 1 invariably acquires a larger eco-innovation level under the unit production subsidy than under the green technology investment subsidy. In the decentralized setting, acquiring a higher level of eco-innovation under the unit production subsidy for manufacturer 1 requires certain conditions to be met, i.e., the technology gap has to be sufficiently large. This is because the decentralized setting will weaken manufacturer 1’s competitive advantage, especially when the technology gap is low. Thus, manufacturer 1 sets a higher eco-innovation level under the green technology investment subsidy if the technology gap is small.

Similarly to in the centralized setting, Proposition 8(ii) indicates that manufacturer 2’s eco-innovation level is the largest under the green technology investment subsidy and is the smallest under the unit product subsidy in the decentralized supply chain. Finally, Proposition 8(iii) shows the same qualitative results as in the centralized supply chain.

Corollary 5. - (i)

Manufacturer 1’s eco-innovation level is higher with centralized supply chains, i.e.,; Manufacturer 2’s eco-innovation level is higher with decentralized supply chains, i.e.,.

- (ii)

The social welfare is higher with centralized supply chains, i.e.,.

As shown in Corollary 5(i), the decentralized setting will weaken manufacturer 1’s competitive advantage; thus, manufacturer 1 does not have enough motivation to increase its eco-innovation level in the decentralized supply chain, while the opposite is true for manufacturer 2. In addition, it is intuitive that the social welfare gains more under the centralized setting, as shown in Corollary 5(ii).

6. Conclusions

Motivated by a growing consciousness of green consumption and carbon abatement, the government provides firms with subsidies to promote the development of the new energy vehicle industry. In this work, we examine the performances of companies’ profits and eco-innovation levels and supply chains’ social welfare under three subsidy policies (no subsidy, the unit production subsidy, and the green technology investment subsidy) in the presence of the technology gap and the spillover effect. We summarize the theoretical contributions and managerial insights of this paper in the following. Then, the limitations and future research directions are analyzed.

6.1. Theoretical Implications

This paper extends the literature on government subsidy policies and eco-innovation strategies in competing supply chains. It differs from the literature stream that studies the subsidy policies in a non-horizontal competitive supply chain. Furthermore, with the technology gap and the spillover effect, we study how the government subsidy policies (no subsidy, unit production subsidy, and green technology investment subsidy) affect firms’ equilibrium eco-innovation levels, profits, and social welfare. Finally, we study the impacts of the supply chain structure on the firms’ decisions under the three subsidies.

6.2. Managerial Insights

First, our analysis shows that, for each supply chain structure and subsidy policy scheme, the eco-innovation level of the technology leader is always higher than that of the technology follower. Meanwhile, as the technology gap increases, the eco-innovation level of the technology leader always increases, while the technology follower’s eco-innovation always decreases, which is consistent with operational practice.

Second, we offer references to governments on how best to subsidize firms from the perspective of social welfare maximization. Specifically, the government should offer larger subsidies to the large-scale firms. Furthermore, because the subsidies are not necessarily better for firms, the government should be careful in providing subsidies.

Third, the way in which the spillover effect impacts both the firm’s eco-innovation levels and its profits rests with the structure of the supply chain, the subsidy policy, and the technology gap. Therefore, we provide new insights for the government on ways to formulate efficient subsidy policies for social welfare maximization. In terms of the choice of the unit production subsidy versus the green technology investment subsidy, when the technology gap is large, the leader has the highest level of eco-innovation under the unit production subsidy. Thus, the government can make full use of the leader’ technological advantages by providing the unit production subsidy. On the other hand, when the technology gap is low, the advantages of the leader’s technology leadership are comparatively small. Meanwhile, both firms’ eco-innovation levels rise with the spillover effects under the green technology investment subsidy. Therefore, the government can further amplify the spillover effect through cooperation and exchange activities, so as to improve the eco-innovation level.

Fourth, the firms get different profits under different supply chain structures and subsidy policies. Furthermore, under the centralized setting, the leader sets the highest eco-innovation level under the unit production subsidy and obtains the highest profit under the green technology investment subsidy. However, under the decentralized setting, the leader’s profit is highest under the green technology investment subsidy if the technology gap is low. Firms can draw some inspiration from these results. For example, firms can use industry lobbyists to put forward their views to the government based on their own actual situations.

6.3. Future Research Directions

One of the limitations of our work is that we consider firms’ eco-innovation strategies and government’s subsidy policies in the case of symmetric information. In practice, information can be asymmetric between firms. It is interesting to consider the impact of information asymmetry on the supply chain’s decisions and efficiency in the presence of the spillover effect and technology gaps. Furthermore, this paper only considers the situation of subsidizing firms. It could further consider scenarios in which the government subsidizes firms and consumers at the same time. Finally, it is interesting to study how to share subsidies and costs as part of the R&D cooperation of firms.