1. Introduction

Paiola et al. [

1] research digital issues concerning servitization, despite a very detailed previous review of servitization by Raddats et al. [

2]. According to their study, servitization is already an established field of research, even though no normative recommendations have yet been provided. They also analysed research methods for the period 2005 to 2017. Qualitative research dominated, presenting a serious research gap. However, in 2017 some doubts about the success of servitization strategy emerged. Benedettini et al. [

3] list several examples where companies started to withdraw rather than extend their service offering, including Johnson Controls, Voith and ABB, who disengaged from facilities and maintained their management contracts. Kowalkowski et al. [

4] list Xerox as an example of deservitization, withdrawing their service offering in 2016 and forming an independent company, Conduent, for the service part of their provision. An interesting observation is that, at some point, these cases have been used as prime successful examples of servitization. They list other examples such as Conglomerate ThyssenKrupp, which sold its service division due to poor performance results; Volth, which sold its service unit; and Michelin, which formed Michelin Solutions to provide services.

Kowalkowski et al. [

4] simply state that a company will deservitize (cooperate with a third party in service provision) if servitization is found to be uneconomical. Authors [

5,

6,

7] have written about the service paradox, where investment in services fails to generate corresponding returns, constituting the early warning signs that servitization strategy is far from straight forward. Benedettini et al. [

3] even show that, wrongly used, servitization leads to bankruptcy. Erkoyuncu et al. [

8] list all of the risks that manufacturers must take when they offer advanced service contracts, with manufacturing companies withdrawing from offering advanced services because of these high risks.

Obviously, there is evidence in the literature that deservitization is occurring. A search of the Scopus database of published academic papers shows that deservitization indeed started to be researched in 2017. For its part, servitization is still being researched, but a careful analysis of the papers reveals that many aspects of the success of servitization are being questioned. Therefore, the main contribution of this study is that it sheds light on the deservitization phenomenon, which is at an incipient stage. Additionally, there are several theoretical lenses in the literature through which the servitization phenomenon is being studied: knowledge-based view (KBV), resource-based view (RBV), relation view, configurational theory and resource-advantage theory. Meanwhile, since deservitization is a much less studied phenomenon, the only dominant theoretical lens is KBV.

Consequently, the first aim of this paper is to position deservitization in the current streams of literature that provide valid theoretical lenses for its study and point to the problems of this phenomenon, which are researched both insufficiently and inadequately in the literature. The second aim is to find out which companies tend to deservitize and why, using a large database captured over a three-year period from the European Manufacturing Survey initiative, led by Fraunhofer ISI. This is a valuable contribution because most research on servitization is conducted using case studies [

2], most frequently focused on large companies. The present paper also fills the quantitative research gap, while generating survey-based research using data coming from a large multi-country survey covering the whole of the manufacturing sector, which has not been done previously. Another aspect of the existing body of literature on servitization is that the studies mainly analyze only a single or a few determinants of the servitization/deservitization decision. We provide a complete model with different influences, orchestrated to provide a more general picture of the deservitization phenomenon. A special focus is placed on product complexity as a contextual factor and its link to servitization and deservitization decisions. The managerial implication is that it is not always beneficial to servitize and losses can arise. To avoid these losses, this research indicates when to enter the servitization arena and when it is more beneficial to deservitize.

Three Southern European countries with comparable levels of servitization and deservitization are researched. A descriptive analysis is performed on the sample of these three countries and reported under descriptive statistics (

Section 4.3). A large database consisting of 296 companies from Spain, Slovenia and Croatia, obtained through the European Manufacturing Survey initiative, is used in our analysis to shed light on both deservitization effects and contextual factors that have emerged in the literature as determinants of servitization/deservitization [

9].

The remainder of this paper is organized as follows:

Section 2 gives an overview of the relevant literature through several theoretical lenses (with the focus on KBV) and servitization/deservitization, as well as the link between servitization/deservitization and product complexity. In

Section 3, we develop our research hypotheses. In

Section 4 we describe our data and research methodology.

Section 5 presents the results of the OLS regression analysis. In

Section 6, the research results are discussed. Finally,

Section 7 concludes and the limitations of the study and directions for future research are formulated.

3. Hypotheses Development

Eggert et al. [

30] show that R&D activity positively moderates servitization revenues; that is, innovation activities will be more prone to servitization than to the deservitization effect because larger revenues can be obtained. However, according to [

11], with increasing innovation activity, risks also arise. Similarly, Ref. [

31] provide empirical evidence that innovation activity influences service provision, but that the effect is different depending on the service in question. The authors divide services into product-related services and customer-related services, finding that only for customer-related services is there a positive effect on share of revenues generated by services. Ref. [

3] provide a list of product- and customer-related services in their appendix. The most common product-related services (basic services—BAS) are (i) maintenance and repair, (ii) installation, and (iii) product upgrade, while customer-related services (advanced services—ADS) are (i) finance, (ii) logistics, (iii) IT development and (iv) end of life services.

Product-related services use the existing knowledge of the manufacturer, who is also the service provider and thus able to provide the service without having to contract with a third party. However, companies that do not possess all the knowledge or capacity to servitize turn to a third party for service provision; that is, they deservitize, in line with the research of [

13].

Customer-related services necessitate different knowledge. The manufacturer wants to enter into the contract for marketing purposes, but due to missing knowledge they contract with a third party. According to [

30,

31], these customer-related services bring better servitization revenues, but the outsourcing might be higher because the provider does not have all the knowledge. However, if the research by [

13,

22] is considered, the outsourcing or deservitization of customer-related advanced services happens only if the manufacturer is a manufacturer of simple products. This is because manufacturers of complex and customized products usually possess all the necessary knowledge to provide the complete solution. However, a question remains: do simple or medium complexity products need advanced services at all? This reflection is in line with the research by [

13], who found no moderation effect if the service is advanced. More precisely, they research whether, depending on the company’s offer, the resource base and activity engage with service providers (deservitize) for provision of product- and customer-related services. The moderation effect for product-related services is positive, meaning that, indeed, product-related services tend to be more outsourced to a service provider (deservitized), while the opposite is true for advanced customer-related services. Valtakoski [

9] brings up the issue of the leakage of knowledge in complex systems, finding that manufacturers of complex products do not tend to engage third parties in service provision (deservitize), tending to keep the service provision in-house. Ref. [

13] explain their finding on customer-related services by the fact that the decision to outsource/deservitize is a strategic matter. Further proof of their claim can be found in [

21], who mathematically model when servitization is a profitable strategy. Thus, the hypotheses formulated were:

Hypothesis 1 (H1). Providers of advanced services for complex products will tend to servitize.

Hypothesis 2 (H2). Providers of non-complex products will tend to deservitize.

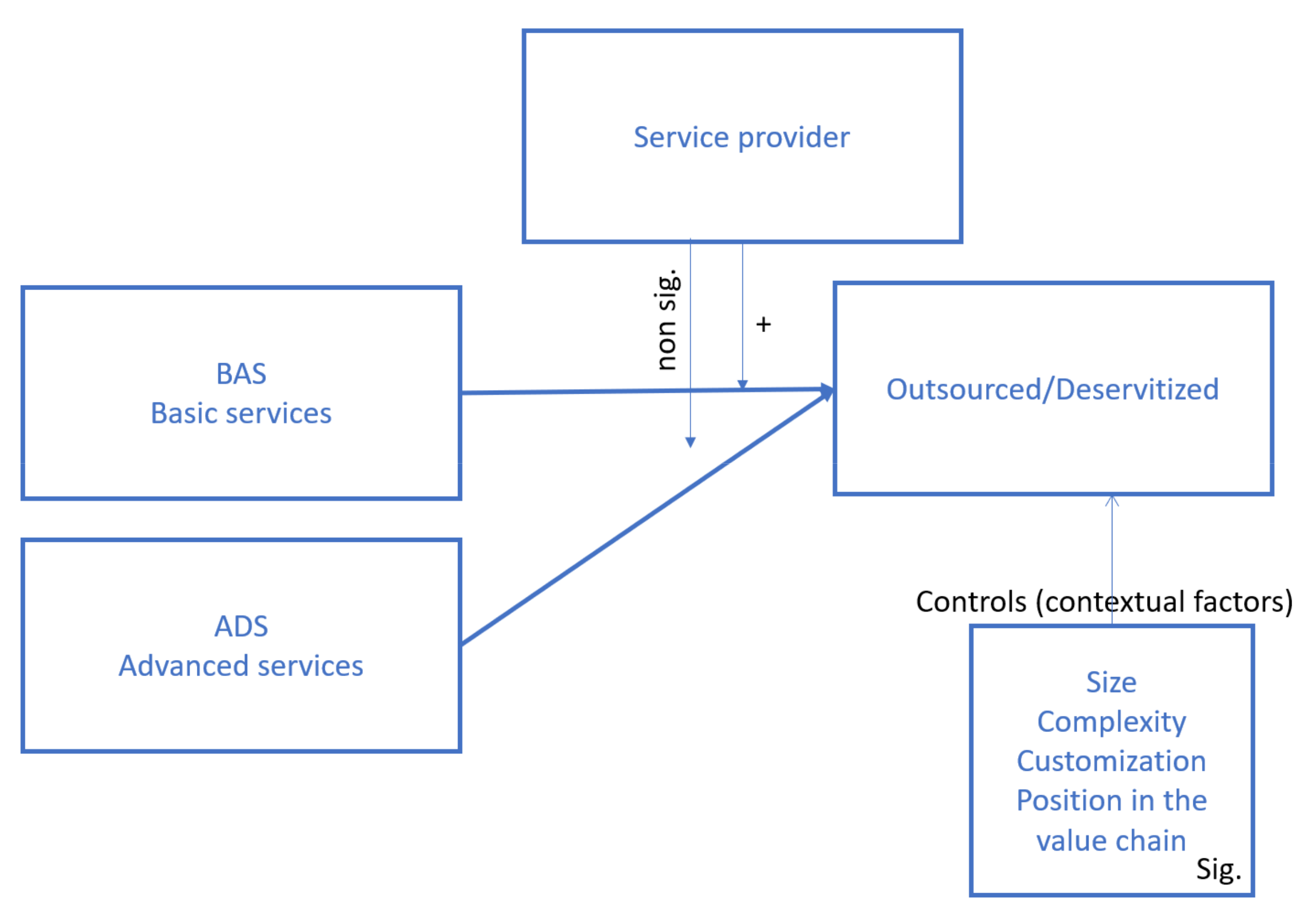

Our proposed research model is presented in

Figure 1. In this model, we summarize all the findings from the previous literature. The decision to outsource services/deservitization is highly influenced by what type of services are offered: BAS—product-related or ADS—customer-related services. We hypothesized that, for basic services, more engagement with service providers will occur due to the high risk, or an inability (lack of knowledge or financial resources) to form their own service provision, which will tend to be deservitized in line with [

13]. As in [

13], we hypothesized that the service provider has a positive moderation effect on deservitization. On the other hand, manufacturers of complex products who also offer advanced services will tend to servitize; that is, the moderation effect of service providers on advanced services will be non-significant.

Accordingly, we hypothesized that:

Hypothesis 3 (H3). Providers of complex products who offer advanced services will tend to servitize, so the moderation effect of the service provider will be non-significant.

Hypothesis 4 (H4). Providers of non-complex products will tend to deservitize and the service provider has a positive moderation effect on deservitization.

Contextual variables play an important role in the model presented in

Figure 1. Böhm et al. [

17] find size of the company to be an important contextual factor (larger companies obtain better growth). Meanwhile, Ref. [

18] show that position in the value chain is an important contextual factor (the more downstream from the customer, the more the manufacturing company will tend to deservitize), and Ref. [

22] state that complexity and customization will have an important impact on servitization or deservitization decisions. In other words, the more complex and more customized the product, the more likely it is that the manufacturer has the knowledge and resources to servitize and, because of the threat of knowledge leaking, they will tend to do so.

The model is built according to the literature presented in the previous sections. Its aim is to prove or discard previous findings, as well as test for the proper theoretical lens.

Model 1 presented in

Figure 1 tests hypothesis H3: Providers of complex products who offer advanced services will tend to servitize, so the moderation effect of the service provider will be non-significant; and H4: Providers of non-complex products will tend to deservitize and the service provider has a positive moderation effect on deservitization, by adding a service provider as a moderator, as advised by the literature. Direct relationships in

Figure 1, from BAS and ADS to deservitization, are there to prove the first two hypotheses, H1: Providers of advanced services for complex products will tend to servitize; and H2: Providers of non-complex products will tend to deservitize. In Model 1, shown in

Figure 1, the hypothesized relationships are presented visually.

Two other models have been included: Model 2, in which the dependent variable is revenue growth (the dependent variable deservitize/outsource is replaced by the dependent variable revenue growth), designed to test whether service provision is even necessary to obtain growth, given that, according to [

17], servitization is not necessary for revenue growth but is caried out for strategic reasons in order to stay competitive; and Model 3, whose dependent variable is share of service revenues. This is included to test the proposal of [

13] to use the relational view, which argues that companies can achieve above-normal benefits when working in relationship with other companies. If this proposition is true, then Model 3 should be significant. If not, then the results are in line with the findings that provision of services is carried out to differentiate from the competition and not solely for financial gain.

4. Research Design and Methodology

The data for the present research were collected using the European Manufacturing Survey (EMS), coordinated by the Fraunhofer Institute for Systems and Innovation Research (ISI), the largest European survey of manufacturing activities [

32]. The questions in the survey cover topics such as manufacturing strategies, application of innovative organizational and technological concepts in production, cooperation issues, production offshoring, servitization and questions of personnel deployment and qualification. In addition, data on performance indicators such as productivity, flexibility, quality and returns are collected. The survey is conducted among manufacturing companies with at least 20 employees (NACE Revision 2 codes from 10 to 31). The EMS project researches the entire manufacturing sector through a condensed eight-page questionnaire. The questionnaire has 21 sections and covers technology, organizational concepts, innovation, servitization and other topics. To collect valid data that allow for international comparisons, the EMS consortium employs various procedures recommended by the Survey Research Centre, designed to avoid problems arising from the use of different languages and specific national terminology. First, a basic questionnaire is developed in English, which is then translated into each country’s respective language and back translated to English to check consistency. Second, pre-tests are conducted in each participating country. Third, identical data harmonization processes are applied [

33]. The sample was collected in 2015 and is made up of 296 companies: 105 companies from Croatia, 91 companies from Slovenia and 100 companies from Spain. These three countries were the only ones that included all the questions needed to conduct the present research.

Since we were dealing with three countries, we tested a potential sample bias using Levene’s test for equality of variances and a

t-test for the equality of means between early and late respondents for each sample. The results of these tests indicated no differences in means or variation between the two groups, consequently there was no evidence of a significant difference in the populations [

34]. Regarding the common method variance, techniques suggested by [

35] to reduce this risk were used. The order of the questions was such that it was hard for the respondent to directly associate the variables. Last, we calculated the Harman’s single-factor test with an exploratory factor analysis to address common method bias [

35] on joint three-country data. This test including all the independent and dependent variables resulted in a first factor that explained only 22% of the observed variance. Since there was no single factor accounting for most of the variance in the model, this test indicates that common method bias may not be a problem for the sample used.

4.1. Measures

For the purpose of this paper, several variables from the EMS questionnaire were used.

As dependent variables, we used:

As independent variables, we used:

- 2.

Services: measured by a dichotomous variable with a value of 1 if the company offered the service, and 0 otherwise. The services considered were:

- a.

Product-related services (BAS): (i) installation, start-up procedure; (ii) maintenance and repair; (iii) remote support

- b.

Customer-related services (ADS): (i) design/consulting/project planning; (ii) software development; (iii) revamping/modernization; (iv) end of life services.

- 3.

Service provider—dichotomous variable with a value of 1 if the company cooperates with a service provider and 0 otherwise.

- 4.

Complexity measured by a three-item scale, where 1 corresponds to simple products (for example, screws, one piece products); 2 refers to medium complexity products (for example, pumps, multi-part products with a simple structure); and 3 represents complex products (for example, machines or manufacturing systems, multi-part products with a complex structure and complex systems).

- 5.

Customization measured by a three-item scale, where 1—according to customer specifications—high customisation; 2—as a standard program with modifications implemented by customer specifications; 3—standard program from which customer chooses—no customization.

- 6.

Company size (number of employees).

- 7.

Position in the value chain—dichotomous variable, which is set to 1 if the manufacturer sells directly to the customer, if it is a supplier or if the company does not sell to the final customer.

- 8.

Revenue growth—measured as percentage increase/decrease in revenues in the past two years.

- 9.

Service revenues—measured as a share of total revenues generated by the services.

We included these last two variables for additional testing. Ref. [

17] used revenue growth as a dependent variable, so we tested the model to prove or discard their hypothesis that growth is more important the larger the company. In the third model, service revenue features as a dependent variable, whereas in most of the research service revenues are used as a dependent variable to measure servitization success and to test the proposal of [

13] to use the relational view, which argues that companies can achieve above-normal benefits when working in relationship with other companies.

4.2. Confirmatory and Exploratory Factor Analysis of Services

On reviewing the servitization literature, which is growing exponentially (see

Figure 1), it was seen that the division regarding what constitutes basic and advanced services has varied over time as technology has progressed. Therefore, we did a confirmatory factor analysis on the division proposed in the literature (for example [

3]). This was done in AMOS and the model fit of two constructs was good. However, in our view some of the services defined by [

3] as advanced were no longer so in 2019 (the time of writing this work). Therefore, we performed an exploratory factor analysis on the six researched services and the result was clear and robust. All five first services belong to basic services and only end-of-life service is in the advanced services category. We considered it more cutting edge to use the exploratory factor analysis results. Factor membership was stored for each data entry, which SPSS allows.

For the data analysis, we used ordinary least squares (OLS). To test the moderation effects, we standardized the independent and moderating variables using a mean-centering (Z-score), creating a multiplicative score for the interaction effect (multiplying the moderator by each independent variable). We tested to confirm the assumptions of normality, linearity and homoscedasticity for all independent and dependent variables using the residuals, plots of partial regression and plots of standardized residuals against the predicted value, respectively [

36]. All these tests confirmed the required assumptions for OLS regression models.

First, the control variables were entered to obtain the size of the effects of the contextual variables on outsourcing. In the next phase, all other independent variables (ADS, BAS) were introduced to detect which of the services is more prone to outsourcing. Before showing the results of the analysis, the sample is presented.

4.3. Descriptive Data

A total of 66% of the companies in our sample are servitized (meaning that they offer their customers at least one service). More precisely, 60% of Croatian manufacturing companies are servitized, while for Spain and Slovenia this figure is 58% and 82%, respectively. Even though Slovenia has a higher percentage of servitization, the Chi-Square Tests did not reveal significant differences among the distribution of servitized and unservitized companies.

Table 1 describes the distribution of NACE codes by countries. There appeared to be differences in the samples, but again the Chi-Square Tests showed non-significant differences.

Table 2 presents the companies’ share according to their size distribution in the three countries and in total. Once again, the Chi-Square Tests showed non-significant differences according to company size.

Regarding the level of service outsourcing, again there were differences, but likewise the Chi-Square Tests showed non-significant differences between proportions, even though around 50% of Slovenian companies provide services in-house, while almost 50% of Croatian and Spanish companies outsource services (deservitize), as presented in

Table 3.

5. Results

The output of the OLS regression is presented in

Table 4, computed in a two-step procedure. First, the control variables were introduced and then the independent variables of different types of services were added. The results of the three models are shown in

Table 4. Each has a different dependent variable, which are clearly marked in

Table 4 and were used to test the proposed hypotheses.

In the first model, the dependent variable was the level of outsourcing. To test the moderation effects, we standardized the independent and moderating variables using a mean-centering (Z-score), creating a multiplicative score for the interaction effect (multiplying the moderator by each independent variable). The procedure was repeated for the other two models, i.e., two additional dependent variables.

The results of Model 1 support the hypothesized model. The first control variable from the top of the table is size. We find that, the smaller the company, the more it outsources services (deservitizes), but not significantly. The researchers of [

17] state that size matters for growth (which is our Model 2). However, our results were not confirmed, so the sign of our beta coefficient is in agreement with [

17] in terms of the effect of size of the company. Furthermore, the coefficient is not significant and thus cannot be treated as a contextual variable, implying that configuration theory might not be the proper theoretical lens for studying servitization/deservitization effects. This result is not in accordance with [

17], who conclude that larger companies will tend to servitize and that contextual factors play a significant role.

Manufacturers of complex products (row 2 in

Table 4) tend to servitize because they have the knowledge to do so and to avoid knowledge leakage. This hypothesis is confirmed and is the only significant relationship.

Row 3—Customization seems to enhance deservitization, but not significantly. This is contrary to [

22], whose results show that, the more customized the product, the higher servitization is.

Row 4—Position in the value chain. The nearer the manufacturer is to the end customer, the more likely it is to provide the entire solution and be more servitized, in line with the proposal of [

18]. If the manufacturer is more downstream, it produces only a part of the final product and the more likely it is that it will need additional help with services in order to differentiate. Not having the know-how to servitize means that the manufacturer needs to outsource services, or to deservitize. However, the coefficient is not significant, meaning that the position in the value chain does not determine deservitization strategy.

The independent variables, ADS (advanced services) and BAS (basic services), are almost negligible and not significant. The sign of the beta coefficient indicates that ADS are less outsourced, meaning less deservitized, which is in line with the findings of [

13]. The same occurs with BAS services, the sign of the coefficient showing that they tend to be more outsourced, or deservitized.

The moderating variable, service provider, is a dichotomous variable. If the company cooperates in service provision, the non-significant coefficient is shown, which can be explained in that it is not the service provider that determines whether the company outsources/deservitizes. When the moderators are included, the results are completely in line with [

13]; that is, there is a moderation effect of the service provider for basic services, but there is a non-significant value for advanced services. Thus, hypotheses H3 and H4 are confirmed. The whole of Model 1 is significant, meaning that, indeed, some conclusions can be reached. The overall explanatory power of the model is good, with R

2 = 0.690 and adjusted R

2 = 0.419. If one takes a more restrictive view and takes Adjusted R2 as a meritory explanatory factor, then 42% of the changes in our independent variables explain the servitization outcome.

Model 2 is not significant, which was expected because there are so many more factors that explain a company’s revenue growth than just a few contingencies and services. This result is totally different from those of [

17], who state that size matters for growth regardless of servitization.

Model 3 is also non-significant, which is contrary to [

13]’s proposition of using the relational view, which argues that companies can achieve above-normal benefits. For example, provision of advanced services should generate more revenue for the company, especially for providers of complex solutions. However, if one goes back to how the advanced services were introduced in the model (only one service, because end-of-life service was in advanced services), then it is understandable that the sign is not significant. This is also a limitation of this study, because leasing, financing, renting, full-service contract services and the like should be in this variable. but are not. For completeness, we decided to show these results, which also demonstrate that all the other basic services do not significantly increase service revenues and are provided more to stay competitive than for financial reasons.

Summary of test of hypotheses:

Hypothesis 1—Explanation: Looking at row 2 of

Table 4, under complexity, for Model 1 it can be observed that the complexity of the product delivered does play an important role. In the ADS row, we see a negative Beta standardized coefficient, indicating that, indeed, the more advanced the service, the less companies tend to outsource/deservitize the offer; that is, they tend to servitize their offerings.

Hypothesis 2—Looking at the second row in

Table 4, where we find the complexity variable, we see a negative standardized Beta coefficient. This shows that, the lower the complexity of the product, the more the company will tend to outsource/deservitize.

Hypothesis 3—As can be seen in

Table 4 under Step 3, Interaction, the moderation effect for advanced services is indeed not significant; that is, there is no moderation effect for advanced services.

Hypothesis 4—As can be seen in

Table 4 under Step 3, Interaction, for basic services the moderation effect is indeed significant; that is, there is a moderation effect for basic services.

These results clearly show that smaller companies with fewer resources and companies producing non-complex products will tend to deservitize, purely due to lack of resources or for cost-effectiveness. On the other hand, companies offering advanced services tend to servitize, because they have more resources both in terms of manpower and physical resources, making them able to provide the entire advanced service. Providing advanced services is risky and only larger companies that are secure in their resources can do so. This is all in accordance with the resource-based view, which is mostly used in the servitization literature. The resource-/knowledge-based view also proposes that, if a company lacks resources (either static or dynamic), it will search the market to acquire these resources externally and thus deservitize. This means that companies that do not possess resources will look for them outside the boundaries of their company. Service revenues in Model 3 are not significant for any of the contextual variables or type of service, meaning that all companies servitize for strategic reasons and not for purely financial reasons, in accordance with the current literature.

The data, even if from the 2015 round of the survey, are still relevant today because the manufacturing sector, unlike the service sector (apart from suffering from shortages of primary inputs due to COVID), still shows a strong safe position, and servitization/deservitization that is usually conducted locally has not suffered from major supply chain disruptions.

6. Discussion

In this work, the KBV was used as the theoretical lens proposed by [

9] to explain the servitization and deservitization effect of a group of three Southern European countries. The main premise of the KBV and [

9], on the grounds of [

12], is that if a company does not possess the necessary knowledge, the manufacturing company will tend to outsource part of service provision. However, advanced services or customer-related services are less likely to be outsourced because the company already has the know-how and does not need external knowledge to provide services. Another benefit of not outsourcing service provision for complex products is knowledge leakage, raised by [

9]. This is entirely in line with the KBV view and is especially pronounced for complex products, which is a significant contextual variable. On the contrary, basic services, or product-related services, tend to be outsourced. The moderation effect of service providers is significant. This means that, for less complex products, cooperation with external partners occurs. This effect is not obtained for advanced services, probably because manufacturers of simple products do not even need to provide advanced services. The entire model is significant.

It is worth noting that, in our operationalization of advanced services, only one service, namely end-of-life services, connects to the field of sustainability and circular supply chains. This is fully in line with the KBV view and recent findings about servitization and sustainability, published by [

37] based on secondary data from 1413 manufacturing companies publicly listed in the USA, and finding a direct link between servitization and sustainability through the company’s knowledge resources. However, Ref. [

38] warns that especially complex product servitization is at high risk because of dependence on a large number of suppliers. Ref. [

39] explore barriers for implementing the circular economy through servitization, finding many obstacles despite a high rate of digitalization of manufacturing companies. Thus, it can be concluded that servitization (as we defined it) does support sustainability, supporting H3. Ref. [

17] hypothesize that, regardless of servitization, companies’ revenue growth is probably a consequence of more factors and their configuration, than just a few contingencies (Model 2). Meanwhile, and contrary to [

13]’s proposition of using the relational view, which argues that companies can achieve above-normal benefits with deservitization, Model 3 is also non-significant. This can be explained by two factors. First, provision of basic services is outsourced (deservitized) and thus the service provider generates the service revenue and not the manufacturing company. Second, and for advanced services, complex products tend to have a higher share of revenues by services. However, the insignificance of the model shows that no abnormal revenues are generated by servitization/deservitization.

7. Conclusions

The contribution of this work is its approach to servitization and deservitization from the KBV, which is only theoretically proposed by [

9]. The paper investigates the phenomenon of deservitization through the KBV and checks for the mediating effects of the service provider. In this work, we adopt the KBV view and propositions are empirically proven using a large European Manufacturing Survey database consisting of 296 cases from three Southern European countries: Spain, Slovenia and Croatia. We also analyze several streams of ground theories, the relation view, the resource advantage theory and the configurational theory [

17], but none of them are supported by our results. The contribution of this work is that it uses empirical results for the phenomenon (servitization/deservitization), which in the current literature is more usually investigated or attempted to be proven using case studies, thus filling the gap created by a lack of empirical studies on the topic. Furthermore, an increasing amount of the current servitization research shows that servitization is not straightforward, or in other words, that it only brings positive benefits. Deservitization is an emerging trend in both practice and research, appearing as a potential alternative to servitization. Another contribution of the paper is that it researches not only advanced services or advanced sectors, but also the low technology sectors, completely absent from the case study research.

The main implication for managers is that they should not be forced to servitize, because servitization might be dangerous if not carried out correctly [

3]. Rather, it is more sensible to cooperate with service providers for provision of services, which is done for competitive as opposed to financial reasons. Our results show that manufacturers of simple products tend to deservitize, while manufacturers of complex products tend to servitize. We found a mediation effect of service provider for simple products but not for complex products, in line with [

13]’s findings. We also found support in the current literature and this is proven through our H3, that in fact servitization does enhance sustainability and the circular economy. Furthermore, and on a conceptual note, deservitization could also contribute to sustainability when, for example, the provider of the outsourced service is a partner committed to and aligned with sustainable culture, operations and practices.

Our research has some limitations. One is that it is conducted on just three Southern European countries. Although our sample includes almost 300 manufacturing companies, the total number of some services may be slightly low. Because of this limited sample size, our regression model findings and interpretations must be treated with caution. Our results also cover all NACE C sectors, although some sectors had a lower number of responses. Nevertheless, it was our decision to cover the entire manufacturing industry and we firmly believe that our results are still a valuable contribution to the servitization and deservitization topic.

Based on these limitations, we suggest some potential directions for future research. A new round of the EMS survey is being executed in 2022, in which the questions on servitization have been enhanced and included in the core questionnaire for all participating countries. This will enable our results to be tested on a much more up-to-date and larger sample of manufacturing companies, including from the same and other countries. This fact will also facilitate a more in-depth analysis of servitization and deservitization in specific industries. Last, and most importantly, our research offers the possibility of covering a more longitudinal perspective on servitization and deservitization developments.