Sustainable Financing and Financial Risk Management of Financial Institutions—Case Study on Chinese Banks

Abstract

:1. Introduction

2. Development and Measurements of Chinese Banks’ Sustainable Financing and Financial Risk Management Effects

3. The Theoretical Reciprocal Causation Relationships of Banks’ Sustainable Financing and Financial Risk Management

- (1)

- Business opportunities and risky project prevention: Banks can increase market share and profitability by expanding sustainable financing activities for governments and investors. Investments in energy conservation, environmental protection, and strategic industries have rapidly developed. However, banks with more resource-oriented sustainable financing businesses can better resist the economic cycle, as most governments would promote sustainable financing policies to realize economic growth. Due to regulatory restrictions and budget constraints, banks could stop providing loans to industries with high pollution, higher energy consumption, and with an excess capacity; for example, steel, paper, aluminum, and flat glass industries.

- (2)

- New credit evaluation policies and evaluation efficiency: Banks’ sustainable financing activities may increase operational costs in the short run due to the implementation of new evaluation policies and time-gap for learning the new process and compliance with environmental policies and laws.

- (3)

- Corporate culture with risk management: This is an important part of internal control mechanism due to its behavioral standards that could help a bank to control risks and ensure steady development [47,48]. As projects under sustainable financing policies focus on government, banks with sustainable financing projects might acquire subsidies from the government; thus, justifying the need to improve risk management capacities while complying with sustainable financing requirements.

4. The Empirical Reciprocal Causation Relationships of Banks’ Sustainable Financing and Financial Risk Management

4.1. The Model

- (1)

- The difference between the proportions of banks’ sustainable financing in periods t and t − 1 is set as , and the difference between banks’ comprehensive financial risk management in periods t and t − 1 is set as . Thus, .

- (2)

- The vector of the exogenous control variable is set , where . is the difference in the banks’ asset size logarithms in periods t and t − 1, and its control reason is the differences in its financial impact based on the bank’s asset scale. is the difference in banks’ cost–income ratios in periods t and t − 1, where the cost–income ratio represents its operational capability. is the difference in GDP logarithms in periods t and t − 1, the impact of which differs depending on the economic cycle.

- (3)

- Γ is the lag operator and p is the lag order. Matrix A reflects the current interaction between and ; is the disturbance term of the reduced form; is the disturbance term of structural form; and the covariance matrix of is normalized as a unit matrix, assuming it follows a multi-dimensional normal distribution. B is a 2 × 2 matrix.

- (4)

- Under the condition of differences in endogenous variables, the fixed effect and invariant variables over time for each sample are effectively controlled. Thus, the AB-type SVAR model was constructed as follows:

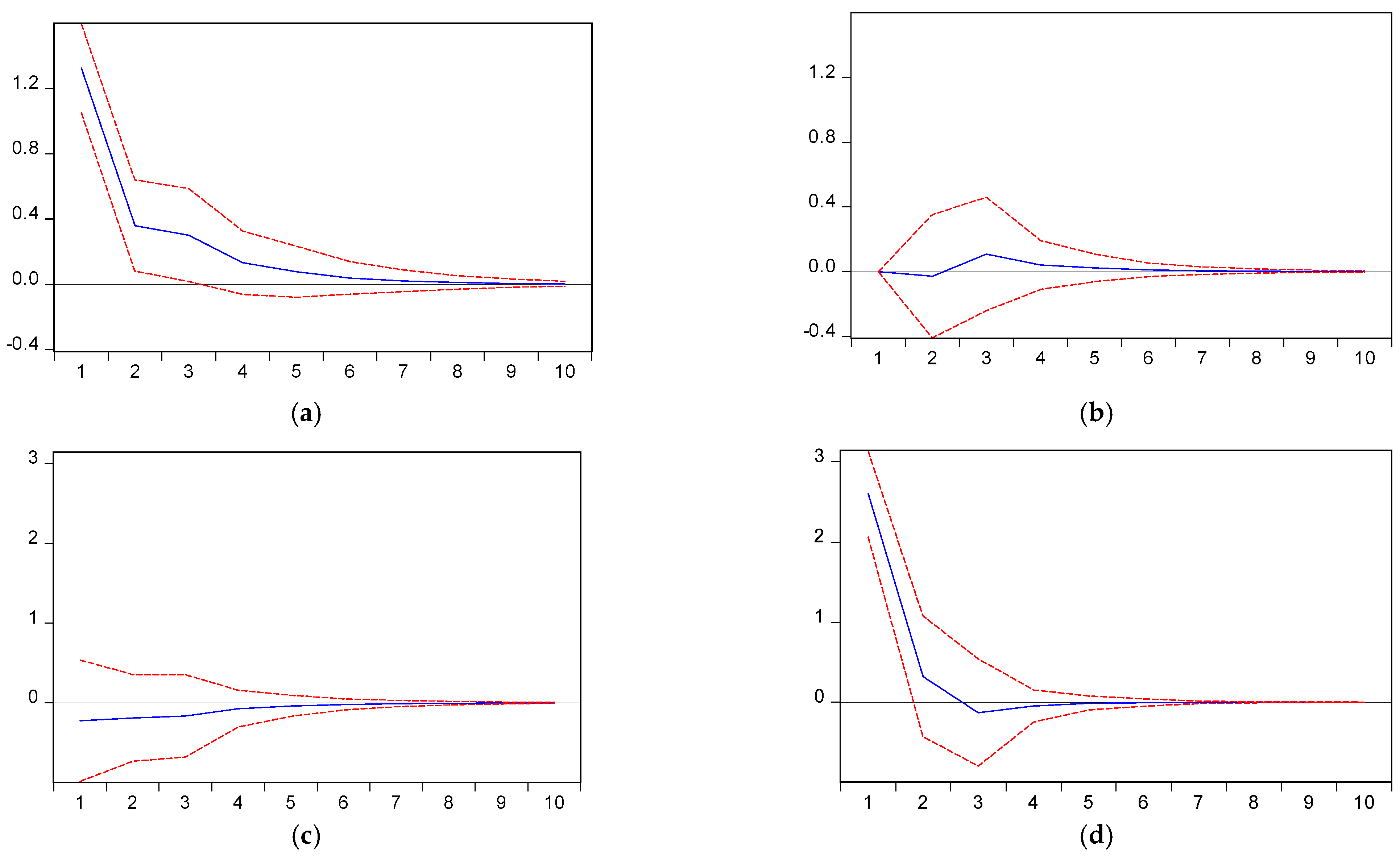

4.2. Empirical Results

4.3. Robustness Test

5. Discussion

- (1)

- There are no discussions on the importance of government regulations. Banking regulations and the government’s supervision of sustainable financing and financial risk management should play critical roles in realizing the objectives of sustainable financing and financial risk management. Smoleńska and van’t Klooster [53] proposed that regulators would face political choices of climate policies and micro-prudential framework for banks, and lawmakers would consider their issues of legality, legitimacy, and accountability.

- (2)

- The study does not discuss the target industry or enterprises for sustainable financing. Financial institutions can promote their financial risk management through their lending decisions and policies. Cheung et al. [54] argued that the barriers to sustainable financing are economic markets, political institutions, and socio-cultural behavior. Ascui et al. [55] suggested that financial institutions are indirectly exposed to risks due to their dependence on natural capital and ecosystem services.

- (3)

- The study does not discuss sustainable financing and financial risk management disclosure. The continuous and full disclosure of sustainable financing and financial risk management could improve banks’ sustainable development, as banks’ economic and financial disclosures are widely disclosed information, while environmental and risk management disclosures are relatively less disclosed Gunawan et al. [56] find that sustainability and green banking disclosures are important to the banking sector.

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kennet, M.; Heinemann, V. Green Economics: Setting the scene. Aims, context, and philosophical underpinning of the distinctive new solutions offered by Green Economics. IJGE 2006, 1, 68–102. [Google Scholar] [CrossRef]

- OECD. Interim Report of the Green Growth Strategy: Implementing Our Commitment for a Sustainable Future; OECD Publishing: Paris, France, 2010; pp. 1–90. Available online: https://www.oecd.org/greengrowth/45312720.pdf (accessed on 1 April 2021).

- OECD. Towards Green Growth; OECD Publishing: Paris, France, 2011; pp. 1–143. Available online: http://sostenibilidadyprogreso.org/files/entradas/towards-green-growth.pdf (accessed on 1 April 2021).

- Campiglio, E. Beyond Carbon Pricing: The Role of Banking and Monetary Policy in Financing the Transition to a Low-carbon Economy. Ecol. Econ. 2016, 121, 220–230. [Google Scholar] [CrossRef] [Green Version]

- European Commission. Commission Action Plan on Financing Sustainable Growth 2018. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52018DC0097 (accessed on 1 April 2021).

- Bauer, R.; Ruof, T.; Smeets, P. Get Real! Individuals Prefer More Sustainable Investments 2019. Available online: https://academic.oup.com/rfs/article/34/8/3976/6237929 (accessed on 1 April 2021).

- United Nations Framework Convention on Climate Change. The Paris Agreement 2015. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 1 April 2021).

- United Nations General Assembly. Transforming Our World: The 2030 Agenda for Sustainable Development (A/RES/70/1) 2015. Available online: https://www.un.org/ga/search/view_doc.asp?symbol=A/RES/70/1&Lang=E (accessed on 1 April 2021).

- Salazar, J. Environmental Finance: Linking Two World. In Proceedings of the Workshop on Financial Innovations for Biodiversity—10th Global Biodiversity Forum, Bratislava, Slovakia, 1–3 May 1998; pp. 2–18. [Google Scholar]

- Ahlstrm, H.; Monciardini, D. The Regulatory Dynamics of Sustainable Finance: Paradoxical Success and Limitations of EU Reforms. J. Bus. Ethics 2022, 177, 193–212. [Google Scholar] [CrossRef]

- Scholtens, B. Finance as a Driver of Corporation Social Responsibility. J. Bus. Ethics 2006, 68, 19–33. [Google Scholar] [CrossRef]

- Eccles, R.G.; Klimenko, S. The investor revolution. Harv. Bus. Rev. 2019, 97, 106–116. [Google Scholar]

- The Equator Principles Association. The Equator Principles July 2020 A Financial Industry Benchmark for Determining, Assessing, and Managing Environmental and Social Risk in Projects 2020. Available online: https://www.panda.org/wwf_news/?346755/Into-the-Wild-integrating-nature-into-investment-strategies (accessed on 1 April 2021).

- Ionescu, L. Corporate Environmental Performance, Climate Change Mitigation, and Green Innovation Behavior in Sustainable Finance. Econ. Manag. Financ. 2021, 16, 94–106. [Google Scholar]

- Ionescu, L. Transitioning to a Low-Carbon Economy: Green Financial Behavior, Climate Change Mitigation, and Environmental Energy Sustainability. Geopolit. Hist. Int. Relat. 2021, 13, 86–96. [Google Scholar]

- Climent, F.; Soriano, P. Green and good? The Investment Performance of US Environmental Mutual Funds. J. Bus. Ethics 2011, 103, 275–287. [Google Scholar] [CrossRef] [Green Version]

- Giese, G.; Lee., L.; Melas., D.; Nagy, Z.; Nishikawa, L. Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, and Performance. JPM 2019, 45, 69–83. [Google Scholar] [CrossRef]

- Liao, J.; Hu, W.; Yang, D. Dynamic Analysis of the Effect of Green credit on Bank Operating Efficiency-Based on Panel VAR Model. Collect. Essays Financ. Econ. 2019, 2, 57–64. [Google Scholar]

- Zhang, L.; Lian, Y. Green credit, Bank Heterogeneity, and Bank Financial Performance. Fin. Reg. Res. 2019, 2, 43–61. [Google Scholar]

- Kharlanov, A.S.; Bazhdanova, Y.V.; Kemkhashvili, T.A.; Sapozhnikova, N.G. The Case Experience of Integrating the SDGs into Corporate Strategies for Financial Risk Management Based on Social Responsibility (with the Example of Russian TNCs). Risks 2022, 10, 12. [Google Scholar] [CrossRef]

- Hu, R.; Zhang, W. Would the Profitability of Commercial Banks Be Affected Green credit? Financ. Regul. Res. 2016, 7, 92–110. [Google Scholar]

- Morales, L.; Gray, G.; Rajmil, D. Emerging Risks in the FinTech Industry—Insights from Data Science and Financial Econometrics Analysis. Econ. Manag. Financ. 2022, 17, 9–36. [Google Scholar]

- Landi, G.C.; Iandolo, F.; Renzi, A.; Rey, A. Embedding sustainability in risk management: The impact of environmental, social, and governance ratings on corporate financial risk. Corp. Soc. Responsib. Rnviron. Manag. 2022, 29, 1096–1107. [Google Scholar] [CrossRef]

- Popp, T.R.; Feindt, P.H.; Daedlow, K. Policy feedback and lock-in effects of new agricultural policy instruments: A qualitative comparative analysis of support for financial risk management tools in OECD countries. Land Use Policy 2021, 103, 105313. [Google Scholar] [CrossRef]

- Chakraborty, G. Evolving profiles of financial risk management in the era of digitization: The tomorrow that began in the past. J. Public Aff. 2019, 20, 2034. [Google Scholar] [CrossRef]

- Meyer, E.S.; Characklis, G.W.; Brown, C. Evaluating financial risk management strategies under climate change for hydropower producers on the Great Lakes. Water Resour. Res. 2017, 53, 2114–2132. [Google Scholar] [CrossRef]

- Ba, S.; Yang, C.; Yao, S. Review on the Research Progress of China’s Green Finance. J. Financial Serv. Res. 2018, 6, 3–11. [Google Scholar]

- Ma, J. On the Construction of China’s Green Finance System. Financ. Forum 2015, 20, 18–27. [Google Scholar]

- Lurie, N.; Keusch, G.T.; Dzau, V.J. Urgent Lessons from COVID-19: Why the World Needs a Standing, Coordinated System and Sustainable Financing for Global Research and Development. Lancet 2021, 397, 1229–1236. [Google Scholar] [CrossRef]

- Nandiwardhana, A.P.; Dan, C. A Sustainable Development Assessment of Indonesia’s State Banks Financing for the Industrial and Non-Industrial Sector. J. Sustain. Financ. Invest. 2022, 12, 894–911. [Google Scholar] [CrossRef]

- Huang, Z.; Liao, G.; Li, Z. Loaning Scale and Government Subsidy for Promoting Green Innovation. Technol. Forecast. Soc. Chang. 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Yuan, F.; Gallagher, K.P. Greening Development Lending in the Americas: Trends and Determinants. Ecol. Econ. 2018, 154, 189–200. [Google Scholar] [CrossRef]

- Vagin, S.G.; Kostyukova, E.I.; Spiridonova, N.E.; Vorozheykina, T.M. Financial Risk Management Based on Corporate Social Responsibility in the Interests of Sustainable Development. Risks 2022, 10, 35. [Google Scholar] [CrossRef]

- Mejia-Escobar, J.C.; González-Ruiz, J.D.; Duque-Grisales, E. Sustainable Financial Products in the Latin America Banking Industry: Current Status and Insights. Sustainability 2020, 12, 5648. [Google Scholar] [CrossRef]

- The Fourteenth Five-Year Plan for National Economic and Social Development of the People’s Republic of China and Its Outline of Long-Term Goals for 2035. 2021. Available online: http://www.gov.cn/xinwen/2021-03/13/content_5592681.htm (accessed on 1 April 2021).

- Chen, W.; Hu, D. An Analysis of the Functional Mechanism and Effect of Green credit on Industrial Upgrading. J. Jiangxi Univ. Financ. Econ. 2011, 4, 12–20. [Google Scholar]

- Su, D.; Lian, L. Does Green credit Policy Affect Corporate Financing and Investment? Evidence from Publicly Listed Firms in Pollution-Intensive Industries. J. Financ. Res. 2018, 12, 123–137. [Google Scholar]

- Miao, J.; Miao, J. Research on Environmental Risk Control in the Financing Process of Japanese Banks. Stds. Intl. Fin. 2008, 2, 10–16. [Google Scholar]

- Laeven, L.; Valencia, F. The Real Effects of Financial Sector Interventions During crises. JMCB 2013, 45, 147–177. [Google Scholar] [CrossRef]

- Boumparis, P.; Milas, C.; Panagiotidis, T. Nonperforming Loans and Sovereign credit Ratings. IFRA 2019, 64, 301–314. [Google Scholar]

- Masood, O.; Ghauri, S.M.K.; Aktan, B. Predicting Islamic Banks Performance through CAMELS Rating Model. Banks Bank Syst. 2016, 11, 37–43. [Google Scholar] [CrossRef] [Green Version]

- Wanke, P.; Azad, M.A.K.; Barros, C.P. Financial Distress and the Malaysian Dual Baking System: A Dynamic Slacks Approach. J. Bank. Financ. 2016, 66, 1–18. [Google Scholar] [CrossRef]

- Agrawal, S.; Meena, R.S. Financial Performance Appraisal of Indian Banks: A Comparative Study of BOB and HDFC Bank. PBR 2020, 13, 130–147. [Google Scholar]

- Sahyouni, A.; Zaid, M.; Adib, M. Bank Soundness and Liquidity creation. EMJB 2021, 16, 86–107. [Google Scholar] [CrossRef]

- Nguyen, H.; Dang, V.D. Bank-Specific Determinants of Loan Growth in Vietnam: Evidence from the CAMELS Approach. J. Asian Financ. Econ. Bus. 2020, 7, 179–189. [Google Scholar] [CrossRef]

- Kliestik, T.; Valaskova, K.; Lăzăroiu, G.; Kovacova, M.; Vrbka, J. Remaining Financially Healthy and Competitive: The Role of Financial Predictors. J. Compet. 2020, 12, 74–92. [Google Scholar] [CrossRef]

- Wu, S.; Chen, H.; Shao, X. Development and Enlightenment of Enterprise Internal Control Theory. Account. Res. 2000, 5, 2–8. [Google Scholar]

- Wang, Z.; Sui, M. Control Structure + Corporate Culture: A New Dualism of Internal Control Elements. Account. Res. 2010, 3, 28–35+96. [Google Scholar]

- Goes, C. Institutions and growth: A GMM/IV Panel VAR approach. Econ. Lett. 2016, 138, 85–91. [Google Scholar] [CrossRef]

- Esmaeili, P.; Rafei, M. Dynamics Analysis of Factors Affecting Electricity Consumption Fluctuations Based on Economic Conditions: Application of SVAR and TVP-VAR Models. Energy 2021, 226, 120340. [Google Scholar] [CrossRef]

- Kse, N.; Nal, E. The Effects of the Oil Price and Oil Price Volatility on Inflation in Turkey. Energy 2021, 226, 120392. [Google Scholar] [CrossRef]

- Sarwar, M.N.; Ali, S.; Hussain, H. Business Cycle Fluctuations and Emissions: Evidence from South Asia. J. Clean. Prod. 2021, 298, 126774. [Google Scholar] [CrossRef]

- Smoleńska, A.; Van‘t Klooster, J. A Risky Bet: Climate Change and the EU’s Microprudential Framework for Banks. J. Financ. Regul. 2022, 8, 51–74. [Google Scholar] [CrossRef]

- Cheung, H.; Baumber, A.; Brown, P.J. Barriers and enablers to sustainable finance: A case study of home loans in an Australian retail bank. J. Clean. Prod. 2022, 334, 130211. [Google Scholar] [CrossRef]

- Ascui, F.; Ball, A.; Kahn, L.; Rowe, J. Is operationalizing natural capital risk assessment practicable? Ecosyst. Serv. 2021, 52, 101364. [Google Scholar] [CrossRef]

- Gunawan, J.; Permatasari, P.; Sharma, U. Exploring sustainability and green banking disclosures: A study of banking sector. Environ. Dev. Sustain. 2022, 24, 11153–11194. [Google Scholar] [CrossRef]

- Ari, I.; Koc, M. Philanthropic-crowdfunding-partnership: A proof-of-concept study for sustainable financing in low-carbon energy transitions. Energy 2021, 222, 119925. [Google Scholar] [CrossRef]

- Reig-Mullor, J.; Brotons-Martinez, J.M.; Sansalvador-Selles, M.E. A Novel Approach to Improve the Bank Ranking Process: An Empirical Study in Spain. J. Intell. Fuzzy Syst. 2020, 38, 5323–5331. [Google Scholar] [CrossRef]

- Varga, J.; Bánkuti, G.; Kovács-Szamosi, R. Analysis of the Turkish Islamic Banking Sector Using Camel and Similarity Analysis Methods. Acta Oecon. 2020, 70, 275–296. [Google Scholar] [CrossRef]

| Year | Strategic Emerging Industries Loans | Energy Conservation and Environmental Protection Projects Loans | Total Loans |

|---|---|---|---|

| 2014 | 1.58 | 4.44 | 6.01 |

| 2015 | 1.69 | 5.32 | 7.01 |

| 2016 | 1.70 | 5.81 | 7.50 |

| 2017 | 1.76 | 6.53 | 8.30 |

| 2018 | - | - | 9.66 |

| 2019 | - | - | >10.00 |

| 2020 | - | - | 11.50 |

| First-Level Index | Second-Level Index | Calculation Formula | Regulatory Requirements (%) |

|---|---|---|---|

| Profitability | Return on total assets (ROA) | Net profit/average total assets | - |

| The weighted average return on equity (ROE) | Net profit/weighted average net asset | - | |

| Capital adequacy | Capital adequacy ratio (CAR) | Capital/risk-weighted assets | 10.5 |

| Tier 1 capital adequacy ratio (TCAR) | Tier 1 capital/risk-weighted assets | 8.5 | |

| Asset quality | Nonperforming loan ratio (NPLR) | Nonperforming loans /total loans | 5 |

| Performing Loan Ratio (PLR) | Loan impairment provision/nonperforming loans | 150 | |

| Liquidity | Liquidity ratio (LR) | Current assets/current liabilities | 25 |

| Loan-to-deposit ratio (LDR) | loans/deposits | 75 |

| GLP | ROE | CAR | NPLR | PLR | LR | LDR | |

|---|---|---|---|---|---|---|---|

| Mean | 5.33 | 17.49 | 12.73 | 1.22 | 251.67 | 46.88 | 72.28 |

| Median | 4.18 | 17.27 | 12.41 | 1.18 | 228.20 | 46.75 | 71.62 |

| Maximum | 30.22 | 27.41 | 17.52 | 2.65 | 524.08 | 75.07 | 109.45 |

| Minimum | 0.37 | 10.61 | 9.88 | 0.38 | 121.72 | 27.60 | 45.98 |

| Standard deviation | 5.10 | 3.66 | 1.58 | 0.46 | 94.33 | 9.55 | 11.26 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Huang, W. Sustainable Financing and Financial Risk Management of Financial Institutions—Case Study on Chinese Banks. Sustainability 2022, 14, 9786. https://doi.org/10.3390/su14159786

Liu H, Huang W. Sustainable Financing and Financial Risk Management of Financial Institutions—Case Study on Chinese Banks. Sustainability. 2022; 14(15):9786. https://doi.org/10.3390/su14159786

Chicago/Turabian StyleLiu, Hao, and Weilun Huang. 2022. "Sustainable Financing and Financial Risk Management of Financial Institutions—Case Study on Chinese Banks" Sustainability 14, no. 15: 9786. https://doi.org/10.3390/su14159786

APA StyleLiu, H., & Huang, W. (2022). Sustainable Financing and Financial Risk Management of Financial Institutions—Case Study on Chinese Banks. Sustainability, 14(15), 9786. https://doi.org/10.3390/su14159786