1. Introduction

Energy is the material basis for the development of human society and a strategic resource for economic development. Energy consumption is one of the driving forces of economic growth [

1]. Energy consumption reflects economic and social performance and, to some extent, can be considered a “simultaneous indicator” of the economic and social development of regions.

With the worldwide outbreak of the energy crisis in the 1970s, the importance of energy issues in economic development has become increasingly prominent, with most countries designating energy as an important strategic resource and incorporating it into their national security framework system [

2]. Taking the BRICs as an example, as the five developing countries that have attracted much attention in the world today, rapid economic development is the common feature of the BRICs countries [

3]. According to the World Economic Outlook released by the International Monetary Fund (IMF) in October 2021, the total GDP of the BRICs has increased to 31.2% in terms of purchasing power parity, accounting for nearly 1/3 of the global economy. However, the high-speed economic growth of BRICs is heavily dependent on energy consumption, research shows that the coal-oriented energy consumption structure is hard to reduce carbon emissions and improve its energy-environment efficiency. Energy-environment efficiency in Brazil is relatively higher and this country is the only one which possesses the higher GDP and the lower carbon emission among BRICS countries; India’s energy-environment efficiency is relatively stable and its average value is only higher than China [

4].

As for China, over the past 40 years of the reform and opening-up, China’s energy consumption has continued to increase and now ranks first in the world in terms of total energy consumption. In 2020, the total energy consumption was 4.98 billion tons of standard coal, up to 2.2% from 2019. In the future, China’s energy demand will continue to grow with the expansion of the economic volume and the improvement of people’s material living standards, resulting in an increasingly prominent energy shortage, which means there is a long way to go to optimize the energy structure. The greenhouse gas emissions and environmental pollution caused by the long-standing rough energy consumption pattern also pose a serious challenge to the improvement of China’s environmental quality [

5]. In current years, China’s energy-environment efficiency appears the ascent trend because of the reasonable implementation of energy saving and emission reduction policies and the deep exploitation of renewable energy. However, there are still dual pressures of energy resource shortage and environmental pollution in the optimization of the Chinese economic structure, and the energy consumption is becoming a constraint on the stage of high-quality development [

6].

Facing the deterioration of the ecological environment and the demand for global climate governance, BRICs have also put forward their own goals of carbon neutrality or net zero emission and formulated relevant policies [

7]. The Chinese government committed to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060 at the 75th Session of the United Nations General Assembly. The 12th Five-Year Plan has taken the development of a low-carbon economy as China’s new economic growth point. The development goals of the 14th Five-Year Plan proposed to improve the dual control of total energy consumption and intensity, accelerate the adjustment and optimization of industrial and energy structures, incorporate low-carbon development into macroeconomic governance—to eventually achieve a green transformation of production and lifestyle, as well as a rational allocation of energy resources [

7,

8]. The white paper “China’s Policies and Actions to Address Climate Change” proposes that China, as the world’s largest developing country, will do its utmost to address global climate change and explore a green and low-carbon development path that is consistent with China’s national conditions.

In this context, it is crucial to adjust the total amount and structure of energy consumption to match economic growth, environmental protection, and social development [

1]. China is a large country with a dualistic economic structure, and there are huge differences in regional economic development levels [

9]. In this context, the dependency between energy consumption and economic growth should be given constant attention. Therefore, from a spatial perspective, this paper quantifies the characteristics of energy consumption, economic growth, and the relationship between the two in each province, city, and autonomous region in China, trying to explore the impact and constraints of energy consumption on regional economic development.

This study’s main contributions are as follows: First, to fulfill the spatial correlation test, this paper uses exploratory spatial data analysis (ESDA). Specifically, we try to visually identify the spatial differences and agglomeration characteristics of energy consumption and economic growth in various regions of China through the spatial pattern map and Lisa agglomeration map, which integrate geographical factors into the research’s framework of traditional energy consumption and regional economic growth, enriches the relevant literature research, laying a foundation for empirical research. Second, a spatial lag model (SAR) is constructed to test the intraregional spillover effect and interregional spillover effect of China’s energy consumption on economic growth. In order to increase the reliability of the test results, the spatial regression in this paper is performed under the weighted adjacency matrix and the inverse distance weight matrix. Further, to fulfill the research objectives, a regression at the disaggregated level in terms of different types of energy consumption and the demographic and geographical characteristics of China is conducted.

The above research is expected to provide a theoretical basis for China’s total energy consumption control and the optimization of energy consumption structure, also provide support for government departments to seek effective ways of sustainable regional economic growth from the perspective of energy consumption.

The rest of the paper is organized as follows: In

Section 2, we offer a literature review.

Section 3 introduces the research methodology and models, explains the meaning of the indicators, and describes the data.

Section 4 conducts an empirical analysis of the spatial econometric model at both aggregated and disaggregated levels.

Section 5 presents research conclusions.

Section 6 presents policy recommendations.

2. Literature Review

In the 1970s, H.A. Merklein’s Energy Economics was published. At that time, the energy crisis broke out all over the world, which attracted the attention of academic circles to the relationship between energy and the economy. Since then, energy economics has officially sprung up as a new branch in the field of economics. Kraft J. and Kraft A. (1978) [

10] conducted a pioneering study on the relationship between energy consumption and economic growth, based on a bivariate Sims causality test on data from the United States for the period 1947–1974, which showed that there was a univariate causal relationship between GNP on energy consumption. However, the early empirical evidence was limited by the development of econometrics, and the test of causality between the two did not consider the stability of the data. With the development of econometrics, scholars began to apply error correction models to test the relationship between the two, and the object of causality tests was expanded from two single variables to multiple variables. Stern (1993) [

11] used the VAR model to conduct regression analysis on GDP, labor force, capital, and energy. It was found that there was no causal relationship between total energy consumption and GDP, but later, he used multiple dynamic cointegration analysis and single equation static cointegration analysis for further research and found that there was a long-term equilibrium relationship between them (2000) [

12].

Since the 21st century, the test of the relationship between the two has been expanded to take the standard panel unit root test, heterogeneity panel, cointegration test, and causal analysis as the framework, which enhances the reliability and effectiveness of the estimation results, so it is widely used. Lee (2005) [

13] first applied this method to test the GDP, energy consumption, and capital stock of 18 developing countries from 1965 to 2001. The result shows that there is a single causal relationship between energy consumption and economic growth in both the short and long term. Mahadevan et al. (2007) [

14] analyzed the energy consumption, GDP, and the price index of 20 net energy exporters and net importers from 1971 to 2002. The result showed that the causal relationship between energy consumption and economic growth was heterogeneous in developed and developing countries. Bao-Linh Tran et al. (2022) [

15] used the panel data of 26 OECD countries from 1971–2014 to investigate the threshold effect of GDP on the causality between GDP and energy consumption by using the threshold regression technique. The results showed that there is a threshold of GDP, and the impact of GDP on energy consumption and the direction of energy-growth causality depends on the initial value of GDP.

The research process on energy consumption and economic growth of China is basically similar to that in the world. Considering the diversification of China’s industrial structure–China is the only country with all industrial categories in the United Nations Industrial Classification, with large energy consumption and rapid growth. Therefore, there is more specific research on the relationship between the two.

In the study of the causality between energy consumption and economic growth of China, many scholars have established econometric models to study the Granger causality between energy consumption and economic growth, and the conclusions obtained are not consistent. Zhao Jinwen and Fan Jitao (2007) [

16] first used a non-linear STR model to study the relationship between energy consumption and economic growth in China and found that economic growth has a non-linear, asymmetric, and stage-specific impact on energy consumption. From a macro perspective, Yang Yiyong (2009) [

17] and Dai Xinying (2014) [

18] found that there is a long-term equilibrium between energy consumption and economic growth, which are Granger reasons for each other by using the error correction model. However, Yan Qiongwei (2011) [

19], Wang Xiuli (2014) [

20] and some other scholars concluded through their studies that there is only a one-way Granger cause of the two from energy consumption to economic growth. Chen Liming et al.(2020) [

21] used the MS-VAR model to study the dynamic relationship between GDP and energy consumption in China from 1980–2016, and concluded that there is an obvious asymmetry in the development trend between the two. The impact of energy consumption on economic growth shows different characteristics at different stages.

In the study of the relationship between energy consumption structure and economic growth, Mou Dunguo (2008) [

22] found that the Granger causes between different types of energy consumption and economic growth are different. Lin Boqiang (2003) [

23] added the factor of electricity consumption to the three-factor production function model, and the results of the study showed that there is a long-term equilibrium relationship between electricity consumption, capital, human capital and economic growth in China. Ma Chaoqun et al. (2004) [

24] found that there is no long-run equilibrium relationship between economic growth and oil and electricity, but Tian Xiaofei et al. (2008) [

25] came to exactly the opposite conclusion. Zhao Mengnan et al. (2008) [

26] conducted a study based on the time series of GDP growth and coal consumption in China over the period 1952–2006 and found a unidirectional causal relationship between coal consumption and economic growth. Xiong Jinhui et al. (2021) [

27] tried to use renewable energy consumption, CO2 emission, and GDP as the explanatory variables to explore the effect on economic development of energy expenditure and environmental pollution. They also explored the causal relationship between energy expenditure and environmental pollution, and discussed some feasible and advanced methods of production in the era of industry 4.0.

Most scholars use panel data to study the regional heterogeneity between energy consumption and economic growth, among which Wu Qiaosheng et al. (2008) [

28] divided China into East, Middle, and West, then used interprovincial panel data to test the relationship between the two and found significant regional heterogeneity. Li Qiang et al. (2013) [

29] used China’s interprovincial panel data from 1990 to 2011 to study the relationship between power consumption and economic growth. The results show that there is a two-way causal relationship between power consumption and economic growth in the short term, and this relationship is different in the eastern and western regions. Liang Jingwei et al. (2014) [

30] studied the relationship between China’s energy consumption and economic growth from the perspective of economic growth by using the two-zone Markov state transition model. The results show that the causality between the two is different due to different regional systems. There is a one-way Granger causality between energy consumption in moderate growth areas and a two-way Granger causality in rapid growth areas. Zhao Xianglian et al. (2012) [

31] established a spatial lag model and a spatial error model to explore the role of energy consumption in driving economic growth from a spatial-geographical perspective in the early stage of industrialization in China, and found that there was a positive correlation between most provinces, showing significant spatial clustering characteristics, but with significant regional differences. Cui Wencong et al. (2021) [

32] used the Multiscale Geographically Weighted Regression (MGWR) to analyze how industrial GDP and employment are related to industrial electricity consumption at the prefecture city level across China. The results proved that this relationship varied over space and time, with clear differences between the cities on the developed east coast and the rest of China.

To sum up, research results on the relationship between energy consumption and economic growth have emerged, but there is still room for expansion and deepening. The methods used by scholars to explore the relationship between energy consumption and economic growth mainly include cointegration tests, error correction models, panel models, and Granger causality tests, with few scholars taking into account geospatial factors in regressions. However, regressions using time series data cannot incorporate sample heterogeneity into the study, let alone consider the spatial spillover effect of the energy economy on economic growth. Further, econometric models using panel data, while incorporating sample heterogeneity, are all based on the assumptions of spatial independence and spatial homogeneity, unable to explore the spatial heterogeneity of variables [

33]. Therefore, based on the exploratory spatial data analysis method (ESDA) and the partial differential method of the spatial regression model, this paper takes 30 provincial units in China as the research objects and measures the spatial spillover effect of energy consumption on economic growth. To enrich the research conclusions, further research were conducted: (1) Research on different types of energy consumption; (2) Research on regional heterogeneity. Based on the research results, the corresponding policy suggestions are put forward to provide a decision-making basis for China’s future macro-control.

5. Conclusions

This paper takes 30 provincial units in China as the research object, constructs a spatial regression model containing multiple variables from a spatial perspective, and empirically measures the spatial spillover effect of energy consumption on economic growth by using the exploratory spatial data analysis method (ESDA) and the partial differential method of the spatial regression model. Moreover, spatial regression analysis is carried out for the differences in energy consumption types and regional heterogeneity to find the specific path of regional economic sustainable growth from the perspective of energy consumption. The brief conclusions are as follows:

- (1)

According to the spatial distribution pattern, it is found that energy consumption and GDP in each province of China show specific agglomeration characteristics, respectively. The distribution of the domestic energy consumption presents a spatial distribution pattern of high in the East and low in the West. In addition, the regional distribution of total economic output is also uneven. It is higher in the South and East but lower in the northern and western regions, which indicates unbalanced regional development. In terms of the correlation between energy consumption and GDP, the spatial agglomeration situation of energy consumption and GDP is similar to some extent. Some provinces along the southeast coast of China consistently rank among the top in both energy consumption and GDP, such as Shandong, Zhejiang, Jiangsu, and Guangdong;

- (2)

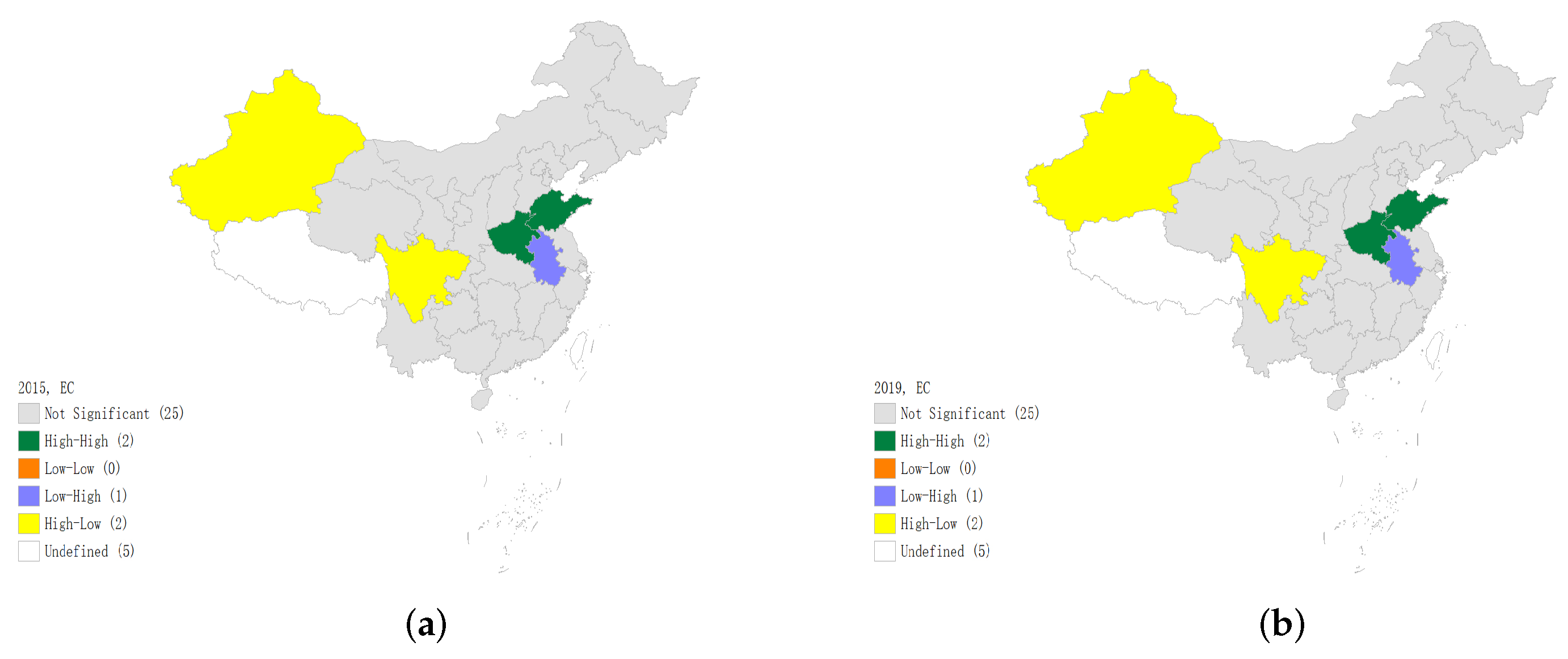

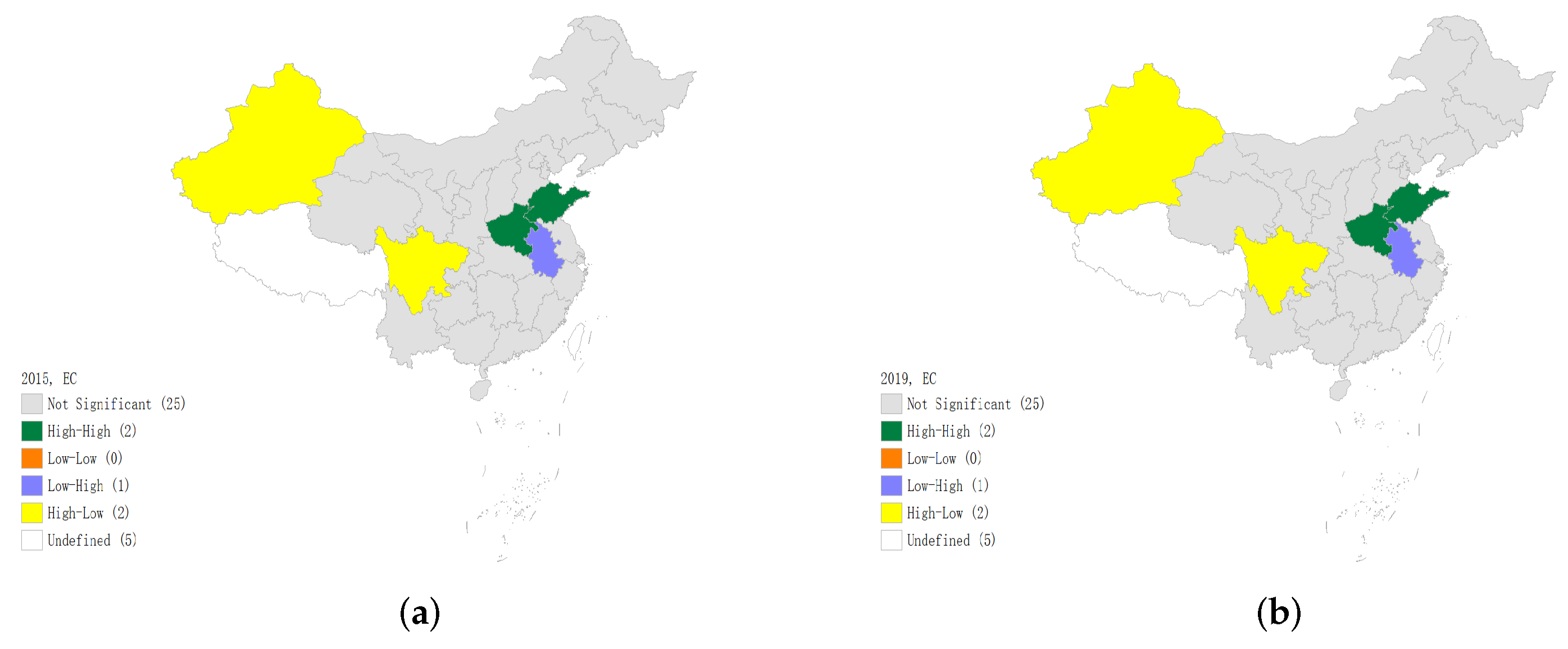

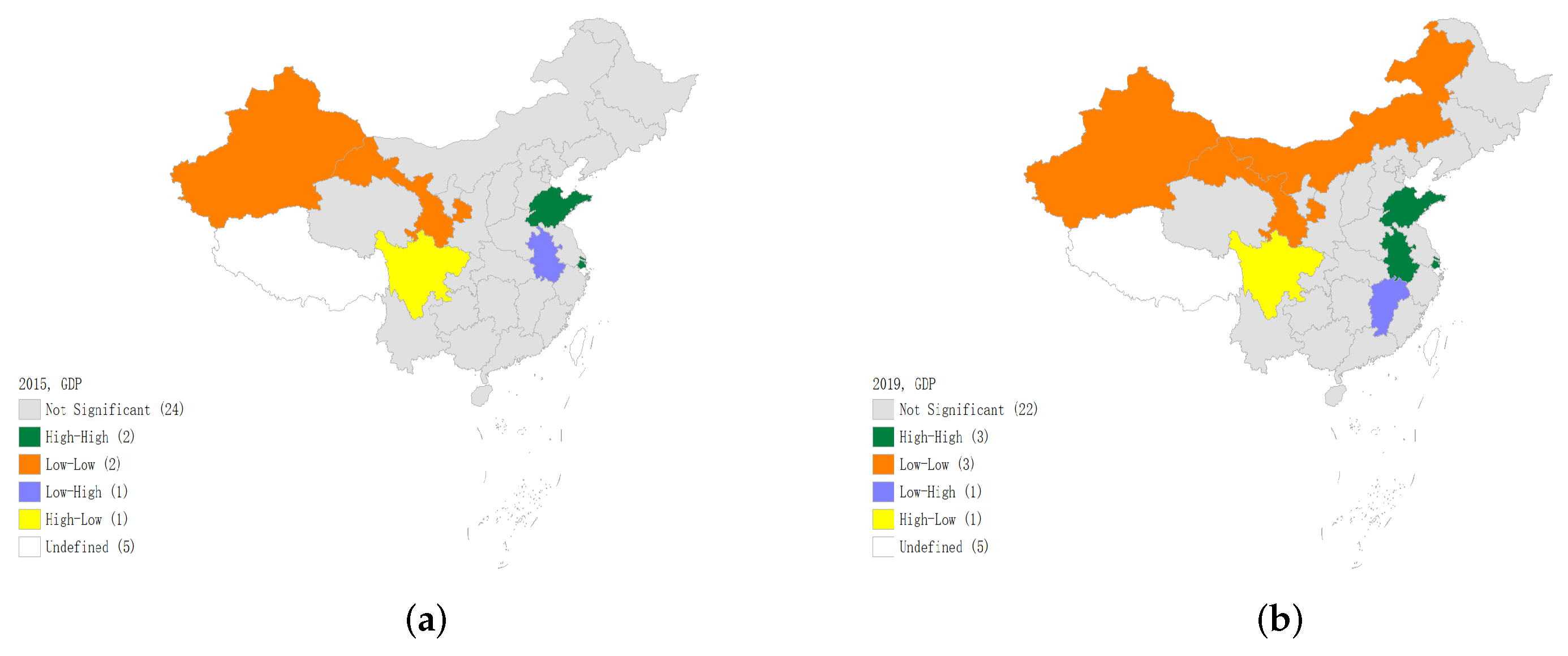

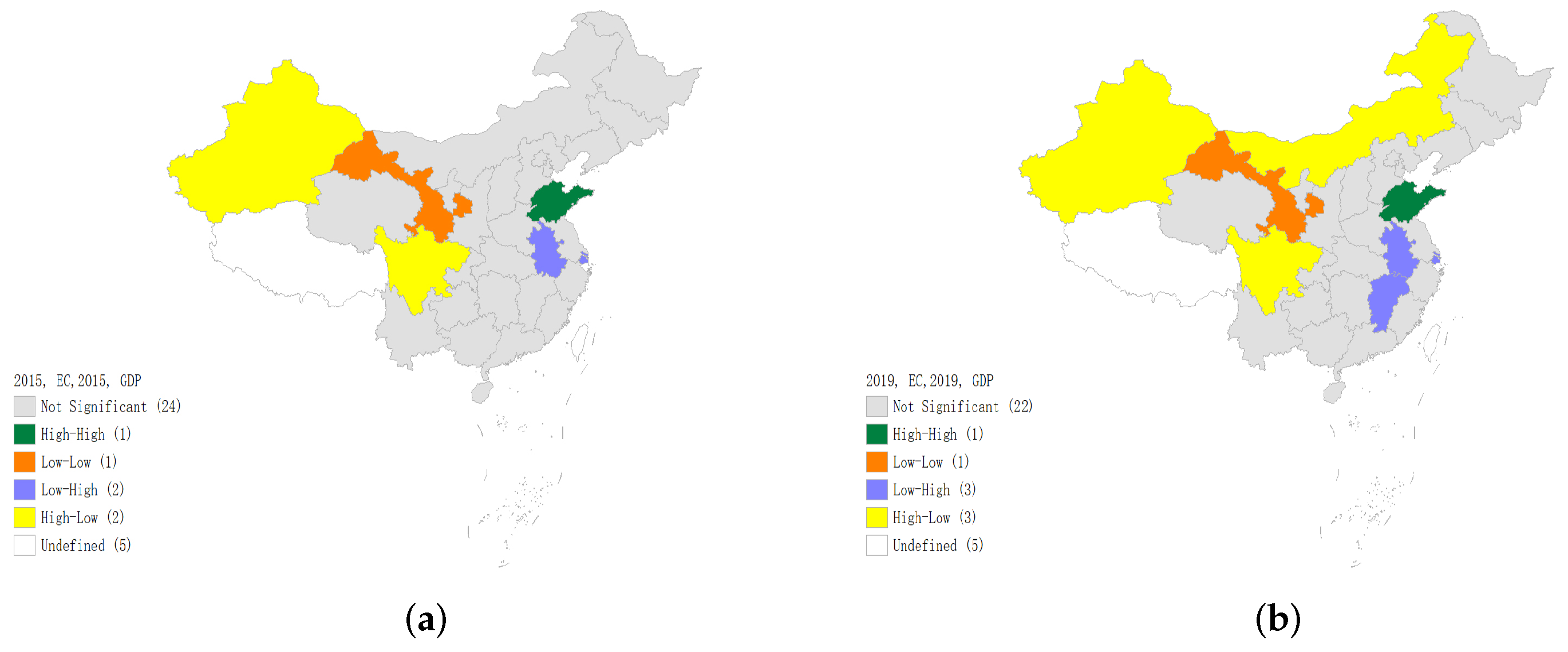

According to spatial correlation test, during the study period, a significant spatial autocorrelation can be witnessed obviously from the aspect of energy consumption and economic development level. Spatial agglomeration has a significant spillover effect, but regional differences in agglomeration types exist. In general, the spatial distribution of energy consumption and economic growth in China shows the agglomeration characteristics of high in the East and South but low in the West and North. Therefore, a particular region with high-value agglomeration forms generally, the core of which is situated in the Yangtze River Delta region and provinces in the middle and lower reaches of the Yangtze River Economic Belt. In the past five years, the spatial agglomeration effect of provinces with similar energy consumption weakened, while provinces with similar GDP levels have increased spatial agglomeration characteristics. As can be seen from the LISA agglomeration map, in terms of economic growth, the agglomeration scope of “high-high” agglomeration regions has been expanded over time. The economic center has been shifting to the central and southeast coastal regions gradually, the economic center has been shifting to the central and southeast coastal regions gradually, a core-periphery model has been formed with the eastern region as the core;

- (3)

According to the spatial regression analysis based on partial differential effect decomposition, energy consumption has a significant intraregional spillover effect on economic growth. However, the interregional spillover effects of energy consumption and other control variables differ on economic growth under different spatial weights. A tentative inference from this result is that the relative magnitudes of the “Backwash effect” and “Diffusion effect” differ in different regions. Combined with the Lisa agglomeration map, there is a “high-high” agglomeration in Sichuan and its surrounding areas, indicating a greater “Backwash effect” than the “Diffusion effect” of economic growth in the western region. On the contrary, the “Diffusion effect” of economic development in the eastern region is greater than the “Backwash effect”. In addition, according to the feedback effect, energy consumption could improve regional economic growth by taking a certain region as the center and driving the economic development of the surrounding areas;

- (4)

According to the research on different types of energy consumption, the consumption of coal, oil, natural gas, and electricity has a positive spillover effect on economic growth. Among them, oil ranks first in contributing to economic growth, followed by electricity, natural gas, and coal. However, coal consumption accounts for a high proportion of the energy structure, with a low contribution to economic growth. That indicates the possibility of changing China’s extensive economic growth that relies on factor input to high-quality development;

- (5)

According to the research on regional heterogeneity, China’s regional economic growth depends on energy consumption, geographical distribution, spatial population density, and urbanization. By relevant policies, 30 provincial units can be divided into three categories for regression tests: eastern and non-eastern, southern and northern, southeast and northwest of “Heihe–Tengchong Line”. It is found that the regions with higher economic development levels are more dependent on energy consumption in the southeast hinterland of China.

This paper systematically explores the energy consumption, economic growth, and the relationship between them of China’s 30 provinces, cities and autonomous regions, combined with spatial and geographical factors on the basis of ordinary panel regression. Actual situations that the direction, path and mode of action of spatial spillover effect may be different due to the individual differences of provincial units. However, the research on the spatial spillover effect of energy consumption on economic growth is based on the assumption that the spillover effects of different provincial units are the same. Therefore, the above issues deserve further exploration and research. Green mountains and clear water are equal to mountains of gold and silver. How to optimize and solve the coordinated development between energy consumption, economic growth, and the environment is an important topic that needs to be continuously studied and explored in the future of the world.