Government Participation in Supply Chain Low-Carbon Technology R&D and Green Marketing Strategy Optimization

Abstract

:1. Introduction

- How do consumers’ green preferences and government interventions affect the low-carbon innovation activities of enterprises within the supply chain?

- How do key model parameters, especially factors related to emission reductions and market demand, affect the optimal outcomes and contract decisions?

2. Literature Review

2.1. Supply Chain Emission Reduction

2.2. Consumer Low-Carbon Preferences and Market Demand

2.3. The Impact of Government Subsidy Policies on Supply Chain Construction

3. Parameter Description and Assumptions

4. Gaming Strategies without Government Subsidies

4.1. Fully Collaborative Decision Making

4.2. Nash Noncollaborative Decision Making

4.3. Retailer-Led R&D Cost-Sharing Decisions

5. Game Strategies for Government Involvement

5.1. Fully Collaborative Decision Making

5.2. Nash Noncollaborative Decision Making

5.3. Retail Companies Lead the Next Three Stages of R&D Incentive Decisions

5.4. Three-Stage R&D Incentive Decision under Manufacturing Company Domination

5.5. Analysis of Results

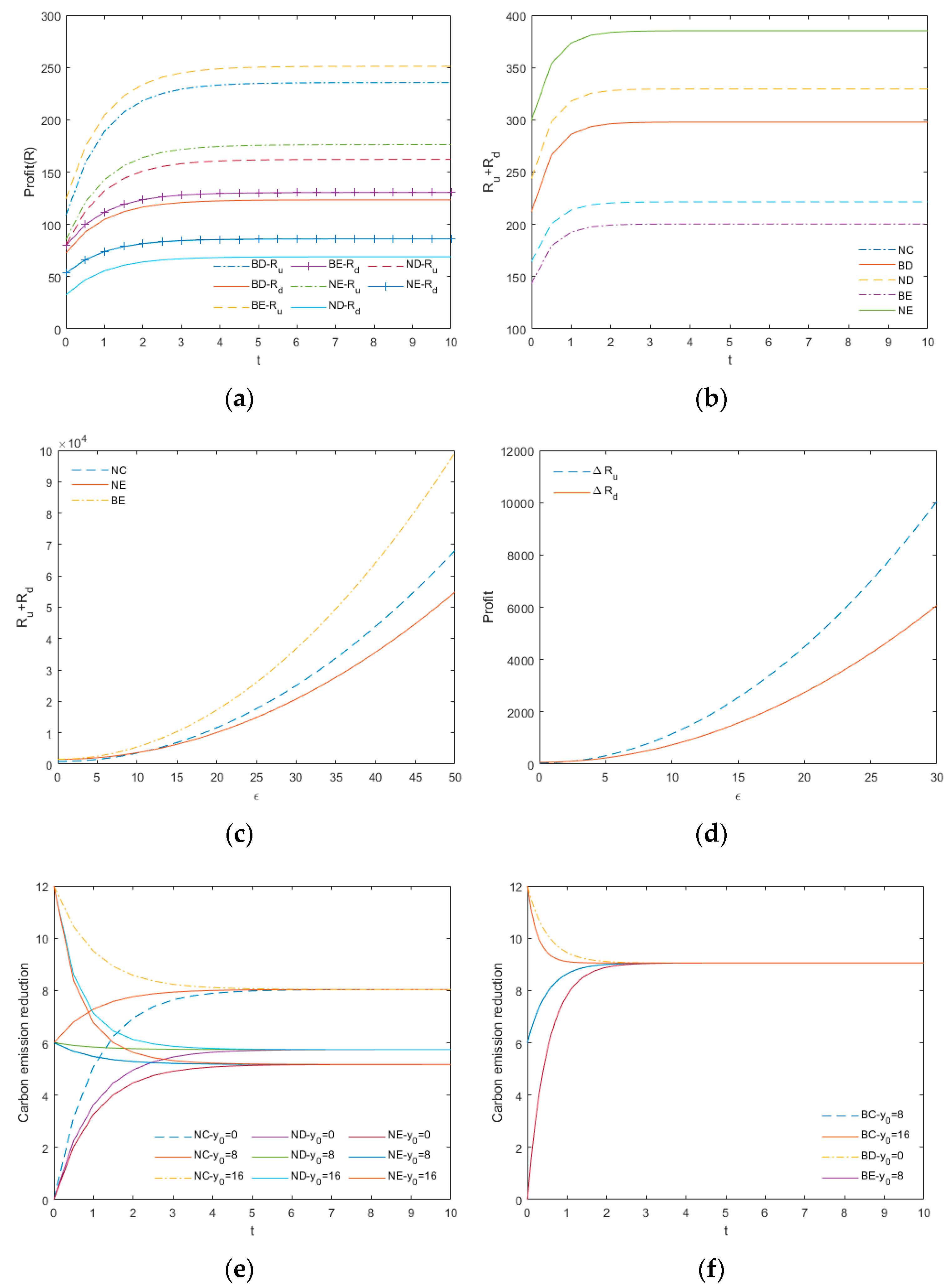

6. Example Analysis

7. Conclusions

- (1)

- The equilibrium coefficients of government subsidies provided to manufacturing and retail enterprises are closely related to their marginal returns. When the government participates in the game, the returns of both enterprises under the R&D incentive decision increase compared to those under the Nash noncooperative decision scenario, and the government subsidy policy also changes the optimal inputs of both enterprises. In addition, the stronger the sensitivity coefficient of market demand to the inputs of both enterprises, the better the effect of the government subsidy strategy on the overall revenue enhancement of the enterprises under the Nash noncooperative and R&D incentive decision scenarios.

- (2)

- Without government subsidies, the technological R&D investment, emission reduction, market demand, and overall corporate revenue of manufacturing enterprises are enhanced under retailer-led R&D incentive-based decision making, compared to the Nash noncooperative decision-making scenario, achieving a win–win situation for the supply chain and the environment. In addition, the relative size of the marginal revenue of manufacturing and retail enterprises has an important impact on their profits.

- (3)

- The effect of commodity emission reduction is influenced by multiple factors, such as the effect of the sensitivity coefficient of market demand on emission reduction and initial emission reduction, and its optimal trajectory shows a diversified trend of change. Compared with the Nash noncooperative decision scenario, the overall benefits of enterprises under the fully collaborative decision and R&D incentive decision scenarios are enhanced, and the net present value of the benefits of each subject is influenced by the specific allocation agreement. Although a regional voluntary negotiation strategy is considered an effective way to obtain the benefits of environmental improvement, in reality, this strategy faces difficulty in terms of achieving full cooperation across regions due to the constraints of information, technology, and policies. The development of scientific and reasonable horizontal technology R&D incentive contracts to balance the interests among enterprises is of great practical significance for the long-term cooperative management of water resource intensification in supply chains.

- (4)

- The government can develop differentiated subsidy programs based on different gaming strategies and benefit distribution agreements, combined with relevant parameters, to help manufacturing enterprises accelerate their development of resource-intensive production methods, help the retail sector create a better green market atmosphere, and improve the consumer recognition of emission-reducing products to enhance the effect of supply chain emission reduction.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F

References

- Chen, J.; Gao, M.; Mangla, S.K.; Song, M.; Wen, J. Effects of technological changes on China’s carbon emissions. Technol. Forecast. Soc. Chang. 2020, 153, 119938. [Google Scholar] [CrossRef]

- Hepburn, C.; Adlen, E.; Beddington, J.; Carter, E.A.; Fuss, S.; Mac Dowell, N.; Minx, J.C.; Smith, P.; Williams, C.K. The technological and economic prospects for CO2 utilization and removal. Nature 2019, 575, 87–97. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Toptal, A.; Ozlu, H.; Konur, D. Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 2014, 52, 243–269. [Google Scholar] [CrossRef]

- Bai, Q.; Chen, M.; Xu, L. Revenue and promotional cost-sharing contract versus two-part tariff contract in coordinating sustainable supply chain systems with deteriorating items. Int. J. Prod. Econ. 2017, 187, 85–101. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E.; Passaro, R.; Shashi, K. Determinants of the transition towards circular economy in SMEs: A sustainable supply chain management perspective. Int. J. Prod. Econ. 2021, 242, 108297. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, R.; Lv, B. Dual-Channel Green Supply Chain Decision-Making and Coordination considering CSR and Consumer Green Preferences. Discret. Dyn. Nat. Soc. 2021, 2021, 5301461. [Google Scholar] [CrossRef]

- Ji, J.; Zhang, Z.; Yang, L. Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Clean. Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Wang, Q.; Zhao, D.; He, L. Contracting emission reduction for supply chains considering market low-carbon preference. J. Clean. Prod. 2016, 120, 72–84. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Basiri, Z. Balancing price and green quality in presence of consumer environmental awareness: A green supply chain coordination approach. Int. J. Prod. Res. 2021, 59, 1957–1975. [Google Scholar] [CrossRef]

- Ma, J.; Yu, W.; Li, S.; Zhang, L.; Zang, S. The Green Product’s Pricing Strategy in a Dual Channel considering Manufacturer’s Risk Attitude. Complexity 2021, 2021, 6663288. [Google Scholar] [CrossRef]

- Xu, L.; Wang, C.; Zhao, J. Decision and coordination in the dual-channel supply chain considering cap-and-trade regulation. J. Clean. Prod. 2018, 197, 551–561. [Google Scholar] [CrossRef]

- Yang, H.; Chen, W. Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-sharing versus Cost-sharing. Omega-Int. J. Manag. Sci. 2018, 78, 179–191. [Google Scholar] [CrossRef]

- Zhou, Y.; Bao, M.; Chen, X.; Xu, X. Co-op advertising and emission reduction cost sharing contracts and coordination in low-carbon supply chain based on fairness concerns. J. Clean. Prod. 2016, 133, 402–413. [Google Scholar] [CrossRef]

- Cao, K.; Xu, X.; Wu, Q.; Zhang, Q. Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. J. Clean. Prod. 2017, 167, 505–513. [Google Scholar] [CrossRef]

- Chen, W.; Hu, Z.-H. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar] [CrossRef]

- de Jesus, A.; Mendonca, S. Lost in Transition? Drivers and Barriers in the Eco-innovation Road to the Circular Economy. Ecol. Econ. 2018, 145, 75–89. [Google Scholar] [CrossRef] [Green Version]

- Hawkins, T.R.; Singh, B.; Majeau-Bettez, G.; Stromman, A.H. Comparative Environmental Life Cycle Assessment of Conventional and Electric Vehicles. J. Ind. Ecol. 2013, 17, 53–64. [Google Scholar] [CrossRef]

- Kehrein, P.; van Loosdrecht, M.; Osseweijer, P.; Garfi, M.; Dewulf, J.; Posada, J. A critical review of resource recovery from municipal wastewater treatment plants—market supply potentials, technologies and bottlenecks. Environ. Sci. Water Res. Technol. 2020, 6, 877–910. [Google Scholar] [CrossRef] [Green Version]

- Mishra, U.; Wu, J.-Z.; Sarkar, B. A sustainable production-inventory model for a controllable carbon emissions rate under shortages. J. Clean. Prod. 2020, 256, 120268. [Google Scholar] [CrossRef]

- White, D.J.; Hubacek, K.; Feng, K.; Sun, L.; Meng, B. The Water-Energy-Food Nexus in East Asia: A tele-connected value chain analysis using inter-regional input-output analysis. Appl. Energy 2018, 210, 550–567. [Google Scholar] [CrossRef] [Green Version]

- Winans, K.; Kendall, A.; Deng, H. The history and current applications of the circular economy concept. Renew. Sustain. Energy Rev. 2017, 68, 825–833. [Google Scholar] [CrossRef]

- Xu, X.; Xu, X.; He, P. Joint production and pricing decisions for multiple products with cap-and-trade and carbon tax regulations. J. Clean. Prod. 2016, 112, 4093–4106. [Google Scholar] [CrossRef]

- Yenipazarli, A. Managing new and remanufactured products to mitigate environmental damage under emissions regulation. Eur. J. Oper. Res. 2016, 249, 117–130. [Google Scholar] [CrossRef]

- Mishra, U.; Wu, J.-Z.; Sarkar, B. Optimum sustainable inventory management with backorder and deterioration under controllable carbon emissions. J. Clean. Prod. 2021, 279, 123699. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Q.; Ji, J. Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int. J. Prod. Econ. 2017, 191, 286–297. [Google Scholar] [CrossRef]

- Li, B.; Zhu, M.; Jiang, Y.; Li, Z. Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 2016, 112, 2029–2042. [Google Scholar] [CrossRef]

- Adams, F.G.; Gabler, C.B.; Landers, V.M. The hiearchical resource nature of green logistics competency. J. Bus. Ind. Mark. 2021, 36, 1474–1485. [Google Scholar] [CrossRef]

- Deng, L.; Xu, W.; Luo, J. Optimal Loan Pricing for Agricultural Supply Chains from a Green Credit Perspective. Sustainability 2021, 13, 12365. [Google Scholar] [CrossRef]

- Li, Y.-H.; Huang, J.-W. The moderating role of relational bonding in green supply chain practices and performance. J. Purch. Supply Manag. 2017, 23, 290–299. [Google Scholar] [CrossRef]

- Ma, Z. Integration Characteristics and Architecture of Green Supply Chain Management. Nankai Bus. Rev. 2002, 5, 47–50. [Google Scholar]

- Bai, Q.; Xu, J.; Zhang, Y. Emission reduction decision and coordination of a make-to-order supply chain with two products under cap-and-trade regulation. Comput. Ind. Eng. 2018, 119, 131–145. [Google Scholar] [CrossRef]

- Daryanto, Y.; Wee, H.M.; Astanti, R.D. Three-echelon supply chain model considering carbon emission and item deterioration. Transp. Res. Part E-Logist. Transp. Rev. 2019, 122, 368–383. [Google Scholar] [CrossRef]

- Eggert, J.; Hartmann, J. Purchasing’s contribution to supply chain emission reduction. J. Purch. Supply Manag. 2021, 27, 100685. [Google Scholar] [CrossRef]

- Liu, Z.; Wu, Y.; Liu, T.; Wang, X.; Li, W.; Yin, Y.; Xiao, X. Double Path Optimization of Transport of Industrial Hazardous Waste Based on Green Supply Chain Management. Sustainability 2021, 13, 5215. [Google Scholar] [CrossRef]

- Long, Q.; Tao, X.; Shi, Y.; Zhang, S. Evolutionary Game Analysis Among Three Green-Sensitive Parties in Green Supply Chains. IEEE Trans. Evol. Comput. 2021, 25, 508–523. [Google Scholar] [CrossRef]

- Rong, L.; Xu, M. Impact of Altruistic Preference and Government Subsidy on the Multinational Green Supply Chain under Dynamic Tariff. Environ. Dev. Sustain. 2022, 24, 1928–1958. [Google Scholar] [CrossRef]

- Guo, F.; Foropon, C.; Xin, M. Reducing carbon emissions in humanitarian supply chain: The role of decision making and coordination. Ann. Oper. Res. 2020. [Google Scholar] [CrossRef]

- He, L.; Hu, C.; Zhao, D.; Lu, H.; Fu, X.; Li, Y. Carbon emission mitigation through regulatory policies and operations adaptation in supply chains: Theoretic developments and extensions. Nat. Hazards 2016, 84, S179–S207. [Google Scholar] [CrossRef]

- He, L.F.; Zhang, X.; Wang, Q.P.; Hu, C.L. Game theoretic analysis of supply chain based on mean-variance approach under cap-and-trade policy. Adv. Prod. Eng. Manag. 2018, 13, 333–344. [Google Scholar] [CrossRef] [Green Version]

- Toktas-Palut, P. An integrated contract for coordinating a three-stage green forward and reverse supply chain under fairness concerns. J. Clean. Prod. 2021, 279, 123735. [Google Scholar] [CrossRef]

- Liu, M.-L.; Li, Z.-H.; Anwar, S.; Zhang, Y. Supply chain carbon emission reductions and coordination when consumers have a strong preference for low-carbon products. Environ. Sci. Pollut. Res. 2021, 28, 19969–19983. [Google Scholar] [CrossRef]

- Peng, H.; Pang, T.; Cong, J. Coordination contracts for a supply chain with yield uncertainty and low-carbon preference. J. Clean. Prod. 2018, 205, 291–302. [Google Scholar] [CrossRef]

- Wang, Z.; Brownlee, A.E.I.; Wu, Q. Production and joint emission reduction decisions based on two-way cost-sharing contract under cap-and-trade regulation. Comput. Ind. Eng. 2020, 146, 106549. [Google Scholar] [CrossRef]

- Yang, M.; Wang, J. Pricing and green innovation decision of green supply chain enterprises. Int. J. Technol. Manag. 2021, 85, 127–141. [Google Scholar] [CrossRef]

- Wang, Z.; Wu, Q. Carbon emission reduction and product collection decisions in the closed-loop supply chain with cap-and-trade regulation. Int. J. Prod. Res. 2021, 59, 4359–4383. [Google Scholar] [CrossRef]

- Yu, B.; Wang, J.; Lu, X.; Yang, H. Collaboration in a low-carbon supply chain with reference emission and cost learning effects: Cost sharing versus revenue sharing strategies. J. Clean. Prod. 2020, 250, 119460. [Google Scholar] [CrossRef]

- Du, S.; Zhu, J.; Jiao, H.; Ye, W. Game-theoretical analysis for supply chain with consumer preference to low carbon. Int. J. Prod. Res. 2015, 53, 3753–3768. [Google Scholar] [CrossRef]

- Zhou, Y.; Ye, X. Differential game model of joint emission reduction strategies and contract design in a dual-channel supply chain. J. Clean. Prod. 2018, 190, 592–607. [Google Scholar] [CrossRef]

- Wang, J.; Feng, T. Supply chain ethical leadership and green supply chain integration: A moderated mediation analysis. Int. J. Logist.-Res. Appl. 2022. [Google Scholar] [CrossRef]

- Li, H.; Li, R.; Shang, M.; Liu, Y.; Su, D. Cooperative decisions of competitive supply chains considering carbon trading mechanism. Int. J. Low-Carbon Technol. 2022, 17, 102–117. [Google Scholar] [CrossRef]

- Yang, M.; Gong, X.-M. Optimal decisions and Pareto improvement for green supply chain considering reciprocity and cost-sharing contract. Environ. Sci. Pollut. Res. 2021, 28, 29859–29874. [Google Scholar] [CrossRef] [PubMed]

- Lampe, M.; Gazda, G.M. Green marketing in Europe and the United States: An evolving business and society interface. Int. Bus. Rev. 1995, 4, 295–312. [Google Scholar] [CrossRef]

- Peattie, K. Towards Sustainability: The Third Age of Green Marketing. Mark. Rev. 2001, 2, 129–146. [Google Scholar] [CrossRef]

- Blome, C.; Hollos, D.; Paulraj, A. Green procurement and green supplier development: Antecedents and effects on supplier performance. Int. J. Prod. Res. 2014, 52, 32–49. [Google Scholar] [CrossRef]

- Liao, X.; Shi, X. Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy 2018, 119, 554–562. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pujari, D.; Pontrandolfo, P. Green Product Innovation in Manufacturing Firms: A Sustainability-Oriented Dynamic Capability Perspective. Bus. Strategy Environ. 2017, 26, 490–506. [Google Scholar] [CrossRef]

- Farias, C.B.B.; Almeida, F.C.G.; Silva, I.A.; Souza, T.C.; Meira, H.M.; Soares da Silva, R.d.C.F.; Luna, J.M.; Santos, V.A.; Converti, A.; Banat, I.M.; et al. Production of green surfactants: Market prospects. Electron. J. Biotechnol. 2021, 51, 28–39. [Google Scholar] [CrossRef]

- Hong, Z.; Guo, X. Green product supply chain contracts considering environmental responsibilities. Omega-Int. J. Manag. Sci. 2019, 83, 155–166. [Google Scholar] [CrossRef]

- Li, P.; Rao, C.; Goh, M.; Yang, Z. Pricing strategies and profit coordination under a double echelon green supply chain. J. Clean. Prod. 2021, 278, 123694. [Google Scholar] [CrossRef]

- Nuttavuthisit, K.; Thogersen, J. The Importance of Consumer Trust for the Emergence of a Market for Green Products: The Case of Organic Food. J. Bus. Ethics 2017, 140, 323–337. [Google Scholar] [CrossRef]

- Zhou, Y.; Hu, F.; Zhou, Z. Study on joint contract coordination to promote green product demand under the retailer-dominance. J. Ind. Eng. Eng. Manag. 2020, 34, 194–204. [Google Scholar]

- Chelly, A.; Nouira, I.; Frein, Y.; Hadj-Alouane, A.B. On The consideration of carbon emissions in modelling-based supply chain literature: The state of the art, relevant features and research gaps. Int. J. Prod. Res. 2019, 57, 4977–5004. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X. Achieve a low carbon supply chain through product mix. Ind. Manag. Data Syst. 2017, 117, 2468–2484. [Google Scholar] [CrossRef] [Green Version]

- Ghosh, S.K.; Seikh, M.R.; Chakrabortty, M. Analyzing a stochastic dual-channel supply chain under consumers’ low carbon preferences and cap-and-trade regulation. Comput. Ind. Eng. 2020, 149, 106765. [Google Scholar] [CrossRef]

- Li, J.; Lai, K.K. The abatement contract for low-carbon demand in supply chain with single and multiple abatement mechanism under asymmetric information. Ann. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Duan, H.B.; Ying, F.; Lei, Z. What’s the most cost-effective policy of CO2 targeted reduction: An application of aggregated economic technological model with CCS? Appl. Energy 2013, 112, 866–875. [Google Scholar] [CrossRef]

- Nie, D.; Li, H.; Qu, T.; Liu, Y.; Li, C. Optimizing supply chain configuration with low carbon emission. J. Clean. Prod. 2020, 271, 122539. [Google Scholar] [CrossRef]

- Liu, C.; Zhou, Z.; Liu, Q.; Xie, R.; Zeng, X. Can a low-carbon development path achieve win-win development: Evidence from China’s low-carbon pilot policy. Mitig. Adapt. Strateg. Glob. Chang. 2020, 25, 1199–1219. [Google Scholar] [CrossRef]

- Liu, Y. Enacting a low-carbon economy: Policies and distrust between government employees and enterprises in China. Energy Policy 2019, 130, 130–138. [Google Scholar] [CrossRef]

- Shen, B.; Ding, X.; Chen, L.; Chan, H.L. Low carbon supply chain with energy consumption constraints: Case studies from China’s textile industry and simple analytical model. Supply Chain Manag.-Int. J. 2017, 22, 258–269. [Google Scholar] [CrossRef]

- Wang, M.; Wu, J.; Kafa, N.; Klibi, W. Carbon emission-compliance green location-inventory problem with demand and carbon price uncertainties. Transp. Res. Part E-Logist. Transp. Rev. 2020, 142, 102038. [Google Scholar] [CrossRef]

- Wang, Y.; Fan, R.; Shen, L.; Miller, W. Recycling decisions of low-carbon e-commerce closed-loop supply chain under government subsidy mechanism and altruistic preference. J. Clean. Prod. 2020, 259, 102038. [Google Scholar] [CrossRef]

- Ya, L.X. Dual mechanism network operation mode of carbon tax subsidy based on green supply chain management. J. Environ. Prot. Ecol. 2020, 21, 2194–2201. [Google Scholar]

- Han, Q.; Wang, Y.; Shen, L.; Dong, W. Decision and Coordination of Low-Carbon E-Commerce Supply Chain with Government Carbon Subsidies and Fairness Concerns. Complexity 2020, 2020, 1974942. [Google Scholar] [CrossRef]

- Ma, J.; Yi, T.; Liu, C. Studying the Complexity of Multichannel Supply Chain with Different Power Structures under Carbon Subsidy Policy. Int. J. Bifurc. Chaos 2021, 31, 2150166. [Google Scholar] [CrossRef]

- Li, X.; Li, Y. On green market segmentation under subsidy regulation. Supply Chain Manag. Int. J. 2017, 22, 284–294. [Google Scholar] [CrossRef]

- Halat, K.; Hafezalkotob, A.; Sayadi, M.K. Cooperative inventory games in multi-echelon supply chains under carbon tax policy: Vertical or horizontal? Appl. Math. Model. 2021, 99, 166–203. [Google Scholar] [CrossRef]

- Li, Q.; Xiao, T.; Qiu, Y. Price and carbon emission reduction decisions and revenue-sharing contract considering fairness concerns. J. Clean. Prod. 2018, 190, 303–314. [Google Scholar] [CrossRef]

- Liu, Z.; Lang, L.; Hu, B.; Shi, L.; Huang, B.; Zhao, Y. Emission reduction decision of agricultural supply chain considering carbon tax and investment cooperation. J. Clean. Prod. 2021, 294, 126305. [Google Scholar] [CrossRef]

- Lou, W.; Ma, J. Complexity of sales effort and carbon emission reduction effort in a two-parallel household appliance supply chain model. Appl. Math. Model. 2018, 64, 398–425. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J.; Dou, Y. Constructing a process model for low-carbon supply chain cooperation practices based on the DEMATEL and the NK model. Supply Chain Manag. Int. J. 2017, 22, 237–257. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Zhou, M. Firms’ green R&D cooperation behaviour in a supply chain: Technological spillover, power and coordination. Int. J. Prod. Econ. 2019, 218, 118–134. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Alizadeh-Basban, N.; Sarker, B.R. Coordinated contracts in a two-echelon green supply chain considering pricing strategy. Comput. Ind. Eng. 2018, 124, 249–275. [Google Scholar] [CrossRef]

- Wang, S.Y.; Choi, S.H. Pareto-efficient coordination of the contract-based MTO supply chain under flexible cap-and-trade emission constraint. J. Clean. Prod. 2020, 250, 119571. [Google Scholar] [CrossRef]

- Wang, Y.; Hou, G. How sticky information and members attitudes affects the co-innovate carbon emission reduction? J. Clean. Prod. 2020, 266, 121996. [Google Scholar] [CrossRef]

- Wang, Y.; Xu, X.; Zhu, Q. Carbon emission reduction decisions of supply chain members under cap-and-trade regulations: A differential game analysis. Comput. Ind. Eng. 2021, 162, 107711. [Google Scholar] [CrossRef]

- He, L.; Yuan, B.; Bian, J.; Lai, K.K. Differential game theoretic analysis of the dynamic emission abatement in low-carbon supply chains. Ann. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Huang, H.; He, Y.; Li, D. Pricing and inventory decisions in the food supply chain with production disruption and controllable deterioration. J. Clean. Prod. 2018, 180, 280–296. [Google Scholar] [CrossRef]

- Yi, Y.; Li, J. Cost-Sharing Contracts for Energy Saving and Emissions Reduction of a Supply Chain under the Conditions of Government Subsidies and a Carbon Tax. Sustainability 2018, 10, 895. [Google Scholar] [CrossRef] [Green Version]

- Yu, S.; Hou, Q. Supply Chain Investment in Carbon Emission-Reducing Technology Based on Stochasticity and Low-Carbon Preferences. Complexity 2021, 2021, 8881605. [Google Scholar] [CrossRef]

- Manteghi, Y.; Arkat, J.; Mahmoodi, A.; Farvaresh, H. Competition and cooperation in the sustainable food supply chain with a focus on social issues. J. Clean. Prod. 2021, 285, 124872. [Google Scholar] [CrossRef]

- Qiao, A.; Choi, S.H.; Wang, X.J. Lot size optimisation in two-stage manufacturer-supplier production under carbon management constraints. J. Clean. Prod. 2019, 224, 523–535. [Google Scholar] [CrossRef]

- Shi, X.; Chan, H.-L.; Dong, C. Value of Bargaining Contract in a Supply Chain System with Sustainability Investment: An Incentive Analysis. IEEE Trans. Syst. Man Cybern. Syst. 2020, 50, 1622–1634. [Google Scholar] [CrossRef]

- Wang, C.; Wang, W.; Huang, R. Supply chain enterprise operations and government carbon tax decisions considering carbon emissions. J. Clean. Prod. 2017, 152, 271–280. [Google Scholar] [CrossRef]

- Xu, X.; He, P.; Xu, H.; Zhang, Q. Supply chain coordination with green technology under cap-and-trade regulation. Int. J. Prod. Econ. 2017, 183, 433–442. [Google Scholar] [CrossRef]

- Zand, F.; Yaghoubi, S. Effects of a dominant retailer on green supply chain activities with government cooperation. Environ. Dev. Sustain. 2022, 24, 1313–1334. [Google Scholar] [CrossRef]

- Jørgensen, S.; Zaccour, G. Incentive equilibrium strategies and welfare allocation in a dynamic game of pollution control. Automatica 2001, 37, 29–36. [Google Scholar] [CrossRef]

| Literature | Cooperation in Supply Chain Emission Reduction | Consumer Low-Carbon Preference | Government Subsidies | Cost-Sharing Contracts |

|---|---|---|---|---|

| Halat, et al. [77,78,79,80,81,82] | √ | × | × | √ |

| [83,84,85,86,87,88] | √ | √ | × | √ |

| [13,25,89,90,91] | √ | × | × | × |

| [92,93,94,95,96] | √ | √ | × | × |

| This paper | √ | √ | √ | √ |

| Notation | Definition |

|---|---|

| Marginal revenue for manufacturers, retailers | |

| Commodity market demand | |

| R&D investment in abatement technology for manufacturing companies | |

| Green marketing input for retail companies | |

| Government subsidy factor for manufacturers, retailers | |

| Commodity emission reductions | |

| Cost factors for manufacturer and retailer inputs | |

| Sensitivity factor of emission reduction effect to input efforts of manufacturing companies | |

| Technical natural attenuation coefficient | |

| Sensitivity factor of market demand to the degree of commodity abatement | |

| Impact coefficient of green marketing on market demand in retail enterprises | |

| Demand at the initial moment of the market | |

| Emission reduction effect at the initial moment of the commodity | |

| Discount rate | |

| R&D incentive subsidies from retail to manufacturing companies | |

| Corporate revenue |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, N.; Deng, M.; Mou, H.; Tang, D.; Fang, Z.; Zhou, Q.; Cheng, C.; Wang, Y. Government Participation in Supply Chain Low-Carbon Technology R&D and Green Marketing Strategy Optimization. Sustainability 2022, 14, 8342. https://doi.org/10.3390/su14148342

Li N, Deng M, Mou H, Tang D, Fang Z, Zhou Q, Cheng C, Wang Y. Government Participation in Supply Chain Low-Carbon Technology R&D and Green Marketing Strategy Optimization. Sustainability. 2022; 14(14):8342. https://doi.org/10.3390/su14148342

Chicago/Turabian StyleLi, Nan, Mingjiang Deng, Hanshu Mou, Deshan Tang, Zhou Fang, Qin Zhou, Changgao Cheng, and Yingdi Wang. 2022. "Government Participation in Supply Chain Low-Carbon Technology R&D and Green Marketing Strategy Optimization" Sustainability 14, no. 14: 8342. https://doi.org/10.3390/su14148342

APA StyleLi, N., Deng, M., Mou, H., Tang, D., Fang, Z., Zhou, Q., Cheng, C., & Wang, Y. (2022). Government Participation in Supply Chain Low-Carbon Technology R&D and Green Marketing Strategy Optimization. Sustainability, 14(14), 8342. https://doi.org/10.3390/su14148342