Incumbent vs. New Firms’ Entry into an Innovative Niche Market: Electric Motorcycles in Italy, 2010–2021

Abstract

1. Introduction

2. Relevant Literature

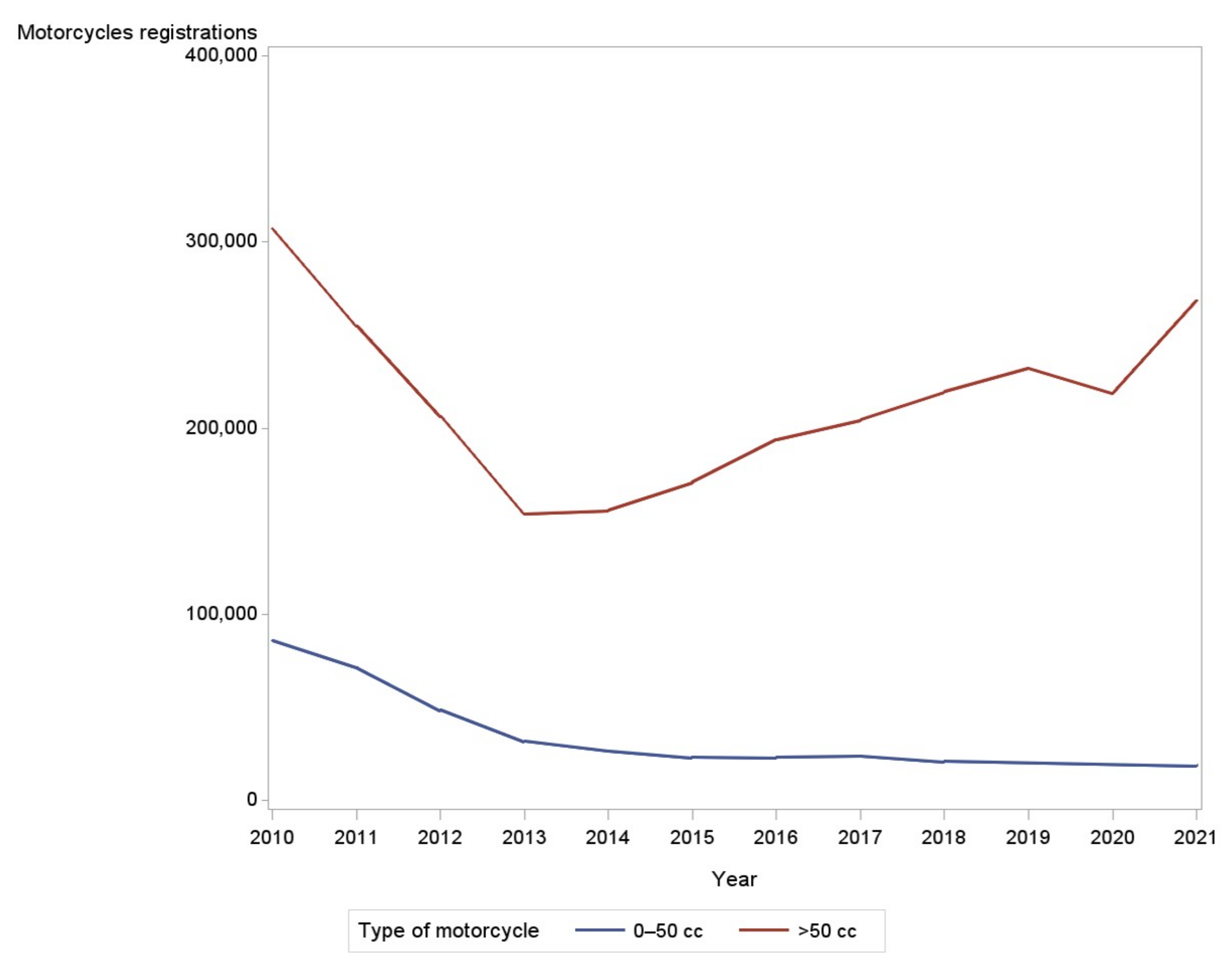

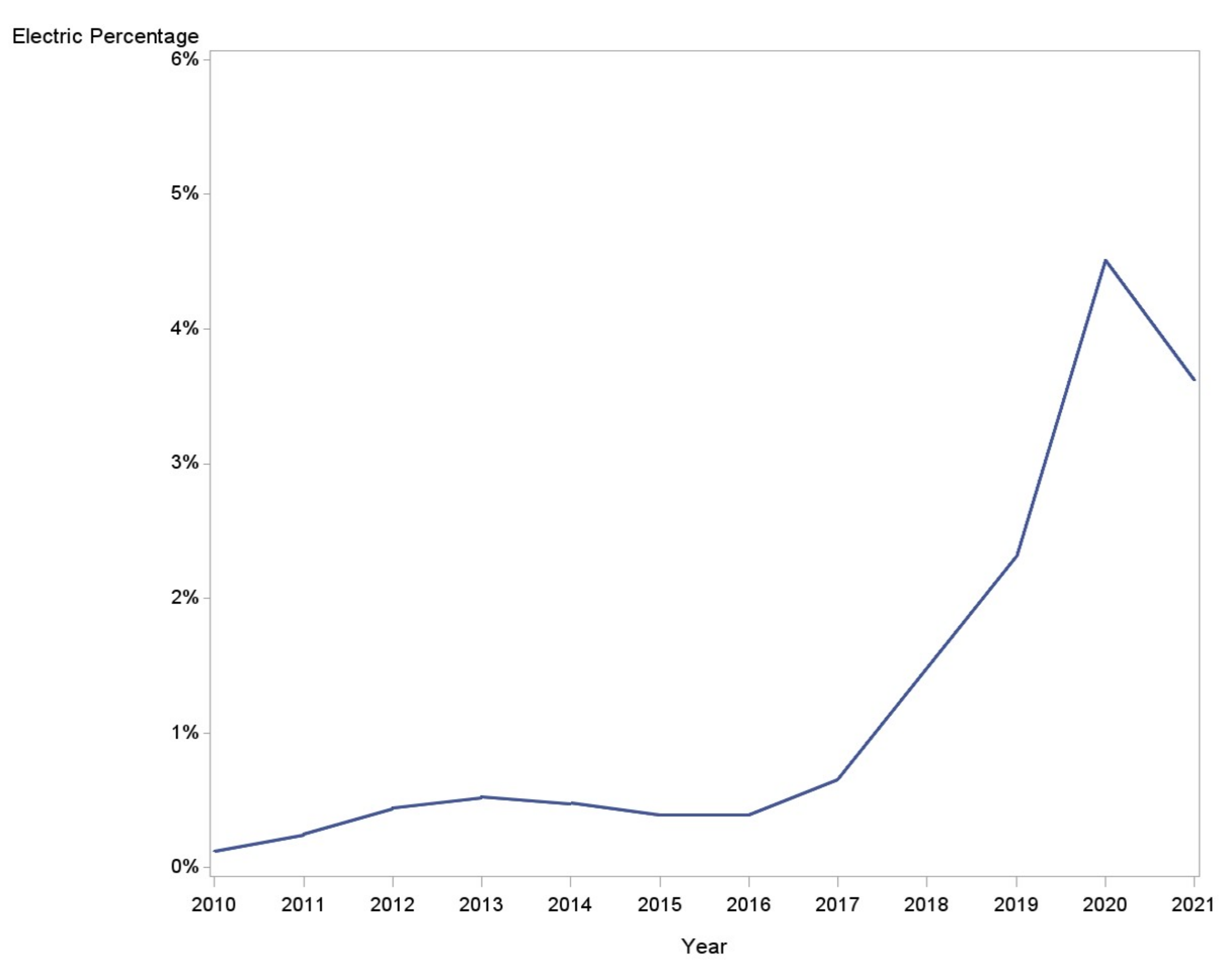

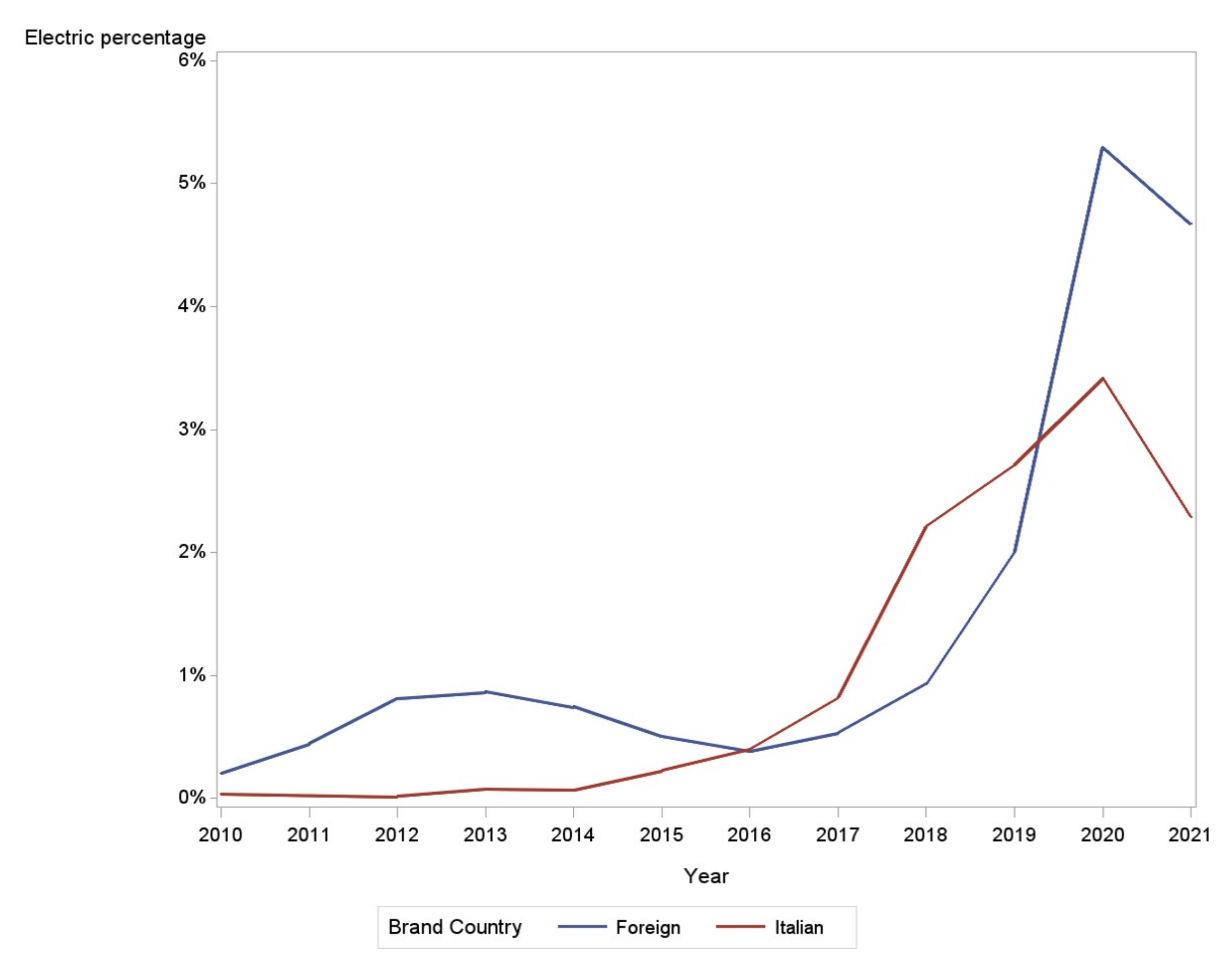

3. The Emergence of the Electric Motorcycle Market Niche in Italy

4. Data and Methods

5. Results

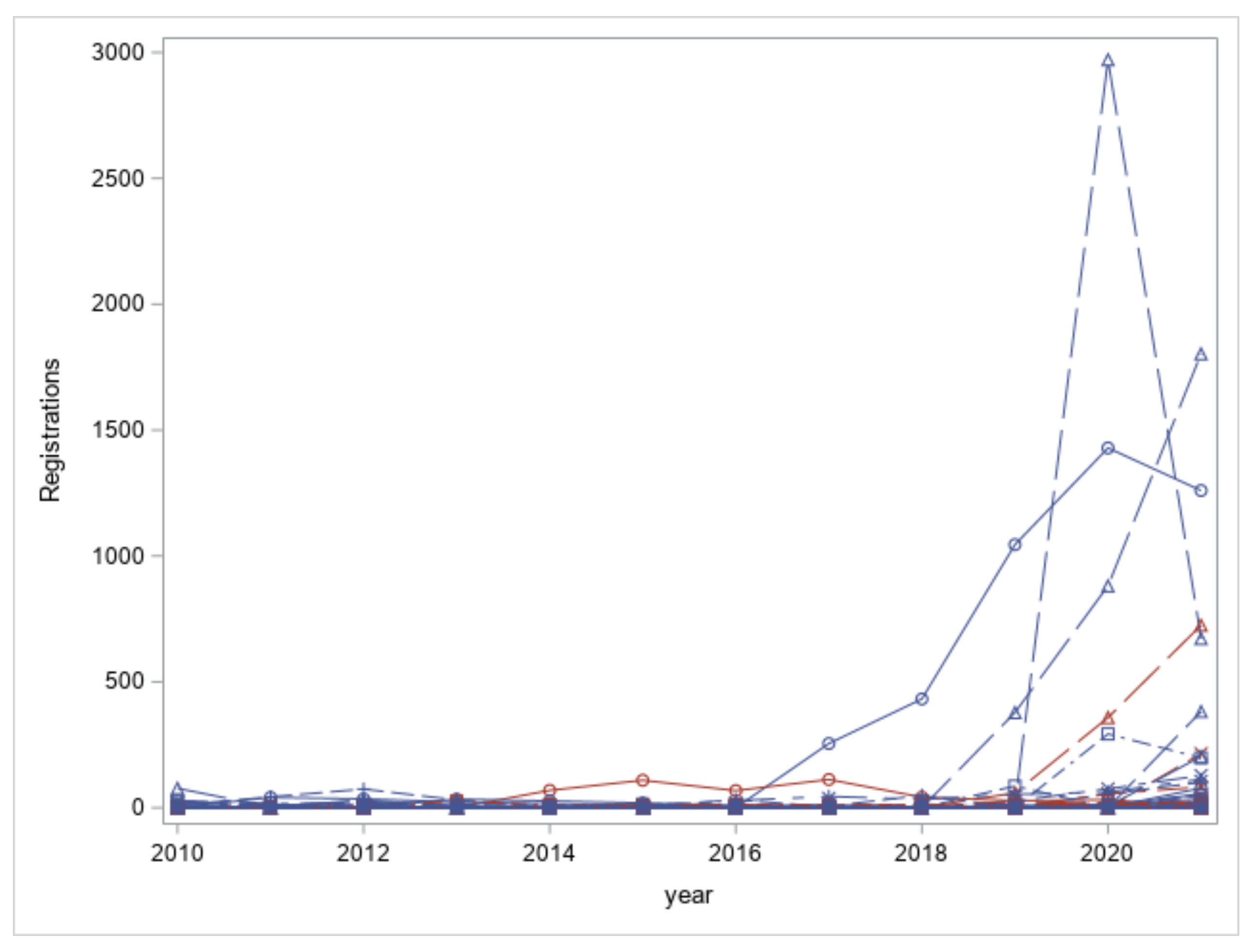

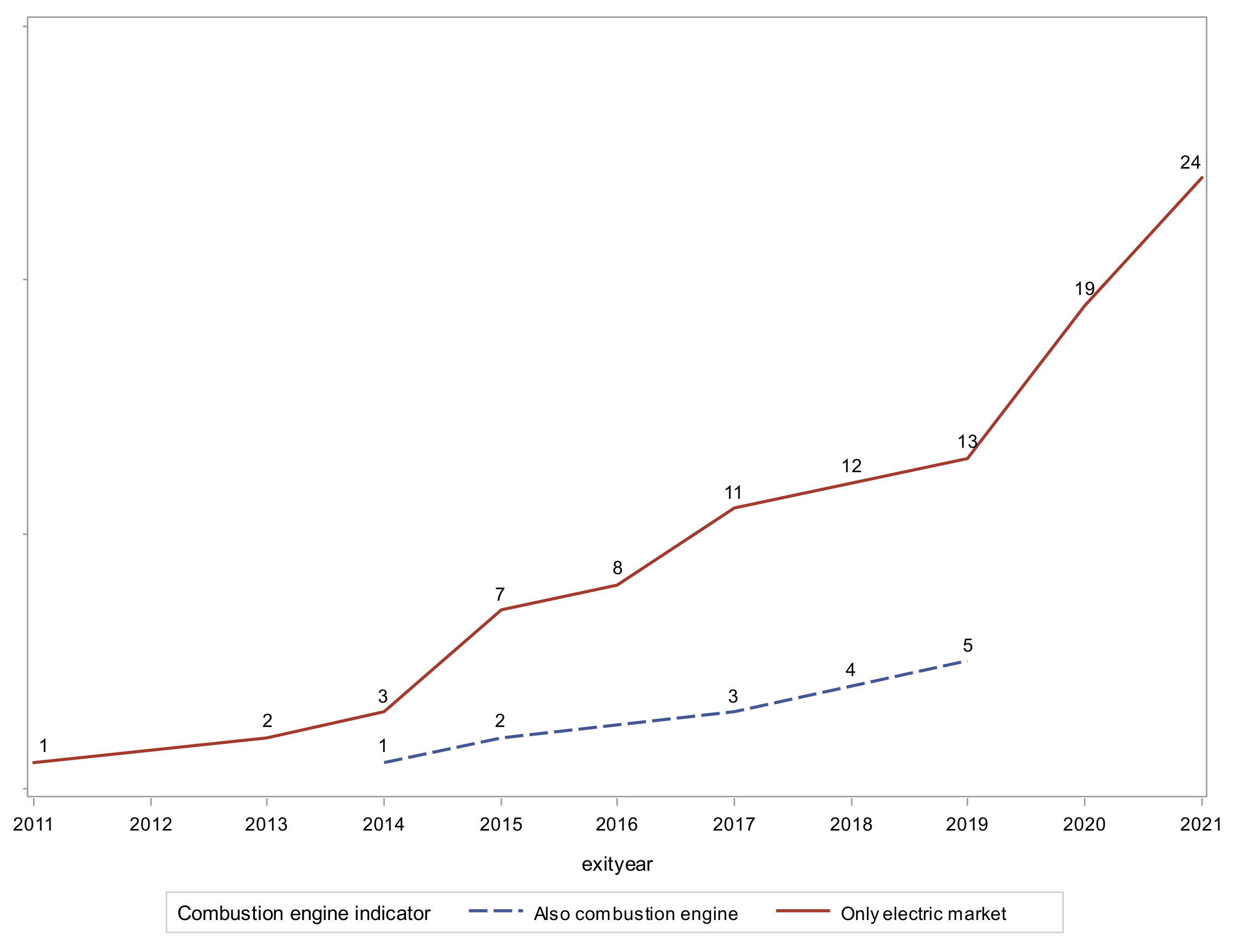

5.1. Descriptive Evidence

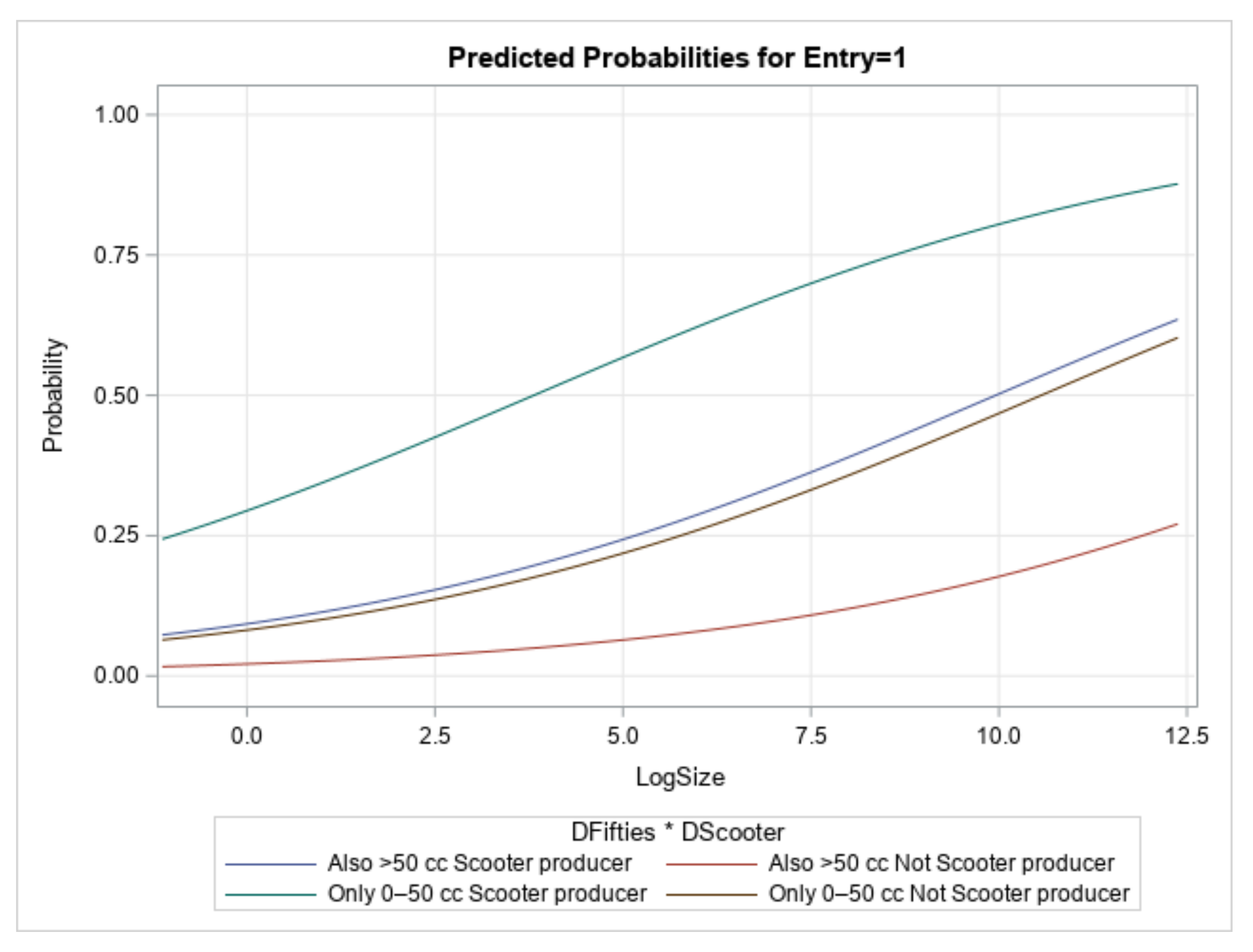

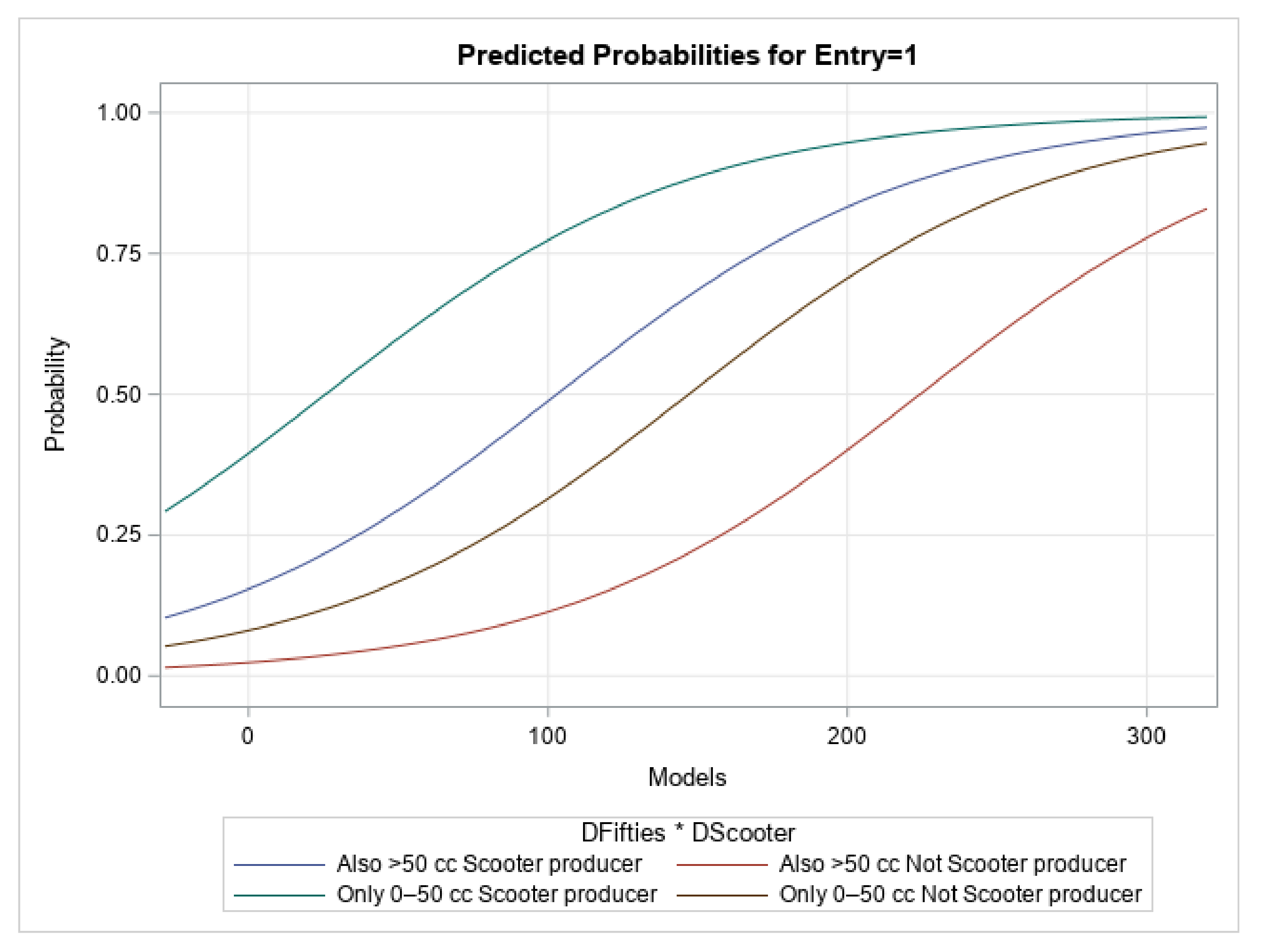

5.2. Econometric Analysis

6. Discussion

7. Conclusions, Limitations, and Further Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Debruyne, M.; Reibstein, D.J. Competitor See, Competitor Do: Incumbent Entry in New Market Niches. Mark. Sci. 2005, 24, 55–66. [Google Scholar] [CrossRef]

- Geels, F.W.; Hekkert, M.P.; Jacobsson, S. The dynamics of sustainable innovation journeys. Technol. Anal. Strateg. Manag. 2008, 20, 521–536. [Google Scholar] [CrossRef]

- Fichter, K.; Clausen, J. Diffusion Dynamics of Sustainable Innovation—Insights on Diffusion Patterns Based on the Analysis of 100 Sustainable Product and Service Innovations. J. Innov. Manag. 2016, 4, 30–67. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 10–11. [Google Scholar] [CrossRef]

- Klepper, S. Entry, Exit, Growth and Innovation over the Product Life Cycle. Am. Econ. Rev. 1996, 86, 562–583. [Google Scholar]

- Klepper, S.; Simons, K.L. Technological extinctions of industrial firms: An inquiry into their nature and causes. Ind. Corp. Chang. 1997, 6, 379–460. [Google Scholar] [CrossRef]

- Klepper, S.; Simons, K.L. The making of an oligopoly: Firm survival and technological change in the evolution of the US tire industry. J. Polit. Econ. 2000, 108, 728–760. [Google Scholar] [CrossRef]

- Hannan, M.T.; Freeman, J. Structural Inertia and Organizational Change. Am. Sociol. Rev. 1984, 49, 149–164. [Google Scholar] [CrossRef]

- Christensen, C.M.; Rosenbloom, R.S. Explaining the attacker’s advantage: Technological paradigms, organizational dynamics, and the value network. Res. Policy 1995, 24, 233–257. [Google Scholar] [CrossRef]

- Greve, H.R. Patterns of competition: The diffusion of a market position in radio broadcasting. Adm. Sci. Q. 1996, 41, 29–61. [Google Scholar] [CrossRef]

- Christensen, C.M. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail; Harvard Business School Press: Boston, MA, USA, 1997. [Google Scholar]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Bohnsack, R.; Pinkse, J.; Kolk, A. Business Models for Sustainable Technologies: Exploring Business Model Evolution in the Case of Electric Vehicles. Res. Policy 2014, 43, 284–300. [Google Scholar] [CrossRef]

- King, A.A.; Tucci, C.L. Incumbent Entry into New Market Niches: The Role of Experience and Managerial Choice in the Creation of Dynamic Capabilities. Manag. Sci. 2002, 48, 171–186. [Google Scholar] [CrossRef]

- Figueiredo, J.M.; Silverman, B.S. Churn, Baby, Churn: Strategic Dynamics Among Dominant and Fringe Firms in a Segmented Industry. Manag. Sci. 2007, 53, 632–650. [Google Scholar] [CrossRef]

- Gang, K. The impact of pre-entry experiences on entry decisions and firm survival. Technol. Forecast. Soc. Chang. 2018, 137, 249–258. [Google Scholar] [CrossRef]

- Dyerson, R.; Pilkington, A. Expecting the Unexpected: Disruptive Technological Change Processes and the Electric Vehicle, International. J. Innov. Technol. Manag. 2004, 1, 165–183. [Google Scholar] [CrossRef]

- Bohnsack, R.; Pinkse, J. Value Propositions for Disruptive Technologies: Reconfiguration Tactics in the Case of Electric Vehicles. Calif. Manag. Rev. 2017, 59, 79–96. [Google Scholar] [CrossRef]

- Schumpeter, J. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1934. First published in 1912. [Google Scholar]

- Schumpeter, J. Capitalism, Socialism and Democracy; Harper Brothers: New York, NY, USA, 1942. [Google Scholar]

- Winter, S. Schumpeterian Competition in Alternative Technological Regimes. J. Econ. Behav. Organ. 1984, 5, 287–320. [Google Scholar] [CrossRef]

- Breschi, S.; Malerba, F.; Orsenigo, L. Technological Regimes and Schumpeterian Patterns of Innovation. Econ. J. 2000, 110, 388–410. [Google Scholar] [CrossRef]

- Loasby, B.J. Knowledge, Institutions and Evolution in Economics; Routledge: London, UK; New York, NY, USA, 1999. [Google Scholar]

- Antonelli, C.; Krafft, J.; Quatraro, F. Recombinant knowledge and growth: The case of ICTs. Struct. Chang. Econ. Dyn. 2010, 21, 50–69. [Google Scholar] [CrossRef]

- Tushman, M.; Anderson, P. Technological Discontinuities and Organizational Environments. Adm. Sci. Q. 1986, 31, 439–465. [Google Scholar] [CrossRef]

- Anderson, P.; Tushman, M. Technological Discontinuities and Dominant Designs: A Cyclical Model of Technological Change. Adm. Sci. Q. 1990, 36, 604–633. [Google Scholar] [CrossRef]

- Levinthal, D.A. The slow pace of rapid technological change: Gradualism and punctuation in technological change. Ind. Corp. Chang. 1998, 7, 217–247. [Google Scholar] [CrossRef]

- Klepper, S.; Thompson, P. Submarkets and the evolution of market structure. RAND J. Econ. 2006, 37, 861–886. [Google Scholar] [CrossRef]

- Schot, J.; Geels, F.W. Niches in evolutionary theories of technical change. A critical survey of the literature. J. Evol. Econ. 2007, 17, 605–622. [Google Scholar] [CrossRef]

- Dosi, G.; Nelson, R.R. Technological Change and Industrial Dynamics as Evolutionary Processes. In Handbook of the Economics of Innovation; Hall, B.H., Rosenberg, N., Eds.; Elsevier: Amsterdam, The Netherlands, 2010; Volume 1. [Google Scholar]

- Kotha, R.; Zheng, Y.; George, G. Entry into new niches: The effects of firm age and the expansion of technological capabilities on innovative output and impact. Strateg. Manag. J. 2011, 32, 1011–1024. [Google Scholar] [CrossRef]

- Garavaglia, C. Entry of new firms and market niches creation. In Handbook of Research Methods and Applications in Industrial Dynamics and Evolutionary Economics; Cantner, U., Guerzoni, M., Vannuccini, S., Eds.; Edward Elgar: Cheltenham, UK, 2022. [Google Scholar]

- United Nations Environment Programme—UNEP. Towards a Green Economy: Pathways to Sustainable Development and Poverty Eradication; UNEP: Nairobi, Kenya, 2011. [Google Scholar]

- Helfat, C.E.; Lieberman, M.B. The birth of capabilities: Market entry and the importance of pre-history. Ind. Corp. Chang. 2002, 11, 725–760. [Google Scholar] [CrossRef]

- Uzunca, B. A Competence-Based View of Industry Evolution: The Impact of Submarket Convergence on Incumbent−Entrant Dynamics. Acad. Manag. J. 2018, 61, 738–768. [Google Scholar] [CrossRef]

- Stieglitz, N. Digital dynamics and types of industry convergence: The evolution of the handheld computers market. Ind. Dyn. New Digit. Econ. 2003, 20, 179–208. [Google Scholar]

- Bhaskarabhatla, A.; Klepper, S. Latent submarket dynamics and industry evolution: Lessons from the U.S. laser industry. Ind. Corp. Chang. 2014, 23, 1381–1415. [Google Scholar] [CrossRef]

- Buenstorf, G.; Klepper, S. Submarket dynamics and innovation: The case of the U.S. tire industry. Ind. Corp. Chang. 2010, 19, 1563–1587. [Google Scholar] [CrossRef]

- Deleersnijder, B.; Geyskens, I.; Gielens, K.; Dekimpe, M.G. How cannibalistic is the Internet channel? A study of the newspaper industry in the United Kingdom and The Netherlands. Internat. J. Res. Mark. 2002, 19, 337–348. [Google Scholar] [CrossRef]

- Sierzchula, W.; Bakker, S.; Maat, K.; van Wee, B. The competitive environment of electric vehicles: An analysis of prototype and production models. Environ. Innov. Soc. Transit. 2012, 2, 49–65. [Google Scholar] [CrossRef]

- Lin, R.-J.; Tan, K.-H.; Geng, Y. Market demand, green product innovation, and firm performance: Evidence from Vietnam motorcycle industry. J. Clean. Prod. 2013, 40, 101–107. [Google Scholar] [CrossRef]

- Guerra, E. Electric vehicles, air pollution, and the motorcycle city: A stated preference survey of consumers’ willingness to adopt electric motorcycles in Solo, Indonesia. Transp. Res. Part D Transp. Environ. 2019, 68, 52–64. [Google Scholar] [CrossRef]

- Sugue, M. Uneasy Rider: How Brussels Could Kill off the Motorbike. 22 November 2021. Available online: https://www.politico.eu/article/motorcycles-european-comission-eu-germany-uk-zero-emission-engine (accessed on 22 March 2022).

- Seebaue, S. Why early adopters engage in interpersonal diffusion of technological innovations: An empirical study on electric bicycles and electric scooters. Transp. Res. Part A Policy Pract. 2015, 78, 146–160. [Google Scholar] [CrossRef]

- Taal, W. FEMA’s International Survey on Motorcycle Emissions. 14 September 2021. Available online: https://www.femamotorcycling.eu/wp-content/uploads/documents_library/web_results_emissions_survey_fema2021.pdf (accessed on 23 March 2022).

- Capacchione, R. Moto e Scooter, Due Mondi a Due Ruote: Differenze e Cosa Scegliere. 2020. Available online: https://www.gazzetta.it/motori/la-mia-moto/04-05-2020/scuola-guida-moto-scooter-due-mondi-due-ruote-differenze-scegliere-370697910637.shtml (accessed on 17 April 2022).

- Lowe, M.; Tokuoka, S.; Trigg, T.; Gereffi, G. Lithium-Ion Batteries for Electric Vehicles: The US Value Chain; Center on Globalization, Governance & Competitiveness: Durham, NC, USA, 2010. [Google Scholar]

- NIU Website. Available online: https://global.niufleet.com/en/our-advantages (accessed on 17 April 2022).

- Scooter.Guide Website. Available online: https://scooter.guide/it/batterie-per-scooter-elettrici-tutto-cio-che-devi-sapere/ (accessed on 18 April 2022).

- Govindarajan, V.; Kopalle, P.K.; Daaneels, E. The Effects of Mainstream and Emerging Customer Orientations on Radical and Disruptive Innovations. J. Prod. Innov. Manag. 2011, 28, 121–132. [Google Scholar] [CrossRef]

- Corrocher, N.; Guerzoni, M. Product variety and price strategy in the ski manufacturing industry. J. Evol. Econ. 2009, 19, 471–486. [Google Scholar] [CrossRef][Green Version]

- Garavaglia, C.; Swinnen, J. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry; Palgrave Macmillan: Basingstoke, UK, 2018. [Google Scholar]

- Garavaglia, C. Industry evolution: Evidence from the Italian brewing industry. Compet. Chang. 2022, 26, 75–95. [Google Scholar] [CrossRef]

| Year | Number of New Firms | Number of Incumbent Firms | Percentage of New Firms | Percentage of Incumbent Firms |

|---|---|---|---|---|

| 2010 | 25 | 6 | 81% | 19% |

| 2011 | 9 | 7 | 56% | 44% |

| 2012 | 4 | 5 | 44% | 56% |

| 2013 | 9 | 2 | 82% | 18% |

| 2014 | 7 | 3 | 70% | 30% |

| 2015 | 4 | 0 | 100% | 0% |

| 2016 | 4 | 1 | 80% | 20% |

| 2017 | 3 | 2 | 60% | 40% |

| 2018 | 8 | 2 | 80% | 20% |

| 2019 | 4 | 3 | 57% | 43% |

| 2020 | 12 | 0 | 100% | 0% |

| 2021 | 14 | 6 | 70% | 30% |

| Variable | Description | Type | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|

| Entry | Report if the incumbent entered into the electric motorcycle niche | Dummy | 0.15 | 0.36 | 0 | 1 |

| LogSize | Log of quantity of internal combustion engine motorcycles | Numerical | 2.77 | 3.09 | 0.00 | 11.25 |

| Models | Number of total models produced | Numerical | 18.82 | 38.36 | 1.00 | 291.00 |

| Submarkets | Number of submarkets with a positive number of motorcycles | Numerical | 2.26 | 1.86 | 1.00 | 10.00 |

| DScooter | Report if the brand produces scooters | Dummy | 0.50 | 0.50 | 0 | 1 |

| DFifties | Report if the brand produces only motorcycles with an engine of 0–50 cc | Dummy | 0.12 | 0.33 | 0 | 1 |

| DForeign | Report if the brand is foreign | Dummy | 0.70 | 0.46 | 0 | 1 |

| Independent Variables | Reference Level (Categorical Variables) | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|---|

| Intercept | −3.8268 *** (0.550) | −3.7063 *** (0.543) | −3.4399 *** (0.530) | −4.4529 *** (0.729) | |

| DScooter | Scooter producer | 1.5458 *** (0.534) | 2.0054 *** (0.547) | 1.915 *** (0.516) | 1.4495 *** (0.538) |

| DFifties | Only 0–50 cc | 1.4072 ** (0.600) | 1.2768 ** (0.578) | 0.979 * (0.573) | 1.4682 ** (0.612) |

| LogSize | 0.2291 *** (0.069) | 0.2500 *** (0.072) | |||

| Models | 0.0165 *** (0.005) | ||||

| Submarkets | 0.1136 (0.094) | ||||

| DForeign | Foreign firm vs. Italian | 0.7895 (0.536) | |||

| −2 log Likelihood | 148.5 | 145.8 | 158.7 | 146.1 | |

| LR test | 33.025 *** | 35.756 *** | 22.849 *** | 35.340 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Garavaglia, C.; Sartirana, C. Incumbent vs. New Firms’ Entry into an Innovative Niche Market: Electric Motorcycles in Italy, 2010–2021. Sustainability 2022, 14, 6734. https://doi.org/10.3390/su14116734

Garavaglia C, Sartirana C. Incumbent vs. New Firms’ Entry into an Innovative Niche Market: Electric Motorcycles in Italy, 2010–2021. Sustainability. 2022; 14(11):6734. https://doi.org/10.3390/su14116734

Chicago/Turabian StyleGaravaglia, Christian, and Claudia Sartirana. 2022. "Incumbent vs. New Firms’ Entry into an Innovative Niche Market: Electric Motorcycles in Italy, 2010–2021" Sustainability 14, no. 11: 6734. https://doi.org/10.3390/su14116734

APA StyleGaravaglia, C., & Sartirana, C. (2022). Incumbent vs. New Firms’ Entry into an Innovative Niche Market: Electric Motorcycles in Italy, 2010–2021. Sustainability, 14(11), 6734. https://doi.org/10.3390/su14116734