1. Introduction

The natural gas (NG) market in South Korea is divided into a wholesale market and a retail market based on the City Gas Business Act. In the wholesale market, the Korea Gas Corporation (KOGAS), a public company, imports and supplies NG to large-scale power generation companies, large-capacity consumers, and city gas companies nationwide [

1]. In the past, the KOGAS monopolized the wholesale market. However, due to the revision of the City Gas Business Act, the wholesale market was partially open to private energy companies. Thus, some large corporations such as SK E&S, GS Energy, Hanwha Energy, and POSCO Energy are importing NG for private use directly without going through the KOGAS.

On the other hand, in the NG retail market or city gas market, thirty-four city gas companies that have obtained business licenses from local governments are supplying city gas to end-users through their own supply pipelines. City gas companies are subject to various regulations from the local government in return for receiving a monopoly right to supply by region. Because the retail price is determined by adding an appropriate return on investment to the supply cost approved by the local government, unlike liquefied petroleum gas or gasoline, city gas companies cannot determine the price.

Thirty years ago, the initial stage of introduction of city gas, the city gas sector experienced a high growth rate of more than 10%. However, the growth rate is currently stagnant between 2% and 6%. Already mature NG penetration rate and the shifts to electricity from city gas as cooking fuel and to district heating system from individual heating system using city gas threaten survival of the companies. In particular, South Korea declared “2050 Carbon Neutrality” in October 2020. In order to implement this, the use of city gas that inevitably emits greenhouse gases during its combustion process must be greatly reduced.

A decrease in the sales volume of city gas companies can cause problems such as not only increasing retail rates, but also hindering reinvestment in old supply pipelines and cross subsidy between city gas companies. Therefore, the city gas sector has almost always achieved a surplus without experiencing a deficit, but in the future, it is expected to suffer from forced demand cuts or even deficits. Therefore, not only the central government but also local governments are deeply interested in restructuring the city gas sector to ensure cost-effective structure while securing stability in city gas supply.

Economies of scale have been mainly analyzed in the water utilities [

2,

3,

4] and electricity utilities [

5,

6]. Wholesale market of NG sector has also been one of the main research areas [

7,

8,

9,

10,

11,

12,

13]. However, there are only a few case studies conducted on the structure of the city gas sector. Only Kim and Lee [

14] and Kim [

15] analyzed economies of scale in the South Korean city gas sector using the data over the 1990s, a period of rapid growth of the city gas market, and confirmed the existence of economies of scale. It is needed to examine whether economies of scale exist even in the current situation in which the city gas market is saturated.

In particular, the local government of Seoul, the capital of South Korea, is seriously considering whether to keep the five existing city gas companies in their current state or induce artificial restructuring. That is, Seoul’s city gas sector, which has already achieved the highest penetration rate of 98% in the country since 2000, is under strong pressure of restructuring in the city gas retail market. The purpose of this paper is, thus, to investigate the existence of economies of scale in city gas sector in Seoul using the translog variable cost function and obtain some implications.

The minimum efficient scale (MES) is also empirically estimated. If the economies of scale of the city gas sector have already been lost, the efficiency can be improved through corporate spin-off, whereas if the economies of scale still exist, it is necessary to promote the merger and acquisition among city gas companies to further expand the scale (production volume). In addition, the size of MSE could be a major basis for determining the appropriate number of companies in the city gas market.

Economies of scale in the South Korean city gas market have great implications for the global natural gas retail market. Although South Korea has a favorable environment for city gas business compared to other countries due to its high population density and urbanization, economies of scale are rapidly disappearing as the demand for city gas is rapidly converted to electricity due to rapid electrification. In addition, due to the recent war between Ukraine and Russia, natural gas prices have skyrocketed, weakening the price competitiveness of city gas. Because the city gas business crisis is not just a South Korean problem but a common problem in the global city gas industry, restructuring the city gas industry for enhancing economies of scale can provide many implications for other countries as well.

This article aims to contribute to the related literature by analyzing the economies of scale in the Seoul city gas sector and deriving implications. The structure of the rest of this article for enforcing the aim is as follows.

Section 3 reports a summary of previous studies dealing with economies of scale in utilities and explains the current state of the city gas market, that is, the retail NG market.

Section 4 provides the model and data adopted in this study.

Section 7 presents conclusions and policy implications based on the empirical results contained in the penultimate section.

2. Literature Review

As shown in

Table 1, most of the former studies that analyzed the economies of scale of the NG sector targeted the wholesale market. Translog cost function is the most frequently used model in the previous studies because it imposes the least assumption on the shape of the cost function, which allows the most flexible form of the cost function. Translog cost function does not restrict the form of production in terms of homogeneity and elasticity of substitution. Cobb–Douglas production function assumes the homogeneous function and unitary elasticity of substitution, and CES production function does the first degree of function and constant elasticity of substitution. Different from the Cobb–Douglas and the CES production function, the translog production function imposes no assumption on homogeneity and elasticity of substitution [

16,

17,

18]. The translog cost function was estimated in various previous studies that analyzed economies of scale not only in the natural gas market but also in the electricity [

19,

20,

21,

22], water and sewage [

23], railroad [

24,

25], telecommunication [

26,

27], and banking [

28,

29,

30] industries. Translog cost function is mainly estimated by seemingly unrelated regression (SUR) or iterated SUR (ITSUR) because it should be estimated simultaneously with Shepard’s lemma equation [

31,

32,

33].

Refs. [

8,

9,

13] used the data for the South Korean NG wholesale market. Ref. [

8] confirmed that economies of scale still exist, although the scale economy index (SEI) decreased from 1 in 1987 to 0.486 in 1993. Shin et al. (1998) dealt with NG companies in six countries: South Korea (KOGAS), France (GdF), Japan (Osaka Gas), Italy (Snam), Germany (Ruhqgas), and Belgium (Distrigas). As a result, Korea (KOGAS) secured economies of scale until 1995 but predicted that economies of scale would disappear between 2006 and 2010.

Ref. [

13] investigated the data from the wholesale NG market monopolized by KOGAS. They confirmed that economies of scale have already been lost since 2000 in terms of the first and fourth quarters when production is high, but that the second and third quarters with low production were located at the boundary of economies of scale after 2010. They suggested that that easing the monopoly status of the KOGAS should be desirable to improve the efficiency of the wholesale NG market.

Refs. [

14,

15] targeted the Korean NG retail market. Ref. [

14] showed that the return to scale ranged from 0.1571 to 0.5341 in 1987, but it became to be from −0.0710 to 0.2082 in 1992, implying deterioration of economies of scale. Ref. [

15] estimated the nonparametric model with locally weighted regression for the years 1990, 1991, 1996, and 1997. It was found that city gas companies were enjoying the effect of scale. Moreover, in the case of city gas companies with a large business area, it was expected that the economy of scale would deteriorate due to a downward slope.

Therefore, this study differs from the former studies in two ways. First, the cost function for the city gas sector is estimated using more up-to-date data from 2008 to 2020. There are no former case studies dealing with data since 2000. Second, the results and implications for the city gas sector in Seoul are derived by limiting the spatial scope of the analysis to Seoul, targeting the retail market rather than the wholesale market.

3. Current State of the Retail City Gas Market

There are thirty-four city gas companies in South Korea. They monopolize the retail market for city gas by region. As shown in

Figure 1, as of the end of 2020, the total sales volume (market size) of the city gas companies was 23.5 billion m

3, and the total demand for city gas was 20.1 million tonnes for residential, commercial, industrial and power generation use.

The total number of consumers for city gas has been continuously increasing by 2 to 4% every year, but there is a significant fluctuation in sales volume. After recording the lowest sales volume in 2015, it increased again, reaching the highest sales volume in 2018 (255.8 billion m3). However, from 2019, sales volume declined again, reducing sales to 235.6 billion m3 in 2020. The fact that the total number of consumers continuously increases while the sales volume rather decreases means that sales per consumer rather decreases.

The reason for the sharp drop in sales volume during the period 2014 to 2015 was due to external factors such as a wholesale rate hike, a worsening domestic economy, and an oil price hike. On the other hand, the decrease in sales volume in the period 2019–2020 suggests that the city gas market itself has undergone a stabilization phase and is slowing down, rather than due to external factors. As the national average penetration rate of city gas exceeded 85% in 2020, it means that city gas sales have reached the limit and it is not easy to expand sales anymore.

In the case of Seoul, unlike other local governments, five city gas companies, including Cowon Energy Service, Seoul City Gas, Yesco, Daeryun E&S, and Kiturami Energy, are supplying city gas in the form of a regional monopoly in twenty-four districts of Seoul. As of the end of 2020, the total sales volume of the five city gas companies in Seoul was 4.1 billion m

3, and out of the total demand for 4.6 million units, households (4.3 million) accounted for most. As presented in

Figure 2, Seoul City Gas has the highest market share with 35.4%, followed by Yesco (23.8%) and Cowon Energy Service (19.8%), showing a typical oligopoly market.

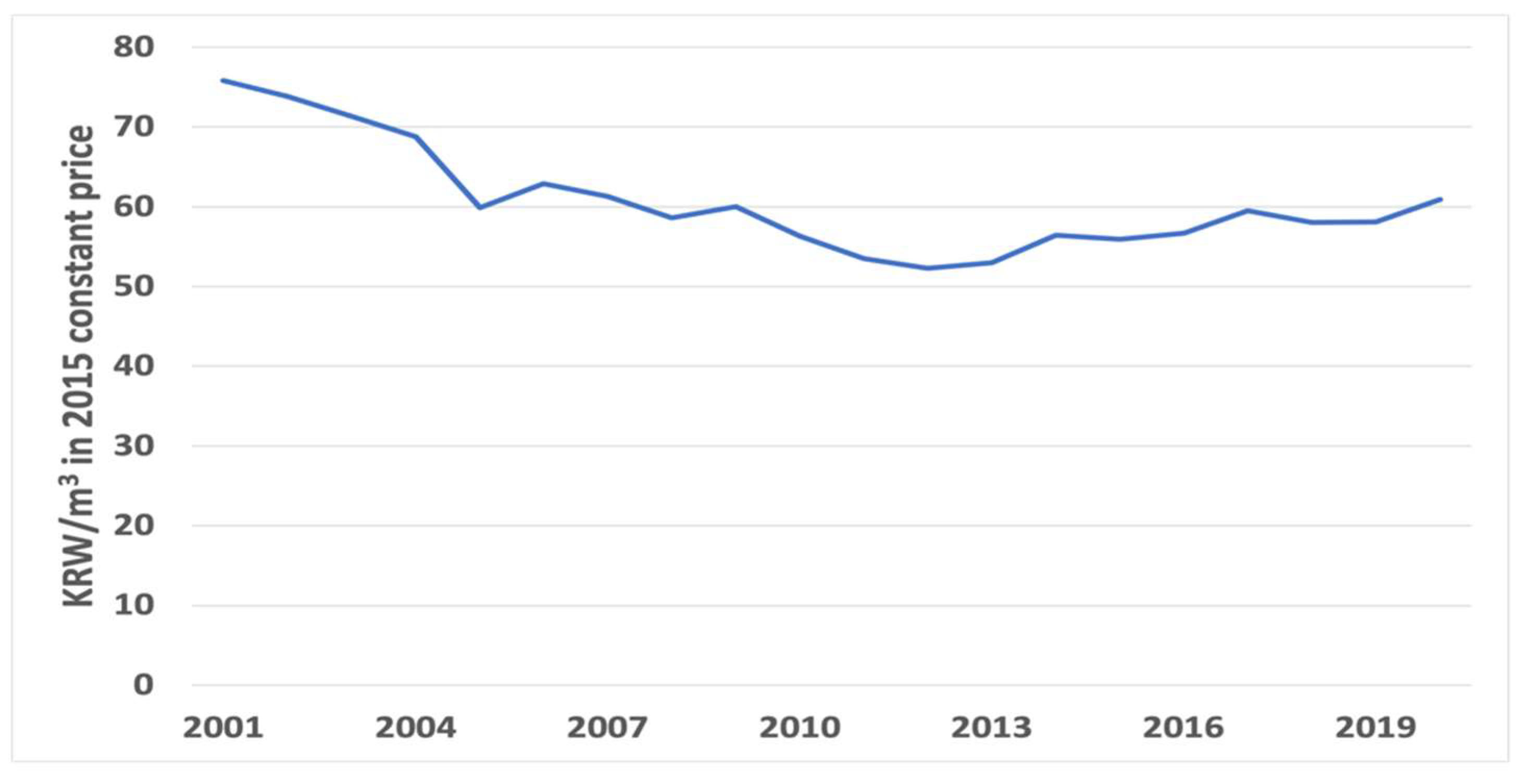

Figure 3 portrays the city gas price trend in constant price of year 2015. The price, which was KRW 75.8 per m

3 of city gas in 2001, is declining to KRW 60.9 per m

3 of city gas in 2020. The situation in which city gas sales are stagnant and retail prices are declining shows the management difficulties city gas companies are facing. In addition, it is difficult to expect a rapid increase in city gas demand in the future when the demand for heating and cooking is switched to electricity and district heating. Due to the expansion of electric induction, the number of households using electricity instead of city gas for cooking continues to increase, and as district heating is basically supplied to new large-scale apartment complexes, individual heating systems where city gas is used are also being replaced with district heating system.

City gas price is set not by market mechanism based on demand and supply, but by local government. The local government sets a single price in a way of adding appropriate profit to the average supply cost of five companies. The reason using the total average cost instead of individual average cost is to facilitate competition among companies. However, different from original purpose, a single price expands the profit gaps among companies because each company is running its business in the different environment in terms of customer size and supply cost. There is a criticism that a single price system distorts the market rather than reinforces the competition, and companies become passive to invest in old pipeline or safety management.

4. Materials and Methods

4.1. Variable Cost Function and Economies of Scale

The authors try to examine the economies of scale with translog cost function which have been employed most in previous studies by using the estimation method of ITSUR. At this time, it is necessary to discuss whether it is appropriate to use the total cost function or the variable cost function as the cost function. Unlike general manufacturing sector, large-scale city gas production facilities are determined by mid- and long-term planning rather than annual decision making [

34,

35,

36]. Therefore, this study assumed capital as a quasi-fixed input factor and defined a variable cost function considering only labor and material costs as the cost function [

37].

There are many studies that estimate variable cost functions instead of total cost functions to estimate economies of scale of network industry (e.g., [

13,

38,

39]). The cost function is theoretically the function of input prices and output. The variable cost function can be defined by the prices of labor and material, quasi-fixed capital input, and production volume. The capital input is used instead of the price of capital because the capital is considered as quasi-fixed input in the variable cost function.

Let

,

,

,

,

, and

denote the variable cost of city gas company, the labor price, the material price, the capital cost, the production volume, and a time variable reflecting technological progress change over time, respectively. In addition, let

and

stand for company and year, respectively. The variable cost function in the form of translog cost function is expressed as

where

’s are disturbance terms, and

’s,

’s,

’s,

’s, and

’s are the parameters to be estimated.

Equation (1) has constraints for concavity and symmetry as

According to Shepard’s lemma, the cost share equation is derived by partial differentiation of the log value of the cost function with the price. However, due to the singularity problem, the cost share equation is applied only to labor between labor and material as

The ITSUR method estimates the simultaneous equations of Equations (1) and (3) subject to Equation (2). In general, economies of scale are defined as the production elasticity of average cost. However, if a variable cost function is used instead of the total cost function, in order to consider the effect quasi-fixed input, the capital (

), as given in Nelson’s research [

40], whether economies of scale are held or not, can be checked using the following equation:

Economies of scale is held if

, constant economies of scale is held if

, and diseconomies of scale is held if

. For convenience,

can be transformed to define the economies of scale index (

) as

If , there are economies of scale, if , there are diseconomies of scale, and if , there are constant economies of scale.

4.2. Data and Variables

To create a dataset to be analyzed, four databases from five city gas companies in Seoul (Seoul City Gas, Cowon Energy Service, Yesco, Daeryun E&S, and Kiturami Energy) were synthesized to construct annual panel data from 2008 to 2020. The four databases are business report and audit report provided by the electronic disclosure system, internal data of city gas companies, research service report on the supply cost of city gas ordered by the Seoul Metropolitan government, and the Handbook of Korea City Gas Association. Four of the five city gas companies also supply city gas to other region adjacent to Seoul, but the authors used data separately only for Seoul.

Table 2 presents the definition and basic statistics of each variable. Variable cost was defined as the sum of labor cost and material cost, and labor and material prices were calculated by dividing the cost by the input quantity. For the cost of capital, following [

41,

42], it was defined as the total cost minus labor cost and material cost. To convert all values into values in the 2015 constant price, variable cost, labor price, material cost, and capital cost are deflated by the total producer price index, the GDP deflator, supply price index of imported intermediate fuel, supply price index of domestic capital goods, respectively.

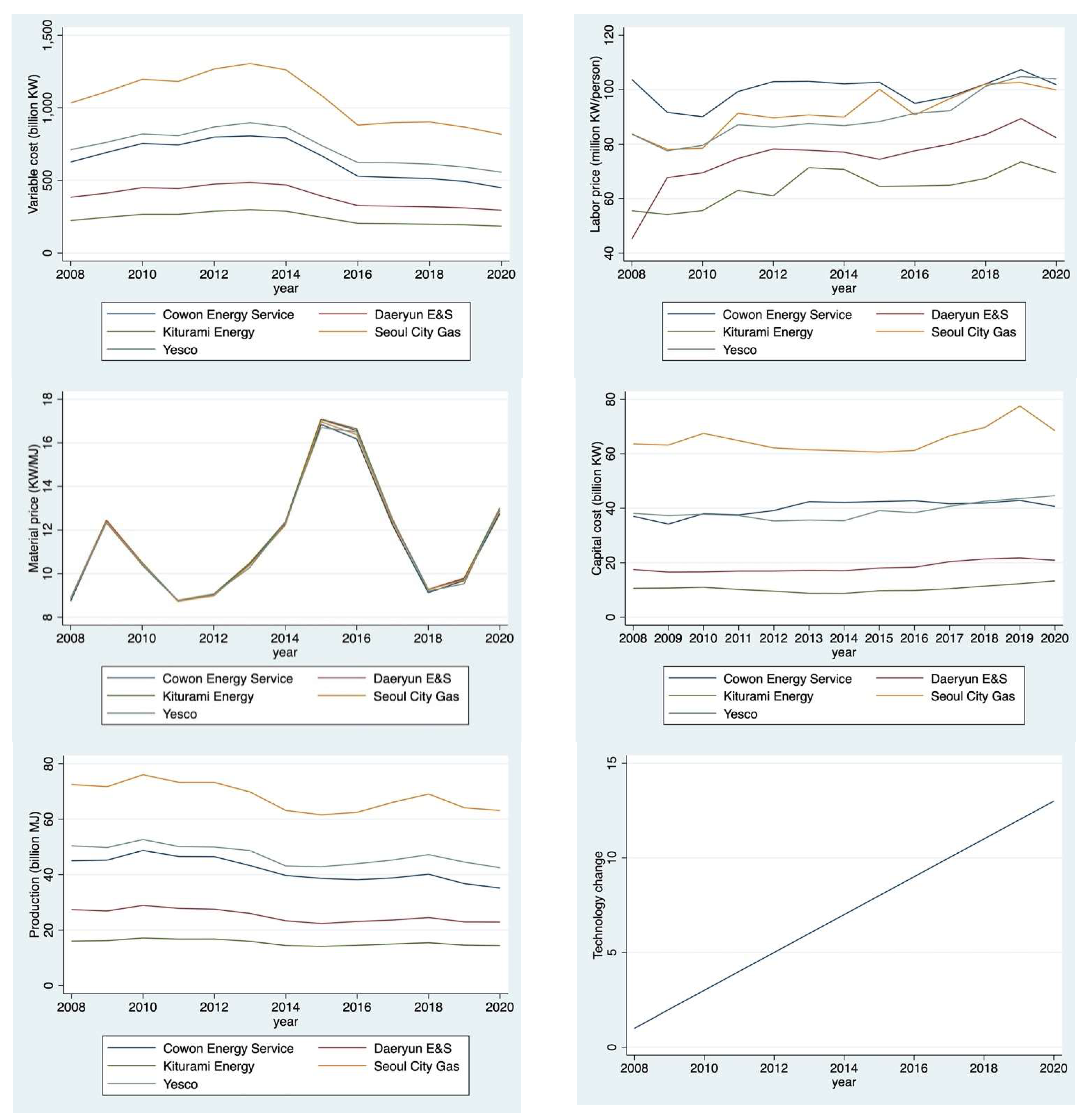

The trends of panel data are presented in the

Figure 4. Each city gas company shows diversified managerial situation in terms of cost structure and production. Material price, however, is almost same across companies as they commonly purchase natural gas from monopolistic supplier, KOGAS.

In the city gas business, technological change through the introduction of geographic information system and supervisory control and data acquisition improves the efficiency of safety management and modernizes safety management for supply facilities, resulting in the change of variable cost. The effect of technological change was controlled by defining the T variable in a way that started with 1 in 2008 and increased by 1 every year following the method of the previous studies [

13,

40,

43,

44]. Alternatively, R&D investment can be a proxy, but time lag effect of R&D investment is hard to be reflected clearly.

5. Results

5.1. Estimation Results of the Translog Cost Function

The simultaneous equations of Equations (1) and (3) under the constraint of Equation (2) are estimated by the use of the ITSUR method. The results are reported

Table 3. High values of the R-squared and chi-squared statistic imply that the translog cost function is valid, and most of the estimated coefficients are statistically significant at the 1% level. For robustness check, 2SLS (2 stage least square) model is also estimated as well as ITSUR, and estimated coefficients of 3SLS are similar to those of ITSUR. Estimation results of 2SLS are not presented here, for brevity.

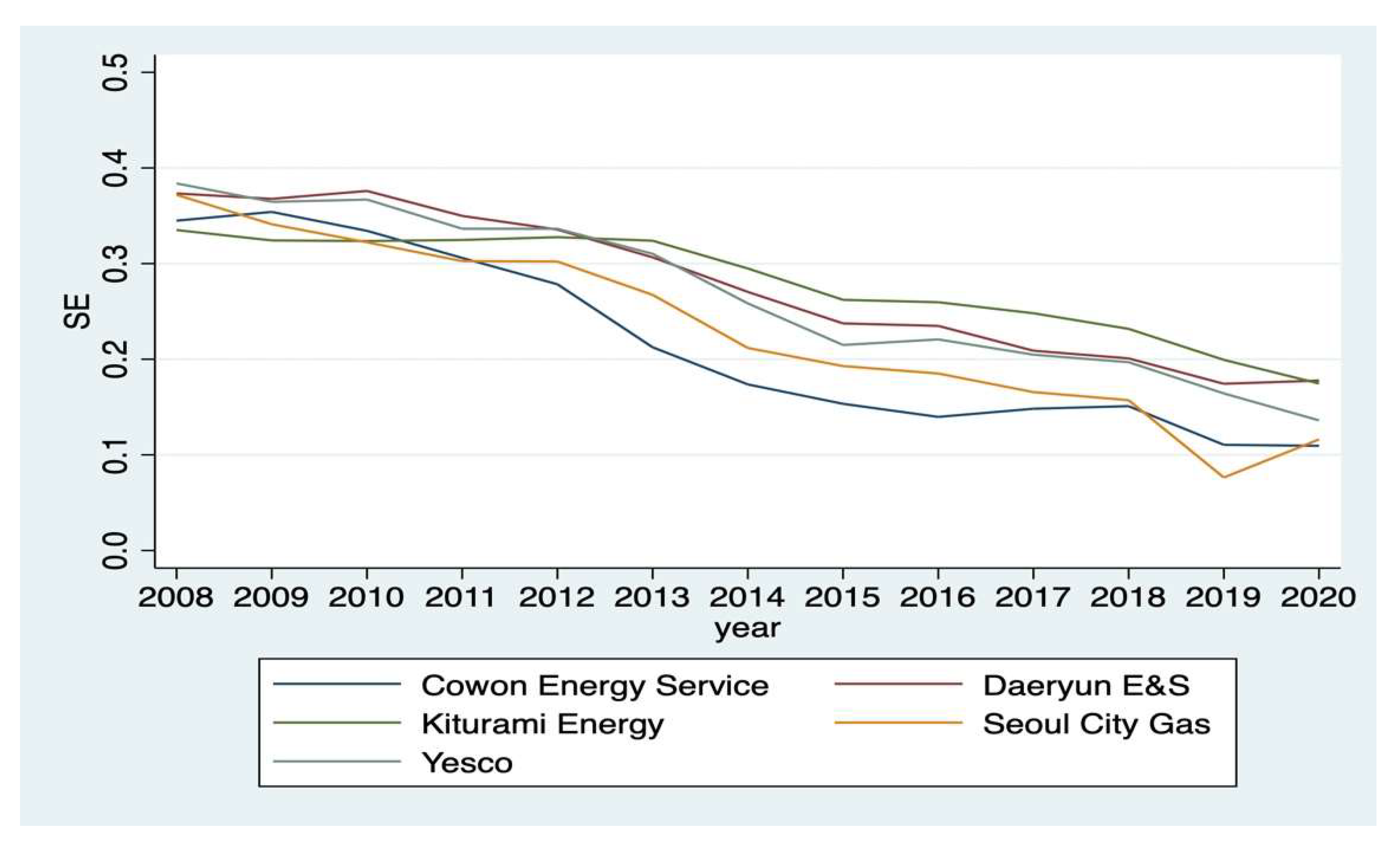

The estimated coefficients of the translog function given in

Table 3 can be substituted into Equations (4) and (5). The results of estimating SE are plotted in

Figure 5. Positive value of SE implies that there exist economies of scale, negative values of SE means that there exist diseconomies of scale, and zero value of SE indicates that there exist constant economies of scale. Although the five city gas companies have shown a declining trend in economies of scale since 2011, it is analyzed that they are still securing economies of scale until 2020. In the period 2008–2010, SE was distributed between 0.3 and 0.4, then decreased from 2011 and reached 0.1–0.2 in 2020. The fact that city gas companies are still maintaining the economies of scale, suggests that the average variable cost can be lowered when the production scale is increased compared to the present.

Analysis of variance (ANOVA) was conducted to ascertain whether the economies of scale vary by city gas company. The F-statistic for the ANOVA is computed to be 1.62 and the corresponding p-value is 0.181. Thus, it is confirmed that there is no statistically significant difference by city gas company at the 1% level.

The findings from this study are somewhat different from those from [

14,

15]. Ref. [

14] said that some city gas companies were facing diseconomies of scale in 1992, and Ref. [

15] analyzed that large city gas companies’ economies of scale were deteriorating during 1990–1997. However, this study drew different results from previous studies in three aspects. First, this study analyzed the period 2008–2020, while previous studies analyzed the 1990s. Second, this study constructed analysis data by combining four different databases to better reflect the characteristics of the city gas industry. Third, unlike previous studies, this study controlled the effects of technological change after 2008.

5.2. Forecasting Economies of Scale

The minimum efficient scale (MES) is defined as the production scale at which the average cost is minimized, that is, the output at which SE = 0. If the production scale of existing city gas companies is lower than MES, the average cost can be lowered through merger and acquisition between city gas companies, so the MES estimate provides important information on the direction of market restructuring.

As in Equation (6), after estimating SE as a function of production and time, the

Q value when SE = 0 and

T = 13 (i.e., year = 2020) becomes the MES as indicated in Equation (7), which is suggested by Ref. [

43].

where

is the production quantity of firm

in year

,

is the technology progress in year

and

is an error term.

In order to minimize the influence of outliers, a robust linear regression model was used to estimate Equation (6) instead of using an ordinary least square model [

44,

45].

Table 4 shows the results of estimating Equation (6) with a robust linear regression model, and all estimated coefficients are statistically significant within the significance level of 1%.

The MES calculated through Equation (7) was estimated to be 189.2 × 109 MJ, which means economies of scale disappear when city gas production reaches this scale.

To verify the accuracy of forecasting, a nonlinear hypothesis test based on the delta method was conducted to determine the statistical significance of this estimate. As a result of the hypothesis test, chi-squared statistics was 34.49; thus, the MES value was statistically significant within the significance level of 1%. MES is 1.06 times the total sales volume (178.1 × 109 MJ) of the five city gas companies in 2020, and when converted to volume, MES is 4.442 billion m3.

6. Discussion

Thirty-six years have passed since Korea’s city gas industry first supplied gas in 1986. In the early days, it had an average annual growth of more than 40%, but it achieved an average annual growth rate of about 11% in 1997–2005. The five city gas companies that monopolize Seoul by region have difficulties in creating new demand due to their high penetration rate of 98%, and they are experiencing difficulties in management as the existing demand shifts to electricity and district heating systems.

This study estimated economy of scale and minimum efficient scale using annual panel data of five city gas companies in Seoul from 2008 to 2020. Although city gas companies’ economies of scale are on the decline, they still have economies of scale in the range of 0.1 to 0.2. There are two previous studies analyzing the city gas market in Korea. In 1987, SE was 0.157–0.534, indicating economies of scale [

14], but in 1992, SE was distributed between −0.107 and 0.208, indicating that the existence of economies of scale differed depending on the analysis model [

15]. However, in this study, it was confirmed that the city gas market still secured economies of scale even in the 2000s, which is expected to be due to the significant growth of the city gas market from the 1990s.

However, the continued downward trend in SE since 2010 is quite worrisome. Demand for city gas stagnated while investment in pipelines continued to occur, resulting in a decrease of about 0.2 in SE over the past decade. It was confirmed that the minimum efficiency scale at which the average cost is minimized is 1.06 times the size of the overall market. The results of the empirical analysis suggest that restructuring is necessary to increase the size of each company through consolidation and abolition, rather than the structure in which the five city gas companies in Seoul maintain their sales business separately.

Amidst the recent war between Ukraine and Russia, natural gas prices have skyrocketed, weakening the price competitiveness of city gas. While the cost of purchasing natural gas for city gas companies increases rapidly, it is difficult for them to pass on the cost increase to consumers due to concerns about rapid electrification [

46,

47]. Therefore, if the current high oil price continues for a long time, the economy of scale of city gas operators will inevitably worsen further.

The above discussion will give important policy implications to the policy makers of the central and local governments in charge of the city gas industry on industrial restructuring and regulation on energy rate. In order to improve economies of scale, M&A between operators should be promoted, and distorted energy relative rates should be normalized to prevent excessive concentration of energy consumption toward electricity.

7. Conclusions

Economies of scale in the South Korean city gas market have great implications for the global natural gas retail market. South Korea has a favorable environment for city gas business because of high degree of population density and urbanization. Economies of scale, however, are rapidly disappearing as the demand for city gas is rapidly converted to electricity due to rapid electrification [

48,

49,

50]. Due to the monopolistic supplier in the wholesale market, it is difficult for city gas companies to find cheaper sources of natural gas. Global retailers of natural gas should avoid the loss of economies of scale caused by rapid electrification by selling bundling products with electricity or other energy sources. The introduction of competition in the natural gas wholesale market should also enable retailers to find cheaper sources of natural gas.

Expanding the production scale to the level of the minimum efficient scale is also important in terms of retail price stability. Because the current city gas rate system is a regulated price system in which local governments guarantee a certain level of profit on the overall cost, an increase in retail rates is inevitable if production decreases or fixed costs rise in the future. Especially a single price system based on the average cost of five companies instead of individual company can cause cross the subsidization issue [

51]. The presence of an inefficient city gas company increases the average supply cost, resulting in additional burden to consumers in other areas.

Recently, as the management difficulties of city gas companies have become serious, they are frequently sold to foreign capital. In July 2021, Haeyarng Energy, Seorabeol City Gas, and Kyungnam Energy were sold to foreign private equity funds. Two out of five city gas companies in Seoul are also rumored to be sold in the financial market. However, a change in ownership without a reorganization of the market structure exposes several problems. As city gas companies hesitate to invest voluntarily, it becomes difficult to preemptively replace old pipes. In addition, as city gas companies are in conflict with local governments with the authority to set rates, they lose mutual trust and ultimately instability in retail costs, causing harm to consumers.

Therefore, the restructuring of the five city gas companies in Seoul should be pursued in the direction of maximizing economies of scale through mergers and acquisitions among the five suppliers rather than transfer of ownership. Reducing the number of city gas companies through mergers and acquisitions among five city gas companies is more desirable in terms of cost reduction. To this end, local governments need to provide incentives such as taxes [

52,

53] and retail price [

54,

55] to promote market restructuring.

As a research work to be additionally carried out in the future, it is necessary to analyze economies of scale by subdividing into quarterly data rather than annual data. Because city gas is also used for heating purposes, there is a large variation in city gas sales by season. Furthermore, it will be meaningful to rethink the city gas sector policy from a national perspective by expanding the analysis target nationwide rather than limiting it to Seoul.