Governance Trends among New EU Member States: Is There Institutional Convergence?

Abstract

:1. Introduction

2. Institutional Change and Varieties of Capitalism Approach

3. Role of Governance in Post-Socialist Institutional Convergence

4. Empirical Assessment of Institutional Convergence in CEECs

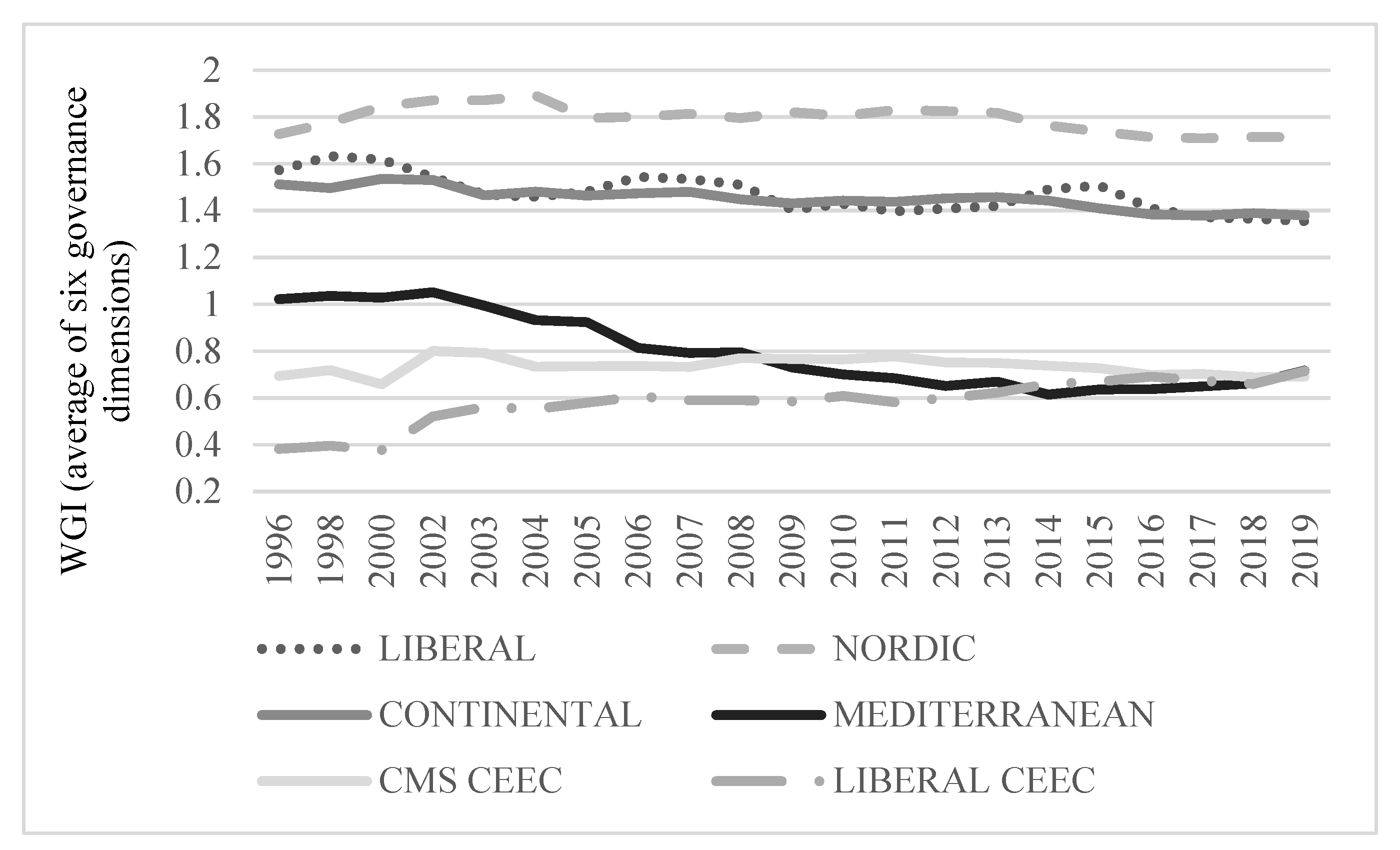

4.1. Quantitative Analysis of Institutional Quality in EU Based on the VoC Approach

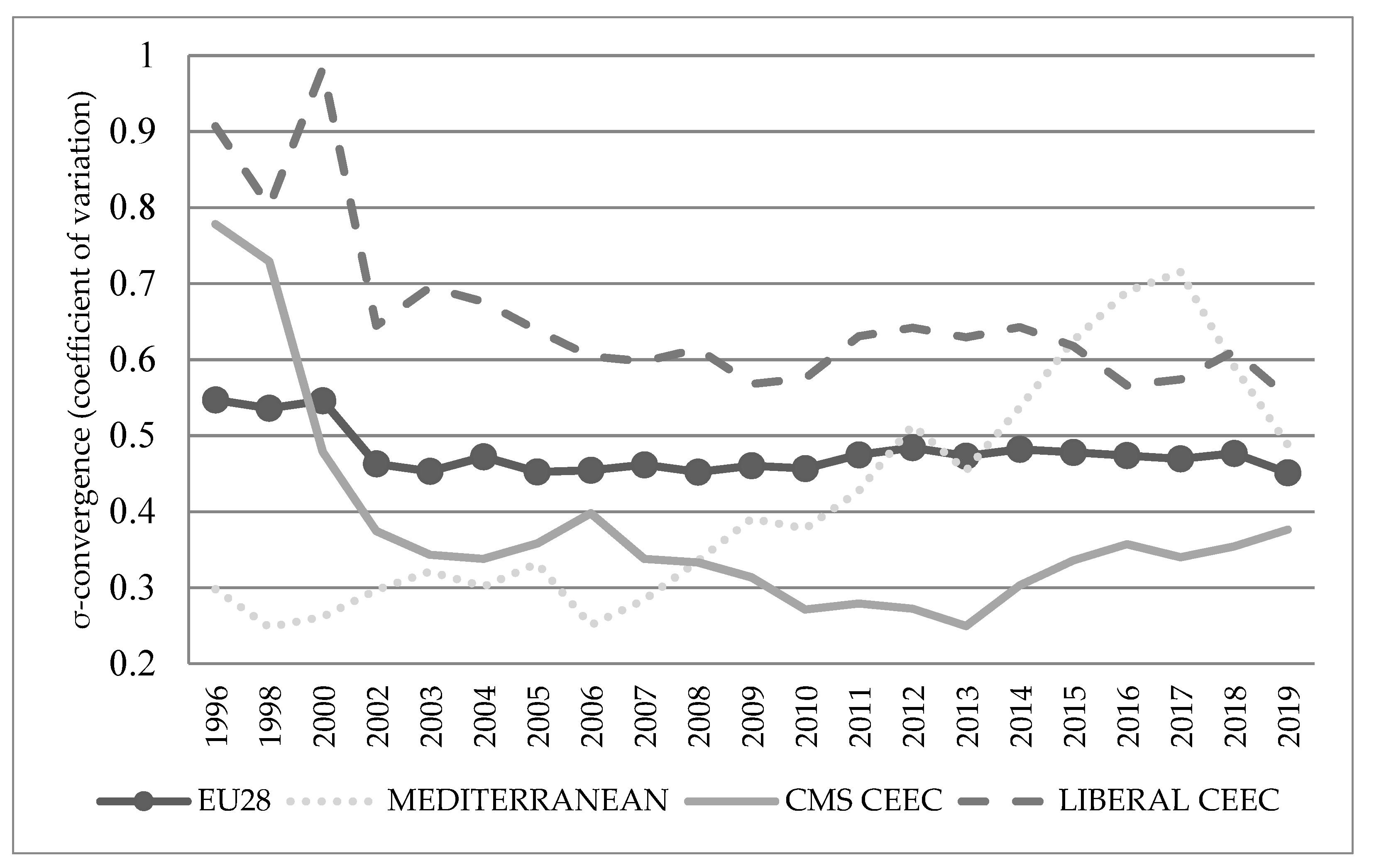

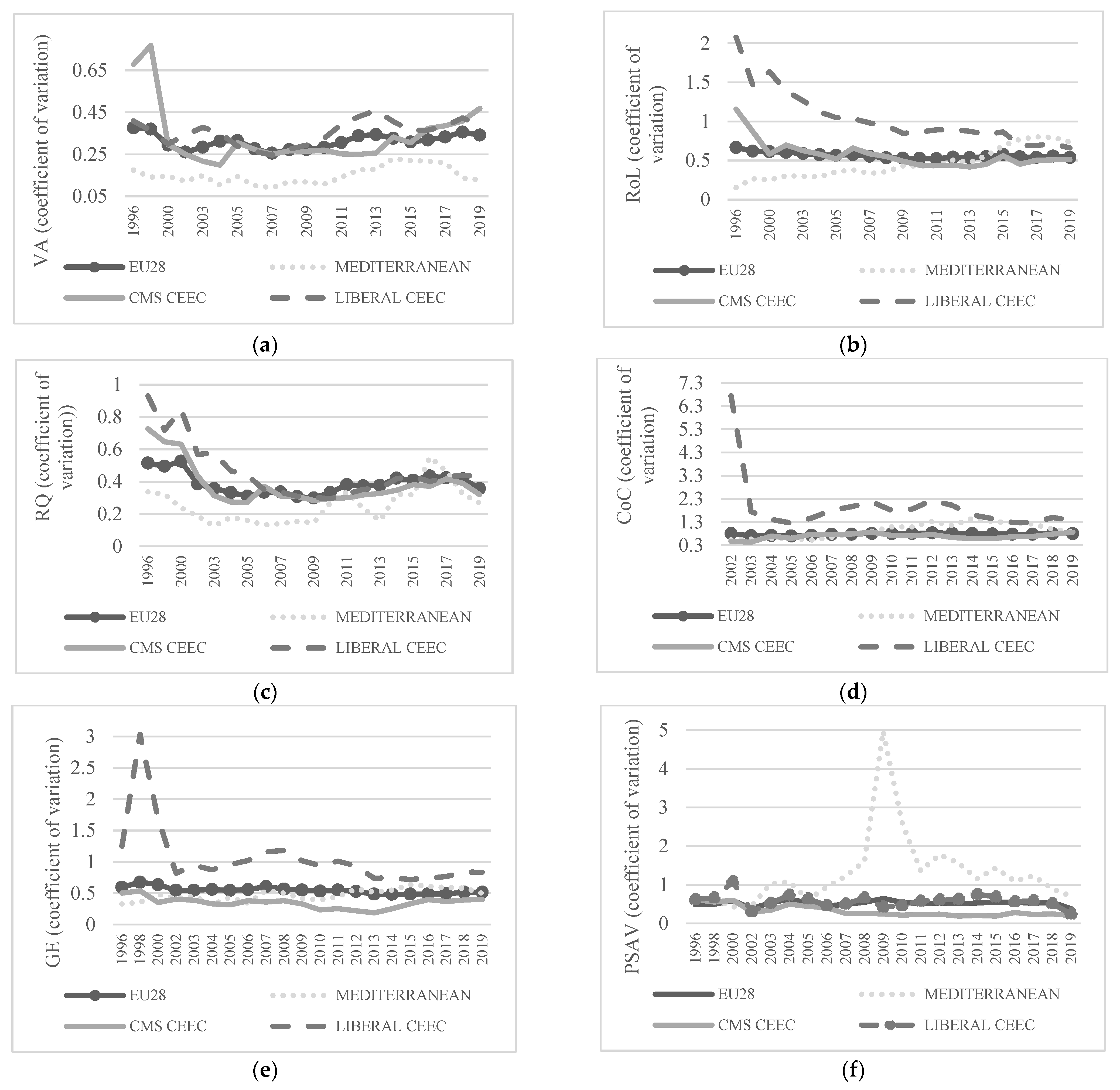

4.2. Sigma (σ) and Unconditional β-Convergence

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Schönfelder, N.; Wagner, H. Institutional convergence in Europe. Economics: The Open-Access. Open-Assess. E-J. 2019, 13, 1–23. [Google Scholar] [CrossRef] [Green Version]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1991. [Google Scholar]

- Barro, R.J.; Sala-i-Martin, X. Convergence. J. Political Econ. 1992, 100, 223–251. [Google Scholar] [CrossRef]

- Savoia, A.; Sen, K. Do we see convergence in institutions? A cross-country analysis. J. Dev. Stud. 2016, 52, 166–185. [Google Scholar] [CrossRef]

- Glawe, L.; Wagner, H. Convergence, Divergence, or Multiple Steady States? New Evidence on the Institutional Development within the European Union. J. Comp. Econ. 2021, 49, 860–884. [Google Scholar] [CrossRef]

- Glawe, L.; Wagner, H. Divergence Tendencies in the European Integration Process: A Danger for the Sustainability of the E (M) U? J. Risk Financ. Manag. 2021, 14, 104. [Google Scholar] [CrossRef]

- Vahabi, M. Introduction: A special issue in honoring Janos Kornai. Public Choice 2021, 187, 1–13. [Google Scholar] [CrossRef]

- Kornai, J. The affinity between ownership forms and coordination mechanisms: The common experience of reform in socialist countries. J. Econ. Perspect. 1990, 4, 131–147. [Google Scholar] [CrossRef] [Green Version]

- Teubner, G. Legal Irritants: How Unifying Law Ends Up in New Divergences. In Varieties of Capitalism: The Institutional Foundations of Comparative Advantage; Hall, P.A., Soskice, D., Eds.; Oxford University Press: Oxford, UK, 2001; pp. 417–441. [Google Scholar]

- King, L. Postcommunist Divergence: A Comparative Analysis of the Transition to Capitalism in Poland and Russia. Stud. Comp. Int. Dev. 2002, 37, 3–34. [Google Scholar] [CrossRef]

- Cornia, G.A. Transition, Structural Divergence; Performance: Eastern Europe and the Former Soviet Union during 2000–2007. In Economies in Transition: The Long-Run View; Roland, G., Ed.; United Nations University–World Institute for Development Economics Research; Palgrave Macmillan: Basingstoke, UK, 2012; pp. 293–316. Available online: https://www.wider.unu.edu/sites/default/files/wp2010-32.pdf (accessed on 9 August 2021).

- Bohle, D.; Greskovits, B. Capitalist Diversity at Europe’s Periphery; Cornell Univeristy Press: Ithaca, NY, USA, 2012. [Google Scholar]

- Ahlborn, M.; Ahrens, J.; Schweickert, R. Large-Scale Transition of Economic Systems–Do CEECs Converge Toward Western Prototypes? Comp. Econ. Stud. 2016, 58, 430–454. [Google Scholar] [CrossRef]

- Hall, P.A.; Soskice, D. An Introduction to Varieties of Capitalisms. In Varieties of Capitalism: The Institutional Foundations of Comparative Advantage; Hall, P.A., Soskice, D., Eds.; Oxford University Press: Oxford, UK, 2001; pp. 1–68. [Google Scholar] [CrossRef] [Green Version]

- Ahrens, J.; Schweickert, R.; Zenker, J. Varieties of Capitalism, Governance and Government Spending: A Cross-Section Analysis; Kiel Working Paper (No. 1726); Kiel Institute for the World Economy (IfW): Kiel, Germany, 2011. [Google Scholar]

- Buchen, C. East European Antipodes: Varieties of Capitalism in Estonia and Slovenia. In Proceedings of the Pre-Publication Conference “Varieties of Capitalism in Post-Communist Countries”, Paisley University, Paisley, UK, 23–24 September 2005. [Google Scholar]

- Mykhnenko, V. What Type of Capitalism in Post-Communist Europe? Poland and Ukraine Compared. Institutional Change in Contemporary European Capitalism: Conflict, Contradiction and Complementarities Conference, London School of Economics and Political Science, London, UK. 2005. Available online: http://www.policy.hu/mykhnenko/Mykhnenko2005GERPISA.pdf (accessed on 3 August 2021).

- Feldmann, M. Emerging Varieties of Capitalism in Transition Countries: Industrial Relations and Wage Bargaining in Estonia and Slovenia. Comp. Political Stud. 2006, 39, 829–854. Available online: http://journals.sagepub.com/doi/pdf/10.1177/0010414006288261 (accessed on 3 August 2021). [CrossRef]

- Noelke, A.; Vliegenthart, A. Enlarging the Varieties of Capitalism: The Emergence of Dependent Market Economies in East Central Europe. World Politics 2009, 61, 670–702. [Google Scholar] [CrossRef] [Green Version]

- King, L. The Role of Existing Theories and the Need for a Theory of Capitalism in Central Eastern Europe. 2010. Available online: http://www.emecon.eu/fileadmin/articles/1_2010/emecon%201_2010%20King.pdf (accessed on 5 October 2020).

- King, L. Central European Capitalism in Comparative Perspective. In Beyond Varieties of Capitalism: Conflict, Contradictions, and Complementarities in the European Economy; Hanké, R., Thatcher, M., Rhodes, M., Eds.; Oxford University Press: New York, NY, USA, 2007; pp. 307–327. [Google Scholar] [CrossRef]

- Hall, P.A.; Thelen, K. Institutional Change in Varieties of Capitalism. Socio-Econ. Rev. 2009, 7, 7–34. [Google Scholar] [CrossRef] [Green Version]

- Hall, P.A.; Gingerich, D.W. Varieties of capitalism and institutional complementarities in the political economy. Br. J. Political Sci. 2009, 39, 449–482. [Google Scholar] [CrossRef] [Green Version]

- Próchniak, M.; Rapacki, R.; Gardawski, J.; Czerniak, A.; Horbaczewska, B.; Karbowski, A.; Towalski, R. The emerging models of capitalism in CEE11 countries—A tentative comparison with Western Europe. Wars. Forum Econ. Sociol. 2016, 7, 7–70. [Google Scholar]

- Farkas, B. Quality of governance and varieties of capitalism in the European Union: Core and periphery division? Post-Communist Econ. 2019, 31, 563–578. [Google Scholar] [CrossRef] [Green Version]

- Vamvakidis, A. Convergence in Emerging Europe. East. Eur. Econ. 2009, 47, 5–27. [Google Scholar] [CrossRef]

- Próchniak, M.; Witkowski, B. On the Stability of the Catching-Up Process Among Old and New EU Member States. East. Eur. Econ. 2014, 52, 5–27. [Google Scholar] [CrossRef]

- Próchniak, M.; Witkowski, B. Real β-Convergence of Transition Countries. East. Eur. Econ. 2013, 51, 6–26. [Google Scholar] [CrossRef]

- Pejovich, S. Understanding the Transaction Costs of Transition: It’s the Culture, Stupid. Rev. Austrian Econ. 2003, 16, 347–361. [Google Scholar] [CrossRef]

- Brousseau, E.; Garrouste, P.; Raynaud, E. Institutional changes: Alternative theories and consequences for institutional design. J. Econ. Behav. Organ. 2011, 79, 3–19. [Google Scholar] [CrossRef] [Green Version]

- Boettke, P.J.; Coyne, C.J.; Leeson, P.J. Institutional Stickiness and the New Development Economics. Am. J. Econ. Sociol. 2008, 67, 331–358. [Google Scholar] [CrossRef] [Green Version]

- Kurkchiyan, M. Russian Legal Culture: An Analysis of Adaptive Response to an Institutional Transplant. Law Soc. Inq. 2009, 33, 337–364. [Google Scholar] [CrossRef]

- Roland, G. The Long-Run Weight of Communism or the Weight of Long-Run History? In Economies in Transition: The Long-Run View; Roland, G., Ed.; United Nations University—World Institute for Development Economics Research; Palgrave Macmillan: Basingstoke, UK, 2012; pp. 153–171. [Google Scholar]

- Murrell, P. Evolution in Economics and in the Economic Reform of the Centrally Planned Economies; Working Paper; Department of Economics, University of Maryland: College Park, MD, USA, 1991; Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.547.8215&rep=rep1&type=pdf (accessed on 3 August 2021).

- Elster, J.; Offe, C.; Preuss, U. Institutional Design in Post-Communist Societies: Rebuilding the Ship at Sea (Theories of Institutional Design); Cambridge University Press: Cambridge, UK, 1998. [Google Scholar]

- Dolowitz, D.; Marsh, D. Learning from Abroad: The Role of Policy Transfer in Contemporary Policy-Making Governance. Int. J. Policy Adm. 2000, 13, 5–24. [Google Scholar] [CrossRef]

- Jaklič, M.; Zagoršek, H. Rationality in Transition: Using Holistic Approach to Rationality to Explain Some Developments in the Slovenian Business System; Working Paper. No. 146; Faculty of Economics, University of Ljubljana: Ljubljana, Slovenia, 2003. [Google Scholar]

- Roland, G. Understanding Institutional Change: Fast-Moving and Slow-Moving Institutions. Stud. Comp. Int. Dev. 2004, 38, 109–131. [Google Scholar] [CrossRef] [Green Version]

- Rodrik, D. One Economics, Many Recipes: Globalization, Institutions, and Economic Growth; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- La Porta, R.; Lopez-de-Silanez, F.; Shleifer, A. The Economic Consequences of Legal Origins. J. Econ. Lit. 2008, 46, 285–332. [Google Scholar] [CrossRef] [Green Version]

- Nye, J. Institutions and Institutional Environment. In New Institutional Economics—A Guidebook; Brousseau, E., Glachant, J.-M., Eds.; Cambridge University Press: Cambridge, UK, 2008; pp. 67–80. [Google Scholar] [CrossRef]

- Kornai, J. What Does ‘Change of System Mean’? In From Socialism to Capitalism; Kornai, J., Ed.; Central University Press: Budapest, Hungary, 2008; pp. 123–150. [Google Scholar]

- Jurlin, K.; Čučković, N. Comparative analysis of the quality of European institutions 2003–2009: Convergence or divergence? Financ. Theory Pract. 2010, 34, 71–98. [Google Scholar]

- Greif, A. Cultural Beliefs and the Organization of Society: A Historical and Theoretical Reflection on Collectivist and Individualist Societies. J. Political Econ. 1994, 102, 912–950. [Google Scholar] [CrossRef]

- Mueller, M.L. Networks and States: The Global Politics of Internet Governance; MIT Press, 2010; Available online: https://mitpress.universitypressscholarship.com/view/10.7551/mitpress/9780262014595.001.0001/upso-9780262014595 (accessed on 9 August 2021).

- Fligstein, N. Markets as Politics: A Political-Cultural Approach to Market Institutions. American Sociological Review. 1996, pp. 656–673. Available online: https://www.researchgate.net/publication/209410174_Markets_as_Politics_A_Political-Cultural_Approach_to_Market_Institutions (accessed on 9 August 2021).

- Šimić Banović, R.; Basarac Sertić, M.; Vučković, V. The Speed of Large-Scale Transformation of Political and Economic Institutions: Insights from (Post-) Transitional European Union Countries. Hrvat. Komparat. Javna Uprava-Croat. Comp. Public Adm. 2018, 18, 555–583. [Google Scholar] [CrossRef]

- Dixit, A.K. Lawlessness and Economics: Alternative Modes of Governance; Princeton University Press: Princeton, NJ, USA, 2004. [Google Scholar]

- Gorodnichenko, Y.; Roland, G. Culture, Institutions and the Wealth of Nations; NBER Working Paper No. 16368; National Bureau of Economic Research: Cambridge, MA, USA, 2021; Available online: http://www.nber.org/papers/w16368.pdf (accessed on 6 August 2021).

- Kyriacou, A.P. Individualism–collectivism, governance and economic development. Eur. J. Political Econ. 2016, 42, 91–104. [Google Scholar] [CrossRef] [Green Version]

- Klasing, M.J. Cultural dimensions, collective values and their importance for institutions. J. Comp. Econ. 2013, 41, 447–467. [Google Scholar] [CrossRef]

- Granovetter, M. Economic Action and Social Structure: The Problem of Embeddedness. In The Sociology of Economic Life, 2nd ed.; Granovetter, M., Swedberg, R., Eds.; Westview Press: Cambridge, MA, USA, 2001; pp. 51–76. [Google Scholar]

- Whitley, R. (Ed.) European Business Systems: Firms and Markets in Their National Contexts; Sage Publications: London, UK, 1997. [Google Scholar]

- United Nations & Economic Commission for Europe. In-Depth Review of Governance Statistics in the UNECE/OECD Region, ECE/CES/BUR/2016/OCT/2. 2016. Available online: https://www.unece.org/fileadmin/DAM/stats/documents/ece/ces/bur/2016/October/02_In_depth_review_Governance_final.pdf (accessed on 9 August 2021).

- Acemoglu, D.; Johnson, S.; Robinson, J.A. Institutions as a fundamental cause of long-run growth. In Handbook of Economic Growth; Elsevier: Amsterdam, The Netherlands, 2005; Volume 1, pp. 385–472. [Google Scholar]

- Han, X.; Khan, H.; Zhuang, J. Do governance indicators explain development performance? A cross-country analysis. In Governance in Developing Asia: Public Service Delivery and Empowerment; Deolalikar, A.B., Jha, S., Quising, P.F., Eds.; Asian Development Bank: Metro Manila, Philippines, 2015. [Google Scholar] [CrossRef] [Green Version]

- University of Gothenburg. Measuring the Quality of Government and Subnational Variation. Report for the European Commission Directorate-General Regional Policy Directorate Policy Development. 2010. Available online: http://ec.europa.eu/regional_policy/sources/docgener/studies/pdf/2010_government_1.pdf (accessed on 9 August 2021).

- Schimmelfennig, F. Good governance and differentiated integration: Graded membership in the European Union. Eur. J. Political Res. 2016, 55, 789–810. [Google Scholar] [CrossRef]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. The Worldwide Governance Indicators: Methodology and Analytical Issues. In World Bank Policy Research Working Paper. 2010. Available online: https://openknowledge.worldbank.org/handle/10986/3913 (accessed on 3 August 2021).

- Worldwide Governance Indicators. Available online: https://info.worldbank.org/governance/wgi/ (accessed on 7 August 2021).

- López-Tamayo, J.; Ramos, R.; Suriñach, J. Institutional and socio-economic convergence in the European Union. Croat. Econ. Surv. 2014, 16, 5–28. [Google Scholar]

- Tóth, I.J.; Hajdu, M. Corruption, Institutions and Convergence. Studies in Economic Transition. 2021, pp. 195–248. Available online: https://ideas.repec.org/h/pal/stuchp/978-3-030-57702-5_9.html (accessed on 6 December 2021).

- Alesina, A.; Tabellini, G.; Francesco, T. Is Europe an Optimal Political Area? In Brookings Papers on Economic Activity; Brookings Institution Press: Washington, DC, USA, 2017; pp. 169–213. Available online: http://www.jstor.org/stable/90013171 (accessed on 9 August 2021).

| Indigenously Introduced Endogenous Institutions (IEN) | Indigenously Introduced Exogenous Institutions (IEX) | Foreign-Introduced Exogenous Institutions (FEX) | |

|---|---|---|---|

| Institutional emergence | Entirely spontaneously | Exogenously imposed by domestic authority | Created and imposed by outsiders |

| Main designers/roots | Local people, their norms and customs | National government | International organisations |

| Acceptance by the inhabitants | High desirability because of its harmony with informal institutions | Great likelihood of a gap between institution and informal institutions | Most likely rejection by the host countries |

| Distinctiveness | Institutionalised informal practices | Opposite directions of development: simultaneous familiarity and distance from metis | High probability of ineffectiveness |

| “Stickiness” level | Highest: the “stickiest” institutions | Medium: some “stickiness” still kept | Lowest: the greatest lack of “stickiness” |

| Examples | Norms of behaviour | Laws, money | Colonial rules, foreign aid initiatives |

| Liberal | Nordic | Continental | Mediterranean | CEECs with a Coordinated Market System | CEECs with a Liberal Market System |

|---|---|---|---|---|---|

| UK | Finland | Belgium | Greece | Hungary | Bulgaria |

| Ireland | Denmark | Netherland | Italy | Poland | Slovakia |

| Sweden | Germany | Portugal | Czech Republic | Romania | |

| Austria | Spain | Croatia | Latvia | ||

| France | Slovenia | Estonia | |||

| Lithuania |

| Countries’ Group Dimension of Institutional Quality | Liberal CEECs | CMS CEECs | Mediterranean | EU25 |

|---|---|---|---|---|

| RoL | β 0.3274 ** | β −0.6889 * | Model not significant | β −0.3386 *** |

| (0.0717) | (0.2330) | (0.1092) | ||

| R2 0.27 | R2 0.74 | R2 0.29 | ||

| RQ | β −0.2902 ** | β −0.6281 * | Model not significant | β −0.3422 *** |

| (0.1057) | (0.2357) | (0.0815) | ||

| R2 0.65 | R2 0.70 | R2 0.43 | ||

| GE | β 0.4852 * | Model not significant | Model not significant | β −0.2945 *** |

| (0.2108) | (0.0958) | |||

| R2 0.57 | R2 0.29 | |||

| CoC | Model not significant | β −0.6357 * | Model not significant | β −0.2116 ** |

| (0.2557) | (0.0835) | |||

| R2 0.67 | R2 0.22 | |||

| IQavg | Model not significant | β −0.7091 ** | β 0.1259 * | β −0.3110 *** |

| (0.2218) | (0.0393) | (0.0799) | ||

| R2 0.77 | R2 0.83 | R2 0.39 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vučković, V.; Šimić Banović, R.; Basarac Sertić, M. Governance Trends among New EU Member States: Is There Institutional Convergence? Sustainability 2021, 13, 13822. https://doi.org/10.3390/su132413822

Vučković V, Šimić Banović R, Basarac Sertić M. Governance Trends among New EU Member States: Is There Institutional Convergence? Sustainability. 2021; 13(24):13822. https://doi.org/10.3390/su132413822

Chicago/Turabian StyleVučković, Valentina, Ružica Šimić Banović, and Martina Basarac Sertić. 2021. "Governance Trends among New EU Member States: Is There Institutional Convergence?" Sustainability 13, no. 24: 13822. https://doi.org/10.3390/su132413822

APA StyleVučković, V., Šimić Banović, R., & Basarac Sertić, M. (2021). Governance Trends among New EU Member States: Is There Institutional Convergence? Sustainability, 13(24), 13822. https://doi.org/10.3390/su132413822