1. Introduction

The global climate warming has brought a series of environmental problems during the last two decades. In response to the increased climate change concerns, policymakers in nearly all countries have makes great efforts to reduce CO

2 emissions. From the financial market perspective, the development of the international carbon market is on the track, and the carbon emission trading (CET) markets have been growing rapidly since the Kyoto Protocol formally came into force in February 2005 [

1]. Moreover, the Paris Agreement coming into effect in November 2016, further promises to control the global average temperature increase within 2 degrees Celsius in this century. These commitments of CO

2 emissions reduction and the establishment of the CET scheme might play important roles in improving the situation of global climate warming.

China, as the largest emerging market, has witnessed a huge economic development since the reform and opening up in 1978. The process of industrialization and rapid economic development inevitably bring with huge energy consumptions, especially coal consumptions (According to the BP Energy Outlook’s data, the consumption shares of coal, oil and natural gas in China accounted for 61.8%, 19%, and 6.2%, respectively in 2016, while non-fossil energy consumption accounted for 13%), leading to large amounts of CO

2 emissions in China. In fact, China has still remained the coal-based energy consumption structure and become the world’s largest CO

2 emitter since 2006 [

2], which makes China undertaking dual pressure from domestic environment problems and external carbon emission commitments. Therefore, aiming to optimize the energy consumption structure and realize the goal of CO

2 emission reduction, the Chinese government makes continuous efforts to set up regional CET scheme pilots and foster the development of new energy in recent years (Until now, there are eight CET market pilots in China’s provinces and cities, namely as, Beijing, Shanghai, Guangdong, Shenzhen, Chongqing, Tianjin, Hubei and Fujian). Under this circumstance, understanding the dynamic nexus between China’s CET market, the energy market, and the development of new energy companies is of policy importance.

The purpose of the paper is to examine the dynamic interactions and price transmission nexus among China’s CET market, coal market, and new energy market. Understanding the linkages and transmission among these markets has operational and political significance highly relevant to the main participants in the Chinese energy markets: polluting industries, governments and financial actors. Previous studies have contributed to explaining this issue by employing several conventional time-domain techniques such as the vector autoregressive (VAR) approach, the autoregressive distribution lag (ARDL) model, the GARCH model, the multivariate empirical mode decomposition (MEMD) model, the Granger causality test, the cointegration test, and among others [

3,

4,

5,

6,

7,

8,

9]. Until now, to our knowledge, there are only two studies considering this interaction in the frequency domain. Sousa et al. [

10] rely on a multivariate wavelet method to investigate the correlation between the U.S. carbon emission trading (U.S. CET) market and several energy prices (the gas, coal, and electricity prices). Wavelet analysis is also adopted by Ortas and Álvarezb [

11] and they reveal the interaction between the European carbon emission trading (EU CET) market and the main energy commodities in time and frequency domains. These studies provide robust evidence that the frequency-varying feature is important not only since energy commodity prices tend to be sticky in the short-run and perfectly flexible in the long-run but also since the information on the interactions in different frequencies provides implications for different players in the energy markets. In general, financial actors are more likely to be interested in understanding high-frequency interactions between energy commodities prices, while the polluters and regulators are also interested in lower frequencies. Considering these arguments, this paper further investigates the time- and frequency-varying feature of the interactions among the three markets, utilizing a novel multivariable wavelet method, especially in the China context, the largest developing economy in the world.

The contribution of this study to the existing literature mainly lies in the following two parts. For one thing, different from a wild range of existing research placing more weight on the EU or U.S. CET markets, we try to fill the research gap in the China context given that the Chinese CET market, despite its rapid development in the latest years, exhibits manifest structural differences from the developed markets. Furthermore, growing empirical evidence in terms of the EU CET and U.S. CET scheme has confirmed that CET allowances and energy markets are closely linked. Nevertheless, their connection with the new energy market is still a topic that remains largely unstudied. Especially for China recently undertaking the period of green economic transformation, which drives benign changes in energy consumption. Changes in energy consumption concepts and the commitment to the reduction of carbon emission both promote the rapid development of new energy industries. In view of this, this paper tries to investigate whether there exists inherent connectedness of the new energy market with the CET market and the coal market. For another, unlike the previous literature mainly considering these interactions in a time dimension, this paper adopts a novel multivariate wavelet analysis to explore the time-variation as well as the frequency-variation relationship of the CET allowances prices with coal market prices and new energy stock prices, which might shed new light on the existing literature. To the best of our knowledge, this study might be one of the first studies to employ a time- and frequency-dimension method to analyze this subject in China.

The remainder of this paper proceeds as follows.

Section 2 reviews the related literature.

Section 3 explains the methodology.

Section 4 describes the data and does a preliminary statistical analysis.

Section 5 discusses the empirical results. Finally,

Section 6 concludes this paper.

2. Literature Review

The issue of dynamic interactions between fossil energy consumption, the CO2 emission trading allowance, and the development of new energy companies arouses much attention in academia during the last near decades. Different studies take different research perspectives and there exist two main fields of literature on detecting the relationship between them.

The first strand of the literature has concentrated on the linkage between the energy market and the CET market. Among these researches, a large number of studies focus on the European carbon emissions trading market and investigate the underlying determinants of the EU CET market price. Their empirical results show that fuel prices (i.e. coal, crude oil, and natural gas price), especially crude oil prices, are the main factor influencing the price of the EU CET market (see, for example, [

4,

12,

13,

14,

15,

16]). The possible reason is that fossil fuel energy demand will be adjusted according to changes in its price. Changes in fossil fuel consumption will lead to changes in carbon dioxide emissions, which may change the carbon demand in the CET market and ultimately affect the CET market price. Different from the literature concerning the traditional fossil fuel energy, D’Adamo [

17] notes that new energy, such as photovoltaic resources, could drive the clean global economy of the future and also affect the price of EU CET market. Besides, Chen et al. [

18] find that CET future market prices could exert an influence on the spot market price too. Through a linear regression model analysis, D’Adamo [

19] reveals that the relationship between the circular economy and the price of CO

2 is currently low. Moreover, there is also a handful of researches investigating the latent factors of U.S CET market prices. Kim and Koo [

3] rely on a linear ARDL model to examine the response of U.S. CET market price to the changes of energy price and their findings indicate that the coal price has an effective influence on the U.S. CET price over the long-term rather than short-term. Hammoudeh et al. [

20] utilize a quantile regression model to investigate the interaction between energy price and U.S. CET price and their empirical results show that the fluctuation of U.S. CET prices can be attributed to the natural gas, the crude oil, and the electricity prices. Marimoutou and Soury [

21] show that the relationships between the energy market and the CO

2 emission market fluctuate over time. Hammoudeh et al. [

22] claim that the negative changes in coal prices can interpret the carbon market price better than the impact of positive changes in the short-term.

In recent years, several types of research start to pay attention to China’s CET market. Among these, Zhang and Zhang [

23] find that there is a long-term negative nexus between the Shanghai CET market prices and the coal price. However, they also notice that it exists a positive interplay across different quantiles. Zeng et al. [

24] rely on a SVAR model to detect the relationship between energy price and CET market price and drew a conclusion that the coal prices show a negative impact on the price of the Beijing CET market. However, Fan and Todorova [

25] notice that there is no statistically significant relationship between energy indices and carbon allowance prices in the Beijing CET market and attribute it to the initial development stages of China’s carbon market. Chang et al. [

26] utilize GARCH models to investigate the asymmetric clustering and regime-switching behaviors of the CET market in China. Furthermore, Chang et al. [

7] apply a cointegration test to examine the dynamic interactions between the CET market and energy price. Lin and Jia [

27] apply a computable general equilibrium model to detect the underlying determinants of CET market price and analyze the impact mechanism in China. Besides, Yang et al. [

28] use the difference-in-differences model to investigate the impact of the policy of China’s CO

2 CET on the carbon price and they find that this policy plays an important role in the stabilization of carbon price. Wang et al. [

29] find that the CET pilot policy undertaken in China could contribute to CO

2 abatement in the pilot provinces. Through applying the data envelopment model-slack based measurement method and difference-in-differences model, Zhang et al. [

30] also examine the impact of the CET policy on environmental efficiency in China and find that the policy has significantly improved environmental efficiency in the pilot regions.

The second strand of the literature has attempted to examine the relationship between the CET market and the stock market of new energy firms. Henriques and Sadorsky [

31] indicate that there does not exist significant interactions between the stock market of clean energy firms and EU CET market prices. Kumar et al. [

32] also draw a similar conclusion. More recently, Jiménez-Rodríguez [

33] finds the impacts of the European stock markets on the EU CET market prices. In China context, Zhu and Kong [

34] apply a VAR model to detect this relationship and find that the interplays between the Shenzhen CET market price and the stock prices of new energy firms are ineffective. Different from these findings, Qin [

6] claims that China’s CET market prices have a certain influence on the stock price of new energy firms and further indicates that the nexus between them is positively correlated. It is can be noticed that the interaction between these market prices still exists argues in academia, due that these findings do not consist of each other. Therefore, it is a worthy investigating issue, especially in China which has not much enough analysis on this topic before.

Compared with numerous researches that pay attention to investigating the CET price and energy price (especially crude oil price) in EU and U.S. markets, fewer studies have focused on China’s CET market. However, in order to realize the goal of CO

2 emission reduction, China’s CET market is developing rapidly in recent years. Therefore, studies of China’s CET market can give us a better understanding of the current development in this market. In terms of empirical methods, Caruso et al. [

35] suggest that mathematical models need to be applied in the related research to evaluate the economic aspects of CET price. However, a large body of research merely considers these interactions in the time domain, not including frequency analysis, which might bias the understanding of the nexus. Hence, this paper re-examines relationships between China’s CET market, the coal market, and the stock market of the new energy firms under time-and frequency-varying perspectives, trying to shew new light on previous researches.

5. Empirical Results

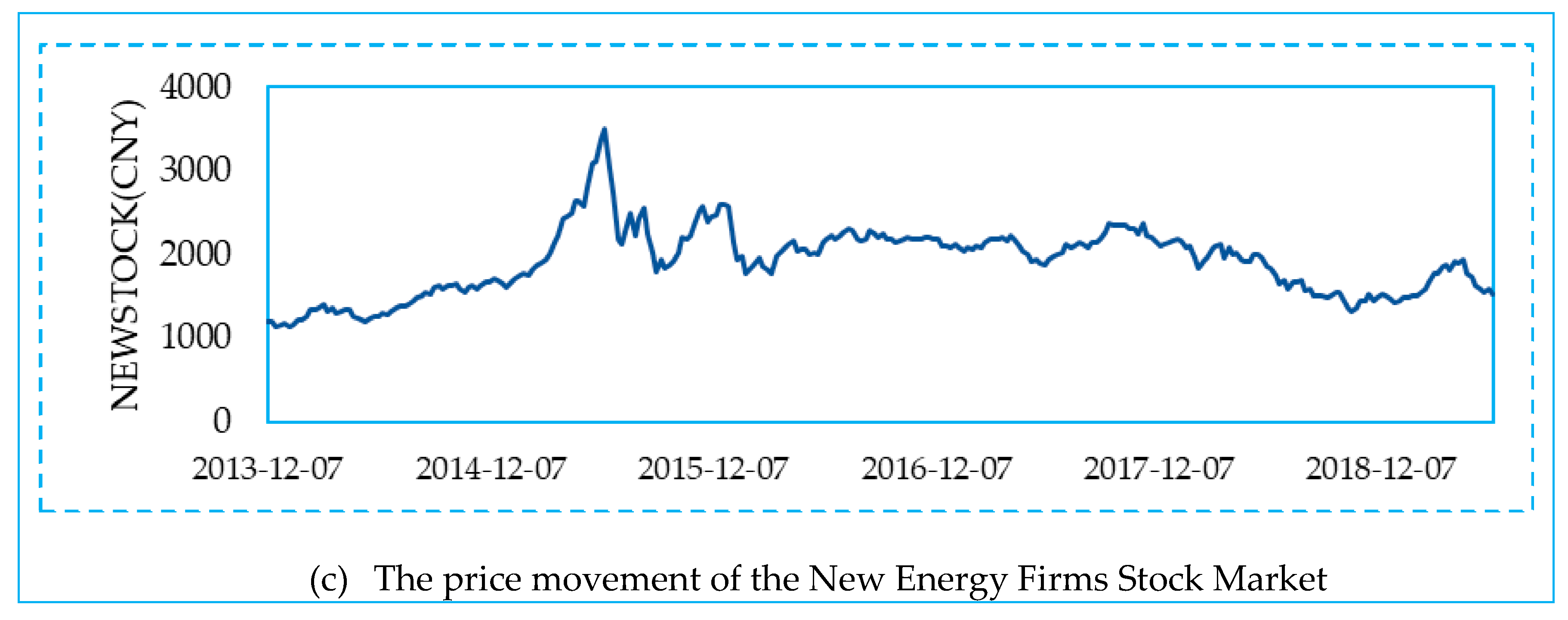

In this section, we will utilize multivariate continuous wavelet tools to investigate the interaction between the CET market, the coal market, and the new energy stock market. The wavelet analysis results between three markets are illustrated in

Figure 3,

Figure 4,

Figure 5 and

Figure 6, which can help us to capture the strongest interplays among them across time- and frequency domain. Note that the significance level of 10% (5%) is depicted by the thick gray (black) curve. The black contours near the edge are cones of influence (COI) in which edge effects exist, indicating unreliable indications of co-movement and causality beyond the COI (Readers can see Grinsted et al. [

41] and Torrence and Compo [

42] for more details on the COI). Moreover, the different color spectrum distinguishes the degree of coherency, ranging from cold color (low coherency-close to blue) to warm color (high coherency-close to yellow). In addition, we define a high-frequency band between 15–20 weeks, a middle-frequency region between 20–40 weeks, and a low-frequency area between 40–80 weeks to facilitate the interpretation of their interactions at each frequency band.

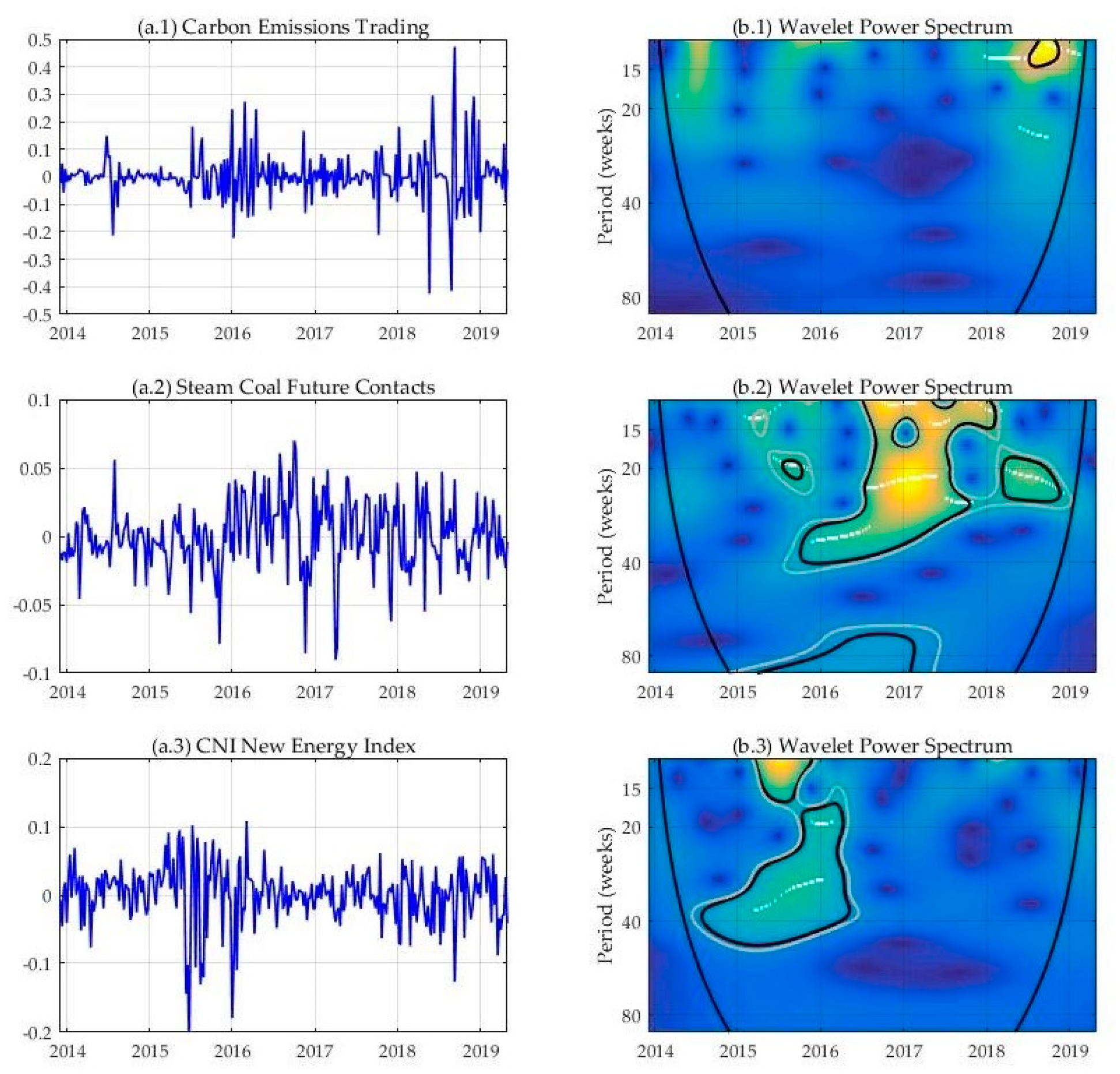

Figure 3 reports the multivariate wavelet coherencies among three markets. According to

Figure 3, it can be clearly noticed that there are six main locations with high coherency at the significance level of 5%, which indicates that the three market prices are jointly significant to affect each other. In the 40–80 weeks frequency band, we find the most important one, which starts from the second half of 2017 to the middle of 2018. Also, in this frequency band, another high coherency runs from the late-2016 to the third quarter of 2017. Moreover, in the 20–40 weeks frequency areas, there is a large region with high coherency starting from the fourth quarter of 2014 to the end of 2015. Finally, the remaining three significant coherency areas are concentrated in the 15–20 weeks. Specifically, one starts from the second quarter of 2014 to the third quarter of 2014. The following one runs from the second quarter of 2015 to the third quarter of 2015. The last one starts in the second quarter of 2018 to the third quarter of 2018.

Although the multiple coherencies can detect the strong relationship between the CET market, the coal market, and the new energy stock market, it is still unable for us to distinguish the different impacts of each market. Therefore, we rely on the partial coherence, combined with the partial phase-difference, and the partial gains to further differentiate the influence of each market price after controlling another variable. The corresponding results are registered in

Figure 4,

Figure 5 and

Figure 6.

Figure 4 displays the partial wavelet coherency between the CET market price and the coal price (left), the corresponding partial phase-differences (mid), and the partial wavelet gains (right).

Figure 4 denotes that there are main five regions with high interactions. In the 15–20 weeks frequency band, we find three areas with significantly high coherency. The first two regions are in the second and third quarters of 2014 and 2015, respectively. In both areas, the partial phase differences are between –π and –π/2, which indicate that two market price returns are out-phase (i.e. negative relationship) with coal market price leading. Therefore, the financial actors in the CET market should also pay attention to the increase in coal price in the short-term, in order to avoid the loss of assets. Moreover, according to partial wavelet gains, we can clearly observe that the effect of coal market price changing on the CET market price is larger in 2015 than that of 2014. Similarly, the third one runs from the second quarter to the third quarter of 2018. The phase difference is between π/2 and π, implying that the relationship between them is still negative, however, with CET market price leading. The magnitude of the impact of the CET market price on the coal market price is as same as that of 2015. The possible reason behind is that when the CET market price increases in the short-term, in order to reduce CO

2 emissions costs, the companies might tend to rely on cleaner energy, therefore, the demand for fuel with higher CO

2 emissions (like coal) will be cut down, which generally brings the lower price of the coal market price.

At a lower frequency band (corresponding to 40–80 weeks), we notice that there are two regions with significantly high coherency. Both areas are located between late 2015 to the end of 2018. For the former region, the phase differences are between π/2 and π, suggesting that the nexus between two market prices are still negative, with the CET market price leading. Moreover, the partial wavelet gains show that the relationship is stable in both regions, with a value close to 1. In the case of the latter region, we find that the phase differences are between –π and –π/2, implying that the coal price negatively affects the CET market. The economic implication behinds these findings are as follows. In the long-term, the decreasing coal price will cut the production costs of industries that heavily depend on coal consumption (i.e. heating power industries and power generation industries). Therefore, these industries might tend to consider more demand for coal. Increasing coal consumption will inevitably increase carbon emissions, which in turn drives up the demand for carbon emission allowances, therefore making the CET market price increase.

Similarly,

Figure 5 represents the partial wavelet coherency between the CET market price and the new energy stock price, the corresponding partial phase-differences, and the partial wavelet gains.

Figure 5 indicates that there are two main high coherency regions at the middle and low-frequency bands, except for a region in the COI. The first one is located in the 20–40 weeks frequency band, running from the fourth quarter of 2014 to the end of 2015. The corresponding partial phase differences are between π/2 and π, which indicates that the relationship between two market price returns is negative, with the new energy stock price leading. Moreover, according to the partial wavelet gain, we can notice that the magnitude of the impact of the new energy stock price on the CET market price is around 0.5. The reason behind is that the cleaner energy will replace fossil energy, due to the development of new energy (economically, reflected in the value of the stock), which results in reduced CO

2 emissions. Therefore, the demand for the CO

2 emissions allowance is dropped and finally leads to the CET market price decreasing. The second is located in the 40-80 weeks frequency band and starts from the first quarter of 2017 to the second quarter of 2018. And the phase difference is between 0 and π/2, implying that the relationship between two market prices is positive, with the CET market price leading. Moreover, the corresponding partial wavelet gain shows that this high coherency relationship is stable and the coefficient appears to be 1. The economic implication of this finding indicates that increasing the CET market price means the pressure of the huge demand for CO

2 emissions. However, in order to implement green economic development and meet the goal of CO

2 emissions reduction, the government might take initiatives to cultivate the growth of new energy companies. Better future prospects make new energy company stock prices rise.

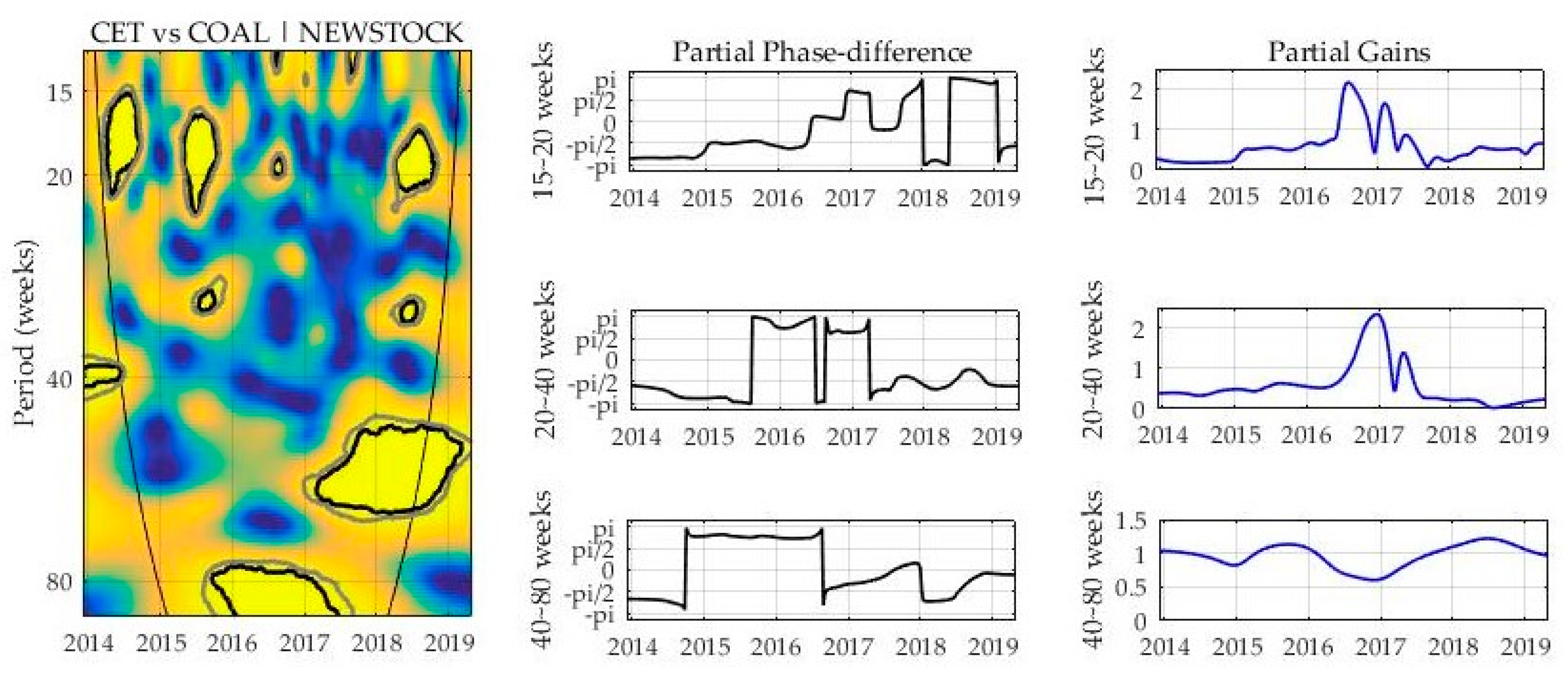

In addition,

Figure 6 illustrates the partial wavelet coherency between the coal price and the new energy stock price (left), the corresponding partial phase-differences (mid), and the partial wavelet gains (right). It can be found that there are major three regions with high interactions. Specifically, in the 15–20 weeks frequency band, we find the first one that begins from the second quarter of 2014 to the third quarter of 2014. Combined with the partial phase-difference, it is clear that the coal price negatively leads to the new energy stock price. In the 40–80 weeks frequency band, we notice that there are two regions with high linkages, running from the second quarter of 2015 to the third quarter of 2015 and the first quarter of 2017 to the second quarter of 2018. Moreover, the partial wavelet gains of significant regions indicate that the connection between new energy stock prices and the coal price is stronger than others from 2017 to 2018. In the former region, the partial phase differences are between π/2 and π, which indicates that the change of new energy company stock prices will negatively alter the coal prices. The economic implication behind this is that there is an obvious substitution effect between these markets. And the continuing development of new energy will reduce the consumption of coal, therefore, the demand for coal and their prices will decline. However, in the latter region, with the help of partial phase-difference, we find the coal price positively affects the new energy firm’s stock price. The reason behind this is that when coal prices rise, the demand for coal will fall, while demand for new energy, as an alternative product, will increase, which in turn forces the research and development of new energy products. The prospect of new energy makes the stock price increase.

To facilitate the presentation, we summarize the above results in

Table 2, which can help us to observe the relationship more clearly and further catch the different influences of each market. It can be clearly found that after controlling the new energy stock price, the relationship between the CET market price and the coal price is negative at both higher frequency (i.e. 15–20 weeks) and lower frequency (40–80 weeks). In addition, these connections are shorter in the higher frequency (in the short-term), while lasting longer in the lower frequency (in the long-term). In the case of the relationship between the CET market price and the new energy stock price, after controlling the coal price, we can obtain a similar finding. In the region of middle frequency, the new energy stock price has a negative impact on the CET market price. Besides, in the region of lower frequency, changes in the CET market price lead changes in the new energy stock price, however, the relationship is altered to be positive. Finally, after controlling the CET market price, we notice that the relationships between the coal price and the new energy company stock price are mixed. The coal price positively affects the new energy company stock price, while the new energy company stock price shows a negative impact on the coal price in the lower frequency. Compared to each partial wavelet gain, we can conclude that the partial wavelet gain in the lower frequency is larger than the middle or higher frequency, which indicates the connectedness among three markets is stronger in the long-term. According to these uncovered time- and frequency-varying characteristics, main participants in these markets, such as polluting industries, governments and financial actors, should pay close attention to the different connectedness among three markets under different frequency, in order to realize the goal of the production, the policymaking, and investment.

6. Conclusions

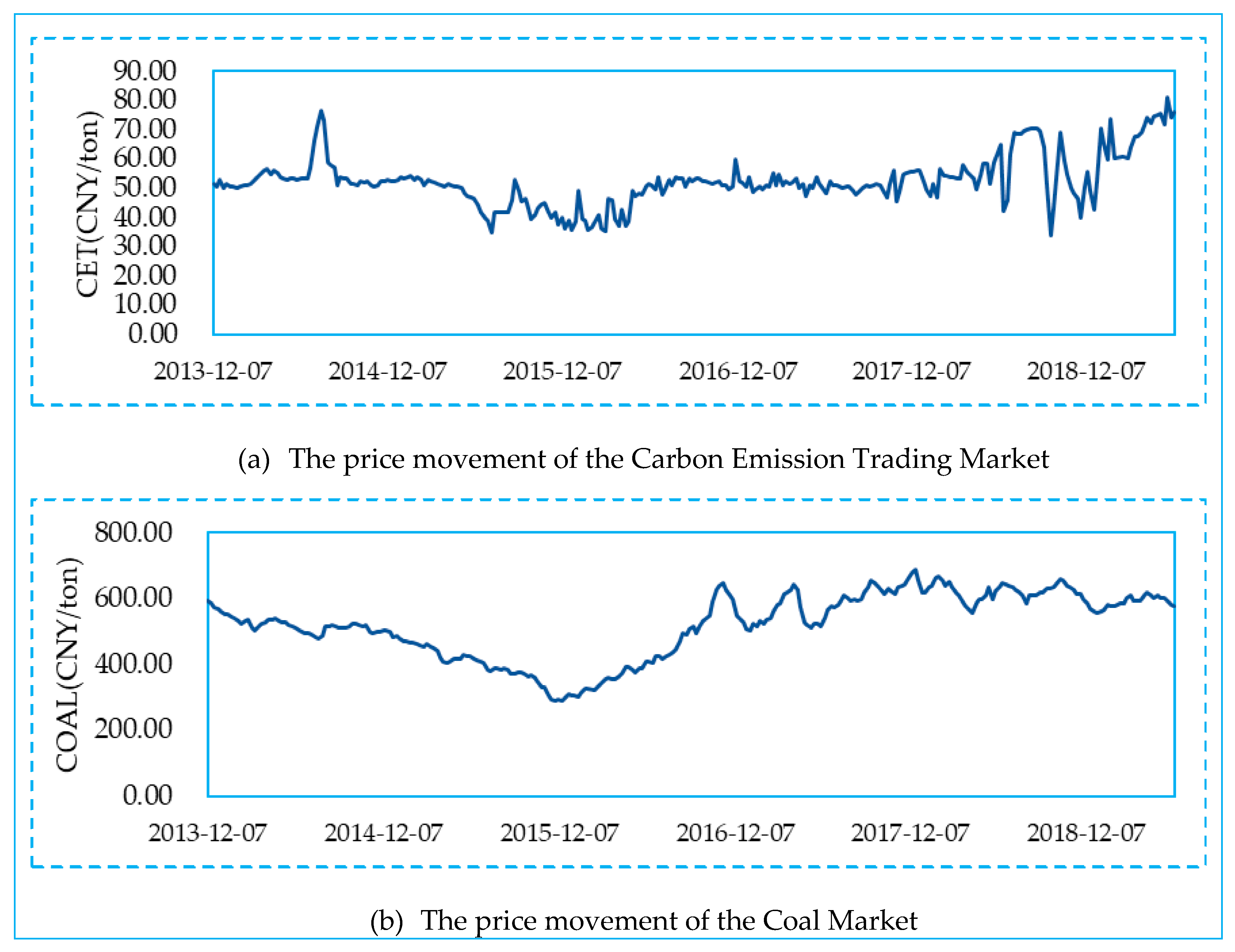

The issue of environment and the dynamic interactions between fossil energy consumption, CO2 emission trading allowance, and the development of new energy companies arouse much attention in academia during the last near decades. This paper adopts a novel multivariate wavelet analysis to explore the time-frequency co-movement and causality among them in China over the sampling period from the 49th week of 2013 (early-December, 2013) to the 23rd week of 2019 (early-June, 2019). Given that each market might have a different impact on others, we utilize the multiple wavelet coherency and the partial wavelet coherency, combined with partial phase difference and the partial wavelet gains to catch the time-frequency interaction between them.

The empirical evidence suggests that there are substantial time- and frequency-varying interactions between three market prices, suggesting that only considering time-domain model estimations performed by previous literature are not suitable to seize the actual nexus. First, the multiple wavelet coherency results suggest that there exists high coherency between the CET markets price and the coal price and the new energy stock price across each frequency band. Besides, there are more and shorter regions at a higher frequency band. Second, the findings of the partial wavelet coherency further help us to find the different impacts of each market price. Specifically, the interaction between the CET market price and the coal price is time-varying and both occur in the lower and higher frequency bands, while the co-movement between the CET market price and the new energy stock price both happen in the middle and lower frequency bands. Moreover, the co-movement between the coal price and the new energy stock price mainly exists in the lower and higher frequency band.

The findings of the current study provide several important implications. First, the presence of time- and frequency-varying features should not be ignored in future research when studying the interaction between the CET market, the coal price, and the new energy stock price. Moreover, this study further provides a better understanding of the dynamic linkages between the three markets for market regulators. For example, the CET market price is affected by the coal price and the new energy stock prices in the short- and middle-term, but in turn, it has limited impact. Therefore, in order to foster the development of the national CET market, the policymakers not only should take initiatives to stabilize China’s CET market price, but also should improve the financial function of the CET market in China, making it could impact related energy prices. In addition, for financial actors that mainly focus on the short-term connectedness among energy commodities prices, those findings might help them understand the high-frequency interactions and accordingly alter the different energy asset allocations in the short-term to avoid the price volatility risk. Besides, the interaction between the coal market price and the CET market in the lower frequencies suggests that polluting industries that heavily depend on coal consumption should pay attention to the changes of CET market prices in the long-term. Moreover, these polluters need to reduce their coal energy dependence through increasing research and development of new energy, which can not only reduce costs of carbon emissions and thus help them achieve their goal of the production but also make China’s environmental quality improved. The improvement of energy dependence structure in these polluting industries will inevitably decrease the demand for carbon emission allowances, therefore making the CET market price decrease.

However, this paper also has some shortcomings. For example, the model employed in the current paper cannot unravel asymmetric interactions among the three variables. The relationship between the CET market price and the other energy prices, such as coal prices and new energy prices, may differ when the CET market prices undergo positive or negative changes. Therefore, different methods could be applied to address this shortcoming in future research. An in-depth analysis of this motivation could give more profound implications.