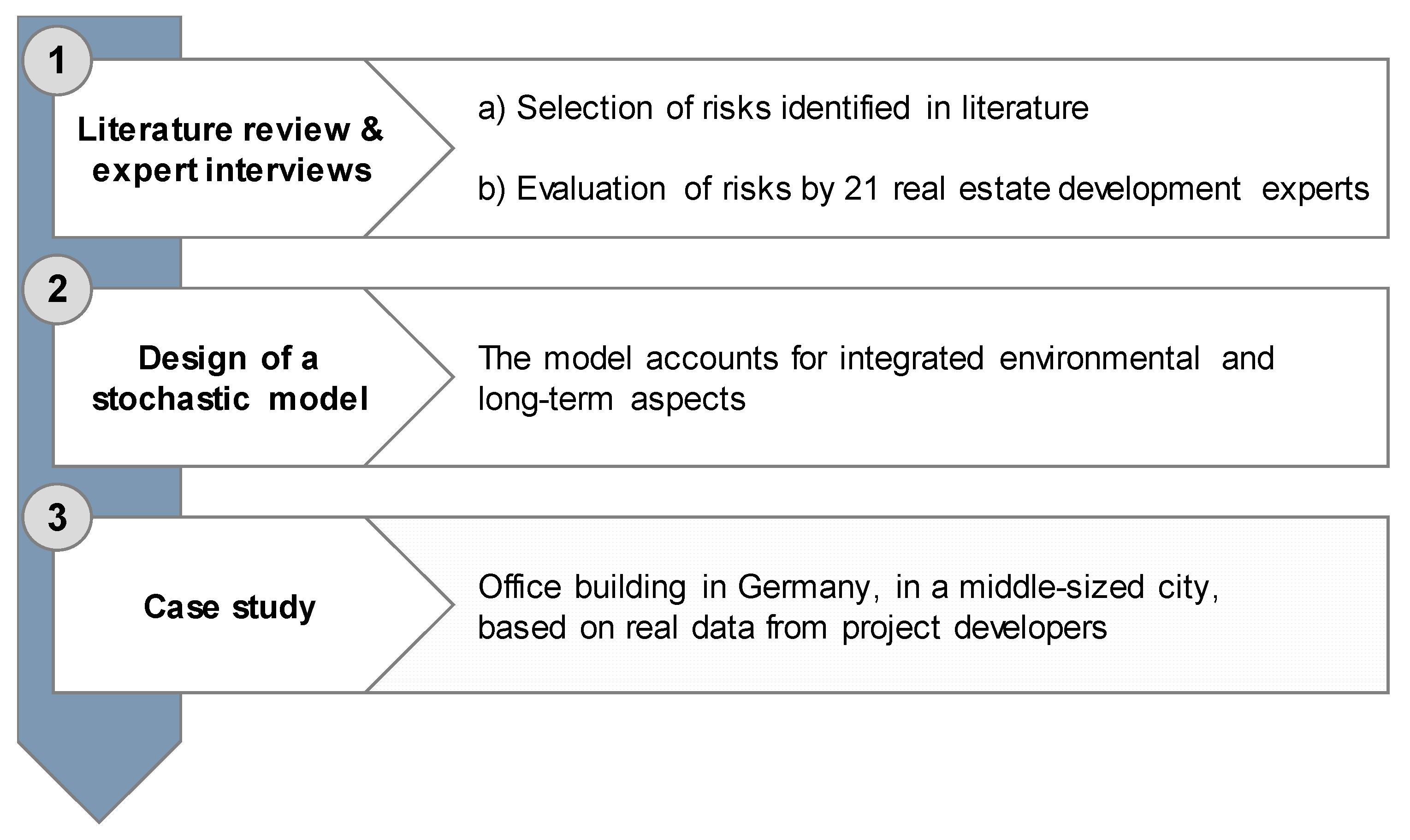

4.1. Identified Risks in Literature and Interviews

In general, customer needs and “wishes” have become more and more important (#15). For most customers, the materials themselves are not of the utmost importance, with their interests focusing more on design or the environmental certification of projects (#8, #15). Other developers argue that the quality of the used material is more important to customers (#1, #5). Additionally, safety measures, e.g., fire prevention, have gained importance in recent years (#5). In general, project developers trust what they know (#15). In order to be applied, HQMs need to be functionally superior (#1) or they need a marketing case, i.e., regional resources that convince customers or politicians (#4). Important questions for developers are: “How established are the innovative materials? Do admissions/approvals exist?” as well as “How do the material characteristics influence the use phase?” (#15). Additionally, most of the risks decrease if the developer is experienced and has professional management and planning, i.e., there is lower risk in contracts with agencies or subcontractors (#6). The better the planning of a project developer, and the more experience and number of actors who are involved in the early stages, the lower the project-related risks (#8). Other developers just hand the risk over to contractors (#5). Finally, sufficient supply of material is important. Developers are very keen on variety within the supply network because monopolistic structures tend to dominate the market and prices (#3, #11). Moreover, having more suppliers lowers the risk if one supplier goes bankrupt (#17).

Table 2 shows the 12 most important risks perceived by the experts.

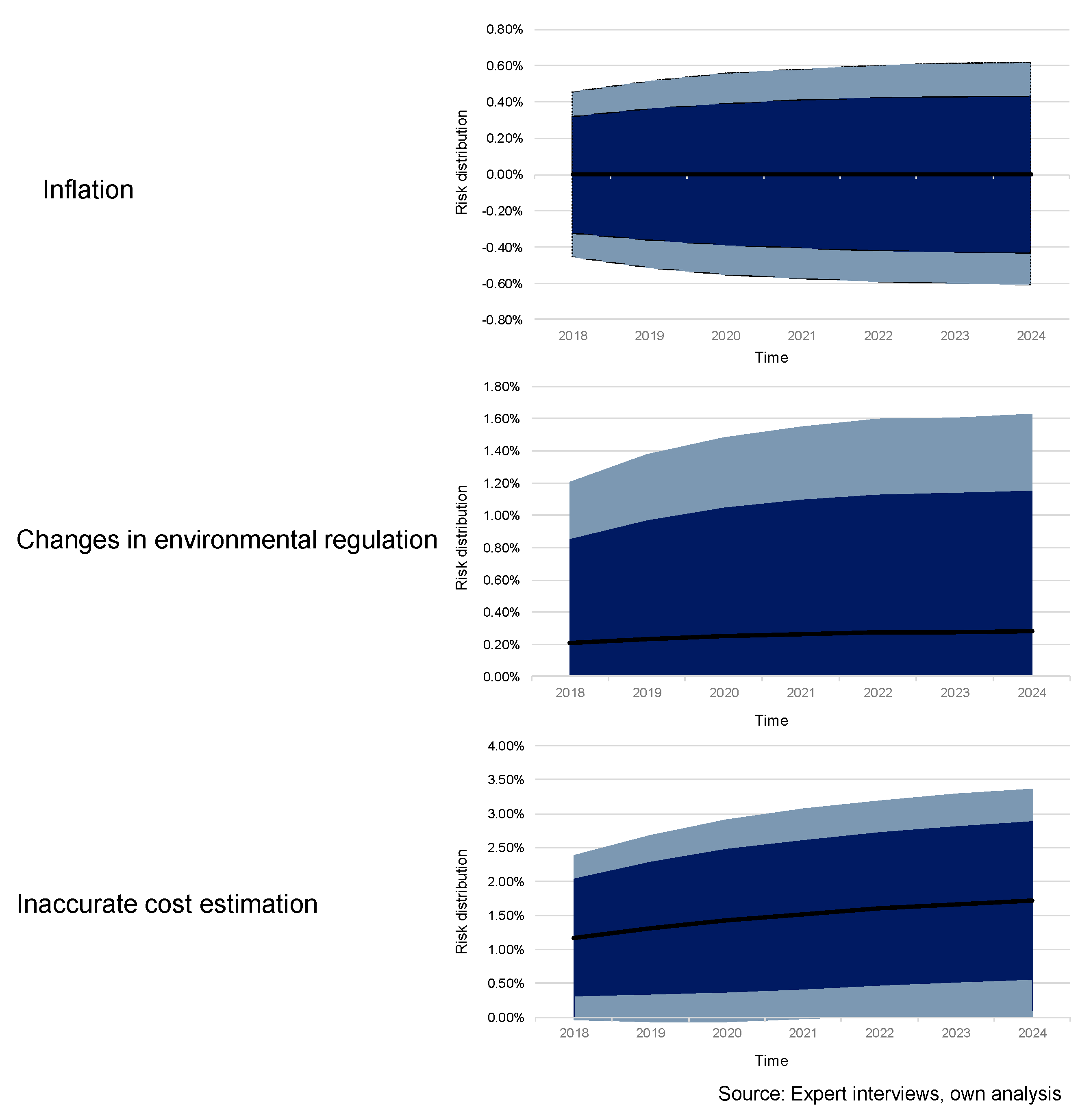

Increasing resource or raw material prices,

changes in environmental regulation, and

changes in building regulations or standards are the most important risks for conventional materials.

In comparison, litigation, increasing resource or raw material prices, and inadequate maintenance are ranked as the most important for HQMs. Some of these risks have a direct financial impact, e.g., increasing resource prices, while others have an indirect effect, e.g., disagreement with stakeholder, and lead to delays in project finalization and thus higher rates in debt capital or financial penalties agreed on in the contract (#1) or shortfalls in revenue (#6).

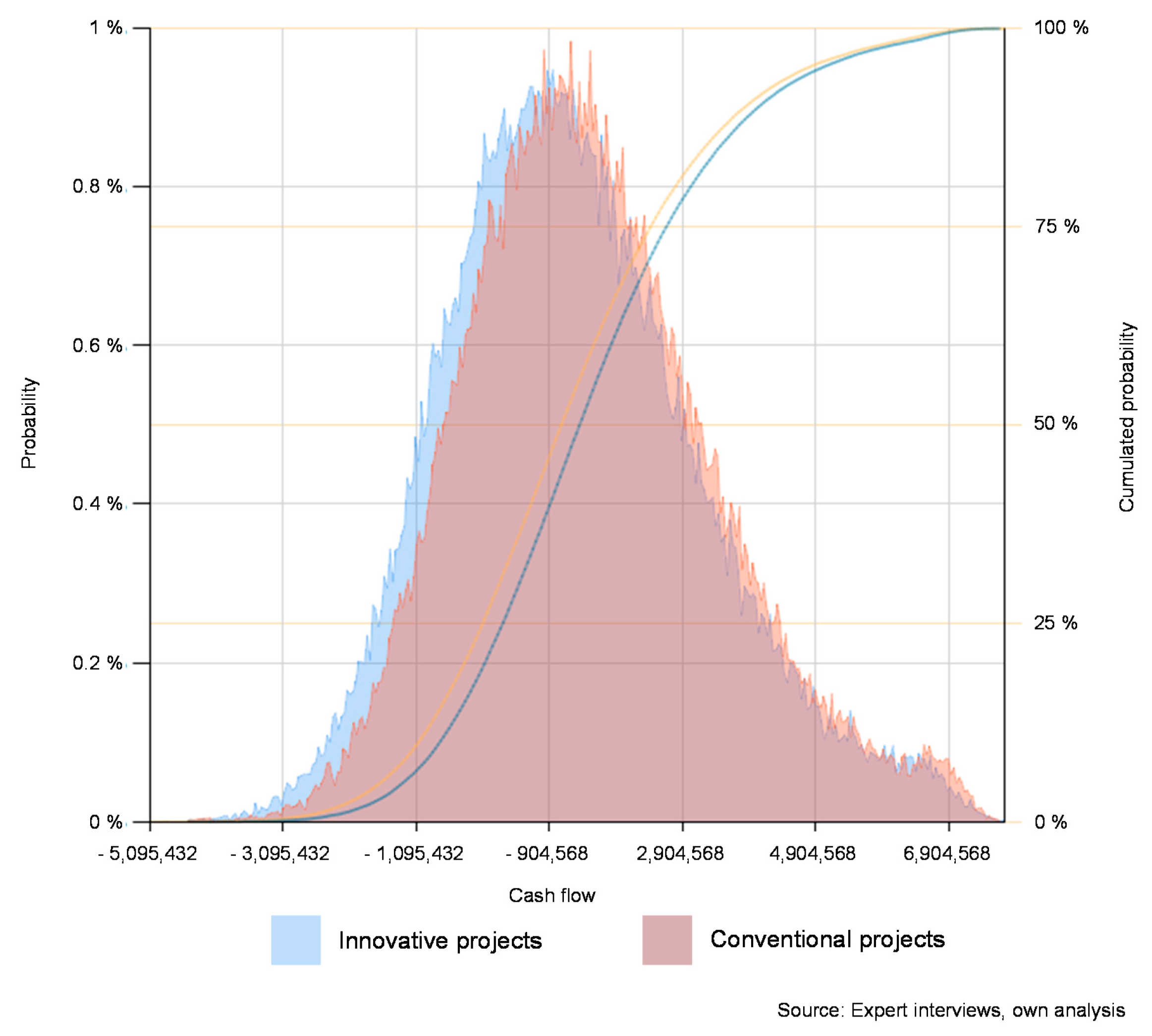

HQMs show overall higher values than conventional materials (see

Table 3). The interviewees confirm that, on average, a higher risk for HQMs (31 times, interviewees rated risks in combination with HQM higher). Three times, interviewees rated risks (all in external) in combination with conventional materials higher than with HQMs. Eight times, risks in combination with conventional materials were rated higher than HQMs. While the average score on the risk-index of all conventional risks was 3.05, HQMs show a score of 3.55. Similar scores are visible for the median values at 3.17 and 4.00, respectively, and standard deviations of 1.16 and 1.28. Differences between conventional materials and HQMs as well as differences for HQM between external and project risks were at least significant on a 90% confidence interval.

For external risks, the dominance of conventional materials over HQMs seem to be less prominent. Overall, 47% (#15) of the external risks rate conventional materials with lower scores, while 20% show the score as equal, and HQMs receive lower scores for 33% of the risks. Moreover, the differences in average score, median, and standard deviation are lower as well.

In the case of internal risks, conventional materials show lower risks 89% of the time. Only 11% of the questioned risks are perceived as lower for HQMs. The results support the tendency that project developers prefer conventional materials, as they expect lower negative impacts on their projects. This is mainly because less experience with innovative materials leads to higher risk in project-related aspects (#4, #14, #15).

The following section discusses the individual risks according to their importance for conventional materials. Moreover, the difference in ranking between conventional and HQMs is analyzed (see

Table 4 at the end of this section). Difference is defined as the variation between the index ranking of the conventional materials and the index ranking of the high-quality materials. The higher the variation, the larger the differences in the ranking. A difference of (+3) means that the risk is ranked three positions higher, and thus is more important for conventional materials than for HQMs.

Changes in environmental regulations are less important for HQMs than for conventional materials (+13). As mentioned earlier, HQMs are better prepared for stricter environmental regulations, and are therefore less prone to risk regarding maintenance and resale value (#1, #7, #8, #20). HQMs might also have an advantage regarding changing regulations; due to their selection in association with a specific reason, they fit better to a certain situation (#4). In general, new environmental legislation, energy efficiency, plays a particularly important role, as it leads to higher investment costs (#1, #8). Most of the experts (i.e., #6) consider efficient technical equipment as an energy efficiency measure. Innovative equipment is more likely to avoid costs than innovative materials, as an exchange is easier in case of a malfunction (#6). The quality of these machines is becoming more and more important, especially in times of smart metering and high connectivity (#1, #5). However, the installation of the equipment is connected to the availability of workers; the more complex the machines, the more difficult it is to find appropriate high-skilled workers (#17).

Increasing resource and raw material prices is important for both material groups, as evidenced by the fact that it is ranked second for both indices (difference is 0). The lower resource use of innovative and green materials could be one reason for that (#14). Other developers argue that HQMs are only used if they are cheaper or allow faster construction time (#6). Resource and material prices are a diverse topic due to some materials being a global topic (steel), and others being sourced regionally (gravel) (#1, #17). As a result, developers rate topics differently, depending on their main use in a company. Moreover, practitioners order the materials and products far in advance due to the capacity of suppliers, leading to the existence of long-term contracts that are less vulnerable to increasing resource prices (#4). The selection of materials and suppliers is an important topic in general, as most developers prefer several suppliers that create competition, thereby decreasing material costs (#6). Developers are seldom faced with the unavailability of materials; a lack of a construction material simply leads to increased prices (#17).

Economic crisis is a high-ranked risk for both conventional and HQMs, although it seems to be more important for conventional materials (difference +1). Its general value is connected to the demand for new real estate projects, the availability of construction companies, and the availability of free cash flows (#17). Materials are purchased regionally, and prices decrease during economic crises (#4). This effect is stronger for conventional materials than for HQMs (#6, #14). Contrastingly, developers want to differentiate themselves from the masses and gain a competitive advantage (#4), which can be achieved by HQMs, as they create unique selling points for projects and attract clients and investors (#11, #13). Others say, however, that during economic crises, people concentrate on what they know, and hence they stick to conventional materials (#6).

Although not as significant, a similar difference (+4) can be observed for changes in building regulations and standards. This risk is not equal for all developers and all phases during construction. First, it can be reduced if developers are in frequent contact with regulatory bodies; good communication between all stakeholders can lower the risk substantially (#5). Second, it depends on which part of the project is influenced by the new regulation. Moreover, the type of regulation change is relevant. On-site approvals count from the day of inspection, while changing standards are applicable until the day of project finalization. Therefore, standards are much riskier for developers as they can influence already-existing parts of the project (#3). HQMs not only seem less vulnerable to environmental standards, but also to building standards in general. However, some experts see HQMs as more vulnerable to changing regulations due to a lack of experience (#4, #6) or additional safety margins (#14). Bureaucratic hurdles are higher for HQMs, which can have a negative effect on the cash flow as implementation takes longer. On the other hand, missing or unspecific regulations are beneficial for a developer as there is more leeway to design and shape a project (#6). Changes in building regulations, as with changes in the tax system, also have indirect consequences, as the administrative body within a company needs to adapt to these changes, and new documentation becomes necessary. This results in additional costs and delays in project finalization (#3, #17).

Political majorities are an important issue as they might result in delays to, or even the cancelation of a project (#1). In our ranking, conventional materials seem more vulnerable to changing political majorities (+10). Different political viewpoints seem to have a higher influence on real estate projects built with conventional materials. One reason for this could be that green and innovative materials have a higher acceptance in public perception, and thus these projects have a higher probability in finalization, regardless of changes to political majorities. In general, the risk resulting from changing majorities is lower if a plan exists and the planning is concluded (#6, #15) since this signifies that development has reached a later stage (#5). The longer the project takes until finalization, the higher the risk of changes being deemed necessary due to changing political majorities (#3, #8). Moreover, there are indirect risks because, e.g., very few decisions are made shortly before and after an election, which increases the risk of delay in project finalization (#17). Finally, some experts even argue that the lack of experience with HQMs might lead to the cancelation of projects, e.g., because certification or EPDs are missing (#8).

Disagreement with stakeholder ranks sixth for conventional materials and ninth for HQMs (+3). Some experts (#3; #4, #6) see no difference, as stakeholders often disagree with the entire project rather than individual material groups. On the other hand, the lower risk for HQMs can be explained by the higher enthusiasm for HQMs. Even so, unforeseen complications, such as vapors, may lead to disagreements with stakeholders (#14). The main impact of a disagreement is a delay in project finalization and thus a later selling date (#8). Additionally, stakeholders might make special requests, like special windows or noise control, which leads to higher costs (#1). In general, stakeholder issues are an up-and-coming topic and are becoming increasingly important (#17), not only during construction, e.g., noise of the construction site, but also because of concerns regarding the entire project (#6). Stakeholders are a highly unpredictable risk if not addressed in advance (#5). Buildings and projects must blend in with their surroundings in order to reduce the risk of disagreement with stakeholders (#4).

Competition of buying parcels is currently a high risk in real estate development. Similarly to the risk of stakeholder disagreement, competition in buying land is a risk at a very early stage of project management. Some experts argue that HQMs might help when acquiring property as HQMs allow for new and innovative buildings (#1), while others argue that vendors just want to see the money (#16). In general, this is currently a high risk as parcels in most developed countries are rare and a lot of investors and developers are looking for new possibilities (#5). If competition of buying parcels leads to delays in project finalization, HQMs might have an advantage, as construction times can be shortened due to innovative processes, i.e., faster drying of concrete (#14). With a difference of +9, the greater importance for conventional materials is clear.

Historical finds or monument protection is the first risk that is ranked higher for HQMs (difference −2). One reason for this might be the strict guidelines in material use for these projects (#5, #9, #14) and missing empirical values for HQMs (#8). However, there is also the possibility of new materials allowing for easier refurbishment of a building, e.g., interior insulation (#8, #9, #11), or strict regulations acting as an argument for HQMs and against cheaper conventional materials (#13). In general, historical finds are always a high risk for developers, as during the building and refurbishment processes new information might come to light (#1).

Litigation is ranked number 1 for HQMs and number 9 (−8) for conventional materials. This can mainly be explained by the lack of experience with new materials and the connected high chance of litigation resulting from misuse, wrong installation, or unforeseen maintenance procedures (#4, #5, #6, #10, #11, #14). The topic has recently become more important (#3, #14, #17) and most of the developers already include a budget for litigation in their project planning (#5). One reason for this growing importance is the complexity of current projects, which often leads to jurisdictional issues (#5). Apart from the design, projects become more complex as more materials are applied, e.g., cements or glues, which is always problematic due to mistakes potentially being associated with the variety of input variables. In particular, if several subcontractors have to work together, cooperation is crucial, and the risk of mistakes increases (#3). The risk of delays due to complexity mainly depends on if the application of HQMs increases or decreases complexity (#14). Finally, missing precedents for HQMs foster the fear of lengthy litigation processes (#14).

Experience in the application of different materials also plays a role in cost estimation. Inaccuracy is ranked 10th for conventional materials and seventh for HQMs (−3). Often, innovative products are planned individually for every project, leading to higher costs being connected to these materials (#2). In addition, more effort and precision are applied to HQMs, as managers and engineers try to minimize risk with new and more expensive materials (#4, #13). In contrast, there is less tolerance in manufacturing HQMs, as precision is important, and thus more volatility in cost estimation occurs (#14). Moreover, HQMs have the general disadvantage that processes and linkages between stakeholders within the construction process are not so well attuned and, thus, the risk of delays for these materials is higher (#8, #11, #14). Bad or insufficient internal management increases costs due to delays or faulty construction (#17). In general, delays due to wrong cost estimations or miscalculations of working hours are a result of external institutions, e.g., administration or politics (#5), and, hence, not always an indicator of internal imprecision. Finally, in some cases, realistic cost estimations might lead to losing the mandate for a project and, thus, lower turnover (#17). Therefore, while not all companies aim to estimate costs realistically in a first step, in the view of a sophisticated risk management strategy, this is irresponsible and endangers the survival of the entire company.

A large difference can also be observed in the availability of labor (−9). This is a general problem during boom periods for the entire construction industry (#5, #8, #12, #18), but this issue is a high risk in particular for HQMs (rank 4). Obviously, it is more difficult to acquire the highly skilled labor necessary to apply complex HQMs, as most of these materials are rather new, and less suppliers are available on the market (#4, #5, #11).

The largest difference in ranking (−13) can be seen for inadequate maintenance. As with the cost estimations, less information is available for new materials (#8, #11). Consequently, maintenance measures are ranked third for HQMs. For conventional materials, it is known which techniques can be applied to certain problems; for HQMs, this experience is missing (#4). The risk for HQMs can be lowered if projects are certified according to environmental standards, e.g., LEED, because life cycle thinking and end-of-life play an important role in certification and thus provide indicators regarding maintenance (#8). Customers want economic solutions for maintenance, and most of the time this is provided by conventional materials (#5).

For some developers, however, importance is not only allocated to the investment costs, but also to the intensity of construction and manufacturing, as well as the complexity of the installation (#15). HQMs are complex systems with expensive maintenance, and are prone to failure (#3).

Meanwhile, the relation of all risk is 36% to 64% regarding external risks (ER) and, for project risks (PR), the percentage rises to 42% and 58%, respectively, for the most important risks. Consequently, external risks are overrepresented in the most important risks.