1. Introduction

Along the lines of what is in place in other European countries, Polish government entities handle only a part of local and regional tasks. In accordance with the principle of subsidiarity, the essential part of tasks having no relevance from the countrywide perspective is performed by local government units, namely, local authorities which are subordinate to, and represent the interests of, a local or regional community. Since 1999, a three-level local government model has been in place in Poland, comprising communes, districts, and voivodeships. As basic local government units (LGUs), the communes carry out tasks of importance in the local context while the districts represent an intermediate level in charge of supra-communal tasks. In turn, voivodeships, the largest entities in the country’s territorial division, carry out regional tasks.

To perform their tasks and functions, Polish local government entities access defined sources of incomes, i.e., own incomes (including fiscal and non-fiscal income and property income) and transferred incomes (targeted grants and state budget subsidies). The sources and structure of LGU incomes are highly important for the implementation of their financial management tasks and policies. LGUs with certain own incomes from precisely defined sources are more autonomous and better positioned to perform their tasks and functions, especially including expensive infrastructural investments. Conversely, a considerable share of transferred incomes (grants, subsidies), largely based on a discretionary allocation of funds by central authorities, restricts the LGUs’ financial autonomy. To perform their own tasks, and, in particular, to implement infrastructure investments, local government entities may access repayable sources of finance (including credit and loans).

When considering the basic entities of the Polish local government sector, attention should be paid to rural communes, which represent the largest population of communes (1548 as at 1 November 2018, i.e., over 60% of all communes). In 2018, over 15 million people lived in rural areas in Poland. Rural communes were inhabited by nearly 11 million people, i.e., as much as 30% of the total population [

1]. The increase in the total number of people inhabiting these areas results from the phenomenon of suburbanisation, which has been observed in recent years. In view of this fact, local communities have growing needs, especially for technical and social infrastructure. According to research carried out by many scientists, including Kozera and Głowicka-Wołoszyn [

2], the functional type of many rural communes is transforming from the one characterised by the traditional agricultural function to the type with residential and service-providing functions. At the local level, it is communes that are chiefly burdened with the financial costs of inhabitants’ growing needs. In order to implement different projects, rural communes often need to rely on EU funds as their own income is limited. In Poland, the communes’ own income potential strictly depends on the functional type they represent. Even though the own income potential of Polish rural communes becomes increasingly higher, it still is the composite result of the demographic potential, local entrepreneurship, and local economic conditions, especially the location rent. As regards many rural communes, low levels of own income potential may be a barrier to socioeconomic development. This is because insufficient incomes make it more difficult to access external funds, whether repayable or non-repayable (including from the EU), which are determinant for the scope of communal investments and local development [

3]. As a result, they use repayable sources of financing. By using these funds, rural communes can function under conditions where their income does not correspond to the costs of tasks implemented. Simultaneously, they can maintain high standards of these tasks [

4]. The difficult financial situation of local governments has a negative influence on all citizens [

5] and economic development in general [

6,

7,

8]. Excessive indebtedness of local government units, especially the rural communes whose financial independence is below the average level in other administrative types of communes, may lead to the loss of financial liquidity or, in extreme cases, it may even result in falling into a debt spiral [

9]. Although according to Polish law, this situation does not result in the bankruptcy of a local government unit, the state takes responsibility for local finance. In view of this fact, it is necessary to apply different measures to prevent the occurrence of this situation. For example, it is necessary to manage the debt adequately and identify the financial risk factors of excessive indebtedness of local government units. Although these actions are not enforced by law, they are the most important aspects of financial management [

10]. In international literature, different approaches to debt management procedures are presented, which would be worth looking into. Special attention is paid to the need for a long-term approach to debt management [

11,

12,

13].

However, a budget deficit cannot be regarded as a purely negative development. Its scale (usually, the relative figures calculated in relation to budget incomes) and, first of all, its reasons must be considered when assessing it [

14]. Debt incurred by local government units to finance ongoing expenditure should definitively be judged negatively and is a prohibited practice in certain countries [

15]. In accordance with the golden rule for a balanced budget, local government should not undertake liabilities to finance their current tasks.

The risk of indebtedness is affected by factors related with administration, government, law, the economic base of local government units, their general financial situation as well as the amount and character of debt [

16]. Kosak-Wojnar and Surówka [

17] indicate that the activity of local government units is characterised by the occurrence of different risks, including financial ones, which are related with the methods of financing of the tasks implemented. One of them is the risk of excessive debt. According to Filipiak [

18], at present, it is caused not only by the fact that local government units implement an increasingly broad spectrum of tasks but also by the consequences of the economic and financial crisis, the decreasing amount of own income. According to Standar [

19], the risk is also caused by the implementation of numerous projects co-financed from EU funds.

It should be noted that in the literature worldwide, especially in America, financial risks are understood as economic distress [

20], sometimes as fiscal health [

21] and fiscal or financial stress [

22]. A solution to this problem is greatly influenced by [

23,

24]. First, the problem is that local authorities show little interest in this process. According to Kolha et al. [

23], of the 50 states covered by their study, only 15 rely on indicators to monitor the local financial conditions. Many of them use indicators that fail to identify local problems before they become important. The above is related to the next major issue involved in this research topic: the selection of indicators. During her research in 264 municipalities of the Chicago metropolitan area, Handrick [

25] found that the analysis of fiscal health is a complex concept whose dimensions, though interlinked, affect each other in an indirect or non-linear manner. This means they must be measured separately rather than being combined into a comprehensive indicator of fiscal standing. Another view is presented by Wang et al. [

26] who defined four dimensions of financial condition: dimensions in cash, budget, long-run and service-level solvencies, and 11 financial condition indicators. In turn, Jones and Walker [

24] proved the existence of a relationship between incomes and population, on one side, and the emergence of fiscal hazards, on the other. In the relevant literature, the third important aspect is tackled by Rivenbark and Roenigk [

27]. They noted the importance of the decision to analyze, interpret, and present the financial condition to selected officials and to see what management practices help in the analysis of financial conditions. The recent interest in the issue of the financial risk of communes has increased, as evidenced by recent research in all the world, e.g., in China—[

28], in Hungary—[

29], in Spain—[

30], in Poland—[

31].

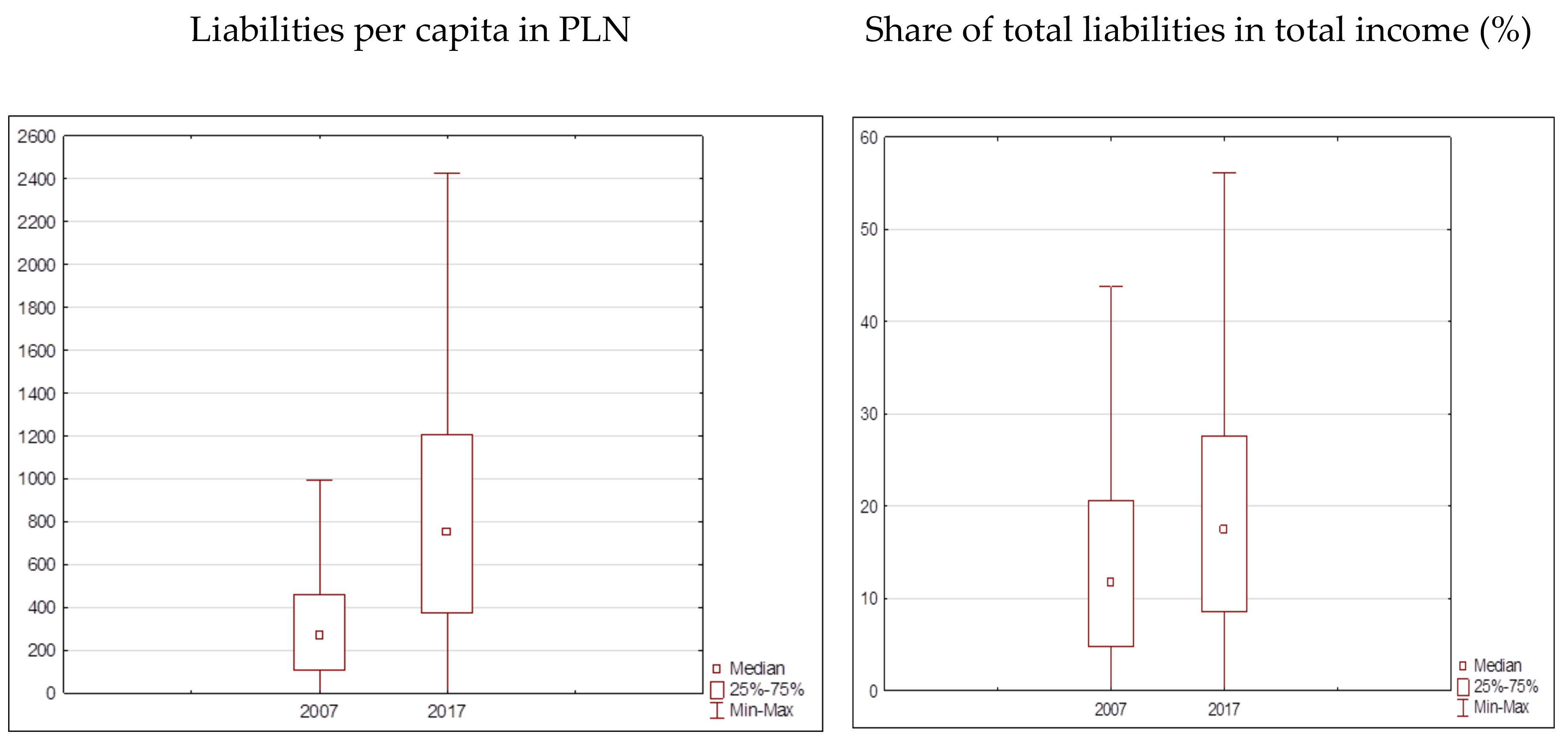

The purpose of this paper is to identify the financial risk factors of excessive indebtedness of Polish rural communes. The objective of this research task is to verify the following research hypothesis: the main determinant of the risk of excessive indebtedness is the rural communes’ own income potential. To meet the objective of this research, the empirical study was carried out in three steps. The first step of the research procedure was the analysis of the operation of Polish rural communes in the context of financial management. In the second step was the analysis of indebtedness of rural communes compared to other types of Polish administrative units in 2007–2017. The evolution of the level and share of total debt in total incomes of entities studied was analysed, and the share of overindebted rural communes was identified. In the third step, a discriminatory analysis was performed to build a model able to forecast the financial risk factors of excessive indebtedness for Polish rural communes.

This paper addresses the issues of public debt, which, in the theoretical sense, are a part of general economic and public finance theories. Generally, there are two conflicting doctrines regarding debt. According to the orthodox doctrine, debt is the consequence of defective financial management. In turn, the interventionist doctrine claims that debt should be viewed as a positive development which stimulates economic growth and makes investments financially feasible [

16].

2. Materials and Methods

The empirical research was based on the database published by the Ministry of Finance [

32] and the Central Statistical Office of Poland [

1]. The results are presented in Polish currency (the key data was converted to euro as per the weighted average exchange rate of the National Bank of Poland, which was from 3.52 EUR/PLN to 4.36 EUR/PLN [

33]). In the first part of the research, basic methods of descriptive statistics were used to process the empirical data collected from the database so as to analyse the indebtedness of rural communes in Poland. The results were shown in boxplots. Tukey [

34] introduced the boxplot to exploratory data analysis. In the third part of the research, discriminant analysis was used to build a model enabling prediction of excessive indebtedness of rural communes and identification of chief financial factors causing the risk of excessive indebtedness of these entities. This method was selected following a literature study and an attempt to build other models, e.g., a logit model, which, however, failed to deliver satisfactory results for the discriminant analysis.

Discriminant analysis is a classification method that is categorised as both a method of multidimensional statistical analysis and as a taxonomic method [

35]. It is used for ordering and classification of economic and financial phenomena according to many explanatory variables at the same time [

36,

37,

38]. Several assumptions needed to be verified in order to use this analysis. While the variables should follow a normal distribution, the discriminatory analysis is tolerant to a moderate violation of this assumption in the case of large samples. The model was built using Statistica software which checks the tolerance value [

39,

40]. Should that principle be violated, a wrong matrix message will be displayed, making it impossible to continue the analysis. The next assumption is about the sample size. In this case, the number of variables is adequate for the number of cases [

40]. Because the discriminatory analysis is highly sensitive to outliers, the variables were scanned for outlying observations, which were subsequently removed.

There are different methods for undertaking discriminant analysis. The most common linear function was used to estimate the form of the discriminant model [

41]:

where:

Zlj—dependent variable for j-th item (j = 1, 2, …, n) in l-th class (excessive debt—yes/no);

βo—discriminant function constant;

β1, …, βk—discriminant function coefficients (i = 1, 2, …, k);

X1, …, Xk—explanatory variables (i = 1, 2, …, k).

The objects under study are classified according to the estimated function value, which is usually a combination of several financial indicators (cf. [

40,

42,

43], which clearly differentiate (discriminate) the collection of items. In order to allocate an item under study to a particular group, the discriminant function value of the total value of products of variables and function parameters (i.e., the indicators’ weights) is compared with the limit value [

44,

45].

The discriminant function is a basic tool used in discriminant analysis. When adequate explanatory variables are selected, the function can be used to allocate an item (e.g., a commune) to a particular group of items [

44,

46]. As far as the prediction of financial factors causing the risk excessive indebtedness of local government units is concerned, discriminant analysis can be used to divide the rural communes under study into two separate classes: 0 and 1, referring to the communes unthreatened or threatened by the risk of excessive debt (dependent variable). The main period covered by the discriminatory model is 2012 to 2014. It was selected purposely because a large number of rural communes experienced debt problems at that time. This situation was preceded by the public finance crisis, which had reduced their incomes while intensifying pressure on the communes to make investments co-financed with available EU funds. Two subsequent discriminative models for the periods 2007–2009 and 2015–2017 were developed in order to carry out a comparative analysis of the main financial factors behind excessive indebtedness of Polish rural communes.

In our research, the rural communes, during the three years, where the average share of the total debt in the total income was greater than 50%, were classified as the communes with excessive debt. The authors of this paper defined the excessive indebtedness threshold as a situation where the ratio of total liabilities to total income is 50%. Until the end of 2013, the total liabilities/total income ratio was the official indebtedness indicator, and could not exceed 60% [

47]. The authors set a more restrictive level because even a ratio of 50% meant financial problems for local government units. First of all, communes with such a high ratio of debt to total income had a poor credit rating, restricting their ability to access repayable instruments (loans). Secondly, local government authorities with a lower financial rating often relied on shadow-banking loans whose high interest rates posed a considerable risk of sending them into a debt spiral in the next years. What also needs to be emphasized is that even at the same level of debt (numerator), the ratio can vary in function of fluctuations in total income (denominator), which could drive a further several percentage point increase in the ratio, resulting in the commune going beyond the defined threshold.

A set of 18 financial indicators was used as explanatory variables showing the financial situation and functioning of the local government units under study. They served as predictors of the risk of excessive indebtedness of local government units. The indicators recommended by the Ministry of Finance and by experts in local finance [

48] were selected (later in this paper, you may find the characteristics of indicators taken into consideration when building the discriminatory model). The selection was also based on an overview of the literature and previous studies concerning the forecasting of the financial threat of local government units (cf. [

43]). The variables were calculated as average values (medians) for three-year periods and they characterised the financial condition of local government units, especially referring to the financial independence and attractiveness of these entities. The time frames of this study were selected purposely because, as mentioned earlier, the communes considered reported the highest levels of debt at that time, translating into a risk of excessive indebtedness. Having made the substantive selection of discriminant variables, they were statistically verified. As a result of conducted statistical verification, due to a high correlation with the other variables, eight variables were eliminated from further analysis. In consequence, the model was based on the following ten variables (financial indicators) characterised by high discriminatory power:

- —

share of own incomes in total incomes (%, OI/TI) which reflects the financial independence from the state budget and financial autonomy (the higher the ratio, the greater the local government’s financial autonomy);

- —

the share of property (investment) expenditures in total incomes (%, PE/TI) showing the scale of investments in relation to the entity’s income potential (the higher the ratio, the greater the focus on development);

- —

share of remunerations and related expenditure in current expenditure (%, R/CE), a ratio which shows the proportion between personnel costs and in-kind expenses, and therefore tells whether the incomes are distributed properly;

- —

the level of property (investment) expenditure per capita in PLN (PE/M) showing the LGU’s investment potential per inhabitant;

- —

fiscal wealth indicator per capita (in zlotys,

FWI)—the indicator shows the commune’s income potential, which is decisive to the economic power of local government units (The expenditure capacity is determined especially by the amount of income from local taxes received by the commune (agricultural tax, forest tax, property tax, vehicle tax, tax on civil law transactions, tax from the tax card income, income from the exploitation fee), which indicates the scale of an entity’s fiscal wealth [

49]);

- —

the level of income from income taxes which are state budget incomes in PLN per capita (IT/M), reflecting the residential and economic attractiveness of the LGU (the higher the ratio, the greater the financial autonomy of the local government);

- —

the amount of EU funds accessed in PLN per capita (EU/M), showing the activity and effectiveness of local authorities in accessing additional investment funds;

- —

the operating surplus in PLN per capita (OS/M), reflecting the financial standing of the commune: its capacity to invest and incur debt;

- —

the share of operating surplus in total incomes (%, OS/TI), showing the part of the total income potential accounted for by investment funds obtained primarily in the form of investment grants and savings from the current part of the budget;

- —

self-financing ratio (SFR)—the ratio refers to the share of operating surplus and property income in property expenditures. It indicates the extent to which a local government unit finances investments with its own funds, i.e., the financing capacity. The higher the ratio is, the lesser is the risk of losing financial liquidity due to excessive debt service costs. However, on the other hand, if the ratio is high, it may also indicate a low implementation of investments in relation to the potential of a particular local government unit.

Afterwards, the selected explanatory variables were standardized. Outliers (extreme values) were eliminated from the data set, as they could considerably affect the results of research. As a consequence, upon removal of outliers, 140 rural communes were found to be overindebted in 2012–2014. Thus, the main discriminant model was based on 280 rural communes split into two equal groups. Group 1 consisted of 140 communes with a ratio of total debt to total incomes beyond 50%; Group 2 was composed of 140 randomly selected communes which did not exhibit overindebtedness in the study period.

4. Conclusions

Repayable financing allows local government units to function when their income does not correspond to the costs of tasks implemented. It also enables these entities to maintain high investment expenditures when their investment potential is low. However, it is necessary to face the problem of safe indebtedness of local government units and to manage the debt appropriately. Excessive indebtedness of entities in the local government sector causes dangers. During an economic downturn, the financial condition is worse and it is a specific barometer indicating local development perspectives. Excessive indebtedness of local government units is a danger not only to their stability and to local development, but also to the entire public finance sector.

The problem of increasing indebtedness can be observed in a growing number of communes and on an increasing scale in Poland. Between 2007 and 2017, rural communes were the least indebted group. However, the greatest increase in the total amount of debt was observed in this group. Apart from that, due to the diversified functions of rural communes, this group was characterised by the greatest diversification both in the amount of debt and the share of total debt in the communes’ budgets. Apart from that, in this group, there were entities facing the biggest problems caused by excessive indebtedness. However, typical units affected by excessive indebtedness are agricultural communes with a tourist function and communes with residential and service functions. In turn, agricultural communes are affected less frequently. The key investment target for the authorities of tourist communes (located mainly in northern and southern Poland) was the enhancement of tourist and similar infrastructure. In turn, communes with residential and service functions (located in main metropolitan centers, in the immediate vicinity of big cities) mainly invested in technical and social infrastructure.

There is a large number of factors of the total debt of communes and the debt of rural communes in Poland. Financial factors are one of the causes of indebtedness. The discriminant analysis showed that in 2012–2014, the share of the operating surplus and own income in total income as well as the amount of EU funds per capita in zlotys) were particularly significant. The study revealed that the smaller the share of the operating surplus in total income is as well as the greater the share of own income in total income and the amount of the EU funds in zlotys per capita are, the lower the value of the estimated discriminatory function and the higher the risk of excessive indebtedness of a rural commune. Thus, we can conclude that the risk of excessive indebtedness is most likely to occur in the rural communes that are more financially independent (characterised by a higher level of own income potential) and in those that make intensive investments in socioeconomic development by acquiring the EU funds for this purpose. The discriminative model of excessive indebtedness of rural communes in 2012–2014 was compared to models built based on 2007–2008 and 2015–2017 data. In 2007–2009 (i.e., at the beginning of the financial perspective of 2007–2013), debt was mainly incurred by communes at lower levels of own income potential which until that time did not access EU funds. In turn, in 2015–2017, the financial factors of risk of excessive indebtedness facing the rural communes were similar to those identified in 2012–2014.

This study allowed us to confirm the research hypothesis that the main determinant of the risk of excessive indebtedness is the rural communes’ own income potential. Considerable indebtedness of many rural communes in Poland, low investment capacity and relatively low operating surplus generated by these entities of the local government sector may become barriers blocking their local development. In the current financial perspective, the human factor in the entities of the local government sector seems to be a particularly important element conditioning appropriate debt management and local development of rural communes. In view of the fact that rural communes’ own funds are limited and these entities have poor capacity to incur new liabilities due to the low operating surplus generated, in the financial perspective of 2014–2020, it will be particularly important to consider all investment plans carefully in terms of the costs borne and potential long-term benefits.