Effect of Transaction Rules on Enterprise Transaction Costs Based on Williamson Transaction Cost Theory in Nanhai, China

Abstract

1. Introduction

2. Theoretical Framework and Hypotheses

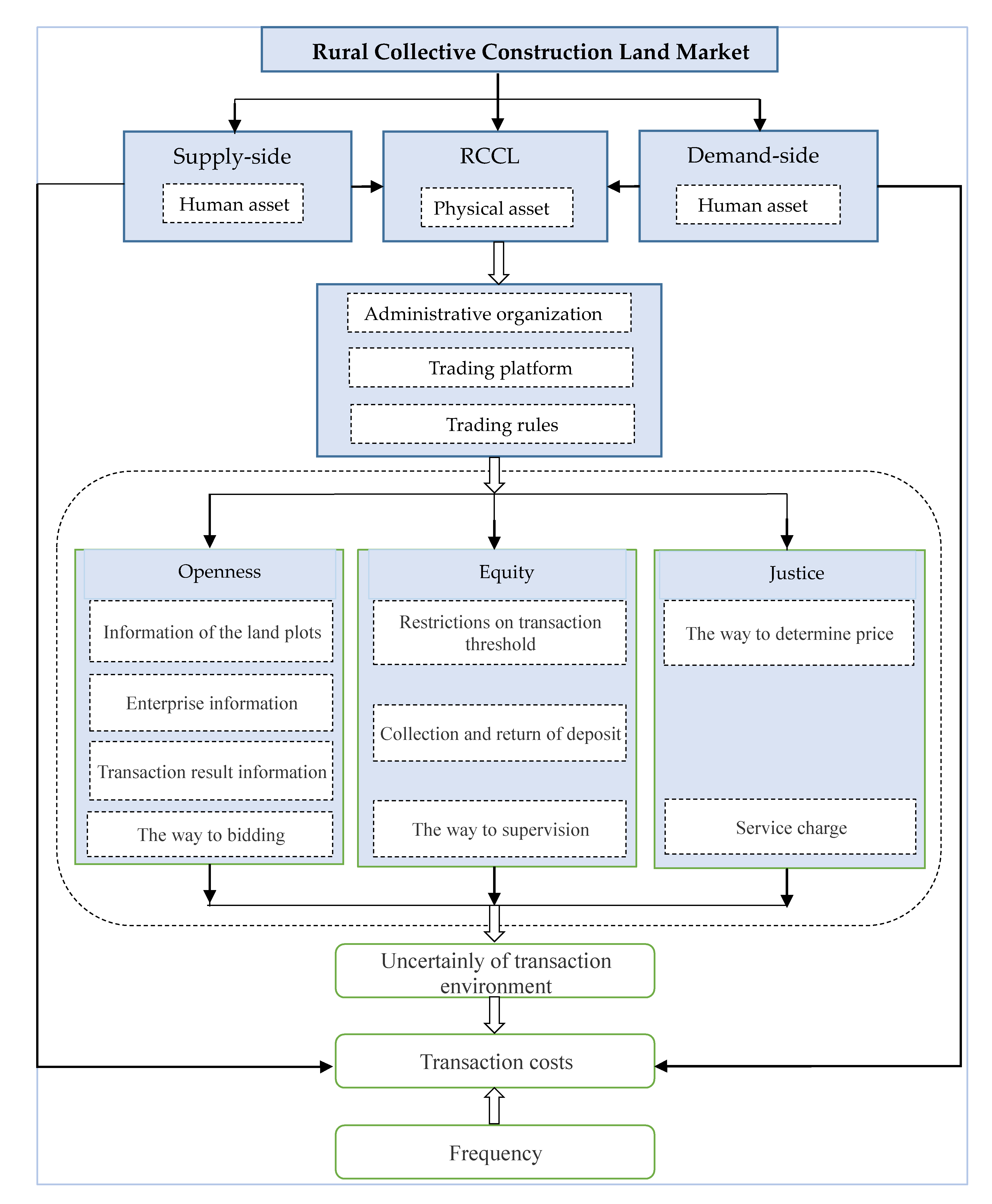

2.1. Theoretical Framework

2.2. Hypothesis

3. Study Area, Data, and Methodology

3.1. Study Area

3.2. Data Collection

3.3. Variables

- (1)

- Physical assets include capital invested by enterprises and annual output value. The more capital an enterprise invests, the higher the risk. If default occurs due to imperfect market trading rules, the more capital the enterprise invests, the greater the risk. Faced with the risk of transaction default, the larger the annual output value, the greater the transaction cost.

- (2)

- Geographical location includes plot scale and parcel location attribute. The size of trading land parcels and the shape of land impact transaction costs. If the construction land is developed for other purposes, the value decreases, thus resulting in high transaction costs. Location can be characterized as the distance from the traded land parcel to the town center. The closer to the town center, the higher the value of construction land.

- (3)

- Uncertainty of transaction environment is composed of openness, equity, and justice characteristics of the RCCL market transaction rules. To prevent other variables from interfering with the results, the influencing factors such as existence of a land use certificate, property ownership certificate, payment of land use tax, and payment of factory rent tax were added as the control variables.

- (4)

- The openness of transaction rules includes (1) the degree of disclosure of information about the plot, (2) the degree of disclosure of information about the enterprise, (3) the degree of disclosure of information about the land transaction results, and (4) the method to bidding. The more information is available about the land transfer and the land transaction result, the lower the cost of information searching. The more information available about the enterprise, the lower the enterprise cost of organizing the negotiation. Explicit bidding is more open than implicit bidding, which can reasonably affect the value of the land.

- (5)

- The equity of transaction rules includes (1) restrictions on transaction threshold, (2) collection and return of transaction deposit, and (3) supervision method. The higher the restrictions on the RCCL entering the market and the more the government intervention, the greater the loss of free competition in the market. The larger the land transaction cash deposit, the higher transaction cost. If more methods of supervision are used, the lower the opportunism and rent-seeking behavior.

- (6)

- The justice of transaction rules is composed of (1) how price is determined (2) and service charges. Compared with negotiating, RCCL transactions through bidding may be more open and fairer, which can reduce the uncertainty of the transaction environment and the transaction costs. If higher service fees are collected, the higher the cost of the enterprise.

- (7)

- Transaction frequency is calculated as 50 (the longest industrial land use rights lease available) divided by the actual contract term in the RCCL market. If the trading rules are imperfect multiple transactions will occur, so negotiation and organization costs increase with transaction frequency.

3.4. Methods

3.4.1. Estimation of Transaction Costs

3.4.2. Tobit Model

4. Results

4.1. Transaction Rosts

4.2. Tobit Model Results

5. Conclusions and Discussion

5.1. Conclusions

5.2. Policy Implications

5.3. Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Long, H. Land consolidation: An indispensable way of spatial restructuring in rural China. J. Geog. Sci. 2014, 24, 211–225. [Google Scholar] [CrossRef]

- Long, H.L.; Li, Y.R.; Liu, Y.S.; Woods, M.; Zou, J. Accelerated restructuring in rural China fueled by “increasing vs. decreasing balance” land-use policy for dealing with hollowed villages. Land Use Policy 2012, 29, 11–22. [Google Scholar] [CrossRef]

- Cui, Z. Partial Intimations of the Coming Whole: The Chongqing Experiment in Light of the Theories of Henry George, James Meade, and Antonio Gramsci. Modern China 2011, 37, 646–660. [Google Scholar] [CrossRef][Green Version]

- Huang, K.; Zhang, A.L. Market Integration Mechanism of Urban and Rural Construction Land. Reform 2016, 2, 69–79. (In Chinese) [Google Scholar]

- Obeng-Odoom, F. Property in the Commons: Origins and Paradigms. Rev. Radic. Political Econ. 2016, 48, 9–19. [Google Scholar] [CrossRef]

- Gürel, B. Semi-private Landownership and Capitalist Agriculture in Contemporary China. Rev. Radic. Political Econ. 2019. [Google Scholar] [CrossRef]

- Obeng-Odoom, F.; Stilwell, F. Security of tenure in international development discourse. Int. Dev. Plan. Rev. 2013, 35, 315–333. [Google Scholar] [CrossRef]

- Yep, R. Filling the institutional void in rural land markets in southern China: Is there room for spontaneous change from below? Dev. Chang. 2015, 46, 534–561. [Google Scholar] [CrossRef]

- Long, H.; Zou, J.; Liu, Y. Differentiation of rural development driven by industrialization and urbanization in eastern coastal China. Habitat Int. 2009, 33, 454–462. [Google Scholar] [CrossRef]

- Xie, X.X.; Zhang, A.L.; Wen, L.J.; Bin, P. How horizontal integration affects transaction costs of rural collective construction land market? An empirical analysis in Nanhai District, Guangdong Province, China. Land Use Policy 2019, 82, 138–146. [Google Scholar] [CrossRef]

- Wen, L.J.; Zhang, A.L.; Chen, Z.; Yang, X.; Wang, H. Evaluation of the Land Development Rights and Protection of the Rural Collective Construction Land Assets—Based on a Choice Experiments of Suppliers and Demanders in Land Market. J. Agrotech. Econ. 2019, 4, 29–42. (In Chinese) [Google Scholar] [CrossRef]

- Wen, L.J.; Zhang, A.L. Relationship among Institutional Innovation of Land Coupon, Market Mechanism of Land Development Right and Fulfillment of Rural Land Assets Value. China Land Sci. 2016, 30, 33–40. (In Chinese) [Google Scholar] [CrossRef]

- Wen, L.J.; Zhang, A.L. Comparative Analysis of Rural Land Market Development in Yangtze River Delta and Pearl River Delta Regions: Based on the Empirical Analysis from Songjiang, Jinshan, Nanhai and Dongguan. China Land Sci. 2016, 30, 64–71. (In Chinese) [Google Scholar] [CrossRef]

- Zhang, T.; Zhang, A.L.; Deng, S.L. Transaction costs research of collective construction land market based on Williamson analysis paradigm: An empirical analysis of 1872 market transaction data and 372 questionnaire data in Nanhai District, Guangdong Province. China Land Sci. 2017, 31, 11–21. (In Chinese) [Google Scholar]

- Zhang, T.; Zhang, A.L.; Deng, S.L.; Hu, Y. Econometric research on the development of rural collective construction land market and its impact factors: An empirical analysis based on 1872 market transaction data and 398 questionnaire data in Nanhai District, Guangdong Province. China Land Sci. 2016, 30, 22–31. (In Chinese) [Google Scholar]

- Mearns, R. Access to Land in Rural India; Policy Research Working Paper 2123; World Bank: Washington, DC, USA, 1999. [Google Scholar]

- Liu, S.; Carter, M.R.; Yao, Y. Dimensions and diversity of property rights in rural China: Dilemmas on the road to further reform. World Dev. 1998, 26, 1789–1806. [Google Scholar] [CrossRef]

- Deng, M.E.; Zhang, A.L.; Chen, H.B. Analysis on Transaction Cost of Supply and Demand Sides under the Rules of Collective Owned Construction Land Use Right Transfer. J. Henan Agric. Univ. 2018, 52, 294–299. (In Chinese) [Google Scholar]

- Long, H.; Heilig, G.K.; Li, X.B.; Zhang, M. Socio-economic development and land use change: Analysis of rural housing land transition in the Transect of the Yangtze River, China. Land Use Policy 2007, 24, 141–153. [Google Scholar] [CrossRef]

- General Office of the State Council of China (GOSC). Management Measures for Cross-Provincial Adjustment of Savings Indicators Linked to Increase and Decrease of Urban and Rural Construction Land; General Office of the State Council: Beijing, China. Available online: http://www.gov.cn/zhengce/content/2018-03/26/content_5277477.htm (accessed on 26 March 2018).

- Ministry of Land and Resources (MLR), National Development and Reform Commission (NDRC) of China, National Land Consolidation Plan (2016–2020). Available online: http://www.mlr.gov.cn/zwgk/zytz/201702/t20170215_1440315.htm (accessed on 1 January 2017).

- Ministry of Land and Resources of China (MLR). Land Consolidation Terms (TD/T1054-2018); Ministry of Land and Resources of China: Beijing, China, 2018. [Google Scholar]

- The Ministry of Land and Resources (MLR). Opinions on Supporting Poverty Alleviation in Deep Poverty-Stricken Areas. Available online: http://www.mlr.gov.cn/zwgk/zytz/201712/t20171227_1712503.htm (accessed on 6 December 2017).

- Banerjee, A.V.; Gertler, P.J.; Ghatak, M. Empowerment and Efficiency: Tenancy Reform in West Bengal. J. Political Econ. 2002, 110, 239–280. [Google Scholar] [CrossRef]

- Bittner, C.; Sofer, M. Land use changes in the rural–urban fringe: An Israeli case study. Land Use Policy 2013, 33, 11–19. [Google Scholar] [CrossRef]

- Deininger, K.; Jin, S. The potential of land rental markets in the process of economic development: Evidence from China. J. Dev. Econ. 2005, 78, 241–270. [Google Scholar] [CrossRef]

- Krusekopf, C.C. Diversity in land tenure arrangements under the household responsibility system in China. China Econ. Rev. 2002, 13, 297–312. [Google Scholar] [CrossRef]

- Yi, R.; Yang, B.; Tao, H. Characterizing the land shareholding cooperative: A case study of Shanglin village in Jiangsu, China. Sustainability 2017, 9, 1175. [Google Scholar]

- Deininger, K.; May, J. Can There be Growth with Equity: An initial assessment of Land Reform in South Africa. Policy Res. Working Paper Series 2000, 1–32. [Google Scholar] [CrossRef]

- Deininger, K.; Olinto, P. Asset distribution, inequality, and growth. Policy Res. Work. Pap. 2000, 93, 1091–1113. [Google Scholar] [CrossRef]

- Deininger, K.; Jin, S.Q.; Nagarajan, H.K. Efficiency and Equity Impacts of Rural Land Rental Restrictions: Evidence from India. Eur. Econ. Rev. 2008, 52, 892–918. [Google Scholar] [CrossRef]

- Carter, M.R.; Zimmerman, F. The Dynamic Cost and Persistence of Asset Inequality in an Agrarian Economy. J. Dev. Econ. 2000, 63, 265–302. [Google Scholar] [CrossRef]

- Bardhan, P.; Bowles, S.; Gintis, H. Wealth inequality, wealth constraints and economic performance. Handb. Income Distrib. 2000, 1, 541–603. [Google Scholar] [CrossRef]

- Shagaida, N. Agricultural land market in Russia: Living with constraints. Comp. Econ. Stud. 2005, 47, 127–140. [Google Scholar] [CrossRef]

- Deininger, K.; Hoogeveen, H.; Kinsey, B.H. Economic Benefits and Costs of Land Redistribution in Zimbabwe in the Early 1980s. World Dev. 2004, 32, 1697–1709. [Google Scholar] [CrossRef]

- Holden, S.T.; Otsuka, K.; Place, F. The Emergence of Land Markets in Africa: Impacts on Poverty, Equity, and Efficiency; Resources for the Future: Washington, DC, USA, 2009. [Google Scholar]

- Yao, Y. The Development of the Land Lease Market in Rural China. Land Econ. 2000, 76, 252–266. [Google Scholar] [CrossRef]

- Walker, G.; Weber, D. A transaction cost approach to make-or-buy decisions. Adm. Sci. Q. 1984, 29, 373–391. [Google Scholar] [CrossRef]

- Williamson, O.; Jeffrey, H. Understanding the Employment Relation: The Analysis of Idiosyncratic Exchange. Bell J. Econ. 1977, 6, 250–280. [Google Scholar] [CrossRef]

- Williamson, O. Markets and Hierarchies: Analysis and Antitrust Implications; Free Press: New York, NY, USA, 1975. [Google Scholar]

- Williamson, O. The New Institutional Economics: Taking Stock, Looking Ahead. J. Econ. Lit. 2000, 38, 595–613. [Google Scholar] [CrossRef]

- Williamson, O. Credible Commitments: Using Hostages to Support Exchange. Am. Econ. Rev. 1983, 73, 519–540. [Google Scholar]

- Waterman, D.; Weiss, A.A. The effects of vertical integration between cable television systems and pay cable networks. J. Econom. 1996, 72, 357–395. [Google Scholar] [CrossRef]

- Hart, O.; Tirole, J.; Carlton, D.W.; Williamson, O.E. Vertical integration and market foreclosure. Working Pap. 1990, 205–286. [Google Scholar] [CrossRef]

- Li, J.; Ning, X.; Sun, J.; Xiong, X. Simulating the Barriers of Transaction Costs to Public Rental Housing Exits: The Case of Wuhan, China. Sustainability 2018, 10, 1549. [Google Scholar] [CrossRef]

- Avery, W.; Wang, Y.; Lee, S.H. The Effect of Cross-Border E-Commerce on China’s International Trade: An Empirical Study Based on Transaction Cost Analysis. Sustainability 2017, 9, 2028. [Google Scholar] [CrossRef]

| Variables | Definition | Mean | ||

|---|---|---|---|---|

| Asset specificity | Human asset | Education level (X1) | Primary school = 1, junior high school = 2, senior high school = 3, University = 4, postgraduate = 5, doctor = 6 | 5.20 |

| Specific professional skills (X2) | yes = 1, no = 0 | 0.45 | ||

| Board size (X3) | the number of persons of board | 51.02 | ||

| The level of Board of directors’ governance (X4) | the number of collective leaders | 3.30 | ||

| The level of Board of directors’ governance (X5) | the number of villager’s shareholders | 2.01 | ||

| Physical asset | Invested capital of the enterprise (X6) | the actual value (104 RMB) | 1100.22 | |

| Annual output value (X7) | the actual value (104 RMB) | 22,085.05 | ||

| Geographical location | Plot scale (X8) | the actual value (m2) | 31,002.73 | |

| Parcel location attribute (X9) | distance from the land traded to the town Centre (km) | 8.11 | ||

| Transaction uncertainty | Openness | Degree of disclosure of information about plot (X10) | village level = 1, town level = 2, district level = 3, national standardized = 4, information platform = 5 | 4.07 |

| Degree of disclosure of information about enterprise (X11) | village level = 1, town level = 2, district level = 3, national standardized = 4, information platform = 5 | 3.96 | ||

| Degree of disclosure of information about results (X12) | village level = 1, town level = 2, district level = 3, national standardized = 4, information platform = 5 | 3.02 | ||

| The way to bidding (X13) | Explicit bidding = 1, implicit bidding = 0 | 0.40 | ||

| Equity | The restrictions on transaction threshold (X14) | yes = 1, no = 0 | 0.38 | |

| Collection and return of transaction deposit (X15) | ≥20% = 1, 10–19% = 1, 5–9% = 3, ≤4% = 4 | 3.92 | ||

| The way of supervision (X16) | no supervision = 1, platform internal supervision = 2, government’s participation in platform supervision, offline = 3, government, villagers and the public’s participation in platform supervision, online = 4 | 2.53 | ||

| Justice | The way to determine price (X17) | government evaluation = 1, third-party intermediary evaluation = 2, government and third-party intermediary together = 3, third party, villagers’ representatives and enterprises participate = 4 | 2.22 | |

| Service charge (102 RMB) (X18) | 1 = ≤1, 2 = 2–3, 3 = 4–5, 4 = ≥6 | 2.74 | ||

| Transaction frequency | Transaction frequency (X19) | 50/years of the contract | 5.49 | |

| Controlled variable | Whether have the Land Use Certificate (X20) | yes = 1, no = 0 | 0.30 | |

| Whether have the Property Ownership Certificate (X21) | yes = 1, no = 0 | 0.42 | ||

| Whether have payed land use tax (X22) | yes = 1, no = 0 | 0.61 | ||

| Whether have payed factory rent tax (X23) | yes = 1, no = 0 | 0.75 |

| Variable | Economic Cooperative (Jingjishe) Model 1 | Economic Joint Community (Jinglianshe) Model 2 | |

|---|---|---|---|

| Human asset of enterprises | Education level (X1) | −0.1121 ** | −0.1257 ** |

| Specific professional skills (X2) | 0.0092 | 0.0423 | |

| Human asset of EC or EJC | Board size (X3) | 1.2025 | 1.3672 |

| the level of Board of directors’ governance (X4) | 0.2980 * | 0.8557 *** | |

| the level of Board of directors’ governance (X5) | 0.3077 | 0.2691 | |

| Physical asset | Invested capital of the enterprises (X6) | 0.5599 *** | 0.4208 ** |

| annual output value (X7) | −0.6011 | −0.6822 | |

| Geographical location | plot scale (X8) | 0.5022 ** | 0.4886 ** |

| Parcel location attribute (X9) | 0.1146 | 0.1153 | |

| Openness | degree of disclosure of information about land plots (X10) | −1.2018 *** | −0.9944 ** |

| degree of disclosure of information about enterprise (X11) | −0.8650 *** | −0.7995 ** | |

| degree of disclosure of information about results (X12) | −0.1972 | −0.1778 | |

| the way to bidding (X13) | 0.0561 | 0.0144 | |

| Equity | the restrictions on transaction threshold (X14) | 0.1626 | 0.1250 |

| Collection and return of transaction deposit (X15) | 0.2923 *** | 0.1989 * | |

| The way of supervision (X16) | −1.7949 *** | −1.5501 ** | |

| Justice | the way to determine price (X17) | −0.9612 ** | −0.8802 ** |

| service charge (X18) | 0.0620 ** | 0.0450 | |

| transaction frequency | transaction frequency (X19) | 0.1300 | 0.1139 |

| controlled variable | Whether have the Land Use Certificate (X20) | −0.1911 *** | −0.1880 *** |

| Whether have the Property Ownership Certificate (X21) | −0.1750 | −0.1551 | |

| Whether have payed land use tax (X22) | −0.0869 ** | −0.0799 * | |

| Whether have payed factory rent tax (X23) | 0.021 | 0.1190 | |

| constant | 2.1023 * | 5.4533 *** | |

| Dependent | Independent | Coef | Std. Err | t | p > t |

|---|---|---|---|---|---|

| Human asset | Education level (X1) | −0.096 *** | 0.013 | −2.89 | 0.009 |

| Specific professional skills (X2) | 0.015 | 0.012 | 1.17 | 0.233 | |

| Board size (X3) | 0.014 | 0.011 | 1.25 | 0.204 | |

| the level of Board of directors’ governance (X4) | −0.027 | 0.001 | −1.83 | 0.151 | |

| the level of Board of directors’ governance (X5) | −0.036 | 0.014 | −0.91 | 0.212 | |

| Physical asset | Invested capital of the enterprise (X6) | 0.569 *** | 0.215 | 2.53 | 0.006 |

| annual output value (X7) | −0.601 | 0.027 | −0.79 | 0.562 | |

| Geographical location | plot scale (X8) | 0.502 ** | 0.206 | 2.92 | 0.045 |

| Parcel location attribute (X9) | 0.114 | 0.045 | 0.46 | 0.280 | |

| Openness | degree of disclosure of information about plot (X10) | −1.261 *** | 0.108 | −2.33 | 0.002 |

| degree of disclosure of information about enterprise (X11) | −0.875 *** | 0.016 | −2.66 | 0.009 | |

| degree of disclosure of information about results (X12) | −0.197 | 0.123 | −1.31 | 0.901 | |

| the way to bidding (X13) | 0.052 | 0.002 | 1.05 | 0.531 | |

| Equity | the restrictions on transaction threshold (X14) | 0.166 | 0.014 | 1.12 | 0.190 |

| Collection and return of transaction deposit (X15) | 0.290 *** | 0.006 | 2.64 | 0.011 | |

| the way of supervision (X16) | −1.795 *** | 0.018 | −2.87 | 0.005 | |

| Justice | the way to determine price (X17) | −0.965 ** | 0.021 | −2.21 | 0.042 |

| service charge (X18) | 0.073 ** | 0.011 | 2.95 | 0.036 | |

| Transaction frequency | transaction frequency (X19) | 0.132 | 0.004 | 1.59 | 0.205 |

| Controlled variable | Whether have the Land Use Certificate (X20) | −0.192 *** | 0.015 | −3.12 | 0.007 |

| Whether have the Property Ownership Certificate (X21) | −0.176 | 0.012 | −0.97 | 0.235 | |

| Whether have payed land use tax (X22) | −0.087 ** | 0.004 | −2.12 | 0.041 | |

| Whether have payed factory rent tax (X23) | 0.021 | 0.010 | 1.36 | 0.309 | |

| constant | 0.102 ** | 0.041 | 2.58 | 0.016 | |

| Log likelihood = | 326.221 | ||||

| Pseudo R2 = | 0.0625 | ||||

| LR chi2 (23) = | 59.80 | ||||

| Prob > chi2 = | 0. 000 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Deng, M.; Zhang, A. Effect of Transaction Rules on Enterprise Transaction Costs Based on Williamson Transaction Cost Theory in Nanhai, China. Sustainability 2020, 12, 1129. https://doi.org/10.3390/su12031129

Deng M, Zhang A. Effect of Transaction Rules on Enterprise Transaction Costs Based on Williamson Transaction Cost Theory in Nanhai, China. Sustainability. 2020; 12(3):1129. https://doi.org/10.3390/su12031129

Chicago/Turabian StyleDeng, Meie, and Anlu Zhang. 2020. "Effect of Transaction Rules on Enterprise Transaction Costs Based on Williamson Transaction Cost Theory in Nanhai, China" Sustainability 12, no. 3: 1129. https://doi.org/10.3390/su12031129

APA StyleDeng, M., & Zhang, A. (2020). Effect of Transaction Rules on Enterprise Transaction Costs Based on Williamson Transaction Cost Theory in Nanhai, China. Sustainability, 12(3), 1129. https://doi.org/10.3390/su12031129