Comparison of Different Monetization Methods in LCA: A Review

Abstract

1. Introduction

- The market price approach,

- The revealed preference approach,

- The stated preference approach.

- Provide an overview of existing and relevant monetization methods in LCA;

- Determine criteria which influence the magnitude of the costs and why;

- Assess how the different monetization methods value and prioritize environmental damages of an average EU citizen;

- Identify overarching weaknesses within the impact categories;

- Outline overarching challenges to establish a roadmap according to which monetization in LCA can develop towards a consensus.

2. Materials and Methods

- They have an associated peer-reviewed case study released after 2012;

- They are the latest method update of the respective method (e.g., because LIME 3 was included, LIME2 and LIME were not);

- They have a strong connection to LCA and provide monetary factor(s) per impact category.

2.1. Qualitative Comparison

- The cost perspective and the type of market used when assessing damages (see Figure 2),

- The included AoPs,

- The use of equity weighting,

- The used discount rate,

- Whether marginal or non-marginal impacts are valued,

- The handling of uncertainty.

2.2. Quantitative Assessment

2.3. Integration of Qualitative Comparison and Quantitative Assessment Per Mid-Point Impact Category

3. Results

3.1. Qualitative Criteria Based Assessment

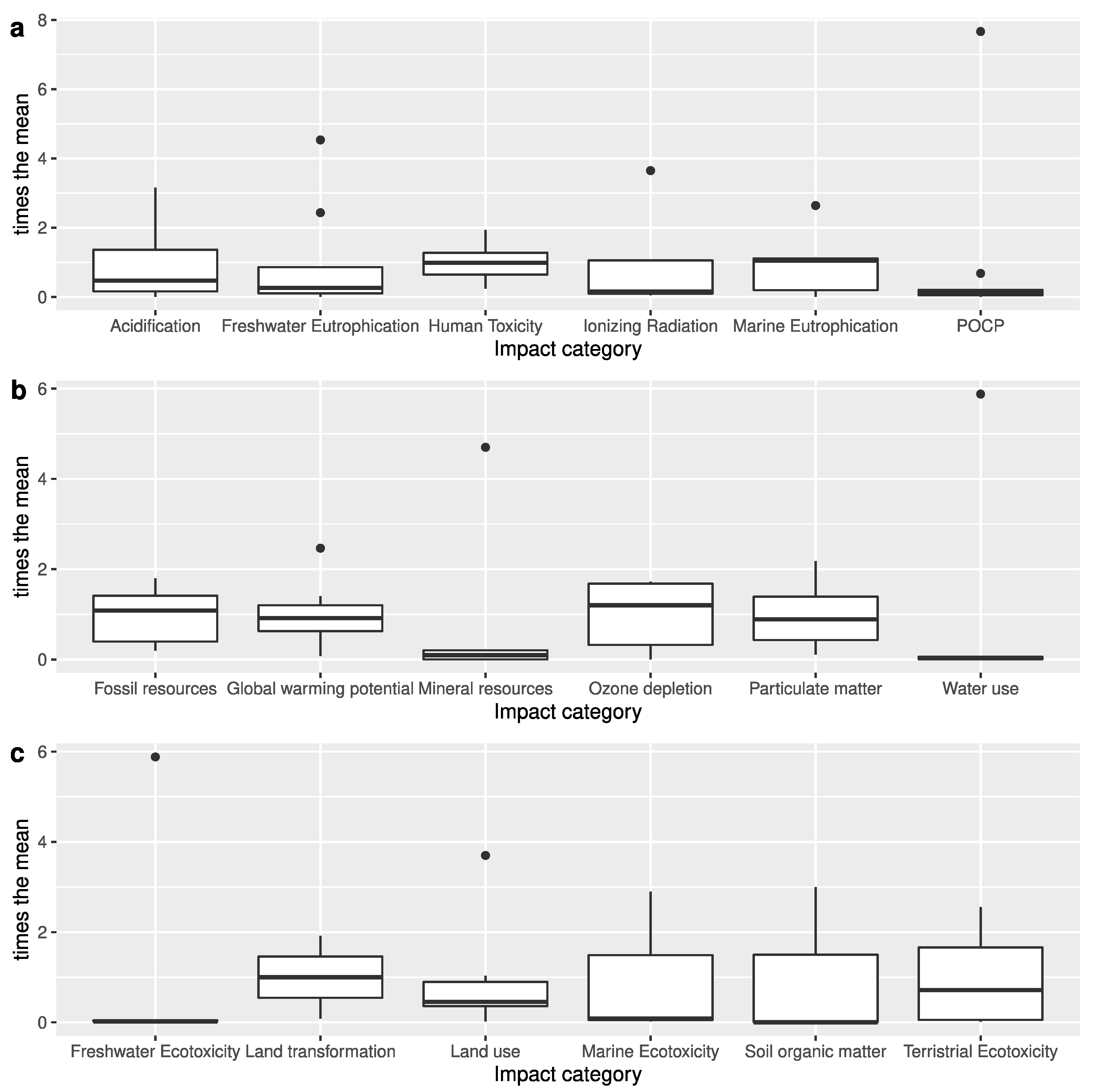

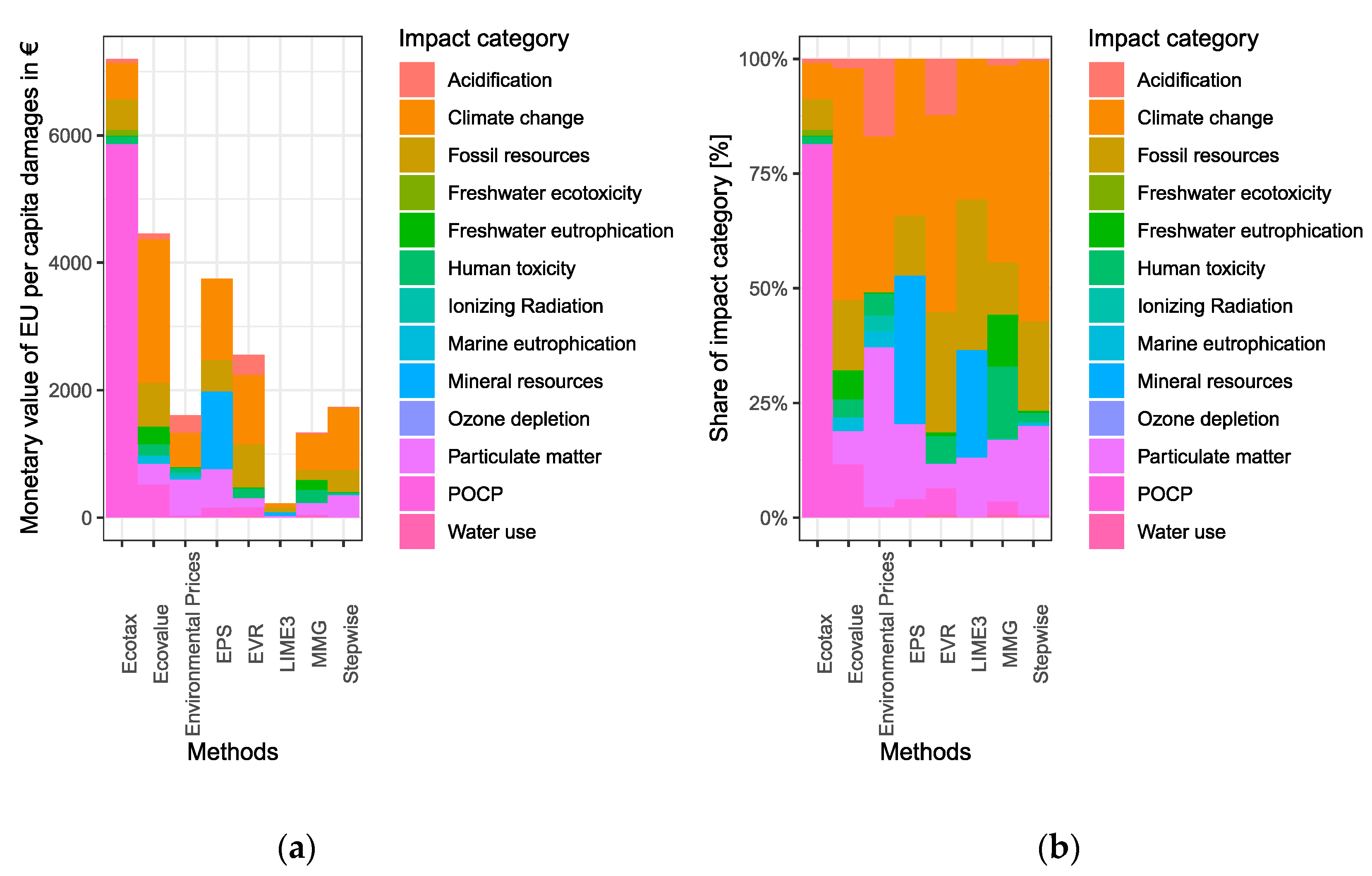

3.2. Quantitative Assessment and Comparison of Different Methods

3.3. Integrated Qualitative Comparison and Quantitative Assessment

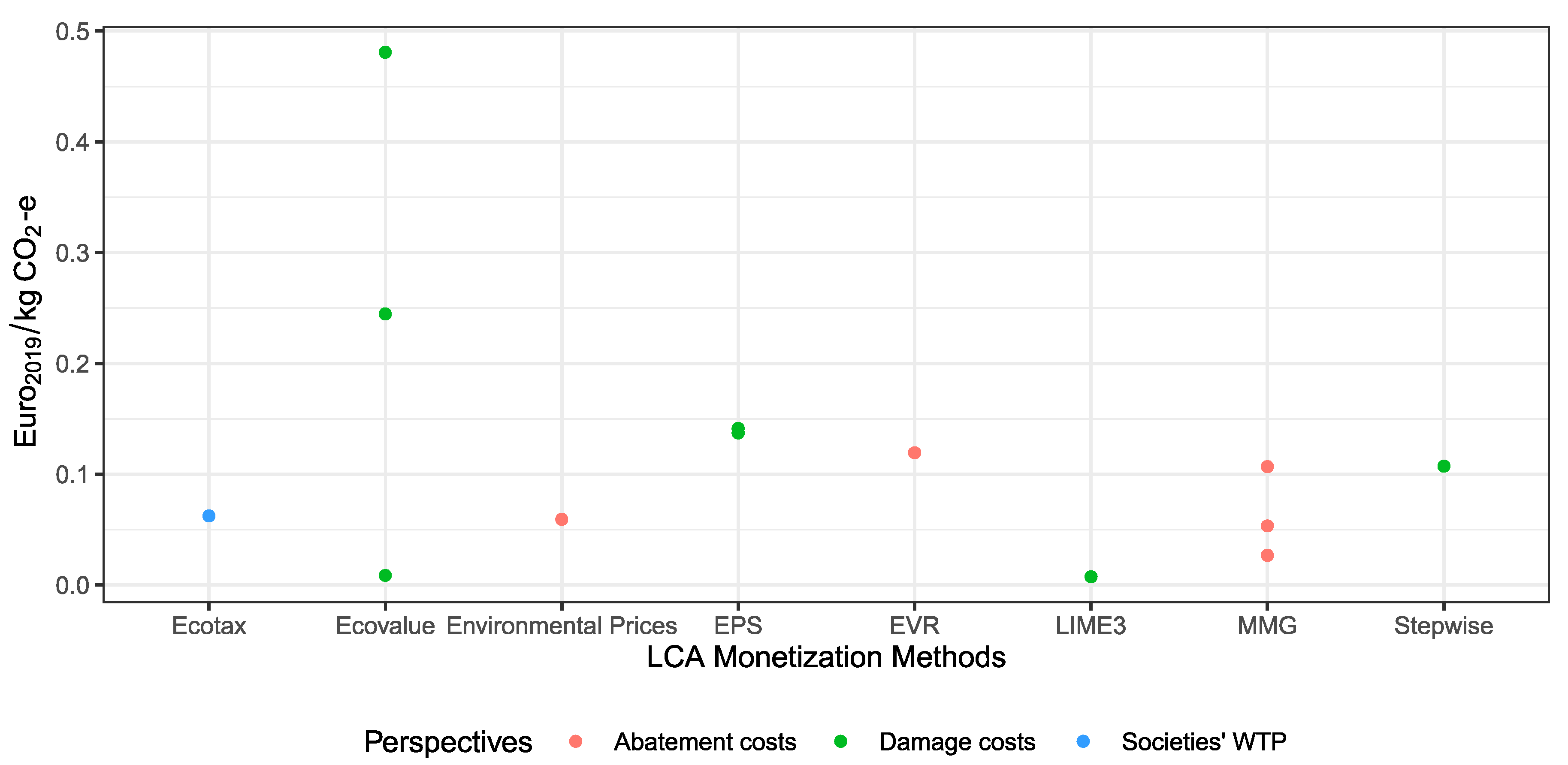

3.3.1. Climate Change

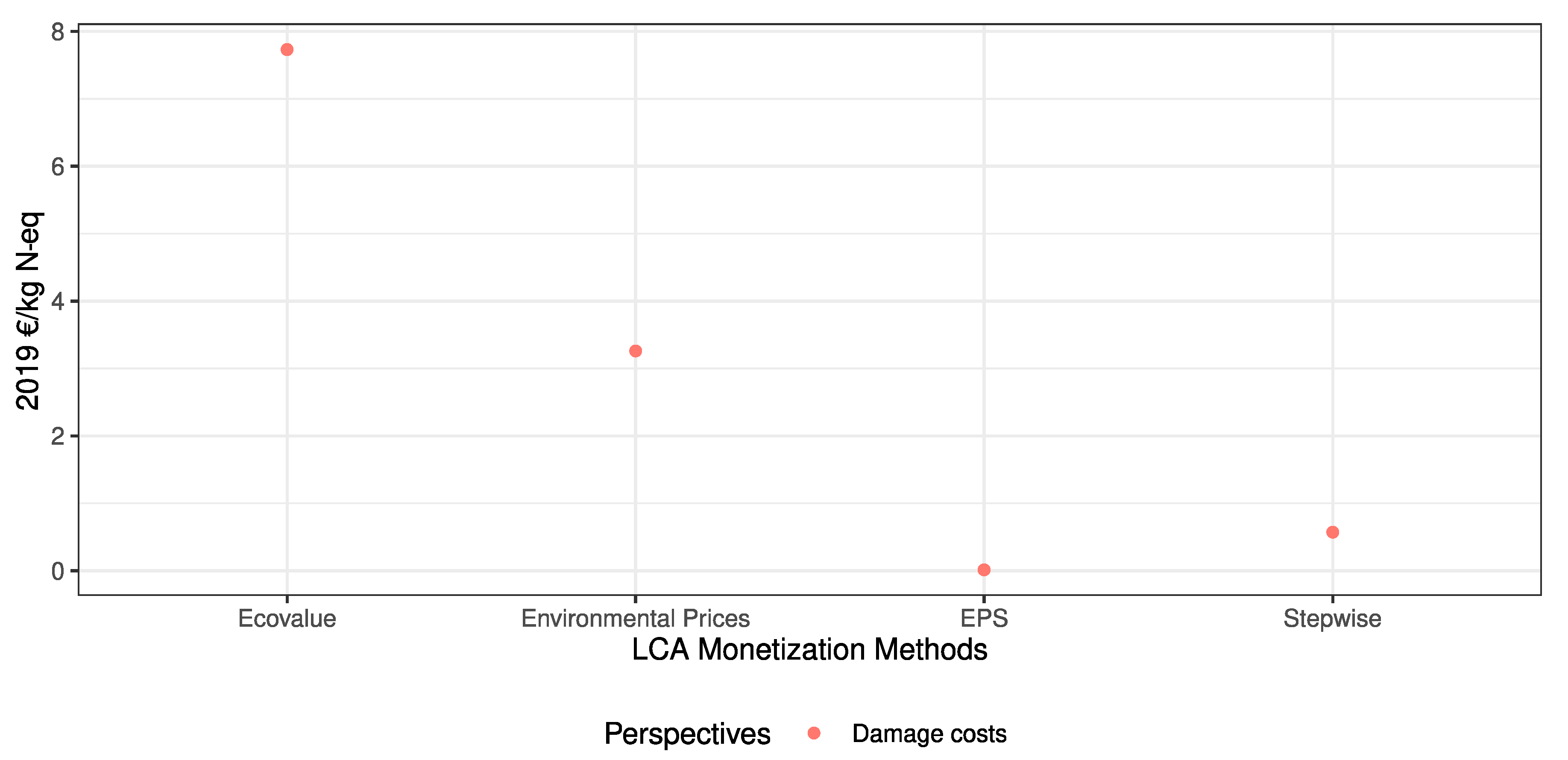

3.3.2. Acidification

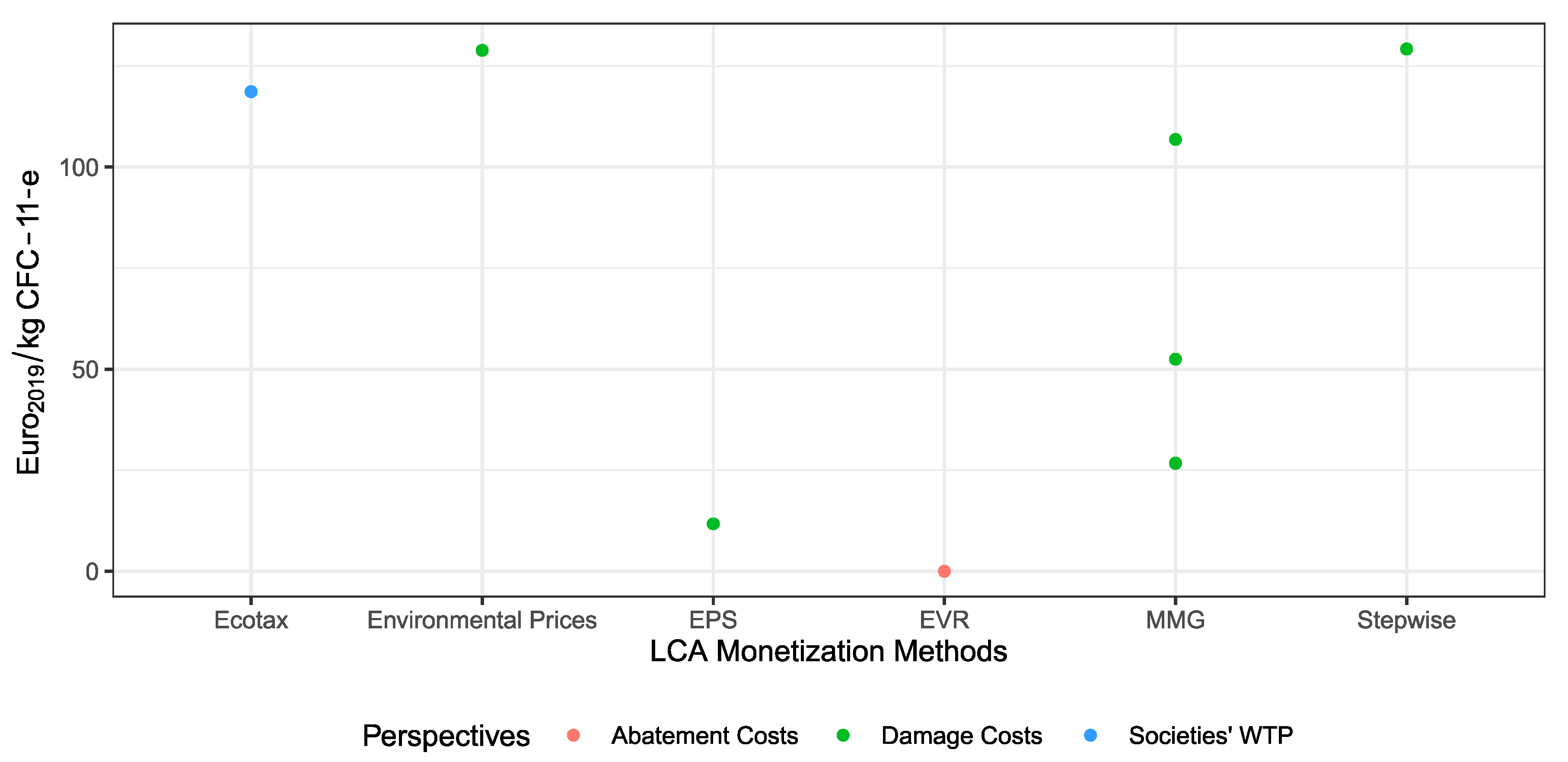

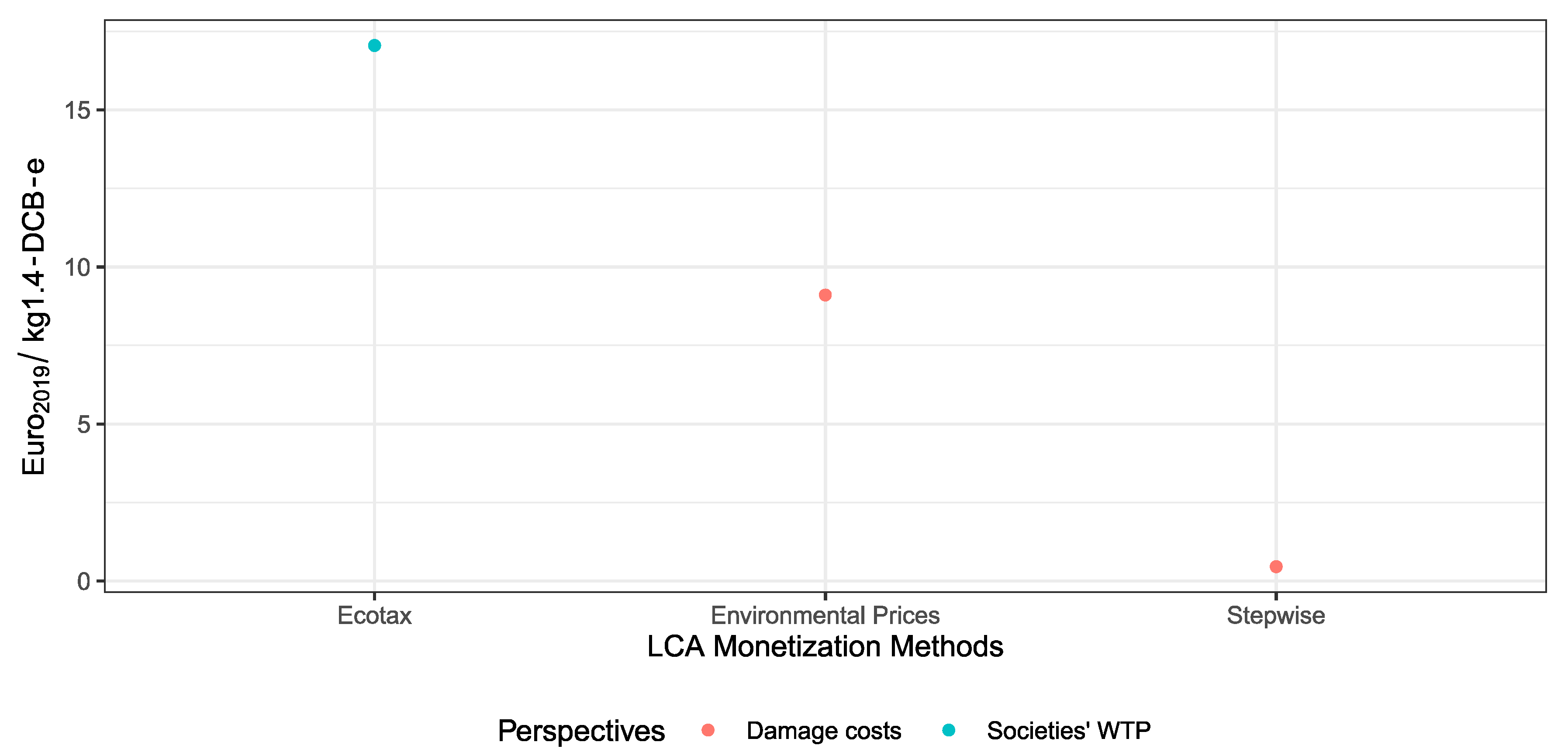

3.3.3. Ozone Depletion

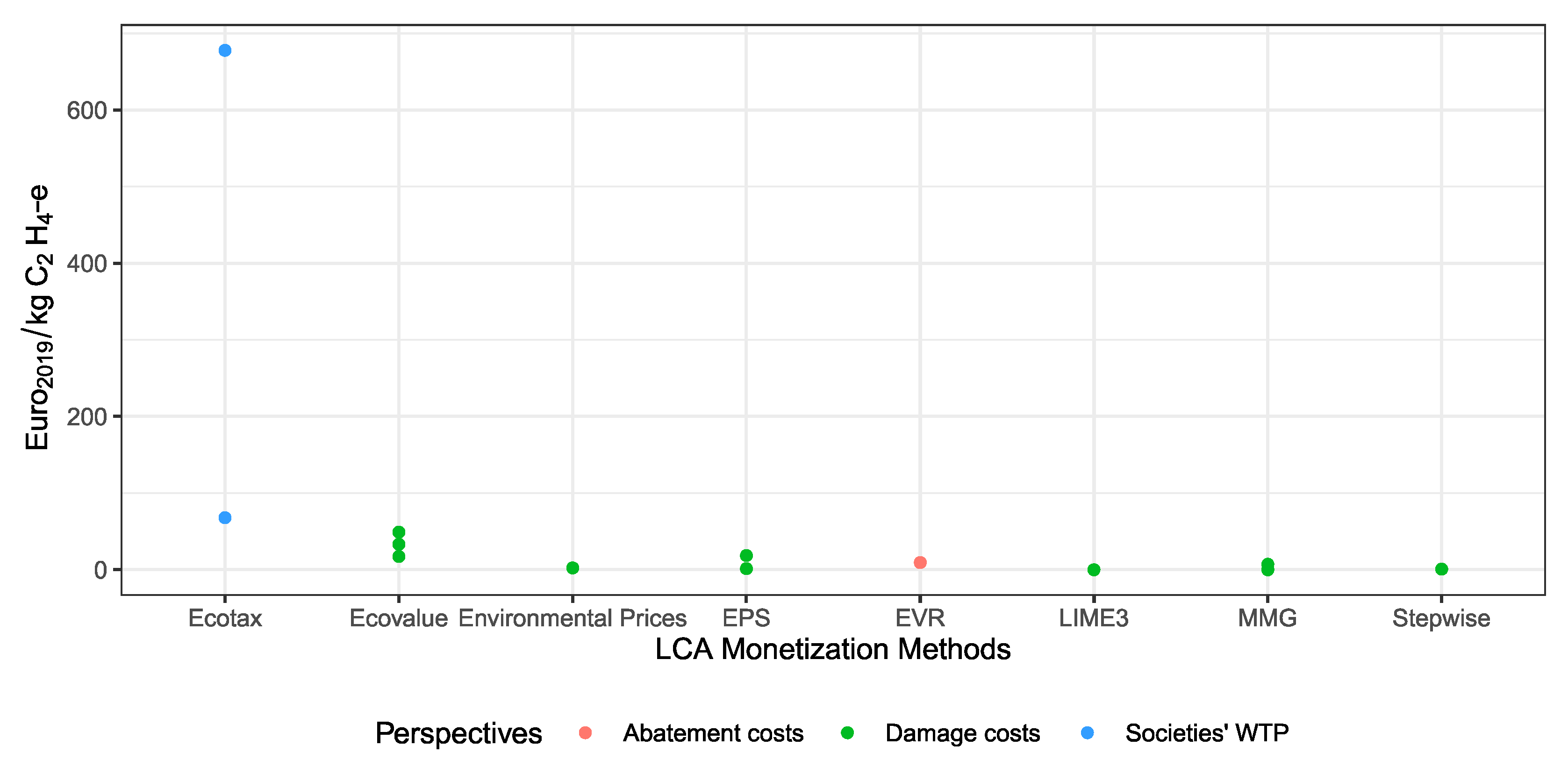

3.3.4. POCP

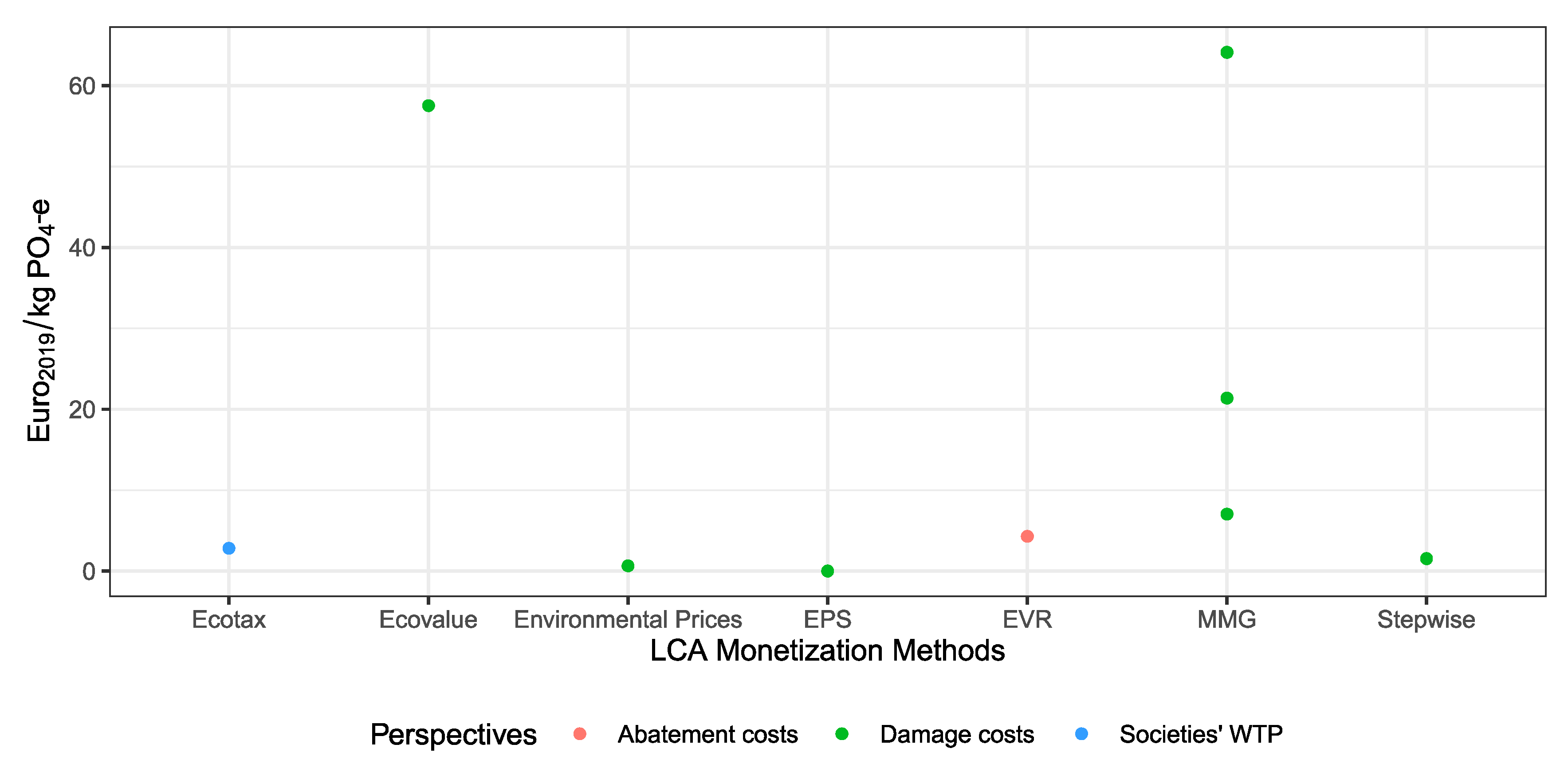

3.3.5. Eutrophication

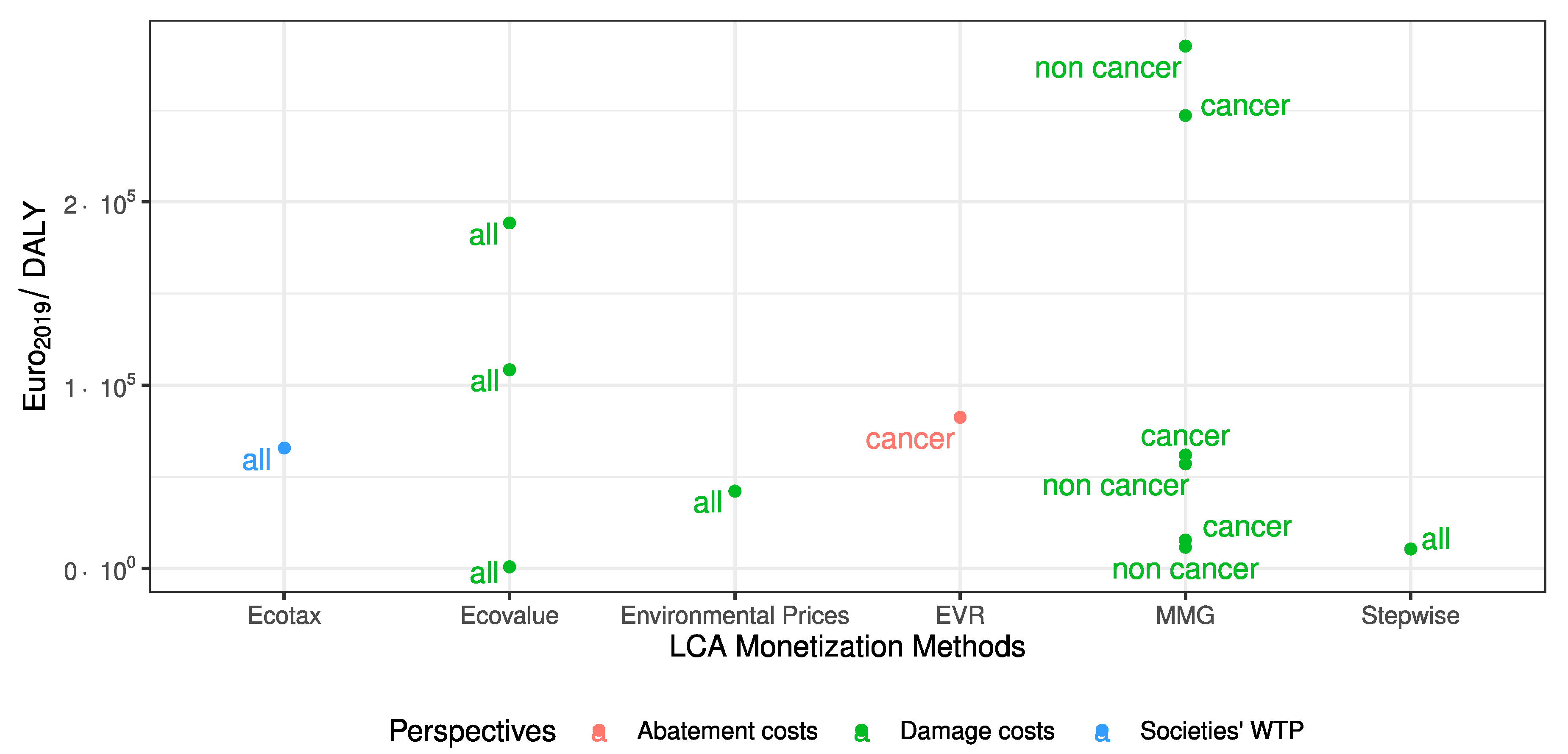

3.3.6. Particulate Matter

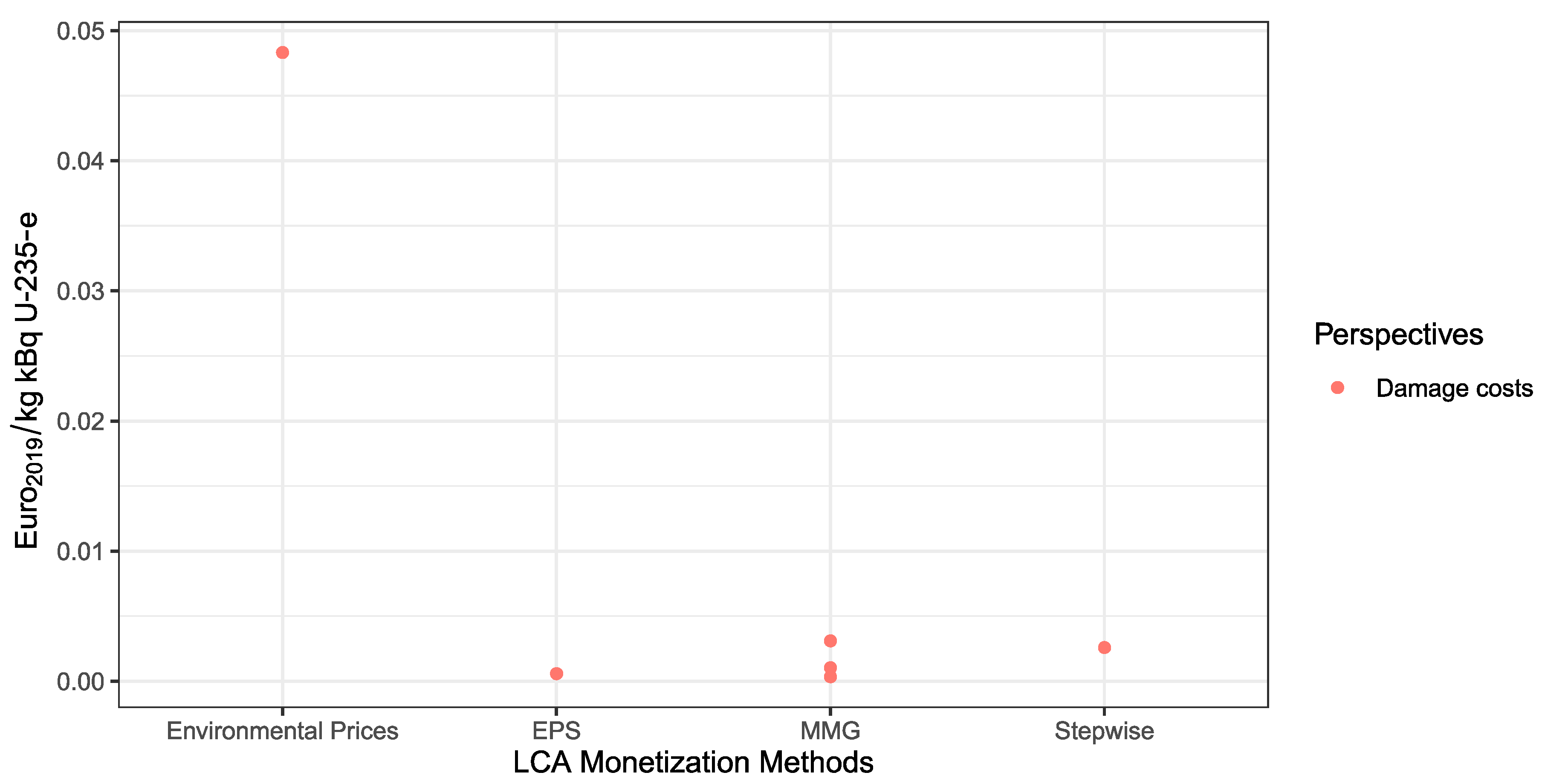

3.3.7. Ionizing Radiation

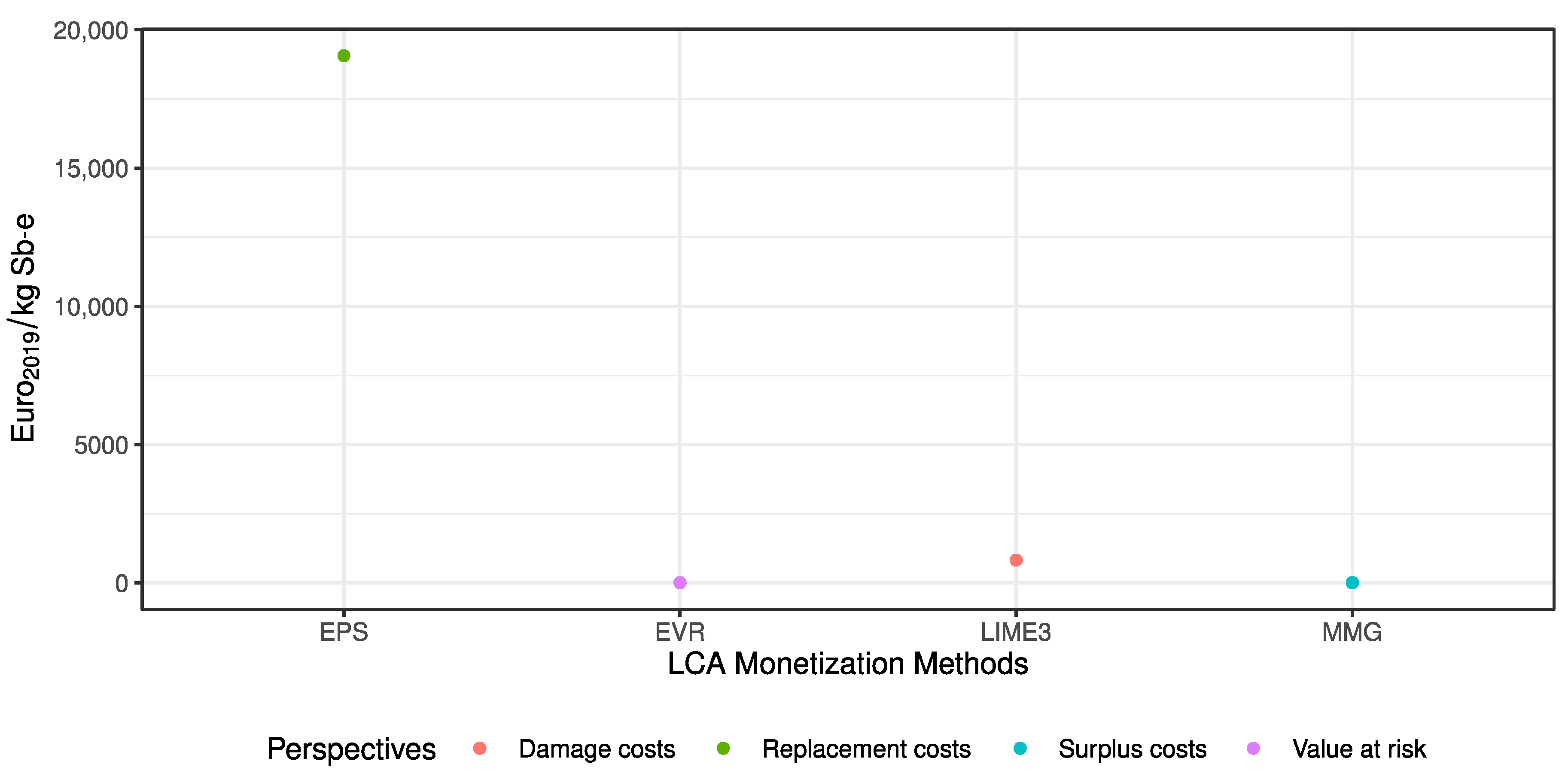

3.3.8. Mineral Resources

3.3.9. Fossil Resources

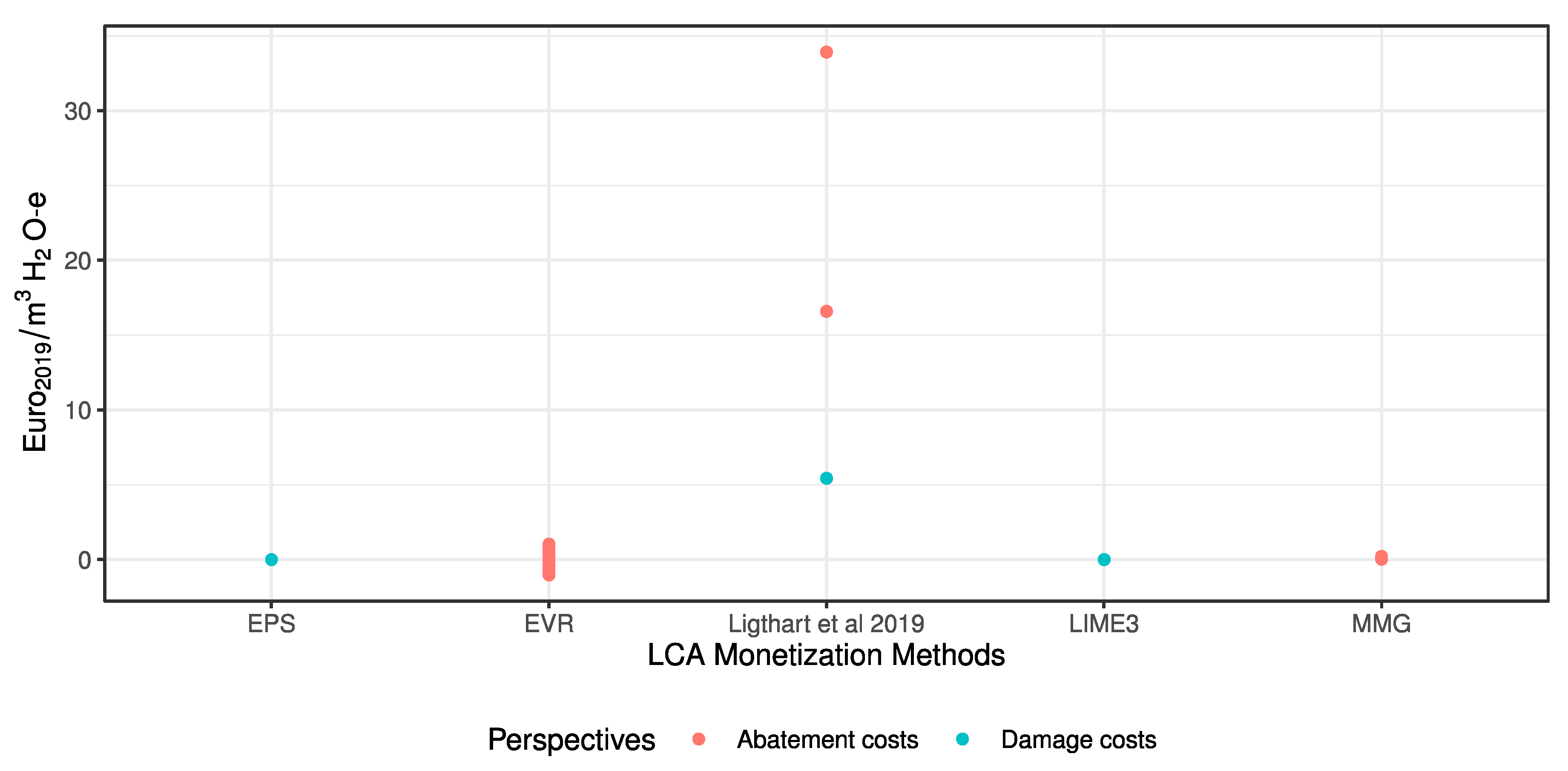

3.3.10. Water

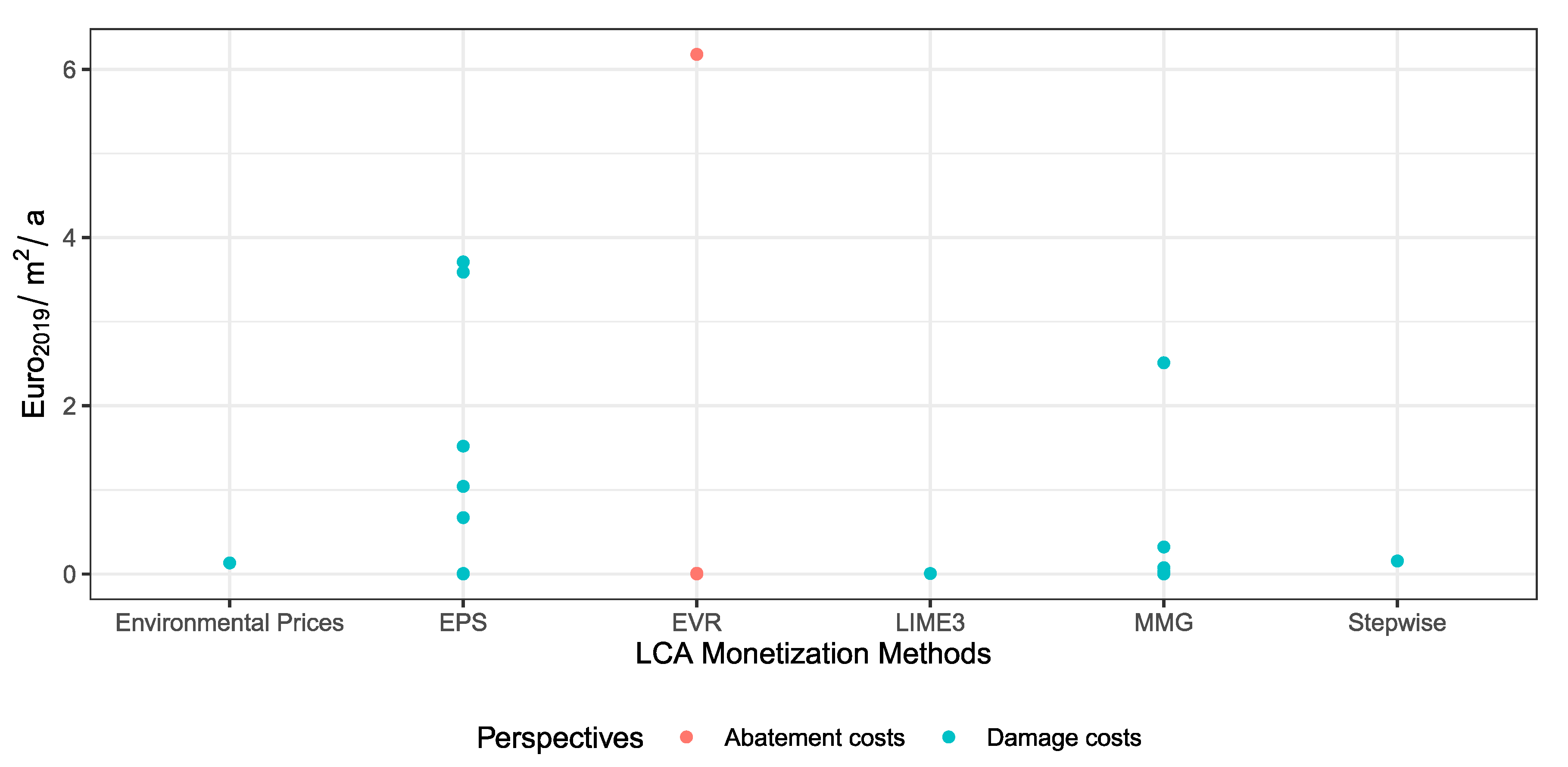

3.3.11. Land Use, Land Transformation and Soil Organic Matter

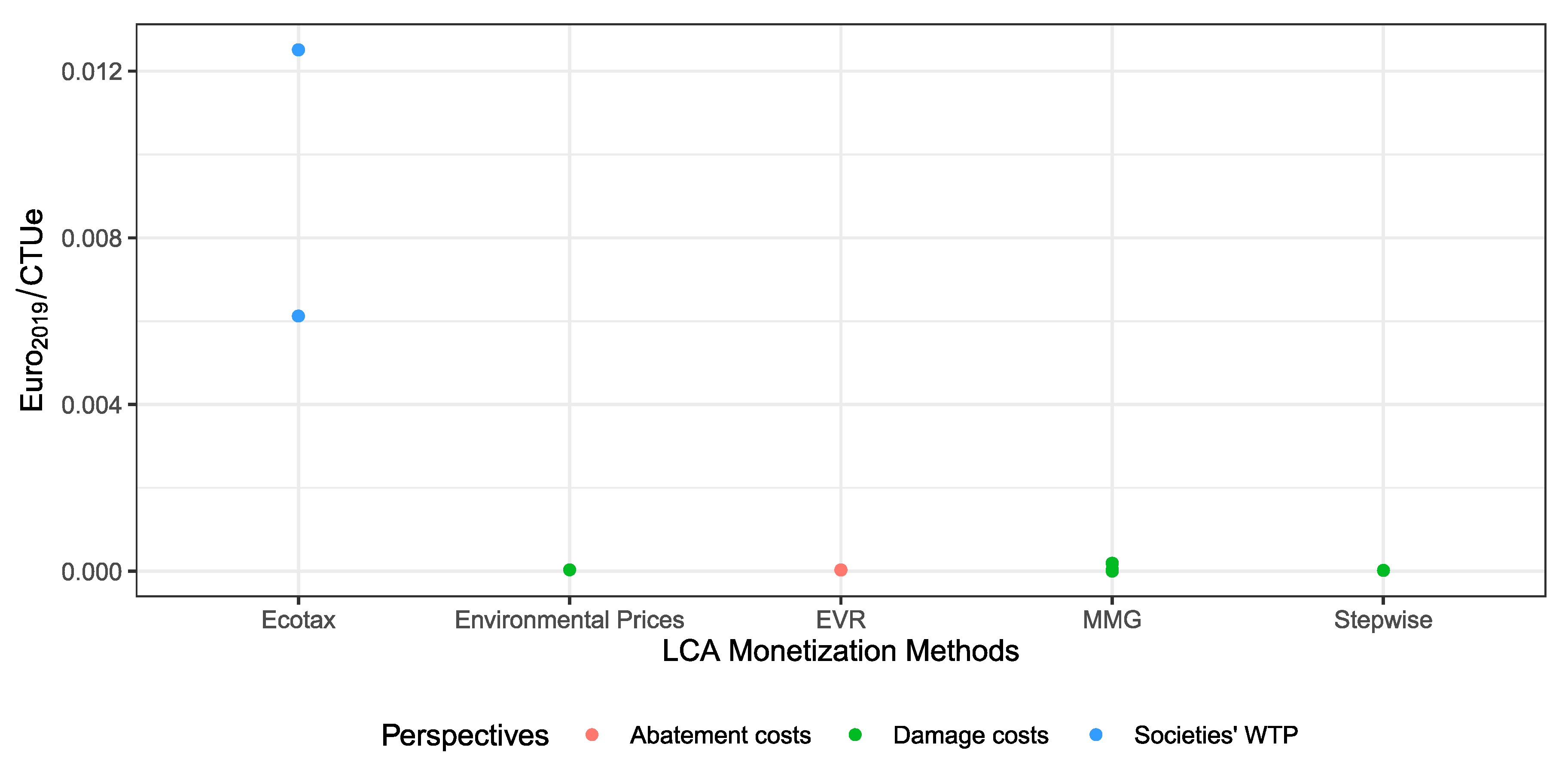

3.3.12. Human Toxicity

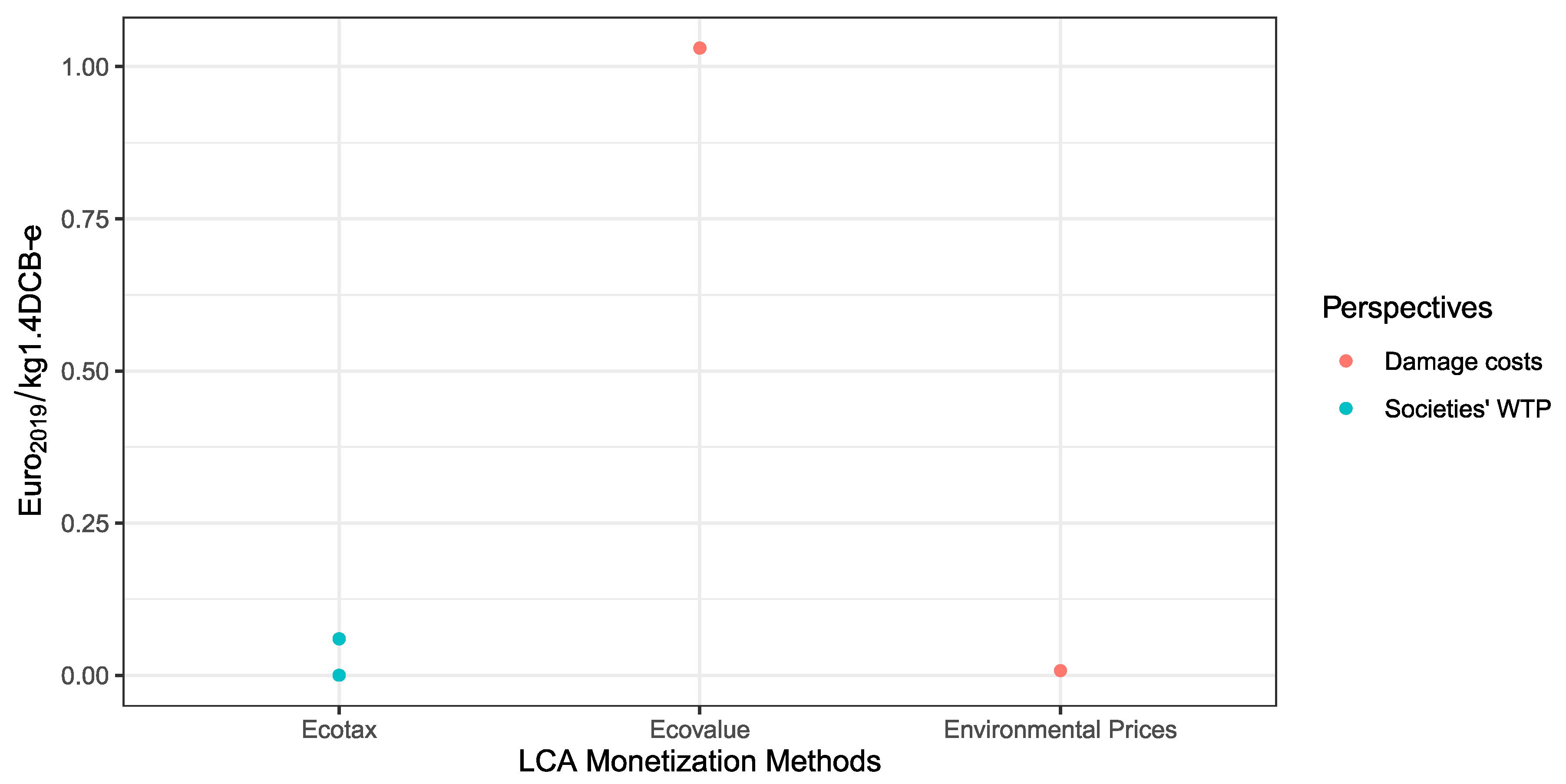

3.3.13. Terrestrial Ecotoxicity

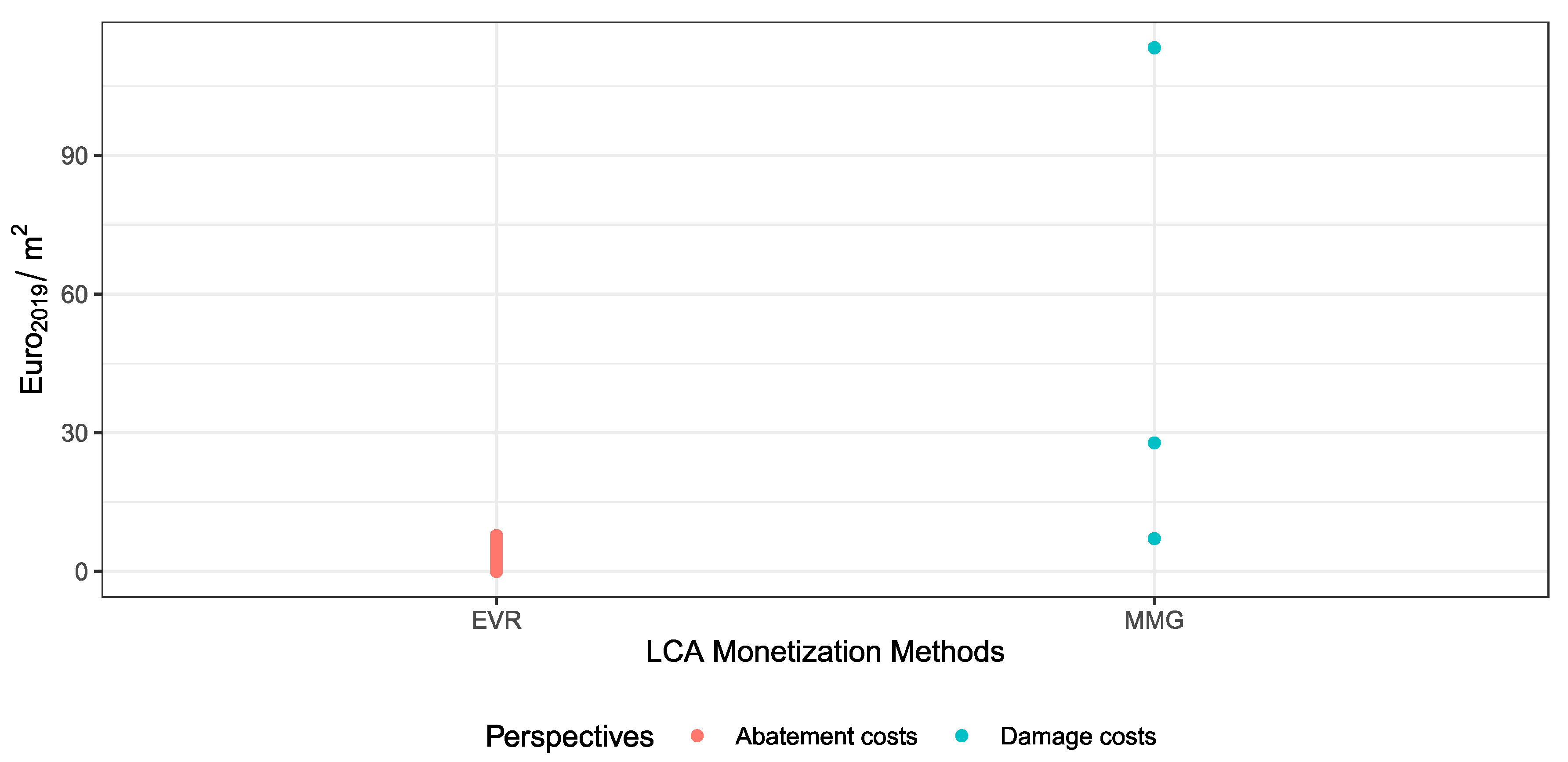

3.3.14. Freshwater Ecotoxicity

3.3.15. Marine Ecotoxicity

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Boardman, A.; Greenberg, D.; Vining, A.; Weimer, D. Cost Benefit Analysis: Concepts and Practice; Cambridge University Press: Cambridge, UK, 2018. [Google Scholar]

- Wolff, F.; Gsell, M. Ökonomisierung der Umwelt und Ihres Schutzes: Unterschiedliche Praktiken, Ihre Theoretische Bewertung und Empirische Wirkungen; German Federal Environmental Agency: Berlin/Dessau, Germany, 2018. [Google Scholar]

- Bachmann, T.M. Considering environmental costs of greenhouse gas emissions for setting a CO2 tax: A review. Sci. Total Environ. 2020, 720, 137524. [Google Scholar] [CrossRef] [PubMed]

- Kylili, A.; Fokaides, P.A.; Ioannides, A.; Kalogirou, S. Environmental assessment of solar thermal systems for the industrial sector. J. Clean. Prod. 2018, 176, 99–109. [Google Scholar] [CrossRef]

- Walker, S.B.; Fowler, M.; Ahmadi, L. Comparative life cycle assessment of power-to-gas generation of hydrogen with a dynamic emissions factor for fuel cell vehicles. J. Energy Storage 2015, 4, 62–73. [Google Scholar] [CrossRef]

- Bachmann, T.M. Optimal pollution: The welfare economic approach to correct related market failures. In Encyclopedia of Environmental Health; Elsevier: Amsterdam, The Netherlands, 2019; Volume 4, pp. 767–777. ISBN 9780444639523. [Google Scholar]

- Pizzol, M.; Laurent, A.; Sala, S.; Weidema, B.; Verones, F.; Koffler, C. Normalisation and weighting in life cycle assessment: Quo vadis? Int. J. Life Cycle Assess. 2017, 22, 853–866. [Google Scholar] [CrossRef]

- Rauner, S.; Bauer, N.; Dirnaichner, A.; Van Dingenen, R.; Mutel, C.; Luderer, G. Coal-exit health and environmental damage reductions outweigh economic impacts. Nat. Clim. Chang. 2020, 10, 308–312. [Google Scholar] [CrossRef]

- Schneider-Marin, P.; Lang, W. Environmental costs of buildings: Monetary valuation of ecological indicators for the building industry. Int. J. Life Cycle Assess. 2020, 25, 1637–1659. [Google Scholar] [CrossRef]

- ISO. ISO 14040: Environmental Management–Life Cycle Assessment—Principles and Framework; ISO: Geneva, Switzerland, 2006. [Google Scholar]

- ISO. ISO 14044:2006 Environmental Management—Life Cycle Assessement—Requirements and Guidelines; ISO: Geneva, Switzerland, 2006. [Google Scholar]

- Steen, B.; Ryding, S.O. The EPS Enviro-Accounting Method; Swedish Environmental Research Institute (IVL): Göteborg, Sweden, 1992. [Google Scholar]

- Inaba, A.; Itsubo, N. Preface. Int. J. Life Cycle Assess. 2018, 23, 2271–2275. [Google Scholar] [CrossRef]

- Itsubo, N.; Inaba, A. A new LCIA method: LIME has been completed. Int. J. Life Cycle Assess. 2003, 8, 305. [Google Scholar] [CrossRef]

- Itsubo, N.; Sakagami, M.; Kuriyama, K.; Inaba, A. Statistical analysis for the development of national average weighting factors-visualization of the variability between each individual’s environmental thought. Int. J. Life Cycle Assess. 2012, 17, 488–498. [Google Scholar] [CrossRef]

- Vogtländer, J.G.; Brezet, H.C.; Hendriks, C.F. The virtual eco-costs ‘99 A single LCA-based indicator for sustainability and the eco-costs-value ratio (EVR) model for economic allocation. Int. J. Life Cycle Assess. 2001, 6, 157–166. [Google Scholar] [CrossRef]

- Finnveden, G. A Critical Review of Operational Valuation/Weighting Methods for Life Cycle Assessment; Swedish Environmental Protection Agency: Stockholm, Sweden, 1999. [Google Scholar]

- Finnveden, G.; Eldh, P.; Johansson, J. Weighting in LCA based on ecotaxes: Development of a mid-point method and experiences from case studies. Int. J. Life Cycle Assess. 2006, 11, 81–88. [Google Scholar]

- Ferreira, S.; Cabral, M.; Da Cruz, N.F.; Marques, R.C. Economic and environmental impacts of the recycling system in Portugal. J. Clean. Prod. 2014, 79, 219–230. [Google Scholar] [CrossRef]

- Pizzol, M.; Weidema, B.; Brandão, M.; Osset, P. Monetary valuation in Life Cycle Assessment: A review. J. Clean. Prod. 2015, 86, 170–179. [Google Scholar] [CrossRef]

- Dong, Y.; Hauschild, M.; Sørup, H.; Rousselet, R.; Fantke, P. Evaluating the monetary values of greenhouse gases emissions in life cycle impact assessment. J. Clean. Prod. 2019, 209, 538–549. [Google Scholar] [CrossRef]

- Durao, V.; Silvestre, J.D.; Mateus, R.; De Brito, J. Economic valuation of life cycle environmental impacts of construction products—A critical analysis. IOP Conf. Ser. Earth Environ. Sci. 2019, 323. [Google Scholar] [CrossRef]

- Hanley, N.; Spash, C.L. Cost-Benefit Analysis and the Environment; Edward Elgar Publishing Company: Cheltenham, UK, 1993; ISBN 1852784555. [Google Scholar]

- Horowitz, J.K.; McConnell, K.E. Willingness to accept, willingness to pay and the income effect. J. Econ. Behav. Organ. 2003. [Google Scholar] [CrossRef]

- Isoni, A. The willingness-to-accept/willingness-to-pay disparity in repeated markets: Loss aversion or “bad-deal” aversion? Theory Decis. 2011. [Google Scholar] [CrossRef]

- Huijbregts, M.A.J.; Steinmann, Z.J.N.; Elshout, P.M.F.; Stam, G.; Verones, F.; Vieira, M.; Zijp, M.; Hollander, A.; van Zelm, R. ReCiPe2016: A harmonised life cycle impact assessment method at midpoint and endpoint level. Int. J. Life Cycle Assess. 2017, 22, 138–147. [Google Scholar] [CrossRef]

- Itsubo, N.; Murakami, K.; Kuriyama, K.; Yoshida, K.; Tokimatsu, K.; Inaba, A. Development of weighting factors for G20 countries—Explore the difference in environmental awareness between developed and emerging countries. Int. J. Life Cycle Assess. 2018, 23, 2311–2326. [Google Scholar] [CrossRef]

- Steen, B. Calculation of Monetary Values of Environmental Impacts from Emissions and Resource Use The Case of Using the EPS 2015d Impact Assessment Method. J. Sustain. Dev. 2016, 9, 15. [Google Scholar] [CrossRef]

- De Bruyn, S.; Bijleveld, M.; de Graaff, L.; Schep, E.; Schroten, A.; Vergeer, R.; Ahdour, S. Environmental Prices Handbook; CE Delft: Delft, The Netherlands, 2018. [Google Scholar]

- Anthoff, D.; Hepburn, C.; Tol, R.S.J. Equity weighting and the marginal damage costs of climate change. Ecol. Econ. 2009, 68, 836–849. [Google Scholar] [CrossRef]

- Hellweg, S.; Hofstetter, T.B.; Hungerbühler, K. Discounting and the environment should current impacts be weighted differently than impacts harming future generations? Int. J. Life Cycle Assess. 2003, 8, 8. [Google Scholar] [CrossRef]

- Nordhaus, W.D. A review of the Stern Review on the economics of climate change. J. Econ. Lit. 2007, 45, 686–702. [Google Scholar] [CrossRef]

- Stern, N. Stern Review: The Economics of Climate Change; Cambridge University Press: Cambridge, UK, 2006. [Google Scholar] [CrossRef]

- Albertí, J.; Balaguera, A.; Brodhag, C.; Fullana-i-Palmer, P. Towards life cycle sustainability assessent of cities. A review of background knowledge. Sci. Total Environ. 2017, 609, 1049–1063. [Google Scholar] [CrossRef] [PubMed]

- Cremer, A.; Müller, K.; Berger, M.; Finkbeiner, M. A framework for environmental decision support in cities incorporating organizational LCA. Int. J. Life Cycle Assess. 2020, 25, 2204–2216. [Google Scholar] [CrossRef]

- Loiseau, E.; Aissani, L.; Le Féon, S.; Laurent, F.; Cerceau, J.; Sala, S.; Roux, P. Territorial Life Cycle Assessment (LCA): What exactly is it about? A proposal towards using a common terminology and a research agenda. J. Clean. Prod. 2018, 176, 474–485. [Google Scholar] [CrossRef]

- Martínez-Blanco, J.; Finkbeiner, M. Organisational LCA. In Life Cycle Assessment: Theory and Practice; Springer International Publishing: Basel, Switzerland, 2017; ISBN 9783319564753. [Google Scholar]

- Boulay, A.M.; Benini, L.; Sala, S. Marginal and non-marginal approaches in characterization: How context and scale affect the selection of an adequate characterization model. The AWARE model example. Int. J. Life Cycle Assess. 2019, 1–13. [Google Scholar] [CrossRef]

- Forin, S.; Berger, M.; Finkbeiner, M. Comment to “Marginal and non-marginal approaches in characterization: How context and scale affect the selection of an adequate characterization factor. The AWARE model example.” Int. J. Life Cycle Assess. 2020, 25, 663–666. [Google Scholar] [CrossRef]

- Nicholson, W.; Snyder, C. Intermediate Microeconomics and Its Application; South-Western College Publishing: Cincinnati, OH, USA, 2009; ISBN 9781439044049. [Google Scholar]

- Revesz, R.L.; Howard, P.H.; Arrow, K.; Goulder, L.H.; Kopp, R.E.; Livermore, M.A.; Oppenheimer, M.; Sterner, T. Global warming: Improve economic models of climate change. Nature 2014, 508, 173. [Google Scholar] [CrossRef]

- ISO. ISO 14008:2019 Monetary Valuation of Environmental Impacts and Related Environmental Aspects; ISO: Geneva, Switzerland, 2019. [Google Scholar]

- Thompson, G. Statistical Literacy Guide: How to Adjust for Inflation; House of Commons Library: London, UK, 2009; pp. 1–6. [Google Scholar]

- Eurostat HICP (2015=100)—Annual Data (Average Index and Rate of Change). Available online: https://ec.europa.eu/eurostat/web/hicp/data/database (accessed on 16 August 2020).

- Statistiska Centralbyrån (SCB) CPI, Fixed Index Numbers (1980=100). Available online: https://www.scb.se/en/finding-statistics/statistics-by-subject-area/prices-and-consumption/consumer-price-index/consumer-price-index-cpi/pong/tables-and-graphs/consumer-price-index-cpi/cpi-fixed-index-numbers-1980100/ (accessed on 16 August 2020).

- U.S. Bureau of Labor Statistics Consumer Price Index Historical Tables for U.S. City Average. Available online: https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm (accessed on 16 August 2020).

- OECD Purchasing Power Parities (PPP). Available online: https://data.oecd.org/conversion/purchasing-power-parities-ppp.htm (accessed on 16 August 2020).

- Owsianiak, M.; Laurent, A.; Bjørn, A.; Hauschild, M.Z. IMPACT 2002+, ReCiPe 2008 and ILCD’s recommended practice for characterization modelling in life cycle impact assessment: A case study-based comparison. Int. J. Life Cycle Assess. 2014, 19, 1007–1021. [Google Scholar] [CrossRef]

- Dreyer, L.C.; Niemann, A.L.; Hauschild, M.Z. Comparison of three different LCIA methods: EDIP97, CML2001 and eco-indicator 99: Does it matter which one you choose? Int. J. Life Cycle Assess. 2003, 8, 191–200. [Google Scholar] [CrossRef]

- Frischknecht, R.; Steiner, R.; Jungbluth, N. The Ecological Scarcity Method—Eco-Factors 2006. A Method for Impact Assessment in LCA; Federal Office for the Environment FOEN: Bern, Switzerland, 2009. [Google Scholar]

- Fantke, P.; Bijster, M.; Guignard, C.; Hauschild, M.; Huijbregts, M.; Jolliet, O.; Kounina, A.; Magaud, V.; Margni, M.; McKone, T.E.; et al. USEtox®2.0 Documentation (Version 1); Technical University of Denmark (DTU): Lyngby, Denmark, 2017. [Google Scholar]

- Jolliet, O.; Margni, M.; Charles, R.; Humbert, S.; Payet, J.; Rebitzer, G.; Rosenbaum, R. IMPACT 2002+: A New Life Cycle Impact Assessment Methodology. Int. J. Life Cycle Assess. 2003, 8, 324. [Google Scholar] [CrossRef]

- Posch, M.; Seppälä, J.; Hettelingh, J.P.; Johansson, M.; Margni, M.; Jolliet, O. The role of atmospheric dispersion models and ecosystem sensitivity in the determination of characterisation factors for acidifying and eutrophying emissions in LCIA. Int. J. Life Cycle Assess. 2008, 13, 477. [Google Scholar] [CrossRef]

- Bare, J. TRACI 2.0: The tool for the reduction and assessment of chemical and other environmental impacts 2.0. Clean Technol. Environ. Policy 2011, 13, 687–696. [Google Scholar] [CrossRef]

- World Nuclear Association Heat Values of Various Fuels. Available online: https://www.world-nuclear.org/information-library/facts-and-figures/heat-values-of-various-fuels.aspx (accessed on 14 November 2020).

- Huijbregts, M.A.J.; Rombouts, L.J.A.; Ragas, A.M.; van de Meent, D. Human-toxicological effect and damage factors of carcinogenic and noncarcinogenic chemicals for life cycle impact assessment. Integr. Environ. Assess. Manag. 2005, 1, 181–244. [Google Scholar] [CrossRef]

- Benini, L.; Mancini, L.; Sala, S.; Schau, E.; Manfredi, S.; Pant, R. Normalisation Method and Data for Environmental Footprints; Publications Office of the European Union: Luxembourg, 2014; ISBN 9789279408472. [Google Scholar]

- Sala, S.; Crenna, E.; Secchi, M.; Pant, R. Global Normalisation Factors for the Environmental Footprint and Life Cycle Assessment; Publications Office of the European Union: Luxembourg, 2017. [Google Scholar] [CrossRef]

- Ahlroth, S.; Finnveden, G. Ecovalue08—A new valuation set for environmental systems analysis tools. J. Clean. Prod. 2011, 19, 1994–2003. [Google Scholar] [CrossRef]

- Ahlroth, S. Valuation of Environmental Impacts and Its Use in Environmental Systems Analysis Tools; KTH Royal Institute of Technology: Stockholm, Sweden, 2009. [Google Scholar]

- Noring, M. Valuing Ecosystem Services: Linking Ecology and Policy; KTH Royal Institute of Technology: Stockholm, Sweden, 2014. [Google Scholar]

- Finnveden, G.; Noring, M. A new set of valuation factors for LCA and LCC based on damage costs: Ecovalue 2012. In Proceedings of the 6th International Conference on Life Cycle Management: Perspectives on Managing Life Cycles, Gothenburg, Sweden, 25–28 August 2013; pp. 197–200, ISBN 978-91-980973-5-1. [Google Scholar]

- Ahlroth, S. Developing a Weighting Set Based on Monetary Damage Estimates. Method and Case Studies; US AB: Stockholm, Sweden, 2009. [Google Scholar]

- Weidema, B.P. Using the budget constraint to monetarise impact assessment results. Ecol. Econ. 2009, 68, 1591–1598. [Google Scholar] [CrossRef]

- Weidema, B.P.; Wesnae, M.; Hermansen, J.; Kristensen, I.; Halberg, N. Environmental Improvement Potentials of Meat and Dairy Products; Publications Office of the European Union: Luxembourg, 2008; Volume 23491, ISBN 9789279097164. [Google Scholar]

- Motoshita, M.; Ono, Y.; Pfister, S.; Boulay, A.M.; Berger, M.; Nansai, K.; Tahara, K.; Itsubo, N.; Inaba, A. Consistent characterisation factors at midpoint and endpoint relevant to agricultural water scarcity arising from freshwater consumption. Int. J. Life Cycle Assess. 2018, 23, 2276–2287. [Google Scholar] [CrossRef]

- Tang, L.; Nagashima, T.; Hasegawa, K.; Ohara, T.; Sudo, K.; Itsubo, N. Development of human health damage factors for PM2.5 based on a global chemical transport model. Int. J. Life Cycle Assess. 2018, 23, 2300–2310. [Google Scholar] [CrossRef]

- Tang, L.; Ii, R.; Tokimatsu, K.; Itsubo, N. Development of human health damage factors related to CO2 emissions by considering future socioeconomic scenarios. Int. J. Life Cycle Assess. 2018, 23, 2288–2299. [Google Scholar] [CrossRef]

- Yamaguchi, K.; Ii, R.; Itsubo, N. Ecosystem damage assessment of land transformation using species loss. Int. J. Life Cycle Assess. 2018, 23, 2327–2338. [Google Scholar] [CrossRef]

- Vogtländer, J.G. The Model of the Eco-costs/Value Ratio (EVR). Available online: https://www.ecocostsvalue.com/index.html (accessed on 17 September 2020).

- Vogtländer, J.; Peck, D.; Kurowicka, D. The eco-costs of material scarcity, a resource indicator for LCA, derived from a statistical analysis on excessive price peaks. Sustainability 2019, 11, 2446. [Google Scholar] [CrossRef]

- Allacker, K.; Trigaux, D.; De Troyer, F. An approach for handling environmental and economic conflicts in the context of sustainable building. WIT Trans. Ecol. Environ. 2014, 181, 79–90. [Google Scholar] [CrossRef]

- Allacker, K.; De Nocker, L. An Approach for Calculating the Environmental External Costs of the Belgian Building Sector. J. Ind. Ecol. 2012, 16, 710–721. [Google Scholar] [CrossRef]

- Debacker, W.; Allacker, K.; Spirinckx, C.; Geerken, T.; De Troyer, F. Identification of environmental and financial cost efficient heating and ventilation services for a typical residential building in Belgium. J. Clean. Prod. 2013, 57, 188–199. [Google Scholar] [CrossRef]

- De Nocker, L.; Debacker, W. Annex: Monetisation of the MMG Method (Update 2017); Public Waste Agency of Flanders (OVAM): Mechele, Belgium, 2018. [Google Scholar]

- De Groot, R.; Brander, L.; van der Ploeg, S.; Costanza, R.; Bernard, F.; Braat, L.; Christie, M.; Crossman, N.; Ghermandi, A.; Hein, L.; et al. Global estimates of the value of ecosystems and their services in monetary units. Ecosyst. Serv. 2012. [Google Scholar] [CrossRef]

- Desaigues, B.; Rabl, A.; Chilton, S.; Hugh Metcalf, A.H.; Ortiz, R.; Navrud, S.; Kaderjak, P.; Szántó, R.; Nielsen, J.S.; Jeanrenaud, C.; et al. Final Report on the Monetary Valuation of Mortality and Morbidity Risks from Air Pollution; Université Paris I: Paris, France, 2006. [Google Scholar]

- Trucost Trucost’s Valuation Methodology. Available online: https://www.gabi-software.com/fileadmin/GaBi_Databases/Thinkstep_Trucost_NCA_factors_methodology_report.pdf (accessed on 8 December 2020).

- Desaigues, B.; Ami, D.; Bartczak, A.; Braun-Kohlová, M.; Chilton, S.; Czajkowski, M.; Farreras, V.; Hunt, A.; Hutchison, M.; Jeanrenaud, C.; et al. Economic valuation of air pollution mortality: A 9-country contingent valuation survey of value of a life year (VOLY). Ecol. Indic. 2011, 11, 902–910. [Google Scholar] [CrossRef]

- Ott, W.; Baur, M.; Kaufmann, Y.; Frischknecht, R.; Steiner, R. NEEDS Deliverable D.4.2-RS 1b/WP4—July 06 “Assessment of Biodiversity Losses”. Available online: http://www.needs-project.org/RS1b/RS1b_D4.2.pdf (accessed on 14 December 2020).

- Mccarthy, D.P.; Donald, P.F.; Scharlemann, J.P.W.; Buchanan, G.M.; Balmford, A.; Green, J.M.H.; Bennun, L.A.; Burgess, N.D.; Fishpool, L.D.C.; Garnett, S.T.; et al. Financial Costs of Meeting Global Biodiversity Conservation Targets: Current Spending and Unmet Needs. Science 2012, 338, 946–949. [Google Scholar] [CrossRef]

- Kuik, O.; Brander, L.; Nikitina, N.; Navrud, S.; Magnussen, K.; Fall, E.H. Report on the Monetary Valuation of Energy Related Impacts on Land Use, D.3.2. CASES Cost Assessment of Sustainable Energy Systems; University of Amsterdam: Amsterdam, The Netherlands, 2008. [Google Scholar]

- Preiss, P.; Friedrich, R.; Klotz, V. Deliverable n° 1.1 - RS 3a “Report on the Procedure and Data to Generate Averaged/Aggregated Data”; University of Stuttgart: Stuttgart, Germany, 2008. [Google Scholar]

- Espreme Estimation of Willingness-To-Pay to Reduce Risks of Exposure to Heavy Metals and Cost-Benefit Analysis for Reducing Heavy Metals Occurrence in Europe. Available online: http://espreme.ier.uni-stuttgart.de (accessed on 14 December 2020).

- Costanza, R.; D’Arge, R.; De Groot, R.; Farber, S.; Grasso, M.; Hannon, B.; Limburg, K.; Naeem, S.; O’Neill, R.V.; Paruelo, J.; et al. The value of the world’s ecosystem services and natural capital. Nature 1997. [Google Scholar] [CrossRef]

- Fleurbaey, M.; Zuber, S. Climate Policies Deserve a Negative Discount Rate. Chic. J. Int. Law 2013, 13, 14–15. [Google Scholar]

- Nordhaus, W.D. Revisiting the social cost of carbon. Proc. Natl. Acad. Sci. USA 2017, 114, 1518–1523. [Google Scholar] [CrossRef] [PubMed]

- Tol, R.S.J. The Social Cost of Carbon: Trends, Outliers and Catastrophes. Assess. E J. 2008. [Google Scholar] [CrossRef]

- Ackerman, F.; Stanton, E.A. Climate risks and carbon prices: Revising the social cost of carbon. Economics 2012, 6, 10. [Google Scholar] [CrossRef]

- Anthoff, D.; Tol, R.S.J.; Yohe, G.W. Risk aversion, time preference, and the social cost of carbon. Environ. Res. Lett. 2009, 4, 024002. [Google Scholar] [CrossRef]

- Wouter Botzen, W.J.; van den Bergh, J.C.J.M. How sensitive is Nordhaus to Weitzman? Climate policy in DICE with an alternative damage function. Econ. Lett. 2012, 117, 372–374. [Google Scholar] [CrossRef]

- Tol, R.S.J. The economic impact of climate change. Perspektiven der Wirtschaftspolitik 2010, 11. [Google Scholar] [CrossRef]

- ISO. ISO 14067:2018 Greenhouse Gases—Carbon Footprint of Products—Requirements and Guidelines for Quantification; ISO: Geneva, Switzerland, 2018. [Google Scholar]

- Goedkoop, M.; Heijungs, R.; Huijbregts, M.; De Schryver, A.; Struijs, J.; Van Zelm, R. ReCiPe 2008—A life Cycle Impact Assessment Method Which Comprises Harmonised Category Indicators at the Midpoint and the Endpoint Level; Ministry of Housing, Spatial Planning and the Environment (VROM): The Hague, The Netherlands, 2008. [Google Scholar]

- Methodex BeTa e Methodex V2e07. 2007. Available online: www.methodex.org/news.htm (accessed on 14 December 2020).

- European Commission. ExternE Externalities of Energy Methodology Update 2005; Publications Office of the European Union: Luxembourg, 2005; ISBN 9279004239. [Google Scholar]

- Gren, I.M. Cost and Benefits from Nutrient Reductions to the Baltic Sea; Swedish Agency for Marine and Water Management: Gothenborg, Sweden, 2008; Volume 46, ISBN 9789162058777. [Google Scholar]

- Liu, Y.; Villalba, G.; Ayres, R.U.; Schroder, H. Global phosphorus flows and environmental impacts from a consumption perspective. J. Ind. Ecol. 2008, 12, 229–247. [Google Scholar] [CrossRef]

- van Zelm, R.; Huijbregts, M.A.J.; den Hollander, H.A.; van Jaarsveld, H.A.; Sauter, F.J.; Struijs, J.; van Wijnen, H.J.; van de Meent, D. European characterization factors for human health damage of PM10 and ozone in life cycle impact assessment. Atmos. Environ. 2008, 42, 441–453. [Google Scholar] [CrossRef]

- Gronlund, C.J.; Humbert, S.; Shaked, S.; O’Neill, M.S.; Jolliet, O. Characterizing the burden of disease of particulate matter for life cycle impact assessment. Air Qual. Atmos. Health 2015, 8, 29–46. [Google Scholar] [CrossRef]

- De Bruyn, S.; Korteland, M.; Markowska, A.; Davidson, M.; de Jong, F.; Bles, M.; Sevenster, M. Shadow Prices Handbook Valuation and Weighting of Emissions and Environmental Impacts; CE Delft: Delft, The Netherlands, 2010. [Google Scholar]

- Goedkoop, M.; Heijungs, R.; Huijbregts, M.; De Schryver, A.; Struijs, J.; van Zelm, R. ReCiPe 2008 Characterisation; Ministry of Housing, Spatial Planning and the Environment (VROM): The Hague, The Netherlands, 2013. [Google Scholar]

- Hotelling, H. The Economics of Exhaustible Resources. J. Political Econ. 1931, 39, 137–175. [Google Scholar] [CrossRef]

- Ligthart, T.N.; van Harmelen, T. Estimation of shadow prices of soil organic carbon depletion and freshwater depletion for use in LCA. Int. J. Life Cycle Assess. 2019, 24, 1602–1619. [Google Scholar] [CrossRef]

- Gassert, F.; Reig, P.; Luo, T.; Maddocks, A. Aqueduct Country and River Basin Rankings: A Weighted Aggregation of Spatially Distinct Hydrological Indicators; World Resources Institute: Washington, DC, USA, 2013. [Google Scholar]

- Motoshita, M.; Itsubo, N.; Inaba, A. Development of impact factors on damage to health by infectious diseases caused by domestic water scarcity. Int. J. Life Cycle Assess. 2011, 16, 65–73. [Google Scholar] [CrossRef]

- Milà i Canals, L.; Bauer, C.; Depestele, J.; Dubreuil, A.; Knuchel, R.F.; Gaillard, G.; Michelsen, O.; Müller-Wenk, R.; Rydgren, B. Key elements in a framework for land use impact assessment within LCA. Int. J. Life Cycle Assess. 2007, 12, 5–15. [Google Scholar] [CrossRef]

- Milà i Canals, L.; Romanyà, J.; Cowell, S.J. Method for assessing impacts on life support functions (LSF) related to the use of “fertile land” in Life Cycle Assessment (LCA). J. Clean. Prod. 2007, 15, 1426–1440. [Google Scholar] [CrossRef]

- Luengo-Fernandez, R.; Leal, J.; Gray, A.; Sullivan, R. Economic burden of cancer across the European Union: A population-based cost analysis. Lancet Oncol. 2013, 14, 1165–1174. [Google Scholar] [CrossRef]

- Rosenbaum, R.K.; Bachmann, T.M.; Gold, L.S.; Huijbregts, M.A.J.; Jolliet, O.; Juraske, R.; Koehler, A.; Larsen, H.F.; MacLeod, M.; Margni, M.; et al. USEtox—The UNEP-SETAC toxicity model: Recommended characterisation factors for human toxicity and freshwater ecotoxicity in life cycle impact assessment. Int. J. Life Cycle Assess. 2008, 13, 532. [Google Scholar] [CrossRef]

- Grosse, S.D. Assessing cost-effectiveness in healthcare: History of the $50,000 per QALY threshold. Expert Rev. Pharm. Outcomes Res. 2008, 8, 165–178. [Google Scholar] [CrossRef]

- Noring, M.; Håkansson, C.; Dahlgren, E. Valuation of ecotoxicological impacts from tributyltin based on a quantitative environmental assessment framework. Ambio 2016, 45, 120–129. [Google Scholar] [CrossRef][Green Version]

- Hejnowicz, A.P.; Rudd, M.A. The value landscape in ecosystem services: Value, value wherefore art thou value? Sustainability 2017, 9, 850. [Google Scholar] [CrossRef]

- Johnston, R.J.; Boyle, K.J.; Vic Adamowicz, W.; Bennett, J.; Brouwer, R.; Ann Cameron, T.; Michael Hanemann, W.; Hanley, N.; Ryan, M.; Scarpa, R.; et al. Contemporary guidance for stated preference studies. J. Assoc. Environ. Resour. Econ. 2017, 4, 319–405. [Google Scholar] [CrossRef]

- Carnoye, L.; Lopes, R. Participatory environmental valuation: A comparative analysis of four case studies. Sustainability 2015, 7, 9823–9845. [Google Scholar] [CrossRef]

- Brown, T.C.; Gregory, R. Why the WTA-WTP disparity matters. Ecol. Econ. 1999, 28, 323–335. [Google Scholar] [CrossRef]

| Method | Cost Perspective | AoPs 1 | Equity Weighting | Geographical Scope | Discounting | Marginal/non-Marginal | Uncertainty | Associated Publications |

|---|---|---|---|---|---|---|---|---|

| Ecovalue12 | Damage costs/stated preference and market price | Divers for different impact categories, partially no documentation | Not clearly documented | Sweden | Unclear | Marginal | Provides min and max values | [59,60,61,62,63] |

| Stepwise 2006 | Damage costs/Ability to pay | Human health biodiversity resources | Yes | Global | Unclear | Marginal | Discussed qualitatively | [64,65] |

| LIME3 | Damage costs/stated preference | Human health, social assets (natural resources), terrestrial ecosystems, NPP 1 | No | Global with country resolution (G20 countries) | No | Marginal except for climate change | No | [13,27,66,67,68,69] |

| Ecotax 2006 | Societies’ willingness to pay | Not applicable | Not applicable- as it is not connected to an AoP | Sweden | Not applicable | Marginal | Provides min and max values | [18] |

| EVR (version 1.6) | Abatement costs | Not applicable | Yes but only applicable for human toxicity | Europe Netherlands 2 | Not applicable | marginal | [16,70,71] | |

| EPS | Damage costs/mostly market price and revealed preference | Human health, bio productivity, biodiversity, abiotic resources, water, labor productivity | Yes, every human welfare loss is treated as if they were an OECD citizen | Global | 0% | average | Provides uncertainty factors | [28] |

| Environmental Prices | Damage costs and abatement costs | Human health, ecosystems, buildings and materials, resource availability, wellbeing | No (but use only one DALY 1 for all European countries) | Europe | 3% | Marginal | High, low and central value (but not for LCA 1 weighting factors) | [29] |

| MMG-Method | Damage costs abatement costs restoration costs | Human health-, biodiversity, agricultural production, resources | Not explicitly treated- | Europe, Flanders 2, global 2 | 3% | CO2, POCP 1, Water -marginal, for the other impacts unspecified | Provides a high middle and low estimate | [72,73,74,75] |

| Trucost | WTP 1 through ecosystem services (market price) or stated preference | Human health, ecosystem services based on de Groot [76], abiotic resources | Yes, DALYS 1 for all people are weighted equally | Global | Yes, but rate is unclear (for human health it is 3% as it is based on [77]) | Eutrophication, abiotic resources acidification, smog, toxicity,: marginal, land use: average: | Qualitative description of uncertainty and limitations | [78] |

| Method | AoP Human Health | AoP Biodiversity |

|---|---|---|

| MMG | 53,363.5 €2012/DALY obtained from [79] | Based on NEEDS/restoration costs [80] value provided is: 46 €/PDF/kg 1.4-DCB-e, as the source is the same as the low value of environmental Prices it should be also 0.024 €2015/PDF/m2/yr |

| EPS | 50,000 €2015YOLL (Years of life lost) | NEX (normalized extinction of species) 56 billion € per year [81] |

| Trucost | Based on New Energy Externalities Development for Sustainability (NEEDS) project [77] Corrected for global average income (value not disclosed) | Through ecosystem services and Net Primary Production (NPP) (the biodiversity will actually measure the same as NPP if they are correlated); with data from de Groot et al. [76] (value not disclosed) |

| Ecovalue | Not explicit at least for acidification and eutrophication. They rather include wellbeing | Not explicit at least for acidification and eutrophication. They rather include wellbeing |

| Stepwise | Ability to pay 74,000 €2003/QALY | 1400 €/BAHY- as One BAHY is equal to 10,000 PDF/m2/yr = 0.14 €2003/PDF/m2/yr |

| LIME 3 | 23,000 USD2013 /DALY | 4,100,000,000 USD2013/EINES |

| Environmental prices | 55,000 €2015/DALY Mortality: 50,000 €2015 to 110,000 €2015 Morbidity 50,000 €2015 to 100,000 €2015 | High: 0.649 €2015/PDF/m2/yr (based on high estimate of [82]) Central: 0.083 €2015/PDF/m2/yr (based on medium estimate of [82]) Low: 0.024 €2015/PDF/m2/yr (based on [80]) |

| Method | Rank |

|---|---|

| Ecovalue | 1 |

| Ecotax | 2 |

| Environmental Prices | 3 |

| EVR | 4 |

| MMG | 5 |

| Trucost | 6 |

| EPS | 7 |

| Stepwise | 8 |

| LIME3 | 9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arendt, R.; Bachmann, T.M.; Motoshita, M.; Bach, V.; Finkbeiner, M. Comparison of Different Monetization Methods in LCA: A Review. Sustainability 2020, 12, 10493. https://doi.org/10.3390/su122410493

Arendt R, Bachmann TM, Motoshita M, Bach V, Finkbeiner M. Comparison of Different Monetization Methods in LCA: A Review. Sustainability. 2020; 12(24):10493. https://doi.org/10.3390/su122410493

Chicago/Turabian StyleArendt, Rosalie, Till M. Bachmann, Masaharu Motoshita, Vanessa Bach, and Matthias Finkbeiner. 2020. "Comparison of Different Monetization Methods in LCA: A Review" Sustainability 12, no. 24: 10493. https://doi.org/10.3390/su122410493

APA StyleArendt, R., Bachmann, T. M., Motoshita, M., Bach, V., & Finkbeiner, M. (2020). Comparison of Different Monetization Methods in LCA: A Review. Sustainability, 12(24), 10493. https://doi.org/10.3390/su122410493