1. Introduction

The Italian Treasury Department published its Public Administration Assets report in 2018. This document examined the composition and value of public real estate assets more than 30 years after the first census made in Republican Italy by the Cassese Commission during the mid-1980s.

The information in the report, relative to publicly-owned real estate assets between 2011–2015, derives from the annual survey public administrations are obliged to produce since 2009 [

1].

According to the report, the value of the Italian public real estate assets, for buildings alone, amounts to roughly 283 billion euros for a portfolio of 325 million square metres. Eighty percent of this area is used for strictly institutional purposes related to office functions. The remaining portion, with an estimated value of approximately 63 billion euros, is available and may be put to better use for social purposes or alienated.

In terms of estimated value this important figure makes the Italian State—at least potentially—the most important operator in the real estate market when compared to the assets held by the 450 real estate funds operating in the country, which total approximately 66 billion euros [

2].

While this public real estate capital available for valorisation operations is very heterogeneous in its typologies, uses, and dimensions—not to mention highly fragmented and, often, in a significant state of disrepair—there is little doubt that it remains a resource with the possibility to generate additional revenue for public coffers.

2. The Real Estate Assets of Italy’s Comuni

In Italy, the reform of local government and the economic and financial crisis, together with the budgetary and spending constraints introduced by the European Fiscal Compact, have generated mounting financial pressure on the public administration and highlighted the role of public assets in debt management [

3]. While these assets generate a negative balance because very often they are underutilised or not utilised at all, they represent a potential source of revenue in the event of sale [

4] or improved use.

As described in the 2015 Ministry of Economy and Finance-Treasury Department report, the majority of these assets are owned by local administrations; the most relevant share belongs to the country’s comuni (municipalities)—67.42% by number and 59.51% by area. While seemingly large, in reality, these figures refer primarily to minor properties (apartments and related appurtenances, garages, commercial spaces, etc.). On the contrary, state, regional, and provincial governments and public healthcare authorities possess smaller though more valuable portfolios (historical buildings, structured offices, former hospitals, etc.).

Despite their small dimensions, in practical terms, the assets owned by Italy’s municipalities can still make a significant financial and social contribution. In fact, it is not so much the asset itself that produces value, as much as the utility derived from it through proper valorisation—“the uses, public and private, economic and social, in any case multiple and diverse, emerge from the context in which the asset is situated” [

5].

What follows is the need to develop design skills and visions that postulate possible new scenarios of use; new functions for spaces and sites within a more general notion of transformation [

6].

This is particularly problematic for small municipalities. Unlike larger towns or metropolitan areas, they suffer from a lack of technical and financial resources and trained staff, which further complicates the implementation of any process of valorisation. It is clear that the complex factors linked to an adequate policy for the valorisation of public real estate assets cannot be a prerogative “solely of larger municipalities with financial and technical-operational capacities” [

7]; hence there is a need to define an operational protocol that is particularly suited to small municipalities.

A further indicator of the need for tools in support of ‘small municipalities’ is offered by Law n. 158/2017. The principal interventions foreseen by this regulation include the establishment of a fund for the structural, economic, and social development of small municipalities. This fund was created to finance investments in the protection of the environment and cultural heritage, the preservation and urban redevelopment of historical centres, the promotion of economic and social development and the establishment of new productive activities. While this fund cannot count on large sums, nonetheless, the resources allocated may still aid small municipalities with the recovery and valorisation of their real estate assets.

3. The Indispensable Role of Knowledge

An adequate knowledge of real estate assets is the building block of a correct valorisation strategy. Two levels of in-depth analysis can be identified: the first is represented by the wealth of technical-financial information we can refer to as ‘material knowledge’; the second, bound to the requirements, expectations and, needs of different communities—evidence of which should be present in political programmes—whose satisfaction can be traced, directly or indirectly, to available real estate assets, represents a level of knowledge that can only be referred to as ‘immaterial’.

3.1. “Material” Knowledge

One of the principal factors hindering the success of valorisation projects is rooted in the Public Administration’s scarce knowledge of its own assets [

8,

9].

Despite the issuance of several laws intent on rationalising this aspect, Italy continues to be plagued by a large number of public institutions with fragmented and often out of date information. Italy currently has no national information system [

10] documenting the many aspects of its assets. Consequently, the country lacks a standardised procedure for their management. These are anything but secondary aspects: the size of a building and the layout of its interior spaces; the general state of maintenance and efficiency of plant systems; energy efficiency; current use and eventual revenues generated, etc. When such information is lacking, it is truly difficult to develop asset, property, and facility management activities [

11], but also to adequately assess the option of selling off these assets.

3.2. Immaterial Knowledge

In the wake of the regulatory changes made during the 1990s and new forms of relationships between the Public Administration and citizens introduced by the principle of horizontal subsidiarity, the public sector has faced a growing demand for greater accountability which led, in turn, to the preparation of the Sustainability Report (or Social Report). This document permits stakeholders to be more informed, and consequently more involved, in the choices made by institutions. It represents a means for re-stitching the institutional ‘rift’ that developed over time between the public administration and citizens, especially after the “tangentopoli” (bribesville) scandal of the 1990s.

There has been a rapid shift from forms of “communication is participation” [

12] involving citizens in public affairs, to even more direct forms of participatory budgeting. Inspired by the concept of participatory democracy, decisions are taken directly by citizens [

13] and represent an approach to the development of budgets for local authorities through the direct participation of citizens in specific expenditures.

Furthermore, the declining demand for public assets to be alienated or valorised, the bureaucratic complexity linked to valorisation operations, and the complicated marketing of public properties that are both large and difficult to transform (such as former barracks, prisons or military hospitals) have directed public administrations “to test new ways of valorising assets, promoting the action of associations and self-organised groups interested in using buildings otherwise destined for abandonment” [

14].

These new forms of bottom-up use (or better yet re-use), directly involve local communities through forms of civic engagement and civic crowdfunding.

While the former can be considered “active” for their civic engagement, the latter can be considered “passive” or “semi-passive” as they occur through fundraising to develop a specific project (or initiative). Without producing economic returns for investors, they are implemented solely due to the common belief that a project is worthy of being developed and implemented [

15]. “Citizens will find bottom-up financing to be a tool for having a say in the management and valorisation of common goods, expressing their requirements and participating as active subjects in the decision-making processes of the public administration” [

16].

Furthermore, the continuous development of new forms of activity, such as urban neo-manufacturing, digital craftsmanship, the creation of spaces for coworking and start-ups, and social services offered in refurbished spaces in former commercial or institutional buildings, paves the way for new policies of reuse in a form of so-called real estate upcycling.

Participatory budgets, civic engagement and civic crowdfunding undoubtedly represent direct forms of participation in decision-making processes; however, there are other forms that, while following indications provided by the community, are in fact implemented indirectly. Typical of all municipal administrations, they are represented by the implementation of an electoral programme.

This programme, comprised of the ideas underlying a political movement [

17], contains the electoral promises made by a candidate during an election (to be respected in the case of victory). “Electoral promises should arise from stakeholder participation in the definition of priorities and the prior verification of reasonably available resources” [

18].

Consequently, any process of valorisation or alienation involving public real estate assets must verify the satisfaction of the interests and expectations of the community in advance: these requests are (or should be) contained in an electoral programme.

As a result, it is impossible to implement policies for the valorisation of public real estate when choices are not shared by the local community [

19]; this prerogative appears to be essential to the success of any project fielded by the public administration [

20]. In fact, many examples demonstrate that when projects are not shared by the community (for example the sale of public assets for immediate monetisation) they can meet with opposition from citizens. Demonstrations of dissent in the interest of protecting these assets, symbols of memory and tradition for an entire community, block (or considerably slow) procedures and compromise any initiative taken by public decision-makers.

The sum of these elements defines the concept of immaterial knowledge.

3.3. Using the Third Sector to Favour the Recovery and Reuse of Public Buildings: A Bottom-Up Approach

Since the 1990s, there have been numerous debates on public real estate and what contribution it could make to the consolidation of public finances. All of the procedures promoted by various legislators share one common element—seeking returns from the market in a relatively short time. Unfortunately, the complexity of regulations and the economic situation have impacted the ability to implement similar operations [

21].

All the same, public buildings have always represented a resource for European cities: historically, they have permitted the production of public services and welfare in European cities, and represented one of the stabilising factors of their real estate markets [

22]. Today, the “conditions of the European real estate market, the economic crisis and the widespread banking credit crunch oblige the identification of alternative solutions to the alienation of public assets” [

23].

The models for valorising traditional public real estate assets have recently begun to make room for new approaches: “temporary uses and the revitalisation of small areas of public buildings are developing progressively, making the practices and management of these processes a possible new way to revitalise these assets” [

24]. These bottom-up approaches arise from the requirements and needs of the local community and the development of forms of civic crowdfunding in which citizens, reunited primarily as non-profit associations, initiate real processes for the adaptive reuse of many abandoned public properties.

These forms of reuse are characterised for the most part by free concessions, for short periods of time, and a preference for small redevelopments over large investments. Nonetheless, these activities help foster a high social value by creating new forms of aggregation, such as urban laboratories for co-living, co-making, and co-working, as well as recovering, albeit in part, buildings otherwise destined for abandonment and deterioration.

Additionally, recent migratory movements have accelerated changes, already underway for several years, in the multi-ethnic city. This has generated “an entirely new demand for public and private assets compared to traditional needs” [

25]. It is clear that the demand for new spaces in which to implement cultural integration projects can be satisfied through the use of abandoned public buildings by non-profit companies.

A greater impetus to the theme of re-use by non-profit associations came with the agreement signed in November 2017 between the Italian Ministry of Labour and Social Policies, the National Agency for the Administration and Allocation of Assets Seized from Organized Crime (ANBSC), the State Property Office, and the National Association of Italian Municipalities (ANCI). This agreement provides for the allocation of unused public real estate and fixed and mobile assets confiscated from organised crime to associations operating in the third sector to be used exclusively for activities of interest to the general public.

This opportunity sets a virtuous path in motion with a twofold objective: the valorisation of unused public buildings and the development of activities with an elevated social value [

26]. Abandoned buildings are often in a poor state of repair. This degradation can expand to the entire neighbourhood in which they are located, generating a flywheel effect of a collective loss of value, [

27] as demonstrated by the “Broken Windows Theory”.

While forms of valorisation of public real estate assets implemented through civic engagement procedures do not provide for the full recovery of an asset, nonetheless they ensure its use and self-maintenance, warding off (further) decay [

28]; moreover, although they do not produce sizable financial resources for the property owner, they can instead heighten the attractiveness of the neighbourhood in which they are located by providing new services to the community that were not present before.

In this perspective, “the success of these bottom-up valorisation processes has highlighted the creation of a new economic and social value linked to redevelopment projects and new functions, restoring the attractiveness of assets” [

29].

4. An Operational Protocol

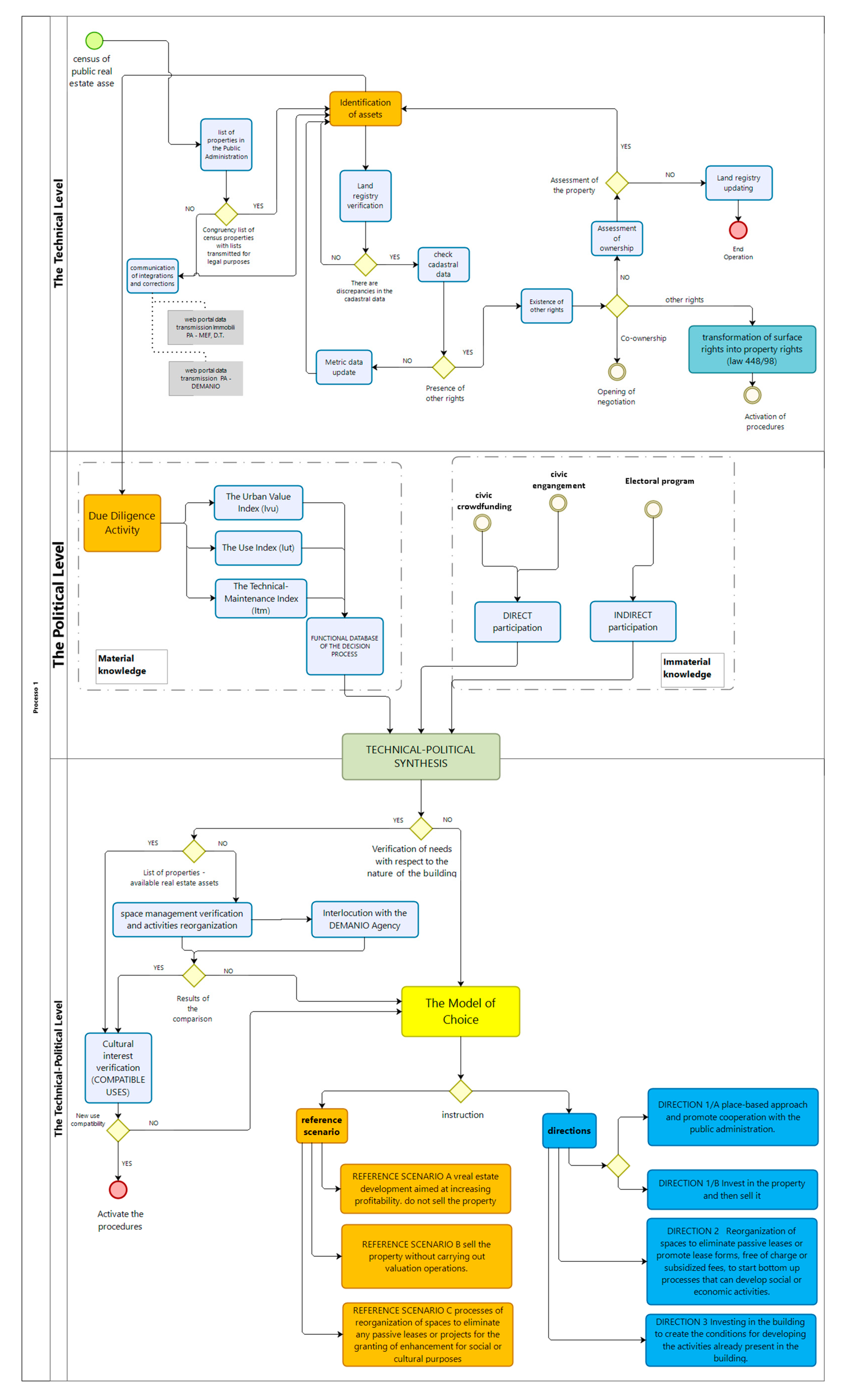

A corporate vision and a managerial approach to the administration of public real estate assets requires the definition of a strategy capable of identifying the full range of activities necessary to reach a desired objective. With this in mind, the representation of the entire decision-making process, capable of guiding a public administration toward the definition of the most appropriate strategies for managing its real estate assets (valorisation, concession or sale), has been translated into a Business Process Modelling exercise (

Figure 1). The modelling of this process makes it possible to define the necessary steps, responsibilities and methods for implementing the strategies to be adopted [

30].

Starting from these premises, three hierarchical levels of action have been identified.

4.1. The Technical Level

The first phase, strictly the responsibility of public technical offices, focuses on identifying all of an administration’s assets [

31], followed by the drafting of a real estate due diligence for each asset.

The information to be provided for each property includes legal status (e.g., real or minor real rights held by a public body), eventual heritage listings, state of repair, building materials and construction methods, general maintenance of building plants, geolocation, and current occupancy (used by the public administration, leased, vacant).

This process must begin with the official lists already drawn up by public administrations (in compliance with laws on transparency and the drafting of the state budget). The next step is to verify the information collected against data present in revenue agency archives (land registry documents). This operation makes it possible to detect and, if necessary, correct inconsistencies in land registry documents, and to note the eventual presence of other property rights beyond those of full ownership—for example, co-ownership, usufruct, or surface rights.

In cases of co-ownership, for example, it is desirable to proceed with the immediate alienation of the relative percentage of ownership of assets with no specifically unique characteristics or when they are located in non-strategic positions. On the contrary, the public administration can proceed toward full ownership of the property and thus implement valorisation policies otherwise difficult to pursue.

When the public administration possesses only a surface right to a fixed asset, there is a need for policies designed to encourage property owners to purchase these rights in order to generate cash flows that can be allocated to budgetary needs [

32] or to initiate valorisation operations involving other assets.

4.2. The Political Level

The second level involves planning and consultation activities. This level is used by political bodies to summarise the material knowledge of its assets and the wealth of immaterial knowledge represented by requests presented (directly and indirectly) by the community. This level involves the construction of two databases: one containing data relative to all buildings surveyed (material knowledge) and another containing the issues, suggestions and requests presented to the administration by associations, stakeholders and locally interested parties (immaterial knowledge).

The elaboration of summary indexes (see

Section 6) helps understand whether public real estate assets can satisfy the requirements and needs expressed by the community. For this reason, the first step involves the identification of properties that could be assigned to associations operating in the area, in order to guarantee the possibility to provide new services. For example, the analysis of requests received from stakeholders should be followed by the identification of properties whose dimensions, location or current state of maintenance are considered suitable. This activity may lead to the development of activities related to urban neo-manufacturing or digital craftsmanship, or propose the creation of spaces dedicated to coworking or the development of social housing, cohousing, etc.

This phase also includes the verification and reorganisation of spaces used by the public administration with the aim of eliminating inefficiencies; the new spaces that may be freed up by this activity can be valorised or sold.

A separate consideration must be made for buildings of notable cultural value [

33]. Unfortunately, they are not always recognised as such and as a result not always listed as foreseen by Italian law: “the assets that represent the history and culture of the community do not always present nationally recognised values. In many cases, the identification and safeguarding of testimonials considered significant by local communities are subject to the sensitivity of decentralised local administrations” [

34].

For assets of this type, the public administration is responsible for ascertaining the existence of these values beforehand and, if confirmed, initiating procedures for their valorisation. This operation allows for both the preservation of an asset’s historical, artistic, or cultural interest and guarantees the possibility to introduce economic activities capable of generating new local economies and a new attractiveness for the territory [

35].

In the event that an institution’s assets are unable to respond to the requests advanced by stakeholders, it is possible to initiate a third phase, which envisages the use of a model of choice [

36] to define the strategies to be adopted (valorisation, concession, or sale).

At this point, it is clear that any future choice made by the public administration should seek to avoid (at least in theory) any criticism and opposition from citizens, already amply involved during the second (political) level of the protocol and therefore in advance of any decision-making process.

4.3. The Technical-Political Level

The third and final level of the protocol, referred to as ‘technical-political’, is characterised by the implementation of the model of choice. This model is designed to provide a political body with indications regarding the most appropriate approach for properties lacking a strategy at the political level.

As the model provides general indications, it is clear that choices will have to be examined from both a technical and a political angle. We can consider, for example, the possibility of valorising a property for its future leasing or alienation: this requires both a technical evaluation of the operation (in financial terms), together with an evaluation of the opportunity to proceed with an activity that will require resources to achieve a particular objective (political decision).

5. The Model of Choice

While the Model tends to provide and/or consolidate a use for these assets, it does not develop a real estate rating capable of mathematically quantifying one specific use with respect to another. Based on objective criteria, this tool is easy to implement as the input data is readily obtainable by the public administration.

The process requires the identification of three thematic areas and three corresponding indexes: urban value (Ivu), use (Iut), and technical maintenance (Itm) of an asset. Using a limited quantity of data, the intention is to maximise the desired objective, given the evident need to simplify the aspects characterising the three themes investigated.

5.1. The Urban Value Index (Ivu)

Urban quality and building quality are multidimensional concepts that can be interpreted from different points of view and perspectives [

37]. One possible definition refers to the analysis of real estate values, to some degree a synthesis, effect and overall measure of these phenomena. The assumption is that the willingness to pay different prices suggests a greater or lesser appreciation of assets, not only in relation to their intrinsic characteristics, but also to the qualities expressed by the urban contexts in which they are located. This latter approach was used to construct the urban values index.

The starting point is defined by the OMI Zone (acronym for the Revenue Agency’s Osservatorio del Mercato Immobiliare, Real Estate Market Observatory): a “continuous portion of the municipal territory that reflects a homogeneous sector of the local real estate market, with a uniform appreciation of economic and socio-environmental conditions”. This uniformity is translated into a homogeneity of characteristics related to position, urban planning, historical-environmental and socio-economic qualities of settled areas, and the offering of urban services and infrastructures. The territorial delimitation of a homogenous market area thus passes through the analysis of the homogeneity of socio-environmental and economic conditions and location: first and foremost the requisite of centrality in terms of the presence of functions, accessibility to public and private facilities and services of varying degrees and levels, the level of urban and suburban transportation services, vehicular connections, the presence of schools, healthcare and sport facilities, shops, tertiary services, etc.

The index defines the distance (in terms of real estate values and therefore of market appreciation) between different urban contexts; it is calculated based on the maximum OMI market value on a municipal basis (for residential buildings in good condition) and the OMI market value where the property is located, according to the following formula:

;

;

= maximum OMI quotation for the municipal territory;

= minimum OMI quotation for the municipal territory;

= OMI listing where the property is located.

5.2. The Use Index (Iut)

The use index represents the yield (or measure of its efficiency) tied to the use of an asset in relation to its occupancy. The index consists of two parameters describing both the actual degree of use in terms of surface area, and the ability of occupants to pay property management/utility costs (electricity, water, gas as well as services such as waste collection taxes, etc.).

The first parameter is linked to the management of spaces: parameter P1 expresses the relationship between the total building area and the portion occupied. This aspect indicates the degree of use of the property, or its underutilisation which permits the allocation of other activities (instrumental to the organisation of the Institution as well as social and/or cultural).

The second parameter, P2, expresses the capacity of the asset to achieve financial autonomy under current conditions of use. This parameter was envisaged as many public buildings are often granted (to non-profit associations) free of charge, meaning that users do not contribute to utility costs.

The index is expressed as follows:

= occupied area,

= total building area,

= utility expenses incurred by users,

= total utility costs paid by the institution.

Structured in this way, the index will have a value of 1 when the building is completely occupied and when utility costs are fully paid by occupants. An index of 0.5 generally refers to intermediate situations, such as total occupancy but no payment of utility costs by occupants (buildings rented free of charge), or situations in which the building is only partially occupied (suggesting better strategies for organising spaces) and utility costs are not covered entirely by occupants.

5.3. The Technical Maintenance Index (Itm)

The technical maintenance condition of an asset undoubtedly represents one of the fundamental elements for planning a correct valorisation strategy, even if not in absolute terms: elements such as the dimensions of the building itself (floor areas and the size of the lot), internal heights, and architectural constraints may take priority over technical maintenance requirements in relation to possible uses. In fact, for example, proceeding with an operation of valorisation through recovery and adaptive reuse to create social welfare or tourism/hospitality activities is highly improbable when building dimensions do not respect legally defined minimum standards. The same is true when future uses are incompatible with heritage listings and conservation projects.

In any case, these aspects must be carefully evaluated: prior to this process, through an initial screening that limits the sample of assets to be evaluated and identifies those best able to satisfy particular requirements; at the end of the process, they verify the congruity of proposed strategies.

Though the technical-maintenance index (Itm) expresses a plurality of parameters, an asset’s current performance level can be analysed by subdividing the seven classes of needs suggested by Italy’s UNI 8289:1981 standard. Furthermore, with a view toward simplification, a dichotomic variable can be proposed for each parameter related to the presence/absence of a specific requirement, evident even during a quick inspection. The following elements were analysed:

Safety: a set of conditions relative to user safety, as well as protection and prevention against accidental damage to the operation of its technical systems. Specifically, this parameter looks exclusively at conditions of accessibility. The parameter will be set to 1 if the building is accessible and 0 otherwise.

Well-being: a set of conditions relative to the asset’s suitability to the life, health and activities of its users. Specifically, this parameter assesses the presence or absence of plant systems (mechanical, electrical and plumbing). The parameter will be set to 1 if the building is fully equipped with all systems, 0 when even only one system is absent.

Usability: a set of conditions relative to the ability of the building system to adequately accommodate the activities of its users. Specifically, this parameter assesses aspects related to the flexibility of layouts offered by the structure; a building with a traditional frame structure (reinforced concrete or steel) imposes less constraints than buildings with a box-like structure (load-bearing masonry). The parameter will be set to 1 for framed structures and 0 otherwise.

Appearance: a set of conditions relative to the perception of the asset by its users. Specifically, this parameter assesses aspects of heritage protection for listed buildings or assets declared of cultural interest. The parameter will be set to 1 if the building is of particular historical-artistic and/or architectural interest and 0 otherwise.

Management: a set of conditions relative to the financial operation of the asset. Specifically, this parameter assesses aspects related to the presence of elements designed to limit energy consumption (PV systems, geothermal energy, insulation) resulting from recent refurbishments. The parameter will be set to 1 if the building has been refurbished and 0 otherwise.

Integrability: a set of conditions relative to the ability to create functional connections between the units and elements of an asset. Specifically, this parameter expresses an overall assessment of the possibility to use the asset even when its individual parts may not fully respond to current regulations. The parameter will be set to 1 if the building is usable and 0 otherwise.

Environmental Protection: a set of conditions relative to the maintenance and improvement of the state of the higher systems to which the asset belongs. Specifically, this parameter identifies eventual sources of pollution in the building (asbestos, waste abandonment, non-ionized radiation from electromagnetic fields, etc.). The parameter will be set to 1 when NO contaminants and/or waste are present in the area and 0 otherwise.

The index is expressed as follows:

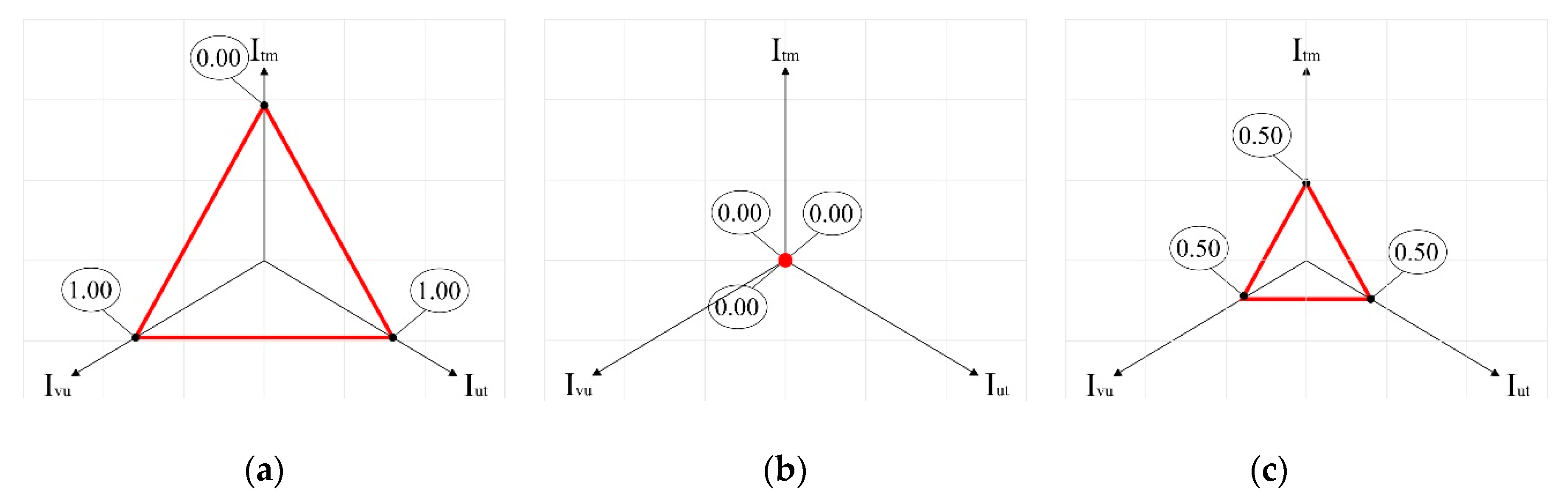

6. Use and Interpretation of the Model

The processing of the three indices is read simultaneously on a star (or radar) diagram that identifies three reference scenarios, three directions, and three uncertain situations for which the model is unable to provide an answer. Situations are defined as uncertain when the model is unable to provide exhaustive indications or when all three indicators share the same value (

Figure 2).

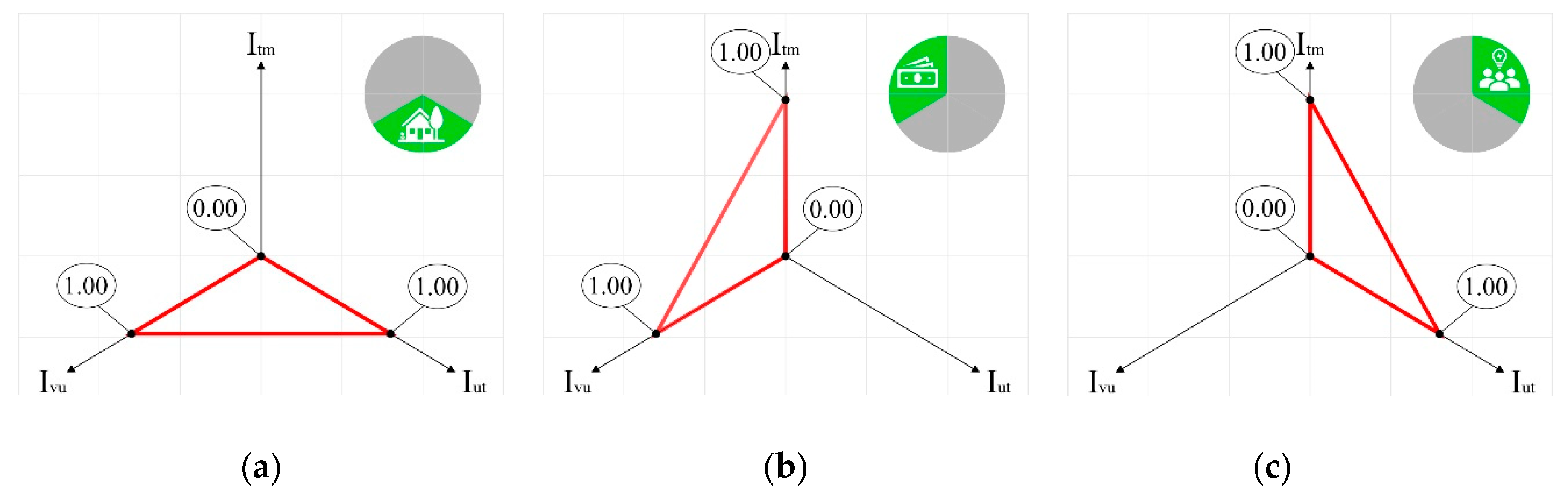

6.1. Reference Scenarios

Each of the areas defined by the reference axes identifies a strategic field in which to develop the process of valorisation (

Figure 3). For greater clarity, limit situations are represented by hypothesising extreme values for the indices (1 or 0). The following scenarios were identified:

Reference Scenario A: An asset is located in a prestigious area, presents a poor technical maintenance level and, is occupied (occupants pay utility costs). The suggestion in this situation is to enhance the property to increase its profitability and maintain its ownership.

Reference Scenario B: An asset is located in a prestigious area, presents a good technical maintenance level, and is unoccupied. The suggestion in this condition is to sell the asset at market value without proceeding with valorisation operations, as the property already presents good technical maintenance characteristics.

Reference Scenario C: An asset is located in the area of no value, presents a good technical maintenance level, and is occupied (occupants pay utility costs). In this context, given the good condition of the asset, the suggestion is to reorganise its use to eliminate any passive leases or proceed with valorisation projects in concession for social or cultural purposes, given its location in an area that, despite a scarce offering of services, is capable of generating attractiveness and interests.

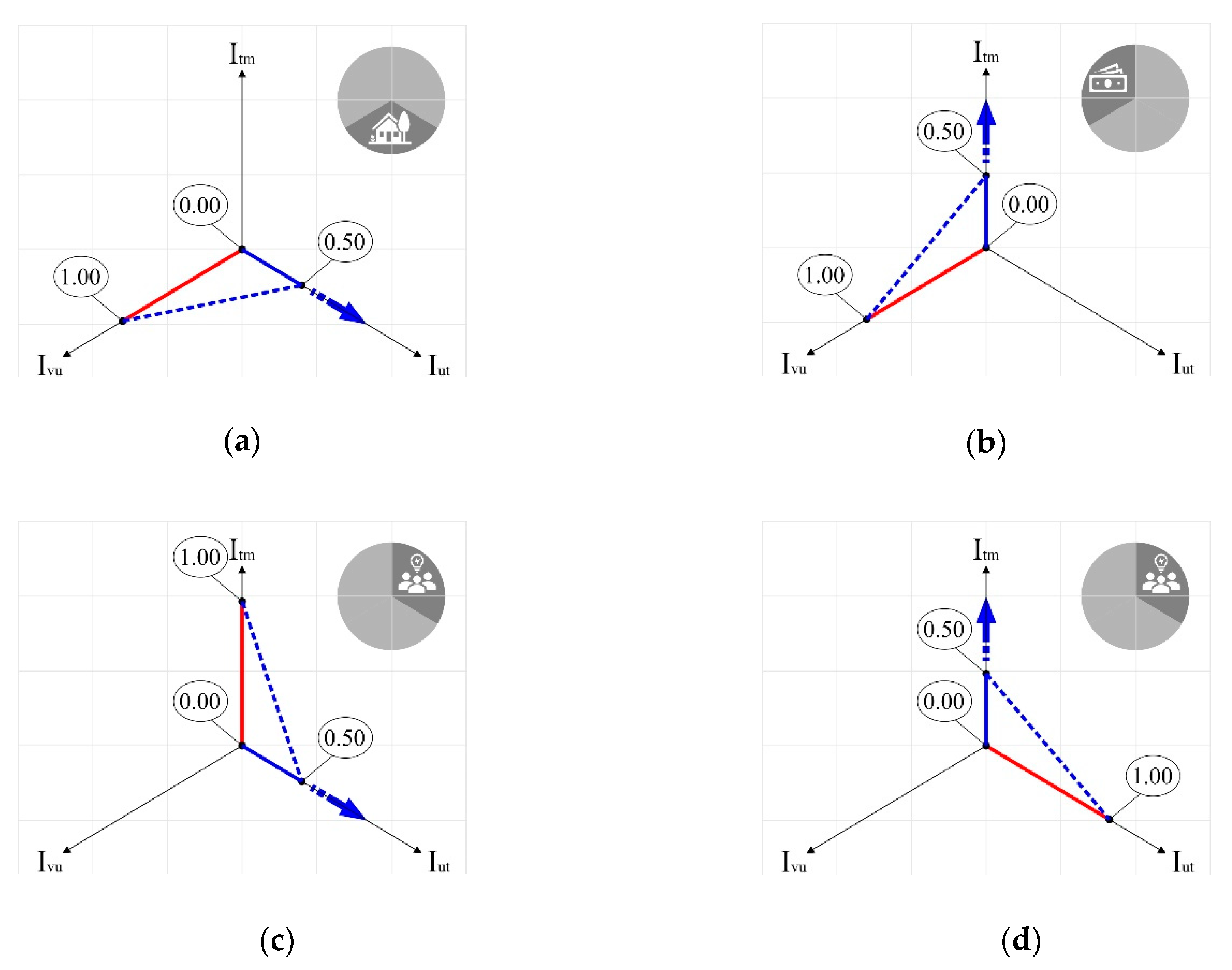

6.2. Directions

In addition to the scenarios presented above, it is possible to encounter limited conditions where only one of the three indicators prevails over the other two. In this situation, the public administration can proceed with activities to increase at least one of the other two indices to reflect one of the scenarios presented above (

Figure 4). However, for a number of reasons, this is not always possible; while the indicators I

tm (technical-maintenance) and I

ut (use) can be modified by making small improvements to an asset or by offering incentives to rental through no-charge lease agreements, it is difficult to influence the I

vu indicator (urban values) without making substantial changes to the urban setting (which require lengthy periods of time) sufficient to modify the structure and equilibriums of the real estate market. The directions identified are:

Direction 1: An asset is located in a prestigious area, presents a poor technical-] maintenance level and is unoccupied. In this situation, it is possible to imagine Development Direction 1A: the public institution could adopt a place-based approach that involves local communities, using their knowledge, collaborating with all territorial stakeholders and promoting institutional cooperation. Another option is Development Direction 1B: the public institution may decide to invest in the redevelopment of the asset and then place it on the market (e.g., dilapidated buildings in prestigious urban contexts).

Single Direction 2: An asset is located in the area of no value but presents a good technical maintenance level and is unoccupied. In this context, the public institution could proceed with a reorganisation of the asset’s spaces to eliminate any passive leases or decide to promote leases, free of charge or subsidised, to favour bottom-up processes that could develop into social or economic activities.

Single Direction 3: An asset is located in the area of no value, presents a poor technical maintenance level, and is occupied (occupants pay utility costs). In this context, the public institution could invest in the asset to create the conditions required to further develop the activities already present in the building.

7. Case Study

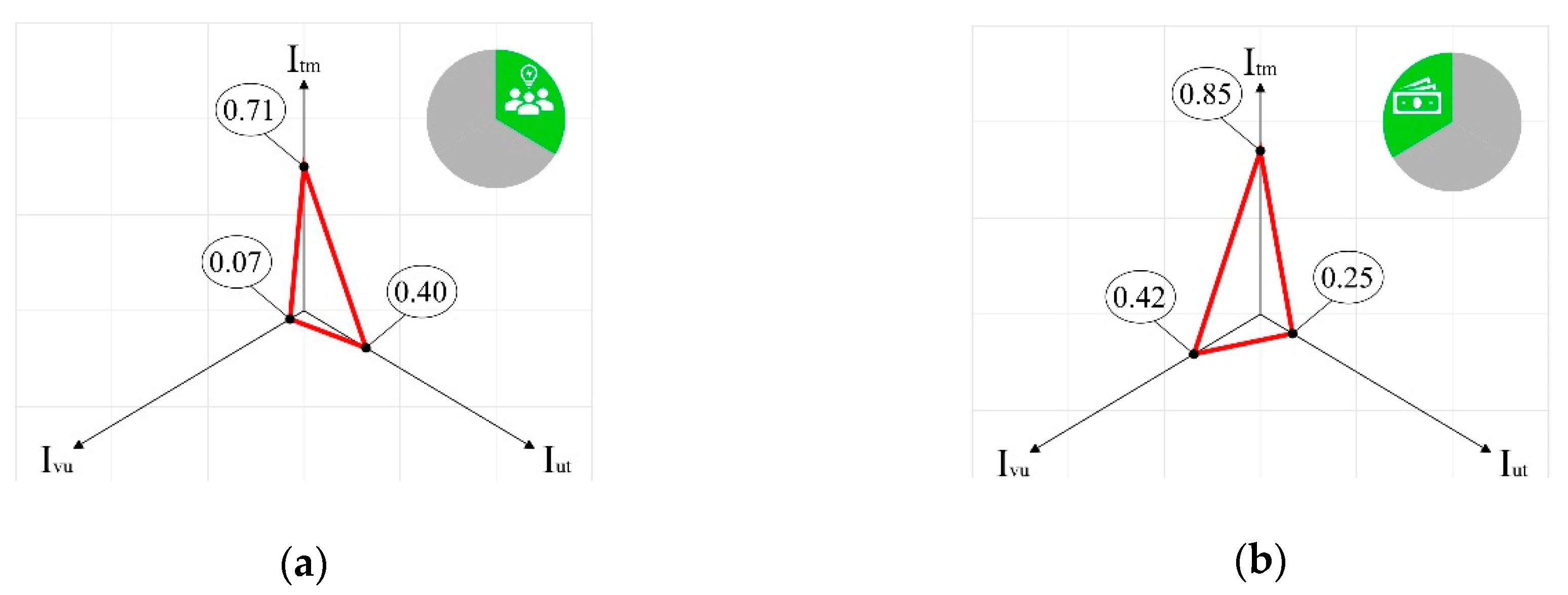

The proposed model was applied to two public buildings in the City of Pescara (Italy): a former school building and a complex of office buildings. In one case the model proved predictive, defining the valorisation strategy eventually adopted by the municipal administration; the second, although not yet developed by the public decision-maker, has nevertheless earned the consent of the population residing in the district and could be incorporated by the public administration (

Figure 5).

7.1. Former School Building in Via Lago di Borgiano, Pescara

This property, owned by the Municipality of Pescara, is located in Via Lago di Borgiano, near the former GTM garage. The site is situated in a public housing district between the Via Tiburtina Valeria and the so-called asse attrezzato urban highway. The building is currently home to various associations (some present under a regular free loan agreement, others illegally). One wing of the building is used as a kitchen serving the cafeterias of the neighbourhood’s schools. Together, the associations and kitchen activity occupy roughly 85% of the available spaces. The costs of kitchen utilities are paid by the kitchen manager, while the utility costs of the associations are paid by the Municipality. The property is zoned D1 OMI. The indices are as follows: IVU = 0.07; IUT = 0.40; ITM = 0.71.

The model tends toward Scenario C—in this context, it is possible to hypothesize concession projects for the enhancement of social services or activities, given the location of the property in an area with a scarce offering of services, though capable of generating attractiveness and interests. The suitability of the proposal was confirmed by the neighbourhood’s citizens. When interviewed about the possible solutions to be implemented, they confirmed the need for spaces and services for children, currently lacking in this densely populated area. In this scenario, a procedure could be activated to legalise occupancy, reorganise the areas assigned to the various associations, and promote, even though free lease agreements or reduced fees, the concession of spaces suitable for the construction of play areas or after-school services for children.

7.2. Offices in Via Tirino, Pescara

These properties are located on the ground floor of two adjacent blocks of flats in Via Tirino, near the G. d’Annunzio University campus. Constructed around the year 2000, they were sold to the Municipality of Pescara as part of an agreement with the builder. To date, they are partially unoccupied (the premises were once leased to the Pescara’s ASL Health Authority) and partially occupied, under a regular contract, by the Misericordia di Pescara Srl company. The property is zoned C4 OMI. The indices are as follows: IVU = 0.42; IUT = 0.25; ITM = 0.85.

The model tends toward Scenario A: in this context, activities focused on selling the asset without proceeding with its valorisation are suggested, including a direct auction.

As confirmation of the hypothesis proposed by the model, it should be noted that the two buildings have already been included in Municipality of Pescara’s Alienations and Valorisations Plan; the current idea is to sell the property to the university.

8. Conclusions

The Protocol and the model of choice represent a possible approach to the technical formalisation of the process, though without overriding the role of politics in decision making. Current literature offers no approaches of a global nature, but only experiments and case studies for individual properties or specific building types, such as barracks [

38,

39], buildings of historical and/or cultural value [

40,

41,

42,

43] or railway stations [

4,

44].

The thick sediment of regulations accumulated over the past 30 years represents an obstacle to the analysis of the problem and the search for solutions. Instead of an organic corpus, it is more a of set of contingent approaches, proposed case-by-case by the legislator to confront urgent budgetary questions or remedy the failures of previous valorisation policies.

Given the conditions described above, only the most structured Institutions, with an adequate administrative apparatus, and to some degrees more farsighted and capable, can confront and govern the complex procedures underlying these processes. It is also true, however, that over the past 10 years, the technical equipment and human resources available to public administrations have proven insufficient: continuous spending cuts and turnover freezes have not allowed public bodies to modernise and hire new (and better trained) staff, or to acquire innovative tools capable of favouring better asset management (for example, property and facility management systems or more complex BIM systems).

This situation reaches its apex in the small municipalities that represent the vast majority in Italy: small towns, or those with a population of less than 5000 inhabitants, account for 69.83% of the total. The protocol elaborated and described here was imagined above all for these realties, precisely because, though they may suffer from an important or total lack of resources and means, they are not without legitimate needs and ambitions.

The purpose of the model of choice provided by the protocol is to guide political actors toward choices based on objective elements that, hopefully, should facilitate the identification of the most appropriate strategies. The validity of the model should be tested in a broad range of cases, beyond the comforting experiments carried out and proposed in this paper.