Factor Affecting Attitude and Purchase Intention of Luxury Fashion Product Consumption: A Case of Korean University Students

Abstract

1. Introduction

2. Literature Review

2.1. Luxury Fashion Goods in Korean University Students

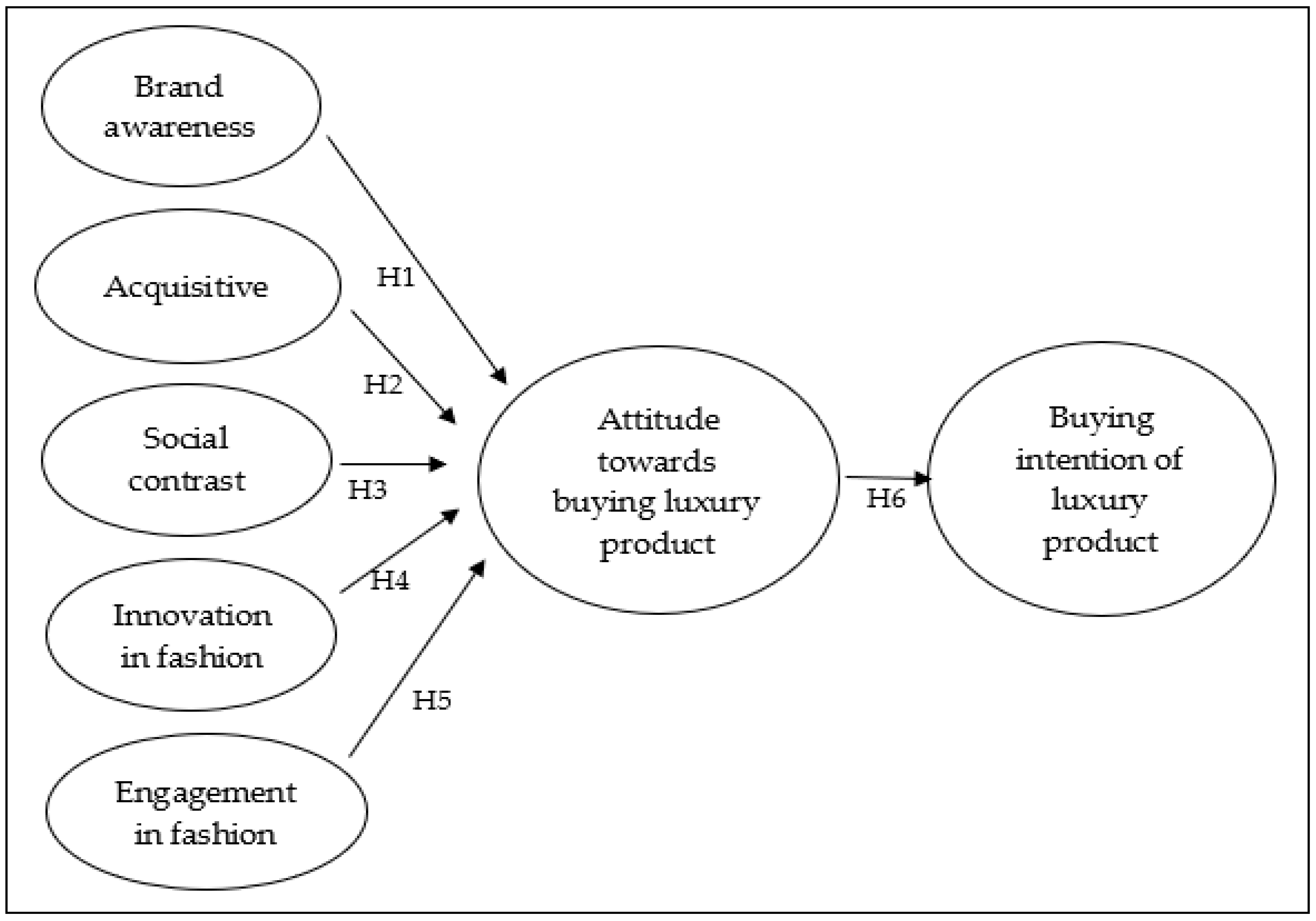

2.2. Hypothesis Development

2.2.1. Brand Awareness

2.2.2. Acquisitive

2.2.3. Social Contrast

2.2.4. Fashion Innovativeness

2.2.5. Engagement in Fashion

2.3. Attitude Toward Buying Luxury Product

3. Research Method

3.1. Data Collection and Its Process

3.2. Instruments

4. Results

4.1. Sample

4.2. Confirmatory Factor Analysis (CFA)

4.3. Testing Hypotheses

4.4. Testing Hypotheses

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Kleiner, J.R. Korea, a Century of Change; World Scientific: Singapore, 2001; Volume 6. [Google Scholar]

- Junkyu, L. Korea’s Trade Structure and Its Policy Challenges; The Future of Korean Trade Policy; Korea Economic Institute of America: Washington, DC, USA, 2012; Volume 28. [Google Scholar]

- The Great Changes in Korean Lifestyle. Available online: https://www.lgad.co.kr/webzine/030102/study/study3.htm (accessed on 3 February 2020).

- Kirk, D. Central Bank Chides Koreans for Their Spendthrift Ways. Available online: https://www.nytimes.com/2002/10/04/business/central-bank-chides-koreans-for-their-spendthrift-ways.html (accessed on 4 August 2020).

- Kweon, Y.H.K.S.A.; Kim, E.J.; Han, A.R. Recognition and Purchasing Attitude toward Fashion Luxury Brand by University Students in Cheongju. 충북대학교 생활과학연구소 2007, 10, 275–288. [Google Scholar]

- Koh, I.K. An Exploratory Study on Korean 20’s Consuming Behaviors in Luxuries and Imitations. Asia-Pac. J. Bus. Ventur. Entrep. 2014, 10, 77–84. [Google Scholar]

- Altagamma 2014 Worldwide Markets Monitor. Available online: http://www.luxesf.com/wp-content/uploads/2014/11/Altagama-Monitor1.pdf (accessed on 5 March 2020).

- Lens on the Worldwide Luxury Consumer. Available online: https://recursos.anuncios.com/files/598/20.pdf (accessed on 5 March 2020).

- Kim, A.J.; Ko, E. Do social media marketing activities enhance customer equity? An empirical study of luxury fashion brand. J. Bus. Res. 2012, 65, 1480–1486. [Google Scholar] [CrossRef]

- Larraufie, A.-F.M.; Kourdoughli, A. The e-semiotics of luxury. J. Glob. Fash. Mark. 2014, 5, 197–208. [Google Scholar] [CrossRef]

- Mortelmans, D. Sign values in processes of distinction: The concept of luxury. Semiotica 2005, 2005, 497–520. [Google Scholar] [CrossRef]

- Cristini, H.; Kauppinen-Räisänen, H.; Barthod-Prothade, M.; Woodside, A. Toward a general theory of luxury: Advancing from workbench definitions and theoretical transformations. J. Bus. Res. 2017, 70, 101–107. [Google Scholar] [CrossRef]

- Miller, K.W.; Mills, M.K. Contributing clarity by examining brand luxury in the fashion market. J. Bus. Res. 2012, 65, 1471–1479. [Google Scholar] [CrossRef]

- Berthon, P.; Pitt, L.; Parent, M.; Berthon, J.-P. Aesthetics and ephemerality: Observing and preserving the luxury brand. Calif. Manag. Rev. 2009, 52, 45–66. [Google Scholar] [CrossRef]

- Godey, B.; Pederzoli, D.; Aiello, G.; Donvito, R.; Chan, P.; Oh, H.; Singh, R.; Skorobogatykh, I.I.; Tsuchiya, J.; Weitz, B. Brand and country-of-origin effect on consumers’ decision to purchase luxury products. J. Bus. Res. 2012, 65, 1461–1470. [Google Scholar] [CrossRef]

- Michel, C.; Gerald, M. Luxury Brand Management; Original work published 2008; Son, J.Y., Translator; Miraebook Publishing: Seoul, Korea, 2008. [Google Scholar]

- Zhang, L.; Cude, B.J. Chinese consumers’ purchase intentions for luxury clothing: A comparison between luxury consumers and non-luxury consumers. J. Int. Consum. Mark. 2018, 30, 336–349. [Google Scholar] [CrossRef]

- Kim, Y. Social Foundation of Luxury Good Obsession in South Korea; Brandeis University: Waltham, MA, USA, 2011. [Google Scholar]

- International, E. Luxury Goods in South Korea. Available online: http://www.euromonitor.com/luxury-goods-in-south-korea/report (accessed on 4 August 2020).

- Company, B. 2013 Luxury Goods Worldwide Market Study. Available online: http://recursos.anuncios.com/files/581/60.pdf (accessed on 6 August 2020).

- Choi, E.-J.; Hong, K.-H.; Lee, Y.-J. Korean consumers’ perceptions toward luxury products. J. Fash. Bus. 2010, 14, 195–215. [Google Scholar]

- Park, J.A. Transactions: A Study on Korean and Japanese Consumers’ Attitudes and Consumer Knowledge about Luxury Brands. J. Korean Soc. Cloth. Text. 2010, 34, 1303–1318. [Google Scholar] [CrossRef][Green Version]

- Hong, K.-H.; Liu, J. Korean fashion brand purchasing behavior by fashion leadership and Korean wave of college women students in China. J. Korean Soc. Cloth. Text. 2009, 33, 655–665. [Google Scholar] [CrossRef][Green Version]

- Shim, S.; Gehrt, K.C. Hispanic and Native American adolescents: An exploratory study of their approach to shopping. J. Retail. 1996, 72, 307–324. [Google Scholar] [CrossRef]

- Sprotles, G.B.; Kendall, E.L. A methodology for profiling consumers’ decision-making styles. J. Consum. Aff. 1986, 20, 267–279. [Google Scholar] [CrossRef]

- SungHawe, H.; Hyun, H.D. Structural Relationships among Brand Consciousness, Happiness, Brand Identification and Brand Loyalty: Focused on In-bound Chinese Tourists. Korea Assoc. Bus. Educ. 2017, 32, 375–395. [Google Scholar] [CrossRef]

- Park, J.; Lee, K. Male emerging adults’ self-perceived superiority and clothing values: The influences on brand conciousness and brand loyalty behavior. J. Brand Des. Assoc. Korea 2013, 26, 225–236. [Google Scholar] [CrossRef]

- Belk, R.W. Materialism: Trait aspects of living in the material world. J. Consum. Res. 1985, 12, 265–280. [Google Scholar] [CrossRef]

- Richins, M.L. When wanting is better than having: Materialism, transformation expectations, and product-evoked emotions in the purchase process. J. Consum. Res. 2012, 40, 1–18. [Google Scholar] [CrossRef]

- Richins, M.L.; Dawson, S. A consumer values orientation for materialism and its measurement: Scale development and validation. J. Consum. Res. 1992, 19, 303–316. [Google Scholar] [CrossRef]

- Goldsmith, R.E.; Clark, R.A. Materialism, status consumption, and consumer independence. J. Soc. Psychol. 2012, 152, 43–60. [Google Scholar] [CrossRef]

- Silvera, D.H.; Lavack, A.M.; Kropp, F. Impulse buying: The role of affect, social influence, and subjective wellbeing. J. Consum. Mark. 2008, 25, 23–33. [Google Scholar] [CrossRef]

- Kim, J.H. The Impact of Materialism on Impulse Buying and Happiness after Shopping. Korea Logist. Res. Assoc. 2017, 27, 181–192. [Google Scholar] [CrossRef]

- Richins, M.L. Special possessions and the expression of material values. J. Consum. Res. 1994, 21, 522–533. [Google Scholar] [CrossRef]

- Ji-Won, J.; Soon-Hee, J.; Wook, C.K. Materialism, Conspicuous Consumption, and Preference for Imported Luxury Brands Among College Students. J. Korean Home Manag. Assoc. 2003, 21, 181–192. [Google Scholar]

- Festinger, L. A theory of social comparison processes. Hum. Relat. 1954, 7, 117–140. [Google Scholar] [CrossRef]

- Moschis, G.P.; Churchill, G.A. Consumer Socialization: A Theoretical and Empirical Analysis. J. Mark. Res. 1978, 15, 599–609. [Google Scholar] [CrossRef]

- Achenreiner, G.B. Materialistic Values and Susceptibility to Influence in Children. Adv. Consum. Res. 1997, 24, 82–88. [Google Scholar]

- Chan, K.; Prendergast, G. Materialism and social comparison among adolescents. Soc. Behav. Personal. Int. J. 2007, 35, 213–228. [Google Scholar] [CrossRef]

- Adams, R. The utility of prestige: Chinese and American hedonic ratings of prestige goods. J. Glob. Mark. 2011, 24, 287–304. [Google Scholar] [CrossRef]

- Kang, J.; Park-Poaps, H. Motivational Antecedents of Social Shopping for Fashion and its Contribution to Shopping Satisfaction. Cloth. Text. Res. J. 2011, 29, 331–347. [Google Scholar] [CrossRef]

- Im, S.; Bayus, B.L.; Mason, C.H. An empirical study of innate consumer innovativeness, personal characteristics, and new-product adoption behavior. J. Acad. Mark. Sci. 2003, 31, 61–73. [Google Scholar] [CrossRef]

- Goldsmith, R.E.; Freiden, J.B.; Kilsheimer, J.C. Social values and female fashion leadership: A cross-cultural study. Psychol. Mark. 1993, 10, 399–412. [Google Scholar] [CrossRef]

- Foxall, G.R.; Bhate, S. Cognitive styles and personal involvement of market initiators for ‘healthy’food brands: Implications for adoption theory. J. Econ. Psychol. 1993, 14, 33–56. [Google Scholar] [CrossRef]

- Ji-Young, K.A.; Eun-Ju, K. The Impact of Design Characteristics on Brand Attitude and Purchase Intention-Focus on Luxury Fashion Brands. J. Korean Soc. Cloth. Text. 2010, 34, 252–265. [Google Scholar] [CrossRef]

- Summers, T.A.; Belleau, B.D.; Xu, Y. Predicting purchase intention of a controversial luxury apparel product. J. Fash. Mark. Manag. Int. J. 2006, 10, 405–419. [Google Scholar] [CrossRef]

- Hong, K.-H.; Rucker, M. The role of product type and consumer fashion involvement in clothing satisfaction. J. Consum. Satisf. Dissatisfaction Complain. Behav. 1995, 8, 198–207. [Google Scholar]

- Goldsmith, R.E.; Hofacker, C.F. Measuring consumer innovativeness. J. Acad. Mark. Sci. 1991, 19, 209–221. [Google Scholar] [CrossRef]

- Tigert, D.J.; Ring, L.J.; King, C.W. Fashion involvement and buying behavior: A methodological study. ACR N. Am. Adv. 1976, 3, 46–52. [Google Scholar]

- Naderi, I. Beyond the fad: A critical review of consumer fashion involvement. Int. J. Consum. Stud. 2013, 37, 84–104. [Google Scholar] [CrossRef]

- Fishbein, M.; Ajzen, I. Belief, attitude, intention, and behavior: An introduction to theory and research. J. Bus.Ventur. 1997, 5, 177–189. [Google Scholar]

- Fishbein, M.; Ajzen, I. Understanding Attitudes and Predicting Social Behavior; Prentice-hall: Englewood Cliffs, NJ, USA, 1980; Volume 278. [Google Scholar]

- Zhang, B.; Kim, J.-H. Luxury fashion consumption in China: Factors affecting attitude and purchase intent. J. Retail. Consum. Serv. 2013, 20, 68–79. [Google Scholar] [CrossRef]

- Bellman, L.M.; Teich, I.; Clark, S.D. Fashion accessory buying intentions among female millennials. Rev. Bus. 2009, 30, 46–57. [Google Scholar]

- Yoh, E.; Damhorst, M.L.; Sapp, S.; Laczniak, R. Consumer adoption of the Internet: The case of apparel shopping. Psychol. Mark. 2003, 20, 1095–1118. [Google Scholar] [CrossRef]

- Zhang, L.; Cude, B.J.; Zhao, H. Determinants of Chinese consumers’ purchase intentions for luxury goods. Int. J. Mark. Res. 2020, 62, 369–385. [Google Scholar] [CrossRef]

- Lei, P.W.; Wu, Q. Introduction to structural equation modeling: Issues and practical considerations. Educ. Meas. Issues Pract. 2007, 26, 33–43. [Google Scholar] [CrossRef]

- Ünal, S.; Deniz, E.; Akın, N. Determining the Factors That Influence the Intention to Purchase Luxury Fashion Brands of Young Consumers. Ege Akad. Bakış Derg. 2019, 19, 221–236. [Google Scholar]

- Li, J.J.; Su, C. How Face Influences Consumption-A Comparative Study of American and Chinese Consumers. Int. J. Mark. Res. 2007, 49, 237–256. [Google Scholar]

| Variables | Authors | No. of Items (1 = Strongly Disagree to 7 = Strongly Agree) | Likert Scales |

|---|---|---|---|

| Brand awareness | Sproles and Kendall (1986) | 7 | 7 |

| Brand awareness | Tai and Tam (1997) | 3 | 7 |

| Acquisitive | Wong et al. (2003), Richins and Dawson’s (1992), and Richins (2004) | 15 | 7 |

| Innovation in fashion | Goldsmith and Hofacker (1991) | 6 | 7 |

| Social Contrast | Chan and Prendergast’s (2007) | 4 | 7 |

| Engagement in Fashion | Chae et al. (2006) | 15 | 7 |

| Buying Intention | Summers et al. (2006) | 2 | 7 |

| Attitude towards buying luxury product | Park et al. (2007) and Zhang B. et al. (2013) | 4 | 7 |

| Measure | Items | Percentage |

|---|---|---|

| Gender | Male | 47 |

| Female | 53 | |

| Age | 20 | 17.6 |

| 21 | 22.9 | |

| 22 | 18.3 | |

| 23 or older | 41.2 | |

| Education | University students | 100 |

| Monthly income in won | Under 300,000 | 26.1 |

| 300,000–399,999 | 34.7 | |

| 400,000–499,999 | 24.8 | |

| 500,000–599,999 | 5.2 | |

| 600,000 and over | 10.5 | |

| Amount of luxury fashion goods purchased within the last 6 months | No items | 55.6 |

| 1–3 items | 30.7 | |

| 4–6 items or more | 13.7 | |

| Money spent on one luxury fashion item | 150,000–499,999 won | 75.2 |

| 500,000–799,999 won | 16.3 | |

| 800,000–999,999 won | 5.2 | |

| 1,000,000–1499,999 won | 1.3 | |

| 1,500,000–4999,999 won | 2.0 |

| Factors and Items | Factor Loading | t-Value | |

|---|---|---|---|

| Brand awareness (α = 0.84; AVE = 0.72; CR = 0.89) | |||

| 4. | High-end specialty stores and department stores offer me the best products | 0.770 | - |

| 3. | The higher the price of a product, the better its quality | 0.874 | 9.82 |

| 5. | I prefer to buy the best-selling brand products | 0.843 | 7.04 |

| 6. | The most advertised brand product is usually a good choice | 0.756 | 5.59 |

| 8. | I am willing to pay a high price for a famous brand | 0.699 | 8.10 |

| 10. | I prefer buying foreign brands to domestic brands | 0.815 | 6.03 |

| Acquisitive (α = 0.81; AVE = 0.61; CR = 0.88) | |||

| 1. | How do you feel about people who own expensive homes, car and clothes? (Do not admire-greatly admire) | 0.681 | - |

| 4. | How do you feel about acquiring material possessions as an achievement in life? (Not important-vary important) | 0.821 | 6.64 |

| 6. | Would your life be any better if you owned certain things that you do not have now? (Not any better-much better) | 0.766 | 4.38 |

| 8. | How would you feel if you could afford to buy more things? (Not any happier—much happier) | 0.883 | 8.07 |

| 9. | How would you feel if you owned something better? | 0.768 | 3.99 |

| 15. | What do you think about living a lot of luxurious life? | 0.688 | 5.02 |

| Social Contrast (α = 0.79; AVE = 0.71; CR = 0.81) | |||

| 1. | I am interested in which brand my favorite entertainer is using. | 0.790 | - |

| 2. | I pay importance to my rich friends’ and watch what they buy. | 0.829 | 6.49 |

| 3. | I give importance to what brands my favorite movie stars and pop singers are using. | 0.910 | 7.05 |

| Innovation in fashion (α = 0.83; AVE = 0.69; CR = 0.84) | |||

| 1. | Normally, I am the last in my circle of friends to know the names of the latest new fashions | 0.743 | - |

| 2. | In general, I am among the last in my circle of friends to buy a new fashion item when it appears. | 0.841 | 8.60 |

| 3. | Compared to my friends, I own few new fashion items. | 0.796 | 7.06 |

| Engagement in fashion (α = 0.85; AVE = 0.77; CR = 0.91) | |||

| 1. | Fashion goods matter to me. | 0.877 | - |

| 3. | My friends turn to me for advice on fashion goods. | 0.707 | 11.03 |

| 4. | I usually have one or more of the very latest style fashion goods. | 0.812 | 8.89 |

| 5. | I like to shop for fashion goods. | 0.719 | 10.18 |

| 6. | I usually dress for fashion not comfort. | 0.898 | 6.62 |

| 7. | I think I am sensitive to fashion. | 0.822 | 7.66 |

| 13. | I spend a lot of time trying to find the fashion products I want. | 0.726 | 9.35 |

| Mean | Std. Dev. | 1 | 2 | 3 | 4 | 5 | ||

|---|---|---|---|---|---|---|---|---|

| 1 | Brand awareness | 4.13 | 1.18 | 1 | ||||

| 2 | Acquisitive | 3.99 | 1.20 | 0.41 | 1 | |||

| 3 | Social contrast | 2.87 | 1.32 | 0.23 | 0.17 | 1 | ||

| 4 | Innovation in fashion | 4.36 | 1.26 | 0.25 | 0.26 | 0.17 | 1 | |

| 5 | Engagement in fashion | 3.81 | 1.55 | 0.32 | 0.21 | 0.29 | 0.44 | 1 |

| Independent variables | Attitudes toward purchasing luxury fashion goods | ||||

| Beta | t-value | p-value | |||

| (Constant) | 1.67 | 5.98 | 0.00 | ||

| 1 | Brand awareness | 0.36 | 2.77 | 0.01 | |

| 2 | Acquisitive | 0.22 | 1.99 | 0.05 | |

| 3 | Social Contrast | 0.14 | 2.67 | 0.03 | |

| 4 | Innovation in fashion | 0.39 | 3.34 | 0.00 | |

| 5 | Engagement in fashion | −0.10 | −1.66 | 0.29 | |

| F-value | 11.06 | ||||

| p | 0.00 | ||||

| R Square | 0.27 | ||||

| Adjust | 0.25 | ||||

| Independent variables | Purchase intent toward purchasing luxury fashion goods | ||||

| Beta | t-value | p-value | |||

| (Constant) | 2.11 | 5.20 | 0.00 | ||

| Attitudes towards purchasing luxury fashion goods | 0.36 | 4.10 | 0.00 | ||

| F-value | 17.09 | ||||

| p | 0.00 | ||||

| R Square | 0.07 | ||||

| Adjust | 0.06 | ||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Islam, M.; Singh, B.N. Factor Affecting Attitude and Purchase Intention of Luxury Fashion Product Consumption: A Case of Korean University Students. Sustainability 2020, 12, 7497. https://doi.org/10.3390/su12187497

Islam M, Singh BN. Factor Affecting Attitude and Purchase Intention of Luxury Fashion Product Consumption: A Case of Korean University Students. Sustainability. 2020; 12(18):7497. https://doi.org/10.3390/su12187497

Chicago/Turabian StyleIslam, Maidul, and Bidhanchandra Nahakpam Singh. 2020. "Factor Affecting Attitude and Purchase Intention of Luxury Fashion Product Consumption: A Case of Korean University Students" Sustainability 12, no. 18: 7497. https://doi.org/10.3390/su12187497

APA StyleIslam, M., & Singh, B. N. (2020). Factor Affecting Attitude and Purchase Intention of Luxury Fashion Product Consumption: A Case of Korean University Students. Sustainability, 12(18), 7497. https://doi.org/10.3390/su12187497