The (Re)Insurance Industry’s Roles in the Integration of Nature-Based Solutions for Prevention in Disaster Risk Reduction—Insights from a European Survey

Abstract

1. Introduction

2. Materials and Methods

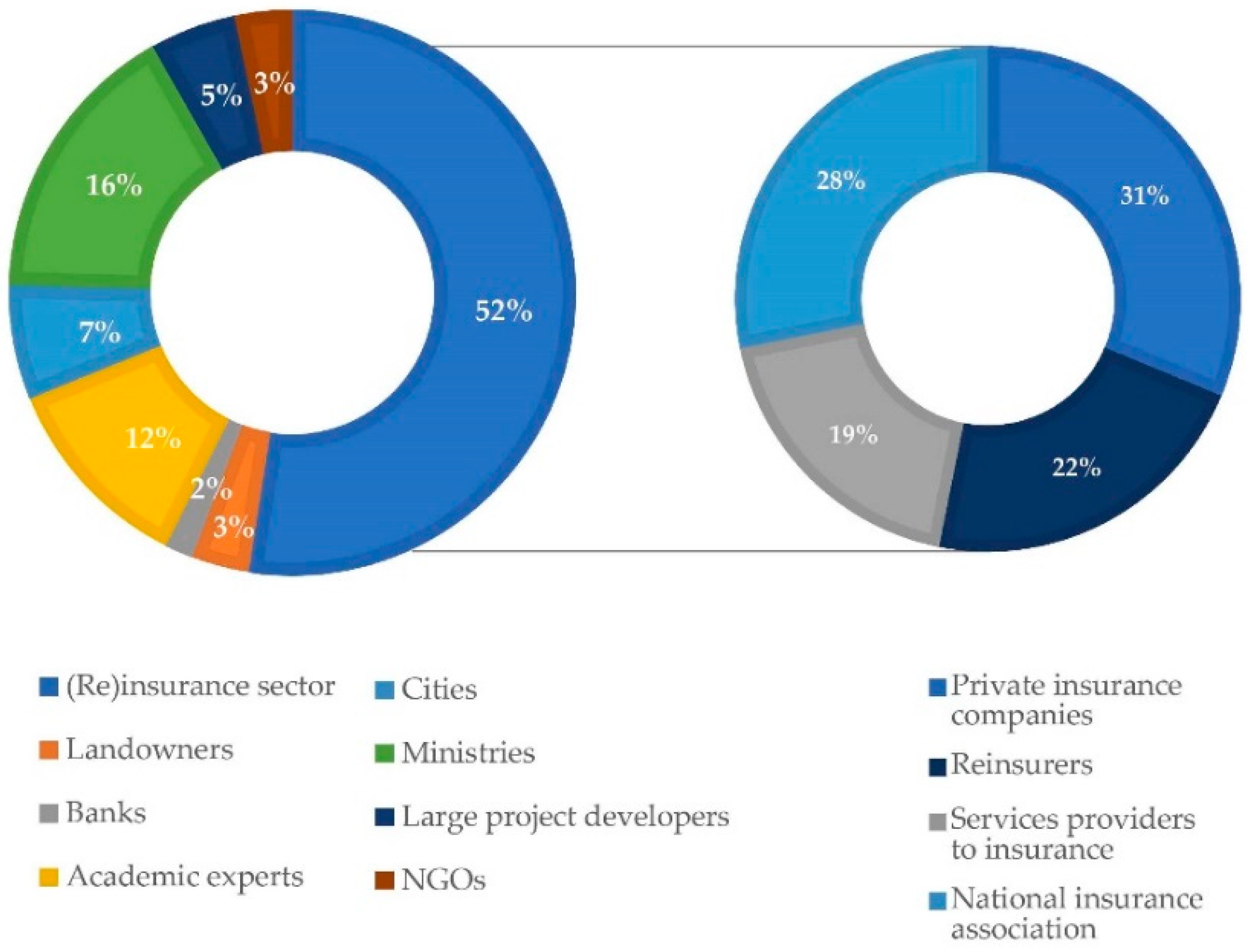

2.1 Data Acquisition

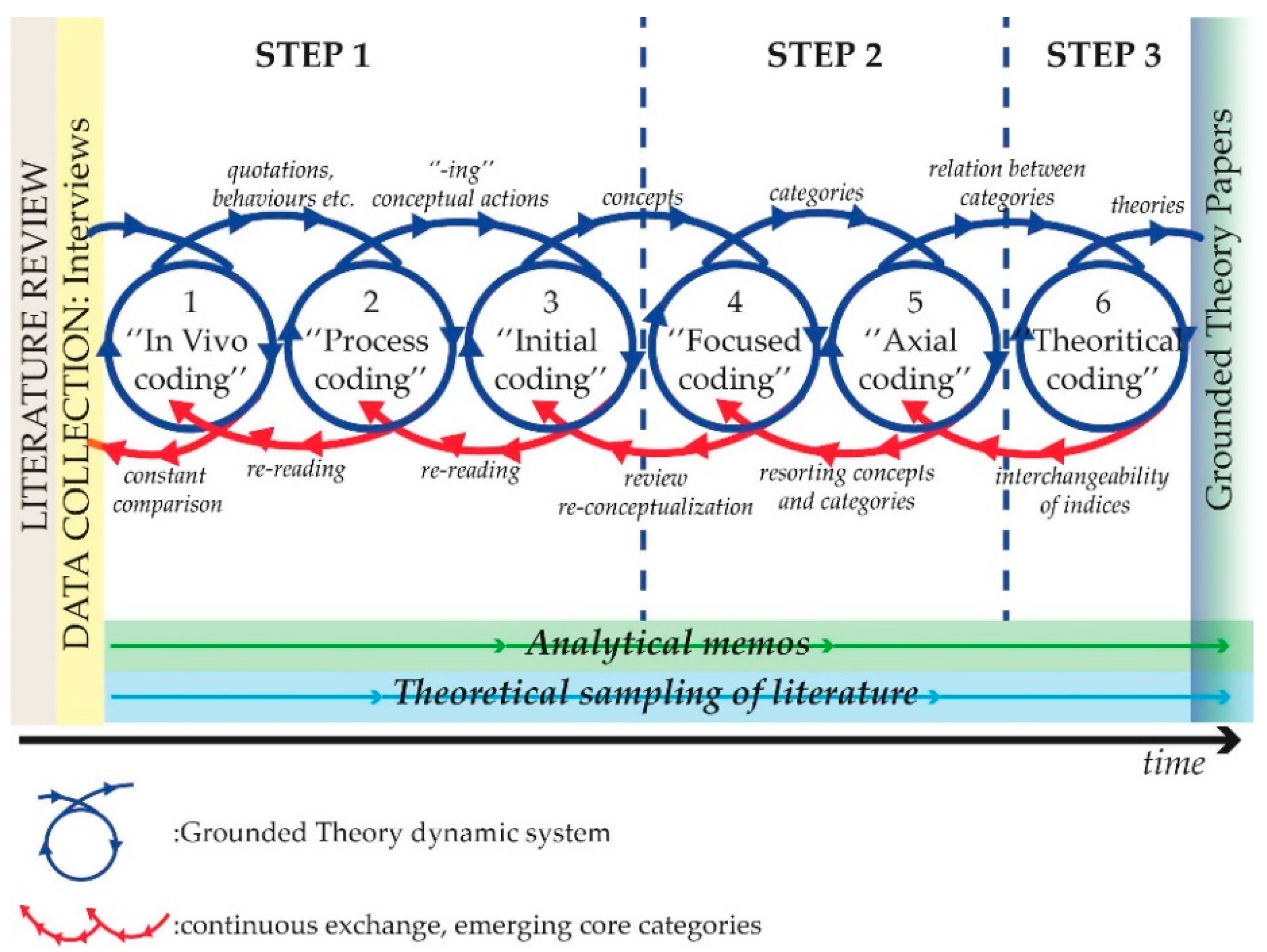

2.2 Research Method

- (1)

- it is based on a literature review that provide both background knowledge and interview questions to bridge the research gaps. The combination of the two allows for a deeper theoretical framework and to theorize subcategories, presented within the results, more easily;

- (2)

- Grounded Theory was chosen because it gives room to emergence from the findings from insurance industry and stakeholders involved around the sector as research that will benefit science and new knowledge. The basis was also that this research would be of use to the sector itself and potentially be actionable or transferable to their business model;

- (3)

- it is a useful method to analyze qualitative textual data from semi-structured interviews that target new research topics that are either in their infancy or non-existent. This is particularly suitable to the NAIAD project because research on linkages between risks-NBS-DRR-insurance industry are being developed;

- (4)

- this method is a suitable approach for managing voluminous qualitative data; during the interviews, an hour and a half long interview generated on average 12 pages of text;

- (5)

- the categories and the developed theories in the results are based on the data only and are not developed from researchers’ hypotheses. The objective to emphasize the current elements of knowledge, feelings, main questions and understanding from the European insurance industry on CCA, loss prevention and NBS.

3. Results

3.1. The (Re)Insurance Industry’s Vision of Climate Change

3.2. The (Re)Insurance Industry—Understanding of New Concepts: “Eco-Drr”, “Nature-Based Solutions (Nbs)” and “Insurance Value of Ecosystems” (IVE)

3.3. (Eco)-Disaster Risk Reduction and the (re)Insurance Industry

3.4. Roles of the (Re)Insurance Industry in Supporting (Eco)-Disaster Risk Reduction

3.4.1. (Re)Insurers as Providers

3.4.2. (Re)insurers as Investors

3.4.3. (Re)Insurers as Innovators

3.4.4. (Re)Insurers as Partners

4. Discussion

5. Conclusions

- (i)

- The findings highlight the current understandings of eco-DRR, NBS and IVE concepts by the insurance industry. The IVE concept can be misunderstood (insurance that can be applied to a natural system in case it is damaged by a natural hazard vs. the reduction of risks that a natural system can provide (and hence, act as a natural insurance). To avoid such a misunderstanding, we propose the use of “natural assurance value” to define the reduction of risks that natural systems can produce.

- (ii)

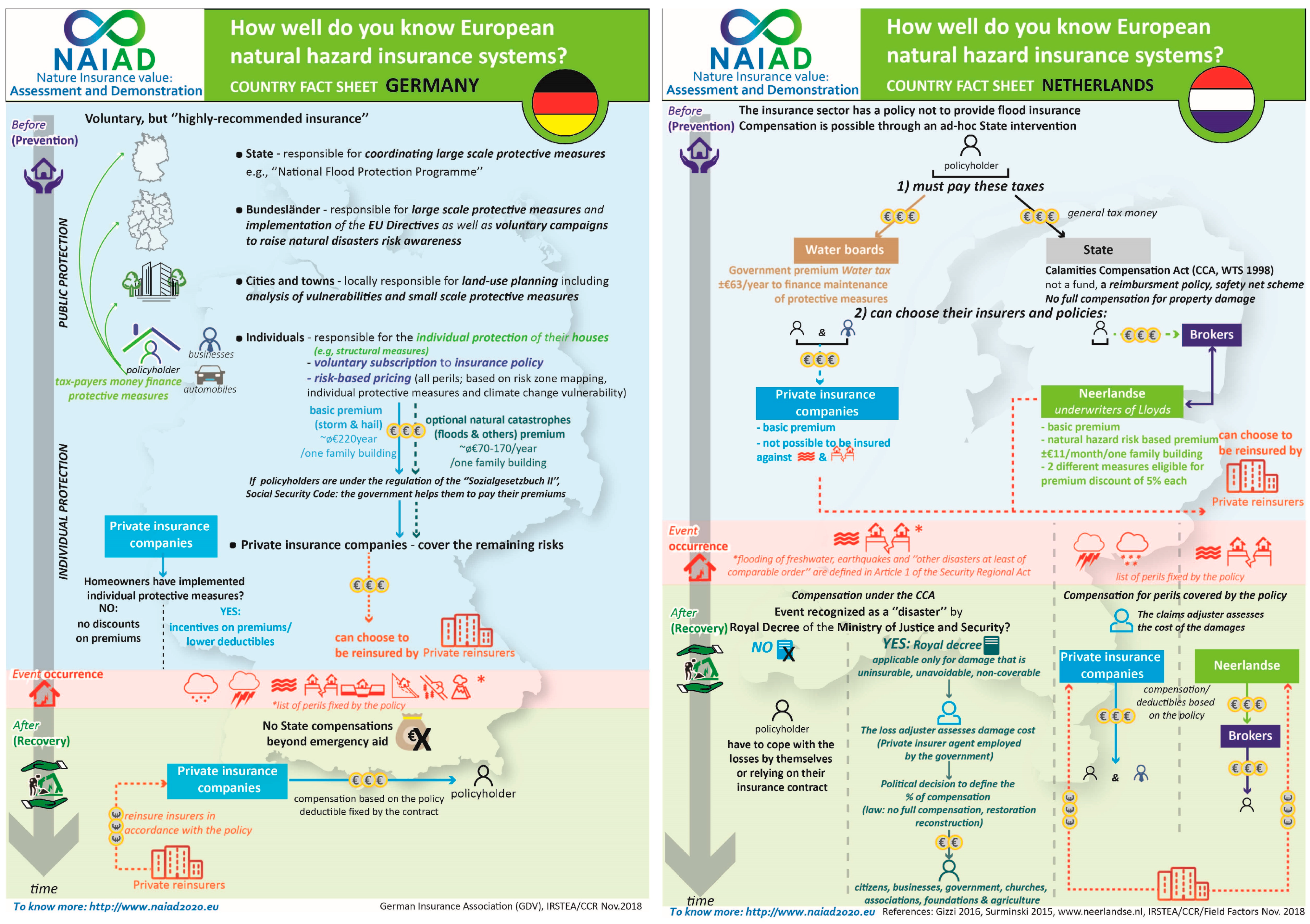

- European natural hazards insurance systems have different considerations of risk management and adaptation strategies, as well as considering ecosystems as reliable means to reduce risks. The generalization of the use of NBS as tools to reduce the impact of natural hazards may take a different time frames in European countries, depending on the existing policies, political frameworks and insurance schemes. Moreover, there is no universal solution for business integration, due to Member States’ specificities, different insurance penetration rates and natural hazards/protective measures portfolios. To achieve the European Commission’s objective to mainstream the use of NBS to mitigate the effect of natural hazard, differences among insurance schemes, opportunities and barriers, presented in this paper, need to be considered.

- (iii)

- Regarding the roles of the insurance industry (insurance providers, investors, innovators and partners in resilience to natural hazards), it is important to highlight that the industry has still great potential to deliver knowledge, evidence tools and technologies throughout transdisciplinary partnerships. The insurance industry plays a strong role in risk perception (sensibilization, alerts, prevention, incentives, etc.) which could lead to drawing up intelligent coverage concepts and new products to mitigate natural disasters losses. Therefore, the insurance industry has a big role in the mainstreaming of NBS as useful and valuable tools for DRR. The insurance industry can as well have a role to develop new investment strategies (e.g., sustainable investments with green/blue/cat bonds, etc.); to create innovative green ways; to mainstream new environmental partnerships; and to reduce its own environmental impacts. Clarifying, defining and integrating ecosystem co(st)-benefits into the core insurance business is an emerging way to tackle the impact of natural disasters in the future. Thus, NBS may be especially suited for coping with specific hazards and possibly are more scalable.

- (iv)

- The insurance industry requires a clear demonstrations of the DRR benefits as well as viable business models to invest in natural infrastructures. The industry needs clear data that supports that NBS are in good combination: economically viable, financially attractive for investment and measures of the positive effects of NBS on risk reduction. The growing role of the insurance industry in DRR recognizes these new challenges to be addressed. The insurance industry can play a key leading part on the necessary research to help generate new supportive facts and knowledge, always if possible, working in partnerships with the scientific community.

- (v)

- The regulatory frameworks are crucial for the functioning of the insurance systems and, therefore the European Union has an opportunity to stimulate new roles from the insurance industry. As raised during the interviews, the insurance industry is asking for clear European and national roadmaps leading to sustainable insurance systems that include NBS as valuable DRR tools. There are as well divergent opinions on the idea of an EU top down leading role.

- (vi)

- The information gathered during the interviews is aligned with the large work performed by the EU on sustainable finance. Contributions from projects like NAIAD are useful to fill the knowledge gaps since it includes scaling-up experimentations, testing and demonstrating the applicability and the limits of NBS for eco-DRR.

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Full Questionnaire

- Have you made a risk assessment of your networks and key assets/Demo/Region? Which assets are more at risk?

- What are the main natural hazards you perceive as risks for your country/Demo/Asset?

- Are Climate-driven extreme events one of them?

- If so, how: do you integrate climate change scenarios in risk evaluation? How is the climate change included in your models? How do you generate climate scenarios?

- What are the physical parameters describing risk at your country/Demo/Asset? (e.g., wind speed, water level, etc.)

- How do you cope with (often imperfect) information and knowledge? How are uncertainties taken into account?

- Is the information/data available to everyone? Where people can find data and other information on natural risks? Can this information help people to have a better understanding of the risk?

- Who are your peers? How do you seek advices?

- Who carries the risks of extreme events? You or your (public) client?

- How do you manage the risks (list mentioned above) under your responsibility? We would value concrete examples.

- (a)

- Taking prevention measures: risk mitigation- risk reduction measures, structural measures, if so, which?

- (b)

- Preparedness and Crisis Management protocols?

- (c)

- Insurance/ transferring the residual risk or pooling/compensation.

- How risks are managed along the project cycle of infrastructure investments (where water management is relevant) and how these risks are shared with the private sector? Give an indication of:

- (a)

- Which sector—public or private—is responsible for managing these risks and therefore willing to invest in DRR measures?

- (b)

- Gaps within the investment system that need to be solved with DRR and system understanding expertise.

- Who maintains and operates protective (Mitigation/adaptation) structures? How are they funded? Who carries the risk of failure?

- Are insurance contracts available for those protective structures, or are they considered in insurance contracts?

- Does the current European legal and market framework permit to harmonize insurance premiums at the EU level? (Develop and discuss your opinion)

- What are the main differences between legal and market frameworks in each country?

- Is it possible to create a regional risk-pooling scheme at the EU level? (Develop and discuss your opinion)

- How are climate risks assigned, for different economic sectors, by European insurance companies? Are these policies under any degree of reconsideration?

- Can the insurer refuse to cover a property because of the future expected natural hazard (in your country)? Does everybody have access to insurance? If insurance coverage is not possible, what is done in this case?

- How do you economically assess the indirect costs/effects of a disaster? (e.g., road/airport closure consequences; business interruption)

- Which insurance options do you have for your key assets and per type of risk?

- Could you give us an impression of the comparative size of insurance premiums you pay for natural hazard risks, versus other risks as safety of employers, fires, burglary, etc.?

- 5.

- How do you evaluate your own insurance system?

- What is the basic knowledge for premiums calculation and how are they calculated?

- Could your insurance company create financial incentives (e.g., premium reduction) for policyholders who have implemented prevention/mitigation measures and what is provided to whom they have not implemented that before any (flooding) natural hazard?

- Are risk reduction measures considered to modify premiums? If yes, which type of measures are they? Please rank these different resilient measures based on which criterion?

- Does the insurance industry have mechanisms in practice or under development to deal with variance in perception of risk?

- How far do the member state’s risk culture aspects have to be considered by your insurance company in your proposal of risk mitigation measures? What are the main risk culture differences in the EU countries?

- How would you most likely communicate with your customer about flood/droughts/other climate related hazard resilience? (e.g., standards for reconstruction of their houses, etc.)

- How has your risk perception changed with the climate change? (brokers: about the perception of their clients)

- What are the new challenges for your insurance company to cope with climate-related risks?

- What are tangible examples of projects to address existing or potential climate risks your organization has pursued?

- What is the insurance company conceptual understanding of ecosystem-based disaster risk reduction?

- What is the insurance company conceptual understanding of insurance value of ecosystem?

- What is your current knowledge of positive or negative effects of ecosystems?

- Do you recognize any particular ecosystem as a defense or resilient measure to face natural hazards?

- Is there any insurance contract for risks related to ecosystem effects? (e.g., wildfires, woody debris jamming on bridges, etc.)

- Do you have a specific strategy to incorporate nature-based solution or insurance value of ecosystems in risk assessment strategies? (e.g., key green policies, monetary choices for integration into green solutions portfolios)

- How your insurance company can develop models for calculating scenarios of risk reduction for different types of ecosystem services?

- Which knowledge and tools would be required? Do you know of tools being developed? (Please list them)

- How your insurance companies can/could develop methods to implement the concept of insurance value of ecosystem?

- To what extent has the concept of nature-based solution been integrated in your policy framework? Are there pioneer examples around the world?

- How could you do partnerships with insurance companies/clients? To design insurance schemes and NBS standards that strengthen and incentive DRR?

- Tell us more about how could that work? (e.g., who pays what, required regulatory changes or economic instruments?) Have you seen such example elsewhere, in EU or outside Europe?

- What do you know and think of Resilience/Green/Cat Bonds? Could they work to finance NBS? Under which conditions? Which other similar products in development you know of?

- In addition to risk reduction role of ecosystems, can the environment preservation be an additional motivation for your insurance company? (e.g., for your image? if so, which options would have your preference?)

- Do you ever finance risk reduction measures? As “insurance” company? And/or as institutional investor? How do you separate these two roles?

- (A)

- If you do invest as insurance company, would you be willing to finance Nature-Based Solutions for DRR? Why?

- (B)

- And as Institutional Investor? If you are investing, could you give us examples? If not, specify the reasons and/or bottlenecks?

- Do you ever reimburse risk reduction investments made by your clients?

- 19.

- What can be the minimal amount of your (re)insurance companies’ investments, that will be required to fund those measures? How much of loss can your (re)insurance companies avert, with investments in what grey, green/blue, hybrid measures? (calculating benefit/investment ratios)

- 20.

- How do your models take into account the green/NBS options for DRR taken by your client? Why?

- 21.

- Concerning the barriers in hindering the uptake of nature-based solutions in practice into insurance policies: How important are the following barriers? Could you please give concrete examples per category?

- What are the most important sources of Funding for Disaster Risk Reduction Measures? Taxes, Tariffs or Transfer? (Explain more in detail) and who collects them and is responsible for their budgeting? And procurement?

- Are there any additional important sources of funds (e.g., Structural funds) and/or strategic partners for the implementation, funding and/or financing of DRR measures?—and for NBS specifically?

- Are Public-Private Partnerships contracts being used for the procurement of DRR measures? If so, could you give us examples?

- Which innovative Green/Climate finance (Urban and Rural NBS, Watershed conservation, Natural Foreshores) Funding strategies, financing mechanisms and innovative business models have been applied in your country?We would value concrete examples and/or contact persons.

- Which economic and regulatory instruments do you consider key in incentivizing private sector and society to opt for NBS, for Resilience and Water Security?

- Do you think a new model would be needed to consider NBS or should we only adapt the current scheme?

- Do you think a preliminary marketing survey would be needed to check that a market really exists? (a real demand from possible customers)

- Do you think using NBS could provide a competitive advantage for your company?

- Do you think those new business models could be created by companies or should it be imposed by European regulations?

References

- Prudential Regulation Authority. The Impact of Climate Change on the UK Insurance Sector; Prudential Regulation Authority, 2015; p. 87. Available online: https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/publication/impact-of-climate-change-on-the-uk-insurance-sector.pdf (accessed on 23 March 2018).

- Surminski, S.; Bouwer, L.M.; Linnerooth-Bayer, J. How insurance can support climate resilience. Nat. Clim. Chang. 2016, 6, 333. [Google Scholar] [CrossRef]

- Faivre, N.; Fritz, M.; Freitas, T.; de Boissezon, B.; Vandewoestijne, S. Nature-based solutions in the EU: Innovating with nature to address social, economic and environmental challenges. Environ. Res. 2017, 159, 509–518. [Google Scholar] [CrossRef] [PubMed]

- Cohen-Shacham, E.; Walters, G.; Janzen, C.; Maginnis, S. Nature-Based Solutions to Address Global Societal Challenges; IUCN: Gland, Switzerland, 2016. [Google Scholar]

- European Commission. Towards an EU Research and Innovation policy agenda for Nature-Based Solutions & Re-Naturing Cities; European Commission: Brussels, Belgium, 2015.

- Strosser, P.; Delacámara, G.; Hanus, H.; Williams, H.; Jaritt, N. A Guide to Support the Selection, Design and Implementation of Natural Water Retention Measures in Europe; Capturing the Multiple Benefits of Nature-Based Solutions; Publications Office of the European Union: Brussels, Belgium, 2015.

- Daigneault, A.; Brown, P.; Gawith, D. Dredging versus hedging: Comparing hard infrastructure to ecosystem-based adaptation to flooding. Ecol. Econ. 2016, 122, 25–35. [Google Scholar] [CrossRef]

- United Nations World Water Assessment Programme. Nature-Based Solutions for Water; The United Nations World Water Development: New York, NY, USA, 2018. [Google Scholar]

- Somarakis, G.; Stagakis, S.; Chrysoulakis, N. Thinknature Nature-Based Solutions Handbook; Grant Agreement, ThinkNature Project: Crete, Greece, 2019. [Google Scholar]

- Raymond, C.M.; Berry, P.; Breil, M.; Nita, M.R.; Kabisch, N.; de Bel, M.; Enzi, V.; Frantzeskaki, N.; Geneletti, D.; Cardinaletti, M.; et al. An Impact Evaluation Framework to Support Planning and Evaluation of Nature-based Solutions Projects; Report Prepared by the EKLIPSE Expert Working Group on Nature-based Solutions to Promote Climate Resilience in Urban Areas; Centre for Ecology and Hydrology: Cavite, UK, 2017. [Google Scholar]

- CCR. Département Analyses et Modélisation Cat Conséquences du Changement Climatique sur le Coût des Catastrophes Naturelles en France à Horizon 2050; CCR: Paris, France, 2018. [Google Scholar]

- COWI; Deloitte; Rambøll; KU LIFE; DHI; GRAS. Copenhagen Climate Adaptation Plan; COWI: Copenhagen, Denmark, 2011. [Google Scholar]

- COWI. Insurance and Pension Estimation of Unit Costs for Flooding; COWI: Copenhagen, Denmark, 2014. [Google Scholar]

- United Nations Framework Convention on Climate Change. Paris Agreement—COP21; UNFCCC: Rio de Janeiro, Brazil; New York, NY, USA, 2015. [Google Scholar]

- United Nations Office for Disaster Risk Reduction. Sendai Framework for Disaster Risk Reduction 2015–2030; UNDRR: Geneva, Switzerland, 2015. [Google Scholar]

- Narayan, S.; Beck, M.W.; Reguero, B.G.; Losada, I.J.; van Wesenbeeck, B.; Pontee, N.; Sanchirico, J.N.; Ingram, J.C.; Lange, G.M.; Burks-Copes, K.A. The Effectiveness, Costs and Coastal Protection Benefits of Natural and Nature-Based Defences. PLoS ONE 2016, 11, e0154735. [Google Scholar] [CrossRef] [PubMed]

- Narayan, S.; Beck, M.W.; Wilson, P.; Thomas, C.J.; Guerrero, A.; Shepard, C.C.; Reguero, B.G.; Franco, G.; Ingram, J.C.; Trespalacios, D. The Value of Coastal Wetlands for Flood Damage Reduction in the Northeastern USA. Sci. Rep. 2017, 7, 9463. [Google Scholar] [CrossRef] [PubMed]

- WBCSD. Incentives for Natural Infrastructure, Review of Existing Policies, Incentives and Barriers Related to Permitting, Finance and Insurance of Natural Infrastructure; WBCSD: Geneva, Switzerland, 2017. [Google Scholar]

- Dow; Swiss Re; Shell; Unilever; The Nature Conservancy. The Case for Green Infrastructure—Joint-Industry White Paper. 2013. Available online: https://www.nature.org/content/dam/tnc/nature/en/documents/the-case-for-green-infrastructure.pdf (accessed on 20 April 2018).

- The Nature Conservancy; Dow. Working Together to Value Nature, 2016 Summary Report. 2017. Available online: https://www.nature.org/content/dam/tnc/nature/en/documents/2016-Dow-collaboration-report.pdf (accessed on 20 April 2018).

- Beck, M.W.; Franco, G.; Guerrero, A.; Ingram, C.J.; Narayan, S.; Reguero, B.G.; Shepard, C.; Thomas, C.; Trespalacios, D.; Wilson, P. Coastal Wetlands and Flood Damage Reduction: Using Risk Industry-based Models to Assess Natural Defenses in the Northeastern USA; Lloyd’s Tercentenary Research Foundation: London, UK, 2016. [Google Scholar]

- Colgan, C.S.; Beck, M.W.; Narayan, S. Financing Natural Infrastructure for Coastal Flood Damage Reduction; Lloyd’s Tercentenary Research Foundation. 2017. Available online: https://conservationgateway.org/ConservationPractices/Marine/crr/library/Documents/FinancingNaturalInfrastructureReport.pdf (accessed on 6 May 2018).

- Comes, M.; Dubbert, M.; Garschagen, M.; und Yew Jin, L.; Grunewald, L.; Lanzendörfer, M.; Mucke, P.; Neuschäfer, O.; Pott, S.; Post, J.; et al. World Risk Report 2016; Bündnis Entwicklung Hilft, United Nations University: Tokyo, Japan, 2016; ISBN 978-3-946785-02-6. [Google Scholar]

- Frantzeskaki, N.; Mcphearson, T.; Collier, M.J.; Kendal, D.; Bulkeley, H.; Dumitru, A.; Walsh, C.; Noble, K.; Van Wyk, E.; Ordonez, C.; et al. Nature-Based Solutions for Urban Climate Change Adaptation: Linking Science, Policy, and Practice Communities for Evidence-Based Decision-Making. BioScience 2019, 69, 455–466. [Google Scholar] [CrossRef]

- Denjean, B.; Altamirano, M.A.; Graveline, N.; Giordano, R.; van der Keur, P.; Moncoulon, D.; Weinberg, J.; Manez Costa, M.; Kozinc, A.; Mullingan, M.; et al. Natural Assurance Scheme: A level playing field framework for Green-Grey infrastructure development. Environ. Res. 2017, 159, 24–38. [Google Scholar] [CrossRef] [PubMed]

- Lo, V. Synthesis Report on Experiences with Ecosystem-Based Approaches to Climate Change Adaptation and Disaster Risk Reduction; Technical Series, Secretariat of the Convention on Biological Diversity, 2016, No. 85. Available online: https://www.cbd.int/doc/publications/cbd-ts-85-en.pdf (accessed on 26 June 2018).

- Renaud, F.; Sudmeier-Rieux, K.; Estrella, M. The Role of Ecosystems in Disaster Risk Reduction, 3rd ed.; Renaud, F., Sudmeier-Rieux, K., Estrella, M., Eds.; United Nations University Press: Tokyo, Japan, 2013; ISBN 978-92-808-1221-3. [Google Scholar]

- Schwarze, R.; Schwindt, M.; Weck-Hannemann, H.; Raschky, P.; Zahn, F.; Wagner, G.G. Natural hazard insurance in Europe: Tailored responses to climate change are needed. Environ. Policy Gov. 2011, 21, 14–30. [Google Scholar] [CrossRef]

- Gizzi, F.T.; Potenza, M.R.; Zotta, C. The Insurance Market of Natural Hazards for Residential Properties in Italy. Open J. Earthq. Res. 2016, 5, 35–61. [Google Scholar] [CrossRef]

- Marchal, R.; Piton, G.; Tacnet, J.-M.; Zorrilla-Miras, P.; Lopez Gunn, E.; Moncoulon, D.; Altamirano, M.; Matthews, J.; Joyce, J.; Nanu, F.; et al. European Survey on Insurance Systems and Natural Assurance Scheme (NAS); No. 730497; Grant Agreement, NAIAD Project: Valladolid, Spain, 2017. [Google Scholar]

- Denzin, N.K.; Lincoln, Y.S. (Eds.) The Sage Handbook of Qualitative Research, 5th ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2017; ISBN 9781483349800. [Google Scholar]

- World Wildlife Fund (WWF). Natural and Nature-Based Flood Management: A Green Guide. 2017. Available online: https://www.worldwildlife.org/publications/natural-and-nature-based-flood-management-a-green-guide (accessed on 22 July 2017).

- Weingärtner, L.; Simonet, C.; Caravani, A.; Overseas Development Institute (ODI). Disaster Risk Insurance and the Triple Dividend of Resilience. 2017. Available online: https://www.odi.org/publications/10926-disaster-risk-insurance-and-triple-dividend-resilience (accessed on 15 October 2017).

- Tipper, A.W.; Francis, A.; Green Alliance & National Trust. Natural Infrastructure Schemes in Practice How to Create New Markets for Ecosystem Services from Land. 2017. Available online: https://www.green-alliance.org.uk/resources/Natural_infrastructure_schemes_in_practice.pdf (accessed on 28 October 2017).

- Francis, A.; Brown, S.A.; Tipper, W.A.; Wheeler, N.; Green Alliance & National Trust. New Markets for Land and Nature How Natural Infrastructure Schemes Could Pay for a Better Environment. 2016. Available online: https://www.green-alliance.org.uk/resources/New_markets_for_land_and_nature.pdf (accessed on 28 October 2017).

- Xavier, L.D.; Matilda, P.; Audrey, B.; Paul, H.; De Ruiter, M.; Laars, D.R.; Kuik, O. Insurance of Weather and Climate-Related Disaster Risk: Inventory and Analysis of Mechanisms to Support Damage Prevention in the EU; European Commission: Brussels, Belgium, 2017; ISBN 978-92-79-73173-0.

- Annells, M. Grounded Theory Method: Philosophical Perspectives, Paradigm of Inquiry, and Postmodernism. Qual. Health Res. 1996, 6, 379–393. [Google Scholar] [CrossRef]

- Saldana, J. (Ed.) The Coding Manual for Qualitative Researches, 3rd ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA; Arizon State University: Tempe, AZ, USA, 2015; ISBN 978-1847875495. [Google Scholar]

- Richards, L. (Ed.) Handling Qualitative Data, a Practical Guide; SAGE Publications, Inc.: Thousand Oaks, CA, USA; RMIT University: Melbourne, Australia, 2014; ISBN 978-1446276051. [Google Scholar]

- European Parliament. Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the Taking-up and Pursuit of the Business of Insurance and Reinsurance (Solvency II). 2009. Available online: http://data.europa.eu/eli/dir/2009/138/oj (accessed on 5 March 2018).

- Baur, E.; Schnarwler, R.; Prystav, A.; Sundermann, L.; Swiss, R. Closing the Protection Gap, Disaster Risk Financing: Smart Solutions for the Public Sector. 2018. Available online: https://www.swissre.com/Library/closing-the-protection-gap-disaster-risk-financing.html (accessed on 13 September 2018).

- University of Cambridge Institute for Sustainability Leadership (CISL). Investing for Resilience; Cambridge Institute for Sustainability Leadership: Cambridge, UK, 2016; Available online: https://www.cisl.cam.ac.uk/resources/sustainable-finance-publications/investing-for-resilience (accessed on 5 November 2019).

- Ozment, S.; Ellison, G.; Jongman, B. Nature-based Solutions for Disaster Risk Management; World Bank Group: Washington, DC, USA, 2019; Available online: http://documents.worldbank.org/curated/en/253401551126252092/Booklet (accessed on 4 February 2019).

- Kabisch, N.; Frantzeskaki, N.; Pauleit, S.; Naumann, S.; Davis, M.; Artmann, M.; Haase, D.; Knapp, S.; Korn, H.; Stadler, J.; et al. Nature-based solutions to climate change mitigation and adaptation in urban areas: Perspectives on indicators, knowledge gaps, barriers, and opportunities for action. Ecol. Soc. 2016, 21, 39. [Google Scholar] [CrossRef]

- Maes, J.; Jacobs, S. Nature-Based Solutions for Europe’s Sustainable Development. Conserv. Lett. 2015. [Google Scholar] [CrossRef]

- Munang, R.; Thiaw, I.; Alverson, K.; Liu, J.; Han, Z. The role of ecosystem services in climate change adaptation and disaster risk reduction. Curr. Opin. Environ. Sustain. Sci. 2013, 5, 47–52. [Google Scholar] [CrossRef]

- Sudmeier-Rieux, K. Ecosystem Approach to Disaster Risk Reduction—Basic Concepts and Recommendations to Governments, with a Special Focus on Europe; European and Mediterranean Major Hazards Agreement (EUR-OPA). 2013. Available online: https://www.coe.int/t/dg4/majorhazards/ressources/pub/Ecosystem-DRR_en.pdf (accessed on 11 October 2017).

- Renaud, F.G.; Sudmeier-Rieux, K.; Estrella, M.; Nehren, U. (Eds.) Ecosystem-Based Disaster Risk Reduction and Adaptation in Practice. In Advances in Natural and Technological Hazards Research; Springer International Publishing: Berlin/Heidelberg, Germany, 2016; ISBN 978-3-319-43631-9. [Google Scholar]

- O’Mara, C.; Carmilani, S. We Can’t Control Where Storms Hit, but We Can Harness Nature to Better Protect Us. The Hill 2018. Available online: https://thehill.com/opinion/energy-environment/396738-we-cant-control-where-storms-hit-but-we-can-harness-nature-to (accessed on 28 January 2018).

- Browder, G.; Ozment, S.; Rehberger Bescos, I.; Gartner, T.; Lange, G.-M. Integrating Green and Gray Creating Next Generation Infrastructure; World Bank Group: Washington, DC, USA, 2019; Available online: https://www.worldbank.org/en/news/feature/2019/03/21/green-and-gray (accessed on 3 March 2019).

- Cohn, C. Mangroves, Coral Reefs Could Cut Flood Insurance Premiums: Lloyd’s. Reuters 2017. Available online: https://www.reuters.com/article/us-insurance-climatechange-research/mangroves-coral-reefs-could-cut-flood-insurance-premiums-lloyds-idUSKBN1932NF?platform=hootsuite (accessed on 25 August 2017).

- Murti, R.; Buyck, C. (Eds.) Safe Havens, Protected Areas for Disaster Risk Reduction and Climate Change Adaptation; IUCN: Gland, Switzerland, 2014. [Google Scholar]

- Caisse Centrale de Réassurance. Retour Sur Les Inondations de Janvier et Février 2018, Modélisation des Dommages et Evaluation Des Actions de Prévention. 2018. Available online: https://www.ccr.fr/documents/23509/29230/CCR+Etude+inondations+janvier+f%C3%A9vrier+2018_vf.pdf/ (accessed on 12 October 2018).

- Tanner, T.; Surminski, S.; Wilkinson, E.; Reid, R.; Rentschler, J.; Rajput, S. Global Facility for Disaster Reduction and Recovery (GFDRR) at the World Bank and Overseas Development Institute (ODI) The Triple Dividend of Resilience: Realising Development Goals through the Multiple Benefits of Disaster Risk Management. 2015. Available online: https://www.odi.org/publications/9599-triple-dividend-resilience-development-goals-multiple-benefits-disaster-risk-management (accessed on 5 November 2018).

- Tanner, T.; Rentschler, J.; Surminski, S.; Mitchell, T.; Wilkinson, E.; Peters, K.; Overseas Development Institute (ODI); International Bank for Reconstruction and Development; International Development Association. Unlocking the “triple dividend’’ of Resilience: Why Investing in Disaster Risk Management Pays off. 2015. Available online: https://www.odi.org/tripledividend (accessed on 5 November 2018).

- Surminski, S.; Tanner, T. (Eds.) Realising the ‘Triple Dividend of Resilience’: A New Business Case for Disaster Risk Management. In Climate Risk Management, Policy and Governance; Springer International Publishing: Berlin/Heidelberg, Germany, 2016; ISBN 978-3-319-40693-0. [Google Scholar]

- Sudmeier-Rieux, K.; Masundire, H.; Rietbergen, S. (Eds.) Ecosystems, Livelihoods and Disasters: An Integrated Approach to Disaster Risk Management. In Ecosystem Management Series; IUCN: Gland, Switzerland, 2006; ISBN 978-2-8317-0928-4. [Google Scholar]

- EU Technical Expert Group on Sustainable Finance. Financing a Sustainable European Economy. 2019. Available online: https://ec.europa.eu/info/sites/info/files/180131-sustainable-finance-final-report_en.pdf (accessed on 12 August 2019).

- European Commission. Guidelines on Non-Financial Reporting: Supplement on Reporting Climate-Related Information. 2019. Available online: https://ec.europa.eu/finance/docs/policy/190618-climate-related-information-reporting-guidelines_en.pdf (accessed on 12 August 2019).

- Crick, F.; Jenkins, K.; Surminski, S. Strengthening insurance partnerships in the face of climate change—Insights from an agent-based model of flood insurance in the UK. Sci. Total Environ. 2018, 636, 192–204. [Google Scholar] [CrossRef] [PubMed]

- Mysiak, J.; Pérez-Blanco, C.D. Partnerships for disaster risk insurance in the EU. Nat. Hazards Earth Syst. Sci. 2016, 16, 2403–2419. [Google Scholar] [CrossRef]

- UNISDR. Disaster Risk Reduction Private Sector Partnership. 2016. Available online: https://www.unisdr.org/files/42926_090315wcdrrpspepublicationfinalonli.pdf (accessed on 26 October 2018).

- Walker, G.R.; Mason, M.S.; Crompton, R.P.; Musulin, R.T. Application of insurance modelling tools to climate change adaptation decision-making relating to the built environment. Struct. Infrastruct. Eng. 2016, 12, 450–462. [Google Scholar] [CrossRef]

| Country | Number |

|---|---|

| Denmark | 1 |

| Germany | 2 |

| Spain | 7 |

| Slovenia | 13 |

| France | 12 |

| Italy | 2 |

| Romania | 7 |

| Netherlands | 6 |

| United-Kingdom | 6 |

| Switzerland | 3 |

| European level | 2 |

| Code Name | What the Code Highlights? | Code Characteristics |

|---|---|---|

| “In Vivo” | Action oriented, capture behavior or processes. Can provide imaginary, symbols or metaphors. | Direct language of respondent, use “quotation”, the terms used by the participants themselves. |

| “Process Coding” | Actual or conceptual actions—routines, rituals. | “-ings”, what people do (rather than have). |

| “Initial Coding” or so-called “Open Coding” | Extractions of relevant concepts (labelling), deeper analysis, being open to selective coding Those codes are grouped into similar concepts. All the codes are gathered within a codebook. | Based on the lines and paragraphs from the data. To code directly from the data and not to force data into preconception. |

| “Focused Coding” or so-called “Selective Coding” | Highlight major categories and themes from the data (core variable analysis) theory—memos as a basis for the formulation of the final reports. | Frequency and significant codes are needed to develop categories (larger segments of data). |

| “Axial Coding” | Relationship between categories and codes. Links between one data to another and comparison between the data Those concepts generated categories which are the basis to write memos (highlight hypotheses about connections between categories, new questions, ideas, relationship between codes). Memos have to be seen as “intellectual workspace for documenting analysis”—all the memos formed memo banks. | To design diagrams of temporal/spatial and cause/effect relationships of the phenomenon (clustering codes into new or more specific codes). |

| “Theoretical Coding” | To identify conflict, obstacles, problems, issues. To integrate and synthesize the categories to create new theories. Consequently, all theories are identified and organized allowing for comparison between them and data, theoretical coding. | To find core categories To condense into a few words that seem to explain, what the research is about. |

| Raw Data | Initial Coding | Focused Coding | Theoretical Coding |

|---|---|---|---|

| Q: What is the (re)insurance company conceptual understanding of insurance value of ecosystem? I am little bit surprised, because I do not understand the meaning of insurance value of ecosystems (IVE), and there seems to be a little bit of confusion concerning this term. I would understand the IVE, as the value of risk reduction. Q: What are tangible examples of projects to address existing or potential climate risks your organization has pursued? Our company is addressing future risks by taking into account climate change. It is a part of our DNA, of our responsibility. There are some examples of projects to address risks: there are the risk management aspects, which is the communication to our customers, we try to highlight, anticipate, adapt and mitigate climate change risks. On the investment side, we are investing in green bonds. It requires wider demonstration of nature-based solutions (NBS) effectiveness in order to increase investments in that side. Finally, the importance of practical programs to understand risk exposure and resilience. | New concept, confusing but trying to define it Classification of examples to address risks Awareness on climate change Risk management for communicating Already investing in green bonds Practical programs on hazard and resilience | Confusion Asking for evidence-based findings on NBS Awareness of the on-going business changes | The process of making sense of evidence on prevention and construction of knowledge in partnerships (practical programs) The process of using and developing roles in both ex-post (risk management) and ex-ante (resilience) |

| Case-based memo | |||

| This was quite an eye-opening interview in the sense that after several performed interviews and discussions with the other interviewers, we had a concern with the IVE concept which creates confusion, positive and negative feelings. This interview was key in our consideration of the IVE concept. So, my question really is, shall we change the terminology to be more understandable and better fitted to the insurance sector? I am so glad we had this interview as the interviewee was very practical and open. The other key element, is that during the interview, when we enter in the questions of the section 7 to the end, I learn so much and the element of responses of some questions (such as in the examples above). I definitely learned that insurers’ business is changing, at the end of the day the on-going reflection within the industry on the issues of climate change and loss prevention. During the interview, there was an explanation of the “roles” of the industry, right now I really need to take care with these “roles” to understand what they are and if other interviewees referred to that… Maybe the axial coding will highlight this within interviews and by comparison between them. As this would largely have impacts on the business model and on the mainstreaming of NBS. On the other hand, it is interesting that the interviewee provides examples on their daily job to integrate climate change into their catastrophe models and on loss prevention, especially on flood events. It was also interesting to gather points of view on financing aspects, notably on green bonds and elements on required regulations. So, I guess that the company of this insurer is really advanced on that topic and had a trusted experience. I tried to highlight differences between the natural hazard insurance schemes; the interviewee neutrally explains how it works. After the different interviews, for now, there is no differences in the understanding or about loss prevention between countries. It is more related to the state of advancement, dedicated research (I will not forget the fact that some of participants cannot explain due to confidentially reasons) between companies. | |||

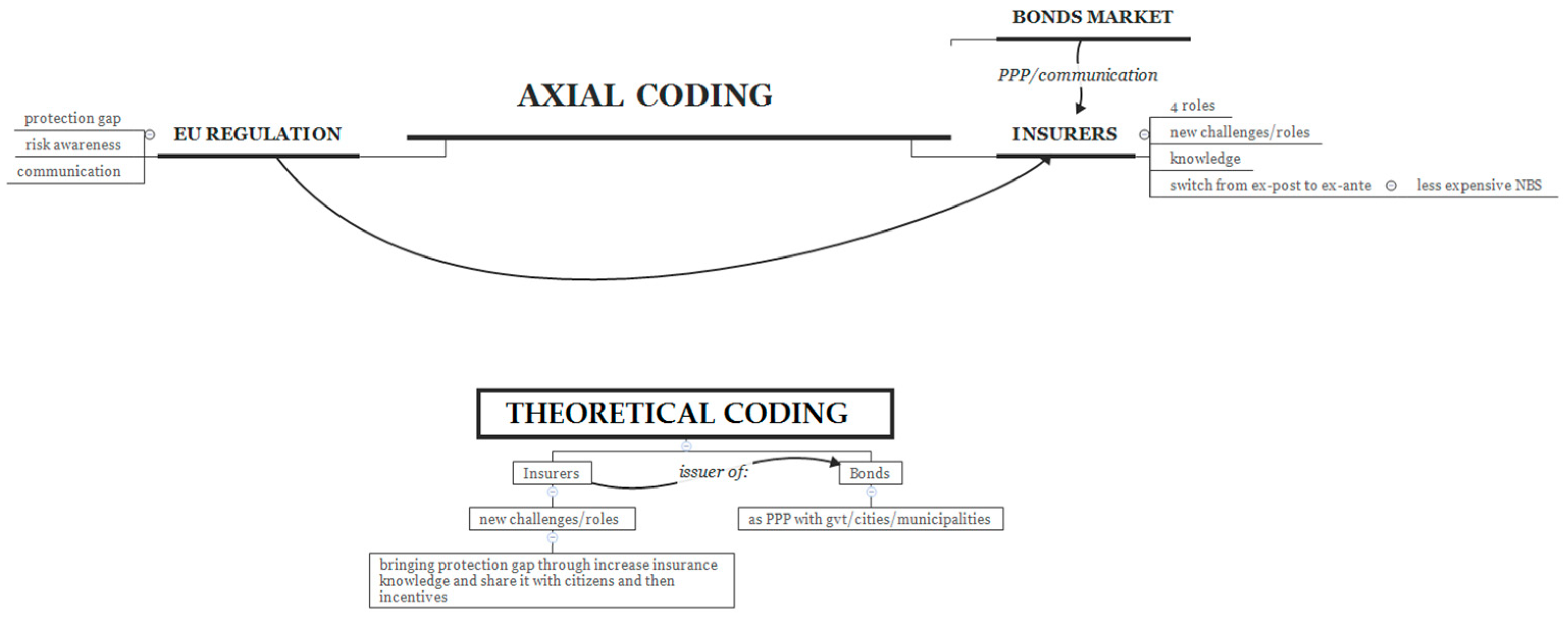

| The memos are written after each interview and the responses to the questions are coded in a table following the Grounded Theoryframework. The constant comparison between the coding processes are exemplified in the following example of axial and theoretical coding. The conceptual memos, categories, subcategories and theorization are the findings presented in Section 3 of this paper. | |||

| What Type of Good Reasons? | Benefits | Role of Insurances |

|---|---|---|

| Compensation of losses, reduction of negative impacts from disasters | Availability and affordability of reinsurance and insurance contracts | Providers |

| Investment in prevention and mitigation | Decrease (non)insured losses, i.e., secured portfolio | Investors |

| Money saved can be reinvested | Investments dedicated to innovation, research and development, policies and regulation | Innovators |

| Economic security and co-benefits | Portfolio diversification, valuing co-benefits | Partners/Providers |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Marchal, R.; Piton, G.; Lopez-Gunn, E.; Zorrilla-Miras, P.; van der Keur, P.; Dartée, K.W.J.; Pengal, P.; Matthews, J.H.; Tacnet, J.-M.; Graveline, N.; et al. The (Re)Insurance Industry’s Roles in the Integration of Nature-Based Solutions for Prevention in Disaster Risk Reduction—Insights from a European Survey. Sustainability 2019, 11, 6212. https://doi.org/10.3390/su11226212

Marchal R, Piton G, Lopez-Gunn E, Zorrilla-Miras P, van der Keur P, Dartée KWJ, Pengal P, Matthews JH, Tacnet J-M, Graveline N, et al. The (Re)Insurance Industry’s Roles in the Integration of Nature-Based Solutions for Prevention in Disaster Risk Reduction—Insights from a European Survey. Sustainability. 2019; 11(22):6212. https://doi.org/10.3390/su11226212

Chicago/Turabian StyleMarchal, Roxane, Guillaume Piton, Elena Lopez-Gunn, Pedro Zorrilla-Miras, Peter van der Keur, Kieran W. J. Dartée, Polona Pengal, John H. Matthews, Jean-Marc Tacnet, Nina Graveline, and et al. 2019. "The (Re)Insurance Industry’s Roles in the Integration of Nature-Based Solutions for Prevention in Disaster Risk Reduction—Insights from a European Survey" Sustainability 11, no. 22: 6212. https://doi.org/10.3390/su11226212

APA StyleMarchal, R., Piton, G., Lopez-Gunn, E., Zorrilla-Miras, P., van der Keur, P., Dartée, K. W. J., Pengal, P., Matthews, J. H., Tacnet, J.-M., Graveline, N., Altamirano, M. A., Joyce, J., Nanu, F., Groza, I., Peña, K., Cokan, B., Burke, S., & Moncoulon, D. (2019). The (Re)Insurance Industry’s Roles in the Integration of Nature-Based Solutions for Prevention in Disaster Risk Reduction—Insights from a European Survey. Sustainability, 11(22), 6212. https://doi.org/10.3390/su11226212