Board Power Hierarchy, Corporate Mission, and Green Performance

Abstract

1. Introduction

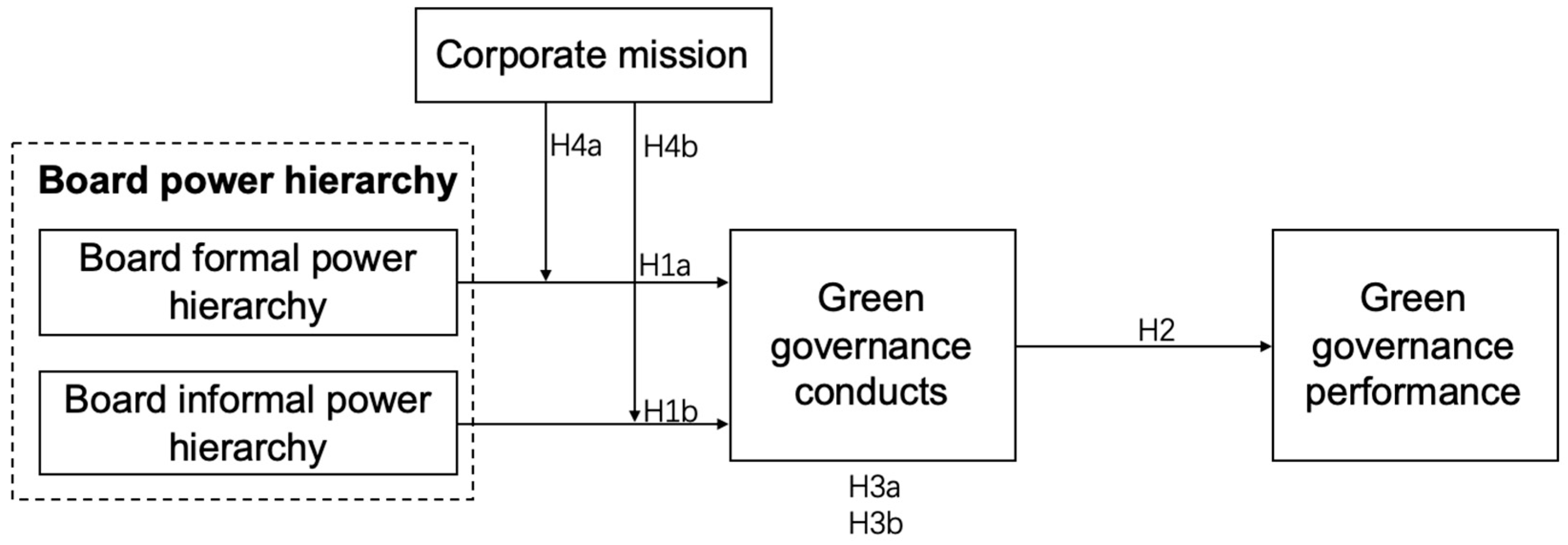

2. Theoretical Analysis and Research Hypothesis

2.1. Board Power Hierarchy and Green Governance Conduct

2.1.1. The Influence of Board Formal Power Hierarchy on Green Governance Conduct

2.1.2. The Influence of Board Informal Power Hierarchy on Green Governance Conduct

2.2. Green Governance Conduct and Green Governance Performance

2.3. Mediating Role of Green Governance Conduct

2.4. Moderating Role of Corporate Mission

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Variables and Measurement

3.2.1. Dependent Variable (GGP: Green Governance Performance)

3.2.2. Independent Variable

Board Formal Power Hierarchy (FP)

Board Informal Power Hierarchy (IP)

3.2.3. Mediating Variable (GGC: Green Governance Conduct)

3.2.4. Moderating Variable (CM: Corporate Mission)

3.2.5. Control Variables

3.3. Research Model

3.3.1. Theoretical Model of the Influence of Board Power Hierarchy on Green Governance Conduct

3.3.2. Theoretical Model of the Moderating Effect of Corporate Mission

3.3.3. Mediating Effect Model of Green Governance Conduct in Impact of Board Power Hierarchy on Green Governance Performance

4. Empirical Research and Result Analysis

4.1. Correlation Analysis of Descriptive Statistical Results

4.2. Analysis of Regression Results

4.3. Robustness Test

4.4. Further Discussion

5. Conclusions, Contributions, and Prospects

5.1. Conclusions

5.2. Contributions

5.2.1. Theoretical Contribution

5.2.2. Practical Contributions

5.3. Suggestions

5.4. Research Prospects

- (1)

- Searching for more appropriate proxy variables is suggested for future research. Referencing Jaaffar and Amran [23], we analyzed the following 10 elements of firm information disclosure: protection of the rights and interests of shareholders, employees, suppliers, customers and consumers; environment and sustainable development; public relations and social public welfare undertakings and social responsibility system construction; and the improvement measures and safety in production. We adopted a (0, 1) assignment method to indirectly measure the green governance conduct of the BOD. The best measurement of conduct is directly measuring the decision-making process of the BOD on green governance, or choosing outcome variables reflecting the board’s decisions about green strategy. For the former option, directly measuring the decision-making process of the BOD with a large sample is difficult as it requires participation during board meetings or questionnaire surveys, but it is still an alternative plan. For the latter, the outcomes of the board’s green governance decisions require listed companies to disclose detailed related information. To evaluate green governance performance, we adopted binary variables related to whether firms obtained green certification, reflecting only a narrow aspect of the green governance effect. Further research is recommended to extend the evaluation of green management performance, more widely adopt the concepts of green and green governance, and extend green governance performance to dark green performance involving economic performance, social performance, the improvement of employees’ spiritual intelligence, and traditional environmental performance [124].

- (2)

- Discussing the influence of board power hierarchy on green governance conduct and green governance performance for different types of listed companies is necessary. Based on the mechanism analysis and effect verification of the influence of board power hierarchy of state-owned listed companies on green governance performance through green governance conduct, we discussed the effect of different performance pressures, and obtained a series of findings. The influence of the power of the board of state-owned and private listed companies in different industries and regions on green governance conduct and green governance performance is also a research direction for future studies. Thus, the power hierarchy difference between state-owned and private listed companies and its influence on green governance conduct and governance performance could be revealed. By comparing the differences in the power hierarchy of the board and green governance, the characteristics of green governance in different industries could be identified. Comparative studies of different regions could help to explore the influence of external factors, such as regional culture, regional economic development, regional market competition, and regional innovation ability, on internal elements such as board power hierarchy, green governance conduct, and green governance performance to discover the common and individual factors affecting green governance in different regions. The influence of governance on enterprise performance is restricted by many situational factors, such as industry competition. This effect is always small and insignificant in competitive industries and large and significant in non-competitive industries [125]. Therefore, future studies may incorporate industry competition into the model to further explore the impact of board governance on corporate green performance in industries with different levels of competition.

- (3)

- The consistency and deviation of the power as well as status of those on the board should be considered. We divided the board power hierarchy into formal and informal power hierarchies. The consistency of board power hierarchy, which is the degree of matching between power and status, may be explored. A mismatch often occurs between power and status within the BOD, which affects the governance behavior of the board and further affects the governance performance. Discussing the consistency and deviation between power and status would help enterprises to build a BOD with matching power and status to improve the governance effectiveness of the BOD.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Li, W.A. Green Governance: Beyond Country Governance. Nankai Bus. Rev. 2016, 19, 1. [Google Scholar]

- Cooke, P. Green governance and green clusters: Regional & national policies for the climate change challenge of Central & Eastern Europe. J. Open Innov. Technol. Mark. Complex. 2015, 1, 1–17. [Google Scholar]

- Li, W.A.; Xu, J.; Jiang, G.S. Green governance principle: To achieve inclusive development between man and nature. Nankai Bus. Rev. 2017, 20, 23–28. [Google Scholar]

- Nankai University Green Governance Standards Research Group; Li, W.A. Green management criterion and its explanation. Nankai Bus. Rev. 2017, 20, 4–22. [Google Scholar]

- Amran, A.; Ooi, S.K.; Wong, C.Y.; Hashim, F. Business strategy for climate change: An ASEAN perspective. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 213–227. [Google Scholar] [CrossRef]

- Güner, S. Evaluation of the Evolution of Green Management with a Kuhnian Perspective. Bus. Res. 2018, 11, 309–328. [Google Scholar] [CrossRef]

- Li, W.A. Comply with green development needs, develop green governance guidelines. Nankai Bus. Rev. 2017, 20, 1. [Google Scholar]

- Dougherty, D. Taking advantage of emergence for complex innovation eco-systems. J. Open Innov. Technol. Mark. Complex. 2017, 3, 14. [Google Scholar] [CrossRef]

- Li, W.A.; Zhang, Y.W.; Zheng, M.N.; Li, X.L.; Cui, G.Y.; Li, H. Research on Green Governance of Chinese Listed Companies and Its Evaluation. Manag. World 2019, 5, 126–133. [Google Scholar]

- Core, J.; Guay, W. The use of equity grants to manage optimal equity incentive levels. J. Account. Econ. 1999, 28, 151–184. [Google Scholar] [CrossRef]

- Li, F.; Lin, S.; Sun, S.; Tucker, A. Risk-Adjusted Inside Debt. Glob. Financ. J. 2018, 35, 12–42. [Google Scholar] [CrossRef]

- Coles, J.L.; Li, Z.F.; Wang, A.Y. Industry Tournament Incentives. Rev. Financ. Stud. 2018, 4, 1418–1459. [Google Scholar] [CrossRef]

- Forbes, D.P.; Milliken, F.J. Cognition and corporate governance: Understanding boards of directors as strategic decision-making groups. Acad. Manag. Rev. 1999, 24, 489–505. [Google Scholar] [CrossRef]

- Fei, X.T. Rural China Fertility System, 1st ed.; Peking University press: Beijing, China, 1998; pp. 24–31. [Google Scholar]

- Magee, J.C.; Galinsky, A.D. Social hierarchy: The self-reinforcing nature of power and status. Acad. Manag. Ann. 2008, 2, 351–398. [Google Scholar] [CrossRef]

- He, J.Y.; Huang, Z. Board informal hierarchy and firm financial performance: Exploring a tacit structure guiding boardroom interactions. Acad. Manag. J. 2011, 54, 1119–1139. [Google Scholar] [CrossRef]

- Zhang, Y.W.; Chen, S.S.; Li, W.A. Study on the Performance Effect and Influence Mechanism of the Informal Level of the Board of Directors. Manag. Sci. 2015, 28, 1–17. [Google Scholar]

- Xie, Y.Z. Gender Growth, Board Performance and Financial Performance—Test of Nonlinear Mediating Effect. Lanzhou Acad. J. 2016, 4, 171–181. [Google Scholar]

- Li, C.E.; Xie, Y.Z. Board power hierarchy, innovation strategy and the growth of private enterprises. Foreign Econ. Manag. 2017, 39, 70–83. [Google Scholar]

- Harjoto, M.A.; Laksmana, I.; Yang, Y.W. Board diversity and corporate investment oversight. J. Bus. Res. 2018, 90, 40–47. [Google Scholar] [CrossRef]

- Wu, L.D.; Xue, K.K.; Wang, K. The Influence of Informal Level on Board Decision Process: Political Behavior or Program Rationality. Manag. World 2018, 34, 80–92. [Google Scholar]

- Ji, H.; Xie, X.Y.; Xiao, Y.P.; Gan, X.L.; Feng, W. Relationship between power hierarchy and team performance: Consistency and deviation between power and status. Acta Psychol. Sin. 2019, 3, 366–382. [Google Scholar]

- Gould, R.V. The origins of status hierarchies: A for-mal theory and empirical test. Am. J. Sociol. 2002, 107, 1143–1178. [Google Scholar] [CrossRef]

- Hogg, M.A.; Abrams, D. Social Identifications: A Social Psychology of Intergroup Relation and Group Processes; Routledge Press: London, UK, 1988; pp. 28–55. [Google Scholar]

- Pettigrew, A.M. On studying managerial elites. Strateg. Manag. J. 1992, 13, 163–182. [Google Scholar] [CrossRef]

- Jaaffar, A.H.; Amran, A. The Influence of Leaders’ Past Environmental-related Experiences and Positive Deviance Behaviour in Green Management Practices. J. Pengur. 2017, 51, 1–18. [Google Scholar] [CrossRef]

- Fama, E.F. Agency problems and the theory of the firm. J. Political Econ. 1980, 88, 288–307. [Google Scholar] [CrossRef]

- Anderson, C.; Brown, C.E. The functions and dysfunctions of hierarchy. Res. Organ. Behav. 2010, 30, 55–89. [Google Scholar] [CrossRef]

- Nielsen, S.; Huse, M. The contribution of women onboards of directors: Going beyond the surface. Corp. Gov. Int. Rev. 2010, 18, 136–148. [Google Scholar] [CrossRef]

- Gore, A.K.; Matsunaga, S.; Yeung, P.E. The role of technical expertise in firm governance structure: Evidence from chief financial officer contractual incentives. Strateg. Manag. J. 2011, 32, 771–786. [Google Scholar] [CrossRef]

- Finkelstein, S.; Mooney, A.C. Not the usual suspects: How to use board process to make boards better. Acad. Manag. Exec. 2003, 17, 101–113. [Google Scholar] [CrossRef]

- Wang, K.; Chang, W. How Does Informal Hierarchy of Board Affect Corporate Strategic Change? J. Cap. Univ. Econ. Bus. 2018, 3, 87–94. [Google Scholar]

- Post, C.; Rahman, N.; Rubow, E. Green Governance: Boards of Directors’ Composition and Environmental Corporate Social Responsibility. Bus. Soc. 2011, 50, 189–223. [Google Scholar] [CrossRef]

- Smith, K.G.; Smith, K.A.; Olian, J.D.; Sims, H.P., Jr.; O’Bannon, D.P.; Scully, J.A. Top management team demography and process: The role of social integration and communication. Adm. Sci. Q. 1994, 39, 412–438. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Malviya, R.K.; Kant, R.; Gupta, A.D. Evaluation and Selection of Sustainable Strategy for Green Supply Chain Management Implementation. Bus. Strategy Environ. 2018, 27, 475–502. [Google Scholar] [CrossRef]

- Smith, A.; Houghton, S.M.; Hood, J.N.; Ryman, J.A. Power relationships among top managers: Does top management team power distribution matter for organizational performance. J. Bus. Res. 2006, 59, 622–629. [Google Scholar] [CrossRef]

- Tarakci, M.; Greer, L.L.; Groenen, P.J.F. When does power disparity help or hurt group performance? J. Appl. Psychol. 2016, 101, 415–429. [Google Scholar] [CrossRef]

- Halevy, N.; Chou, E.Y.; Galinsky, A.D.; Murnighan, J.K. When hierarchy wins: Evidence from the national basketball association. Soc. Psychol. Personal. Sci. 2012, 3, 398–406. [Google Scholar] [CrossRef]

- Ronay, R.; Greenaway, K.; Anicich, E.M.; Galinsky, A.D. The path to glory is paved with hierarchy: When hierarchical differentiation increases group effectiveness. Psychol. Sci. 2012, 23, 669–677. [Google Scholar] [CrossRef]

- Xie, Y.Z.; Zhang, Y.M.; Wu, L.Y.; Dong, F.R. The Mechanism and Empirical Research of Directors ‘Status Differences, Behavior Strength of Decision-Making and Financial Performance of Private Listed Companies. Chin. J. Manag. 2017, 14, 1767–1776. [Google Scholar]

- Bloom, M. The performance effects of pay dispersion on individuals and organizations. Acad. Manag. J. 1999, 42, 25–40. [Google Scholar]

- Hu, A.; Zhou, S. Green Development: Functional Definition, Mechanism Analysis and Development Strategy. China Popul. Resour. Environ. 2014, 24, 14–20. [Google Scholar]

- Lim, H.; Eun, J. Exploring Perceptions of Sustainable Development in South Korea: An Approach Based on Advocacy Coalition Framework’s Belief System. J. Open Innov. Technol. Mark. Complex. 2018, 4, 54. [Google Scholar] [CrossRef]

- Hicks, J.R. Value and Capital: An Inquiry into Some Fundamental Principles of Economic Theory, 1st ed.; The Commercial Press: Beijing, China, 2010; pp. 159–190. [Google Scholar]

- David, P. Blueprint for A Green Economy, 1st ed.; Beijing Normal University Press: Beijing, China, 1996; pp. 11–56. [Google Scholar]

- World Bank. Available online: http://documents.worldbank.org/curated/en/345361468164047807/pdf/691250PUB0v20I00Box379796B00PUBLIC0.pdf (accessed on 8 August 2019).

- Cheema, S.; Javed, F. The Effects of Corporate Social Responsibility Toward Green Human Resource Management: The Mediating Role of Sustainable Environment. Cogent Bus. Manag. 2017, 4, 1–10. [Google Scholar] [CrossRef]

- Laari, S.; Töyli, J.; Ojala, L. The Effect of a Competitive Strategy and Green Supply Chain Management on the Financial and Environmental Performance of Logistics Service Providers. Bus. Strategy Environ. 2018, 27, 872–883. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D. Revisiting the Relation Between Environmental Performance and Environmental Disclosure: An Empirical Analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Lin, S.; Tian, S.; Wu, T. Emerging Stars and Developed Neighbors: The Effects of Development imbalance and Political Shocks on Mutual Fund Investments in China. Financ. Manag. 2013, 42, 339–371. [Google Scholar] [CrossRef]

- Tang, J.F.; Li, P.F.; Lin, X.H. Empirical Research on Social Responsibility Report and Environmental Performance Information Disclosure—Experience Data from the Chemical Industry of China’s Securities Market. Macroecon. Res. 2012, 1, 67–72. [Google Scholar]

- Xu, J.; Chen, M.Y. Research on Environmental Performance and Influencing Factors of China’s Petrochemical Industry—Based on the Analysis Framework of Corporate Environmental Responsibility Information Disclosure. Ind. Econ. Res. 2017, 11, 113. [Google Scholar]

- He, L.T.; Chen, W. An Empirical Study on the Relationship between Economic Performance and Environmental Performance of Heavy Polluting Enterprises. Shanghai Manag. Sci. 2017, 39, 95–101. [Google Scholar]

- Cox, P.; Wicks, P.G. Institutional Interest in Corporate Responsibility: Portfolio Evidence and Ethical Explanation. J. Bus. Ethics 2011, 103, 143–165. [Google Scholar] [CrossRef]

- Kong, T.; Feng, T.W.; Ye, C.M. Advanced Manufacturing Technologies and Green Innovation: The Role of Internal Environmental Collaboration. Sustainability 2016, 8, 1056. [Google Scholar] [CrossRef]

- Saunila, M.; Ukko, J.; Rantala, T. Sustainability as a Driver of Green Innovation Investment and Exploitation. J. Clean. Prod. 2018, 179, 631–641. [Google Scholar] [CrossRef]

- Ziegler, A.; Schroder, M.; Rennings, K. The Effect of Environmental and Social Performance on the Stock Performance of European Corporation. Environ. Resour. Econ. 2008, 40, 609. [Google Scholar] [CrossRef][Green Version]

- Mo, S.Y.; Zhang, C.J. Environmental values, environmental behavior and environmental performance-empirical evidence from listed companies in heavy pollution industries in China. Financ. Account. Mon. 2016, 36, 13–18. [Google Scholar]

- Finkelstein, S.; Hambrick, D.C.; Cannella, B. Strategic Leadership: Theory and Research on Executives, Top Management Teams, and Boards; Oxford University Press: Oxford, UK, 2009; pp. 227–254. [Google Scholar]

- Ma, L.F.; Gao, Y.; Du, B. Hidden Order: A Literature Review of Board Informal Hierarchy and Prospects. Foreign Econ. Manag. 2019, 4, 111–125. [Google Scholar]

- Bainbridge, S. Why a Board? Group Decision-making in Corporate Governance. Vanderbilt Law Rev. 2002, 55, 1–55. [Google Scholar]

- Hendry, K.; Kiel, G.C. The role of the board in firm strategy: Integrating agency and organizational control perspectives. Corp. Gov. Int. Rev. 2010, 12, 500–520. [Google Scholar] [CrossRef]

- Miller, T.; Del Carmen Triana, M. Demographic diversity in the boardroom: Mediators of the board diversity–firm performance relationship. J. Manag. Stud. 2009, 46, 755–784. [Google Scholar] [CrossRef]

- Li, X.Q. Research on the Influence of Board of Directors’ Cognitive Heterogeneity on Enterprise Value—Based on the Perspective of Innovative Strategy Mediating Role. J. Econ. Manag. 2012, 8, 14–22. [Google Scholar]

- Shao, Y.P.; Wang, Y.Q. An Empirical Study of Board Capital and Firm Performance—Based on the Mediating Effect of R&D Investment. Collect. Essays Financ. Econ. 2015, 6, 66–74. [Google Scholar]

- Niu, J.B.; Li, S.N. Research on the governance performance of director board-based on the empirical research of private listed companies. J. Shanxi Univ. Financ. Econ. 2008, 1, 75–83. [Google Scholar]

- Chou, H.L.; Li, H.; Yin, X. The effects of financial distress and capital structure on the work effort of outside directors. J. Empir. Financ. 2010, 17, 300–312. [Google Scholar] [CrossRef]

- Brick, I.E.; Chidambaran, N.K. Board meetings, committee structure, and firm value. J. Corp. Financ. 2010, 16, 533–553. [Google Scholar] [CrossRef]

- Stockmans, A.; Lybaert, N.; Voordeckers, W. The conditional nature of board characteristics in constraining earnings management in private family firms. J. Fam. Bus. Strategy 2013, 4, 84–92. [Google Scholar] [CrossRef]

- Marra, A.; Mazzola, P.; Prencipe, A. Board monitoring and earning management pre- and post IFRS. Int. J. Account. 2011, 46, 205–230. [Google Scholar] [CrossRef]

- Hu, Y.M.; Tang, S.L. The quality of earnings information of independent directors and listed companies. Manag. World 2008, 9, 149–160. [Google Scholar]

- Wang, W.; Yang, W. The Relationship between the Characteristics of Independent Directors and the Quality of Information Disclosure of Listed Companies—Taking Shenzhen A-share Listed Companies as an Example. Shanghai Econ. Res. 2010, 5, 54–63. [Google Scholar]

- Yang, D.Y.; Xie, Y. Corporate social responsibility, green innovation ability and corporate environmental performance. Commun. Financ. Account. 2019, 6, 100–104. [Google Scholar]

- David, F.R. How companies define their mission. Long Range Plan. 1989, 22, 90–97. [Google Scholar] [CrossRef]

- David, M.E.; David, F.R.; David, F.R. Mission statement theory and practice. A content analysis and new direction. Int. J. Bus. Mark. Decis. Sci. 2014, 7, 95–110. [Google Scholar]

- Cooney, J. Say It and Live It: 50 Corporate Mission Statement That Hit the Mark. Bus. Q. 1995, 60, 97–98. [Google Scholar]

- Campbell, A. Mission Statements. Long Range Plan. 1997, 30, 931–932. [Google Scholar] [CrossRef]

- Lin, Q.; Deng, Z.H.; Zhu, C.R. A Comparative Study of the Mission Statements of State-owned and Private Enterprises. Manag. World 2010, 09, 116–122. [Google Scholar]

- Atrill, P.; Omran, M.; Pointon, J. Company mission statements and financial performance. Corp. Ownersh. Control 2005, 2, 28–35. [Google Scholar] [CrossRef]

- Bart, C.; Baetz, M.C. The relationship between mission statements and firm performance: An exploratory study. J. Manag. Stud. 1998, 35, 823–853. [Google Scholar] [CrossRef]

- David, F.R.; David, F.R.; David, M.E. Benefits, characteristics, components and examples of customer-oriented mission statements. Int. J. Bus. Mark. Decis. Sci. 2016, 9, 19–32. [Google Scholar]

- Desmidt, S.; Prinzie, A.; Decramer, A. Looking for the value of mission statements: A meta-analysis of 20 years of research. Manag. Decis. 2011, 49, 468–483. [Google Scholar] [CrossRef]

- Palmer, T.B.; Short, J.C. Mission statements in U.S. colleges of business: An empirical examination of their content with linkages to configurations and performance. Acad. Manag. Learn. Educ. 2008, 7, 454–470. [Google Scholar] [CrossRef]

- Rarick, C.; Vitton, J. Mission statements that make cents. J. Bus. Strategy 1995, 16, 11–12. [Google Scholar] [CrossRef]

- Sidhu, J. Mission Statements: Is it Time to Shelve Them. Eur. Manag. J. 2003, 21, 439–446. [Google Scholar] [CrossRef]

- Bartkus, B.R.; Glassman, M.; Mcafee, R.B. A comparison of the quality of European, Japanese and U.S. mission statements: A content analysis. Eur. Manag. J. 2004, 22, 393–401. [Google Scholar] [CrossRef]

- Xu, E.M.; Xi, Y.Y. The Relationship Between Mission Statements and Corporate Social Performance. In Proceedings of the 2011 International Conference on Management Science & Engineering 18th Annual Conference, Rome, Italy, 13–15 September 2011; pp. 287–295. [Google Scholar]

- Gao, Z.J.; Mao, L.Y. An Analysis of the Importance of Corporate Vision and Mission when Dealing with Financial Crisis—An Empirical Study on China’s Top 500 Listed Companies. Shanghai Manag. Sci. 2014, 4, 26–32. [Google Scholar]

- Peng, T.; Wang, K. The impact of corporate vision and mission statement on corporate performance. Perform. Manag. 2014, 34, 78–80. [Google Scholar]

- Collins, J.; Porras, J. Building a visionary company. Calif. Manag. Rev. 1995, 37, 80–100. [Google Scholar] [CrossRef]

- Van der Vegt, G.S.; de Jong, S.B.; Bunderson, J.S.; Molleman, E. Power asymmetry and learning in teams: The moderating role of performance feedback. Organ. Sci. 2010, 21, 347–361. [Google Scholar] [CrossRef]

- Cochran, D.S.; David, F.R.; Gibson, C.K. A framework for developing an effective mission statement. J. Bus. Strateg. 2008, 25, 27–39. [Google Scholar]

- Powers, E.L. Organizational mission statement guidelines revisited. Int. J. Manag. Inf. Syst. 2012, 16, 281–290. [Google Scholar] [CrossRef]

- Hickson, D.J. Decision-making at the top of organizations. Annu. Rev. Sociol. 1987, 13, 165–192. [Google Scholar] [CrossRef]

- Zhang, Q. Selection and Construction of Indicators for Enterprise Green Management Performance Evaluation System. Contemp. Econ. 2017, 16, 136–138. [Google Scholar]

- National Certification and Accreditation Information Public Service Platform. Available online: http://cx.cnca.cn/CertECloud/result/skipResultList?certItemOne=A (accessed on 10 April 2019).

- Harrison, D.A.; Klein, K.J. What’s the difference? Diversity constructs as separation, variety, or disparity in organizations. Acad. Manag. Rev. 2007, 32, 1199–1228. [Google Scholar] [CrossRef]

- Wei, X.H.; Liu, Y.M.; Yue, L.Q. The influence of the power inequality of senior management team on the innovation intensity of enterprises-a moderated mediating effect. Nankai Bus. Rev. 2015, 3, 24–33. [Google Scholar]

- Albertini, E. Does environmental management improve financial performance? A meta-analytical review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Bart, C.; Baetz, M.C. Developing mission statements which work. Long Range Plan. 1996, 29, 526–533. [Google Scholar]

- Kang, J.X.; Tang, H.; Liang, W.; Jia, J.D. The Impact of Corporate Mission Statement on Corporate Performance. Coop. Econ. Technol. 2017, 19, 40–43. [Google Scholar]

- Shanghai Stock Exchange. Available online: http://www.sse.com.cn (accessed on 12 April 2019).

- Shenzhen Stock Exchange. Available online: http://www.szse.cn (accessed on 12 April 2019).

- Wen, Z.L.; Zhang, L.; Hou, J.T. Intermediary regulating variables and regulated mediator variables. Acta Psychol. Sin. 2006, 3, 448–452. [Google Scholar]

- Wu, L.Z.; Liu, J.; Xu, J. Workplace Ostracism and Organizational Citizenship Behavior: The Roles of Organizational Identification and Collectivism. Nankai Bus. Rev. 2010, 13, 36–44. [Google Scholar]

- Inderst, R.; Mueller, H.M. CEO replacement under private information. Rev. Financ. Stud. 2009, 93, 276–291. [Google Scholar] [CrossRef]

- Li, Z.F. Mutual monitoring and corporate governance. J. Bank. Financ. 2014, 45, 255–269. [Google Scholar]

- Mutual Monitoring and Agency Problem. Available online: https://www.researchgate.net/publication/272305464_Mutual_Monitoring_and_Agency_Problems (accessed on 22 August 2019).

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Bazerman, M.H. Judgement in Managerial Decision Making, 5th ed.; Wiley: Chichester, UK, 2005. [Google Scholar]

- Dean, J.W.; Sharfman, M.P. The Relationship Between Procedural Rationality and Political Behavior in Strategic Decision Making. Decis. Sci. 1993, 24, 1069–1083. [Google Scholar] [CrossRef]

- Pfeffer, J. Size and Composition of Corporate Boards of Directors: The Organization and Its Environment. Adm. Sci. Q. 1972, 17, 163–182. [Google Scholar] [CrossRef]

- Greer, L.L.; Caruso, H.M.; Jehn, K.A. The bigger they are, the harder they fall: Linking team power, team conflict, and performance. Organ. Behav. Hum. Decis. Process. 2011, 116, 116–128. [Google Scholar] [CrossRef]

- Greer, L.L.; van Bunderen, L.; Yu, S.Y. The dysfunctions of power in teams: A review and emergent conflict perspective. Res. Organ. Behav. 2017, 37, 103–124. [Google Scholar] [CrossRef]

- Groysberg, B.; Polzer, J.T.; Elfenbein, H.A. Too many cooks spoil the broth: How high-status individuals decrease group effectiveness. Organ. Sci. 2011, 22, 22–737. [Google Scholar] [CrossRef]

- Turner, J.C.; Brown, R.J.; Tajfel, H. Social Comparison and Group Interest in Ingroup Favouritism. Eur. J. Soc. Psychol. 1979, 9, 187–204. [Google Scholar] [CrossRef]

- Anicich, E.M.; Swaab, R.I.; Galinsky, A.D. Hierarchical cultural values predict success and mortality in high-stakes teams. Proc. Natl. Acad. Sci. USA 2016, 5, 1338–1343. [Google Scholar] [CrossRef] [PubMed]

- Fiske, S.T.; Lee, T.L. Diversity at Work; Cambridge University Press: Cambridge, UK, 2008; pp. 13–52. [Google Scholar]

- Roese, N.J.; Sherman, J.W. Social Psychology: Handbook of Basic Principles; Guilford: New York, NY, USA, 2007; pp. 91–115. [Google Scholar]

- Ferrier, W.J. Navigating the competitive landscape: The drivers and consequences of competitive aggressiveness. Acad. Manag. J. 2001, 44, 858–877. [Google Scholar]

- Zahra, S.A.; Pearce, J.A. Board of Directors and Corporate Financial Performance: A Review and Integrative Model. J. Manag. 1989, 15, 291–334. [Google Scholar] [CrossRef]

- Liao, L.; Luo, L.; Tang, Q.L. Gender Diversity, Board Independence, Environmental Committee and Greenhouse Gas Disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Zohar, D. The Quantum Leader: A Revolution in Business Thinking and Practice, 1st ed.; China Machine Press: Beijing, China, 2016; pp. 53–107. [Google Scholar]

- Giroud, X.; Mueller, H.M. Corporate governance, product market competition, and equity prices. J. Financ. 2011, 66, 563–600. [Google Scholar] [CrossRef]

| Element | Measurement Standard |

|---|---|

| Customers | Are the company’s customers, including the company’s main target market customer group, or the company’s strategic customer group clearly defined? If the relevant concepts are explicitly presented, the value is 1; otherwise, 0. |

| Product and service | Are the main products and services provided by the company clear? If the relevant concepts are explicitly presented, the value is 1; otherwise, 0. |

| Market | Is where the company operates primarily or where it will expand clear? The market here mainly refers to the geographical concept. If the relevant concepts are explicitly presented, the value is 1; otherwise, 0. |

| Technology | Is the core technology of the company’s business development clear? If the relevant concepts are explicitly presented, the value is 1; otherwise, 0. |

| Concern for production, growth, and profit | Does the company clearly indicate its efforts to achieve business growth and sound financial position? If the company explicitly states it attempts to achieve business growth and financial health, the value is 1; otherwise, 0. |

| Corporate philosophy | Does it clearly state the company’s business philosophy, values, or moral predisposition to reflect the company’s philosophy of expression? If the relevant concepts are explicitly presented, the value is 1; otherwise, 0. |

| Corporate self-perception | Does the firm clearly identify and state the company’s unique capabilities or core competitive advantages, or evaluate the company’s competitive advantages and disadvantages? If the relevant concepts are explicitly presented, the value is 1; otherwise, 0. |

| Concern for public image | Does the company clearly indicate its concern for the development of society and the community, and for environmental protection, or assume corresponding social responsibilities and provide contributions? If the relevant concepts are explicitly presented, the value is 1; otherwise, 0. |

| Concern for employees | Is it clear that the company regards employees as assets and cares about employees’ lives and development? If the relevant concepts are explicitly presented, the value is 1; otherwise, 0. |

| Variable | Mean | SD | Min. | Max. |

|---|---|---|---|---|

| GGP | 0.3270 | 0.4700 | 0.0000 | 1.0000 |

| FP | 0.3790 | 0.0600 | 0.2665 | 0.6124 |

| IP | 0.6950 | 0.1600 | 0.1667 | 1.0000 |

| CM | 8.4020 | 0.7400 | 6.0000 | 9.0000 |

| GGC | 7.3510 | 1.3600 | 1.0000 | 10.0000 |

| LTA | 23.1800 | 1.4100 | 20.3261 | 28.5087 |

| ROA | 0.0310 | 0.0700 | –0.6829 | 0.2198 |

| LEV | 0.4820 | 0.2200 | 0.0370 | 1.1123 |

| IDB | 0.3540 | 0.0700 | 0.2143 | 0.6667 |

| BSZ | 11.1020 | 2.8300 | 6.0000 | 25.0000 |

| EQR | 6.8970 | 9.9800 | 0.3459 | 82.5512 |

| AGC | 0.1580 | 0.1200 | 0.0060 | 0.7410 |

| SHC3 | 56.7040 | 15.0600 | 11.9803 | 98.4689 |

| Variables | GGP | FP | IP | CM | GGC | LTA | ROA | LEV | IDB | BSZ | EQR | AGC | SHC3 | STI3 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GGP | 1 | |||||||||||||

| FP | 0.1167 * | 1 | ||||||||||||

| IP | 0.0834 | −0.2338 * | 1 | |||||||||||

| CM | 0.0195 | 0.0065 | −0.0093 | 1 | ||||||||||

| GGC | 0.0910 | −0.0146 | −0.0251 | −0.0793 | 1 | |||||||||

| LTA | −0.0483 | −0.0414 | −0.0284 | 0.0577 | −0.0726 | 1 | ||||||||

| ROA | 0.0270 | 0.1345 * | −0.1321 * | 0.0760 | 0.0313 | −0.0045 | 1 | |||||||

| LEV | −0.1228 * | −0.0752 | −0.0825 | −0.0774 | −0.0305 | 0.5711 * | −0.2962 * | 1 | ||||||

| IDB | 0.0466 | 0.0994 * | −0.1160 * | −0.0273 | 0.0180 | 0.2013 * | 0.1322 * | 0.0459 | 1 | |||||

| BSZ | 0.0065 | −0.3169 * | 0.3933 * | 0.0196 | 0.0496 | 0.2068 * | −0.0895 | 0.0931 | −0.1065 * | 1 | ||||

| EQR | 0.0133 | −0.1740 * | 0.0020 | −0.1573 * | 0.0768 | −0.0029 | −0.1639 * | 0.1488 * | −0.1037 * | −0.0386 | 1 | |||

| AGC | −0.0613 | 0.0158 | 0.0025 | 0.0847 | 0.0573 | −0.2039 * | 0.2084 * | −0.2735 * | −0.0917 | 0.0740 | −0.2350 * | 1 | ||

| SHC3 | 0.0138 | −0.0140 | −0.0371 | 0.0710 | −0.1586 * | 0.2047 * | 0.0694 | 0.0404 | −0.0053 | 0.0320 | 0.1016 * | −0.1476 * | 1 | |

| STI3 | −0.0512 | 0.1335 * | −0.1627 * | −0.0275 | 0.0888 | −0.0914 | 0.1408 * | −0.1567 * | 0.0862 | −0.0276 | −0.2644 * | 0.1166 * | −0.2078 * | 1 |

| Model 1 | Model 2 | Model 3 | |

|---|---|---|---|

| Dependent Variable | GGC | GGC | GGC |

| LTA | −0.1240 *** (−2.96) | −0.1230 *** (−2.94) | −0.1140 *** (−2.67) |

| ROA | −0.8470 (−0.95) | −0.9810 (−1.07) | −1.1780 (−1.29) |

| LEV | 0.1890 (0.66) | 0.1420 (0.49) | 0.1800 (0.62) |

| IDB | −0.1310 (−0.18) | −0.1940 (−0.27) | −0.0238 (−0.03) |

| BSZ | 0.0288 (1.44) | 0.0352 * (1.72) | 0.0372 * (1.79) |

| EQR | −0.0081 (−1.32) | −0.0088 (−1.39) | −0.0101 (−1.55) |

| AGC | 0.4500 (1.10) | 0.3720 (0.89) | 0.4400 (1.05) |

| FP | - | −0.2610 (−0.25) | −17.8700 * (−1.74) |

| IP | - | −0.5730 * (−1.68) | 6.2110 (1.58) |

| CM | - | - | −0.3550 (−0.57) |

| FP × CM | - | - | 2.1280 * (1.76) |

| IP × CM | - | - | 0.8120 * (1.75) |

| _cons | 9.8660 *** (11.07) | 10.3400 *** (10.01) | 12.9500 ** (2.36) |

| Adjusted R2 | 0.0465 | ||

| F | 3.2100 *** |

| Model 4 | Model 5 | |

|---|---|---|

| Dependent Variable | GGP | GGP |

| LTA | 0.0250 (0.24) | 0.0330 (0.32) |

| LEV | −1.6140 ** (−2.24) | −1.6700 ** (−2.37) |

| ROA | −0.7760 (−0.45) | −0.5750 (−0.34) |

| BSZ | 0.0570 (1.34) | 0.0460 (1.07) |

| SHC3 | 0.0030 (0.46) | 0.0050 (0.59) |

| STI3 | −0.0620 (−1.50) | −0.0650 (−1.56) |

| FP | 36.0900 * (1.78) | 40.3800 * (1.86) |

| IP | −1.3430 (−0.13) | −3.8410 (−0.37) |

| FP × IP | −20.9000 * (−1.74) | −18.2100 (−1.44) |

| CM | −0.0010 (−0.00) | 0.1970 (0.12) |

| FP × CM | −2.0610 (−0.86) | −2.7920 (−1.07) |

| IP × CM | 1.2370 (1.13) | 1.4300 (1.26) |

| GGC | - | 0.2130 ** (2.39) |

| _cons | −8.7010 (−0.66) | −11.4200 (−0.83) |

| Pseudo R2 | 0.0575 | 0.0694 |

| Wald χ2 | 35.0700 | 35.9800 |

| N | 416 | 416 |

| Model 6 | Model 7 | |

|---|---|---|

| Dependent Variable | GGP | GGP |

| FP | 18.3400 (1.55) | 21.4200 * (1.73) |

| IP | −0.5310 (−0.08) | −2.5410 (−0.35) |

| FP × IP | −11.3100 * (−1.81) | −9.8570 (−1.52) |

| CM | −0.0538 (−0.05) | 0.0420 (0.04) |

| FP × CM | −0.9090 (−0.63) | −1.4030 (−0.94) |

| IP × CM | 0.6720 (0.91) | 0.8560 (1.13) |

| LTA | 0.0154 (0.23) | 0.0166 (0.25) |

| LEV | −1.1030 ** (−2.29) | −1.1090 ** (−2.37) |

| ROA | −0.5300 (−0.46) | −0.4030 (−0.36) |

| BSZ | 0.0408 (1.47) | 0.0328 (1.19) |

| SHC3 | 0.0023 (0.46) | 0.0029 (0.57) |

| STI3 | −0.0424 (−1.49) | −0.0446 (−1.59) |

| GGC | - | 0.1380 ** (2.49) |

| _cons | −5.3700 (−0.59) | −6.7950 (−0.74) |

| N | 416 | 416 |

| Model 8 | Model 9 | Model 10 | Model 11 | Model 12 | Model 13 | |

|---|---|---|---|---|---|---|

| Performance Pressure? | No | Yes | No | Yes | No | Yes |

| Dependent Variable | GGC | GGC | GGC | GGC | GGC | GGC |

| LTA | −0.1212 * (−1.69) | −0.1212 **(−1.97) | −0.1205 * (−1.68) | −0.1151 * (−1.86) | −0.1203* (−1.68) | −0.0993 (−1.62) |

| ROA | −1.3080 (−1.20) | −1.0320 (−0.63) | −1.3161 (−1.21) | −1.1603 (−0.71) | −1.3034 (−1.19) | −1.6756 (−1.02) |

| LEV | −0.0286 (−0.06) | 0.2792 (0.66) | −0.0304 (−0.07) | 0.2566 (0.61) | 0.0273 (0.06) | 0.2947 (0.71) |

| IDB | 0.2114 (0.17) | −0.5426 (−0.51) | 0.1959 (0.16) | −0.5673 (−0.53) | 0.3834 (0.31) | −0.2681 (−0.25) |

| BSZ | 0.0274 (0.98) | 0.0470 (1.50) | 0.0275 (0.98) | 0.0525 * (1.67) | 0.0218 (0.77) | 0.0599 * (1.92) |

| EQR | −0.0246 *** (−2.74) | −0.0010 (−0.13) | −0.0252 *** (−2.74) | −0.0008 (−0.12) | −0.0251 *** (−2.66) | −0.0012 (−0.17) |

| AGC | −0.2042 (−0.30) | 0.9125 (1.33) | −0.1768 (−0.26) | 1.1212 (1.61) | −0.2176 (−0.31) | 1.1745 * (1.70) |

| FP | −0.3432 (−0.27) | −0.0422 (−0.03) | −0.3781 (−0.29) | 0.0614 (0.05) | −5.9032 (−0.41) | −27.1776 ** (−2.15) |

| IP | −0.8173 * (−1.66) | −0.3958 (−0.73) | −0.8312 * (−1.67) | −0.3069 (−0.57) | 8.1837 (1.30) | 6.4869 (1.11) |

| CM | - | - | −0.0348 (−0.31) | −0.1625 (−1.58) | 0.4602 (0.47) | −0.8795 (−1.02) |

| FP × CM | - | - | - | - | 0.6673 (0.39) | 3.3104 ** (2.18) |

| IP × CM | - | - | - | - | −1.0689 * (−1.44) | −0.8215 (−1.17) |

| _cons | 10.6170 *** (6.50) | 9.9858 *** (6.61) | 10.9237 *** (5.69) | 11.0183 *** (6.70) | 6.6729 (0.78) | 16.3530 ** (2.25) |

| F | 1.7900 * | 1.1700 | 1.6200 | 1.3100 | 1.6000 * | 1.8100 ** |

| R2 | 0.0598 | 0.0300 | 0.0601 | 0.0371 | 0.0710 | 0.0607 |

| N | 264 | 350 | 264 | 350 | 264 | 350 |

| Model 14 | Model 15 | Model 16 | Model 17 | |

|---|---|---|---|---|

| Performance Pressure? | No | Yes | No | Yes |

| Dependent Variable | GGP | GGP | GGP | GGP |

| LTA | 0.0594 (0.36) | 0.0409 (0.29) | 0.0488 (0.29) | 0.0395 (0.28) |

| LEV | −1.4915 (−1.39) | −1.8775 ** (−1.98) | −1.3791 (−1.24) | −2.0444 ** (−2.10) |

| ROA | 2.4713 (0.89) | −8.8865 *** (−2.60) | 3.1082 (1.11) | −8.1772 ** (−2.34) |

| BSZ | 0.1074 * (1.84) | 0.0130 (0.21) | 0.0918 (1.53) | −0.0003 (−0.01) |

| SHC3 | −0.0150 (−1.30) | 0.0244 ** (2.27) | −0.0150 (−1.28) | 0.0261 ** (2.36) |

| STI3 | −0.1261 *** (−1.96) | −0.0119 (−2.23) | −0.1105 (−1.61) | −0.0086 (−0.16) |

| FP | 10.0948 *** (3.42) | 4.3908 * (1.86) | 66.4405 (1.46) | 33.2608 (1.24) |

| IP | 1.7414 (1.38) | 0.4254 (0.38) | −0.2726 (−0.01) | −4.4102 (−0.27) |

| CM | - | - | 1.1734 (0.37) | 0.2281 (0.11) |

| FP × CM | - | - | −5.1112 (−0.99) | −2.4422 (−0.78) |

| IP × CM | - | - | 1.2880 (0.60) | 1.2510 (0.74) |

| GGC | - | - | 0.2751 * (1.83) | 0.2042 * (1.75) |

| _cons | −5.6425 (−1.53) | −3.8478 (−1.23) | −22.9712 (−0.82) | −10.4908 (−0.57) |

| Wald χ2 | 23.8000 *** | 17.6000 ** | 31.1200 *** | 23.8400 ** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dong, F.; Xie, Y.; Cao, L. Board Power Hierarchy, Corporate Mission, and Green Performance. Sustainability 2019, 11, 4826. https://doi.org/10.3390/su11184826

Dong F, Xie Y, Cao L. Board Power Hierarchy, Corporate Mission, and Green Performance. Sustainability. 2019; 11(18):4826. https://doi.org/10.3390/su11184826

Chicago/Turabian StyleDong, Feiran, Yongzhen Xie, and Linjun Cao. 2019. "Board Power Hierarchy, Corporate Mission, and Green Performance" Sustainability 11, no. 18: 4826. https://doi.org/10.3390/su11184826

APA StyleDong, F., Xie, Y., & Cao, L. (2019). Board Power Hierarchy, Corporate Mission, and Green Performance. Sustainability, 11(18), 4826. https://doi.org/10.3390/su11184826