Do Private Benefits of Control Affect Corporate Social Responsibility? Evidence from China

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

2.1. Private Benefits of Control

2.2. Corporate Social Responsibility

2.3. Hypotheses Development

2.3.1. Private Benefits of Control and CSR

2.3.2. Two Possible Channels

3. Research Methodology

3.1. Model Specification and Variable Definition

3.2. Sample Selection and Data Sources

4. Empirical Results

4.1. Channel Analyses

4.2. Cross-Sectional Analyses

4.3. Sensitive Tests

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| CSR Measures | ||

| CSR_Score | = | The comprehensive score of five first-class CSR indexes calculated by the weighted average method, range from 0 to 100; To keep readability, we use the score deflated by 100. |

| CSR_Level | = | An indicator variable based on CSR-Score; it takes the value of 5 if the CSR_Score ranks in the top fifth (80–100), and 1 if in the bottom fifth (0–20); |

| Private benefit of control proxies | ||

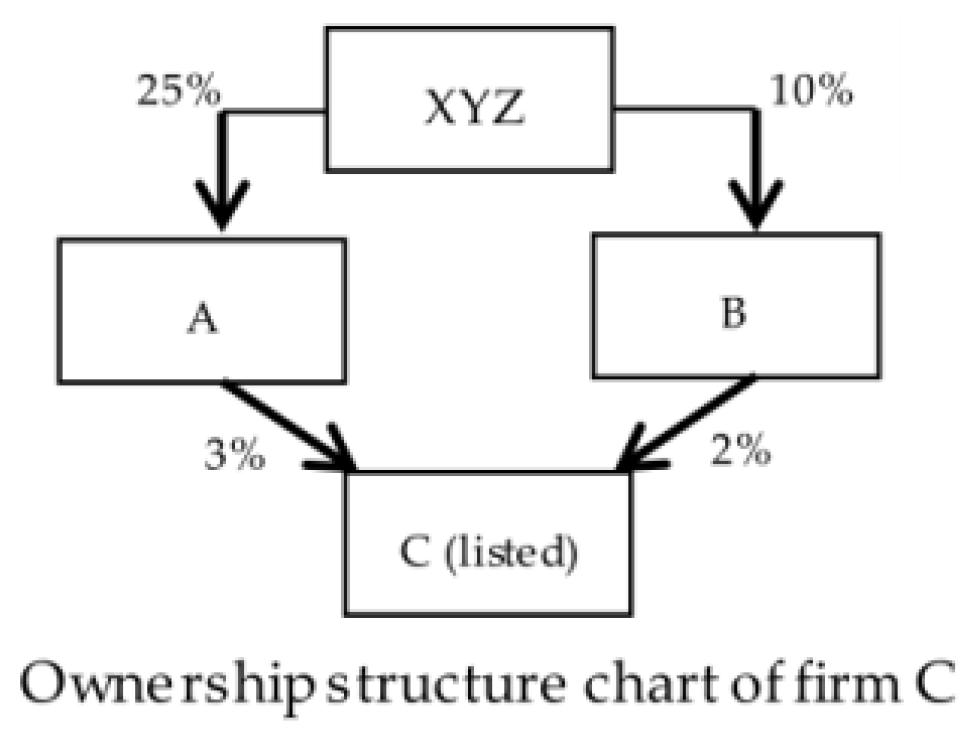

| PB1 | = | Divergence between cash-flow rights and control rights of controlling shareholders; |

| PB2 | = | Natural logarithm of the number of intermediate layers of the longest pyramidal chain; |

| Firm characteristics and other variables | ||

| SIZE | = | Natural logarithm of total assets; |

| LEV | = | Total debt (the sum of current liabilities and long-term debt) scaled by total assets of same period; |

| GROWTH | = | Annual change in sales revenue; |

| ROA | = | The returns on assets, equals EBIT divided by average total assets; |

| AGE | = | Listing age, defined as the number of years a firm’s stocks have been listed; |

| EM | Discretionary accruals following the model of Bartov et al. (2000); | |

| TUNNEL | The proportion of other receivables to the total assets; | |

| Industry fixed effects | = | Indicator variables for different industries, defined according to the version 2012 of industry classifications published by the CSRC; |

| Year fixed effects | = | Indicator variables for different years; |

| i,t | = | Firm i, year t subscripts. |

Appendix B

References

- Hemingway, C.A.; Maclagan, P.W. Managers’ personal values as drivers of corporate social responsibility. J. Bus. Ethics 2004, 50, 33–44. [Google Scholar] [CrossRef]

- Bénabou, R.; Tirole, J. Individual and corporate social responsibility. Economica 2010, 77, 1–19. [Google Scholar] [CrossRef]

- Du, X.; Jian, W.; Du, Y.; Feng, W.; Zeng, Q. Religion, the nature of ultimate owner, and corporate philanthropic giving: Evidence from China. J. Bus. Ethics 2014, 123, 235–256. [Google Scholar] [CrossRef]

- Lin, K.J.; Tan, J.; Zhao, L.; Karim, K. In the name of charity: Political connections and strategic corporate social responsibility in a transition economy. J. Corp. Financ. 2015, 32, 327–346. [Google Scholar] [CrossRef]

- Faller, C.M.; Zu Knyphausen-Aufseß, D. Does equity ownership matter for corporate social responsibility? A literature review of theories and recent empirical findings. J. Bus. Ethics 2018, 150, 15–40. [Google Scholar] [CrossRef]

- Chan, M.C.; Watson, J.; Woodliff, D. Corporate governance quality and csr disclosures. J. Bus. Ethics 2014, 125, 59–73. [Google Scholar] [CrossRef]

- Bae, S.M.; Masud, M.A.; Kim, J.D. A cross-country investigation of corporate governance and corporate sustainability disclosure: A signaling theory perspective. Sustainability 2018, 10, 2611. [Google Scholar] [CrossRef]

- Dyck, A.; Zingales, L. Private benefits of control: An international comparison. J. Financ. 2004, 59, 537–600. [Google Scholar] [CrossRef]

- Claessens, S.; Djankov, S.; Lang, L.H. The separation of ownership and control in East Asian corporations. J. Financ. Econ. 2000, 58, 81–112. [Google Scholar] [CrossRef]

- Wang, K.; Xiao, X. Controlling shareholders’ tunneling and executive compensation: Evidence from China. J. Account. Public Policy 2011, 30, 89–100. [Google Scholar] [CrossRef]

- Lei, G.; Jie, Z. On the corporate governance, fund appropriation and earning manipulation. J. Financ. Res. 2009, 26, 121–141. (In Chinese) [Google Scholar]

- Fan, J.P.; Wong, T.J.; Zhang, T. Institutions and organizational structure: The case of state-owned corporate pyramids. J. Law Econ. Organ. 2013, 29, 1217–1252. [Google Scholar] [CrossRef]

- Silanes, A.; Vishny, R.W.; Porta, R.L.; Lopez-de-Shleifer, F. Investor protection and corporate governance. J. Financ. Econ. 2000, 58, 3–27. [Google Scholar]

- Johnson, S.; Porta, R.L.; Lopez-De-Silanes, F.; Shleifer, A. Tunneling. Am. Econ. Rev. 2000, 90, 22–27. [Google Scholar] [CrossRef]

- Grossman, S.J.; Hart, O.D. One share-one vote and the market for corporate control. J. Financ. Econ. 1988, 20, 175–202. [Google Scholar] [CrossRef]

- Zingales, L. The value of the voting right: A study of the milan stock exchange experience. Rev. Financ. Stud. 1994, 7, 125–148. [Google Scholar] [CrossRef]

- Jensen, M.C.; Ruback, R.S. The market for corporate control: The scientific evidence. J. Financ. Econ. 1983, 11, 5–50. [Google Scholar] [CrossRef]

- Coffee, J.C. Do Norms Matter? A cross-Country Examination of the Private Benefits of Control. SSRN 2001, Columbia Law and Economics Working Paper No. 183. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=257613 (accessed on 14 September 2018).

- Pacces, A.M. Control Matters: Law and Economics of Private Benefits of Control. SSRN 2009, Rotterdam Institute of Law and Economics (RILE) Working Paper No. 2009/04. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1448164 (accessed on 14 September 2018).

- Kang, P.K.; Kim, Y.C. The impact of the ownership discrepancy between cash-flow rights and voting rights on firms’ soft asset investment decisions: Evidence from large business groups in South Korea. Group Decis. Negot. 2015, 24, 429–450. [Google Scholar] [CrossRef]

- Baldenius, T. Delegated investment decisions and private benefits of control. Account. Rev. 2003, 78, 909–930. [Google Scholar] [CrossRef]

- Filatotchev, I.; Strange, R.; Piesse, J.; Lien, Y.C. FDI by firms from newly industrialised economies in emerging markets: Corporate governance, entry mode and location. J. Int. Bus. Stud. 2007, 38, 556–572. [Google Scholar] [CrossRef]

- Gopalan, R.; Jayaraman, S. Private control benefits and earnings management: Evidence from insider controlled firms. J. Account. Res. 2012, 50, 117–157. [Google Scholar] [CrossRef]

- Doidge, C.; Karolyi, G.A.; Lins, K.V.; Miller, D.P.; Stulz, R.M. Private benefits of control, ownership, and the cross-listing decision. J. Financ. 2009, 64, 425–466. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Complex ownership structures and corporate valuations. Rev. Financ. Stud. 2007, 21, 579–604. [Google Scholar] [CrossRef]

- Lins, K.V. Equity ownership and firm value in emerging markets. J. Financ. Quant. Anal. 2003, 38, 159–184. [Google Scholar] [CrossRef]

- Li, S.; Feng, G.; Cao, G. Private benefits of managerial control, government ownership, and acquirer returns: Evidence from the chinese state-controlled listed companies. Can. J. Admin. Sci. 2012, 29, 165–176. [Google Scholar] [CrossRef]

- Filatotchev, I.; Mickiewicz, T. Ownership Concentration, ‘Private Benefits of Control’ and Debt Financing; Houndmills Palgrave Macmillan: London, UK, 2006. [Google Scholar]

- Alafi, K.; Hasoneh, A.B. Corporate social responsibility associated with customer satisfaction and financial performance a case study with housing banks in Jordan. Int. J. Hum. Soc. Sci. 2012, 2, 102–115. [Google Scholar]

- Galbreath, J.; Shum, P. Do customer satisfaction and reputation mediate the csr–fp link? Evidence from australia. Aust. J. Manag. 2012, 37, 211–229. [Google Scholar] [CrossRef]

- Beurden, P.V.; Gössling, T. The worth of values—A literature review on the relation between corporate social and financial performance. J. Bus. Ethics 2008, 82, 407–424. [Google Scholar] [CrossRef]

- Rettab, B.; Brik, A.B.; Mellahi, K. A study of management perceptions of the impact of corporate social responsibility on organisational performance in emerging economies: The case of Dubai. J. Bus. Ethics 2009, 89, 371–390. [Google Scholar] [CrossRef]

- Lin, C.H.; Yang, H.L.; Liou, D.Y. The impact of corporate social responsibility on financial performance: Evidence from business in Taiwan. Technol. Soc. 2009, 31, 56–63. [Google Scholar] [CrossRef]

- Garriga, E.; Melé, D. Corporate social responsibility theories: Mapping the territory. J. Bus. Ethics 2004, 53, 51–71. [Google Scholar] [CrossRef]

- Julian, S.D.; Ofori-Dankwa, J.C. Financial resource availability and corporate social responsibility expenditures in a sub-Saharan economy: The institutional difference hypothesis. Strat. Manag. J. 2013, 34, 1314–1330. [Google Scholar] [CrossRef]

- Zhou, Y.; Poon, P.; Huang, G. Corporate ability and corporate social responsibility in a developing country: The role of product involvement. J. Glob. Mark. 2012, 25, 45–56. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Rupp, D.E.; Williams, C.A.; Ganapathi, J. Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Acad. Manag. Rev. 2007, 32, 836–863. [Google Scholar] [CrossRef]

- Thanetsunthorn, N. The impact of national culture on corporate social responsibility: Evidence from cross-regional comparison. Asian J. Bus. Ethics 2015, 4, 1–22. [Google Scholar] [CrossRef]

- Calveras, A.; Ganuza, J.J.; Llobet, G. Regulation, corporate social responsibility and activism. J. Econol. Manag. Strat. 2007, 16, 719–740. [Google Scholar] [CrossRef]

- Gainet, C. Exploring the impact of legal systems and financial structure on corporate responsibility. J. Bus. Ethics 2010, 95, 195–222. [Google Scholar] [CrossRef]

- Longoni, A.; Misani, N.; Pogutz, S.; Ragozzino, R. CSR commitment and industry environment: Do competition, munificence and uncertainty matter? Acad. Manag. 2015, 2015, 16047. [Google Scholar] [CrossRef]

- Yang, S.; Ye, H.; Zhu, Q. Do peer firms affect firm corporate social responsibility? Sustainability 2017, 9, 1967. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The Corporate social performance-financial performance Link. Strat. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M. The role of environmental disclosures as tools of legitimacy: A research note. Account. Organ. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Manner, M.H. The impact of CEO characteristics on corporate social performance. J. Bus. Ethics 2010, 93, 53–72. [Google Scholar] [CrossRef]

- Myung, J.K.; Choi, Y.H.; Kim, J.D. Effects of CEOs’ negative traits on corporate social responsibility. Sustainability 2017, 9, 543. [Google Scholar] [CrossRef]

- Matthiesen, M.L.; Salzmann, A.J. Corporate social responsibility and firms’ cost of equity: Does culture matter? Cross Cult. Strateg. Manag. 2017, 24, 105–124. [Google Scholar] [CrossRef]

- Galbreath, J. Drivers of corporate social responsibility: The role of formal strategic planning and firm culture. Br. J. Manag. 2010, 21, 511–525. [Google Scholar] [CrossRef]

- Chun, H.M.; Shin, S.Y. The Impact of labor union influence on corporate social responsibility. Sustainability 2018, 10, 1–7. [Google Scholar] [CrossRef]

- Zhang, J.Q.; Zhu, H.; Ding, H.B. Board composition and corporate social responsibility: An empirical; investigation in the post Sarbanes-Oxley era. J. Bus. Ethics 2013, 114, 381–392. [Google Scholar] [CrossRef]

- Oh, W.Y.; Chang, Y.K.; Martynov, A. The effect of ownership structure on corporate social responsibility: Empirical evidence from Korea. J. Bus. Ethics 2011, 104, 283–297. [Google Scholar] [CrossRef]

- Burkart, M.; Gromb, D.; Panunzi, F. Large shareholders, monitoring, and the value of the firm. Q. J. Econ. 1997, 112, 693–728. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M. The separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. Corporate ownership around the world. J. Financ. 1999, 54, 471–517. [Google Scholar] [CrossRef]

- Bebchuk, L.A. Rent-Protection Theory of Corporate Ownership and Control; No. w7203; National Bureau of Economic Research: Cambridge, MA, USA, 1999. [Google Scholar]

- Faccio, M.; Lang, L.H.; Young, L. Dividends and expropriation. Am. Econ. Rev. 2001, 91, 54–78. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Kraakman, R.; Triantis, G. Stock Pyramids, Cross-Ownership, and the Dual Class Equity: The Creation and Agency Costs of Seperating Control from Cash Flow Rights; University of Chicago Press: Chicago, IL, USA, 2000; pp. 295–318. [Google Scholar]

- Liu, S. The paradox of private benefits of control and excessive benefits of control: A new theoretical explanation of large shareholders’ expropriation of small ones. Econ. Res. J. 2007, 2, 85–96. [Google Scholar]

- Desender, K.; Epure, M. Corporate governance and corporate social performance. Acad. Manag. Proc. 2014, 2014, 16483. [Google Scholar] [CrossRef]

- Tristiarini, N. CSR’s capability as a conflict’s resolution to enhance a firm’s value in Indonesia. Int. J. Corp. Financ. Account. 2015, 2, 50–66. [Google Scholar] [CrossRef]

- Wang, Y. Control chain, agency conflicts and auditor choice. Account. Res. 2009, 6, 65–72. [Google Scholar]

- Wang, Q.; Wong, T.J.; Xia, L. State ownership, the institutional environment, and auditor choice: Evidence from China. J. Account. Econ. 2008, 46, 112–134. [Google Scholar] [CrossRef]

- Prat, A. The wrong kind of transparency. Am. Econ. Rev. 2005, 95, 862–877. [Google Scholar] [CrossRef]

- Wong, T.J.; Jian, M. Propping and Tunneling Through Related Party Transactions. Rev. Account. Stud. 2008, 15, 70–105. [Google Scholar]

- Liu, Q.; Lu, Z. Corporate governance and earnings management in the Chinese listed companies: A tunneling perspective. J. Corp. Financ. 2007, 13, 881–906. [Google Scholar] [CrossRef]

- Lei, G.Y.; Liu, H.L. Nature of control shareholder, tunneling and magnitude of earnings management. Chin. Ind. Econ. 2007, 8, 90–97. [Google Scholar]

- Conyon, M.J.; He, L. Executive compensation and corporate governance in China. J. Corp. Financ. 2011, 17, 1158–1175. [Google Scholar] [CrossRef]

- Bartov, E.; Gul, F.A.; Tsui, J.S.L. Discretionary-accruals models and audit qualifications. J. Account. Econ. 2000, 30, 421–452. [Google Scholar] [CrossRef]

- Liang, SK.; Chen, D.; Accountancy, S.O. Will managers be hurt by large shareholder? Evidence from tunneling and managers’ turnover. J. Financ. Res. 2015, 3, 192–206. (In Chinese) [Google Scholar]

- Kalcheva, I.; Lins, K.V. International evidence on cash holdings and expected managerial agency problems. Rev. Financ. Stud. 2007, 20, 1087–1112. [Google Scholar] [CrossRef]

- Fan, G.; Wang, W.; Yu, J. The Report on the Marketization Index of China’s Provinces; Social Sciences Academy Press: Beijing, China, 2016. [Google Scholar]

- Bertrand, M.; Schoar, A. Managing with style: The effect of managers on firm policies. Q. J. Econ. 2003, 118, 1169–1208. [Google Scholar] [CrossRef]

- Sun, G.; Sun, R. Can Controlling Shareholders Appoint Executive Directors Improve Corporate Governance. China HowNet 2018, CateGory Index: F271. 2018. Available online: http://xueshu.baidu.com/s?wd=paperuri%3A%28283d17ce96ad231321ffeeb361b2a093%29&filter=sc_long_sign&tn=SE_xueshusource_2kduw22v&sc_vurl=http%3A%2F%2Fen.cnki.com.cn%2FArticle_en%2FCJFDTotal-LKGP201801011.htm&ie=utf-8&sc_us=2841877628516146632 (accessed on 12 September 2018).

- Cheng, M.; Lin, B.; Wei, M. How does the relationship between multiple large shareholders affect corporate valuations? Evidence from China. J. Econ. Bus. 2013, 70, 43–70. [Google Scholar] [CrossRef]

| Variable | N | Mean | SD | P25 | P50 | P75 |

|---|---|---|---|---|---|---|

| CSR_Score | 14,064 | 0.267 | 0.189 | 0.161 | 0.220 | 0.295 |

| CSR_Level | 14,064 | 2.262 | 0.698 | 2 | 2 | 2 |

| CSR_1 | 14,064 | 0.135 | 0.064 | 0.095 | 0.140 | 0.181 |

| CSR_2 | 14,064 | 0.032 | 0.036 | 0.009 | 0.018 | 0.040 |

| CSR_3 | 14,064 | 0.025 | 0.055 | 0 | 0 | 0 |

| CSR_4 | 14,064 | 0.027 | 0.061 | 0 | 0 | 0 |

| CSR_5 | 14,064 | 0.048 | 0.046 | 0.024 | 0.042 | 0.069 |

| PB1 | 14,064 | 0.054 | 0.080 | 0 | 0 | 0.099 |

| PB2 | 14,064 | 0.775 | 0.471 | 0.693 | 0.693 | 1.099 |

| LEV | 14,064 | 0.454 | 0.220 | 0.278 | 0.449 | 0.622 |

| SIZE | 14,064 | 22.06 | 1.298 | 21.15 | 21.89 | 22.80 |

| ROA | 14,064 | 0.037 | 0.053 | 0.012 | 0.033 | 0.062 |

| AGE | 14,064 | 11.05 | 6.469 | 5 | 11 | 17 |

| GROWTH | 14,064 | 0.525 | 1.753 | −0.037 | 0.132 | 0.422 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| CSR_Score | 1 | ||||||||

| CSR_Level | 0.918 | 1 | |||||||

| PB1 | −0.039 | −0.033 | 1 | ||||||

| PB2 | −0.067 | −0.083 | 0.376 | 1 | |||||

| LEV | −0.005 | −0.059 | 0.046 | 0.244 | 1 | ||||

| SIZE | 0.389 | 0.345 | 0.041 | 0.196 | 0.470 | 1 | |||

| ROA | 0.375 | 0.224 | 0.039 | −0.104 | −0.405 | −0.010 | 1 | ||

| AGE | 0.019 | 0.048 | 0.097 | 0.443 | 0.385 | 0.248 | −0.193 | 1 | |

| GROWTH | −0.007 | −0.024 | −0.014 | 0.056 | 0.0861 | −0.002 | 0.007 | 0.118 | 1 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | CSR_Score | CSR_Score | CSR_Level | CSR_Level |

| PB1 | −0.0218 ** | −0.0380 *** | ||

| (−2.36) | (−2.58) | |||

| PB2 | −0.0120 *** | −0.0542 *** | ||

| (−4.04) | −(4.48) | |||

| LEV | −0.0859 *** | −0.0867 *** | −0.2107 *** | −0.2157 *** |

| (−10.71) | (−10.83) | (−6.53) | (−6.68) | |

| SIZE | 0.0602 *** | 0.0598 *** | 0.1964 *** | 0.1947 *** |

| (49.18) | (48.79) | (39.87) | (39.44) | |

| ROA | 1.1887 *** | 1.1933 *** | 2.6554 *** | 2.6682 *** |

| (42.79) | (43.05) | (23.74) | (23.91) | |

| AGE | 0.0005 ** | 0.0001 | 0.0053 *** | 0.0037 *** |

| (2.07) | (0.56) | (5.60) | (3.67) | |

| GROWTH | −0.0021 *** | −0.0021 *** | −0.0073 ** | −0.0074 ** |

| (−2.66) | (−2.71) | (−2.29) | (−2.32) | |

| Constant | −1.0566 *** | −1.0536 *** | −1.9805 *** | −1.9657 *** |

| (−39.68) | (−39.57) | (−18.47) | (−18.34) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Adj.R2 | 0.3400 | 0.3408 | 0.2151 | 0.2162 |

| Observations | 14,064 | 14,064 | 14,064 | 14,064 |

| High CSR | Low CSR | |||

|---|---|---|---|---|

| Variable | (1) | (2) | (3) | (4) |

| PB1 | 0.0023 | 0.0114 ** | ||

| (0.31) | (1.99) | |||

| PB2 | −0.0015 | 0.0032 ** | ||

| (−1.01) | (2.45) | |||

| LEV | 0.0187 *** | 0.0190 *** | 0.0128 *** | 0.0129 *** |

| (4.00) | (4.06) | (4.17) | (4.22) | |

| SIZE | −0.0030 *** | −0.0030 *** | 0.0001 | 0.0002 |

| (−4.81) | (−4.76) | (0.24) | (0.34) | |

| ROA | 0.0556 *** | 0.0560 *** | 0.1061 *** | 0.1041 *** |

| (3.57) | (3.61) | (9.27) | (9.10) | |

| AGE | −0.0009 *** | −0.0009 *** | −0.0008 *** | −0.0008 *** |

| (−7.93) | (−7.15) | (−8.74) | (−7.37) | |

| GROWTH | 0.0027 *** | 0.0027 *** | 0.0019 *** | 0.0019 *** |

| (6.41) | (6.40) | (6.03) | (6.10) | |

| Constant | 0.0560 *** | 0.0562 *** | −0.0072 | −0.0074 |

| (4.10) | (4.11) | (−0.61) | (−0.63) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Adj.R2 | 0.0820 | 0.0852 | 0.0953 | 0.0977 |

| Observations | 4975 | 4975 | 9089 | 9089 |

| High CSR | Low CSR | |||

|---|---|---|---|---|

| Variable | (1) | (2) | (3) | (4) |

| PB1 | −0.0033 | 0.0068 ** | ||

| (−0.82) | (2.40) | |||

| PB2 | −0.0011 | 0.0029 ** | ||

| (−1.38) | (2.04) | |||

| LEV | 0.0169 *** | 0.0169 *** | 0.0352 *** | 0.0352 *** |

| (6.85) | (6.87) | (16.26) | (16.25) | |

| SIZE | −0.0012 *** | −0.0012 *** | −0.0057 *** | −0.0057 *** |

| (−3.65) | (−3.57) | (−14.83) | (−14.80) | |

| ROA | 0.0088 | 0.0084 | 0.0013 | 0.0004 |

| (1.07) | (1.03) | (0.16) | (0.05) | |

| AGE | 0.0002 *** | 0.0002 *** | 0.0003 *** | 0.0004 *** |

| (3.59) | (3.77) | (5.01) | (4.96) | |

| GROWTH | 0.0007 *** | 0.0007 *** | 0.0001 | 0.0001 |

| (3.13) | (3.13) | (0.62) | (0.66) | |

| Constant | 0.0310 *** | 0.0308 *** | 0.1269 *** | 0.1270 *** |

| (4.30) | (4.28) | (15.36) | (15.38) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Adj.R2 | 0.0792 | 0.0794 | 0.0875 | 0.0874 |

| Observations | 4975 | 4975 | 9089 | 9089 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | CSR_Score | CSR_Score | CSR_Level | CSR_Level |

| PB1 | −0.0231 ** | −0.0337 ** | ||

| (−2.40) | (−2.51) | |||

| Law | 0.0006 | 0.0007 | 0.0003 | −0.0002 |

| (1.10) | (1.16) | (−0.22) | (−0.16) | |

| PB1 × Law | −0.0152 ** | −0.0305 *** | ||

| (−2.21) | (−2.68) | |||

| PB2 | −0.0131 *** | −0.0567 *** | ||

| (−4.22) | (−4.55) | |||

| PB2× Law | −0.0522 ** | −0.0226 ** | ||

| (−1.99) | (−2.31) | |||

| LEV | −0.0846 *** | −0.0855 *** | −0.2112 *** | −0.2160 *** |

| (−10.53) | (−10.64) | (−6.53) | (−6.68) | |

| SIZE | 0.0600 *** | 0.0597 *** | 0.1965 *** | 0.1948 *** |

| (49.00) | (48.59) | (39.82) | (39.39) | |

| ROA | 1.1854 *** | 1.1898 *** | 2.6568 *** | 2.6692 *** |

| (42.61) | (42.86) | (23.71) | (23.88) | |

| AGE | 0.0006 ** | 0.0002 | 0.0053 *** | 0.0037 *** |

| (2.35) | (0.85) | (5.51) | (3.62) | |

| GROWTH | −0.0020 *** | −0.0021 *** | −0.0073 ** | −0.0074 ** |

| (−2.59) | (−2.63) | (−2.29) | (−2.33) | |

| Constant | −1.0566 *** | −1.0535 *** | −1.9805 *** | −1.9657 *** |

| (−39.69) | (−39.58) | (−18.47) | (−18.34) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Adj.R2 | 0.3402 | 0.3409 | 0.2150 | 0.2162 |

| Observations | 14,064 | 14,064 | 14,064 | 14,064 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | CSR_Score | CSR_Score | CSR_Level | CSR_Level |

| PB1 | −0.0416 ** | −0.0918 * | ||

| (−2.00) | (−1.90) | |||

| UM | −0.0145 | −0.0208 | −0.0608 | −0.0858 |

| (−1.44) | (−1.07) | (−1.01) | (−1.17) | |

| PB1 × UM | −0.0456 ** | −0.1423 ** | ||

| (−1.97) | (−2.05) | |||

| PB2 | −0.0178 *** | −0.0750 *** | ||

| (−2.77) | (−3.00) | |||

| PB2 × UM | −0.0106 *** | −0.0387 ** | ||

| (−3.84) | (−2.27) | |||

| LEV | −0.0850 *** | −0.0858 *** | −0.2068 *** | −0.2114 *** |

| (−10.61) | (−10.71) | (−6.41) | (−6.56) | |

| SIZE | 0.0597 *** | 0.0594 *** | 0.1944 *** | 0.1926 *** |

| (48.66) | (48.23) | (39.34) | (38.88) | |

| ROA | 1.1867 *** | 1.1928 *** | 2.6461 *** | 2.6648 *** |

| (42.74) | (43.04) | (23.67) | (23.89) | |

| AGE | 0.0006 ** | 0.0002 | 0.0058 *** | 0.0042 *** |

| (2.58) | (1.00) | (6.14) | (4.14) | |

| GROWTH | −0.0021 *** | −0.0021 *** | −0.0072 ** | −0.0073 ** |

| (−2.63) | (−2.68) | (−2.25) | (−2.29) | |

| Constant | −1.0556 *** | −1.0557 *** | −1.9747 *** | −1.9718 *** |

| (−39.65) | (−39.50) | (−18.42) | (−18.33) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Adj.R2 | 0.3409 | 0.3419 | 0.2163 | 0.2178 |

| Observations | 14,064 | 14,064 | 14,064 | 14,064 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| First PB1 | Second CSR_Score | First PB2 | Second CSR_Score | |

| Mean PB1 | 1.0409 *** | |||

| (0.0000) | ||||

| PB1 | −0.0318 ** | |||

| (0.0316) | ||||

| Mean PB2 | 0.2259 *** | |||

| (0.0000) | ||||

| PB2 | −0.0173 *** | |||

| (0.0000) | ||||

| LEV | 0.0137 *** | −0.0389 *** | 0.0805 *** | −0.0405 *** |

| (0.0006) | (0.0000) | (0.0002) | (0.0000) | |

| SIZE | 0.0017 *** | 0.0550 *** | 0.0290 *** | 0.0546 *** |

| (0.0040) | (0.0000) | (0.0000) | (0.0000) | |

| ROA | 0.0971 *** | 1.2992 *** | −0.1571 ** | 1.3036 *** |

| (0.0000) | (0.0000) | (0.0366) | (0.0000) | |

| AGE | 0.0011 *** | 0.0003 | 0.0284 *** | −0.0002 |

| (0.0000) | (0.2622) | (0.0000) | (0.3968) | |

| GROWTH | −0.0010 *** | −0.0003 | −0.0006 | −0.0004 |

| (0.0068) | (0.6866) | (0.7699) | (0.6339) | |

| Constant | −0.0635 *** | −0.9807 *** | −0.3596 *** | −0.9773 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Observations | 14,064 | 14,064 | 14,064 | 14,064 |

| R−squared | 0.1872 | 0.2847 | 0.2086 | 0.2860 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | CSR_Score | CSR_Score | CSR_Level | CSR_Level |

| PB1 | −0.0057 *** | −0.0031 ** | ||

| (−2.65) | (−2.01) | |||

| PB2 | −0.0051 *** | −0.0047 ** | ||

| (−5.01) | (2.40) | |||

| LEV | −0.0172 *** | −0.0176 *** | −0.0170 *** | −0.0175 *** |

| (−6.54) | (−6.70) | (−4.01) | (−4.11) | |

| SIZE | 0.0146 *** | 0.0145 *** | 0.0171 *** | 0.0169 *** |

| (36.43) | (36.00) | (22.48) | (22.34) | |

| ROA | 0.0692 *** | 0.0706 *** | 0.0419 *** | 0.0427 *** |

| (7.58) | (7.76) | (3.16) | (3.21) | |

| AGE | 0.0005 *** | 0.0004 *** | 0.0005 *** | 0.0004 *** |

| (7.11) | (4.97) | (3.63) | (2.63) | |

| GROWTH | −0.0007 *** | −0.0007 *** | −0.0007 *** | −0.0007 *** |

| (−2.74) | (−2.79) | (−2.72) | (−2.75) | |

| Constant | −0.2727 *** | −0.2715 *** | −0.3288 *** | −0.3275 *** |

| (−31.21) | (−31.08) | (−19.74) | (−19.71) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Adj.R2 | 0.1581 | 0.1595 | 0.1708 | 0.1718 |

| Observations | 14,064 | 14,064 | 14,064 | 14,064 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Q.; Ge, G.; Ning, C.; Tao, X.; Sun, Y. Do Private Benefits of Control Affect Corporate Social Responsibility? Evidence from China. Sustainability 2018, 10, 3309. https://doi.org/10.3390/su10093309

Liu Q, Ge G, Ning C, Tao X, Sun Y. Do Private Benefits of Control Affect Corporate Social Responsibility? Evidence from China. Sustainability. 2018; 10(9):3309. https://doi.org/10.3390/su10093309

Chicago/Turabian StyleLiu, Qiang, Guoqing Ge, Chong Ning, Xiaobo Tao, and Yongbo Sun. 2018. "Do Private Benefits of Control Affect Corporate Social Responsibility? Evidence from China" Sustainability 10, no. 9: 3309. https://doi.org/10.3390/su10093309

APA StyleLiu, Q., Ge, G., Ning, C., Tao, X., & Sun, Y. (2018). Do Private Benefits of Control Affect Corporate Social Responsibility? Evidence from China. Sustainability, 10(9), 3309. https://doi.org/10.3390/su10093309