“One Belt, One Road” Initiative to Stimulate Trade in China: A Counter-Factual Analysis

Abstract

1. Introduction

1.1. Literature Review

1.2. Institutional Background

2. Research Model

2.1. The HCW’s Factor Model Approach

2.2. Control Variable Selection by Elastic-Net

3. The Treatment Effects of the OBOR Initiative in China

3.1. Data

3.2. Control Group Selection and Treatment Effects Estimation

3.3. Robustness Check

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Aoyama, R. “One Belt, One Road”: Chin’s New Global Strategy. J. Contemp. East Asia Stud. 2016, 5, 3–22. [Google Scholar] [CrossRef]

- Hsiao, C.; Ching, H.S.; Wan, S.K. A Panel Data Approach for Program Evaluation: Measuring the Benefits of Political and Economic Integration of Hongkong with Mainland China. J. Appl. Econom. 2012, 27, 705–740. [Google Scholar] [CrossRef]

- Zou, H.; Hastie, T. Regularization and Variable Selection via the Elastic Net. J. R. Stat. Soc. Ser. B Stat. Methodol. 2005, 67, 301–320. [Google Scholar] [CrossRef]

- Grossman, G.M.; Helpman, E. Trade, Innovation, and Growth. Am. Econ. Rev. 1990, 80, 86–91. [Google Scholar]

- Edwards, S. Openness, Trade Liberalization, and Growth in Developing Countries. J. Econ. Lit. 1993, 31, 1358–1393. [Google Scholar]

- Nannicini, T.; Billmeier, A. Economies in Transition: How Important Is Trade Openness for Growth? Oxf. Bull. Econ. Stat. 2011, 73, 287–314. [Google Scholar] [CrossRef]

- Madsen, J.B. Trade Barriers, Openness, and Economic Growth. South. Econ. J. 2009, 76, 397–418. [Google Scholar] [CrossRef]

- Sarkar, P. Trade Openness and Growth: Is There Any Link? J. Econ. Issues 2008, 42, 763–785. [Google Scholar] [CrossRef]

- Ju, J.; Wu, Y.I.; Zeng, L.I. The Impact of Trade Liberalization on the Trade Balance in Developing Countries. IMF Staff Pap. 2010, 57, 427–449. [Google Scholar] [CrossRef]

- Santos-Paulino, A.; Thirlwall, A.P. The impact of trade liberalisation on exports, imports and the balance of payments of developing countries. Econ. J. 2004, 114, F50–F72. [Google Scholar] [CrossRef]

- Berggren, N.; Jordahl, H. Does Free Trade Really Reduce Growth? Further Testing Using the Economic Freedom Index. Public Choice 2005, 122, 99–114. [Google Scholar] [CrossRef]

- Kashia, A. Alexander Del Mar: Free Trade and the Chinese Question. South. Calif. Q. 2012, 94, 304–345. [Google Scholar]

- Lu, Y.; Yu, L. Trade Liberalization and Markup Dispersion: Evidence from China’s WTO Accession. Am. Econ. J. Appl. Econ. 2015, 7, 221–253. [Google Scholar] [CrossRef]

- Du, Z.; Zhang, L. Home-purchase restriction, property tax and housing price in China: A counterfactual analysis. J. Econom. 2015, 188, 558–568. [Google Scholar] [CrossRef]

- Ouyang, M.; Peng, Y. The treatment-effect estimation: A case study of the 2008 economic stimulus package of China. J. Econom. 2015, 188, 545–557. [Google Scholar] [CrossRef]

- Abadie, A.; Diamond, A.; Hainmueller, J. Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California’s Tobacco Control Program. J. Am. Stat. Assoc. 2010, 105, 493–505. [Google Scholar] [CrossRef]

- Abadie, A.; Gardeazabal, J. The Economic Costs of Conflict: A Case Study of the Basque Country. Am. Econ. Rev. 2003, 93, 113–132. [Google Scholar] [CrossRef]

- Billmeier, A.; Nannicini, T. Assessing Economic Liberalization Episodes: A Synthetic Control Approach. Rev. Econ. Stat. 2013, 95, 983–1001. [Google Scholar] [CrossRef]

- Bove, V.; Eliay, L.; Smith, R.P. The Relationship between Panel and Synthetic Control Estimators of the Effect of Civil War; BCAM Working Paper 1406; Birkbeck Centre for Applied Macroeconomics: London, UK, 2014. [Google Scholar]

- Munasib, A.; Rickman, D. Regional economic impacts of the shale gas and tight oil boom: A synthetic control analysis. Reg. Sci. Urban Econ. 2015, 50, 1–17. [Google Scholar] [CrossRef]

- Dollar, D. China’s rise as a regional and global power. J. Int. Relat. Sustain. Dev. 2015, 1, 12–14. [Google Scholar]

- Swaine, M.D. Chinese Views and Commentary on the “One Belt, One Road” Initiative. China Leadersh. Monit. 2015, 2, 3. [Google Scholar]

- Nalbantoglu, C. One Belt One Road Initiative: New Route on China’s Change of Course to Growth. Open J. Soc. Sci. 2017, 5, 87–99. [Google Scholar] [CrossRef]

- Li, K.T.; Bell, D.R. Estimation of average treatment effects with panel data: Asymptotic theory and implementation. J. Econom. 2017, 197, 65–75. [Google Scholar] [CrossRef]

- Bai, J. Inferential Theory for Factor Models of Large Dimensions. Econometrica 2010, 71, 135–171. [Google Scholar] [CrossRef]

- Akaike, H. A new look at the statistical model identification. IEEE Trans. Autom. Control 1974, 19, 716–723. [Google Scholar] [CrossRef]

- Akaike, H. Factor analysis and AIC. Psychometrika 1987, 52, 317–332. [Google Scholar] [CrossRef]

- Hurvich, C.M.; Tsai, C. Regression and time series model selection in small samples. Biometrika 1989, 76, 297–307. [Google Scholar] [CrossRef]

- Hoerl, A.E.; Kennard, R.W. Ridge Regression: Biased Estimation for Nonorthogonal Problems. Technometrics 2000, 42, 80–86. [Google Scholar] [CrossRef]

- Zou, H.; Zhang, H.H. On the Adaptive Elastic-Net with a diverging number of Parameters. Ann. Stat. 2009, 37, 1733–1751. [Google Scholar] [CrossRef] [PubMed]

- Tibshirani, R. Regression shrinkage and selection via the lasso: A retrospective. J. R. Stat. Soc. Ser. B Stat. Methodol. 2011, 73, 273–282. [Google Scholar] [CrossRef]

| Columbia | 3.829 | Georgia | −62.651 | Israel | 7.701 |

| (0.46) | (−1.60) | (1.30) | |||

| UK | −0.434 | Holland | 1.120 | Bolivia | −13.586 |

| (−0.91) | (0.42) | (−0.84) | |||

| Romania | −4.055 | Ecuador | −12.681 * | Czech Republic | −9.067 |

| (−0.58) | (−1.91) | (−1.73) | |||

| Swiss | −0.081 | Nigeria | −0.248 | Iceland | −55.579 * |

| (−0.04) | (−0.41) | (−2.09) | |||

| Egypt | −8.956 ** | Finland | 2.419 | Bulgaria | 8.828 |

| (−2.44) | (0.55) | (0.96) | |||

| Romania | −4.055 | Chile | 1.774 | Sweden | 3.177 |

| (−0.58) | (0.69) | (0.75) | |||

| Swiss | −0.081 | Egypt | −8.956 ** | Ivory Coast | 11.379 |

| (−0.04) | (−2.44) | (1.49) | |||

| Austria | −7.988 | France | −0.229 | ||

| (−1.46) | (−0.18) | ||||

| Intercept | −36.761 | ||||

| (−1.18) | |||||

| T 44 | |||||

| F(36,7) | 22.71 | ||||

| r2 | 0.9915 | ||||

| Adj_r2 | 0.9478 | ||||

| Time | China | Counterfactuals |

|---|---|---|

| 2003q4 | 16 | 10 |

| 2004q4 | 28 | 28 |

| 2005q4 | 34 | 34 |

| 2006q4 | 68 | 69 |

| 2007q4 | 76 | 77 |

| 2008q4 | 114 | 114 |

| 2009q4 | 62 | 64 |

| 2010q4 | 63 | 61 |

| 2011q4 | 48 | 48 |

| 2012q4 | 83 | 84 |

| 2013q4 | 91 | 89 |

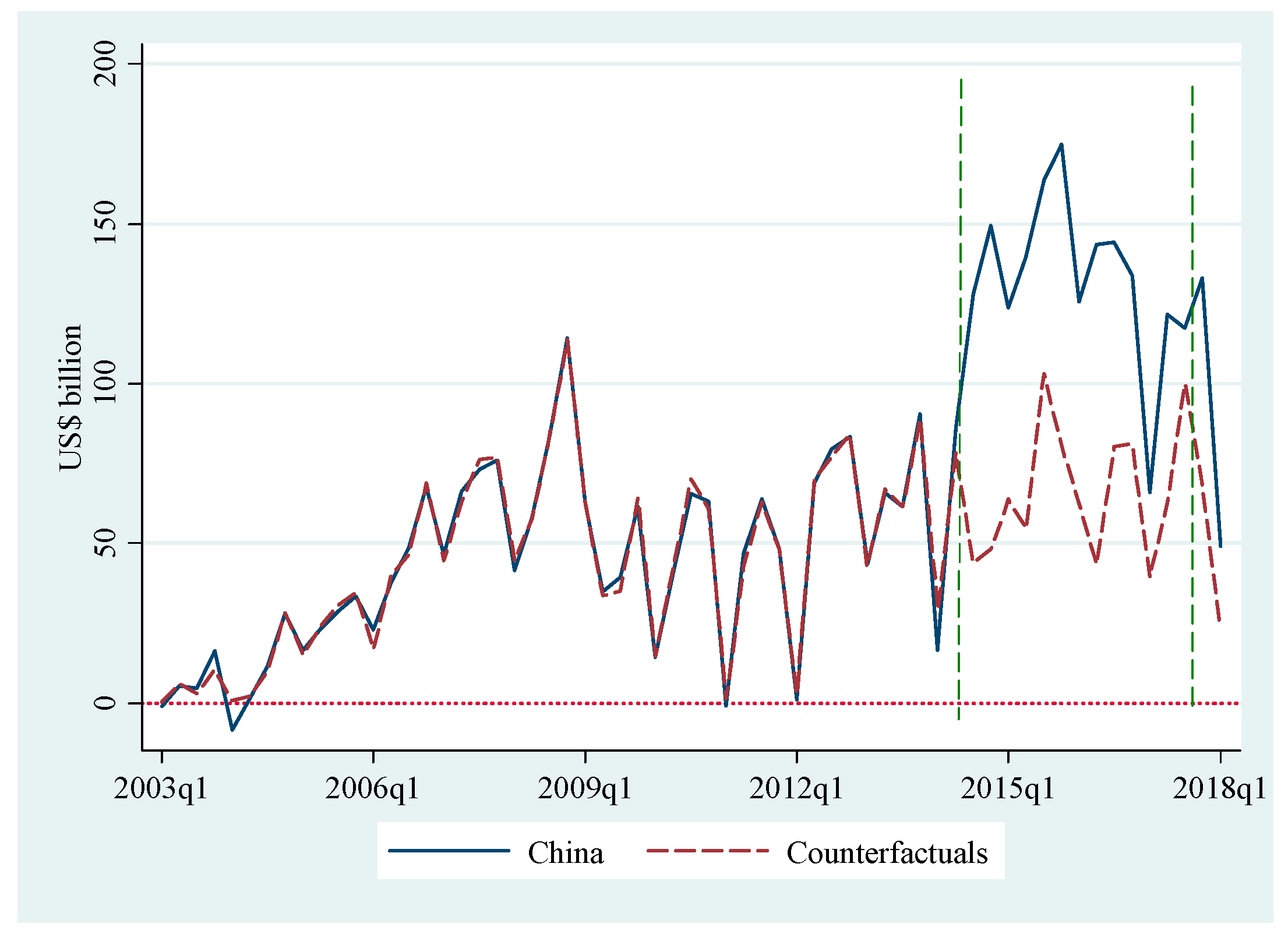

| Time | China | Counterfactual | Treatment |

|---|---|---|---|

| 2014q1 | 17 | 29 | −12 |

| 2014q2 | 86 | 79 | 7.3 |

| 2014q3 | 128 | 44 | 84 |

| 2014q4 | 149 | 48 | 101 |

| 2015q1 | 124 | 64 | 60 |

| 2015q2 | 140 | 55 | 85 |

| 2015q3 | 164 | 103 | 60 |

| 2015q4 | 175 | 81 | 94 |

| 2016q1 | 126 | 62 | 63 |

| 2016q2 | 143 | 44 | 100 |

| 2016q3 | 144 | 80 | 64 |

| 2016q4 | 134 | 81 | 53 |

| 2017q1 | 66 | 39 | 27 |

| 2017q2 | 122 | 63 | 59 |

| 2017q3 | 117 | 100 | 17 |

| 2017q4 | 133 | 68 | 65 |

| 2018q1 | 49 | 23 | 26 |

| Luxemburg | −0.105 | Uruguay | −0.302 | Ecuador | −0.552 |

| (−0.54) | (−1.66) | (−1.95) | |||

| Bolivia | 0.571 ** | Finland | 0.457 | Romania | −0.492 |

| (2.62) | (1.57) | (−1.47) | |||

| Austria | 2.322 *** | Azerbaijan | 0.026 | Turkey | 0.530 ** |

| (4.81) | (1.94) | (2.73) | |||

| Hungary | 0.449 | Swiss | −0.192 | Georgia | 0.126 * |

| (1.70) | (−1.23) | (2.38) | |||

| Jordan | −0.148 | Bulgaria | −0.734 ** | India | 0.061 |

| (−0.60) | (−2.91) | (0.26) | |||

| Lebanon | −0.050 | Nigeria | 0.242 ** | France | −2.127 |

| (−0.71) | (2.74) | (−1.16) | |||

| Chile | 0.357 * | Malta | 0.177 | Estonia | −0.320 * |

| (2.31) | (1.39) | (−2.56) | |||

| Iceland | −0.142 | Russia | 0.202 | Peru | 0.360 |

| (−1.39) | (0.85) | (1.86) | |||

| Egypt | −0.396 *** | Sri Lanka | 0.066 | UK | 0.695 ** |

| (−4.60) | (0.39) | (3.47) | |||

| Tunisia | 0.174 | Norway | 0.171 | Portugal | −1.303 ** |

| (0.63) | (0.73) | (−3.79) | |||

| Intercept | 7.401 | ||||

| (1.25) | |||||

| T | 36 | ||||

| F(30,5) | 46.24 | ||||

| r2 | 0.996 | ||||

| Adj_r2 | 0.9749 |

| Time | China | Counterfactual |

|---|---|---|

| 2005q4 | 22 | 23.34 |

| 2006q4 | 29 | 30.05 |

| 2007q4 | 22 | 22.32 |

| 2008q4 | 4.7 | 5.37 |

| 2009q4 | 2.2 | 3.63 |

| 2010q4 | 24 | 25.39 |

| 2011q4 | 13 | 12.28 |

| 2012q4 | 11 | 10.82 |

| 2013q4 | 6.7 | 7.16 |

| Time | China | Counterfactual | Treatment |

|---|---|---|---|

| 2014q1 | −0.73 | 26.95 | −27 |

| 2014q2 | 6 | 8.81 | −3.4 |

| 2014q3 | 6.6 | 8.11 | −0.66 |

| 2014q4 | 8.6 | −3.40 | 20 |

| 2015q1 | −0.73 | −33.26 | 42 |

| 2015q2 | −2.1 | −32.04 | 46 |

| 2015q3 | −4.5 | −11.81 | 19 |

| 2015q4 | −4.3 | −7.12 | 13 |

| 2016q1 | −7 | −6.87 | 8.3 |

| 2016q2 | −3 | 1.43 | −2.3 |

| 2016q3 | −4.9 | −16.73 | 16 |

| 2016q4 | −4.9 | −12.14 | 13 |

| 2017q1 | 10 | 29.76 | −25 |

| 2017q2 | 8.9 | 34.40 | −23 |

| 2017q3 | 6.2 | 44.88 | −35 |

| 2017q4 | 11 | 36.62 | −27 |

| 2018q1 | 11 | 29.66 | −20 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, S.-C.; Hou, J.; Xiao, D. “One Belt, One Road” Initiative to Stimulate Trade in China: A Counter-Factual Analysis. Sustainability 2018, 10, 3242. https://doi.org/10.3390/su10093242

Chen S-C, Hou J, Xiao D. “One Belt, One Road” Initiative to Stimulate Trade in China: A Counter-Factual Analysis. Sustainability. 2018; 10(9):3242. https://doi.org/10.3390/su10093242

Chicago/Turabian StyleChen, Shih-Chih, Jianing Hou, and De Xiao. 2018. "“One Belt, One Road” Initiative to Stimulate Trade in China: A Counter-Factual Analysis" Sustainability 10, no. 9: 3242. https://doi.org/10.3390/su10093242

APA StyleChen, S.-C., Hou, J., & Xiao, D. (2018). “One Belt, One Road” Initiative to Stimulate Trade in China: A Counter-Factual Analysis. Sustainability, 10(9), 3242. https://doi.org/10.3390/su10093242