Environmental Proactivity and Firms’ Performance: Mediation Effect of Competitive Advantages in Spanish Wineries

Abstract

1. Introduction

2. Theoretical Approach

3. Materials and Methods

3.1. Data Collection and Sample

3.2. Measures

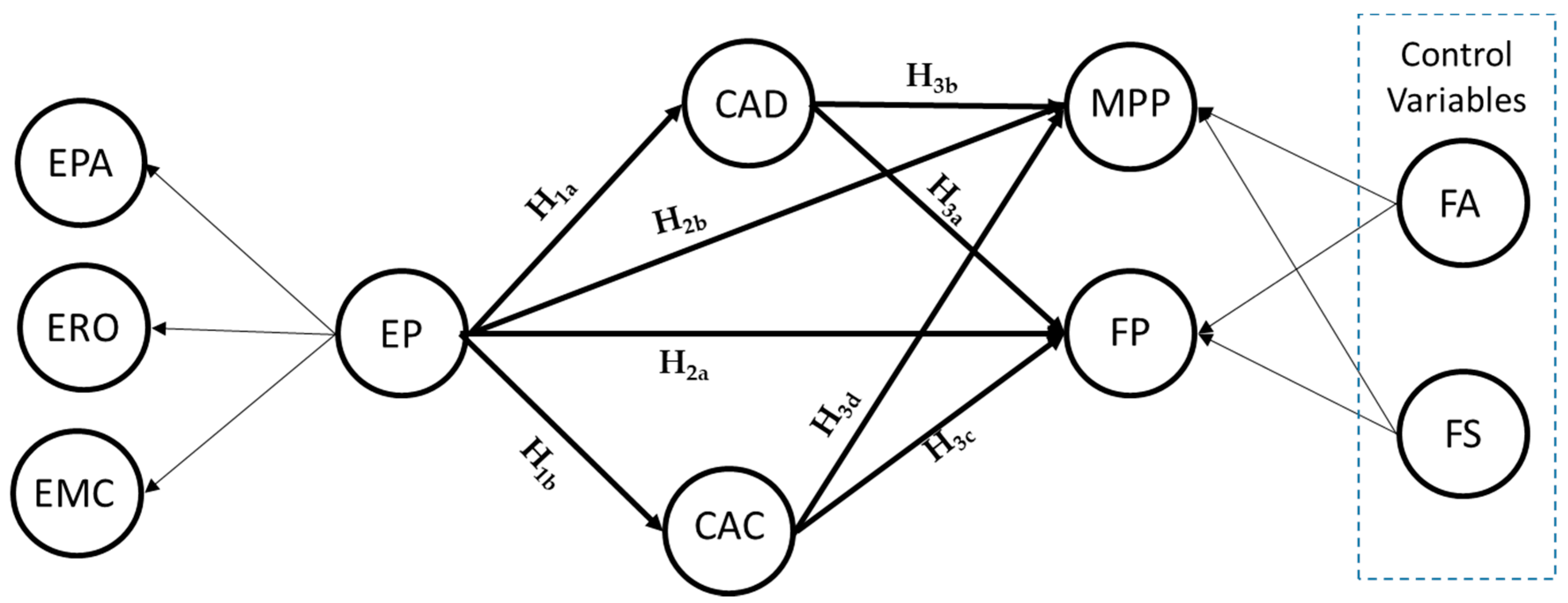

3.2.1. Environmental Proactivity

- Environmental planning and analysis (EPA): this dimension comprises five items which evaluate the integration level of environmental concerns in the winery’s strategic planning process.

- Environmental responsibility and organization (ERO): this dimension comprises three items and reflects the importance placed by the winery on the environment and the communication of environmental values to its members.

- Environmental management control (EMC): this dimension comprises four items relating to feature rules, standard operating procedures and result controls.

3.2.2. Competitive Advantage

3.2.3. Company Performance

- Manager’s Perception of Performance (MPP): A subjective measurement has been obtained by asking the winery managers to assess the effect that implemented environmental practices have had on four items in terms of an increase in turnover, exports, and long-term and short-term profits following the proposal by Sellers-Rubio [83] and Sambasivan et al. [45].

3.2.4. Control Variables

4. Results

4.1. Measurement Model

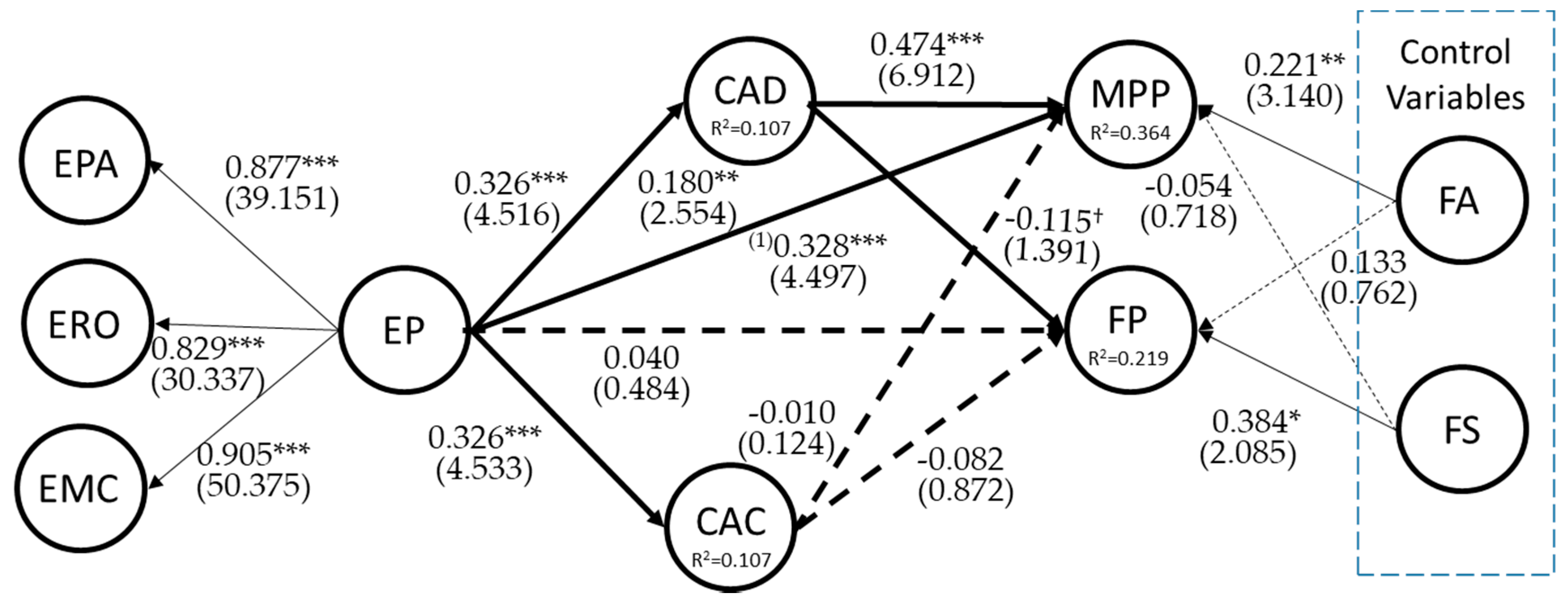

4.2. Structural Model

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Constructs | Related Variables | Sources |

|---|---|---|

| Environmental Proactivity (EP): | ||

| Environmental Planning & Analysis (EPA) | EPA1: This winery has a clearly-defined, formal, written environmental policy. EPA2: Our strategic plan includes an extensive, detailed section outlining our environmental objectives. EPA3: We constantly identify and evaluate new environmental aspects in terms of their impact. EPA4: We provide our suppliers with a detailed, written list of environmental requirements. EPA5: We have conducted a life-cycle analysis of the main products manufactured by this company 1. | [2,49,69,81] [2,27,69] [2,69] [2,69] [69,81] |

| Environmental Responsibility & Organization (ERO) | ERO1: Everyone in the winery is responsible for environmental performance 1. ERO2: Employee suggestions are an excellent source of ideas for improving the environmental result. ERO3: Formal work teams are used to identify environmental problems and opportunities and to develop solutions. | [2,69] [49,69] [69,105] |

| Environmental Management Control (EMC) | EMC1: The environmental impact of operations is formally reviewed at least once a year. EMC2: Formal procedures exist to examine the environmental implications of new investments. EMC3: An annual audit of waste reduction programs and their results is conducted in all production areas. EMC4: An annual audit of the environmental risks of existing production processes is conducted in all production areas. | [2,69] [69,106] [2,69] [69,105] |

| Differentiation-based Competitive Advantage (CAD) | CAD1: Loyalty of existing customers CAD2: Attracting new customers CAD3: Product image CAD4: Corporate image | [27,49] [49] [49] [2,49,107] |

| Cost-based Competitive Advantage (CAC) | CAC1: Water consumption CAC2: Energy consumption 1 CAC3 Raw material consumption | [27,81,108] [49,81] [2,27,81] |

| Manager’s Perception of Performance (MPP) | MPP1: Sales volume MPP2: Volume of exports MPP3: Long-term benefits 1 MPP4: Short-term benefits 1 | [69,81] [69] [53,69] [69] |

| Financial Performance (FP) | FP1: Return on assets (ROA) FP2: Return on equity (ROE) FP3: Value-added | [2,82,109] [43,81] [82] |

| Firm’s Age (FA) | FA1: Age of winery | [69,71] |

| Firm’s Size (FS) | FS1: Number of employees FS2: Turnover | [2,49,82] [2,81] |

References

- Cramer, J. Environmental management: From ‘fit’ to ‘stretch’. Bus. Strategy Environ. 1998, 7, 162–172. [Google Scholar] [CrossRef]

- González-Benito, J.; González-Benito, O. Environmental proactivity and business performance: An empirical analysis. Omega 2005, 33, 1–15. [Google Scholar] [CrossRef]

- González-Benito, J.; González-Benito, O. A review of determinant factors of environmental proactivity. Bus. Strategy Environ. 2006, 15, 87–102. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Brockhoff, K.; Chakrabarti, A.K.; Kirchgeorg, M. Corporate Strategies in Environmental Management. Res. Technol. Manag. 1999, 42, 26–30. [Google Scholar] [CrossRef]

- Roy, D. Designing and marketing green products: The Hoover case. In Greener Marketing: A Global Perspective to Greener Marketing Practice; Charter, M., Polonsky, M.J., Eds.; Greenleaf Publishing: Sheffield, UK, 1999; pp. 126–142. [Google Scholar]

- Shrivastava, P. The Role of Corporations in Achieving Ecological Sustainability. Acad. Manag. Rev. 1995, 20, 936–960. [Google Scholar] [CrossRef]

- Stead, W.E.; Stead, J.G. Management for a Small Planet: Strategic Decision Making and the Environment; Sage: Thousand Oaks, CA, USA, 1996. [Google Scholar]

- Gage, J.S. A recipe for disruption. Manag. Rev. 2000, 89, 46. [Google Scholar]

- Thomassin, P.J.; Cloutier, L.M. Informational Requirements and the Regulatory Process of Agricultural Biotechnology. J. Econ. Issues 2001, 35, 323–333. [Google Scholar] [CrossRef]

- Hart, S.L. A Natural-Resource-Based View of the Firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Hart, S.L.; Ahuja, G. Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strategy Environ. 1996, 5, 30–37. [Google Scholar] [CrossRef]

- Christmann, P. Effects of “Best Practices” of Environmental Management on Cost Advantage: The Role of Complementary Assets. Acad. Manag. Rev. 2000, 43, 663–680. [Google Scholar]

- Knight, C. Pollution prevention, technology challenges and competitive advantage in the process industries. Total Qual. Environ. Manag. 1995, 5, 87–92. [Google Scholar] [CrossRef]

- Fiksel, J. Achieving eco-efficiency through design for environment. Total Qual. Environ. Manag. 1996, 5, 47–54. [Google Scholar] [CrossRef]

- Sharma, S.; Vredenburg, H. Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strateg. Manag. J. 1998, 19, 729–753. [Google Scholar] [CrossRef]

- Ellington, R.T.; Sharfman, M.; Meo, M. Dupont, conoco and the biodegradable grease project: Using innovation to turn chemical by-products into a new product. Corp. Environ. Strategy 2000, 7, 62–71. [Google Scholar] [CrossRef]

- Azzone, G.; Noci, G. Seeing ecology and “green” innovations as a source of change. J. Organ. Chang. Manag. 1998, 11, 94–111. [Google Scholar] [CrossRef]

- Brennan, L.; Gupta, S.M.; Taleb, K.N. Operations Planning Issues in an Assembly/Disassembly Environment. Int. J. Oper. Prod. Manag. 1994, 14, 57–67. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Green and competitive: Ending the Stalemate. Harv. Bus. Rev. 1995, 73, 120–134. [Google Scholar]

- Angell, L.C.; Klassen, R.D. Integrating environmental issues into the mainstream: An agenda for research in operations management. J. Oper. Manag. 1999, 17, 575–598. [Google Scholar] [CrossRef]

- Curkovic, S.; Melnyk, S.A.; Handfield, R.B.; Calantone, R. Investigating the linkage between total quality management and environmentally responsible manufacturing. IEEE Trans. Eng. Manag. 2000, 47, 444–464. [Google Scholar] [CrossRef]

- Aggeri, F. Environmental policies and innovation: A knowledge-based perspective on cooperative approaches. Res. Policy 1999, 28, 699–717. [Google Scholar] [CrossRef]

- Checkland, P. Systems Thinking, Systems Practice; Wiley: Chicherter, UK, 1981. [Google Scholar]

- Vickers, G. Human Systems Are Different; Harper Row: London, UK, 1983. [Google Scholar]

- Corbett, C.J.; Van Wassenhove, L.N. The Green Fee: Internalizing and Operationalizing Environmental Issues. Calif. Manag. Rev. 1993, 36, 116–135. [Google Scholar] [CrossRef]

- Banerjee, S.B.; Iyer, E.S.; Kashyap, R.K. Corporate Environmentalism: Antecedents and Influence of Industry Type. J. Mark. 2003, 67, 106–122. [Google Scholar] [CrossRef]

- Nordhaus, W. Invention Growth and Welfare; MIT Press: Cambridge, UK, 1969. [Google Scholar]

- Stoneman, P. Patenting activity: A re-evaluation of the influence of demand pressures. J. Ind. Econ. 1979, 27, 385–401. [Google Scholar] [CrossRef]

- Scherer, F.M. Demand-pull and technological invention: Schmookler revisited. J. Ind. Econ. 1982, 30, 225–237. [Google Scholar] [CrossRef]

- Gort, M.; Wall, R.A. The Evolution of Technologies and Investment in Innovation. Econ. J. 1986, 96, 741–757. [Google Scholar] [CrossRef]

- Narasimhan, R.; Carter, J.R. Environmental Supply Chain Management; Center for Advanced Purchasing Study: Tempe, AZ, USA, 1998. [Google Scholar]

- Junquera, B.; Brío, J.A.D. The role of environmental activity integration into the R&D department to obtain competitive advantage. Int. J. Sustain. Dev. World Ecol. 2012, 19, 210–218. [Google Scholar]

- Rivera, J.; Delmas, M. Business and environmental protection. Human Ecol. Rev. 2004, 11, 230–234. [Google Scholar]

- Walley, N.; Whitehead, B. It’s not easy being green. Harv. Bus. Rev. 1994, 72, 46–52. [Google Scholar]

- Jermier, J.M.; Forbes, L.C.; Benn, S.; Orsato, R.J. The new corporate environmentalism and green politic. In Handbook of Organization Studies; Clegg, S.R., Hardy, C., Lawrence, T.B., Nord, W.R., Eds.; Sage Publications: London, UK, 2006; pp. 618–650. [Google Scholar]

- Aragón-Correa, J.A.; Sharma, S. A Contingent Resource-Based View of Proactive Corporate Environmental Strategy. Acad. Manag. Rev. 2003, 28, 71–88. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A Resource-Based Perspective On Corporate Environmental Performance and Profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar]

- Aragón-Correa, J.A. Strategic Proactivity and Firm Approach to the Natural Environment. Acad. Manag. J. 1998, 41, 556–567. [Google Scholar] [CrossRef]

- Buysse, K.; Verbeke, A. Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 2003, 24, 453–470. [Google Scholar] [CrossRef]

- Jiang, R.J.; Bansal, P. Seeing the Need for ISO 14001. J. Manag. Stud. 2003, 40, 1047–1067. [Google Scholar] [CrossRef]

- Schylander, E.; Martinuzzi, A. ISO 14001—Experiences, effects and future challenges: A national study in Austria. Bus. Strategy Environ. 2007, 16, 133–147. [Google Scholar] [CrossRef]

- Toke, L.K.; Gupta, R.C.; Dandekar, M. An empirical study of green supply chain management in Indian perspective. Int. J. Appl. Sci. Eng. Res. 2012, 1, 372–383. [Google Scholar]

- Chiappetta Jabbour, C.J.; Lopes de Sousa Jabbour, A.B.; Govindan, K.; Alves Teixeira, A.; de Souza Freitas, W.R. Environmental management and operational performance in automotive companies in Brazil: The role of human resource management and lean manufacturing. J. Clean. Prod. 2012, 47. [Google Scholar] [CrossRef]

- Sambasivan, M.; Bah, S.M.; Jo-Ann, H. Making the case for operating “Green”: Impact of environmental proactivity on multiple performance outcomes of Malaysian firms. J. Clean. Prod. 2013, 42, 69–82. [Google Scholar] [CrossRef]

- Elkington, J. Towards the Sustainable Corporation: Win-Win-Win Business Strategies for Sustainable Development. Calif. Manag. Rev. 1994, 36, 90–100. [Google Scholar] [CrossRef]

- Galdeano-Gómez, E.; Céspedes-Lorente, J.; Martínez-Del-Río, J. Environmental performance and spillover effects on productivity: Evidence from horticultural firms. J. Environ. Manag. 2008, 88, 1552–1561. [Google Scholar] [CrossRef] [PubMed]

- Miles, M.P.; Covin, J.G. Environmental Marketing: A Source of Reputational, Competitive, and Financial Advantage. J. Bus. Ethics 2000, 23, 299–311. [Google Scholar] [CrossRef]

- López-Gamero, M.D.; Molina-Azorín, J.F. Environmental Management and Firm Competitiveness: The Joint Analysis of External and Internal Elements. Long Range Plan. 2016, 49, 746–763. [Google Scholar] [CrossRef]

- Ambec, S.; Lanoie, P. Does It Pay to Be Green? A Systematic Overview. Acad. Manag. Perspect. 2008, 22, 45–62. [Google Scholar]

- Dean, T.J.; Brown, R.L. Pollution Regulation as a Barrier to New Firm Entry: Initial Evidence and Implications for Future Research. Acad. Manag. J. 1995, 38, 288–303. [Google Scholar]

- Starik, M.; Marcus, A.A. Introduction to the Special Research Forum on the Management of Organizations in the Natural Environment: A Field Emerging from Multiple Paths, with Many Challenges Ahead. Acad. Manag. J. 2000, 43, 539–547. [Google Scholar]

- Bansal, P.; Roth, K. Why Companies Go Green: A Model of Ecological Responsiveness. Acad. Manag. J. 2000, 43, 717–736. [Google Scholar]

- Walker, K.; Wan, F. The Harm of Symbolic Actions and Green-Washing: Corporate Actions and Communications on Environmental Performance and Their Financial Implications. J. Bus. Ethics 2012, 109, 227–242. [Google Scholar] [CrossRef]

- Izagirre-Olaizola, J.; Fernández-Sainz, A.; Vicente-Molina, M.A. Antecedentes y barreras a la compra de productos ecológicos. Universia Bus. Rev. 2013, 38, 108–127. [Google Scholar]

- Barba-Sánchez, V.; García-Pérez, M.E.; Martínez-Belmonte, M. The wine consumers’ perception of good environmental practices: A study in gourmet shops. In E2KW 2013. Energy Environment Knowledge Week; UCLM: Toledo, Spain, 2013. [Google Scholar]

- Darnall, N.; Henriques, I.; Sadorsky, P. Adopting proactive environmental strategy: The influence of stakeholders and firm size. J. Manag. Stud. 2010, 47, 1072–1094. [Google Scholar] [CrossRef]

- Hill, J. Thinking about a more sustainable business—An Indicators approach. Corp. Environ. Strategy 2001, 8, 30–38. [Google Scholar] [CrossRef]

- Managi, S.; Opaluch, J.J.; Jin, D.; Grigalunas, T.A. Environmental Regulations and Technological Change in the Offshore Oil and Gas Industry. Land Econ. 2005, 81, 303–319. [Google Scholar] [CrossRef]

- Sanderlands, G. 3M find brass in muck. Manag. Decis. 1994, 32, 63–64. [Google Scholar]

- Newman, W.R.; Hanna, M.D. An empirical exploration of the relationship between manufacturing strategy and environmental management: Two complementary models. Int. J. Oper. Prod. Manag. 1996, 16, 69–87. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Bansal, P. From Issues to Actions: The Importance of Individual Concerns and Organizational Values in Responding to Natural Environmental Issues. Organ. Sci. 2003, 14, 510–527. [Google Scholar] [CrossRef]

- Ramus, C.A. Organizational Support for Employees: Encouraging Creative Ideas for Environmental Sustainability. Calif. Manag. Rev. 2001, 43, 85–105. [Google Scholar] [CrossRef]

- Sharma, S. Managerial Interpretations and Organizational Context as Predictors of Corporate Choice of Environmental Strategy. Acad. Manag. J. 2000, 43, 681–697. [Google Scholar]

- Andersson, L.M.; Bateman, T.S. Individual Environmental Initiative: Championing Natural Environmental Issues in U.S. Business Organizations. Acad. Manag. J. 2000, 43, 548–570. [Google Scholar]

- Spanos, Y.E.; Lioukas, S. An examination into the causal logic of rent generation: Contrasting Porte’s competitive strategy framework and the resource-based perspective. Strateg. Manag. J. 2001, 22, 907–934. [Google Scholar] [CrossRef]

- Cámaras de Comercio. Camerdata. Available online: http://www.camerdata.es/index.php (accessed on 18 September 2015).

- Barba-Sánchez, V.; Atienza-Sahuquillo, C. Environmental Proactivity and Environmental and Economic Performance: Evidence from the Winery Sector. Sustainability 2016, 8, 1014. [Google Scholar] [CrossRef]

- Bureau Van Dijk. SABI Database (Sistema de Análisis de Balances Ibéricos). Available online: https://sabi.bvdinfo.com/version-201845/home.serv?product=SabiNeo (accessed on 25 September 2017).

- Feng, T.; Cai, D.; Wang, D.; Zhang, X. Environmental management systems and financial performance: The joint effect of switching cost and competitive intensity. J. Clean. Prod. 2016, 113, 781–791. [Google Scholar] [CrossRef]

- Perelló, S. Metodología de la Investigación Social; Dykinson: Madrid, Spain, 2011. [Google Scholar]

- Hair, J.F.; Hult, T.M.; Ringle, C.M.; Sarstedt, M.A. Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage: Thousand-Oaks, CA, USA, 2014. [Google Scholar]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS 3; SmartPLS GmvH: Boenningstedt, Germany, 2015. [Google Scholar]

- Roldán, J.L.; Sánchez-Franco, M.J. Variance-based structural equation modeling: Guidelines for using partial least squares in information systems research. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems; Mora, M., Gelman, O., Steenkamp, A.L., Raisinghani, M., Eds.; IGI Global: Hershey, PA, USA, 2012; pp. 193–221. [Google Scholar]

- James, L.R.; Mulaik, S.A.; Brett, J.M. A tale of two methods. Organ. Res. Methods 2006, 9, 233–244. [Google Scholar] [CrossRef]

- Nitzl, C.; Roldán, J.L.; Cepeda-Carrión, G. Mediation analysis in partial least squares path modeling: Helping researchers discuss more sophisticated models. Ind. Manag. Data Syst. 2016, 116, 1849–1864. [Google Scholar] [CrossRef]

- Wright, R.T.; Campbell, D.E.; Thatcher, J.B.; Roberts, N. Operationalizing multidimensional constructus in structural equation modeling: Recommendations for IS research. Commun. Assoc. Inf. Syst. 2012, 30, 367–412. [Google Scholar]

- López-Gamero, M.D.; Molina-Azorín, J.F.; Claver-Cortés, E. The whole relationship between environmental variables and firm performance: Competitive advantage and firm resources as mediator variables. J. Environ. Manag. 2009, 90, 3110–3121. [Google Scholar] [CrossRef] [PubMed]

- Atienza-Sahuquillo, C.; Barba-Sánchez, V. Desing of a Measurement Model for Environmental Performance: Application to the Food Sector. Environ. Eng. Manag. J. 2014, 13, 1463–1472. [Google Scholar]

- Sen, P.; Roy, M.; Pal, P. Exploring role of environmental proactivity in financial performance of manufacturing enterprises: A structural modelling approach. J. Clean. Prod. 2015, 108, 583–594. [Google Scholar] [CrossRef]

- Endrikat, J.; Guenther, E.; Hoppe, H. Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. Eur. Manag. J. 2014, 32, 735–751. [Google Scholar] [CrossRef]

- Sellers-Rubio, R. Evaluating the economic performance of Spanish wineries. Int. J. Wine Bus. Res. 2010, 22, 73–84. [Google Scholar] [CrossRef]

- Coad, A.; Holm, J.R.; Krafft, J. Firm age and performance. J. Evolut. Econ. 2018, 28, 1–11. [Google Scholar] [CrossRef]

- Henseler, J. Bridging design and behavioral research with variance-based Structural Equation Modeling. J. Advert. 2017, 46, 178–192. [Google Scholar] [CrossRef]

- Dijkstra, T.; Henseler, J. Consistent and asymptotically normal PLS estimators for linear structural equations. Comput. Stat. Data Anal. 2015, 81, 10–23. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Muhammad, N.; Scrimgeour, F.; Reddy, K.; Abidin, S. The relationship between environmental performance and financial performance in periods of growth and contraction: Evidence from Australian publicly listed companies. J. Clean. Prod. 2015, 102, 324–332. [Google Scholar] [CrossRef]

- Hu, L.-T.; Bentler, P.M. Cutoff Criteria for Fit Indexes in Covariance Structure Analysis: Conventional Criteria versus New Alternatives. Struct. Equ. Model. Interdiscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Garson, G.D. Instrumental Variables and 2SLS Regression; Statistical Associates Publishing: Asheboro, NC, USA, 2018. [Google Scholar]

- Taasoobshizazi, G.; Wang, S. The performance of the SRMR, RMSEA, CFI, and TLI: An examination of sample size, path size, and degrees of freedom. J. Appl. Quant. Methods 2016, 11, 31–39. [Google Scholar]

- Bentler, P.M. On tests and indices for evaluating structural models. Personal. Individ. Differ. 2007, 42, 825–829. [Google Scholar] [CrossRef]

- Wetzels, M.; Odekerken-Schroder, G.; Oppen, C.V. Using PLS path modeling for assessing hierarchical construct models: Guidelines and empirical illustration. MIS Q. 2009, 33, 177–195. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Smith, D.; Reams, R.; Hair, J.F. Partial least squares structural equation modeling (PLS-SEM): A useful tool for family business researchers. J. Fam. Bus. Strategy 2014, 5, 105–115. [Google Scholar] [CrossRef]

- Junquera, B.; Brío, J.A.D. Preventive Command and Control Regulation: A Case Analysis. Sustainability 2016, 8, 99. [Google Scholar] [CrossRef]

- Miniero, G.; Codini, A.; Bonera, M.; Corvi, E.; Bertoli, G. Being green: From attitude to actual consumption. Int. J. Consum. Stud. 2014, 38, 521–528. [Google Scholar] [CrossRef]

- Murillo-Luna, J.L.; Garcés-Ayerbe, C.; Rivera-Torres, P. Barriers to the adoption of proactive environmental strategies. J. Clean. Prod. 2011, 19, 1417–1425. [Google Scholar] [CrossRef]

- Sudbury-Riley, L.; Hofmeister-Toth, A.; Kohlbacher, F. A cross-national study of the ecological worldview of senior consumers. Int. J. Consum. Stud. 2014, 38, 500–509. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Chang, C.-H. Enhance environmental commitments and green intangible assets toward green competitive advantages: An analysis of structural equation modeling (SEM). Qual. Quant. 2013, 47, 529–543. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate Responsibility and Financial Performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Blackburn, R.A.; Hart, M.; Wainwright, T. Small business performance: Business, strategy and owner-manager characteristics. J. Small Bus. Enterp. Dev. 2013, 20, 8–27. [Google Scholar] [CrossRef]

- Song, H.; Zhao, C.; Zeng, J. Can environmental management improve financial performance: An empirical study of A-shares listed companies in China. J. Clean. Prod. 2017, 141, 1051–1056. [Google Scholar] [CrossRef]

- Junquera, B.; Brío, J.A.D.; Fernández, E. The client as co-manufacturer and environmental entrepreneur: A research agenda. Serv. Ind. J. 2008, 28, 1029–1040. [Google Scholar] [CrossRef]

- Junquera, B.; Brío, J.Á.D.; Fernández, E. Clients’ involvement in environmental issues and organizational performance in businesses: An empirical analysis. J. Clean. Prod. 2012, 37, 288–298. [Google Scholar] [CrossRef]

- Bernal-Conesa, J.A.; Nieto, C.N.; Briones-Peñalver, A.J. CSR Strategy in Technology Companies: Its Influence on Performance, Competitiveness and Sustainability. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 96–107. [Google Scholar] [CrossRef]

- Pomarici, E.; Vecchio, R.; Mariani, A. Wineries’ Perception of Sustainability Costs and Benefits: An Exploratory Study in California. Sustainability 2015, 7, 16164–16174. [Google Scholar] [CrossRef]

- Woo, C.; Kim, M.G.; Chung, Y.; Rho, J.J. Suppliers’ communication capability and external green integration for green and finalcial performance in Korean construction industry. J. Clean. Prod. 2016, 112, 483–493. [Google Scholar] [CrossRef]

- Kim, M.; Woo, C.; Rho, J.; Chung, Y. Environmental Capabilities of Suppliers for Green Supply Chain Management in Construction Projects: A Case Study in Korea. Sustainability 2016, 8, 82. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Overell, M.B.; Chapple, L. Environmental Reporting and its Relation to Corporate Environmental Performance. Abacus 2011, 47, 27–60. [Google Scholar] [CrossRef]

| Construct 1 | Cronbach’s Alpha | Dijkstra–Henseler’s Rho | Composite Reliability (CR) | Average Variance Extracted (AVE) |

|---|---|---|---|---|

| Environmental planning and analysis (EPA) | 0.874 | 0.881 | 0.914 | 0.726 |

| Environmental responsibility and organization (ERO) | 0.711 | 0.738 | 0.872 | 0.774 |

| Environmental management control (EMC) | 0.866 | 0.868 | 0.909 | 0.714 |

| Environmental proactivity (EP) 2 | 0.916 | 0.921 | 0.929 | 0.547 |

| Differentiation-based competitive advantage (CAD) | 0.799 | 0.813 | 0.866 | 0.617 |

| Cost-based competitive advantage (CAC) | 0.705 | 0.766 | 0.868 | 0.767 |

| Manager’s perception of performance (MPP) | 0.751 | 0.751 | 0.889 | 0.801 |

| Financial performance (FP) | 0.732 | 0.763 | 0.759 | 0.504 |

| Firm Size (FS) | 0.775 | 0.780 | 0.899 | 0.816 |

| Construct | EPA | ERO | EMC | CAD | CAC | MPP | FP | FS a | FA a |

|---|---|---|---|---|---|---|---|---|---|

| EPA | 0.852 | ||||||||

| ERO | 0.621 | 0.880 | |||||||

| EMC | 0.651 | 0.684 | 0.845 | ||||||

| CAD | 0.228 | 0.313 | 0.318 | 0.785 | |||||

| CAC | 0.259 | 0.247 | 0.325 | 0.294 | 0.876 | ||||

| MPP | 0.326 | 0.317 | 0.261 | 0.542 | 0.203 | 0.895 | |||

| FP | 0.159 | −0.020 | 0.026 | −0.063 | −0.061 | −0.005 | 0.710 | ||

| FS a | 0.263 | 0.176 | 0.166 | 0.133 | 0.080 | 0.146 | 0.430 | 0.903 | |

| FA a | 0.133 | 0.087 | 0.019 | 0.088 | 0.083 | 0.254 | 0.289 | 0.442 | 1.000 |

| R2 | Q2 | Direct Effect | t-Value 1 | Variance Explained | |

|---|---|---|---|---|---|

| CAD | 0.107 | 0.060 | |||

| H1a: EP | 0.326 *** | 4.516 | 10.65% | ||

| CAC | 0.107 | 0.068 | |||

| H1b: EP | 0.326 *** | 4.533 | 10.66% | ||

| MPP | 0.364 | 0.259 | |||

| H2b: EP | 0.180 ** | 2.554 | 6.10% | ||

| H3b: CAD | 0.474 *** | 6.912 | 25.69% | ||

| H3d: CAC | −0.010 | 0.872 | −0.20% | ||

| FA | 0.221 ** | 3.140 | 5.61% | ||

| FS | −0.054 | 0.718 | −0.79% | ||

| FP | 0.219 | 0.041 | |||

| H2a: EP | 0.040 | 0.484 | 0.28% | ||

| H3a: CAD | −0.115 † | 1.391 | 0.72% | ||

| H3c: CAC | −0.082 | 0.872 | 0.50% | ||

| FA | 0.133 | 0.762 | 3.84% | ||

| FS | 0.384 * | 2.085 | 16.51% |

| Hypothesis | Total Effect Coefficients (t-Value) 1 | Direct Effect Coefficients (t-Value) 1 | Indirect Effect | |

|---|---|---|---|---|

| Point Estimate | Bootstrap 95% CI | |||

| H2a: EP → FP | −0.025 (0.329) | 0.040 (0.484) | −0.064 * | [−0.130; −0.016] |

| H3a: via CAD | −0.037 | [−0.094; −0.002] | ||

| H3c: via CAC | −0.027 | [−0.084; 0.024] | ||

| H2b: EP → MPP | 0.332 *** (4.595) | 0.180 ** (2.554) | 0.152 ** | [0.076; 0.238] |

| H3b: via CAD | 0.155 *** | [0.091; 0.231] | ||

| H3d: via CAC | −0.003 | [−0.049; 0.039] | ||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Junquera, B.; Barba-Sánchez, V. Environmental Proactivity and Firms’ Performance: Mediation Effect of Competitive Advantages in Spanish Wineries. Sustainability 2018, 10, 2155. https://doi.org/10.3390/su10072155

Junquera B, Barba-Sánchez V. Environmental Proactivity and Firms’ Performance: Mediation Effect of Competitive Advantages in Spanish Wineries. Sustainability. 2018; 10(7):2155. https://doi.org/10.3390/su10072155

Chicago/Turabian StyleJunquera, Beatriz, and Virginia Barba-Sánchez. 2018. "Environmental Proactivity and Firms’ Performance: Mediation Effect of Competitive Advantages in Spanish Wineries" Sustainability 10, no. 7: 2155. https://doi.org/10.3390/su10072155

APA StyleJunquera, B., & Barba-Sánchez, V. (2018). Environmental Proactivity and Firms’ Performance: Mediation Effect of Competitive Advantages in Spanish Wineries. Sustainability, 10(7), 2155. https://doi.org/10.3390/su10072155