1. Introduction

The end of 1990s and the beginning of the 21st century saw a number of corporate accounting scandals across the United States (US) and Europe, such as HealthSouth, Tyco, Enron, Parmalat, WorldCom and Xerox [

1]. These financial crises show the need for effective audit committees (ACs) to ensure high corporate sustainability (CS) [

2]. In response, various financial regulatory bodies imposed new regulations to ensure the presence of independent and financially qualified directors (FQD) in ACs, in particular, the Sarbanes–Oxley Act (SOX) and New York Stock Exchange (NYSE) bound their listed companies to maintain an independent AC with at least one FQD. Financial regulators issue these reforms as an optimal solution to mitigate an agency problem between firms’ management and their stakeholders [

3].

Prior research [

4,

5], indicated that a high quality of reported earnings depends on firms having efficient corporate governance (CG) mechanisms, which divulge the need for effective AC to ensure high CS. Effective ACs are expected to oversee the financial reporting process and restrict any attempt to fabricate those financial reports. Even after the introduction of numerous CG reforms in many developed and developing countries, it is widely accepted that managers can use financial information for their own benefit to commit fraud, which seriously compromises the confidence of shareholders on business affairs [

6]. Therefore, to increase the confidence of shareholders and to avoid the likelihood of intentional earnings management (EM), an effective AC is necessary to ensure high CS [

7].

The past two decades have seen a positive trend in terms of legislative reforms, (both in developed and developing economies) on the issue to strengthen ACs through ensuring the presence of FQDs, e.g., SOX (2002), the Cadbury Report (1992), the Corporations Act Australia (2001), the Code of Corporate Governance (CCG) Pakistan (2012). As a result of these legislations, a significant number of companies are hiring FQDs in their corporate boards. For example, during 2017, companies in the US, Canada, and Belgium had 29%, 36% and 34% of financially qualified non-executive directors on their boards respectively [

8]. Therefore, there is an increasing need to investigate the impact that FQDs has of firms’ financial performance.

Studies on the role of FQDs in CS have usually focused on developed countries [

9,

10], with strong corporate environment. However, limited literature covering issues of CG in developing economies exists [

11]. This provides an impulse to investigate the CG environment of emerging economies, such as Pakistan, as developing economies are more susceptible to accounting frauds due to their weak corporate structure [

12]. However, empirical work on issues of CG in developing economies is still in its infancy [

12]. Therefore, an examination of various characteristics of corporate boards and their diversity as a major contributor towards enhancing firms’ CS may be beneficial to improving practices of CG in an emerging economy such as Pakistan.

In particular, this study specially examines the effectiveness of the presence of FQDs in ACs of Pakistani non-financial companies and their effect on CS, even in the presence of powerful chief executive officers (CEOs). This research is motivated by the recommendations of the CCG of Pakistan (2012), which legally bound all the listed companies of Pakistan to appoint at least one FQD in their ACs to effectively face the challenges of CG in the country. This study includes an examination of various financial expertise of FQD, including leadership of ACs and CEO power in relation to firms’ performances, as these characteristics of CG play a pivotal role in the development of efficient corporate practices.

This study is likely to contribute to the understanding of the role of good CG practices in developing economies. It focuses on the non-observable characteristics of AC members, since ACs act as a major tool of the CG mosaic to effectively monitor and supervise the furnishing of financial reports of publicly listed firms [

13]. Research into AC leadership is also vital in the Pakistani context due to recent changes in CG regulations that focus on the specific requirements for ACs [

14]. Additionally, as there is empirical evidence that CEOs are the most powerful players in the CG mosaic due to their legitimate authority and thorough knowledge of firms’ internal processes, they are in a position to influence the furnishing of financial reports [

15]. This research empirically examines whether factors which are typically associated with CG practices in developed economies can be implemented in the developing economy of Pakistan. As there is insufficient literature on CG in Pakistan, the examination of these vital CG characteristics and their association with firms’ CS provides a unique chance to understand how the emerging economy of Pakistan is managing the needs of global markets.

This paper is structured as follows:

Section 2 provides a theoretical background and develops hypothesis;

Section 3 presents the research methodology and provides details about the sample size, data collection, variables, and regressions used in this study;

Section 4 contains details of the empirical results of our regression models;

Section 5 contains a discussion about the empirical results of the study; and

Section 6 contains concluding remarks, limitations, and future implications of the study. See

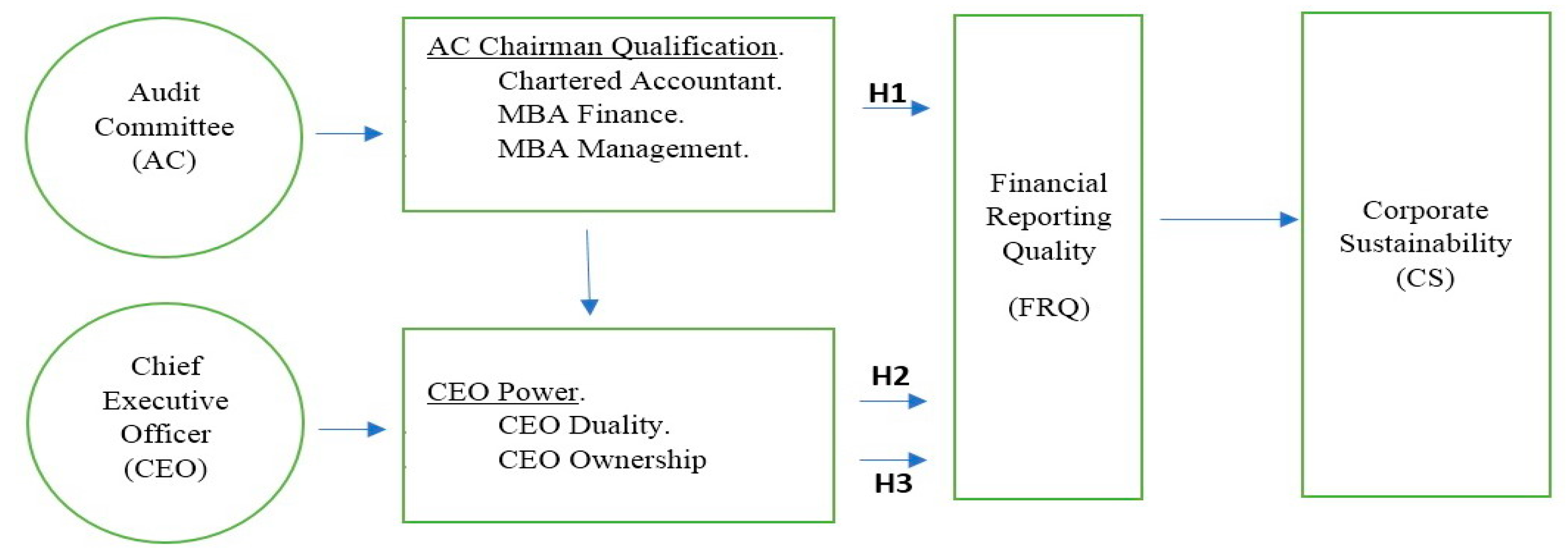

Figure 1.

2. Theoretical Background and Hypothesis Development

Many researchers have empirically examined the observable and non-observable characteristics of corporate boards due to the difference in market environments and market imperfections. Therefore, many empirical results cover the issues pertaining to the composition of corporate boards and ACs. However, these issues still need to be resolved for developing economies because of the difference in their corporate environment. Understanding the concept of firm performance is complex, and it is widely believed that there is no single corporate theory that fully explains the association between the various characteristics of corporate boards, ACs and firm performance [

11]. Prior literature [

16,

17], suggests that most researchers have utilized agency theory to examine the contribution of corporate boards to the performance of organizations. Earlier work also suggests that under agency theory, corporate boards serve two vital roles: Monitoring management on behalf of the shareholders (principals), and providing necessary resources to successfully complete firm tasks. The analysis of prior literature within the context of agency theory builds the basis for the development of our various hypotheses.

2.1. Corporate Governance and Firm Performance

CG is a broad term which attracted much attention after various corporate frauds, corporate failures, abuses of power by management, and excessive executive remuneration [

18,

19,

20]. CG plays a pivotal role in helping firms to achieve their investment and profitability goals [

21]. In prior literature, two categories of CG mosaic were elaborated, which are internal mechanisms (e.g., board size, board independence, board activity level, ACs, CEO duality, ownership structure) and external mechanisms (e.g., competitive markets, labor markets, markets for corporate control). This study focuses on the internal mechanism of CG since the majority of studies examine the relationship between various inputs of top management teams and their association with firm performance.

The work of [

22] conducted a study on the relationship between organizational diversity and firm performance, and found a significant positive association between the diversity added value and firm performance measures. Additionally, [

23] examined the relationship between Tobin’s q and the structure of equity ownership for a sample of firms, and found a significant relationship between common stock ownership and firm value. However, after studying 511 US corporations, [

24] found no relationship between insider ownership and firm performance. This indicates that results on the relationship between the various internal mechanisms of CG and firm performance are disputed and many prior studies [

25] have largely focused on developed economies.

In this context, this research attempts to fill this research void by attempting to provide empirical evidence on the connection between various international CG mechanisms and firm performance in Pakistan.

2.2. Earnings Management and Corporate Governance

Researchers have focused on quality factors of financial reporting, such as earning management [

26,

27,

28], financial restatements [

29,

30,

31], and fraud [

32,

33,

34,

35]. These authors have used these quality factors, which restrict the production of high-quality corporate financial reports, as evidence in the collapse of financial reporting. To increase the quality of financial reporting and reduce the chances of intentional EM, researchers have focused on the CG environment by testing whether corporate boards [

36,

37,

38,

39], ACs [

40,

41,

42], external auditors [

43,

44,

45], and internal auditors [

46,

47,

48], exert their individual or collective influence on the formulation of financial reports that are free from misrepresentation and show the true financial position of the firm.

Prior research [

4,

49,

50], indicated that a higher quality of reported earnings depends on the efficient CG mechanism of the firms, which ultimately results in the reduction of manipulated accruals which divulge the need for efficient and effective Boards of Directors (BODs). BODs are expected to oversee the financial reporting process and restrict any attempt to fabricate those financial reports [

5]. Due to the importance of the monitoring role of effective BODs, many financial regulatory agencies have emphasized the need for, and importance of, effective CG practices and have issued many regulations to enhance the effectiveness of internal control (IC) mechanisms to increase the authenticity of financial reports, for example, ASX (2007) in Australia, NZX (2007) in New Zealand, SOX (2002) in the US, and the Cadbury Report (1992) in the United Kingdom (UK).

Financial regulators issue and enforce corporate rules because researchers have realized for years that managements use various accounting rules to manage and manipulate reported earnings in various ways [

51]. In [

52], the authors elaborated that EM occurs when corporate managers use their discretionary powers to fabricate financial figures to mislead outside shareholders about the actual financial position of the company and to influence accounting outcomes. The literature also explains that managers perform intentional EM for two main reasons: First, as a result of capital market expectations; and second, due to the fact that contracts are written based on managers’ performances [

53]. In this context, [

50], argued that the practice of intentional EM can be restricted by enhancing the CG mechanism. Furthermore, recent studies show the positive effects of effective CG practices and reduced EM [

54].

Therefore, in this study, we select the quality of accruals as a proxy for CS to test our hypothesis. We empirically examine the presence of FQD in ACs and compare it with the financial performance of non-financial listed companies in emerging economy since accruals arise due to a variation between the timing of cash flow (from operations) and the realization of accounting transactions [

55]. Based on the literature discussed above, this study expects to observe a significant relationship between the presence of FQD on boards and corporate performance due to the rapid diversification of companies in emerging economies.

2.3. Role of FQDs as Board Members

Understanding the determinants of BODs is important because BODs play a pivotal role in the CG mosaic of publicly listed companies [

37]. Most empirical studies on the composition of BODs [

37,

56,

57,

58,

59], show that corporate boards perform three key roles: First, BOD members constantly monitor the management by hiring, promoting, and vigorously assessing decision-making of managers [

25,

60]; second, corporate boards provide valuable advice to management to set-up future strategies which help to increase the share value of outside shareholders [

61,

62,

63]; third, corporate boards provide sufficient resources to management to enable them to positively work on the profit-making strategies [

64].

Diverse boards have remained an area of research for many researchers and policymakers for more than two decades [

65]. In [

66], diverse boards are defined as, “the heterogeneous composition of the board regarding gender, age, race, education, experience, nationality, lifestyle, culture, religion and many other facets that make each of us unique as individuals.” In the literature, board diversity is categorized in two ways: First, the observable or demographic attributes, which are race, age, and ethnic background [

65,

67]; and second, non-observable or cognitive characteristics, which are experience, education, technical abilities, personality and socioeconomic background [

68,

69].

This study focuses on the cognitive characteristics of the board, which is the educational background of board members. The literature on the presence of FQDs in corporate boards shows two contradicting theories about the impact of FQDs on EM. The first theory focuses on the benefits and the positive impact of the presence of FQDs in controlling intentional EM. It shows that the presence of FQDs increases board independence as the presence of more financial experts on the board is more effective in restricting the practice of intentional EM [

70]. The second theory states that FQDs are less effective and unable to maintain the monitoring tasks of corporate boards due to the complex nature of modern accounting principles [

71]. After the internationalization of firms, demand for information for corporate decision-making has also increased, which created the problem of greater information asymmetry and higher agency cost [

72]. To face the demands of internationalization, modern corporations hire FQDs on their boards to reduce the possibility of information asymmetry. This diversity of corporate boards provides corporations with a unique opportunity to expand their business and, acquire new knowledge, technology and resources for the longevity of their firm [

73]. The diversification of corporate boards has dramatically changed the dynamics of corporations as a result of new ideas and new perspectives on the formulation of financial information. Corporations diversify their boards for efficient IC, which increases the quality of their CG environments, which includes BODs and ACs [

74].

Due to the contradictory results in the prior literature, this study focuses on cognitive characteristics of boards and examine how the presence of FQDs in diverse boards affects corporate performance in the modern business environment. To test our hypothesis, this study examines how diversified ACs (with at least one FQD) influence a firm’s accrual quality.

2.4. Hypothesis Development

2.4.1. Financial Expertise of Audit Committee

ACs are regarded as the most important component of active BODs as they help to establish confidence in financial markets [

75].

Section 2 of SOX (2002) elaborates an AC as, “a committee (or equivalent body) established by and amongst the BOD of an issuer to oversee the accounting and financial reporting processes of the issuer and audits of the financial statements of the issuer.” Research regarding ACs measures their ability to effectively monitor the formulation of financial reports and reduce the chances of EM in three dimensions, which are: Its financial expertise [

40,

76], its independence [

77,

78], and its frequency of meetings [

77,

79]. In [

76], the authors investigated the impact of AC expertise on audit quality, and the results suggest that both specialist and non-specialist financial experts influence the audit quality, however in different ways. In [

50], the author examined whether AC and BOD characteristics are related to EM by the firm and found that there is a negative relationship between AC independence and a firm’s abnormal accruals. Likewise, [

74], examined the association between AC composition and quality of corporate IC and found a negative relationship between the autonomy of AC and the existence of IC problems.

Additionally, this study also focuses on two characteristics of FQDs in ACs. First, it empirically examines the accounting qualification of FQDs and its relation to firms’ CS. If an FQD is qualified as a chartered accountant (CA) then the FQD is considered as accounting qualified. Secondly, this study empirically examines non-accounting related qualifications of FQDs. If an FQD holds a Masters of Business Administration (MBA) with specialization in management or finance or has another qualification, then they are considered as non-accounting qualified. In the light of the above discussion, we expect that the presence of qualified accounting personnel in an AC is positively related with the firm’s CS. Thus, our first hypothesis is stated as:

Hypothesis 1. The presence of FQDs with accounting expertise in ACs has a positive effect on firm accrual quality, hence increasing CS.

2.4.2. CEO Duality, Accounting Expertise of FQDs and Corporate Sustainability

The first dimension of CEO power, which is structural power, involves holding multiple positions while being CEO [

80]. A primary form of power for a CEO is to jointly serve as a chairman of the BOD which is commonly known as CEO duality [

81]. The literature on CEO duality [

82,

83,

84,

85], includes controversy as to whether CEO duality is related positively or negatively to the performance of a company. Research on CEO duality is based on two entirely different theories, namely the stewardship theory and the agency theory [

86].

The stewardship theory is based on the total empowerment of CEOs, whereas the agency theory is based on the protection of shareholders’ interests by effective monitoring and control systems [

87]. Under the stewardship theory, CEO duality is beneficial for startup firms which are going through a significant change [

88]. Likewise, [

89] explains that firms with CEO duality have the benefit of being able to make quick organizational decisions and react quickly to new emerging organizational scenarios. In [

90] the authors found that CEO duality is positively related to shareholders’ interests. Furthermore, [

91] examined the performance of 200 firms that had either switched away from or switched to CEO duality, and found significantly lower returns for the firms without CEO duality. In [

92], the authors examined the Spanish non-listed family firms, and the results showed a positive response when the same person held top positions in the BOD and management. On the other hand, [

88] examined the relation between Initial Public Offering (IPO) underpricing, CEO duality, and strategic ownership in 12 Arab countries of the Middle East and North Africa (MENA) region, and showed that underpricing increases with CEO duality.

The above mentioned studies on CEO duality showed mixed results; some studies were in favor of CEO duality, while several others were against it. Hence, from the above review of the literature, this study assumes that the effect of CEO duality and the financial expertise of ACs on CS is unresolved, and therefore needs to be investigated. Under agency theory, this study expects to see an adverse effect of CEO duality on CS when it is combined with AC chairman accounting expertise. Hence, this study posits its second hypothesis as:

Hypothesis 2. The presence of FQDs with accounting expertise has an adverse effect on firm accrual quality for firms with CEO duality, hence decreasing CS.

2.4.3. CEO Ownership, Accounting Expertise of FQDs and Corporate Sustainability

The second dimension of CEO power is ownership and CEO stockholdings in a firm. Insider ownership has been recognized as an essential dimension of the CG structure [

93]. Equity ownership by CEOs has monetary interests that align with the interest of outsiders [

94]. The pros and cons of this monitory interest between CEOs and outside stockholders remains an area of interest for many researchers [

15,

23,

50,

95,

96,

97,

98]. On one hand, the literature states that higher employee ownership leads to an increase in common goal alignment, which increases outside shareholder returns [

99], while, on the other hand, empirical evidence suggests that a higher level of ownership by firm employees will negatively affect shareholder value [

100].

In [

16], the authors found that shareholder value increases when the portion of shares owned by managers increases, due to the alignment of interests. However, [

82] found that the chance of director entrenchment is higher when the frequency of insider ownership is high. In [

101] the author explain that equity ownership is the most critical dimension, which is used to ensure that CEOs continue to defend shareholders’ interests due to personal interests. In some sense, [

102] suggested that shareholdings by CEOs show a degree of convergence among the BOD and outside shareholders. Other research explains that, as managers’ stock ownership increases, managers on the BOD will slowly align their interests with those of the outside shareholders and ultimately make a good quality decision for the betterment of the firm [

34]. However, [

97] explained that the interests of managers are not adequately aligned with those of outside stockholders when managers have low-level ownership in the firm, but that at high stock ownership level, managers are the stockholders and their improper decisions will also affect their interest.

The above discussion on managers’ stock ownership shows that a conflict of interest has a potential agency cost, for example, CEO decisions which do not increase outside stockholders value [

103]. This is due to the fact that managers are sometimes intentionally engaged in the manipulation of reported earnings to justify their corporate actions, and this EM may lead to an agency cost. In a firm, there is a range of factors that impact accounting practices, which includes EM [

51]. In [

104] the authors provide empirical evidence that managers who own a higher proportion of their firm’s stocks have less incentive to misrepresent reported accounting information. These studies suggest that CEO ownership structure has a crucial effect on a firm’s EM practices and CS. However, prior research has not been able to show a significant association between CEO ownership and firms’ disclosure accuracy [

105], while [

15] also found inconclusive evidence to infer a relationship between CEO shareholding and EM.

Therefore, this research follows the study of [

93], and expects to see an adverse effect of higher levels of CEO stock ownership on CS when it is combined with the presence of an AC chairman with accounting expertise. Hence this research posits its third hypothesis as:

Hypothesis 3. The presence of FQDs with accounting expertise in audit committees has an adverse effect on firm accrual quality for firms with a higher level of CEO stock ownership, hence decreasing CS.

5. Discussion

The primary findings of this study are as follows. First, this study examined the impact of the presence of FQDs in top-tier management on sustainable firm performance in the Pakistani transitional economy. The results show that there is a negative relationship between firm performance and the lack of financially qualified members in top management, for example BOD and AC. Secondly, these results also show that the presence of accounting-qualified members subsumes the power of CEOs and helps to improve the formulation of financial reporting. The presence of financially qualified members also helps to restrict the practice of intentional EM which ultimately improves the sustainable corporate profitability.

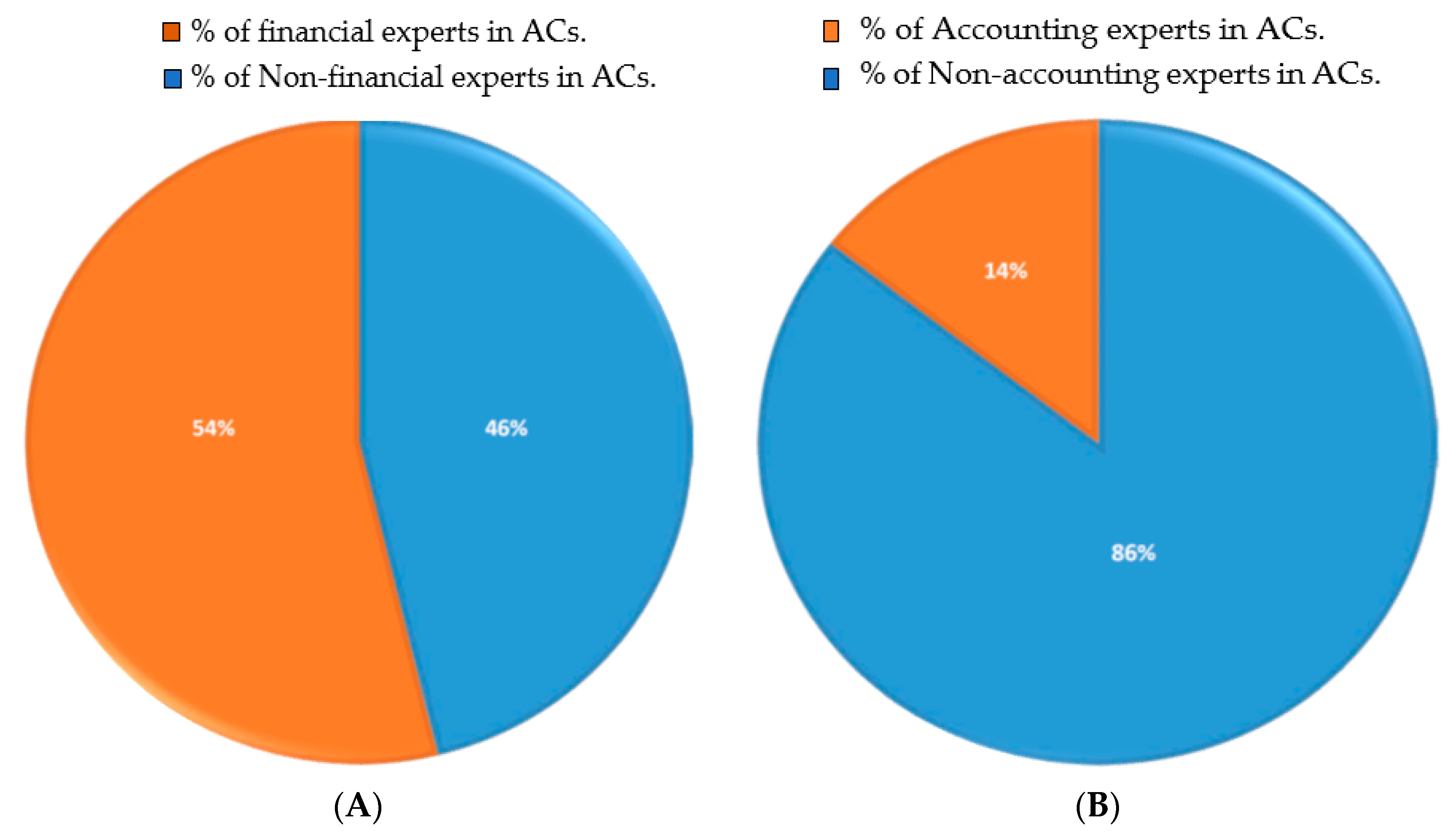

According to our findings, the majority of non-financial companies (54%) in our sample of the PSX, hire financial experts in their ACs. These financial experts possess a variety of financial qualifications, ranging from accounting-qualified to non-accounting-qualified (see

Figure 2A). This indicates a positive trend which shows that the majority of listed companies on the PSX are hiring FQDs in their ACs by following the legal legislations of the CCG (2012) of Pakistan.

However, we also found some contradictions: This research found that the majority of ACs do not contain accounting-qualified members. The results show that only 14% of non-listed companies in our sample had accounting-qualified FQD on their corporate boards (see

Figure 2B).

This research shows the positive effects of hiring FQDs in ACs, for example that the financially qualified members are able to effectively understand the complex accounting numbers and formulate authentic financial reports which show the actual financial position of the company. The findings in this study were consistent with those of prior studies which addressed the financial expertise of AC members [

74].

6. Conclusions

This study covered an agency role of financially qualified AC members by explaining how AC member’s financial expertise affects their firm’s accrual quality. The above results show that the presence of an accounting-qualified member in AC significantly enhances the quality of a firm’s financial reporting. Meanwhile, the results for the presence of a non-accounting expert in AC suggest that ACs which do not have an accounting expert are unable to effectively monitor the formulation of authentic financial reports and are unable to detect abnormal accruals. This research also suggests that the presence of a powerful CEO has a detrimental effect on the performance of the firm. The results show that CEO duality and higher CEO ownership are negatively associated with CS.

This study suggests that one of the key recommendations for the CCG of almost every developed and developing economy should be the availability of financially-qualified people in ACs to allow high-quality and effective sustainability of profit-making procedures in firms. These findings show that CS is positively influenced by the presence of accounting-qualified FQD in AC, which supports the arguments of prior research which argued that more effective ACs are likely to be associated with higher accounting expertise [

76]. Another important contribution of this study is that the random effect model suggests that the absence of FQD with accounting expertise in AC has a negative relationship with the quality of financial statements, as measured by ROA; this shows that the absence of accounting literate members in AC may compromise accounting figures of the company which ultimately results in low CS. These findings can help government regulators at the time of formulation of their acts and policies to legally bind firms to keep an accounting expert in their ACs, since the presence of accounting expert in ACs acts as a deterrent to protect the shareholder’s equity, which helps to increase CS.

However, this study also has some potential limitations. First, we used discretionary accruals as a proxy for CS. Discretionary accruals are widely used for the computation of abnormal accruals, however, they are also likely to contain measurement errors [

46]. Second, it is difficult to examine the internal control elements of firms’ environments as it is difficult to separate various internal industry factors, for example, internal function, AC and executive setup. Third, this study relied on the information provided by the firms’ annual reports, which may hold some clerical errors. Fourth, the main limitation of this research is the availability of firms’ annual reports: Many firms do not have their annual reports or have incomplete yearly reports on their websites. Consequently, we used a

t-test, and found no systematic difference between firms which were considered for analysis and those not included in the sample due to missing or incomplete CG data.

However, this study is unique in the sense that it is one of the few studies which has examined the relationship between AC characteristics, CEO power and its impact on CG procedures which firms have to adapt to enhance and improve the sustainability of shareholders’ equity and its profits in a developing economy. However, the use of firms’ annual reports for the collection of required variables, which was due to the unavailability of any official and authentic databases (for example, Compustat), limited the depth of this study. We propose that adopting and implementing the recommendations of CCG by firms will increase their financial benefits and encourage further studies on the composition of BODs and ACs and their impact on the overall sustainable profit margins of firms in developing economies.