Sustainable Value of Investment in Real Estate: Real Options Approach

Abstract

1. Introduction

Literature Review

2. Methodology and Data

Process of Investment Evaluation

3. Results

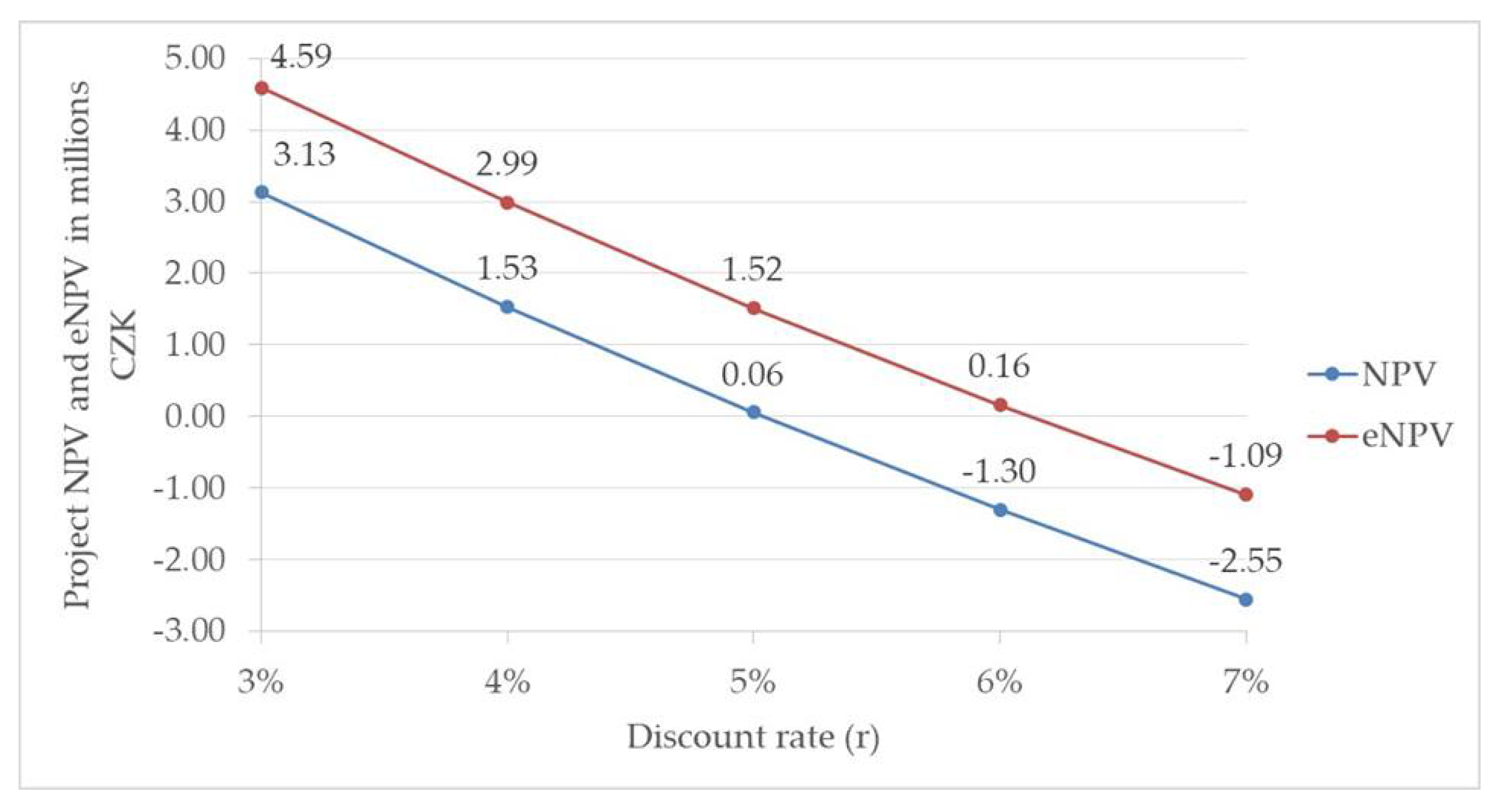

3.1. Net Present Value of the Investment Project

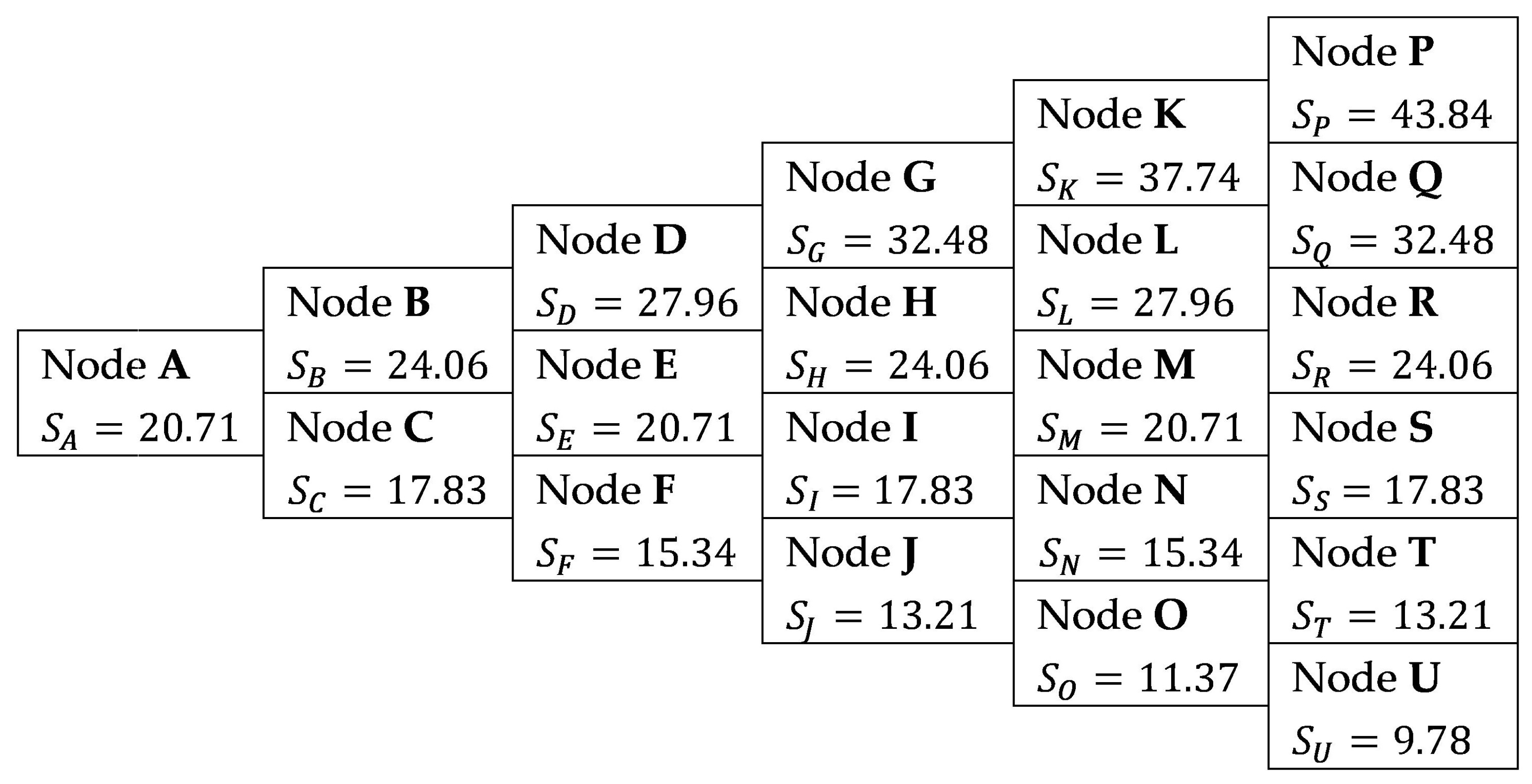

3.2. The Evaluation of the Project Flexibility

- In case of expansion of the project in the node P, following Equation (2), we get

- In case of contraction of the project in the node P, following Equation (3), we get

- In case of abandonment of the project in the node P, following Equation (4), we get

- In case the project will continue in the original range in the node P, following Figure 1, we get

- In case of expansion of the project in the node O, following Equation (2), we get

- In case of contraction of the project in the node O, following Equation (3), we get

- In case of abandonment of the project in the node O, following Equation (4), we get

- In case the project continues in the original range, we will use the discounted weight average of the present values of the expected cash flows in the nodes T and U so that

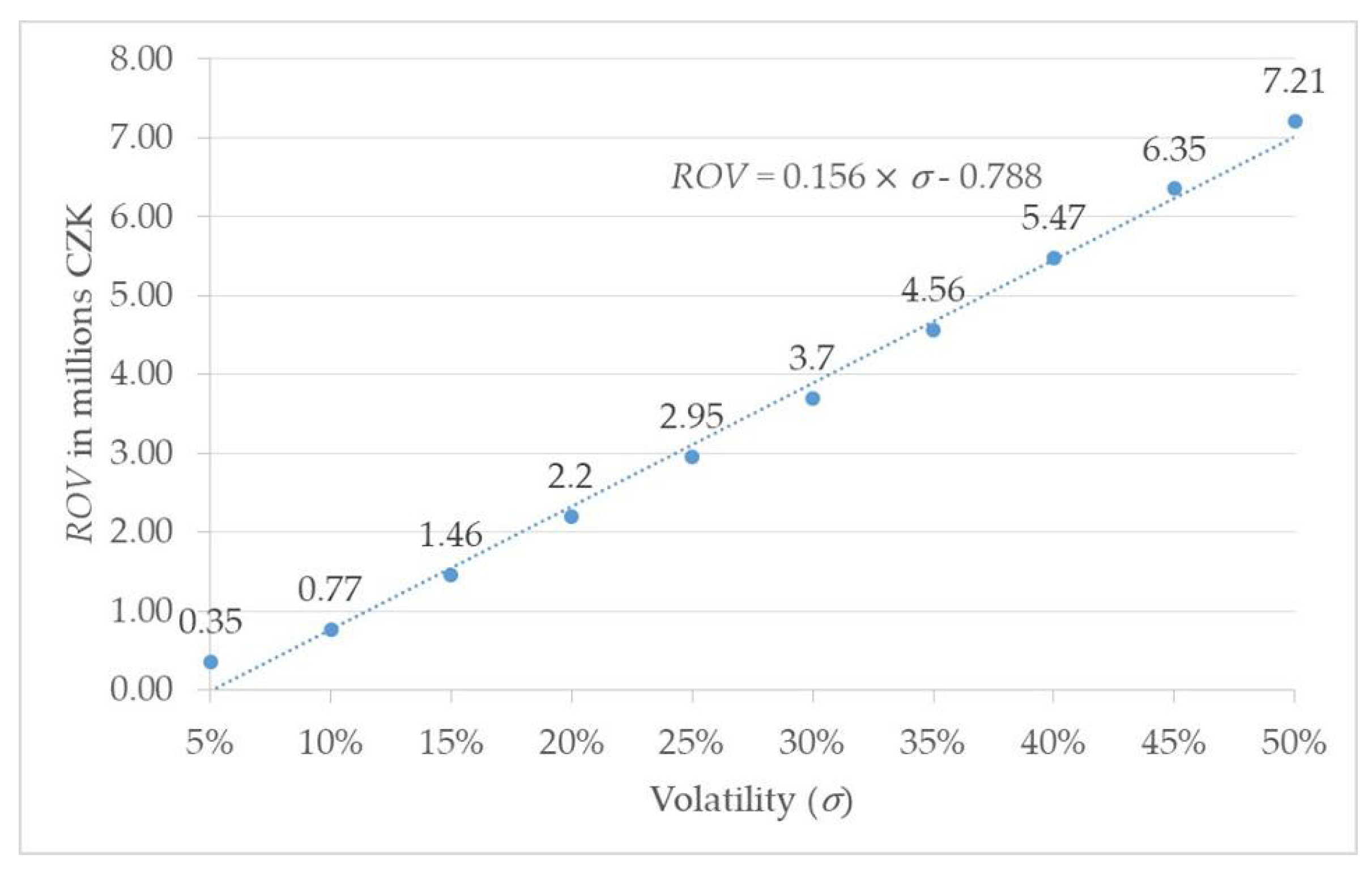

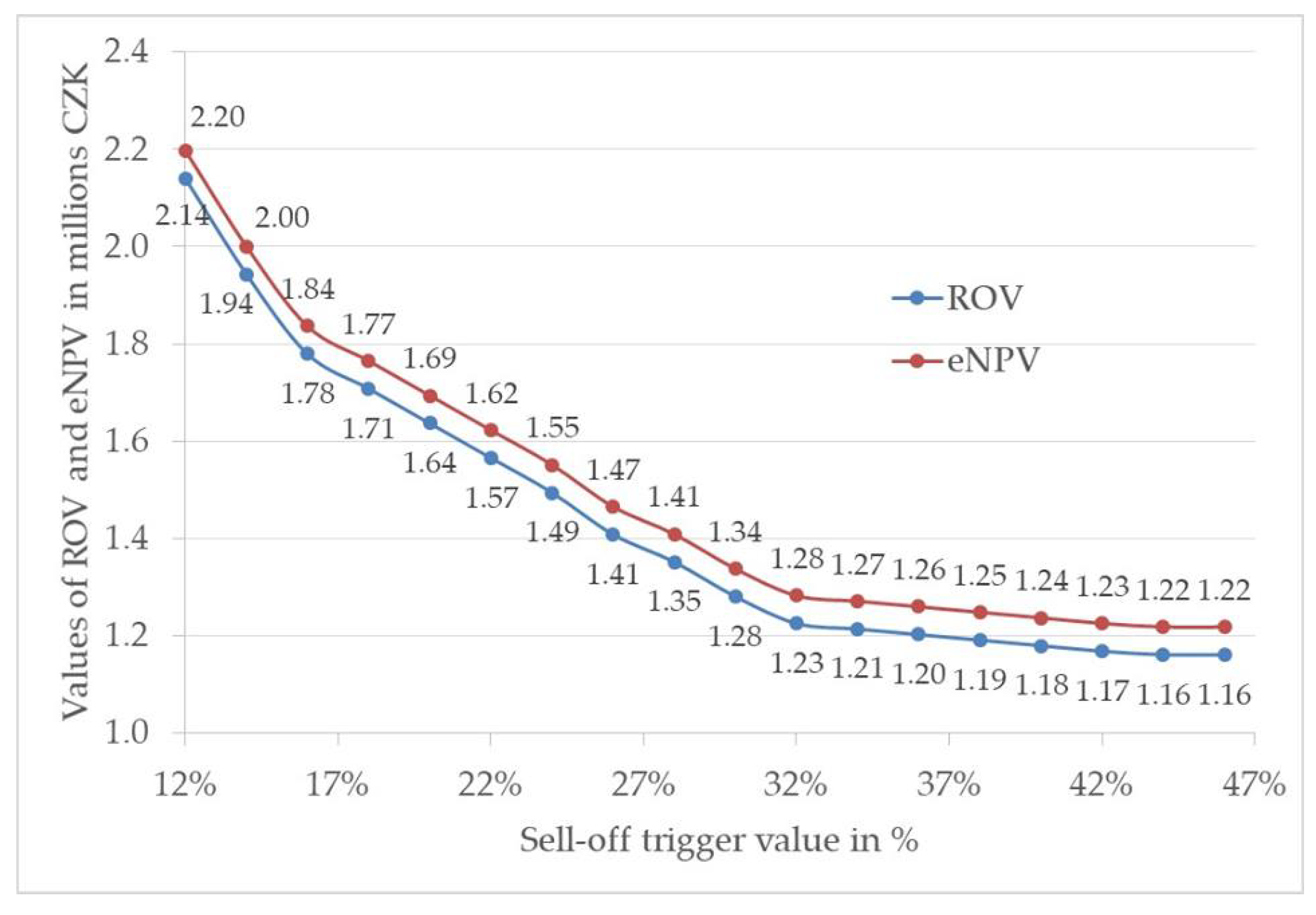

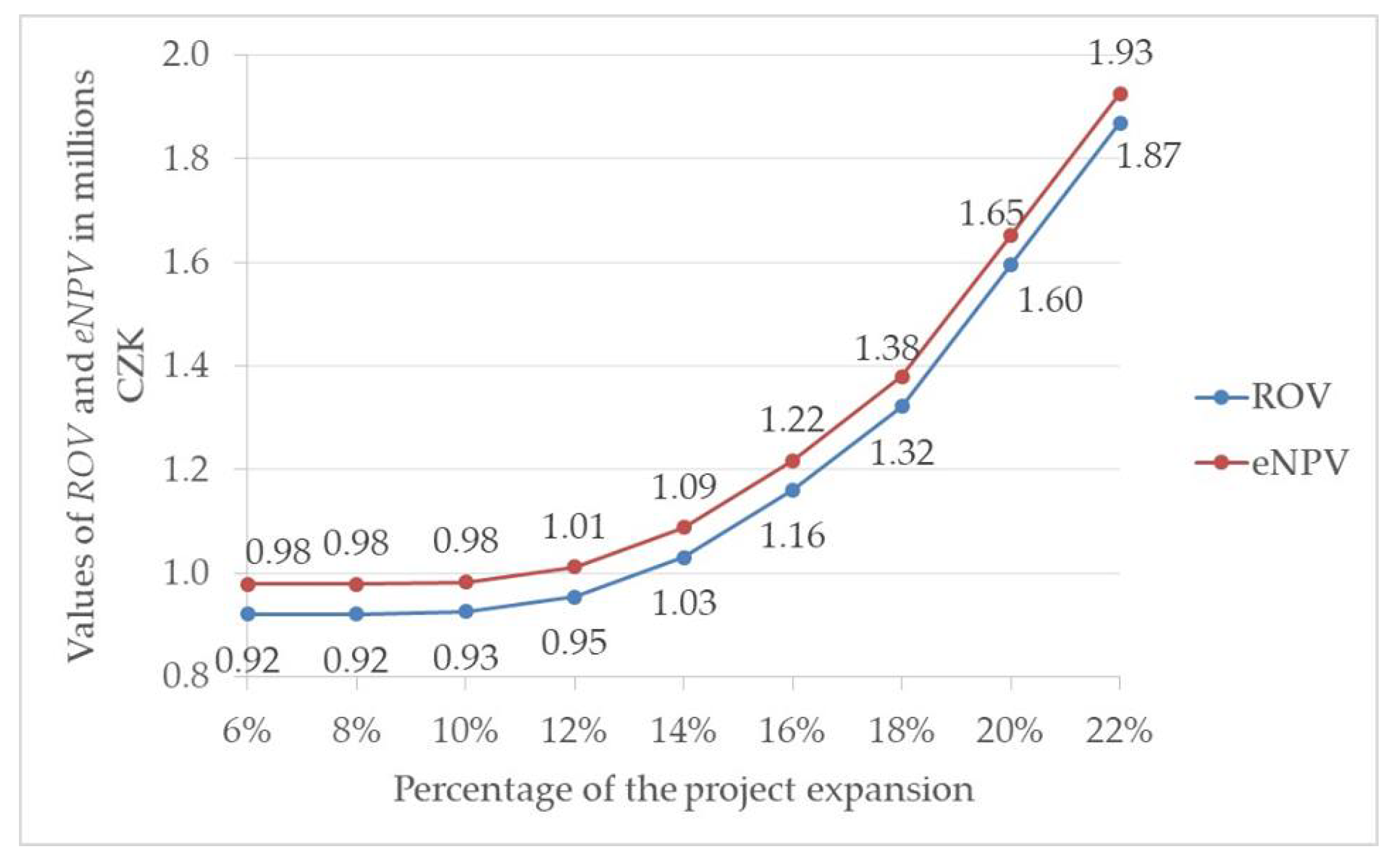

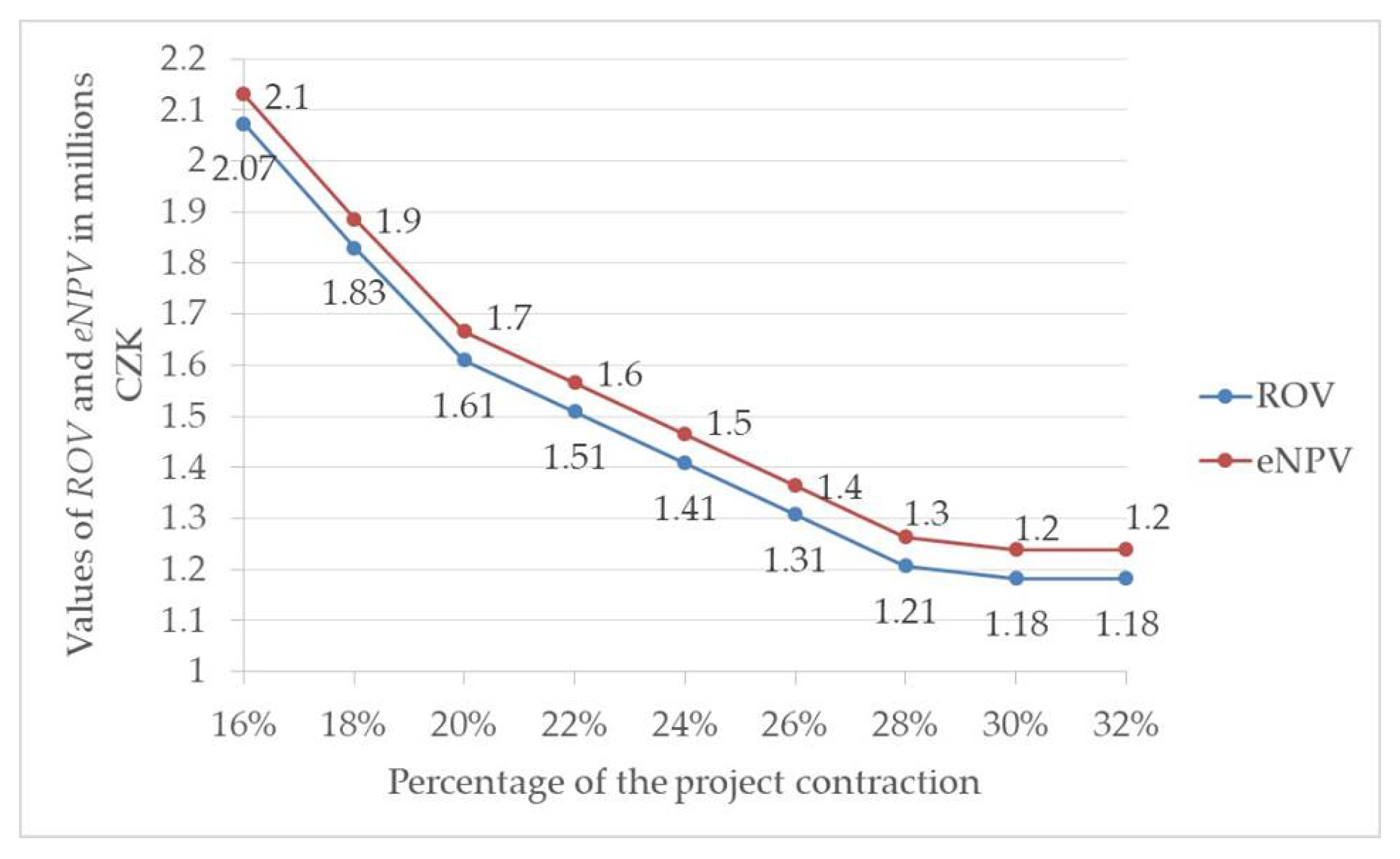

3.3. Sensitivity Analysis

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Myers, S.C. Modern Developments in Financial Management; Praeger: New York, NY, USA, 1976; ISBN 978-02-7534-100-8. [Google Scholar]

- Folta, T.B.; O’Brien, J.P. Entry in the presence of duelling options. Strat. Manag. J. 2004, 25, 121–138. [Google Scholar] [CrossRef]

- Borison, A. Real Options Analysis: Where are the Emperor’s Clothes? J. Appl. Corp. Financ. 2005, 17, 17–31. [Google Scholar] [CrossRef]

- Agaton, C.B.; Karl, H. A real options approach to renewable electricity generation in the Philippines. Energy Sustain. Soc. 2018, 8, 1. [Google Scholar] [CrossRef]

- Boomsma, T.K.; Meade, N.; Fleten, S.-E. Renewable energy investments under different support schemes: A real options approach. Eur. J. Oper. Res. 2012, 220, 225–237. [Google Scholar] [CrossRef]

- Wesseh, P.K.; Lin, B. A real options valuation of Chinese wind energy technologies for power generation: Do benefits from the feed-in tariffs outweigh costs? J. Clean. Prod. 2016, 112, 1591–1599. [Google Scholar] [CrossRef]

- Ranieri, L.; Mossa, G.; Pellegrino, R.; Digiesi, S. Energy Recovery from the Organic Fraction of Municipal Solid Waste: A Real Options-Based Facility Assessment. Sustainability 2018, 10, 368. [Google Scholar] [CrossRef]

- Zhang, M.; Zhou, D.; Ding, H.; Jin, J. Biomass Power Generation Investment in China: A Real Options Evaluation. Sustainability 2016, 8, 563. [Google Scholar] [CrossRef]

- Zhu, L. A simulation based real options approach for the investment evaluation of nuclear power. Comput. Ind. Eng. 2012, 63, 585–593. [Google Scholar] [CrossRef]

- Li, Y.; Yang, W.; Tian, L.; Yang, J. An Evaluation of Investment in a PV Power Generation Project in the Gobi Desert Using a Real Options Model. Energies 2018, 11, 257. [Google Scholar] [CrossRef]

- Moon, Y.; Baran, M. Economic analysis of a residential PV system from the timing perspective: A real option model. Renew. Energy 2018, 125, 783–795. [Google Scholar] [CrossRef]

- Tian, L.; Pan, J.; Du, R.; Li, W.; Zhen, Z.; Qibing, G. The valuation of photovoltaic power generation under carbon market linkage based on real options. Appl. Energy 2017, 201, 354–362. [Google Scholar] [CrossRef]

- Fleten, S.E.; Haugom, E.; Ullrich, C.J. The real options to shutdown, startup, and abandon: U.S. electricity industry evidence. Energy Econ. 2017, 63, 1–12. [Google Scholar] [CrossRef]

- Haehl, C.; Spinier, S. Capacity expansion under regulatory uncertainty: A real options-based study in international container shipping. Transp. Res. Part E Logist. Transp. Rev. 2018, 113, 75–93. [Google Scholar] [CrossRef]

- Ansaripoor, A.H.; Oliveira, F.S. Flexible lease contracts in the fleet replacement problem with alternative fuel vehicles: A real-options approach. Eur. J. Oper. Res. 2018, 266, 316–327. [Google Scholar] [CrossRef]

- Xiao, Y.; Fu, X.; Oum, T.H.; Yan, J. Modeling airport capacity choice with real options. Transp. Res. Part B Methodol. 2017, 100, 93–114. [Google Scholar] [CrossRef]

- Chen, Q.; Shen, G.; Xue, F.; Xia, B. Real Options Model of Toll-Adjustment Mechanism in Concession Contracts of Toll Road Projects. J. Manag. Eng. 2018, 34, 04017040. [Google Scholar] [CrossRef]

- Liu, J.; Gao, R.; Cheah, C.Y.J. Pricing Mechanism of Early Termination of PPP Projects Based on Real Option Theory. J. Manag. Eng. 2017, 33, 04017035. [Google Scholar] [CrossRef]

- Ma, G.; Du, Q.; Wang, K. A Concession Period and Price Determination Model for PPP Projects: Based on Real Options and Risk Allocation. Sustainability 2018, 10, 706. [Google Scholar] [CrossRef]

- Khan, S.S.; Zhao, K.; Kumar, R.L.; Stylianou, A. Examining Real Options Exercise Decisions in Information Technology Investments. J. Assoc. Inf. Syst. 2017, 18, 372–402. [Google Scholar] [CrossRef]

- Dimakopoulou, A.G.; Pramatari, K.C.; Tsekrekos, A.E. Applying real options to IT investment evaluation: The case of radio frequency identification (RFID) technology in the supply chain. Int. J. Prod. Econ. 2014, 156, 191–207. [Google Scholar] [CrossRef]

- Jacome, A.R.; Garrido, A. A Real Option Analysis applied to the production of Arabica and Robusta Coffee in Ecuador. Span. J. Agric. Res. 2017, 15, e0104. [Google Scholar] [CrossRef]

- Henderson, R.T. Sink or Sell: Using Real Estate Purchase Options to Facilitate Coastal Retreat. Vanderbilt Law Rev. 2018, 71, 641–680. [Google Scholar]

- Titman, S. Urban land prices under uncertainty. Am. Econ. Rev. 1985, 75, 505–514. [Google Scholar]

- Bragt, D.V.; Francke, M.K.; Singor, S.N.; Pelsser, A. Risk-Neutral Valuation of Real Estate Derivatives. J. Deriv. 2015, 23, 89–110. [Google Scholar] [CrossRef]

- Cirjevskis, A.; Tatevosjans, E. Empirical Testing of Real Option in the Real Estate Market. Procedia Econ. Financ. 2015, 24, 50–59. [Google Scholar] [CrossRef]

- Parthasarathy, K.V.; Madhumathi, R. Real Options Analysis in Valuation of Commercial Project: A Case Study. IUP J. Infrastruct. 2010, 8, 7–25. [Google Scholar]

- Wu, M.; Lin, I.; Huang, Y.; Lu, C.R. Forecasting Prices Of Presale Houses: A Real Option Approach. Rom. J. Econ. Forecast. 2015, 18, 143–158. [Google Scholar]

- Li, D.; Chen, H.; Hui, E.C.-M.; Xiao, C.; Cui, Q.; Li, Q. A real option-based valuation model for privately-owned public rental housing projects in China. Habitat Int. 2014, 43, 125–132. [Google Scholar] [CrossRef]

- Morano, P.; Tajani, F. Urban Renewal and Real Option Analysis: A Case Study. In Lecture Notes in Computer Science; Springer: Cham, Switzerland, 2014; pp. 148–160. [Google Scholar] [CrossRef]

- Dortland, M.V.R.; Voordijk, H.; Dewulf, G. Towards phronetic knowledge for strategic planning in corporate real estate management: A real options approach. J. Corp Real Estate 2014, 16, 203–219. [Google Scholar] [CrossRef]

- Vimpari, J.; Junnila, S. Value of waiting—Option pricing as a tool for residential real estate fund divestment management. Prop. Manag. 2014, 32, 400–414. [Google Scholar] [CrossRef]

- Baldi, F. Valuing a greenfield real estate property development project: A real options approach. J. Eur. Real Estate Res. 2013, 6, 186–217. [Google Scholar] [CrossRef]

- Shen, J.; Pretorius, F. Binomial option pricing models for real estate development. J. Prop. Investig. Financ. 2013, 31, 418–440. [Google Scholar] [CrossRef]

- Bravi, M.; Rosii, S. Real Estate Development, Highest and Best Use and Real Options. Aestimum 2012, 479–498. [Google Scholar] [CrossRef]

- Kim, K.; Song, J.W. Managing Bubbles in the Korean Real Estate Market: A Real Options Framework. Sustainability 2018, 10, 2875. [Google Scholar] [CrossRef]

- Mintah, K.; Higgins, D.; Callanan, J. Wakefield, R. Staging option application to residential development: Real options approach. Int. J. Hous. Mark. Anal. 2018, 11, 101–116. [Google Scholar] [CrossRef]

- Mintah, K.; Higgins, D.; Callanan, J. A real option approach for the valuation of switching output flexibility in residential property investment. J. Financ. Manag. Prop. Construct. 2018, 23, 133–151. [Google Scholar] [CrossRef]

- Lucius, D.I. Real options in real estate development. J. Prop. Investig. Financ. 2001, 19, 73–78. [Google Scholar] [CrossRef]

- Guthrie, G. Evaluating Real Estate Development Using Real Options Analysis. SSRN Electron. J. 2009. [Google Scholar] [CrossRef]

- Miller, M.H. The history of finance. J. Portfolio Manag. 1999, 25, 95–101. [Google Scholar] [CrossRef]

- Antikarov, V.; Copeland, T. Real Options: A Practitioner’s Guide; Texere: New York, NY, USA, 2001; ISBN 978-15-8799-186-8. [Google Scholar]

- Scholleova, H. Reálné Opce; Oeconomica: Prague, Czech Republic, 2005; ISBN 80-245-0868-0. [Google Scholar]

- Scholleova, H. Hodnota Flexibility: ReáLné Opce; C.H. Beck: Prague, Czech Republic, 2007; ISBN 978-80-7179-735-7. [Google Scholar]

- Culik, M. Aplikace Realnych Opci v Investicnym Rozhodovani Firmy; Series on Advanced Economic Issues; VŠB-Technical University: Ostrava, Czech Republic, 2013; Volume 19, ISBN 978-80-248-3069-8. [Google Scholar]

- Culik, M. Investment project valuation as a portfolio of real options. Eur. J. Manag. 2008, 8, 23–31. [Google Scholar]

- Culik, M. Flexibility and project value: Interactions and multiple real options. AIP Conf. Proc. 2010, 1239, 326–334. [Google Scholar] [CrossRef]

- Culik, M. (Ed.) Financial assessment of the hard coal mining in the chosen region of the Czech Republic: Real options approach. In Proceedings of the 7th International Scientific Conference on Managing and Modelling of Financial Risk, Ostrava, Czech Republic, 8–9 September 2014; pp. 136–150. [Google Scholar]

- Culik, M. (Ed.) Real Options Valuation with Variable Parameters. In Proceedings of the 10th International Scientific Conference on Financial Management of Firms and Financial Institutions, Ostrava, Czech Republic, 7–8 September 2015; pp. 181–194. [Google Scholar]

- Zmeskal, Z. Generalised soft binomial American real option pricing model (fuzzy–stochastic approach). Eur. J. Oper. Res. 2010, 207, 1096–1103. [Google Scholar] [CrossRef]

- Zmeskal, Z. Application of the American Real Flexible Switch Options Methodology: A Generalized Approach. Financ. Uver 2008, 58, 261–275. [Google Scholar]

- Zmeskal, Z. Flexible business model—Real option approach. In Proceedings of the 9th International Scientific Conference on Financial Management of Firms and Financial Institutions, Ostrava, Czech Republic, 9–10 September 2013; pp. 1098–1104. [Google Scholar]

- Guttenova, D. The application of Real Options. In Proceedings of the International Scientific Conference on Knowledge for Market Use 2016—Our Interconnected and Divided World, Olomouc, Czech Republic, 8–9 September 2016; pp. 115–121. [Google Scholar]

- Kramarova, K.; Kicova, E. The use of real options as a method of evaluation of projects under the investment activities of the company [In Slovak]. Grant J. 2014, 3, 37–41. [Google Scholar]

- Reuter, W.H.; Fuss, S.; Szolgayova, J.; Obersteiner, M. Investment in wind power and pumped storage in a real options model. Renew. Sustain. Energy Rev. 2012, 16, 2242–2248. [Google Scholar] [CrossRef]

- Szolgayova, J.; Fuss, S.; Khabarov, N.; Obersteiner, M. A dynamic CVaR-portfolio approach using real options: An application to energy investments. Eur. Trans. Electr. Power 2011, 21, 1825–1841. [Google Scholar] [CrossRef]

- Fuss, S.; Szolgayova, J. Fuel price and technological uncertainty in a real options model for electricity planning. Appl. Energy 2010, 87, 2938–2944. [Google Scholar] [CrossRef]

- Wafi, Y. Effect of Real Option Approach Investment in the Information Technology. In Proceedings of the 5th Central European Conference in Regional Science (CERS), Kosice, Slovakia, 5–8 October 2014; pp. 1142–1150. [Google Scholar]

- Eurostat. Unemployment Rates in the EU Regions Ranged from 1.7% to 29.1%. Available online: https://ec.europa.eu/eurostat/documents/2995521/8830865/1-26042018-AP-EN.pdf/bb8ac3b7-3606-47ef-b7ed-aadc4d1e2aae (accessed on 16 November 2018).

- Divinova, J. Ceny Bytů v Česku StáLe Rostou. Proč a Jaký Bude Další VýVoj. Available online: https://ekonomika.idnes.cz/ceny-bytu-nemovitosti-realitni-trh-developeri-flt-/ekonomika.aspx?c=A18 0524\_403249_ekonomika_div (accessed on 16 November 2018).

- Deloitte. Deloitte Real Index Q1 2018. Available online: https://www2.deloitte.com/content/dam/Deloitte/cz/Documents/real-estate/Deloitte-Real-Index-Q1-2018-CS.pdf (accessed on 16 November 2018).

- Votocek, L. Za bydlení platíme pořád více. Statistika My 2017, 7, 24–26. [Google Scholar]

- Czech National Bank. Zpráva o FinančNí Stabilitě 2017/2018; Czech National Bank: Prague, Czech Republic, 2018; ISBN 978-80-87225-79-0. [Google Scholar]

- Czech Statistical Office. Indices of Realized Flat Prices—2. Quarter Of 2018. Available online: https://www.czso.cz/csu/czso/indices-of-realized-flat-prices-2-quarter-of-2018/ (accessed on 1 December 2018).

- Hull, J.C. Options, Futures, and Other Derivatives, 9th ed.; Pearson Education: Upper Saddle River, NJ, USA, 2005; ISBN 978-01-3345-631-8. [Google Scholar]

- Mun, J. Real Option Analysis: Tools and Techniques for Valuing Strategic Investment and Decisions, 2nd ed.; Wiley: Hoboken, NJ, USA, 2005; ISBN 978-04-7174-748-2. [Google Scholar]

- Rambaud, S.C.; Perez, A.M.S. The option to expand a project: Its assessment with the binomial options pricing model. Oper. Res. Perspect. 2017, 4, 12–20. [Google Scholar] [CrossRef]

- Brandao, L.E.; Dyer, J.S.; Hahn, W.J. Using Binomial Decision Trees to Solve Real-Option Valuation Problems. Decis. Anal. 2005, 2, 69–88. [Google Scholar] [CrossRef]

- Quigg, L. Empirical Testing of Real Option-Pricing Models. J. Financ. 1993, 48, 621–640. [Google Scholar] [CrossRef]

- Williams, J.T. Real estate development as an option. J. Real Estate Financ. Econ. 1991, 4, 191–208. [Google Scholar] [CrossRef]

- Williams, J.T. Equilibrium and Options on Real Assets. Rev. Financ. Stud. 1993, 6, 825–850. [Google Scholar] [CrossRef]

- Childs, P.D.; Riddiough, T.J.; Triantis, A.J. Mixed Use and the Redevelopment Options. Real Estate Econ. 1996, 24, 317–339. [Google Scholar] [CrossRef]

- Williams, J.T. Redevelopment of Real Assets. Real Estate Econ. 1997, 25, 387–407. [Google Scholar] [CrossRef]

- Trigeorgis, L. Real Options: Managerial Flexibility and Strategy in Resource Allocation; MIT Press: Cambridge, MA, USA, 1996; ISBN 978-02-6220-102-5. [Google Scholar]

- Holland, A.S.; Ott, S.H.; Riddiough, T.J. The Role of Uncertainty in Investment: An Examination of Competing Investment Models Using Commercial Real Estate Data. Real Estate Econ. 2000, 28, 33–64. [Google Scholar] [CrossRef]

- Grovenstein, R.A.; Kau, J.B.; Munneke, H.J. Development Value: A Real Options Approach Using Empirical Data. J. Real Estate Financ. Econ. 2011, 43, 321–335. [Google Scholar] [CrossRef]

- Rocha, K.; Salles, L.; Gracia, F.A.A.; Sardinha, J.A.; Teixeira, J.P. Real Estate and Real Options—A Case Study. Emerg. Mark. Rev. 2007, 8, 67–79. [Google Scholar] [CrossRef]

- Hull, J.C. Fundamentals of Futures and Options Markets, 5th ed.; Pearson Education: Upper Saddle River, NJ, USA, 2005; pp. 6, 243–247, 349–255. ISBN 978-01-3144-565-9. [Google Scholar]

- Kodukula, P.; Papudesu, C. Project Valuation Using Real Options: A Practitioner’s Guide; Ross Publishing: Fort Lauderdale, FL, USA, 2006; pp. 40–48, 53–66, 72–96, 110–135. ISBN 978-19-3215-943-1. [Google Scholar]

| Flat | Location | Area in m2 | Price in Millions CZK | Monthly Rent in CZK |

|---|---|---|---|---|

| 1 | Křenická (Praha 10) | 65 | 3.85 | 16,000 |

| 2 | Pod Strání (Praha10) | 65 | 4.63 | 18,000 |

| 3 | Sekaninová (Praha 2) | 51 | 3.59 | 14,000 |

| 4 | Biskupcova (Praha 3) | 54 | 3.89 | 15,000 |

| 5 | Bořislavka (Praha 6) | 52 | 4.19 | 15,000 |

| Total | 20.15 | 78,000 | ||

| Description | Parameter Value |

|---|---|

| Purchased price of the flats and their equipment. | millionsCZK |

| Monthly flats rents without energy. | 78,000 CZK |

| Monthly costs of the maintenance and insurance. | 7500 CZK |

| Corporate income tax. | 19% p.a. |

| Annual growth coefficient (inflation rate). | 2% p.a. |

| Option | % of Initial Investment | Amount in Millions CZK | Description |

|---|---|---|---|

| Expansion | 19% | Additional investment. | |

| Contraction | 23% | Sell-off price of a single flat. | |

| Abandonment | 25% | Trigger value for selling off all flats. |

| Types of the Real Options | ||

|---|---|---|

| without real option | 0 | 57,176 |

| expand | 537,606 | 594,782 |

| contract | 623,473 | 680,649 |

| abandon | 644,089 | 701,265 |

| contract and abandon | 920,694 | 977,870 |

| expand and contract | 1,161,088 | 1,218,264 |

| expand and abandon | 1,181,694 | 1,238,870 |

| expand, contract and abandon | 1,458,319 | 1,515,495 |

| Input | Tested | Change of | Effect on Partial Options | ||

|---|---|---|---|---|---|

| Parameter | Range (in %) | Dependence | Range (in Millions CZK) | Parameter Value | Type of Partial Option |

| Volatility | direct | - | Value of all types increases. | ||

| Sell-off trigger value | indirect | above 42% | Value of abandonment option is zero. | ||

| Factor of expansion | direct | below 10% | Value of expansion option is zero. | ||

| Factor of contraction | indirect | above 30% | Value of contraction option is zero. | ||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Durica, M.; Guttenova, D.; Pinda, L.; Svabova, L. Sustainable Value of Investment in Real Estate: Real Options Approach. Sustainability 2018, 10, 4665. https://doi.org/10.3390/su10124665

Durica M, Guttenova D, Pinda L, Svabova L. Sustainable Value of Investment in Real Estate: Real Options Approach. Sustainability. 2018; 10(12):4665. https://doi.org/10.3390/su10124665

Chicago/Turabian StyleDurica, Marek, Danuse Guttenova, Ludovit Pinda, and Lucia Svabova. 2018. "Sustainable Value of Investment in Real Estate: Real Options Approach" Sustainability 10, no. 12: 4665. https://doi.org/10.3390/su10124665

APA StyleDurica, M., Guttenova, D., Pinda, L., & Svabova, L. (2018). Sustainable Value of Investment in Real Estate: Real Options Approach. Sustainability, 10(12), 4665. https://doi.org/10.3390/su10124665