The Role and Impact of Industry 4.0 and the Internet of Things on the Business Strategy of the Value Chain—The Case of Hungary

Abstract

1. Introduction

2. Literature Review

2.1. Importance of Industry 4.0

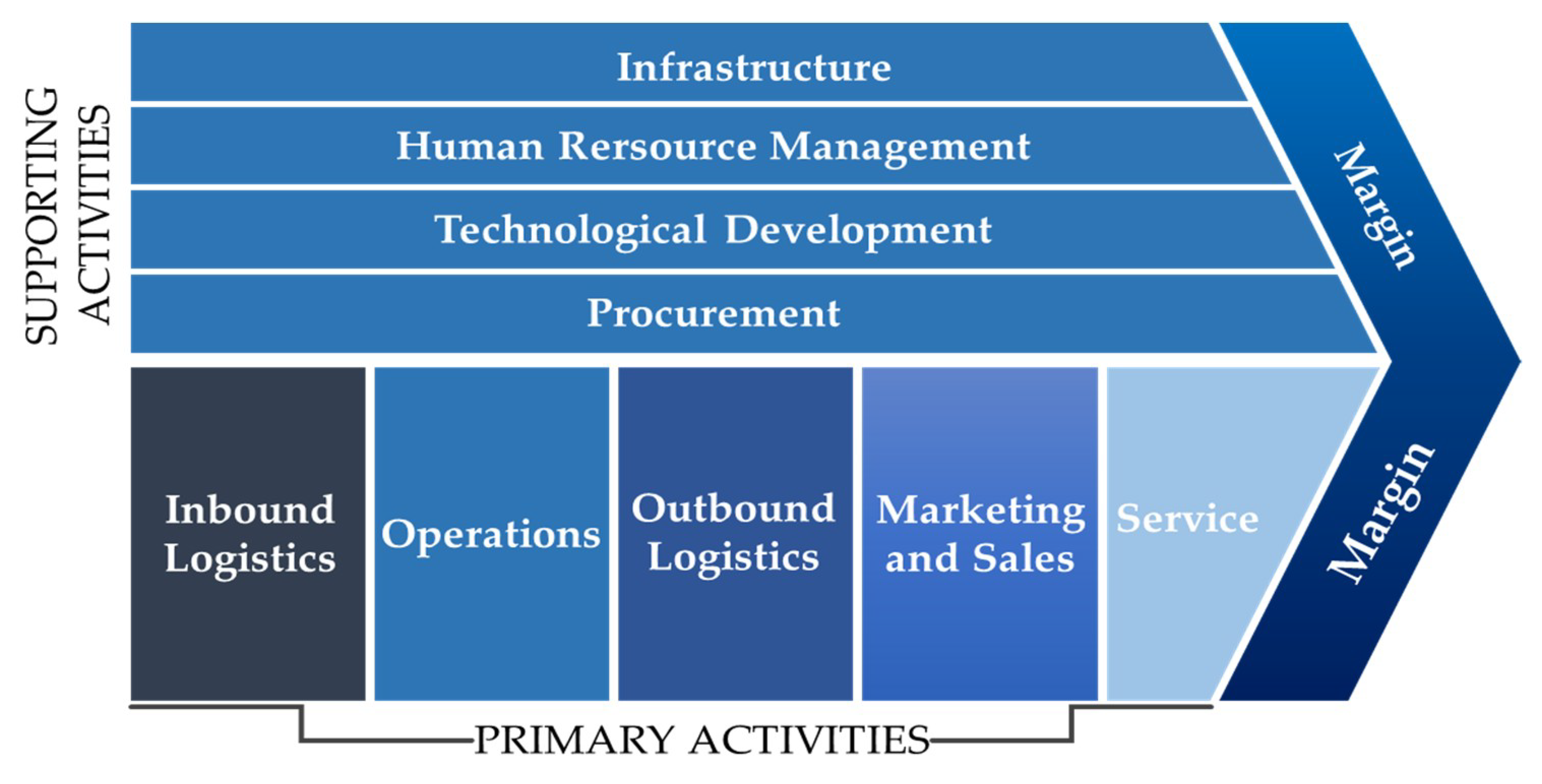

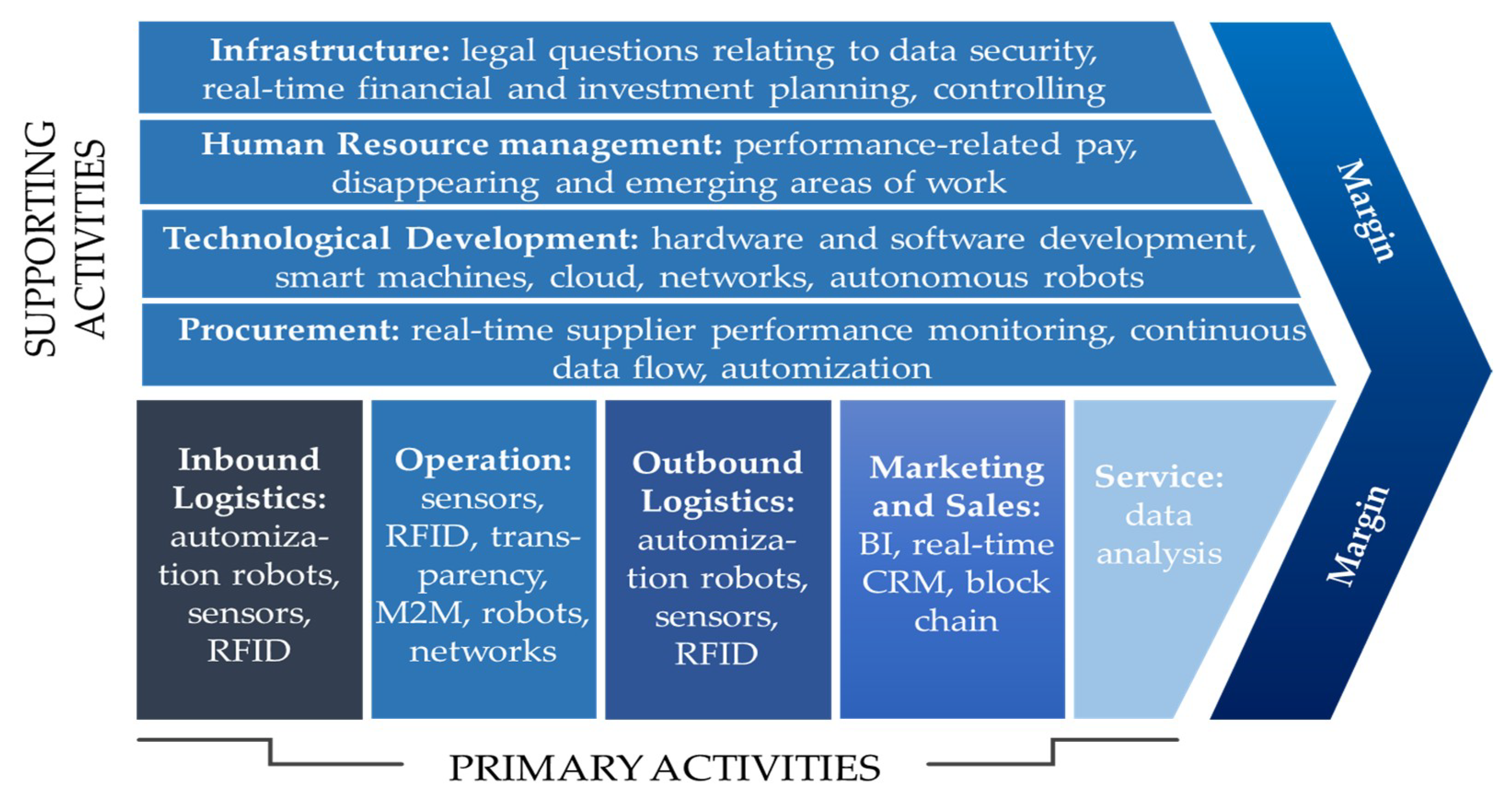

2.2. Porter’s Value Chain Theory and Its Relationship to Industry 4.0

2.3. Impact of the 4th Industrial Revolution on Relationships between Companies

2.4. Factors Obstructing the Implementation of Industry 4.0

2.5. Internet of Things: Tools and Solutions

- Applying tools and technologies to networking to ensure the transparency of the entire business process.

- Horizontal integration, which means close, real-time connectivity and cooperation within the enterprise’s field of activity.

- Vertical integration, which primarily involves cooperation with partners in the supply chain, later with partners in the supply network, including digital connection.

- Rethinking the business model in the spirit of a focus on customers, even by transforming the organizational structure.

3. Materials and Methods

Expert Interviews

4. Results

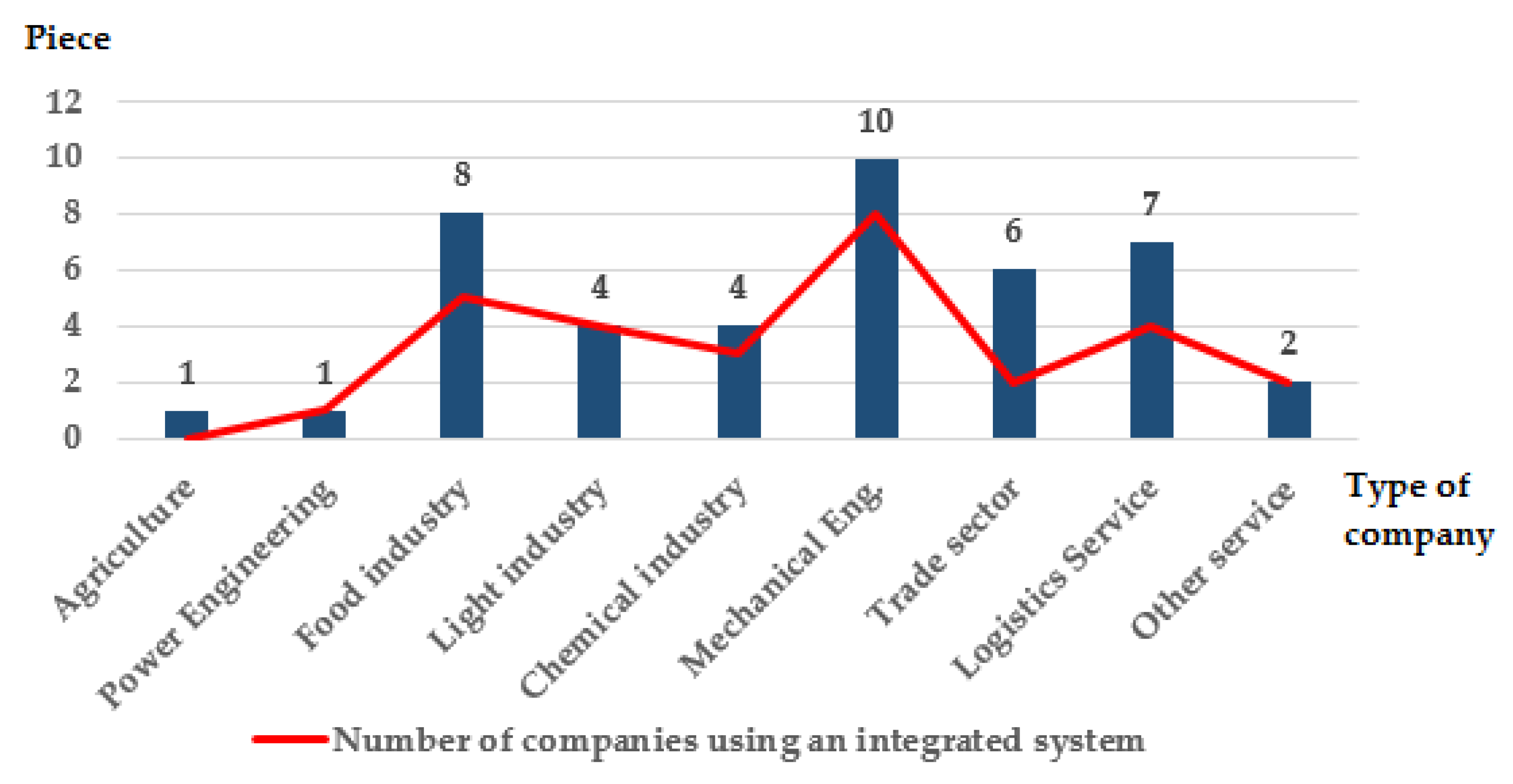

4.1. Analysis of the Spread of IoT Tools and Solutions

- The efficiency of the company’s internal logistic processes (higher level of logistic service) (Q1).

- The efficiency of processes with the ordering partner in the supply chain (Q2).

- The efficiency of processes with the supplier partner in the supply chain (Q3).

- Cooperation between certain functions of the company (e.g., marketing, finance, logistics) (Q4).

- Market performance of the company (e.g., ensuring greater market share (Q5).

- Financial performance of the company (Q6).

- Competitiveness of the company (Q7).

4.2. Results of Expert Interviews

4.2.1. Approach to Industry 4.0

“An information revolution in the industry.”(V1 interview, 2017)

“To use and interpret the enormous amount of data, and use it to predict the future. This is the secret of success.”(V2 interview, 2017)

“Industry 4.0 Data and Behavior. Everyone gets all the relevant information, enabling them to react and decide on it in different ways.”(V3 interview, 2017)

“Linking to a smarter network that encompasses the industry”(V4 Interview)

4.2.2. Industry 4.0 in Production

4.2.3. Data Analysis, the Critical Point

4.2.4. Human-Machine Connections, DIGITAL Ecosystems

4.2.5. Human Resource Issues

4.2.6. Smart Products

4.3. Determining the Level of Development of Companies

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Pedersen, M.R.; Nalpantidis, L.; Andersen, R.S.; Schou, C.; Bøgh, S.; Krüger, V.; Madsen, O. Robot skills for manufacturing: From concept to industrial deployment. Robot. Comput.-Integr. Manuf. 2016, 37, 282–291. [Google Scholar] [CrossRef]

- Ślusarczyk, B. Industry 4.0—Are we ready? Pol. J. Manag. Stud. 2018, 17. [Google Scholar] [CrossRef]

- Deloitte. Industry 4.0,Challenges and Solutions for the Digital Transformation and Use of Exponential Technologies; Deloitte: Swiss, Zurich, 2015. [Google Scholar]

- Geissbauer, R.; Vedso, J.; Schrauf, S. Industry 4.0: Building the Digital Enterprise. 2016 Global Industry 4.0 Survey. What We Mean by Industry 4.0/Survey Key Findings/Blueprint for Digital Success. Retrieved from PwC. 2016. Available online: https://www.pwc.com/gx/en/industries/industries-4.0/landing-page/industry-4.0-building-your-digital-enterprise-april-2016.pdf (accessed on 12 March 2018).

- Monostori, L. Cyber-physical production systems: Roots, expectations and R&D challenges. Procedia CIRP 2014, 17, 9–13. [Google Scholar] [CrossRef]

- Nick, G.; Pongrácz, F. How to Measure Industry 4.0 Readiness of Cities. Int. Sci. J. Ind. 4.0 2016, 2, 64–68. Available online: http://industry-4.eu/winter/sbornik/2016/2/16.HOW%20TO%20MEASURE%20INDUSTRY%204.0%20READINESS%20OF%20CITIES.pdf (accessed on 12 March 2018).

- Berger, R. Industry 4.0: The New Industrial Revolution—How Europe Will Succeed; Roland Berger Strategy Consultants: Munich, Germany, 2014; pp. 1–24. Available online: https://www.rolandberger.com/publications/publication_pdf/ro (accessed on 12 March 2018).

- Pereira, A.; Romero, F. A review of the meanings and the implications of the Industry 4.0 concept. Procedia Manuf. 2017, 13, 1206–1214. [Google Scholar] [CrossRef]

- Weyer, S.; Schmitt, M.; Ohmer, M.; Gorecky, D. Towards Industry 4.0-Standardization as the crucial challenge for highly modular, multi-vendor production systems. IFAC-PapersOnline 2015, 48, 579–584. [Google Scholar] [CrossRef]

- Wang, G.; Gunasekaran, A.; Ngai, E.W.; Papadopoulos, T. Big data analytics in logistics and supply chain management: Certain investigations for research and applications. Int. J. Prod. Econ. 2016, 176, 98–110. [Google Scholar] [CrossRef]

- Bauer, W.; Schlund, S.; Marrenbach, D.; Ganschar, O. Industrie 4.0—Volkswirtschaftliches Potenzial für Deutschland; BITKOM und Fraunhofer–Institut für Arbeitswirtschaft und Organisation: Berlin, Germany, 2014; pp. 1–46. Available online: https://www.bitkom.org/noindex/Publikationen/2014/Studien/Studie-Industrie-4-0-Volkswirtschaftliches-Potenzial-fuer-Deutschland/Studie-Industrie-40.pdf (accessed on 12 March 2018).

- Rüßmann, M.; Lorenz, M.; Gerbert, P.; Waldner, M.; Justus, J.; Engel, P.; Harnisch, M. Industry 4.0: The Future of Productivity and Growth in Manufacturing Industries; Boston Consulting Group: Boston, MA, USA, 2015; pp. 1–14. Available online: http://www.inovasyon.org/pdf/bcg.perspectives_Industry.4.0_2015.pdf (accessed on 12 March 2018).

- Bildstein, A.; Seidelmann, J. Migration zur Industrie-4.0-Fertigung; Springer Vieweg: Berlin/Heidelberg, Germany, 2016; pp. 1–16. [Google Scholar]

- Lasi, H.; Fettke, P.; Kemper, H.-G.; Feld, T.; Hoffmann, M. Industrie 4.0. Wirtschaftsinformatik 2014, 56, 261–264. [Google Scholar] [CrossRef]

- Hermann, M.; Pentek, T.; Otto, B. Design principles for industrie 4.0 scenarios. In Proceedings of the 49th Hawaii International Conference on IEEE System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016. [Google Scholar]

- Bughin, J. Big data, Big bang? J. Big Data 2016, 3, 1–14. [Google Scholar] [CrossRef]

- Graetz, G.; Michaels, G. Robots at Work; CEP Discussion Papers, No. 1335; Centre for Economic Performance: London, UK, 2015; Available online: http://cep.lse.ac.uk/pubs/download/dp1335.pdf (accessed on 12 March 2018).

- Popp, J.; Erdei, E.; Oláh, J. A precíziós gazdálkodás kilátásai Magyarországon. Int. J. Eng. Manag. Sci. 2018, 3, 133–147. Available online: http://ijems.lib.unideb.hu/cikk/cikk/5af01cf23a77a (accessed on 12 March 2018). [CrossRef]

- Herrmann, C.; Schmidt, C.; Kurle, D.; Blume, S.; Thiede, S. Sustainability in manufacturing and factories of the future. Int. J. Precis. Eng. Manuf.-Green Technol. 2014, 1, 283–292. [Google Scholar] [CrossRef]

- Heynitz, H.V.; Bremicker, M.; AmadoriI, D.M.; Reschke, K. The Factory of the Future; KPMG AG: Amstelveen, The Netherlands, 2016; Available online: https://assets.kpmg.com/content/dam/kpmg/jp/pdf/jp-factory-of-future.pdf (accessed on 12 March 2018).

- Burmeister, C.; Lüttgens, D.; Piller, F.T. Business Model Innovation for Industrie 4.0: Why the Industrial Internet Mandates a New Perspective on Innovation. Die Unternehm. 2016, 70, 124–152. [Google Scholar] [CrossRef]

- Oláh, J.; Karmazin, G.; Pető, K.; Popp, J. Information technology developments of logistics service providers in Hungary. Int. J. Logist. Res. Appl. 2018, 21, 332–344. [Google Scholar] [CrossRef]

- Wang, S.; Wan, J.; Zhang, D.; Li, D.; Zhang, C. Towards smart factory for industry 4.0: A self-organized multi-agent system with big data based feedback and coordination. Comput. Netw. 2016, 101, 158–168. [Google Scholar] [CrossRef]

- Hofmann, E.; Rüsch, M. Industry 4.0 and the current status as well as future prospects on logistics. Comput. Ind. 2017, 89, 23–34. [Google Scholar] [CrossRef]

- Kovács, G.; Kot, S. New logistics and production trends as the effect of global economy changes. Pol. J. Manag. Stud. 2016, 14, 115–126. [Google Scholar] [CrossRef]

- Ślusarczyk, B. Shared Services Centres in Central and Eastern Europe: The Examples of Poland and Slovakia. Econ. Sociol. 2017, 10, 46–58. [Google Scholar] [CrossRef] [PubMed]

- Porter, M.A. Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Chikán, A. Vállalatgazdaságtan; Saldo Könyvkiadás: Budapest, Hungary, 2017; ISBN 978-963-12-6640-5. [Google Scholar]

- Rayport, J.F.; Sviokla, J.J. Exploiting the virtual value chain. Harv. Bus. Rev. 1995, 73, 75–85. [Google Scholar]

- KPMG. The Factory of the Future; Germany, 2016; KPMG AG: Amstelveen, The Netherlands, 2016; Available online: https://home.kpmg.com/xx/en/home/insights/2017/05/industry-4-0-its-all-about-the-people.html (accessed on 12 March 2018).

- Shrouf, F.; Miragliotta, G. Energy management based on Internet of Things: Practices and framework for adoption in production management. J. Clean. Prod. 2015, 100, 235–246. [Google Scholar] [CrossRef]

- Costanza, R.; de Groot, R.; Sutton, P.; Van der Ploeg, S.; Anderson, S.J.; Kubiszewski, I.; Farber, S.; Turner, R.K. Changes in the global value of ecosystem services. Glob. Environ. Chang. 2014, 26, 152–158. [Google Scholar] [CrossRef]

- Ehret, M.; Wirtz, J. Unlocking value from machines: Business models and the industrial internet of things. J. Mark. Manag. 2017, 33, 111–130. [Google Scholar] [CrossRef]

- PwC. Industry 4.0-Building the Digital Enterprise; PricewaterhouseCoopers LLP: Berlin, Germany, 2016; Available online: https://www.google.com/search?q=PwC+%282016%29%3A+Industry+4.0+-+Building+the+digital+enterprise.+PricewaterhouseCoopers+LLP+Hermann%2C+M.%2C+Pentek%2C+T.%2C+Otto%2C+B.+%282016%29%3A+Design+principles+for+industrie+4.0+scenarios.+In+System+Sciences+%28HICSS%29%2C+2016+49th+Hawaii+International+Conference+on+%28p.+392&ie=utf-8&oe=utf-8&client=firefox-b (accessed on 12 March 2018).

- Stock, T.; Seliger, G. Opportunities of sustainable manufacturing in industry 4.0. Procedia CIRP 2016, 40, 536–541. [Google Scholar] [CrossRef]

- Laureti, T.; Piccarozzi, M.; Aquilani, B. The effects of historical satisfaction, provided services characteristics and website dimensions on encounter overall satisfaction: A travel industry case study. TQM J. 2018, 30, 197–216. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How smart, connected products are transforming competition. Harv. Bus. Rev. 2014, 92, 64–88. [Google Scholar]

- Ilie-Zudor, E.; Kemény, Z.; Van Blommestein, F.; Monostori, L.; Van Der Meulen, A. A survey of applications and requirements of unique identification systems and RFID techniques. Comput. Ind. 2011, 62, 227–252. [Google Scholar] [CrossRef]

- Ketchen, D.J., Jr.; Hult, G.T.M. Bridging organization theory and supply chain management: The case of best value supply chains. J. Oper. Manag. 2007, 25, 573–580. [Google Scholar] [CrossRef]

- Tupa, J.; Simota, J.; Steiner, F. Aspects of Risk Management Implementation for Industry 4.0. Procedia Manuf. 2017, 11, 1223–1230. [Google Scholar] [CrossRef]

- Oesterreich, T.D.; Teuteberg, F. Understanding the implications of digitisation and automation in the context of Industry 4.0: A triangulation approach and elements of a research agenda for the construction industry. Comput. Ind. 2016, 83, 121–139. [Google Scholar] [CrossRef]

- Hossain, M.S.; Muhammad, G. Cloud-assisted industrial internet of things (iiot)—Enabled framework for health monitoring. Comput. Netw. 2016, 101, 192–202. [Google Scholar] [CrossRef]

- Tesch, J.F.; Brillinger, A.-S.; Bilgeri, D. Internet of things business model innovation and the stage-gate process: An exploratory analysis. Int. J. Innov. Manag. 2017, 21, 1740002. [Google Scholar] [CrossRef]

- Wielki, J. The impact of the internet of things concept development on changes in the operations of modern enterprises. Pol. J. Manag. Stud. 2017, 15, 262–275. [Google Scholar] [CrossRef]

- Arnold, C.; Kiel, D.; Voigt, K.-I. How the industrial internet of things changes business models in different manufacturing industries. Int. J. Innov. Manag. 2016, 20, 1640015. [Google Scholar] [CrossRef]

- Müller, J.M.; Kiel, D.; Voigt, K.-I. What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability 2018, 10, 247. [Google Scholar] [CrossRef]

- Lee, J.; Kao, H.-A.; Yang, S. Service innovation and smart analytics for industry 4.0 and big data environment. Procedia CIRP 2014, 16, 3–8. [Google Scholar] [CrossRef]

- Atzori, L.; Iera, A.; Morabito, G. The internet of things: A survey. Comput. Netw. 2010, 54, 2787–2805. [Google Scholar] [CrossRef]

- Laney, D. 3D Data Management: Controlling Data Volume, Velocity and Variety, META Group Research Note; Meta Group, Gartner: Stamford, CT, USA, 2001; Volume 6, pp. 1–3. [Google Scholar]

- Schlechtendahl, J.; Keinert, M.; Kretschmer, F.; Lechler, A.; Verl, A. Making existing production systems Industry 4.0-ready. Prod. Eng. 2015, 9, 143–148. [Google Scholar] [CrossRef]

- Reinhart, G.; Engelhardt, P.; Geiger, F.; Philipp, T.R.; Wahlster, W.; Zühlke, D.; Schlick, J.; Becker, T.; Löckelt, M.; Pirvu, B.; et al. CYBER physical Production-Systeme: Enhancement of Productivity and Flexibility by Networking of Intelligent Systems in the Factor; Springer: Frankfurt, Germany, 2013; pp. 84–89. [Google Scholar]

- Toro, C.; Barandiaran, I.; Posada, J. A perspective on Knowledge Based and Intelligent systems implementation in Industrie 4.0. Procedia Comput. Sci. 2015, 60, 362–370. [Google Scholar] [CrossRef]

- Gubbi, J.; Buyya, R.; Marusic, S.; Palaniswami, M. Internet of Things (IoT): A vision, architectural elements, and future directions. Future Gener. Comput. Syst. 2013, 29, 1645–1660. [Google Scholar] [CrossRef]

- Kortuem, G.; Kawsar, F.; Sundramoorthy, V.; Fitton, D. Smart objects as building blocks for the internet of things. IEEE Internet Comput. 2010, 14, 44–51. [Google Scholar] [CrossRef]

- Kocsi, B.; Oláh, J. Potential connections of unique manufacturing and industry 4.0. LogForum 2017, 13. [Google Scholar] [CrossRef]

- Zhong, R.Y.; Huang, G.Q.; Lan, S.; Dai, Q.; Chen, X.; Zhang, T. A big data approach for logistics trajectory discovery from RFID-enabled production data. Int. J. Prod. Econ. 2015, 165, 260–272. [Google Scholar] [CrossRef]

- Bologa, R.; Lupu, A.-R.; Boja, C.; Georgescu, T.M. Sustaining Employability: A Process for Introducing Cloud Computing, Big Data, Social Networks, Mobile Programming and Cybersecurity into Academic Curricula. Sustainability 2017, 9, 2235. [Google Scholar] [CrossRef]

- Woo, S.; Jo, H.J.; Lee, D.H. A practical wireless attack on the connected car and security protocol for in-vehicle CAN. IEEE Trans. Intell. Transp. Syst. 2015, 16, 993–1006. [Google Scholar] [CrossRef]

- Piccarozzi, M.; Abbate, T.; Aquilani, B. Do platforms contribute to value co-creation processes? Insights from a service-dominant logic perspective. In Proceedings of the 20th Excellence in Services International Conferences, Verona, Italy, 14 March 2017; University of Verona: Verona, Italy, 2017; pp. 645–656. [Google Scholar]

- Bordeleau, F.-E.; Mosconi, E.; Santa-Eulalia, L.A. Business Intelligence in Industry 4.0: State of the art and research opportunities. In Proceedings of the 51st Hawaii International Conference on System Sciences, Waikoloa Village, HI, USA, 2–6 January 2018; pp. 3944–3953. [Google Scholar]

- Lin, K.C.; Shyu, J.Z.; Ding, K. A Cross-Strait Comparison of Innovation Policy under Industry 4.0 and Sustainability Development Transition. Sustainability 2017, 9, 786. [Google Scholar] [CrossRef]

- Wang, S.; Wan, J.; Li, D.; Zhang, C. Implementing smart factory of industrie 4.0: An outlook. Int. J. Distrib. Sens. Netw. 2016, 12, 3159805. [Google Scholar] [CrossRef]

- Aquilani, B.; Silvestri, C.; Ruggieri, A. Sustainability, TQM and value co-creation processes: The role of critical success factors. Sustainability 2016, 8, 995. [Google Scholar] [CrossRef]

- Kliestik, T.; Misankova, M.; Valaskova, K.; Svabova, L. Bankruptcy Prevention: New Effort to Reflect on Legal and Social Changes. Sci. Eng. Ethics 2018, 24, 791–808. [Google Scholar] [CrossRef] [PubMed]

- Kliestikova, J.; Misankova, M.; Kliestik, T. Bankruptcy in Slovakia: International comparison of the creditor’s position. Oecon. Copernic. 2017, 8, 221–237. [Google Scholar] [CrossRef]

| Cultural Market Obstructing Factors | Labor Market Obstructing Factors | Organizational Obstructing Factors | Technological Obstructing Factors |

|---|---|---|---|

| Distrust | Inadequate quality workforce | Lack of digital strategy | Expensive technologies |

| Uncertainty | Shortages among workforce | Risky investment | Lack of standards |

| Realistic judgment of the abilities of the organization | Old-fashioned training | Fear of loss of control over intellectual property | Security of data, uncertainty regarding the level of encryption |

| Lack of demand for continuous learning | Partners do not have the technology | Underdeveloped data analysis | |

| Failure to develop data-based services | |||

| Lack of senior management support |

| Tool | Prevalence in the Sample | Number of Observations |

|---|---|---|

| CPS | 67.4% | 28 |

| Big data analytics | 62.8% | 26 |

| CPPS | 53.5% | 22 |

| Cloud | 32.6% | 14 |

| Sensors | 30.2% | 12 |

| Robot arms | 23.3% | 10 |

| RFIDs | 14% | 6 |

| Smart tools | 9.3% | 4 |

| Smart products | 7% | 3 |

| AGV | 2.3% | 1 |

| Type | CPS | Big Data | CPPS | Cloud | Sensors | Robots | RFID | Smart Tools | Smart Products | |

|---|---|---|---|---|---|---|---|---|---|---|

| Levene’s F | Q1 | 26.144 | 2.243 | 12.095 | 0.017 | 0.003 | 0.172 | 0.084 | 0.047 | 0.249 |

| t | 2.361 * | 2.071 ** | 2.171 ** | 0.162 | 0.422 | −0.431 | 0.552 | −0.221 | 0.359 | |

| Mean Diff. | 1.423 | 0.807 | 0.786 | 0.061 | 0.158 | −0.173 | 0.229 | −0.136 | 0.195 | |

| S.E.D. | 0.379 | 0.389 | 0.362 | 0.371 | 0.373 | 0.401 | 0.415 | 0.617 | 0.543 | |

| Levene’s F | Q2 | 5.741 | 0.089 | 2.284 | 0.088 | 2.103 | 1.039 | 0.672 | 0.993 | 0.879 |

| t | 2.674 ** | 1.867 * | 2.809 *** | 0.136 | 1.077 | 0.857 | 0.645 | −0.184 | 1.266 | |

| Mean Diff. | 1.415 | 0.773 | 0.977 | 0.051 | 0.401 | 0.343 | 0.269 | −0.114 | 0.673 | |

| S.E.D. | 0.379 | 0.414 | 0.348 | 0.374 | 0.371 | 0.401 | 0.417 | 0.618 | 0.531 | |

| Levene’s F | Q3 | 1.041 | 0.006 | 0.004 | 1.198 | 0.057 | 1.512 | 0.442 | 0.152 | 0.962 |

| t | 2.362 ** | 1.452 | 2.427 ** | −0.241 | 0.778 | 0.302 | 1.015 | 0.152 | 0.941 | |

| Mean Diff. | 1.003 | 0.618 | 0.898 | −0.091 | 0.295 | 0.123 | 0.421 | 0.094 | 0.507 | |

| S.E.D. | 0.534 | 0.471 | 0.371 | 0.379 | 0.379 | 0.408 | 0.415 | 0.621 | 0.539 | |

| Levene’s F | Q4 | 5.046 | 6.699 | 0.274 | 0.921 | 2.009 | 0.462 | 0.185 | 2.517 | 0.099 |

| t | 2.712 ** | 1.911 * | 1.676 | −0.038 | −0.541 | 0.288 | −0.687 | −0.696 | −0.444 | |

| Mean Diff. | 0.918 | 0.567 | 0.631 | −0.014 | −0.204 | 0.116 | −0.286 | −0.427 | −0.242 | |

| S.E.D. | 0.338 | 0.297 | 0.375 | 0.374 | 0.355 | 0.404 | 0.416 | 0.614 | 0.544 | |

| Levene’s F | Q5 | 2.173 | 0.296 | 2.409 | 0.281 | 0.001 | 5.929 | 2.919 | 4.856 | 1.847 |

| t | 2.902 *** | 0.041 | 2.464 ** | 1.511 | 0.143 | 0.893 | −0.558 | −0.529 | −0.103 | |

| Mean Diff. | 1.182 | 0.018 | 0.881 | 0.544 | 0.054 | 0.357 | −0.233 | −0.326 | −0.056 | |

| S.E.D. | 0.407 | 0.439 | 0.357 | 0.361 | 0.383 | 0.399 | 0.417 | 0.616 | 0.546 | |

| Levene’s F | Q6 | 0.315 | 0.009 | 5.661 | 2.321 | 0.196 | 1.912 | 0.084 | 0.682 | 0.637 |

| t | 2.467 ** | 1.462 | 0.675 | 0.151 | −1.417 | 0.992 | −0.168 | −0.752 | −0.441 | |

| Mean Diff. | 1.038 | 0.619 | 0.311 | 0.056 | −0.519 | 0.395 | −0.071 | −0.461 | −0.239 | |

| S.E.D. | 0.421 | 0.423 | 0.389 | 0.374 | 0.366 | 0.398 | 0.419 | 0.613 | 0.544 | |

| Levene’s F | Q7 | 0.956 | 3.941 | 0.931 | 2.678 | 0.561 | 1.076 | 0.784 | 0.174 | 0.031 |

| t | 3.709 *** | 3.172 *** | 1.751 * | −0.039 | −0.563 | 0.299 | 1.571 | −0.065 | 0.115 | |

| Mean Diff. | 1.411 | 0.997 | 0.655 | −0.014 | −0.212 | 0.121 | 0.633 | −0.041 | 0.063 | |

| S.E.D. | 0.381 | 0.314 | 0.374 | 0.374 | 0.377 | 0.404 | 0.402 | 0.619 | 0.546 |

| CPS | Big Data | CPPS | |

|---|---|---|---|

| Q1 | 15.624 *** | 5.931 | 10.552 ** |

| Q2 | 13.854 *** | 5.311 | 7.875 * |

| Q3 | 9.092 * | 5.244 | 6.729 |

| Q4 | 4.211 | 4.814 | 5.547 |

| Q5 | 10.685 ** | 1.611 | 9.568 * |

| Q6 | 9.286 * | 2.289 | 5.443 |

| Q7 | 13.333 *** | 5.932 | 6.446 * |

| Digital Novice | Horizontal (Internal Processes) Integrator | Cooperating Vertically (with External Partners) | Digital Champion | |

|---|---|---|---|---|

| 1. Digital business model and customer access | First digital solutions, island-like applications | Digital product service with portfolio software, network (M2M, machine-to-machine) and data as distinctive features | Integrated customer solutions across the supply chain, cooperation with external actors | Development of new, disruptive business models, innovative product and service portfolio, including one-item series (Lot size 1) |

| 2. Digitalization of product portfolio | Online and offline channels are distinct, product focus instead of customer focus | Multi-channel sales, online and offline channels are integrated, data analysis is used for customization | Unique customer approach, integrated with value chain partners. Shared and integrated interfaces | Integrated Customer Life Path Management in all marketing and sales channels, customer empathy, CRM |

| 3. Digitizing, horizontal and vertical integration of the value chain | Digitized and automated sub-processes. Partial integration with production and/or internal or external partners. Standard processes adopted in cooperation | Horizontal digitization, standard and coordinated internal processes and data flow, limited integration with external partners | Vertical integration of processes and data flows with customers and external partners, intensive data usage in the fully integrated network | Fully digitized, partner-integrated ecosystem, self-optimizing, virtual processes, concentration on basic skills; decentralized autonomy. Near real-time access to comprehensive production information |

| 4. Data and Analysis as a Key Capability | Data analysis is based on semi-manual data retrieval. Selected things are monitored and processed, and there are no systems for sudden events | The analytical capability is supported by a central business intelligence (BI) system. Isolated, non-standardized decision support system | The central BI system consolidates all relevant external and internal resources, some forward looking analyses are made. A special decision-support system operates and has a developed protocol for handling sudden events | Centrally uses forward-looking (predictive) analyses for real-time optimization and automatic handling of sudden events. The intelligent database and learning algorithms make analysis and decision support more efficient. |

| 5. Agile IT Structure | Separated IT architecture, in-house | Homogeneous IT architecture in-house. The connection between different data cubes is developing | A similar IT structure in the partner network. Linked Data Lake, a powerful architecture | Unified Data Lake with external data integration capability and flexible organization. Providing service and data exchange services to partners |

| 6. Complaint handling, security, law and tax | Traditional structures, no focus on digitization | The digital challenge has been identified, but is not dealt with in a deliberate manner | Legal risks are constantly addressed acting together with partners | Complaints, legal issues, security and taxation are optimized at the level of the entire supply chain |

| 7. Organization, employees, digital culture | Functional silos | Cross-functional co-operations, but not structured and continuous | Corporate cross-border cooperation, the sharing of incentives is part of the culture | Collaboration is a key value driver |

| Criterion Firm | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|

| V1 | |||||||

| V2 | |||||||

| V3 | |||||||

| V4 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nagy, J.; Oláh, J.; Erdei, E.; Máté, D.; Popp, J. The Role and Impact of Industry 4.0 and the Internet of Things on the Business Strategy of the Value Chain—The Case of Hungary. Sustainability 2018, 10, 3491. https://doi.org/10.3390/su10103491

Nagy J, Oláh J, Erdei E, Máté D, Popp J. The Role and Impact of Industry 4.0 and the Internet of Things on the Business Strategy of the Value Chain—The Case of Hungary. Sustainability. 2018; 10(10):3491. https://doi.org/10.3390/su10103491

Chicago/Turabian StyleNagy, Judit, Judit Oláh, Edina Erdei, Domicián Máté, and József Popp. 2018. "The Role and Impact of Industry 4.0 and the Internet of Things on the Business Strategy of the Value Chain—The Case of Hungary" Sustainability 10, no. 10: 3491. https://doi.org/10.3390/su10103491

APA StyleNagy, J., Oláh, J., Erdei, E., Máté, D., & Popp, J. (2018). The Role and Impact of Industry 4.0 and the Internet of Things on the Business Strategy of the Value Chain—The Case of Hungary. Sustainability, 10(10), 3491. https://doi.org/10.3390/su10103491