1. Introduction

EVs have progressed into a dependable technology; certain countries aim for 100% new vehicle registrations made of EVs [

1,

2]. Presently, EVs and ICE vehicles have comparable performances even if EVs show shorter range and faster depreciation rates. Nevertheless, according to the literature review [

3,

4,

5], it appears that the faster depreciation of EVs, compared to ICE vehicles, has limited impact on the vehicle purchasing decision-making process. However, upon closer examination, purchasers indirectly factor in the depreciation of EVs among their primary motivations or apprehensions about buying an EV. In fact, in priority they take into account aspects like price, range, and charging network accessibility. Other consumer preferences and context can have major influences on the market evolution. It can be about technology, brand reputation, oil prices, or other economic conditions. For example, when gas prices rise sharply or environmental regulations tighten significantly, there can be an important surge in the demand for EVs, resulting in higher prices and slower depreciation. Conversely, if incentives decrease or consumer focus turns to the newest technology cars, the interest of potential buyers in EVs might wane, resulting in a rapid decline in value.

Another important element leading to the decline in the value of electric cars concerns the after-warranty coverage. This is primarily due to the potential need for battery replacement. These elements are the primary variables influencing the pace of depreciation of EVs. This can be comprehended by examining how the loss of value of EVs affects drivers’ choices to purchase an electric car. Therefore, it is essential to investigate the reality of EVs and the depreciation of popular models. Manufacturers and governments promote EVs via decarbonization strategies for road transport because of reduced ownership expenses, ignoring the variable depreciation that occurs.

Governmental structures provided subsidies for EVs to encourage their uptake [

6,

7,

8] and lessen reliance on oil simultaneously. EVs are eco-friendlier compared to ICE cars [

9,

10,

11], and they generate zero tailpipe emissions. Conversely, subsidies may serve as a means to enhance the local EV manufacturing sector.

Subsidies for acquisitions have led to a distortion in the market [

12,

13,

14]. The anticipated removal of subsidies is likely to inject new energy into the pre-owned market because of a greater cost disparity between new and used electric cars. However, focusing solely on acquisition and not on operation will probably see barely a minimal impact. This will remain valid unless there is a significant advancement in energy storage technology that will make the relative decrease in autonomy less sensitive to the natural deterioration of the battery. Battery presents the double role of driving the EV market and being a main player in EV depreciation. In fact, recognized for their impressive energy density and compactness, Li-ion batteries have outperformed earlier battery technologies regarding power generation, charge sustainability, and diminished environmental harm [

15,

16,

17]. In the last almost 30 years, Li-ion batteries have seen an annual increase in efficiency of 5–10% and a decrease in cost of 15–18% [

18,

19]. This rapid progress has resulted in an extraordinary rise in the worldwide total of the EV fleet, which expanded more than 1000-fold from 2010 to 2024 [

18]. Forecasts from the International Energy Agency (IEA) indicate a possible increase of 12 to 21 times in EV stocks from 2021 to 2030 [

18]. Even with this hopeful outlook, numerous obstacles still need to be tackled, such as safety concerns; problems regarding mineral availability and their social and policy consequences; environmental challenges tied to mineral extraction; infrastructure challenges; and disposal challenges. All these may contribute directly or indirectly to the adoption but as well as the depreciation of EVs.

At the moment, the future impact of subsidy reduction is not clear even if the existence of certain companies may be threatened. As subsidies come to be removed, few EV manufacturing companies might struggle to remain competitive. Producers with sufficient influence might take in the subsidy reduction, whereas lesser competitors could encounter significant challenges. Consequently, just a handful of big corporations might control the market down the line. Nonetheless, various factors may still propel the expansion of the EV market, such as increasing fuel costs, governmental regulations, and advancements in technology. Should these factors develop positively, the EV market could keep expanding swiftly in the years ahead without financial aid.

The EV market after subsidies could introduce a new dynamic in the pre-owned electric car market around the world.

The decline in the value of electric cars affects both owners and manufacturers. Currently, ICE vehicles maintain their value more effectively compared to EVs [

20,

21,

22,

23], but this may change as the EV market reaches maturity, particularly in technology. Tesla cars are a good illustration as they depreciate less rapidly primarily because of the brand’s strong reputation and established cutting-edge technology.

As technology advances and consumer demand rises, it is anticipated that EVs will hold their value more effectively, resulting in a reduced pace of loss of value and a bigger used car market.

The decline in the value of electric cars is a real issue during the evaluation period of 3 to 5 years after the purchase of a new vehicle. The swift loss of value might postpone the time when EVs reach the used car market.

The research on depreciation concentrated primarily on calculation techniques related to different types of products. The existing literature on depreciation methods has identified a variety of approaches that allow public and private organizations to compute asset depreciation more precisely and in accordance with their unique requirements. These techniques have developed throughout the years, adjusting to various settings. The straight-line method is among the easiest and most widely utilized techniques. Alternative methods encompass component depreciation, which analyzes distinct parts of the asset individually, recoverable amount, revalued cost, and variable depreciation [

24,

25]. The declining balance method speeds up depreciation during the initial years of the asset’s lifespan. The double declining balance method is notably aggressive, whereas the declining balance paired with straight-line depreciation permits a shift to linear depreciation in the subsequent years. Additional variations consist of variable declining balance, stepped declining balance, adjusted declining balance, and component declining balance [

26,

27]. The units of production method for depreciation relies on the asset’s actual usage, like operating hours or the number of units created. This method has variations such as adjusted production unit depreciation and component production unit depreciation [

28,

29]. The sum-of-years digits method is an alternative accelerated depreciation approach that allocates a greater expense during the initial years. Variants consist of the altered sum-of-years digits, reverse sum-of-years digits, component-based sum-of-years digits, and productivity-modified sum-of-years digits [

30,

31]. The general accelerated depreciation method encompasses methods like the modified accelerated cost recovery system. Other options include alternative accelerated depreciation and customized accelerated depreciation, designed to meet particular requirements [

32]. There exist various less frequent yet equally beneficial methods and approaches in particular situations. Included are the replacement value method, which determines depreciation based on the expense of replacing the asset instead of its initial value; the parabolic Kuentzle method, which modifies depreciation following a parabolic curve, suitable for assets that experience non-linear wear; the Ross method, applied in cases where the asset’s depreciation occurs irregularly throughout its useful life; and accelerated depreciation for intangible assets, which emphasizes the swift reduction in value of assets like patents or copyrights [

33,

34,

35].

The role of second-hand EVs in the EV transition is becoming increasingly important, especially as more countries push for the decarbonization of transport. Lower upfront costs make second-hand EVs more accessible to middle- and low-income households. Pre-owned EVs help democratize clean transport, not just keeping it in the hands of wealthier early adopters. Faster Market Penetration increases the overall share of EVs on the road more quickly. A robust second-hand market helps reduce the average vehicle age and phase out older, polluting vehicles. Extended vehicle lifespan encourages circular economy principles by extending the usable life of batteries and vehicles and supports sustainability by reducing waste and maximizing the value extracted from manufacturing emissions.

Nevertheless, battery health with battery degradation over time affects range and resale value.

A healthy second-hand EV market indicates a mature EV ecosystem with buyers, sellers, service networks, and regulations all in place. There are major challenges, as battery replacement cost can be high for older EVs, affecting resale value. Misinformation or a lack of consumer knowledge about EVs may deter used EV purchases. There is currently a limited supply of used EVs, but this will improve as more EVs age. Fleet retirements from companies and ride-share services will significantly expand the second-hand EV pool. Smart reconditioning (battery swaps, software updates) will help older EVs remain viable. Second-hand EVs will likely become the gateway for EV adoption in developing countries.

This manuscript explores the interplay between the different factors affecting the value of EVs and the second-hand market. The main factors that affect EV depreciation: subsidies, progress in technology, including battery, and battery deterioration. The battery technology affects EVs in different aspects: performance that makes EVs a practical reality and older models obsolete, cost that affects the price of new EVs, and deterioration that impacts depreciation. Clearly, the speed of depreciation of EVs does not benefit a significant second-hand market, especially in the initial phases of an innovative industry like EVs. It is fair to anticipate that once the elements causing the depreciation of EVs are managed, especially subsidies and improved battery technology, and price parity is reached between EVs and ICE vehicles, the used electric car market will expand significantly.

The approach to sustainability in this manuscript is the ability to maintain or support over time subsidies of all sorts before reaching the maturity of markets and the price parity between new EVs and new ICE vehicles. This is particularly relevant in the context of dependence on natural resources as fossil fuels and environment issues such as global warming. It emphasizes the need to use financial resources to foster technological progress in a way that meets current needs to reduce pollution from the transport industry without limiting the possibility of developing an important future pre-owned market.

This study attempts to understand the second-hand EV market in relation to technological progress and depreciation. This involves analyzing how rapid advances in EV technology affect the resale value, adoption trends, and overall market behavior of used EVs. The study of depreciation of EVs in this manuscript attempts to understand how their value declines over time, particularly in the first three to five years, compared to their initial purchase price. The goal of this study includes the following:

- ○

The drivers of the EV market as cost of ownership, technology, and subsidies.

- ○

Analysis of resale value trends across different EV makes and models in different countries.

- ○

Comparison of depreciation rates of EVs versus ICE vehicles.

- ○

Assessment of the impact of governments’ policies or market conditions on resale values.

- ○

Identification of other major factors affecting EV depreciation such as progress in battery technology and battery degradation, swift progress in technology such as AI, and brand perception.

- ○

The evolution of the second-hand EV market.

Regarding the monetary analysis, the depreciation in this manuscript is generally presented within a country based on a given currency, even though the depreciation rates can be compared between two different countries or economic zones.

2. EV Market Drivers from Consumers’ Perspective

The battery is the first factor that made EVs a practical reality and continuously drives their uptake. Advancements in energy storage technology will be determinant in the environmental effects and sustainability of the EV transition. Among different possible technologies, Li-ion-based chemistry seems to have a bright future even with advancements in alternative technologies like sodium–ion (Na-ion) [

36,

37,

38].

A value between 100% and 80% is an acceptable state of health (SOH) for batteries [

39]. When the capacity drops below 80%, it raises some issues, and the battery must be replaced for reliable EV functioning. The cost of battery replacement remains exorbitant.

Certain technical and economic issues in EV batteries involve the tradeoff between cost and the limited availability of certain elements like cobalt. Lithium Iron Phosphate (LFP) [

1,

39,

40,

41] technology, which is free from cobalt, is commonly utilized in EVs, yet it still has a lower energy density compared to Lithium Nickel Manganese Cobalt (LNMC) technology [

1,

39,

42].

At present, a yearly average loss of 2.5% of the battery capacity in EVs can typically be observed, which means that, in 7 to 10 years, their capacity declines to 70–80%, necessitating a battery replacement [

43,

44]. Consequently, due to the SOH, a decade-old EV will not be appealing to buyers.

Almost 60% of the value of an EV was from the battery in 2015; by 2020, this dropped to 33%, and it is projected to reach 20% by the end of 2025 [

45]. Additionally, enhanced battery longevity will alleviate consumer concerns regarding replacement expenses and after-warranty support. Customer concerns include not just battery expenses but also quicker charging, extended range, and increased energy density for lighter automobiles.

Another consequence of the drop regarding battery prices is the upcoming price equivalence between EVs and ICE cars. It would be a perfect situation for the reduction in incentives [

45].

Progress in Li-ion battery technology has been determinant in the uptake of electric cars. Improvements in battery technology have been essential for the adoption of EVs. Major progress was achieved in safety, performance, and range by using more sustainable materials, enhanced durability, and batteries with higher energy density.

Technological progress is still advancing, as significant achievements remain attainable in energy density for batteries that are lighter and offer longer range, especially aiming towards generalized solid-state batteries [

46]. In spite of all the significant accomplishments that have established the EV as the leading option for decarbonizing road transportation, the battery appears to be the primary instrument that enables EVs to become a sustainable reality, supported by an adequate charging network. However, the primary factor that distinguishes the EV driving experience from that of ICE vehicles extends beyond just the powertrain: it is probably the technology that introduces the most significant innovation within the EV experience, and this reality becomes increasingly evident over time with the growing adoption of DNNs (deep neural networks), ML (machine learning), and AI. Such programs progressively establish autonomous driving as a norm in the EV experience, along with enhanced battery management, increased safety, improved driver–vehicle interaction, and soon greater automobile internet, similar to the evolution in mobile communication (2G through 5G). Adopting a smartphone from a basic 2G phone allows greater possibilities than phone calls. Swift advancements in technology appear to be the key influence in the electric mobility business, but they also significantly contribute to the quick decline in EVs’ value.

Lithium batteries using solid electrolytes without a separator, or solid-state Li-ion batteries, are considered the batteries of the future, offering improved energy density and greater safety [

47,

48].

Lithium will very likely continue to hold an important role in the electric car industry. Innovative battery technology is being developed rapidly by car manufacturers, which includes solid-state batteries. The improved storage capacity may improve autonomy by up to 50%. A prototype was created by Toyota for a vehicle that utilizes a solid-state battery, with manufacturing initially expected to begin in 2024 [

49].

Energy storage in electric transportation demands an extended lifespan, lower degradation rates, reduced volume, and less sensitivity to external factors. A significant level of investigation is underway to improve battery quality and efficiency via experiments, theoretical methods, or simulations [

50,

51,

52,

53,

54,

55]. To achieve such an objective, more research is needed in materials and design for higher efficiency, security, and better control of external factors [

50,

51,

52,

53,

54,

55].

- b.

Cost of ownership

An automobile’s global cost of ownership comprises the buying price, any grants, and operational costs, including the loss of value over time. This parameter is often omitted or entirely disregarded in comparisons between EVs and ICE cars.

The reduced ownership costs of EVs compared to ICE vehicles are frequently highlighted as a key factor in countries with significant EV adoption [

1]. Reduced operational costs are accompanied by subsidies and rapid technological advancements to enhance the shift to EVs. The latter two elements contribute to the widespread acceptance of EVs and the quick depreciation of EVs. High-tech EVs as Tesla models, featuring advanced technology and artificial intelligence (AI) integration, experience a lower depreciation rate due to higher market demand compared to more affordable EVs, exemplified here by the Nissan Leaf. These simpler cars experience a steeper rate of depreciation. There is a continuous progress in battery technology and performance, featuring greater storage density that enables extended range at reduced costs as battery prices consistently decline [

56,

57]. The growing technological incorporation in the automotive sector, especially in EVs, is AI; AI aids in machine learning, safety, efficiency, battery management, and driver assistance. The expense of ownership is a key factor in the EV sector, especially in nations where EV adoption is at its peak, as shown in

Table 1. The cost of ownership primarily relates to the price of electricity in comparison to gasoline. Nations that have the cheapest electricity and the most expensive gasoline are likely to see the greatest EV adoption rate, especially in urban regions. In

Table 1, it is indicated that the average EV driver is a person earning an important revenue, who lives in a country where gasoline is significantly more expensive than electricity, resides in an urban area not densely populated and where electric vehicles have a certain level of acceptance. Norway, Iceland, and Sweden therefore exhibit the most important levels of EV adoption (

Table 1).

In 2022, EV sales accounted for 14% of the worldwide car market [

42], and various studies estimate that, by 2040, EV sales will comprise 54% of new vehicles available on the global market, with forecasts indicating approximately 70 million EVs sold by that year [

45,

46].

The main consideration for car buyers when opting for an EV is affordability, followed by the vehicle’s range and the availability of public charging stations [

1]. From the perspective of the owners, numerous other criteria can be articulated in terms of cost-effectiveness. This suggests a potentially thriving second-hand EV market if the cars are priced competitively against new models and the battery preserves a considerable part of its initial capacity to satisfy range requirements. Subsidies have a major influence on buying costs, thereby impacting the gap between new and pre-owned EVs.

The two top countries in the list of countries with the highest EV penetration rates, Norway and Iceland, occupy the second and fourth places in GDP per capita, as presented in

Table 1. Norway and Iceland also have some of the highest ratios of gasoline costs to electricity.

This is an indication that in the absence of subsidies, the operational expenses of an EV would be significantly more advantageous in these countries than in any of the other nations on the list.

Ultimately, the markets that exhibit the greatest EV adoption are those where owning ICE vehicles is costlier and in nations with more substantial subsidies.

Many of the other factors are closely linked to batteries, including vehicle cost, EV performance, safety, or longevity. Despite the competitive maturity of EV technology, further research is still required due to market demands. As time goes on, more research is needed to develop batteries with enhanced performance that can compete better regarding cost, energy density, longevity, and simpler material recycling.

The non-subsidy parameters listed in

Table 1 above clearly apply to both new EVs and used EVs. The primary distinction between owners of new EVs and those of used EVs is probably related to budget.

The hidden factor of the reduced ownership expense concerning electric cars is their steeper depreciation rate, which is often overlooked in comparison with ICE cars considering that the cost of ownership is considerably more important for an EV than for an ICE vehicle of the similar brand and model.

For instance, in 2023, the price of an electric Kia Soul is about USD 43,000, whereas a gasoline Kia Soul costs USD 21,000 [

64].

Table 2 shows the difference in the cost of ownership for the first 3 years, between an electric Kia Soul and an ICE Kia Soul while the vehicles operated under the manufacturer’s warranty coverage.

Table 2 juxtaposes EV and ICE Kia Souls, considering the vehicles’ depreciation. An in-depth evaluation of the swift decrease in EV values should lead to an extended ownership period for EV buyers to maintain reasonable ownership expenses.

Evidently, the depreciation rate of electric vehicles will differ by country depending on various influencing factors. For instance, attraction for pre-owned EVs will rise, and the rate of depreciation will fall as subsidies decrease. Subsidies have an important impact on the time required to achieve parity in the cost of ownership between EVs and ICE vehicles.

Attaining the equal cost of ownership between electric and internal combustion engine vehicles will offer a notable financial advantage to support the shift towards full EV adoption alongside a more dynamic used EV marketplace.

- c.

Technology

Technology is the primary force accelerating the growth and transformation of the EV market. Technology is the primary driver of the EV transition, enabling cleaner, more efficient, and economically viable alternatives to ICE vehicles. Technology is not just enabling EVs; it is redefining how engineers design, build, drive, and interact with vehicles. It is accelerating a systemic shift from fossil fuels to electrified, smart, and sustainable transportation. Lithium-ion batteries are becoming more efficient, storing more energy in smaller, lighter packs, increasing EV range. Solid-state batteries promise even greater safety and performance [

65]. Battery prices have fallen dramatically over the last decade, making EVs more affordable [

66]. Cost per kilowatt-hour (kWh) has dropped from over USD 1000 in 2010 to under USD 150 in 2024, making EVs more accessible [

66].

The energy density of Li-ion batteries has tripled-plus since the early 1990s. Future gains (lab-scale solid-state, anode-free designs) may double these figures, but, for now, commercial limits hover in the 300–350 Wh/kg range with ~500 Wh/L volumetric energy density for premium cells in 2025. The evolution of energy density in lithium-ion batteries from 1992 to 2030 reflects major advancements in materials science, battery design, and manufacturing [

67].

Table 3 shows the evolution of the battery density of Li-ion batteries from the early 1990s.

Table 4 shows the technical progress while comparing the 2011 Nissan Leaf and the 2018 Nissan Leaf. It is particularly striking to see the difference in battery size 24 kWh in 2011 vs. 40 kWh in 2018 and the price difference of USD 37,550 vs. USD 36,200 for the 2018 model. As after inflation adjustment, the 2011 model with lower specifications is more expensive than the 2018 model; this is almost essentially for the battery price drop from about USD 800/kWh in 2011 to about USD 200/kWh in 2018 [

66]. This comparison is particularly relevant due to the sharp price drop between 2011 and 2018. The battery price drop is much slower after 2018 [

66].

Developments in fast-charging technologies (like solid-state batteries and ultra-fast chargers) reduce charging times from hours to minutes. Smart grid integration allows optimized charging during off-peak hours, reducing stress on electricity networks. Wireless and bidirectional charging (vehicle-to-grid, V2G) is emerging to enhance convenience and grid resilience. Modern electric drivetrains are more efficient and require less maintenance than ICEs (over 85% efficiency vs. ~25–30%). The regenerative braking technology captures kinetic energy and converts it into electricity, extending vehicle range. Over-the-air (OTA) updates, autonomous driving, and vehicle-to-grid (V2G) communication are transforming EVs into smart mobility platforms. AI and machine learning enable better vehicle diagnostics, reducing downtime and improving safety. Rapid growth in public and home charging stations makes EV ownership more convenient. Regenerative braking and advanced thermal management improve overall energy use. Software updates (like Tesla’s OTA updates) enhance features and fix issues post-sale. Lightweight materials (e.g., aluminum, carbon fiber) help reduce energy consumption. Automation and robotics increase manufacturing efficiency and lower costs. Recyclable and sustainable materials are being integrated into battery and car production. In wireless charging, inductive charging pads and dynamic charging roads are in development for hands-free energy replenishment. In recycling technologies, innovations in battery recycling and second-life use reduce environmental impact. Automakers are adopting sustainable practices, like using renewable energy and eco-friendly materials. There is a more important integration of renewable energy. EVs can act as energy storage units for smart grids, aiding in the integration of solar and wind power. Vehicle-to-grid (V2G) and vehicle-to-home (V2H) technologies allow EVs to supply energy back to homes or the grid during peak demand. Technological strides in sensors and AI are making autonomous EVs more feasible.

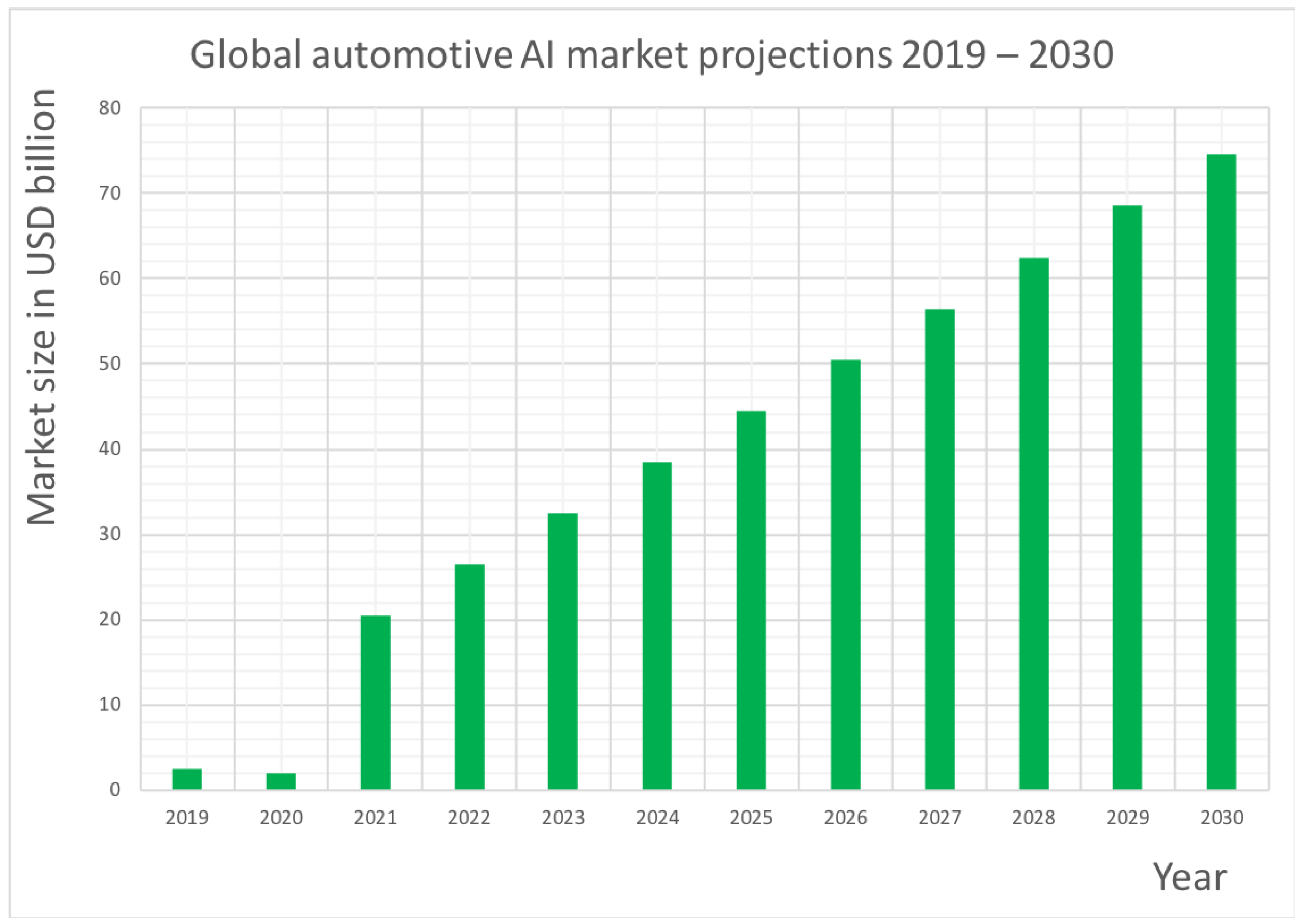

AI supports machine learning, safety, efficiency, battery control, driver engagement, intelligent driving … AI is increasingly essential to vehicle technology, and additionally, its incorporation in EVs is accelerating quickly, as illustrated in

Figure 1.

Algorithms inspired by evolutionary technologies are increasingly being explored and applied in the field of autonomous driving to enhance decision making, control systems, and adaptation in complex environments. These algorithms are often bio-inspired and fall under the broader categories of evolutionary computation and genetic programming.

These include Genetic Algorithms (GA), Genetic Programming (GP), Evolution Strategies (ES), and Differential Evolution (DE). EAs are used to generate optimal or near-optimal driving paths while avoiding obstacles, considering dynamic constraints, and maintaining safety. GAs and Artificial Neural Networks (ANN) are both utilized in EV technology to optimize various aspects like energy management, battery performance, and overall efficiency. GA is used for optimization tasks, while ANN excels at modeling complex systems and making predictions. They are often combined to leverage their respective strengths. Other notable techniques include the following:

Applications include the following:

Train neural networks that map raw sensory inputs (camera, LiDAR, radar) directly to control commands.

Neuro-evolution helps design controllers that adapt to new or unseen driving conditions, such as inclement weather or road anomalies.

Evolved models can improve upon human demonstrations by optimizing performance over time.

Evolutionary algorithms are particularly suited for training in simulated environments, where many scenarios can be tested, mutated, and evolved over generations. Tools like CARLA or LGSVL simulators allow the rapid iteration of evolved driving strategies.

Genetic programming can evolve symbolic representations of decision trees or logic structures that combine multi-sensor inputs for robust decision making.

Evolution strategies help fine-tune fusion parameters under varying environmental conditions.

EAs support online adaptation by evolving driving strategies in real-time or semi-real-time, especially for

EAs are good for non-differentiable, noisy, or multi-modal optimization problems. They can explore novel solutions that might be hard to discover via gradient-based learning. There is flexibility in evolving both control logic and model architectures. Evolutionary methods require large numbers of simulations. Evolved solutions in simulation may not always generalize well to real-world environments. Some evolved behaviors might be hard to interpret or verify. Uber ATG and NVIDIA have experimented with evolutionary methods in reinforcement learning setups for driving policy optimization. Similarly, DeepMind has used neuro-evolution (like NEAT) to train control policies in complex simulations, which can be translated to driving domains.

Ride-sharing and subscription models are reshaping car ownership patterns, favoring electric fleets. AI and machine learning improve battery management, predictive maintenance, and route optimization. Connected vehicles enable real-time data exchange for traffic, charging availability, and software enhancements. EVs are foundational for autonomous vehicle (AV) development due to their simpler mechanical systems and digital control. Mobility-as-a-service models often prefer EVs due to the lower total cost of ownership.

- d.

Subsidies

Subsidies have indeed been a major driver of the EV transition globally [

70]. Subsidies reduce upfront costs. EVs generally have higher sticker prices than comparable internal combustion engine vehicles due to costly battery packs. Government subsidies, like tax credits, rebates, and grants, help reduce this initial price gap, making EVs more attractive to consumers. In the U.S. for example, federal tax credits of up to USD 7500 have significantly boosted EV adoption. The EU and China both offer purchase subsidies and incentives like tax exemptions and license plate privileges. Subsidies encourage industry investment. In fact, subsidies and government incentives also spur automakers to ramp up EV production, invest in R&D, and localize battery manufacturing key steps in reducing long-term costs and boosting innovation. Public funding helps roll out EV charging networks, which are critical for reducing “range anxiety” and enabling mass adoption. Infrastructure subsidies lower risk for private investors and accelerate deployment.

- ▪

Subsidies have an important role in driving market demand. Fleet procurement programs and corporate incentives push demand for EVs in commercial and government fleets, helping scale production and reduce costs through economies of scale.

- ▪

Subsidies support as well equitable access to EV technology. In some regions, EV subsidies are targeted toward low-income buyers to ensure a just transition and broader societal benefit.

- ▪

Nevertheless, subsidies may have some major negative effects. Over-reliance on subsidies may distort markets and delay cost-competitiveness. Gradual phase-outs are essential to encourage self-sustaining market dynamics. Policies like carbon pricing, fuel economy standards, and ZEV mandates can complement or even outperform subsidies in certain contexts.

Subsidies are not the only driver of the EV transition, but they have been essential in catalyzing early adoption, stimulating industry shifts, and enabling infrastructure development. As EVs reach price parity and mature technologically, the role of subsidies may evolve, but for now, they remain a cornerstone of global EV policy.

- e.

Consumer Trust and Adoption

Brand reputation plays a critical role in the transition to electric vehicles (EVs), influencing consumer adoption, investor confidence, and policy support. Established automakers (e.g., Tesla, BMW, Toyota) benefit from trust in their engineering, safety, and after-sales service. This reassures consumers when trying relatively new EV technologies. Brands known for innovation (e.g., Tesla, Rivian) are more likely to be perceived as leaders in EV development, making their models more appealing despite potentially higher prices. A strong brand reputation can offset concerns about EV reliability, battery life, or charging infrastructure by implying that the brand stands behind its product. Automakers like Polestar and Tesla have cultivated a distinct EV identity. This focused branding helps create emotional appeal and loyalty, especially among early adopters and eco-conscious consumers. Premium brands leverage reputation to sell high-end EVs (Porsche Taycan), while others use trust in affordability (Nissan with the Leaf) to target mainstream segments. A strong reputation makes it easier to attract investors and secure funding for Research and Development (R&D) and manufacturing capacity expansions. Trusted brands are more likely to be chosen as partners by battery suppliers, tech firms, and charging infrastructure companies. Brands with strong reputations may have better relationships with regulators, enabling them to shape EV policies or secure incentives and subsidies. A positive brand image encourages firms to adopt environmentally responsible practices, minimizing regulatory and reputational risks as sustainability becomes a public expectation. Well-regarded brands are better positioned to recover from EV-related issues (battery recalls, fires, or range discrepancies) because of pre-existing consumer goodwill.

Tesla’s reputation for innovation has created a loyal customer base and investor enthusiasm, accelerating EV adoption despite limited model variety and customer service issues. For Volkswagen, post-Dieselgate, VW has made EVs central to its brand rebuild, and its commitment to electrification (via the ID series) is helping shift public perception. For Ford, the Mustang Mach-E and F-150 Lightning leverage Ford’s strong American legacy to build trust in EVs among traditional truck and muscle car buyers.

3. The Global Pre-Owned EV Market

Depreciation shapes the second-hand EV market. Depreciation, while normally a price-lowering force, ironically fuels both high demand and low supply in the second-hand EV market. It discourages owners from selling and attracts price-sensitive buyers resulting in a squeeze that boosts prices and intensifies competition for used models. Depreciation plays a unique role in shaping the second-hand EV market, especially when demand is high but supply is low. Depreciation slows down supply; EVs depreciate faster than internal ICE vehicles in their first few years due to rapid battery technology improvements, government incentives that lower new EV prices, and consumer uncertainty about battery life and replacement cost. Because of this steep early depreciation, existing EV owners may hesitate to sell their vehicles because they would take a significant loss. This hesitation leads to fewer EVs entering the second-hand market, worsening the supply shortage. Depreciation drives demand in the used market; while new EVs are still relatively expensive, depreciated second-hand EVs become more affordable, making them attractive to budget-conscious buyers. First-time EV adopters want to test the waters. This makes demand for used EVs stronger, especially in regions where fuel prices are high, urban policies favor EVs (e.g., low-emission zones), and charging infrastructure is growing. Price imbalance emerges; the fast depreciation should mean lower prices and high supply, but instead, low supply keeps second-hand prices high, sometimes even stabilizing or appreciating values for popular models (e.g., Teslas, Nissan Leafs). Buyers compete over a small pool of EVs, pushing up resale value, distorting typical depreciation patterns. There is a feedback loop effect; high demand and limited supply keep prices artificially high for used EVs. This in turn slows further depreciation, as owners realize that their EVs hold value. Depreciation encourages more people to buy new EVs (with subsidies) while waiting for resale values to hold. This further delays existing owners from selling, tightening the supply even more.

Leasing companies play a crucial role in shaping the depreciation rate of EVs, primarily because they are key stakeholders in the used vehicle market and manage large EV fleets. Their role affects both how depreciation is calculated and how market trends evolve.

1. Setting residual values

Leasing companies determine residual values, the expected market value of a vehicle at the end of a lease. This figure is foundational to calculating depreciation, defined as

For EVs, leasing companies consider the following:

Battery degradation risks.

Technological obsolescence (e.g., newer models with better range).

Government subsidies and their impact on new EV prices.

Secondary market demand for used EVs.

2. Data-Driven Forecasting

Leasing firms collect vast data from fleet performance, maintenance, and resale values. This data informs the following:

Battery longevity and performance trends.

Market appetite for specific EV models.

Real-world total cost of ownership (TCO).

These insights help refine depreciation curves more accurately than traditional methods.

3. Market Influence

As major fleet operators and sellers of used vehicles, leasing companies influence market pricing, which in turn affects depreciation norms. They may flood or restrict the used EV market, affecting the supply–demand balance. They often negotiate buy-back guarantees or manufacturer partnerships, which can stabilize depreciation rates.

4. Risk management and pricing

Leasing companies are risk-averse. Because EVs are newer tech, they tend to apply conservative residual values, especially early in the adoption curve. This leads to higher calculated depreciation until more predictable performance data emerges.

5. External factors considered by lessors

When setting depreciation-related values for EVs, leasing companies must factor in

Charging infrastructure expansion.

Regulatory pressures (ICE bans).

Technological improvements in battery capacity and cost.

Manufacturer warranties and incentives.

These elements are reflected in their models, affecting how depreciation is projected.

Table 5 summarizes the role of leasing companies in the development of second-hand EVs.

3.1. The Vehicles of the Second-Hand Market

The top sources of second-hand EVs are:

Fleet and leasing companies [

71]

These companies regularly cycle vehicles every 2–4 years. Examples: corporate fleets, rental companies, or government EVs. Their contribution is often the largest single source of used EVs. These vehicles are typically well-maintained and newer: Nissan Leaf, Tesla Model 3, and Hyundai Kona EV are among the most popular.

- b.

Private owners (individual resales)

Private sellers upgrade or change cars regularly. The market share varies by region, often 20–40% of the second-hand EV market [

72]. These vehicles present a wide variety of ages and conditions. Motivation includes upgrades to newer models with longer range.

- c.

Car dealerships and trade-ins

People trade in their EVs when buying a new car. Dealers recondition and resell EVs or auction them off. There may often be overlaps. In fact, these cars may come originally from private owners or fleets.

- d.

Rental car companies

Rental agencies increasingly rotate their EV stock into the second-hand market. The recent trend is that Hertz and others added EVs but also began offloading them in 2023–2024. The condition of these vehicles is moderate mileage, used heavily but maintained.

- e.

Manufacturer buybacks/Certified Pre-Owned (CPO) Programs

Automakers offer CPO vehicles, which are inspected and warrantied. There is a limited volume, but they are rising in importance as OEMs build out used EV programs. Examples: Tesla CPO, BMW i-series programs.

In nations that import used EVs, the origin often reflects where surplus supply exists. Japan is a major exporter of used EVs (Nissan Leaf) to countries like New Zealand, UK, and parts of Africa; the USA exports some used Teslas and other EVs, especially into Canada or Latin America; Europe EVs from Germany, the UK, and the Netherlands often flow to Eastern Europe and Nordic countries. The origin of second-hand EVs in the market can be ranked by importance as volume and influence, based on factors like market size, early adoption, government incentives, and fleet turnover. Here is a breakdown of the top countries of origin of second-hand EVs:

The importance of this origin is from the large EV market with high early adoption in states like California. The key sources from this market are off-lease Teslas, Nissan Leafs, Chevy Bolts, and Ford EVs, fleet turnover from companies, and ride-hailing services. There is an important impact as it is a major source of affordable used EVs exported to other markets.

- g.

China

The importance of this origin is due to the fact that China is the world’s largest EV market. The vehicles are from the high volume of low-cost EVs (BYD, Wuling), short vehicle ownership cycles, and government-subsidized fleets now retiring older models. These used EVs have an impact on growing exports to lower-income countries and internal rural markets.

- h.

European Union (especially Germany, Netherlands, Norway, UK)

The importance of this origin comes from aggressive EV policies, early adoption, and short leasing cycles. The key sources are Tesla, Renault, BMW, VW, and Hyundai EVs from corporate and personal leases. These vehicles have an important impact as they drive second-hand EV markets in Eastern Europe and Africa.

Secondary Origin

- i.

Japan

The second-hand EVs are mostly Nissan Leaf, Mitsubishi i-MiEV. This source is particularly relevant as Japan is an early EV producer, with the consistent export of used cars including EVs to Southeast Asia, Australia, and Africa. The impact of Japanese used EVs is limited, but the export volume of used EVs is growing.

- j.

South Korea

The used EVs are mostly Hyundai Kona EV, Kia Soul EV, Kia EV6, and Ioniq. These vehicles increase the domestic adoption with export potential. South Korea also has an impact as an emerging contributor to the used EV supply.

There are export trends to increase toward:

Africa: importing second-hand EVs mainly from Europe and Japan.

Southeast Asia: growing demand, especially from middle-income buyers.

Eastern Europe: a significant destination for Western Europe’s used EVs.

The leasing market acts as a feeder, stabilizer, and trust-builder for the second-hand EV market. It promotes EV adoption, ensures a consistent and quality-controlled supply of used EVs, and improves affordability and transparency, which are key to growing the second-hand EV ecosystem. The leasing market plays a crucial role in the development and sustainability of the second-hand EV market. The leasing market plays an important role in the vehicle supply for the second-hand market. There is a high turnover of leased EVs, leasing contracts typically last 2–4 years. At the end of these terms, a steady stream of relatively new, well-maintained EVs enters the second-hand market. Many leasing companies serve corporate fleets. As more companies electrify their fleets through leasing, this increases the future supply of used EVs. Leasing companies influence residual value as they closely monitor and project future resale values, which helps stabilize and even boost confidence in used EV values. With more EVs being leased, better data is collected on depreciation trends, making second-hand pricing more accurate and transparent. The leasing market allows better consumer accessibility. A lower upfront cost of leasing encourages EV uptake. In fact, many consumers lease rather than buy EVs due to high initial costs. This helps boost EV adoption, indirectly feeding into the used market. The leasing market makes used EVs more affordable. After leases expire, EVs are resold at lower prices, making them more accessible to a broader demographic. Leased EVs often come with battery health reports. Leasing companies maintain records of battery condition and service history, which builds buyer confidence in used EV purchases. Leasing absorbs some of the perceived risk around EV ownership as battery degradation, technology obsolescence, which increases initial uptake and feeds supply to the second-hand market. Leasing companies often resell off-lease EVs with extended warranties or as certified pre-owned vehicles, making them more attractive. Leasing ensures that EVs are used efficiently and then reintroduced to the market, supporting sustainability goals, therefore maximizing vehicle lifespan. Leased EVs may be refurbished or their batteries repurposed for energy storage before resale.

The second-hand EV market is poised for continued growth, supported by increasing consumer interest, technological advancements, and a growing supply of used vehicles. However, addressing challenges related to depreciation and consumer confidence will be crucial for sustained market development.

The second-hand EV market is experiencing significant growth and transformation in 2025, driven by increased consumer demand, falling prices, and a surge in supply from lease returns.

Market growth and demand are marked by record sales: in the UK, used EV transactions rose by 57.4% in 2024, reaching 188,382 units and capturing a 2.5% market share, up from 1.7% in 2023 [

73]. In the U.S., used EV sales increased by 62.6% year-over-year in 2024, with 287,175 units sold. Tesla still dominates the market. Used Tesla sales surged by 27% in April 2025 compared to the previous month, giving Tesla a dominant 47% share of the used EV market [

74].

Pricing trends and affordability are to be considered. Depreciation has an important impact on the used EV market. EVs are experiencing faster depreciation compared to ICE vehicles. In the UK, EVs retain only 49% of their value after two years, compared to 70% for petrol and diesel vehicles [

75]. Price parity may be achieved in the near future. In the UK, one in three used EVs are now priced under EUR 20,000, making them more accessible to a broader audience [

76]. The battery cost will change the market landscape. Advancements in battery technology have led to a significant drop in prices, with forecasts predicting battery costs to fall to USD 80 per kilowatt-hour by 2026, down from USD 115/kWh in 2024 [

77].

Supply dynamics and lease returns will change the market structure. A wave of off-lease EVs is entering the second-hand market. In 2025, approximately 123,000 leased EVs will return to the market, with projections of 329,000 in 2026 and 650,000 by 2027 [

78].

There is a need for higher inventory levels. In the U.S., the supply of used EVs has tightened, decreasing by 36% year-over-year, indicating strong demand [

78].

There are challenges and other considerations to take into account. The rapid depreciation of EVs poses challenges for owners and leasing companies, potentially leading to higher leasing costs and reduced resale values.

There is a change in consumer confidence. In fact, while battery replacement costs are decreasing, concerns about battery longevity and replacement remain a consideration for potential buyers.

3.2. Challenges

The used EV market is expanding, yet it faces several significant challenges that hinder its growth and consumer adoption. Battery health is a paramount concern for used EV buyers. Over time, EV batteries degrade, leading to reduced driving range and performance. This degradation not only affects the vehicle’s usability but also its resale value. For instance, in Europe, the second-hand EV market faces issues related to battery health status, making it a critical factor for potential buyers. Used EVs tend to depreciate faster than their ICE counterparts. This accelerated depreciation is influenced by factors such as rapid technological advancements, leading to newer models with better features, and aggressive pricing strategies by manufacturers. For example, EVs have been reported to retain only about 50% of their value after three years, a significant drop compared to the 65% retention rate for petrol and diesel vehicles [

79]. The availability and accessibility of charging stations remain a significant barrier. In regions like Andhra Pradesh, India, the scarcity of charging infrastructure has been a major deterrent to EV adoption, with only 601 charging stations statewide, equating to one per 205 km of road [

80]. This limitation is even more pronounced for used EV owners who may not have access to home charging solutions. The variety of used EV models available in the market is relatively limited compared to ICE vehicles. This scarcity restricts consumer choice, making it challenging for buyers to find a used EV that fits their specific needs and preferences. The limited availability is partly due to the still-growing new EV market, which naturally leads to fewer available used models. While EVs generally require less maintenance than ICE vehicles, concerns about the cost and availability of specialized repair services persist. Battery replacements, in particular, can be expensive, and not all service centers are equipped to handle EV-specific issues. This uncertainty can deter potential buyers from considering used EVs. Government incentives and support for EVs vary widely by region. In some areas, used EV buyers may not benefit from subsidies or tax incentives, making new EVs with available incentives more financially attractive. This disparity can skew consumer decisions away from the used EV market. The rapid pace of technological advancement in the EV sector means that older models can quickly become outdated. Features such as battery efficiency, range, and infotainment systems improve with each new model, making used EVs less appealing to tech-savvy consumers. There exists a knowledge gap among consumers regarding the benefits and limitations of used EVs. Misconceptions about battery life, charging infrastructure, and maintenance can lead to hesitation in purchasing used EVs. Enhanced consumer education is essential to bridge this gap and foster confidence in the used EV market.

Addressing these challenges requires concerted efforts from manufacturers, policymakers, and stakeholders to enhance battery technologies, expand charging infrastructure, and provide consistent incentives. Such measures will be pivotal in bolstering consumer confidence and accelerating the growth of the used EV market.

EV battery replacement is one of the main challenges that used EV buyers may have to face. When considering EVs, two significant cost factors over time are battery replacement and depreciation. For a long-term plan for an EV, battery replacement could become relevant. But if the vehicle is to be sold or traded within 5–7 years, depreciation will almost always have a greater financial impact.

EV batteries are among the most expensive components, often costing USD 5000 to USD 20,000 depending on the make and model [

81]. Battery replacement is a long-term cost, often avoided if the car is sold before major degradation occurs. The cost makes battery replacement economically unviable for older vehicles with low residual value. EV battery replacement can range from USD 4000 to over USD 20,000, depending on the vehicle and battery capacity [

81]. For example: ~USD 6000–USD 8000 for Nissan Leaf [

82], ~USD 12,000–USD 20,000+ for Tesla Model S/X [

83]. This cost can deter consumers from buying used EVs or keeping older ones on the road. Most modern EV batteries last 8–15 years or 100,000–300,000 miles. Most EVs come with an 8-year/100,000-mile warranty for the battery [

84]. Actual battery failures are rare within warranty; degradation (loss of range) is more common than total failure.

Figure 2 shows the battery pack of a BMW i3 to be replaced.

Furthermore, in addition to their high economic cost, battery replacement in EVs presents a range of challenges spanning technical and environmental dimensions. The key issues are:

1. Lack of Standardization

EV batteries vary significantly across manufacturers in terms of design, size, voltage, and integration. This lack of standardization complicates the mass production of replacement units and battery-swapping infrastructure. The lack of standard battery sizes and architectures across manufacturers hinders interchangeability and mass reuse. This fragmentation complicates refurbishment and second-life applications.

2. Battery degradation uncertainty

It is hard to predict exactly how a battery will degrade over time. Degradation depends on temperature, charging habits, driving patterns, and chemistry, which complicates decisions on when replacement is necessary.

3. Limited infrastructure for battery swapping

Battery swapping, quickly exchanging a depleted battery for a charged one, is technically viable but not widely adopted. Requires standardized battery designs and heavy infrastructure investment. Unlike refueling or even charging infrastructure, battery swapping stations are rare and generally limited to fleet vehicles in places like China. Swapping requires precise alignment and compatibility, which again is hindered by non-standardized designs; it is less feasible globally due to a lack of coordination.

4. Supply chain and raw material constraints

Lithium, cobalt, nickel, and other key materials face supply bottlenecks. Recycling and second-life use are still developing, which limits circularity and sustainability in battery replacement cycles.

5. Technical Complexity

Many batteries are integrated into the vehicle’s structure (especially in newer EVs), making them difficult and costly to access and replace. Replacement often requires certified technicians and specialized tools.

6. Environmental Impact

The improper disposal or recycling of used batteries can cause environmental harm. Recycling processes are energy-intensive and not yet widespread or efficient enough. The disposing of or recycling of lithium-ion batteries is complex and resource-intensive. Inadequate recycling infrastructure can lead to e-waste or environmental pollution. The battery supply chain also involves ethical concerns (e.g., cobalt mining).

7. Warranty and service restrictions

Many manufacturers restrict battery replacement or repair to authorized service centers, limiting consumer choice and increasing costs.

8. Software lock-in and compatibility

Some EVs may require software reprogramming or the pairing of new batteries, further complicating third-party replacement options.

Possible solutions and innovations

Battery leasing models to reduce upfront cost.

Improved battery chemistries with longer life and lower degradation.

Second-life applications for used EV batteries (e.g., grid storage).

Investment in recycling technologies and circular economy initiatives.

Industry-wide standards for battery formats and diagnostics.

Depreciation is typically the larger and more immediate cost than battery replacement, especially in the first 3–5 years. EVs depreciate faster than gas cars historically (due to tech obsolescence, tax credits lowering new EV prices, range anxiety, and charging infrastructure concerns). Some EVs lose 50–60% of their value in 3 to 5 years, compared to 35–50% for ICE vehicles. Tesla models depreciate more slowly due to brand strength and over-the-air updates. Factors accelerating depreciation are as follows: rapid EV tech advancement, newer models with longer ranges and faster charging, and government incentives on new EVs.

Table 6 shows a comparison between the role of battery replacement and depreciation in the EV market.

3.3. Technology

Technology has had a significant impact on the second-hand EV market, both improving its value proposition and shaping consumer perceptions. Advanced diagnostic tools allow the precise evaluation of EV battery health, which is the most critical (and expensive) component in an EV. Platforms like Recurrent and OEM-specific tools, as Tesla’s battery degradation reports, provide transparency to buyers.

This reduces uncertainty and risk, making used EVs more appealing. Many EVs receive over-the-air (OTA) software updates, meaning that even used models can gain new features or performance enhancements long after the initial purchase. This extends the technological relevance of older models and boosts resale value. Integrated AI-based telematic systems help forecast component wear and suggest preventive maintenance, which is helpful for both sellers and buyers. Buyers are more confident purchasing used EVs with detailed usage and maintenance logs enabled by technology. Platforms like Carvana, AutoTrader, and EV-specific marketplaces use AI-driven tools to match buyers with suitable used EVs.

These platforms often include battery health reports, financing options, and warranty comparisons, streamlining the purchase process. The expansion of charging networks and smart home chargers makes owning older EVs more practical, even if their range is lower than new models. Second-hand EVs become more usable and attractive, especially in urban or suburban environments. Machine learning models are being used by insurers, dealerships, and fleet managers to predict depreciation more accurately. This helps buyers make informed decisions and encourages leasing companies to offload EVs into the second-hand market with confidence. Companies are using AI and robotics to refurbish EVs, especially fleets, more efficiently, which improves the quality and safety of used vehicles. Battery repurposing, as for energy storage, also helps manage end-of-life batteries sustainably, reducing environmental concerns. Battery replacement cost is key although diagnostics help, tech cannot yet solve the high cost of replacing worn-out batteries. Compatibility and software lock-in have major importance. Some manufacturers limit features or updates for used vehicles, which can reduce long-term appeal.

Technology has made the second-hand EV market more transparent, trustworthy, and efficient. It helps mitigate traditional concerns around battery degradation and vehicle longevity, opening the market to more mainstream buyers. As these tools become more accessible and standardized, the second-hand EV market is likely to grow significantly.

3.4. Subsidies

Subsidies for second-hand EVs can significantly influence the EV market, consumer behavior, and environmental outcomes. Subsidies reduce the upfront cost of used EVs, making them accessible to middle- and lower-income households. They also help democratize EV adoption, as new EV subsidies primarily benefit wealthier buyers who can afford higher-priced vehicles, and encourage owners of new EVs to sell earlier, feeding more EVs into the second-hand market. More consumers consider used EVs as a viable option, increasing overall EV penetration. By propping up demand, subsidies help stabilize or increase residual values of EVs, which can reduce the total cost of ownership concerns for both new and used buyers. More EVs on the road, regardless of new or used, displace ICE vehicles, reducing emissions. Incentivizing the use of second-hand EVs increases the total mileage and environmental benefit per EV produced. Broader EV ownership encourages demand for charging infrastructure and promotes general EV awareness. It works best when combined with support for public charging networks, battery health diagnostics, and EV education. Supporting second-hand EVs can often deliver similar environmental benefits at lower subsidy costs than new EV programs. It is important to address challenges like battery degradation, odometer fraud, and warranty limitations in used vehicles. France and Germany have piloted subsidies for used EVs with success in increasing adoption. California offers grants and financing assistance specifically for low-income buyers purchasing used EVs.

3.5. The Market

An analytical overview of the global pre-owned car market evolution from 2025 to 2034 can be based on current trends, historical data, and forward-looking projections [

85].

The global pre-owned car market evolution (2025–2034) can be observed through different points:

2025 Market value: ~USD 1.5 trillion globally.

Dominated by the USA, China, and Europe.

Projected global growth (2025–2034): 6–8%.

2034 market projected value:~USD 3.5 trillion.

Electrification of used car fleets.

Rise in used electric vehicles (EVs) as more new EVs enter the market.

EV depreciation trends influence affordability.

Secondary market for EVs becomes essential in mass adoption strategies.

In the United States, the typical age of vehicles reached 12.6 years on average as a new record lifespan of [

86]. Typically a new vehicle is sold to a second owner after 4 to 5 years of usage. A study shows that a typical second-hand car buyer is looking for a vehicle with an average age of about 6.5 years [

87].

In 2025, the global used-car market is valued at about USD 1.5 trillion, and it is projected to reach almost USD 3.5 trillion in 2034 (

Table 7). Such progress corresponds to a growth rate between 6% and 8% [

88]. North America is the largest market for pre-owned cars. North America accounts for almost one-third of the global market, while Europe follows; China, the Middle East, and Africa constitute the least significant markets, holding merely 5% of global sales [

89]. At the same time, the United States represented under 10% of all new electric vehicle registrations globally in 2022 [

90].

A brand-new car is typically beyond the financial reach of many individuals. Households with high incomes are more prone to owning new cars compared to households with low incomes. In Norway, where the EV penetration rate is the highest, a 2019 study indicates that 31% of new car registrations were made by the wealthiest 10% of families, whereas the lowest income, 10% of households, accounted for merely 0.6% of registrations [

91]. This difference holds greater significance when looking at the EV market. In 2019, Norway saw that 37% of newly registered EVs were from the wealthiest 10% of households, while only 0.7% were from the bottom 10% of households [

91]. Less expensive, used EVs can meet the demands of a wider range of consumers globally.

A key factor consistently influencing the market for used vehicles is the rising demand for EVs and hybrid electric vehicles (HEVs).

Taking the EU as an example,

Figure 3 shows that, even though the EV market is continually expanding, sales for used EVs are still quite minimal when compared to conventional ICE vehicles. The growing practicality and cost-effectiveness of used EVs could partially change the market landscape in the years ahead. Additionally, the widespread appeal of premium variants of HEVs and plug-in hybrid electric vehicles (PHEVs) has enhanced the reputation of EVs. The dynamics of pre-owned electric car sales might exhibit distinct patterns once the market achieves complete maturity.

The second-hand EV sales are currently expanding as early owners change vehicles. Pre-owned EV sales play a vital role in promoting widespread adoption, particularly as new EVs are still costly and used models become more accessible. For ICE vehicles, purchasing a used car is usually the main way to obtain a vehicle in lower-income as well as higher-income nations, and it is expected to be analogous to electric cars. Studies show that 80% of European Union residents purchase used cars, with this proportion rising to around 90% in low- and middle-income countries [

91]. Roughly 70% of vehicles sold in the U.S. are used cars, and just 17% of less affluent families purchase a new vehicle [

91].

As major EV markets develop, a growing volume of used EVs is entering the secondary market. However, the size of the used EV market is still relatively small when compared to new EV registrations. Approximately 14 million new electric vehicles were recorded globally in 2023, bringing the total number on the roads to 40 million. In 2023, approximately 60% of new electric vehicle registrations took place in China, about 25% in Europe, and 10% in the United States, representing nearly 95% of worldwide electric vehicle sales. On the other hand, projections suggest that, in 2023, the pre-owned EV market reached around 800,000 units in China, 400,000 in the United States, and more than 450,000 when combining France, Germany, Italy, Spain, the Netherlands, and the United Kingdom. In the United States, the sale of pre-owned EVs is expected to increase by 40% in 2024 versus 2023. Despite progress, the second-hand EV market remains small in comparison to the well-established second-hand ICE markets, which have had decades to grow: 30 million in France, Germany, Italy, Spain, the Netherlands, and the UK together, almost 20 million in China, and 36 million in the USA.

Still, used EVs are progressively becoming more budget-friendly, allowing them to rival pre-owned ICE counterparts soon. In the United States, for instance, a significant share of used EVs is currently listed at under USD 30,000 [

92]. Additionally, there are projections that the average price will decrease to around USD 25,000, the threshold for used EVs to qualify second-hand vehicle reduction in USD 4000 at the federal level, thereby allowing them to be competitive compared to top-selling fuel-powered vehicles, new or used. The cost of a pre-owned Tesla in the U.S. was more than USD 50,000 in early 2023 and decreased to slightly over USD 33,000 in 2024. This allowed Tesla to be competitive compared to both used SUVs and numerous new vehicles. In Europe, used EVs are available for prices ranging from EUR 15,000 to EUR 25,000 (USD 16,000 to 27,000), while the price is approximately EUR 30,000 (USD 32,000) for pre-owned plug-in hybrid vehicles. Several European nations provide financial incentives for used EVs, including the Netherlands (EUR 2000), where, since 2020, the support for new vehicles continues decreasing gradually, in contrast to the stable assistance for pre-owned vehicles, and France (EUR 1000). In 2023, in China the average cost of used EVs was approximately CNY 75,000 (USD 11,000) [

92].

When examining countries that have the greatest electric car adoption, similar factors will account for the trends in the sales of second-hand EVs. The primary distinction lies in direct subsidies, which can be crucial in the decision to adopt a new EV. There ought to be a significant distinction between markets supported by subsidies and those after subsidies. Subsidies are not the sole constraint influencing the used EV market; rapid technological advancements, alongside the loss of value of electric car parts like motors and energy storage, also affect the outcome of the worldwide used electric car sales.

The rise and growth of electric vehicles in global EV sales and their contribution to the electrification of road transport will likely follow an S-curve pattern [

1]. It pertains to an early stage where uptake is slow because consumers do not have enough understanding and confidence in investing in used electric vehicles. With the increasing popularity of EVs (

Figure 4) driven by subsidies, consumers will become more confident in EV technology and will be more likely to buy used EVs as they learn what to anticipate. This will continue until an equilibrium is established between new and pre-owned EVs in the market annually. The proportion of new vehicles to used ones in the market differs by nation. In the United States, in 2022, new cars represented about 30% of new registrations, whereas used cars represented approximately 70% [

92].

The S-curve is described by the subsequent Equation (1):

where R(t) represents the market penetration rate of pre-owned electric vehicles, as t tends to infinity, R(t) tends towards saturation. The details of the S-curve are presented in Reference [

1]. An important question that needs a forecasted response is the trend that will affect the proportion of used EVs during the shift to electric mobility, both globally and within specific nations. The rate at which EVs depreciate and technological progress will have a major impact. Pre-owned EVs are expected to markedly enter the market, since EVs were launched ten years ago to enter the international road transport. It is expected that the ratio of new to pre-owned EV registrations will level off at x% for new EVs and y% for used EVs. A similar equilibrium is noted in most non-perishable consumer items: mobile phones, laptops, bicycles, etc. This equilibrium between innovation and the transfer of ownership will depend on market conditions. Countries with higher economies that generally have good access to finances are likely to show a larger proportion of new vehicles in total new registrations, while, in the lower-income nations, almost all new registrations consist of pre-owned imported vehicles. It is recognized that worldwide, in the first decade, almost all EV registrations will comprise new EVs.

In recent years, the resale values of electric vehicles have been increasing. In Europe, the resale value of electric vehicles sold after a year has steadily increased from 2017 to 2022, surpassing all other types of vehicles and exceeding 70% by mid-2022 [

91]. The resale value of electric cars after three years was below 40% in 2017 but has been closing the gap with other powertrains, reaching around 55% by mid-2022 [

91]. This result arises from multiple factors, including increasing prices of new EVs and technological advancements that allow vehicles and batteries to retain their value longer; these factors decrease depreciation and enhance demand for used EVs. Similar patterns were observed in China. With existing electrification rates, 33 million homes in the EU will gain access to used electric vehicles from now until 2035. However, if the leasing industry speeds up its adoption of EVs, this figure would increase by 56%—reaching 51 million, according to a report by Transport & Environment (T&E) [

93]. These 18 million extra households would be reducing their expenditures on vehicle costs.

The leasing industry serves as a significant pathway for vehicles in the pre-owned car market. Every year in the EU, four out of ten cars entering the used car market originate from the leasing industry. If leasing firms transition to electric vehicles more quickly, they will hasten the speed at which the pre-owned market becomes eco-friendly. T&E urges Europe’s leading seven leasing firms to pledge to eliminate fossil fuel cars and to lease only battery electric vehicles (BEVs) starting in 2028. The entire industry must accomplish this by 2030.

Currently, nearly 80% of EU residents purchase their vehicles used. Approximately 90% of individuals in low and middle-income brackets purchase vehicles from the used car market. The proportion remains considerable (62%) even within affluent groups.

A used battery EV has significantly reduced ownership expenses compared to a pre-owned petrol car, according to research conducted by consumer organization BEUC. Families can save nearly EUR 6000 in 7 years by choosing electric over petrol cars [

94]. According to T&E, a consistent flow of electric vehicles in the used car market is crucial for European households aiming to cut expenses. The significant arrival of budget-friendly electric vehicles in the used car market is achievable, and leasing firms have control over this. If they transition to green quicker, European households will also go green at a lower expense. It is no exaggeration to claim that leasing firms can speed up and make EVs accessible for the 80%. “Stef Cornelis concludes that their responsibility is environmental and social.”

Eight million pre-owned electric vehicles priced at EUR 10,000 are on the streets.

This study indicates that, if the leasing industry takes the initiative instead of merely responding to the market regarding the adoption of battery electric vehicles, it could result in an additional 18 million used BEVs available by 2035. Crucially, 8 million of these vehicles would be priced at EUR 10,000 or under, which represents the typical amount that low- and middle-income families spend on a second-hand car.

However, T&E research indicates that, despite assertions of green leadership, leasing companies are not progressing rapidly enough in the shift to EVs. For instance, none of Europe’s major leasing firms has established a timeline to eliminate fossil fuel cars, and the adoption of battery EVs simply matches the general market trend. A T&E undercover probe in France and Germany reveals that leasing company sales personnel do not consistently assist their clients in transitioning to EVs.

The matter of pre-owned EVs can become more complex when we consider the possibility of future coexistence between electric cars and fuel cars. Certainly, as demonstrated, energy transition technologies are often anticipated to follow S-curves: rapidly rising, followed by achieving full market acceptance. However, it is very likely that EVs will continue to exist alongside ICE vehicles, making it essential to evaluate the future balance between the two technologies worldwide. Some analysts predict that electric vehicles could attain a saturation level of 15–30% of sales by the years 2025 to 2030 [

91]. In 2023, electric vehicle sales, presently at 15% of worldwide vehicle sales, will keep progressing, particularly due to specific policies. Consequently, what effects would the limited EV potential have on energy consumption and the ability to provide and source materials? The expense remains a major barrier to the acceptance of electric vehicles. Consequently, without coercive measures in place, income will limit EV uptake, resulting in a level of saturation in the EV market. Data on income distributions will determine the barrier to EV adoption. Perspectives on climate present another hurdle to the uptake of EVs. The saturation of the electric vehicle market would greatly impact energy and materials markets due to the substantial demand. The need for EVs and ICE vehicles will be tied to oil demand, electricity usage for EVs, lithium needs for batteries, and the impacts on new energy resources and investments.

Tesla vehicles maintain their value well for a variety of reasons. Tesla cars obtain remote updates for the duration of their operational life. This technical decision minimizes value loss from obsolescence since upgrades to newer models will also benefit older cars. Moreover, another element is the uniqueness that buyers have started to link with Tesla. The company additionally manages a network of superchargers. Tesla, similar to other producers, does not depend as heavily on consumer incentives. Tesla enjoys significant popularity and acclaim among electric vehicle brands, acknowledged as the leading seller of new EVs, showcasing the most cutting-edge technology and undergoing the least depreciation, a trend that is similarly observed in the used EV market. Pre-owned EVs that see the biggest price drops are typically older models, often thought to have outdated technology, particularly the Nissan Leaf and Chevrolet Bolt EV. In 2023, Tesla dominated the USA’s second-hand electric vehicle market, with Model 3 representing 34.9% of sales.

Models aged one to five years face the sharpest decline in value. A report by STATZON [

91] related to Europe as a reference market for 2023, details the sales share of used models.

Table 8 shows that the top-selling used EVs in 2023 feature Tesla and Volkswagen. A comprehensive model of the used EV market is provided in reference [

91].

3.6. Emerging Markets

The market for used electric vehicles (EVs) in lower-income countries is an emerging and complex space influenced by economic, infrastructural, policy, and technological factors.