Abstract

During the early phases of EV market penetration, German policy makers supported the roll-out of a nation-wide charging infrastructure network by extensive state activities, most notably voluminous funding schemes to provide subsidies for publicly owned as well as business-driven charge point operators. An increasing EV adoption rate and therefore an increasing demand has since shifted the focus of policy making towards enabling a privately funded, competitive market. More recently, budgetary constraints have led to abrupt restrictions on policy making and market disruptions. This paper aims to provide insight into policy making during this transitional period, give reason for why a state-funded jump start was necessary for developing the charging infrastructure, and explore how policy makers now intend to foster the development of a functioning market while phasing out detrimental interventionist measures.

1. Introduction

Since the early 2010s, the roll-out of EV-Charging Infrastructure in Germany has been guided and supported by extensive public intervention, mostly in the form of public funding schemes to overcome what is often called a ‘chicken-and-egg-problem’ of supply and demand. A rapidly increasing market penetration of EVs in the current decade, however, enables a more market-driven roll-out of charging infrastructure by privately owned and profit driven companies backed by private investments. This development has recently led to a shift in public policies from a main emphasis on subsidies to support the installation of as many public and private charging points as possible towards a focus on creating the framework for a functioning and competitive market design and towards a mid- to long-term phase-out of public interventions.

This article analyses the evolution of public policies towards charging infrastructure in Germany during the initial phases of EV charging infrastructure roll-out and especially the policy measures that were taken to bridge the gap between the demand and supply of a precursory roll-out during this phase.

1.1. Mitigation of External Effects

Road traffic in Germany caused around 145 million tons of carbon dioxide (CO2) emissions in 2023, which makes up for about 21.5 percent of the country’s total 673 million tons of CO2 emissions in that year, which in turn accounts for about 1.5 percent of global CO2 emissions [1]. CO2 is a greenhouse gas (GHG) and one of the main contributors towards the increase in global mean temperatures, meaning that Germany—and its road traffic sector—heavily contribute towards the phenomenon of global warming. Economically speaking, GHG emissions are so called external effects, which characterize a form of market failure. Such external effects occur if the production or consumption of a good or service causes costs for the society (or other third parties) that do not get compensated via the price of the good or other market-driven mechanisms. The scale of the external effects of GHG emissions and the potential consequences of global warming have led to an unprecedented amount of international interventionists efforts.

1.2. International and National Emission Reduction Targets

With the 1997 Kyoto Protocol, countries first vowed to reduce their GHG emissions under international law. The protocol included quantified GHG emission reduction targets for every country, classified by their economic state. Through the so called ‘burden sharing’ approach between the then 15 member states of the European Union (EU), Germany agreed to reducing its emissions by 21 percent compared to 1990 [2]. This target was met by 2007, five years prior to the protocol’s obligation and even before the actual commitment period (2008–2012) [3]. The successor of the Kyoto Protocol, the Paris Climate Agreement (2015) does not quantify GHG emission reduction targets but instead pledges to keep the global mean temperature increase to 1.5 percent compared to pre-industrial levels [4]. It is up to the national governments to translate these into climate policies and emission reduction targets. The EU is tackling the resulting obligations with the ‘Fit-For-55’ program [5], and Germany, in turn, implemented the Climate Protection Act (‘Klimaschutzgesetz’, KSG). The KSG does include quantified emission reduction targets by sector, which require the corresponding ministries to set up policy measures and other instruments to meet their sectors target. This multi-level cascade of international, EU and national law manifests not only an economic obligation (mitigation of external effects) but also a legal obligation for interventions and therefore the implementation of climate protection policies.

1.3. Decarbonization of Road Traffic

As previously determined, road traffic is one of the main contributors to Germany’s and most other industrialized country’s total GHG emissions, making it a strong lever for emission reductions. As mobility demand is almost non-elastic in the short and medium term [6], such reductions must, however, be achieved by replacing CO2-intensive internal combustion engines (ICE) with low emission drive technologies. In the last couple of years, battery-electric vehicles (BEV) have emerged as the most market-ready and best-suited technology available for the decarbonization of most road traffic, especially passenger cars and light duty vehicles. While these cars are not entirely carbon free (vehicle production and power generation still cause GHG emissions), they can already achieve a significant reduction in carbon emissions over their lifetime compared to ICEs as Figure 1 shows.

Figure 1.

Lifetime CO2 emissions by drive technology including production process [7].

BEV market penetration, therefore, is a critical parameter when trying to decarbonize road traffic, making an increasing adoption rate of consumers a legitimate policy making goal in order to achieve the relevant emission reduction targets that countries are both economically and legally obliged to. A necessary prerequisite of a widespread BEV adoption by consumers is the existence of a sufficient electric vehicle charging network. BEV market penetration and charging infrastructure rollout are inextricably linked, which means that the aforementioned emission reduction targets not only constitute the need for interventionist measures to increase BEV adoption rate but also to stimulate the rollout of charging infrastructure, as this paper will demonstrate. The interdependencies between infrastructure rollout and adoption rate require integrated considerations when discussing policy making and its goals, which this paper will provide. According to a 2023 comprehensive literature review, strategies for the roll-out of charging infrastructure have become a major focus in the more recent scientific discussions on EV-Adoption [8] and concurrently a pressing matter of public policy making.

1.4. Methodology

In order to analyze the policy making in regard to electric vehicles and charging infrastructure in the past and present and to derive recommendations for the future, this paper highlights four phases of policy making with unique characteristics as follows:

- Phase 1: Jump starting and ‘Paving the Way’.

- Phase 2: Commitment and Stimulation.

- Phase 3: Scaling and ‘Crossing the Chasm’.

- Phase 4: Moderating and Safeguarding.

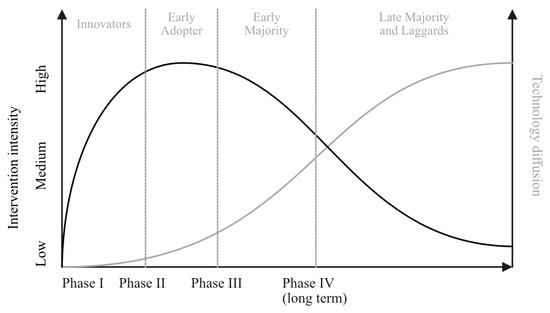

It is, however, important to note that these phases can have considerable overlaps and are by no means independent of each other. While the ongoing market penetration of BEVs does not provide a clear distinction between the phases due to its rather continuous nature, notable legislations and other political milestones can determine the beginning of a new phase. Revisions of existing legislations or the passing of a new one often times signal a need for policy adjustments caused by shifts in the market itself. To identify and differentiate between (past) phases, the paper therefore took European and national legislations and especially grants and subsidies into account that could be indicative of observed developments within the market or the political intention to provoke new dynamics. The four phases will be connected with E. Rogers’ model of diffusion of innovations [9] in order to align the intensity of intervention in the different phases with the degree of technology adoption according to Rogers as seen in Figure 2.

Figure 2.

Technology adoption and intensity of public interventions (schematic).

This allows for an analysis of policy making in regard to different consumer groups and therefore the development of such policies throughout the identified phases. It is, however, not within the scope of this paper to evaluate past policy making. Data used for this paper include data from public sources like the charging infrastructure register of the German Infrastructure Authority (‘Bundesnetzagentur’), the German Monopoly Commission as well as data collected from public funding schemes by the National Centre for Charging Infrastructure.

The original impetus for this article was to create a meaningful contribution to the discussions and exchanges at the 37th International Electric Vehicle Symposium and Exhibition in April 2024. Since then, the relevant policy framework for EV-adoption in Germany has significantly changed. Thus, the original article has been revised and updated to take these developments and fresh insights into account [10].

2. Phase I: Jump Starting and ‘Paving the Way’

While there have been multiple attempts at electric vehicle technology since the late 19th century, this paper only considers the most recent iteration, starting roughly around the year 2010. Around that time, the first generation of modern BEVs suitable for everyday use came into the market, such as the Tesla Roadster (2008), Nissan Leaf (2010), Tesla Model S (2012), and Renault Zoe (2013). With increased urgency regarding emission reduction regulations, both internationally and nationally, the rollout of electric vehicles became not just a matter for technology enthusiasts but also for the general public, and the adoption of the technology was, generally speaking, embraced by policy makers and governments.

2.1. ‘Chicken-And-Egg’ Dilemma

The early phases of EV adoption, however, illustrate a common problem with infrastructure-dependent technology diffusion: Consumers’ willingness to adopt EVs is highly reliant on the quality and density of the charging infrastructure network [11]. A sufficiently sized charging network on the other hand requires substantial initial investment, which might not be economically viable due to low demand in early diffusion stages [12]. Policy intervention is often considered necessary in these situations in order to be able to foster innovation and avoid lock-in effects [13]. Interventions can include both fiscal as well as regulatory instruments to either incentivize the new technology or disincentivize (or even ban) the use of the old technology, avoiding said lock-in effects. Several studies aim to determine the best policy strategy to overcome the chicken-and-egg dilemma. Studies utilizing game-based model approaches like Ma et al. [14], Brozynski and Leibowicz [13], Yu et al. [15], or Li et al. [16] often found cost efficiency advantages of consumer subsidies for EV adoption while agent-based models such as in Luo et al. [17] find no such significant advantages of either approach but instead come to the conclusion that both infrastructure investments and consumer subsidies are suitable as long as their subsidy level is appropriate.

2.2. Early Funding Schemes and Public Investments

The first attempt at a coherent electric mobility strategy in Germany was the ‘Government program Electric Mobility’, released in 2011, which included funding schemes as well as other fiscal measures to incentivize EV adoption. The program ‘Schaufenster Elektromobilität’ provided funding for large scale demonstration and pilot projects and lasted from 2012 to 2016. Simultaneously, the government program introduced tax incentives for EVs, stimulating demand from the consumer group of innovators. These tax incentives included a tax exemption from the vehicle tax as well as tax reductions for company cars and are both still in place as of early 2024. The program ‘Modellregionen Elektromobilität’ supported the rollout of both EVs as well as charging infrastructure in eight selected metropolitan areas and had a similar demonstration purpose. Most funding schemes of the time had a focus on research and development since the technology was still in the very early stages of diffusion and market share was vanishingly small. A common denominator of charging infrastructure and electric mobility projects in this phase was the close integration of local municipalities. A unique feature of the German market are the many local grid operators and energy suppliers, which are often controlled by the municipalities. These public entities, often called ‘Stadtwerke’, were responsible for a large share of the charging infrastructure rollout in the early stages in which charging infrastructure investments have not yet been economically viable due to the chicken-and-egg dilemma. In the absence of sufficient private investments, public companies like the grid operators and energy suppliers, supported by public funding schemes, provided a significant share of the necessary investments to jump start a charging infrastructure network.

Despite those efforts, this phase was not designed by policy makers to fully solve the chicken-and-egg dilemma, as subsidy levels had not been sufficient for that just yet. According to the government program electric mobility, the goal was to pave the way and prepare for a market ramp-up which was sighted until 2017.

2.3. Setting up a Regulatory Framework

‘Paving the way’ not only meant funding schemes for demonstrators and other projects but also preparing the regulatory framework to support such a market ramp-up. In those early stages of technology diffusion, European and German policy makers focused on definitions and standardization efforts:

The first major milestone in that regard was the Directive 2014/94/EU on the deployment of alternative fuels infrastructure (AFID), which introduced several new standards into European law including connector types (‘Type 2’ connector for alternating current recharging points and ‘CCS/Combo 2’ connector for direct current recharging points) elevating interoperability across the entire EU. Since directives do not immediately apply to a national level, Germany introduced the Charging Station Ordinance (‘LSV’) to implement the content of the AFID into German law as well as to add additional definitions and regulations regarding public accessibility and reporting obligations. The Electric Mobility Act (‘EmoG’) from 2015 stipulates the granting of privileges for using electric vehicles and consequently incudes definitions of vehicles eligible for these privileges. It serves as the de facto standard in German policy making for EV definitions as many other Acts and Ordinances reference the EmoGs definitions of electric vehicles. Many of these regulatory cornerstones are still in place (the AFI Directive is being replaced by the AFI Regulation as per April 2024 but said fundamental definitions are mostly untouched) and therefore span the regulatory framework to this day.

This approach of demonstrating everyday viability, paving the way, and preparing the market for a future ramp-up characterizes the first phase which lasted roughly until the year 2017. Solving the chicken-and-egg dilemma in order to advance to subsequent stages of technology diffusion (early adopters and early majority), however, required a stronger technology commitment and therefore a much higher intervention intensity from policy makers, which was yet to be made.

3. Phase II: Commitment and Stimulation

Generally speaking, subsidies and other interventions are usually set up to influence and change a consumer’s behavior. In order for consumers to act accordingly and adopt a new technology, the policy maker’s goal needs to be credible and dependable to them which requires a certain degree of commitment to the policy strategy. To achieve a credible commitment, policies including subsidies should both have a long-term scope as well as sufficient financial backing. If policy makers suddenly back out of their communicated strategy (subsidies and other incentives), they might risk consumer’s trust in the technology, which can be detrimental to their initial goal of increasing the adoption rate.

3.1. Introducing a Buyer’s Premium to Subsidize Consumers

To really foster the market ramp-up, Germany started its first large-scale consumer subsidy, the ‘Environmental Bonus’, a buyer’s premium for BEVs, PHEVs, and FCEVs that was co-financed by OEMs and the federal government from 2016. The premium was ultimately canceled in November 2023 due to a lack of financial backing but had been a continuous policy instrument since its introduction. During a seven-year period from 2016 to 2023 a total of 2.2 million EV passenger vehicles received this premium. A total of around EUR 10 billion was spent on this instrument. In the early phases of the market ramp-up, however, the effectiveness of the buyer’s premium was considered low, which was not necessarily due to an inappropriate subsidy level but could be accounted to technology maturity as well as the still present chicken-and-egg dilemma between EV adoption and the charging infrastructure rollout [18].

In return, the lack of EV adoption could not yet facilitate viable business models for private Charge Point Operators (CPO) on its own, which led to additional government measures to not only subsidize consumers but also infrastructure investments, resulting in a mixed policy strategy to ultimately overcome the chicken-and-egg dilemma.

3.2. Charging Infrastructure Master Plan I and Supply-Side Interventions

With the first ‘Charging Infrastructure Master Plan’, the government for the first time outlined an overall strategy aimed at ensuring a comprehensive, demand-oriented and user-friendly expansion of charging infrastructure. As part of the program, the National Centre for Charging Infrastructure was created as a permanent institution tasked with helping policy makers achieve this goal by supporting and consulting in policy making and implementation. In addition to some adjustments to the legal framework for charging infrastructure, the program particularly contained the intention to comprehensively promote charging infrastructure along its various relevant use cases.

The ‘Charging Infrastructure Master Plan’ outlined that in contrast to the uniform energy supply of ICEs at uniform fuel stations for all customer groups, EVs can be provided with electricity in different configurations (‘use cases’) depending on the residential situation, mobility behavior, and settlement structure. The number, location, charging capacity and technical complexity (e.g., authentication and billing capacity) of the charging infrastructure to be established must be tailored to the respective user requirements. The same applies to subsidies and other incentives, which also need to be tailored to meet the specific market they are targeted at as not all funding designs work in all applications. Charging stations located directly in service areas on federal highways offer good accessibility on long-distance journeys. EVs can be charged at such stations while resting on long-distance journeys. However, charging stations away from main highways can also be relevant for long-distance travel. This requires several charging points with a sufficient high charging capacity at the same location and in the immediate vicinity of federal highways. These are very likely to offer a free charging point that enables fast charging. There is also a need to charge EVs quickly and at short notice in local traffic. This is particularly the case when users deviate from their routine journeys, plan a short trip or when unexpected charging needs arise for other reasons. For this use case, there must be fast charging stations in the areas relevant for local transport, which provide a sufficient number of charging points with high power at the same location. If users want to charge their EV during their routine journeys, during shopping, leisure activities or visits to public facilities, there is generally no need for a particularly high charging capacity. If residents do not have private parking facilities with charging options, they are dependent on publicly accessible charging stations located on the roadside in their residential area or at their workplace as their primary charging option. As the longest standing times are to be expected here, no minimum performance is required. The German Government therefore designed several funding schemes and programs to facilitate the installation of Charging Infrastructure at residential buildings, at carparks for employees’ and a companies’ fleet vehicles, at car parks at retail stores and fast charging hubs in urban areas, as well as in underserviced areas nationwide as listed in Table 1.

Table 1.

Government grants for charging infrastructure in Germany.

In general, these funding programs were designed as investment subsidies targeting costs for charging hardware and grid connection. However, since funding programs as a policy instrument are only partially suitable for determining the location and sizing of the installed charging infrastructure, the funding programs led to a sharp increase in the number of charging points but did not result in the complete elimination of the ‘blank spots” in terms of coverage.

In order to ensure comprehensive and future-proof demand-oriented coverage of the entire country with publicly accessible fast-charging infrastructure, the German government thus designed a public tendering process with the so-called “Deutschlandnetz” (“Germany network”). These tenders were deliberately designed to extend and complement the previous grant-subsidized private-sector expansion of the charging infrastructure. The “Deutschlandnetz” contains approximately 1000 sites for the creation of fast charging hubs. The construction and the at least eight-year operating phase receive up to EUR 1.9 billion in government funding. This program takes into account that consumers’ behavior towards EV adoption is driven in large by range-anxiety. As a result, the visibility and physical presence of charging stations is increasing significantly, which has been deemed highly effective for consumer confidence in EV-technology [19]. Moving from grants to a tender can be considered an early attempt at increasing competitive intensity in the allocation of subsidies for public charging infrastructure.

In recent years, the German government has therefore provided a total of around EUR 5 billion for the various applications of charging infrastructure. These funds were used to kick-start the construction and operation of the public charging infrastructure. Towards the end of 2023, 100,000 publicly accessible and many more non-public charge points were installed in Germany. These measures also achieved important successes in the goal of making the operation of charging infrastructure economically attractive. All subsidy programs funded the investment costs for the installation of charging hardware and for expenses for grid connections. Concurrently, not only has a nationwide supply of publicly accessible charging facilities been created, but a diversified portfolio of products and services has also emerged to meet individual charging needs. The goal of the infrastructure investment strategy had been to match policy parameters with consumer preferences, lower investment costs by unlocking economies of scale and higher profits for the operating businesses, and also to kick-start business models and the creation of sustainable capacity for further expansion.

3.3. Emerging Markets and Business Cases

During this phase of extensive government supply-side intervention, the number of charge points as well as of operating businesses drastically increased. While data on non-public use-cases is very limited, extensive analyses of public charging infrastructure by the National Centre for Charging Infrastructure clearly show an emerging business landscape around EV charging that developed simultaneously and in response to the aforementioned government programs. As Table 2 shows, the number of public charge points has increased twenty-fold from 2017 to 2024.

Table 2.

Public Charging infrastructure in Germany [20].

As of 1 January 2024, 1,381 companies were registered as operators of publicly accessible charge points in Germany. A total of 102,269 public charge points were in operation on 1 January 2024, of which 22 percent have received public subsidies. While the absolute number of Charge Points that have been installed with the help of government subsidies continuously rises, the relative decline in subsidized Charge Points shows a rise in solely business funded expansion. Data collected in regard to the various funding programs show that charging hardware by more than 300 manufacturers has been installed.

The significance of Public Utility Companies, who had largely driven the initial expansion in Phase I and who still had been responsible for more than 40 percent of newly installed CPs in the year 2017, started to decline in Phase II as shown in Figure 3. In part, this can be explained by newly introduced EU unbundling regulations, strongly separating the operation of electricity grids and charging infrastructure. Instead, investing in Charging Infrastructure has become attractive for a variety of players. The growing activities of OEMs, traditional utility companies, the oil and gas industry, as well as new and solely charging-focused enterprises indicate that EV technology can successfully achieve a broad market ramp-up within various industries and that a diffusion toward the majority of users is expected. This demonstrates that the government supply-side strategy and its thereby communicated commitment towards EV-technology have convinced these market players to begin large-scale investment strategies. In turn, these observable growing market activities reduced the need for continued government subsidies in the future.

Figure 3.

Share of total added charging capacity by selected sectors (2017–2023) [21].

4. Phase III: Scaling and ‘Crossing the Chasm’

During the previous phase, marked by heavy supply-side government intervention in charging infrastructure, the number of registered EVs drastically increased. Between the years 2017 and 2022 the number of registered EVs increased almost twentyfold. By the year 2022 one in four newly registered cars in Germany had been an EV. This increase in EV market share creates a sustainable demand for charging infrastructure, making it more attractive for businesses. For government policy, this increased profitability reduced the need for a continuation of previous supply-side interventions. Instead, the increased pressure by a growing segment of customers has made the existing structural problems ever more apparent. Expanding from innovators and early adaptors towards more majority users requires not only the availability of charging infrastructure but also ubiquitously available charging opportunities, which are designed in a user-friendly fashion. Additionally, the future mid-term expansion of the charging network needs to be credible for consumers.

4.1. Streamlining Regulation and Creating a Level Playing Field

For government policy, this meant a shift from direct supply-side interventions, toward creating a regulatory framework, which allows private sector actors to scale. During the phase of initial expansion, the need to create a ubiquitous, nationwide, and consistent charging network collided with the decentralized and multi-layered organizational structure within Germany. Businesses scaling their charging businesses had to face inconsistent and unequal framework conditions within the country. This was mainly caused by the existence of 11,000 municipalities, who are responsible for construction permits, and by the more than 800 electricity distribution network operators. During Phase II, it became more and more apparent that heterogenous procedures and technical requirements created increased transaction costs for businesses and created barriers for entering local markets, making individual municipalities and grid areas unattractive for CPOs. Against the backdrop of the politically desired market ramp-up of EVs, this had become unacceptable for business and government actors alike. The efficiency of processes at municipalities and distribution network operators therefore emerged as bottlenecks for charging infrastructure expansion and became the focal points of government policy.

4.2. Charging Infrastructure Master Plan II

Leveling these regional disparities and creating a level playing field in which companies, but ultimately consumers too, can find uniform conditions is one of the central goals that the German government has been pursuing with the Charging Infrastructure Master Plan II, which was approved by the Federal Cabinet in October 2022 [22]. The aim of the plan was to reduce the amount of transaction costs, which companies face when providing charging services. Government policy shifted from supply-side interventions towards regulatory streamlining.

Over the course of 2022, the German government carried out a comprehensive review of the expansion of charging infrastructure during Phase II. A total of 68 measures were developed, particularly in the area of electricity grids and municipalities, with the aim of creating a standardized, affordable, and stable long-term framework. The integration of EVs and charging infrastructure into the system of electricity production, distribution and consumption emerged as a further focus of policy making. The policy objective of effective harmonization is being pursued by various measures, among which are the integration and early consideration of charging expansion in the expansion of the electricity grid. To be able to scale charging in the long term, the electricity grid must be prepared. To this end, distribution network operators have been legally mandated to take into account the forecasts on future charging demands based on comprehensive data analyses by the National Centre for Charging Infrastructure.

Additionally, processes and technical requirements in the more than 800 distribution networks are being harmonized to allow for economies of scale. Similarly, the focus in the municipalities is on harmonizing and accelerating permit procedures. Due to the legal and organizational autonomy of the municipalities within Germany, the federal government cannot intervene directly. Instead, the Master Plan contains a series of assistance packages and guidelines. If local authorities follow these, uniformity is created. The third—very decisive—focus of the master plan and a crucial factor on the threshold from early adopters to majority users—to the ‘average consumer’—is user-friendliness. Charging infrastructure that is not user-friendly, e.g., where payment is complicated, which is not easy to find or whose prices are not transparent, weakens the acceptance of EV-technology.

4.3. ‘Crossing the Chasm’ and Continued Government Commitment

The explicit aim of the Charging Infrastructure Master Plan II was to create an advantageous and harmonized framework so that government interventions (especially of a fiscal nature) could be reduced to a minimum as soon as possible. It therefore represents a break with the charging infrastructure policy previously dominated by supply-side interventions. At the same time, the identification and implementation of a total of 68 measures marks the conclusion to the phase of a high degree of government intervention. This peak of government activity towards charging infrastructure coincides with a highly critical stage of EV-technology adoption, which American organizational theorist Geoffrey Moore has termed ‘Crossing the Chasm’ [23]. The ‘Chasm’ describes the difference in needs and expectations between ‘visionary’ Innovators and ‘pragmatic’ Majority Consumers, to which products need to adapt to in order to achieve wider market penetration.

In contrast to the previous years, data on registered EVs in the year 2023 show a plateau in the rate of EV-adoption. A recent survey by the National Academy of Science and Engineering also indicated that the demand by consumers of the Early Adopter variety has been somewhat saturated, while consumers “beyond the Chasm” remain somewhat hesitant [24]. The same survey also examined the population’s attitude towards EVs and has shown a great willingness to embrace change, but also some remaining reservations. Within the group of those who are willing to switch to electromobility, a lack of charging facilities persists as a main reservation for two thirds. The actual or even perceived lack of charging facilities must therefore be countered by continuous credible political commitment to successfully “cross the Chasm”.

Even if supply-side interventions have mostly been replaced by regulatory measures, continued government involvement signals a commitment to the success of EVs. The preparedness for direct interventions is needed to instill confidence in consumers. This assurance is essential for overcoming reluctance to adopt EVs and fostering a positive perception of the technology among the general public. Of course, not only government policies need to take ‘the Chasm into account but it needs to be addressed by OEMs by adjusting their product portfolios, marketing strategies and pricing policies.

4.4. Waiting Beyond the ‘Chasm’: User Experience and Expectations of the ‘Next Segment’

The German market research firm USCALE GmbH operated extensive surveys of electric vehicle (EV) owners’ charging behavior and infrastructure usage in Germany [25]. The aim was to gain insights into charging habits, user segments, and the challenges and needs of EV drivers. The surveys were carried out from March to September 2024 and included a total of 2986 respondents. Various sub-studies were combined to create a comprehensive picture of charging habits and needs. Online surveys using quantitative methods were employed, and participants were recruited through multiple channels to ensure a representative sample of the current user base. To better understand the differences between groups of EV drivers, participants were divided into two main segments:

- Pioneers: This group includes “Innovators” and “Early Adopters” based on Everett Rogers’ diffusion model, characterized by high involvement with EV technology and a strong interest in innovation.

- Next Segment: Comprising users with lower involvement in EVs, this group typically adopts EVs later and represents a broader societal spectrum, particularly from urban areas, with a different attitude toward charging infrastructure.

For the ‘next segment’ customer groups, their expectations and requirements are specifically the conditions which create the ‘chasm’. Overcoming the ‘chasm’ between ‘pioneers’ and the ‘next segment’ can therefore only be achieved when the differing preconditions are recognized. The surveys found that the user base is becoming more diverse: the “next segment” is younger and more balanced in gender compared to earlier groups, with many from larger cities and higher income brackets. Notably, 59% of all respondents have a household income above EUR 5000 per month. Home charging remains the dominant method, with around 80% of pioneers and next segment users charging at home. Public charging is growing, especially for those unable to install a private charging station. The next segment is increasingly charging at work, public charging stations on the street, and charging hubs at retail car parks. Despite 62% of all users being satisfied with public charging options in general, 50% have encountered issues like blocked or broken stations and payment problems. The next segment feels less secure about charging, which leads to more frequent use and a perception of higher station occupancy. Next segment users demand improvements in charging infrastructure, particularly more public charging points in residential areas and more fast chargers in cities. While pioneers stronger prioritize low charging costs, the next segment values fast and comfortable charging.

The surveys highlight that EV adoption in Germany is entering a new phase. Early adopters were focused on technology and cost, while the next segment is driven by comfort, ease of use, and charging speed. The growing importance of public charging infrastructure presents new challenges for cities and charging operators. Issues such as malfunctioning or occupied charging stations and complex payment methods need to be addressed by market actors and policy makers. The results underscore that the success of EV adoption largely depends on the user-friendliness of charging infrastructure. Considering these attitudes, it is clear that without continued improvement, the process of EV adoption could stall. The reliability of government programs is needed to further strengthen confidence and technology acceptance.

5. Policy Shifts and Market Reactions: How the Sudden End of the Buyer’s Premium Impacted EV Adoption

On 15 November 2023, a ruling by the German Federal Constitutional Court altered the budgetary options available to the German government, which had an immediate and drastic impact on support measures for EV adoption [26]. With very short notice, the “Environmental Bonus”, Germany’s buyer’s premium for BEVs, PHEVs, and FCEVs that had been introduced in 2016, was discontinued. The possibility of receiving investment grants when purchasing a new EV ended abruptly with just five weeks’ notice, leaving consumers and companies without sufficient opportunity to adapt to the change. This politically unplanned and unforeseen decision caused significant damage to public trust, which was reflected in EV registrations, as new registrations in 2024 fell significantly behind the previous year’s figures.

The abrupt policy change led to a sharp increase in very short-term new registrations of battery-electric vehicles (BEVs) in the last weeks of 2023, as many buyers rushed to secure the expiring subsidies. In January 2024, new registrations dropped significantly, due to both a pull-forward effect in 2023 and the increased total cost of ownership for private and commercial customers. At the same time, OEMs attempted to compensate for the lost state subsidies with discounts. After the discontinuation of the Environmental Bonus in December 2023, many OEMs in Germany responded with their own price reductions to maintain a stable pricing of EVs. Volkswagen, for example, offered discounts on its ID models until the end of March 2024, in some cases exceeding the previous subsidy amounts. The price reduction for the ID.4 and ID.5 models amounted to more than EUR 7700 [27]. Other manufacturers, such as Dacia and Tesla, also lowered the prices of their EVs to compensate for the loss of government incentives. Dacia, for instance, granted a discount of EUR 10,000 on its Spring electric SUV, bringing the price down to just under EUR 13,000. Tesla reduced the price of the Model Y by nearly EUR 5000. These measures demonstrate that manufacturers sought to cushion the increased costs for consumers through their own discounts and to sustain EV sales despite the policy shift.

Nevertheless, a significant decline in registrations followed the end of the Environmental Bonus. In 2023, a total of 699,943 EVs were newly registered, accounting for a 24.61% market share. In contrast, EV registrations declined in 2024 after the end of the buyer’s premium. In 2024, EV registrations dropped to 572,514 and a market share of 20.32% (see Table 3). This decline is primarily attributed to the discontinuation of the government purchase premium. This suggests that the downturn in EV registrations in Germany was indeed driven by the loss of consumer confidence caused by the abrupt end of the subsidy rather than merely by price effects. In the time since then, the abrupt removal of subsidies has slowed the market penetration of EVs, particularly in price-sensitive customer segments. While companies and fleet operators continue to benefit from tax advantages such as reduced company car taxation, private buyers, who rely more heavily on purchase incentives, have increasingly postponed their purchasing decisions or turned to the used car market. As a result, the ramp-up of electromobility in Germany is progressing more slowly than initially expected.

Table 3.

EV-Adoption (BEV + PHEV; passenger cars only) in Germany [28].

Beyond the economic effects, the abrupt end of the Environmental Bonus has also impacted public acceptance of electromobility. In public discourse, the funding halt was perceived as a breach of trust, particularly by consumers who had expected reliable and long-term political support for the mobility transition. This has led to increased skepticism toward future policy measures in the field of sustainable mobility and has weakened confidence in government incentive systems. This loss of trust occurred precisely at a critical stage of technology adoption, where due to the previously described “chasm”, market dynamics are particularly vulnerable. Crossing the ‘chasm’ dividing early adopters from majority users in the mass market could therefore not be achieved by the end of 2024. This can be attributed to tumultuous political developments. Thus, policy making remains stuck in Phase III for now. After the end of the ‘Environmental Bonus’ Germany’s federal government has repeatedly tried to implement new policy measures to substitute the prematurely stopped buyer’s premium. In July 2024, the government announced the introduction of special depreciation and taxation write-off regulations to incentivize companies to invest in EVs [29]. Due to the premature break-up of the government coalition in November 2024 these plans did not come to fruition.

6. Phase IV: Moderating and Safeguarding

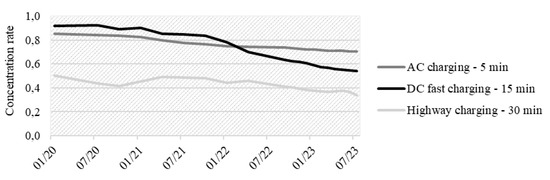

While there is still both economic justification as well as political willingness to continuously support and subsidize the ongoing market ramp-up, there a state of technology diffusion needs to be reached, where most interventions, most notably those detrimental to the development of a functioning market, can be safely phased out without risking any perceived time inconsistencies or a lack of commitment by policy makers. For this point in time, it is worth looking into possible long-term role models between the public and private sector and especially the long-term role of the federal state. Once technology adoption has reached a degree of maturity that allows for it to further run without significant outside stimulation, state activities must shift towards being a moderator rather than an incubator. While the entire market for (public) charging infrastructure might not be a natural monopoly that would require continuous intervention, it is not guaranteed that a sufficient level of competition can be achieved in all of its sub-markets. Figure 4 displays the average market concentration rate CR_1 (which describes the market share of the charge point operator with the highest share) for three selected sub-markets. The sub-markets are classified by technology (AC normal charging, DC fast charging) as well as where the chargers are located (Highway charging) and defined by the amount of time consumers are willing to spend to substitute a charging point with a different one.

Figure 4.

Average market concentration CR1 for selected sub-markets by technology and distance [30].

While the average CR1 value for DC fast charging has been continuously decreasing since early 2020, for AC normal charging it is resting at an extremely high level. Highway charging has a lower concentration rate, mostly due to the longer distances that can be covered in 30 min. German and European competition laws assume a market dominance at a CR1 value of 0.4 or higher, which suggest that a lot of charging infrastructure sub-markets are potentially dominated by one operator. The decreasing tendencies especially in the fast charging sub-markets are a positive signal for an increase in competition intensity, which would allow for a lower level of intervention expenses in the long-term while the ceaseless high level of market dominance in the (mostly urban and rural) AC normal charging market might require ongoing regulatory efforts to protect consumers from the risk of supracompetitive pricing. Regulators and policy makers will have to continuously observe the market and look for signs of market failure in vulnerable sub-markets as well as use all available levers to facilitate an increase in competition intensity on all levels.

First insights into how public agencies intend to approach this moderating role have been provided by the sector investigation of the German federal competition authority (Bundeskartellamt. BKartA) released in 2024 [31]. In this, the BKartA aims to identify structural challenges in competition and ultimately pricing in an early market stage, in order to prevent any negative impacts for consumers, as outlined earlier. The results regarding market concentration match those cited and presented earlier (largely due to being based on the same datasets, see Figure 4); however, the report also outlines instruments and levers available to regulators and policy makers and discusses ways of utilizing antitrust laws in this context. While it focuses on Germany, national antitrust and competition laws are rooted within European competition law. Therefore, the authority’s findings are, to a certain degree, applicable to other countries as well. The two main tools of antitrust policies are codified in Articles 101 and 102 of the Treaty of the Functioning of the European Union (TFEU) and prohibit both anticompetitive agreements (ultimately cartels) as well as the abuse of dominance with the latter being identified as the more applicable fact. According to the report, several types of such abuse of dominance can occur within the market for EV charging infrastructure, the so-called ‘margin squeeze’ of vertically integrated CPOs being the most prevalent. Margin-squeeze can occur if a dominant CPO, which also acts as a distributor of electricity asks prices from end consumers that are lower than what he asks from competing third party EMPs. As a result, third party EMPs are unlikely to be able to realize any margins at those charging stations. Such practices are best addressed by regulations that require non-discriminatory (B2B-) pricing. General antitrust laws already prohibit this for actors with absolute or relative market power (see § 19, 20 of the German Competition Act ‘GWB’), additionally, the European AFIR requires non-discriminatory pricing from all market participants, extending such regulations beyond their initial scope. Monitoring and executing these regulations can be a key piece to preventing the undermining of competition and supracompetitive pricing without dedicated price regulation. In particular, the extension of non-discriminatory pricing requirements can be considered an important instrument to not rely exclusively on antitrust laws which often only provide ex-post levers when problematic market power has already been established organically (practices like merger control can only prevent an increase in market dominance through acquisition or merging).

Even if the charging infrastructure might at one point move frictionless, innovation and technology advancements can, to a degree, constitute a new need for interventions. Electric cars have systemic relevance for the energy system, due to their electricity demand but also their mid- to long-term potential as energy storage and in grid extension. ‘Vehicle to Grid’ or ‘Vehicle to Home’ (V2X) technologies connect electric mobility even closer to critical infrastructures and while their advantages also benefit consumers, it will be in a policy maker’s best interest to support the rollout of such technologies. The need for adoption and integration of innovations such as V2X technologies has the potential to initiate a new cycle of public interventions, especially if there is a risk of economically disadvantageous lock-in effects.

Both moderating and safeguarding must be the core activities of regulators and policy makers in a long-term mature market due to the systemic relevance of electric mobility and charging infrastructure and the vulnerability of consumers to any market imperfection, especially beyond 2035. In order to reach such a level of market maturity it is furthermore advised to phase out any subsidies and other instruments in a controlled manner to not risk eroding consumers trust in the technology.

7. Conclusions and Outlook

The chicken-and-egg dilemma of supply and demand between EV adoption and charging infrastructure has required extensive public intervention, most notably subsidies and other incentives for consumers and infrastructure investments. The market ramp-up starting in 2017 indicates that these efforts at overcoming the dilemma have been successful for now. The observed plateau in EV adoption lately, however, suggests that there is a real risk of a ‘chasm’ in the technology adoption. Crossing that chasm most likely requires continuous policy efforts to incentivize and support the ramp-up of both EV adoption and infrastructure investments for now. Additionally, phasing out subsidies too quickly can cause not only economic shocks but also erode consumer’s trust in the credibility of policy makers, as seen by the sudden end of the buyer’s premium [32]. Correspondingly, policy makers should communicate at a fairly early stage a predictable and gradual phase-out process of continually reduced government measures.

Further comparative studies examining EV market adoption in other comparable countries could help to further identify effective and ineffective approaches to guide EV technology adoption in order to provide policy makers with further guidance. Since extensive case-studies of these comparative countries would be required beforehand, this article is limited in making such comparisons. In any case, the trade-off between ramp-up pace and market maturity needs to be considered for future policy instruments, especially in the transition from Phase II to Phase III. Enabling competition should be a cornerstone of the policy strategy in order to prepare for a long-term phasing out of subsidies and other interventions. Once a certain degree of market maturity is achieved, the role of the state and its regulators and policy makers needs to shift towards moderating and safeguarding. The interconnection with the highly regulated energy systems will continue to impose a baseline regulatory demand and technological innovations could start a new cycle of interventions if there is a risk of disadvantageous lock-in effects once again.

Additionally, the transition of the light- and heavy-duty sector towards electric mobility is on the horizon and regulations are being put in place already. This poses both a challenge due to even higher technological demands of said vehicles (for example so called ‘megawatt charging’ with a power output of up to 1 megawatt) but also a chance to apply the learnings from the EV and infrastructure rollout thus far. As infrastructures will most likely not be fully interoperable, the sector will face an entirely new chicken-and-egg dilemma and a fresh technology adoption cycle. While there have been various funding schemes in the past that subsidized both vehicles and infrastructure, German policy makers intend to stimulate the rollout by an extensive investment into the infrastructure with a tender to install and operate 350 charging stations across motorways (Tender 553148-2024 ‘Germany—Vehicle refuelling services—Planung, Errichtung und Betrieb von Schnellladeinfrastruktur für E-Lkw’). This, once again, follows the approach from passenger cars where a sufficient charging network is seen as a prerequisite for vehicle adoption, prioritizing infrastructure investments to overcome the dilemma. The tender design, most notably regulations regarding third party access to charging stations, contains elements of the ‘essential facilities doctrine’ of competition policies, indicating increased attention towards a competitive market design early on in the technology adoption cycle.

This paper tries to shed light on policy making in regard to the rollout of charging infrastructure in Germany and especially the transition of the state’s role and policy strategies towards a more mature market. For a more comprehensive understanding, the same considerations can be made for other countries as well. Future research should also focus on evaluating past and present policy instruments and strategies that have been utilized for overcoming the ‘chicken-and-egg’ dilemma. A potential future phase-out of all or most subsidies should also be monitored closely to avoid falling victim to the chasm of technology adoption.

Author Contributions

All authors contributed equally to this work. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original data presented in the study are openly available in the EV charging station register of the Bundesnetzagentur at https://www.bundesnetzagentur.de/DE/Fachthemen/ElektrizitaetundGas/E-Mobilitaet/start.html (accessed on 22 May 2025) as well as the FörderMONITORING of the National Centre for Charging Infrastructure at https://nationale-leitstelle.de/verstehen/foerdermonitoring/ (accessed on 22 May 2025). Data derived from surveys of electric vehicle (EV) owners’ charging behavior and infrastructure usage (4.4) are not publicly available, but can be purchased at German market research firm UScale GmbH.

Conflicts of Interest

Johannes Martin Loehr and Maik Hanken are employees of National Centre for Charging Infrastructure c/o NOW GmbH. The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| AC | Alternating Current |

| AFID | Alternative Fuels and Infrastructure Directive |

| AFIR | Alternative Fuels and Infrastructure Regulation |

| BEV | Battery-electric Vehicle |

| BKartA | Bundeskartellamt |

| CPO | Charge Point Operator |

| CO2 | Carbon Dioxide |

| DC | Direct Current |

| EMP | Electric Mobility Provider |

| EU | European Union |

| EV | Electric Vehicle |

| FCEV | Fuel Cell Electric Vehicle |

| GHG | Greenhouse Gas |

| GWB | Gesetz gegen Wettbewerbsbeschränkungen (Competition Act) |

| ICE | Internal Combustion Engine |

| KW | Kilowatts |

| KSG | Klimaschutzgesetz (Climate Protection Act) |

| LSV | Ladesäulenverordnung (Charging Station Ordinance) |

| MW | Megawatts |

| OEM | Original Equipment Manufacturer |

| PHEV | Plug-In Hybrid Vehicle |

| TFEU | Treaty on the Functioning of the European Union |

| V2X | Vehicle-to-X |

References

- Agora Energiewende. Press Release. Available online: https://www.agora-energiewende.de/aktuelles/deutschlands-co2-ausstoss-sinkt-auf-rekordtief-und-legt-zugleich-luecken-in-der-klimapolitik-offen (accessed on 15 February 2024).

- United Nations. Kyoto Protocol to the United Nations Framework Convention on Climate Change. Available online: https://unfccc.int/resource/docs/convkp/kpeng.pdf (accessed on 15 February 2024).

- German Federal Government. Fortschrittsbericht. 2008. Available online: https://www.bundesregierung.de/resource/blob/975274/464742/d485cdb8c8c35da2ea3af74942e299fc/2008-11-17-fortschrittsbericht-2008-data.pdf?download=1 (accessed on 15 February 2024).

- United Nations. The Paris Agreement. Available online: https://unfccc.int/sites/default/files/resource/parisagreement_publication.pdf (accessed on 15 February 2024).

- Fit for 55. Available online: https://www.consilium.europa.eu/en/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/ (accessed on 15 February 2024).

- Foquet, R. Trends in income and price elasticities of transport demand (1850–2010). Energy Policy 2012, 50, 62–71. [Google Scholar] [CrossRef]

- David, F.; Holger, H.; Stefan, L. Die Ökobilanz von Personenkraftwagen. Available online: https://www.umweltbundesamt.at/fileadmin/site/publikationen/rep0763.pdf (accessed on 15 February 2024).

- Pendam, D.V.; Tofin, T.M. Electric Vehicle and Charging Infrastructure Development, Applications of Emerging Technologies and AI/ML Algorithms; Springer Nature: Singapore, 2023; pp. 267–302. ISBN 978-981-99-1018-2. [Google Scholar]

- Rogers, E.M. Diffusion of Innovation; The Free Press: Los Angeles, CA, USA, 1983; ISBN 0-02-926650-5. [Google Scholar]

- Loehr, J.; Hanken, M. From Jump-Start to Phase-Out—Transitioning Policy Making Towards a Primarily Market Driven Charging Infrastructure Rollout in Germany. In Proceedings of the for EVS37 Symposium, Seoul, Republic of Korea, 23–26 April 2024. [Google Scholar]

- van Dijk, J.; Delacrétaz, N.; Lanz, B. Technology Adoption and Early Network Infrastructure Provision in the Market for Electric Vehicles. Environ. Resour. Econ. 2022, 83, 631–679. [Google Scholar] [CrossRef] [PubMed]

- Schroeder, A.; Traber, T. The economics of fast charging infrastructure for electric vehicles. Energy Policy 2012, 43, 136–144. [Google Scholar] [CrossRef]

- Brozynski, M.; Leibowicz, B. A multi-level optimization model of infrastructure-dependant technology adoption: Overcoming the chicken-and-egg problem. Eur. J. Oper. Res. 2022, 300, 755–770. [Google Scholar] [CrossRef]

- Ma, G.; Lim, M.K.; Mak, H.Y.; Wan, Z. Promoting Clean Technology Adoption: To Subsidize Products or Service Infrastructure. Serv. Sci. 2019, 11, 75–154. [Google Scholar] [CrossRef]

- Yu, J.J.; Tang, C.S.; Li, M.K.; Shen, Z.J.M. Coordinating Installation of Electric Vehicle Charging Stations Between Governments and Automakers. Prod. Oper. Manag. 2022, 31, 681–696. [Google Scholar] [CrossRef]

- Li, G.; Luo, T.; Song, Y. Spatial equity analysis of urban public services for electric vehicle charging—Implications of Chinese cities. Sustain. Cities Soc. 2022, 76, 103519. [Google Scholar] [CrossRef]

- Luo, T.; Song, Y.; Li, G. An agent-based simulation study for escaping the “chicken-egg” dilemma between electric vehicle penetration and charging infrastructure deployment. Resour. Conserv. Recycl. 2023, 194, 106966. [Google Scholar] [CrossRef]

- Kurz, C. Finanzielle Anreizwirkung der Förderung von Elektromobilität durch die Bundesregierung: Empirische Evidenz Bezüglich der Umweltprämie und der Kfz-Steuerbefreiung; UASM Discussion Paper Series, 6/2017; University of Applied Sciences Mainz: Mainz, Germany, 2017. [Google Scholar]

- Nationale Leitstelle Ladeinfrastruktur. Ladeinfrastruktur nach 2025/2030: Szenarien für den Markthochlauf. 2020. Available online: https://nationale-leitstelle.de/wp-content/pdf/broschuere-lis-2025-2030-final-web.pdf (accessed on 15 February 2024).

- Ö-Lis-Report der Nationalen Leitstelle Ladeinfrastruktur. Available online: https://nationale-leitstelle.de/verstehen/o-lis-report_der_nationalen_leitstelle_ladeinfrastruktur/ (accessed on 18 March 2025).

- Modified Based on Data Collected by the National Centre for Charging Infrastructure; NOW GmbH: Berlin, Germany, 2024.

- Federal Government of Germany. Charging Infrastructure Masterplan II. Available online: https://bmdv.bund.de/SharedDocs/EN/publications/charging-infrastructure-masterplan-ii.pdf?__blob=publicationFile (accessed on 3 February 2024).

- Moore, G.A. Crossing the Chasm; HarperCollins: New York, NY, USA, 2001; ISBN 0-06-018987-8. [Google Scholar]

- Acatech Mobilitätsmonitor. Available online: https://www.acatech.de/allgemein/umfrage-mobilitaetsmonitor/ (accessed on 11 February 2024).

- UScale GmbH. Customer Insights on E-Mobility. Available online: https://uscale.digital/ladestudien/ (accessed on 26 March 2025).

- Federal Constitutional Court. Judgment of 15 November 2023. Available online: https://www.bundesverfassungsgericht.de/SharedDocs/Entscheidungen/EN/2023/11/fs20231115_2bvf000122en.html (accessed on 16 March 2025).

- Weser Kurier. Statt Umweltbonus Gibt es Rabatte Beim E-Auto-Kauf. Available online: https://www.weser-kurier.de/bremen/wirtschaft/e-auto-kauf-rabatte-manchmal-hoeher-als-der-umweltbonus-doc7tpjkl5rcr8a9n8h30j (accessed on 14 March 2025).

- Federal Motor Transport Authority. Environmental Statistics. Available online: https://www.kba.de/DE/Statistik/Fahrzeuge/Umwelt/umwelt_node.html (accessed on 15 March 2025).

- Federal Ministry of Finance. Wachstumsinitiative—Neue Wirtschaftliche Dynamik für Deutschland. Available online: https://www.bundesfinanzministerium.de/Content/DE/Downloads/Oeffentliche-Finanzen/Bundeshaushalt/bundeshaushalt-2025-und-wachstumsinitiative-2.pdf?__blob=publicationFile&v=5 (accessed on 14 March 2025).

- Modified Based on: Monopoly Commission, 9. Sektorgutachten Energie. Available online: https://www.monopolkommission.de/images/PDF/SG/9sg_energie_volltext.pdf (accessed on 15 February 2024).

- Bundeskartellamt. Sektoruntersuchung Zur Bereitstellung und Vermarktung Öffentlich Zugänglicher Ladeinfrastruktur Für Elektrofahrzeuge. Available online: https://www.bundeskartellamt.de/SharedDocs/Publikation/DE/Sektoruntersuchungen/Sektoruntersuchung_Ladesaeulen_Abschlussbericht.html (accessed on 21 March 2025).

- FAZ. Beschädigte Pläne Für die Transformation. Available online: https://www.faz.net/aktuell/wirtschaft/kommentar-ende-des-umweltbonus-verursacht-vertrauensschaden-19391382.html (accessed on 15 February 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).