Transitioning to Electric UTVs: Implications for Assembly Tooling

Abstract

1. Introduction

1.1. The Assembly Tooling Industry

1.2. E-Mobility

1.3. The UTV Industry

1.4. Problem Description and Contribution

1.5. Research Gaps and Novelty of Research

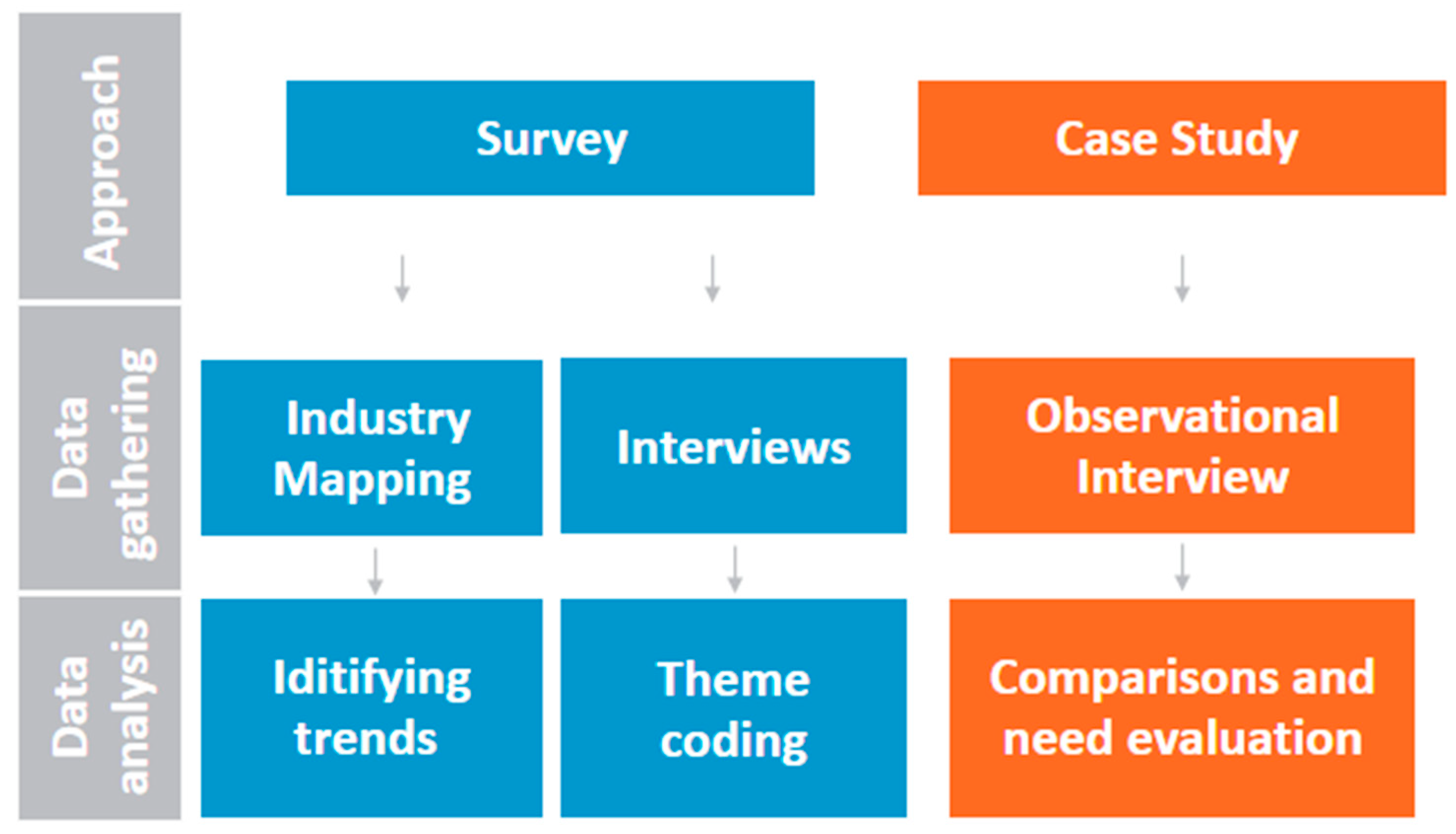

2. Methodology

2.1. Research Approach

2.1.1. Case Study

2.1.2. Survey

2.2. Data Collection Methods

2.2.1. Data Collection for Case Study

2.2.2. Data Collection for Survey

2.3. Analysis Methods

2.3.1. Survey Analysis

2.3.2. Case Study Analysis

2.3.3. Opportunities and Challenges

2.4. Ethical Considerations

2.5. Research Boundaries

2.5.1. Assembly Solutions Boundaries

2.5.2. Vehicle Boundaries

3. Theory

3.1. Principles of Tightening Technique

3.1.1. Screw Joint

3.1.2. Errors in Tightening

3.1.3. Material Properties and Clamping Force

3.1.4. Tightening Measurements

3.1.5. Tightening Tools

Pneumatic

Impact Tools

Hydraulic Pulse Tools

Electric Clutch

Electric Transducer

Battery Tools

3.1.6. Tightening Strategies

3.2. Industry 4.0

3.3. EV Battery Pack Assembly

4. Results

4.1. Survey Result

4.1.1. Industry Mapping

4.1.2. Interviews

“Nobody will want to be the last manufacturer to only produce combustion vehicles, so once the EV industry gets traction on the market, the change to electric will be very rapid”—Interviewee 4

“The recreational vehicle segment is likely to continue using combustion engines for quite some time, at least in the U.S. Most customers work in the countryside and prefer a reliable product that is easy to fuel. Electric vehicles will have niche applications, such as hunters who need a quiet vehicle and companies that want to have zero carbon footprint. I would say 90% will still be combustion engine based.”—Interviewee 8

“Some big investments are needed to switch to producing electric, especially concerning the handling of the battery which is a very sensitive component and needs special warehousing conditions. I believe only a few very big companies will assemble their own battery packs, since this requires a lot of new know-how in, for example, electronics and material sciences. More companies will assemble their own electrical motor, as this is an area they might already have the know-how for.”—Interviewee 6

“It is much easier to produce electric vehicles. The drivetrain consists of three main components: a motor, a battery and a controller. There are fewer moving parts and no need for oil, transmission, exhausts and fuel system. It’s a simpler setup. However, more electrical wiring is usually needed, and the battery requires special care due to regulations.”—Interviewee 4

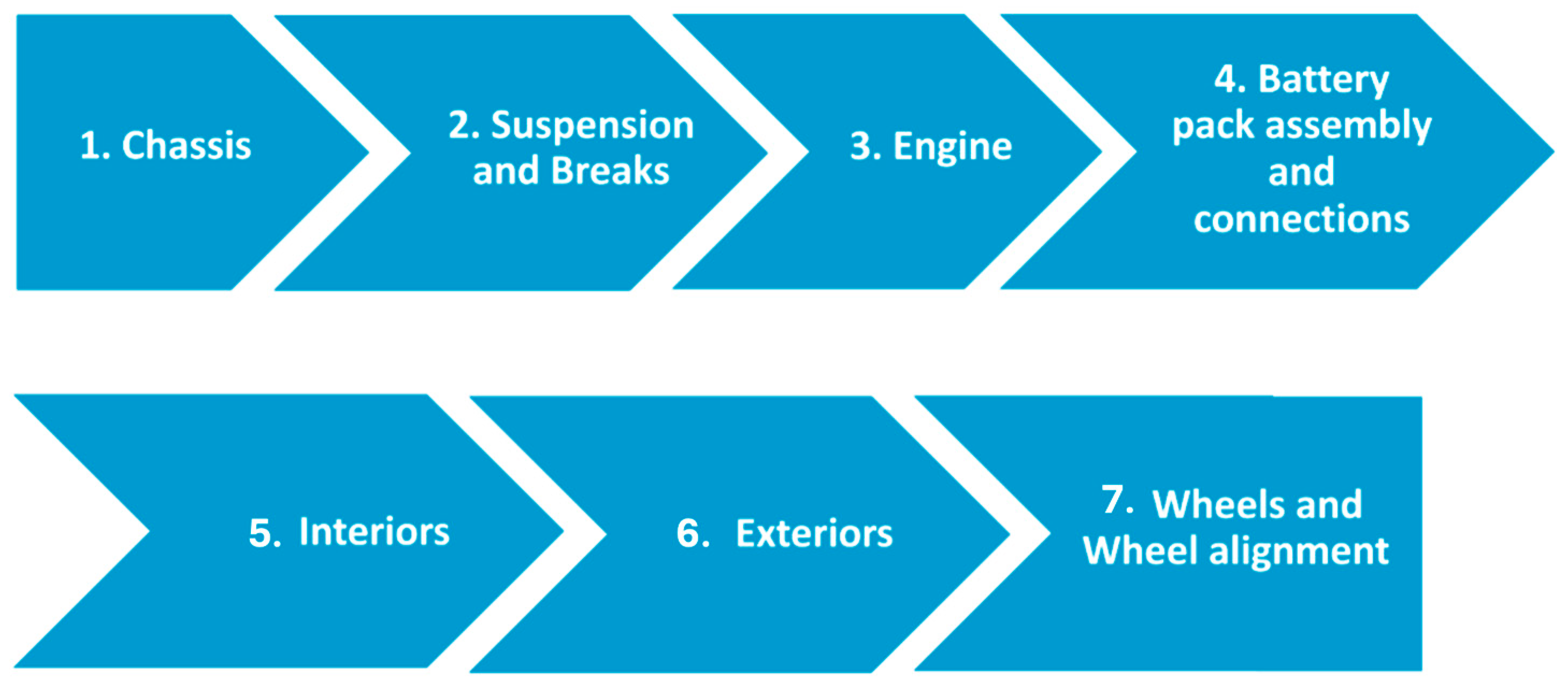

4.2. Case Study Result

4.2.1. Final Assembly Overview

4.2.2. Critical Assembly Applications

4.2.3. EV Specific Critical Assembly Applications

4.2.4. Assembly Solutions

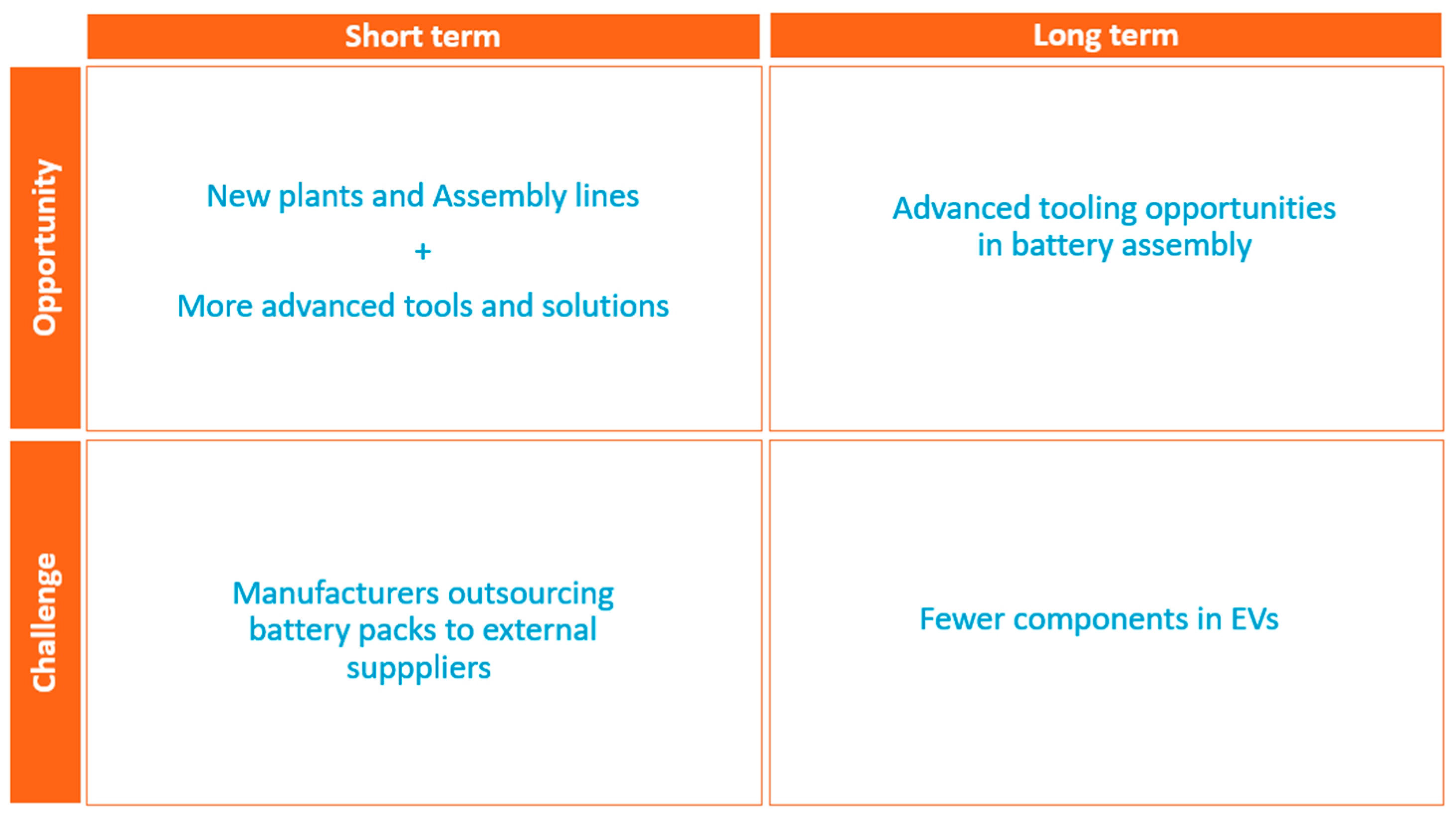

5. Discussion

5.1. Trend Towards Electrification

5.2. Challenges and Opportunities

5.2.1. External Sourcing of Battery Pack

5.2.2. Fewer Components in EVs

5.2.3. New Plants and Need for Advanced Tools

5.2.4. Tooling Needs for Battery Pack Assembly

5.2.5. Labor Skill Requirements

5.2.6. Long-Term Market Predictions

5.3. Execution and Limitations

5.4. Novelty of Research

5.5. Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Interview Guide—Survey

- Introduction of the interviewers, the publication, Atlas Copco’s role, and the purpose of the interview.

- Ask for permission to record the interview.

- Clarify that the interviewee and their employer will be anonymous in the final publication.

- Ask the interviewee to introduce themselves and explain their background in the power sport industry.

- Can you give a brief overview of the current state of the UTV industry and the trends towards transitioning to electric drive?

- What are the main reasons behind the shift to electric drive in UTVs (environmental regulations, customer demand, technological advancements, etc.)?

- How will the transition to electric drive affect the assembly process of UTVs, such as changes in design, manufacturing, and assembly techniques?

- Ask the interviewee to share their insights on how the shift to electric drive will impact the sourcing and integration of components, such as batteries, motors, and power electronics in UTV assembly. Will the drivetrain and battery most likely be produced in-house by manufacturers or sourced from third parties?

- How will the transition to electric drive impact the number of tightening operations in the assembly process of UTVs?

- Are there any differences in tightening requirements between internal combustion engine UTVs and electric UTVs, and what are the reasons behind these differences?

- Are there any increased regulation and safety requirements for producing EVs/batteries that might require more high-end tools and QA solutions?

- How could the transition to electric drive impact the assembly tools and solutions used in UTV assembly?

- Are manufacturers of electric UTVs more likely to invest in electric smart assembly tools than manufacturers of traditional UTVS?

- Ask the interviewee to provide any additional insights or recommendations on how the transition to electric drive will affect UTV assembly.

- Summarize the key findings and insights from the interview.

- Thank the interviewee for their time and expertise, and ask if there are any additional resources or contacts they would recommend for further research on this topic.

Appendix B. Interview Guide—Case Study

- Can you give a brief overview of the current state of the UTV industry and the trend toward transitioning to electric drive?

- ○

- What are the main reasons behind the shift?

- What are the overall differences in the final assembly of an internal combustion engine vehicle and an electric vehicle?

- ○

- Are there more or less assembly stations?

- ○

- Are there more or less components in an electric UTV vs. its IC counterpart?

- ○

- What new needs come from having to install a battery back and electric powertrain?

- ○

- In general, is the task time longer or shorter compared to IC?

- What are the differences when it comes to the use of assembly tools?

- ○

- Are more or less assembly tools used?

- ○

- What type of tools are most common in EV assembly (pneumatic tools, electric clutch tools, battery tools)?

- ○

- Are there more or less safety-critical tightenings?

- ○

- Is there an increased need for smart reporting tools in EV assembly?

- ○

- How are the tooling needs affected by the transition to electric drive?

- ○

- Are there any new features that you wish that new tools would have that would help facilitate the transition to electric vehicle assembly?

- ○

- Do you find that there are any gaps in Atlas Copco’s current product offering that could be a problem when it comes to EV assembly?

- What are the biggest challenges when transitioning to EV assembly?

- Insights on the future of electrification within the power sports industry

- ○

- Do you think manufacturers are more likely to produce their powertrains and battery packs in-house or buy from third parties in the future?

- In comparison to the automotive industry, do you think that the electrification of the powersports industry will be faster/slower/similar?

Appendix C. Industry Mapping

| Identifyer | EV Status | Vehicle Size | Battery Pack Sourcing | Drivetrain Sourcing |

| Manufacturer 1 | EV but not ATV/UTV | |||

| Manufacturer 2 | EV but not ATV/UTV | External supplier | External Supplier | |

| Manufacturer 3 | EV but not ATV/UTV | In-house | In-House | |

| Manufacturer 4 | EV but not ATV/UTV | In-house | In-House | |

| Manufacturer 5 | EV but not ATV/UTV | In-house | In-House | |

| Manufacturer 6 | EV but not ATV/UTV | In-house | In-House | |

| Manufacturer 7 | EV but not ATV/UTV | External supplier | In-House | |

| Manufacturer 8 | EV but not ATV/UTV | External supplier | External Supplier | |

| Manufacturer 9 | EV but not ATV/UTV | |||

| Manufacturer 10 | EV on the market | Full size | ||

| Manufacturer 11 | EV on the market | Mid size | ||

| Manufacturer 12 | EV on the market | Mid size | ||

| Manufacturer 13 | EV on the market | Mid size | ||

| Manufacturer 14 | EV on the market | Mid size | ||

| Manufacturer 15 | EV on the market | Full size | ||

| Manufacturer 16 | EV on the market | Mid size | ||

| Manufacturer 17 | EV on the market | Mid size | ||

| Manufacturer 18 | EV on the market | Full size | External supplier | |

| Manufacturer 19 | EV on the market | Full size | External supplier | |

| Manufacturer 20 | EV on the market | Mid size | In-house | |

| Manufacturer 21 | EV on the market | Full size | External supplier | External Supplier |

| Manufacturer 22 | EV on the market | Full size | External supplier | External Supplier |

| Manufacturer 23 | EV on the market | Full size | External supplier | External Supplier |

| Manufacturer 24 | EV on the market | Full size | In-house | External Supplier |

| Manufacturer 25 | EV on the market | Full size | External supplier | In-House |

| Manufacturer 26 | EV on the market | Mid size | In-house | In-House |

| Manufacturer 27 | EV on the market | Mid size | In-house | In-House |

| Manufacturer 28 | EV Prototype Annonced | |||

| Manufacturer 29 | EV Prototype Annonced | |||

| Manufacturer 30 | EV Prototype Annonced | In-house | In-house | |

| Manufacturer 31 | Hybrid ATV/UTV Announced | External supplier | ||

| Manufacturer 32 | No EV Announced | Not relevant | Not relevant | |

| Manufacturer 33 | No EV Announced | Not relevant | Not relevant | |

| Manufacturer 34 | No EV Announced | Not relevant | Not relevant |

Appendix D. Interview Results

| Person | Company | Role | The Trend to Electric | Component Differences | Tooling Need | Component Sourcing |

| Interview 1 | Atlas Copco | Business Manager Mobility | The transition to electric in the automotive industry is happening much faster than most predictions. | There are fewer components overall. | A lot of advanced tooling opportunities connected to the assembly of battery packs. Less tightening operations, more adhesive, riveting, automation, and machine vision opportunities. | Battery packs are bought from third party. Currently in the process of manufacturing their own electric engine. |

| Interview 2 | Manufacturer A | Production Implementation Manager | The transition to electric is imminent, but it might take time. | Electric vehicles have much fewer components. | Currently produce small volumes, don’t have budget for advanced tooling systems. Still uses reporting manual wrenches to gather torque data. | Battery packs are bought from third party. Currently in the process of manufacturing their own electric engine. |

| Interview 3 | Atlas Copco | Sales Engineer | Has seen the trend of electrification in many industries, believes powersports will be no exception. | Less components in general. | A lot of business opportunities for Atlas Copco with EV accounts. Especially connected to battery pack manufacturing. This includes advanced tracking systems and insulated tools and sockets. | Key EV customer has decided to produce both battery pack and engines in-house. This is facilitated by strategic acquisitions. |

| Interview 4 | Manufacturer B | Head of Business Development | Thinks that everything will be electric or hydrogen very soon. They have been all electric for over 10 years. Their customers value silent vehicles very highly. | A lot fewer components in EVs. Much simpler construction and assembly in general. Way more electrical components and IoT solutions in EV. | Uses torque measuring tools but does not gather any data. | They source battery packs and engines from external suppliers. Believes that very few will produce their own. |

| Interview 5 | Manufacturer C | Manufacturing Engineer | Believes electric will take over soon, more efficient, no noise, and direct acceleration being the most important drivers. They see a very high demand for EVs, the challenge is enough production. | Less components overall. Yet the EV versions often have more tech such as connectivity and screens. | More potential operator safety issues, increased need for smart tools and Industry 4.0 solutions. Same amount of tools in the final assembly line but more attachments. | Currently sourcing both battery packs and engines. Parts of the battery pack assembly are done at their own plant. |

| Interview 6 | Atlas Copco | Sales Engineer | Many new EV companies emerging in California after the success of Tesla. | Less components in general. | EV manufacturers prefer smart electric battery tools. Not only for more advanced tightening but also because they embrace Industry 4.0. | More likely to buy from external suppliers. Has one EV account that produces both battery packs and engines for their vehicles. |

| Interview 7 | Atlas Copco | Business Development Manager | Believes powersports will follow the automotive industry. | Less components in general. | There are many opportunities for Atlas Copco connected to battery pack assembly. High voltages mean strict safety standards and small tolerances. | More likely to buy from external suppliers. |

| Interview 8 | Manufacturer D | Automotive Project and Engineering Manager | Does not think the powersport industry will go fully electric. They have an EV, but it is produced in very small quantities. Does not think demand is high from their customer base. | EV is much simpler and has much fewer components. Less tightening operations, fewer operators needed. Managing electric components is difficult and requires many adaptations. | Will need fewer tools overall. Will, however, need new solutions for battery applications. | They are buying both engines and batteries from external suppliers. Believes most companies will do the same. |

References

- Avinash, S.; Sunita, S. Assembly Fastening Tools Market Size—By Type (Corded, Cordless), Tool Type (Right Angle Tool, Inline Tool, Pistol Grip Tool), Control Mechanism (Transducer Controlled, Current Controlled, Clutch Controlled), End-Use, Distribution Channel & Forecast 2023–2032. Available online: https://www.gminsights.com/industry-analysis/assembly-fastening-tools-market (accessed on 16 March 2023).

- Stockkamp, C.; Schäfer, J.; Millemann, J.A.; Heidenreich, S. Identifying Factors Associated with Consumers’ Adoption of e-Mobility—A Systematic Literature Review. Sustainability 2021, 13, 10975. [Google Scholar] [CrossRef]

- History of ATVs: How 3-Wheeler ATVs Became 4-Wheelers. Available online: https://atvtrailreviews.com/history-of-atv (accessed on 27 September 2024).

- Prescient & Strategic Intelligence. Electric ATV and UTV Market Demand Forecast, 2022–2030. Available online: https://www.psmarketresearch.com/market-analysis/electric-all-terrain-vehicle-utility-terrain-vehicle (accessed on 27 September 2024).

- Straits Research. ATV and UTV Market Size, Suppliers to 2030. Available online: https://straitsresearch.com/report/atv-and-utv-market (accessed on 27 September 2024).

- Dudziak, A.; Droździel, P.; Stoma, M.; Caban, J. Market Electrification for BEV and PHEV in Relation to the Level of Vehicle Autonomy. Energies 2022, 15, 3120. [Google Scholar] [CrossRef]

- Čulík, K.; Štefancová, V.; Hrudkay, K.; Morgoš, J. Interior Heating and Its Influence on Electric Bus Consumption. Energies 2021, 14, 8346. [Google Scholar] [CrossRef]

- Heale, R.; Twycross, A. What is it? Examples of case studies What is a case study? Évid. Based Nurs. 2018, 21, 102845. [Google Scholar] [CrossRef]

- DePoy, E. Introduction to Research: Understanding and Applying Multiple Strategies, 5th ed.; Elsevier: Amsterdam, The Netherlands, 2016. [Google Scholar] [CrossRef]

- Martyn, D. The Good Reasearch Guide for Small Social Research Projects, 4th ed.; Open University Press: Berkshire, UK, 2010. [Google Scholar]

- DiCicco-Bloom, B.; Crabtree, B. The qualitative research interview. Med. Educ. 2006, 40, 314–321. [Google Scholar] [CrossRef]

- Brinkmann, S. Qualitative interviews. In International Encyclopedia of Education, 4th ed.; Elsevier Science: Amsterdam, The Netherlands, 2023; pp. 210–218. [Google Scholar] [CrossRef]

- Copco, A. Pocket Guide to Tightening Technique. 2015. Available online: https://www.atlascopco.com/content/dam/atlas-copco/industrial-technique/general/documents/pocketguides/9833864801_L.pdf (accessed on 4 April 2023).

- Bickford, J. Introduction to the Design and Behavior of Bolted Joints Non-Gasketed Joints, 4th ed.; CRC Press: Boca Raton, FL, USA, 2007. [Google Scholar]

- Copco, A. Pocket Guide to Screwdriving. 2016. Available online: https://www.atlascopco.com/content/dam/atlas-copco/industrial-technique/general/documents/pocketguides/1007%2001Pocket%20Guide%20to%20Screwdriving.pdf (accessed on 4 April 2023).

- Mahesh, M.; Rukmaji, K.S.; Raja, R.; Dillip Narayan, S.; Asmare, H.M. Industry 4.0 and the Future of Industrial Automation: The Role of Industrial Communication Networks. 2022. Available online: https://www.kalaharijournals.com/resources/APRIL_07.pdf (accessed on 4 April 2023).

- Assessing the Impact of Industry 4.0 on Manufacturing|ATS. Available online: https://www.advancedtech.com/blog/impact-of-industry-4-0-on-manufacturing/ (accessed on 27 September 2024).

- Ford, M. Circuits Assembly Online Magazine—Cost and Risk Reductions Using the IPC Traceability Standard. Available online: https://www.circuitsassembly.com/ca/magazine/26953-standards-1702.html (accessed on 27 September 2024).

- A Guide to Real-Time Location Systems (RTLS) in Manufacturing|ManufacturingTomorrow. Available online: https://www.manufacturingtomorrow.com/story/2022/11/a-guide-to-real-time-location-systems-rtls-in-manufacturing/19649/ (accessed on 27 September 2024).

- Sharma, A.; Zanotti, P.; Musunur, L.P. Enabling the Electric Future of Mobility: Robotic Automation for Electric Vehicle Battery Assembly. IEEE Accesss 2019, 7, 170961–170991. [Google Scholar] [CrossRef]

- Caban, J.; Małek, A.; Kroczyński, D. A Method for Assessing the Technical Condition of Traction Batteries Using the Metalog Family of Probability Distributions. Energies 2024, 17, 3096. [Google Scholar] [CrossRef]

- Caban, J.; Zarajczyk, J.; Malek, A. Possibilities of using electric drives in city buses. In Proceedings of the Transport Means 2019 23rd International Scientific Conference, Palanga, Lithuania, 2–4 October 2019; pp. 543–547. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hjorth, J.; Hirdman, C.; Kristav, P. Transitioning to Electric UTVs: Implications for Assembly Tooling. World Electr. Veh. J. 2024, 15, 552. https://doi.org/10.3390/wevj15120552

Hjorth J, Hirdman C, Kristav P. Transitioning to Electric UTVs: Implications for Assembly Tooling. World Electric Vehicle Journal. 2024; 15(12):552. https://doi.org/10.3390/wevj15120552

Chicago/Turabian StyleHjorth, Jonatan, Carl Hirdman, and Per Kristav. 2024. "Transitioning to Electric UTVs: Implications for Assembly Tooling" World Electric Vehicle Journal 15, no. 12: 552. https://doi.org/10.3390/wevj15120552

APA StyleHjorth, J., Hirdman, C., & Kristav, P. (2024). Transitioning to Electric UTVs: Implications for Assembly Tooling. World Electric Vehicle Journal, 15(12), 552. https://doi.org/10.3390/wevj15120552