1. Introduction

From 1990 to 2020, greenhouse gas (GHG) emissions have decreased by 32% in the European Union (EU) [

1]. The reduction in GHG emissions is likely to continue, especially with strong regulatory support. For example, the legislative proposal “Fit for 55” aims to reduce the EU’s GHG emissions by 55 percent by 2030. The REPowerEU Plan presented by the European Commission aims to promote energy saving, clean energy production, and the diversification of energy suppliers. All these will help bring the 2030 EV sales target and climate ambition within reach. Looking ahead to address the ambitious 2030 and 2050 target, measures for serious emission reduction are still needed, especially in the transportation sector, which emits the most GHG emission [

2].

Transportation electrification has been considered a promising pathway to decarbonization in the road transportation sector in the long term. Worldwide, the sales of electric vehicles (EVs) in 2021 hit a new record of 6.6 million; in Europe, EV sales increased by two-thirds year-on-year to 2.3 million. Germany remained the largest EV market in Europe in terms of the number of EVs sold; Norway had the highest market share of new EV sales in Europe, followed by Iceland and Sweden [

3]. The growth in EV sales has grown significantly, thanks in part to strong policy support [

4], and Europe is determined to reduce GHG emissions and to retake the lead in EV transition. More recently, the EU agreed on legislation that could ban new internal combustion engine vehicle sales beginning in 2035 [

5].

Despite regulatory support, most EU member states provide financial support via different institutions and programs to support a strong EV uptake [

6]. The European Investment Bank (EIB) has provided funding for strengthening the electric charging network in Germany [

7] and Italy [

8]. Lienert and Bellon argued that global automakers are spending nearly USD 515 billion in investment into the EV and related battery industry through 2030 [

9], and European automakers are leading EV and battery investment in total dollar amounts. While the importance of decarbonizing the road transportation sector is well known, as is the need for significant capital investments in the EV and battery industries, there is a lack of detailed estimates of the overall investment needs for expanding the production of EVs and batteries to achieve different transitional targets in the EV transition. This research effort to track announced investments and compare them to requirements fills a void in this area.

In particular, this study collects and examines publicly available original equipment manufacturers (OEMs) and battery suppliers’ announcements for expanding the production of EVs and batteries in Europe between 2020 and 2022 and out to 2030. This paper is interested in two particular questions, as follows:

What is the planned production capacity of EVs and batteries in Europe towards 2030, given investment announcements made by OEMs and battery suppliers?

How fast will upfront capital investment into EVs and batteries need to scale up to meet different EV penetration levels and transitional targets, and are the announcements and plans adequate for this picture?

For the purpose of clarification, EV in this paper refers to battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV) in the light-duty vehicle (LDV) sector. Due to investment announcement data availability, battery production in this paper only covers the downstream battery production, including battery cell production and battery pack assembly. Processes like acquiring and processing minerals for batteries are not included. Lastly, Europe in this paper includes the 27 EU members, the European Free Trade Association (Iceland, Norway, Liechtenstein, and Switzerland), and the United Kingdom.

2. Background

To achieve a successful and rapid diffusion of EVs in the future, countries and regions have been offering various incentives to attract capital investment into not only EV assembly and battery production but also other automotive parts and battery recycling. There has been an increasing emphasis on “localizing” the EV supply chain in major EV supply markets, including Europe [

10]. From the government’s perspective, localization helps locate the automotive industry’s value-creation efforts, including creating more high-skilled jobs and capturing innovation spillovers [

11].

From the view of OEMs, having assembly plants close to critical parts supply (such as the supply of EV batteries, which account for between 30% and 40% of the total cost of an EV [

12]) can help reduce their supply chain risks. Yet localizing the whole EV supply chain and relying less on EV imports is not easy. OEMs need to align their investments in EV production with battery production and, on the battery side, must secure enough raw materials to produce the batteries. Nevertheless, the demand for EVs needs to be spurred in parallel so that OEMs have the confidence to continue investing.

As the EV transition continues to accelerate, the question that needs to be asked has shifted from “Will the automotive future be electric” to “How large will the EV market be”, and “Can the EV market scale up fast enough?” Previously, Slowik and Lutsey evaluated plants that are manufacturing EVs currently and some major carmakers’ newly announced commitments in the US but did not further investigate how much total investment might be needed in the future, given different sales targets or other market growth assumptions [

13]. Since 2021, there has been some grey literature containing EV-related investment data, including CIC energiGUNE [

14], Environmental Resources Management (ERM) [

15], and Atlas Public Policy [

16]. In the past several months, as Reuters documented, more companies have invested in EV battery factories in Europe [

17]. S&P Global also observed an increase in private equity investment in the European EV industry [

18]. Despite weaker sales growth due to high interest rates and slow economic growth, analysts at Automotive News claim that EV investment will stay strong in Europe [

19].

To the authors’ knowledge, no academic research in current literature has provided a detailed picture of how much investment for EV and battery production has been committed in Europe towards 2035 and if the planned production capacities behind these investments align with Europe’s fast EV growth plans. Therefore, this is the first known research paper that fills the aforementioned research gap by investigating the planned production capacity of EV assembly and battery production in Europe to 2030 and estimating how fast the investment for EV and battery production needs to scale up to meet various EV penetration levels and transitional targets. Moreover, by comparing the announced investment to the investment need under each scenario, this paper also contributes by providing critical benchmarks and timely insights on whether the current industry ambition and plans are adequate for each different picture in the future.

3. Methodology

In the Cobb–Douglas production function, total production is a function of labor and capital input constrained by the total factor productivity [

20]. In Equation (1),

is total production,

is labor input,

is capital input,

is total factor productivity,

and

are the output elasticities of capital and labor, respectively. This study assumes

is sufficient and constant and investigates how EV assembly and final battery production capacity will be affected by changes in

in Europe. Therefore, this study focuses on investigating the relationship between capital investment and EV assembly and final battery production capacity in Europe.

As such, this study starts with collecting publicly available OEM investment announcements that mention both the amount of investment and the production capacity and end up with 57 OEM investment announcements of expanding the production of EVs and batteries in Europe made by OEMs and suppliers from 2020 to 2022 towards 2030 which are documented in [

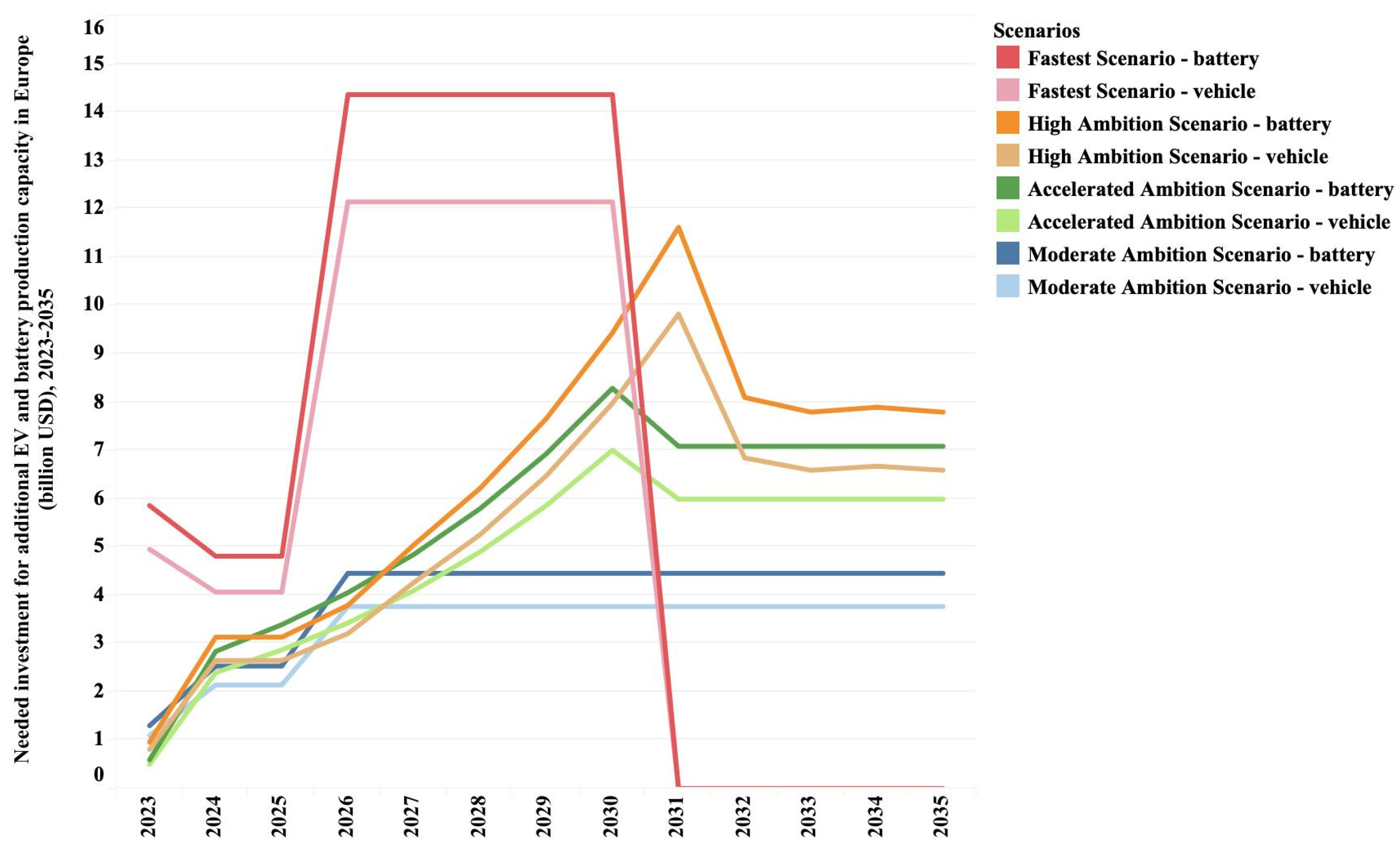

21]. As shown in

Figure 1, this study uses these announced investment plans to calculate the average investment per unit of production capacity of EVs and batteries in Europe through 2030, which will be explained in

Section 3.1.

Based on the average investment per unit of production capacity, this study then estimates either the investment or the production capacity in announcements where such information is not clarified. For both EVs and batteries, this study adds their respective planned production capacity to their base production capacity; the base production capacity of EVs was estimated based on historical EV sales data in Europe. Finally, this study compares the planned capacities to the required EV sales needs to meet different EV penetration levels and transitional targets. How different EV sales scenarios are developed will be explained in

Section 3.2.

3.1. Planned EV and Battery Production Capacity

The total planned production capacity is derived as the sum of the base production capacity and the planned production capacity. This paper chooses the highest annual EV sales number between 2010 and 2021 annual EV sales in Europe and uses this number as the base production capacity of EVs in Europe. According to the International Energy Agency (IEA), 2284 thousand units of EVs were sold in Europe in 2021, which is assumed as the base production capacity of EVs in Europe for this study. The base production capacity of EVs is not further categorized by OEM to avoid missing any production capacity provided through non-major OEMs.

In this study, investment plans are divided into either firm or tentative announcements. Firm announcements are usually very specific and disclose information, including the use of the investment, the anticipated start time of the actual production, and the plant’s rated capacity and/or the investment size. On the other hand, tentative investment plans may not disclose the use or the amount of the investment or when production can start. For example, some tentative investment plans are in the “advanced discussion” or “proposal submission” stage as of the time of writing. In summary, there are 41 firm announcements (11 for EV and 30 for battery) and 16 tentative announcements (7 for EV and 9 for battery). All currencies in this study are in the 2022 US dollar.

3.1.1. Planned Battery Production Capacity

The process of estimating how many EV batteries can be produced in the future based on relevant investment announcements can be complicated due to factors like the future EV driving range, size of EV, and EV sales composition (BEV versus PHEV). In this study, it is assumed that impacts from all possible factors are eventually reflected in one value—the average battery capacity per vehicle in Europe, regarding the new EV sales.

According to the most recent research, EV battery size varies between 52 kWh/vehicle and 85 kWh/vehicle in Europe [

22]. For example, the Tesla Model Y was the best-selling EV in Europe in 2022 [

23], and the new entry-level Tesla Model Y has a 55 kWh/vehicle battery [

24]. Furthermore, there is a trend that sports utility vehicles (SUVs) and large BEV models are dominating current EV options [

25]. Therefore, looking out to 2030 and 2035, this study selects the upper quantile between 52 kWh/vehicle and 85 kWh/vehicle (which is 74 kWh/vehicle) and assumes the battery capacity per vehicle Is 74 kWh/vehicle on average through 2035.

Announced investment for battery production in Europe ranges from USD 0.48 billion to USD 8.80 billion. Equation (2) explains how the investment per unit of production capacity for batteries on average is calculated. Thereinto,

is the number of announcements that mention both the investment and the capacity, which are documented in [

21],

is the announced amount of investment, and

is the rated production capacity announced by OEMs and suppliers. This study uses the interquartile range (IQR) to detect outliers. If any outlier exists, it will fall out of the IQR in a boxplot. If identified, outliers are excluded to calculate

.

In this study,

is USD 91/kWh/year. As indicated in an earlier section, this value only covers the final battery production process. This paper then uses

to calculate the planned capacity of a battery plant (i.e., the number of EVs that a facility can build to support) and the committed amount of investment behind the announcement in the cases where they are not disclosed in other announcements, following Equations (3) and (4). Thereinto,

is the calculated battery production capacity, and

is the calculated investment for a certain battery production announced by OEMs and suppliers.

3.1.2. Planned EV Production Capacity

Likewise, this paper uses the announcements that mention the investment and the capacity to calculate the average investment per unit of EV production capacity in Europe. and these announcements are documented in [

21]. The amount of announcements is labeled as

in Equation (5);

is the announced amount of the investment; and

is the rated production capacity of EVs announced by OEMs.

It is found that is about USD 5699/vehicle/year in Europe. Following the same logic as described in Equations (3) and (4), this is further used to calculate the planned EV production capacity or the investment in cases where they are not disclosed in some announcements.

3.2. Required Annual New EV Sales

The new EV sales towards 2035 are projected based on multiple sources. Bloomberg New Energy Finance (BNEF) projects annual sales of new EVs in Europe to reach around 4.3 million in 2025, which is about 28% of all passenger vehicle sales [

26]. It is also assumed in BNEF’s accelerated scenario that all new sales of passenger vehicles will be 100% electric by 2035, which aligns with the aforementioned legislation that can potentially ban all sales of new internal combustion engine vehicles.

In IEA’s Announced Policy Scenario, the annual new EV sales in Europe are projected to reach 7.6 million by 2030, representing 52% of EV sales share [

27]. This study estimates that 100% of the annual new EV sales share can be translated into 15.4 million and 14.6 million annual new EV sales in volume based on BNEF and IEA’s projections, respectively. Therefore, this paper chooses the mean between these two projections, 15 million, as the volume that corresponds to 100% EV sales share for this study.

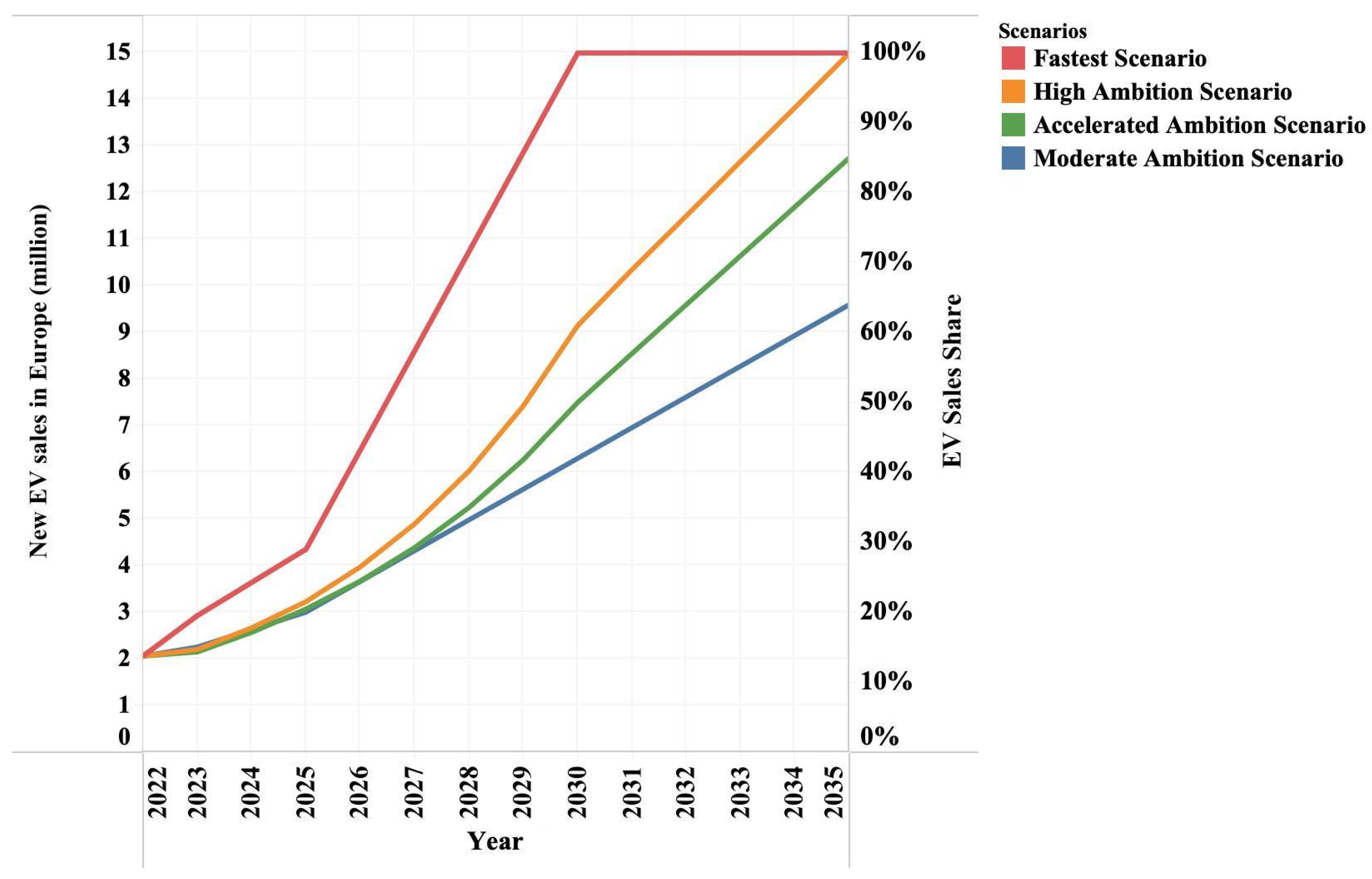

In this study, four EV sales scenarios (

Table 1) are created based on two BNEF scenarios and four scenarios used in Mock and Díaz’s study. Annual new EV sales share is specified every 5 years. The annual new EV sales are derived by multiplying 15 million new sales of light-duty vehicles (LDVs) with the new EV sales share.

3.3. Investment Needs for EV and Battery Production

In each scenario, the estimated annual investment needs for EV production are derived as the production of and the annual additional EV production capacity needs. The estimated annual investment needs for battery production are derived as the production of and the average battery capacity per vehicle, and multiplied by the annual additional capacity, which is the same as the annual additional capacity of EV production because this study assumes one battery per EV.

3.4. Sensitivity Analysis

The planned production capacities can vary, depending on OEM and supplier commitments. Therefore, a tentative scenario is created so that firm and tentative OEM investment announcements are both taken into account for calculating the future planned production capacities. The tentatively planned production capacities are also compared with the required production capacities.

As mentioned in

Section 3.1.1, estimating how many EV batteries can be produced in the future can be affected by various factors. To complement the baseline scenario, a lower case is created where this study assumes the battery capacity per vehicle in Europe is 62.5 kWh/vehicle on average. This value is derived based on the assumption of new EV sales and the assumption of the average battery capacity per PHEV in Europe. This study assumes that the new BEV sales to the new PHEV sales are about 4 to 1 based on current market trends and expert suggestions; this study also assumes that the average battery capacity per PHEV in Europe is about 16.5 kWh/vehicle, according to Mock and Díaz’s study. Additionally, a higher case is created to reflect a potential future market where more BEVs than PHEVs are sold, or the EV driving range is higher. In this case, after consulting with industry experts, the average battery capacity per vehicle is adjusted to 92.5 kWh/vehicle, representing a 25% increase over 74 kWh in the base case. The investment needs for battery production will thus vary accordingly, and this study calculates the investment needs for all four scenarios in the lower and higher case.

4. Results

4.1. Compare the Annual Planned Production Capacities to the Annual New EV Sales

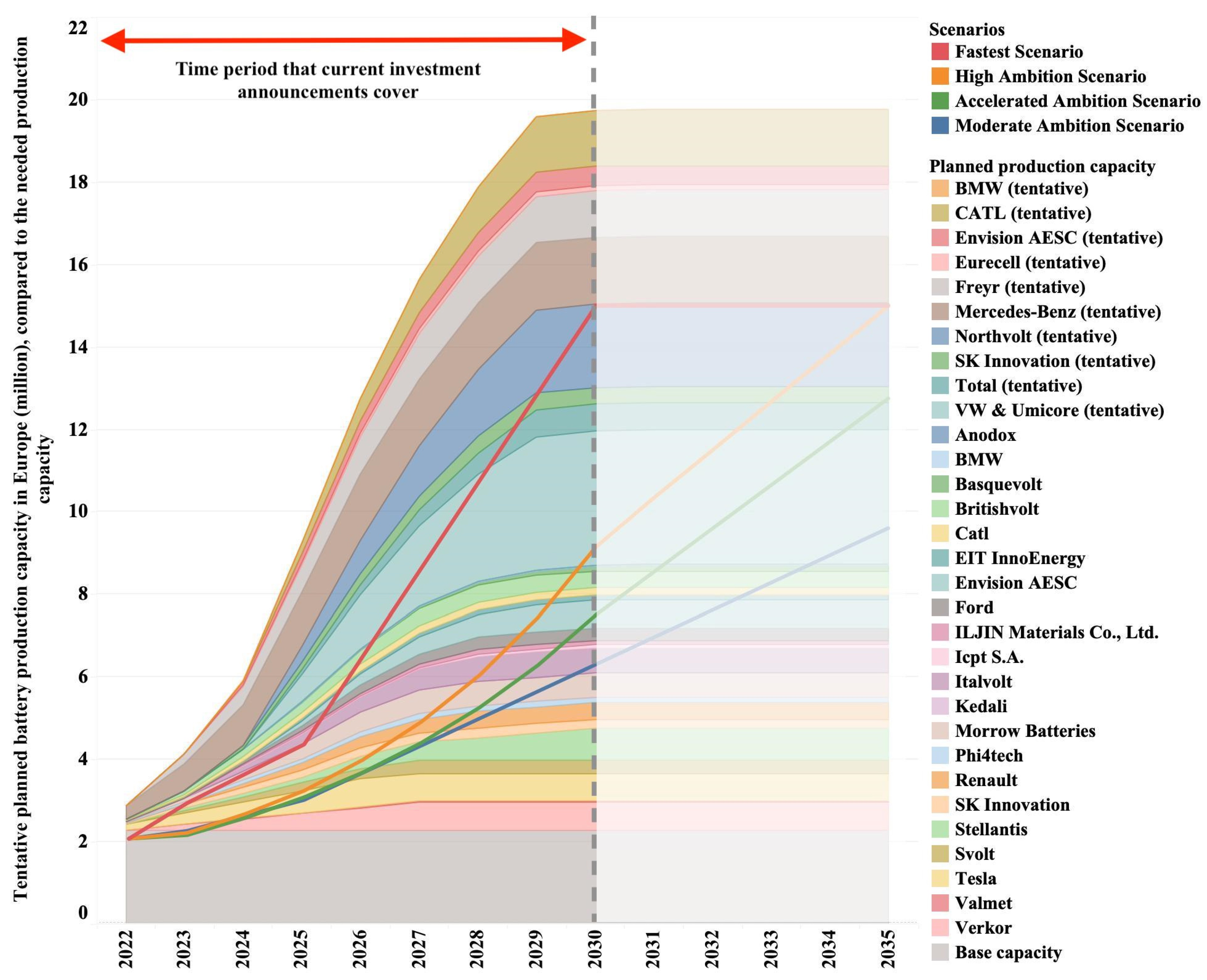

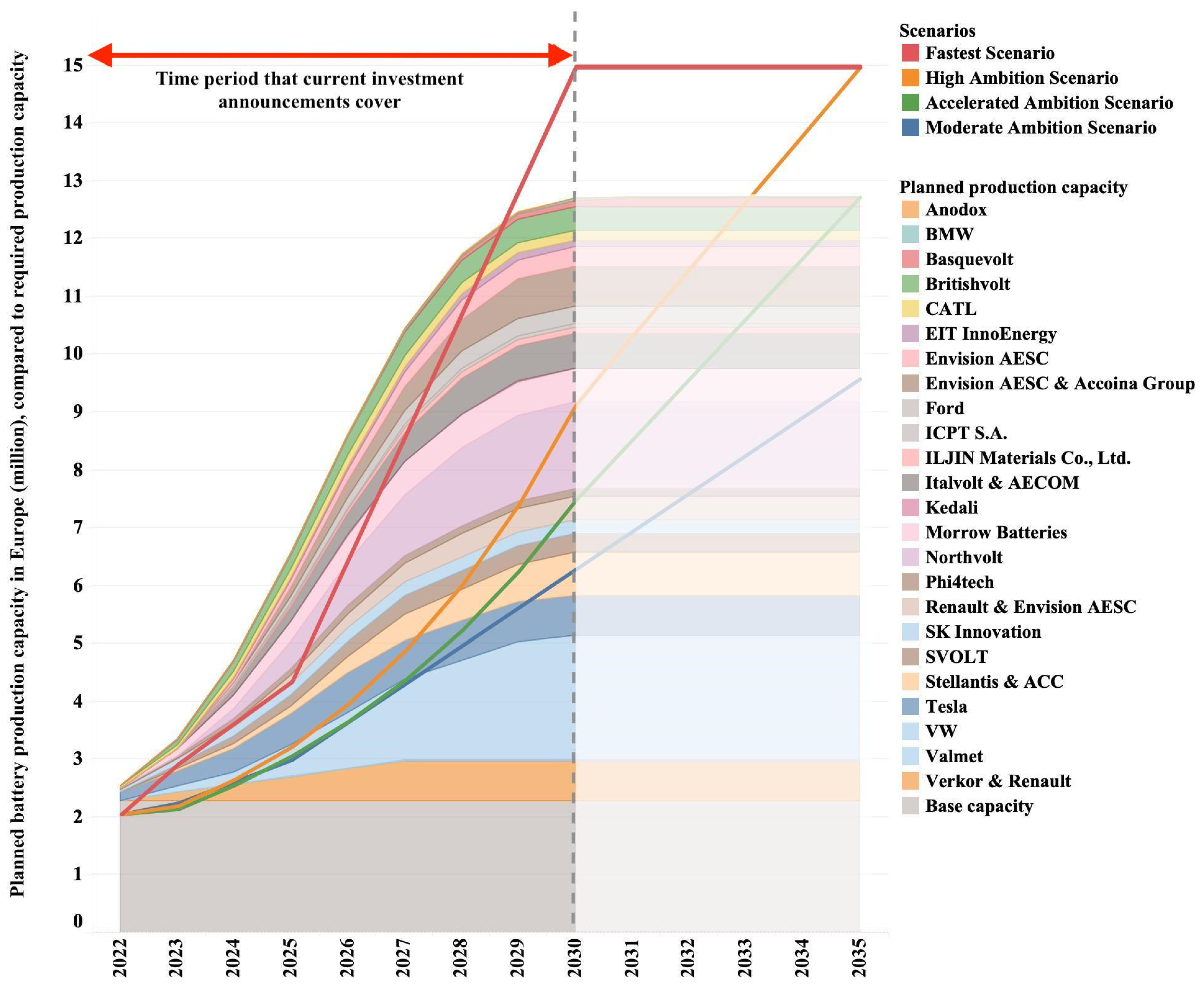

As depicted in

Figure 2, the new EV sales are likely to reach 9.2 million in Europe by 2030 in the High Ambition scenario, representing about 60% of EV sales share. In the Accelerated Ambition scenario and Moderate Ambition scenario, the new EV sales could reach 7.5 million and 6.3 million by 2030, respectively.

As mentioned in

Section 3.1, the base production capacity of batteries in Europe in this study is about 2.3 million. According to [

28], battery plants take about 5 years to ramp up to their full capacity. Therefore, this paper assumes that the battery plant’s capacity factor is 20% in the first year and increases linearly until it reaches 100% in the fifth year.

If only firm investment announcements are considered, the planned battery production capacity in Europe will be able to support 12.7 million EVs by 2030, with an average of 74 kWh/vehicle battery capacity per vehicle; this is sufficient for the High Ambition scenario (

Figure 3). The planned battery production capacity from 2030 to 2035 is currently flat because the investment plans announced so far only cover through 2030. More investment plans for battery production are anticipated. Notably, though the planned production capacity of batteries may not be enough for the fastest scenario by 2030, it seems to be fully sufficient for all scenarios through the late 2020s.

The planned production capacity of EVs will be 4.8 million EVs in Europe by 2030, which is about 1.5 million short of the Moderate Ambition in Europe by 2030. As indicated in

Figure 4, the production capacity of EVs in Europe may be lagging for most of the scenarios in this paper before 2030.

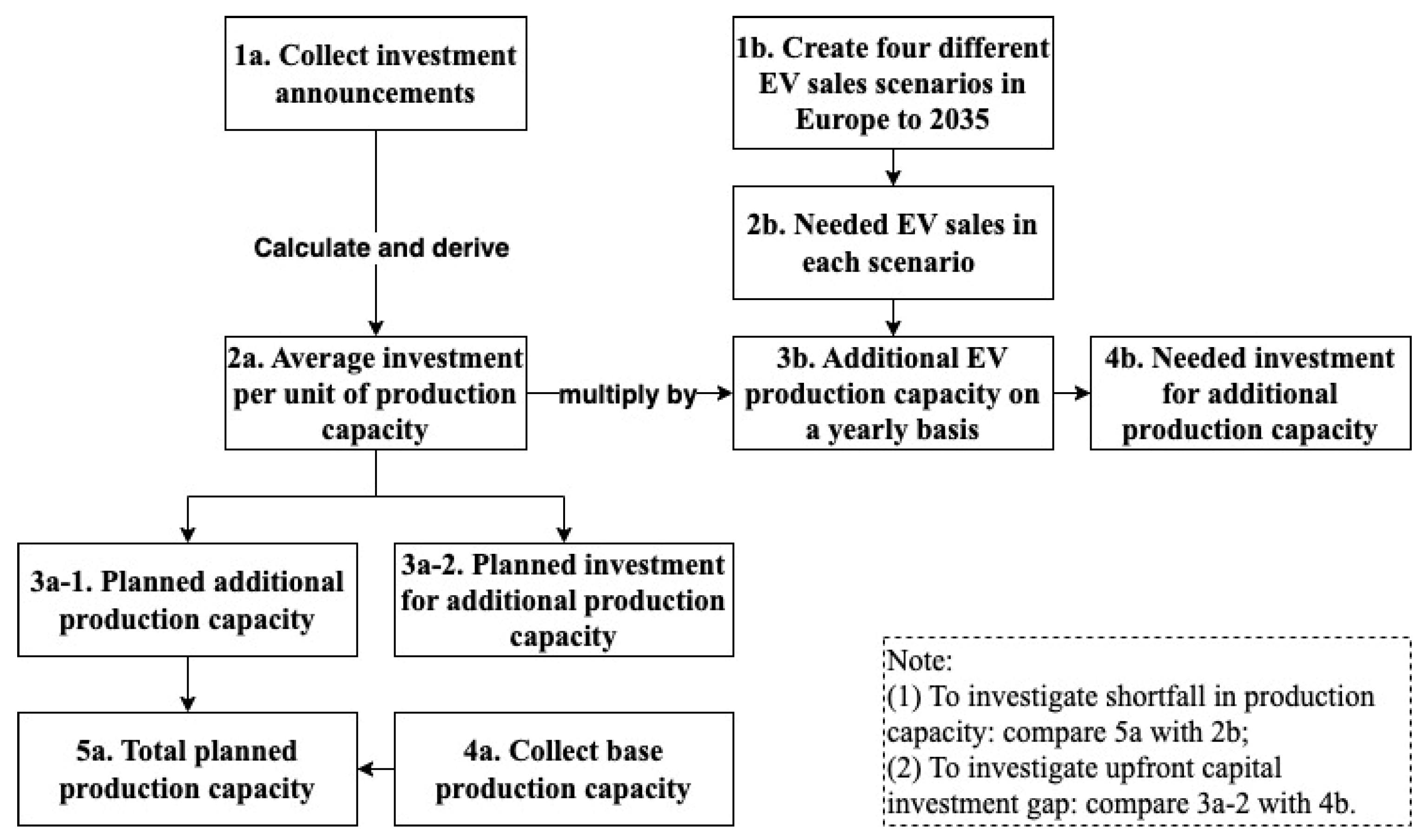

4.2. Compare the Investment Needs to the Announced Investment for Expanding EV and Battery Production

To achieve an ambitious EV sales scenario, more investment will be needed soon (

Appendix A). In the Fastest scenario, investment needs can reach USD 14.4 and USD 12.1 billion in 2026 to support additional production capacity of EVs and batteries, respectively; such annual additional investments may be needed at least through 2030 to sustain this scenario. The High Ambition scenario may face its first uptake in investment needs in 2031, with investment for additional EV and battery production reaching about USD 11.6 and USD 9.8 billion, respectively.

As shown in

Table 2, about USD 69 billion for battery production has been announced in Europe between 2020 and 2022 towards 2030 based on firm announcements. This can be translated into many batteries that can support about 12.7 million EVs with a battery capacity of 74 kWh/vehicle, enabling Europe to meet the High Ambition scenario. If the fastest scenario is pursued, about USD 18 billion in investment would be needed before 2030 or earlier. For EV production, USD 15 billion has been announced through firm announcements in Europe towards 2030. With tentative investments included, the investment amounts to about USD 28 billion and the planned production capacity of EVs is sufficient for the Moderate Ambition scenario by 2030.

4.3. Sensitivity Analysis Results

When tentative investment announcements are also taken into consideration, the planned production capacity of batteries in Europe by 2030 can increase to nearly 19.7 million EVs being supported, exceeding the need in the fastest scenario by 4.2 million (

Figure A2). For EV production, the planned production capacity of EVs can increase to about 7.2 million, which is sufficient for the Moderate Ambition scenario and is only 0.3 million short of the Accelerated Ambition scenario by 2030 (

Figure A3).

As suggested in

Table 3, with a lower battery capacity per vehicle on average, the planned battery production capacity can increase to 14.6 million by 2030 based on firm announcements, which can put Europe very close to meeting the fastest scenario. As indicated in the results from the higher case, the planned production capacity of batteries is nearly 16.2 million by 2030 based on both firm and tentative announcements; and when only firm announcements are considered, Europe can meet the High Ambition scenario.

This paper also examines the investment needs in the lower and the higher case (

Table 4). In the lower case, the firm announced investment for battery production (i.e., USD 69 billion) almost reaches the investment needs in the fastest scenario (i.e., USD 74 billion). In the higher case, the firm announced investment would put Europe on track for the High Ambition scenario; with tentative investments included, the fastest scenario could be met by 2030.

5. Discussion

By tracking the announced investment plans for expanding the production capacity of EVs and batteries in Europe, translating them into future production capacities, and comparing these to different EV transitional targets towards 2030 and 2035, this paper provides a better understanding of whether these announced investment plans appear to be adequate to meet the EV sale targets and emission reduction goals in Europe. This paper also gives a sense of how fast future investments will need to scale up to be sufficient. There are several implications of this study, as follows.

In general, this study suggests that if Europe is committed to meeting the High Ambition scenario (on track for 100% EV sales share by 2035), the planned production capacity of batteries seems to be adequate, but the production capacity of EVs will require a lot more investment that has yet been announced. This provides practical insights for automakers and automotive suppliers and helps improve the EV supply chain “visibility” (knowledge of sourcing options and potential supply scale). The results of this study may help automakers and suppliers better understand where the EV assembly and battery production is going within Europe, what is happening elsewhere, and whether trouble of shortage might be brewing in the supply chain [

29].

In terms of the source of investment, while existing OEMs and battery companies will likely continue expanding their investments directly, this study suggests that some support for financing could be provided by the governments through different fiscal incentives and subsidies, including vehicle purchase incentives which can help spur EV demand growth and supply-side investments. In addition to direct incentives, regulatory policies that can help de-risk the market and help boost OEMs’ confidence that EV demand will be spurred to achieve these targets, may be needed as well to keep incentivizing production investments.

For investment in battery production, this paper suggests that OEMs and battery suppliers seem on track to achieve the required targets in the 2030 time frame, even for the most ambitious scenario. This means that some battery investments announced so far may come from OEM and battery suppliers’ anticipation of future vehicle investments, investments for a future market of PHEVs, potential export of EVs, or battery swapping.

However, such a ramp-up in battery manufacturing needs to be treated carefully. If the ramp-up in battery production capacity happens before significant EV demand is in place, battery plants may run the risk of low operational efficiency. Operational efficiency is one of the major concerns for gigafactories. For example, if a 50 GWh plant only achieves 66% of its planned annual output, it can lose about USD 500 million in value annually; the loss can also be translated to a modeled profit of 6% to 8% [

30]. To mitigate risks of low operation efficiency of battery plants, it may be reasonable to consider export as an important destination for the over-production of batteries.

Though more investment is desired in general, the results in this paper also point at one potential risk: the gap between investments in different parts of the EV supply chain. The results in this paper suggest that in Europe, more investment plans and production capacities have been announced for batteries than for EV production so far. One explanation may be that OEMs and battery suppliers are concerned about the supply chain shortage, especially the scarcity of certain raw materials for producing batteries. European governments and automakers have invested heavily to push the expansion of battery production in Europe in recent years, to manage such supply chain risk and to avoid relying on battery imports from Asia [

13]. Therefore, OEMs prefer securing enough battery capacity (or securing a strategic partnership with a battery supplier who can secure enough raw materials for producing batteries) before investing in any EV production facility close by. The increasing demand for batteries may seem more certain for the industry at this moment.

To bridge the production capacity gap, as well as the investment gap, between EV production and battery production, this study suggests that an additional investment of USD 5 billion to USD 18 billion may be needed to increase the production capacity of EVs in Europe to reach the High Ambition scenario by 2030. In the meantime, it may be beneficial to consider importing EVs from other countries and regions into Europe as well. The European Automobile Manufacturers’ Association, the American Automotive Policy Council, the Truck and Engine Manufacturers Association, and the Alliance for Automotive Innovation have made a joint statement in support of the US-EU Transatlantic Trade and Technology Council to revive the coordination on issues arising from the nexus of trade with the supply chain. In the tentative scenario, Europe would be about 0.3 million short of the Accelerated Ambition scenario (50% EV sales share by 2030 and 85% by 2035). Such volume is within the range of EV imports seen in 2020 as 30% of 3.0 million EVs were imported into Europe [

31].

It has to be stressed that the results presented in this research rely on various assumptions that reflect the current announced investment plans and understanding of the key trends in the EV market. For example, this study assumes that the average battery capacity per vehicle in Europe towards 2035 is about 74 kWh/vehicle based on the current range of EV battery size in Europe and the trend of preferring larger BEV models and SUVs. This study also assumes that all firms announced investment plans will come through on time, while OEMs and suppliers can change their plans anytime due to reasons like changes in the overall company strategy and geopolitical tension. Hence, the analysis should be updated as more investment plans are announced and updated.

In addition to the exploration of possible variations presented in the sensitivity analyses, the authors also recognize other factors that may lead to potential variations in the estimated needs for battery and EV production presented in this paper. Firstly, this study could overestimate the investment needs for additional battery and EV production, if economies of scale and learning curve are considered. Further, if the EV assembly factories find ways to retrofit their existing factories instead of constructing new assembly facilities in the near future, then the estimated investment needs for EV production in this paper could be overestimated. However, if the investment cost for construction materials increases, the estimated investment needs presented in this paper can be underestimated. Last but not least, as the EV market is driven by ambitious policy targets and incentives, changes in EV sale targets and policy incentives can increase the volatility of the EV market, which further increases the variations in the estimates in this paper.

Additionally, this study has not covered the full EV supply chain. There are other important auto parts and materials, and all industries and stakeholders should work collaboratively to ensure enough materials and production capacity are available at all stages. In addition to issues around the production and supply, OEMs are also watching the charging infrastructure roll-out and are waiting for the EV sales to ramp up as recharging networks develop. However, building up the charging infrastructure requires significant amounts of planning and capital investment upfront as well. This research effort will be extended to estimate the investment needs in charging infrastructure and other possible areas to better understand the investment needs for an EV-dominated vehicle future by 2035.

6. Conclusions

The analysis presented in this paper provides several contributions. Firstly, it provides a timely picture of the future production capacity of EVs and batteries in Europe, based on publicly available investment announcements made by OEMs and suppliers from 2020 to 2022. The results in this paper indicate that the planned production capacity of batteries will be sufficient for the High Ambition scenario towards 2030, putting Europe on the trajectory of achieving 100% new EV sales share by 2035. However, the planned production capacity of EVs currently falls short of meeting the High Ambition scenario, or even the Moderate Ambition scenario (42% EV sales share towards 2030) in the same timeframe.

Secondly, the results of the sensitivity analyses in this paper show that, with tentative investment plans considered, the planned production capacity of batteries may exceed the Fastest scenario by 2030. However, the planned production capacity of EVs may still risk facing a 0.3 million shortage for the Accelerated Ambition scenario and a 2.0 million shortage for the High Ambition scenario. This study acknowledges different factors and uncertainties (e.g., changes in policies and incentives, technology improvement, and economies of scale) in the future EV market, leading to potential over- or underestimations in this study. It is anticipated that more investment in EV production will still come in the future. Yet with time for hitting 2030 targets getting short, it may be challenging to achieve the more ambitious scenarios without importing vehicles from other world regions.

Therefore, this study suggests that policies that help spur faster investment for EV production are needed in Europe; at the same time, consideration of potential trade dynamics with other major EV supply markets, such as importing EVs due to a shortage in domestic capacity, may be needed as well. There is also a completely different risk: markets will not develop quickly, and investment proves to be greater than market needs. In this case, opportunities to sell excess production (such as batteries) into other markets may be welcome.

Overall, this paper is the first known effort that shows how fast upfront capital investment for EV and battery production will need to scale up in Europe under four different EV sales scenarios. The interpretation of capital investment signals future expected capacity and gives an idea of the final cost of EVs. These signals can inform the industry of the current landscape of investment opportunities and help governments formulate regulatory and fiscal incentives that would accelerate the pace of achieving the EV sales targets by 2030 in Europe.

It is important to keep track of such investment announcements and update the results in this paper when more announcements become available in the next few years. While this research provides insights into the planned capacity and investment needs for future battery and EV production in Europe, it has not included the investment needs for other parts of the EV supply chain, which can be investigated in the future. This paper does not discuss the source of upfront investment, though it may not need to be a new investment but redirections. For future research, it may be interesting to consider trade dynamics between Europe and other major EV markets or extend such research to the other transportation sectors, such as the medium- and heavy-duty vehicle sectors.