The Effect of Reducing Electric Car Purchase Incentives in the European Union †

Abstract

1. Introduction

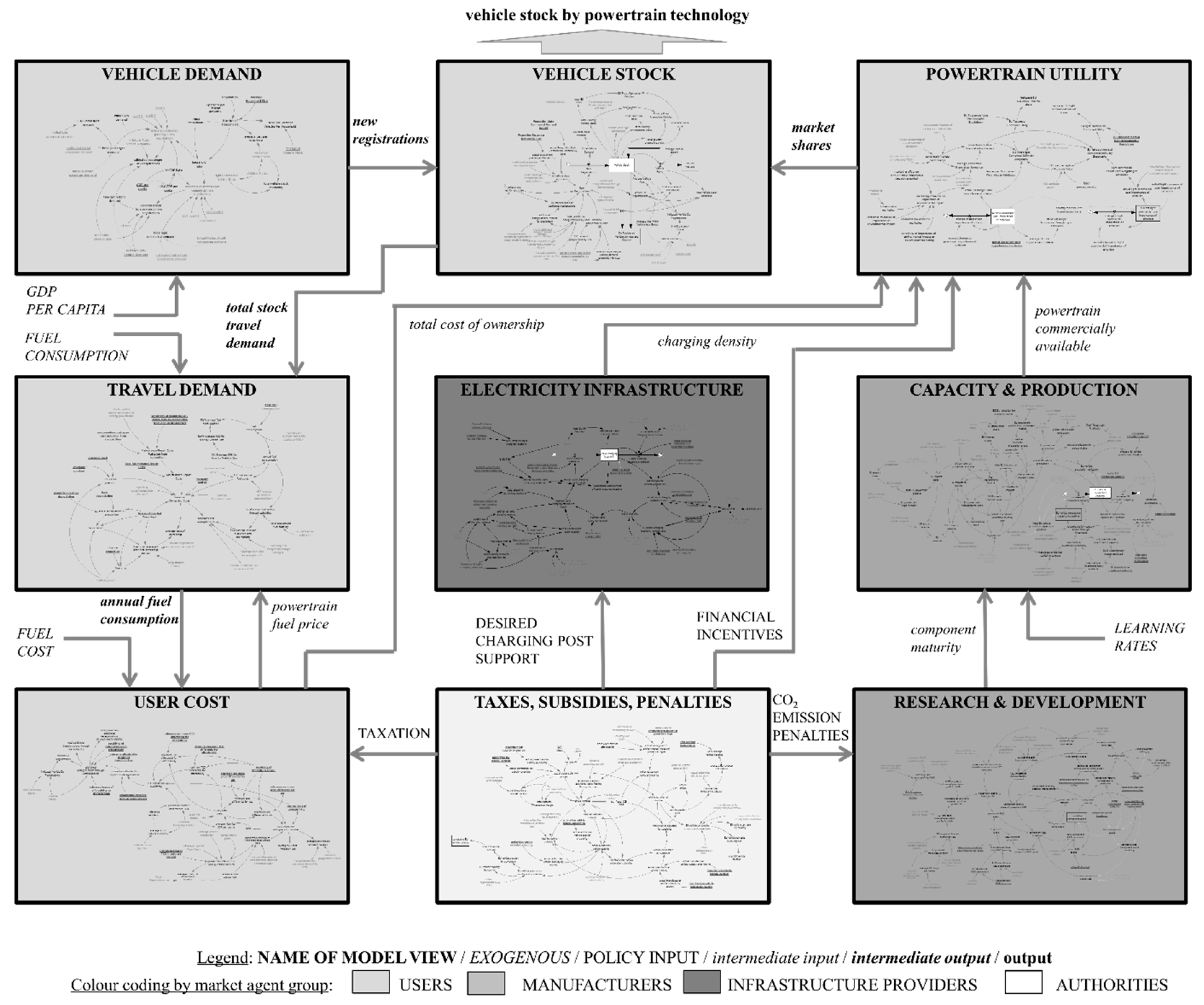

2. Simulation Model

- Users evaluate, respond to respond to marketing and policies, purchase, use and dispose vehicles;

- Manufacturers invest in capacity and research and development (R&D), produce and price vehicles;

- Infrastructure providers invest, build, operate and decommission refueling/recharging stations;

- Authorities introduce policy measures, monitoring policy and regulation.

3. Assumptions and Scenarios

3.1. Main Model Assumptions

3.1.1. CO2 Emission Standards

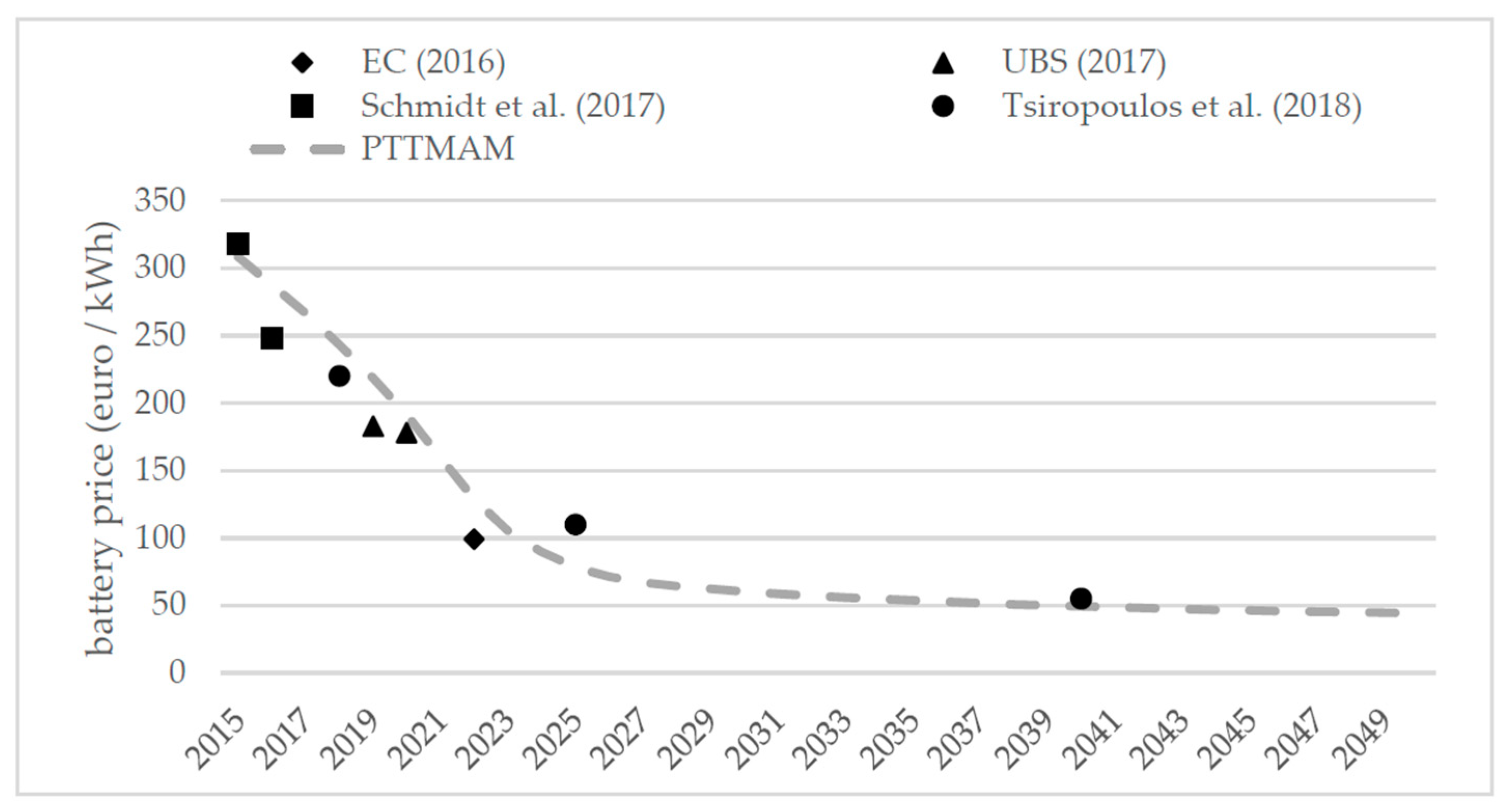

3.1.2. Battery Price

3.1.3. Public Recharging Infrastructure Deployment

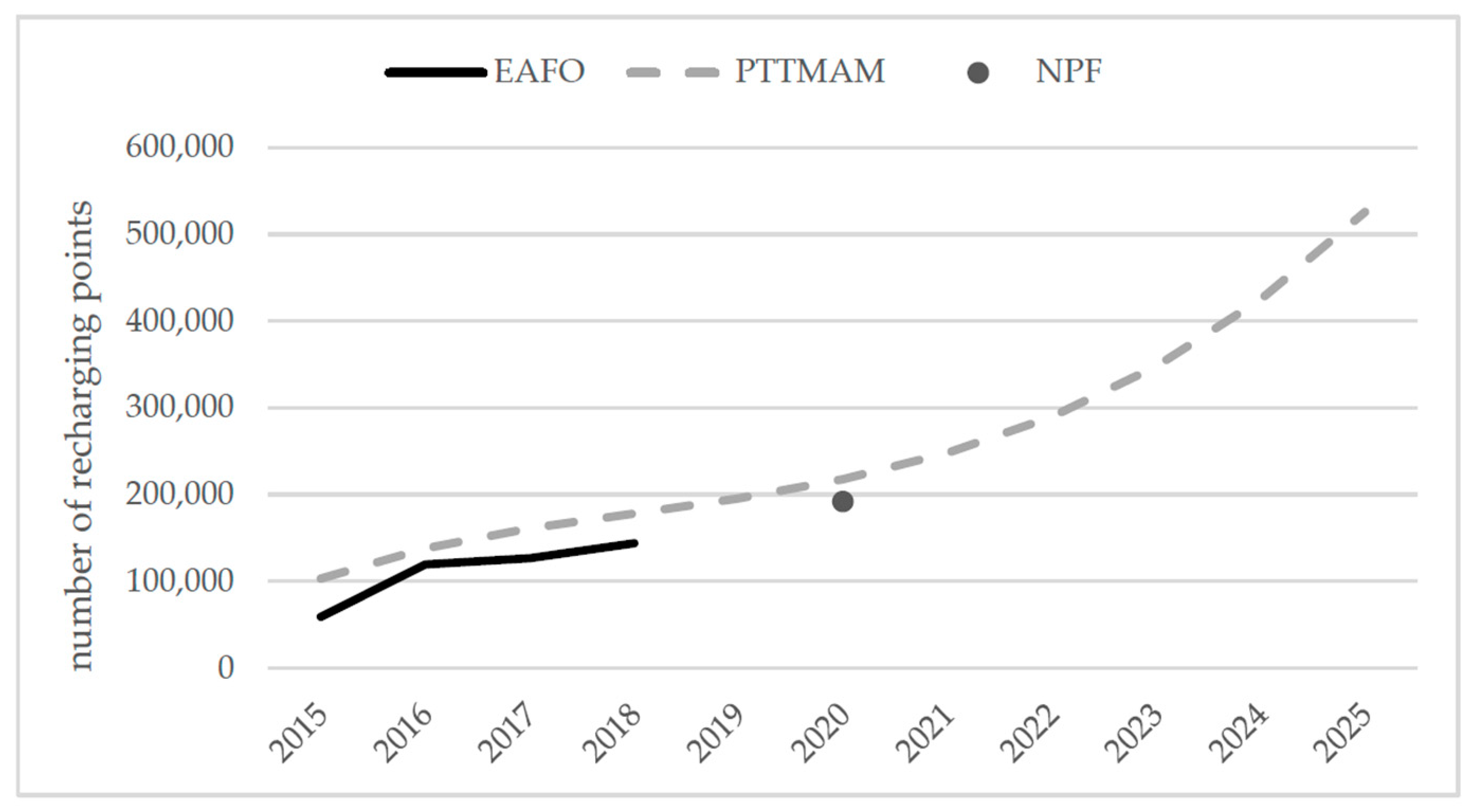

3.2. Construction of Purchase Incentive Scenarios

4. Model-Based Results

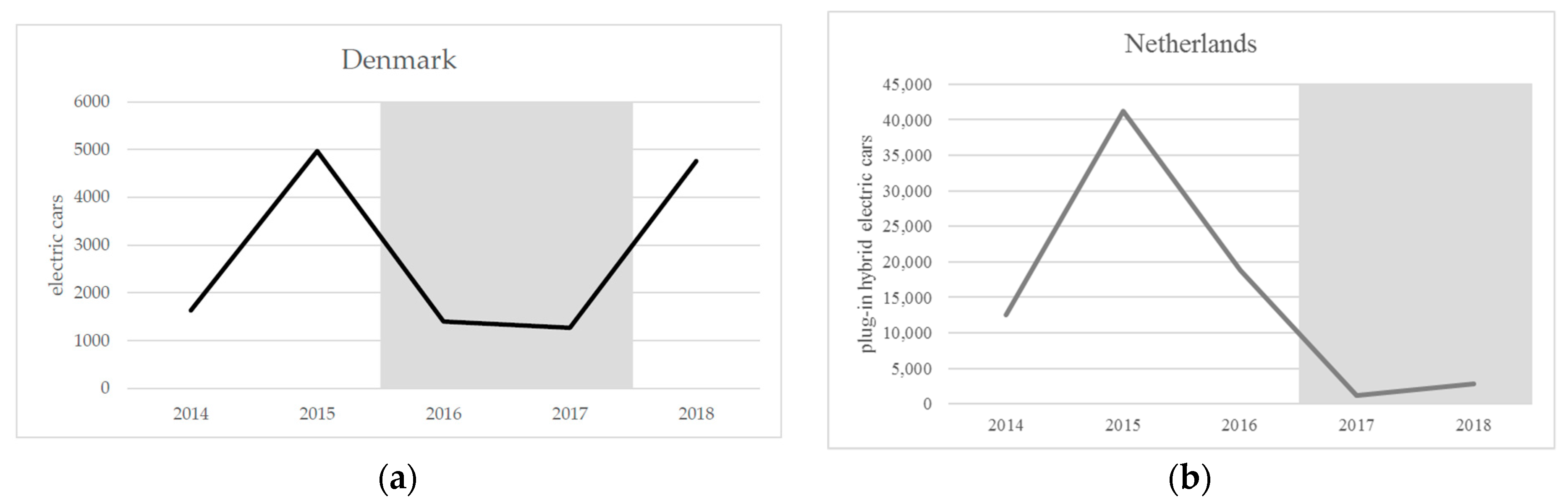

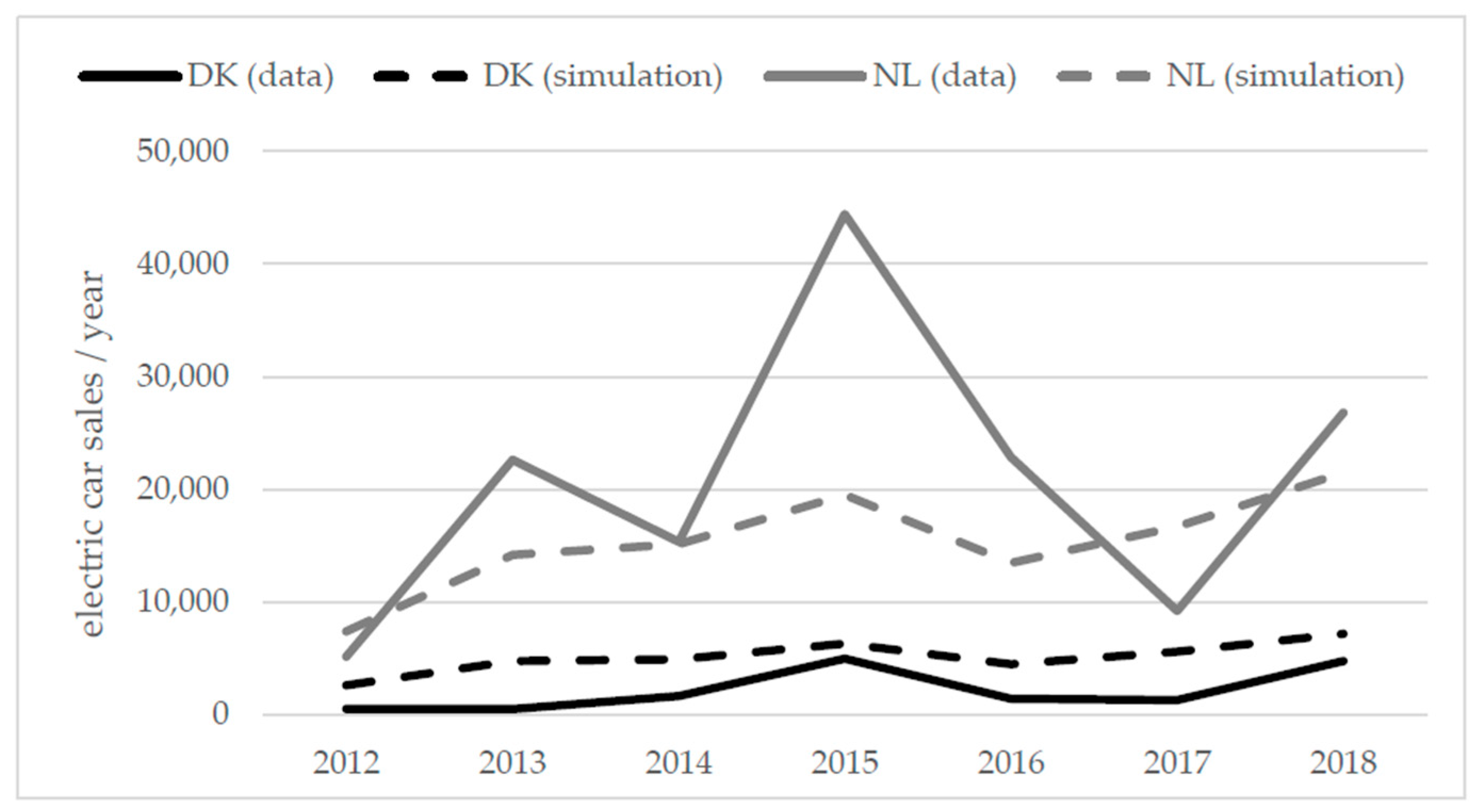

4.1. Data Fit at the Country Level

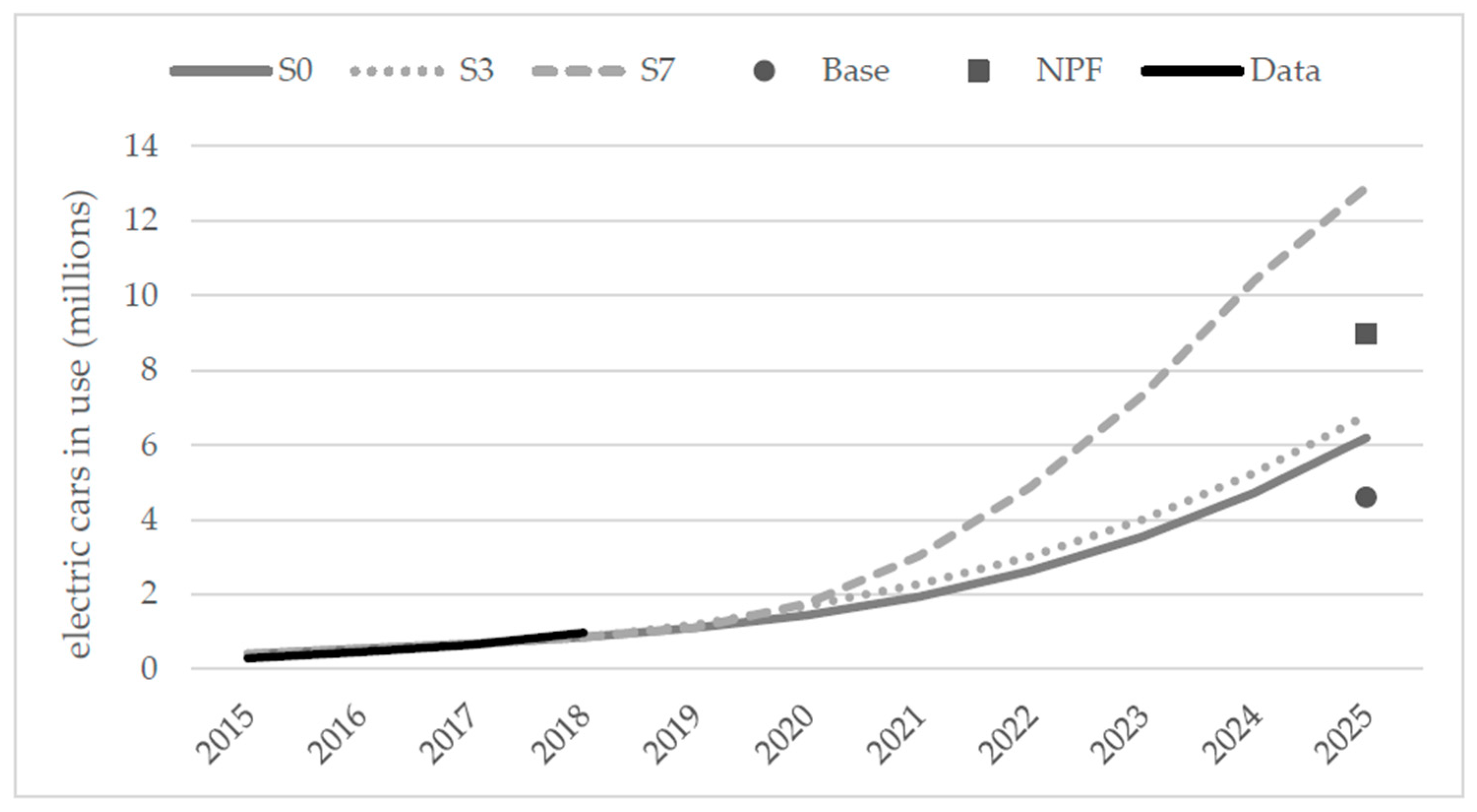

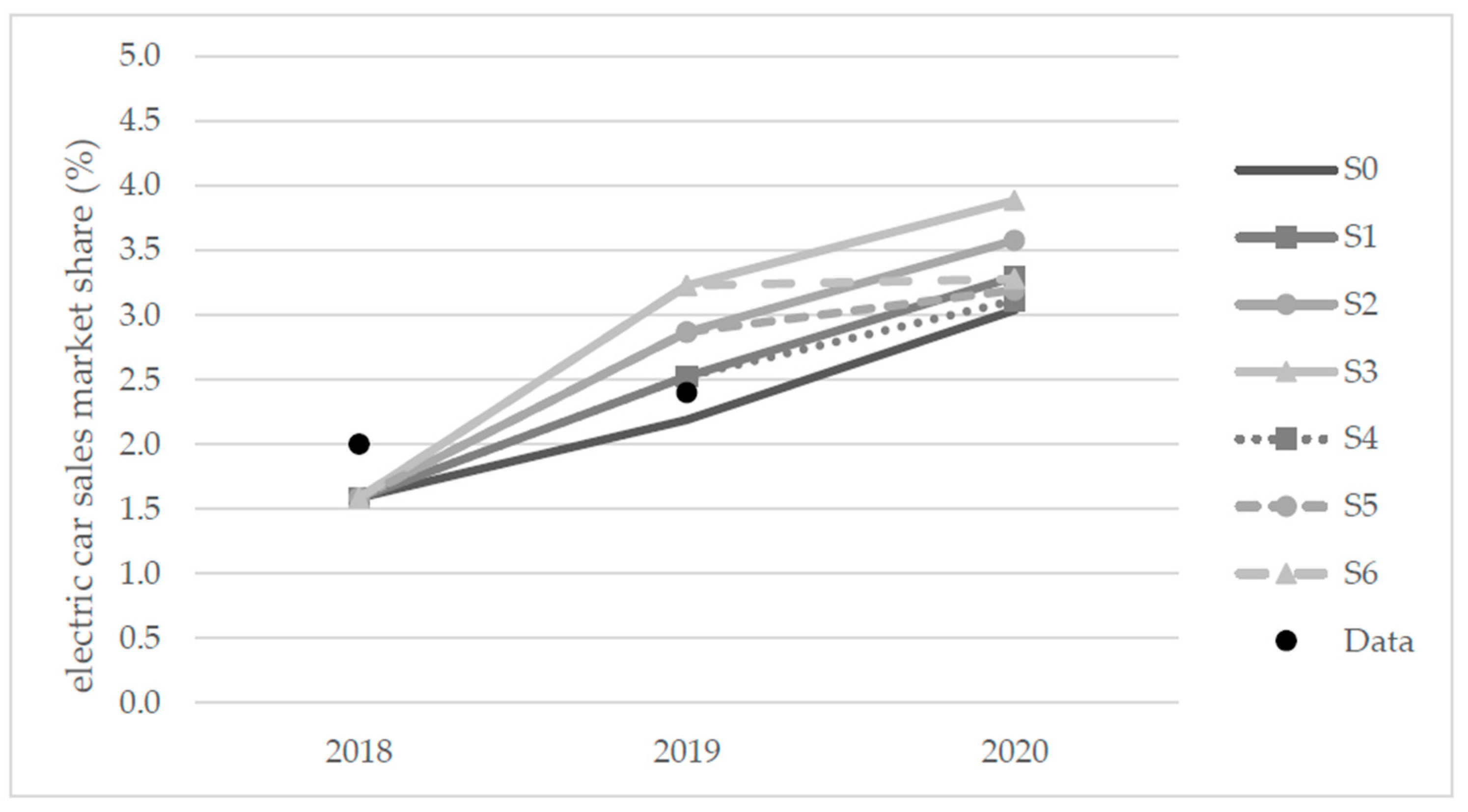

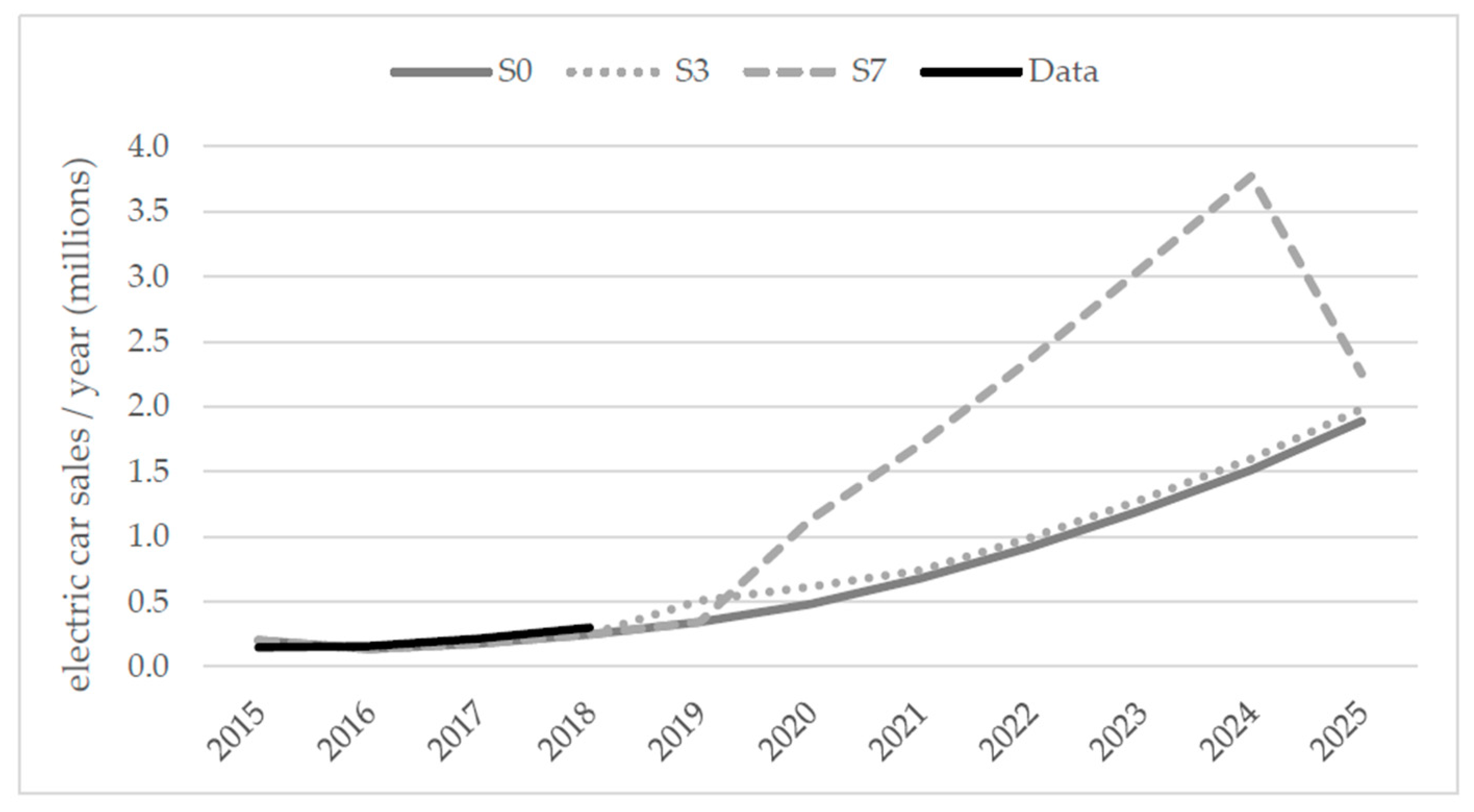

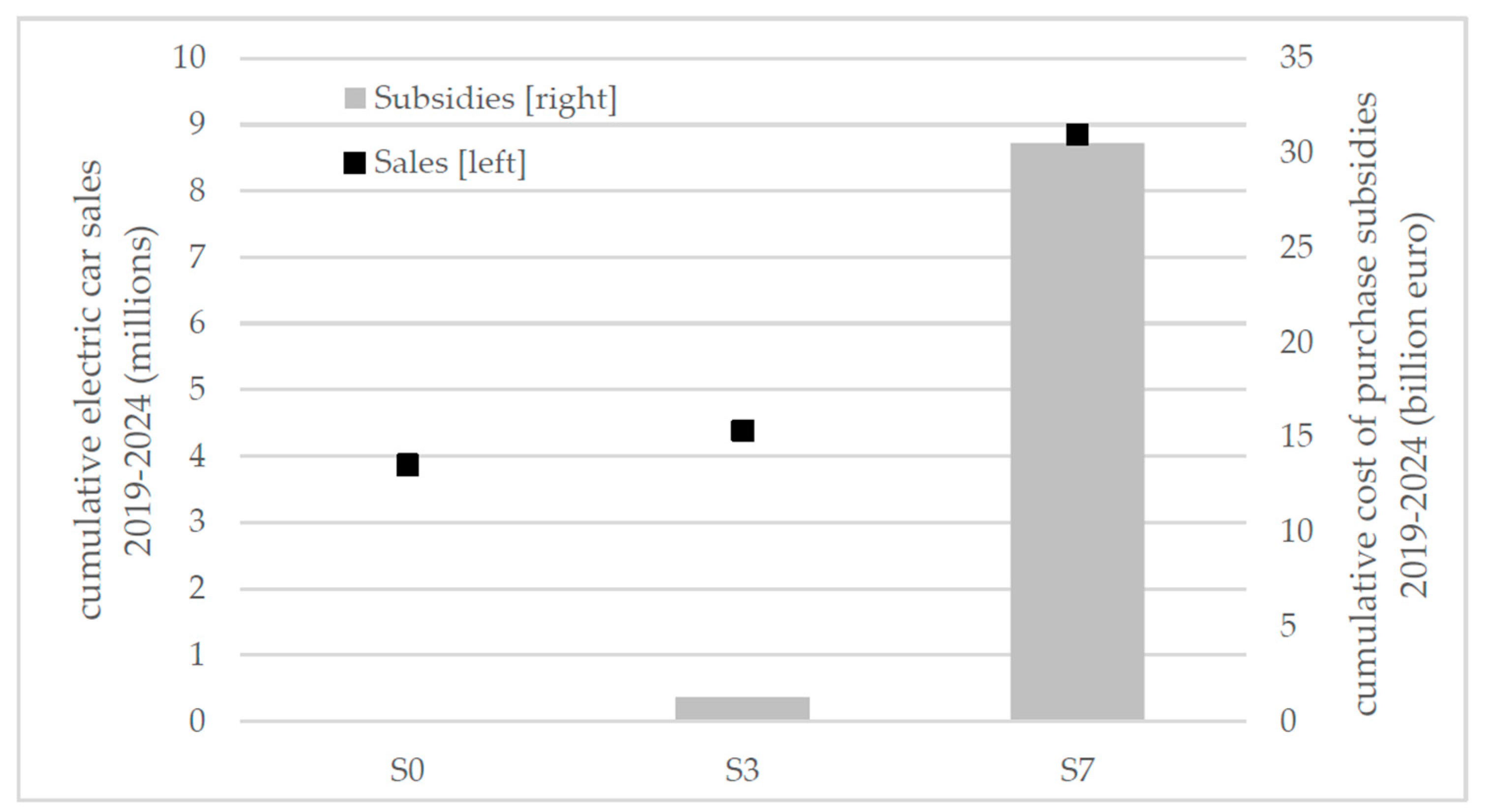

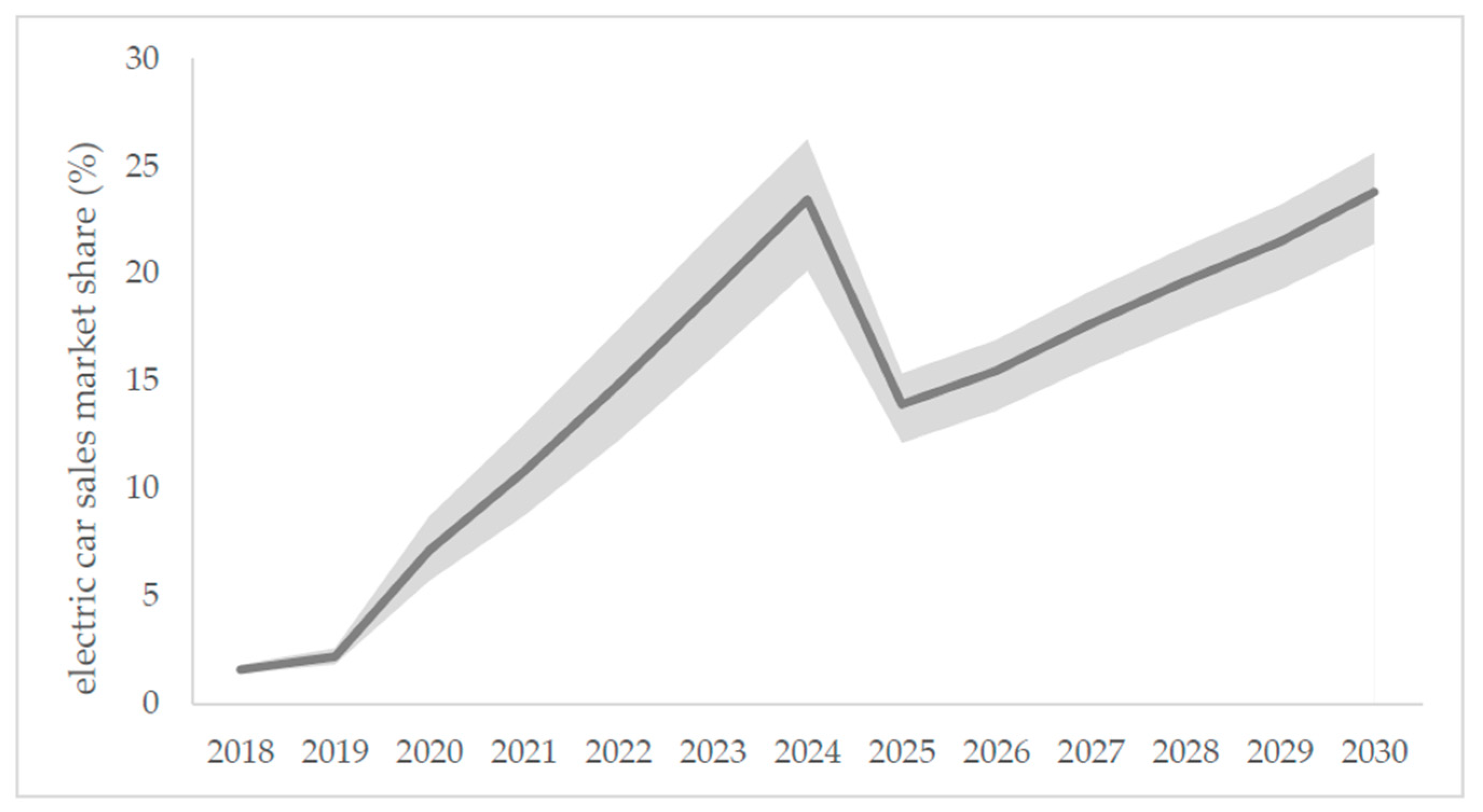

4.2. Electric Car Market Shares, Sales and Stock

- The greatest market share was achieved under S3, both in 2019 and 2020;

- By reducing the size of the subsidy, the market share was reduced (compare S3 to S1 and S2), both in 2019 and 2020;

- The removal of purchase subsidies led to a lower market share (compare S0 to S1–S3), both in 2019 and 2020;

- Shortening the duration of the subsidy had a severe impact on the market share, particularly under the most generous subsidy level (see S3 in 2020);

- Offering a small subsidy in one year only had a temporarily minor effect on the market share (compare S4 to S0).

4.3. Testing the Sensitivity of the Battery Learning Curve

5. Conclusions and Further Research

5.1. Conclusions and Policy Implications

5.2. Limitations and Further Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Disclaimer

References

- EVI. Global EV Outlook 2018; Electric Vehicles Initiative (EVI): Cambridge, UK; Organization for Economic Co-operation and Development (OECD): Paris, France; International Energy Agency (IEA): Paris, France, 2018; Available online: https://www.iea.org/gevo2018/ (accessed on 8 October 2019).

- European Alternative Fuels Observatory (EAFO). Available online: http://www.eafo.eu (accessed on 8 October 2019).

- Regulation (EC) No 443/2009 of the European Parliament and of the Council of 23 April 2009 Setting Emission Performance Standards for New Passenger Cars as Part of the Community’s Integrated Approach to Reduce CO2 Emissions from Light-Duty Vehicles. Euro. Available online: http://eur-lex.europa.eu/legal-content/en/ALL/?uri=CELEX:32009R0443 (accessed on 3 September 2019).

- Regulation (EU) No 333/2014 of the European Parliament and of the Council of 11 March 2014 Amending Regulation (EC) No 443/2009 to Define the Modalities for Reaching the 2020 Target to Reduce CO2 Emissions from New Passenger Cars. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?toc=OJ%3AL%3A2014%3A103%3AFULL&uri=uriserv%3AOJ.L_.2014.103.01.0015.01.ENG (accessed on 3 September 2018).

- Directive 2014/94/EU of the European Parliament and of the Council of 22 October 2014 on the Deployment of Alternative Fuels Infrastructure. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32014L0094 (accessed on 3 September 2019).

- Lévay, P.Z.; Drossinos, Y.; Thiel, C. The effect of fiscal incentives on market penetration of electric vehicles: A pairwise comparison of total cost of ownership. Energy Policy 2017, 105, 524–533. [Google Scholar] [CrossRef]

- ACEA. Overview: Tax Incentives for Electric Vehicles in the EU; European Automobile Manufacturers Association (ACEA): Brussels, Belgium, 2018. [Google Scholar]

- Kindleberger, C.P. Manias, Panics and Crashes: A History of Financial Crises; Macmillan Press: New York, USA, 1996. [Google Scholar]

- Bloomberg, Denmark Does U-Turn on Electric Cars to Reach Fossil-Free Future. Available online: https://www.bloomberg.com/news/articles/2018-10-09/denmark-does-u-turn-on-electric-cars-to-reach-fossil-free-future (accessed on 3 September 2019).

- Deuten, S.; Gómez Vilchez, J.J.; Thiel, C. Analysis and testing of electric car incentive scenarios in the Netherlands and Norway. Technol. Forecast. Soc. Chang. 2019. under review. [Google Scholar]

- ACEA. Tax Guide. European Automobile Manufacturers Association (ACEA). Available online: https://www.acea.be/industry-topics/tag/category/tax-guide (accessed on 3 September 2019).

- Schmidt, O.; Hawkes, A.; Gambhir, A.; Staffell, I. The future cost of electrical energy storage based on experience rates. Nat. Energy 2017, 2, 17110. [Google Scholar] [CrossRef]

- Forrester, J.W. Industrial Dynamics; Massachusetts Institute of Technology Press: Cambridge, MA, USA, 1961. [Google Scholar]

- Sterman, J.D. Business Dynamics: Systems Thinking and Modeling for a Complex World; Irwin/McGraw-Hill: Boston, MA, USA, 2000. [Google Scholar]

- Harrison, G.; Thiel, C.; Jones, L. Powertrain Technology Transition Market Agent Model (PTTMAM): An Introduction; Joint Research Centre (JRC) Technical Report; European Commission (EC): Luxembourg, 2016; Available online: http://publications.jrc.ec.europa.eu/repository/bitstream/JRC100418/pttmam%20technical%20report%20final_online.pdf (accessed on 3 September 2019).

- Powertrain Technology Transition Market Agent Model (PTTMAM). EU Science Hub—The European Commission’s Science and Knowledge Service. Available online: https://ec.europa.eu/jrc/en/pttmam (accessed on 3 September 2019).

- Pasaoglu, G.; Harrison, G.; Jones, L.; Hill, A.; Beaudet, A.; Thiel, C. A system dynamics based market agent model simulating future powertrain technology transition: Scenarios in the EU light duty vehicle road transport sector. Technol. Forecast. Soc. Change 2016, 104, 133–146. [Google Scholar] [CrossRef]

- Harrison, G.; Gómez Vilchez, J.J.; Thiel, C. Industry strategies for the promotion of E-mobility under alternative policy and economic scenarios. Eur. Transp. Res. Rev. 2018, 10, 19. [Google Scholar] [CrossRef]

- Harrison, G.; Thiel, C. Policy insights and modelling challenges: The case of passenger car powertrain technology transition in the European Union. Eur. Transp. Res. Rev. 2017, 9, 37. [Google Scholar] [CrossRef]

- UBS. UBS Evidence Lab Electric Car Teardown—Disruption Ahead; UBS Group SA: Zurich, Switzerland, 2017. [Google Scholar]

- Tsiropoulos, I.; Tarvydas, D.; Lebedeva, N. Li-ion Batteries for Mobility and Stationary Storage Applications—Scenarios for Costs and Market Growth; Joint Research Centre (JRC) Science for Policy Report; European Commission (EC): Luxembourg, 2018; Available online: http://publications.jrc.ec.europa.eu/repository/bitstream/JRC113360/kjna29440enn.pdf (accessed on 3 September 2019).

- EC. SET-Plan ACTION n°7—Declaration of Intent ‘Become Competitive in the Global Battery Sector to Drive E-Mobility Forward’; European Commission (EC): Brussels, Belgium, 2016; Available online: https://setis.ec.europa.eu/system/files/integrated_set-plan/action7_declaration_of_intent_0.pdf (accessed on 3 September 2018).

- Commission Staff Working Document Detailed Assessment of the National Policy Frameworks Accompanying the Document Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions Towards the Broadest Use of Alternative Fuels—An Action Plan for Alternative Fuels Infrastructure under Article 10(6) of Directive 201/94/EU, Including the Assessment of National Policy Frameworks under Article 10(2) of Directive 2014/94/EU; SWD/2017/0365 Final, 2017. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1512384850915&uri=CELEX:52017SC0365 (accessed on 3 September 2019).

- FuelsEurope. Statistical Report 2017; FuelsEurope: Brussels, Belgium, 2017. [Google Scholar]

- Keith, D.R.; Naumov, S.; Sterman, J.D. Driving the Future: A Management Flight Simulator of the US Automobile Market. Simul. Gaming 2017, 48, 735–769. [Google Scholar] [CrossRef]

- Thiel, C.; Schmidt, J.; Van Zyl, A.; Schmid, E. Cost and well-to-wheel implications of the vehicle fleet CO2 emission regulation in the European Union. Transp. Res. Part A Policy Pract. 2014, 63, 25–42. [Google Scholar] [CrossRef]

- Gómez Vilchez, J.J.; Julea, A.; Peduzzi, E.; Pisoni, E.; Krause, J.; Siskos, P.; Thiel, C. Modelling the impacts of EU countries’ electric car deployment plans on atmospheric emissions and concentrations. Eur. Transp. Res. Rev. 2019, 11, 40. [Google Scholar] [CrossRef]

- ACEA. New Passenger Car Registrations European Union; European Automobile Manufacturers Association (ACEA): Brussels, Belgium, 2019. [Google Scholar]

- Hardman, S.; Chandan, A.; Tal, G.; Turrentine, T. The effectiveness of financial purchase incentives for battery electric vehicles—A review of the evidence. Renew. Sustain. Energy Rev. 2017, 80, 1100–1111. [Google Scholar] [CrossRef]

- Gómez Vilchez, J.J.; Harrison, G.; Kelleher, L.; Smyth, A.; Thiel, C. Quantifying the Factors Influencing People’s Car Type Choices in Europe: Results of a Stated Preference Survey; Joint Research Centre (JRC) Science for Policy Report; European Commission (EC): Luxembourg, 2017; Available online: http://publications.jrc.ec.europa.eu/repository/bitstream/JRC109452/kjna28975enn.pdf (accessed on 3 September 2019).

| Country | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|

| France | €4.5–7.0 1 | €4.0–6.3 1 | €2.0–6.3 1 | €0.7–6.3 1 | €1.0–10.0 2 | €2.5–10.0 3 |

| Germany | €0.0 | €0.0 | €0.0 | €3.0–4.0 4 | €3.0–4.0 4 | €3.0–4.0 4 |

| Denmark | €0.0 | €0.0 | €0.0 | €0.0 | €0.0 | €0.0 |

| The Netherlands | €0.0 | €0.0 | €0.0 | €0.0 | €0.0 | €0.0 |

| United Kingdom | ≤£5.0 | ≤£5.0 | ≤£5.0 | €0.0 | €0.0 | €0.0 |

| 2021–2024 | 2025–2029 | 2030–2034 | 2035–2039 | 2040–2044 | 2045–2050 |

|---|---|---|---|---|---|

| 95.00 | 80.75 | 66.50 | 50.00 | 40.00 | 30.00 |

| Scenario No. | S1 | S2 | S3 | S4 | S5 | S6 |

|---|---|---|---|---|---|---|

| Size (%) | 10% | 20% | 30% | 10%/0% | 20%/0% | 30%/0% |

| Timing (year) | 2019–2020 | 2019–2020 | 2019–2020 | 2019/2020 | 2019/2020 | 2019/2020 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gómez Vilchez, J.J.; Thiel, C. The Effect of Reducing Electric Car Purchase Incentives in the European Union. World Electr. Veh. J. 2019, 10, 64. https://doi.org/10.3390/wevj10040064

Gómez Vilchez JJ, Thiel C. The Effect of Reducing Electric Car Purchase Incentives in the European Union. World Electric Vehicle Journal. 2019; 10(4):64. https://doi.org/10.3390/wevj10040064

Chicago/Turabian StyleGómez Vilchez, Jonatan J., and Christian Thiel. 2019. "The Effect of Reducing Electric Car Purchase Incentives in the European Union" World Electric Vehicle Journal 10, no. 4: 64. https://doi.org/10.3390/wevj10040064

APA StyleGómez Vilchez, J. J., & Thiel, C. (2019). The Effect of Reducing Electric Car Purchase Incentives in the European Union. World Electric Vehicle Journal, 10(4), 64. https://doi.org/10.3390/wevj10040064