1. Introduction

A scenario in which climate change and sustainable energy pressures continue to intensify within a socio-economic environment characterized by rapid change calls for corporations to be major players in this environment. The financial risk management mechanisms practiced by corporations have become a major concern for researchers and policymakers alike [

1]. Increasing external pressure-from European regulation policies [

2,

3], decarbonization policies globally [

4,

5,

6], and increasing demands for corporations from investors and customers [

7] are pushing corporations to revisit their business model structures and sustainability policies. As part of the current debate regarding environmental and social management standards for corporations (ESG factors) and social responsibility for corporations (CSR), researchers have pointed out that while such factors contain enhanced potential for increasing corporate resilience towards changing environments, such factors are also associated with problems concerning enhanced costs entailed in mainstreaming green technology. This suggests a persistent gap between corporate resilience and the management of climate-related financial risks.

Specifically, the energy sector appears more susceptible to climate-related risks and uncertainties arising from the green transition. This can be because extreme climate-related events, changes in energy demand, and instabilities in traditional energy supply can affect cash flow and financial performance. Nevertheless, other factors, such as significant initial investments in renewable energy [

8,

9] and changes in existing operational processes [

10] associated with the green transition, are also involved. Notably, a continued focus on integrating ESG approaches with renewable energy investments appears to offer a potential means of managing future financial risks, thereby enhancing climate resilience. Public discourse on the real effects of ESG policies and renewable energy investments on companies’ financial risk profiles varies. Apparently, while some researchers believe that this integration leads to a better response to climate-related risk and a more stable risk profile [

11,

12,

13], others focus more on the burdens associated with compliance risk, a possible temporary competitive risk for firms with more aggressive investments in renewable energy, while this agenda remains primarily as a means of risk communication [

14,

15]. There is debate about the role of public policies: while some authors propose a strong interventionist approach to facilitate a green transformation, others consider the possible distorting effects of market interventions [

16,

17]. This diversity of opinions makes a thorough empirical examination of the influence of ESG and CSR approaches on climate risk vulnerability in the energy sector legitimate.

Existing studies typically examine sustainability dimensions in isolation, employ heterogeneous methodologies, or fail to account for sector-specific vulnerabilities. This fragmentation leaves a significant gap in understanding the integrated effects of corporate sustainability strategies on financial resilience, particularly in the context of the energy sector’s increased exposure to climate shocks and regulatory pressure; therefore, a systematic and comprehensive analysis is needed. Moreover, the subject remains open to exploration, also due to the volatility of the corporate sector, especially in the use of energy resources, which has recently undergone a forced transition from traditional to sustainable sources, driven by numerous international regulations and corporate social responsibility.

While recent empirical studies increasingly document positive associations between ESG performance, renewable energy adoption, and firm-level financial [

18] or market performance [

19], most of this literature remains focused on standard financial outcomes and relies on average-effect estimations, such as profitability, firm value, or stock returns. In contrast, the present study shifts the analytical focus from performance outcomes to firms’ exposure to climate-related financial risks and their capacity to build financial resilience amid heightened uncertainty. Moreover, unlike prior empirical work, which typically treats ESG engagement, renewable energy investments, and sustainable finance as separate explanatory factors, this research adopts an integrated framework that examines their joint and interactive effects within a single empirical setting. By explicitly accounting for sector-specific vulnerabilities in the European energy industry and by capturing heterogeneous risk responses across firms, this study provides evidence that extends beyond existing ESG-performance linkages and contributes new insights into the role of sustainability strategies in mitigating climate-induced financial instability.

Taking these factors into account, this research aims to explore, in a fully integrated manner, the effects of CSR involvement, renewable energy investments, and sustainable funding on firms’ vulnerability to climate-related financial risks and on the broader effort to enhance corporate resilience. This appears to be a complex phenomenon regarding social responsibility approaches and vulnerability to climate disruptions, as suggested by the literature.

The contribution of this study is threefold. First, to rigorously capture these interconnections, our study adopts an advanced empirical analysis design, based on robust regression with Huber and biweight iterations and quantile-on-quantile (Q–Q) regression. This methodological selection enables the analysis of firm behavior under conditions of high variability and non-uniform data distributions. Such approaches are applied to a sample of 300 firms in the European energy industry in 2024, sourced using LSEG Data & Analytics. In addition, this first contribution reflects the study’s integrative perspective, which jointly examines CSR engagement, renewable energy investment, and sustainable finance as interconnected determinants of firms’ exposure to climate-related financial risks—an angle seldom treated simultaneously in existing literature. Our empirical results offer new insights into the ongoing initiatives by many international organizations to accelerate their transition to low-carbon operating models in the European energy sector. Thus, the analysis also examines how the company manages its climate risk strategies, which influence its performance and investors’ perceptions of risk. In this sense, the research investigates how elements such as green finance, emission-reduction policies, investments in green technologies, and the adoption of effective sustainable governance practices shape the company’s capacity to respond to climate challenges in a high-performing, cost-effective manner. Second, advancing methodological rigor would provide a basis for a comparative examination of a company’s actions and responses to climate-related pressures, allowing analysis of how financial risks related to climate change are distributed across different conditions or segments. Third, it complements the empirical results with an adequate review of the relevant literature, which maps the intellectual trends and thematic focuses in sustainability research. The proposed approach examines the impact of climate-related financial risks on firms’ sustainability performance, with a particular emphasis on renewable energy and access to sustainable finance. This extensive examination of scientific literature is carried out with the support of VOSviewer software (version 1.6.20) for a decade-long period, from 2015 to present, in the Web of Science Core Collection. This bibliometric approach strengthens the paper’s contribution by identifying research clusters, influential publications, and international collaboration patterns, thereby positioning the study within the most recent scientific developments in sustainable finance and energy transition research.

The paper is organized into several interconnected sections, each contributing to understanding the phenomenon under study. After the introductory presentation, which outlines the conceptual framework and the relevance of the topic, a section follows devoted to a detailed review of the literature, in which previous research is analyzed and existing gaps are highlighted. Based on this synthesis, the authors outline the study’s objectives and central hypotheses. The next chapter describes the data used and the methodology adopted, highlighting the rigor of the empirical approach and justifying the selection of statistical and econometric techniques. Subsequently, the results derived are presented and interpreted, providing a clear perspective on the practical and theoretical implications of the research. The paper then discusses the conclusions reached, the limitations of the analysis, and possible directions for future investigations. In conclusion, the authors formulate relevant recommendations for economic and managerial policy based on empirical findings and designed to support strategic decisions in the field under consideration.

2. Literature Review

2.1. Defining ESG, CSR, and Sustainable Finance: Conceptual and Operational Framework

Nowadays, society is at the peak of its evolution and prosperity, where all resources are used to the fullest, but the cost of this prosperity is the obligation to provide future generations with the resources they need, which remain unexhausted. For this reason, organisations that constantly use large volumes of both human and material resources are directly affected by this issue. Thus, the sustainable behavior of companies and their commitment to ESG (environmental, social, and governance) factors have been thoroughly investigated, becoming a highly controversial topic in research [

20,

21,

22], because the risks associated with climate change present both opportunities and challenges for companies’ activities.

To better capture all these credentials, this research applies three key concepts, each with theoretical richness, representing different aspects of the link between finance and the broader notion of sustainability: environmental, social, and governance (ESG) coordinates; corporate social responsibility (CSR); and sustainable finance. ESG captures the firm’s specific measures related to its exposure to sustainability risks, while CSR concerns the corporation’s core strategy, and sustainable finance delineates the mechanisms by which sustainability becomes the reward criterion within finance.

ESG represents an analytical framework derived from responsible investing that integrates

environmental,

social,

and governance dimensions [

23] into the measurement of corporate behavior, financial prospects, and the sustainable development of companies. In this sense, ESG factors serve as essential benchmarks for investors, facilitating both capital allocation decisions and the assessment of a company’s social impact and sustainability. However, in the specialist literature, consensus is limited, with researchers expressing dissenting opinions that can be classified into two main categories. Some authors argue that commitment to ESG principles benefits a company’s performance and reputation [

24,

25,

26], while others argue that it can have negative consequences, affecting business operations and financial results [

27,

28].

From a functional standpoint, ESG can be conceptualized not as a set of stated intentions or voluntary sustainable behavior, but as an externally defined rule set that enables a quantitative translation of disparate non-financial factors into comparable data [

23,

29]. More specifically, it can be assumed that ESG represents a proxy set of composite indexes and pillar-specific ratings (E, S, G) based on standardized factors such as emission intensity and mitigation strategy, employee and human capital outcomes, governance systems, and quality and consistency of disclosures, which are generally calculated and provided by third-party rating agencies [

23,

30].

ESG is operationalized in current research as an outcome-focused sustainability construct that reflects publicly observable firm actions across environmental, social, and governance areas. Aligning with its role in capital markets, the ESG proxy is configured as a set of normalized firm-level indicators and sustainability indexes that enable cross-sectional comparisons.

Overall ESG performance is tracked through the ESG Score, which can also be viewed in sector-specific indices for environmental, social, and governance scores. These overall composite scores are broken down into thematic indicators focusing on specific sustainability outcomes to preserve analytical granularity.

In this manner, decarbonization, resource efficiency, and environmental innovation are considered part of the environmental pillars, using indicators such as renewable energy use, energy use, CO2 emissions, emission management, environmental innovation, resource reduction policy, waste recovery, environmental product performance, and environmental materiality exposure.

The social pillar covers outcomes related to human capital and stakeholder engagement. This is operationalized in current research through the implementation of various metrics, including employee turnover, employee engagement, and their relation to CSR; the quality of the workforce; human resource policies; training and development policies; the availability of flexible working hours; and the performance of its stakeholders based on CSR.

The governance pillar refers to the institutional level of governance and strategic integration. This is operationalized in the current study through board attendance, the gender diversity of the board, the skill level on the board, the establishment of a sustainability committee for the CSR, the quality of the sustainability reports, and the strategic categorization based on the CSR.

As markets have evolved, there has been a significant shift in corporate awareness of

corporate social responsibility (CSR). Within this study, CSR is conceptualized as a firm-level, voluntary governance and management approach through which companies integrate social, environmental, and ethical considerations into their core strategies, organizational structures, and stakeholder relationships. CSR thus reflects managerial intent and institutional commitment, rather than externally evaluated performance outcomes, and is primarily embedded in internal policies, board-level oversight mechanisms, and operational practices aimed at long-term value creation and legitimacy building [

31,

32,

33]. In this sense, CSR constitutes the strategic and organizational backbone of corporate sustainability, shaping firms’ capacity to adapt to regulatory pressure, social expectations, and environmental constraints, while operating upstream of market-based ESG assessments.

The underlying premise of CSR is that any business activity should be conducted in a manner that minimizes environmental destruction and prioritizes human rights norms, thereby reducing the potential for negative social implications [

31]. In this regard, corporations have a critical role to play in relation to climate change management and intervention [

34].

In the current analysis, corporate social responsibility (CSR) is measured through the sustainability governance and disclosure framework adopted by corporations, with a focus on the presence and coverage of CSR sustainability committees and the level and clarity of sustainability reporting practices. These metrics determine the depth to which social and environmental responsibilities are integrated into corporate governance frameworks, reflecting pre-existing organizational commitments and readiness rather than outcomes related to sustainability. Consequently, CSR serves as a foundation for the design and management of sustainability goals and practices.

By contrast,

sustainable finance refers to the financial expression of sustainability issues, reflecting how environmental and social factors are incorporated into companies’ financing frameworks, investment practices, and resource allocation. From a theoretical perspective, sustainable finance involves incorporating climate and sustainability risks into capital markets, thereby affecting companies’ cost of capital and capital market constraints [

35].

Therefore, this research quantifies sustainable finance based on firm-level metrics that reflect financial performance, productivity, and resource efficiency. Such metrics are sensitive to sustainability risk prices and investment motives. Together, these metrics reflect how well firms have performed in translating sustainability strategies into economic outcomes. Thus, the empirical models can conclude how sustainability-focused governance and environmental strategies affect firms’ climate-related financial risk and resilience.

2.2. The Impact of Embracing Renewable Energy on Corporate Financial Potential

Over the recent period, a widely discussed topic worldwide has been the climate crisis, which is becoming an increasingly preoccupying issue. It is essential to recognize that global warming poses significant risks that affect us all, as it has a ripple effect on economic activity across all sectors. Thus, corporations must take greater responsibility for the environmental dimension. Perera & Hong [

36] suggest that the utilization of renewable energy can enhance society’s economic capacity to function and contribute positively to reducing climate risk, sensitivity, and vulnerability to climate change. Additionally, Suman [

37] argues that renewable energy not only mitigates global warming through its carbon reduction effects but also promotes climate change adaptation and strengthens the capacity to confront it.

Furthermore, following their study, Zhuo et al. [

38] concluded that adapting to climate change through the gradual adoption of clean energy sources increases the sustainability of energy infrastructure and ensures the continuity of a sustainable energy supply. Østergaard & Sperling [

39] and Wang et al. [

40] contribute to this perspective with the conclusion that the development of renewable energy is considered the most effective way to attenuate environmental problems, provided that economic development is ensured, and technology constitutes the foundation for the development and expansion of renewable energy production capacities [

41].

Notwithstanding the positive opinions, a critical position is expressed in a part of the specialized literature, arguing that innovation-oriented investments can bring substantial financial constraints for enterprises [

42,

43], an element that may inhibit rather than stimulate companies’ financial results [

44]. Nonetheless, Li et al. [

45] argue that climate change serves as a catalyst for proactive eco-innovation by businesses, providing a pathway to adapt to and address environmental challenges while achieving competitive advantage [

46]. Against the backdrop of accentuated exposure to climate risks, Xiang et al. [

47] support the idea that companies tend to voluntarily adjust their strategies and operational processes, focusing on the use of alternative energy sources, the development of sustainable technologies, the design of environmentally friendly products and services, and increased energy efficiency through green innovation. These adjustments aim both to reduce costs and maintain optimal commercial operations, as well as to manage the impact of climate change and minimize losses from environmental risks. Consequently, we developed the following research hypothesis:

H1. “ESG commitment of companies, especially renewable energy mainstreaming, enhances their ability to mitigate and adapt to climate-related shocks and increase financial outcomes”.

Stakeholder Theory explains why firms adopt ESG practices and renewable energy, increasing legitimacy and reducing climate risks (H1). The resource-based perspective (RBV) frames renewable energy capacities and green investments as strategic resources that strengthen corporate resilience and financial stability, thereby supporting H1.

2.3. Investments in Carbon Reduction and Corporate Resilience

The European Commission has reaffirmed its commitment to reducing carbon emissions by approving the European Union Climate Law, which sets a target of reducing greenhouse gas emissions by 55% by 2030. As a measure to ensure this goal is achieved, the European executive has launched a comprehensive review of the energy and climate legal framework based on the 2030 Agenda for Sustainable Development [

48]. This legal measure reduces global carbon emissions and sets a challenging target within Europe through the “Fit for 55” legislative package, which aims to cut net emissions relative to 1990 levels while positioning Europe for a climate-neutral economy by 2050. Among those approved policies and measures is a review of the Emissions Trading System (EU ETS) [

49].

However, it should be noted that the CSR role in managing carbon emissions is complex. Thus, according to Zhang et al. [

50], CSR that modifies industrial processes directly has a positive effect on a specific region in terms of emission-reduction parameters. On the one hand, reputation factors, coupled with state prescriptions, may encourage specific firms to take on targets for emissions reduction, thereby benefiting from compensation for negative environmental factors. On the other hand, approaches to innovation within a business environment might be negatively affected by empirical assessments presented in Pirtea et al. [

51]. Environmental and social factors determine the importance of a particular sector in sustainable development; energy is among the most important [

52,

53]. In this regard, the energy sector plays a role in reducing greenhouse gas emissions, preventing the depletion of conventional energy resources, and promoting the use of renewable energy sources [

54,

55]. Sadiq et al. [

56] state that in the energy arena, one of the most critical roles for a corporate social responsibility committee is monitoring financials and protecting shareholder value. The current focus of this committee is carbon emissions from energy firms. The regulation of carbon emissions directly influences not only environmental quality but also improves the efficiency of decision-making [

57], thereby increasing shareholder value [

58] and profits. Baraibar-Diez & Odriozola [

32] emphasize the apparent success of CSR committees as a precursor to reduced operational and environmental expenditures, using empirical evidence indicating that involvement directly influences sustainability factors related to carbon emissions in the energy arena.

Additionally, Duong et al. [

59] argue that a significant increase in production does have a profound effect on worsening global environmental imbalance. This debate clearly calls for firms to embrace social responsibility and environmental sustainability. This means that firms embrace sustainable development principles and develop innovative methods for producing and managing with a reduced carbon approach. This would help firms develop environmental competitiveness to safeguard the environment. Business resilience basically determines whether a business environment supports and sustains a firm commercially. By this means, firms would better withstand environmental risk via effective adjustment and resource management. This would therefore limit operational risk while maintaining their environmental competitiveness. Jung et al. [

60] argue that carbon risk has become a significant concern among investors. Carbon risk basically dominates investment decisions. This requires a determined effort to reduce environmental warming. Additionally, empirical evidence from Pirtea et al. [

61] indicates that risk negatively influences returns. This requires significant involvement of governance decision-makers to reduce risk. Negative influences of carbon emissions on corporate valuation and investment decisions were shown in studies by Clarkson et al. [

49] and Phan et al. [

62]. Additionally, firms with a great degree of carbon risk face significant capital and debt requirements [

60].

Zheng et al. [

63] argue that viable companies can capitalize on the “Porter effect” by innovating in production processes, offsetting the costs of environmental restrictions, and facilitating the transition to a low-carbon economy. On the other hand, Shi et al. [

64] argue that non-viable firms encounter difficulties in implementing environmental governance, complying with regulations, and adopting green technologies, thereby exacerbating environmental constraints and increasing carbon emissions. Based on the literature mentioned above, we have established the following research hypothesis:

H2. “CSR compliance, environmental certifications, and green investments in low-carbon operational models increase the corporate resilience of energy companies and reduce their financial vulnerability to climate risks”.

Institutional theory emphasises the influence of regulatory pressures, such as EU decarbonisation policies, on driving CSR compliance and carbon reduction initiatives (H2). In parallel, the resource-based view (RBV) links H2 to long-term performance outcomes by conceptualising renewable energy capabilities and green investments as strategic assets that enhance corporate resilience and financial stability.

2.4. Bibliometric Analysis of Corporate Social Responsibility in Attenuating Climate Risks on Financial Position

Given the growing body of studies published over the past decade on consolidating corporate resilience through the incorporation of CSR and ESG principles, including their role in mitigating climate risks, we conducted a bibliometric analysis to map the intellectual landscape and identify research gaps relevant to our empirical study. We found that the topic under investigation is highly relevant and frequently appears in international analyses across fields such as environmental sciences, economics, business and finance, management, and energy and fuels, as shown in

Figure 1.

Consequently, conducted a bibliometric analysis based on a rigorous process (

Figure 2) of identifying and selecting the specialized literature, using the Web of Science–Core Collection platform to collect exclusively English-language academic papers published globally between 2015 and 2025, associated with the following topics: renewable energy, CSR, financial risks, and climate risks and applying the established criteria led to the selection of 5655 relevant articles from an initial total of 7931 publications, which were then subjected to the analysis’ methodology.

The analysis was performed using the scientific networking visualization tool VOSviewer software, version 1.6.20 to assess the collected articles qualitatively (

Figure 3). This is considered an essential technique in literature reviews, also applied by other authors, such as Mihancea et al. [

65], to ensure the rigor and relevance of the academic approach. It examines the main components of the research, including keywords, authors, key references, and reference countries, as illustrated in

Figure 4,

Figure 5 and

Figure 6, thereby allowing the identification of current trends and highlighting the most relevant keywords, institutions, and international collaborations within the analyzed research topic.

Keyword analysis aims to extract and examine the central concepts that structure the literature included in the sample by evaluating their occurrence in the selected publications, thus outlining the main research directions associated with corporate social responsibility and sustainable energy strategies. To delimit the relevant works, the following four key expressions (“renewable energy”, “CSR”, “climate risks”, and “financial risks”) were used, after which VOSviewer software (version 1.6.20) generated a set of related terms with high visibility in the analyzed literature (

Figure 4) highlighting the dominant focus of research on climate risks and sustainable performance.

Figure 4 highlights the set of terms considered relevant by the software after applying a minimum threshold of 7 occurrences. The size of the nodes reflects the frequency of use of each keyword in the sampled articles, while the thickness of the links indicates the intensity of the relationships between terms. Their distribution is organized into 17 large, distinct clusters, each marked by a different color. Thus, we identified that the red group has the highest share in the network, which highlights that adopting renewable energy and technological innovations reduces carbon emissions and exposure to climate risks, thereby strengthening environmental performance and corporate sustainability, at the same time facilitating the transition to resilient business models aligned with the Sustainable Development Goals. The second cluster, the green one, also has a significant influence, focusing on risk assessment and stating that in the context of the transition to green energy, this becomes essential for strategic business decision-making, prompting businesses to optimize their risk management processes to maintain operational stability. Next, the following cluster is marked in blue and focuses on adaptation. It reflects the idea that, in the context of the increasing impact of climate change, achieving carbon neutrality requires surmounting the main structural barriers and accelerating the implementation of adaptation and mitigation technologies. Cluster 4, represented in yellow, is also particularly relevant. It highlights climate risk, proposing that, in the European Union, rising carbon emissions and the intensification of the climate transition are increasingly influencing market volatility and the structure of corporate bonds. This determines the importance of strengthening climate governance and financing mechanisms to combat climate change in the context of a complex political economy of energy transition.

The following analysis (

Figure 5) shows the conceptual structure of the literature on the relationship between climate change, climate risks, and green finance, based on a sample of 1073 documents that met the minimum inclusion threshold of 17 citations/document.

The citation network obtained highlights a dense nucleation of fundamental documents that structure the literature on climate risks and green finance—in particular the articles by Engle (2020)-winner of the 2003 Nobel Prize for his study of volatility [

66], Huang (2018), and Campiglio (2018), which represent both numerous citations and many links, indicating a central role in consolidating the field. Around this nucleus, well-defined thematic clusters emerge, consisting of studies on extreme climate risks and adaptation on corporate resilience, notably Zscheischler (2018), as well as a peripheral group of methodological contributions to risk modeling, such as Li (2023b). The core-periphery structure of the network shows an interdisciplinary literature, in which the financial-climate theme serves as a point of convergence, connecting contributions from economics, climate science, and advanced modelling, while specialized sub-themes are less connected to each other but remain relevant to the field’s development.

The final section of the bibliometric analysis explores the citation network by country of affiliation, focusing on articles that examine the impact of corporate social responsibility on financial resilience during the transition to sustainable energy. This analysis is illustrated in

Figure 6, considering only 71 countries out of 154 based on the following selection criteria: minimum thresholds of 10 documents and 40 citations per country.

The co-citation of countries’ affiliation networks (

Figure 6) highlights a complex global structure of research on the impact of corporate social responsibility on corporate resilience through the transition to sustainable energy. The VOSviewer software (version 1.6.20) visualization indicates four major clusters: the green cluster, dominated by China, France, and Scotland, focused on energy transition and operational resilience; the blue cluster, in which England, Germany, Italy, and Sweden contribute to the development of the conceptual framework and governance of CSR. In addition, the red cluster, consisting mainly of emerging countries such as India, South Africa, Kenya, and Mexico, focuses on sustainability, climate adaptation, and systemic vulnerability. The next cluster, marked in yellow, includes Switzerland, Iran, Vietnam, and Taiwan. It focuses on renewable energy technologies and technological transition. Overall, the network appears to be an ecosystem of intense collaboration, in which major hubs such as China, the USA, and England are closely connected to regional nodes, while also strengthening the network through transcontinental collaborations, fostering a multidimensional approach to the connection between CSR, sustainable energy, and corporate resilience.

The bibliometric analysis highlights both the growing relevance and the fragmentation of literature linking CSR, renewable energy, sustainable finance, and climate-related financial risks. While dominant research clusters confirm strong conceptual connections among sustainability practices, risk management, and corporate resilience, empirical studies often examine these dimensions in isolation and rely primarily on average-effect estimates. These insights directly motivate our empirical strategy by supporting the joint examination of CSR engagement, renewable energy deployment, and sustainable finance, and by justifying the use of robust, quantile-on-quantile regression techniques to capture heterogeneous firm-level exposure to climate-related financial risks within the European energy sector.

3. Materials and Methods

3.1. Methodology

The objective of this study is to examine how corporate social responsibility (CSR) engagement, renewable energy deployment and sustainable finance instruments jointly influence firms’ exposure to climate-related financial risks in the European energy sector. A further aim is to determine whether firms with stronger sustainability orientations exhibit greater structural resilience—reflected in lower volatility of financial indicators and more stable risk profiles—thereby linking micro-level corporate transitions to broader debates on socio-economic resilience and sustainable development [

67].

In particular, to capture the complex nature inherent within these interactions, the econometric approach is broken down into three interrelated parts. To explain this further, this structure provides benefits for evaluating the central and distributional aspects simultaneously while accounting for potential data-root problems, such as multicollinearity and heavy-tailed phenomena typical of energy industry datasets.

To start, cross-sectional regression models are employed to determine the overall relationship between sustainability features and companies’ exposure to risk. The basic regression model is conditioned on company size, debt, and profits to control for structural differences. To eliminate the impact of outliers on the estimation process and given the observed volatility within energy risk [

68], robust regression methods are used. The general form for this model is provided as

denotes the climate-related financial risk indicator; the firm’s CSR engagement; its renewable energy deployment; its sustainable finance activity; and the set of control variables.

Secondly, a quantile regression framework is employed within a quantile-on-quantile (Q–Q) regression approach, which allows for a more comprehensive analysis and captures the interlink between the joint distribution functions of sustainability factors and risk exposure. Instead of focusing on measuring the mean impact on specific conditions within the regression model for analysis (as in previous regression models), Q–Q regression seeks to identify the impact on various risk quantiles, given specific quantiles for CSR indices, renewable energy adoption, and other sustainable finance factors. This is more applicable to research focusing on complex, nonlinear, and asymmetric system behavior with structural breaks—something that has been documented in energy and environment risk research [

69,

70].

In Q–Q regression analysis, this specific function can be represented by

and denote the -th and -th quantiles of the dependent and explanatory variables, respectively, and is estimated non-parametrically.

Broadly aligned with the main focus of this study, the Q–Q regression analysis provides robust evidence on whether firms with higher engagement in CSR, renewable energy, and sustainable finance exhibit greater structural resilience across varying risk and performance scenarios. More specifically, instead of an average treatment effect, the approach explores the relationships between selected quantiles of various sustainability metrics and higher or lower quantiles of performance, providing insights into these relationships in both normal and stress environments. More practically, the values of the estimated Q–Q regression coefficients offer information on the nature and degree of relationships between selected quantiles of each sustainability metric and each selected quantile of risk exposure or financial performance. When the estimated regression coefficients remain relatively small and close to zero for ROE, EBIT, EBITDA, profit, and revenue, it can be concluded that higher engagement with the respective sustainability metric is associated with only marginal improvements in the lower-to-median quantiles of financial performance. Alternatively, if the regression coefficient rises and/or becomes positive at higher quantiles, this indicates a stronger association between higher sustainability engagement and higher-quantile (high-performance) outcomes.

Thirdly, before proceeding with model estimation, a diagnostic analysis of the dataset is conducted based on pairwise correlations (

Appendix A,

Table A1). This is necessary to check for unduly high correlations and to provide interpretable insight into the observed empirical validity of the concept-based groups used. The correlations display valid and interpretable outcomes: PROFITABILITY ratios tend to be highly clustered together; Governance ratios and CSR engagement reveal moderate and positively correlated values; ENVIRONMENTAL INNOVATION is negatively correlated with CARBON EMISSIONS while being positively correlated with RENEWABLE ENERGY USE. More importantly, none of the core regressors exhibit unduly high correlations with each other, thereby validating the suitability and empirical design of the dataset for multivariate analysis. Taken together, these methodological building blocks form a coherent framework. The cross-sectional models provide meaningful baseline effects, and the Q–Q regression analyses identify asymmetries and resilience differences for both benign and stressed scenarios. On the other hand, the diagnostic correlation analysis provides a foundation for the method’s validity. To clarify the structure of the empirical workflow,

Figure 7 summarizes the sequence of methodological steps—from data preparation and diagnostic assessment to the implementation of cross-sectional and distributional models, and finally to model validation. This visual synthesis illustrates how each analytical block contributes to the broader methodological architecture and facilitates transparent interpretation of the results presented in subsequent sections.

Econometric analysis is well-structured and follows a logical flow. It starts with thorough data preparation and diagnostic checks to ensure all variables are consistent, accurate, and comparable. Once the dataset’s integrity has been established, the analysis proceeds in a structured sequence: cross-sectional estimation, quantile-on-quantile (Q–Q) analysis, and diagnostics based on correlations. This setup allows us to assess both the average effects and the variation in sustainability-risk linkages across the distribution. This process culminates in model validation, including residual checks and robustness comparisons that enhance the credibility of the results.

Before estimating the models, a number of pre-processing tasks were performed. We examined descriptive statistics and generated exploratory visualizations to understand how indicators are distributed, paying particular attention to climate-risk measures and sustainability metrics. We used leverage and Cook’s distance to identify outliers and influential observations. We winsorized extreme values at the 1st and 99th percentiles, or employed robust estimation methods that down-weight anomalous observations based on their influence.

In order to test the internal coherence and detect potential collinearity, we calculated a matrix of pairwise correlations (

Table A1). The correlations confirm intuitive expectations: profitability measures tend to cluster together; governance indicators show a moderate connection with CSR dimensions; environmental innovation appears inversely related to carbon emissions but positively correlated with renewable-energy use. Importantly, none of the core explanatory variables showed excessively high correlations, confirming the dataset’s suitability for multivariate modelling and supporting the conceptual organization of variables adopted throughout the empirical strategy.

The cross-sectional estimations, presented earlier in the methodological sequence, provide a baseline assessment of how CSR engagement, renewable deployment, and sustainable finance relate to firms’ climate-risk exposure, conditional on structural controls such as firm size, leverage, and profitability. This is further deepened by the Q–Q regression framework, which examines how different quantiles of sustainability indicators correspond to quantiles of the risk distribution. Such an approach uncovers heterogeneous and nonlinear responses, for example, whether benefits of sustainability are stronger in lower-risk settings, or whether firms in the upper tail are disproportionately vulnerable despite strong sustainability efforts [

71,

72].

All analyses involved the use of Stata 18 and R 4.1.8. Stata served as the primary tool for robust cross-sectional and Q–Q estimations, whereas R handled diagnostics, distributional visualizations, and data transformations. The combined workflow supports precision, reproducibility, and consistency in all methodological steps.

3.2. Data

The empirical research uses a company-level dataset collected from the LSEG Data & Analytics platform and comprises 300 European energy firms operating in the Electricity, Oil and Gas, Renewable Energy, Multi-utilities, and other relevant sectors. The sample is selected on two conditions: (i) the companies must be primarily listed in Europe, and (ii) they must be able to supply complete information on their finances and sustainability performances for the year 2024. It should be noted that this sample method ensures all included firms face equal exposure to laws and conditions for sustainability reporting.

Focusing our analysis on cross-sectional data for 2024, we examine strategic configurations and specific resilience conditions through which companies can sustain financial performance during various periods of structural transition. Moreover, in 2024, European energy companies were shaped by critical actions, namely regulatory pressure, the integration of ESG criteria, the implementation of renewable energy, and the application of sustainable finance initiatives. Marked by these considerations, which are still under continuous discussion and have a significant impact even today, the study offers a concrete overview of how financial strategies respond to sustainability imperatives in contemporary transitional conditions; thus, our results can be considered a reference study for future analyses.

To harmonize the dataset with the analysis goal of examining the cumulative effect of CSR engagement activities on firms’ susceptibility to CC-related F-Risk, all indicators were grouped into three abstract categories: financial and structural basics; corporate sustainability and governance features; and environment-related performance and resource efficiency. The above classification is based on the theoretical premise that firms’ ability to withstand CC-related shocks is driven by their capacity to withstand financial shocks and their environmental positioning [

67,

73].

A list of the indicators employed within the empirical analysis and gathered from the LSEG Data & Analytics platform, 2024, is given below:

Financial Performance

- ▪

Return on Equity (ROE): It measures the return generated for every unit of equity and gives information on management’s ability to generate revenue from equity.

- ▪

Revenues (REVENUE)—It is the indicator of overall earnings made from core business operations. It defines the business’s size and reach.

- ▪

Earnings Before Interest and Taxes (EBIT): A commonly used indicator for measuring the operations’ efficiency and profitability regardless of the financing and taxation structure.

- ▪

Earnings Before Interest and Tax, Depreciation, and Amortization (EBITDA)—Measures operating cash flow by removing the effect of non-cash items and focusing on earnings power.

- ▪

Profit (PROFIT)—It is used to calculate net earnings after all types of expenses and taxes.

- ▪

Total Assets (ASSETS)—It represents business size and investment capacity/resource endowment and is used as a structural variable for controlling the model.

- ▪

Employee Turnover (EMPL TURN)—Measures the stability within the workforce by reflecting the percentage of employees leaving the company within a specific time period.

- ▪

Turnover per Employee (TURN_EMPL)—This represents labor productivity and is calculated by revenue per employee.

Corporate Sustainability, Human Capital, and Governance

- ▪

CSR Employment Engagement (EMPL CSR): Reflects the pledge to adopt socially responsible employment principles, such as employees’ welfare and treatment.

- ▪

Workforce Score (WOKF SCORE): It gives insights into workforce quality and stability with respect to retention, safety, and welfare aspects.

- ▪

Human Resources Score (HR SCORE): It judges the strength of human resource policies on recruitment and development, and human resource management.

- ▪

Training and Development Policies (TRAIN DEV POL): It identifies investments made by companies for upgrading and developing skills and knowledge.

- ▪

Flexible Working Hours (FLEX WORK H): Reflects institutional support for flexible working and acknowledgement that work–life balance is important.

- ▪

Board Attendance Score (BOARD ATT SCORE): It provides information on the directors’ rate of board attendance at corporate governance activities.

- ▪

Board Gender Diversity (BOARD GEN DIV): It identifies overall female representation on corporate boards and is then associated with decision-making quality and governance diversity.

- ▪

Board Skills (BOARD_SKILLS): This is used to determine the range and relevance of directors’ skills and experience. It is an indicator of governance quality.

- ▪

CSR Sustainability Committee (CSR_SUST_COM): This is evidence of having a specific governance structure responsible for sustainability management and CSR practices.

- ▪

CSR Sustainability Reporting (CSR_SUST_REP): This metric deals with the transparency and completeness of sustainability disclosures.

- ▪

ESG Score (ESG SCORE): A metric reflecting corporate performance on all dimensions from the environment to governance.

- ▪

Social Pillar Score (SOCIAL_PILLAR): Indicates relative strength within categories such as Labor Rights, Community Engagement, and Social Responsibility.

- ▪

Governance Pillar Score (GOVERNANCE_PILLAR): Measures governance quality and focuses on board matters, shareholder issues, and internal governance structure.

- ▪

CSR Strategic Classification (CSR STR CLS): It categorizes companies based on strategic approach and stage of maturity for CSR activities.

- ▪

CSR Stakeholder Score (CSR_ST_SCORE): It assigns a CSR performance score in relation to stakeholders.

Environmental Performance and Resource Efficiency

- ▪

Renewable Energy Use (RES_USE): It quantifies the share of energy from renewable sources and is a measure of decarbonization progress.

- ▪

Energy Use (ENERGY_USE): Indicates the overall energy use and is used as an indicator for operational efficiency and intensity.

- ▪

CO2 Emissions (CO2_EMISS): It measures the amount of greenhouse gases being produced by the business.

- ▪

Emissions Score (EMISS SCORE): It provides an analysis of the ability to manage emissions relative to other firms within the industry.

- ▪

Environmental Innovation Score (ENV_INNO_SCORE): Captures the degree to which companies employ innovative methods to mitigate their negative effect on the environment.

- ▪

Environmental Innovation (ENV INNOV): Reflects innovations involving the development and application of new knowledge and processes to increase environment-related performance.

- ▪

Environmental Materiality Score (ENV MAT SCORE): This indicator focuses on the relevance and management of material environment-related risks for operations.

- ▪

Resource Reduction Policy Score (RES_RED_POL_SCORE): It represents the strength of policies and practices within the organization that influence resource reduction.

- ▪

Environmental Product Score (ENV_PROD_SCORE): Assesses the environment-related properties and characteristics of products made by firms.

- ▪

Waste Recovery Score (WASTE_REV_SCORE): It is utilized to calculate the efficiency of the company with regard to recycling or recovering wastes.

- ▪

Product Resource Score (PROD_RES_SCORE): It focuses on resource utilization efficiency embodied within product formulation, production, and distribution.

- ▪

Environmental Pillar Score (ENV_PILLAR): It is a compound indicator that identifies overall natural resource and pollution management.

Despite the indicators being depicted separately for greater transparency, each indicator serves a unique conceptually grounded purpose within the empirical framework. The inclusion of financial and structural indicators captures firms’ economic strength and their capacity to adapt to and respond to sustainability pressures, which is essential for informing resilience drivers and principles for firms subject to climate risk [

73,

74]. CSR, employment, and governance indicators comprise various organizational and strategic quality aspects and behaviors that are informed to affect firms’ strategic and adaptive longevity and sustainability [

67,

72]. Environmental indicators represent various quantifiable aspects and dimensions, such as operational intensity and renewable energy integration, and the intensity and maturity of environmental innovation, grounded in exposure and risk principles for firms confronting climate-related financial risk [

75,

76]. Before empirical estimation, all monetary variables were expressed in euros and deflated with respect to harmonized price indices for intercountry comparability. Variables with strong right-skewness, such as revenues, assets, renewable energy use, and emissions intensity, were log-transformed to stabilize variance and alleviate heteroscedasticity—often applied adjustments for energy-related observations with nonlinear and fat-tailed behavior [

68,

69].

To further document the data-generating structure and quantify the magnitude of cross-sectional heterogeneity prior to estimation,

Table 1 summarizes the descriptive statistics for all variables, highlighting their central moments, dispersion metrics, and distributional features relevant for subsequent econometric specification.

Table 1 summarizes the distributional properties of the financial, CSR, governance, and environmental indicators employed in the empirical analysis. The financial variables exhibit extreme dispersion, with revenues, EBIT, EBITDA, and total assets displaying very large standard deviations and pronounced right-skewness (skewness > 7), accompanied by kurtosis levels exceeding 50. The evidence confirms the presence of heavy tails and scale-driven heterogeneity, consistent with sectoral structures in which firms range over several orders of magnitude in operational capacity. The properties exhibited by the distribution justify the use of log transformations and robust regression analysis.

Indicators for CSR, human capital, and governance tend to be more narrowly distributed and more symmetrical, with means ranging between 45 and 65 and moderate skewness. This is evidence that variability is more similar across firms in organizational and sustainability factors than in financial ones. Some indicators, such as flexible work and training and development policies, show moderate negative skewness, reflecting a bias towards the upper end due to industry-wide adoption.

The environmental performance variables demonstrate significant variability, specifically in CO2 emissions, energy consumption, and waste material recovery, all of which have non-normal distributions with pronounced skewness and positive kurtosis. On the other hand, innovation-driven indicators (such as the environment innovation score and the product/resource efficiency score) tend to be normally distributed, with balanced variability across firms.

In general, the dataset is dual-structured: size-financial variables that exhibit heavy-tail properties and ESG-based dimensions that tend to be more stable with respect to dispersion. The properties illustrated above, specifically the heavy-tail properties exhibited by size-financial variables, emphasize the need for further visualization of scale variability. In this regard, the descriptive statistics above are complemented by a log-scale depiction of the market capitalization of the sample firms.

Figure 8 depicts the high degree of dispersion in firm size, ranging from small-capitalization firms to large global energy conglomerates. While a logarithmic transformation normalizes differences in size and removes multiplicative variation, so that equal amounts on the y-axis represent tenfold increases in market share, this process reduces highly skewed distributions and allows for a better understanding of their heavy-tailed properties in European energy markets.

To evaluate the structural correlation within the dataset and identify possible multicollinearity among the indicators, a correlation matrix is produced (

Table A1). The correlations obtainable from this exercise hold ground from the analytical stance: indicators for profitability tend to form a close cluster; governance indicators tend to be moderately and positively correlated with the CSR dimensions; while indicators for environment innovation tend to be negatively correlated with respect to carbon emission and tend to be positively correlated with respect to the use of renewable energy. More importantly, however, all pairwise correlations are well within the range expected for potential instances of multicollinearity.

In sum, the breadth and scope of the dimensions in this aggregated data provide a robust empirical foundation for inquiry into how sustainability methods interact with real conditions in firms to shape their climate risk vulnerability. This data weaves together data points on structure, organization, and ecology, using a single model to represent the complex process by which energy firms adapt to climate-related pressures.

Altogether, the observed structures of variability and inter-variable relationships in this data facilitate multivariate estimates. By combining data on financial, organizational, and environmental factors, a diversified empirical basis for discovering linear and nonlinear relationships in climate risk exposure for firms can be established.

Starting with this analytical basis, the following section reports on empirical findings and focuses on basic effects, distributive heterogeneities, and statistically identified sustainability determinants of climate risk exposure.

4. Results

4.1. Results of Robust Regression Models (RREG)

Therefore, our paper aims to explore the factors that determine European energy firms’ ability to manage the economic and climate pressures arising from ongoing sector transformations. To evaluate the extent to which there are direct/favorable or indirect/unfavorable effects of CSR engagement, renewable energy deployment, and sustainable finance on the financial outcomes of the EU companies within the global climate risks framework, we first employed the robust regression models (RREG) (

Table 2, Model 1–Model 5). The results emphasize significant associations among selected credentials, as well as notable impacts on financial outcomes (ROE, EBIT, EBITDA, PROFIT, REVENUE).

The results highlight heterogeneous impacts of sustainability and CSR performance variables on firms’ financial outcomes. Within the negative influences and implications on ROE (Model 1,

Table 1) we noticed unfavorable direct implications of RES_USE, ENV_INNO_SCORE, RES_RED_POL_SCORE, WASTE_REV_SCORE, CSR_SUST_COM, GOVERNANCE_PILLAR, and TURN_EMPL, with negative and statistically significant coefficients, explained by the effective and significant costs, invitational risks, and short-term operational disruptions generated by these credentials related to CSR, innovations, and environmental policies, as Peris et al. [

77] also emphasized. Conversely, CSR engagement, renewable energy deployment, and sustainable finance dimensions have recorded favorable and significant direct effects (with positive and statistically significant coefficients) on the ROE from the following variables, such as

(i) renewable energy deployment (ENERGY_USE, CO

2_EMISS)—reveals that efficient use of energy and the reduction in gas emissions led to low operational costs, competitive advantages, and high renewable energy deployment;

(ii) ENV_PROD_SCORE, PROD_RES_SCORE, CSR_SUST_REP)—highlighting the operational efficiency, optimization processes and a high degree of sustainable technology adoption;

(iii) and corporate and CSR governance dimensions BOARD_SKILLS, SOCIAL_PILLAR, CSR_ST_SCORE—pointed out that a well-structured and knowledgeable steering committee can spur the degree transparency and trust of investors, thus leading to low risk and better access to capital, as Farza et al. [

78] confirmed. Model 2 (

Table 2) suggests a low influence of the specific dimensions CSR, renewable energy, and sustainability on EBIT, with the only notable and positive influence being from ENV_PROD_SCORE (coeff. = 0.276). In this sense, operational performance independent of financing and tax policy is influenced by the company’s sustainability decisions. The results suggest that a high degree of ecological productivity optimizes the operational process and financial outcomes. As regards Model 3 (

Table 2), we have noticed significant positive influences of ENV_INNO_SCORE and ENV_PROD_SCORE on EBITDA, as also Oeyono et al. [

79] confirmed, suggesting environmental innovations and ecological productivity can become one of the core areas that can help companies from the energy sector to generate operational profit by allocating substantial investments in sustainable technologies. At the same time, taking into account the negative impact of SOCIAL_PILLAR and CSR_SUST_REP on financial outcomes (EBITDA), we can attest that multiple costs within the company can be generated by social networking and the reports that incorporate the sustainability scores. Furthermore, to better capture the effects of CSR, renewable energy, and sustainable finance on PROFIT, we configured Model 4 (

Table 2). Moreover, ENV_INNO_SCORE, RES_RED_POL_SCORE, CO

2_EMISS, CSR_SUST_COM, and GOVERNANCE_PILLAR may have a notable positive effect on financial outcomes, indicating that companies oriented towards the environmental pillar succeed in transferring operational efficiency into profit, as Lankoski [

80] and Blomgren [

81] also found. Model 5 (

Table 2) includes positive effects of RES_USE on financial outcomes (REVENUE). Thus, these results indicate that firms that incorporate innovation-specificities alongside efficient resource management achieve a high level of revenue. In contrast, negative influences stem from the WASTE_REV_SCORE, highlighting that companies that are not sustainability-oriented experience a lack of demand; they cannot expand in the market, undermining corporate reputation, which is reflected in the decrease in revenues.

Beyond statistical significance, the results convey important economic and managerial insights regarding how sustainability strategies translate into firm-level performance. These disparate outcomes in the realm of finance illustrate divergence in economic performance generated by sustainability activities, which depend on their placement within the value chains of the entities. Environmental innovation and related product strategies emerge as productivity drivers, positively impacting efficiency and profitability and thereby underpinning managers’ motivation to consider sustainability factors in innovation and production. On the other hand, the negative consequences of renewable energy adoption in the short term for return-focused indicators indicate path-dependent adjustment problems in capital intensity, innovation, and structuring, which are not necessarily efficiency problems. The association with revenue growth confirms improvements in the industry position.

In light of this background, we shall proceed to isolate sustainability-related variables with stable signs and consistent significance across robust regression and quantile-on-quantile estimates, thereby highlighting the core determinants of firms’ financial outcomes. In this regard, a small set of sustainability-related variables with consistent significance emerges across various model specifications for firms’ financial outcomes. Environmental innovation (ENV_INNO_SCORE) and environmental product performance (ENV_PROD_SCORE) exhibit stable and significant effects across return-based and operating indicators, with recurrent patterns confirmed by both robust regression and quantile-on-quantile estimates. Renewable energy use (RES_USE) displays a structurally heterogeneous yet directionally consistent role, exerting short-term pressure on returns while supporting revenue generation across estimation frameworks. Institutional CSR governance, captured by the presence of a sustainability committee (CSR_SUST_COM), remains significant in profitability and revenue models, indicating a persistent link between formal sustainability oversight and financial outcomes. In contrast, employee turnover (TURN_EMPL) consistently shows negative effects across profit-related specifications, highlighting its role as a structural vulnerability factor. Together, the sign stability and cross-method robustness of these variables identify them as the central transmission channels through which sustainability practices influence corporate performance and resilience in the European energy sector.

Taken together, these findings provide direct empirical support for the theoretical framework and the two research hypotheses formulated in this study. The consistently positive effects of environmental innovation and environmentally oriented product performance on operating and profitability indicators confirm Hypothesis H1, in line with the resource-based view, which frames sustainability-driven capabilities as sources of efficiency gains and competitive advantage. The recurrent significance of CSR-related governance mechanisms—most notably the presence of sustainability committees—supports Hypothesis H2, consistent with stakeholder and institutional theories emphasizing the role of formal governance structures in enhancing legitimacy, coordination, and long-term value creation. At the same time, the mixed effects associated with renewable energy deployment—negative for return-based indicators but positive for revenue generation—suggest a partial confirmation of Hypothesis H2, reflecting short-term adjustment costs alongside longer-term resilience and market-positioning benefits. The persistent negative impact of employee turnover further reinforces stakeholder theory’s arguments for the importance of human capital stability for effective sustainability implementation.

4.2. Results of Quantile-on-Quantile (Q–Q) Regression

To determine whether the sustainability-risk relationships inferred with the robust regression methods are evenly distributed with little observable heterogeneity in this conditional distribution of variables or instead contain a degree of observable heterogeneity,

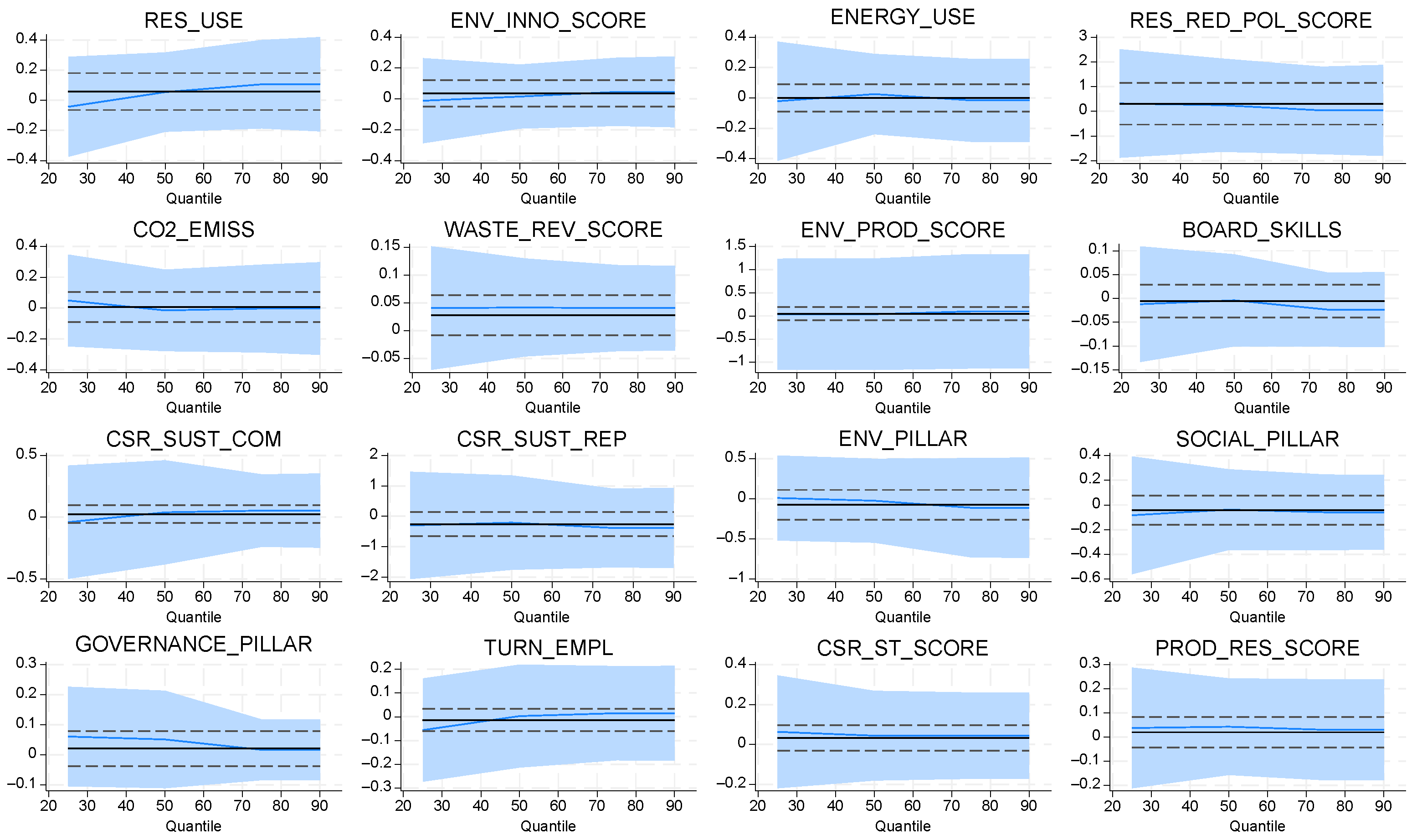

Figure 9 presents a Q–Q regression graph for Model 1.

The robust regression estimates shown in

Table A2 offer a comprehensive insight into how sustainability-related factors affect the firms’ financial results and risk profiles for Models (1) to (5). Some statistically strong and coherent relationships have come to light. A strong, positive relationship between environmental innovation (ENV_INNO_SCORE) and environmental product score (ENV_PROD_SCORE), as well as operational performance variables such as EBITDA and EBIT, indicates that firms implementing innovation-focused environmental upgrades achieve efficiency gains. This finding lends credence to the notion that environmental upgrades may serve as a source of competitive advantage rather than an additional expense [

82]. The strong positive relationships observed between environmental and social pillar scores (ENV_PILLAR and SOCIAL_PILLAR) and profitability-adjusted variables lend additional support to the role of sustainability-related factors in improving robustness and adaptability [

83].

Compared with this, the use of renewable energy (RES_USE) has a negative and very significant influence on ROE but positive and insignificant relationships with operating earnings and revenues. This might be associated with transitional effects, whereby firms that increase their use of renewables face adjustment difficulties in the short run. However, looking back at previous studies indicating that environmental upgrades help firms achieve enhanced export performance and revenue structuring [

84], one might argue that firms with strong reliance on renewable energy could be poised for better future growth.

The dynamics of variables associated with emissions activity support and reinforce structures. CO2 emissions (CO2_EMISS) strongly and significantly influence ROE and PROFIT due to the natural scale economies and asset utilization by existing generators. Nevertheless, such a profitability advantage should be interpreted with caution, as purely static profitability benefits coexist with increased transition risks, which are indirectly unobserved in one-period regression analyses. Conversely, effective resource reduction policies (RES_RED_POL_SCORE) significantly and positively affect PROFIT, as firms with effective resource reduction actions always realize cost savings. The variables for governance and organization follow a heterogeneous but logically consistent pattern. Board skills (BOARD_SKILLS) negatively affect PROFIT but positively affect ROE. This indicates that a more sophisticated level of corporate governance may entail some transitional burdens in monitoring and alignment but ultimately achieve better capital management efficiency. Establishing a CSR sustainability management system (CSR_SUST_COM) leads to a significantly positive effect on PROFIT and REVENUE. This finding indicates that maintaining a systematic sustainability management process can facilitate a more effective operationalization of CSR achievement. On the other hand, CSR sustainability reports (CSR_SUST_REP) are associated with negative coefficients for several profitability equations.

Labor market factors perform as expected. A high level of employee turnover (TURN_EMPL) negatively and significantly affects PROFIT due to operational inefficiencies. Product-resource efficiency scores (PROD_RES_SCORE) positively affect ROE because efficient manufacturing processes increase capital productivity.

To further examine whether sustainability-risk relationships differ across the conditional distribution of climate risk facing firms,

Figure 10 below reports tile-to-tile (Q–Q) regression results for Model 2.

The Q–Q regression surfaces shown in

Figure 10 indicate a great degree of distributional heterogeneity in the effects of CSR, environmental, and governance variables on climate risk. A number of coefficients follow a quantile pattern, indicating that sustainability factors do not have a uniform effect but differ substantially between low- and high-risk quantiles. This complements the theory that climate risk transmission channels are nonlinear and asymmetric, especially across sectors that differ in their technological intensity [

69].

This indicates that environmental innovation and product-level environmental scores are more negatively correlated with climate risk for firms in higher quantiles. This additional resilience when firms face intense conditions confirms previous research showing that green technological innovation shields firms from risk [

76]. Conversely, indicators such as CO

2 emissions and resource-reduction policies show muted effects in the lower quantiles but intensify in the higher portions of the distribution, signaling that risk-amplifying and risk-mitigating mechanisms become more salient when firms are structurally exposed to elevated climate-related financial pressures.

To extend the distributional assessment of sustainability-risk dynamics,

Figure 11 presents the Q–Q regression outputs for Model 3, capturing how each indicator influences climate-risk exposure across the full conditional quantile space.

The panels in

Figure 11 display, for each key sustainability indicator, the estimated Q–Q coefficient across the conditional risk distribution together with its pointwise confidence band. Overall, most relationships appear relatively stable around zero, indicating that for a large subset of CSR, environmental, and governance variables, the marginal effect on climate-risk exposure does not vary strongly across quantiles. However, several indicators exhibit pronounced slope and band-width changes. For instance, RES_USE, ENERGY_USE, and ENV_PILLAR show mildly increasing profiles towards the upper quantiles, suggesting that the risk-mitigating (or risk-amplifying) impact of these variables becomes more pronounced for firms in higher-risk states. Conversely, the nearly flat curves for CSR_SUST_COM, CSR_SUST_REP, and GOVERNANCE_PILLAR imply that the influence of institutional CSR governance is largely homogeneous across the risk spectrum.

The widening confidence bands in some panels at extreme quantiles further indicate greater parameter uncertainty in the tails, a standard feature of quantile-on-quantile estimation in finite samples and in highly volatile sectors. These patterns are consistent with recent evidence that sustainability and energy-related shocks propagate asymmetrically across the conditional distribution of financial and environmental outcomes, reinforcing the importance of distribution-sensitive methods in this domain [

70].

To further investigate whether the sustainability-risk relationships remain stable once additional firm-level controls are incorporated,

Figure 12 presents the quantile-on-quantile (Q–Q) dependence structure for Model (4).

The Q–Q profiles in

Figure 12 reveal a predominantly moderate and stable association between sustainability dimensions and climate-risk exposure once extended financial controls are included. Most indicators exhibit coefficient paths centered around zero with relatively narrow confidence bands, indicating limited distributional sensitivity and suggesting that the incremental explanatory contribution of sustainability attributes is attenuated when profitability-adjusted outcomes are modelled. Nonetheless, several variables—particularly RES_USE, ENV_PROD_SCORE, and ENV_PILLAR—display mild upward slopes across higher quantiles, suggesting that environmental performance exerts a more pronounced influence among firms in elevated risk states. Conversely, governance-related measures such as BOARD_SKILLS and GOVERNANCE_PILLAR appear largely invariant across quantiles, signaling that internal governance structures maintain uniform effects irrespective of firms’ risk positions.

To assess whether sustainability-risk relationships intensify or attenuate once the full set of financial, organizational, and environmental controls is incorporated,

Figure 13 summarizes the quantile-specific dependence patterns obtained from Model (5).

The Q–Q plots for the Q–Q estimates shown in

Figure 13 appear stable for most sustainability factors across their quantiles, except for a few that show some degree of asymmetry. The mild slopes observed for ENV_PROD_SCORE, ENV_PILLAR, and SOCIAL_PILLAR on the right indicate that environmental and social strengths provide more effective buffers for companies in a relatively high climate risk state. Conversely, variables such as CO

2_EMISS, RES_RED_POL_SCORE, and TURN_EMPL are more negatively tilted towards their right side. This may imply that factors with high emissions intensity, tough resource-reduction policies, and unstable employment continue to increase risk for corporations occupying a relatively high level of climate risk. Governance factors such as BOARD_SKILLS and GOVERNANCE_PILLAR appear more stable.

The strong regression estimates in

Table A2 indicate a stable, theoretically consistent mapping between sustainability factors and financial performance variables. Environmental innovation and product-based environmental performance (ENV_INNO_SCORE, ENV_PROD_SCORE) continue to boost EBITDA and EBIT, substantiating that innovation-based environmental upgrades operate as efficiency gains rather than a compliance cost [

82]. Conversely, use of renewable energy sources (RES_USE) imposes an adverse pressure effect on ROE values but sustains revenue growth in a form consistent with observed adjustment frictions in ESG-performance relationships for decarbonization-related investments in a short window of time [

30].

Variables relating to emissions also reflect several additional structural asymmetries: a positive coefficient for CO2 emissions indicates a positive association with ROE and PROFIT, suggesting an advantage attributable to existing firms’ size. By contrast, effective policies for reducing resource use (RES_RED_POL_SCORE) have a strong positive effect on profitability, confirming a priori expectations based on a large body of literature showing the positive effects of operational sustainability. Governance and organizational indicators exhibit moderate but coherent effects: board skills (BOARD_SKILLS) reduce net profitability yet marginally improve capital-efficiency metrics, while employee turnover (TURN_EMPL) systematically depresses profit margins, signaling human-capital vulnerabilities.

5. Discussion

Following the research results drawn, respectively, the comprehensive examination of the obtained results from the RREG (Robust Regression) models with Huber and biweight iterations (Model 1–Model 5) guided us to conclude that the investments in green technologies not only reduce dependence on volatile energy markets and environmental impact, as confirmed by Marti-Ballester [

85], but they also bring considerable competitive advantages: financial performance, reduced operating costs [

86], a solid reputation, and more substantial support from employees, customers, investors, and even governments.

According to the results in

Table 2, intensive use of resources by companies in the energy sector (RES_USE) leads to a decrease in return on equity (ROE) (Model 1), highlighting both the high operational costs of companies in this sector [

87] and the importance of investments in energy transition. Simultaneously, the significant contribution to the advancement of ROE of indicators representing production efficiency (ENV_PROD_SCORE), the integration of CSR strategy (CSR_ST_SCORE), sustainability reporting (CSR_SUST_REP), as well as performance on environmental and social pillars (ENV_PILLAR and SOCIAL_PILLAR) emphasize the positive consequences [

88] for companies that optimize their technical processes and consider it profitable to adopt a strategic approach to sustainability. The results indicate a significant relationship between the industrialization process [

89] and the proper implementation of the ESG framework and return on capital, a determining factor in the more advantageous positioning of energy companies in the transition toward integrating sustainable resources. Moreover, as regards Model 1, which comprise the most notable and statistical significant coefficients, the results highlight the fact that, in the context of the existence of a board management characteristics that possesses the essential skills and is adapted to all future changes, challenges and transformations, there are crucial factors with a positive influence on financial outcomes (especially ROE), such as the transition and use of renewable energies, reduction of carbon emissions, actions strongly supported by the social, environmental and governance pillar characteristics, even by the CSR actions undertaken within the company.

The EBIT model (Model 2) presents production efficiency (ENV_PROD_SCORE), indicating that technical process optimization is the central driver of operating profit [