Abstract

Green hydrogen is a promising energy carrier for the decarbonization of hard-to-abate sectors and supporting renewable energy integration, aligning with carbon neutrality goals like the European Green Deal. Iceland’s abundant renewable energy and decarbonized electricity system position it as a strong candidate for green hydrogen production. Despite early initiatives, its hydrogen economy has yet to significantly expand. This study evaluated Iceland’s hydrogen development through stakeholder interviews and a techno-economic analysis of alkaline and PEM electrolyzers. Stakeholders were driven by decarbonization goals, economic opportunities, and energy security but faced technological, economic, and governance challenges. Recommendations include building stakeholder confidence, financial incentives, and creating hydrogen-based chemicals to boost demand. Currently, alkaline electrolyzers are more cost-effective (EUR 1.5–2.8/kg) than PEMs (EUR 2.1–3.6/kg), though the future costs for both could drop below EUR 1.5/kg. Iceland’s low electricity costs and high electrolyzer capacity provide a competitive edge. However, this advantage may shrink as solar and wind costs decline globally, particularly in regions like Australia. This work’s findings emphasize the need for strategic planning to sustain competitiveness and offer transferable insights for other regions introducing hydrogen into ecosystems lacking infrastructure.

1. Introduction

Interest in hydrogen is increasing globally as industries and governments around the world explore different decarbonization strategies [1,2]. Hydrogen has gained a growing role in these plans due to its potential use both as an energy carrier and potential feedstock for essential industries such as the fertilizer and steel industries, as well as a form of energy storage if produced under the right operating conditions [3]. The potential it offers to decarbonize such hard-to-abate sectors has led to this rising interest.

This can be seen in the international energy policy landscape, where in 2017, Japan was the only country in the world with a hydrogen strategy. By 2024, more than 60 countries had announced hydrogen strategies or were developing them [4]. The IEA conducted a detailed analysis of the current state of hydrogen technologies, studying their potential to contribute to the transformation of energy systems across the world and the challenges to be overcome for their widespread adoption [5]. This analysis further identified what governments and industry should do to address those challenges.

The relevance of hydrogen for achieving emission reduction goals is reflected by the increasing inclusion of hydrogen technology in global energy models. Such models developed by the Energy Transitions Commission [6,7], Hydrogen Council [8,9], and International Energy Agency (IEA) [10,11,12] estimate hydrogen to supply 7–24% of the global energy demand by 2050 and expect the annual hydrogen demand to be between 500 and 800 Mt. These production quantities of hydrogen will bring about carbon emissions that are expected to significantly reduce the chances of reaching the 1.5 °C warming target depending on the production technologies and energy sources used and the resulting emission factor of hydrogen [13].

Right now, almost all hydrogen comes from natural gas and coal, which releases about 830 Mt CO2-e per year [5], and since hydrogen is only an energy carrier, the supply from fossil fuels cannot advance a climate-sustainable hydrogen economy. As another hydrogen production pathway, water electrolysis uses electricity to break water into hydrogen and oxygen. In 2020, this method produced only a very small share (0.03%) of the hydrogen used for energy and industry. One of the reasons is that electrolysis itself requires large energy inputs, and due to this, the potential of electrolysis has been questioned [10].

Currently, there are four main electrolyzer technologies: alkaline electrolyzers; proton exchange membranes (PEMs); solid oxide electrolysis cells (SOECs); and anion exchange membranes (AEMs). Alkaline electrolyzers dominate electrolyzer production shares with 61% of the installed capacity in 2020 [11], while PEMs have a 31% share. The remaining capacity is made up of unspecified electrolyzer technology and SOECs (installed capacity of 0.8 MW). Table 1 summarizes the main operating conditions of the four types of water electrolyzers. Alkaline electrolyzers operate at low temperatures and do not require catalysts to start hydrogen production [14]. PEM electrolyzers are safer and can run at normal pressure on the anode side, while the cathode side experiences higher pressures. However, scaling up PEM electrolyzers for large-scale (MW) applications remains a challenge [15]. SOEC and AEM electrolyzers are still in the research and development stage and are not as advanced as alkaline and PEM technologies. AEM electrolyzers offer benefits such as lower costs and more stable hydrogen production but still require significant development before they can be used for large-scale industrial hydrogen production [16]. For a detailed overview of hydrogen production using various water electrolysis methods, see [17].

Table 1.

Summary of the key operating conditions for the four types of water electrolyzers.

The high production cost of green hydrogen continues to be the main barrier slowing the development of the green hydrogen industry. The two factors dominating the production cost include the CAPEX of electrolyzers and the cost of electricity. However, supportive legislative can help overcome this barrier through financial support helping to solve the supply/demand issue. The European Green Deal [18] is an example of this which sets the goal to achieve net-zero GHG emissions by 2050, with clean hydrogen as a key pillar of this plan.

Photocatalytic hydrogen production is another path for hydrogen production that uses semiconductor materials to harness sunlight for splitting water molecules into hydrogen and oxygen. The process occurs when light energy excites electrons in the photocatalyst, driving chemical reactions that generate hydrogen gas [19,20,21].

Within this discussion on promoting the expansion of clean hydrogen, Iceland presents an interesting case study and opportunity for the EU. Iceland has an abundance of renewable energy resources, particularly in low-carbon geothermal energy [22], at a low cost as well as access to clean water, which are both critical feedstocks for green hydrogen production. There is limited information on the cost competitiveness of hydrogen produced in Iceland, however. If the hydrogen economy is set to expand, this could represent a potentially significant source of low-cost and low-carbon electricity to produce green hydrogen and so should be further explored. This environmental and economic potential has put hydrogen on the government of Iceland’s agenda, where the government has specific goals to further utilize domestic energy resources to further diversify the Icelandic economy and support higher living standards. The national energy company Landsvirkjun started a pre-feasibility study in 2020 to explore the potential to export green hydrogen to the Port of Rotterdam [23].

The objective of this work was to gather diverse viewpoints from stakeholders in the Icelandic hydrogen economy to create a comprehensive overview of its current development status and combine this with a techno-economic analysis using the levelized cost of hydrogen (LCOH) production in Iceland. Through interviews with key stakeholders, this study examined the existing challenges hindering the growth of the Icelandic green hydrogen sector and identified the potential opportunities that could arise from its further development. The primary goals were to evaluate the techno-economic potential of green hydrogen in Iceland and to compare the production costs of hydrogen in Iceland with global averages, highlighting Iceland’s potential to become a leading producer of green hydrogen.

2. Background

Previous studies have focused on the techno-economic assessment of hydrogen production in several EU countries.

Reigstad [24] explored the future hydrogen demand, infrastructure optimization, business case development, and environmental impacts through life cycle assessments, identifying opportunities and challenges in countries such as Germany, the UK, the Netherlands, Switzerland, and Norway. The industrial sector emerged as a key driver for large-scale hydrogen value chains. Reigstad suggested prioritizing research to improve the integration and optimization of hydrogen applications, especially for industrial clusters and the transport sector, and emphasized the need for better financial incentives and support policies to attract investment in hydrogen and CCS technologies. Collaboration across borders and long-term investment strategies were highlighted as crucial for successful hydrogen deployment. Similarly, Lebrouhi et al. [25] reviewed the road maps and strategies developed by various countries for large-scale hydrogen production, noting that the competitiveness of green hydrogen relies on the large-scale development of renewable energy, the establishment of electrolyzer and fuel cell manufacturing facilities, and the creation of hydrogen refueling stations for mobility. Achieving this requires coordinated efforts from governments, industry, and investors, along with significant sector investment. Countries with abundant, inexpensive renewable energy resources can produce green hydrogen for export to regions with a limited renewable energy capacity, though hydrogen transportation challenges must be addressed.

Van der Spek et al. [26] reinforced the importance of government and industry support in deploying a hydrogen economy as part of the transition to net-zero CO2 emissions. They emphasized that a fully developed hydrogen economy will not emerge spontaneously and requires coordinated efforts across various levels of government and industries such as the steel, electricity, and chemical industries. Without this collaboration, only small-scale projects, like hydrogen production for industrial clusters or bus fleet refueling stations, would be feasible. While hydrogen may not be the only energy vector of the future, it could play a crucial role in future energy systems, particularly for sector coupling, if it receives integrated support.

Kuckshinrichs et al. [27] conducted an economic analysis of hydrogen production with an alkaline water electrolyzer at three different site locations in Europe (Germany, Austria, and Spain). They reported that the levelized cost of hydrogen (LCOH) was around 3.64 EUR/kg H2 in Germany, whereas in Austria and Spain, it was estimated to be slightly higher (15 to 18%) due to higher electricity costs. Matute et al. [28] also assessed the cost of green H2 production in Spain to be around 6 EUR/kg H2 for an alkaline electrolyzer and about 7 EUR/kg H2 for a PEM electrolyzer.

Fragiacomo and Genovese [29] also examined the technical and economic factors of producing renewable hydrogen in three regions of southern Italy. They concluded that depending on the level of hydrogen mobility and electricity prices, the LCOH may range from EUR 6.90 to EUR 9.85 per kg, which is significantly lower than the EUR 13.9 per kg reported by Viktorsson et al. [30] for a hydrogen station in Belgium, although Viktorsson et al. [30] found that the levelized cost dropped significantly if the initial investment cost could be reduced, down to the lower boundary of the range provided by Fragiacomo and Genovese. Franco et al. [31] explored different options for offshore wind-powered hydrogen production and transportation. Their research pointed out that using pipelines to transport hydrogen could potentially reduce the LCOH to EUR 2.17 per kg.

More recently, Overbeek [32] analyzed the LCOH of various hydrogen production methods, emphasizing the effects of uncertainties in technical and economic data. Overbeek identified the capital cost and cost of electricity as the main sources of uncertainty. Furthermore, Fazeli et al. [2] focused on the transition from fossil fuel-based hydrogen to renewable hydrogen production and concluded that the uncertainty around the cost of electrolyzer systems, the capacity factor, and the gas price were the most critical factors affecting the transition to renewable H2. Benalcazar and Komorowska [28] also explored the prospects of green hydrogen in Poland using a Monte Carlo Approach and they found promising geographical locations with the lowest cost for large-scale hydrogen production.

Although numerous studies have evaluated the economic feasibility of individual green hydrogen production and storage facilities in European member states, there is a lack of techno-economic analysis of large-scale green hydrogen production units in areas with significant potential for such projects, like Iceland. This study aimed to fill that gap by providing project managers, policymakers, and decision-makers with a comprehensive overview of the current state of the Icelandic green hydrogen economy. By offering a clear and reliable picture of the present conditions and key influencing factors, this work sought to enhance decision-making processes related to hydrogen initiatives. Additionally, the study intended to establish a scientific assessment of the current status of Iceland’s hydrogen economy, serving as a foundation for further research and the development of an indicator to measure its progress.

3. Methods

This study consisted of three key steps. First, stakeholder engagement was conducted to identify and map stakeholders relevant to Iceland’s green hydrogen economy. Second, semi-structured interviews were carried out with 11 experts to gather insights into the opportunities and challenges of green hydrogen development. Finally, a techno-economic analysis was performed to evaluate the cost competitiveness of green hydrogen production in Iceland. The following sections describe in detail how these steps were conducted.

3.1. Stakeholder Engagement

Freeman [33] defines stakeholders as “groups and individuals who can affect or are affected by, the achievement of an organization’s mission”. Integrating stakeholders into the research process contributes to the research becoming more socially robust and solution-oriented [34]. Leventon et al. [35] suggest a methodological approach to stakeholder identification aimed at transdisciplinary sustainability research projects. The methodology revolves around early stakeholder identification during the design phase of the research project. This is argued to enable the stakeholders to influence the following research process and thereby lead to more relevant results. Stakeholders can be identified using different methods, e.g., a value chain approach, life cycle approach, brainstorming, generic stakeholder lists, and mind mapping [36]. Gunnarsdottir et al. [37] suggest a top-down analysis combining brainstorming and a value chain approach to identify all relevant stakeholders. This is expected to yield more comprehensive results since relying on one method might yield restricted results.

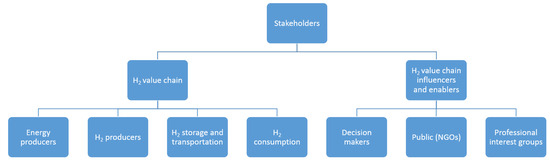

In the case of the present work, stakeholders were identified based on stakeholder lists from Durham et al. [30,31,32] and complemented by inputs from various researchers in the field. Gunnarsdottir [38] offers a comprehensive list of stakeholders in the Icelandic energy sector. The energy sector is closely linked to the hydrogen economy as hydrogen is supposed to form a major pillar of the energy system by becoming a widely used energy carrier [39]. Consequently, the list of stakeholders in the energy sector formed a good basis for a stakeholder assessment of the green hydrogen economy. A generic stakeholder map provided by Gunnarsdottir et al. [37] served as the basis for developing a stakeholder map of the green hydrogen economy in Iceland. This stakeholder map was used to assist us in compiling a comprehensive stakeholder list, shown in Figure 1. The stakeholder list from Perruchoud et al. [40] was a valuable resource for adding additional stakeholders specifically associated with the hydrogen economy in Iceland. The combined stakeholder list was reviewed by experts whose input aided us in finalizing the stakeholder list used for this study.

Figure 1.

Stakeholder map of the green hydrogen economy in Iceland.

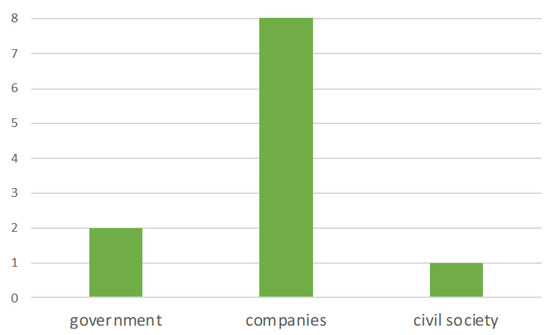

For the data collection, 11 stakeholder interviews were conducted during 2022–2023. The interviewees represented organizations from all societal sectors, as shown in Figure 2. However, most of the interviewed stakeholders were associated with companies—the industrial sector was dominant over the other two societal sectors in terms of the number of conducted interviews. However, within the industry sector there was significant variation in terms of the position in the value chain of each company, as shown in Table 2, which added to the heterogeneity of the interviewee sample. In addition, the aim of such a qualitative enquiry is typically to reveal interesting perspectives and opinions or underlying reasons and factors, not to reach full coverage of all the possible perspectives and attitudes or to allow for broad generalizations [41]. We will return to the interviewee sample issue in the Section 5.

Figure 2.

Categorization of interviewed stakeholders by their societal sector.

Table 2.

Interview participants and their abbreviations.

The two interviewees from the governmental sector were employed by the Ministry of the Environment, Energy and Climate and by the National Energy Authority of Iceland. The civil society sector was represented by a university professor. The civil society and governmental sectors were rounded off by a range of interviewees representing various Icelandic companies. Three of the industrial representatives were associated with energy companies. One interviewee was employed by a public transport provider and a further one was employed by a gas station operator. An engineering consulting firm, an industrial federation, an infrastructure operator, and an alternative fuels company employed one interviewee each.

3.2. Semi-Structured Interviews

This study utilized qualitative interviews, more specifically semi-structured interviews, for collecting the stakeholders’ views. Qualitative interviews are considered a method well suited for reconstructing experiences in which the researcher did not participate. They enable the description of political and social processes and can thereby contribute to the understanding of specific phenomena [42].

Rubin and Rubin [42] suggest a categorization of qualitative interviews by considering their breadth of focus and their subject of focus. Open-ended, unstructured interviews with a broad focus are characterized by open questions that enable the interviewee to answer the way they wish. This enables the researcher to be aware of different facets of the topic of interest. A narrowly focused interview, in contrast, is used to understand the meaning of a certain core idea, with focused and precise questions guiding the interviewee. In between these two extremes, semi-structured interviews are located. These interviews combine the characteristics of both previously mentioned interview types and can be used to unveil the different facets of an issue, while also being useful for diving deeper into specific pieces of information. The subject of focus is considered the second dimension for categorizing qualitative interviews. The interview can either aim to elicit the meanings of certain words or concepts or to describe specific processes or events.

Semi-structured interviews are based on reciprocity between the interviewer and the interviewee [43]. This exploratory character makes semi-structured interviews well suited for exploring the various facets of a theme in question. The method allows for sufficient flexibility to provide space and time to clarify and deepen any answers whenever needed [44]. This is considered useful for the discussion of broad themes like the hydrogen economy or the hydrogen value chain, which have complex interlinkages with individual companies and other organizations. Unveiling these more complex relationships is achieved through improvised follow-up questions posed by the interviewer [43]. Holladay et al. [45] argue that the main questions should be formulated as openly as possible and that these questions should be used as invitations to tell a story. The following answers are expected to yield a wide spectrum of starting points for follow-up questions to explore the discussed themes in more detail.

According to Guest et al. [46], no more interviews are needed once a saturation is reached and interviews do not add any additional themes or perspectives. It seems apparent that this measure cannot be used as an indicator of when sufficient data have been gathered. Due to the manifold perspectives on a complex theme that can be discussed in any technological depth, new themes are expected to emerge whenever the questions or discussion points are slightly adapted. Therefore, in this study, the number of interviews was considered sufficient when at least one participant from each of the stakeholder groups had been interviewed.

The goal of the interviews conducted for this study was to explore the various perspectives of Icelandic stakeholders on the Icelandic green hydrogen economy and to reveal the opportunities that lie within its development and the barriers that prevent it from developing more rapidly. The questions associated with this goal were considered best answered using qualitative research methods, as such methods are well suited for exploring and explaining phenomena and processes [42].

In total, 17 stakeholders were contacted via e-mail, given a summary of the research project, and given a brief explanation of the goal of the interview. Out of these 17 potential candidates, 11 responded positively and were subsequently interviewed. The interviews were conducted one-to-one and via a video call. This allowed each interview sufficient time and facilitated interview scheduling [44]. The interviews were not recorded to prevent the risk of participants being uncomfortable or intimidated and potentially unwilling to unveil their whole opinions. The interviews lasted from 30 to 55 min and they were documented through note-taking during the interview to ensure the availability of the interviewee’s answers for later analysis [44]. After ending an interview, the notes taken during the interviews were expanded.

Since most participants were not familiar with the interviewer, the interviews began with a brief introduction by the interviewer and a summary of the research that was being conducted. Following this, the interviewee was asked to give a brief description of their area of professional activity and potential experience with hydrogen-related projects. During the earlier interviews, sub-questions from the interview guide were used as a conversation starter on the hydrogen economy. The initial interviews were relatively close to the interview guide, usually only deviating from it when the interviewer asked for the clarification of less-developed thoughts by the interviewee. With more interviews being conducted, the structure of the interviews became less standardized, and sub-questions were replaced by a deeper conversation about the interviewees’ experience with hydrogen projects. Ultimately, the interviewee’s experience became the main thread of the interview, offering insights into the motivations and expectations of the interviewee associated with their hydrogen-related activities, as well as the barriers they encountered while executing their activities.

3.3. Techno-Economic Analysis

The anticipated profitability of the new hydrogen capacity was assessed using the LCOH, which is calculated by considering the present value of all costs incurred over the plant’s lifetime relative to the present value of hydrogen production, as follows:

where Ct is the capital investment in year t, Ot the annual fixed operation expenditure (OPEX), Ft the annual feedstock cost (natural gas or electricity), Ht the annual hydrogen production (kg H2), r the real discount rate (7% was considered here), and N the plant’s lifetime.

Table 3 presents the techno-economic assumptions for four hydrogen production technologies, which served as the basis for calculating the LCOH in the reference scenario throughout the analysis period (from now until 2050). Most of the techno-economic parameters (the capital cost of electrolyzers, the efficiency, the stack lifetime) were taken from recent IEA reports [10,11,47]. The range for the price of electricity (23.6–41.4 EUR/MWh) was estimated based on the electricity costs of energy-intensive industries in Iceland reported by the Fraunhofer Institute [48].

Table 3.

Techno-economic assumptions for hydrogen production technologies.

4. Results

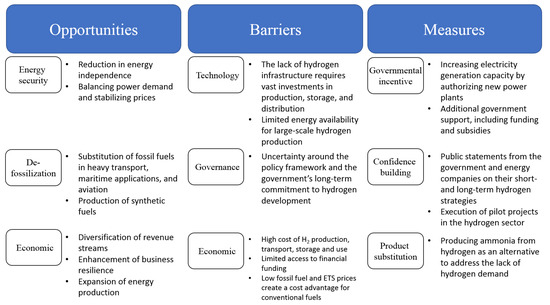

Figure 3 provides an overview of the three main themes and their sub-themes derived from the interview analysis (step 2 of the analysis). Through the careful examination of the interview data, we identified nine key aspects that were significant across all stakeholder groups. These aspects were then grouped into three categories: opportunities, barriers, and measures (for Accelerating the Development of the Hydrogen Economy).

Figure 3.

Categorization of themes discovered in the interviews.

4.1. Opportunities for Developing the Icelandic Green Hydrogen Economy

This theme offers insights into the motivation of stakeholders to engage in the Icelandic hydrogen economy and their expectations about the benefits of developing the hydrogen economy.

4.1.1. Economic Opportunities

Multiple participants from different links of the hydrogen value chain stated that they expected economic opportunities with the further development of the green hydrogen economy. Hydrogen was seen as a business opportunity by multiple participants representing the commercial sector (GO, TC, IO). This conception of hydrogen as a business opportunity was revealed to be a driver for companies engaging in the Icelandic hydrogen economy. Engagement in hydrogen-related activities was said to be mainly driven by attempts to create additional revenue through the development of hydrogen projects (GO, TC, IO). Two interviewees stated that they expected that hydrogen could aid in diversifying revenue streams, fostering improved business resilience (IO, GO). “Hydrogen and e-fuels are opportunities to open up new business fields and diversify our revenue streams.”—GO.

Developing the hydrogen economy was connected to increasing RE production and utilization rates. An increased level of RE production and higher utilization would create additional sales potential, decrease certain costs, and thereby offer the potential to improve margins. Interviewees representing the production and use chain links of the hydrogen value chain considered the currently used RE sources, geothermal power and hydropower, as suitable for hydrogen production (AF, EC I, EC II). There were varying ideas on how to achieve low hydrogen production costs. To increase the utilization of RE power plants, it was suggested by an employee of an energy company to concentrate hydrogen production at night time when the electricity demand would be lower (EC II). Another suggestion from energy company representatives was to combine hydro- and geothermal power to achieve high electrolyzer utilization rates and low hydrogen costs (EC I). It was further suggested by interviewees representing a broad range of hydrogen value chain links that hydrogen production could enable the increased adoption of wind power, potentially opening new streams of value creation (AF, EC I, PM, TC). A different perspective on the benefits of developing the Icelandic green hydrogen economy was offered when it was suggested that Iceland would become a more attractive business location due to its RE usage and adoption of innovative technologies (AF). Developing the hydrogen economy and expanding hydrogen production were said to benefit domestic value creation and the economy as a whole (GO). The potential of Iceland becoming a player in the global energy market was brought up as well (AF).

4.1.2. Decarbonization Opportunities

The decarbonization potential of hydrogen appeared to be a driver for stakeholders to engage in the hydrogen economy. Two interviewees who were closely associated with the operation of hydrogen infrastructure stated that their engagement in the hydrogen economy was linked to their efforts in contributing to the Icelandic energy transition (GO, IO). One interviewee explained that economic opportunities were only secondary drivers for their engagement in the hydrogen economy. Public ownership and the consequential responsibility to execute national decarbonization strategies were said to be the main motivations (EC I). This is well reflected by the following quote: “We are interested in hydrogen not to make a profit in the short term, but to contribute to achieving the national decarbonization goals.”—EC I.

Interviewees who were associated with the operation of hydrogen infrastructure said that their companies’ willingness to contribute to the Icelandic energy transition was the main driver for their interest in green hydrogen (GO, IO). A stronger commitment was revealed when an energy company employee mentioned corporate decarbonization efforts as a driving factor for engaging in the hydrogen economy (EI II).

The potential of hydrogen to decarbonize various applications was a frequently mentioned theme. Multiple participants stated their belief that hydrogen would be an important contributor to achieving comprehensive decarbonization in Iceland (IF, AF). Multiple interviewees mostly associated with the hydrogen production value chain link referred to the potential of hydrogen as a substitute for fossil energy carriers and thus in contributing to reaching carbon emission reduction goals (EC I, EC II, EC III, TC, PM). According to most of the interviewees, hydrogen is a suitable energy carrier to be used within the heavy land transport sector, where it can replace gasoline as a fuel for heavy-duty trucks (AF, EC I, IF, PM, GO, TC). In most cases, this was justified by the superior range and short refueling times of FC vehicles. Using hydrogen as a fuel for urban and regional buses was suggested by one interviewee (TC), while another participant (PT) negated this option due to the complexity and relatively higher cost of the hydrogen supply chain and technology. Maritime applications for hydrogen or hydrogen-based fuels were brought up by various participants who were associated with the hydrogen production sector, who stated that they expected hydrogen to play a role in the decarbonization of the Icelandic fishing vessel fleet (AC, EC, EC II). The conversion of ferries to being hydrogen-fueled was also suggested (AF, PT). The possibility of using hydrogen as a fuel for domestic aviation was a popular theme among a broad range of interviewees representing various links of the hydrogen value chain (EC I, EC II, PT, PM, TC), and highland vehicles was mentioned (AF). Using hydrogen for producing synthetic fuels or precursor materials was suggested by multiple interviewees (IF, PM, EC). One interviewee suggested hydrogen as a backup power supply source for data centers and other appliances that require a continuous and reliable power supply (TC).

4.1.3. Energy Security

There appeared to be a consensus among participants representing energy companies and industry federations that the large-scale production of hydrogen would require the development of a substantial additional RE production capacity. Representatives mentioned the potential of expanded hydrogen production (and synthetic hydrogen alternatives) to reduce energy dependence on foreign countries, while at the same time increasing domestic value creation (EC I, EC III, IF). They also touched on the potential to reduce the price fluctuations of energy through domestic energy production as opposed to sourcing the energy supply from global energy commodity markets. Half of the interviewees considered engaging in the hydrogen economy to be an opportunity to balance the supply of and demand for energy (EC II, IF, PT, EC III, PM).

4.2. Barriers to the Development of the Icelandic Green Hydrogen Economy

This theme offers insight into the barriers to the development of the Icelandic green hydrogen economy encountered or expected by the interviewees.

4.2.1. Economic Barriers

From the interviews, it was clear that the investment cost for hydrogen equipment and the operational costs were considered as key barriers to the development of the Icelandic green hydrogen economy. The high cost of hydrogen equipment needed to further the hydrogen economy was mentioned as a barrier by interviewees at each link of the hydrogen value chain (EC I, EC II, EC III, PT, PM, TC). The mentioned elements ranged from the production cost of hydrogen to the cost of hydrogen equipment such as FCEVs like buses and trucks, as well as HRS and electrolyzers. One participant spoke about the complexity of electrolyzer operation, which was said to use more resources than anticipated and thus led to unexpectedly high costs (EC II). One participant brought up the large-scale hydrogen liquefication capacity that would be required for exporting hydrogen but which first requires substantial investments (IO).

One interviewee raised awareness about the difficulty of attaining sufficient financial funding for investments into hydrogen technology due to Iceland not being a member state of the EU. This was said to complicate or in some cases even prevent hydrogen-associated projects in Iceland from becoming sufficiently funded (AF).

“Many hydrogen projects struggle to get sufficient funding. This is also because we are not an EU member and don’t get EU funding.”—AF.

A high level of economic uncertainty was observed to slow down any serious hydrogen-associated commitments. Three of the participants who were associated with the hydrogen production and infrastructure value chain links mentioned the lack of demand for green hydrogen in Iceland. This was said to inhibit investments in hydrogen production facilities since the future demand is highly uncertain (EC II, EC III, GO). Low fossil fuel prices were mentioned as a barrier for the development of the hydrogen economy. The shift from conventional fuels to hydrogen was said to be inhibited by the low cost of fossil energy as this would manifest a cost disadvantage for hydrogen and hydrogen-based fuels. Low Emissions Trading Scheme (ETS) prices were also mentioned to contribute to the cost advantage of conventional fuels and thereby slow the uptake of hydrogen technology (PM).

The high upfront cost of hydrogen technology was a frequently mentioned issue that was suggested to inhibit the development of the green hydrogen economy in Iceland. It was mentioned that the exclusively domestic hydrogen demand would not require hydrogen production volumes significant enough to maintain long-term cost advantages over alternative technologies. Only a large-scale and export-focused hydrogen economy was considered by interviewees to achieve demand levels sufficient to take advantage of the hydrogen economy’s potential in an economically sound way (IO).

4.2.2. Governance Barriers

Uncertainty revolving around long-term policy support for hydrogen from the government was additionally perceived as a barrier to the development of the Icelandic green hydrogen economy. Two participants mentioned the Icelandic government’s lack of a comprehensive hydrogen strategy. This was said to leave investors and companies in doubt about future legislation and support schemes that could influence the developing hydrogen value chain (AF, IF). It was also brought up by participants linked to hydrogen production and infrastructure operation that the current governmental support was insufficient, leaving pioneering companies in financially unfavorable situations (GO, EC II).

“Currently, the risk of investing in hydrogen projects is very high. It’s difficult to get enough support from the government and we don’t know about the future policies that will influence how we operate and finance hydrogen projects.”—GO.

4.2.3. Technology Barriers

Two interviewees from the hydrogen production and consumption value chain links additionally raised the issue of the current lack of hydrogen infrastructure as another barrier. Significant investments were said to be required to enable the large-scale production, storage, and distribution of hydrogen (PT, EC I). One participant mentioned the need for large-scale hydrogen liquefication in the case of exporting hydrogen (IO). The limited availability of energy for the large-scale production of hydrogen was said to inhibit the development of substantial hydrogen production capacities. This was attributed by participants from various sectors to the already high level of domestic energy production and the high load on the electricity grid (AC, EC II, TC). The development of a substantial additional energy generation capacity was perceived as unlikely. Interviewees underlined the public’s opposition to the development of new power plants and explained this by the impact on the environment (AC, EC II).

One employee of an energy-producing company spoke about how experience and know-how regarding hydrogen technology in Iceland are sparse, which was said to inhibit synergies and collaborations with other companies (EC II).

The competition between the fields of hydrogen and alternative technologies was addressed when two interviewees mentioned battery technology as a barrier for the development of the hydrogen economy (EC, IF). Advances in battery technology were said to inhibit the adoption of hydrogen technology in applications in which both hydrogen and battery technology could be used. One interviewee raised awareness about the availability of CO2 to produce synthetic fuels. Only with sufficient domestically available CO2 could hydrogen-based synthetic fuels be produced at an industrial scale (AC).

4.3. Measures for Accelerating the Development of the Hydrogen Economy

This theme explores the participants’ perspectives deemed beneficial to the development of the Icelandic green hydrogen economy.

4.3.1. Governmental Incentives

A lack of governmental support was seen as a hindrance by several interviewees, as depicted in Section 4.2.2. Multiple interviewees mentioned an increase in the electricity generation capacity as a measure contributing to the development of the hydrogen economy in Iceland. Authorizing the construction of additional power plants would enable the expansion of the electricity generation capacity and thereby contribute to the production of green hydrogen at a lower cost (IF, PM, TC).

One interviewee suggested collaboration between players in the energy sector and the government to prevent transmission fees on electricity that is used to produce green hydrogen. This would reduce the cost of electricity to produce hydrogen and contribute to achieving hydrogen costs which are competitive with those of fossil fuels (EC II).

“It would help if there was more collaboration between the companies to prevent [transmission] fees and make the electricity for hydrogen cheaper.” (EC II).

Multiple interviewees from various hydrogen value chain links suggested a need for additional governmental support for hydrogen-related projects (AF, EC II, IF, PM, EC III, PM, GO). Government support was suggested to come in the form of funding or subsidizing investments (AF). Contracts for difference were brought up as a form of financial support scheme which would have the government pay the whole or a share of the additional investment cost of an FCEV compared to a conventional vehicle, thereby reducing the disadvantage of hydrogen-fueled vehicles regarding their upfront cost (AF). Alternatively, measures to increase the taxation on conventional vehicles, which would at least partially offset the price advantage of cheap fossil fuels, were suggested (AF). It was also suggested to reduce the taxes on FCEVs and other hydrogen-related equipment to reduce their initial investment as well as O&M costs (AF).

4.3.2. Confidence Building

It was further suggested by interviewees that the uncertainty among investors and industrial players regarding the future green hydrogen market could be addressed through governmental efforts to improve the economic conditions for hydrogen investments (AF, EC I). Public statements by the government and energy companies about their hydrogen-related short-term actions and long-term strategy were said to increase the confidence of stakeholders about the future development of the green hydrogen economy (EC I). The publishing of a hydrogen road map by the Icelandic government was mentioned by a participant representing hydrogen infrastructure operators as an important measure providing confidence for and guiding various stakeholders (GO). Energy companies were suggested to sign LOIs to underline their willingness and commitment to engage in the hydrogen economy. This was said to build trust among the actors along the hydrogen value chain (EC I). Additionally, the execution of pilot projects in the hydrogen field was said to build experience and trust in the technology (GO).

4.3.3. Cost Reduction and Product Substitution

The last measure to accelerate the development of the Icelandic hydrogen economy identified by interviewees was efforts surrounding reducing costs and product substitution. One method to reduce costs suggested by a couple of the interviewees was to develop centralized hydrogen production close to electricity generation sites to reduce transmission costs and further loading on the electricity grid (EC I, EC II). An alternative suggestion by a participants representing infrastructure operators pointed towards the advantages of having electrolyzer locations close to ports, which would enable short transport distances between production and shipping sites (IO). This interviewee stated that the development of the hydrogen economy in Iceland requires the substantial export of hydrogen or hydrogen derivatives to achieve sufficiently large production quantities and economies of scale effects to drive down the cost of hydrogen sufficiently for domestic applications. Another perspective stated by an interviewee aiming at decreasing the cost of hydrogen production in Iceland comprised the operation of containerized electrolyzers. These would be set up at dispensing sites of hydrogen and eliminate the need for costly hydrogen transport to remote areas of the country (GO). One interviewee representing an energy company suggested combining multiple energy sources, such as geothermal power and hydropower. This would enable higher electrolyzer utilization rates and consequently decrease the cost of the hydrogen produced (EC I).

An alternative route was suggested when an interviewee from the same sector mentioned producing ammonia from hydrogen. Ammonia was said to be an easily and widely traded chemical with significant global demand. By using hydrogen to produce ammonia, they said, the lack of demand for hydrogen could be neglected while still building up a hydrogen production capacity of a sufficient scale to reach acceptable hydrogen production costs (EC III).

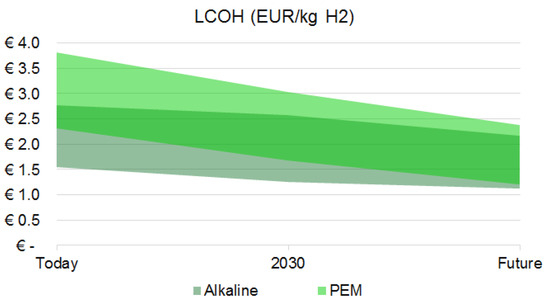

4.4. Findings from Techno-Economic Analysis

Figure 4 shows the projected reductions in the cost of green hydrogen produced in Iceland with alkaline and PEM electrolyzers (step 3 of the analysis). While currently, the LCOH for alkaline electrolyzers is lower, it is clear that PEMs could be cost-competitive in the future. The LCOH for alkaline electrolyzers ranges between EUR 1.5–2.8 per kg now, compared to EUR 2.1–3.6 per kg for PEMs. However, in the future, it is projected that the cost of production for both technologies could drop below EUR 1.5 per kg.

Figure 4.

Development of hydrogen production cost in Iceland using alkaline and PEM electrolyzers.

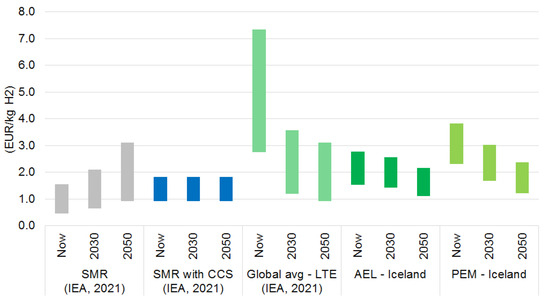

Figure 5 compares the levelized cost of green hydrogen production in Iceland with the global average and that of other technologies (the Steam Methane Reforming (SMR) of natural gas with and without carbon capture and storage (CCS), obtained from a recent IEA report [11].

Figure 5.

Comparison of the levelized cost of hydrogen production in Iceland with global estimates from the IEA, (2021) [11].

Iceland currently has an advantage because the cost of electricity from the grid is very low. This allows hydrogen production to run efficiently and at lower costs compared to competitors who rely on off-grid power sources like wind and solar energy, which are less consistent. However, Iceland is facing challenges with its electricity demand reaching its maximum supply, which some believe will limit hydrogen production. While wind power could be a promising option in the future, Iceland’s advantage may fade over time. As the cost of generating electricity from solar and wind energy continues to drop worldwide, countries with abundant renewable resources, like Australia, may become stronger competitors.

5. Discussion

The idea of a hydrogen economy has gained considerable attention in recent years, offering the potential to decarbonize multiple energy sectors while also aiding the integration of renewable energy (RE) into the broader energy system [42]. Iceland, uniquely situated on the Mid-Atlantic Rift in the high northern latitudes just below the Arctic Circle, is endowed with abundant RE resources that already supply its electricity needs entirely. However, other energy-intensive sectors, such as the heavy transport, marine, and aviation sectors, remain dependent on fossil fuels. Hydrogen and hydrogen-based energy carriers are often highlighted as potential enablers for a fully renewable energy system and present a potential solution for Iceland to decarbonize these sectors. Moreover, exporting hydrogen or hydrogen-derived chemicals could connect Iceland’s isolated energy system to global markets, presenting substantial business opportunities for the nation.

Despite these prospects, the hydrogen economy’s ability to fulfill its promises remains uncertain. Although green hydrogen was introduced as an alternative fuel over two decades ago, and despite Iceland’s abundant RE resources, the local green hydrogen economy has struggled to gain momentum [43,44]. This has to do with the rapidly increasing electricity demand of Icelandic society, which has led to a situation in which there has been little room for scaling up hydrogen production without major investments in production infrastructure.

Based on these premises, this study aimed to develop a stakeholder-based understanding of the current state of Iceland’s green hydrogen economy, identifying factors that support or hinder its progress. To achieve this, semi-structured interviews were conducted with stakeholders from various societal sectors and with different roles in the value chain in Iceland’s hydrogen economy. These interviews explored their experiences and perspectives, providing a multifaceted view of the hydrogen economy’s development in Iceland. Finally, the qualitative analysis was complemented with a techno-economic assessment of the LCOH in Iceland, with different production methods compared to the global production now and in the future.

The subsequent sections address the key findings from the stakeholder interviews and from the LCOH analysis in the context of the existing literature and discuss the study’s limitations and recommendations for future research. The LCOH analysis revealed that the estimated cost range for green hydrogen production in Iceland aligns with prior studies, underscoring the country’s potential to become an early leader in green hydrogen production. However, several factors must be considered when evaluating the techno-economic feasibility of green hydrogen in Iceland, as discussed by the interviewees.

A key issue is the source of power generation. While Iceland relies heavily on hydropower and geothermal energy, producing substantial quantities of green hydrogen for export would require significant investments in both power generation and transmission infrastructure. The required investments, together with a perceived lack of governmental support or access to EU-level funding, has kept the risk level too high, slowing the development of the hydrogen economy in Iceland. The stakeholders hoped for the government to incentivize investments and reduce the risks related to these investments. The involved stakeholders further saw expanding the Icelandic hydrogen economy as an opportunity to reduce dependence on foreign energy sources and therefore as an improvement in the energy security of Iceland. What remains as a debate, however, is if hydrogen should be seen primarily as a potential export product or as a local replacement for fossil fuels. Moreover, opinions about how to power large-scale green hydrogen production vary substantially. Many see wind power as something Iceland should scale up rapidly, as the windy conditions in the country make it an appealing option. At the same time, there are multiple barriers hindering the fast large-scale adoption of wind power. The interviewees also brought up the existing public opposition to the development of new power plants. It therefore seems unlikely that there will be major scaling up of hydrogen production in Iceland in the near future.

Apart from the domestic barriers in Iceland, from a global perspective, scaling up production in Iceland could support a climate-sustainable green transition. According to Dillman and Heinonen [12], only if hydrogen is produced from energy sources with very low GHG emissions, <0.48 kgCO2/kgH2, can it support staying within the carbon budget for global warming of <1.5 °C. The current Icelandic electricity emission intensity is ~0.028 kgCO2/kWh and therefore well below the boundary level. The achievement of increased rates of carbon capture and storage from geothermal power plants in the near future [45] and the expected large-scale adoption of wind power generation in the medium term will enable a further reduction in the emission intensity and enhanced compliance with the requirements set out by Dillman and Heinonen [12]. How other countries utilize the opportunities created by the declining RE installation prices and the improvements in their production efficiency and how this development affects Iceland’s position in the global market remain to be seen.

Further, how much growth the hydrogen economy will see will likely be highly influenced both by the factors seen in our interviews as well as additional factors relevant in other contexts. We saw in our interviews, as well as in the literature, that consistent political support will likely be needed to jump start and ensure the long-term economic viability of the hydrogen economy. This is needed because, as some of the stakeholders pointed out, there exists a ‘chicken-and-egg problem’ [49] on the supply and demand sides of the hydrogen economy, where the infrastructure is underdeveloped on both sides, and in order to spur development, the supply or demand side (and vice versa) will want to know that the other will be developed in step. Such development requires strong and consistent economic support if the technology is still some way from being economically competitive with the alternative of fossil fuels. This is challenging to ensure in unstable economic and geopolitical environments [50], however, and examples of wavering political support can be seen internationally.

For example, in the United States, a wavering commitment to stopping climate change has been a political back and forth according to the administration in charge [51]. The Biden administration enacted the Inflation Reduction Act (IRA) [52], which had specific policies providing significant economic incentives for hydrogen and renewable energy production. This is likely to be dismantled during the second Trump administration, which is likely to slow the pace of development. An example of the geopolitical factors which could additionally affect the development of the hydrogen economy can be seen in the EU as well, where immediately following the start of the Russian–Ukrainian conflict, the EU faced an energy crisis linked to the instability of natural gas imports. Faced with this crisis, the European Commission launched the REPower EU plan in 2022 [53], with expansive aims for the hydrogen economy. Since then, however, national European governments have not developed hydrogen strategies aligned with EU hydrogen targets, potentially partially due to lowering energy costs and rising inflation impacting the political priority to do so. The European Union Agency for the Cooperation of Energy Regulators (ACER) has since estimated that this lack of alignment presents the high likelihood that the EU will not achieve its own 2030 green hydrogen production targets [54].

If a decarbonized future is to be achieved and hydrogen is to play a key role, from stakeholder perspectives and a global view, it is likely that hydrogen will need stronger and more consistent political support to make it more economically viable and allow both the supply- and demand-side hydrogen technologies to proliferate.

Limitations and Future Study

Some limitations should be recognized when interpreting the results. First, the stakeholder selection was a potential source of bias. For this study, the interviewed stakeholders were identified by relying on the available literature and through brainstorming with experts in the field, and the selection was validated with a model of societal sectors and the hydrogen value chain. The selection can therefore be considered as relatively well balanced. However, in most cases, only one or two stakeholders were interviewed from each identified branch of the hydrogen supply chain. Moreover, no interviews were conducted with NGO member stakeholders, and only one interview was conducted with a member of the societal sector of civil society. The low number of interviewees within each branch of the hydrogen value chain, together with a lack of NGO representatives, might have led to missing perspectives. A higher number of interviewees within each branch of the hydrogen value chain could also have brought additional perspectives. However, one strength of qualitative interviews as a research method is that each interview can bring up something valuable, although such interviews seldom provide opportunities for generalizations without further research with broader samples. Another issue is that this study focused on production costs but did not account for the potentially high costs of hydrogen transport, which can be substantial, estimated by some studies to potentially range between 0.13 and 1.81 USD/kg, e.g., [46]. Further research is needed to identify the most efficient methods for shipping hydrogen—whether as a liquid or compressed gas—to international markets. Either method would likely add additional costs as well as lead to additional environmental impacts [47], which are important to monitor considering that increasing the decarbonization potential of green hydrogen is one of the primary goals of expanding its production. Understanding these costs is important, particularly in the current global inflationary environment, where green hydrogen would likely be used as an input to essential upstream industries like fertilizer, steel, and heavy-duty transportation industries [48]. It will be important to ensure that these costs do not lead to regressive impacts on lower-income households, with the potential to generate further pushback against the expansion of the production of fuel for a green transition, such as hydrogen [5,49].

6. Conclusions

To reach net-zero emissions by 2050, the global transition must prioritize energy efficiency, shifts in behavior, electrification, renewable energy, and hydrogen and hydrogen-based fuels, as well as carbon capture, utilization, and storage. Hydrogen, while not a standalone solution, plays a vital role in decarbonizing hard-to-abate sectors like steel production, chemical industries, heavy transport, shipping, and aviation. It can serve as a feedstock, energy carrier, or balancing agent in energy systems, enabling seasonal storage and load management.

This study highlights the critical role of hydrogen in the global transition to net-zero emissions by 2050, with a particular focus on Iceland’s potential as a hub for green hydrogen production and export. By examining the opportunities and challenges through stakeholder interviews, this research underscores the importance of hydrogen in decarbonizing hard-to-abate sectors such as heavy transport, maritime applications, and steel production. The study identifies key barriers, including high technology costs, a lack of government support, and policy uncertainty, while also recognizing Iceland’s competitive advantage in green hydrogen production due to its rich renewable energy potential. Based on the conducted research, several key policy implications and recommendations can be highlighted. First, to address the barriers of high hydrogen technology costs, insufficient government support, and policy uncertainty, it is essential for policymakers to implement clear, long-term strategies that provide financial incentives to reduce risks and encourage investment. These incentives could include subsidies, tax breaks, and public–private partnerships to stimulate the growth of the green hydrogen sector. Furthermore, given Iceland’s access to low-cost renewable energy, policymakers must act quickly to capitalize on this competitive advantage and develop a robust export strategy for hydrogen-based chemicals such as methanol and ammonia. By leveraging established global supply chains, Iceland can address domestic demand limitations and position itself as an early hydrogen exporter. Delaying investment could risk losing this opportunity, especially as global renewable electricity costs decline, making swift and decisive action critical to securing Iceland’s place in the emerging hydrogen economy. In terms of future research, further investigation is needed into the potential for exporting hydrogen-based chemicals, such as methanol and ammonia, which could help address Iceland’s limited domestic hydrogen demand. Research into the market demand, global supply chains, and pricing mechanisms will be critical for ensuring that hydrogen exports are competitive and sustainable in the long term. Moreover, as global renewable electricity costs are expected to decline, further research should examine how Iceland can maintain its competitive advantage in green hydrogen production, particularly amid growing international competition.

To address this, we are now investigating evolving policy trends, technological advancements, and global supply chain dynamics that may impact Iceland’s role as an early hydrogen exporter.

Author Contributions

Conceptualization, N.E., R.F. and J.H.; methodology, R.F. and J.H.; validation, N.E. and T.S.T.; formal analysis, N.E. and T.S.T.; investigation, N.E., R.F. and T.S.T.; data curation, N.E. and T.S.T.; writing—original draft preparation, N.E., R.F., K.J.D. and J.H.; writing—review and editing, N.E., R.F., T.S.T., K.J.D. and J.H.; visualization, N.E., R.F. and T.S.T.; supervision, R.F. and J.H.; project administration, J.H.; funding acquisition, N.E., R.F. and J.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Landsvirkjun (the national power company in Iceland).

Data Availability Statement

The data reported in this study will be available upon request from the corresponding author.

Acknowledgments

We thank the funding body and the interviewees for enabling this research.

Conflicts of Interest

The authors declare no conflicts of interest. The authors declare that this study received funding from Landsvirkjun. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Abbreviations

The following abbreviations are used in this manuscript:

| AEL | Alkaline Electrolyzer |

| CAPEX | Capital Expenditure |

| CCS | Carbon Capture and Storage |

| LTE | Low-Temperature Electrolyzer |

| OPEX | Operation Expenditure |

| PEM | Polymer Electrolyte Membrane |

| SMR | Steam Methane Reforming |

| SOECs | Solid Oxide Electrolysis Cells |

References

- White, L.V.; Fazeli, R.; Cheng, W.; Aisbett, E.; Beck, F.J.; Baldwin, K.G.H.; Howarth, P.; O’Neill, L. Towards emissions certification systems for international trade in hydrogen: The policy challenge of defining boundaries for emissions accounting. Energy 2021, 215, 119139. [Google Scholar] [CrossRef]

- Fazeli, R.; Beck, F.J.; Stocks, M. Recognizing the role of uncertainties in the transition to renewable hydrogen. Int. J. Hydrogen Energy 2022, 47, 27896–27910. [Google Scholar] [CrossRef]

- Griffiths, S.; Sovacool, B.K.; Kim, J.; Bazilian, M.; Uratani, J.M. Industrial decarbonization via hydrogen: A critical and systematic review of developments, socio-technical systems and policy options. Energy Res. Soc. Sci. 2021, 80, 102208. [Google Scholar] [CrossRef]

- IRENA. Geopolitics of the Energy Transformation: The Hydrogen Factor; IRENA: Abu Dhabi, United Arab Emirates, 2022. [Google Scholar]

- IEA. The Future of Hydrogen; IEA: Paris, France, 2019. [Google Scholar]

- Energy Transitions Commission. Making the Hydrogen Economy Possible: Accelerating Clean Hydrogen in an Electrified Economy; Energy Transitions Commission: London, UK, 2021. [Google Scholar]

- Energy Transitions Commission. Making Mission Possible: Delivering a Net-Zero Economy; Energy Transitions Commission: London, UK, 2020. [Google Scholar]

- Hydrogen Council. Hydrogen Scaling up: A Sustainable Pathway for the Global Energy Transition; Hydrogen Council: Belgium, Brussel, 2017. [Google Scholar]

- Hydrogen Council. Hydrogen Decarbonization Pathways: Potential Supply Scenarios; Hydrogen Council: Belgium, Brussel, 2022. [Google Scholar]

- IEA. Net Zero by 2050—A Roadmap for the Global Energy Sector; IEA: Paris, France, 2021. [Google Scholar]

- IEA. Global Hydrogen Review 2021; IEA: Paris, France, 2021. [Google Scholar]

- IEA. Global Hydrogen Review 2022; IEA: Paris, France, 2022. [Google Scholar]

- Dillman, K.; Heinonen, J. Towards a Safe Hydrogen Economy: An Absolute Climate Sustainability Assessment of Hydrogen Production. Climate 2023, 11, 25. [Google Scholar] [CrossRef]

- Ferrero, D.; Lanzini, A.; Santarelli, M.; Leone, P. A comparative assessment on hydrogen production from low- and high-temperature electrolysis. Int. J. Hydrogen Energy 2013, 38, 3523–3536. [Google Scholar] [CrossRef]

- Godula-Jopek, A. Hydrogen Production: By Electrolysis; John Wiley & Sons: Hoboken, NJ, USA, 2015. [Google Scholar]

- Pavel, C.C.; Cecconi, F.; Emiliani, C.; Santiccioli, S.; Scaffidi, A.; Catanorchi, S.; Comotti, M. Highly Efficient Platinum Group Metal Free Based Membrane-Electrode Assembly for Anion Exchange Membrane Water Electrolysis. Angew. Chemie Int. Ed. 2014, 53, 1378–1381. [Google Scholar] [CrossRef]

- El-Shafie, M. Hydrogen production by water electrolysis technologies: A review. Results Eng. 2023, 20, 101426. [Google Scholar] [CrossRef]

- European Commission. The European Green Deal; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Liao, G.; Wu, M. Photoreforming of lignocellulose into hydrogen. Innov. Energy 2024, 1, 100047. [Google Scholar] [CrossRef]

- Zhu, H.; Gou, L.; Li, C.; Fu, X.; Weng, Y.; Chen, L.; Fang, B.; Shuai, L.; Liao, G. Dual interfacial electric fields in black phosphorus/MXene/MBene enhance broad-spectrum carrier migration efficiency of photocatalytic devices. Device 2024, 2, 100283. [Google Scholar] [CrossRef]

- Li, C.; Lu, H.; Ding, G.; Ma, T.; Liu, S.; Zhang, L.; Liao, G. Interfacial coordination bonds accelerate charge separation for unprecedented hydrogen evolution over S-scheme heterojunction. Chinese J. Catal. 2024, 65, 174–184. [Google Scholar] [CrossRef]

- Karlsdottir, M.R.; Heinonen, J.; Palsson, H.; Palsson, O.P. High-Temperature Geothermal Utilization in the Context of European Energy Policy—Implications and Limitations. Energies 2020, 13, 3187. [Google Scholar] [CrossRef]

- Landsvirkjun Will Hydrogen Be Produced in Iceland for Export? Available online: https://icelandmonitor.mbl.is/news/news/2020/10/23/will_hydrogen_be_produced_in_iceland_for_export/ (accessed on 24 November 2020).

- Reigstad, G.A.; Roussanaly, S.; Straus, J.; Anantharaman, R.; de Kler, R.; Akhurst, M.; Sunny, N.; Goldthorpe, W.; Avignon, L.; Pearce, J.; et al. Moving toward the low-carbon hydrogen economy: Experiences and key learnings from national case studies. Adv. Appl. Energy 2022, 8, 100108. [Google Scholar] [CrossRef]

- Lebrouhi, B.E.; Djoupo, J.J.; Lamrani, B.; Benabdelaziz, K.; Kousksou, T. Global hydrogen development—A technological and geopolitical overview. Int. J. Hydrogen Energy 2022, 47, 7016–7048. [Google Scholar] [CrossRef]

- van der Spek, M.; Banet, C.; Bauer, C.; Gabrielli, P.; Goldthorpe, W.; Mazzotti, M.; Munkejord, S.T.; Røkke, N.A.; Shah, N.; Sunny, N.; et al. Perspective on the hydrogen economy as a pathway to reach net-zero CO2 emissions in Europe. Energy Environ. Sci. 2022, 15, 1034–1077. [Google Scholar] [CrossRef]

- Kuckshinrichs, W.; Ketelaer, T.; Koj, J.C. Economic Analysis of Improved Alkaline Water Electrolysis. Front. Energy Res. 2017, 5, 1. [Google Scholar] [CrossRef]

- Matute, G.; Yusta, J.M.; Correas, L.C. Techno-economic modelling of water electrolysers in the range of several MW to provide grid services while generating hydrogen for different applications: A case study in Spain applied to mobility with FCEVs. Int. J. Hydrogen Energy 2019, 44, 17431–17442. [Google Scholar] [CrossRef]

- Fragiacomo, P.; Genovese, M. Technical-economic analysis of a hydrogen production facility for power-to-gas and hydrogen mobility under different renewable sources in Southern Italy. Energy Convers. Manag. 2020, 223, 113332. [Google Scholar] [CrossRef]

- Viktorsson, L.; Heinonen, J.T.; Skulason, J.B.; Unnthorsson, R. A step towards the hydrogen economy—A life cycle cost analysis of a hydrogen refueling station. Energies 2017, 10, 763. [Google Scholar] [CrossRef]

- Franco, B.A.; Baptista, P.; Neto, R.C.; Ganilha, S. Assessment of offloading pathways for wind-powered offshore hydrogen production: Energy and economic analysis. Appl. Energy 2021, 286, 116553. [Google Scholar] [CrossRef]

- Overbeek, J.G.A. Cost-Effective Hydrogen Production: A Comparison of Uncertainties in the Levelized Cost of Hydrogen for the Dominant Hydrogen Production Pathways. Master’s Thesis, Utrecht University, Utrecht, The Netherlands, 2020. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman Publishing: Boston, MA, USA, 2010. [Google Scholar]

- Hurni, H.; Wiesmann, U. Transdisciplinarity in Practice. Experience from a Concept-based Research Programme Addressing Global Change and Sustainable Development. GAIA-Ecol. Perspect. Sci. Soc. 2014, 23, 275–277. [Google Scholar] [CrossRef]

- Leventon, J.; Fleskens, L.; Claringbould, H.; Schwilch, G.; Hessel, R. An applied methodology for stakeholder identification in transdisciplinary research. Sustain. Sci. 2016, 11, 763–775. [Google Scholar] [CrossRef] [PubMed]

- Durham, E.; Baker, H.; Smith, M.; Moore, E.; Morgan, V. Stakeholder Engagement Handbook; The Biodiversa: Paris, France, 2014. [Google Scholar]

- Gunnarsdóttir, I.; Davíðsdóttir, B.; Worrell, E.; Sigurgeirsdottir, S. It is best to ask: Designing a stakeholder-centric approach to selecting sustainable energy development indicators. Energy Res. Soc. Sci. 2021, 74, 101968. [Google Scholar] [CrossRef]

- Gunnarsdóttir, I. Towards Sustainable Energy Development: Sustainability Indicators and Stakeholders. Ph.D. Thesis, University of Iceland, Reykjavik, Iceland, 2020. [Google Scholar]

- Sivill, L.; Bröckl, M.; Semkin, N.; Ruismäki, A.; Pilpola, H.; Laukkanen, O.; Lehtinen, H.; Takamäki, S.; Vasara, P.; Patronen, J. Hydrogen Economy—Opportunities and Limitations; Prime Minister’s Office: Helsinki, Finland, 2022. [Google Scholar]

- Perruchoud, R.; Vögeli, G.; Finger, D.C. Opportunities and drivers for green hydrogen production from renewable energy: Constructing of a causal loop diagram from stakeholders perspective in Iceland. In Proceedings of the 24th EGU General Assembly, Vienna, Austria, 23–27 May 2022. [Google Scholar]

- Ngumbi, D.E.; Edward, O.M. Qualitative inter-viewing. Sch. J. Arts Humanit. Soc. Sci. 2015, 3, 1053–1059. [Google Scholar]

- Rubin, H.; Rubin, I. Qualitative Interviewing, (): The Art of Hearing Data, 2nd ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2005. [Google Scholar]

- Kallio, H.; Pietilä, A.-M.; Johnson, M.; Kangasniemi, M. Systematic methodological review: Developing a framework for a qualitative semi-structured interview guide. J. Adv. Nurs. 2016, 72, 2954–2965. [Google Scholar] [CrossRef]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students; Pearson Education Limited: London, UK, 2009. [Google Scholar]

- Holladay, J.D.; Hu, J.; King, D.L.; Wang, Y. An overview of hydrogen production technologies. Catal. Today 2009, 139, 244–260. [Google Scholar] [CrossRef]

- Guest, G.; Bunce, A.; Johnson, L. How Many Interviews Are Enough?: An Experiment with Data Saturation and Variability. Field Methods 2006, 18, 59–82. [Google Scholar] [CrossRef]

- IEA. Global Average Levelized Cost of Hydrogen Production by Energy Source and Technology, 2019 and 2050; IEA: Paris, France, 2020. [Google Scholar]

- Fraunhofer Institute for Systems and Innovation Research ISI. Electricity Costs of Energy Intensive Industries in Iceland—A Comparison with Energy Intensive Industries in Selected Countries; Fraunhofer Institute for Systems and Innovation Research ISI: Karlsruhe, Germany, 2020. [Google Scholar]

- Kayacik, S.E.; Basciftci, B.; Schrotenboer, A.H.; Vis, I.F.A.; Ursavas, E. Hydrogen Network Expansion Planning considering the Chicken-and-egg Dilemma and Market Uncertainty. arXiv 2025, arXiv2501.03744. [Google Scholar]

- de Graaf, T.; Overland, I.; Scholten, D.; Westphal, K. The new oil? The geopolitics and international governance of hydrogen. Energy Res. Soc. Sci. 2020, 70, 101667. [Google Scholar] [CrossRef]

- Burgess, M.G.; Van Boven, L.; Wagner, G.; Wong-Parodi, G.; Baker, K.; Boykoff, M.; Converse, B.A.; Dilling, L.; Gilligan, J.M.; Inbar, Y. Supply, demand and polarization challenges facing US climate policies. Nat. Clim. Change 2024, 14, 134–142. [Google Scholar] [CrossRef]

- US Government. Inflation Reduction Act of 2022; US Government: Washington, DC, USA, 2022.

- European Commission. REPowerEU: Joint European Action for More Affordable, Secure and Sustainable Energy; European Commission: Strasbourg, France, 2022. [Google Scholar]

- ACER. European Hydrogen Markets 2024 Market Monitoring Report; ACER: Camberwel, UK, 2024. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).