Petroleum Consumption and Financial Development: Evidence from Selected EMEs: Panel ARDL-PMG Approach

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Framework

2.1.1. Energy-Led Growth (ELG) Hypothesis

2.1.2. Financial Development-Energy Consumption Nexus

2.1.3. Resource Curse Hypothesis

2.1.4. The Dutch Disease Theory

2.1.5. Institutional Theory

2.1.6. Financialization Perspective

2.1.7. Integrated Conceptual Model

- ELG-consistent outcome: Petroleum consumption enhances financial development via energy-driven growth.

- Resource curse/Dutch disease outcome: Petroleum dependence undermines financial development through volatility, rent-seeking, and structural distortions.

- Institutionally moderated outcome: The sign and magnitude of the petroleum–finance relationship depend on the quality of governance and the maturity of the financial market.

2.2. Empirical Literature Review on the Petroleum Consumption and Financial Development Nexus

2.2.1. Positive Long-Run Effects

2.2.2. Mixed or Negative Findings

2.2.3. Gaps in the Literature

3. Data and Methodology

3.1. Data and Variables

3.1.1. Descriptive Statistics

3.1.2. Cross-Correlation Analysis

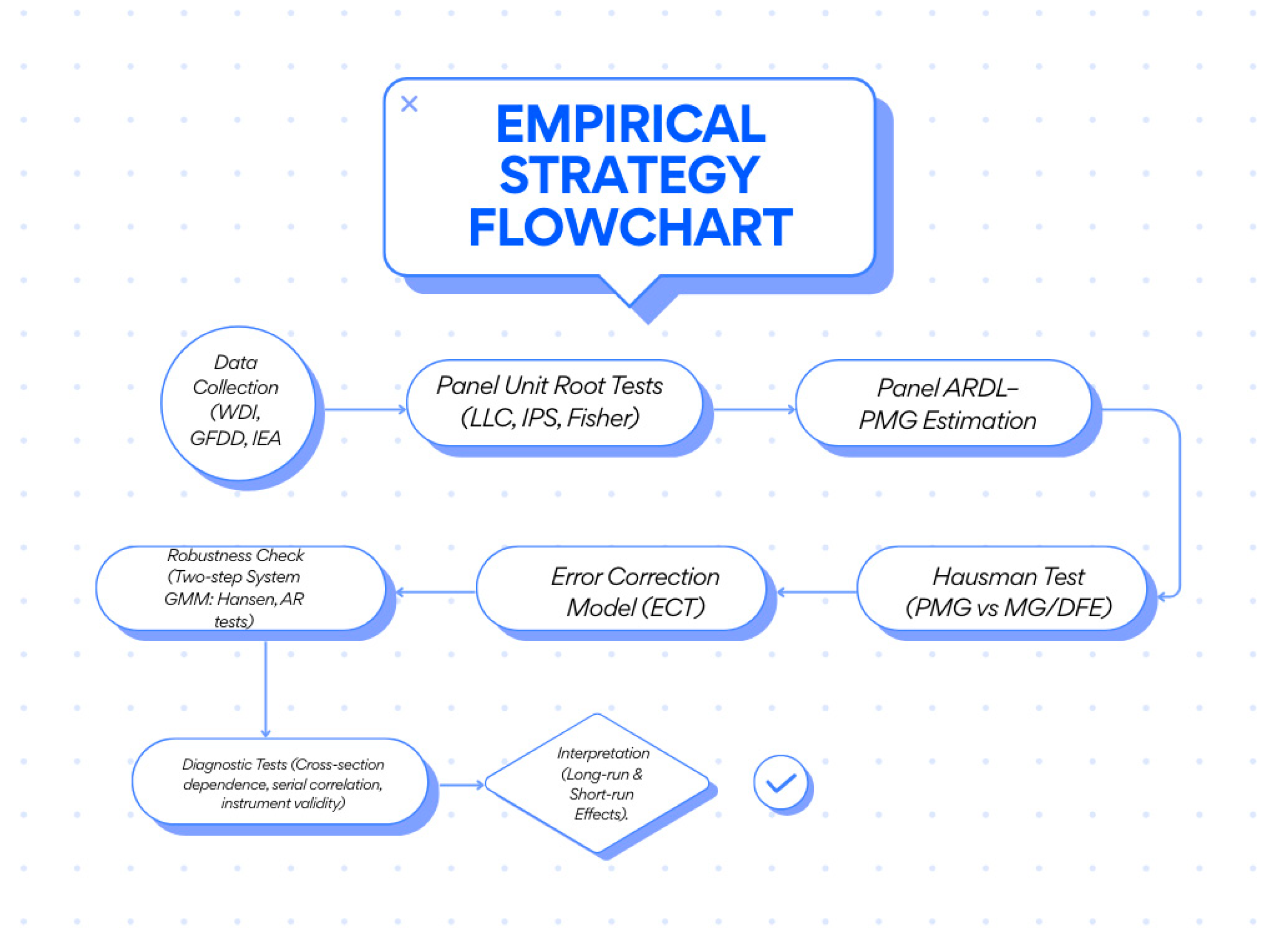

3.2. Methodology

3.2.1. Panel Unit Root Test

3.2.2. Empirical Analysis

Model Specification and Estimation Techniques

- = The change in Financial Development for country i at time t.

- = The error correction term captures the long-run equilibrium relationship between financial development (FD), petroleum consumption (PC), and economic growth (EG). The term represents the speed of adjustment back to equilibrium.

- = The lagged changes in financial development, accounting for short-term dynamics.

- = The short-run effects of changes in energy development and economic growth, respectively.

- = The country-specific fixed effect.

- = The error term or disturbance.

Robustness Check: Two-Step System GMM

- ΔFDit: Changes in financial development.

- = lagged changes in financial development.

- = cumulative changes in petroleum consumption.

- = cumulative changes in economic growth.

- = changes in other explanatory variables (FDI, infrastructure, inflation, government effectiveness, prices, natural resources, and real interest rates).

- = dummy variables (global financial crisis and the COVID-19 pandemic).

- = Error term capturing unobserved factors.

3.2.3. PMG Estimation

4. Discussion

4.1. Error Correction Model

4.2. Long-Run Relationships

Control Variables

4.3. Short-Run Relationships

5. Conclusions and Policy Implications

Limitations and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | No Trend | Intercept and Trend | Individual Effects | Decision |

|---|---|---|---|---|

| (a): Panel Unit Root Test Using the LLC | ||||

| PC | −7.72546 *** | 2.95045 *** | 3.08854 *** | I (1) |

| FD | −12.5368 *** | −5.76010 *** | −7.01951 *** | I (1) |

| EG | −9.00243 *** | −14.1579 *** | −14.8932 *** | I (1) |

| FDI | −3.73481 *** | −3.84931 *** | −3.59057 *** | I (1) |

| (b): Panel unit root tests using IPS | ||||

| PC | - | −1.54789 *** | −3.68186 *** | I (1) |

| EG | - | −7.32238 *** | −8.86368 *** | I (1) |

| FD | - | −6.80194 *** | −8.89608 *** | I (1) |

| FDI | - | −3.15388 *** | −4.64037 *** | I (1) |

| (c): Panel unit root testing using ADF—Fisher chi-square | ||||

| PC | 205.413 ** | 121.031 *** | 155.718 *** | I (1) |

| EG | 162.126 *** | 119.625 *** | 165.202 *** | I (1) |

| PC | 131.662 *** | 57.1864 *** | 82.3936 *** | I (1) |

| FDI | 58.5960 *** | 69.1745 *** | 95.5074 *** | I (1) |

| (d): Panel unit root testing via PP—Fisher chi-square | ||||

| FD | 342.526 *** | 282.882 *** | 338.690 *** | I (1) |

| EG | 288.937 *** | 183.140 *** | 211.156 *** | I (1) |

| PC | 236.900 *** | 142.993 *** | 169.306 *** | I (1) |

| FDI | 62.4167 *** | 99.6138 *** | 125.058 *** | I (1) |

| PMG D.FD | PMG D.PC | PMG D.EG | PMG D. FDI | 2-Step System GMM FD | |

|---|---|---|---|---|---|

| Long-Run | |||||

| EG | 0.0252 ** (5.11) | −0.0420 *** (−3.32) | −0.216 (1.66) | 0.0105 ** (0.00407) | |

| PC | 0.0664 *** (1.19) | 6.644 *** (2.05) | 5.586 *** (−9.63) | 0.149 ** (0.0472) | |

| FD | 0.850 *** (14.68) | 18.35 ** (−2.65) | 0.241 (0.17) | 0.532 *** (0.116) | |

| FDI | 0.0186 *** (9.91) | 0.00773 *** (1.77) | −0.0815 (−1.24) | 0.000201 *** (0.0000531) | |

| ECT | −0.210 *** (−3.79) | −0.140 ** (−2.86) | −0.0224 *** (−1.34) | −0.599 *** (−7.66) | |

| Short-Run | |||||

| D.EconGR | 0.0196 (0.77) | 0.0584 (0.88) | −1.672 (−0.89) | ||

| D.PC | 0.0264 (0.34) | 0.891 (1.01) | −18.33 (−0.79) | ||

| FD | −0.0516 (−0.70) | −0.629 (−0.57) | 14.16 (0.88) | ||

| D. FDI | 0.000416 (−0.21) | −0.00186 (−1.15) | 0.0329 (0.96) | ||

| _cons | 0.00723 (1.16) | 0.365 ** (2.70) | −0.138 (−1.26) | 10.93 *** (7.54) | |

| Dummy1 | 0.00432 (0.00497) | ||||

| Dummy2 | 0.0205 *** (0.00333) | ||||

| N | 399 | 399 | 399 | 399 | 359 |

| Groups | - | - | - | - | 20 |

| Instruments | - | - | - | - | 14 |

| Arellano Bond AR 1 | - | - | - | - | −2.97 |

| Arrellano Bond AR 2 | - | - | - | - | −0.51 |

| Sargan Test | 41.38 | ||||

| Hansen Test | - | - | - | - | 9.69 |

| Hausman | 44.75 *** | 39.55 *** | 64.80 *** | 9.42 * |

| PMG D.FD | MG D.FD | DFE D.FD | |

|---|---|---|---|

| Long Run | |||

| EG | 0.0252 *** (5.11) | −0.559 (−1.36) | 0.0191 (1.72) |

| PC | 0.0664 (1.19) | −1.689 (−0.54) | 0.337 *** (3.64) |

| FDI | 0.0186 *** (9.91) | −0.0384 (−1.79) | 0.00186 (1.31) |

| ECT | −0.210 *** (−3.79) | −0.455 *** (−6.06) | −0.184 *** (−6.04) |

| Short Run | |||

| D.EG | 0.0196 (0.77) | 0.0709 * (2.12) | −0.00426 (−1.03) |

| D.PC | 0.0264 (0.34) | −0.0519 (−0.79) | −0.0279 (−0.64) |

| D. FDI | −0.000416 (−0.21) | 0.00141 (0.71) | −0.000219 (−0.95) |

| _cons | 0.00723 (1.16) | −0.257 (−1.12) | −0.118 (−1.95) |

| N | 399 | 399 |

| PMG D.PC | MG D.PC | DFE D.PC | |

|---|---|---|---|

| Long Run | |||

| FD | 0.850 *** (14.68) | −0.225 (−0.27) | 0.686 ** (3.12) |

| EG | −0.0420 *** (−3.32) | 0.352 * (2.06) | −0.0329 (−1.82) |

| FDI | 0.00773 (1.77) | −0.00235 (−0.21) | −0.00109 (−0.48) |

| ECT | −0.140 ** (−2.86) | −0.404 *** (−6.01) | −0.134 *** (−5.29) |

| Short Run | |||

| D.FD | −0.0516 (−0.70) | −0.190 (−1.50) | −0.0436 (−0.70) |

| D.EG | 0.0584 (0.88) | −0.0630 (−0.91) | −0.000147 (−0.03) |

| D. FDI | −0.00186 (−1.15) | 0.000207 (0.06) | 0.0000418 (0.15) |

| _cons | 0.365 ** (2.70) | 0.292 (0.83) | 0.382 *** (5.49) |

| N | 399 | 399 |

| PMG D.EG | MG D.EG | DFE D.EG | |

|---|---|---|---|

| Long Run | |||

| FD | −18.35 ** (−2.65) | −0.0505 (−0.01) | 3.031 (1.29) |

| PC | 6.644 * (2.05) | 1.599 (0.40) | −3.280 * (−2.04) |

| FDI | −0.0815 | 0.0945 | 0.0184 |

| (−1.24) | (0.72) | (0.92) | |

| ECT | −0.0224 ** (−1.34) | −0.379 *** (−5.87) | −0.157 *** (−6.37) |

| Short Run | |||

| D.FD | −0.629 (−0.57) | −2.133 (−0.78) | −0.585 (−0.93) |

| D.PC | 0.891 (1.01) | (1.49) | 0.0438 (0.08) |

| D. FDI | 0.0329 (0.96) | 0.0206 (0.80) | −0.00235 (−0.85) |

| _cons | −0.138 (−1.26) | 2.705 (0.90) | 2.155 ** (2.97) |

| N | 399 | 399 |

| PMG | MG | DFE | |

|---|---|---|---|

| D.FDI | D.FDI | D.FDI | |

| Long Run | |||

| FD | 0.241 (0.17) | −4.989 (−0.66) | −11.74 (−0.87) |

| EG | 0.216 (1.66) | 4.995 (0.81) | 0.551 (0.61) |

| PC | 5.586 *** (−9.63) | 15.91 (0.93) | 10.08 (1.09) |

| ECT | −0.599 *** (−7.66) | −0.882 *** (−10.96) | −0.700 *** (−10.70) |

| Short Run | |||

| D.FD | 14.16 (0.88) | 11.66 (0.72) | 18.72 (1.23) |

| D.EG | −1.672 (−0.89) | −2.143 (−1.05) | −0.0753 (−0.06) |

| D.PC | −18.33 (−0.79) | −32.08 (−0.96) | −13.33 (−1.05) |

| _cons | 10.93 *** (7.54) | −38.27 (−1.24) | −16.93 (−0.96) |

| N | 399 | 399 |

References

- Mmbaga, N.F.; Kulindwa, Y.J. Energy Consumption and Economic Growth: Evidence from Electricity and Petroleum in Eastern Africa Region. Clean Energy Sustain. 2024, 2, 10019. [Google Scholar] [CrossRef]

- Alshubiri, F.N.; Tawfik, O.I.; Jamil, S.A. Impact of petroleum and non-petroleum indices on financial development in Oman. Financ. Innov. 2020, 6, 15. [Google Scholar] [CrossRef]

- Huang, Y.; Bebi, B.B.; Ladtakoun, S. Does financial development have an impact on mineral resource rents? Evid. China. Miner. Econ. 2025, 38, 337–357. [Google Scholar] [CrossRef]

- Javed, H.; Du, J.; Iqbal, S.; Nassani, A.A.; Basheer, M.F. The impact of mineral resource abundance on environmental degradation in ten mineral- rich countries: Do the green innovation and financial technology matter? Resour. Policy 2024, 90, 104706. [Google Scholar] [CrossRef]

- Okolo, C.V.; Wen, J.; Susaeta, A. Maximizing natural resource rent economics: The role of human capital development, financial sector development, and open-trade economies in driving technological innovation. Environ. Sci. Pollut. Res. Int. 2024, 31, 4453–4477. [Google Scholar] [CrossRef]

- Paramati, S.R.; Ummalla, M.; Apergis, N. The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ. 2016, 56, 29–41. [Google Scholar] [CrossRef]

- Krzemień, A.; Riesgo Fernández, P.; Suárez Sánchez, A.; Diego Álvarez, I. Beyond the pan-european standard for reporting of exploration results, mineral resources and reserves. Resour. Policy 2016, 49, 81–91. [Google Scholar] [CrossRef]

- International Energy Agency. World Energy Outlook 2024; International Energy Agency: Paris, France, 2024. [Google Scholar]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Odhiambo, N.M. Energy consumption and financial development in south africa: An empirical investigation. Ekon. Pregl. 2019, 70, 41–61. [Google Scholar] [CrossRef]

- Behera, J. Examined the Energy-Led Growth Hypothesis in India: Evidence from Time Series Analysis. Energy Econ. Lett. 2015, 2, 46–65. [Google Scholar] [CrossRef]

- Apergis, N.; Tang, C.F. Is the energy-led growth hypothesis valid? New evidence from a sample of 85 countries. Energy Econ. 2013, 38, 24–31. [Google Scholar] [CrossRef]

- Durusu-Ciftci, D.; Soytas, U.; Nazlioglu, S. Financial development and energy consumption in emerging markets: Smooth structural shifts and causal linkages. Energy Econ. 2020, 87, 104729. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance and Growth: Schumpeter Might Be Right. Q. J. Econ. 1993, 108, 717–737. [Google Scholar] [CrossRef]

- Samadi, A.H.; Owjimehr, S.; Nezhad Halafi, Z. The cross-impact between financial markets, COVID-19 pandemic, and economic sanctions: The case of Iran. J. Policy Model 2021, 43, 34–55. [Google Scholar] [CrossRef]

- Rousseau, P.L.; Wachtel, P. What is happening to the impact of financial deepening on economic growth? Econ. Inq. 2011, 49, 276–288. [Google Scholar] [CrossRef]

- Shan, J.; Jianhong, Q. Does Financial Development ‘Lead’ Economic Growth? The Case of China. Ann. Econ. Financ. 2006, 1, 197–216. [Google Scholar]

- Chung, C.; Jin, T. Revealing the role of institutional quality and geopolitical risk in natural resources curse hypothesis. Resour. Policy 2025, 100, 105457. [Google Scholar] [CrossRef]

- Rahim, S.; Murshed, M.; Umarbeyli, S.; Kirikkaleli, D.; Ahmad, M.; Tufail, M.; Wahab, S. Do natural resources abundance and human capital development promote economic growth? A study on the resource curse hypothesis in Next Eleven countries. Resour. Environ. Sustain. 2021, 4, 100018. [Google Scholar] [CrossRef]

- Badeeb, R.A.; Lean, H.H.; Clark, J. The evolution of the natural resource curse thesis: A critical literature survey. Resour. Policy 2017, 51, 123–134. [Google Scholar] [CrossRef]

- Hasanov, F.J.; Aliyev, R.; Taskin, D.; Suleymanov, E. Oil rents and non-oil economic growth in CIS oil exporters. The role of financial development. Resour. Policy 2023, 82, 103523. [Google Scholar] [CrossRef]

- Tatjana, S.; Hristoski, I. How the Macroeconomic Determinants Underpin the Capital Market Development in North Macedonia? Manag. Mark. 2022, 20, 286–325. [Google Scholar] [CrossRef]

- Wanzala, R.W.; Obokoh, L.O. Sustainability Implications of Commodity Price Shocks and Commodity Dependence in Selected Sub-Saharan Countries. Sustainability 2024, 16, 8928. [Google Scholar] [CrossRef]

- Karl, T.L. The Perils of the Petro-State: Reflections on the Paradox of Plenty. J. Int. Aff. 1999, 53, 31–48. [Google Scholar]

- Corden, W.M.; Neary, J.P. Booming Sector and De-Industrialisation in a Small Open Economy. Econ. J. 1982, 92, 825–848. [Google Scholar] [CrossRef]

- Xu, Q.; Meng, T.; Sha, Y.; Jiang, X. Volatility in metallic resources prices in COVID-19 and financial Crises-2008: Evidence from global market. Resour. Policy 2022, 78, 102927. [Google Scholar] [CrossRef] [PubMed]

- Makoni, P.L.; Marozva, G. The nexus between foreign portfolio investment and financial market development: Evidence from Mauritius. Acad. Strateg. Manag. J. 2018, 17, 1–17. [Google Scholar]

- Billmeier, A.; Massa, I. What drives stock market development in emerging markets-institutions, remittances, or natural resources? Emerg. Mark. Rev. 2009, 10, 23–35. [Google Scholar] [CrossRef]

- Addison, T.; Roe, A.R. Extractive Industries: Transforming Companies for Better Development Outcomes; UNU-WIDER: Helsinki, Finland, 2024; Volume 2024. [Google Scholar] [CrossRef]

- Nxumalo, I.S.; Makoni, P.L. Analysis of international capital inflows and institutional quality in emerging markets. Economies 2021, 9, 179. [Google Scholar] [CrossRef]

- Asongu, S.A.; Odhiambo, N.M. Foreign direct investment, information technology and economic growth dynamics in Sub-Saharan Africa. Telecomm. Policy 2020, 44, 101838. [Google Scholar] [CrossRef]

- Epstein, G.A. Financialization and the World Economy; Edward Elgar Publishing: Northampton, MA, USA, 2005. [Google Scholar]

- Lapavistas, C.; Mendieta-Munoz, I. The Profits of Financialization. Mon. Rev. 2016, 68, 49–62. [Google Scholar] [CrossRef] [PubMed]

- Zhang, R.; Ben Naceur, S. Financial development, inequality, and poverty: Some international evidence. Int. Rev. Econ. Financ. 2019, 61, 1–16. [Google Scholar] [CrossRef]

- Chen, J.E.; Tan, Y.L.; Lee, C.Y.; Goh, L.T. Petroleum Consumption and Financial Development in Malaysia. Int. J. Manag. Stud. 2016, 23, 27–44. [Google Scholar] [CrossRef]

- Huang, Y. Determinants of Financial Development; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Baltagi, B.H. Econometric Analysis of Panel Data, 3rd ed.; Rohn Wiley: Hoboken, NJ, USA, 2005. [Google Scholar]

- Hsiao, C. Analysis of Panel Data, 3rd ed.; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Nkalu, C.N.; Ugwu, S.C.; Asogwa, F.O.; Kuma, M.P.; Onyeke, Q.O. Financial Development and Energy Consumption in Sub-Saharan Africa: Evidence from Panel Vector Error Correction Model. Sage Open 2020, 10, 2158244020935432. [Google Scholar] [CrossRef]

- Toktaş, Y.; Bozkurt, E.; Altiner, A. Energy Consumption and Financial Development: Evidence from MENA Countries with Panel Hidden Cointegration Energy Consumption and Financial Development: Evidence from MENA Countries with Panel Hidden Cointegration Enerji Tüketimi ve Finansal Gelişme: Saklı Eşbütünleşme ile MENA Ülkelerinden Kanıtlar. J. Homepage: Cointegration J. Emerg. Econ. Policy 2022, 7, 253. [Google Scholar]

- Nguyen, H.M.; Hoang Bui, N.; Vo, H.; Mcaleer, M. Energy Consumption and Economic Growth: Evidence from Vietnam. J. Rev. Glob. Econ. 2019, 8, 350–361. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Shin, Y.; Pesaran, M.H. Discussion Paper Series Number 16 Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Economics 1998, 44, 1–27. [Google Scholar]

- Narayan, K. Fiji’s tourism demand: The ARDL approach to cointegration. Tour. Econ. 2004, 10, 193–206. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Bertsatos, G.; Sakellaris, P.; Tsionas, M.G. Extensions of the Pesaran, Shin and Smith (2001) bounds testing procedure. Empir. Econ. 2021, 61, 1719–1742. [Google Scholar] [CrossRef]

- Wehncke, F.C.; Marozva, G.; Makoni, P.L. Economic Growth, Foreign Direct Investments and Official Development Assistance Nexus: Panel ARDL Approach. Economies 2023, 11, 4. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Belloni, A.; Hansen, C.; Newey, W. High-dimensional linear models with many endogenous variables. J. Econom. 2022, 228, 4–26. [Google Scholar] [CrossRef]

- Areliano, M.; Boverb, O. Another look at the instrumental variable estimation of error-components models. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Nwafor, F.U.; Kalu, E.U.; Arize, A.C.; Onwumere, J.U.J. Spatiotemporal analysis of energy consumption and financial development in African OPEC countries. Int. J. Energy Sect. Manag. 2023, 17, 925–949. [Google Scholar] [CrossRef]

- Shahbaz, M.; Zakaria, M.; Shahzad, S.J.H.; Mahalik, M.K. The energy consumption and economic growth nexus in top ten energy-consuming countries: Fresh evidence from using the quantile-on-quantile approach. Energy Econ. 2018, 71, 282–301. [Google Scholar] [CrossRef]

- Achuo, E.D.; Kakeu, P.B.C.; Asongu, S.A. EDWRG Working Paper Series Financial development, human capital and energy transition: A global comparative analysis. Int. J. Energy Sect. Manag. 2023, 19, 59–80. [Google Scholar] [CrossRef]

- Doytch, N.; Narayan, S. Does FDI influence renewable energy consumption? An analysis of sectoral FDI impact on renewable and non-renewable industrial energy consumption. Energy Econ. 2016, 54, 291–301. [Google Scholar] [CrossRef]

- Zou, G.; Chau, K.W. Short- and long-run effects between oil consumption and economic growth in China. Energy Policy 2006, 34, 3644–3655. [Google Scholar] [CrossRef]

- Lefatsa, P.M.; Sibanda, K.; Garidzirai, R. The relationship between financial development and energy consumption in South Africa. Economies 2021, 9, 158. [Google Scholar] [CrossRef]

- Agboola, E.; Chowdhury, R.; Yang, B. Oil price fluctuations and their impact on oil-exporting emerging economies. Econ. Model 2024, 132, 106665. [Google Scholar] [CrossRef]

- Çoban, S.; Topcu, M. The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ. 2013, 39, 81–88. [Google Scholar] [CrossRef]

| Authors | Time | Countries | Methodology | Results |

|---|---|---|---|---|

| [1] | 2000–2020 | 12 Eastern African Countries | Driscoll–Kraay Fixed Effects Model | Petroleum consumption has a significant impact on economic growth both in the short and long term, and economies that heavily rely on it are susceptible to fluctuations in global oil prices. |

| [2] | 1978–2017 | Oman | ARDL Model | Petroleum consumption has a significant positive impact on financial development in the long run, but an insignificant effect in the short run due to fluctuations in oil prices. |

| [36] | 1990–2020 | China | ARDL Model, Toda–Yamamoto test | Financial development and mineral resource rents have a positive and statistically significant long-term relationship, but the short-term relationship is negligible. |

| [35] | 1990–2015 | Malaysia | ARDL framework, Granger Causality test | Petroleum consumption has a positive impact on financial development in both the short and long run, indicating a bidirectional causal relationship. |

| Variable | Definition of Variables | Data Source | Expected Sign |

|---|---|---|---|

| Dependent Variable | |||

| FD | The Financial Development Index measures the breadth and depth of financial markets. | World Bank’s Global Financial Development Database (2023) | N/A |

| Independent Variables | |||

| PC | Petroleum consumption (millions of barrels/d) | International Energy Agency | +/− |

| EG | Real GDP per capita | World Development Indicators | +/− |

| FDI | Foreign Direct Investment | World Development Indicators | + |

| Mean | Median | Minimum | Maximum | Std Dev. | Skewness | Kurtosis | Jarque-Bera | Obser | |

|---|---|---|---|---|---|---|---|---|---|

| FD | 0.42 | 0.42 | 0.09 | 0.74 | 0.14 | 0.08 | 2.39 | 6.90 | 419 |

| PC | 1513.04 | 717.32 | 50.06 | 14,432.72 | 2172.24 | 3.50 | 17.27 | 4413.54 | 419 |

| EG | 8264.37 | 6141.83 | 755.48 | 59,986.44 | 9618.28 | 3.51 | 13.50 | 4062.22 | 419 |

| FDI | 3.08 | 219 | −40.09 | 106.60 | 7.81 | 7.76 | 93.34 | 146,682.60 | 419 |

| Variables | FD | PC | EG | FDI |

|---|---|---|---|---|

| FD | 1 | |||

| PC | 0.2947 *** | 10,000 | ||

| EG | −0.2951 *** | −0.0266 | 1 | |

| FDI | 0.0977 ** | −0.0564 | −0.0788 | 1 |

| PC → FD | 0.0664 *** | Petroleum consumption boosts financial development |

| FD → PC | 0.850 *** | Financial development increases petroleum consumption |

| EG → FD | 0.0252 ** | Growth stimulates the financial sector |

| EG → PC | −0.0420 *** | Growth reduces petroleum reliance (possible diversification) |

| FDI → FD | 0.0186 *** | FDI supports financial development |

| ECT (FD) | −0.210 *** | 21% adjustment speed |

| ECT (PC) | −0.140 ** | 14% adjustment speed |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mugodzva, C.; Marozva, G. Petroleum Consumption and Financial Development: Evidence from Selected EMEs: Panel ARDL-PMG Approach. Energies 2025, 18, 5892. https://doi.org/10.3390/en18225892

Mugodzva C, Marozva G. Petroleum Consumption and Financial Development: Evidence from Selected EMEs: Panel ARDL-PMG Approach. Energies. 2025; 18(22):5892. https://doi.org/10.3390/en18225892

Chicago/Turabian StyleMugodzva, Collen, and Godfrey Marozva. 2025. "Petroleum Consumption and Financial Development: Evidence from Selected EMEs: Panel ARDL-PMG Approach" Energies 18, no. 22: 5892. https://doi.org/10.3390/en18225892

APA StyleMugodzva, C., & Marozva, G. (2025). Petroleum Consumption and Financial Development: Evidence from Selected EMEs: Panel ARDL-PMG Approach. Energies, 18(22), 5892. https://doi.org/10.3390/en18225892