Harnessing ESG Sustainability, Climate Policy Uncertainty and Information and Communication Technology for Energy Transition

Abstract

1. Introduction

- What is the effect of ESG sustainability on energy transition?

- How does ICT impact energy transition?

- Does financial development influence energy transition?

- What role does climate policy uncertainty play in fostering energy transition?

Novelty of this Study

2. Theoretical Underpinning and Empirical Review

2.1. Theoretical Underpinning

2.2. Empirical Review

2.3. Gap in the Literature

3. Data and Methods

3.1. Data

3.2. Method

4. Results of Analysis

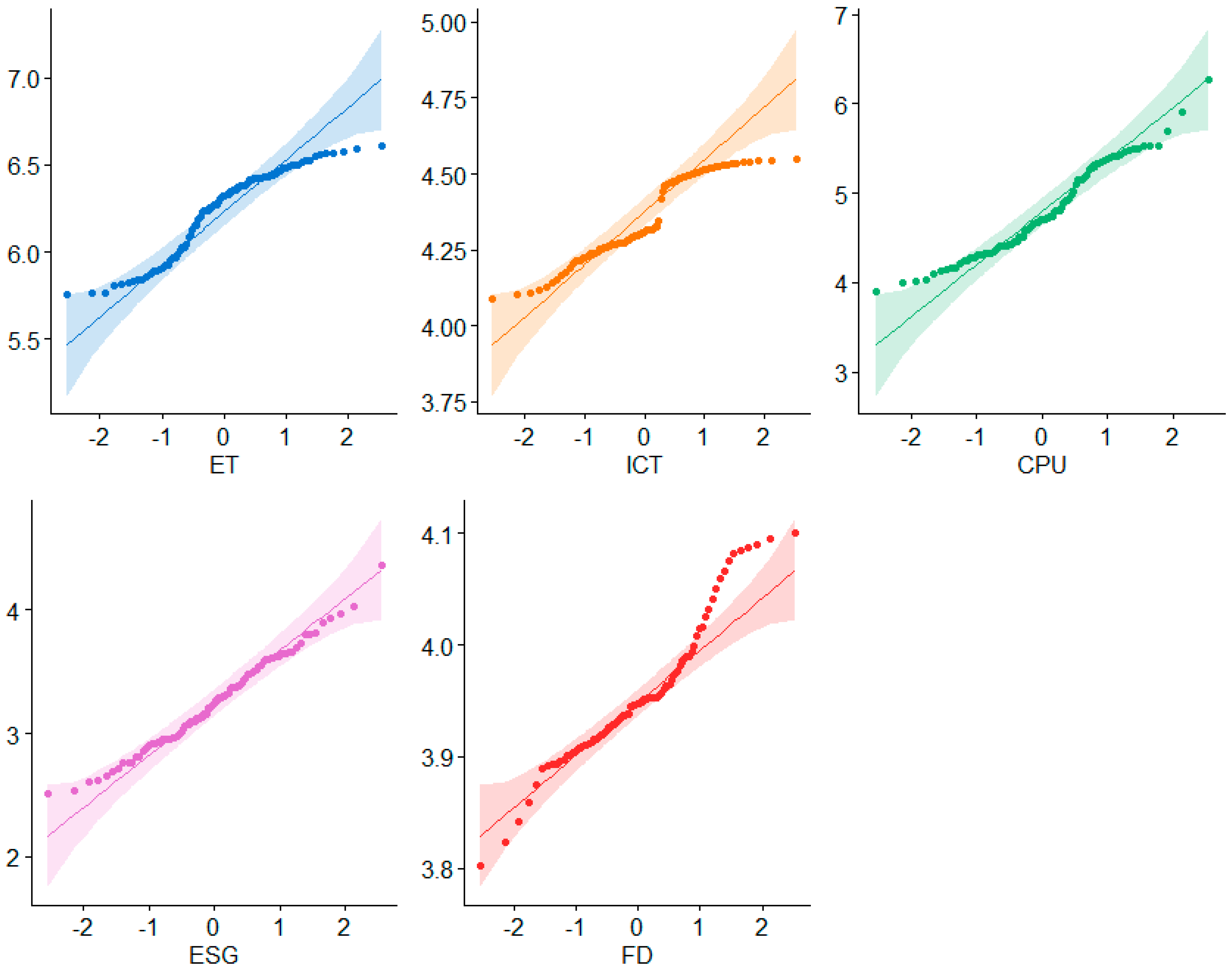

4.1. Descriptive Statistics

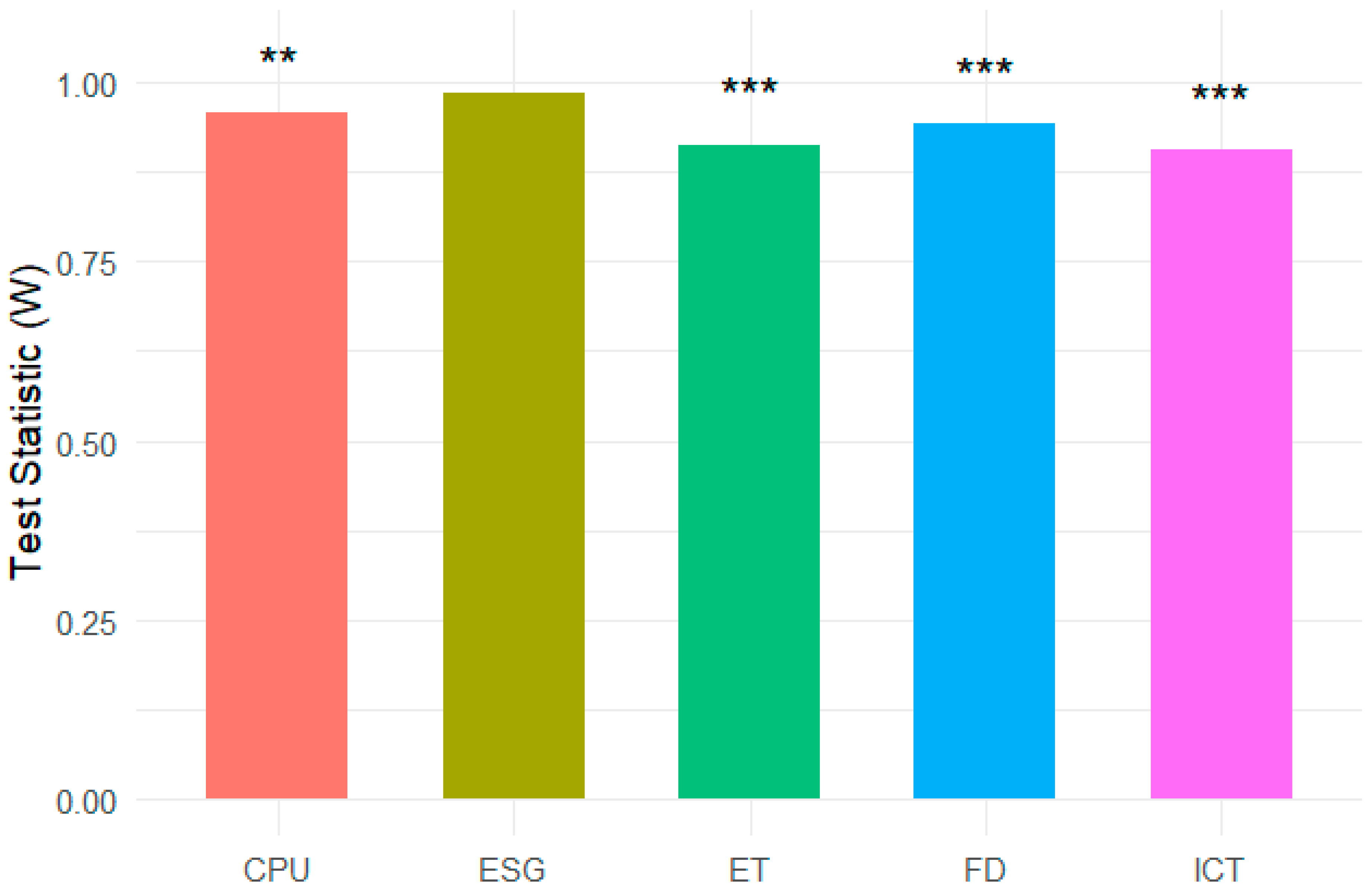

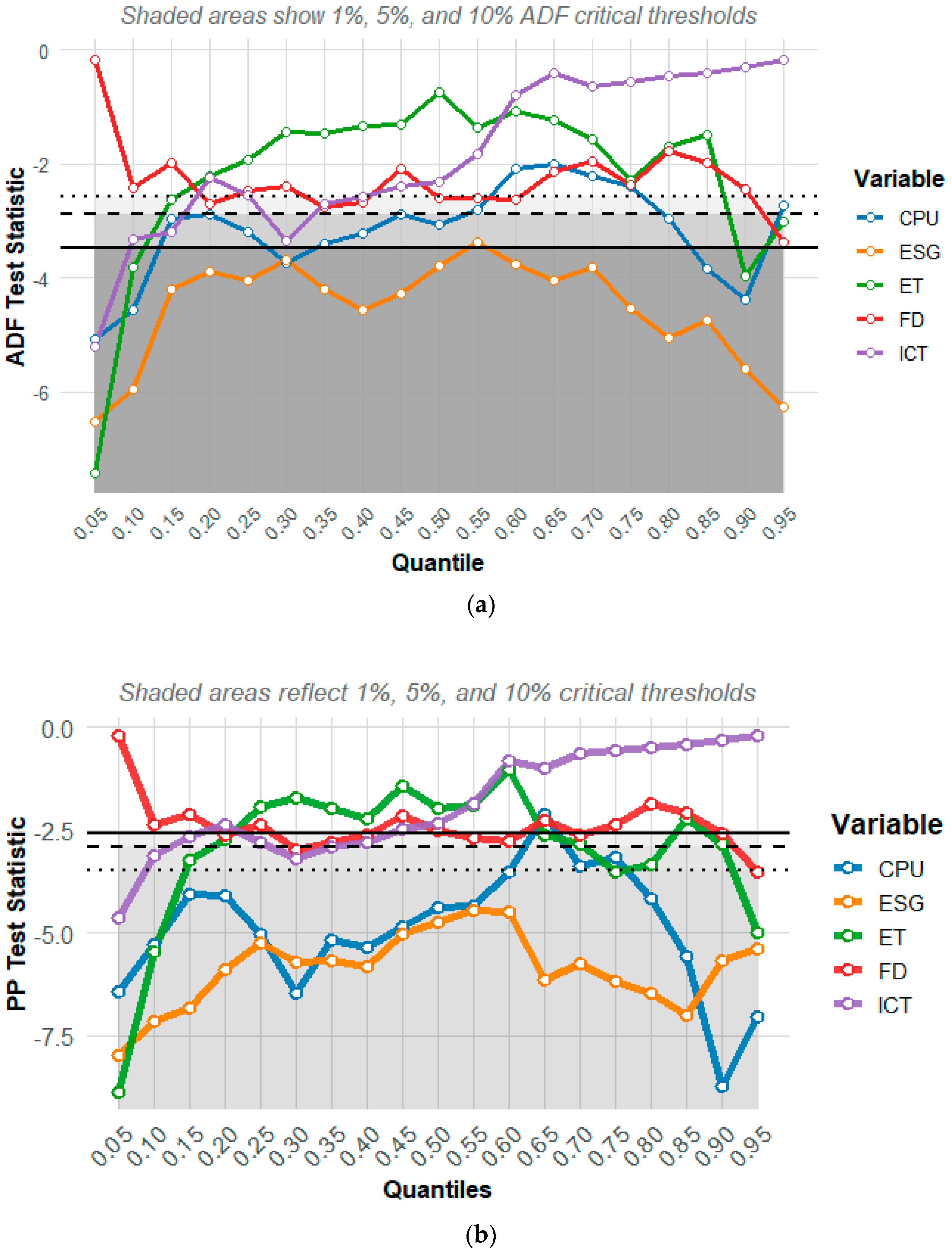

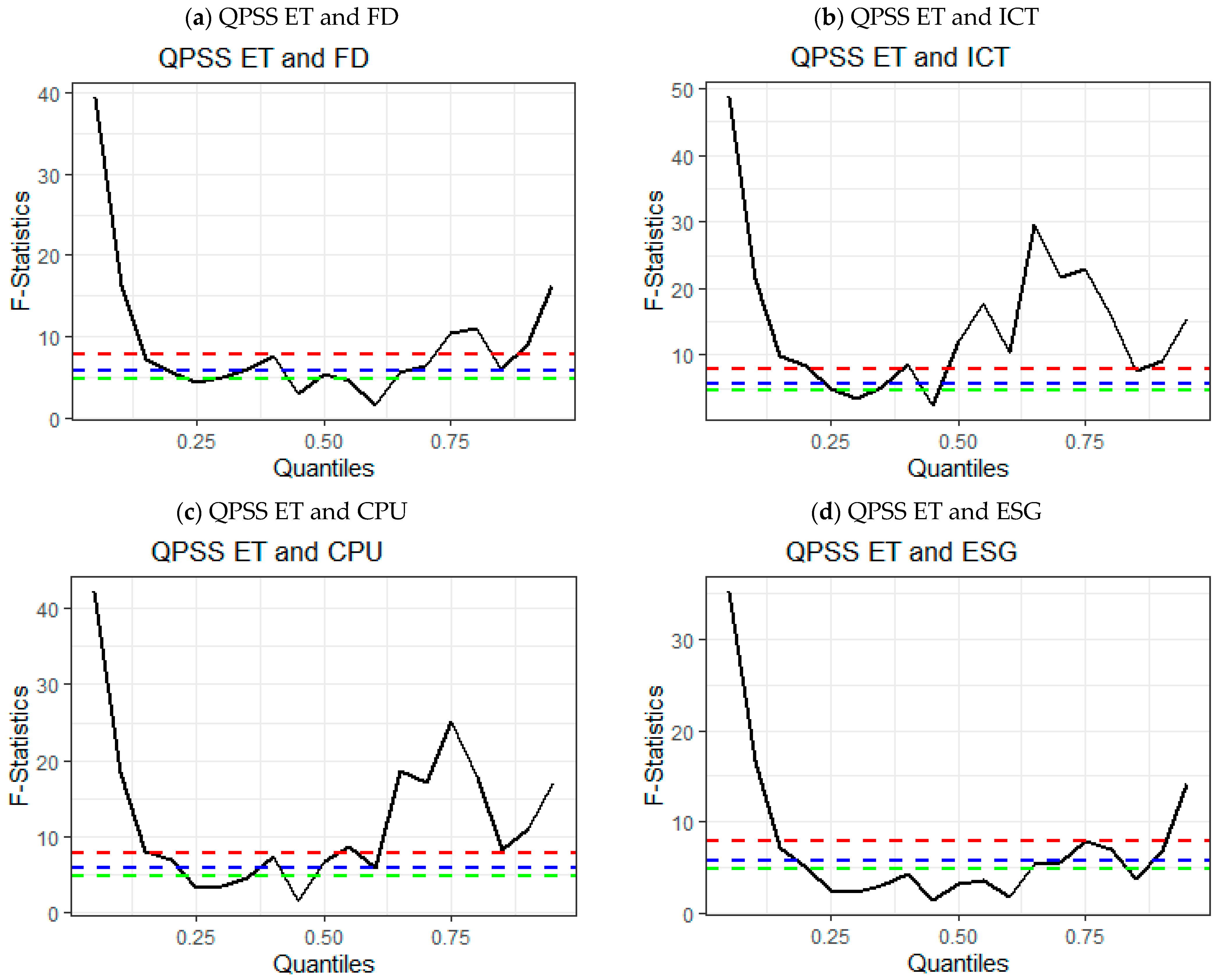

4.2. Quantile Cointegration

4.3. Quantile ARDL Results

4.3.1. Short-Term Effects (δ Coefficients)

4.3.2. Long-Term Effects (φ Coefficients)

4.3.3. Adjustment Coefficient (ρ)

4.3.4. Speed of Adjustment (ζ)

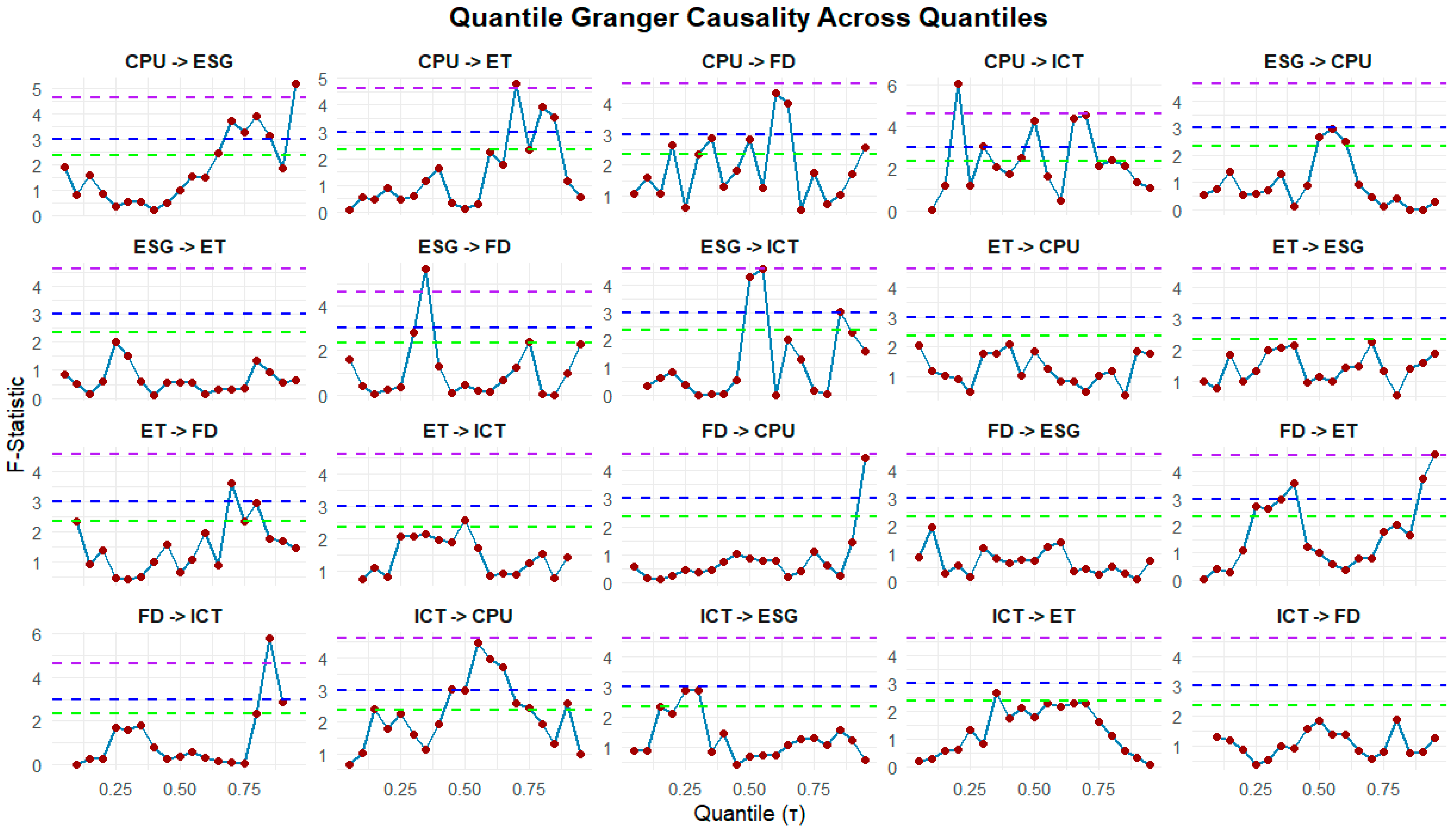

4.4. Quantile Granger Causality

4.5. Discussion of Findings

5. Conclusions and Policy Recommendations

5.1. Conclusions

5.2. Policy Recommendations

- (a)

- Financial Development (FD): To capitalize on FD’s positive impact on ET at lower quantiles, policymakers should prioritize enhancing financial incentives and regulatory frameworks that promote green investments. This includes expanding tax credits for renewable energy projects, incentivizing green bonds, and fostering partnerships between financial institutions and clean energy developers. By facilitating easier access to capital for sustainable infrastructure, such policies can accelerate the deployment of renewable technologies, particularly in underserved communities and rural areas.

- (b)

- ICT (Information and Communication Technology): Recognizing ICT’s initial negative impact on ET in lower quantiles, policies should focus on balancing digital innovation with environmental sustainability. This can be achieved by promoting energy-efficient ICT solutions, such as smart grid technologies, AI-driven energy management systems, and incentivizing data centers to adopt renewable energy sources. Additionally, regulatory measures can be implemented to ensure that ICT infrastructure investments align with long-term sustainability goals, minimizing the short-term energy consumption drawbacks associated with digital expansion.

- (c)

- Climate Policy Uncertainty (CPU): Given CPU’s disruptive impact across quantiles, policy responses should focus on enhancing the stability and credibility of the U.S. climate policy framework. This involves establishing consistent and long-term regulatory signals, institutionalizing climate targets through legislation, and designing adaptive policy instruments that can withstand political and economic cycles. By reducing ambiguity around future climate regulations, tax incentives, and renewable energy mandates, such measures can strengthen investor confidence and reduce the risk premium associated with clean energy investments. Furthermore, fostering domestic energy security through expanded deployment of renewable resources, supporting innovation in green technologies, and enhancing international cooperation on climate governance can insulate the U.S. energy sector from policy-induced volatility. A stable and predictable climate policy environment is essential for mobilizing sustained investments and accelerating the clean energy transition.

- (d)

- ESG Integration: To address the short-term costs of ESG compliance and maximize its long-term benefits, policymakers should promote regulatory clarity and support mechanisms for firms transitioning towards sustainable practices. This includes incentivizing ESG reporting through tax incentives, promoting transparency in environmental audits, and fostering public-private partnerships to facilitate ESG integration across industries. By aligning financial incentives with environmental and governance standards, policies can foster a business environment where ESG considerations drive innovation and long-term value creation.

- (a)

- Financial Development (FD): Building on its foundational role, long-term policies should focus on expanding green finance initiatives and strengthening institutional support for sustainable investments. This includes developing standardized green finance guidelines, supporting the growth of green bonds and investment funds, and integrating climate risk assessments into financial decision-making processes. By fostering a robust green finance ecosystem, policymakers can ensure continued capital flows into renewable energy projects, supporting ET goals across all quantiles.

- (b)

- ICT (Information and Communication Technology): To harness ICT’s potential as a long-term enabler of ET, policies should promote the deployment of advanced digital infrastructure that enhances energy efficiency and integrates renewable energy sources. This involves investing in smart grid technologies, accelerating the adoption of AI-driven energy management systems, and incentivizing ICT innovations that support environmental sustainability. Regulatory frameworks should incentivize the use of ICT for optimizing energy consumption patterns and promoting grid modernization, ensuring that digital advancements contribute positively to long-term ET objectives.

- (c)

- Climate Policy Uncertainty (CPU): Long-term strategies should prioritize reducing climate policy uncertainty by establishing consistent, transparent, and forward-looking regulatory frameworks that support clean energy development. This includes enacting stable climate legislation, setting clear decarbonization targets, and institutionalizing long-term incentives for renewable energy investments. Such measures can reduce ambiguity for investors and firms, lower risk premiums, and encourage sustained capital flows into green infrastructure. Additionally, promoting energy independence through diversified local renewable resources, enhancing grid resilience via advanced energy storage systems, and strengthening international cooperation on climate and energy governance can help insulate the U.S. energy system from external shocks. By minimizing the destabilizing effects of climate policy uncertainty, these efforts will foster a more predictable policy environment that facilitates long-term planning, drives innovation, and accelerates the transition to a low-carbon economy.

- (d)

- ESG Integration: As ESG frameworks evolve, long-term policies should continue to support firms in adopting sustainable business practices and aligning with global sustainability standards. This involves implementing stringent climate risk disclosure requirements, fostering industry collaboration on ESG best practices, and incentivizing green innovation through research grants and tax incentives. By embedding ESG considerations into corporate governance and investment decisions, policymakers can enhance the long-term competitiveness of U.S. firms, drive innovation in clean technologies, and accelerate progress towards achieving ET goals across quantiles.

5.3. Limitation and Future Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- EIA. Energy Information Association. United States. 2024. Available online: https://www.eia.gov/todayinenergy/detail.php?id=48396 (accessed on 4 March 2024).

- EIA. Electricity Consumption in United States. 2025. Available online: https://www.eia.gov/environment/emissions/carbon/ (accessed on 21 July 2025).

- EIA. The United States Uses a Mix of Energy Sources. 2024. Available online: https://www.eia.gov/energyexplained/us-energy-facts/ (accessed on 10 August 2025).

- IEA. International Energy Agency. World Energy Investment 2024: United States. 2024. Available online: https://www.iea.org/reports/world-energy-investment-2024/united-states (accessed on 4 June 2024).

- Işık, C.; Ongan, S.; Islam, H.; Balsalobre-Lorente, D.; Sharif, A. ECON-ESG factors on energy efficiency: Fostering sustainable development in ECON-growth-paradox countries. Gondwana Res. 2024, 135, 103–115. [Google Scholar] [CrossRef]

- Abakah, E.J.A.; Tiwari, A.K.; Abdullah, M.; Ji, Q.; Sulong, Z. Monetary policy uncertainty and ESG performance across energy firms. Energy Econ. 2024, 136, 107699. [Google Scholar] [CrossRef]

- Işık, C.; Ongan, S.; Islam, H.; Pinzon, S.; Jabeen, G. Navigating sustainability: Unveiling the interconnected dynamics of ESG factors and SDGs in BRICS-11. Sustain. Dev. 2024, 32, 5437–5451. [Google Scholar] [CrossRef]

- Mohammed, K.S.; Pata, U.K.; Serret, V.; Kartal, M.T. The role of renewable energy and carbon dioxide emissions on the ESG market in European Union. Manag. Decis. Econ. 2024, 45, 5146–5158. [Google Scholar] [CrossRef]

- Shahbaz, M.; Topcu, B.A.; Sarıgül, S.S.; Vo, X.V. The effect of financial development on renewable energy demand: The case of developing countries. Renew. Energy 2021, 178, 1370–1380. [Google Scholar] [CrossRef]

- Adams, S.; Fotio, H.K. Economic integration and environmental quality: Accounting for the roles of financial development, industrialization, urbanization and renewable energy. J. Environ. Plan. Manag. 2024, 67, 688–713. [Google Scholar] [CrossRef]

- Eren, B.M.; Taspinar, N.; Gokmenoglu, K.K. The impact of financial development and economic growth on renewable energy consumption: Empirical analysis of India. Sci. Total Environ. 2019, 663, 189–197. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Adebayo, T.S. Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain. Dev. 2021, 29, 583–594. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Ozsahin, D.U.; Olanrewaju, V.O.; Uzun, B. Decoding the environmental role of nuclear and renewable energy consumption: A time-frequency perspective. Ann. Nucl. Energy 2025, 223, 111660. [Google Scholar] [CrossRef]

- Higón, D.A.; Gholami, R.; Shirazi, F. ICT and environmental sustainability: A global perspective. Telemat. Inform. 2017, 34, 85–95. [Google Scholar] [CrossRef]

- Ghallabi, F.; Souissi, B.; Du, A.M.; Ali, S. ESG stock markets and clean energy prices prediction: Insights from advanced machine learning. Int. Rev. Financ. Anal. 2025, 97, 103889. [Google Scholar] [CrossRef]

- Aydin, M.; Demirtas, N.; Sogut, Y.; Degirmenci, T. On the road to environmental sustainability: The role of ICT penetration, renewable energy, and investment freedom on load capacity factor. Environ. Dev. Sustain. 2025. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Li, T.-H. Quantile Fourier Transform, Quantile Series, and Nonparametric Estimation of Quantile Spectra. arXiv 2024, arXiv:2211.05844. [Google Scholar] [CrossRef]

- Rajendra, M.A.; Setiastuti, S.U. Climate Policy Uncertainty and the Demand for Renewable Energy in the United States of America: Evidence from a Non-Linear Threshold Autoregressive Model. Gadjah Mada Economics Working Paper Series 202312012. 2023. Available online: https://ideas.repec.org//p/gme/wpaper/202312012.html (accessed on 30 July 2025).

- Pata, S.K.; Balcilar, M. Identifying the influence of climate policy uncertainty and oil prices on modern renewable energies: Novel evidence from the United States. Clean Technol. Environ. Policy 2024, 27, 2969–2980. [Google Scholar] [CrossRef]

- Meo, M.S.; Adebayo, T.S. Role of financial regulations and climate policy uncertainty in reducing CO2 emissions—An application of bootstrap subsample rolling-window Granger causality. Clean Technol. Environ. Policy 2024, 27, 2377–2393. [Google Scholar] [CrossRef]

- Chomać-Pierzecka, E.; Błaszczak, B.; Godawa, S.; Kęsy, I. Human Safety in Light of the Economic, Social and Environmental Aspects of Sustainable Development—Determination of the Awareness of the Young Generation in Poland. Sustainability 2025, 17, 6190. [Google Scholar] [CrossRef]

- Jin, C. Investigating the intersection of ESG investing, green recovery, and SME development in the OECD. Humanit. Soc. Sci. Commun. 2025, 12, 572. [Google Scholar] [CrossRef]

- Kong, X.; Li, Z.; Lei, X. Research on the impact of ESG performance on carbon emissions from the perspective of green credit. Sci. Rep. 2024, 14, 10478. [Google Scholar] [CrossRef]

- Paramati, S.R.; Mo, D.; Gupta, R. The effects of stock market growth and renewable energy use on CO2 emissions: Evidence from G20 countries. Energy Econ. 2017, 66, 360–371. [Google Scholar] [CrossRef]

- Prempeh, K.B. The role of economic growth, financial development, globalization, renewable energy and industrialization in reducing environmental degradation in the economic community of West African States. Cogent Econ. Financ. 2024, 12, 2308675. [Google Scholar] [CrossRef]

- Sun, Z.; Zhang, X.; Gao, Y. The Impact of Financial Development on Renewable Energy Consumption: A Multidimensional Analysis Based on Global Panel Data. Int. J. Environ. Res. Public Health 2023, 20, 3124. [Google Scholar] [CrossRef]

- Saba, C.S. Nexus between CO2 emissions, renewable energy consumption, militarisation, and economic growth in South Africa: Evidence from using novel dynamic ARDL simulations. Renew. Energy 2023, 205, 349–365. [Google Scholar] [CrossRef]

- Lee, C.-C.; Chen, M.-P.; Yuan, Z. Is information and communication technology a driver for renewable energy? Energy Econ. 2023, 124, 106786. [Google Scholar] [CrossRef]

- Hu, J.-L.; Chen, Y.-C.; Yang, Y.-P. The Development and Issues of Energy-ICT: A Review of Literature with Economic and Managerial Viewpoints. Energies 2022, 15, 594. [Google Scholar] [CrossRef]

- Shang, Y.; Han, D.; Gozgor, G.; Mahalik, M.K.; Sahoo, B.K. The impact of climate policy uncertainty on renewable and non-renewable energy demand in the United States. Renew. Energy 2022, 197, 654–667. [Google Scholar] [CrossRef]

- Athari, S.A.; Kirikkaleli, D. How do climate policy uncertainty and renewable energy and clean technology stock prices co-move? evidence from Canada. Empir. Econ. 2025, 68, 353–371. [Google Scholar] [CrossRef]

- Zaier, L.H.; Mokni, K.; Ajmi, A.N. Causality relationships between climate policy uncertainty, renewable energy stocks, and oil prices: A mixed-frequency causality analysis. Future Bus. J. 2024, 10, 112. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Rasoulinezhad, E. Accelerating the renewable energy transition in the EU: The role of smart technologies and ESG investments. Discov. Sustain. 2025, 6, 692. [Google Scholar] [CrossRef]

- Ren, M.; Zhou, J.; Si, J.; Wang, G.; Guo, C. The Impact of ESG Performance on Green Innovation among Traditional Energy Enterprises—Evidence from Listed Companies in China. Sustainability 2024, 16, 3542. [Google Scholar] [CrossRef]

- Policy Uncertainty. 2023. Available online: https://www.policyuncertainty.com/us_monthly.html (accessed on 2 March 2023).

- WDI. World Development Indicator. 2024. Available online: https://data.worldbank.org (accessed on 1 April 2024).

- Ahmed, Z.; Nathaniel, S.P.; Shahbaz, M. The criticality of information and communication technology and human capital in environmental sustainability: Evidence from Latin American and Caribbean countries. J. Clean. Prod. 2021, 286, 125529. [Google Scholar] [CrossRef]

- Cheng, J.; Mohammed, K.S.; Misra, P.; Tedeschi, M.; Ma, X. Role of green technologies, climate uncertainties and energy prices on the supply chain: Policy-based analysis through the lens of sustainable development. Technol. Forecast. Soc. Chang. 2023, 194, 122705. [Google Scholar] [CrossRef]

- Zhao, Y.; Ramzan, M.; Brika, S.K.; Eweade, B.S. Uncertainty in climate and ESG policies: Implications for renewable energy investments. Appl. Econ. 2025, 1–15. [Google Scholar] [CrossRef]

- Athari, S.A. The impact of financial development and technological innovations on renewable energy consumption: Do the roles of economic openness and financial stability matter in BRICS economies? Geol. J. 2024, 59, 288–300. [Google Scholar] [CrossRef]

- Ahmed, Z.; Le, H.P. Linking Information Communication Technology, trade globalization index, and CO2 emissions: Evidence from advanced panel techniques. Environ. Sci. Pollut. Res. 2021, 28, 8770–8781. [Google Scholar] [CrossRef] [PubMed]

- Bouri, E.; Iqbal, N.; Klein, T. Climate policy uncertainty and the price dynamics of green and brown energy stocks. Finance Res. Lett. 2022, 47, 102740. [Google Scholar] [CrossRef]

- Hu, Z.; Borjigin, S. The amplifying role of geopolitical Risks, economic policy Uncertainty, and climate risks on Energy-Stock market volatility spillover across economic cycles. N. Am. J. Econ. Finance 2024, 71, 102114. [Google Scholar] [CrossRef]

- Yadav, A.; Bekun, F.V.; Ozturk, I.; Ferreira, P.J.S.; Karalinc, T. Unravelling the role of financial development in shaping renewable energy consumption patterns: Insights from BRICS countries. Energy Strategy Rev. 2024, 54, 101434. [Google Scholar] [CrossRef]

- Appiah-Otoo, I.; Acheampong, A.O.; Song, N.; Chen, X. The impact of information and communication technology (ICT) on carbon dioxide emissions: Evidence from heterogeneous ICT countries. Energy Environ. 2023, 34, 3080–3102. [Google Scholar] [CrossRef]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Adebayo, T.S. How do energy and precious metals markets respond to climate policy uncertainty? A multi-frequency quantile framework. Appl. Econ. Lett. 2025, 3, 1–7. [Google Scholar] [CrossRef]

- Charfeddine, L.; Hussain, B.; Kahia, M. Analysis of the Impact of Information and Communication Technology, Digitalization, Renewable Energy and Financial Development on Environmental Sustainability. Renew. Sustain. Energy Rev. 2024, 201, 114609. [Google Scholar] [CrossRef]

- Haldar, A.; Sethi, N. Environmental effects of Information and Communication Technology—Exploring the roles of renewable energy, innovation, trade and financial development. Renew. Sustain. Energy Rev. 2022, 153, 111754. [Google Scholar] [CrossRef]

- Xu, Y.; Li, M.; Yan, W.; Bai, J. Predictability of the renewable energy market returns: The informational gains from the climate policy uncertainty. Resour. Policy 2022, 79, 103141. [Google Scholar] [CrossRef]

- Siddique, M.A.; Nobanee, H.; Hasan, M.B.; Uddin, G.S.; Hossain, M.N.; Park, D. How do energy markets react to climate policy uncertainty? Fossil vs. renewable and low-carbon energy assets. Energy Econ. 2023, 128, 107195. [Google Scholar] [CrossRef]

| Author(s) | Period(s) | Nation(s) | Method(s) | Finding(s) |

|---|---|---|---|---|

| Impact of Financial Development on Energy Transition | ||||

| [9] | 1994–2015 | 34 upper-middle-income developing countries | Panel cointegration, FMOLS | FD ↑ ET |

| [11] | 1971–2015 | India | Maki cointegration, DOLS, VECM | FD ↑ ET |

| [26] | 1990–2018 | Ghana | ARDL, FMOLS, VECM | FD ↑↓ ET |

| [27] | 1990–2019 | ASEAN + 3 countries | Panel ARDL | FD ↑↓ ET |

| [25] | 1991–2012 | G20, OECD, EU countries | FMOLS, STIRPAT model | FD ↑ ET |

| Impact of ICT on Energy Transition | ||||

| [28] | 2001–2020 | Africa (panel, ~29 countries) | PARDL | ICT ↑ ET |

| [16] | 1996–2021 | Denmark | regression | ICT → ET |

| [29] | 2000–2019 | 126 countries (global) | Panel regression | ICT ↑ ET |

| [30] | Not Defined | Multinational studies | Review | ICT ↑ ET |

| Impact of Climate Policy Uncertainty on Energy Transition | ||||

| [31] | 2000–2022 | United States | ARDL/FMOLS/DOLS | CPU ↑ ET |

| [19] | Not Defined | United States | Non-linear threshold AR model | CPU ↓ ET |

| [32] | 2013–2022 | Canada | Wavelet Power Spectrum & Coherence | CPU ↑ ET |

| [20] | 1987–2024 | United States | Granger causality | CPU ↑ ET |

| [21] | 1989–2023 | USA | Rolling Window | CPU ↑ ET |

| [33] | varies | developed countries | Panel regression | CPU ↑ ET |

| Impact of ESG Sustainability on Energy Transition | ||||

| [35] | 2011–2024 | China (traditional energy firms) | Zero-inflated negative binomial model | ESG ↑ ET |

| [24] | 2013–2022 | China (provinces) | Threshold regression/fixed effects | ESG ↑↓ ET |

| [23] | 2005–2020 | OECD (10 countries) | Panel regression | ESG ↑ ET |

| [34] | 2000–2021 | EU-10 nations | VECM & FMOLS | ESG ↔ ET |

| [15] | – | 10 countries | Machine learning forecasting | ESG ↑ ET |

| Sign | Variables | Measurement | Sources |

|---|---|---|---|

| CPU | Climate Policy Uncertainty | Index | [36] |

| ESG | Environmental Social Governance Sustainability | Index | [36] |

| ET | Energy Transition | (Trillion Btu) | [1] |

| FD | Financial Development | Domestic credit to private sector by banks (% of GDP) | [37] |

| ICT | Information and Communication Technology | Individuals using the Internet (% of population) | [37] |

| Statistic | CPU | ESG | ET | FD | ICT |

|---|---|---|---|---|---|

| Minimum | 3.896 | 2.512 | 5.759 | 3.802 | 4.091 |

| Maximum | 6.275 | 4.357 | 6.61 | 4.101 | 4.547 |

| Mean | 4.782 | 3.253 | 6.245 | 3.955 | 4.351 |

| Median | 4.701 | 3.252 | 6.322 | 3.947 | 4.311 |

| Stdev | 0.501 | 0.375 | 0.247 | 0.061 | 0.135 |

| Skewness | 0.485 | 0.26 | −0.539 | 0.567 | 0.017 |

| Kurtosis | 2.534 | 2.708 | 1.989 | 3.443 | 1.713 |

| Jarque-Bera | 4.339 * | 1.334 | 8.187 *** | 5.555 *** | 6.213 *** |

| Quantiles | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.05 | Coefficient | −0.002 | −0.218 *** | 0.357 | −0.072 | −0.01 * | −0.169 | 0.896 * | 0.260 *** | −0.017 ** | 0.002 | 0.005 |

| SE | 0.004 | 0.047 | 0.238 | 0.039 | 0.018 | 0.097 | 0.185 | 0.158 | 0.008 | 0.007 | 0.043 | |

| 0.10 | Coefficient | −0.005 ** | −0.056 * | 0.443 ** | −0.049 * | −0.031 *** | −0.240 *** | 0.835 *** | 0.185 ** | −0.005 * | 0.001 | 0.016 |

| SE | 0.002 | 0.032 | 0.172 | 0.029 | 0.015 | 0.072 | 0.113 | 0.096 | 0.005 | 0.004 | 0.027 | |

| 0.20 | Coefficient | −0.004 ** | −0.043 | 0.487 *** | −0.053 * | −0.036 ** | −0.264 *** | 0.828 *** | 0.152 * | −0.007 ** | 0.000 | 0.035 * |

| SE | 0.002 | 0.028 | 0.135 | 0.03 | 0.018 | 0.050 | 0.100 | 0.085 | 0.004 | 0.004 | 0.024 | |

| 0.30 | Coefficient | −0.003 | −0.020 ** | 0.499 | −0.047 *** | −0.009 | −0.270 | 0.824 *** | 0.141 *** | −0.002 * | −0.002 | 0.034 * |

| SE | 0.001 | 0.026 | 0.14 | 0.032 | 0.022 | 0.044 | 0.093 | 0.079 | 0.004 | 0.004 | 0.022 | |

| 0.40 | Coefficient | −0.001 | −0.016 | 0.470 | −0.041 *** | 0.010 | −0.254 | 0.818 *** | 0.119 *** | −0.001 ** | −0.001 | 0.004 |

| SE | 0.001 | 0.024 | 0.145 | 0.035 | 0.022 | 0.058 | 0.09 | 0.076 | 0.004 | 0.004 | 0.021 | |

| 0.50 | Coefficient | 0.000 | −0.032 | 0.320 | 0.003 ** | 0.005 | −0.302 *** | 0.745 *** | 0.098 *** | 0.000 * | −0.001 | −0.004 *** |

| SE | 0.001 | 0.025 | 0.126 | 0.026 | 0.021 | 0.067 | 0.087 | 0.075 | 0.004 | 0.003 | 0.021 | |

| 0.60 | Coefficient | 0.000 | −0.02 | 0.419 | 0.010 *** | −0.013 | −0.381 ** | 0.739 *** | 0.062 *** | 0.001 | 0.001 | −0.006 |

| SE | 0.001 | 0.026 | 0.081 | 0.017 | 0.016 | 0.057 | 0.089 | 0.076 | 0.004 | 0.004 | 0.022 | |

| 0.70 | Coefficient | 0.001 | −0.01 | 0.435 | 0.002 *** | −0.014 | −0.401 * | 0.709 *** | 0.049 *** | 0.000 | −0.001 | 0.001 |

| SE | 0.001 | 0.026 | 0.085 | 0.018 | 0.015 | 0.048 | 0.091 | 0.078 | 0.004 | 0.004 | 0.022 | |

| 0.80 | Coefficient | 0.003 | −0.013 ** | 0.462 | −0.013 *** | −0.018 | −0.411 ** | 0.447 *** | 0.155 * | 0.002 | −0.002 | 0.005 |

| SE | 0.001 | 0.028 | 0.091 | 0.018 | 0.017 | 0.043 | 0.101 | 0.086 | 0.004 | 0.004 | 0.025 | |

| 0.90 | Coefficient | 0.007 *** | 0.007 | 0.429 *** | 0.020 | −0.043 *** | −0.424 | 0.368 ** | 0.082 *** | −0.003 *** | 0.001 | 0.034 |

| SE | 0.002 | 0.035 | 0.109 | 0.022 | 0.022 | 0.035 | 0.124 | 0.106 | 0.005 | 0.005 | 0.03 | |

| 0.95 | Coefficient | 0.008 * | 0.002 | 0.583 *** | −0.009 | −0.046 * | −0.453 *** | 0.423 *** | 0.09 | 0.000 | −0.005 | 0.04 |

| SE | 0.002 | 0.038 | 0.121 | 0.026 | 0.027 | 0.046 | 0.133 | 0.114 | 0.006 | 0.005 | 0.033 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ali, A.R.; Iyiola, K.; Alzubi, A. Harnessing ESG Sustainability, Climate Policy Uncertainty and Information and Communication Technology for Energy Transition. Energies 2025, 18, 5301. https://doi.org/10.3390/en18195301

Ali AR, Iyiola K, Alzubi A. Harnessing ESG Sustainability, Climate Policy Uncertainty and Information and Communication Technology for Energy Transition. Energies. 2025; 18(19):5301. https://doi.org/10.3390/en18195301

Chicago/Turabian StyleAli, Ali Ragab, Kolawole Iyiola, and Ahmad Alzubi. 2025. "Harnessing ESG Sustainability, Climate Policy Uncertainty and Information and Communication Technology for Energy Transition" Energies 18, no. 19: 5301. https://doi.org/10.3390/en18195301

APA StyleAli, A. R., Iyiola, K., & Alzubi, A. (2025). Harnessing ESG Sustainability, Climate Policy Uncertainty and Information and Communication Technology for Energy Transition. Energies, 18(19), 5301. https://doi.org/10.3390/en18195301