Energy Management in an Insular Region with Renewable Energy Sources and Hydrogen: The Case of Graciosa, Azores

Abstract

1. Introduction

2. Green Hydrogen

2.1. Hydrogen Production

2.2. Green Hydrogen Storage

3. The Case of the Graciosa Island, Azores, Portugal

4. Methodology

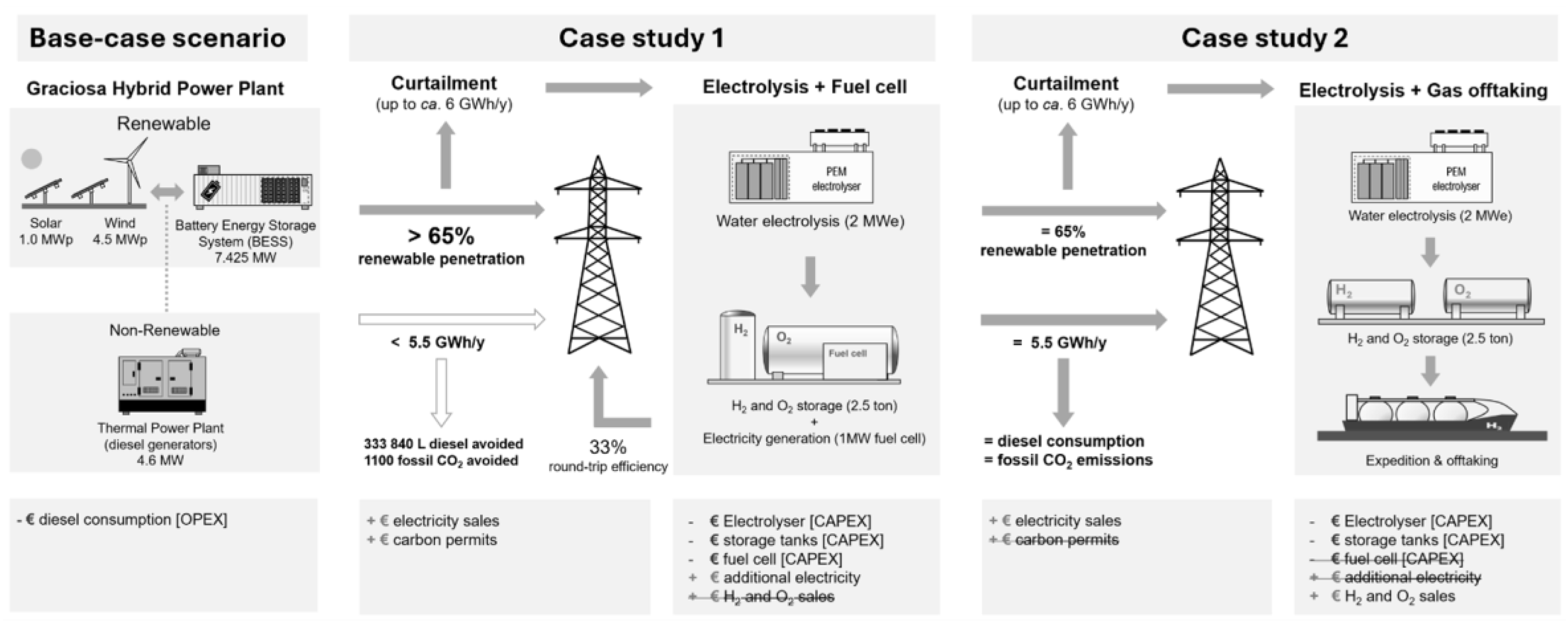

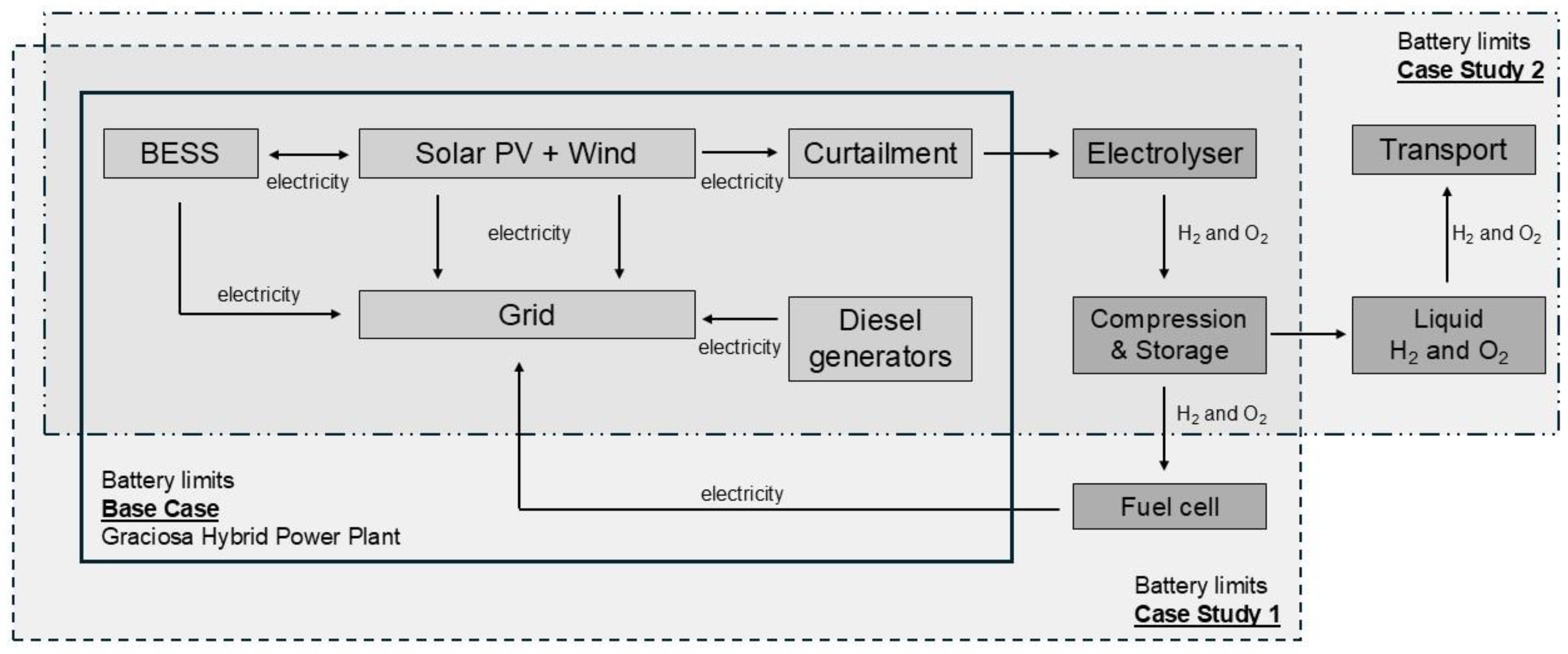

4.1. Case Studies

4.2. Data Collection and Assumptions

5. Results

5.1. Initial Scenarios

5.2. Sensitivity Analysis

5.3. Simulation of Possible Scenarios

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| AEM | Anion Exchange Membrane |

| CO2 | Carbone Dioxide |

| EU | European Union |

| GHG | Greenhouse Gases |

| H2 | Hydrogen |

| IRR | Internal Rate of Return |

| LCOE | Levelized Cost of Energy |

| LCOH | Levelized Cost of Hydrogen |

| NPV | Net Present Value |

| O2 | Oxygen |

| PBP | Payback Period |

| PEM | Proton Exchange Membrane |

| RES | Renewable Energy Sources |

| RES-E | Electricity generation from Renewable Sources |

| SOE | Solid Oxide Electrolysis |

| TEA | Technical–Economic Analysis |

| WACC | Weighted Average Cost of Capital |

References

- Jelić, M.; Corrêa, D.P.; Jelić, D.; Berbakov, L.; Werner, D.; Maruf, N.I.; Lázaro, I.; Fernández, I.; Keane, M.; Tomašević, N. Integrated cloud platform for energy management of self-sustainable island communities. Energy Rep. 2025, 13, 6233–6250. [Google Scholar] [CrossRef]

- Lal, R.; Kumar, S. Energy security assessment of small Pacific Island Countries: Sustaining the call for renewable energy proliferation. Energy Strat. Rev. 2022, 41, 100866. [Google Scholar] [CrossRef]

- Babaei, R.; Ting, D.S.K.; Carriveau, R. Feasibility and optimal sizing analysis of stand-alone hybrid energy systems coupled with various battery technologies: A case study of Pelee Island. Energy Rep. 2022, 8, 4747–4762. [Google Scholar] [CrossRef]

- Hardjono, V.Z.P.; Reyseliani, N.; Purwanto, W.W. Planning for the integration of renewable energy systems and productive zone in Remote Island: Case of Sebira Island. Clean. Energy Syst. 2023, 4, 100057. [Google Scholar] [CrossRef]

- Noussan, M.; Raimondi, P.P.; Scita, R.; Hafner, M. The Role of Green and Blue Hydrogen in the Energy Transition—A Technological and Geopolitical Perspective. Sustainability 2020, 13, 298. [Google Scholar] [CrossRef]

- Dokhani, S.; Assadi, M.; Pollet, B.G. Techno-economic assessment of hydrogen production from seawater. Int. J. Hydrogen Energy 2023, 48, 9592–9608. [Google Scholar] [CrossRef]

- IRENA. Renewable Power Generation Costs in 2022; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2023. [Google Scholar]

- Kakoulaki, G.; Kougias, I.; Taylor, N.; Dolci, F.; Moya, J.; Jäger-Waldau, A. Green hydrogen in Europe—A regional assessment: Substituting existing production with electrolysis powered by renewables. Energy Convers. Manag. 2021, 228, 113649. [Google Scholar] [CrossRef]

- Nuñez-Jimenez, A.; De Blasio, N. Competitive and secure renewable hydrogen markets: Three strategic scenarios for the European Union. Int. J. Hydrogen Energy 2022, 47, 35553–35570. [Google Scholar] [CrossRef]

- Hesel, P.; Braun, S.; Zimmermann, F.; Fichtner, W. Integrated modelling of European electricity and hydrogen markets. Appl. Energy 2022, 328, 120162. [Google Scholar] [CrossRef]

- Yue, M.; Lambert, H.; Pahon, E.; Roche, R.; Jemei, S.; Hissel, D. Hydrogen energy systems: A critical review of technologies, applications, trends and challenges. Renew. Sustain. Energy Rev. 2021, 146, 111180. [Google Scholar] [CrossRef]

- Habour, M.R.; Benyounis, K.Y.; Carton, J.G. Green hydrogen production from renewable sources for export. Int. J. Hydrogen Energy 2025, 128, 760–770. [Google Scholar] [CrossRef]

- Scafidi, J.; Wilkinson, M.; Gilfillan, S.M.V.; Heinemann, N.; Haszeldine, R.S. A quantitative assessment of the hydrogen storage capacity of the UK continental shelf. Int. J. Hydrogen Energy 2021, 46, 8629–8639. [Google Scholar] [CrossRef]

- Nogueira, T.; Jesus, J.; Magano, J. Graciosa Island’s Hybrid Energy System Expansion Scenarios: A Technical and Economic Analysis. J. Sustain. Res. 2024, 6, e2400010. [Google Scholar] [CrossRef]

- Melo, I.; Torres, J.P.N.; Fernandes, C.A.F.; Lameirinhas, R.A.M. Sustainability economic study of the islands of the Azores archipelago using photovoltaic panels, wind energy and storage system. Renew. Wind Water Sol. 2020, 7, 4. [Google Scholar] [CrossRef]

- Silva, D.C.; Deruyter, J.; Zech, C.; Murugesan, R.; Witmer, L. Implementation of energy storage systems in the Azores islands as a flexibility tool to increase renewable penetration. CIRED CP767 2020, 2020, 525–528. [Google Scholar] [CrossRef]

- ISO/TS 14074:2025; Environmental Management—Environmental Techno-Economic Assessment—Principles, Requirements and Guidance. International Organization for Standardization (ISO): Geneva, Switzerland, 2025. Available online: https://www.iso.org/standard/61119.html (accessed on 8 March 2025).

- Park, J.; Ryu, K.H.; Kim, C.-H.; Cho, W.C.; Kim, M.; Lee, J.H.; Cho, H.-S. Green hydrogen to tackle the power curtailment: Meteorological data-based capacity factor and techno-economic analysis. Appl. Energy 2023, 340, 121016. [Google Scholar] [CrossRef]

- Travaglini, R.; Superchi, F.; Lanni, F.; Manzini, G.; Serri, L.; Bianchini, A. Towards the development of offshore wind farms in the Mediterranean Sea: A techno-economic analysis including green hydrogen production during curtailments. IET Renew. Power Gener. 2024, 18, 3112–3126. [Google Scholar] [CrossRef]

- Xu, Y.; Ji, M.; Klemeš, J.J.; Tao, H.; Zhu, B.; Varbanov, P.S.; Yuan, M.; Wang, B. Optimal renewable energy export strategies of islands: Hydrogen or electricity? Energy 2023, 269, 126750. [Google Scholar] [CrossRef]

- Abdin, Z.; Zafaranloo, A.; Rafiee, A.; Mérida, W.; Lipiński, W.; Khalilpour, K.R. Hydrogen as an energy vector. Renew. Sustain. Energy Rev. 2020, 120, 109620. [Google Scholar] [CrossRef]

- Amin, M.; Shah, H.H.; Fareed, A.G.; Khan, W.U.; Chung, E.; Zia, A.; Farooqi, Z.U.R.; Lee, C. Hydrogen production through renewable and non-renewable energy processes and their impact on climate change. Int. J. Hydrogen Energy 2022, 47, 33112–33135. [Google Scholar] [CrossRef]

- Vilanova, A.; Dias, P.; Lopes, T.; Mendes, A. The route for commercial photoelectrochemical water splitting: A review of large-area devices and key upscaling challenges. Chem. Soc. Rev. 2024, 53, 2388–2434. [Google Scholar] [CrossRef]

- Kojima, H.; Nagasawa, K.; Todoroki, N.; Ito, Y.; Matsui, T.; Nakajima, R. Influence of renewable energy power fluctuations on water electrolysis for green hydrogen production. Int. J. Hydrogen Energy 2023, 48, 4572–4593. [Google Scholar] [CrossRef]

- Shiva Kumar, S.; Lim, H. An overview of water electrolysis technologies for green hydrogen production. Energy Rep. 2022, 8, 13793–13813. [Google Scholar] [CrossRef]

- Jang, D.; Kim, K.; Kim, K.H.; Kang, S. Techno-economic analysis and Monte Carlo simulation for green hydrogen production using offshore wind power plant. Energy Convers. Manag. 2022, 263, 115695. [Google Scholar] [CrossRef]

- Ye, Q.; Lu, J.; Zhu, M. Wind Curtailment in China and Lessons from the United States. Available online: https://www.brookings.edu/research/wind-curtailment-in-china-and-lessons-from-the-united-states/ (accessed on 8 March 2025).

- Abdin, Z.; Khalilpour, K.; Catchpole, K. Projecting the levelized cost of large-scale hydrogen storage for stationary applications. Energy Convers. Manag. 2022, 270, 116241. [Google Scholar] [CrossRef]

- Gahleitner, G. Hydrogen from renewable electricity: An international review of power-to-gas pilot plants for stationary applications. Int. J. Hydrogen Energy 2013, 38, 2039–2061. [Google Scholar] [CrossRef]

- Ma, N.; Zhao, W.; Wang, W.; Li, X.; Zhou, H. Large scale of green hydrogen storage: Opportunities and challenges. Int. J. Hydrogen Energy 2024, 50, 379–396. [Google Scholar] [CrossRef]

- Resolução do Conselho de Ministros nº 63/2020. D.R. I Série. 158 (2020.08.14). 2020, pp. 7–88. Available online: https://dre.pt/application/file/a/140333689 (accessed on 8 March 2025).

- DRAAC. Relatório do Estado do Ambiente dos Açores 2017–2019. Direção Regional do Ambiente e Ação Climática. 2019. Available online: https://rea.azores.gov.pt/store/REAA-2019.pdf (accessed on 8 March 2025).

- Langhorst, T.; McCord, S.; Zimmermann, A.; Müller, L.; Cremonese, L.; Strunge, T.; Wang, Y.; Zaragoza, A.V.; Wunderlich, J.; Marxen, A.; et al. Techno-Economic Assessment & Life Cycle Assessment Guidelines for CO₂ Utilization (Version 2.0); Global CO₂ Initiative: Ann Arbor, MI, USA, 2022. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, Z.; He, Y.; Li, M.; Wang, X.; Wang, B.; Zhu, Y.; Cen, K. Comparison of onshore/offshore wind power hydrogen production through water electrolysis by life cycle assessment. Sustain. Energy Technol. Assess. 2023, 60, 103515. [Google Scholar] [CrossRef]

- Li, W.; Tian, H.; Ma, L.; Wang, Y.; Liu, X.; Gao, X. Low-temperature water electrolysis: Fundamentals, progress, and new strategies. Mater. Adv. 2022, 3, 5598–5644. [Google Scholar] [CrossRef]

- International Energy Agency. Global Hydrogen Review 2024; IEA: Paris, France, 2024; Available online: https://www.iea.org/reports/global-hydrogen-review-2024 (accessed on 8 March 2025).

- Angelico, R.; Giametta, F.; Bianchi, B.; Catalano, P. Green hydrogen for energy transition: A critical perspective. Energies 2025, 18, 404. [Google Scholar] [CrossRef]

- European Commission. Fuel Cells and Hydrogen 2 Joint Undertaking; European Commission: Brussels, Belgium, 2024. [Google Scholar]

- Edwards, R.; Padella, M.; Giuntoli, J.; Koeble, R.; O’Connell, A.; Bulgheroni, C.; Marelli, L. Definition of input data to assess GHG default emissions from biofuels in EU legislation (Version 1d—2019); EUR 28349 EN; Publications Office of the European Union: Luxembourg, 2019. [Google Scholar]

- European Central Bank. The ECB’s Monetary Policy Strategy Statement; European Central Bank: Frankfurt, Germany, 2021. [Google Scholar]

- Dhimish, M.; Vieira, R.G.; Badran, G. Investigating the stability and degradation of hydrogen PEM fuel cell. Int. J. Hydrogen Energy 2021, 46, 37017–37028. [Google Scholar] [CrossRef]

- Wang, B.; Zhaoxiang, B. Hydrogen energy storage: Mitigating variability in wind and solar power for grid stability in Australia. Int. J. Hydrogen Energy 2025, 97, 1249–1260. [Google Scholar] [CrossRef]

- Liu, Z.; Yang, M.; Tang, X.; Shi, L.; Xu, S.; Zhou, Q. Mechanism insights and system-level operation analysis of cathode recirculation for durability enhancement in automotive PEMFC. Appl. Energy 2025, 401, 126647. [Google Scholar] [CrossRef]

- Meng, X.; Liu, M.; Mei, J.; Li, X.; Grigoriev, S.; Hasanien, H.M.; Tang, X.; Li, R.; Sun, C. Polarization loss decomposition-based online health state estimation for proton exchange membrane fuel cells. Int. J. Hydrogen Energy 2025, 157, 150162. [Google Scholar] [CrossRef]

- Endrődi, B.; Trapp, C.A.; Szén, I.; Bakos, I.; Lukovics, M.; Janáky, C. Challenges and Opportunities of the Dynamic Operation of PEM Water Electrolyzers. Energies 2025, 18, 2154. [Google Scholar] [CrossRef]

- Campbell-Stanway, C.; Becerra, V.; Prabhu, S.; Bull, J. Investigating the role of byproduct oxygen in uk-based future scenario models for green hydrogen electrolysis. Energies 2024, 17, 281. [Google Scholar] [CrossRef]

- Shan, R.; Kittner, N. Sector-specific strategies to increase green hydrogen adoption. Renew. Sustain. Energy Rev. 2025, 214, 115491. [Google Scholar] [CrossRef]

- Bałys, M.; Brodawka, E.; Korzeniewska, A.; Szczurowski, J.; Zarębska, K. LCA and economic study on the local oxygen supply in Central Europe during the COVID-19 pandemic. Sci. Total Environ. 2021, 786, 147401. [Google Scholar] [CrossRef]

- Collis, J.; Schomäcker, R. Determining the production and transport cost for H2 on a global scale. Front. Energy Res. 2022, 10, 909298. [Google Scholar] [CrossRef]

- Hassan, M.A.; El-Amary, N.H. Economic and technical analysis of hydrogen production and transport: A case study of Egypt. Sci. Rep. 2025, 15, 9002. [Google Scholar] [CrossRef]

- Alonso, A.M.; Matute, G.; Yusta, J.M.; Coosemans, T. Multi-state optimal power dispatch model for power-to-power systems in off-grid hybrid energy systems: A case study in Spain. Int. J. Hydrogen Energy 2024, 52, 1045–1061. [Google Scholar] [CrossRef]

- Zhang, Z.; Wang, C.; Lv, H.; Liu, F.; Sheng, H.; Yang, M. Day-ahead optimal dispatch for integrated energy system considering power-to-gas and dynamic pipeline networks. IEEE Trans. Ind. Appl. 2021, 57, 3317–3328. [Google Scholar] [CrossRef]

- Maketo, L.; Ashworth, P. Social acceptance of green hydrogen in European Union and the United Kingdom: A systematic review. Renew. Sustain. Energy Rev. 2025, 218, 115827. [Google Scholar] [CrossRef]

- Buchner, J.; Menrad, K.; Decker, T. Public acceptance of green hydrogen production in Germany. Renew. Sustain. Energy Rev. 2025, 208, 115057. [Google Scholar] [CrossRef]

| Non-Renewable Energy Sources | Cost ($/kg H2) | Disadvantages | Advantages |

|---|---|---|---|

| Natural Gas | 0.9–3.2 | High GHG emissions; High capital costs | Commercially proven, technologically mature, and widely available; More effective and cleaner than coal |

| Coal | 1.2–2.2 | High GHG emissions; If carbon capture is not considered, the cost of the process can escalate with high carbon taxes | Efficient process in the conversion of hydrocarbon fuels to H2; Low rate of return; Low water usage |

| Nuclear Energy | 3.2–3.6 | Energy-intensive process and release of toxic gases during production; Security issues | Nuclear energy production itself already produces electricity and heat necessary for the production of H2; Low GHG emissions |

| Renewable Energy Sources | Disadvantages | Advantages |

|---|---|---|

| Solar | Solar intermittency incompatible with some electrolyzers; Large area occupation required; Critical materials used in panel production | Mature and developed technology; Renewable and clean source |

| Wind | High capital cost; Wind resource burst incompatible with some electrolyzers; High visual impact on natural landscape; Disruption of some bird migration paths | Mature and developed technology; Renewable and clean source; Low occupation area |

| Characteristics | Technological Maturity | Theoretical Efficiency (%) | Lifespan (Hours) | Minimum Capital Costs 1 MW ($/kW) | Minimum Capital Costs 10 MW ($/kW) | Advantages | Disadvantages |

|---|---|---|---|---|---|---|---|

| Alkaline water electrolysis | Developed | 50 to 78 | 60,000 | 250 | 460 to 930 | Marketable on a large scale; low-cost technology—does not require high-purity inlet water; simple and easy-to-operate equipment | Low operation dynamics with little pressure; high start-up time; highly corrosive operating environment; lower hydrogen purity; carbonate formation in the electrodes; high susceptibility to power fluctuations |

| AEM electrolysis | Recent in the market | 57 to 59 | 30,000 | unknown | unknown | ||

| PEM electrolysis | Recent in the market for large-scale | 50 to 83 | 50,000 to 100,000 | 370 | 650 to 1300 | Highly dynamic operation; compact design; higher H2 purity ratio; fast response and high current densities; reduced susceptibility to power fluctuations | Lower durability; acidic environment; high cost of components; high degree of water purity; |

| SOE | In development | 89 | 20,000 | 1855 | unknown | Operation pressure is high; no noble materials are needed for the catalysts; high efficiency | Low durability; still in the laboratory phase; |

| Technology | Local | Applications | Disadvantages | Advantages | |

|---|---|---|---|---|---|

| Hydrogen compression gaseous | Physical storage using own containers | Production site | Hydrogen fuel stations, stationary storage at the production site | Energy losses in the process | Fast refueling times and high energy density |

| Geological storage | Salt caves, aquifers, depleted oil and gas fields | Dedicated hydrogen storage | Geographical limitations, limited capacity, compromised long-term stability and safety, energy losses in the process | Fast refueling times and high energy density | |

| Liquid hydrogen | Liquid storage | Varied | Aerospace, automotive, energy production | High energy consumption for H2 liquefaction | Large gravimetric energy density, low volumetric density, and ease of transport |

| Introduction of hydrogen in natural gas pipelines | Power-to-gas | Use of existing natural gas infrastructure | Replacement or addition to natural gas | Existing pipelines can have a greater risk of failure, combustion stability, equipment damage if not adapted | Safer and better cost-effectiveness, greater reduction in greenhouse gas emissions, greater potential for scale-up |

| Fuels | H2-to-ammonia/H2-to-methanol | Ammonia and methanol production plants | Hydrogen long-distance transport, chemical industry, heavy transport. | High synthesis CAPEX, transport leakage toxicity | Use of current infrastructure, high market potential, high energy density |

| National Hydrogen Strategy | Injection of Green H2 into Natural Gas Networks (%) | Green H2 in the Energy Consumption of the Industry Sector (%) | Green H2 in the Energy Consumption of the Road Transport Sector (%) | Green H2 in the Energy Consumption of the Domestic Shipping Sector (%) | Green H2 on Final Energy Consumption (%) | Installed Capacity of Electrolyzers (GW) | Hydrogen Refueling Stations |

|---|---|---|---|---|---|---|---|

| Targets by 2030 | 10 to 15 | 2 to 5 | 1 to 5 | 3 to 5 | 1.5 to 2 | 2 to 2.5 | 50 to 100 |

| Targets by 2050 | 75 to 80 | 20 to 25 | 20 to 25 | 20 to 25 | 15 to 20 | 10 | 1000 to 1500 |

| Portugal’s Strategies for the Hydrogen Value Chain | Description |

|---|---|

| Power to Gas (P2G) | Green H2 can be injected directly into natural gas networks or by converting hydrogen into synthetic methane |

| Power to Mobility (P2M) | Green H2 is transported, or produced locally, to provide vehicle fueling stations |

| Power to Industry (P2I) | Replacing natural gas with green H2 in the industrial sector |

| Power to Synfuel (P2Fuel) | Replacing fossil fuels with synthetic fuels from renewable sources |

| Power to Power (P2P) | Excess renewable electricity can be converted into green H2, and later reconverted into electricity |

| Support Mechanisms in Portugal | Description |

|---|---|

| Differentiated tariff treatment | Total or partial exemption of the payment to access grids |

| Production support | Production support mechanism covering the difference between the production price of green H2 and the price of natural gas in MIBGAS |

| System services market share | Opportunity for increased remuneration |

| Taxation | Green taxation that internalizes environmental impacts and positively discriminates against products/services with high environmental performance, penalizing natural gas and benefiting green H2 |

| Indicators | Formula | Variables |

|---|---|---|

| Levelized Cost of Energy | Capex: Initial investment costs (€); : Operating and maintenance costs (€); : Equipment replacement costs (€); : Environmental costs (€); : Energy generated in year i (kWh); : Inflation rate; : Degradation rate; : Annual discount rate; : Project life (years) | |

| Levelized Cost of Hydrogen | : Electrolyzer costs (€): : Electricity costs (€); : Hydrogen produced in year i (Kg) | |

| Electrolyzer Costs (€) | : CAPEX of electrolyzer (€); : Amount of electricity required by the electrolyzer (kWh/Kg); : Electrolyzer efficiency (%); t: Electrolyzer lifetime (years); 8760: Number of hours in a year; SCF: System capacity factor (%) | |

| Electricity Costs (€) | : Energy needed each year (kWh); t: Years of activity | |

| Payback Period (years) | : Cash inflow per period (€/year) | |

| Cash Inflow per period (€/year) | ||

| Net Present Value (€) | : Net cash flow in year i (€); r: Annual discount rate | |

| Internal Rate of Return (%) |

| Case Study | Description | Main Energy Source | CAPEX and OPEX Included | Main Profit Sources |

|---|---|---|---|---|

| 1 | Green H2 production and subsequent electricity conversion through fuel cells, generating carbon credits | Curtailment energy | Electrolyzer; storage and fuel cells | Additional green electricity; carbon credits |

| 2 | Sales of produced H2 and O2 without additional electricity generation | Curtailment energy | Electrolyzer; storage | Green H2 and O2 sales |

| Process Block | Data | Proposed Value | Source | Description |

|---|---|---|---|---|

| Existing system | Curtailment energy data | 5500.9 MWh/year | Local operator | Sum of the data provided regarding the curtailment generated in photovoltaic and wind power plants |

| Existing system | Diesel consumed annually by generators | 1,300,000 L/year | Literature | [14] |

| Existing system | Electricity injected into the grid by generators | 5551 MWh/year | Calculation | Sum of actual data provided by the operator |

| Electrolyzer | Amount of hydrogen produced by the electrolyzer | 86,773 H2 kg/year | Technology supplier 1 | Obtained in a commercial proposal for the case study presented, based on the actual curtailment values |

| Electrolyzer | Electricity Consumed Electrolyzer | 50.50 MWh/H2 ton | Technology supplier 1 | Obtained in a commercial proposal for the case study presented, based on the actual curtailment values |

| Electrolyzer | Electricity required electrolyzer | 4380 MWh/year | Calculation | Obtained in a commercial proposal for the case study presented, based on the actual curtailment values |

| Electrolyzer | Amount of oxygen produced | 686,991 kg/year | Calculation | Obtained by the stoichiometric relationship between O2 and H2 in the electrolysis of water |

| Electrolyzer | CAPEX | €2,891,836 | Technology supplier 1 | Obtained in a commercial proposal for the case study presented, based on the actual curtailment values |

| Electrolyzer | H2 Sale Price | €6/kg | Local operator | Based on market procurement |

| Electrolyzer | O2 Sale Price | €0.25/kg | The literature | |

| Electrolyzer | Water price | €0.5/m3 | Technology supplier 1 | Obtained in a commercial proposal for the case study presented, based on the actual curtailment values |

| Electrolyzer | OPEX | €57,836/year | Technology supplier 1 | Obtained in a commercial proposal for the case study presented; corresponds to 2% of the total CAPEX of electrolysis |

| Electrolyzer | Stack replacement every 10 years | €86,755/year | Technology supplier 2 | Obtained in a commercial proposal for the case study presented; a value of 30% of the CAPEX is considered for stack replacement every 10 years |

| Storage and compression | Storage capacity | 2500 kg H2 | Technology supplier 2 | Obtained in commercial proposal for the case study presented; considers a 2.5-ton H2 tank, stored at 100 bar |

| Storage and compression | Total CAPEX (compression + tanks, for H2 and O2) | €1,430,000 | Technology supplier 2 | Obtained in a commercial proposal for the case study presented |

| Fuel Cell | Power required | 1 MW | Calculation | Assumption to ensure peak supply considering 50% efficiency |

| Fuel Cell | CAPEX | €1,500,000 | [38] | Assuming a unity of 1 MW |

| Fuel Cell | OPEX | €44,495/year | [38] | |

| Electricity production system from green H2 | Electricity selling price | €300/MWh | Local operator | Real data |

| Electricity production system through green H2 | Round-trip efficiency | 33% | Calculation | Combined efficiency of the fuel cell and the electrolyzer, assuming a 100% efficiency in storage because the latter is performed with the remaining curtailment |

| Carbon credits | Diesel consumption avoided | 338,470 L/year | Calculation | Diesel equivalent avoided |

| Carbon credits | CO2 avoided by diesel combustion | 1103.4 CO2 ton eq./year | Calculation | Product of the amount of diesel avoided by its emission factor (supply + combustion based on the report [39] |

| Carbon credits | National voluntary market | €25/year | Assumed | Average expected value for the voluntary carbon market in Portugal, starting in 2025 |

| BoP | Project lifespan | 20 years | Technologist 1 | Given by the limiting element, in this case, the electrolyzer, whose value comes directly from the commercial proposal |

| BoP | Days of operation | 365 d | Assumed | For a typical electrolysis system, it is assumed that it can operate in continuous mode every day of the year |

| Depreciation Rate | 5% | According project lifespan | ||

| WACC | 7% | Assumed | Weighted average cost of financing | |

| Inflation rate | 2% | [40] |

| Revenues and Cost Values | |||

|---|---|---|---|

| Case Study 1 | Case Study 2 | ||

| Revenues | H2 sales | €0/year | €520,396/year |

| O2 sales | €0/year | €176,238/year | |

| Emission allowances sales | €27,585/year | €0/year | |

| Electricity sales | €433,620 | €0/year | |

| Costs | CAPEX electrolyzer | €2,891,836 | €2,891,836 |

| CAPEX H2 storage | €1,300,000 | €1,300,000 | |

| CAPEX O2 storage | €130,000 | €130,000 | |

| CAPEX Fuel cell | €1,500,000 | €0 | |

| OPEX electrolyzer | €57,836/year | €57,836/year | |

| OPEX stack replacement | €86,755/year | €86,755/year | |

| OPEX Fuel cell | €44,495/year | €0/year | |

| Water costs | €736/year | €736/year | |

| Techno-Economic Indicators | Case Study 1 | Case Study 2 |

|---|---|---|

| IRR | 3.7% | 17.1% |

| Payback time | 15.2 years | 6.1 years |

| LCOH | €3.06/kg | €2.68/kg |

| NPV | €−1,067,411 | €2,740,564 |

| Scenarios | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Parameters | Case Study 1 | 1-A | 1-B | 1-C | 1-D | 1-E | 1-F | 1-G | 1-H |

| Carbon permits | €25.00 | €100.00 | €25.00 | €25.00 | €25.00 | €25.00 | €25.00 | €62.50 | €100.00 |

| Funding rate | 25% | 25% | 40% | 25% | 25% | 25% | 25% | 33% | 40% |

| Round-trip efficiency | 33% | 33% | 33% | 45% | 33% | 33% | 33% | 39% | 45% |

| CAPEX Electrolysis | €2.89 M | €2.89 M | €2.89 M | €2.89 M | €2 M | €2.89 M | €2.89 M | €2.45 M | €2 M |

| Electricity selling price | €300.00 | €300.00 | €300.00 | €300.00 | €300.00 | €250.00 | €300.00 | €275.00 | €300.00 |

| Inflation rate | 2% | 2% | 2% | 2% | 2% | 2% | 4% | 3% | 4% |

| IRR | 3.7% | 6.1% | 6.1% | 8.0% | 6.6% | 1.2% | 5.3% | 9.8% | 19.8% |

| NPV | €−1.07 M | €−2.93 k | €−2.51 k | €3.57 k | €−1.18 k | €−1.75 M | €−5.97 k | €8.85 k | €4.05 M |

| Payback time (years) | 15.2 | 13.9 | 13.9 | 11.5 | 12.3 | 19.4 | 14.6 | 10.6 | 6.6 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Azevedo, L.; Silva, S.; Vilanova, A.; Laranjeira, E. Energy Management in an Insular Region with Renewable Energy Sources and Hydrogen: The Case of Graciosa, Azores. Energies 2025, 18, 5196. https://doi.org/10.3390/en18195196

Azevedo L, Silva S, Vilanova A, Laranjeira E. Energy Management in an Insular Region with Renewable Energy Sources and Hydrogen: The Case of Graciosa, Azores. Energies. 2025; 18(19):5196. https://doi.org/10.3390/en18195196

Chicago/Turabian StyleAzevedo, Luís, Susana Silva, António Vilanova, and Erika Laranjeira. 2025. "Energy Management in an Insular Region with Renewable Energy Sources and Hydrogen: The Case of Graciosa, Azores" Energies 18, no. 19: 5196. https://doi.org/10.3390/en18195196

APA StyleAzevedo, L., Silva, S., Vilanova, A., & Laranjeira, E. (2025). Energy Management in an Insular Region with Renewable Energy Sources and Hydrogen: The Case of Graciosa, Azores. Energies, 18(19), 5196. https://doi.org/10.3390/en18195196