The Economic Effects of the Green Transition of the Greek Economy: An Input–Output Analysis

Abstract

1. Introduction

2. Materials and Methods

2.1. Methodological Framework

2.2. Construction of the Investment Vectors—Main Assumptions

2.2.1. The Main Transition Interventions

- Electricity generation;

- The production of synthetic fuels;

- The promotion of energy efficiency in buildings;

- An enhancement in energy efficiency in industry;

- Intervention in the transportation sector.

2.2.2. The Cost of Transition Measures and Technologies

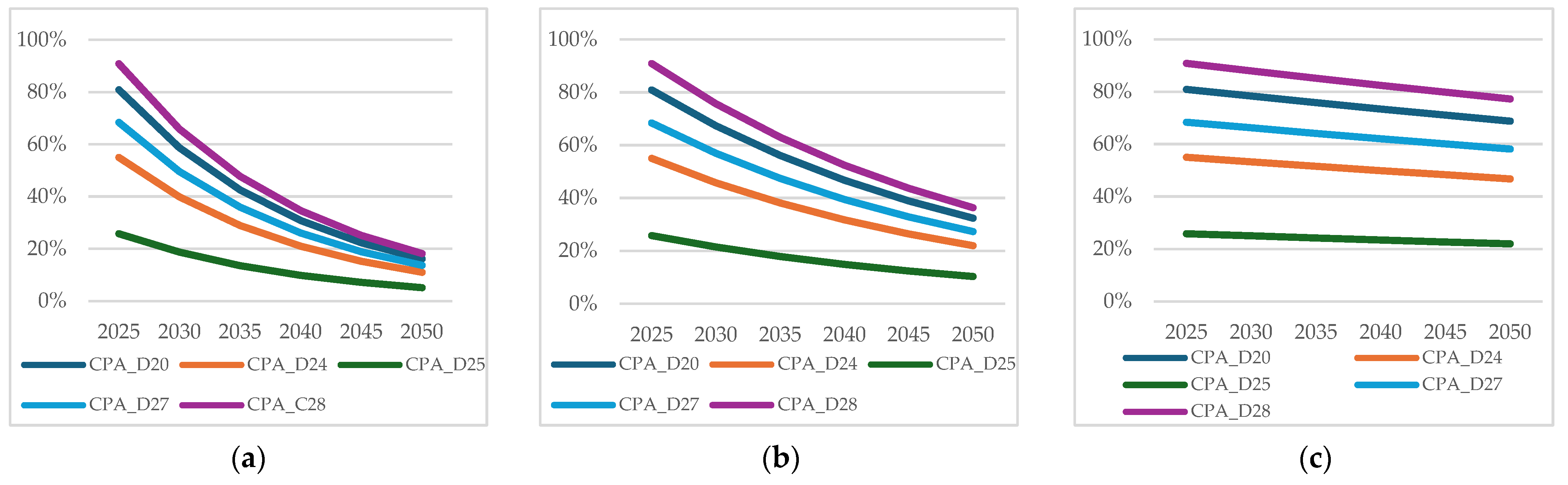

2.2.3. The Penetration of Transition Measures and Technologies

2.2.4. Sectoral Distribution Matrix

2.2.5. Substitution Sub-Scenarios

3. Results

3.1. Direct and Indirect Effects

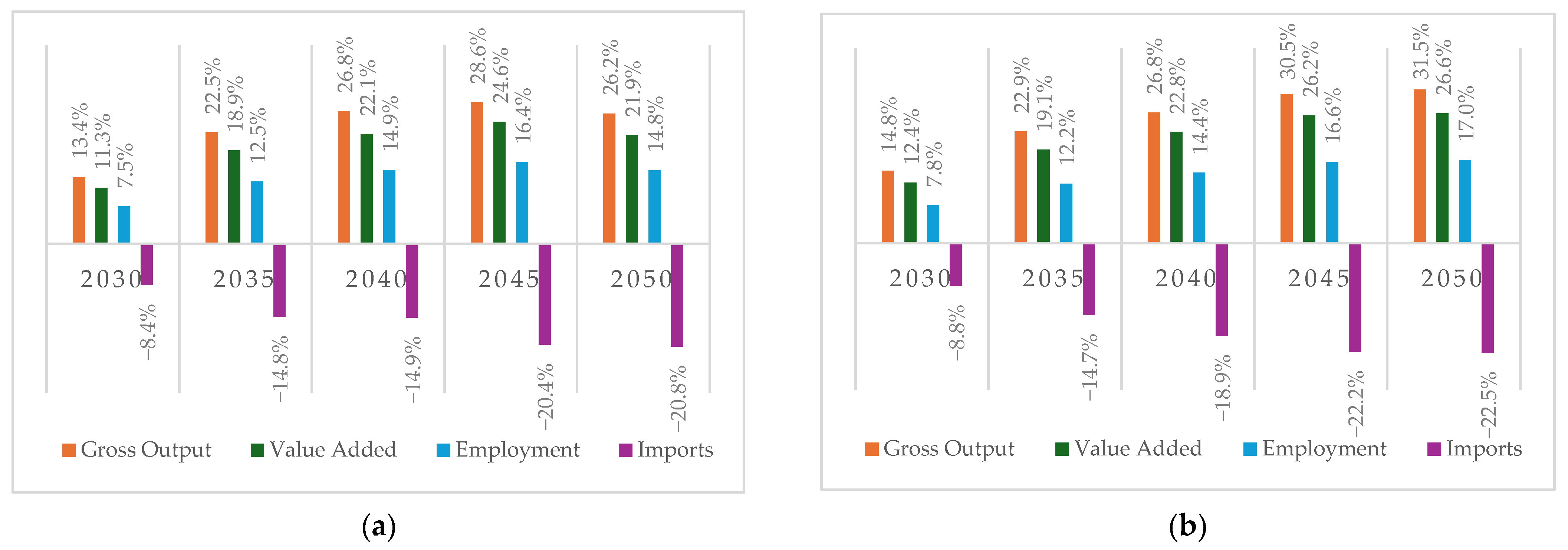

3.2. Sectoral Analysis

3.3. Effects by Occupation

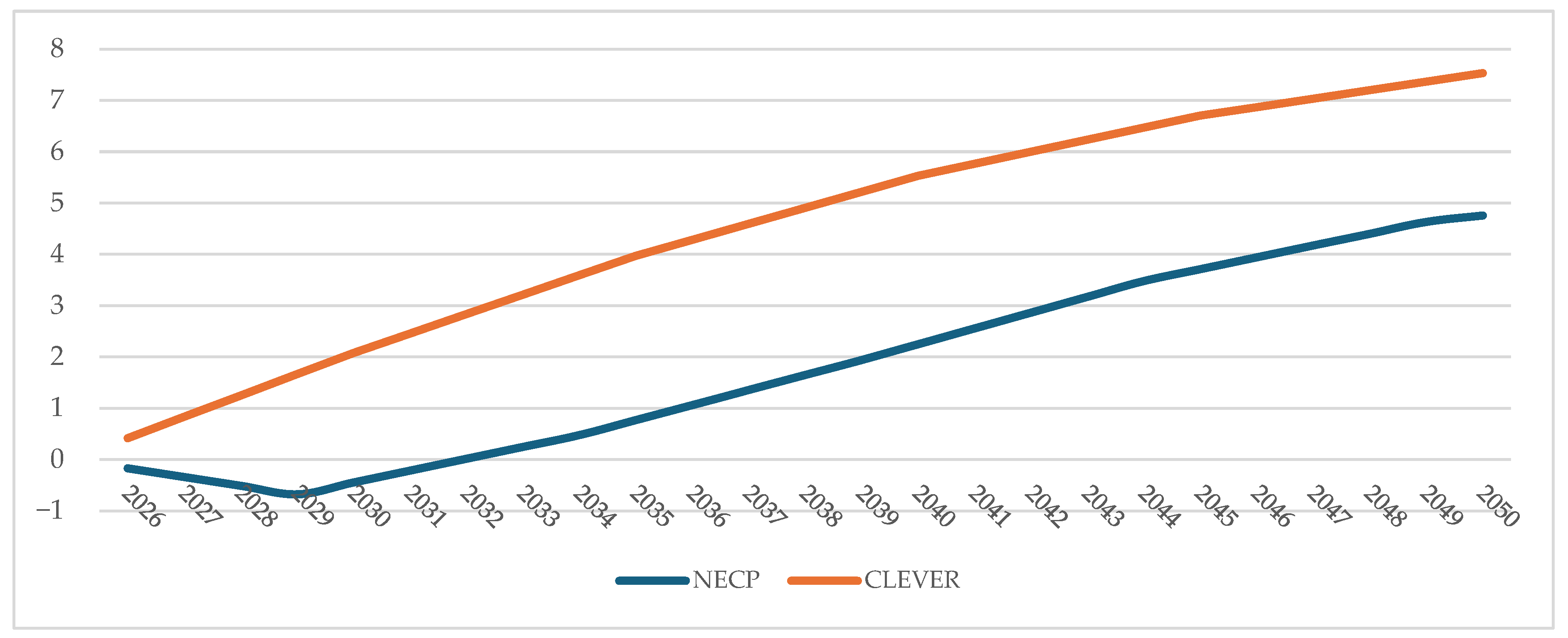

3.4. The Induced Effects of the Green Transition

3.5. Additional Socioeconomic Impacts of Energy Savings in Households

3.6. Multipliers per Type of Intervention and by Sub-Scenario

4. Conclusions and Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| AFIR | Alternative Fuels Infrastructure Regulation. |

| CapEx | Capital Expenditure. |

| CBAM | Carbon Border Adjustment Mechanism. |

| CLEVER | A Decarbonization Pathway for Europe. |

| DAC | Direct air capture. |

| EU | European Union. |

| EU-ETS | Emissions Trading System. |

| GDP | Gross Domestic Product. |

| GHG | Greenhouse Gas. |

| IOA | Input–Output Analysis. |

| NECP | National Environment and Climate Plan. |

| O&M | Operation and Maintenance. |

| OpEx | Operational Expenditures. |

| REPowerEU | EU Plan Aimed at Reducing Europe’s Dependence on Fossil Fuels and Accelerating the Transition to Green Energy. |

| PtF | Power to Fuels. |

| RES | Renewable Energy Sources. |

| RNFBOs | Renewable Fuels of Non-Biological Origin. |

| SCF | Social Climate Fund. |

Appendix A. Penetrations and Costs of the Green Transition Interventions

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | ||||

|---|---|---|---|---|---|---|---|---|---|

| Power Generation | Photovoltaics | Utility scale | Penetration (GW) | 7.4 | 11.9 | 16.4 | 22.4 | 31.7 | 36.3 |

| CapEx (bill. EUR) | 3.2 | 2.9 | 2.5 | 3.9 | 4.2 | 3.7 | |||

| OpEx (bill. EUR) | 0.5 | 0.9 | 1.1 | 1.4 | 1.8 | 2.2 | |||

| Total investment (bill. EUR) | 3.7 | 3.8 | 3.6 | 5.3 | 6 | 5.9 | |||

| Rooftop | Penetration (GW) | 0.8 | 1.5 | 2.3 | 3 | 3.5 | 4 | ||

| CapEx (bill. EUR) | 0.5 | 1 | 0.9 | 1 | 0.9 | 1 | |||

| OpEx (bill. EUR) | 0 | 0.1 | 0.1 | 0.1 | 0.2 | 0.2 | |||

| Total investment (bill. EUR) | 0.5 | 1.1 | 1 | 1.1 | 1.1 | 1.2 | |||

| Wind parks | Onshore | Penetration (GW) | 6 | 7.6 | 8.5 | 9.2 | 11.8 | 11.9 | |

| CapEx (bill. EUR) | 2.3 | 1.9 | 1.6 | 1.3 | 3.8 | 1.6 | |||

| OpEx (bill. EUR) | 0.7 | 0.9 | 1 | 1.1 | 1.2 | 1.3 | |||

| Total investment (bill. EUR) | 3 | 2.8 | 2.6 | 2.4 | 5 | 2.9 | |||

| Offshore | Penetration (GW) | 0 | 1.9 | 6.2 | 9.8 | 15.4 | 17.3 | ||

| CapEx (bill. EUR) | 0 | 5.1 | 10.9 | 8.7 | 13.1 | 4.3 | |||

| OpEx (bill. EUR) | 0 | 0.4 | 1.5 | 2.8 | 4.1 | 5.2 | |||

| Total investment (bill. EUR) | 0 | 5.5 | 12.4 | 11.5 | 17.2 | 9.5 | |||

| Other RES | Geothermal power stations | Penetration (GW) | 0.2 | 0.2 | 0.4 | 0.6 | 0.7 | 0.7 | |

| CapEx (bill. EUR) | 0.2 | 0.1 | 0.5 | 0.3 | 0.3 | 0.2 | |||

| OpEx (bill. EUR) | 0.1 | 0.2 | 0.2 | 0.3 | 0.4 | 0.4 | |||

| Total investment (bill. EUR) | 0.3 | 0.3 | 0.7 | 0.6 | 0.7 | 0.6 | |||

| Biogas power plants | Penetration (GW) | 0.3 | 0.4 | 0.9 | 1.2 | 1.3 | 1.4 | ||

| CapEx (bill. EUR) | 0.3 | 0.1 | 0.8 | 0.6 | 0.4 | 0.2 | |||

| OpEx (bill. EUR) | 0.1 | 0.3 | 0.5 | 0.7 | 0.9 | 1 | |||

| Total investment (bill. EUR) | 0.4 | 0.4 | 1.3 | 1.3 | 1.3 | 1.2 | |||

| Hydroelectric power stations | Penetration (GW) | 3.1 | 3.8 | 3.8 | 3.8 | 3.8 | 3.9 | ||

| CapEx (bill. EUR) | 0 | 1.8 | 0 | 0 | 0 | 0.1 | |||

| OpEx (bill. EUR) | 1.2 | 1.4 | 1.5 | 1.5 | 1.5 | 1.5 | |||

| Total investment (bill. EUR) | 1.2 | 3.2 | 1.5 | 1.5 | 1.5 | 1.6 | |||

| Natural gas power plants | Penetration (GW) | 6.9 | 7.7 | 5.7 | 5.2 | 2.8 | 4.2 | ||

| CapEx (bill. EUR) | 0.7 | 0.4 | 0 | 0 | 0 | 0.6 | |||

| OpEx (bill. EUR) | 1.7 | 1.7 | 1.4 | 1 | 0.7 | 0.6 | |||

| Total investment (bill. EUR) | 2.4 | 2.1 | 1.4 | 1 | 0.7 | 1.2 | |||

| Storage | Batteries | Penetration (GW) | 1.9 | 3.1 | 3.6 | 8.8 | 19.1 | 22.6 | |

| CapEx (bill. EUR) | 0.5 | 0.4 | 0.2 | 1.3 | 2.5 | 0.8 | |||

| OpEx (bill. EUR) | 0.2 | 0.5 | 0.6 | 1 | 2.2 | 2.9 | |||

| Total investment (bill. EUR) | 0.7 | 0.9 | 0.8 | 2.3 | 4.7 | 3.7 | |||

| Pumped storage stations | Penetration (GW) | 1.4 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | ||

| CapEx (bill. EUR) | 2.2 | 2.5 | 0 | 0 | 0 | 0 | |||

| OpEx (bill. EUR) | 0.1 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | |||

| Total investment (bill. EUR) | 2.3 | 2.7 | 0.2 | 0.2 | 0.2 | 0.2 | |||

| Transmission and distribution network | Total investment (bill. EUR) | 1.4 | 2 | 5.2 | 3.9 | 2.6 | 3.6 | ||

| Total investment in power generation (bill. EUR) | 15.9 | 24.8 | 30.7 | 31.1 | 41 | 31.6 | |||

| H2—Synthetic Fuels | Electrolysis | Penetration (GW) | 0 | 0.3 | 7 | 12.5 | 17.4 | 20.7 | |

| CapEx (bill. EUR) | 0 | 0.2 | 4.7 | 3.6 | 2.9 | 1.8 | |||

| OpEx (bill. EUR) | 0 | 0.1 | 0.7 | 1.6 | 2.4 | 2.9 | |||

| Total investment (bill. EUR) | 0 | 0.3 | 5.4 | 5.2 | 5.3 | 4.7 | |||

| Power to fuels | Penetration (GW) | 0 | 0.3 | 1 | 1.9 | 3 | 4 | ||

| CapEx (bill. EUR) | 0 | 0.2 | 0.6 | 0.8 | 0.7 | 0.6 | |||

| OpEx (bill. EUR) | 0 | 0.1 | 0.1 | 0.2 | 0.4 | 0.5 | |||

| Total investment (bill. EUR) | 0 | 0.3 | 0.7 | 0.9 | 1.1 | 1.1 | |||

| DAC to CO2 | Annual potential (ΜtCO2) | 0 | 0 | 0.5 | 2.7 | 3.3 | 5.6 | ||

| CapEx (bill. EUR) | 0 | 0 | 0.1 | 0.4 | 0.1 | 0.3 | |||

| OpEx (bill. EUR) | 0 | 0 | 0 | 0.1 | 0.1 | 0.2 | |||

| Total investment (bill. EUR) | 0 | 0 | 0.1 | 0.5 | 0.2 | 0.5 | |||

| Total investment in the production of synthetic fuels (bill. EUR) | 0 | 0.6 | 6.2 | 6.6 | 6.6 | 6.3 | |||

| Residences | No. of renovated residences (5-year period, thousands) | 289 | 396 | 454 | 402 | 392 | 418 | ||

| External shell renovation cost (bill. EUR) | 2.8 | 3.1 | 3.9 | 3.8 | 3.6 | 4.3 | |||

| Cost of cool-heating devices (bill. EUR) | 6.8 | 4.7 | 6.9 | 6.8 | 7.9 | 6.8 | |||

| Cost (differential) of electrical appliances (bill. EUR) | 0.4 | 1.1 | 1.1 | 1.3 | 1.4 | 1.4 | |||

| Total investment (bill. EUR) | 10 | 8.9 | 11.9 | 11.9 | 12.9 | 12.5 | |||

| Buildings’ Energy Efficiency Upgrade | Services buildings | No. of renovated building (5-year period, thousands) | 11 | 12 | 26 | 13 | 24 | 19 | |

| External shell renovation cost (bill. EUR) | 0.3 | 0.4 | 0.7 | 0.4 | 0.7 | 0.6 | |||

| Heat pumps cost (bill. EUR) | 0.2 | 1.2 | 0.9 | 0.8 | 0.3 | 0.3 | |||

| Total investment (bill. EUR) | 0.5 | 1.6 | 1.6 | 1.2 | 1 | 0.9 | |||

| Total investment in the energy upgrade of residential and tertiary sector buildings (bill. EUR) | 10.5 | 10.5 | 13.5 | 13.1 | 13.9 | 13.4 | |||

| Industry | Total investment in the energy upgrade of industrial sector (bill. EUR) | 0.6 | 1.3 | 1.7 | 1.9 | 1.2 | 0.8 | ||

| Transportation | Vehicles | Passenger vehicles | Stock of battery electric vehicles (thousands) | 34.8 | 178.1 | 592.8 | 1317.4 | 2307.7 | 3696.6 |

| Total (differential) purchase expenditures (bill. EUR) | 0.5 | 1.4 | 2.9 | 3.4 | 3.5 | 5 | |||

| Stock of plug-in hybrid electric vehicles (thousands) | 34.8 | 87.7 | 65.9 | 0 | 0 | 0 | |||

| Total (differential) purchase expenditures (bill. EUR) | 0.3 | 0.5 | 0.2 | 0 | 0 | 0 | |||

| Stock of hydrogen (fuel cell electric) vehicles (thousands) | 0 | 0 | 52 | 459.4 | 630.6 | 673.3 | |||

| Total (differential) purchase expenditures (bill. EUR) | 0 | 0 | 2.1 | 15.7 | 6.5 | 3.6 | |||

| Light-duty trucks | Stock of battery electric vehicles (thousands) | 3.6 | 17 | 45 | 92 | 162.6 | 261.3 | ||

| Total (differential) purchase expenditures (bill. EUR) | 0 | 0.1 | 0.1 | 0.2 | 0.4 | 0.6 | |||

| Total (differential) expenditures for vehicle purchase (bill. EUR) | 0.8 | 2 | 5.3 | 19.3 | 10.4 | 9.2 | |||

| Charging stations | Penetration (GW) | 0.1 | 0.3 | 0.9 | 1.8 | 3.2 | 5.2 | ||

| CapEx (bill. EUR) | 0.1 | 0.2 | 0.4 | 0.8 | 1.1 | 1.5 | |||

| OpEx (bill. EUR) | < 0.1 | < 0.1 | 0.1 | 0.1 | 0.2 | 0.3 | |||

| Total investment (bill. EUR) | 0.1 | 0.2 | 0.5 | 0.9 | 1.3 | 1.8 | |||

| Railway network | Total investment in the electrification of railway network (bill. EUR) | 1.3 | 0.9 | 0 | 0 | 0 | 0 | ||

| Rest of transportation | Total investment in the decarbonation of the rest of transport (bill. EUR) | 34.2 | 35.6 | 41 | 42 | 50 | 50 | ||

| Expenditures Reduction | Solid fuels | Electricity generation (ΤWh) | 9.6 | 0 | 0 | 0 | 0 | 0 | |

| Production cost reduction (bill. EUR) | 0.4 | −0.9 | 0 | 0 | 0 | 0 | |||

| Oil | Final demand (ktoe) | 8687 | 7243 | 4643 | 2042 | 1044 | 188 | ||

| Reduction in consumption expenditures (bill. EUR) | 1.3 | −2.2 | −3.9 | −3.9 | −1.5 | −1.3 | |||

| Natural gas | Final demand (ktoe) | 1077 | 788 | 616 | 682 | 89 | 8 | ||

| Reduction in consumption expenditures bill. EUR) | < 0.1 | −0.3 | −0.2 | < 0.1 | −0.6 | −0.1 | |||

| Total expenditure reduction (bill. EUR) | 1.7 | −3.4 | −4.1 | −3.9 | −2.1 | −1.4 | |||

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Power Generation | Photovoltaics | Utility scale | Penetration (GW) | 5.7 | 8.5 | 10.2 | 12.0 | 13.5 | 14.7 | ||

| CapEx (bill. EUR) | 2.2 | 1.9 | 1 | 1.9 | 0.9 | 2.4 | |||||

| OpEx (bill. EUR) | 0.4 | 0.6 | 0.7 | 0.8 | 0.9 | 0.9 | |||||

| Total investment (bill. EUR) | 2.6 | 2.5 | 1.7 | 2.7 | 1.8 | 3.3 | |||||

| Rooftop | Penetration (GW) | 0.8 | 1.5 | 2.3 | 3 | 3.5 | 4 | ||||

| CapEx (bill. EUR) | 0.5 | 1 | 0.9 | 1 | 0.9 | 1 | |||||

| OpEx (bill. EUR) | 0 | 0.1 | 0.1 | 0.1 | 0.2 | 0.2 | |||||

| Total investment (bill. EUR) | 0.5 | 1.1 | 1 | 1.1 | 1.1 | 1.2 | |||||

| Wind parks | Onshore | Penetration (GW) | 7 | 9 | 10.5 | 11 | 11.5 | 12 | |||

| CapEx (bill. EUR) | 3.3 | 2.2 | 2.1 | 1.1 | 2.1 | 1.9 | |||||

| OpEx (bill. EUR) | 0.8 | 1 | 1.2 | 1.3 | 1.3 | 1.3 | |||||

| Total investment (bill. EUR) | 4.1 | 3.3 | 3.3 | 2.4 | 3.4 | 3.2 | |||||

| Offshore | Penetration (GW) | 0 | 1.5 | 1.8 | 2 | 2.5 | 3 | ||||

| CapEx (bill. EUR) | 0 | 4 | 0.6 | 0.6 | 1.2 | 1.1 | |||||

| OpEx (bill. EUR) | 0 | 0.3 | 0.6 | 0.6 | 0.7 | 0.9 | |||||

| Total investment (bill. EUR) | 0 | 4.3 | 1.2 | 1.2 | 1.9 | 2 | |||||

| Other RES | Geothermal power stations | Penetration (GW) | 0.0 | 0.2 | 0.3 | 0.4 | 0.5 | 0.5 | |||

| CapEx (bill. EUR) | 0 | 0.4 | 0.2 | 0.2 | 0.2 | 0 | |||||

| OpEx (bill. EUR) | 0 | 0.1 | 0.2 | 0.2 | 0.3 | 0.3 | |||||

| Total investment (bill. EUR) | 0.3 | 0.5 | 0.4 | 0.4 | 0.5 | 0.3 | |||||

| Biogas power plants | Penetration (GW) | 0 | 0 | 0.3 | 0.5 | 0.6 | 0.8 | ||||

| CapEx (bill. EUR) | 0 | 0 | 0.5 | 0.4 | 0.2 | 0.3 | |||||

| OpEx (bill. EUR) | 0 | 0 | 0.1 | 0.3 | 0.4 | 0.5 | |||||

| Total investment (bill. EUR) | 0 | 0 | 0.6 | 0.7 | 0.6 | 0.8 | |||||

| Hydroelectric power stations | Penetration (GW) | 3.5 | 4 | 4 | 4.7 | 4.7 | 4.7 | ||||

| CapEx (bill. EUR) | 0.3 | 1.3 | 0 | 1.3 | 0 | 0 | |||||

| OpEx (bill. EUR) | 1.4 | 1.5 | 1.6 | 1.7 | 1.8 | 1.8 | |||||

| Total investment (bill. EUR) | 1.7 | 2.8 | 1.6 | 3 | 1.8 | 1.8 | |||||

| Natural gas power plants | Penetration (GW) | 6.9 | 7.7 | 5.7 | 5.2 | 2.8 | 4.2 | ||||

| CapEx (bill. EUR) | 0.7 | 0.4 | 0 | 0 | 0 | 0.6 | |||||

| OpEx (bill. EUR) | 1.7 | 1.7 | 1.4 | 1 | 0.7 | 0.6 | |||||

| Total investment (bill. EUR) | 2.4 | 2.1 | 1.4 | 1 | 0.7 | 1.2 | |||||

| Storage | Batteries | Penetration (GW) | 1.7 | 2.6 | 3.7 | 4.6 | 8.9 | 10.0 | |||

| CapEx (bill. EUR) | 0.5 | 0.2 | 0.3 | 0.2 | 1 | 0.3 | |||||

| OpEx (bill. EUR) | 0.2 | 0.5 | 0.6 | 0.7 | 1 | 1.3 | |||||

| Total investment (bill. EUR) | 0.7 | 0.7 | 0.9 | 0.9 | 2 | 1.6 | |||||

| Pumped storage stations | Penetration (GW) | 1.4 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | ||||

| CapEx (bill. EUR) | 1.4 | 1.6 | 0 | 0 | 0 | 0 | |||||

| OpEx (bill. EUR) | 0.1 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | |||||

| Total investment (bill. EUR) | 1.5 | 1.8 | 0.2 | 0.2 | 0.2 | 0.2 | |||||

| Transmission and distribution network | Total investment (bill. EUR) | 0.9 | 1.4 | 3.5 | 2.6 | 1.8 | 2.4 | ||||

| Total investment in power generation (bill. EUR) | 14.4 | 20.4 | 15.8 | 16.2 | 15.6 | 18.1 | |||||

| H2—Synthetic Fuels | Electrolysis | Penetration (GW) | 0.1 | 0.5 | 1.1 | 2.1 | 2.7 | 3.3 | |||

| CapEx (bill. EUR) | 1 | 0.2 | 0.5 | 0.6 | 0.3 | 0.3 | |||||

| OpEx (bill. EUR) | <0.1 | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | |||||

| Total investment (bill. EUR) | 0.1 | 0.3 | 0.7 | 0.9 | 0.7 | 0.8 | |||||

| Power to fuels | Penetration (GW) | 0 | 0 | 0.3 | 0.5 | 0.6 | 0.8 | ||||

| CapEx (bill. EUR) | 0 | 0 | 0.2 | 0.2 | 0.1 | 0.1 | |||||

| OpEx (bill. EUR) | 0 | 0.1 | <0.1 | <0.1 | 0.1 | 0.1 | |||||

| Total investment (bill. EUR) | 0 | 0 | 0.2 | 0.2 | 0.2 | 0.2 | |||||

| DAC to CO2 | Annual potential (ΜtCO2) | 0 | 0 | 0.1 | 1.3 | 2.1 | 4.5 | ||||

| CapEx (bill. EUR) | 0 | 0 | <0.1 | 0.2 | 0.1 | 0.4 | |||||

| OpEx (bill. EUR) | 0 | 0 | <0.1 | 0.1 | 0.1 | 0.1 | |||||

| Total investment (bill. EUR) | 0 | 0 | <0.1 | 0.3 | 0.2 | 0.5 | |||||

| Total investment in the production of synthetic fuels (bill. EUR) | 0.1 | 0.3 | 0.9 | 1.4 | 1.1 | 1.5 | |||||

| Buildings’ Energy Efficiency Upgrade | Residences | No. of renovated residences (5-year period, thousands) | 25 | 646 | 672 | 688 | 700 | 596 | |||

| External shell renovation cost (bill. EUR) | 0.7 | 19.3 | 20 | 20.5 | 20.8 | 17.8 | |||||

| Cost of cool-heating devices (bill. EUR) | 2.9 | 5.3 | 4.5 | 4.4 | 4.3 | 3.4 | |||||

| Cost (differential) of electrical appliances (bill. EUR) | 0.4 | 1.1 | 1.1 | 1.3 | 1.4 | 1.4 | |||||

| Total investment (bill. EUR) | 4 | 25.7 | 25.6 | 26.2 | 26.5 | 22.6 | |||||

| Service buildings | No. of renovated building (5-year period, thousands) | 8 | 23 | 32 | 32 | 32 | 32 | ||||

| External shell renovation cost (bill. EUR) | 0.3 | 0.6 | 0.9 | 1 | 0.9 | 1.1 | |||||

| Heat pumps cost (bill. EUR) | 0.3 | 0.7 | 0.9 | 0.8 | 0.8 | 0.8 | |||||

| Total investment (bill. EUR) | 0.6 | 1.5 | 1.8 | 1.8 | 1.7 | 1.9 | |||||

| Total investment in the energy upgrade of residential and tertiary sector buildings (bill. EUR) | 4.6 | 27.2 | 27.4 | 28 | 28.2 | 24.5 | |||||

| Industry | Total investment in the energy upgrade of industrial sector (bill. EUR) | 0.6 | 1.3 | 1.7 | 1.9 | 1.2 | 0.8 | ||||

| Transportation | Vehicles | Private vehicles | Cars | BEV | Stock of battery electric vehicles (thousands) | 105.5 | 489.2 | 898.9 | 1492.2 | 2043.1 | 3465.4 |

| Total (differential) purchase expenditures (bill. EUR) | 1.6 | 3.8 | 2.9 | 3.1 | 3.1 | 5.8 | |||||

| Synthetic gas/Hydridic | Stock of gas/methane vehicles (thousands) | 0.1 | 0.2 | 0.3 | 0.3 | 0.3 | 0.2 | ||||

| Total (differential) purchase expenditures (bill. EUR) | 2.6 | 4.8 | 3.9 | 3.6 | 3.7 | 6.4 | |||||

| Motorcycles | Battery electric | Stock of battery electric motorcycles (thousands) | 105.1 | 210.3 | 315.4 | 420.6 | 525.7 | 736 | |||

| Total (differential) purchase expenditures (bill. EUR) | 0.3 | 0.4 | 0.8 | 0.5 | 0.4 | 0.5 | |||||

| Synthetic gas/methane | Stock of gas/methane motorcycles (thousands) | 105.1 | 210.3 | 315.4 | 420.6 | 525.7 | 736 | ||||

| Total (differential) purchase expenditures (bill. EUR) | 0.2 | 0.2 | 0.5 | 0.2 | 0.1 | 0 | |||||

| Light-duty trucks | Battery electric | Stock of battery electric vehicles (thousands) | 17.9 | 46.7 | 114.3 | 189.2 | 263 | 367.1 | |||

| Total (differential) purchase expenditures (bill. EUR) | 0.3 | 0.3 | 0.4 | 0.4 | 0.5 | 1 | |||||

| Synthetic gas/methane | Stock of gas/methane vehicles (thousands) | 0 | 0 | 0 | 0 | 0 | 0.2 | ||||

| Total (differential) purchase expenditures (bill. EUR) | 0 | 0 | 0 | 0 | 0 | 0.2 | |||||

| Heavy-duty trucks | Battery electric | Stock of battery electric vehicles (thousands) | 7.5 | 15 | 22.5 | 30 | 37.5 | 45 | |||

| Total (differential) purchase expenditures (bill. EUR) | 0.2 | 0.2 | 0.1 | 0.1 | 0.1 | 0.2 | |||||

| Synthetic gas/methane | Stock of gas/methane vehicles (thousands) | 30 | 60 | 90 | 120 | 150 | 180 | ||||

| Total (differential) purchase expenditures (bill. EUR) | 0.5 | 0.6 | 0.5 | 1 | 1.4 | 1.9 | |||||

| Buses | Battery electric | Stock of battery electric vehicles (thousands) | 2.1 | 3.5 | 4.9 | 6.3 | 7.6 | 10.4 | |||

| Total (differential) purchase expenditures (bill. EUR) | 0.3 | 0.2 | 0.1 | <0.1 | 0.1 | <0.1 | |||||

| Synthetic gas/methane | Stock of gas/methane vehicles (thousands) | 5.2 | 7 | 8.7 | 10.4 | 12.2 | 15.6 | ||||

| Total (differential) purchase expenditures (bill. EUR) | 0.8 | 0.1 | 0.1 | <0.1 | 0.2 | 0.2 | |||||

| Total (differential) expenditures for vehicle purchase (bill. EUR) | 5.2 | 6.7 | 6.4 | 5.9 | 6.6 | 10.5 | |||||

| Charging stations | Penetration (GW) | 0.3 | 0.9 | 1.6 | 2.5 | 3.4 | 5.6 | ||||

| CapEx (bill. EUR) | 0.2 | 0.5 | 0.6 | 0.7 | 0.7 | 1.7 | |||||

| OpEx (bill. EUR) | <0.1 | 0.1 | 0.1 | 0.2 | 0.2 | 0.4 | |||||

| Total investment (bill. EUR) | 0.2 | 0.6 | 0.7 | 0.9 | 0.9 | 2.1 | |||||

| Railway network | Total investment in the electrification of railway network (bill. EUR) | 1.3 | 0.9 | 0 | 0 | 0 | 0 | ||||

| Rest of transportation | Total investment in the decarbonation of the rest of transport (bill. EUR) | 34.2 | 35.6 | 41 | 42 | 50 | 50 | ||||

| Expenditures Reduction | Solid fuels | Electricity generation (ΤWh) | 9.6 | 0 | 0 | 0 | 0 | 0 | |||

| Production cost reduction (bill. EUR) | 0.4 | −0.9 | 0 | 0 | 0 | 0 | |||||

| Oil | Final demand (ktoe) | 8687 | 7243 | 4643 | 2042 | 1044 | 188 | ||||

| Reduction in consumption expenditures (bill. EUR) | 1.3 | −2.2 | −3.9 | −3.9 | −1.5 | −1.3 | |||||

| Natural gas | Final demand (ktoe) | 1.077 | 788 | 616 | 682 | 89 | 8 | ||||

| Reduction in consumption expenditures bill. EUR) | <0.1 | −0.3 | −0.2 | <0.1 | −0.6 | −0.1 | |||||

| Total expenditure reduction (bill. EUR) | 1.7 | −3.4 | −4.1 | −3.9 | −2.1 | −1.4 | |||||

Appendix B. Sectoral Distribution Matrix

| Id. | Interventions | Sector Cost | Agriculture, Hunting, Forestry | Chemical and Chemical Products | Basic Metals | Fabricated Metal Products | Electrical Equipment | Machinery and Equipment, Nec | Manufacturing Nec; Repair and Installation of Machinery and Equipment | Electricity, Gas, Steam, and Air Conditioning Supply | Water supply, Sewerage, Waste Management, and Remediation Activities | Construction | Retail Trade | Land transport and Transport via Pipelines | Financial Service Activities | Real Estate Activities | Professional, Scientific, and Technical Activities | Administrative and Support Service Activities | Imports |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.1 | Utility scale photovoltaics | Construction | 10.4 | 27.8 | 20.7 | 19.0 | 5.0 | 17.2 | |||||||||||

| 1.2 | Operation and maintenance | 7.3 | 16.7 | 10.0 | 15.0 | 38.7 | 8.3 | 4.1 | |||||||||||

| 2.1 | Rooftop photovoltaics | Construction | 8.6 | 38.4 | 10.0 | 15.0 | 5.0 | 22.9 | |||||||||||

| 2.2 | Operation and maintenance | 8.5 | 19.7 | 5.0 | 53.7 | 8.3 | 4.8 | ||||||||||||

| 3.1 | Onshore wind parks | Construction | 2.6 | 37.1 | 19.0 | 6.0 | 35.3 | ||||||||||||

| 3.2 | Operation and maintenance | 3.4 | 56.3 | 34.0 | 4.3 | 1.9 | |||||||||||||

| 4.1 | Offshore wind parks | Construction | 2.1 | 24.0 | 1.7 | 49.0 | 23.2 | ||||||||||||

| 4.2 | Operation and maintenance | 10.7 | 30.0 | 16.0 | 5.0 | 27.3 | 5.0 | 6.0 | |||||||||||

| 5.1 | Geothermal power stations | Construction | 18.6 | 8.0 | 49.7 | 6.0 | 17.7 | ||||||||||||

| 5.2 | Operation and maintenance | 5.6 | 10.5 | 28.3 | 38.0 | 5.0 | 12.7 | ||||||||||||

| 6.1 | Biogas power plants | Construction | 15.4 | 17.2 | 12.0 | 31.0 | 24.4 | ||||||||||||

| 6.2 | Operation and maintenance | 43.0 | 3.8 | 2.1 | 9.3 | 5.0 | 31.0 | 1.7 | 4.1 | ||||||||||

| 7.1 | Hydroelectric power stations | Construction | 8.9 | 2.7 | 6.9 | 74.0 | 7.5 | ||||||||||||

| 7.2 | Operation and maintenance | 6.9 | 5.5 | 26.1 | 8.7 | 37.7 | 6.2 | 8.9 | |||||||||||

| 8.1 | Batteries | Construction | 3.5 | 51.2 | 16.0 | 29.3 | |||||||||||||

| 8.2 | Operation and maintenance | 12.4 | 22.3 | 6.0 | 40.0 | 12.3 | 6.9 | ||||||||||||

| 9.1 | Pumped storage stations | Construction | 1.7 | 25.1 | 1.3 | 48.0 | 23.9 | ||||||||||||

| 9.2 | Operation and maintenance | 5.3 | 10.1 | 22.7 | 45.5 | 4.2 | 12.2 | ||||||||||||

| 10.1 | Natural gas power plants | Construction | 31.7 | 14.5 | 16.8 | 6.0 | 31.0 | ||||||||||||

| 10.2 | Operation and maintenance | 11.1 | 17.4 | 29.3 | 4.3 | 26.8 | 4.7 | 6.3 | |||||||||||

| 11.1 | Electrolysis | Construction | 2.8 | 9.8 | 28.1 | 1.3 | 28.3 | 7.0 | 3.0 | 19.7 | |||||||||

| 11.2 | Operation and maintenance | 12.3 | 1.6 | 61.7 | 3.1 | 11.2 | 1.7 | 8.4 | |||||||||||

| 12.1 | Power to fuels | Construction | 2.7 | 6.5 | 10.1 | 20.9 | 21.1 | 12.0 | 26.8 | ||||||||||

| 12.2 | Operation and maintenance | 9.1 | 5.0 | 35.3 | 9.5 | 7.6 | 19.1 | 4.7 | 9.7 | ||||||||||

| 13.1 | DAC to CO2 | Construction | 13.3 | 21.7 | 20.8 | 17.0 | 27.3 | ||||||||||||

| 13.2 | Operation and maintenance | 5.8 | 5.5 | 41.3 | 5.8 | 16.3 | 11.3 | 5.7 | 8.3 | ||||||||||

| 14.1 | Transmission and distribution network | Construction | 64.1 | 35.9 | |||||||||||||||

| 14.2 | Operation and maintenance | 28.1 | 36.4 | 1.7 | 15.8 | 18.1 | |||||||||||||

| 15.1 | Resident energy upgrade | Renovation | 25.9 | 17.3 | 20.0 | 15.0 | 21.8 | ||||||||||||

| 15.2 | Heat pumps | 0.6 | 4.3 | 2.6 | 26.9 | 2.6 | 33.0 | 10.0 | 20.0 | ||||||||||

| 15.3 | Air conditioners | 64.1 | 35.9 | ||||||||||||||||

| 15.4 | Electrical appliances | 64.1 | 35.9 | ||||||||||||||||

| 16.1 | Energy upgrade of service buildings | Renovation | 25.9 | 17.3 | 20.0 | 15.0 | 21.8 | ||||||||||||

| 16.2 | Heat pumps | 0.6 | 4.3 | 2.6 | 26.9 | 2.6 | 33.0 | 10.0 | 20.0 | ||||||||||

| 17 | Industrial sector | 0.6 | 4.3 | 2.6 | 26.9 | 2.6 | 33.0 | 10.0 | 20.0 | ||||||||||

| 18.1 | Charging stations | Construction | 32.0 | 12.5 | 35.0 | 2.5 | 18.0 | ||||||||||||

| 18.2 | Operation and maintenance | 3.0 | 1.2 | 38.8 | 1.9 | 9.4 | 42.8 | 2.8 | |||||||||||

| 19 | Vehicles | 10 | |||||||||||||||||

| 20 | Electrification of railway network | 14.7 | 17.3 | 14.0 | 32.0 | 10.0 | 12.0 | ||||||||||||

| 21.1 | Transportation | Public transport vehicle fleet replacement | 100.0 | ||||||||||||||||

| 21.2 | Ship conversion | 100.0 | |||||||||||||||||

| 21.3 | Electrical equipment | 42.7 | 33.3 | 24.0 | |||||||||||||||

| 21.4 | Mechanical equipment | 34.8 | 33.3 | 31.8 | |||||||||||||||

| 21.5 | Construction/civil engineering projects | 100.0 | |||||||||||||||||

| 21.6 | Licenses/permits-Assessments | 100.0 | |||||||||||||||||

Appendix C. Total Effects of the Scenarios Examined

| Effect | Sub-Scenario | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 |

|---|---|---|---|---|---|---|---|

| NECP Scenario | |||||||

| Output (in billions of EUR) | Optimistic | 10.3 | 14.2 | 20.4 | 22.6 | 29.0 | 27.6 |

| Moderate | 10.3 | 13.4 | 18.9 | 20.8 | 26.9 | 25.8 | |

| Pessimistic | 10.3 | 12.5 | 16.7 | 17.8 | 22.6 | 21.9 | |

| Value added (in billions of EUR) | Optimistic | 4.7 | 6.5 | 9.4 | 10.4 | 13.1 | 12.6 |

| Moderate | 4.7 | 6.2 | 8.8 | 9.7 | 12.2 | 11.9 | |

| Pessimistic | 4.7 | 5.8 | 7.9 | 8.5 | 10.5 | 10.3 | |

| Imports of intermediate products (in billions of EUR) | Optimistic | 1.6 | 2.1 | 3.0 | 3.4 | 4.8 | 4.5 |

| Moderate | 1.6 | 1.9 | 2.7 | 3.0 | 4.3 | 4.0 | |

| Pessimistic | 1.6 | 1.7 | 2.1 | 2.3 | 3.3 | 3.1 | |

| Imports of final products (in billions of EUR) | Optimistic | 6.1 | 5.5 | 6.1 | 7.9 | 5.9 | 4.7 |

| Moderate | 6.1 | 6.0 | 7.1 | 9.1 | 7.4 | 5.8 | |

| Pessimistic | 6.1 | 6.6 | 8.5 | 11.0 | 10.2 | 8.5 | |

| Total imports (in billions of EUR) | Optimistic | 7.7 | 7.6 | 9.1 | 11.3 | 10.7 | 9.2 |

| Moderate | 7.7 | 7.9 | 9.7 | 12.1 | 11.6 | 9.9 | |

| Pessimistic | 7.7 | 8.3 | 10.7 | 13.3 | 13.4 | 11.5 | |

| Employment (in thousands of employees) | Optimistic | 143.6 | 195.8 | 275.3 | 300.4 | 379.2 | 361.3 |

| Moderate | 143.6 | 189.7 | 262.8 | 285.9 | 361.0 | 346.9 | |

| Pessimistic | 143.6 | 182.1 | 244.7 | 261.6 | 325.7 | 314.7 | |

| CLEVER Scenario | |||||||

| Output (in billions of EUR) | Optimistic | 6.7 | 15.6 | 17.3 | 19.4 | 19.9 | 20.3 |

| Moderate | 6.7 | 14.7 | 16.0 | 17.9 | 18.3 | 18.8 | |

| Pessimistic | 6.7 | 13.6 | 14.0 | 15.3 | 15.2 | 15.4 | |

| Value added (in billions of EUR) | Optimistic | 3.5 | 7.4 | 8.0 | 8.9 | 9.1 | 9.3 |

| Moderate | 3.5 | 7.0 | 7.5 | 8.2 | 8.4 | 8.7 | |

| Pessimistic | 3.5 | 6.5 | 6.7 | 7.2 | 7.2 | 7.4 | |

| Imports of intermediate products (in billions of EUR) | Optimistic | 0.5 | 2.0 | 2.5 | 3.0 | 3.1 | 3.1 |

| Moderate | 0.5 | 1.8 | 2.2 | 2.7 | 2.8 | 2.8 | |

| Pessimistic | 0.5 | 1.6 | 1.8 | 2.1 | 2.1 | 2.0 | |

| Imports of final products (in billions of EUR) | Optimistic | 6.4 | 7.1 | 5.6 | 4.6 | 4.0 | 4.2 |

| Moderate | 6.4 | 7.7 | 6.5 | 5.6 | 5.1 | 5.2 | |

| Pessimistic | 6.4 | 8.4 | 7.7 | 7.3 | 7.1 | 7.5 | |

| Total imports (in billions of EUR) | Optimistic | 6.8 | 9.1 | 8.1 | 7.6 | 7.1 | 7.3 |

| Moderate | 6.8 | 9.5 | 8.7 | 8.3 | 7.8 | 8.0 | |

| Pessimistic | 6.8 | 10.0 | 9.5 | 9.4 | 9.2 | 9.4 | |

| Employment (in thousands of employees) | Optimistic | 112.7 | 218.7 | 228.9 | 250.6 | 253.9 | 260.7 |

| Moderate | 112.7 | 211.7 | 218.8 | 238.8 | 241.7 | 249.0 | |

| Pessimistic | 112.7 | 202.9 | 204.1 | 219.0 | 217.9 | 222.7 | |

| Sub-Scenario | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

|---|---|---|---|---|---|---|---|

| NECP Scenario | |||||||

| Output (in billion euro) | Optimistic | 1.96 | 2.69 | 3.86 | 4.25 | 5.39 | 5.14 |

| Moderate | 1.96 | 2.57 | 3.62 | 3.97 | 5.04 | 4.87 | |

| Pessimistic | 1.96 | 2.43 | 3.27 | 3.51 | 4.35 | 4.25 | |

| Value added (in billion euro) | Optimistic | 1.57 | 2.00 | 2.70 | 2.93 | 3.61 | 3.47 |

| Moderate | 1.57 | 1.93 | 2.56 | 2.77 | 3.40 | 3.30 | |

| Pessimistic | 1.57 | 1.85 | 2.35 | 2.49 | 3.00 | 2.93 | |

| Employment (in thousands of employees) | Optimistic | 21.83 | 29.75 | 42.58 | 46.83 | 59.27 | 56.57 |

| Moderate | 21.83 | 28.49 | 39.94 | 43.80 | 55.43 | 53.56 | |

| Pessimistic | 21.83 | 26.90 | 36.12 | 38.70 | 47.96 | 46.79 | |

| CLEVER Scenario | |||||||

| Output (billion euro) | Optimistic | 1.47 | 3.04 | 3.28 | 3.62 | 3.70 | 3.80 |

| Moderate | 1.47 | 2.90 | 3.08 | 3.38 | 3.46 | 3.57 | |

| Pessimistic | 1.47 | 2.73 | 2.79 | 2.99 | 2.98 | 3.04 | |

| Value added (in billion euro) | Optimistic | 1.28 | 2.21 | 2.36 | 2.56 | 2.61 | 2.67 |

| Moderate | 1.28 | 2.13 | 2.24 | 2.42 | 2.46 | 2.53 | |

| Pessimistic | 1.28 | 2.03 | 2.06 | 2.19 | 2.18 | 2.22 | |

| Employment (in thousands of employees) | Optimistic | 16.51 | 33.60 | 36.24 | 39.91 | 40.84 | 41.92 |

| Moderate | 16.51 | 32.09 | 34.03 | 37.35 | 38.16 | 39.37 | |

| Pessimistic | 16.51 | 30.18 | 30.83 | 33.05 | 32.94 | 33.65 | |

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

|---|---|---|---|---|---|---|

| NECP Scenario | ||||||

| Savings (in billions of EUR) | - | - | 0.5 | 2.2 | 3.9 | 5.2 |

| Consumption (in million EUR) | - | - | 0.4 | 2.1 | 3.5 | 4.7 |

| Domestic consumption (in billions of EUR) | - | - | 0.4 | 1.9 | 3.2 | 4.3 |

| Impact on production (in billions of EUR) | - | - | 0.6 | 2.7 | 4.6 | 6.1 |

| Impact on value added (in billions of EUR) | - | - | 0.3 | 1.6 | 2.7 | 3.6 |

| Impact on employment (in thousands of employees) | - | - | 4.9 | 23.4 | 40.0 | 52.8 |

| CLEVER Scenario | ||||||

| Savings (in billions of EUR) | - | 1.2 | 3.2 | 4.9 | 6.2 | 7.2 |

| Consumption (in million EUR) | - | 1.2 | 3.0 | 4.6 | 5.7 | 6.5 |

| Domestic consumption (in billions of EUR) | - | 1.1 | 2.8 | 4.2 | 5.2 | 5.9 |

| Impact on production (in billions of EUR) | - | 1.5 | 3.9 | 5.9 | 7.4 | 8.4 |

| Impact on value added (in billions of EUR) | - | 0.9 | 2.3 | 3.4 | 4.3 | 4.9 |

| Impact on employment (in thousands of employees) | - | 12.8 | 32.8 | 49.4 | 61.9 | 70.4 |

Appendix D. Sectoral Distribution of Total Effects

| Sector (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| D41T43 | 1687.93 | 2863.80 | 3806.64 | 3796.92 | 5071.81 | 4283.52 | 1687.93 | 2862.35 | 3803.62 | 3793.43 | 5067.62 | 4280.03 | 1687.93 | 2860.53 | 3799.23 | 3787.56 | 5059.46 | 4272.18 |

| D31T33 | 1970.12 | 2182.05 | 3030.25 | 3295.25 | 3834.21 | 3919.29 | 1970.12 | 2179.81 | 3025.52 | 3289.86 | 3827.09 | 3913.95 | 1970.12 | 2177.01 | 3018.65 | 3280.79 | 3813.24 | 3901.92 |

| D69T75 | 1388.61 | 1790.47 | 2352.25 | 2678.77 | 3361.42 | 3559.77 | 1388.61 | 1767.13 | 2303.07 | 2622.29 | 3290.18 | 3503.71 | 1388.61 | 1737.77 | 2231.60 | 2527.33 | 3151.68 | 3377.56 |

| D27 | 1115.49 | 1791.16 | 2695.21 | 3311.35 | 3969.22 | 3688.02 | 1115.49 | 1531.16 | 2215.08 | 2713.02 | 3288.33 | 3106.75 | 1115.49 | 1204.14 | 1517.47 | 1707.50 | 1964.53 | 1798.47 |

| D45T47 | 586.44 | 822.15 | 1176.37 | 1295.44 | 1665.28 | 1557.31 | 586.44 | 776.43 | 1082.73 | 1186.10 | 1531.58 | 1448.89 | 586.44 | 718.91 | 946.65 | 1002.31 | 1271.63 | 1204.91 |

| D25 | 511.00 | 715.77 | 1178.65 | 1190.13 | 1303.88 | 1278.63 | 511.00 | 689.03 | 1115.22 | 1118.75 | 1225.33 | 1208.09 | 511.00 | 655.39 | 1023.06 | 998.79 | 1072.65 | 1049.38 |

| D68 | 404.42 | 559.62 | 770.99 | 872.33 | 1109.99 | 1133.62 | 404.42 | 544.91 | 740.17 | 836.76 | 1065.47 | 1098.40 | 404.42 | 526.41 | 695.37 | 776.98 | 978.91 | 1019.14 |

| D24 | 368.25 | 576.35 | 1028.41 | 1115.68 | 1246.99 | 1229.07 | 368.25 | 518.82 | 895.03 | 963.46 | 1082.61 | 1082.17 | 368.25 | 446.47 | 701.19 | 707.62 | 762.96 | 751.61 |

| D28 | 116.58 | 628.19 | 1356.66 | 1599.27 | 2551.67 | 1949.99 | 116.58 | 451.21 | 965.10 | 1167.20 | 1923.35 | 1520.69 | 116.58 | 228.49 | 395.86 | 440.62 | 701.85 | 554.89 |

| D35 | 337.53 | 362.59 | 553.76 | 618.65 | 560.56 | 658.63 | 337.53 | 340.46 | 505.22 | 562.93 | 495.50 | 604.00 | 337.53 | 312.63 | 434.65 | 469.28 | 369.01 | 481.09 |

| Others | 1793.84 | 1881.20 | 2482.31 | 2854.85 | 4373.60 | 4342.17 | 1793.84 | 1769.68 | 2250.27 | 2592.36 | 4058.43 | 4069.10 | 1793.84 | 1629.40 | 1913.01 | 2151.13 | 3445.65 | 3454.69 |

| Sector (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| D31T33 | 982.76 | 1088.47 | 1511.59 | 1643.78 | 1912.62 | 1955.07 | 982.76 | 1087.36 | 1509.23 | 1641.08 | 1909.07 | 1952.40 | 982.76 | 1085.96 | 1505.80 | 1636.56 | 1902.16 | 1946.40 |

| D69T75 | 824.28 | 1062.83 | 1396.30 | 1590.12 | 1995.34 | 2113.08 | 824.28 | 1048.97 | 1367.11 | 1556.59 | 1953.06 | 2079.80 | 824.28 | 1031.54 | 1324.68 | 1500.22 | 1870.84 | 2004.92 |

| D41T43 | 559.13 | 948.65 | 1260.97 | 1257.75 | 1680.06 | 1418.94 | 559.13 | 948.17 | 1259.97 | 1256.59 | 1678.67 | 1417.78 | 559.13 | 947.57 | 1258.51 | 1254.65 | 1675.97 | 1415.18 |

| D68 | 364.23 | 504.01 | 694.38 | 785.64 | 999.69 | 1020.97 | 364.23 | 490.76 | 666.62 | 753.61 | 959.59 | 989.25 | 364.23 | 474.10 | 626.27 | 699.77 | 881.64 | 917.86 |

| D45T47 | 333.68 | 467.80 | 669.35 | 737.10 | 947.54 | 886.11 | 333.68 | 441.79 | 616.07 | 674.89 | 871.47 | 824.42 | 333.68 | 409.06 | 538.64 | 570.31 | 723.55 | 685.59 |

| D27 | 314.62 | 505.20 | 760.18 | 933.96 | 1119.52 | 1040.20 | 314.62 | 431.86 | 624.76 | 765.21 | 927.47 | 876.26 | 314.62 | 339.63 | 428.00 | 481.60 | 554.09 | 507.26 |

| D25 | 190.53 | 266.87 | 439.46 | 443.74 | 486.15 | 476.74 | 190.53 | 256.91 | 415.81 | 417.13 | 456.87 | 450.44 | 190.53 | 244.36 | 381.45 | 372.40 | 399.94 | 391.26 |

| D64T66 | 171.77 | 246.32 | 351.94 | 387.58 | 499.32 | 477.15 | 171.77 | 236.20 | 330.97 | 363.23 | 469.18 | 453.04 | 171.77 | 223.47 | 300.50 | 322.31 | 410.59 | 398.80 |

| D35 | 159.39 | 171.22 | 261.49 | 292.13 | 264.70 | 311.01 | 159.39 | 160.77 | 238.57 | 265.82 | 233.98 | 285.22 | 159.39 | 147.63 | 205.25 | 221.60 | 174.25 | 227.18 |

| D29 | 104.60 | 110.95 | 0.58 | 0.63 | 0.81 | 0.75 | 104.60 | 110.93 | 0.54 | 0.59 | 0.76 | 0.71 | 104.60 | 110.91 | 0.49 | 0.52 | 0.65 | 0.61 |

| Others | 712.47 | 1114.84 | 2020.52 | 2293.77 | 3154.70 | 2869.54 | 712.47 | 982.35 | 1731.51 | 1971.35 | 2724.55 | 2545.36 | 712.47 | 815.65 | 1311.40 | 1429.26 | 1888.28 | 1815.98 |

| Sector (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| D41T43 | 30,670 | 52,036 | 69,168 | 68,992 | 92,157 | 77,833 | 30,670 | 52,010 | 69,113 | 68,928 | 92,081 | 77,770 | 30,670 | 51,977 | 69,033 | 68,822 | 91,932 | 77,627 |

| D31T33 | 38,933 | 43,121 | 59,883 | 65,120 | 75,771 | 77,452 | 38,933 | 43,077 | 59,790 | 65,013 | 75,630 | 77,346 | 38,933 | 43,021 | 59,654 | 64,834 | 75,356 | 77,109 |

| D69T75 | 28,856 | 37,207 | 48,881 | 55,666 | 69,852 | 73,974 | 28,856 | 36,722 | 47,859 | 54,492 | 68,372 | 72,809 | 28,856 | 36,112 | 46,374 | 52,519 | 65,493 | 70,187 |

| D45T47 | 9720 | 13,627 | 19,498 | 21,471 | 27,601 | 25,811 | 9720 | 12,869 | 17,946 | 19,659 | 25,385 | 24,014 | 9720 | 11,915 | 15,690 | 16,613 | 21,076 | 19,971 |

| D27 | 7772 | 12,479 | 18,778 | 23,071 | 27,654 | 25,695 | 7772 | 10,668 | 15,433 | 18,902 | 22,911 | 21,645 | 7772 | 8390 | 10,573 | 11,897 | 13,687 | 12,530 |

| D25 | 4817 | 6748 | 11,111 | 11,219 | 12,292 | 12,054 | 4817 | 6496 | 10,513 | 10,547 | 11,551 | 11,389 | 4817 | 6178 | 9644 | 9416 | 10,112 | 9893 |

| D29 | 4160 | 4412 | 23 | 25 | 32 | 30 | 4160 | 4412 | 22 | 23 | 30 | 28 | 4160 | 4411 | 19 | 21 | 26 | 24 |

| D28 | 1031 | 5557 | 12,002 | 14,148 | 22,573 | 17,251 | 1031 | 3992 | 8538 | 10,326 | 17,015 | 13,453 | 1031 | 2021 | 3502 | 3898 | 6209 | 4909 |

| D16 | 2752 | 3164 | 4393 | 4771 | 5621 | 5653 | 2752 | 3140 | 4343 | 4713 | 5549 | 5596 | 2752 | 3110 | 4271 | 4617 | 5408 | 5468 |

| D77T82 | 1663 | 2310 | 3162 | 3837 | 5144 | 5700 | 1663 | 2267 | 3073 | 3734 | 5014 | 5598 | 1663 | 2213 | 2943 | 3560 | 4762 | 5368 |

| Others | 13,241 | 15,098 | 28,374 | 32,114 | 40,490 | 39,838 | 13,241 | 14,059 | 26,171 | 29,597 | 37,498 | 37,297 | 13,241 | 12,753 | 22,970 | 25,365 | 31,682 | 31,581 |

| Sector (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| D24 | 488.04 | 759.92 | 1171.94 | 1349.27 | 1634.95 | 1516.75 | 488.04 | 677.94 | 1009.86 | 1154.33 | 1406.21 | 1326.77 | 488.04 | 574.83 | 774.33 | 826.68 | 961.50 | 899.20 |

| D45T47 | 135.54 | 182.04 | 265.15 | 299.21 | 399.81 | 374.65 | 135.54 | 167.42 | 235.57 | 264.42 | 357.88 | 340.19 | 135.54 | 149.04 | 192.59 | 205.93 | 276.36 | 262.64 |

| D25 | 98.91 | 154.55 | 221.39 | 234.87 | 301.34 | 267.34 | 98.91 | 148.00 | 207.89 | 219.13 | 281.60 | 251.84 | 98.91 | 139.77 | 188.25 | 192.68 | 243.23 | 216.96 |

| D20 | 95.56 | 141.31 | 218.76 | 244.10 | 296.50 | 291.03 | 95.56 | 128.81 | 193.31 | 214.74 | 262.51 | 260.79 | 95.56 | 113.07 | 156.33 | 165.39 | 196.43 | 192.73 |

| D64T66 | 86.48 | 124.34 | 177.77 | 193.77 | 249.73 | 234.09 | 86.48 | 119.23 | 167.18 | 181.46 | 234.54 | 221.91 | 86.48 | 112.79 | 151.80 | 160.78 | 204.99 | 194.50 |

| D16 | 103.70 | 119.27 | 165.66 | 179.93 | 212.03 | 213.17 | 103.70 | 118.34 | 163.73 | 177.70 | 209.22 | 210.96 | 103.70 | 117.18 | 160.92 | 173.96 | 203.76 | 205.99 |

| D23 | 66.55 | 110.95 | 150.52 | 153.26 | 202.90 | 173.56 | 66.55 | 109.53 | 147.69 | 149.91 | 198.81 | 170.26 | 66.55 | 107.74 | 143.59 | 144.27 | 190.85 | 162.82 |

| D27 | 60.10 | 96.18 | 140.47 | 159.46 | 202.32 | 182.73 | 60.10 | 87.88 | 124.29 | 139.98 | 178.78 | 163.68 | 60.10 | 77.44 | 100.77 | 107.24 | 133.01 | 120.82 |

| D19 | 65.08 | 71.56 | 105.19 | 118.78 | 166.51 | 166.17 | 65.08 | 65.88 | 93.12 | 105.10 | 150.13 | 152.21 | 65.08 | 58.74 | 75.58 | 82.09 | 118.28 | 120.79 |

| D22 | 41.11 | 62.23 | 91.72 | 101.41 | 132.52 | 121.04 | 41.11 | 58.14 | 83.06 | 91.53 | 119.47 | 111.25 | 41.11 | 53.00 | 70.46 | 74.92 | 94.10 | 89.23 |

| Others | 380.75 | 272.69 | 317.18 | 408.95 | 966.97 | 918.57 | 380.75 | 235.81 | 239.83 | 320.07 | 853.64 | 830.32 | 380.75 | 189.41 | 127.41 | 170.66 | 633.31 | 631.75 |

| Occupation (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| 71 | 18,460 | 30,148 | 40,514 | 40,869 | 54,051 | 46,418 | 18,460 | 30,033 | 40,264 | 40,588 | 53,670 | 46,139 | 18,460 | 29,889 | 39,899 | 40,115 | 52,930 | 45,511 |

| 75 | 12,728 | 14,387 | 20,019 | 21,801 | 25,542 | 25,878 | 12,728 | 14,308 | 19,861 | 21,613 | 25,313 | 25,694 | 12,728 | 14,208 | 19,632 | 21,298 | 24,870 | 25,279 |

| 21 | 10,481 | 14,455 | 19,902 | 22,016 | 28,040 | 27,766 | 10,481 | 14,113 | 19,180 | 21,192 | 26,978 | 26,944 | 10,481 | 13,683 | 18,131 | 19,807 | 24,914 | 25,095 |

| 74 | 9200 | 13,594 | 19,888 | 21,197 | 27,212 | 24,320 | 9200 | 13,107 | 18,915 | 20,044 | 25,779 | 23,189 | 9200 | 12,494 | 17,502 | 18,107 | 22,993 | 20,644 |

| 72 | 11,034 | 13,583 | 19,967 | 21,595 | 27,175 | 25,007 | 11,034 | 12,798 | 18,242 | 19,656 | 24,584 | 23,088 | 11,034 | 11,810 | 15,733 | 16,397 | 19,547 | 18,770 |

| 24 | 8032 | 10,440 | 13,920 | 15,625 | 19,559 | 20,281 | 8032 | 10,285 | 13,594 | 15,251 | 19,095 | 19,908 | 8032 | 10,090 | 13,119 | 14,622 | 18,193 | 19,066 |

| 41 | 7724 | 10,705 | 14,648 | 16,236 | 20,226 | 19,585 | 7724 | 10,268 | 13,777 | 15,203 | 18,991 | 18,563 | 7724 | 9719 | 12,511 | 13,468 | 16,588 | 16,264 |

| Others | 65,956 | 88,446 | 126,415 | 141,095 | 177,382 | 172,035 | 65,956 | 84,798 | 118,968 | 132,386 | 166,624 | 163,421 | 65,956 | 80,208 | 108,145 | 117,747 | 145,710 | 144,038 |

| Sector (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| D69T75 | 3260.45 | 6928.31 | 7268.22 | 7847.39 | 8025.57 | 8171.67 | 3260.45 | 6843.81 | 7144.27 | 7703.58 | 7874.97 | 8029.05 | 3260.45 | 6737.50 | 6964.12 | 7461.84 | 7582.17 | 7708.15 |

| D31T33 | 3994.96 | 5335.25 | 5541.05 | 5753.49 | 5560.27 | 5734.49 | 3994.96 | 5329.25 | 5532.64 | 5743.85 | 5549.90 | 5724.46 | 3994.96 | 5321.69 | 5520.42 | 5727.65 | 5529.76 | 5701.90 |

| D41T43 | 2467.74 | 5309.35 | 4820.74 | 5318.36 | 5296.25 | 5392.48 | 2467.74 | 5305.82 | 4815.35 | 5312.02 | 5289.71 | 5386.45 | 2467.74 | 5301.38 | 4807.50 | 5301.37 | 5277.00 | 5372.90 |

| D68 | 1372.98 | 2856.01 | 3064.10 | 3343.84 | 3452.64 | 3570.15 | 1372.98 | 2777.27 | 2948.78 | 3209.98 | 3313.17 | 3437.56 | 1372.98 | 2678.21 | 2781.16 | 2984.96 | 3042.02 | 3139.21 |

| D45T47 | 1089.19 | 2567.88 | 2823.88 | 3196.10 | 3277.40 | 3334.91 | 1089.19 | 2405.34 | 2583.66 | 2915.02 | 2987.48 | 3062.35 | 1089.19 | 2200.86 | 2234.53 | 2442.56 | 2423.83 | 2449.07 |

| D25 | 606.45 | 2259.37 | 2599.05 | 2753.60 | 2695.94 | 2690.53 | 606.45 | 2178.97 | 2465.79 | 2598.18 | 2541.31 | 2543.54 | 606.45 | 2077.77 | 2272.19 | 2336.99 | 2240.81 | 2212.79 |

| D27 | 1377.71 | 2290.90 | 2603.34 | 3056.62 | 3094.79 | 3303.31 | 1377.71 | 1958.90 | 2140.21 | 2505.30 | 2564.57 | 2783.09 | 1377.71 | 1541.31 | 1467.30 | 1578.77 | 1533.67 | 1612.20 |

| D64T66 | 619.27 | 1352.66 | 1461.62 | 1626.87 | 1667.76 | 1712.26 | 619.27 | 1292.04 | 1372.62 | 1523.23 | 1560.39 | 1610.49 | 619.27 | 1215.78 | 1243.28 | 1349.01 | 1351.65 | 1381.50 |

| D20 | 64.22 | 1610.63 | 2338.39 | 2878.58 | 3267.18 | 3048.99 | 64.22 | 1279.76 | 1796.16 | 2227.97 | 2580.39 | 2468.61 | 64.22 | 863.52 | 1007.98 | 1134.33 | 1244.98 | 1163.03 |

| D28 | 261.18 | 1283.43 | 1605.58 | 1894.09 | 2440.92 | 2720.86 | 261.18 | 923.00 | 1144.66 | 1385.05 | 1842.12 | 2122.54 | 261.18 | 469.42 | 474.59 | 529.03 | 678.01 | 776.48 |

| Others | 2285.47 | 4999.71 | 6031.43 | 6618.50 | 6568.60 | 7006.50 | 2285.47 | 4706.41 | 5583.20 | 6101.23 | 6049.45 | 6503.13 | 2285.47 | 4337.44 | 4931.76 | 5231.77 | 5040.07 | 5370.46 |

| Sector (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| D69T75 | 652.09 | 1385.66 | 1453.64 | 1569.48 | 1605.11 | 1634.33 | 652.09 | 1368.76 | 1428.85 | 1540.72 | 1574.99 | 1605.81 | 652.09 | 1347.50 | 1392.82 | 1492.37 | 1516.43 | 1541.63 |

| D31T33 | 798.99 | 1067.05 | 1108.21 | 1150.70 | 1112.05 | 1146.90 | 798.99 | 1065.85 | 1106.53 | 1148.77 | 1109.98 | 1144.89 | 798.99 | 1064.34 | 1104.08 | 1145.53 | 1105.95 | 1140.38 |

| D41T43 | 493.55 | 1061.87 | 964.15 | 1063.67 | 1059.25 | 1078.50 | 493.55 | 1061.16 | 963.07 | 1062.40 | 1057.94 | 1077.29 | 493.55 | 1060.28 | 961.50 | 1060.27 | 1055.40 | 1074.58 |

| D68 | 274.60 | 571.20 | 612.82 | 668.77 | 690.53 | 714.03 | 274.60 | 555.45 | 589.76 | 642.00 | 662.63 | 687.51 | 274.60 | 535.64 | 556.23 | 596.99 | 608.40 | 627.84 |

| D45T47 | 217.84 | 513.58 | 564.78 | 639.22 | 655.48 | 666.98 | 217.84 | 481.07 | 516.73 | 583.00 | 597.50 | 612.47 | 217.84 | 440.17 | 446.91 | 488.51 | 484.77 | 489.81 |

| D25 | 121.29 | 451.87 | 519.81 | 550.72 | 539.19 | 538.11 | 121.29 | 435.79 | 493.16 | 519.64 | 508.26 | 508.71 | 121.29 | 415.55 | 454.44 | 467.40 | 448.16 | 442.56 |

| D27 | 275.54 | 458.18 | 520.67 | 611.32 | 618.96 | 660.66 | 275.54 | 391.78 | 428.04 | 501.06 | 512.91 | 556.62 | 275.54 | 308.26 | 293.46 | 315.75 | 306.73 | 322.44 |

| D64T66 | 123.85 | 270.53 | 292.32 | 325.37 | 333.55 | 342.45 | 123.85 | 258.41 | 274.52 | 304.65 | 312.08 | 322.10 | 123.85 | 243.16 | 248.66 | 269.80 | 270.33 | 276.30 |

| D20 | 12.84 | 322.13 | 467.68 | 575.72 | 653.44 | 609.80 | 12.84 | 255.95 | 359.23 | 445.59 | 516.08 | 493.72 | 12.84 | 172.70 | 201.60 | 226.87 | 249.00 | 232.61 |

| D28 | 52.24 | 256.69 | 321.12 | 378.82 | 488.18 | 544.17 | 52.24 | 184.60 | 228.93 | 277.01 | 368.42 | 424.51 | 52.24 | 93.88 | 94.92 | 105.81 | 135.60 | 155.30 |

| Others | 457.09 | 999.94 | 1206.29 | 1323.70 | 1313.72 | 1401.30 | 457.09 | 941.28 | 1116.64 | 1220.25 | 1209.89 | 1300.63 | 457.09 | 867.49 | 986.35 | 1046.35 | 1008.01 | 1074.09 |

| Sector (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| D41T43 | 27,073 | 58,247 | 52,887 | 58,346 | 58,103 | 59,159 | 27,073 | 58,208 | 52,827 | 58,276 | 58,031 | 59,093 | 27,073 | 58,159 | 52,741 | 58,159 | 57,892 | 58,944 |

| D69T75 | 22,828 | 48,508 | 50,888 | 54,943 | 56,191 | 57,214 | 22,828 | 47,917 | 50,021 | 53,937 | 55,137 | 56,215 | 22,828 | 47,173 | 48,759 | 52,244 | 53,087 | 53,969 |

| D31T33 | 31,653 | 42,272 | 43,903 | 45,586 | 44,055 | 45,436 | 31,653 | 42,225 | 43,836 | 45,510 | 43,973 | 45,356 | 31,653 | 42,165 | 43,739 | 45,381 | 43,813 | 45,177 |

| D45T47 | 6345 | 14,960 | 16,451 | 18,620 | 19,093 | 19,428 | 6345 | 14,013 | 15,052 | 16,982 | 17,404 | 17,841 | 6345 | 12,822 | 13,018 | 14,230 | 14,121 | 14,268 |

| D25 | 3067 | 11,425 | 13,143 | 13,924 | 13,633 | 13,605 | 3067 | 11,019 | 12,469 | 13,138 | 12,851 | 12,862 | 3067 | 10,507 | 11,490 | 11,818 | 11,331 | 11,190 |

| D27 | 6806 | 11,318 | 12,862 | 15,101 | 15,290 | 16,320 | 6806 | 9678 | 10,574 | 12,377 | 12,670 | 13,750 | 6806 | 7615 | 7249 | 7800 | 7577 | 7965 |

| D28 | 1064 | 5226 | 6538 | 7713 | 9939 | 11,079 | 1064 | 3758 | 4661 | 5640 | 7501 | 8643 | 1064 | 1911 | 1933 | 2154 | 2761 | 3162 |

| D16 | 2225 | 3167 | 3286 | 3449 | 3367 | 3470 | 2225 | 3137 | 3243 | 3398 | 3314 | 3420 | 2225 | 3100 | 3180 | 3313 | 3210 | 3307 |

| D20 | 151 | 3786 | 5496 | 6766 | 7679 | 7167 | 151 | 3008 | 4222 | 5237 | 6065 | 5802 | 151 | 2030 | 2369 | 2666 | 2926 | 2734 |

| D29 | 2579 | 2741 | 18 | 20 | 21 | 21 | 2579 | 2741 | 17 | 19 | 19 | 20 | 2579 | 2740 | 16 | 17 | 17 | 17 |

| Others | 8943 | 17,058 | 23,435 | 26,112 | 26,574 | 27,771 | 8943 | 16,010 | 21,863 | 24,292 | 24,724 | 25,991 | 8943 | 14,691 | 19,578 | 21,233 | 21,126 | 21,984 |

| Sector (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| D24 | 398.58 | 772.83 | 870.92 | 980.24 | 990.20 | 1046.37 | 398.58 | 695.63 | 760.27 | 850.81 | 862.72 | 920.73 | 398.58 | 598.52 | 599.49 | 633.28 | 614.87 | 637.99 |

| D20 | 67.35 | 222.85 | 278.84 | 324.84 | 347.08 | 340.88 | 67.35 | 195.58 | 235.85 | 273.68 | 293.99 | 293.99 | 67.35 | 161.27 | 173.37 | 187.70 | 190.78 | 188.49 |

| D45T47 | 58.73 | 190.95 | 227.83 | 269.46 | 279.05 | 278.40 | 58.73 | 172.73 | 200.82 | 237.77 | 246.60 | 247.93 | 58.73 | 149.80 | 161.58 | 184.51 | 183.52 | 179.38 |

| D25 | 81.12 | 173.45 | 175.96 | 194.15 | 196.65 | 202.54 | 81.12 | 166.52 | 166.07 | 182.70 | 184.76 | 191.02 | 81.12 | 157.79 | 151.70 | 163.45 | 161.65 | 165.08 |

| D64T66 | 62.36 | 139.11 | 148.80 | 165.92 | 169.47 | 173.63 | 62.36 | 132.95 | 139.73 | 155.36 | 158.54 | 163.28 | 62.36 | 125.19 | 126.57 | 137.61 | 137.29 | 140.00 |

| D23 | 57.96 | 123.35 | 115.52 | 128.01 | 128.31 | 131.09 | 57.96 | 121.80 | 113.30 | 125.41 | 125.65 | 128.55 | 57.96 | 119.85 | 110.07 | 121.04 | 120.48 | 122.82 |

| D16 | 83.84 | 119.44 | 123.99 | 130.16 | 127.09 | 130.97 | 83.84 | 118.29 | 122.30 | 128.19 | 125.03 | 129.03 | 83.84 | 116.83 | 119.84 | 124.89 | 121.01 | 124.65 |

| D27 | 49.18 | 98.62 | 104.13 | 117.89 | 120.78 | 126.68 | 49.18 | 90.72 | 93.15 | 105.03 | 107.83 | 114.00 | 49.18 | 80.79 | 77.18 | 83.40 | 82.65 | 85.46 |

| D19 | −3.36 | 81.20 | 115.84 | 142.34 | 149.58 | 144.41 | −3.36 | 70.17 | 98.53 | 121.91 | 128.29 | 125.34 | −3.36 | 56.30 | 73.37 | 87.56 | 86.89 | 82.44 |

| D22 | 31.32 | 69.52 | 74.43 | 82.68 | 86.27 | 89.40 | 31.32 | 65.10 | 68.23 | 75.57 | 78.62 | 82.01 | 31.32 | 59.53 | 59.23 | 63.63 | 63.77 | 65.38 |

| Others | −404.69 | 52.40 | 269.51 | 496.97 | 542.13 | 436.93 | −404.69 | 8.04 | 205.13 | 422.32 | 463.49 | 362.39 | −404.69 | −47.78 | 111.57 | 296.85 | 310.60 | 194.67 |

| Occupation (Code) | Optimistic Scenario | Moderate Scenario | Pessimistic Scenario | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| 71 | 16,061 | 33,437 | 30,882 | 33,936 | 33,830 | 34,522 | 16,061 | 33,313 | 30,709 | 33,739 | 33,615 | 34,313 | 16,061 | 33,158 | 30,458 | 33,410 | 33,198 | 33,844 |

| 21 | 8376 | 17,959 | 18,848 | 20,570 | 21,085 | 21,516 | 8376 | 17,519 | 18,205 | 19,824 | 20,293 | 20,773 | 8376 | 16,965 | 17,271 | 18,570 | 18,754 | 19,101 |

| 72 | 7999 | 15,123 | 16,743 | 18,105 | 18,527 | 19,131 | 7999 | 14,280 | 15,555 | 16,755 | 17,064 | 17,699 | 7999 | 13,221 | 13,828 | 14,486 | 14,221 | 14,475 |

| 75 | 10,326 | 14,194 | 14,752 | 15,421 | 14,971 | 15,443 | 10,326 | 14,110 | 14,632 | 15,281 | 14,828 | 15,305 | 10,326 | 14,004 | 14,458 | 15,045 | 14,551 | 14,996 |

| 74 | 7634 | 14,417 | 14,803 | 16,323 | 16,422 | 17,008 | 7634 | 13,942 | 14,143 | 15,556 | 15,633 | 16,237 | 7634 | 13,344 | 13,185 | 14,267 | 14,100 | 14,503 |

| 24 | 6284 | 13,222 | 13,902 | 15,062 | 15,361 | 15,632 | 6284 | 13,005 | 13,576 | 14,680 | 14,963 | 15,262 | 6284 | 12,732 | 13,101 | 14,039 | 14,189 | 14,431 |

| 41 | 5919 | 12,338 | 12,991 | 14,346 | 14,605 | 14,955 | 5919 | 11,797 | 12,194 | 13,407 | 13,649 | 14,057 | 5919 | 11,118 | 11,036 | 11,831 | 11,788 | 12,035 |

| Others | 50,133 | 98,019 | 105,987 | 116,818 | 119,143 | 122,464 | 50,133 | 93,746 | 99,770 | 109,563 | 111,643 | 115,346 | 50,133 | 88,370 | 90,736 | 97,368 | 97,062 | 99,332 |

References

- European Commission. “Fit for 55”: Delivering the EU’s 2030 Climate Target on the Way to Climate Neutrality. COM(2021) 550 Final. European Union. 2021. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021DC0550 (accessed on 24 June 2025).

- Ministry of Enviroment and Energy. National Energy and Climate Plan; Draft revised version; Ministry of Environment and Energy: Athens, Greece, 2023.

- Creutzig, F.; Roy, J.; Lamb, W.F.; Azevedo, I.M.; De Bruin, W.B.; Dalkmann, H.; Edelenbosch, O.Y.; Geels, F.W.; Grubler, A.; Hepburn, C.; et al. Towards demand-side solutions for mitigating climate change. Nat. Clim. Change 2018, 8, 260–263. [Google Scholar] [CrossRef]

- Zell-Ziegler, C.; Thema, J.; Best, B.; Wiese, F.; Lage, J.; Schmidt, A.; Toulouse, E.; Stagl, S. Enough? The role of sufficiency in European energy and climate plans. Energy Policy 2021, 157, 112483. [Google Scholar] [CrossRef]

- Wiese, F.; Thema, J.; Cordroch, L. Strategies for climate neutrality. Lessons from a meta-analysis of German energy scenarios. Renew. Sustain. Energy Transit. 2022, 2, 100015. [Google Scholar] [CrossRef]

- Markaki, M.; Belegri-Roboli, A.; Michaelides, P.; Mirasgedis, S.; Lalas, D.P. The impact of clean energy investments on the Greek economy: An input–output analysis (2010–2020). Energy Policy 2013, 57, 263–275. [Google Scholar] [CrossRef]

- Guadagno, F.; Reiter, O.; Stehrer, R. The Impact of Green Technologies on GDP and Employment in the EU; wiiw Policy Notes 80; The Vienna Institute for International Economic Studies, wiiw: Vienna, Austria, 2024. [Google Scholar]

- Černý, M.; Bruckner, M.; Weinzettel, J.; Wiebe, K.; Kimmich, C.; Kerschner, C.; Hubacek, K. Employment effects of the renewable energy transition in the electricity sector: An input-output approach. ETUI Res. Pap.-Work. Pap. 2021, 2022, 14. [Google Scholar] [CrossRef]

- Gelo, T.; Šimurina, N.; Šimurina, J. The economic impact of investment in renewables in Croatia by 2030. Energies 2021, 14, 8215. [Google Scholar] [CrossRef]

- Gözkün, K.A.; Orhangazi, Ö. Green transition for Turkey: Growth, employment, and trade deficit effects. Energy Policy 2025, 202, 114577. [Google Scholar] [CrossRef]

- Güler, İ. The Transition of CO2 Emission and Employment Multipliers from Brown to Green Under a Renewable Energy-Based Economic Growth Scenario in Türkiye: 2053 Vision. Int. J. Smart Grid 2025, 9, 43–58. [Google Scholar] [CrossRef]

- Acar, S.; Kat, B.; Rogner, M.; Saygin, D.; Taranto, Y.; Yeldan, A.E. Transforming Türkiye’s power system: An assessment of economic, social, and external impacts of an energy transition by 2030. Clean. Energy Syst. 2023, 4, 100064. [Google Scholar] [CrossRef]

- Alyousif, M.; Belaid, F.; Almubarak, N.; Almulhim, T. Mapping Saudi Arabia’s low emissions transition path by 2060: An input-output analysis. Technol. Forecast. Soc. Change 2025, 211, 123920. [Google Scholar] [CrossRef]

- Ji, J.; Cao, L.; Bi, Y.; Zeng, Y.; Wang, D. Low-Carbon Transformation in Megacities: Benefits for Climate Change Mitigation and Socioeconomic Development—A Case Study of Shenzhen, China. Sustainability 2024, 16, 6062. [Google Scholar] [CrossRef]

- Luo, P.; Tang, X.; Dou, X.; Liu, S.; Ren, K.; Jiang, Y.; Yang, Z.; Ding, Y.; Li, M. Uncovering the socioeconomic impacts of China’s power system decarbonization. Environ. Impact Assess. Rev. 2022, 99, 107015. [Google Scholar] [CrossRef]

- Mulumba, A.N.; Hooman, F. Economic Contributions and Green Job Implications of Japan’s Energy Transition: An Integrated Assessment of Decarbonization Scenarios in Kyushu Region. In Proceedings of the International Exchange and Innovation Conference on Engineering & Sciences (IEICES), Fukuoka, Japan, 17 October 2024; Volume 10, pp. 1246–1254. [Google Scholar] [CrossRef]

- Kim, J.H.; Yoo, S.H. Comparison of the economic effects of nuclear power and renewable energy deployment in South Korea. Renew. Sustain. Energy Rev. 2021, 135, 110236. [Google Scholar] [CrossRef]

- Cai, M.; Cusumano, N.; Lorenzoni, A.; Pontoni, F. A comprehensive ex-post assessment of RES deployment in Italy: Jobs, value added and import leakages. Energy Policy 2017, 110, 234–245. [Google Scholar] [CrossRef]

- Garrett-Peltier, H. Green versus brown: Comparing the employment impacts of energy efficiency, renewable energy, and fossil fuels using an input-output model. Econ. Model. 2017, 61, 439–447. [Google Scholar] [CrossRef]

- Hanna, R.; Heptonstall, P.; Gross, R. Job creation in a low carbon transition to renewables and energy efficiency: A review of international evidence. Sustain. Sci. 2024, 19, 125–150. [Google Scholar] [CrossRef]

- Henriques, C.O.; Sousa, S. A review on economic input-output analysis in the environmental assessment of electricity generation. Energies 2023, 16, 2930. [Google Scholar] [CrossRef]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Cameron, L.; Van Der Zwaan, B. Employment factors for wind and solar energy technologies: A literature review. Renew. Sustain. Energy Rev. 2015, 45, 160–172. [Google Scholar] [CrossRef]

- Dvořák, P.; Martinát, S.; Van der Horst, D.; Frantál, B.; Turečková, K. Renewable energy investment and job creation; a cross-sectoral assessment for the Czech Republic with reference to EU benchmarks. Renew. Sustain. Energy Rev. 2017, 69, 360–368. [Google Scholar] [CrossRef]

- Mardones, C. Economic, environmental, and social assessment of the replacement of coal-fired thermoelectric plants for solar and wind energy in Chile. J. Clean. Prod. 2023, 411, 137343. [Google Scholar] [CrossRef]

- Bradley, P.; Whittard, D.; Green, L.; Brooks, I.; Hanna, R. Empirical research of green jobs: A review and reflection with practitioners. Sustain. Futures 2025, 9, 100527. [Google Scholar] [CrossRef]

- Mirasgedis, S.; Tourkolias, C.; Pavlakis, E.; Diakoulaki, D. A methodological framework for assessing the employment effects associated with energy efficiency interventions in buildings. Energy Build. 2014, 82, 275–286. [Google Scholar] [CrossRef]

- Perrier, Q.; Quirion, P. How shifting investment towards low-carbon sectors impacts employment: Three determinants under scrutiny. Energy Econ. 2018, 75, 464–483. [Google Scholar] [CrossRef]

- Markaki, M.; Papadakis, S.; Putnová, A.A. Modern Industrial Policy for the Czech Republic: Optimizing the Structure of Production. Mathematics 2021, 9, 3095. [Google Scholar] [CrossRef]

- Jenniches, S. Assessing the regional economic impacts of renewable energy sources–A literature review. Renew. Sustain. Energy Rev. 2018, 93, 35–51. [Google Scholar] [CrossRef]

- Nega Watt Association. Available online: https://negawatt.org/clever-energy-scenario (accessed on 24 June 2025).

- IRENA. Renewable Power Generation Costs in 2021; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2022; ISBN 978-92-9260-452-3. [Google Scholar]

- NRER. Electricity ATB Technologies and Data Overview. 2023. Available online: https://atb.nrel.gov/electricity/2023/technologies (accessed on 24 June 2025).

- Thunder Said Energy. Available online: https://thundersaidenergy.com (accessed on 24 June 2025).

- PWC Electric Vehicles and the Charging Infrastructure: A New Mindset? Available online: https://www.pwc.com/us/en/industrial-products/publications/assets/pwc-electric-vehicles-charging-infrastructure-mindset.pdf (accessed on 24 June 2025).

- Stefanakos, I.P. Possibilities for constructing pumped storage projects in areas of Mainland Greece. In Proceedings of the 17th National Conference of Institute of Energy for South-East Europe: Energy and Development 2012, Athens, Greece, 30–31 October 2012. (In Greek). [Google Scholar]

- Hydrogen Europe. Clean Hydrogen Monitor 2022. Available online: https://hydrogeneurope.eu/clean-hydrogen-monitor-2022/ (accessed on 24 June 2025).

- Sulewski, P.; Ignaciuk, W.; Szymańska, M.; Wąs, A. Development of the Biomethane Market in Europe. Energies 2023, 16, 2001. [Google Scholar] [CrossRef]

- Fasihi, M.; Bogdanov, D.; Breyer, C. Techno-Economic Assessment of Power-to-Liquids (PtL) Fuels Production and Global Trading Based on Hybrid PV-Wind Power Plants. In Proceedings of the 10th International Renewable Energy Storage Conference, Düsseldorf, Germany, 15–17 March 2016. [Google Scholar]

- International Energy Agency. The Future of Hydrogen: Seizing Today’s Opportunities. Report Prepared by the IEA for the G20, Japan. 2019. Available online: https://iea.blob.core.windows.net/assets/9e3a3493-b9a6-4b7d-b499-7ca48e357561/The_Future_of_Hydrogen.pdf (accessed on 24 June 2025).

- Slowik, P.; Isenstadt, A.; Pierce, L.; Searle, S. Assessment of Light-Duty Electric Vehicle Costs and Consumer Benefits in the United States in the 2022–2035 Time Frame. ICCT White Paper. 2022. Available online: https://theicct.org/wp-content/uploads/2022/10/ev-cost-benefits-2035-oct22.pdf (accessed on 24 June 2025).

- ERGOSE. Available online: https://www.ergose.gr/projects/ (accessed on 24 June 2025).

- Markaki, M.; Economakis, G. International Structural Competitiveness and the Hierarchy in the World Economy. World Rev. Political Econ. 2021, 12, 195–219. [Google Scholar] [CrossRef]

| Author(s) | Country | Timescale | Key Results |

|---|---|---|---|

| [13] | Saudi Arabia | Up to 2060 | Under Vision 2030 and the Saudi Green Initiative (SGI), the country can sustain annual non-oil GDP growth of 2.6% through 2030 and 2.0% through 2060. This transformation is projected to generate approximately 23 million new jobs by 2060, primarily through expansion in non-oil manufacturing and service sectors. Green bond financing is identified as a key enabler of this transition, with its market share expected to increase from 3.4% in 2020 to about 15% by 2030 (roughly USD 14 billion) and 30% by 2060 (around USD 39 billion). |

| [10] | Turkey | 2020–2030 | An evaluation of two investment scenarios in solar and wind energy in Turkey over a ten-year period reveals substantial macroeconomic impacts. The scenarios involve total investments of USD 23.6 billion and USD 62.4 billion, corresponding to 0.3% and 0.9% of Turkey’s 2020 GDP on an annual basis. Findings indicate that these investment levels are associated with annual GDP growth ranging from 0.6% to 1.8% relative to 2020 levels. Over the whole investment horizon, total employment is projected to reach 27.8 million, implying net job creation of approximately 1 million positions attributable to the green energy transition. However, this benefit may be moderated by an increase in imports—estimated to be between USD 7.8 billion and USD 21 billion—driven by the foreign content of renewable energy technologies. |

| [11] | Turkey | Up to 2053 | The production, employment, and CO2 emission multipliers caused by the transition to renewable energy are calculated under two scenarios in Turkey: in the first scenario, employment and CO2 emission multipliers are calculated for every USD 1 million of final demand for all sectors in the Turkish economy with the current use of energy resources. The second scenario analysis was conducted for Turkey’s COP29 target of increasing the share of renewable energy to 69.1% in 2053. “Electricity, gas, steam, and air conditioning supply” has the highest sectoral production multiplier (3.37). Within the production framework with existing energy resources, 828 new employment opportunities will arise in the economy due to a separate USD 1 million final demand for all sectors. A USD 1 million investment in the fossil fuel-based energy sector creates about 14 jobs. Transitioning 69.1% of energy production to renewables would generate 10 new jobs. |

| [7] | EU27 | 2017–2022 | This study assesses how reshoring production of photovoltaics, wind turbines, batteries, electric motors, and electric vehicles to the EU would affect GDP and employment. The study assumes that the EU ceases imports from non-EU countries and meets this demand only through domestic production. The findings show that reshoring these five technologies would increase EU GDP by EUR 18.4 billion, or 0.13% of EU GDP, and create 242,728 new jobs. The same shift of imports to EU production would have had roughly half of the impact in 2010. The study also finds significant spillover effects on other sectors of the economy, particularly for metal products, wholesale and retail, professional, scientific and technical activities, and administrative and support services. |

| [20] | Review Paper | A synthesis of twelve international studies covering North America, Europe, and Asia shows that employment from different energy investments varies widely: every additional USD 1 million spent on fossil fuel energy generation supports only 5 full-time jobs, 8 nuclear power jobs, and about 15 jobs in the main renewable energy technologies (wind, solar, small hydro, biomass, and related options), while upgrading the energy efficiency of buildings creates about 22 jobs. | |

| [14] | China | 2020–2030 | Two scenarios are assessed for Shenzhen, China, for 2030: (i) a business-as-usual baseline and (ii) a green transition pathway. The green transition plan entails an additional CNY 462 billion investment and is projected to generate CNY 799.5 billion in gross output and CNY 311.4 billion in value added. These figures imply multipliers of CNY 1.73 of output and CNY 0.67 of GDP for every CNY 1 invested. The package is also expected to create 1.79 million full-time jobs, about 3.9 jobs per CNY 1 million invested (≈27.9 jobs per USD 1 million). |

| [16] | Japan | Up to 2030 | The study examines the economic and employment effects of renewable energy systems (RES) in Kyushu, Japan, focusing on solar, wind, and biomass power. Employment coefficients highlight indirect, construction, and operational job impacts (person-years per GWh). For Solar PV Power, 0.6856 construction jobs, 0.2101 operational jobs, and 2.905 indirect jobs are created per GWh. Wind power generates 0.6069 construction jobs, 0.12513 operational jobs, and 2.268 indirect jobs per GWh. Biomass power creates 0.6768 construction jobs, 3.162 operational jobs, and 1.870 indirect jobs per GWh. Biomass operation jobs contribute the highest portion (34%), while PV and wind power plants have lower economic contributions (11%, and 7%, respectively). |

| [12] | Turkey | 2018–2030 | Two scenarios—the business-as-usual scenario and the transformation scenario—are evaluated. In the transformation scenario, the average annual investment rises by USD 12.3 billion, equivalent to 1.6% of 2018 GDP. This expenditure increases real GDP by 1.1% in 2030 (USD 1.143 trillion versus USD 1.132 trillion under business-as-usual). Labor-market effects are likewise favorable: the transformation scenario yields a net gain of 43,382 full-time jobs, driven by 95,000 new positions. |

| [15] | China | 2030 and 2050 | Evaluation of the impacts of China’s power decarbonization on the economy, employment, and greenhouse gas (GHG) emissions for two alternative scenarios. Decarbonization creates inclusive growth in employment (1.02%) and the economy (1.21%). However, the renewable power sector creates 0.43 million jobs, whereas direct and indirect job losses total 2.04 million (fossil fuel power sector) and 19.18 million (construction, machinery manufacturing, chemicals, and coal mining sectors) in 2050 China’s NZEE (net-zero emissions in the electricity sector) scenario. Middle-skilled workers account for 74.46% of total job losses, with a higher impact on males (67.37%) than on females (32.63%). China’s overall economic loss from the transition is approximately EUR 209.36 billion, though renewable power contributes EUR 110.69 billion to economic growth. |

| [8] | EU27 + UK | Up to 2050 | This study analyzes employment shifts in the electricity sector by operation and maintenance versus capital investment and domestic versus international effects—within 165 sectors, across 13 electricity sources, and in 28 countries. In the “ambitious low-carbon scenario.” The results show a growth in labor demand as the share of renewable energy sources increases. In a 100 percent renewable energy scenario, the electricity sector would see total labor demand in the period up to 2050, which is approximately twice as high as the reference scenario. However, the employment created by capital investments would take place only on a temporary basis, signaling a boom in labor demand during the first phase of the transition (approximately until 2030), followed by a decline that continues up to 2050. |

| [9] | Croatia | 2020–2030 | Evaluation of two investment plans for Croatia’s transition to the electricity sector: an accelerated transition mobilizing EUR 2.55 billion over the period 2021–2030 and a moderate transition requiring EUR 2.18 billion. In the first scenario, annual expenditures correspond to approximately 0.48% of Croatia’s GDP in 2019 and adds 3500 full-time jobs. The second scenario generates EUR 92 million per year of additional GDP and 3000 jobs. For every EUR 1 million invested, the direct and indirect impacts are EUR 0.336 million of value added and 14 full-time jobs, while import leakages average EUR 0.643 million. |

| [17] | Korea | Current year | Evaluation of two power generation scenarios for South Korea: the old nuclear power chain and an expanded renewable energy industry. The results show that every USD 1 million invested in renewable energy generates a gross output of USD 1718 million to the entire national economy, compared to USD 1606 million for nuclear power. The pattern remains consistent for income generation: value added increases by USD 0.859 million in the case of renewables and by USD 0.856 million in the case of nuclear power, while wage payments rise to USD 0.174 million versus USD 0.168 million, respectively. |

| [18] | Italy | 2006–2014 | Ex-post evaluation of renewable-energy investments in Italy for the period 2006–2014. During the construction phase, the program absorbed EUR 46 billion, yet import leakages reached 61%, meaning that less than two-fifths of the outlay remained in the domestic economy. Each EUR 1 million spent on construction generated just EUR 0.43 million in domestic value added and 7.3 full-time jobs (direct + indirect). By contrast, the operational phase delivered stronger multipliers: every EUR 1 million of operating expenditure produced EUR 0.73 million in value added and 14.5 full-time jobs. |

| [19] | USA | Current year | Two alternative public spending investments are evaluated: a “brown” baseline that maintains USD 1 billion of annual support for fossil fuel extraction, and a counterfactual “green” reallocation that directs the same outlay either to renewable energy deployment or to energy efficiency. Fossil fuel activities exhibit the lowest employment impact, sustaining only 2.65 full time equivalent jobs per USD 1 million of final demand (0.94 direct; 1.71 indirect). Redirecting the expenditure to renewables raises this ratio to 7.49 FTE jobs/USD 1 million (4.50 direct plus 2.99 indirect), while energy efficiency investments generate 7.72 FTE jobs/USD 1 million (4.59 direct plus 3.13 indirect). |

| [6] | Greece | 2010–2020 | A macroeconomic evaluation of Greece’s clean energy investment roadmap for the period 2010 2020. The Green Investment plan amounts to EUR 47.9 billion, corresponding to approximately 2% of 2010 GDP. The study projects an average annual output increase of EUR 9.4 billion, equivalent to 4–5% of baseline GDP, and an output–investment multiplier of 1.96 (partitioned into 45.4% direct, 30.7% indirect, and 23.9% induced effects). Green investments support 108,000 full-time equivalent (FTE) positions annually, or 22.54 FTE job years per EUR 1 million invested. |

| Sector 1 | … | Sector n | Final Demand | Total Output | ||

|---|---|---|---|---|---|---|

| Domestic production | Sector 1 | |||||

| … | ||||||

| Sector n | ||||||

| Value added | ||||||

| Imports | Sector 1 | |||||

| … | ||||||

| Sector n | ||||||

| Total input | ||||||

| Sectors | Measures | Technologies | |

|---|---|---|---|

| Power Generation | Increasing the penetration of RES in electricity production | Photovoltaics | Utility scale |

| Rooftop | |||

| Wind parks | Onshore | ||

| Offshore | |||

| Other RES | Geothermal power stations | ||

| Biogas power plants | |||

| Hydroelectric power stations | |||

| Natural gas power plants | |||

| Increasing electricity storage capacity | Batteries | ||

| Pumped storage stations | |||

| Developing the electricity transmission and distribution network | Voltage transformers | ||

| Conductors | |||

| Pylons | |||

| Synthetic Fuels | Increasing the penetration of H2 and gaseous synthetic fuels in the country’s energy mix | Electrolysis | |

| Direct air capture to CO2 production (DAC to CO2) | |||

| Power to fuels | |||

| Energy Efficiency | Upgrading energy of residential/non-residential buildings | External shell thermal insulation—thermal facades, energy-efficient PVC and aluminum frames, double-triple glazing | |

| Heat pumps—fan coils | |||

| Energy-efficient electrical appliances | |||

| Increasing energy efficiency in industrial sector | Energy consumption control systems | ||

| Transportation | Replacing conventional vehicle fleet (petrol-diesel engines) | Electric vehicles/hydrogen and synthetic fuel vehicles | |

| Charging stations | |||

| Electrifying railway network | Overhead power lines | ||

| Electric trains | |||

| Reducing the carbon footprint of coastal and air transport | Electric-hybrid ships/airplanes | ||

| Electrification/synthetic fuel supply infrastructure | |||

| Interventions | Average Unitary Cost (2020–2050) | NECP Scenario | CLEVER Scenario | |||||

|---|---|---|---|---|---|---|---|---|

| Investment | O&M | Penetration (Up to 2050) | Total Investments (in bill. EUR) | Penetra-tion (Up to 2050) | Total Investments Required (in bill. EUR) | |||

| Photovoltaics a | Utility scale | 536 EUR/kW | 15.7 EUR/kW/y | 36.3 GW | 28.4 | 14.7 GW | 14.7 | |

| Rooftop | 1116 EUR/kW | 15.0 EUR/kW/y | 4.0 GW | 6.1 | 4.0 GW | 6.1 | ||

| Wind parks a | Onshore | 915 EUR/kW | 24.5 EUR/kW/y | 11.9 GW | 18.6 | 12 GW | 19.7 | |

| Offshore | 2554 EUR/kW | 73.2 EUR/kW/y | 17.3 GW | 56.1 | 3.0 GW | 10.8 | ||

| Other RES b | 1879 EUR/kW | 153 EUR/kW/y | 2.1 GW | 9.2 | 1.3 GW | 4.9 | ||

| Hydroelectric power stations | 2113 EUR/kW | 77.9 EUR/kW/y | 3.9 GW | 10.4 | 4.7 GW | 12.5 | ||

| Storage | Batteries | 256 EUR/kW | 36.4 EUR/kW/y | 22.6 GW | 13.1 | 10.0 GW | 6.8 | |

| Pumped storage stations c | 3147/1950 EUR/kW | 18.7 EUR/kW/y | 2.2 GW | 5.8 | 2.2 GW | 4.0 | ||

| Natural gas power plants | 438 EUR/kW | 36.5 EUR/kW/y | 7.7 GW | 8.6 | 7.7 GW | 8.6 | ||

| Electrolysis d | 713 EUR/kW | 37.1 EUR/kW/y | 20.7 GW | 20.8 | 3.3 GW | 3.4 | ||

| Power to Fuels e | 798 EUR/kW | 34.1 EUR/kW/y | 4.0 GW | 4.0 | 0.8 GW | 0.8 | ||

| DAC to CO2 f | 253 EUR/tCO2/y | 8.84 EUR/tCO2/y | 5.6 Mt CO2 | 1.4 | 4.5 Mt CO2 | 1.0 | ||

| Transmission and distribution network g | 18.8 | 12.5 | ||||||

| Energy upgrade h | Residential buildings | External shell renovation i | 101/336 EUR/m2 | 2.4 mill. dwellings | 68.0 | 3.5 mill. dwellings | 130.7 | |

| Heat-pumps j | 9100/6800 EUR/unit | 3.9 mill. units | 34.2 | 3.5 mill. units | 21.8 | |||

| A/C | 667 EUR/unit | 5.1 mill. units | 5.7 | 3.6 mill. units | 3.1 | |||

| Electrical appliances k | 27 EUR/unit | 87.6 mill. units | 6.7 | 87.6 mill. units | 6.7 | |||

| Service buildings | External shell renovation l | 50.4 EUR/m2 | 0.1 mill. buildings | 6.9 | 0.2 mill. buildings | 9.2 | ||

| Heat-pumps j | 64/48 EUR/m2 | 229,500 units | 3.7 | 229,500 units | 4.4 | |||

| Industrial sector m | 7.5 | 7.5 | ||||||

| Vehicles n | Cars | 7000 EUR/vehicle | 4.4 mill. | 45.4 | 3.7 mill. | 25.0 | ||

| Motorcycles | 1800. EUR/vehicle | 1.5 mill. | 4.2 | |||||

| Light-duty trucks | 7400 EUR/vehicle | 261,300 | 1.6 | 611,800 | 3.0 | |||

| Heavy-duty trucks | 15,400 EUR/vehicle | 225,000 | 6.8 | |||||

| Buses | 76,700 EUR/vehicle | 26,000 | 2.4 | |||||

| Charging stations | 800 EUR/kW | 16.0 EUR/kW/y | 5.2 GW | 4.8 | 5.6 GW | 5.4 | ||

| Transportation infrastructure o | 255 | 255 | ||||||

| Expenditures’ reduction (-) | 13.1 | 13.1 | ||||||

| Effect | Sub-Scenario | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 |

|---|---|---|---|---|---|---|---|

| NECP Scenario | |||||||

| Contribution of value added to GDP (% of GDP2023) | Optimistic | 2.4% | 3.3% | 4.8% | 5.3% | 6.7% | 6.5% |

| Moderate | 2.4% | 3.2% | 4.5% | 5.0% | 6.3% | 6.1% | |

| Pessimistic | 2.4% | 3.0% | 4.1% | 4.4% | 5.4% | 5.3% | |

| Contribution to employment (% of employment2023) | Optimistic | 3.5% | 4.8% | 6.8% | 7.4% | 9.4% | 8.9% |

| Moderate | 3.5% | 4.7% | 6.5% | 7.1% | 8.9% | 8.6% | |

| Pessimistic | 3.5% | 4.5% | 6.0% | 6.5% | 8.0% | 7.8% | |

| Contribution to net exports of goods (% of GDP2023) | Optimistic | −3.4% | −3.2% | −3.6% | −4.5% | −3.9% | −3.2% |

| Moderate | −3.4% | −3.4% | −4.0% | −5.0% | −4.5% | −3.7% | |

| Pessimistic | −3.4% | −3.6% | −4.5% | −5.8% | −5.5% | −4.7% | |

| CLEVER Scenario | |||||||

| Contribution of value added to GDP (% of GDP2023) | Optimistic | 1.8% | 3.8% | 4.1% | 4.6% | 4.7% | 4.8% |

| Moderate | 1.8% | 3.6% | 3.9% | 4.2% | 4.3% | 4.5% | |

| Pessimistic | 1.8% | 3.4% | 3.5% | 3.7% | 3.7% | 3.8% | |

| Contribution to employment (% of employment2023) | Optimistic | 2.8% | 5.4% | 5.6% | 6.2% | 6.3% | 6.4% |

| Moderate | 2.8% | 5.2% | 5.4% | 5.9% | 6.0% | 6.1% | |

| Pessimistic | 2.8% | 5.0% | 5.0% | 5.4% | 5.4% | 5.5% | |

| Contribution to net exports of goods (% of GDP2023) | Optimistic | −3.1% | −3.8% | −3.2% | −2.9% | −2.6% | −2.7% |

| Moderate | −3.1% | −4.0% | −3.6% | −3.3% | −3.1% | −3.1% | |

| Pessimistic | −3.1% | −4.3% | −4.1% | −4.0% | −3.9% | −4.0% | |

| Output | Value Added | Employment | |||

|---|---|---|---|---|---|

| NECP Scenario | |||||

| D41T43 | 21.3% | D31T33 | 17.5% | D41T43 | 27.4% |

| D31T33 | 16.2% | D69T75 | 16.9% | D31T33 | 22.7% |

| D69T75 | 13.2% | D41T43 | 15.3% | D69T75 | 19.4% |

| D27 | 11.4% | D68 | 7.9% | D45T47 | 6.8% |

| D45T47 | 5.8% | D45T47 | 7.1% | D27 | 5.6% |

| D23D25 | 5.1% | D27 | 7.0% | D25 | 3.4% |

| D68 | 4.1% | D25 | 4.1% | D29 | 2.3% |

| D24 | 3.9% | D64T66 | 3.8% | D28 | 2.1% |

| D28 | 3.4% | D28 | 3.2% | D16 | 1.7% |

| D35 | 2.5% | D35 | 2.6% | D77T82 | 1.2% |

| Other sectors | 13.2% | Other sectors | 14.5% | Other sectors | 7.4% |

| CLEVER Scenario | |||||

| D69T75 | 19.6% | D69T75 | 18.4% | D41T43 | 27.5% |

| D31T33 | 15.2% | D31T33 | 16.3% | D69T75 | 22.6% |

| D41T43 | 15.2% | D41T43 | 15.4% | D31T33 | 19.9% |

| D68 | 7.9% | D68 | 8.1% | D45T47 | 6.6% |

| D45T47 | 6.9 | D45T47 | 8.0% | D25 | 5.2% |

| D25 | 6.2% | D25 | 6.5% | D27 | 4.6% |

| D27 | 5.6% | D27 | 5.2% | D28 | 1.8% |

| D64T66 | 3.7 | D64T66 | 3.3% | D16 | 1.5% |

| D20 | 3.7% | D20 | 3.1% | D20 | 1.4% |

| D28 | 2.6% | D28 | 2.1% | D29 | 1.3% |

| Other sectors | 13.4% | Other sectors | 13.6% | Other sectors | 7.6% |

| Sub-Scenario | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |

|---|---|---|---|---|---|---|---|

| NECP Scenario | |||||||

| Contribution of value added to GDP (% of GDP2023) | Optimistic | 0.81% | 1.03% | 1.39% | 1.51% | 1.86% | 1.78% |

| Moderate | 0.81% | 0.99% | 1.32% | 1.42% | 1.75% | 1.70% | |

| Pessimistic | 0.81% | 0.95% | 1.21% | 1.28% | 1.54% | 1.51% | |