The Impact of Energy Intensity, Renewable Energy, and Financial Development on Green Growth in OECD Countries: Fresh Evidence Under Environmental Policy Stringency

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Financial Development and Green Growth

2.2. Energy Intensity and Green Growth

2.3. Renewable Energy and Green Growth

2.4. Environmental Policy Stringency and Green Growth

2.5. Research Gap

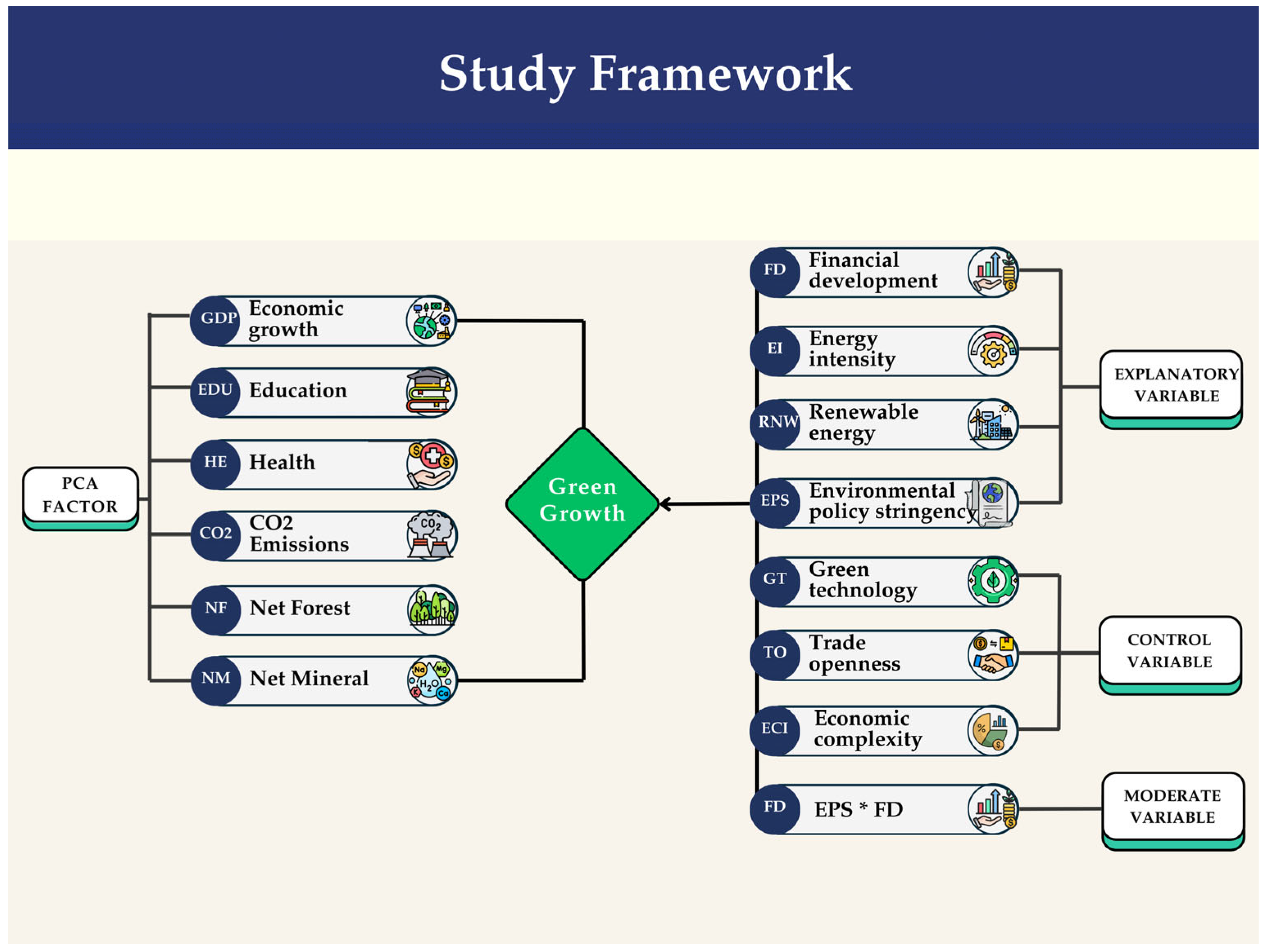

3. Data, Model Construction, and Methodology

3.1. Data

3.2. Model Construction

3.3. Methodology

3.3.1. Cross-Sectional Dependency

3.3.2. Slope Heterogeneity

3.3.3. Unit Root Tests

3.3.4. Panel Cointegration Tests

3.3.5. Fully Modified Ordinary Least Squares (FMOLS)

4. Empirical Results

Pre-Test Results

5. Discussion

6. Conclusions and Policy Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kim, S.E.; Kim, H.; Chae, Y. A new approach to measuring green growth: Application to the OECD and Korea. Futures 2014, 63, 37–48. [Google Scholar] [CrossRef]

- OECD. Towards Green Growth; OECD: Paris, France, 2011; Available online: https://www.oecd.org/en/publications/towards-green-growth_9789264111318-en.html (accessed on 10 March 2025).

- Saqib, N.; Usman, M.; Ozturk, I.; Sharif, A. Harnessing the synergistic impacts of environmental innovations, financial development, green growth, and ecological footprint through the lens of SDGs policies for countries exhibiting high ecological footprints. Energy Policy 2024, 184, 113863. [Google Scholar] [CrossRef]

- Hickel, J.; Kallis, G. Is green growth possible? New Polit. Econ. 2020, 25, 469–486. [Google Scholar] [CrossRef]

- Qamruzzaman, M.; Karim, S. Green energy, green innovation, and political stability led to green growth in OECD nations. Energy Strategy Rev. 2024, 55, 101519. [Google Scholar] [CrossRef]

- Ngo, T.; Trinh, H.H.; Haouas, I.; Ullah, S. Examining the bidirectional nexus between financial development and green growth: International evidence through the roles of human capital and education expenditure. Resour. Policy 2022, 79, 102964. [Google Scholar] [CrossRef]

- Huang, J. Resources, innovation, globalization, and green growth: The BRICS financial development strategy. Geosci. Front. 2024, 15, 101741. [Google Scholar] [CrossRef]

- Anwar, A.; Huong, N.T.T.; Sharif, A.; Kilinc-Ata, N.; Çitil, M.; Demirtaş, F. Is a green world real or a dream? A look at green growth from green innovation and financial development: Evidence from fragile economies. Geol. J. 2024, 59, 98–112. [Google Scholar] [CrossRef]

- Ozkan, O.; Popescu, I.A.; Destek, M.A.; Balsalobre-Lorente, D. Time-quantile impact of foreign direct investment, financial development, and financial globalisation on green growth in BRICS economies. J. Environ. Manag. 2024, 371, 123145. [Google Scholar] [CrossRef]

- Shang, Y.; Lian, Y.; Chen, H.; Qian, F. The impacts of energy resource and tourism on green growth: Evidence from Asian economies. Resour. Policy 2023, 81, 103359. [Google Scholar] [CrossRef]

- Hao, L.N.; Umar, M.; Khan, Z.; Ali, W. Green growth and low carbon emission in G7 countries: How critical the network of environmental taxes, renewable energy, and human capital is? Sci. Total Environ. 2021, 752, 141853. [Google Scholar] [CrossRef]

- Razzaq, A.; Sharif, A.; Ozturk, I.; Skare, M. Asymmetric influence of digital finance, and renewable energy technology innovation on green growth in China. Renew. Energy 2023, 202, 310–319. [Google Scholar] [CrossRef]

- Lu, L.; Chen, Q.; Huang, R.; Usman, A. Education and its impact on renewable energy demand, carbon intensity, and green growth: Do digital financial inclusion and environmental policy stringency matter in China. Environ. Sci. Pollut. Res. 2023, 30, 12020–12028. [Google Scholar] [CrossRef] [PubMed]

- Xie, P.; Xu, Y.; Tan, X.; Tan, Q. How does environmental policy stringency influence green innovation for environmental managements? J. Environ. Manag. 2023, 338, 117766. [Google Scholar] [CrossRef]

- Alalmaee, H. Sustainability through policy stringency: Analysing the impact on financial development. Sustainability 2025, 17, 1374. [Google Scholar] [CrossRef]

- Ketchoua, G.S.; Arogundade, S.; Mduduzi, B. Revaluating the Sustainable Development Thesis: Exploring the moderating influence of technological innovation on the impact of foreign direct investment (FDI) on green growth in the OECD countries. Discov. Sustain. 2024, 5, 252. [Google Scholar] [CrossRef]

- OECD. Trust in Global Cooperation—The Vision for the OECD for the Next Decade; OECD: Paris, France, 2021; Available online: https://www.oecd.org/en/about/legal/trust-in-global-cooperation-the-vision-for-the-oecd-for-the-next-decade.html (accessed on 10 March 2025).

- Ahmed, F.; Kousar, S.; Pervaiz, A.; Shabbir, A. Do institutional quality and financial development affect sustainable economic growth? Evidence from South Asian countries. Borsa Istanb. Rev. 2022, 22, 189–196. [Google Scholar] [CrossRef]

- OECD. Finance and Investment for Environmental Goals; OECD: Paris, France, 2024; Available online: https://www.oecd.org/en/topics/finance-and-investment-for-environmental-goals.html (accessed on 10 March 2025).

- Singh, S.; Arya, V.; Yadav, M.P.; Power, G.J. Does financial development improve economic growth? The role of asymmetrical relationships. Glob. Financ. J. 2023, 56, 100831. [Google Scholar] [CrossRef]

- Elfaki, K.E.; Ahmed, E.M. Globalization and financial development contributions toward economic growth in Sudan. Res. Glob. 2024, 9, 100246. [Google Scholar] [CrossRef]

- Oroud, Y.; Almahadin, H.A.; Alkhazaleh, M.; Shneikat, B. Evidence from an emerging market economy on the dynamic connection between financial development and economic growth. Res. Glob. 2023, 6, 100124. [Google Scholar] [CrossRef]

- Yang, L.; Ni, M. Is financial development beneficial to improve the efficiency of green development? Evidence from the “Belt and Road” countries. Energy Econ. 2022, 105, 105734. [Google Scholar] [CrossRef]

- Danish; Baloch, M.A.; Mahmood, N.; Zhang, J.W. Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci. Total Environ. 2019, 678, 632–638. [Google Scholar] [CrossRef] [PubMed]

- Al-Mulali, U.; Tang, C.F.; Ozturk, I. Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ. Sci. Pollut. Res. 2015, 22, 14891–14900. [Google Scholar] [CrossRef]

- Yin, Q. Nexus among financial development and equity market on green economic finance: Fresh insights from European Union. Renew. Energy 2023, 216, 118938. [Google Scholar] [CrossRef]

- Yang, C.; Qi, H.; Jia, L.; Wang, Y.; Huang, D. Impact of digital technologies and financial development on green growth: Role of mineral resources, institutional quality, and human development in South Asia. Resour. Policy 2024, 90, 104699. [Google Scholar] [CrossRef]

- Saint Akadiri, S.; Bekun, F.V.; Sarkodie, S.A. Contemporaneous interaction between energy consumption, economic growth and environmental sustainability in South Africa: What drives what? Sci. Total Environ. 2019, 686, 468–475. [Google Scholar] [CrossRef]

- Brożyna, J. Energy consumption and greenhouse gas emissions against the background of Polish economic growth. In Energy Transformation Towards Sustainability; Tvaronavičienė, M., Ślusarczyk, B., Eds.; Elsevier: Amsterdam, The Netherlands, 2020; pp. 52–70. [Google Scholar] [CrossRef]

- Xing, Y. Under the Goal of Sustainable Development, Do Regions with Higher Energy Intensity Generate More Green Innovation? Evidence from Chinese Cities. Sustainability 2024, 16, 6679. [Google Scholar] [CrossRef]

- Khan, M.K.; Babar, S.F.; Oryani, B.; Dagar, V.; Rehman, A.; Zakari, A.; Khan, M.O. Role of financial development, environmental-related technologies, research and development, energy intensity, natural resource depletion, and temperature in sustainable environment in Canada. Environ. Sci. Pollut. Res. 2022, 29, 622–638. [Google Scholar] [CrossRef]

- Ullah, O.; Zeb, A.; Shuhai, N.; Din, N.U. Exploring the role of green investment, energy intensity and economic complexity in balancing the relationship between growth and environmental degradation. Clean Technol. Environ. Policy 2024, 1–18. [Google Scholar] [CrossRef]

- Danish, M.; Ulucak, R.; Khan, S.U.D. Relationship between energy intensity and CO2 emissions: Does economic policy matter? Sustain. Dev. 2020, 28, 1457–1464. [Google Scholar] [CrossRef]

- Fiorito, G. Can we use the energy intensity indicator to study “decoupling” in modern economies? J. Clean. Prod. 2013, 47, 465–473. [Google Scholar] [CrossRef]

- Huang, W.; He, J. Impact of energy intensity, green economy, and natural resources development to achieve sustainable economic growth in Asian countries. Resour. Policy 2023, 84, 103726. [Google Scholar] [CrossRef]

- Díaz, A.; Marrero, G.A.; Puch, L.A.; Rodríguez, J. Economic growth, energy intensity and the energy mix. Energy Econ. 2019, 81, 1056–1077. [Google Scholar] [CrossRef]

- Mahmood, T.; Ahmad, E. The relationship of energy intensity with economic growth: Evidence for European economies. Energy Strat. Rev. 2018, 20, 90–98. [Google Scholar] [CrossRef]

- Suparjo, S.; Darma, S.; Kurniadin, N.; Kasuma, J.; Priyagus, P.; Darma, D.C.; Haryadi, H. Indonesia’s new SDGs agenda for green growth: Emphasis in the energy sector. Int. J. Energy Econ. Policy 2021, 11, 395–402. [Google Scholar] [CrossRef]

- Ernawati, E.; Syarif, M.; Suriadi, L.O.; Rosnawintang, R.; Madi, R.A. Does energy intensity correlate with economic growth and government governance? IOP Conf. Ser. Earth Environ. Sci. 2024, 1324, 012098. [Google Scholar] [CrossRef]

- Sarwar, S. Impact of energy intensity, green economy and blue economy to achieve sustainable economic growth in GCC countries: Does Saudi Vision 2030 matter to GCC countries. Renew. Energy 2022, 191, 30–46. [Google Scholar] [CrossRef]

- Pyra, M. The role of the green economy in shaping economic growth in Poland. Ann. Polish Assoc. Agric. Agrobuss. Econ. 2024, 26, 129–142. [Google Scholar] [CrossRef]

- Dzwigol, H.; Kwilinski, A.; Lyulyov, O.; Pimonenko, T. Digitalization and energy in attaining sustainable development: Impact on energy consumption, energy structure, and energy intensity. Energies 2024, 17, 1213. [Google Scholar] [CrossRef]

- Degirmenci, T.; Sofuoglu, E.; Aydin, M.; Adebayo, T.S. The role of energy intensity, green energy transition, and environmental policy stringency on environmental sustainability in G7 countries. Clean Technol. Environ. Policy 2024, 1–13. [Google Scholar] [CrossRef]

- Ackah, I.; Kizys, R. Green growth in oil-producing African countries: A panel data analysis of renewable energy demand. Renew. Sustain. Energy Rev. 2015, 50, 1157–1166. [Google Scholar] [CrossRef]

- Khan, A.; Khan, T.; Ahmad, M. The role of technological innovation in sustainable growth: Exploring the economic impact of green innovation and renewable energy. Environ. Chall. 2025, 18, 101109. [Google Scholar] [CrossRef]

- Behera, P.; Behera, B.; Sethi, N.; Handoyo, R.D. What drives environmental sustainability? The role of renewable energy, green innovation, and political stability in OECD economies. Int. J. Sustain. Dev. World Ecol. 2024, 31, 761–775. [Google Scholar] [CrossRef]

- Dai, H.; Xie, X.; Xie, Y.; Liu, J.; Masui, T. Green growth: The economic impacts of large-scale renewable energy development in China. Appl. Energy 2016, 162, 435–449. [Google Scholar] [CrossRef]

- Sohag, K.; Husain, S.; Hammoudeh, S.; Omar, N. Innovation, militarization, and renewable energy and green growth in OECD countries. Environ. Sci. Pollut. Res. 2021, 28, 36004–36017. [Google Scholar] [CrossRef]

- Li, R.; Wang, X.; Wang, Q. Does renewable energy reduce ecological footprint at the expense of economic growth? An empirical analysis of 120 countries. J. Clean. Prod. 2022, 346, 131207. [Google Scholar] [CrossRef]

- Saqib, N.; Ozturk, I.; Usman, M. Investigating the implications of technological innovations, financial inclusion, and renewable energy in diminishing ecological footprints levels in emerging economies. Geosci. Front. 2023, 14, 101667. [Google Scholar] [CrossRef]

- Joof, F.; Samour, A.; Ali, M.; Rehman, M.A.; Tursoy, T. Economic complexity, renewable energy, and ecological footprint: The role of the housing market in the USA. Energy Build. 2024, 311, 114131. [Google Scholar] [CrossRef]

- Wang, L.; Ye, F.; Lin, J.; Bibi, N. Exploring the impact of climate technology, financial inclusion and renewable energy on ecological footprint: Evidence from top polluted economies. PLoS ONE 2024, 19, e0302034. [Google Scholar] [CrossRef]

- Rahadian, D.; Anggadwita, G.; Firli, A.; Adibroto, A. Environmental impact of renewable energy projects: Life cycle assessment and ecological footprint. In Renewable Energy Projects and Investments Interdisciplinary Knowledge, Analysis, Opportunities, and Outlook; Dinçer, H., Yüksel, S., Eds.; Elsevier: London, UK, 2025; pp. 95–116. [Google Scholar]

- Danish, M.; Ulucak, R. How do environmental technologies affect green growth? Evidence from BRICS economies. Sci. Total Environ. 2020, 712, 136504. [Google Scholar] [CrossRef]

- Mohsin, M.; Taghizadeh-Hesary, F.; Iqbal, N.; Saydaliev, H.B. The role of technological progress and renewable energy deployment in green economic growth. Renew. Energy 2022, 190, 777–787. [Google Scholar] [CrossRef]

- Dzwigol, H.; Kwilinski, A.; Lyulyov, O.; Pimonenko, T. The role of environmental regulations, renewable energy, and energy efficiency in finding the path to green economic growth. Energies 2023, 16, 3090. [Google Scholar] [CrossRef]

- Murshed, M. Can renewable energy transition drive green growth? The role of good governance in promoting carbon emission-adjusted economic growth in Next Eleven countries. Innov. Green Dev. 2024, 3, 100123. [Google Scholar] [CrossRef]

- Li, Y.; Xu, H.; Li, H.; Xu, Y. Digital economy, environmental regulations, and green economic development. Finance Res. Lett. 2025, 75, 106858. [Google Scholar] [CrossRef]

- Chen, L.; Kenjayeva, U.; Mu, G.; Iqbal, N.; Chin, F. Evaluating the influence of environmental regulations on green economic growth in China: A focus on renewable energy and energy efficiency guidelines. Energy Strategy Rev. 2024, 56, 101544. [Google Scholar] [CrossRef]

- Martínez-Zarzoso, I.; Bengochea-Morancho, A.; Morales-Lage, R. Does environmental policy stringency foster innovation and productivity in OECD countries? Energy Policy 2019, 134, 110982. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Ahmed, K. Environmental policy stringency, related technological change and emissions inventory in 20 OECD countries. J. Environ. Manag. 2020, 274, 111209. [Google Scholar] [CrossRef]

- Chen, L.; Tanchangya, P. Analyzing the role of environmental technologies and environmental policy stringency on green growth in China. Environ. Sci. Pollut. Res. 2022, 29, 55630–55638. [Google Scholar] [CrossRef]

- Feng, M.; Zou, D.; Hafeez, M. Mineral resource volatility and green growth: The role of technological development, environmental policy stringency, and trade openness. Resour. Policy 2024, 89, 104630. [Google Scholar] [CrossRef]

- Arjomandi, A.; Gholipour, H.F.; Tajaddini, R.; Harvie, C. Environmental expenditure, policy stringency and green economic growth: Evidence from OECD countries. Appl. Econ. 2023, 55, 869–884. [Google Scholar] [CrossRef]

- Gao, X.; Yu, J.; Pertheban, T.R.; Sukumaran, S. Do fintech readiness, digital trade, and mineral resources rents contribute to economic growth: Exploring the role of environmental policy stringency. Resour. Policy 2024, 93, 105051. [Google Scholar] [CrossRef]

- Wang, W.; Imran, M.; Ali, K.; Sattar, A. Green policies and financial development in G7 economies: An in-depth analysis of environmental regulations and green economic growth. Nat. Resour. Forum 2024. [Google Scholar] [CrossRef]

- Lin, S.; Zhou, Z.; Hu, X.; Chen, S.; Huang, J. How can urban economic complexity promote green economic growth in China? The perspective of green technology innovation and industrial structure upgrading. J. Clean. Prod. 2024, 450, 141807. [Google Scholar] [CrossRef]

- Saud, S.; Haseeb, A.; Zaidi, S.A.H.; Khan, I.; Li, H. Moving towards green growth? Harnessing natural resources and economic complexity for sustainable development through the lens of the N-shaped EKC framework for the European Union. Resour. Policy 2024, 91, 104804. [Google Scholar] [CrossRef]

- Yousaf, M.; Khalid, S.; Sheikh, S.M.; Subhani, J. From Policy to Progress: Evaluating Institutional Quality, Trade Openness, FDI, and Green Technologies’ Role in Green Economic Growth Using an ARDL Approach in Emerging Asian Economies. J. Asian Dev. Stud. 2024, 13, 1022–1039. [Google Scholar] [CrossRef]

- Sarafidis, V.; Yamagata, T.; Robertson, D. A test of cross section dependence for a linear dynamic panel model with regressors. J. Econom. 2009, 148, 149–161. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Feng, Q.; Kao, C. A Lagrange Multiplier test for cross-sectional dependence in a fixed effects panel data model. J. Econom. 2012, 170, 164–177. [Google Scholar] [CrossRef]

- Swamy, P.A. Efficient inference in a random coefficient regression model. Econometrica 1970, 38, 311–323. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.; Pesaran, H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Baltagi, B.H. Econometric Analysis of Panel Data; John Wiley & Sons Inc.: West Sussex, UK, 2005. [Google Scholar]

- Johansen, S. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Pedroni, P. Fully modified OLS for heterogeneous cointegrated panels. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels; Baltagi, B.H., Fomby, T.B., Carter Hill, R., Eds.; Emerald Group Publishing Limited: Leeds, UK, 2001; pp. 93–130. [Google Scholar]

- Narayan, S.; Narayan, P.K. Determinants of demand for Fiji’s exports: An empirical investigation. The Developing Economies 2004, 42, 95–112. [Google Scholar] [CrossRef]

- Singh, S.G.; Kumar, S.V. Dealing with multicollinearity problem in analysis of side friction characteristics under urban heterogeneous traffic conditions. Arab. J. Sci. Eng. 2021, 46, 10739–10755. [Google Scholar] [CrossRef]

- Abbass, K.; Amin, N.; Khan, F.; Begum, H.; Song, H. Driving sustainability: The nexus of financial development, economic globalization, and renewable energy in fostering a greener future. Energy Environ. 2025, 1, 1–23. [Google Scholar] [CrossRef]

- Tawiah, V.; Zakari, A.; Adedoyin, F.F. Determinants of green growth in developed and developing countries. Environ. Sci. Pollut. Res. 2021, 28, 39227–39242. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Nur, T.; Topaloglu, E.E.; Evcimen, C. Assessing the impact of the economic complexity on the ecological footprint in G7 countries: Fresh evidence under human development and energy innovation processes. Gondwana Res. 2024, 127, 226–245. [Google Scholar] [CrossRef]

| Variable | Variable Symbol | Variable Definitions | Source |

|---|---|---|---|

| Green growth | GG | GG index calculated by PCA analysis based on the dimensions of economic growth, educational, health expenditures, CO2 emissions, net forest, and mineral depletions. | WB |

| Financial development | FD | Financial Development Index | IMF |

| Energy intensity | EI | Primary energy consumption per GDP | Our World |

| Renewable energy | RNW | Renewable energy consumption (% of total final energy consumption) | WB |

| Environmental policy | EPS | Environmental Policy Stringency Index | OECD |

| Trade openness | TO | Trade (% of GDP) | WB |

| Green technology | GT | Development of environment-related technologies Index | OECD |

| Economic complexity | ECI | Economic Complexity Index | OEC |

| Elemental Indicators of GG | Symbol | Basic Indicators | Source |

| Economic growth | GDP | Gross domestic product growth (% annual) | WB |

| Education | EDU | School enrollment, secondary (% gross) | WB |

| Health | HE | Current health expenditure (% of GDP) | WB |

| CO2 Emissions | CO2 | Carbon dioxide (CO2) emissions excluding LULUCF per capita (t CO2e/capita) | WB |

| Net Forest | NF | Adjusted savings: net forest depletion (% of GNI) | WB |

| Net Mineral | NM | Adjusted savings: mineral depletion (% of GNI) | WB |

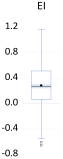

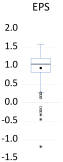

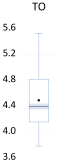

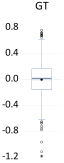

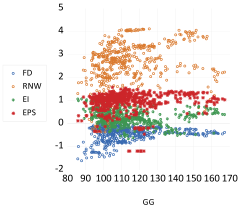

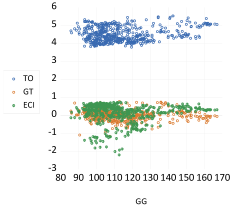

| Box Plots |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| Stats. | GG | FD | RNW | EI | EPS | TO | GT | ECI |

| Mean | 114.000 | −0.435 | 2.572 | 0.284 | 0.938 | 4.488 | 0.002 | 0.115 |

| Median | 109.776 | −0.362 | 2.721 | 0.272 | 1.051 | 4.396 | 0.014 | 0.281 |

| Max. | 167.260 | −0.003 | 4.117 | 1.165 | 1.587 | 5.522 | 0.763 | 0.719 |

| Min. | 85.839 | −1.611 | −0.357 | −0.657 | −1.186 | 3.784 | −1.178 | −2.214 |

| Std. Dev. | 16.994 | 0.302 | 0.947 | 0.342 | 0.442 | 0.398 | 0.271 | 0.525 |

| Skewness | 1.153 | −1.397 | −0.810 | 0.037 | −2.157 | 0.476 | −0.254 | −1.763 |

| Kurtosis | 3.802 | 4.870 | 3.553 | 2.930 | 9.214 | 2.179 | 4.341 | 6.104 |

| J-B | 137.1 *** | 260.1 *** | 67.340 *** | 0.239 *** | 1316.2 *** | 36.306 *** | 47.277 *** | 507.6 *** |

| Obs. | 552 | 552 | 552 | 552 | 552 | 552 | 552 | 552 |

| Scatters plots |   | |||||||

| 1/VIF | VIF | GG | 1.000 | 0.095 | 0.291 | −0.223 | 0.169 | 0.094 | −0.139 | −0.132 |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.599 | 1.669 | FD | 0.095 | 1.000 | −0.071 | −0.244 | 0.271 | −0.322 | −0.124 | 0.274 |

| 0.874 | 1.144 | RNW | 0.291 | −0.071 | 1.000 | −0.132 | 0.290 | −0.093 | 0.169 | −0.071 |

| 0.722 | 1.385 | EI | −0.223 | −0.244 | −0.132 | 1.000 | −0.375 | −0.063 | 0.140 | −0.137 |

| 0.600 | 1.668 | EPS | 0.169 | 0.271 | 0.290 | −0.375 | 1.000 | 0.143 | 0.158 | 0.350 |

| 0.580 | 1.723 | TO | 0.094 | −0.322 | −0.093 | −0.063 | 0.143 | 1.000 | −0.130 | 0.262 |

| 0.783 | 1.276 | GT | −0.139 | −0.124 | 0.169 | 0.140 | 0.158 | −0.130 | 1.000 | −0.054 |

| 0.701 | 1.426 | ECI | −0.132 | 0.274 | −0.071 | −0.137 | 0.350 | 0.262 | −0.054 | 1.000 |

| Mean VIF | (1.470) | GG | FD | RNW | EI | EPS | TO | GT | ECI |

| Block Exogenous Wald Test. | |||

|---|---|---|---|

| Hypothesis—H0: Exogenous | Chi-sq | Prob. | |

| FD | RNW | 1.843 | 0.606 |

| EI | 0.992 | 0.803 | |

| EPS | 5.675 | 0.129 | |

| TO | 1.154 | 0.764 | |

| GT | 2.948 | 0.400 | |

| ECI | 5.959 | 0.114 | |

| RNW | FD | 1.616 | 0.656 |

| EI | 4.898 | 0.179 | |

| EPS | 6.075 | 0.108 | |

| TO | 3.405 | 0.333 | |

| GT | 5.619 | 0.132 | |

| ECI | 2.622 | 0.454 | |

| EI | FD | 0.064 | 0.800 |

| RNW | 0.001 | 0.970 | |

| EPS | 0.006 | 0.938 | |

| TO | 0.890 | 0.345 | |

| GT | 0.162 | 0.688 | |

| ECI | 0.026 | 0.871 | |

| EPS | FD | 0.001 | 0.980 |

| RNW | 0.005 | 0.946 | |

| EI | 3.508 | 0.061 | |

| TO | 3.031 | 0.082 | |

| GT | 0.100 | 0.752 | |

| ECI | 0.769 | 0.381 | |

| TO | FD | 0.116 | 0.733 |

| RNW | 0.140 | 0.709 | |

| EI | 0.052 | 0.820 | |

| EPS | 0.002 | 0.965 | |

| GT | 0.174 | 0.677 | |

| ECI | 0.650 | 0.420 | |

| GT | FD | 1.039 | 0.308 |

| RNW | 0.127 | 0.722 | |

| EI | 1.340 | 0.247 | |

| EPS | 0.387 | 0.534 | |

| TO | 0.241 | 0.624 | |

| ECI | 1.037 | 0.309 | |

| ECI | FD | 1.608 | 0.205 |

| RNW | 0.581 | 0.446 | |

| EI | 0.025 | 0.875 | |

| EPS | 0.021 | 0.885 | |

| TO | 0.658 | 0.417 | |

| GT | 0.001 | 0.974 | |

| Sargan–Hansen Test | |||

| Instrument specification: | Instrument | Sargan–Hansen J stat. | Prob(J-stat.) |

| @DYN(GG,-2) FD(-1) RNW(-1) EI(-1) EPS(-1) TO(-1) GT(-1) ECI(-1) | Model A | 21.305 | 0.127 |

| @DYN(GG,-2) FD(-1) RNW(-1) EI(-1) EPS(-1) TO(-1) GT(-1) ECI(-1) EPS*FD(-1) | Model B | 18.972 | 0.165 |

| H0: The instruments are valid | |||

| Variable | Bias-Cor. Scaled LM | Delta Tests | ||||

|---|---|---|---|---|---|---|

| Stat. | Prob. | Prob. | Prob. | |||

| GG | −2.960 | 0.998 | 6.004 | 0.000 | 6.419 | 0.000 |

| FD | −0.114 | 0.545 | 3.026 | 0.001 | 3.235 | 0.001 |

| RNW | −4.125 | 1.000 | 2.568 | 0.005 | 2.746 | 0.003 |

| EI | −1.251 | 0.894 | 4.406 | 0.000 | 4.710 | 0.000 |

| EPS | −3.528 | 1.000 | 0.171 | 0.432 | 0.183 | 0.428 |

| TO | 0.835 | 0.202 | 0.669 | 0.252 | 0.715 | 0.237 |

| GT | 0.313 | 0.377 | 5.003 | 0.000 | 5.348 | 0.000 |

| ECI | −4.878 | 1.000 | 1.818 | 0.034 | 1.944 | 0.026 |

| Model A | 1.015 | 0.155 | 5.078 | 0.000 | 6.348 | 0.000 |

| Model B | −2.274 | 0.989 | 4.485 | 0.000 | 5.790 | 0.000 |

| Intercept | Trend-Intercept | |||||||

|---|---|---|---|---|---|---|---|---|

| IPS | LLC | IPS | LLC | |||||

| W Stat. | Prob. | t-Stat. | Prob. | W Stat. | Prob. | t-Stat. | Prob. | |

| GG | 1.997 | 0.977 | 0.261 | 0.603 | −0.023 | 0.490 | 0.275 | 0.608 |

| ΔGG | −11.578 | 0.000 | −6.741 | 0.000 | −9.023 | 0.000 | −3.743 | 0.000 |

| FD | −0.064 | 0.473 | 1.008 | 0.843 | −1.398 | 0.081 | −1.090 | 0.137 |

| ΔFD | −12.592 | 0.000 | −11.418 | 0.000 | −11.081 | 0.000 | −10.174 | 0.000 |

| RNW | 3.476 | 0.999 | −1.147 | 0.125 | −0.792 | 0.214 | 1.764 | 0.961 |

| ΔRNW | −14.160 | 0.000 | −15.149 | 0.000 | −12.314 | 0.000 | −12.385 | 0.000 |

| EI | 1.362 | 0.913 | −1.018 | 0.154 | 0.172 | 0.568 | 0.246 | 0.597 |

| ΔEI | −11.743 | 0.000 | −4.960 | 0.000 | −10.362 | 0.000 | −4.406 | 0.000 |

| EPS | −0.788 | 0.215 | 1.146 | 0.874 | −0.642 | 0.260 | 2.010 | 0.977 |

| ΔEPS | −6.591 | 0.000 | −6.655 | 0.000 | −6.486 | 0.000 | −3.009 | 0.001 |

| TO | 2.037 | 0.979 | −0.642 | 0.260 | −0.616 | 0.268 | 0.901 | 0.816 |

| ΔTO | −10.518 | 0.000 | −4.335 | 0.000 | −8.556 | 0.000 | −3.284 | 0.000 |

| GT | −0.371 | 0.355 | −0.215 | 0.414 | 1.310 | 0.905 | 0.087 | 0.534 |

| ΔGT | −17.427 | 0.000 | −13.832 | 0.000 | −10.580 | 0.000 | −15.124 | 0.000 |

| ECI | −1.206 | 0.113 | 0.185 | 0.573 | −1.015 | 0.155 | −0.146 | 0.441 |

| ΔECI | −7.516 | 0.000 | −3.115 | 0.000 | −7.214 | 0.000 | −2.020 | 0.021 |

| Johansen Panel Cointegration | |||||

|---|---|---|---|---|---|

| Model A | Hyp. | Trace | 0.05 | ||

| No. of CE(s) | Eigenv. | Stat. | Crt. Val. | Prob | |

| None | 0.493 | 1544.408 | 159.530 | 0.000 | |

| No more than 1 | 0.478 | 1232.170 | 125.615 | 0.000 | |

| No more than 2 | 0.402 | 933.310 | 95.754 | 0.000 | |

| No more than 3 | 0.354 | 697.170 | 69.819 | 0.000 | |

| No more than 4 | 0.305 | 496.243 | 47.856 | 0.000 | |

| No more than 5 | 0.261 | 328.637 | 29.797 | 0.000 | |

| No more than 6 | 0.219 | 189.452 | 15.495 | 0.000 | |

| No more than 7 | 0.152 | 75.888 | 3.841 | 0.000 | |

| Hyp. | Max-Eigen | 0.05 | |||

| No. of CE(s) | Eigenv. | Stat. | Crt. Val. | Prob. | |

| None | 0.493 | 312.238 | 52.363 | 0.000 | |

| No more than 1 | 0.478 | 298.860 | 46.231 | 0.000 | |

| No more than 2 | 0.402 | 236.139 | 40.078 | 0.000 | |

| No more than 3 | 0.354 | 200.927 | 33.877 | 0.000 | |

| No more than 4 | 0.305 | 167.606 | 27.584 | 0.000 | |

| No more than 5 | 0.261 | 139.185 | 21.132 | 0.000 | |

| No more than 6 | 0.219 | 113.565 | 14.265 | 0.000 | |

| No more than 7 | 0.152 | 75.888 | 3.841 | 0.000 | |

| Model B | Hyp. | Trace | 0.05 | ||

| No. of CE(s) | Eigenv. | Stat. | Crt. Val. | Prob. | |

| None | 0.494 | 1745.055 | 197.371 | 0.000 | |

| No more than 1 | 0.484 | 1431.569 | 159.530 | 0.000 | |

| No more than 2 | 0.415 | 1127.091 | 125.615 | 0.000 | |

| No more than 3 | 0.382 | 880.830 | 95.754 | 0.000 | |

| No more than 4 | 0.345 | 659.440 | 69.819 | 0.000 | |

| No more than 5 | 0.267 | 464.675 | 47.856 | 0.000 | |

| No more than 6 | 0.245 | 321.539 | 29.797 | 0.000 | |

| No more than 7 | 0.218 | 192.336 | 15.495 | 0.000 | |

| No more than 8 | 0.158 | 79.307 | 3.841 | 0.000 | |

| Hyp. | Max-Eigen | 0.05 | |||

| No. of CE(s) | Eigenv. | Stat. | Crt. Val. | Prob. | |

| None | 0.494 | 313.486 | 58.434 | 0.000 | |

| No more than 1 | 0.484 | 304.478 | 52.363 | 0.000 | |

| No more than 2 | 0.415 | 246.261 | 46.231 | 0.000 | |

| No more than 3 | 0.382 | 221.391 | 40.078 | 0.000 | |

| No more than 4 | 0.345 | 194.765 | 33.877 | 0.000 | |

| No more than 5 | 0.267 | 143.136 | 27.584 | 0.000 | |

| No more than 6 | 0.245 | 129.203 | 21.132 | 0.000 | |

| No more than 7 | 0.218 | 113.029 | 14.265 | 0.000 | |

| No more than 8 | 0.158 | 79.307 | 3.841 | 0.000 | |

| Kao Residual Cointegration | |||||

| Model A | t-Statistic | Prob. | Model B | t-Statistic | Prob. |

| ADF | −10.641 | 0.000 | ADF | −3.861 | 0.000 |

| Residual var. | 1.047556 | Residual var. | 1.047339 | ||

| HAC var. | 0.712478 | HAC var. | 0.712091 | ||

| Model A | Model B | |||||||

|---|---|---|---|---|---|---|---|---|

| Variable | Coef. | Std. Er. | t-Stat. | Prob. | Coef. | Std. Er. | t-Stat. | Prob. |

| FD | −2.094 | 0.341 | −6.135 | 0.000 | −3.760 | 0.546 | −6.885 | 0.000 |

| EI | −1.861 | 0.141 | −13.187 | 0.000 | −1.669 | 0.153 | −10.909 | 0.000 |

| RNW | 0.981 | 0.059 | 16.555 | 0.000 | 0.089 | 0.005 | 16.339 | 0.000 |

| EPS | 0.206 | 0.045 | 4.564 | 0.000 | 0.322 | 0.044 | 7.311 | 0.000 |

| TO | −0.022 | 0.003 | −7.223 | 0.000 | −0.019 | 0.003 | −5.575 | 0.000 |

| GT | 0.463 | 0.121 | 3.830 | 0.000 | 0.505 | 0.098 | 5.168 | 0.000 |

| ECI | −0.333 | 0.120 | −2.776 | 0.006 | −0.238 | 0.118 | −2.021 | 0.044 |

| EPS*FD | - | - | - | - | 0.444 | 0.195 | 2.280 | 0.023 |

| Stat. | Prob. | Stat. | Prob. | |||||

| Ramsey’s Reset | 0.882 | 0.378 | 0.627 | 0.530 | ||||

| Serial Correlation LM (Breusch–Godfrey) | 1.699 | 0.115 | 1.168 | 0.132 | ||||

| Heteroskedasticity (Breusch–Pagan–Godfrey) | 1.197 | 0.302 | 0.919 | 0.499 | ||||

| Adj. R2 | 0.716 *** | 0.714 *** | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nur, T.; Topaloglu, E.E.; Yilmaz-Ozekenci, S.; Koycu, E. The Impact of Energy Intensity, Renewable Energy, and Financial Development on Green Growth in OECD Countries: Fresh Evidence Under Environmental Policy Stringency. Energies 2025, 18, 1790. https://doi.org/10.3390/en18071790

Nur T, Topaloglu EE, Yilmaz-Ozekenci S, Koycu E. The Impact of Energy Intensity, Renewable Energy, and Financial Development on Green Growth in OECD Countries: Fresh Evidence Under Environmental Policy Stringency. Energies. 2025; 18(7):1790. https://doi.org/10.3390/en18071790

Chicago/Turabian StyleNur, Tugba, Emre E. Topaloglu, Sureyya Yilmaz-Ozekenci, and Erol Koycu. 2025. "The Impact of Energy Intensity, Renewable Energy, and Financial Development on Green Growth in OECD Countries: Fresh Evidence Under Environmental Policy Stringency" Energies 18, no. 7: 1790. https://doi.org/10.3390/en18071790

APA StyleNur, T., Topaloglu, E. E., Yilmaz-Ozekenci, S., & Koycu, E. (2025). The Impact of Energy Intensity, Renewable Energy, and Financial Development on Green Growth in OECD Countries: Fresh Evidence Under Environmental Policy Stringency. Energies, 18(7), 1790. https://doi.org/10.3390/en18071790