1. Introduction

Driven by the imperatives of global climate governance and sustainable development, hydrogen energy has been widely regarded as one of the key pathways to drive the deep decarbonization of the energy system and the green transformation of terminal energy, due to its zero carbon emissions, cross-sectoral applicability, and storable and transportable characteristics [

1]. Research suggests that the industrial and transportation sectors are major contributors to CO

2 emissions [

2], and hydrogen is anticipated to achieve large-scale deployment in these areas by 2025, serving as a central pillar in the pursuit of carbon neutrality [

3]. Meanwhile, with continuous breakthroughs in key technologies, such as green hydrogen production, storage, and transportation, the global hydrogen energy industry chain and trade network are rapidly taking shape [

4]. More than 30 countries and regions have released or formulated national hydrogen energy strategies (including import and export plans), and cross-border hydrogen energy cooperation and trade have grown significantly [

5]. For example, Saudi Arabia’s 1.2 Mt/year green ammonia export project has entered the final investment decision stage, and India is advancing its 1 Mt/year green ammonia project. Some projections forecast that clean hydrogen will increase 500-fold by 2050 and account for 11% of the cumulative emissions reductions required to stay well below 2 °C of warming [

6]. It is evident that the Global Hydrogen Trade Network (GHTN) is gradually evolving from a regional energy supplement to an emerging pillar of the global energy system.

However, structural risks and system vulnerabilities have increasingly emerged as the hydrogen trade system undergoes rapid development. As one example, the GHTN exhibits highly centralized characteristics, with a few hub countries performing critical supply and transit functions. Should any of these nodes experience supply disruptions, it could trigger a chain reaction, threatening the global hydrogen supply–demand balance [

7]. Additionally, hydrogen energy, as an emerging industry, still faces challenges, such as immature global production and transportation systems, policy barriers, limited pathways, and insufficient redundancy [

8]. The hydrogen energy industry chain is also a typical complex system, where the behavior of complex systems is unpredictable, as disturbances at one node can spread throughout the system [

9]. Amid increasingly complex international dynamics and the rising frequency of extreme climate events, the GHTN is highly vulnerable to external disruptions. Therefore, it is essential to develop a research framework that can capture the system’s dynamic evolution, based on its overall risk absorption and adaptive capacity.

Despite the large body of research that has quantified the sustainability of hydrogen systems using lifecycle carbon footprints, energy efficiency indicators, and other methods, these approaches are primarily based on static perspectives, making it difficult to reveal the dynamic characteristics of network propagation and system evolution under risk shocks [

4]. Resilience theory, as a process-oriented framework, emphasizes a system’s capacity to absorb, adapt to, and recover from uncertain disturbances, offering a new theoretical perspective for analyzing the sustainability of complex energy systems [

10,

11]. In recent years, resilience research has been widely applied in fields such as urban infrastructure, power systems, and disaster management, but it remains a gap in the context of transnational hydrogen trade networks [

12]. The resilience perspective offers a comprehensive understanding of system dynamics and risk pathways under disruptions, providing adaptive and forward-looking insights for sustainable governance.

Building on the preceding analysis, a GHTN was constructed using UN Comtrade data. A risk propagation model that incorporates node-level absorption capacity was employed to simulate the propagation of supply shocks within the network. Based on the simulation results, a composite sustainability index was developed. This index integrates structural resilience, economic resilience, and environmental resilience to dynamically assess the overall stability and adaptive capacity of the system under supply disruption scenarios.

This study is distinguished from previous research by the following contributions: (1) Resilience theory is incorporated into the sustainability assessment of the hydrogen trade system through the development of an integrated evaluation framework that combines risk propagation dynamics with multi-dimensional resilience metrics. This framework contributes to the theoretical advancement of sustainability analysis in green energy networks. (2) A complex network-based risk propagation model is developed, accounting for node heterogeneity and risk absorption capacity, to simulate the dynamic evolution of trade network indicators under hydrogen supply disruption scenarios. This model serves as a resilience analytical tool for capturing nonlinear system responses and identifying potential instability pathways. (3) The multi-dimensional resilience of the GHTN is quantitatively evaluated, enabling the identification of critical vulnerable nodes and fragile links. The analysis highlights key sustainability challenges arising from structural centralization, economic dependence, and carbon rebound volume, and puts forward risk-informed policy recommendations to enhance international hydrogen governance.

The remainder of this paper is organized as follows.

Section 2 reviews the relevant literature.

Section 3 presents the modeling framework and methodological indicators.

Section 4 provides the simulation results and corresponding analysis.

Section 5 concludes the study and proposes policy recommendations.

4. Results and Discussion

4.1. Evolution of the GHTN Topological Structure

As an emerging component of the global energy trade system, the evolution of the hydrogen trade network is shaped by shifts in energy strategies, technological advances, and geopolitical dynamics. To visualize changes in network participation, trade density, and spatial patterns, global hydrogen trade networks for 2017, 2019, 2021, and 2023 are depicted in

Figure 1. For more accurate comparison of key topological parameter changes in the GHTN from 2017 to 2023, the node, edge, average degree, density, average path length, and average clustering coefficient are summarized and presented in

Table 2.

The GHTN underwent significant expansion and evolution from 2017 to 2023, as illustrated in

Figure 1 and

Table 2. In 2017, the GHTN was limited in size, with a relatively small number of participating countries, and trade relationships primarily concentrated in European countries, such as the Netherlands, Germany, the United Kingdom, and France, while countries in Asia and the Americas were positioned at the periphery, resulting in an overall decentralized network. In 2019, global interest in hydrogen trade rose, accompanied by an increase in the number of trading countries, with notably more active participation and stronger network connections in Asian countries, such as China. Europe remained at the center, while the United States became significantly more connected to Asia, and global hydrogen trade began to diversify. The size of the network remained stable in 2021, but the number of edges increased further, with more frequent trade links established between countries. In addition, connectivity between different regions increased that year, and the structure of the network became more polycentric, with Asian countries, such as China and Singapore, gaining further ground. In 2023, although the number of participating countries decreased slightly, the network as a whole became tighter and more efficient, possibly due to the global economic situation or policy changes. The number of edges decreased slightly, but the average degree reached its highest, implying that trade became more concentrated among the core countries, with European countries continuing to dominate global hydrogen trade. Meanwhile, the United States continues to maintain a high level of activity, while Asia, particularly China and Singapore, has emerged as an important player that cannot be overlooked and has grown increasingly influential in global hydrogen trade.

In summary, over the past few years, the GHTN has gradually evolved from its initial dominance in Western Europe and decentralization at the periphery to a multi-centered and closely interconnected global hydrogen energy trade network. Hydrogen energy, as a clean energy source, is gaining prominence in international trade, and the GHTN is expected to expand and deepen further in the future as global demand for green energy grows.

4.2. Structure Resilience of the GHTN

4.2.1. Avalanche Size Parameter

Avalanche size is defined as the total number of countries that fail due to the initial risk source, serving as a measure of the risk propagation scope within the network. The magnitude of avalanche size depends on the ratio . When is too large, the failure of any single country can trigger widespread cascading failures across the network. In contrast, when is too small, the failure of a country does not lead to the collapse of others, resulting in ineffective risk propagation.

The distribution of avalanche sizes in the GOTN is illustrated in

Figure 2. When the cumulative count distribution of avalanche sizes is observed to follow a power-law pattern, the network is considered to be in a critical state, and the corresponding value of

is regarded as the optimal parameter setting.

As increases, the distribution curve becomes convex; when decreases, it turns concave, both deviating from the typical long-tailed power-law shape and indicating a departure from the critical state. The optimal propagation parameter is identified as 5, where the avalanche size distribution exhibits a power-law pattern.

4.2.2. Structural Resilience of the GHTN Based on Avalanche Size

To evaluate structural resilience, each country is set as the initial risk source to simulate and record avalanche size, avalanche rate, and propagation rounds. Results are summarized in

Table 1. Simulation results indicate that only 45 countries trigger non-zero avalanche sizes, suggesting that most initial shocks fail to spread and the network possesses inherent fault tolerance. Further analysis shows that the average avalanche size of the GHTN is 2.736, accounting for approximately 0.02% of all nodes, indicating that risk propagation is effectively contained in most cases.

However, a few critical nodes exist in the network, where a reduction in their export volumes leads to widespread risk across many countries. Among the top 10 risk source countries shown in

Table 3, Belgium triggers the largest avalanche size, affecting 38 countries—approximately 30.4% of all trade participants—followed by the United States and the Netherlands, with 25 and 16 affected countries, respectively. These countries typically combine high export intensity with central hub positions, making their failure likely to disrupt multiple importers and generate cumulative effects during subsequent propagation. The network displays a progressive propagation pattern, with most large-scale avalanches expanding sharply in the second round, reflecting high sensitivity to early disturbances. Overall, the GHTN exhibits global robustness but local fragility: while the system remains broadly resilient, the failure of a few key countries can trigger systemic disruptions.

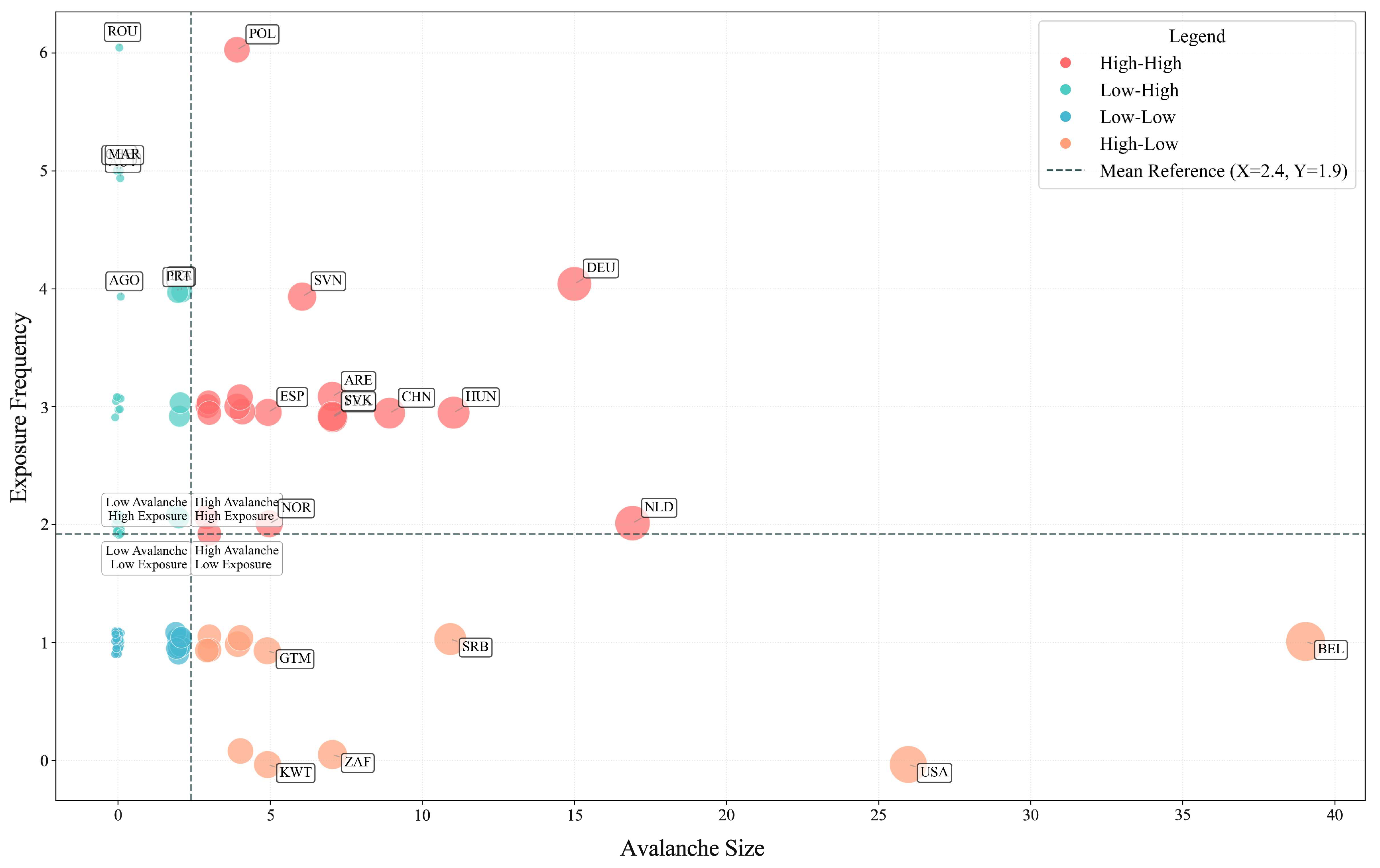

To further examine structural resilience at the country level, specifically the frequency with which each country is affected under different initial risk scenarios, a four-quadrant positioning map was constructed based on avalanche size and exposure frequency (

Figure 3). The x-axis represents the avalanche size triggered when a country serves as the initial risk source, and the y-axis indicates how frequently it is passively affected by shocks. Bubble size corresponds to the country’s avalanche size. Different structural roles can be identified from the figure. The first quadrant (upper right, high avalanche–high exposure) represents “critical intermediary” countries that both trigger large avalanches and are highly exposed to failures from others. For example, Germany and Poland not only serve as important bridging nodes in the network but also exhibit relatively high vulnerability. The second quadrant (lower right, low avalanche–high exposure) corresponds to “vulnerable receivers,” referring to countries with limited capacity to propagate risk but high sensitivity to external shocks. Examples include Romania and Morocco, which may require greater import diversification to reduce systemic dependence. The third quadrant (lower left, low avalanche–low exposure) represents “peripheral robust” countries, which are typically located at the margins of the network. These countries are neither likely to trigger risks nor easily affected by others. Examples include Guatemala and Kuwait. The fourth quadrant (upper left, high avalanche–low exposure) represents “latent triggers,” such as Belgium and the United States, which possess strong risk propagation capacity while remaining relatively unaffected themselves. Supply disruptions from these countries are highly likely to trigger large-scale avalanches, making them critical risk sources that warrant close monitoring within the hydrogen trade system.

4.3. Economic Resilience of the GOTN

To assess the economic resilience of the GHTN, the impact of a supply disruption originating from Belgium on global hydrogen trade value is simulated in this section. Simulation results estimate a total global trade loss of USD 59.61 million, with an average of USD 0.48 million per country and a 15.4% decline in overall trade value. While a few countries incur substantial losses, most are only marginally affected, suggesting that the GHTN maintains economic resilience under localized disruptions.

In absolute terms, as shown in

Table 4, excluding the risk source Belgium, the most significantly affected countries are the Netherlands, Germany, the United Kingdom, and Ireland, with estimated losses of approximately USD 25.99 million, 1.87 million, and 1.7 million, respectively. These countries experience direct economic shocks due to their strong hydrogen trade linkages with Belgium, underscoring the structural vulnerability associated with high network dependency. In relative terms (as a share of GDP), small economies, such as Luxembourg, and Namibia, rank low in absolute losses but high in relative impact. Their modest trade losses account for a significant portion of GDP, indicating weak economic resilience under disruptions from Belgium due to their small size and high hydrogen dependency.

Overall, the economic impacts of risk shocks within the GHTN exhibit significant heterogeneity. On one hand, advanced economies incur greater absolute losses due to their high network centrality and extensive trade with the risk source. On the other hand, smaller economies, despite lower trade volumes, may experience severe relative losses due to dependence on a single market. These findings suggest that enhancing economic resilience requires not only greater redundancy among key nodes but also improved trade diversification for peripheral countries, thereby strengthening the network’s overall economic resilience.

4.4. Environmental Resilience of the GHTN

To evaluate the environmental resilience of the GHTN under supply shortage shocks, the carbon rebound volume was employed as the primary indicator. It is defined as the additional greenhouse gas emissions generated by a shift to more carbon-intensive alternative energy sources following a decline in hydrogen imports, reflecting the passive emission risk induced by reduced trade volumes.

From a systemic perspective, a simulation with Belgium (BEL) as the initial risk source indicates that its supply disruption would lead to a global carbon rebound of approximately 5393 tons of CO2, with a rebound rate of 11.55%. This suggests that the current GOTN exhibits a degree of environmental vulnerability when exposed to supply shocks from key nodes. Once green hydrogen supply chains are disrupted, countries are often unable to rapidly transition to low-carbon alternatives, resulting in widespread carbon rebound and heightened environmental instability.

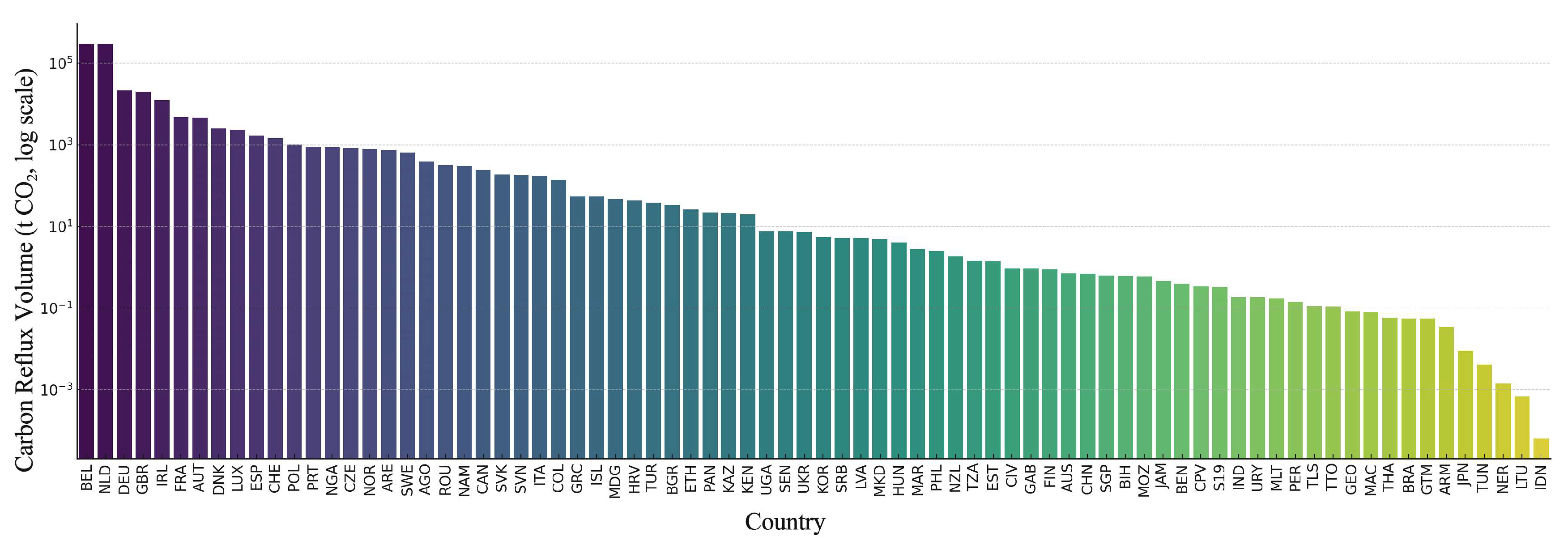

The distribution of carbon rebound volumes across countries is presented in

Figure 4. To improve readability and facilitate comparison across different magnitudes, a logarithmic scale (log

10) was applied. The results reveal a clear core concentration pattern, with a small number of countries accounting for the majority of system-wide emission increases. Specifically, countries such as Germany, the Netherlands, France, and the United Kingdom exhibit the highest carbon rebound volumes, due to their large-scale hydrogen imports, concentrated supply chains, and partial reliance on carbon-intensive sources. Disruptions in key exporters lead to sharp emission increases, exposing weak environmental resilience. These countries should enhance their green hydrogen portfolios by diversifying supply routes and building structural redundancy. In contrast, countries with lower carbon rebound volumes such as Finland, Slovenia, and New Zealand demonstrate greater environmental stability. This is attributed to their relatively small import volumes, more diversified trade routes, or reliance on lower-carbon supply sources. As a result, their carbon input structures remain less volatile under supply shocks, reflecting stronger environmental resilience. These countries function as a green buffer zone within the GHTN.

The GHTN displays environmental resilience marked by localized vulnerability and peripheral stability. Without low-carbon transitions or diversified supply in key countries, supply disruptions may induce widespread rebound emissions. Strengthening green resilience is, therefore, essential, particularly by enhancing redundancy and decarbonization in central nodes of the system. It should be noted that the modeling of the carbon rebound volume in this study is simplified and only provides an approximate estimate of the environmental resilience of the GHTN. Complex country-level substitution mechanisms are not considered. Future studies could enhance this component by incorporating more detailed and heterogeneous substitution pathways.

4.5. Sustainability of the GHTN

The sustainability of the GHTN under supply shocks is evaluated using a system-level framework comprising structural, economic, and environmental resilience. All three dimensions are standardized on a [0, 1] scale, with higher values indicating greater resilience. By averaging the normalized scores, a composite sustainability index of approximately 0.809 is obtained. The results indicate that, despite the persistence of structural vulnerabilities associated with a few critical nodes, the GHTN exhibits considerable buffering and adaptive capacity in both economic and environmental dimensions, reflecting a moderately high level of overall sustainability. However, underlying challenges remain, including the concentration of trade flows and the limited diversification of green supply routes. To enhance the long-term sustainability of the system, global hydrogen cooperation should be advanced in parallel across three pillars: security, equity, and environmental integrity.

To verify the robustness of the CSI under varying weight schemes, a sensitivity analysis was conducted with three alternative scenarios that respectively emphasize structural, economic, and environmental resilience using weight ratios of 2:1:1, 1:2:1, and 1:1:2. The results show that while CSI values fluctuate slightly (ranging from 0.78 to 0.83), the overall sustainability assessment remains largely unchanged, indicating that the proposed evaluation framework is relatively robust to weight perturbations.

5. Conclusions and Policy Implications

In the context of the global carbon neutrality transition, hydrogen has been increasingly recognized as a strategic clean energy source and acts as a key enabler in reshaping the international energy system through transnational trade. In this study, a complex network approach combined with a risk propagation model was employed to systematically evaluate the sustainability of the GOTN under supply shocks from structural, economic, and environmental perspectives. The main conclusions are as follows: (1) The structural evolution of the GHTN reveals a shift from a unipolar configuration toward a more polycentric architecture. Countries such as China and Singapore have progressively emerged as key interregional bridging nodes, facilitating connectivity across trade communities in Europe and Asia, thereby strengthening the structural cohesion of the network. (2) From a system-wide perspective, the GHTN exhibits multiple disturbance responses under supply shortage shocks, including risk propagation, economic losses, and increases in carbon rebound. However, these effects remain concentrated in a few core regions, such as Germany, the Netherlands, and the United Kingdom, which maintain strong trade dependencies on the disrupted source. In contrast, most peripheral countries experience only limited spillover effects. Consequently, the network’s overall sustainability remains within a manageable and resilient range. (3) A country-level assessment revealed marked heterogeneity in the resilience performance of the hydrogen trade network across structural, economic, and environmental dimensions. In terms of structural resilience, supply shortages in countries, such as Belgium, the United States, and the Netherlands, are highly susceptible to initiating large-scale avalanches within the network, whereas countries such as Romania and Morocco exhibit greater vulnerability to secondary transmission effects. In terms of economic resilience, countries with large hydrogen trade volumes, such as the Netherlands, Germany, and the United Kingdom, experience significant absolute economic losses, while smaller economies, including Luxembourg, Ireland, and Namibia, rank higher in terms of relative losses. In terms of environmental resilience, the carbon rebound volume is also more pronounced in countries such as the Netherlands, Germany, and the United Kingdom. These heterogeneous manifestations suggest that risk in the GHTN does not spread uniformly, but rather exhibits distinct characteristics of hub-triggered initiation, chain-like transmission, and localized concentration.

Based on the above analysis, the following policy recommendations are proposed. (1) Strengthen polycentric cooperation mechanisms to enhance the structural sustainability of the hydrogen trade network. It is recommended to advance the development of cross-regional strategic cooperation platforms for hydrogen, and to promote the formation of hydrogen corridors and supply chain node alliances jointly led by multicenter hub countries and other emerging economies. By diversifying trade routes and coordinating infrastructure investments, the connectivity and hierarchical structure of the network can be optimized, thereby mitigating the systemic impact of supply shortages in any single country and improving the overall resilience and sustainability of the global hydrogen trade system. (2) Establish regional emergency coordination mechanisms to enhance the GHTN’s sustainable response capacity in economic and environmental dimensions. It is recommended that regional frameworks, such as the European Union and the Asia–Pacific, develop hydrogen trade disruption contingency mechanisms encompassing risk monitoring, alternative dispatching, and temporary supply functions. Countries should be encouraged to incorporate green hydrogen reserves into their national energy security strategies to improve their ability to respond to high-carbon fallback scenarios. At the international level, the establishment of hydrogen import agreements based on a green-first principle should be promoted to reduce the environmental sustainability risks associated with carbon rebound volume. (3) Advance differentiated capacity building for key hubs and vulnerable countries to foster an inclusive and resilient global hydrogen governance framework. The significant national heterogeneity observed across the GHTN’s multidimensional resilience highlights the necessity of globally coordinated yet tailored governance. For structurally critical countries, trade route redundancy should be strengthened to prevent systemic risks from single-point failures. Vulnerable countries should be prioritized within international hydrogen cooperation initiatives, with support for developing localized hydrogen reception and conversion infrastructure and diversifying import sources. For countries highly exposed to carbon rebound risks, the promotion of green hydrogen procurement agreements and responsibility-sharing mechanisms under the United Nations’ sustainable energy platforms is recommended to enhance environmental governance capacity. By combining differentiated strategies with global coordination, an equitable, well-structured, and sustainable hydrogen trade network can be realized.