1. Introduction

The introduction of dual-carbon goals has resulted in a progressively higher proportion of renewable energy generation each year; however, the widespread integration of clean energy inevitably brings strong intermittency, leading to frequent power imbalances and diminishing the system’s regulation capability. Continuing to address these issues from the generation side by constructing new power plants or increasing reserve capacities not only conflicts with the dual-carbon objectives but also imposes substantial economic costs. Therefore, implementing demand response (DR) on the load side constitutes an effective approach to resolving these challenges.

DR participants can be broadly categorized into three sectors: residential loads, industrial loads, and commercial loads. Residential loads can be further divided into household appliances and electric vehicles (EVs). Compared to household appliances, EVs exhibit higher charging power and more regular travel patterns. In China, EVs are growing at an annual rate of up to 90%, exceeding ten million, indicating tremendous potential for DR.

EVs are capable of providing various ancillary services to the power system, and a wide range of control strategies have been extensively studied. Ref. [

1] dynamically adjusts the discharge rate of pure EVs in real time, considering actual grid load and EV characteristics, to provide peak-shaving support for the system. In [

2], a hierarchical and distributed frequency regulation strategy for EV clusters was optimized based on demand-driven charging loads. A method for evaluating frequency regulation capacity is introduced in [

3], taking into account user charging demands and battery degradation. Refs. [

4,

5] further explore cloud–edge collaborative architectures and reserve provision mechanisms under uncertain activation conditions, respectively, aiming to enhance real-time responsiveness and reliability. However, most of these works focus primarily on system-level control or cluster-level optimization, without fully addressing the heterogeneity and dynamic behavior of EVs at individual charging stations.

In contrast to control-focused strategies, another body of literature emphasizes the commercialization of EV flexibility resources, exploring trading mechanisms between EVs and the grid or aggregators. Ref. [

6] treats EVs as mobile storage units participating in peer-to-peer (P2P) energy trading. In [

7], a blockchain-based consortium framework is proposed to ensure secure and trustworthy energy trading between EVs and service providers (SPs). A user-perception-based approach that incorporates response willingness is developed in [

8], enabling regulation capacity (RC) estimation for individual EVs based on their charging/discharging state and state of charge (SOC). Refs. [

9,

10] explore auction-based trading mechanisms to incentivize EVs to participate in DR. These energy trading models rely on well-designed scheduling strategies that aim to meet system requirements while maximizing profits or minimizing costs for participants. An adaptive robust optimization model is presented in [

11] to handle uncertainty in EV charging demand and reduce station operation costs, while [

12] proposes an option-based DR strategy to mitigate supply–demand imbalance risks.

Moreover, refs. [

13,

14,

15] investigate the impact of high energy consumption, usage randomness, and storage constraints of pure EVs on residential DR elasticity and fairness. A decentralized EV scheduling scheme is proposed in [

14] to reshape grid load profiles, and [

15] further considers user-side time-aware fairness in scheduling. Despite the progress in both control and trading domains, a critical limitation in the above works lies in the lack of detailed, station-level temporal estimation of EV response potential.

Some studies, such as [

16], incorporate EVs into energy system planning models, but their treatment of response potential remains qualitative or embedded within upper-level decisions without quantitative analysis. Although Ref. [

17] optimizes the DR capability of EV groups, it does not explicitly characterize regulation capacity or account for the fine-grained temporal distribution of charging behaviors at individual stations.

Current research faces the following issues: (1) EV response capability is inherently time dependent, and accurately describing its temporal response potential remains a challenge. (2) Charging stations vary significantly in size, and the sheer number of stations makes direct participation in transactions with the dispatching center highly complex. To address these gaps, this paper proposes a station-aggregator response resource trading mechanism considering energy–power coupling of response capability. The key innovations are as follows:

- (1)

An innovative energy–power coupling description method is introduced to accurately estimate the response potential at the charging station level, which captures station-level flexibility by considering both energy and power constraints.

- (2)

A risk-aware load aggregation mechanism is introduced, whereby the load aggregator (LA) coordinates multiple charging stations to form a stable response portfolio.

- (3)

A Stackelberg game-based interaction model is developed to facilitate strategic decision making between the LA and individual charging stations.

2. Framework and Models

2.1. Framework

From the perspectives of system optimization and market design, the station-based aggregation mode—using charging stations as intermediaries—demonstrates significant advantages compared with the bilateral contracting mode directly between EVs and LAs, which involves high transaction costs, uncertainties in user behavior, and complexities of decentralized management.

As critical infrastructure nodes in integrated transportation–energy coupled systems, charging stations possess the following core advantages: (1) physical aggregation: EV resources can be spatially aggregated through centralized charging pile clusters; (2) operational stability: a predictable baseline of charging loads is formed based on fixed locations; (3) economies of scale: a typical single station, generally equipped with 50–200 charging piles, has MW-level potential for regulation. This “resource pooling” business model significantly reduces transaction friction costs.

However, from the current research perspective, studies on the response capability of charging stations remain relatively limited. DR in EV charging stations exhibits a typical domino effect. When a charging station operator adjusts the charging power for a specific EV, this intervention directly impacts the charging schedule of that EV, consequently altering its charging state in subsequent periods. The central constraint of this chain reaction lies in the charging demand targets set by vehicle owners. Most users specify clear charging objectives, establishing rigid boundaries for DR strategies. Neglecting this characteristic and estimating response capability based solely on instantaneous available power could result in significant risks of strategic failure.

From a behavioral perspective, charging response decisions are further influenced by multiple psycho-economic factors. The willingness of users to respond does not follow a simple linear relationship; instead, it exhibits clear threshold effects and loss aversion characteristics. When electricity pricing incentives or compensations are insufficient, user participation willingness may experience a precipitous decline. Moreover, significant differences exist among users regarding sensitivity to charging duration. Commercial vehicle users might exhibit extreme sensitivity to charging delays, whereas private vehicle users may demonstrate greater temporal flexibility.

Resource competition within charging stations further complicates the issue. During peak periods, when a large number of EVs require simultaneous charging, charging resources may face a risk analogous to a bank run scenario. Under these conditions, simple power regulation could trigger a nonlinear increase in queuing times, and this congestion effect significantly reduces the actual schedulable capacity of the station.

In response to the aforementioned challenges, this paper undertakes the following research. Firstly, an estimation model of the charging station’s response capability is proposed, considering the chain reactions associated with responses, to assess the maximum achievable response capability under given conditions. Then, the behavior models for charging stations and LAs are developed. Finally, a transaction model for response resources between charging stations and LAs is developed to identify appropriate transaction prices and capacities.

Figure 1 shows the flowchart of the proposed mechanism. To ensure the reliability and applicability of the estimation, this study utilizes charging data collected over a one-month period as the foundation for response potential estimation. By incorporating continuous operational data from the charging station, the evaluation framework captures the station’s stable response characteristics across diverse conditions, including variations in weather and traffic flow.

2.2. EV Model

EVs are essentially mobile energy storage units, whose core characteristic is the dynamic nature of the battery’s SOC. In grid-interactive scenarios, the charging behavior of EVs can be viewed both as adjustable loads and as flexible regulation resources. Through optimized scheduling of charging sequences via intelligent chargers, temporal and spatial shifts in electricity usage can be achieved. The specific EV model is formulated as follows in Equations (1)–(6): Equation (1) calculates the user-specified SOC need, and (2) computes the SOC level at the next time interval, and (3) ensures that the total charging amount meets the user-defined requirement. Equations (4)–(5) impose constraints on charging power and SOC levels. Equation (6) constrains the operational time window during which EV charging is permitted.

where

Sne(

i) denotes the charging energy demand of user

i,

C0 represents the battery capacity,

Sex(

i) indicates the expected state of charge (SOC) for user

i,

S0(

i) represents the initial SOC at the time of user

i’s connection,

S(

i,

t) represents the SOC of user

i at time

t,

η is the charge/discharge efficiency, defined as charging efficiency

ηc during charging and as the reciprocal of discharging efficiency

ηd during discharging,

P(

i,

t) denotes the charging/discharging power of user

i at time

t, Δ

t represents the duration of each time interval,

PcN and

PdN denote the rated charging and discharging power of the EV, respectively,

Smax and

Smin denote the upper and lower SOC limits of the EV battery, respectively, and

tar(

i) and

tle(

i) represent the arrival and expected departure times of user

i, respectively.

3. Response Capacity Estimation

Constrained by the rigid charging requirements of EVs, their regulation capacity is not fixed but rather temporally shiftable. Thus, the estimation of their response potential should be based on energy rather than power. This is in contrast to thermostatically controlled loads where direct power adjustments can be achieved by changing temperature setpoints or switching operational states without significantly impacting subsequent usage within reasonable limits, i.e., only affecting user comfort. EVs have urgent charging objectives; adjusting or shifting their charging amount or charging periods inevitably influences subsequent behavior, thereby causing a chain reaction. Therefore, for charging stations, the available regulation power at any given moment is influenced by previous charging behaviors, and the current charging state directly impacts subsequent charging periods. Consequently, the potential estimation should be performed from an energy perspective rather than a power perspective.

To accurately quantify the regulation capability of EVs, the core indicator “drift energy” is introduced, which is defined as the total amount of electrical energy that can be reallocated to other periods without violating users’ charging objectives. Drift energy maintains energy conservation, emphasizing that regulation fundamentally represents temporal redistribution of electricity rather than the creation or elimination of energy. The amount of energy available for shifting depends on the current SOC, remaining parking duration, and charger power capacity. The drift energy gradually diminishes as the scheduled departure time approaches.

Equation (7) computes the required charging time

trq(

i) to achieve the target SOC for users; here, regulation resources are provided solely through pausing EV charging. This is because overly frequent charging and discharging cycles negatively impact EV batteries, resulting in capacity degradation. From the user’s perspective, the negative sentiment induced by battery degradation significantly outweighs the positive feedback from monetary compensation; hence, EV discharging is not considered. Equation (8) calculates the idle time

tdf(

i), and (9) computes the drift energy

Edf(

i) that a specific EV can offer based on this surplus charging time and the rated charging power. This drift energy thus represents the regulation energy available between intervals [

tar(

i),

tle(

i)] while still satisfying users’ charging demands.

Drift energy is distributed across specific intervals, yet it remains uncertain precisely within which interval this energy will be realized during actual regulation. While drift energy can effectively characterize the regulation capability of individual EVs, differences in drift durations and drift energies among EVs make it challenging to represent the overall response capability of an entire charging station. For instance, a charging station might offer a drift energy of 10 MWh, yet its actual achievable regulation power within 1 h may not necessarily reach 10 MW due to constraints such as the number of charging vehicles and their charging states. Thus, additional descriptors are required to effectively characterize drift energy. Therefore, the concept of average drift power

df(

i,

t) is introduced, as described in (10). Equation (11) calculates the average drift power provided by

I EVs

DF(

i,

t) within the station over the specified interval.

However, using the average drift power fails to accurately reflect the variations in actual regulation capacity across different intervals, obscuring critical differences. In practice, there exist cases where regulation capacity is achievable, but these scenarios cannot be captured by an averaged value alone. Therefore, further exploration into the configuration of response capabilities is required. Consequently, this paper proposes a novel method for evaluating temporal response capacity, using the overall average drift power as a benchmark to investigate the actual regulation capacity available in each interval.

Considering that charging stations must provide relatively stable response capacity rather than extreme values, it is necessary to evaluate the temporal regulation capacity available within each time interval, rather than focusing solely on extreme capacities concentrated in individual intervals. Thus, a scaling factor

m is introduced for calculation, as shown in (12). And the response capacity of a charging station

ESTA is obtained in (13).

Based on the Monte Carlo method, possible drift power values are generated within the limits set by drift energy and drift intervals. Assume there are

T time intervals, with each interval having a discrete value

xi, where

xi lies within the range [

ai,

bi]. The generation model is listed below.

The generated candidate response curves must undergo rigorous feasibility verification to ensure their implementation ability under real-world operating conditions. Feasibility evaluation of the curves requires a comprehensive consideration of multiple constraints, including the real-time utilization of charging piles, grid power availability, and user charging demands. To this end, a optimization-based verification model is developed in (17)–(20), enabling quantitative validation of the alignment between response curves and actual operating conditions. The core objective function aims to minimize the sum of squared deviations between the generated response curve and the total charging load, thereby ensuring a high degree of alignment between the scheduling plan and actual load demand. Equation (18) strictly requires that the total charged energy meets the user-defined charging demand, a fundamental condition for maintaining service quality. Equation (19) introduces a deviation threshold constraint; if the deviation exceeds a predefined constant, the solution is deemed infeasible. This mechanism effectively mitigates operational risks caused by significant mismatches between generated curves and actual behavior. Equations (1)–(6) enforces constraints on the normal charging requirements of EVs.

According to the model described above, all generated and feasible x = [

x1, …,

xi, …

xT] are organized into a matrix form

M {N

T}, as in (21). Here,

N denotes the number of generated curves, and

T represents the time dimension. Given that individual curves fail to sufficiently represent the overall statistical characteristics of the station’s response capability, this study employs functional data analysis (FDA), utilizing kernel smoothing and principal component decomposition to extract intervals of high-probability response curves with a confidence level

p ≥ 95%. Combined with drift energy, this further characterizes the distribution features of the charging station’s response resources.

FDA treats each curve as a smooth function, which can be regarded as a random function drawn from a function space. Functional principal component analysis (FPCA) is employed to extract the main modes of variation. Each function

yi(

t) is modeled as shown in (22).

μ(

t) represents the mean function of all curves, obtained through pointwise averaging.

ϕj(

t) denotes the jth principal component function, derived from the decomposition of the covariance operator.

ξkj is the score of the kth curve along the jth principal component direction. According to the Karhunen–Loève expansion,

ξkj∼N(0,

λj) approximately follows a normal distribution. This allows the construction of a confidence band that captures the majority of function trajectories, as shown in (23).

Finally, the response resource that the charge station can provide is described as drift energy, and the response distribution .

4. Response Resource Trading

4.1. Trading Behavior Formulation

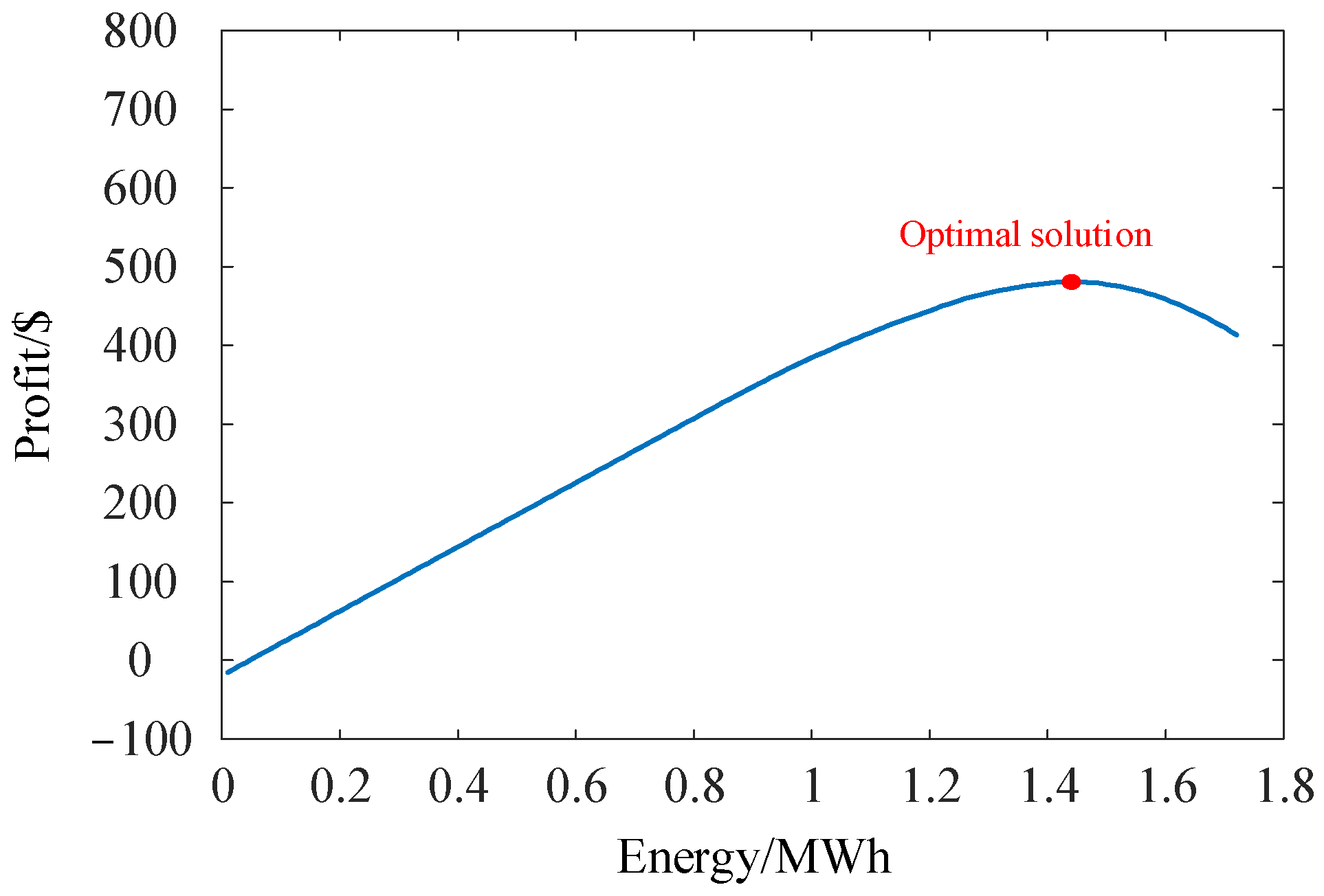

For EV charging stations, accurately assessing the economic cost of their regulation capability is a key challenge in enabling participation in DR with LAs. The amount of response resources that a station can offer to an LA is closely linked to its potential revenue, with the core objective being to maximize profit while maintaining the minimum amount of resource commitment necessary to meet contractual requirements. As such, stations will not provide regulation capacity beyond economically optimal levels but will dynamically adjust their resource provision strategies based on operational status.

where

FSTA represents the cost of the charging station for offering response capacity

Ei;

α,

β, and

γ are constant coefficients;

cLA and

cEP,max represent the pricing strategy of the LA, and the maximum intraday electricity price.

To quantify the economic performance of charging stations participating in DR, this study develops a cost model as in (24), which divides the cost of regulating EVs to provide response resources into three components. The first component involves compensation payments from the charging station to EV users to incentivize their participation in load regulation. As the specific distribution of response periods is unknown when the station signs an aggregate contract with the LA, the compensation price is conservatively calculated as the product of the highest daily electricity price and a regulation coefficient. This conservative setting ensures that the station can cover compensation costs even under the most unfavorable electricity price scenarios, thereby avoiding losses caused by price fluctuations.

The second component accounts for the additional control cost incurred when the station adjusts the charging power of EVs. This cost is modeled using a nonlinear function to reflect the increasing marginal cost associated with large-scale regulation efforts; at the same time, it constrains the extent of regulation to prevent excessive disruption of users’ regular charging needs, thereby maintaining service reliability. Given that the specific allocation of response resources during transactions is unknown and thus cannot be calculated based on actual values, an energy-based summary approach is adopted for the computation.

The third component reflects the economic return that the station obtains by providing regulation capacity to the LA. This revenue depends on the contractually agreed response capacity and the prevailing market pricing mechanism. Equation (25) imposes constraints on the response capacity that can be provided during each time interval, and (26) ensures that the total response energy across all intervals does not exceed the contracted amount of response resources.

When procuring regulation resources from charging stations, the LA must consider both economic efficiency and grid demand constraints. The LA’s trading decisions are influenced not only by contractual negotiations with charging stations but also directly by the dynamics of transactions with the dispatching center. Specifically, if the dispatching center anticipates a future increase in DR requirements, the LA is likely to purchase additional station capacity in advance to secure higher returns in subsequent market transactions. However, since the dispatching center’s actual procurement volume Pw is uncertain while the LA’s resource acquisition PLA must be committed in advance, the LA must optimize its resource allocation based on risk assessment to balance potential profit against cost-related risks.

When the dispatching center’s demand

Ew exceeds the LA’s allocated capacity

ELA, the LA misses out on potential market opportunities due to insufficient resource reserves, thereby incurring implicit opportunity costs. Conversely, if

Ew <

ELA, the LA faces the risk of resource surplus and bears economic losses arising from contractual commitments with the charging stations. Therefore, the LA’s decision-making behavior can be modeled as shown in (27), with 0 < σ < 1. Equation (29) limits the range of

cLA.

where

cw represents the purchasing price from the dispatching center.

Ultimately, the feasible strategy sets of the ith charging station (Ω

STA) and LA (Ω

LA) can be defined as (30) and (31), respectively.

4.2. Trading Model

The decision-making process between charging stations and LAs exhibits characteristics of a dynamic game, in which both parties engage in co-optimization through resource pricing and capacity adjustments. Specifically, the station’s decision on response capacity is directly influenced by the LA’s pricing strategy—when the LA raises its offer, the station is inclined to provide more adjustable power to capture higher profits; conversely, if the LA lowers its offer, the station may reduce its response capacity to manage operational costs. This bidirectional dependency forms a closed-loop feedback mechanism: upon receiving the reported available capacity from stations, the LA re-optimizes its pricing strategy based on current market supply and demand conditions, thereby indirectly regulating the total volume of response resources to be procured and ultimately maximizing its own profit. The model of the processes is formulated as (32)–(34) based on the Stackelberg game.

Considering that DR events typically occur in the context of the distribution network, it is necessary to take into account the safety operation constraints of the distribution network, as expressed in (35)–(37).

where

e and

f represent bus

e and bus

f,

Ve,t represents the voltage magnitudes at bus e,

Pef,t and

Qef,t represent active and reactive power flow from bus

e to bus

f.

When all participating agents (i.e., charging stations and LAs) reach a state in which no party can improve its payoff by unilaterally changing its own strategy, the system is considered to have reached a stable equilibrium, as shown in (38) and (39).

Lemma 1. For a noncooperative game, an SE exists when the following three conditions are met:

- 1.

The player set is finite.

- 2.

The strategy set is convex, closed, and bounded.

- 3.

The utility function is continuous and concave.

Clearly, the player set is finite, and ΩLA and ΩSTA i are linear and readily defined as nonempty, convex, and bounded. Then, taking the derivatives of (24) and (27), an SE exists because > 0 and = 0, .

Given the uncertainty in

Pw, and the fact that the LA optimizes its resource allocation based on this parameter, this study conducts a sensitivity analysis of the LA’s profit function (

FLA) to reveal the dynamic characteristics of its optimal decision-making. Take the derivative of

FLA, as in (40).

In the interaction between the LA and the dispatching center, the dynamic variation of the resource matching ratio (

ELA/

EW) exhibits clear regularity: When the LA’s

FLA approaches

EW, the system’s marginal benefit tends to increase. Conversely, as the deviation between the two increases, overall system efficiency declines significantly. However, since the value of

EW is difficult to determine in advance, it is approximated using the average value over the observed period as in (41); this value in the trading model is used to calculate as follows: