Integrated Production and Multi-Market Optimization of Biomethane in Germany: A Two-Step Linear Programming Approach

Abstract

1. Introduction

1.1. Biomethane Production and Markets in Germany

1.1.1. Status Quo

1.1.2. Post-EEG Transition

1.1.3. Future Contribution of Biomethane to the Gas Supply in Germany

1.2. The German GHG Quota Market

1.3. Dynamics of Interconnected Markets in the Context of Biomethane

1.4. Research Gaps and Questions

- Address the stated issue of supply shortages in non-transport biomethane markets by proposing a two-step optimization approach that enables all BGPs to simultaneously meet the demand across all biomethane markets. This approach improves the GAP from the BGP operator’s perspective and maximizes the overall profitability of the biomethane market system.

- Conduct a sensitivity analysis to examine how variations in GHG quota prices influence the market dynamics, including changes in market-clearing prices and substrate mix consumption.

- Perform a scenario analysis to evaluate the impact of shifting market demand shares on the profitability of the biomethane market system.

2. Methodology

2.1. Overview

2.2. Development of Substrate Mix Optimization Model

2.2.1. Objective Function

2.2.2. Constraints

2.3. Biomethane Markets Optimization and Price Formation Utilizing the Merit-Order Approach

2.3.1. Objective Function

2.3.2. Constraints

2.4. Study Setup

3. Results

3.1. Comparison of CE-GAP with IGAP

3.2. Sensitivity Analysis

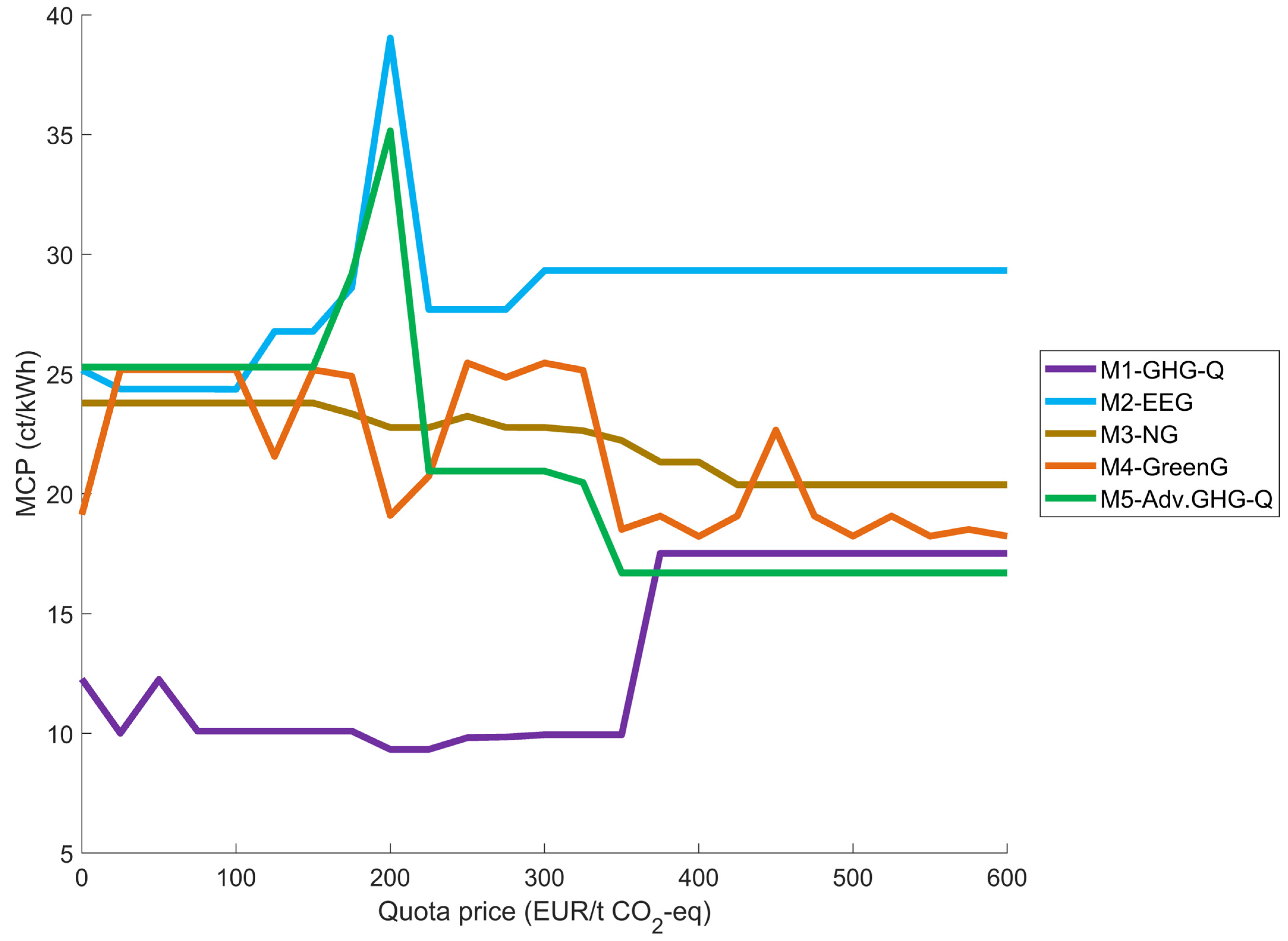

3.2.1. MCP Development vs. GHG Quota Price

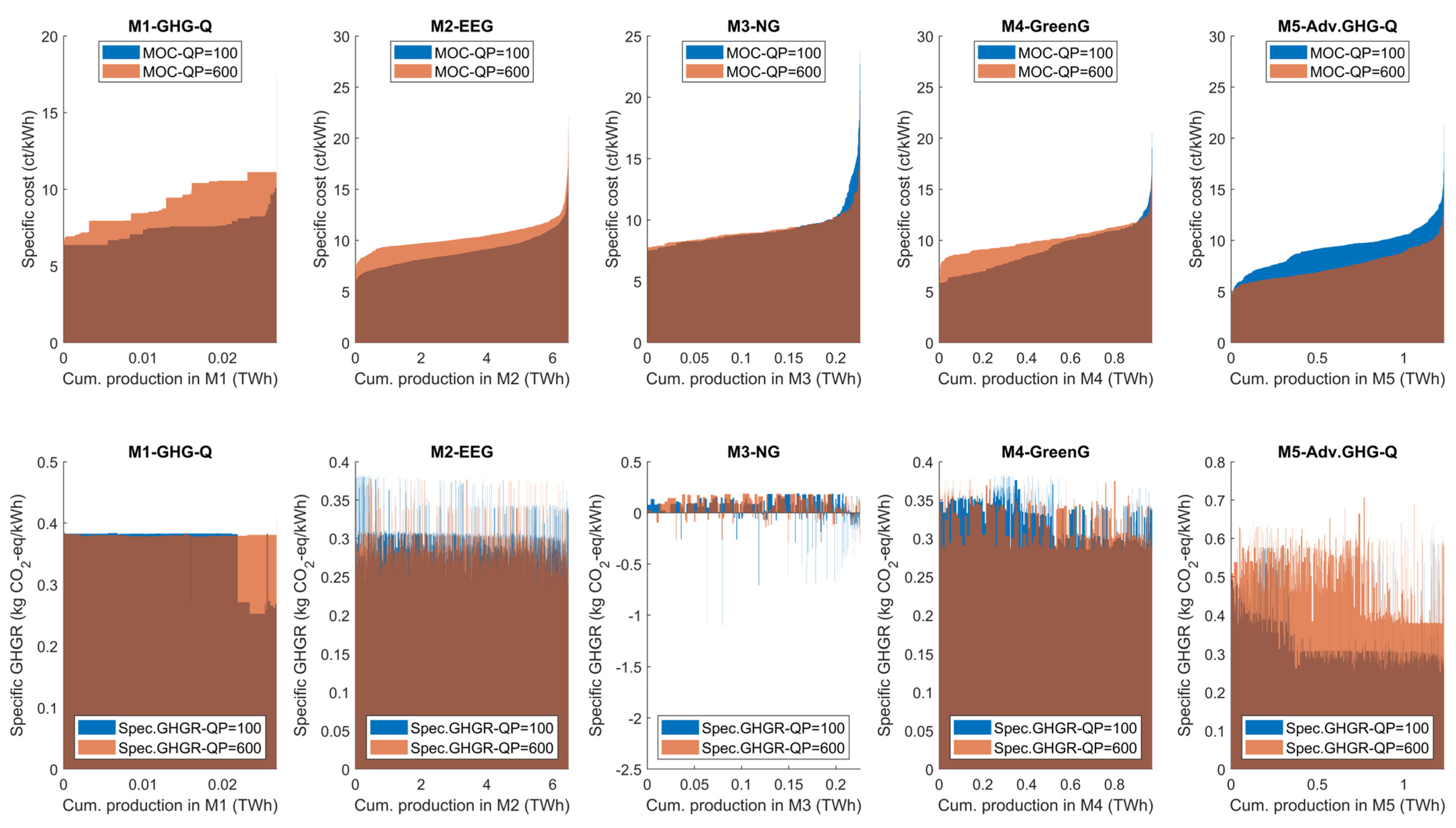

3.2.2. Impact of GHG Quota Price on Optimized Markets Clearing

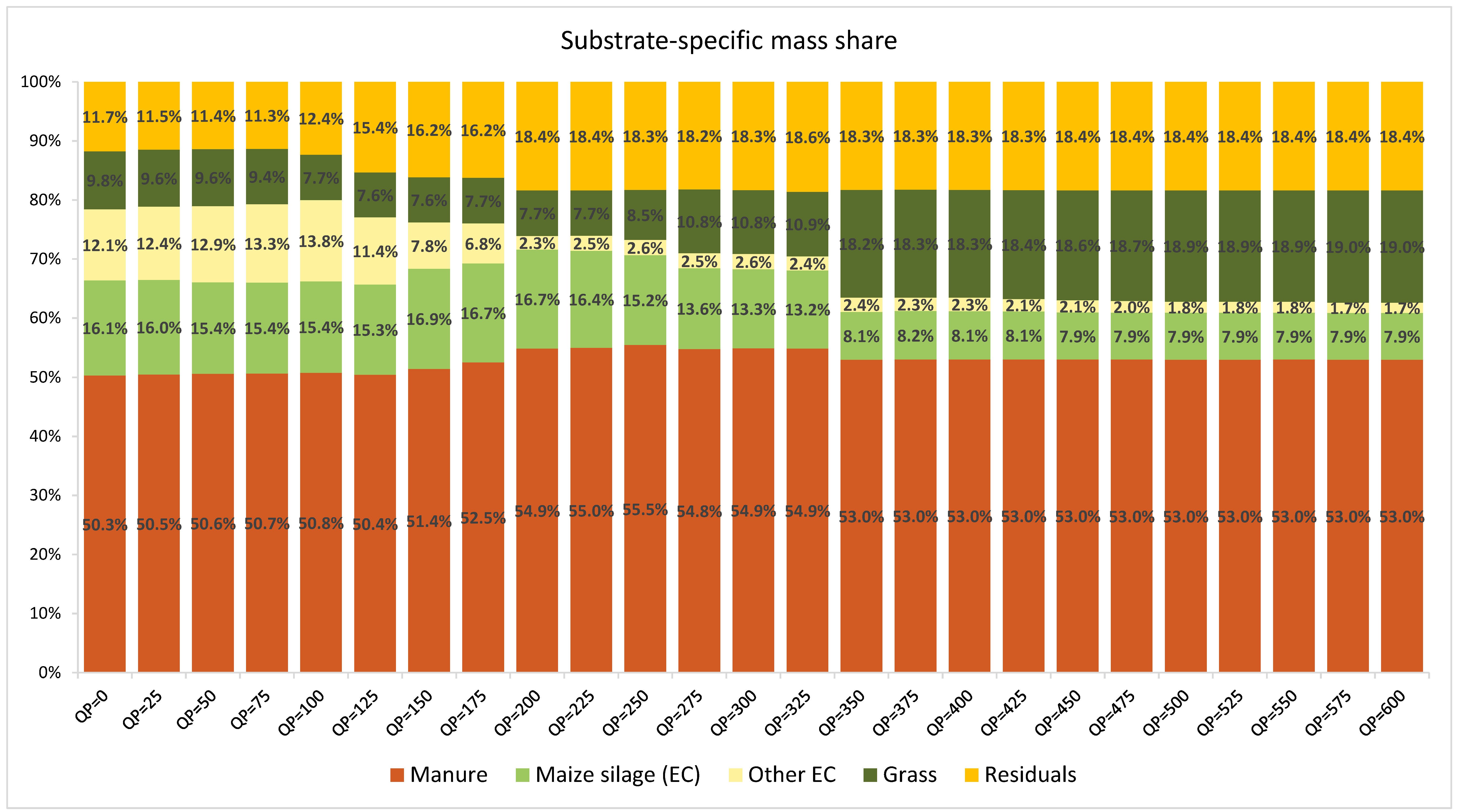

3.2.3. Impact of GHG Quota Price on Substrate Mix Consumption

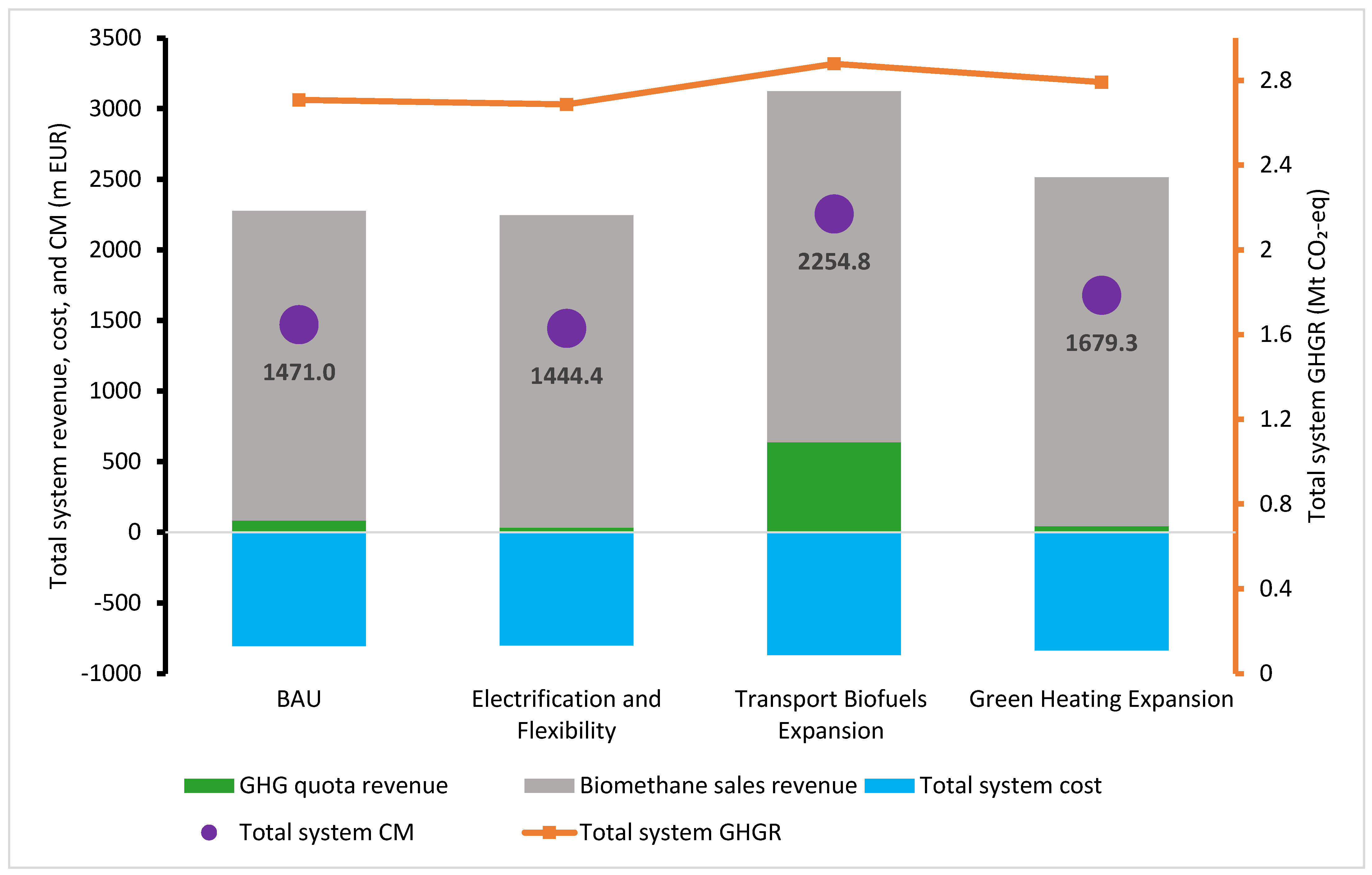

3.3. Scenario Analysis

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| BGP | Biogas Plant |

| MCP | Market-clearing Price |

| EEG | Renewable Energy Sources Act |

| REDII | Renewable Energy Directive II |

| BImschV | Federal Emission Control Ordinance |

| BEHG | Fuel Emissions Trading Act |

| GEG | Building Energy Act |

| CHP | Combined Heat and Power |

| FM | Fresh Mass |

| DSC | Digestate Storage Capacity |

| OLR | Organic Loading Rate |

| GHG | Greenhouse Gas |

| LHV | Lower Heating Value |

| SNG | Substitute Natural Gas |

| BAU | Business As Usual |

| FAME | Fatty Acid Methyl Ester |

References

- IEA. Renewables 2024; International Energy Agency (IEA): Paris, France, 2024. [Google Scholar]

- Geschäftsstelle der Arbeitsgruppe Erneuerbare Energien-Statistik (AGEE-Stat) am Umweltbundesamt. Erneuerbare Energien in Deutschland Daten zur Entwicklung im Jahr 2021; Umweltbundesamt: Dessau-Roßlau, Germany, 2022; p. 28. [Google Scholar]

- Deutsche Energie-Agentur GmbH (dena). ANALYSE Branchenbarometer Biomethan 2024; Deutsche Energie-Agentur GmbH (dena): Berlin, Germany, 2024. [Google Scholar]

- Güsewell, J.; Rousta, M.; Eltrop, L. Trade-Offs in Biomethane Production by Substrate Mixture Optimization under German Market Conditions. Energy Sustain. Soc. 2024, 14, 42. [Google Scholar] [CrossRef]

- dos Santos, N.P. German GHG Compliance Costs Drop to 2023 Level. 2024. Available online: https://www.argusmedia.com/en/news-and-insights/latest-market-news/2532952-german-ghg-compliance-costs-drop-to-2023-level (accessed on 30 January 2024).

- Achtunddreißigste Verordnung zur Durchführung des Bundes-Immissionsschutzgesetzes1,2 (Verordnung zur Festlegung weiterer Bestimmungen zur Treibhausgasminderung bei Kraftstoffen—38. BImSchV). Available online: https://www.gesetze-im-internet.de/bimschv_38_2017/BJNR389200017.html (accessed on 25 November 2024).

- Güsewell, J.; Härdtlein, M.; Eltrop, L. A Plant-specific Model Approach to Assess Effects of Repowering Measures on Existing Biogas Plants: The Case of Baden-Wuerttemberg. GCB Bioenergy 2019, 11, 85–106. [Google Scholar] [CrossRef]

- Lauer, M.; Thrän, D. Biogas Plants and Surplus Generation: Cost Driver or Reducer in the Future German Electricity System? Energy Policy 2017, 109, 324–336. [Google Scholar] [CrossRef]

- Güsewell, J.; Scherzinger, K.; Holstenkamp, L.; Vincent, L.; Eltrop, L. Extending the Operation of Existing Biogas Plants: Which Follow-Up Concepts and Plants Will Prevail? Front. Energy Res. 2021, 9, 719697. [Google Scholar] [CrossRef]

- Schröer, D.; Latacz-Lohmann, U. Flexibilization or Biomethane Upgrading? Investment Preference of German Biogas Plant Operators for the Follow-up of Guaranteed Feed-in Tariffs. GCB Bioenergy 2024, 16, e13111. [Google Scholar] [CrossRef]

- Matschoss, P.; Steubing, M.; Pertagnol, J.; Zheng, Y.; Wern, B.; Dotzauer, M.; Thrän, D. A Consolidated Potential Analysis of Bio-Methane and e-Methane Using Two Different Methods for a Medium-Term Renewable Gas Supply in Germany. Energy Sustain. Soc. 2020, 10, 41. [Google Scholar] [CrossRef]

- Ladislaw, S.; Naimoli, S.J. Climate Solutions Series: Decarbonizing Heavy Industry; Center for Strategic & International Studies: Washington, DC, USA, 2020. [Google Scholar]

- Sulewski, P.; Ignaciuk, W.; Szymańska, M.; Wąs, A. Development of the Biomethane Market in Europe. Energies 2023, 16, 2001. [Google Scholar] [CrossRef]

- Bundesregierung. Für Mehr Klimafreundliche Heizungen; Germany. 2024. Available online: https://www.bundesregierung.de/breg-de/aktuelles/neues-gebaeudeenergiegesetz-2184942 (accessed on 27 August 2024).

- Schnaars, P.; Willers, P.; Nalbach, H.; Diers, H.; Kienscherf, P.A. Die Kraftwerksstrategie 2026: Ziele und Herausforderungen. 2023. Available online: https://www.ewi.uni-koeln.de/de/publikationen/kraftwerksstrategie-2026-ziele-und-herausforderungen/ (accessed on 27 April 2025).

- Bundesregierung. § 37h—Bundes-Immissionsschutzgesetz (BImSchG); Germany. 2013. Available online: https://www.buzer.de/37h_BImSchG.htm (accessed on 24 September 2021).

- Liepold, C.; Fabianek, P.; Madlener, R. A Critical Evaluation of the 2022 Greenhouse Gas Mitigation Quota in Germany from an Environmental Economics and Policy Perspective. SSRN J. 2023, 191. [Google Scholar] [CrossRef]

- Sechsunddreißigste Verordnung zur Durchführung des Bundes-Immissionsschutzgesetzes (Verordnung zur Durchführung der Regelungen der Biokraftstoffquote) (36. BImSchV) § 11 Anpassung der Treibhausgasminderungs-Quote. Available online: https://www.gesetze-im-internet.de/bimschv_36/BJNR006010007.html (accessed on 4 June 2024).

- THG-Experten. Die Höhe Der THG Quote 2023 Sinkt; Grünwald, Germany. 2023. Available online: https://thg-experten.de/blog/posts/die-hohe-der-thg-quote-2023 (accessed on 1 February 2023).

- The Brussels Times. EU Biodiesel Sector Applauds Anti-Dumping Probe into Chinese Imports. 2024. Available online: https://www.brusselstimes.com/875541/eu-launches-anti-dumping-investigation-into-chinese-biodiesel-imports (accessed on 13 January 2024).

- Auburger, S.; Jacobs, A.; Märländer, B.; Bahrs, E. Economic Optimization of Feedstock Mix for Energy Production with Biogas Technology in Germany with a Special Focus on Sugar Beets—Effects on Greenhouse Gas Emissions and Energy Balances. Renew. Energy 2016, 89, 1–11. [Google Scholar] [CrossRef]

- Güsewell, J.; Bahret, C.; Eltrop, L. AuRaSa–BIOGAS Auswirkungen von Veränderten Energie-und Umweltrelevanten Rahmenbedingungen und Technologiefortschritt auf die Entwicklung Sächsischer Biogasanlagen; Sächsisches Landesamt für Umwelt, Landwirtschaft und Geologie (LfULG): Dresden, Germany, 2020. [Google Scholar]

- European Union. Richtlinie des Europäischen Parlaments und des Rates zur Förderung der Nutzung von Energie Aus Erneuerbaren Quellen (Neufassung): RED II. 2018. Available online: https://eur-lex.europa.eu/eli/dir/2018/2001/oj?locale=de (accessed on 11 December 2018).

- Gesetz zur Einsparung von Energie und zur Nutzung Erneuerbarer Energien zur Wärme- und Kälteerzeugung in Gebäuden* (Gebäudeenergiegesetz—GEG) § 71 Anforderungen an Eine Heizungsanlage. Available online: https://www.gesetze-im-internet.de/geg/BJNR172810020.html (accessed on 16 October 2023).

- Federal Ministry for Economic Affairs and Climate Action (BMWK). Directive on the Funding of Climate-Neutral Production Processes in Industry Through Carbon Contracts for Difference; Germany. 2024. Available online: https://www.klimaschutzvertraege.info/lw_resource/datapool/systemfiles/elements/files/214a25cf-6ea3-11ef-80a9-a0369fe1b6c9/live/document/240601_EN_F%C3%B6rderrichtlinie_Klimaschutzvertr%C3%A4ge.pdf?utm_source=chatgpt.com (accessed on 11 March 2024).

- Bioenergy Insight Woodcote Media Ltd. Bmp Greengas Insolvency to Cause “at Least” €150 Million in Losses; Morden, England. 2023. Available online: https://www.bioenergy-news.com/news/bmp-greengas-insolvency-to-cause-at-least-e150-million-in-losses/ (accessed on 7 August 2023).

- Der Spiegel. Pleite von BMP Greengas Besorgt Deutsche Stadtwerke; Hamburg, Germany. 2023. Available online: https://www.spiegel.de/wirtschaft/enbw-tochter-pleite-von-bmp-greengas-besorgt-deutsche-stadtwerke-a-4b35d74e-15f5-4180-bc90-91141686b2b8 (accessed on 3 August 2023).

- Kristiansen, T. The Flow Based Market Coupling Arrangement in Europe: Implications for Traders. Energy Strategy Rev. 2020, 27, 100444. [Google Scholar] [CrossRef]

- Federal Ministry for Economic Affairs and Energy, Public Relations Division. The National Hydrogen Strategy; Federal Ministry for Economic Affairs and Energy, Public Relations Division: Berlin, Germany, 2020.

- Willeghems, G.; Buysse, J. Changing Old Habits: The Case of Feeding Patterns in Anaerobic Digesters. Renew. Energy 2016, 92, 212–221. [Google Scholar] [CrossRef]

| Market Type (Abbreviation) | Description | Regulatory Framework |

|---|---|---|

| Market 1 (M1-GHG-Q) | Fuel in the transport sector (linked to GHG quota market) | REDII, BImschV, BEHG |

| Market 2 (M2-EEG) | Fuel for biomethane CHP plants working under the EEG requirements | EEG |

| Market 3 (M3-NG) | Regulatory-free SNG buyers | |

| Market 4 (M4-GreenG) | Green gas market for heating processes | GEG, BEHG |

| Market 5 (M5-Adv.GHG-Q) | Advanced fuel in the transport sector (linked to GHG quota market) | REDII, BImschV, BEHG |

| Type | Constraints | Class | Unit | Boundary Conditions for Each Market | ||||

|---|---|---|---|---|---|---|---|---|

| M1-GHG-Q | M2-EEG | M3-NG | M4-GreenG | M5-Adv.GHG-Q | ||||

| Market-specific equilibrium | Gas supply | Equality | kWh | Market-specific demand | ||||

| Plant-specific | Methane production | Max | Nm3 | Plant-specific REF values (production capacity) | ||||

| Digestate storage capacity (DSC) | Min | d | Plant-specific REF values | |||||

| Regulatory | HRTgastight system | Min | d | 0 | 150 | 0 | 0 | 0 |

| GRT vs. fossil reference * | Max * | % | −78 | −80 | 0 | −80 | −78 | |

| Maize cap | Max | % of the mix | 0 | 36 | 0 | 0 | 0 | |

| Upper bounds for substrate groups | Max | % of mix | EC: 0%, grass: 0%, residuals: 20%, manure: 100% | |||||

| Process | TSIn, digester | Max | % | 36 | ||||

| TSOut, digester | Max | % | 15 | |||||

| OLR | Max | kg VS/m3 d | 6 | |||||

| HRTdigester | Min | d | Plant-specific REF values | |||||

| Normative | Upper bounds for substrate groups | Max | % of mix | EC: 80%, grass: 50%, residues: 20%, manure: 100% | ||||

| Upper substrate-specific bounds | Max | % of mix | See substrate property data in the Supplementary Materials File S1 | |||||

| Lower/upper bounds manure | Max/Min | t FM/a | 0% of the REF input/130% of the REF input | |||||

| Products | P1 | P2 | P3 | P4 | P5 | |

|---|---|---|---|---|---|---|

| Markets | ||||||

| Fuel in the transport sector (M1-GHG-Q) | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Biomethane CHP units (M2-EEG) | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Regulatory-free SNG buyers (M3-NG) | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Industrial heating processes (M4-GreenG) | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Advanced fuel in the transport sector (M5-Adv.GHG-Q) | ✔ | ✔ | ✔ | ✔ | ✔ | |

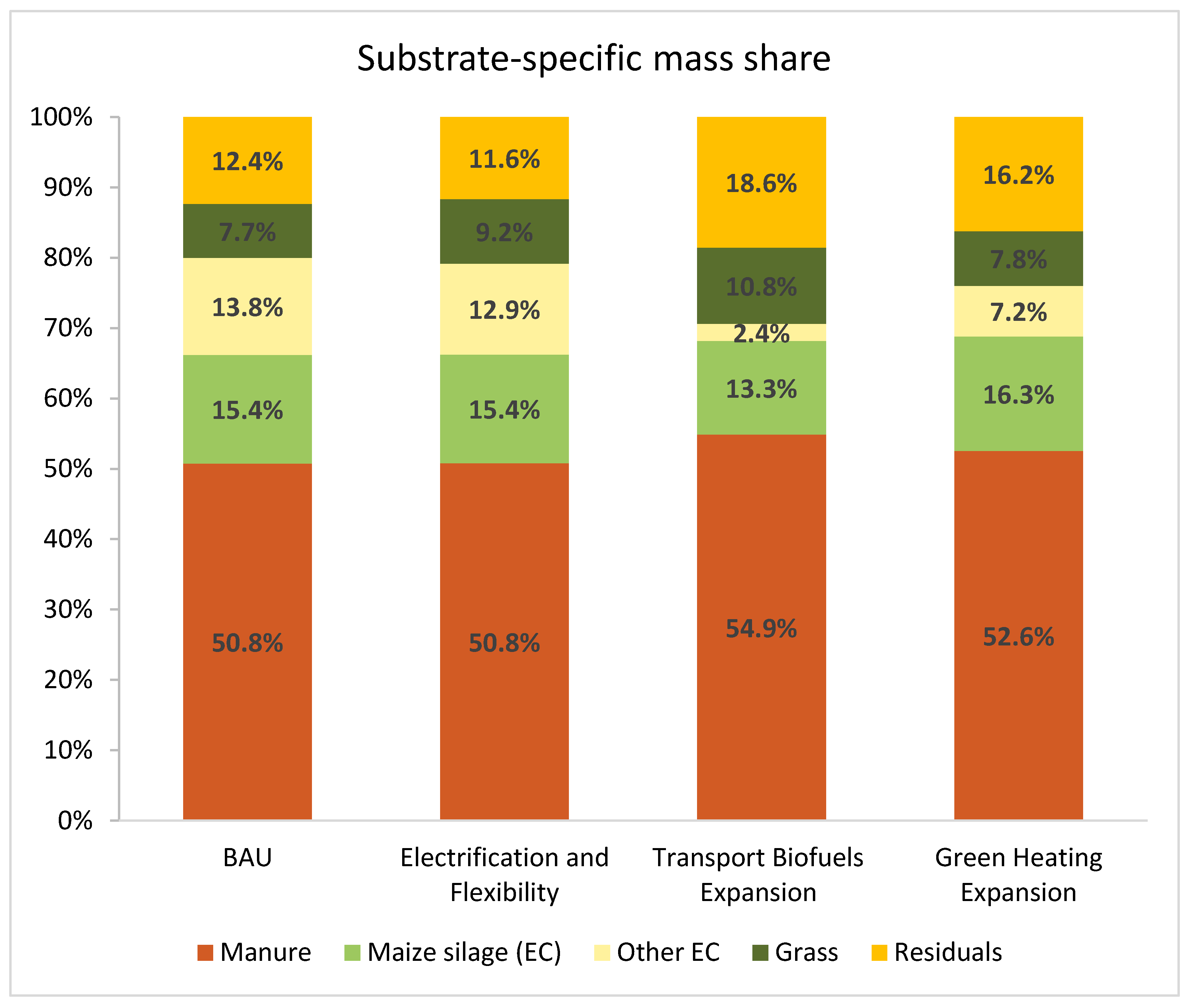

| Scenarios | BAU [3] | Electrification and Flexibility | Transport Biofuels Expansion | Green Heating Expansion | |

|---|---|---|---|---|---|

| Market Type | |||||

| M1-GHG-Q | 0.30% | 0.01% | 0.30% | 0.01% | |

| M2-EEG | 72.49% | 80.00% | 60.00% | 60.00% | |

| M3-NG | 2.53% | 2.53% | 2.53% | 2.53% | |

| M4-GreenG | 10.87% | 10.87% | 7.17% | 30.00% | |

| M5-Adv.GHG-Q | 13.81% | 6.59% | 30.00% | 7.46% | |

| Total volume (TWhLHV) [3] | 8.9388 | ||||

| GHG quota price (EUR/t CO2-eq) | 100 | 80 | 300 | 100 | |

| Scenarios | Narratives and Key Drivers |

|---|---|

| BAU [3] |

|

| Electrification and Flexibility (Peak-Load Balancing) |

|

| Transport Biofuels Expansion (GHG Quota Growth) |

|

| Green Heating Expansion |

|

| Total Prod. Cost Share (%) | Change (%) | Total GHGR Share (%) | Change (%) | Total Revenue (m EUR) | Change (%) | TCM (m EUR) | Change (%) | |

|---|---|---|---|---|---|---|---|---|

| IGAP_M1 | 0.288 | −0.042 | 0.273 | +0.085 | 4.37 | −15.90 | 2.06 | −17.39 |

| CE-GAP_M1 | 0.246 | 0.358 | 3.68 | 1.70 | ||||

| IGAP_M2 | 73.490 | −1.622 | 71.043 | +0.873 | 1639.00 | −3.68 | 1047.50 | −4.52 |

| CE-GAP_M2 | 71.868 | 71.916 | 1578.60 | 1000.20 | ||||

| IGAP_M3 | 2.596 | 0.000 | 0.611 | 0.000 | 53.74 | 0.00 | 32.84 | 0.00 |

| CE-GAP_M3 | 2.596 | 0.611 | 53.74 | 32.84 | ||||

| IGAP_M4 | 9.389 | +1.635 | 12.791 | −0.984 | 158.42 | +54.47 | 82.86 | +88.26 |

| CE-GAP_M4 | 11.024 | 11.807 | 244.70 | 155.99 | ||||

| IGAP_M5 | 14.237 | +0.029 | 15.282 | +0.026 | 383.50 | +3.01 | 268.93 | +4.20 |

| CE-GAP_M5 | 14.266 | 15.308 | 395.04 | 280.23 | ||||

| Net Change (system) | 0.000 | 0.000 | ↑1.64% ≈ 36.78 m EUR | ↑2.56% ≈ 36.78 m EUR | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rousta, M.; Güsewell, J.; Eltrop, L. Integrated Production and Multi-Market Optimization of Biomethane in Germany: A Two-Step Linear Programming Approach. Energies 2025, 18, 2991. https://doi.org/10.3390/en18112991

Rousta M, Güsewell J, Eltrop L. Integrated Production and Multi-Market Optimization of Biomethane in Germany: A Two-Step Linear Programming Approach. Energies. 2025; 18(11):2991. https://doi.org/10.3390/en18112991

Chicago/Turabian StyleRousta, Milad, Joshua Güsewell, and Ludger Eltrop. 2025. "Integrated Production and Multi-Market Optimization of Biomethane in Germany: A Two-Step Linear Programming Approach" Energies 18, no. 11: 2991. https://doi.org/10.3390/en18112991

APA StyleRousta, M., Güsewell, J., & Eltrop, L. (2025). Integrated Production and Multi-Market Optimization of Biomethane in Germany: A Two-Step Linear Programming Approach. Energies, 18(11), 2991. https://doi.org/10.3390/en18112991