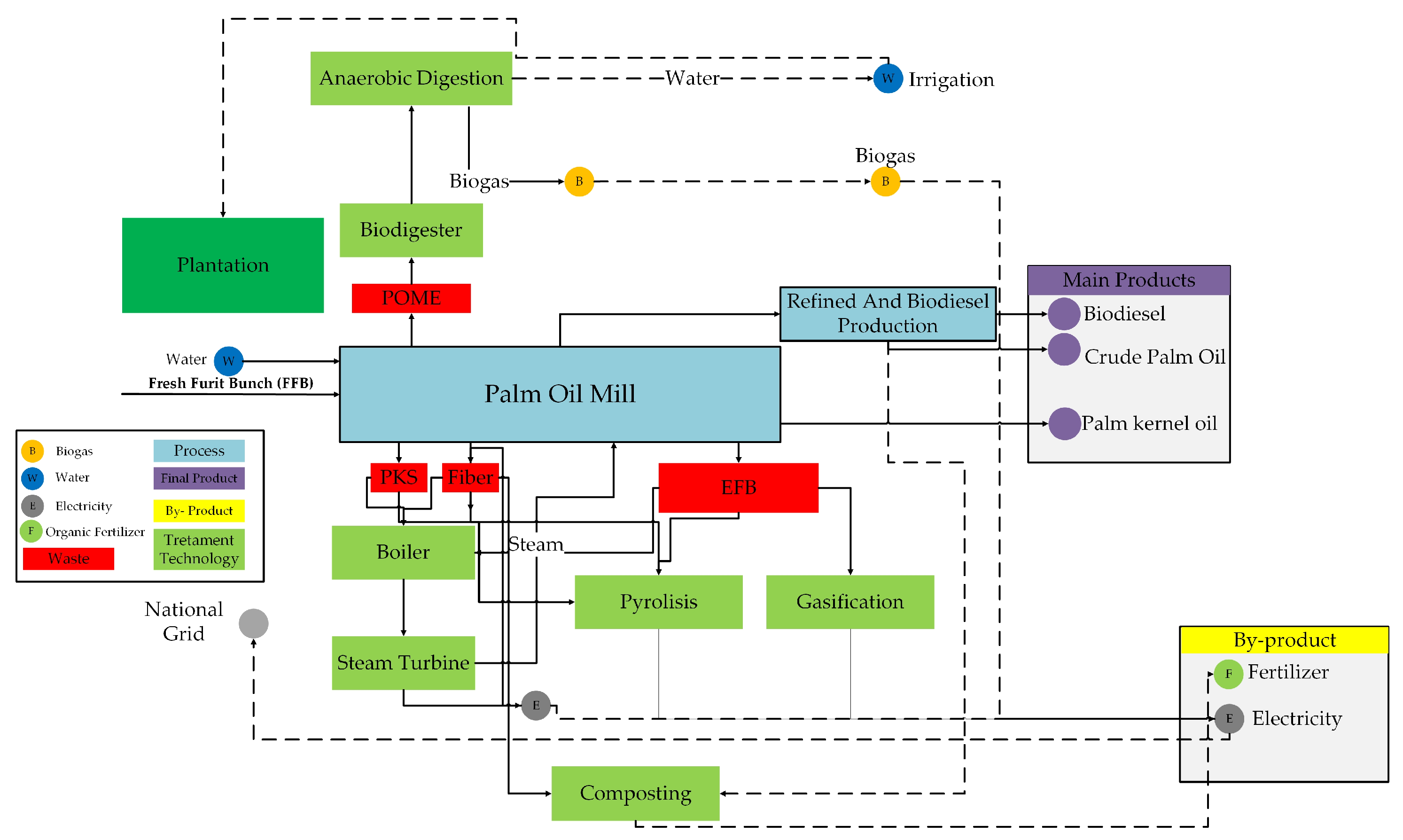

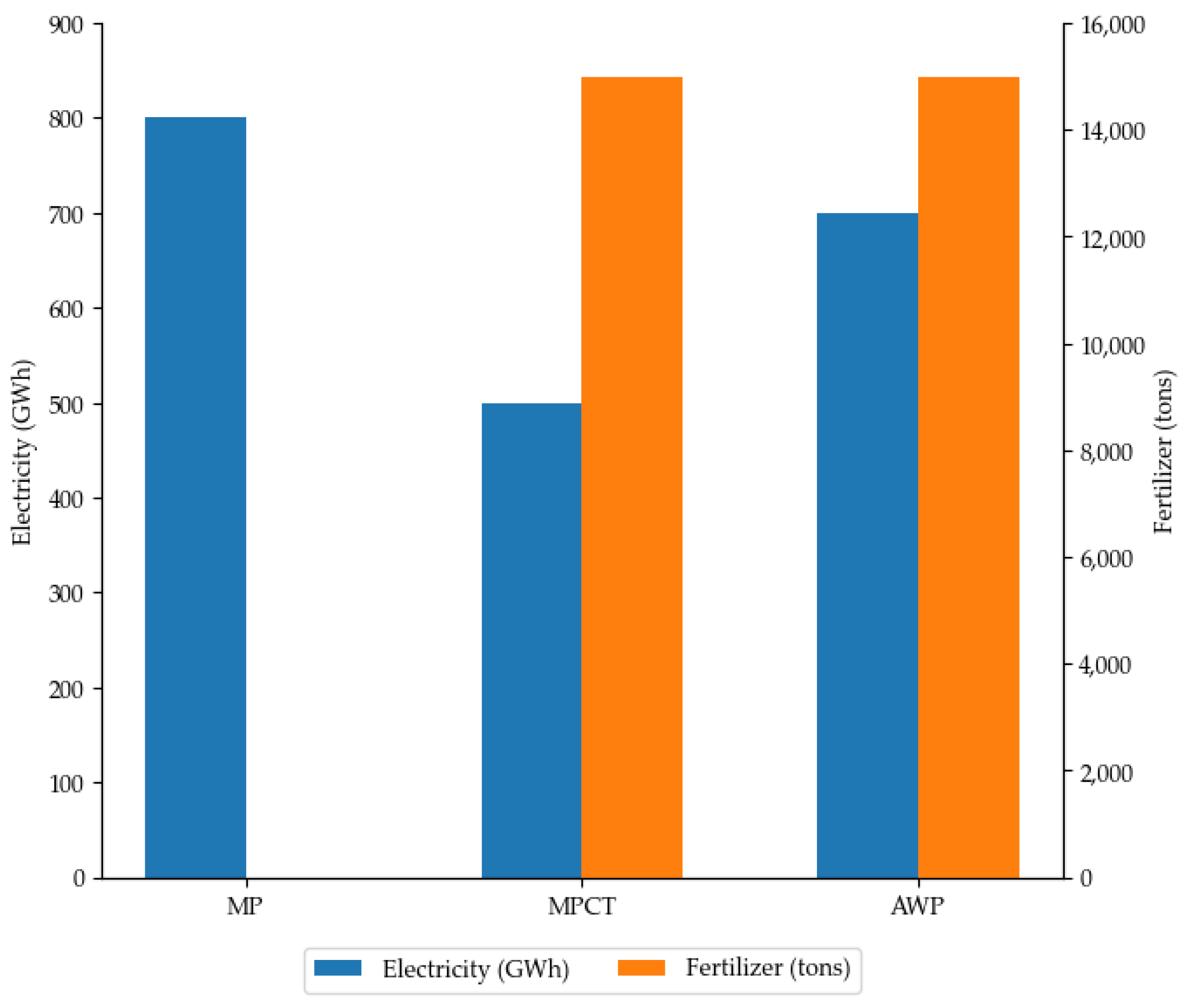

When a carbon tax is introduced into the system (USD 2/tCO

2e, adopted nationally in Indonesia), the optimization model shifts preferences by penalizing high-emission processes. This excludes POME → AD, which previously contributed high emissions with poor profitability. Technologies such as EFB → Gasification and EFB → Composting emerge as optimal solutions, offering a balance between profit and environmental performance (USD 27.49 M with 4560 tCO

2e and USD 5.47 M with only 450 tCO

2e, respectively). Emissions are significantly reduced (39,386 tCO

2e vs. 99,014 tCO

2e in the all-inclusive case), highlighting how even low carbon prices can drive substantial sustainability gains. This is consistent with Lo et al. [

37], who observed that carbon pricing reshapes the waste valorization landscape by embedding environmental externalities into economic frameworks. The findings support the argument that market-based environmental instruments such as carbon taxes or cap-and-trade systems can be powerful levers for accelerating the adoption of circular economy practices in agro-industrial systems [

38,

39,

40,

41,

42]. A similar study by Stichnothe and Schuchardt [

43] shows that while POME treatment via AD in Malaysia can reduce methane emissions, its economic feasibility remains limited unless biogas capture technologies and energy market incentives are supported. This mirrors the results of the current study, where POME → AD contributes the highest emissions and offers minimal profitability unless penalized by carbon pricing. Similarly, EFB gasification and incineration have been highlighted in Malaysian contexts as efficient pathways for energy recovery with moderate emissions, consistent with this study’s conclusion that EFB → Gasification offers the best trade-off between profit and emissions, especially when carbon taxes are applied.

Despite providing valuable insights, the proposed optimization model has several limitations. It assumes uniform waste composition across all palm oil mills, ignoring variability that may affect energy output and emissions. Market demand for electricity and fertilizer is treated as constant, overlooking fluctuations. Additionally, the model does not account for future policy uncertainties, such as shifts in renewable energy incentives or subsidies, that could alter the economic viability of treatment options.

5.1. Sensitivity Analysis

In this study, sensitivity analysis is used to evaluate the sensitivity of a palm oil waste treatment system to changes in external parameters, especially the electricity selling price. This approach aims to understand how changes in the economic value, such as electricity price, fertilizer price, carbon tax rate, and technological efficiency, can affect strategic decisions in technology selection, waste allocation, and the economic and environmental outcomes of the system. Uncertainty in this variable is common in renewable energy projects, especially in developing countries, where it is influenced by government policies, feed-in tariff (FiT) regulations, and global energy market dynamics. The sensitivity analysis is detailed as follows:

- (1)

Sensitivity analysis of electricity price

In the steps, the parameter that changed is the electricity selling price, with values varying from USD 0.005/kWh to USD 0.115/kWh. The baseline price of electricity is USD 0.085/kWh. The main reason for choosing electricity price as an uncertainty variable is that electricity is the system’s dominant product and has a much higher economic value than by-products such as fertilizers. In addition, key technologies such as gasification, incineration, and anaerobic digestion directly depend on the electricity selling price to determine their financial viability. Therefore, variations in electricity prices become the leading indicator in assessing the system’s response to external changes.

Table 9 shows the impact of changes in electricity prices on emissions, profits, and the energy output produced.

The results indicate that increasing electricity selling prices significantly enhances profitability, rising from approximately USD 43 million at USD 0.05/kWh to nearly USD 387 million at USD 0.115/kWh. A critical transition occurs between USD 0.075/kWh and USD 0.085/kWh. At lower prices (USD 0.05–0.075/kWh), most waste is processed through gasification for EFB, composting for fiber, and incineration for PKS, resulting in fertilizer production of 35,825 tons. When electricity prices exceed USD 0.085/kWh, all waste types, including POME, are utilized to maximize electricity generation, eliminating fertilizer production and a sharp increase in carbon emissions (from approximately 22,000 to over 51,000 tCO2e). These findings reveal a clear trade-off between economic and environmental objectives. At lower electricity prices, allocating a portion of waste for fertilizer production via composting is recommended, as it offers additional benefits such as emission reductions and enhanced product value, independent of electricity market volatility. Conversely, at higher electricity prices, economic incentives drive the prioritization of electricity production at the expense of nutrient recycling. Therefore, prioritizing fertilizer production through organic waste treatment offers a more sustainable and resilient approach to energy market uncertainty in markets with low or unstable electricity prices.

- (2)

Sensitivity analysis of fertilizer price

The sensitivity analysis of fertilizer price was conducted to evaluate the economic responsiveness of the palm oil waste-to-product system under varying market conditions. Given the volatility of fertilizer prices in agricultural markets and their significant impact on profitability, this analysis aims to understand how fluctuations in fertilizer revenue affect the optimal allocation of waste and overall system performance. The primary objective is to identify threshold values at which composting becomes more or less favorable compared to energy-focused technologies such as gasification or incineration. The impact of fertilizer price on profit and emissions is shown in

Table 10.

Table 10 presents the outcomes of a sensitivity analysis on fertilizer selling price, highlighting its influence on profit, emissions, electricity generation, and fertilizer output. It consistently allocates all waste streams to electricity-producing technologies at lower fertilizer prices (USD 400–535/ton), resulting in zero fertilizer production and high electricity output (812 GWh). Correspondingly, emissions remain at 51,680 tCO

2e and profit stabilizes at approximately USD 224.5 million, indicating that composting is economically unattractive under low fertilizer price scenarios. As the fertilizer price increases beyond USD 535/ton, a notable shift in waste allocation occurs. At USD 1070/ton, the system begins to divert a portion of biomass to composting, yielding 11,250 tons of fertilizer and reducing electricity output to 757 GWh. This trade-off reflects a rebalancing between energy and material recovery in response to improved market incentives. At USD 1605/ton and USD 2140/ton, fertilizer production reaches 35,825 tons, while electricity output declines further to 637 GWh. Importantly, these shifts are accompanied by substantial reductions in emissions, falling to 44,515 tCO

2e—a 13.8% decrease compared to the baseline case.

Profitability also increases with higher fertilizer prices, peaking at USD 244.9 million at USD 2140/ton. This suggests that, beyond a critical price threshold, composting not only becomes economically viable but also preferable in terms of emissions performance. These results underscore the dual benefits of high fertilizer pricing: enhanced economic return and lower environmental impact, thereby supporting policy mechanisms such as compost subsidies or green fertilizer pricing to encourage sustainable waste treatment practices.

- (3)

Sensitivity analysis of carbon tax rate

The sensitivity analysis of the carbon tax rate was performed to examine the impact of environmental regulatory instruments on the economic and environmental performance of palm oil waste treatment strategies. As carbon taxation becomes an increasingly adopted policy to reduce greenhouse gas emissions, it is critical to assess how varying carbon tax levels influence technology selection and system profitability. This analysis aims to identify cost-emission trade-offs and evaluate the feasibility of low-emission technologies, such as anaerobic digestion and composting, under different carbon pricing scenarios.

Table 11 shows the relationship between the carbon tax rate and profit and emissions.

Table 11 reports the effects of increasing carbon tax rates on profitability, emission levels, electricity generation, and fertilizer production in a palm oil waste treatment system. The carbon tax rate varies from USD 0 to USD 10 per ton of CO

2-equivalent, while fertilizer prices are constant. The results demonstrate a clear trade-off between economic performance and environmental benefits as the carbon tax increases. At the baseline (USD 0/tCO

2e), the system achieves its highest profit of USD 59.43 million, with total emissions at 39,386 tCO

2e and 512 GWh of electricity generated. However, the imposition of even a modest carbon tax (USD 2/tCO

2e) leads to a slight decline in both profit (USD 59.35 million) and electricity output (508 GWh), with emissions remaining unchanged—suggesting limited system reconfiguration at low tax levels.

As the tax rate increases further, the system begins to internalize the cost of carbon emissions more aggressively. At USD 4/tCO2e, emissions drop to 36,629 tCO2e (a 7% reduction from baseline), accompanied by a moderate decrease in profit and electricity generation. At the highest tax level of USD 10/tCO2e, the system achieves a 28% reduction in emissions (28,358 tCO2e), but profits decline to USD 54.5 million—approximately 8% below the no-tax scenario. This indicates that while carbon taxation effectively incentivizes emission reductions, it does so at the expense of economic return. The analysis reveals that fertilizer production demonstrates remarkable consistency across all examined scenarios, with output values ranging between 34,853 and 35,825 tons. This consistency suggests that composting operations maintain their economic viability as an optimal waste allocation strategy even under carbon pricing mechanisms. This stability indicates a shift in the system, which reduces reliance on high-emission electricity pathways (e.g., incineration or gasification) while maintaining material recovery through composting, which is less emission-intensive. These results highlight the efficacy of carbon taxation as a policy instrument for directing palm oil waste management systems toward adopting cleaner technologies and achieving reduced emission profiles. Nevertheless, the findings simultaneously illuminate the critical importance of establishing an equilibrium between fiscal penalties and complementary incentive structures to prevent adverse effects on economic profitability within the sector.

- (4)

Sensitivity analysis of technological efficiency

The sensitivity analysis of technological efficiency was conducted to assess how changes in the performance of waste-to-energy and waste-to-product technologies affect the overall outcomes of the palm oil waste management system. Since technological parameters such as conversion rates of waste to electricity or fertilizer are important, it is essential to understand their influence on profitability, emissions, and product output. This analysis aims to evaluate the robustness of optimal waste allocation strategies under different efficiency levels and to identify which technologies are most sensitive to performance variations. We systematically adjusted the conversion efficiency rates of each technology by ±20% around baseline values. By comparing the resulting system outputs across scenarios, we were able to determine critical thresholds where small changes in efficiency could significantly alter the economic or environmental viability of the system.

Table 12 presents a sensitivity analysis examining technological efficiency impacts on palm oil waste-to-energy system performance across efficiency variations ranging from −20% to +20% relative to baseline conditions. This analysis evaluates system robustness under operational and technological variability by assessing total profit, emissions, electricity generation, and fertilizer production. The baseline scenario (0% efficiency) generates USD 224.47 million profit, 812 GWh electricity output, and 51,680 tCO

2e emissions. Enhanced efficiency demonstrates a strong positive correlation with economic performance: +10% efficiency increases profit to USD 252.90 million (12.7% improvement) and electricity output to 894 GWh, while +20% efficiency achieves maximum performance with USD 281.33 million profit and 975 GWh generation. Conversely, reduced efficiency scenarios exhibit substantial performance degradation, with −10% and −20% efficiency yielding profits of USD 196.03 million and USD 167.60 million, respectively, alongside decreased electricity output reaching 650 GWh at minimum efficiency. Notably, emissions decrease under reduced efficiency conditions due to lower overall system activity, with −20% efficiency producing 45,541 tCO

2e (11.9% reduction) despite a 25% profit decline. Fertilizer production remains consistently zero across all scenarios, indicating optimization model preference for energy recovery over composting under current economic assumptions, reinforcing electricity generation technology dominance absent favorable fertilizer pricing or policy incentives.

The analysis reveals technological efficiency as a critical determinant of economic and energy performance in palm oil waste management systems. However, the observed efficiency–emissions trade-off necessitates balanced consideration, supporting the integration of emission control technologies or carbon mitigation strategies alongside efficiency improvements to achieve sustainable outcomes.