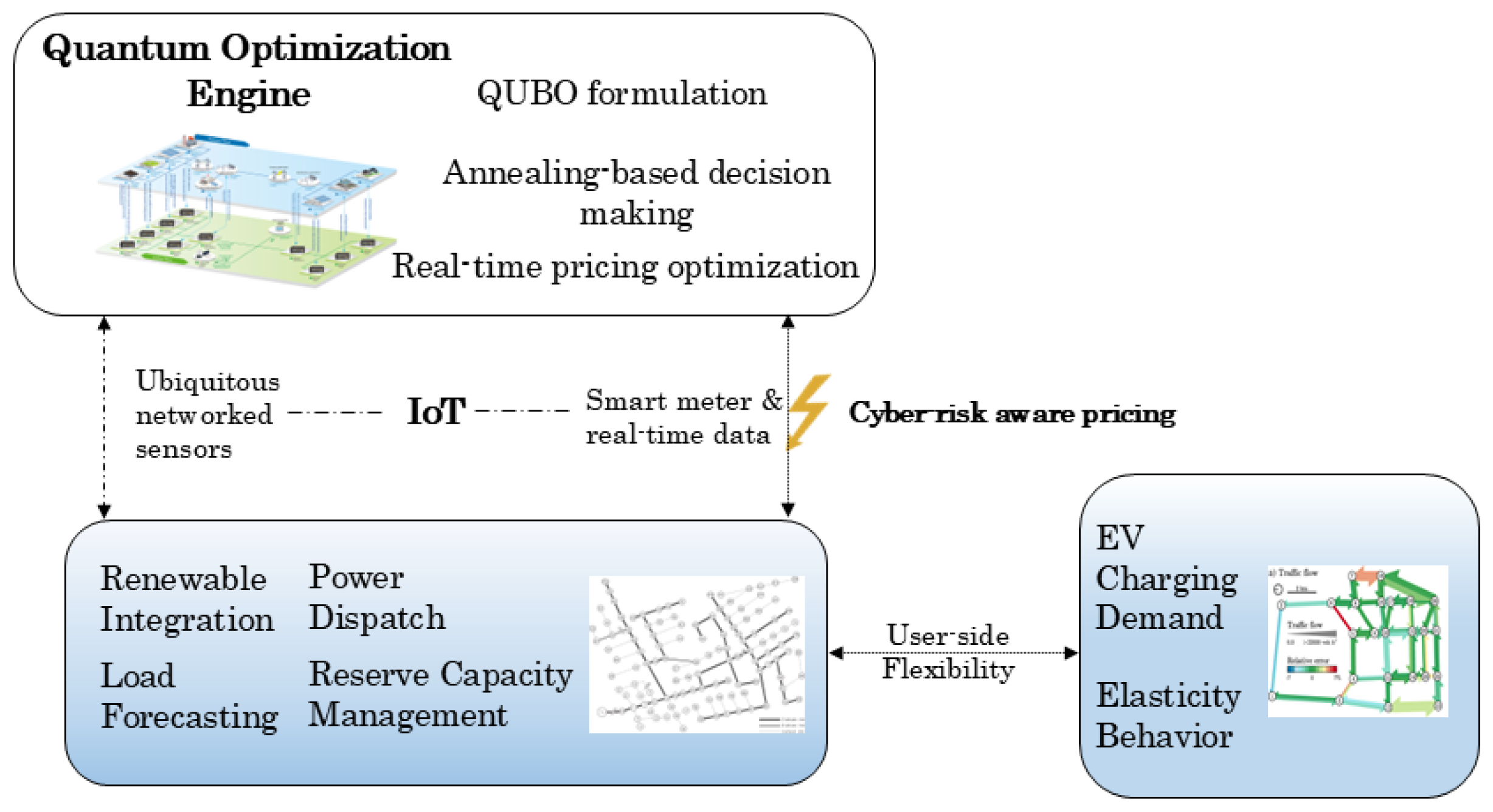

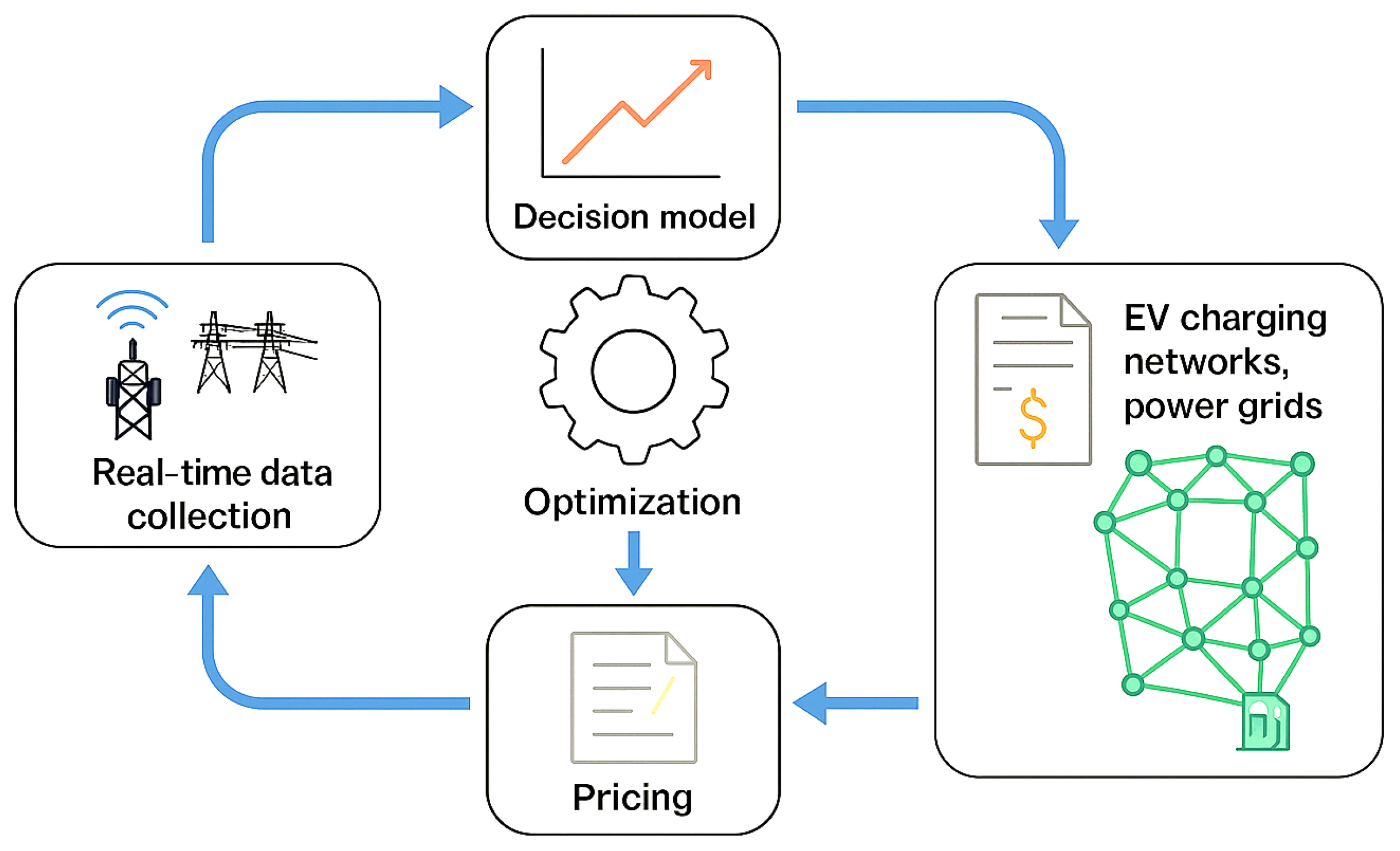

To rigorously capture the interplay between real-time pricing, electric vehicle (EV) charging behavior, and grid-level operational dynamics, we now formulate the core mathematical architecture and optimization methodology underpinning this research. This section presents the theoretical foundation of our proposed quantum annealing-assisted real-time pricing framework, beginning with the formal definition of the objective function and system constraints, followed by the detailed construction of the quantum-aware optimization process. The formulation is designed to reflect realistic power system behaviors, integrate demand elasticity, encode renewable availability, and respect physical grid limitations. By leveraging a structured and analytically expressive mathematical model, we enable an accurate and adaptable representation of the complex, nonlinear relationships embedded within the smart EV charging ecosystem. Subsequently, we introduce the optimization methodology employed to solve the proposed formulation—built upon the quantum annealing paradigm and enhanced through strategic model encoding and real-time data integration. The combined modeling and methodological architecture forms the basis of a responsive, efficient, and scalable solution for next-generation energy pricing under uncertainty and high EV penetration.

Electric vehicle charging cost optimization is critical for balancing grid efficiency and economic feasibility. The objective function here integrates multiple factors: the first term ensures the cost-effectiveness of EV charging through a ratio of demand to grid capacity, influenced by elasticity parameters

, while the second term accounts for renewable energy penetration, normalizing renewable generation availability with charging demand. Additionally, terms involving

and

regulate supply-demand mismatches, mitigating curtailment losses and optimizing cost recovery across different market participants.

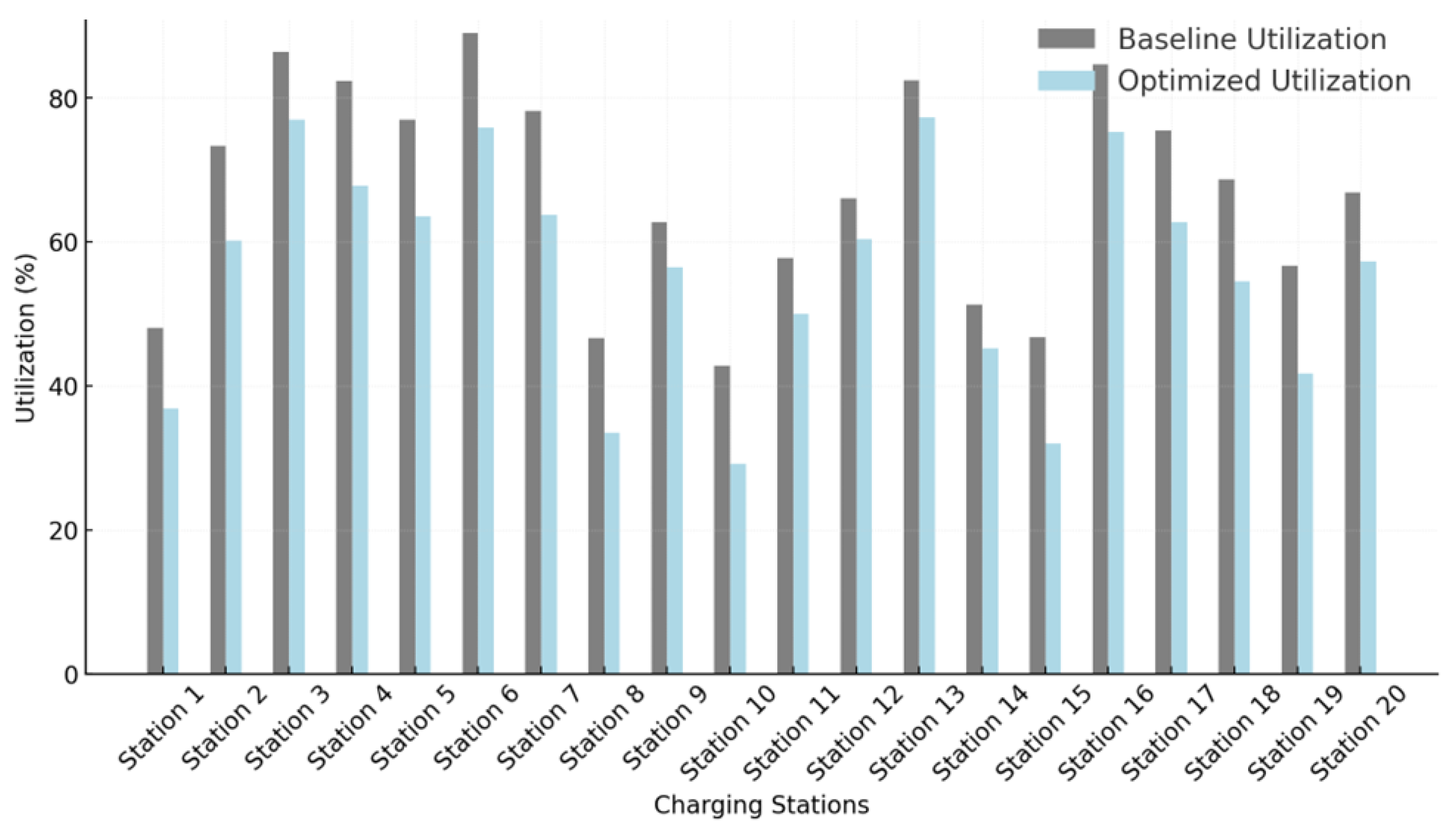

Consumer behavior plays a significant role in the effectiveness of real-time pricing, and this formulation encapsulates user responsiveness to dynamic pricing signals. The first term represents elasticity-driven demand shifts based on deviations from baseline consumption patterns, where

models price elasticity, and

governs response sensitivity. The second term emphasizes demand shifting potential, linking energy demand shifts

to pricing strategies

. Furthermore, congestion management mechanisms introduce penalties proportional to station congestion levels, ensuring grid reliability and mitigating overload risks. While our framework imposes explicit constraints on price volatility to ensure user acceptance and grid stability (e.g., smooth temporal transitions and upper/lower price bounds), this does not conflict with the advantage of fast optimization enabled by quantum annealing. The price adjustment constraint (e.g.,

) operates as a regulatory control to maintain continuity and predictability in pricing signals. Meanwhile, the speed of optimization refers to the system’s ability to recompute valid and feasible pricing vectors in near real time, even under frequent grid state changes or user behavior shifts. Thus, the pricing updates are both computationally rapid and smoothly bounded, ensuring that real-time responsiveness does not introduce erratic price behavior, but rather adapts within well-defined operating margins.

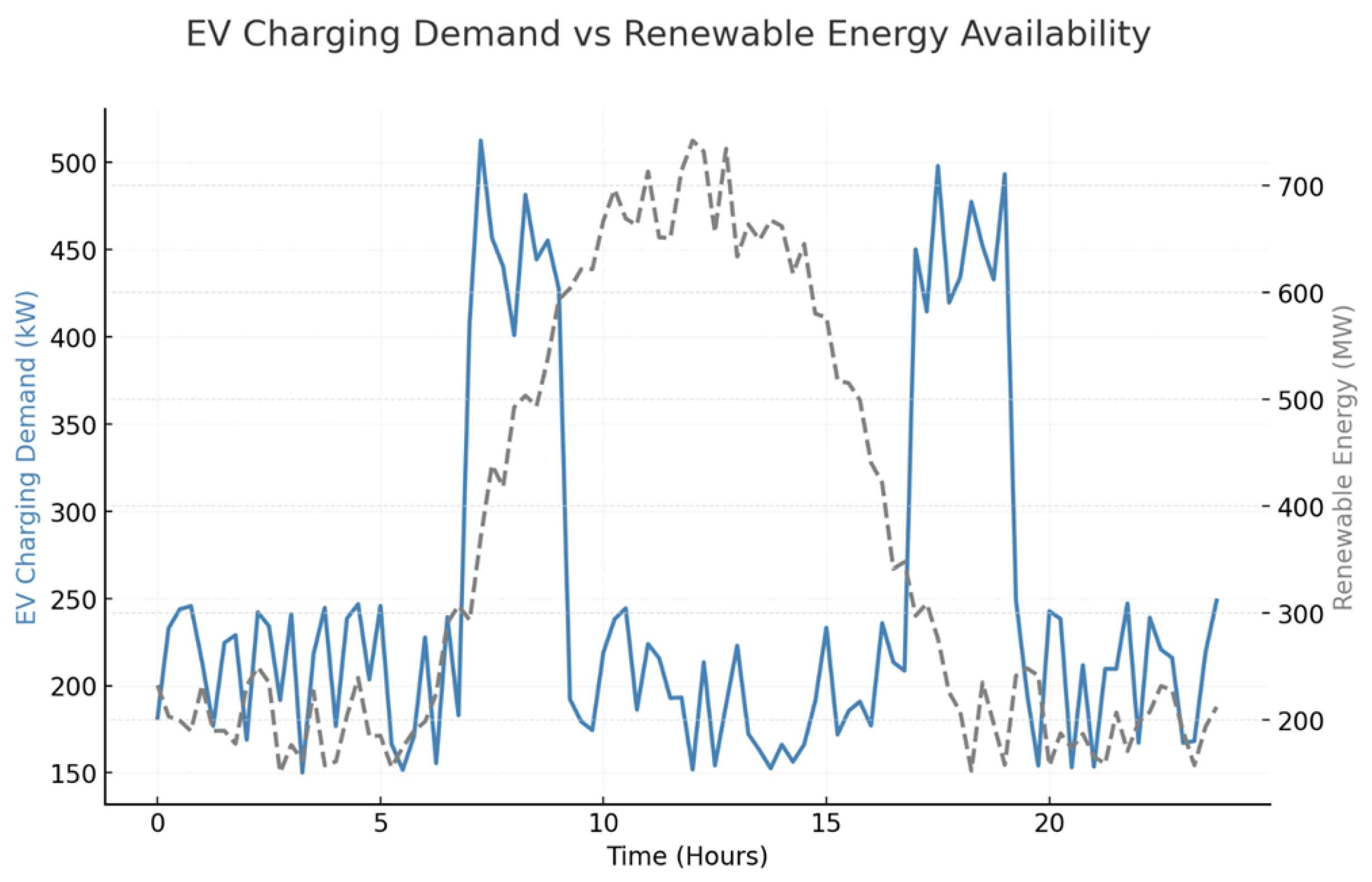

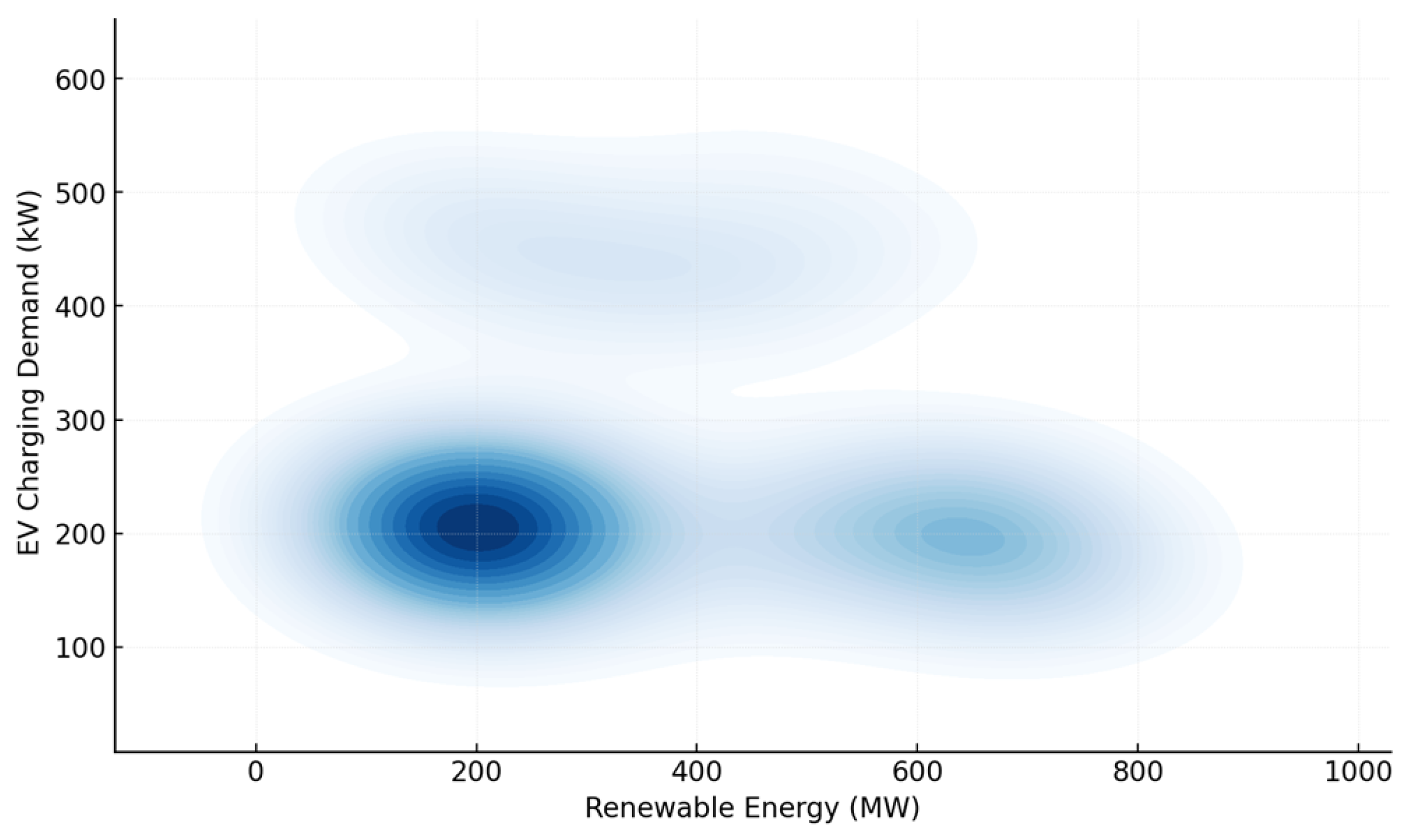

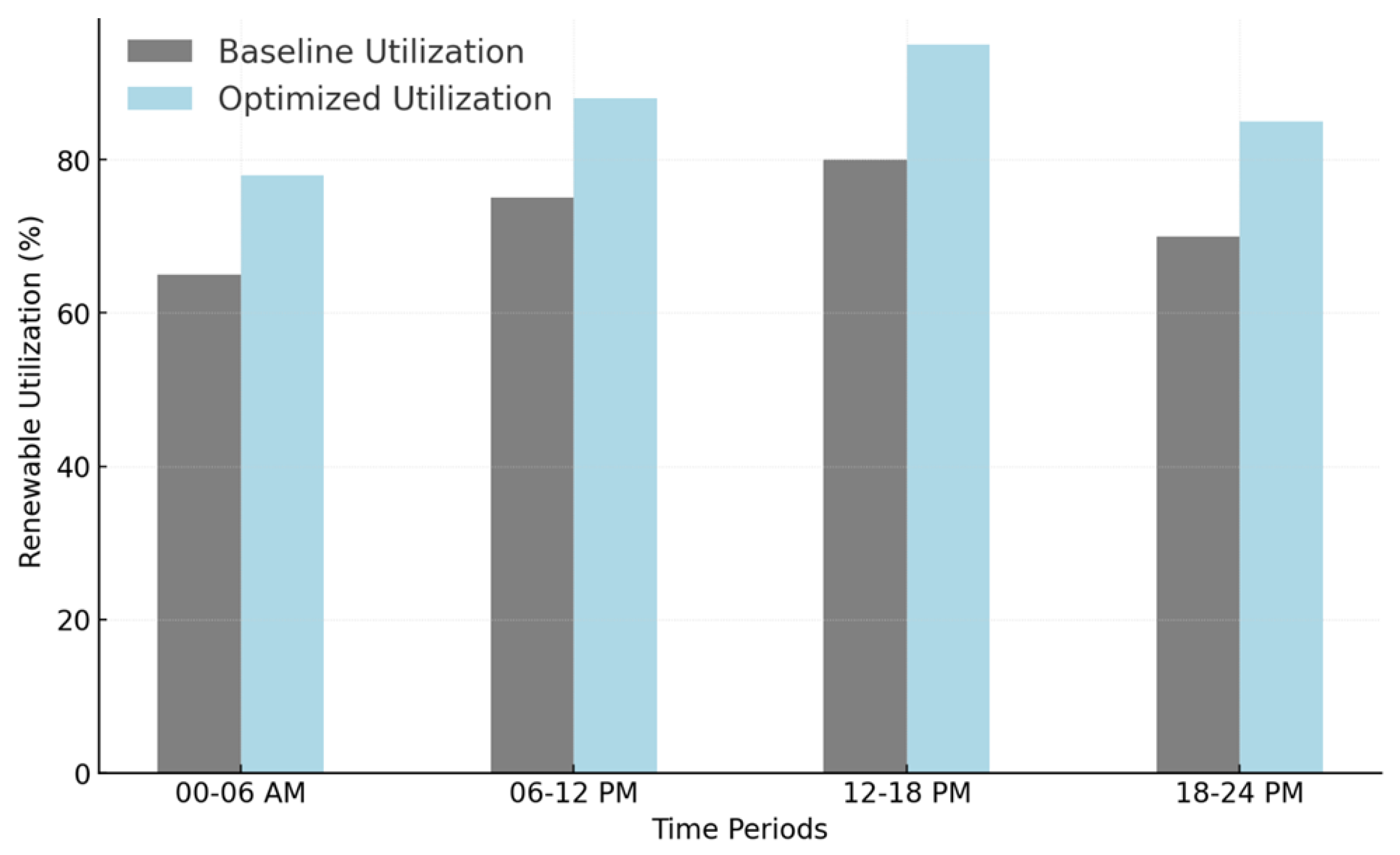

Renewable energy integration is a pivotal factor in optimizing charging grid economics. This formulation considers renewable availability constraints, normalizing energy dispatch

by overall grid power

, adjusted by system uncertainty

. Furthermore, the model incorporates renewable intermittency factors, ensuring forecasting accuracy and mitigating power fluctuation impacts. Terms with

capture curtailment penalties, incentivizing excess generation utilization, while

addresses carbon offset pricing, leveraging carbon credit mechanisms for environmental sustainability.

Quantum annealing mechanisms drive the real-time pricing optimization framework. This formulation constructs an energy landscape representation, where annealing parameter

determines the interaction between system energy constraints

and cost penalties

. Quantum state evolution equations model the system’s transition across energy states, ensuring robust convergence to globally optimal pricing solutions. Additionally, annealing step optimization, captured by

, aligns with practical constraints, enabling computational efficiency and real-time decision-making in large-scale grid environments.

Ensuring the power balance is fundamental to maintaining a stable smart grid operation. This constraint guarantees that the sum of the total supplied power—including electric vehicle charging demand, grid energy dispatch, and renewable generation—matches the aggregated demand from EV users, general grid consumers, and system losses. The incorporation of renewable energy into this balance is critical for sustainability, reducing reliance on conventional energy sources while maintaining equilibrium in real-time pricing decisions.

Voltage and frequency stability are essential to maintaining the reliability of an electric vehicle charging grid. This equation represents the nodal voltage variations and power flows across transmission lines, ensuring that voltage levels at different buses adhere to operational thresholds. The term

represents line reactance, which influences voltage stability, while

denotes power injections at various nodes. By controlling voltage deviations within prescribed safety margins, this constraint ensures that grid disturbances do not disrupt the optimal charging process.

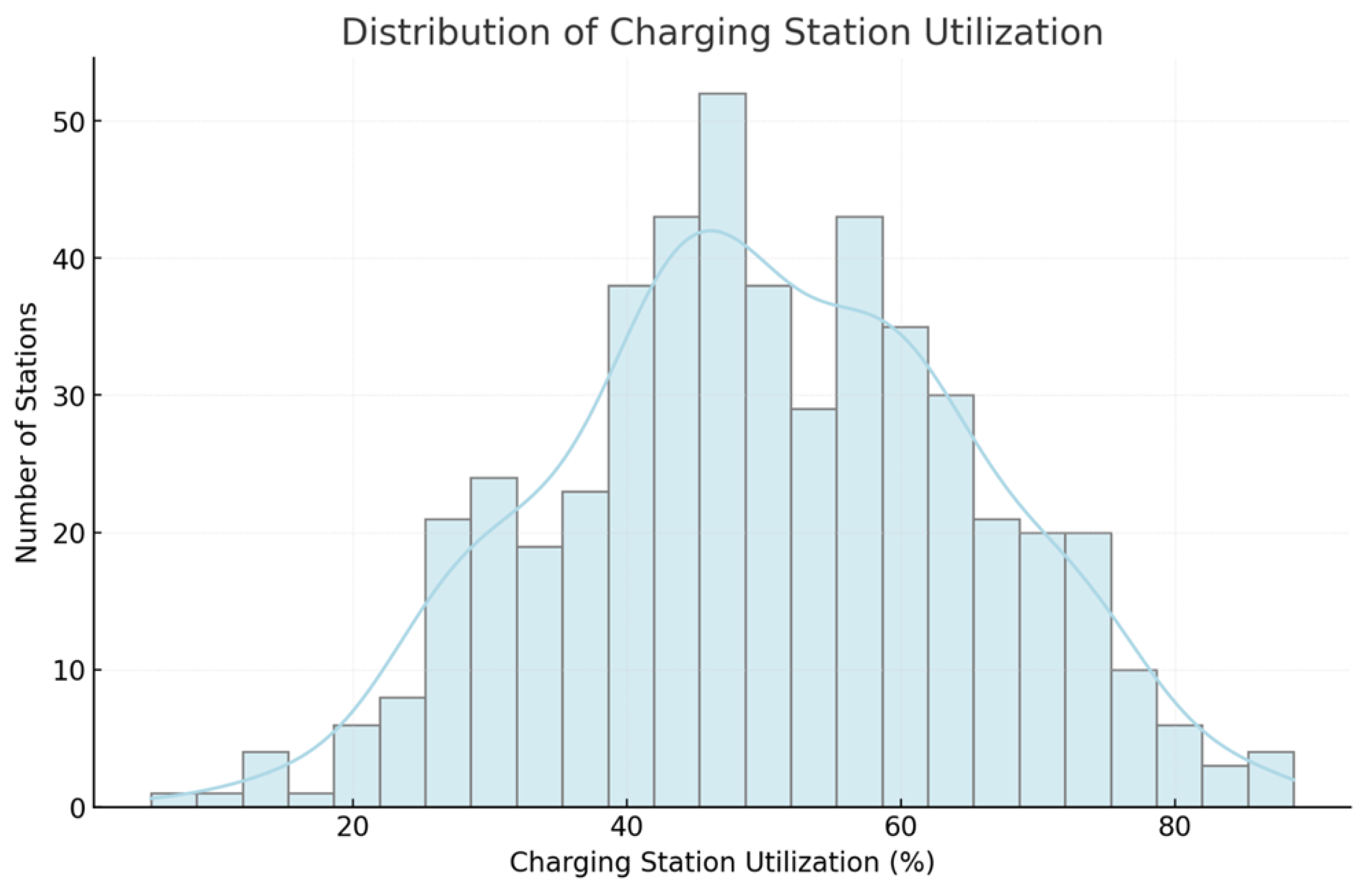

To prevent overloading of charging stations, each EV charger is constrained to operate within predefined maximum power limits. The upper bound

ensures that individual charging stations do not exceed their rated capacity, safeguarding grid components from overheating and ensuring longevity of charging infrastructure. This constraint is particularly crucial for real-time pricing strategies since price signals must be set in a way that prevents excessive demand from overwhelming local station capacities.

Network congestion management plays a critical role in optimizing electric vehicle charging schedules. This constraint ensures that the power flow along each transmission line remains within its maximum allowable capacity

, preventing thermal overloading and voltage collapse. Overloaded transmission lines can severely disrupt real-time pricing mechanisms, leading to inefficient grid operation. By integrating congestion-aware pricing models, this constraint helps redistribute charging demand across different times and locations to enhance grid flexibility.

Renewable energy availability is inherently time-dependent, with fluctuations driven by meteorological conditions. This constraint ensures that the dispatched renewable power at each charging station does not exceed the locally available wind and solar generation at a given time. The terms

and

represent wind and photovoltaic energy availability, respectively. By dynamically adjusting real-time prices based on renewable output, the system incentivizes EV users to charge when renewable generation is high, promoting carbon-free mobility.

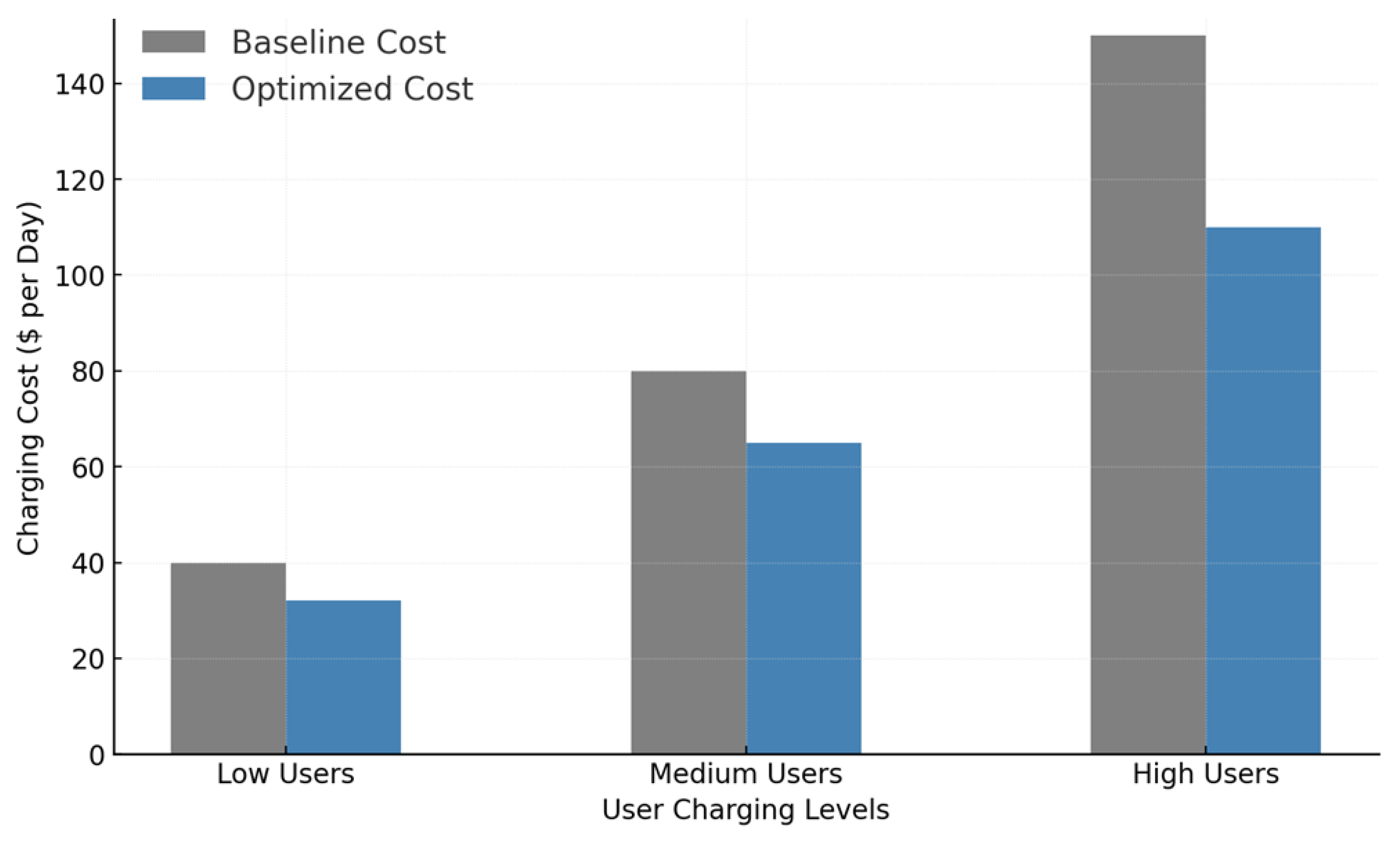

Price volatility is a significant concern in real-time EV charging markets. This constraint enforces upper and lower bounds on the price adjustments applied at each charging station, preventing extreme price swings that could lead to economic inefficiencies or discourage EV adoption. The terms

and

define the minimum and maximum permissible price levels. By keeping prices within reasonable limits, this condition fosters a balanced trade-off between grid efficiency and consumer affordability.

Affordability is a key factor in the successful deployment of electric vehicle charging infrastructure. This constraint ensures that the cumulative charging cost incurred by an EV user does not exceed an affordability threshold

, which may be determined based on average consumer income or policy regulations. By incorporating affordability constraints into the optimization framework, the system promotes equitable access to charging services while maintaining economic sustainability for grid operators.

Grid flexibility plays a pivotal role in ensuring that real-time pricing mechanisms do not cause supply shortages. This constraint ensures that the power allocated for EV charging, scaled by the elasticity factor

, does not exceed the sum of available grid dispatch and renewable power generation, accounting for system losses. By enforcing this restriction, the system prevents instability and over-reliance on expensive emergency energy sources.

Abrupt fluctuations in real-time pricing can lead to erratic charging behaviors, negatively impacting both grid stability and consumer trust. This constraint ensures that the absolute change in charging price from one time step to the next does not exceed a predefined maximum adjustment

, thereby maintaining smooth transitions in price signals and preventing unnecessary volatility.

Market equilibrium must be preserved when setting real-time prices for EV charging. This equation ensures that the aggregated charging power, weighted by pricing factors

, remains within the available energy supply, combining both conventional grid electricity and renewable sources. This constraint is particularly critical in preventing excessive demand peaks that could lead to grid congestion or supply shortages.

Charging station capacities must be respected to ensure seamless service. This constraint states that the total power drawn by EVs at each time step, scaled by the demand response factor

, should not exceed the physical capacity of the charging infrastructure. This ensures that individual stations are not overwhelmed by sudden spikes in demand.

Carbon footprint considerations are an essential part of sustainable pricing strategies. This constraint ensures that the cumulative energy consumption from EV charging, normalized by the carbon intensity factor

, does not exceed a predefined carbon cap

. This incentivizes grid operators to structure pricing in a way that promotes charging during low-carbon periods, such as when renewable generation is high.

Cybersecurity risks must be accounted for when integrating smart charging infrastructure. This equation imposes a limit on the aggregated charging power that can be controlled by a single cyber entity, ensuring that potential cyberattacks (modeled through risk factor

) do not compromise the grid. A predefined security threshold

is set to mitigate large-scale coordinated attacks.

Battery degradation is an important consideration when designing real-time pricing models. This constraint ensures that the total degradation effect, modeled by the function

, remains within a predefined acceptable threshold

, preventing excessive wear and tear on EV batteries caused by aggressive charging incentives.

User engagement in demand response programs is critical to the success of real-time pricing. This equation ensures that the total user response to price signals, scaled by social behavior factors

, does not exceed a predefined engagement cap

. This prevents excessive reliance on user participation, which could lead to demand imbalances if overestimated.

To ensure resilience in EV charging operations, this constraint enforces that the total reserve power capacity, including backup generation resources, must be sufficient to meet unexpected deviations in demand. The equation accounts for real-time charging demand, grid power supply, and renewable availability fluctuations. Maintaining an adequate power reserve prevents service disruptions due to unanticipated load surges, ensuring that EV users experience minimal charging delays.

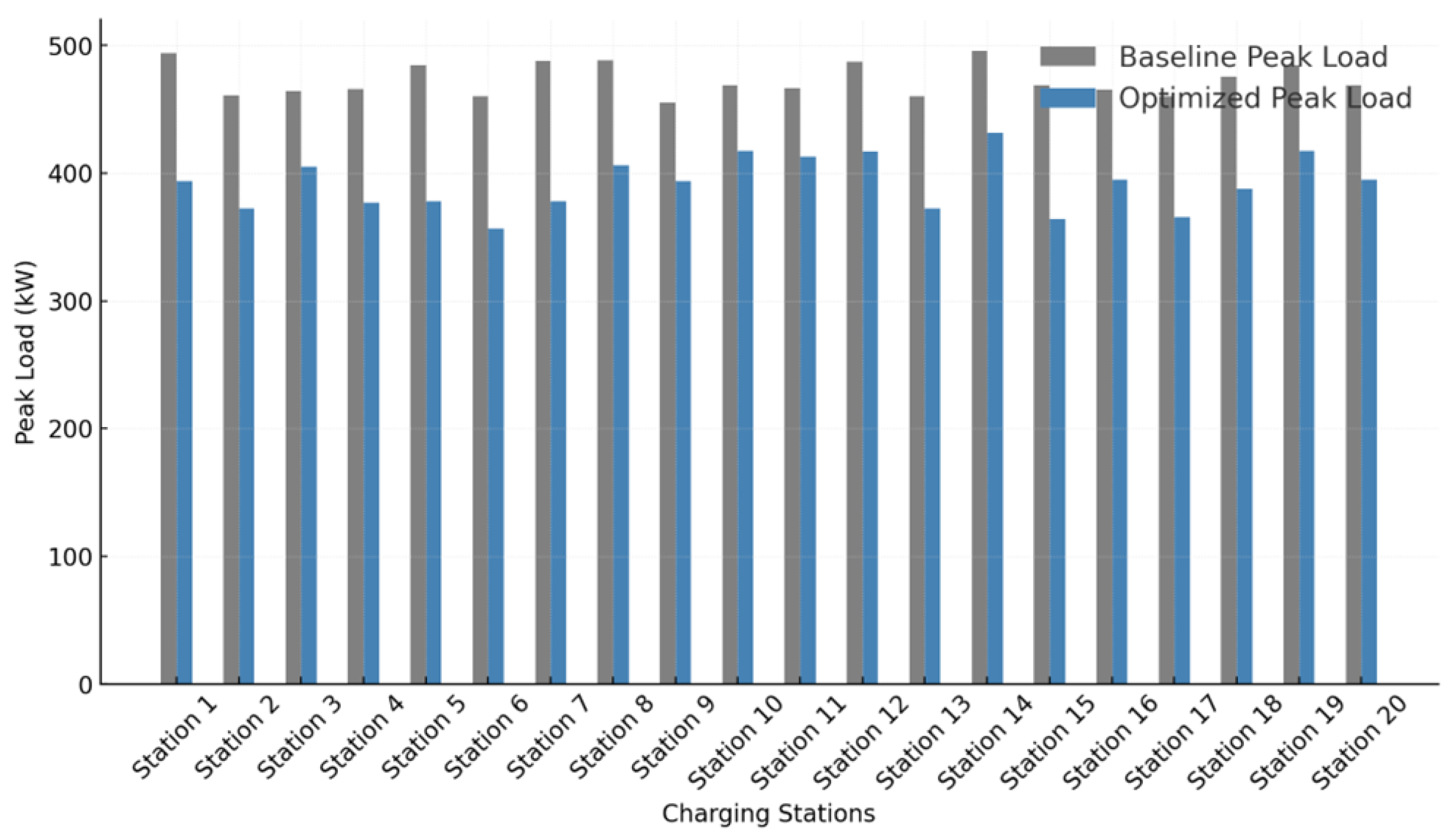

Peak load management is a critical component of demand-side optimization in EV charging grids. This constraint ensures that sufficient load-shifting strategies are in place to balance the difference between peak and off-peak demand. The parameter

represents the aggregate shifted load across all charging stations, helping to alleviate stress on the grid during peak hours. By dynamically adjusting pricing strategies, this constraint facilitates effective load balancing and grid stability.

Flexibility in charging demand is essential for ensuring efficient real-time pricing adjustments. This equation constrains the proportion of demand that can be dynamically adjusted within each time period, preventing excessive fluctuations that might destabilize grid operations. The flexibility factor

is divided by the demand elasticity coefficient

, ensuring that changes in charging power remain within the allowable threshold

. This helps avoid unintended consequences such as extreme demand shifts or overcorrections in price response.

Economic sustainability is a key consideration in designing real-time pricing strategies for EV charging grids. This constraint ensures that the aggregated revenue from charging demand, weighted by market influence factors

, meets or exceeds a predefined profitability threshold

. By maintaining a balance between consumer affordability and operator profitability, this condition supports long-term financial viability while encouraging continued investment in charging infrastructure.

Charging efficiency constraints ensure that the power drawn by electric vehicles does not exceed the combined available supply from the grid and renewable sources. Here,

represents the efficiency factor of the charging process, accounting for energy conversion losses. This constraint guarantees that the power supplied to EVs remains within sustainable limits, preventing excessive grid stress and optimizing the integration of renewable energy.

Demand-side management (DSM) strategies play a crucial role in optimizing EV charging schedules. This constraint ensures that the total charging demand, adjusted by consumer response elasticity

, does not exceed the allocated DSM capacity

. By enforcing this condition, the system dynamically regulates consumer participation in load-shifting programs, enhancing grid flexibility and cost-effectiveness.

To mitigate peak demand spikes, this constraint enforces a minimum load-shifting requirement. The parameter

represents the total power that is actively shifted from peak to off-peak periods, ensuring that peak-hour loads do not surpass grid safety margins. This optimization technique enhances system resilience, reduces operational costs, and improves overall efficiency by aligning charging demand with periods of high renewable generation.

Carbon footprint control is vital for ensuring that EV charging supports sustainability goals. This constraint limits the total emissions impact of charging demand by normalizing power consumption with a carbon intensity factor

. The predefined cap

prevents excessive carbon emissions, incentivizing cleaner energy usage and promoting environmentally responsible charging behavior.

Grid resilience must be maintained in the face of demand fluctuations and potential supply disruptions. This equation ensures that the total backup energy capacity

meets or exceeds a predefined resilience threshold

. This guarantees that sufficient emergency power reserves are available to handle contingencies such as sudden demand surges, renewable energy shortfalls, or unexpected grid failures.

Surge pricing mechanisms must be carefully controlled to prevent excessive financial burdens on EV users. This constraint ensures that the total increase in price-sensitive demand, weighted by a risk factor

, does not exceed a predefined cap

. By incorporating this safeguard, the system prevents exploitative pricing fluctuations while allowing for controlled, dynamic price adjustments that balance supply and demand effectively.

Energy storage integration is essential for balancing supply and demand in EV charging grids. This constraint ensures that the combined power dispatch and energy drawn from storage facilities is sufficient to cover the net demand at all times. By allowing storage systems to absorb excess renewable generation and discharge when demand peaks, this condition improves grid flexibility and prevents power shortages.

Elasticity-based pricing mechanisms ensure that the total power drawn by EVs, scaled by an elasticity factor

, does not exceed a predefined system-wide charging limit

. This prevents excessive surges in demand that could compromise grid stability. By dynamically adjusting real-time pricing signals, the system encourages load redistribution to maintain operational efficiency.

Availability constraints ensure that charging stations provide an adequate supply of energy to meet consumer demand. The left-hand side models the actual energy available for charging, weighted by an availability factor

, while the right-hand side represents the minimum energy required by active EV users. This condition guarantees that no user experiences unexpected shortages or long wait times due to inadequate energy supply.

Infrastructure capacity constraints prevent excessive strain on the charging network. This equation ensures that the aggregated power demand from all EVs, normalized by station-specific capacity factors

, does not exceed an overall network limit

. This prevents congestion, station malfunctions, and suboptimal charging experiences for consumers.

To maintain price stability, this constraint enforces gradual changes in charging prices. The total price adjustments, weighted by a control factor

, must remain within a smoothing limit

. This ensures that EV users do not face abrupt cost increases, preserving consumer trust while enabling controlled, market-driven pricing strategies.

Demand-side participation constraints ensure that a sufficient number of consumers actively respond to price incentives. The left-hand side represents total user response, scaled by a participation factor

, while the right-hand side specifies a minimum target for demand-side management (DSM). This condition is essential for ensuring that real-time pricing strategies achieve their intended effects on grid stability and load balancing.

Grid stability is a fundamental concern when implementing real-time EV charging pricing. This constraint ensures that the total power drawn from charging demand, scaled by a stability factor

, remains within a predefined threshold

. By preventing excessive fluctuations in demand, this condition enhances the resilience of grid operations while ensuring a reliable power supply.

Dynamic price adjustments must be controlled to prevent sharp fluctuations that could disrupt market behavior. This constraint ensures that the aggregate price-induced demand surge, weighted by a limiting factor

, does not exceed a predefined cap

. This maintains the smooth operation of real-time pricing mechanisms while mitigating unintended consequences such as panic-driven consumer responses.

Ensuring gradual transitions in pricing is key to consumer acceptance of dynamic tariffs. This constraint limits the total price adjustment across all charging stations within a given time step, preventing drastic fluctuations that could deter EV adoption or cause market instability. The cap

ensures that price modifications are incremental and predictable.

Participation in demand-side response (DSR) programs must meet a minimum engagement level for effective load balancing. This constraint ensures that total consumer response, adjusted by an elasticity factor

, meets or exceeds a defined lower bound

. This guarantees that enough users adjust their charging behavior in response to real-time pricing, facilitating effective grid management.

Renewable energy integration into EV charging must be optimized to minimize curtailment losses. This constraint ensures that the total amount of renewable power utilized for charging, adjusted by a curtailment factor

, does not exceed the available renewable generation limit

. This maximizes renewable utilization while preventing energy waste.

To mitigate financial risks in real-time pricing, this constraint ensures that the total deviation in price-driven demand shifts, scaled by a compensation factor

, remains within a permissible limit

. This prevents extreme price fluctuations that could financially disadvantage consumers or operators.

Ensuring grid resilience against unforeseen demand spikes or supply disruptions is critical. This constraint mandates that the total power allocated to resilience-focused strategies, such as energy storage and reserve dispatch, meets a predefined threshold

. This guarantees reliable system operation even under extreme conditions.

EV charging infrastructure must meet consumer demand reliably. This constraint ensures that the total charging power available, weighted by a usage factor

, satisfies a predefined demand target

. This prevents the underutilization of charging stations while ensuring availability during peak periods.

Grid stability requires an adequate level of control measures to prevent frequency and voltage deviations. This equation enforces a minimum power allocation for stability-oriented operations, ensuring that system-wide stability thresholds

are met at all times.

Social engagement in real-time pricing must be maintained at a sufficient level to drive effective consumer participation. This constraint ensures that total user-driven demand adjustments, scaled by an engagement factor

, meet a required participation level

. This fosters active consumer involvement in optimizing grid operations through behavioral incentives.

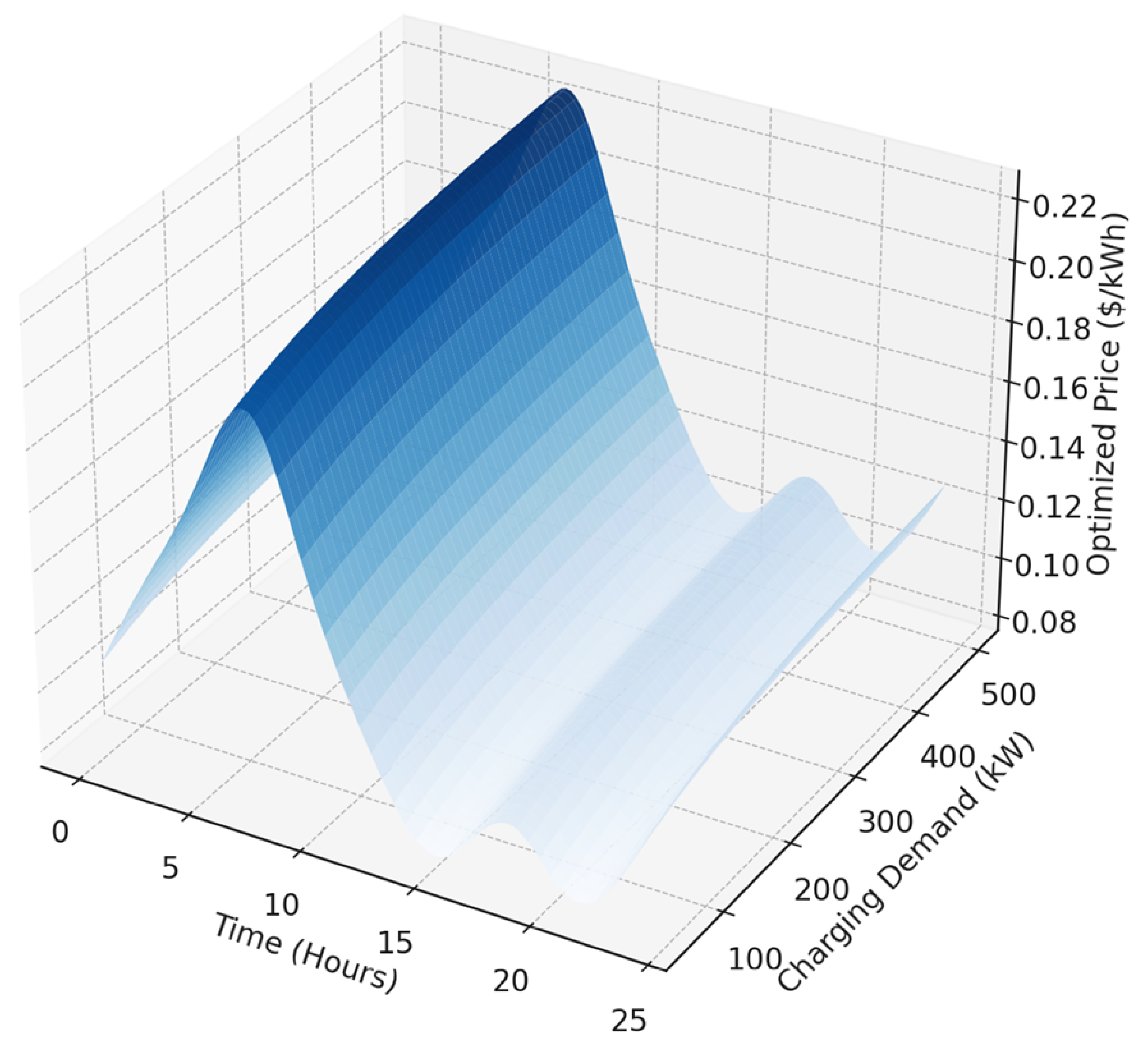

In the proposed framework, quantum annealing is employed as the core optimization engine to solve high-dimensional pricing problems formulated as Quadratic Unconstrained Binary Optimization (QUBO) models. These QUBO models encode key system objectives—including cost minimization, renewable integration, and congestion mitigation—into a binary energy landscape, where each feasible pricing configuration corresponds to a unique energy state. The quantum annealer seeks the lowest-energy configuration that satisfies multiple conflicting constraints simultaneously. To approximate real-world behavior, we incorporate stochastic elasticity models and empirical load profiles directly into the QUBO formulation. This ensures that the quantum-optimized pricing reflects realistic demand shifts, grid availability, and temporal correlations. The implementation leverages the D-Wave Advantage 5000Q system, where each optimization run consists of 1000 annealing cycles and uses approximately 1800 logical qubits through minor embedding. Real-time data from EV charging stations and grid sensors are processed every 15 min, and the updated QUBO is submitted for annealing. The outputs of the quantum annealer are then decoded into price vectors, which are post-processed to meet volatility constraints and operational limits before being dispatched across the network. This hybrid quantum-classical pipeline enables near-real-time responsiveness while maintaining practical relevance under dynamic grid conditions.