Is the Industrial Policy Suitable for the Industrial Chain? A Case Study from the Photovoltaic Industry in China—Evidence from Shenzhen

Abstract

1. Introduction

2. Materials and Methods

3. Results

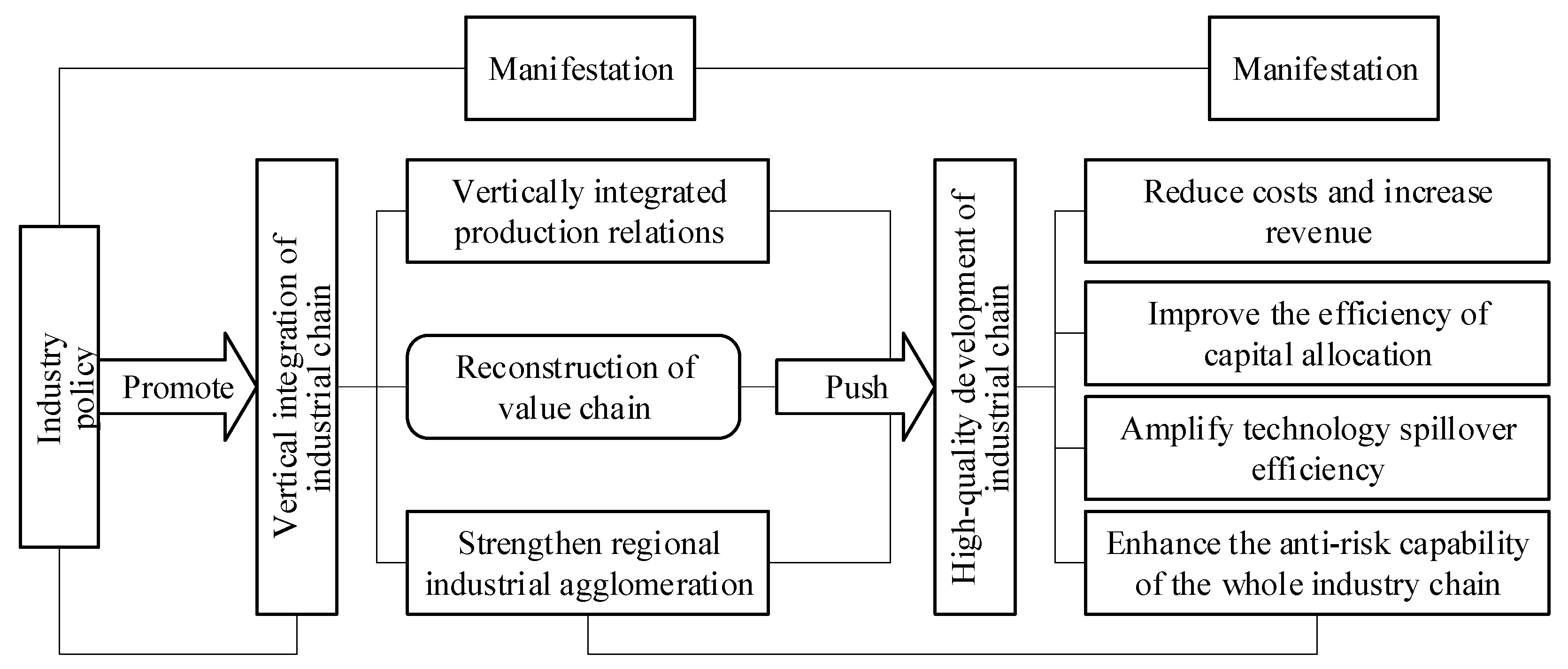

3.1. Adaptation Model of the Industrial Policy and Industrial Chain

3.2. Indicator Standards

3.2.1. Expression of Resource Dependence Degree

3.2.2. Expression of the Allocation Structure of Production Factors

3.2.3. Expression of the Development Stage of the Industrial Chain

3.3. Comprehensive Expression of Industrial Chain Development

4. Data Collection and Preprocessing

4.1. Data on PV Industry Policy in Shenzhen

4.2. Data on PV Industry Chain in Shenzhen

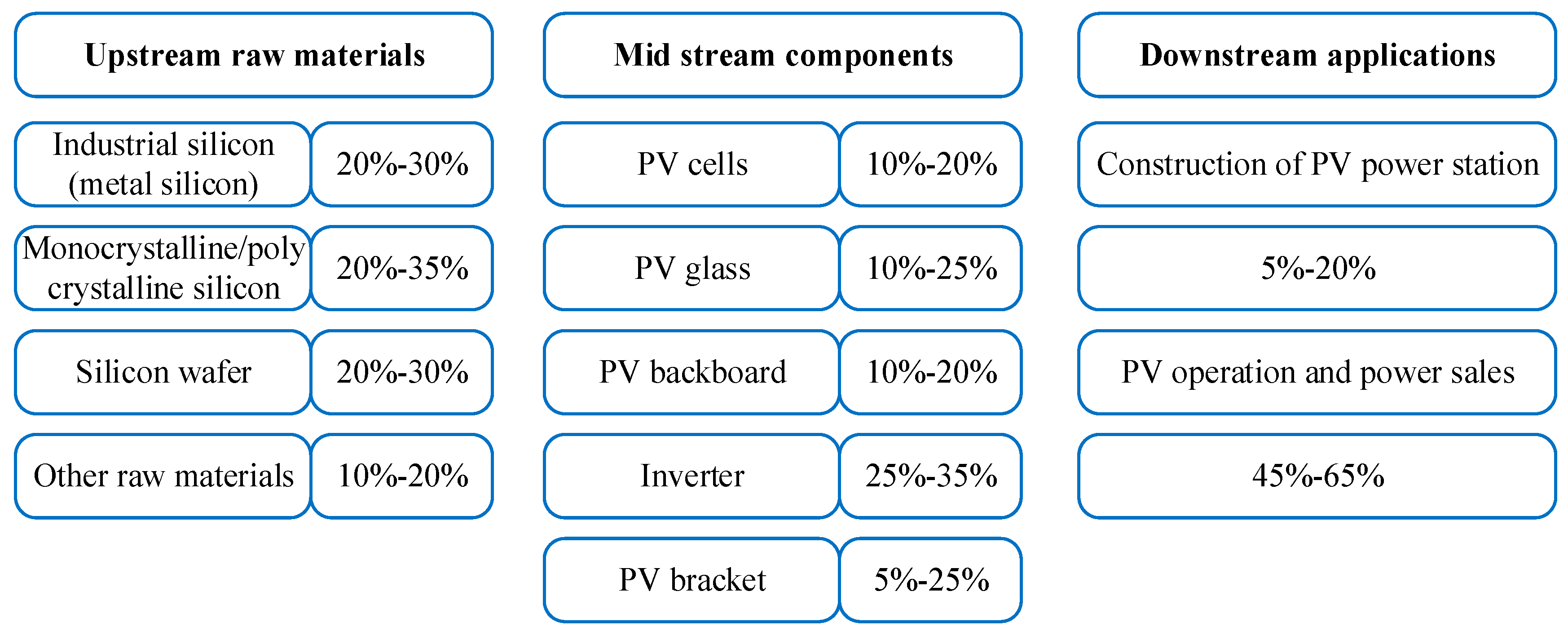

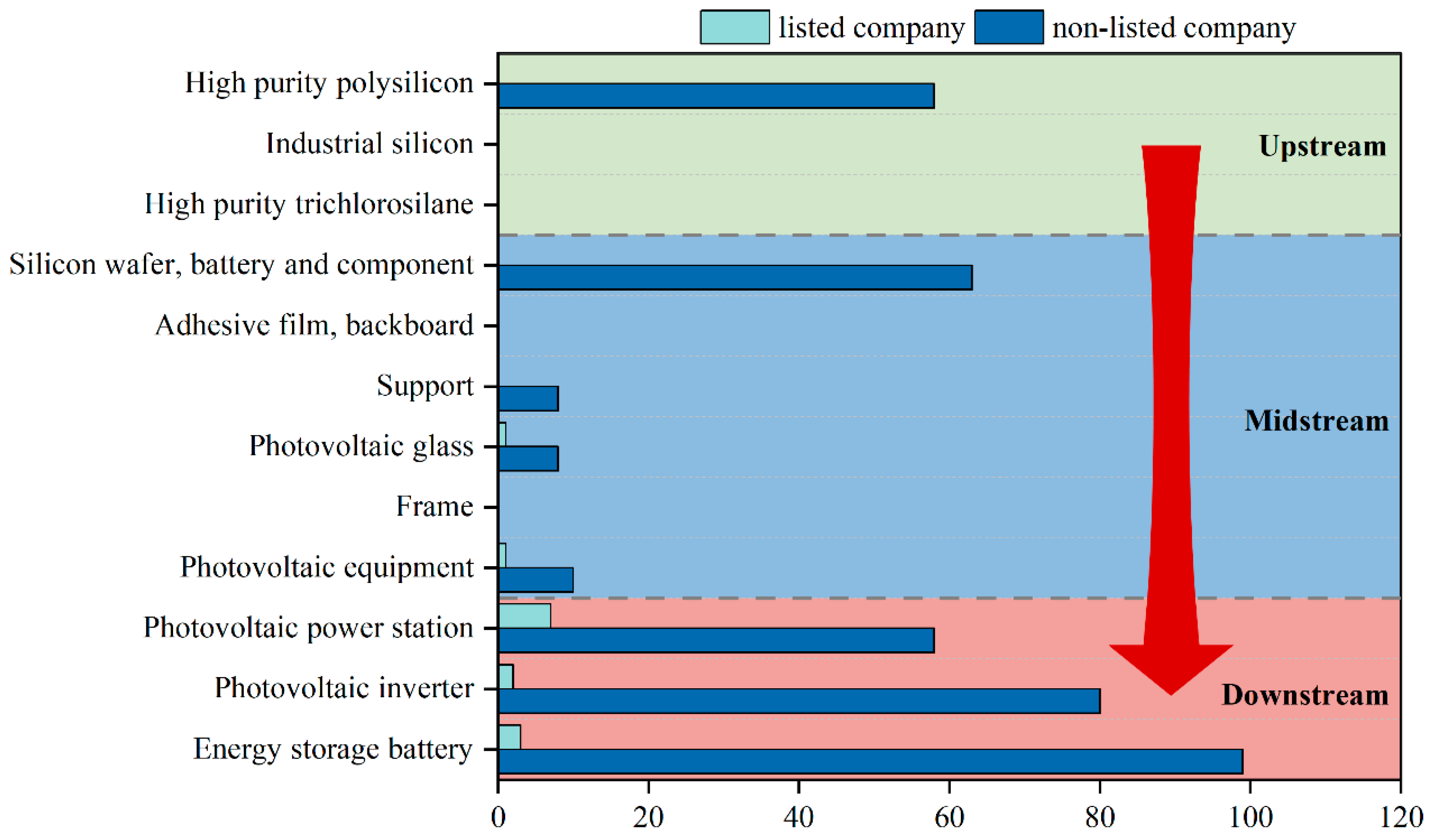

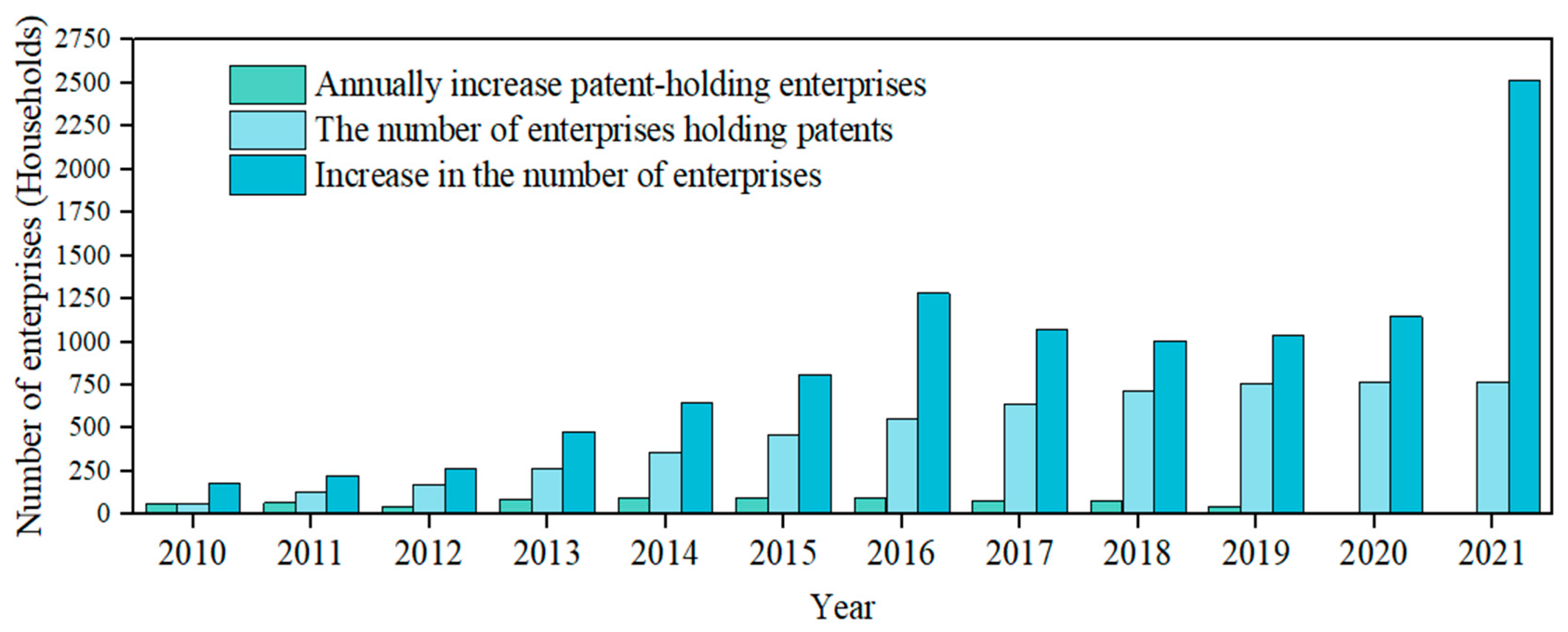

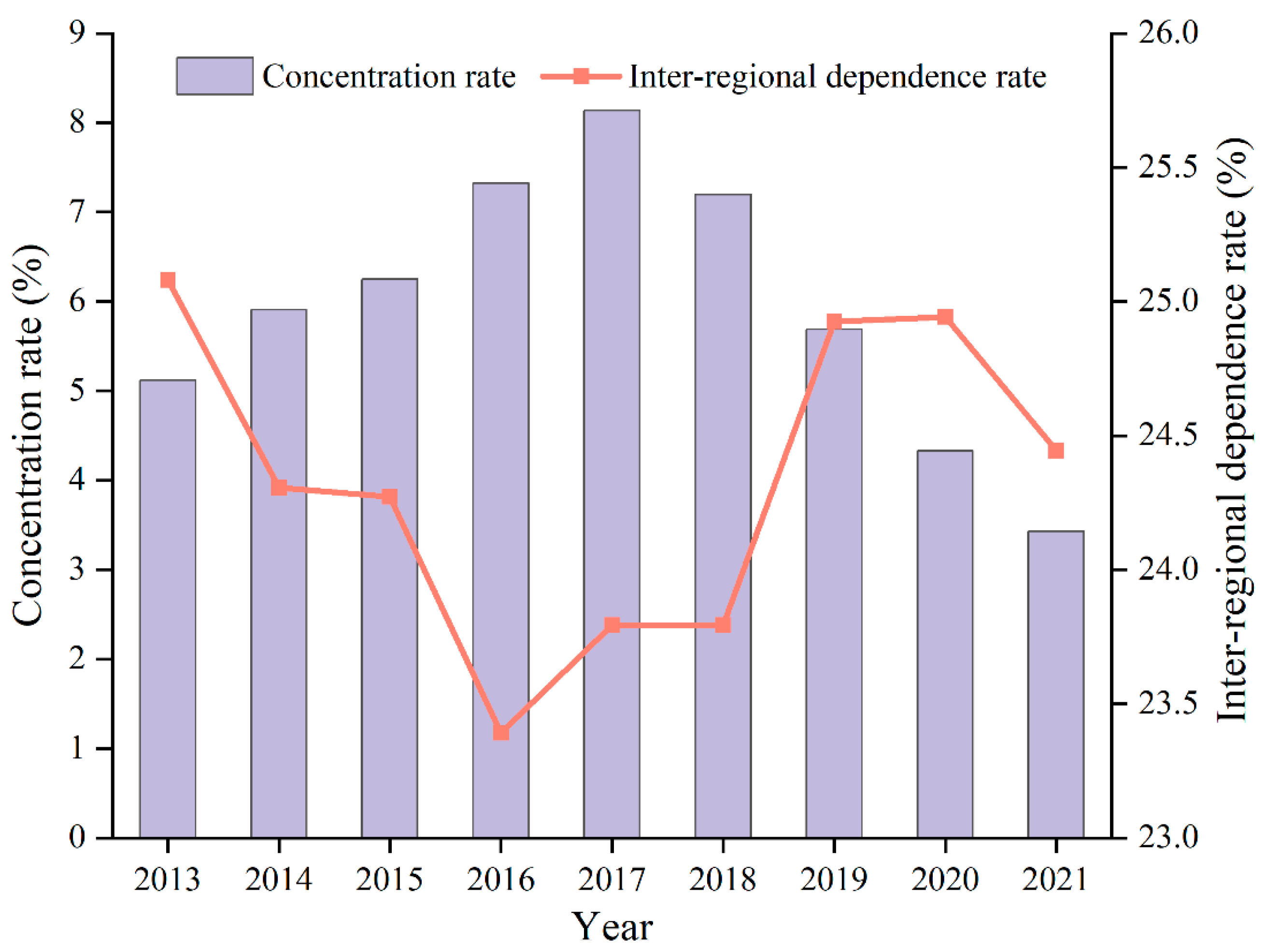

Interdependence Within the PV Industry Chain in Shenzhen

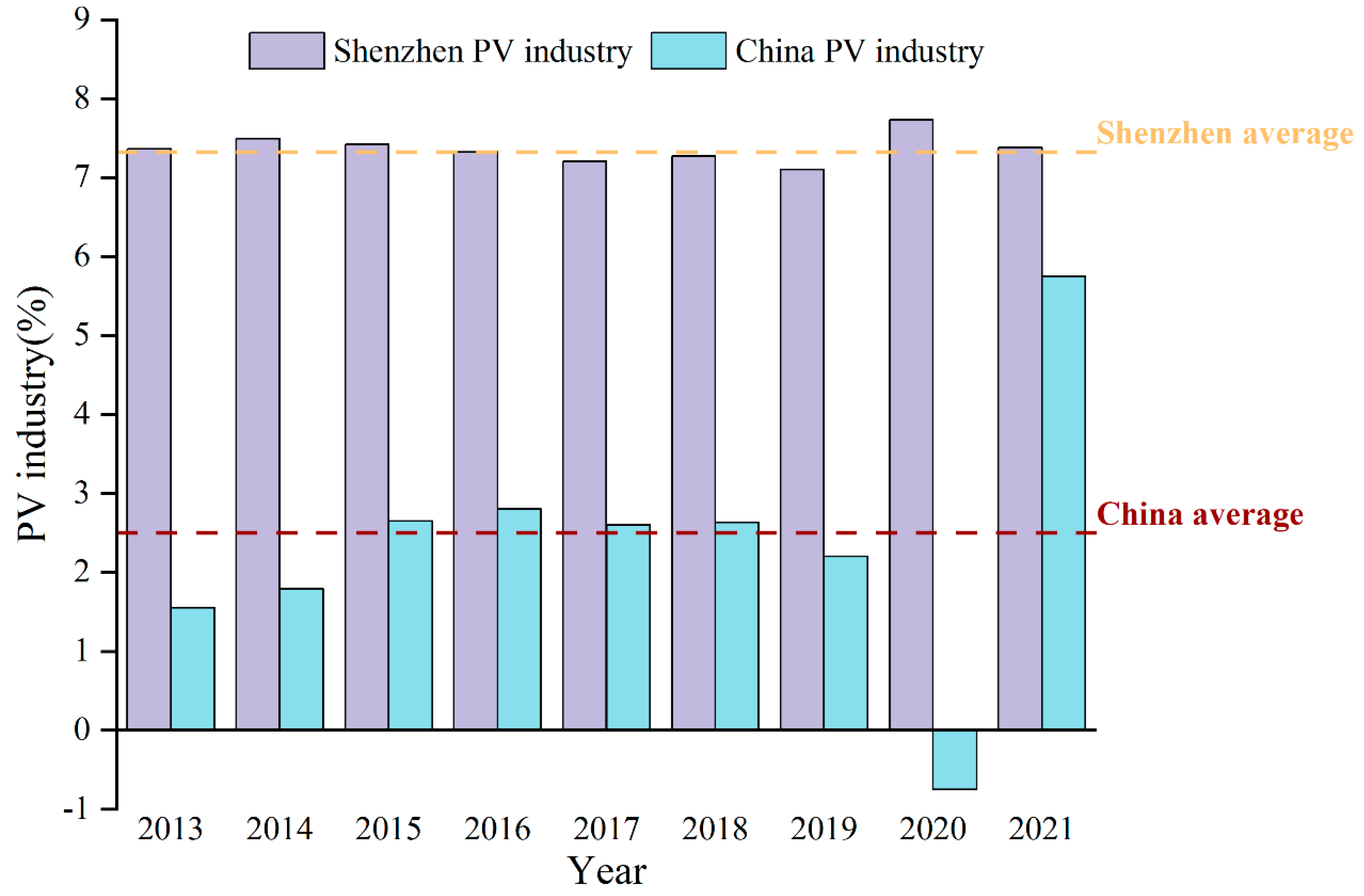

4.3. Estimation of TFP in PV Industry Chain in Shenzhen

4.4. Life-Cycle Judgment of the Main Products in PV Industry Chain

5. Adaptation Results

5.1. Adaptation Index Results

5.1.1. Industry Concentration Rises First and Then Falls

5.1.2. Steady Rise in the Life Cycle of the Industrial Chain

5.1.3. No Change in the Structure of Production Factors

5.1.4. Increase in Comprehensive Indicators

5.2. Industrial Policy Adaptation Results

6. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Helveston, J.; He, G.; Davidson, M. Quantifying the cost savings of global solar photovoltaic supply chains. Nature 2022, 612, 83–87. [Google Scholar] [CrossRef]

- Luo, Z.; He, J.C.; Hu, S. Driving force model to evaluate China’s photovoltaic industry: Historical and future trends. J. Clean. Prod. 2020, 311, 127637. [Google Scholar] [CrossRef]

- Shen, W.; He, J.; Yao, S. Green industrial policy in the post grid parity era: Governing integrated Solar projects in China. Energ. Policy 2021, 150, 112129. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, R.; Tanaka, K. Accelerating the energy transition towards photovoltaic and wind in China. Nature 2023, 619, 761–767. [Google Scholar] [CrossRef] [PubMed]

- Piila, N.; Sarja, M. Extraordinary supply chain disruptions and the circular economy transition in the construction industry—An opportunity within crisis? Sustain. Prod. Consum. 2024, 47, 71–86. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Khan, Z.; Adomako, S.; Khan, H. Business failure in post-pandemic era: New challenges for industrial networks, emerging insights and market opportunities. Ind. Mark. Manag. 2024, 117, A3–A9. [Google Scholar] [CrossRef]

- Marcato, M.; Dweck, E.; Montanha, R. The densification of Chinese production chains in the context of vertically fragmented production. Struct. Change Econ. Dyn. 2022, 60, 75–89. [Google Scholar] [CrossRef]

- Chang, K.; Zhang, H.; Li, B. The impact of digital economy and industrial agglomeration on the changes of industrial structure in the Yangtze River Delta. J. Knowl. Econ. 2023, 15, 9207–9227. [Google Scholar] [CrossRef]

- Cen, X.; Zhang, X.; Thron, A.M.; Van Benthem, K. Agglomeration and long-range edge retraction for Au/Ni bilayer films during thermal annealing. Acta Mater. 2016, 119, 167–176. [Google Scholar] [CrossRef]

- Liu, Z.; Zeng, S.; Jin, Z.; Shi, J. Transport infrastructure and industrial agglomeration: Evidence from manufacturing industries in China. Transp. Policy 2022, 121, 100–112. [Google Scholar] [CrossRef]

- Yu, Z.; Xiao, Z.; Liu, X. Characterizing the spatial-functional network of regional industrial agglomerations: A data-driven case study in China’s greater bay area. Appl. Geogr. 2023, 152, 102901. [Google Scholar] [CrossRef]

- Kenderdine, T. China’s Industrial Policy, Strategic Emerging Industries and Space Law. Asia Pac. Policy Stud. 2017, 4, 325–342. [Google Scholar] [CrossRef]

- Van Assche, K.; Beunen, R.; Verweij, S.; Evans, J.; Gruezmacher, M. Policy learning and adaptation in governance: A co-evolutionary perspective. Adm. Soc. 2022, 54, 1226–1254. [Google Scholar] [CrossRef]

- Cuaresma, J.; Huber, F.; Onorante, L. Fragility and the effect of international uncertainty shocks. J. Int. Money Financ. 2022, 108, 102151. [Google Scholar] [CrossRef]

- Yuan, C.; Geng, C.; Sun, J.; Cui, H. Vertical integration and corporate value under uncertainty shock: Evidence from the COVID-19 pandemic. China Econ. Q. Int. 2022, 2, 239–251. [Google Scholar] [CrossRef]

- Milner, C.; Reed, G.; Talerngsri, P. Vertical linkages and agglomeration effects in Japanese FDI in Thailand. J. Jpn. Int. Econ. 2006, 20, 193–208. [Google Scholar] [CrossRef]

- Han, A.; Ge, J.; Lei, Y. Vertical vs. horizontal integration: Game analysis for the rare earth industrial integration in China. Resour. Policy 2016, 50, 149–159. [Google Scholar] [CrossRef]

- Shayan, M.E.; Petrollese, M.; Rouhani, S.H.; Mobayen, S.; Zhilenkov, A.; Su, C.L. An innovative two-stage machine learning-based adaptive robust unit commitment strategy for addressing uncertainty in renewable energy systems. Int. J. Electr. Power Energy Syst. 2024, 160, 110087. [Google Scholar] [CrossRef]

- Devos, E.; Li, H. Vertical integration to mitigate internal capital market inefficiencies. J. Corp. Financ. 2021, 69, 101994. [Google Scholar] [CrossRef]

- Epede, M.; Wang, D. Global value chain linkages: An integrative review of the opportunities and challenges for SMEs in developing countries. Int. Bus. Rev. 2022, 31, 101993. [Google Scholar] [CrossRef]

- Araujo, R.A.; Santini, T.; de Acypreste, R. A vertically integrated approach to increasing returns and cumulative causation. Struct. Change Econ. Dyn. 2023, 65, 49–58. [Google Scholar] [CrossRef]

- Peng, D.; Li, R.; Shen, C.; Beladi, H.; Chen, C. Industrial agglomeration, urban characteristics, and economic growth quality: The case of knowledge-intensive business services. Int. Rev. Econ. Financ. 2022, 81, 18–28. [Google Scholar] [CrossRef]

- Bao, X.; Gao, L.; Jun, Y.; Sun, J. Industrial agglomeration and firm exports: Micro-evidence based on input-output linkages. Econ. Model. 2023, 119, 106123. [Google Scholar] [CrossRef]

- Drucker, J.; Feser, E. Regional industrial structure and agglomeration economies: An analysis of productivity in three manufacturing industries. Reg. Sci. Urban Econ. 2015, 42, 1–14. [Google Scholar] [CrossRef]

- Schneider, C. Steel manufacturing clusters in a hydrogen economy—Simulation of changes in location and vertical integration of steel production in northwestern. J. Clean. Prod. 2022, 341, 130913. [Google Scholar] [CrossRef]

- Leith, P.; Warman, R.; Harwood, A.; Bosomworth, K.; Wallis, P. An operation on ‘the neglected heart of science policy’: Reconciling supply and demand for climate change adaptation research. Environ. Sci. Policy 2018, 82, 117–125. [Google Scholar] [CrossRef]

- Golfam, P.; Ashofteh, P.; Loáiciga, H.A. Modeling adaptation policies to increase the synergies of the water-climate-agriculture nexus under climate change. Environ. Dev. 2021, 37, 100612. [Google Scholar] [CrossRef]

- Chand, P.; Tarei, P.K. Do the barriers of multi-tier sustainable supply chain interact? A multi-sector examination using resource-based theory and resource-dependence theory. J. Purch. Supply Manag. 2021, 27, 100722. [Google Scholar] [CrossRef]

- Mao, Y.; Yang, B.; Lin, S. Trend and policy implications of regional industrial agglomeration: An empirical analysis of the manufacturing industries in Guangdong Province. Reg. Sci. Policy Pract. 2014, 6, 361–381. [Google Scholar] [CrossRef]

- Lin, B.; Zhang, A. Impact of government subsidies on total factor productivity of energy storage enterprises under dual-carbon targets. Energy Policy 2024, 187, 114046. [Google Scholar] [CrossRef]

- Wang, F.; Bu, H.; Wang, Y.; Yu, L.; Yin, X. Estimation of global waste smartphones and embedded critical raw materials: An industry life cycle perspective. Resour. Conserv. Recycl. 2023, 196, 107063. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X.; Song, Y.; Jiang, F. Can green industrial policy improve total factor productivity? Firm-level evidence from China. Struct. Change Econ. Dyn. 2021, 59, 51–62. [Google Scholar] [CrossRef]

- Wang, Y.; Quan, T.; Bai, Y.; Ran, R.; Hua, L. Influence and effect of industrial agglomeration on urban green total factor productivity–On the regulatory role of innovation agglomeration and institutional distance. Econ. Anal. Policy 2023, 78, 1158–1173. [Google Scholar] [CrossRef]

- Piron, M.; Wu, J.; Fedele, A.; Manzardo, A. Industry 4.0 and life cycle assessment: Evaluation of the technology applications as an asset for the life cycle inventory. Sci. Total Environ. 2024, 916, 170263. [Google Scholar] [CrossRef] [PubMed]

- Rossini, M.; Ahmadi, A.; Staudacher, A.P. Integration of lean supply chain and industry 40. Procedia Comput. Sci. 2024, 232, 1673–1682. [Google Scholar] [CrossRef]

- Wang, P.; Guo, K.; Yan, S. China’s total factor productivity: Estimation and global comparison. Q. J. Econ. Manag. 2023, 2, 1–26. [Google Scholar]

- Bressanelli, G.; Visintin, F.; Saccani, N. Circular Economy and the evolution of industrial districts: A supply chain perspective. Int. J. Prod. Econ. 2021, 243, 108348. [Google Scholar] [CrossRef]

- Guo, J.; Guo, B.; Zhou, J.; Wu, X. How does the ambidexterity of technological learning routine affect firm innovation performance within industrial clusters? The moderating effects of knowledge attributes. Technol. Forecast. Soc. Change 2020, 155, 119990. [Google Scholar] [CrossRef]

- O’Connor, J.; Liu, L. Shenzhen’s OCT-LOFT: Creative space in the city of design. City Cult. Soc. 2014, 5, 131–138. [Google Scholar] [CrossRef]

- Pathak, A.; Leu, S.; Robertson, M.L.; Siriwardana, M. Technical efficiency, scale effect, and trade liberalization: Evidence from the Nepalese manufacturing sector. Appl. Econ. 2025, 9, 934–9501. [Google Scholar] [CrossRef]

- Tian, K.; Dietzenbacher, E.; Jong-A-Pin, R. Global value chain participation and its impact on industrial upgrading. World Econ. 2022, 45, 1362–1385. [Google Scholar] [CrossRef]

- Bode, C.; Wagner, S.M. Structural drivers of upstream supply chain complexity and the frequency of supply chain disruptions. J. Oper. Manag. 2015, 36, 215–228. [Google Scholar] [CrossRef]

| Indicators | Optimization Direction of Indicators | Policy Adaptability Direction |

|---|---|---|

| Resource-dependence degree | Raise | Positive |

| Allocation structure of production factors | Raise | Positive |

| Industrial chain life cycle | Reduce | Negative |

| Comprehensive indicators for industrial chain development | Raise | Positive |

| Inflection Point | Development Stage | |||

|---|---|---|---|---|

| Formation period | ||||

| Early expansion | ||||

| Late expansion | ||||

| Mature period |

| Life Cycle | Formation Period | Early Expansion | Late Expansion | Mature Period |

|---|---|---|---|---|

| Assignment (j) | 1 | 2 | 3 | 4 |

| Policy Connotation | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|

| Resource-dependence improvement | 1 | ||||||||

| Production factor-allocation structure improvement | 2 | 1 | 2 | 1 | 1 | 1 | 1 | ||

| Industrial chain life-cycle decline | 1 | 1 | 1 | 1 | 1 | 2 |

| Products | 2009 Output | 2014 Output | 2015 Output | 2021 Output | A Value |

|---|---|---|---|---|---|

| ton) | (1, 2.0) | (5, 13.6) | (6, 24.2) | (13, 50.6) | 59.17 |

| Silicon wafer (GW) | (1, 6.8) | (5, 50.4) | (6, 105) | (13, 407.2) | 697.81 |

| Battery cells (GW) | (1, 4.9) | (5, 33) | (6, 72) | (13, 197.9) | 270.24 |

| Assembly (GW) | (1, 4.4) | (5, 35.6) | (6, 75) | (13, 181.8) | 218.54 |

| Products | B Value | k Value | T1 | T2 | T3 |

|---|---|---|---|---|---|

| Polysilicon (Y) | 67.26 | 0.37 | −1.61 | 4.92 | 11.44 |

| Silicon wafer (Y) | 785.60 | 0.35 | 1.33 | 8.18 | 15.04 |

| Battery cells (Y) | 304.61 | 0.36 | 0.16 | 6.97 | 13.78 |

| Assembly (Y) | 246.45 | 0.36 | −0.09 | 6.70 | 13.48 |

| Power station (Y) | 2953.24 | 0.35 | 2.96 | 9.84 | 16.72 |

| Life Cycle | Formation Period | Early Expansion | Late Expansion | Mature Period |

|---|---|---|---|---|

| Polysilicon | before 2007 | 2007~2014 | 2014~2021 | after 2021 |

| Silicon wafer | before 2011 | 2011~2017 | 2017~2025 | after 2025 |

| Battery cells | before 2010 | 2010~2016 | 2016~2023 | after 2023 |

| Assembly | before 2008 | 2008~2010 | 2010~2023 | after 2023 |

| Power station | before 2016 | 2016~2023 | 2023~2030 | after 2030 |

| Industrial Concentration Degree | Comprehensive Indicator of Vertical Integration | Life Cycle | TFP | Intra-Regional Dependence |

|---|---|---|---|---|

| 2013–2017 | 0.974 *** (7.409) | 0.977 ** (7.880) | −0.158 (−1.525) | 0.869 * (−3.036) |

| 2017–2021 | −0.978 (−8.176) | −0.660 (−1.523) | −0.260 (−0.466) | −0.720 (−1.799) |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|

| Adaptation of industrial concentration policies | 0 | 0 | 0 | 0 | - | - | - | - |

| Adaptation of resource-dependence policies | - | 0 | - | 0 | - | 0 | 0 | - |

| Adaptation of industrial chain policies | - | 0 | 0 | 0 | - | - | + | + |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Song, Y.; Qin, Q. Is the Industrial Policy Suitable for the Industrial Chain? A Case Study from the Photovoltaic Industry in China—Evidence from Shenzhen. Energies 2025, 18, 2558. https://doi.org/10.3390/en18102558

Li Y, Song Y, Qin Q. Is the Industrial Policy Suitable for the Industrial Chain? A Case Study from the Photovoltaic Industry in China—Evidence from Shenzhen. Energies. 2025; 18(10):2558. https://doi.org/10.3390/en18102558

Chicago/Turabian StyleLi, Yin, Yazhi Song, and Qi Qin. 2025. "Is the Industrial Policy Suitable for the Industrial Chain? A Case Study from the Photovoltaic Industry in China—Evidence from Shenzhen" Energies 18, no. 10: 2558. https://doi.org/10.3390/en18102558

APA StyleLi, Y., Song, Y., & Qin, Q. (2025). Is the Industrial Policy Suitable for the Industrial Chain? A Case Study from the Photovoltaic Industry in China—Evidence from Shenzhen. Energies, 18(10), 2558. https://doi.org/10.3390/en18102558