1. Introduction

The Polish energy sector is currently undergoing a profound modernisation phase, with its primary goal for the next two decades being decarbonisation. At present, coal is still the dominant energy source; however, its consumption has been regularly reduced in recent years. The Energy Policy of Poland until 2040 (EPP2040), which came into force a year before the outbreak of the Russian–Ukrainian conflict, established that natural gas would play a special role in the energy transition. Its primary function will be to stabilise the power industry following the gradual phasing out of coal-fired power plants. This process implies the need to increase the consumption of natural gas over a period of several years. Polish natural gas production is insufficient for these needs, so most of it is imported. Until 2022, the Russian Federation, from which up to 60–90% of the gas was imported annually via the Yamal pipeline, was the strategic supplier. Dependence on a single source posed a serious threat to Poland’s energy security, so the diversification of supply sources presented itself as a necessity. Unfortunately, it was only the Russian–Ukrainian dispute that proved that the expansion of an alternative gas transmission infrastructure was overdue for many Central and Eastern European countries (CEEs). In the case of Poland, the investment offensive in the gas sector helped to maintain stability, but the integration of gas transmission systems with those of its neighbours remains a weakness. The North–South Gas Corridor (NSGC), which has been under construction for many years, features bottlenecks, making it dysfunctional in the event of a possible gas crisis.

Certainly, an opportunity to obtain new gas sources for CEEs and, thus, increase the importance of the NSGC is the development of a gas transmission infrastructure in the Eastern Mediterranean. Recently discovered and still not fully explored gas fields in this region prove the powerful potential that can be successfully exploited by European countries to ensure a stable supply of gas. This issue has become all the more complicated in the wake of sanctions imposed on Russian energy resources, which have been a major source for many CEEs. Thus, Israel, Egypt, and Cyprus, if they develop their natural gas sectors and expand their transmission infrastructure, could become strategic partners for Europe. Nevertheless, it must not be forgotten that the region in question is highly conflicted, and competition for energy resources may make international cooperation all the more difficult. It is also worth pointing out that time is of the essence, as the future of natural gas in Europe is probably a matter of several decades.

The scientific literature extensively discusses issues pertaining to the natural gas sector. In particular, it applies to CEEs that have accelerated their energy transformation in recent years. Natural gas is regarded as a vital source of electricity [

1], a transitional fuel in the decarbonisation process [

2,

3], or a component of energy security [

4]. The effects of Russia’s raw material policy [

5,

6] and the risks to Europe’s hydrocarbon supply are currently receiving attention [

7,

8]. Without a doubt, the topic of natural gas transmission systems in Europe is a significant one in the discourse on science and research. The development of gas infrastructure in light of challenges to its distribution is a special area of attention [

9,

10]. However, the expansion of natural gas transmission capacity in CEEs and in Eastern Mediterranean countries is usually perceived from the perspective of the interests of a specific country [

11,

12,

13,

14,

15,

16,

17,

18]. This study aims to address the aforementioned issue from a more comprehensive regional standpoint.

The primary objective of this study is to define the role of the development of natural gas transmission infrastructure in the Eastern Mediterranean in the process of diversifying gas supply sources for Poland and other CEEs. This study attempts to answer the question of whether the development of natural gas transmission infrastructure in the Eastern Mediterranean will have an impact on the distribution of gas to CEEs, including Poland. Is this a viable alternative to Russian gas? A SWOT analysis was used to answer the above research questions. The selected strengths and weaknesses, as well as opportunities and threats, determine the potentially most favourable strategy for Poland and, from a broader perspective, for CEEs.

The first part of this paper presents the current state of the Polish energy sector, highlighting the role of the gas sector. Then, the issues related to the NSGC are discussed from the perspective of the development of the natural gas transmission infrastructure from the Eastern Mediterranean while taking the EastMed project and the identification of gas resources in this region into account. The next part of the paper describes the methods used to analyse the research problem. Then, the section containing the results and discussion includes an SWOT analysis relating to the development of natural gas transmission infrastructure in the Eastern Mediterranean in the context of distribution to Central Europe and Poland. The summary refers to the assessment of the importance of the development of gas transmission infrastructure in the Eastern Mediterranean in the process of diversifying gas supply sources for Poland and other CEEs, indicating the most advantageous strategies.

2. Background

2.1. The Role of the Gas Sector in the Polish Power Sector—Current Status

Poland has been modernising its energy sector for many years, primarily in the direction of increased diversification of sources of strategic raw materials for energy. Unfortunately, during this period, there was a noticeable dependence on the Russian Federation, so there was heavy investment in infrastructure that would allow broader diversification of hydrocarbon suppliers. Certainly, the commissioning of the Świnoujście LNG terminal in 2016 and the increase in the capacity of the Gdańsk oil terminal were milestones in this regard. Despite increasing investment in fossil fuels and renewable energy, the Polish power sector was still dominated by coal at the end of 2022. Hard coal and lignite accounted for as much as 70.7% of electricity production [

19]. However, it should be noted that according to the Ministry of Climate and Environment, the use of coal has generally been declining over the last several years (86.6% in 2010, 71.2% in 2021) [

20]. The opposite trend can be seen in the natural gas sector, which met approximately 8.8% of electricity needs in 2021. Nevertheless, it is worth mentioning that natural gas consumption has significantly increased compared to previous years. Unfortunately, Poland’s natural gas reserves supply about 20–25% of its needs, so large quantities are imported, mainly from Russia [

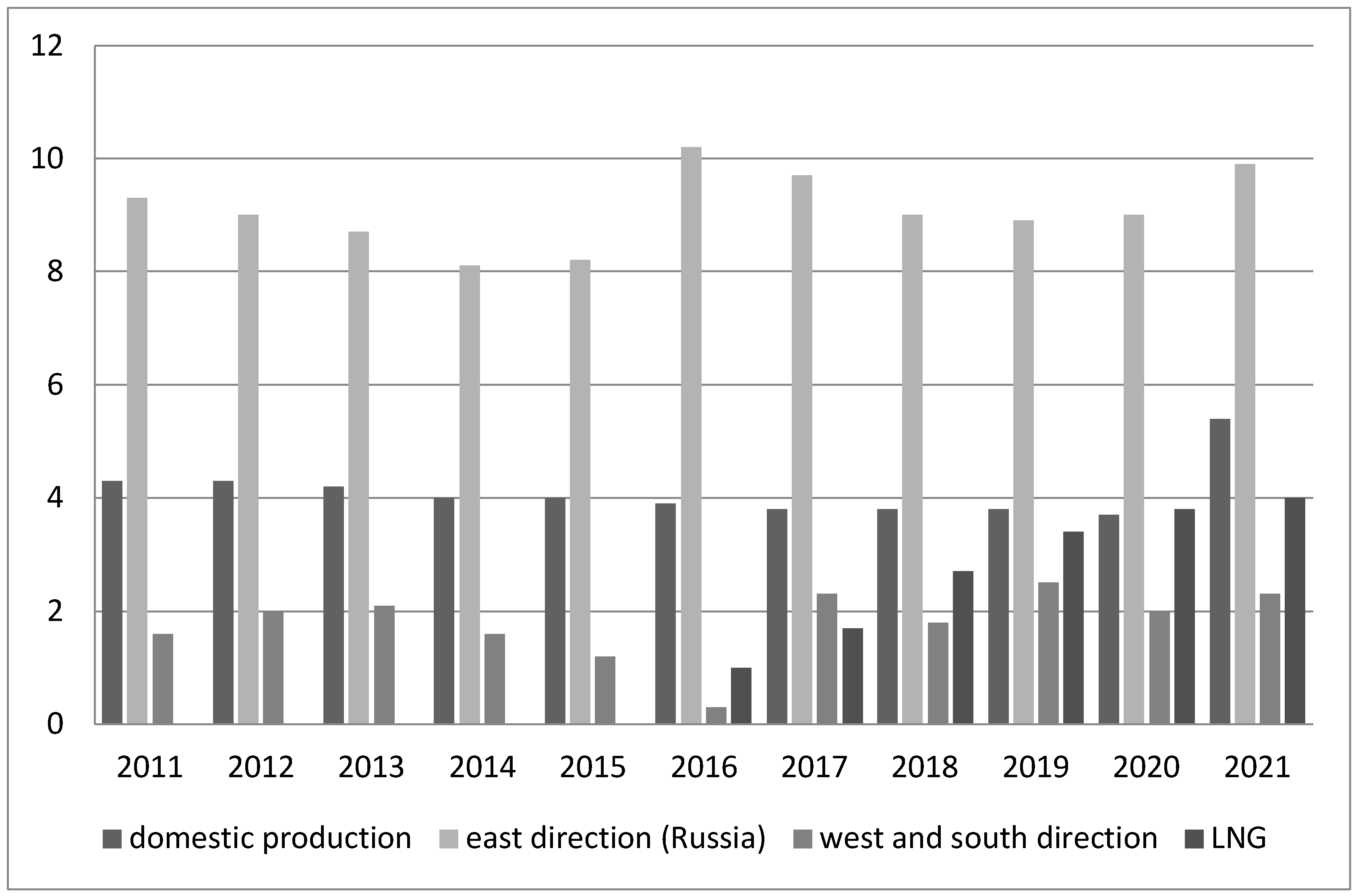

21] (

Figure 1).

Poland’s energy transition is taking place not only through the increased use of natural gas but, above all, through renewable energy sources, which are expected to replace fossil fuels in a few decades. The dynamism of the green energy sector is evidenced by the fact that, in the energy mix, it accounted for around 8% in 2011, while in 2022, it already accounted for nearly 21% [

24]. The largest increases in generation capacity were achieved in wind power (especially between 2010 and 2016) and solar power (after 2018). In 2022, wind power supplied 10.8%, photovoltaics supplied 4.5%, biomass and biogas plants supplied 4.2% and hydropower plants supplied 1.7% of the electricity [

25].

The year 2022 was marked by major setbacks in the natural gas sector in Poland. Although there had already been investments in infrastructure to diversify its supply routes for many years, the war in Ukraine clearly made this process more difficult. In this context, it is worth mentioning that dependence on Russian raw materials for energy has clearly decreased (from around 89% in 2016 to 55% in 2021), which is mainly due to the commissioning of the LNG terminal in Świnoujście [

26]. Even before the outbreak of the conflict, the Polish government declared a complete abandonment of Russian gas. However, at the turn of 2021 and 2022, there were already problems with the flow of fuel through the Yamal pipeline. In the following months, it became obvious that the Russians would not fulfil their contract, which incidentally ran until the end of 2022. Finally, in May 2022, Poland terminated the Yamal gas agreement with Russia [

27]. This situation meant that the Baltic Pipe and the NSGC had to be finished as soon as possible, which was to be helped by the gas infrastructure construction mode provided for in the special law and its subsequent amendments that extended its scope [

28]. In the case of the former, the official commissioning took place on 27 September 2022, while the full capacity of the pipeline was reached two months later [

29]. The Baltic Pipe made it possible to import 10 billion cubic metres (bcm) of gas per year, corresponding to more than 60% of domestic demand. At the same time, projects were implemented for the NSGC, which is ultimately intended to be a system of gas interconnections between CEEs with LNG terminals located on the Baltic and Adriatic Sea [

26,

30]. In May 2022, the Poland–Lithuania Interconnector was commissioned, giving the Polish side access to the Lithuanian LNG terminal in Klaipėda with a capacity of approximately 2 bcm per year [

31]. Meanwhile, six months later, the Poland–Slovakia Interconnector was put into service, with an annual capacity of 5.7 bcm towards Poland [

32]. By the conclusion of 2022, the objective of establishing infrastructure within the natural gas industry to enable the transportation of gas from different routes apart from the Russian direction had been achieved. Certainly, the contracting of adequate gas volumes with new partners and the high price of gas on world markets have proved more challenging for the Polish government in recent months [

33].

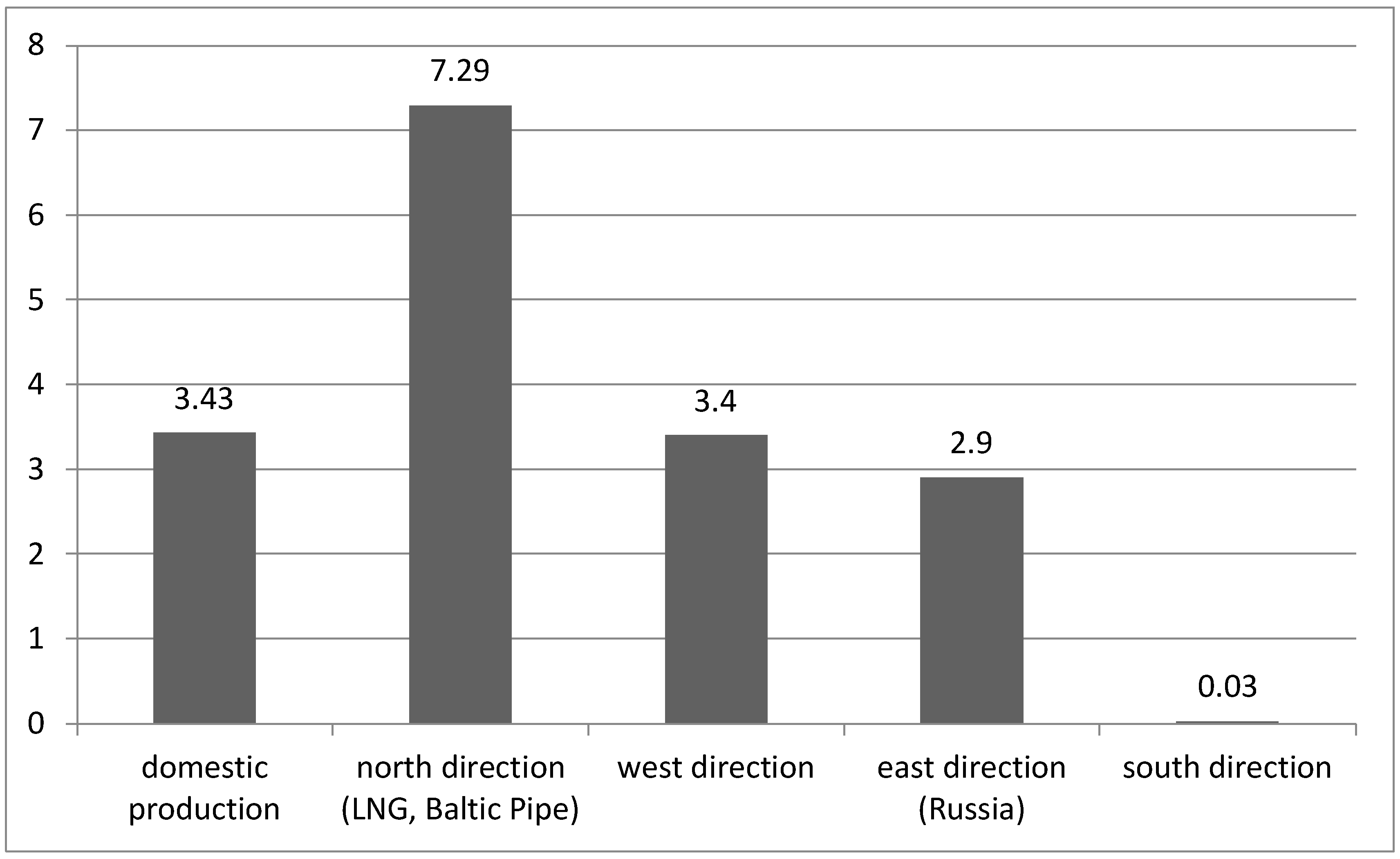

Investment in natural gas transmission infrastructure and the abandonment of Russian gas have significantly changed the structure of Poland’s gas sourcing. In 2022, LNG became the dominant source (6 bcm, 43%), with more than half coming from the US (3.4 bcm). The second most significant direction in terms of imported gas was the western direction, i.e., the Germany–Poland Interconnectors (3.4 bcm). In contrast, as a result of the suspension of supplies from Russia on 27 April 2022, there has been a significant reduction in the gas purchased from Gazprom (2.9 bcm). It is worth noting that the diversification of gas sources has been strengthened by new transmission infrastructure, i.e., the Baltic Pipe (0.7 bcm), as well as the Poland–Lithuania (0.55 bcm) and Poland–Slovakia (0.03 bcm) Interconnectors [

34] (

Figure 2).

2.2. The North–South Gas Corridor in the Context of Mediterranean Resources and the Development of Gas Infrastructure in the Eastern Mediterranean

The war in Ukraine and Poland’s investment offensive in natural gas transmission infrastructure have made the process of diversifying the directions of this fuel supply more dynamic. It is worth recalling that until 2022, the key pipeline for Poland was Yamal, which supplied gas from Russia. In order to achieve the objective of excluding the Russian supplier, it was necessary to commission an alternative transmission infrastructure. A milestone in this undertaking was the achievement of increased capacity in the NSGC.

The fundamental objective of the NSGC is to strengthen the energy security of CEEs, including Poland in particular. This security is to be ensured by increasing opportunities to diversify natural gas supply sources and destinations, increasing regional gas market integration, and deepening energy cooperation. In this way, the main task of the NSGC will be to make CEEs independent of Russian supplies. It should be borne in mind that this European region is still significantly dependent on the Russian supplier [

10]. It is also not without significance that the NSGC is an essential element in the European Union’s endeavours towards energy neutrality from a two-decade perspective. The expansion of the gas infrastructure will create the conditions for a transition from coal to energy sources with a much lower environmental impact, such as natural gas, which can be used as a separate energy source or as a stabilising fuel for renewable energy sources used in industrial power generation and heating. In addition, the NSGC is intended to change the traditional gas distribution model of the CEEs, which has so far been based on the East–West direction, by introducing a North–South/South–North alternative [

36].

From a technical point of view, the NSGC will connect the Baltic LNG terminals via Poland, the Czech Republic, Slovakia, and Hungary to the LNG terminal in Croatia. It will be composed of two-way interconnectors and national gas pipelines. In this respect, the Czech Republic has been operating an interconnector with Poland since 2011; however, another (Stork 2) is planned in the coming years to increase the bidirectional capacity [

36]. Czech Republic is also planning to construct an interconnector with Austria (Bidirectional Austrian–Czech Interconnector), although it should be borne in mind that neither project is a Project of Common Interest (PCI) [

37]. Undoubtedly, the state of Slovakia’s gas infrastructure is still unfavourable, which is why cooperation with its neighbours in the context of launching new gas connections has intensified in recent years [

38]. Since 2015, the Slovak gas network has gained a connector with Hungary, and at the end of 2022, it gained one with Poland. In addition to the connection to Slovakia, Hungary has had an interconnector with Romania since 2010 and with Croatia since 2011. In this context, their low capacity and the need for expansion to accommodate gas flow is problematic. In the last two years, key projects for the NSGC were implemented in Croatia, namely, in 2020, reverse gas flow with Hungary was put into operation (previously, gas flow was only possible from Hungary to Croatia), and at the beginning of 2021, a floating LNG terminal was commissioned, with its current capacity standing at 2.9 billion cubic metres annually. Thus, the concept of the NSGC has not been fully implemented, but there is a high probability that in the near future, this corridor will be operational to enable more effective diversification of gas sources for CEEs.

Given the Russian–Ukrainian conflict and the EU sanctions applied to Russian energy resources, many European countries are looking for alternative suppliers [

39]. In this context, high expectations are directed towards resources located in the Eastern Mediterranean. Studies to date indicate that there may be as much as 122 trillion cubic feet of gas within the exclusive economic zones of Cyprus, Israel, Lebanon, and Egypt [

40]. Israel’s capabilities certainly look promising in this respect. The Israeli Ministry of Energy assesses that Israel’s discovered reservoirs hold 921 bcm of technically recoverable resources, while another 500 bcm could be discovered through the current licenses [

41]. More than half of the fields are located in the Leviathan gas field that was discovered in 2010. Similarly, the potential of the Egyptian gas sector appears promising thanks to the substantial reserves at the Zohr gas field, which amount to as much as 845 bcm [

42]. Estimates from the end of 2022 indicated that Egyptian gas reserves amounted to as much as 2209 bcm [

43]. In contrast, the Republic of Cyprus has several gas fields in the southern part of the exclusive economic zone, the largest of which is Aphrodite (128 bcm) [

44]. The situation regarding Lebanon’s gas resources is problematic due to its location on the border with Israel. Nevertheless, it is worth noting that the Sidon–Qana gas field alone may contain as much as 100 bcm [

45]. It is important to remember that exploration and drilling are still ongoing in this part of the Mediterranean, so the capacity of the above-mentioned countries could well be greater.

Certainly, the biggest challenge in the context of the natural gas deposits in question remains the issue of their exploitation. The relatively long distances to the coasts of the individual countries require investment in transmission infrastructure. To date, the best-developed pipeline network is in Israel, which has commissioned a network of pipelines allowing production from most gas fields [

42]. In addition, the Arish–Ashkelon offshore gas pipeline (East Mediterranean Gas Pipeline) transporting gas from Israel to Egypt is of strategic importance, with a capacity of approximately 5–7 bcm per year. In 2013, the Hadera Deepwater Floating Storage Regasification Unit (FSRU), with a capacity of approximately 2.5 bcm per year (half of Israel’s demand), was commissioned. In the case of Egypt, the transmission infrastructure is being intensively expanded, which is also a consequence of the country’s increasing gas consumption [

15]. Two pipelines, each with a length of 216 km, connecting the Zohr gas field to the onshore gas facility in El-Gamil, are of paramount importance. In addition, there is an extensive network of gas pipelines connecting gas fields located in the Nile Delta Basin. Egypt’s export capabilities are bolstered by two LNG Liquefaction Terminals (Damietta and Idku). There is certainly a disadvantage in terms of being able to exploit Cyprus’ natural gas resources due to the lack of suitable infrastructure. The Vassiliko FSRU has already been under construction for several years and is likely to be commissioned in 2023 [

41]. It is estimated that, from the proven offshore gas fields of Israel, Cyprus, and Egypt alone, around 20–25 bcm/year can be delivered to Europe over a period of 15–20 years [

46].

The powerful gas export capacity of the countries located around the fields in the Eastern Mediterranean translates into the need for a joint/international project to enable the transfer of fuel to importing countries/regions. From this perspective, it is worth referring to the EastMed project, which aims to build a 1900 km gas pipeline connecting Israeli and Cypriot Mediterranean gas fields with Greece. The project includes a 200 km section of offshore pipeline that will be laid from the Leviathan gas field through the Aphrodite gas field to a compressor station built in Cyprus. Another 700 km offshore section will connect Cyprus to a compressor station located on Crete, from which a 400 km pipeline will transport gas to mainland Greece through the southern Peloponnese. The final part of EastMed will be a 600 km onshore section connecting the Peloponnese to the planned Poseidon pipeline in Western Greece. Poseidon will then send the natural gas across the Adriatic Sea to Italy [

47]. EastMed’s throughput will initially be 10 bcm, but is nevertheless expected to eventually reach 20 bcm per year.

In 2015, the EastMed project received approval from the governments of Italy, Greece, and the Republic of Cyprus. Two years later, Israel and the ministers responsible for energy for the above countries signed a joint venture declaration to confirm their support for the development of the project. However, it was not until 2020 that a final tripartite (Greece–Cyprus–Israel) agreement was reached on the construction of EastMed. By the end of 2023, a final investment decision was scheduled to be made, which meant that if approved, the pipeline would be operational no earlier than 2027. The project’s estimated implementation costs stand at approximately USD 6.7 billion and receive support from the European Commission, making it eligible for EU funding. The main investor is IGI Poseidon, a 50:50 joint venture between the Public Gas Corporation of Greece (DEPA) and Edison International Holding [

48].

3. Materials and Methods

In order to define the role of the development of natural gas transmission infrastructure in the Eastern Mediterranean in the process of diversifying gas supply sources for Poland and other CEEs, an SWOT analysis was applied. The SWOT method is used to create strategies in order to gain an understanding of the current state of the subject under study and to plot potential solutions to existing problems [

49]. The SWOT method was successfully used in the energy discipline, for instance, in the study of sustainable energy development [

50,

51,

52] and the transition to renewable energy [

53,

54]. The above method involves dividing the collected information into four groups (four categories of strategic factors): strengths (elements to leverage and develop), weaknesses (related areas of guidance and assistance), opportunities (related fields of benefit utilisation), and threats (components that prevent the object from developing). This method is most often used in a simplified form, i.e., it takes the form of four lists of factors (usually presented in a tabular form). However, the full usefulness of the SWOT technique is only revealed when the four apparently independent groups of factors are subjected to an analysis of their interrelationships, which comes down to answering a series of questions (SWOT matrix): Will a given strength enable us to take advantage of a given opportunity? Will a given strength enable us to negate a given threat? Does a given weakness limit the ability to take advantage of an opportunity? Does a given weakness exacerbate the risk associated with the threat? The answers to these questions allow the identification of strong links and problem areas within which solutions and sub-strategies can be initiated, making SWOT not only an analytical tool but also one for planning. This can also lead to another type of inference from SWOT, i.e., the selection of the appropriate strategy according to the strongest quadrant that shows the most connections. Assuming that we consider strengths and weaknesses as internal factors and opportunities and threats as external factors, the above strategies can be explained as follows:

Aggressive strategy: A given country is characterised by strengths and strongly related opportunities in its environment—an aggressive strategy is a strategy of expansion and development using both factors.

Conservative strategy: A country operates in an external environment that is unfavourable to it, but it has a set of strengths that are strongly linked to external threats and is, therefore, able to decisively respond to them. The set of strengths does not correspond to the opportunities of the environment but is nevertheless able to successfully overcome threats in anticipation of improving external conditions.

Competitive strategy: A country has a prevalence of weaknesses over strengths but operates in a friendly environment that allows it to maintain its position. Nevertheless, internal weaknesses prevent the effective use of opportunities provided by the external environment, so the competitive strategy should focus on eliminating internal weaknesses in such a way as to take better advantage of the opportunities of the surrounding environment in the future.

Defensive strategy: A country’s weaknesses are strongly linked to external threats. A defensive strategy is a strategy geared towards survival.

The SWOT analysis was carried out based on a systematic literature review that included peer-reviewed scientific journals and books, as well as reports of NGOs, data from statistical offices, and other press materials. The information obtained, especially those from the recent period relating to the new geopolitical situation in Central Europe, made it possible to create a new perspective on the situation of the gas sector of Poland, as well as those of other Central European countries.

4. Results and Discussion

Poland and other CEEs are intensively transitioning their power sectors through decarbonisation. Natural gas is seen as a transitional fuel for stabilising the electricity supply, especially in coal-dependent countries. For this reason, there will be increased gas consumption in the coming years in the light of EPP2040 following the phasing out of coal-fired power plants [

55]. The main supplier of gas to Poland and most countries in the region until the outbreak of the war in Ukraine was Russia. The lack of prospects for its quick ending has translated into the need to reduce or give up energy resources from Russia. Successive EU sanction packages have limited the ability to distribute gas, oil, and coal to European countries [

56]. Unfortunately, most CEEs were not prepared to cut off a key supply direction, which has resulted in an energy crisis and a serious destabilisation of energy security. In 2022, Poland completely gave up the importation of Russian gas, changed the directions and sources of supply, and maintained stability in its gas sector [

57]. Nevertheless, its weaknesses are still pronounced, and thus, it is necessary to achieve a more efficient state. Certainly, the issue of the inadequacy of the transmission infrastructure remains the biggest drawback. It is essential to remember that Poland shifted its supply direction from the east to the north (LNG and Baltic Pipe), which poses a certain risk, for instance, in the event of a blockade in the Baltic Sea. The alternative in this context is the southern direction by increasing the supply through the NSGC and gaining access to gas located in the Eastern Mediterranean.

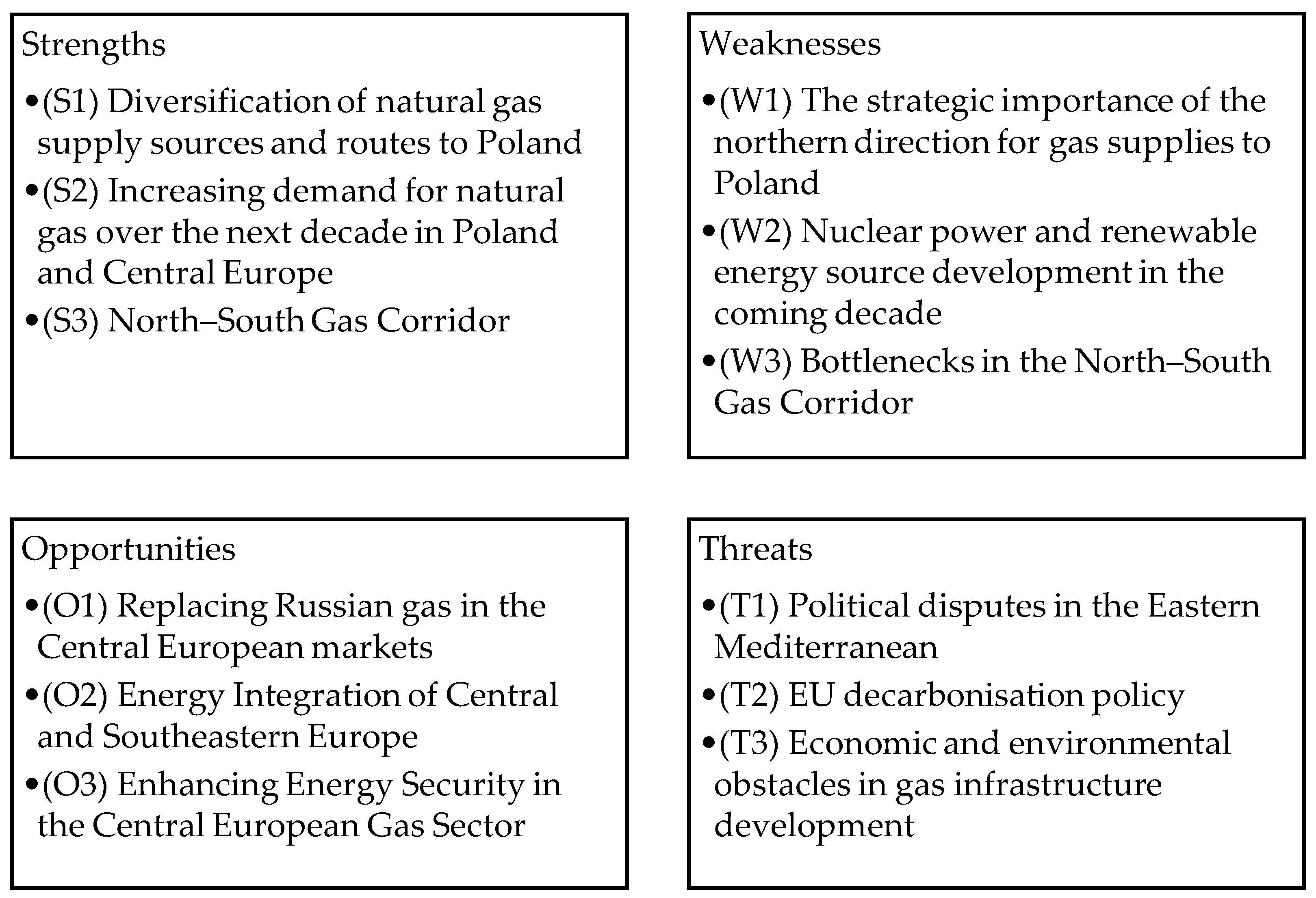

Below, a SWOT analysis is carried out with the primary goal of seeking an answer to the following question: Will the development of gas infrastructure in the Eastern Mediterranean enable the distribution of gas to Central Europe (including Poland) from the southern direction? What are the strengths, weaknesses, opportunities, and threats in this context? This analysis will attempt to formulate a recommended strategy for the Polish gas sector in light of the increase in the significance of the southern direction for natural gas distribution (

Figure 3).

4.1. Strengths

4.1.1. Diversification of Natural Gas Supply Sources and Routes to Poland (S1)

For several years, Poland has been dynamically diversifying the directions of its gas supply in order to become independent from Russia. Undoubtedly, a significant turning point in this regard was the year 2022, when Russian supplies were significantly reduced, and interconnectors with Slovakia and Lithuania and the Baltic Pipe were commissioned. Nevertheless, it should be emphasised that diversification requires further efforts, especially in the distribution of gas from the southern direction. The development of natural gas transmission infrastructure in the Eastern Mediterranean strengthens the possibilities for Central/Southern European countries [

38,

58,

59] and Poland [

57] to access new sources of hydrocarbons. Israel, Egypt, and Cyprus could become strategic gas suppliers over the next two decades [

60]. Importantly, increasing the volume of gas supplies from the southern direction is key in maintaining energy security for Poland, which imports most of its gas via the Baltic Sea. This makes the southern direction all the more important for landlocked CEEs, which are characterised by their dependence on the east and, in particular, Russia, e.g., Hungary. Contracting gas with new partners (Israel, Cyprus, Egypt) will strengthen mutual relations not only economically but also politically.

4.1.2. Increasing Demand for Natural Gas over the Next Decade in Poland and Central Europe (S2)

The commissioning of gas-flow infrastructure from the Eastern Mediterranean could significantly meet the growing demand for this fuel in Poland and other CEEs. The process of decarbonisation of the energy sector in Poland is based on increased consumption of natural gas by power plants, as well as in industry and by households. In line with EPP2040, gas consumption by 2030 will increase by over 3 bcm (in the moderate scenario) even to around 9 bcm (in the optimal scenario), necessitating an increase in gas supply. In the 2030s, natural gas consumption in Poland will remain at 21–27 bcm per year (in recent years, it has fluctuated between 18 and 20 bcm) [

26]. For Slovakia, the Czech Republic, and Hungary, the annual gas consumption in the coming years will be around 25 bcm [

7].

4.1.3. North–South Gas Corridor (S3)

Natural gas is an important energy resource for Poland and other countries in the region, especially those whose electricity generation uses fossil fuels. Most CEEs are effectively modernising and expanding their gas transmission infrastructure [

61]. To ensure energy security, gas interconnectors were also commissioned to integrate the national gas systems (NSGC). The Russian-induced gas crises of a dozen years ago and—even more so—the Russian–Ukrainian conflict underscored the serious weaknesses in the gas sectors of many European countries and the high dependence on Russian raw materials for energy [

62]. This issue particularly concerned the countries in the Visegrad Group, i.e., Poland, the Czech Republic, Slovakia, and Hungary. The NSGC created the possibility of transporting gas to CEEs from a northerly or southerly direction, creating an alternative to the eastern (Russian) direction. In this respect, Poland has developed infrastructure to allow gas supply from the north. There is an LNG terminal in Croatia, which admittedly has a small capacity, but it allows for the supply of gas from the south. Thus, the flow of gas from the Eastern Mediterranean to CEEs can take place via the existing NSGC.

4.2. Weaknesses

4.2.1. The Strategic Importance of the Northern Direction for Gas Supplies for Poland (W1)

The reduction and then complete cessation of gas distribution from the eastern direction to Poland necessitated the creation of alternative supply options. Within a few years, the northern direction, i.e., via the Baltic Sea, has become so important that it is now an indispensable corridor through which the vast majority of natural gas is imported [

63]. It is worth mentioning that as recently as 2015, over 70% of gas entered the Polish market from Russia through the Yamal Pipeline. The commissioning of the Świnoujście LNG terminal has reduced this dependency year on year, but it was not until the construction of the Baltic Pipe and the interconnector with Lithuania that the possibilities for gas distribution from the northern direction were significantly increased. In 2022, more than 40% of the gas imported to Poland was already brought in through the gas port, and it is important to remember that the Baltic Pipe has only been fully utilised since 2023. Bearing in mind the capacity of the existing gas transmission systems on the northern side (a total of around 20 bcm per year), it should be emphasised that their full utilisation makes it possible to meet Poland’s current and future needs. Thus, the southern direction is losing its importance, and, consequently, the expansion of infrastructure to increase its capacity may not be economically viable.

4.2.2. Development of Nuclear Power and Renewable Energy Sources (RESs) in the Coming Decade (W2)

The revised EU and Polish policies on RESs are to the detriment of the expansion of gas infrastructure and the planned increase in its consumption. The Russian–Ukrainian dispute has clearly destabilised the European market for fossil fuels, leading the EU to place greater emphasis on accelerating moves towards zero- or low-carbon economies [

64]. Green energy, such as wind power, solar power, and electromobility, is to be the driving force for deeper change, especially in the power and transport sectors. In many countries, the energy transition will be assisted by nuclear power. In this context, it is worth noting that Poland, which, so far, has not used uranium for energy purposes, plans to commission its first nuclear power plant in 2033 [

65]. The target is to build two large power plants and several small modular reactors. Increased investment in RESs and the integration of nuclear power plants will reduce consumption of fossil fuels.

4.2.3. Bottlenecks in the North–South Gas Corridor (W3)

It is essential to note the emerging disparity in the capacity of entry points in the NSGC. In the case of infrastructure located on the northern side, there are two LNG terminals (Świnoujście, Klaipėda) with a combined capacity of more than 8 bcm per year (with a target of more than 10 bcm) and the Baltic Pipe, which has the potential to deliver 10 bcm. In total, up to 20 bcm can be distributed to Poland via the Baltic Sea. On the southern side, there is only one FSRU in Croatia with a capacity of just 2.9 bcm/year. Furthermore, an even more significant drawback is the interconnectors between CEEs and their low capacities, such as the Croatia–Hungary Interconnector (1.8 bcm/year) or Hungary–Slovakia Interconnector (1.7 bcm/year), as well as the absence of a reverse flow from Hungary to Austria [

66].

4.3. Opportunities

4.3.1. Replacing Russian Gas in the Central European Markets (O1)

Following the Russian–Ukrainian dispute, EU member states declared their intention to phase out Russian energy resources, including natural gas (REPowerEU), in the shortest possible timeframe. However, the lack of alternative gas distribution options for some of the countries makes it impossible to meet this target. This issue is particularly relevant for Central Europe, as the transmission infrastructure in this region mainly allows gas to be transported from Russia [

67]. In 2022, gas deliveries through Ukraine decreased significantly, and notably, the transmission through the Yamal–Europe and Nord Stream pipelines ceased entirely. Transport via the TurkStream route through the Black Sea to Turkey is still ongoing. Currently, Russia is sending about six times less gas to Europe through pipelines than the average in the first half of 2021, but since the fall of 2022, such deliveries have remained relatively stable. Preliminary estimates indicate that in 2022, they amounted to approximately 67 bcm, representing a decrease of around 56% year on year. On the other hand, Russian LNG deliveries increased by over 35% to approximately 19 bcm [

68]. The development of natural gas transmission infrastructure in the Eastern Mediterranean offers an opportunity to further reduce gas coming from Russia. However, it should be noted that the needs are far greater than the assumed capacity of EastMed. Thus, there is an opportunity to boost ventures aimed at increasing production in Israel, Egypt, or Cyprus so that not only gas but also LNG comes to Europe via EastMed [

69].

4.3.2. Energy Integration of Central and Southeastern Europe (O2)

The commissioning of the EastMed pipeline and the development of gas transmission infrastructure in the Eastern Mediterranean create opportunities for improving the political and economic relations between the Middle East and North African countries. Increasing the significance of the southern direction for gas supplies to Europe opens up the possibility of deepening energy integration, especially among the countries of Central and Southeastern Europe. Russia’s policy and the dependence on Russian energy resources in this part of Europe have created an unfavourable situation in terms of energy cooperation. It is only in recent years that the appropriate gas infrastructure has been developed to integrate countries from the Baltic Sea to the Mediterranean and Black Seas [

36]. Access to an alternative source of gas (Israel, Egypt, Cyprus) can boost activities in the area of the development of gas transmission infrastructure between Poland and the Baltic States and Central European and Balkan countries. Strengthening cooperation in the context of natural gas supply can accelerate initiatives aimed at integrating this part of Europe in terms of other energy sectors, such as oil, renewable energy, and more. Furthermore, it will provide an opportunity to increase mutual trade and invigorate economic cooperation.

4.3.3. Enhancing Energy Security in the Central European Gas Sector (O3)

The Russian–Ukrainian conflict has caused significant destabilisation in the natural gas sectors of many European countries, particularly those that are heavily reliant on Russian resources [

70]. It is worth noting that some of these countries have completely severed their cooperation with Gazprom (e.g., Poland), while others have significantly reduced their gas imports (e.g., Germany). Additionally, certain strategic sections of infrastructure have been excluded from gas supplies (Yamal, Nord Stream). Consequently, there is a pressing need to source gas from alternative suppliers. The commissioning of new gas transmission infrastructure from the southern direction will significantly enhance the energy security of CEEs in the natural gas sector. It will create an opportunity to diversify sources of gas supplies for Europe and, importantly, reduce or eliminate Russian resources in future deliveries.

4.4. Threats

4.4.1. Political Disputes in the Eastern Mediterranean (T1)

One of the major threats to the development and functionality of natural gas transmission infrastructure in the Eastern Mediterranean region continues to be unresolved and potentially possible disputes/conflicts between the countries in the region [

71]. For the EastMed project, a significant threat is the conflict in Cyprus between Cypriot Turks and Greeks and, from the international perspective, between Turkey and Greece. This conflict revolves around the boundaries of territorial and economic waters between the Republic of Cyprus and the Turkish Republic of Northern Cyprus, which could hinder the exploitation of resources around Cyprus [

72]. It is worth noting that another concern for EastMed is the signing of a maritime boundary treaty between Turkey and Libya’s Government of National Accord in 2019 [

73]. According to this agreement, an underwater pipeline would pass through Turkish economic waters. Turkey has the ability to effectively block any initiatives by Greece, Cyprus, and Israel concerning infrastructure for transmission to Europe. Unfortunately, relations between the other countries in the region are also fraught with potential for conflict. The relations between Israel and Palestine are certainly among the most difficult, as are those with Lebanon and Egypt. It is important to bear in mind that there is a high risk of further escalation in the region, potentially leading to significant destabilisation.

4.4.2. EU Decarbonisation Policy (T2)

EU decarbonisation policy (REPowerEU, the Green Deal, Fit for 55) should be included in the category of threats to the development of infrastructure for the transmission of gas to Europe from the Eastern Mediterranean. Its fundamental objective is to achieve zero-carbon economies by 2050. In order to achieve this, many EU countries must, in particular, modernise their energy sectors by moving away from sources that emit harmful substances into the environment. This primarily in reference to coal, but also oil and natural gas. A gradual shift away from fossil fuels in the electricity sector towards green energy and increased energy efficiency is planned over the coming years [

74]. One of the assumptions is a 40% reduction in the gas demand of EU countries by 2030 compared to 2021. However, it should not be forgotten that for many countries that are in the process of decarbonisation, natural gas is intended to serve as a bridging fuel, including for Poland. Currently, in some EU countries, such as Germany, a negative trend towards increased natural gas consumption in the coming years can be observed. This is due, in part, to the exclusion of the main source of gas, which was Russia, and the challenges of replacing it [

75]. Consequently, there is an emphasis on the need for much faster modernisation towards a low- or zero-emission economy through investments in green energy. As a result, the gas requirements of many EU countries may be decreasing. Therefore, the commissioning of EastMed in 2027 may not align with the needs of potential gas consumers in Europe. It is worth noting that in 2022, the USA withdrew support for the mentioned project, which was primarily due to its inconsistency with decarbonisation goals.

4.4.3. Economic and Environmental Obstacles in Gas Infrastructure Development (T3)

It should be emphasised that the implementation of the EastMed project has been reviewed and postponed several times for various reasons [

76]. These include disputes over maritime borders between regional countries, Turkish policies, and economic feasibility. The estimated cost of constructing the gas pipeline is USD 6.4 trillion, and without financial support from the EU, it may not be realised. It is essential to remember that the gas is intended for the markets of EU member states, and therefore, it must gain approval from the European Commission and align with the decarbonisation process of EU countries. The price of the resource that guarantees a return on investment and the competitiveness of the newly established infrastructure compared to the existing one are also significant. The payback period is estimated to be 15–20 years; hence, to maintain profitability, EastMed would need to operate at least until 2047. Furthermore, a much more flexible solution for gas-importing countries, especially during energy crises, would be the potential increase in gas flow through existing infrastructure or the purchase of LNG. The technical challenges associated with building a pipeline on a very deep seabed with complex geological structures are substantial. From a climate perspective, even the most cautious estimates attribute a significant climate footprint to the EastMed pipeline: The gas transported in one year would be responsible for emitting 38 million tonnes of carbon dioxide and methane leaks (a greenhouse gas 72 times more potent than carbon dioxide) totalling 365 tons annually. In one year, EastMed would be responsible for greater emissions than the coal-fired power plant in Bełchatów, which currently has the highest emission level in Europe [

77].

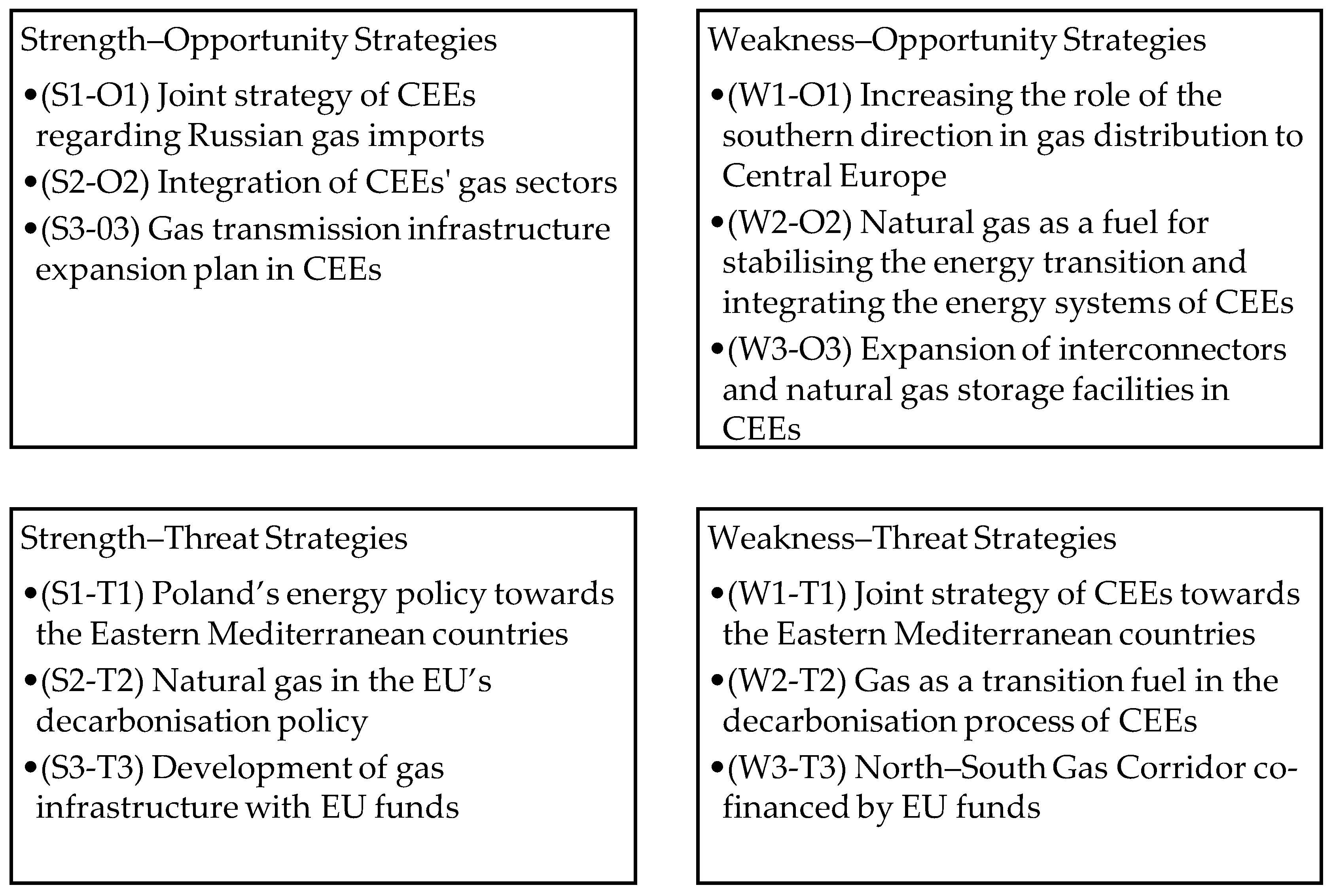

This section presents an SWOT matrix for the distribution of gas to Poland and Central Europe from the Eastern Mediterranean. A portfolio of strategies was created by combining internal factors encompassing

Strengths and

Weaknesses with external factors covering

Opportunities and

Threats. As a result, 12 strategies were developed (

Figure 4).

4.5. Strength–Opportunity Strategies

4.5.1. Joint Strategy of CEEs Regarding Russian Gas Imports (S1-O1)

Poland, along with other CEEs, should develop a joint strategy for dealing with Russian gas imports. Critical to this effort should be coordinated actions that enable the reduction or elimination of Russian supplies in the shortest possible time [

70]. In this context, the expansion of gas transmission infrastructure in Central and Southeastern Europe plays a crucial role. The commissioning of new gas transmission infrastructure from the Eastern Mediterranean to CEEs signifies increased gas distribution capabilities. This not only provides a new source from the southern direction but, more importantly, offers the opportunity to exclude or significantly reduce Russian gas in the markets of CEEs. Poland should take a leadership role in efforts to eliminate Russian natural gas from the region.

4.5.2. Integration of CEEs’ Gas Sectors (S2-O2)

In recent years, there has been a noticeable increase in natural gas consumption in many CEEs. Consequently, for energy security purposes, gas distribution from various sources is desirable. This issue has become more problematic following the Russian–Ukrainian dispute. Unfortunately, integration efforts in the field of transmission infrastructure among CEEs have been insufficient thus far. Each country individually pursues its energy security in the natural gas sector, making it susceptible to threats. Initiatives that promote the integration of gas sectors are essential in the context of energy crises [

78]. They will help enhance energy security and strengthen collective efforts in other economic sectors. In this regard, the commissioning of the relevant infrastructure in the Eastern Mediterranean offers significant potential for enhancing regional energy integration.

4.5.3. Gas Transmission Infrastructure Expansion Plan in CEEs (S3-O3)

The implementation of gas transmission infrastructure projects in the Eastern Mediterranean not only signifies the potential to increase the significance of the NSGC and expand its capabilities—especially regarding interconnectors—but also enhances the energy security of CEEs. Increasing the energy security in the natural gas sector is also an important factor, as there will be an opportunity to improve the distribution of gas from the southern direction, which is an alternative to the current situation. In this context, CEEs should develop a coordinated plan for expanding their gas transmission infrastructure [

79]. The primary goal of this plan should be to increase the operational efficiency (eliminating bottlenecks, increasing gas transmission volumes between countries, and constructing gas storage facilities). Given the current geopolitical situation, the plan should encompass actions for the next decade.

4.6. Strength–Threat Strategies

4.6.1. Poland’s Energy Policy towards the Eastern Mediterranean Countries (S1-T1)

The Polish authorities should amend EPP2040 regarding the gas sector by increasing the importance of the southern direction in gas distribution. This is primarily about measures to enable the supply of this fuel from Israel or Egypt. Poland should make greater efforts to expand the NSGC and support initiatives within the EU to open a gas corridor from the Eastern Mediterranean countries to Europe. Unfortunately, the permanent political disputes in the Middle East, which have, at times, escalated into armed conflicts, may mean that the opportunity to develop a new source of gas for European countries may open up another area of contention. Energy raw material policy is conflictual, as demonstrated by the Turkish–Greek dispute over Cyprus’s hydrocarbon resources and Turkey’s policy of an exclusive economic zone. Thus, the increase in the importance of the southern direction for Poland may face political obstacles.

4.6.2. Natural Gas in the EU’s Decarbonisation Policy (S2-T2)

It is important to remember that the exploitation of the rich energy resources of the countries in the Eastern Mediterranean by EU countries must be coupled with an EU hydrocarbon policy. An important threat to the implementation of infrastructure in this part of Europe may be the decarbonisation policy, which has recently been negative towards increasing natural gas consumption [

80]. Placing more emphasis on the development of RESs and nuclear power may mean that there is no need for investment to develop natural gas transmission infrastructure. Therefore, Poland, as well as other countries will use this fuel to decarbonise their economies, should aim to maintain the status of natural gas as a transition fuel in decarbonisation.

4.6.3. Development of Gas Infrastructure with EU Funds (S3-T3)

The new gas transmission infrastructure in the southeastern part of Europe opens up the possibility of supplying gas from the southern direction (via the NSGC) to CEEs. However, there is a real risk that obstacles of an economic (e.g., unprofitable investments, insufficient investor capital) and an environmental nature (increased environmental risk, EU environmental regulations limiting natural gas consumption) may be an important factor in achieving the above goal. Thus, countries whose energy policies envisage sustaining or increasing their consumption of natural gas should seek to place projects developing gas transmission infrastructure in Central Europe within their PCIs. Support from EU funds is crucial for making international investments [

81].

4.7. Weakness–Opportunity Strategies

4.7.1. Increasing the Role of the Southern Direction in Gas Distribution to Central Europe (W1-O1)

In endeavours aimed at reducing or eliminating CEEs’ dependence on Russian gas, increasing the role of the southern direction is of paramount importance. A significant challenge will be aligning or coming close to the gas transmission capacities from the northern direction (through the Baltic Sea). Therefore, it is necessary to outline a plan for expanding the gas transmission infrastructure in Croatia, with a particular emphasis on increasing the capabilities of the LNG terminal (or potentially commissioning another one) and interconnectors with neighbouring countries [

36]. Regional energy security will be significantly enhanced with the use of transmission infrastructure that connects the NSGC with Balkan countries and further with Trans-Anatolian Gas Pipeline and the Greek gas system.

4.7.2. Natural Gas as a Fuel for Stabilising the Energy Transition and Integrating the Energy Systems of CEEs (W2-O2)

The development of gas infrastructure in Central Europe must be coupled with maintaining the status of natural gas not only as a transitional fuel in the decarbonisation process but also as a stabilising fuel for energy transformation [

82]. This issue is particularly relevant for countries where the power sector relies on coal, such as Poland and the Czech Republic. One element of the transition toward a low-emission economy is replacing coal-fired units with natural gas units in power plants. Periodic increases in natural gas consumption by the power sector stabilise the loss of generating capacity in coal-fired power plants and create opportunities to systematically increase the production of electricity from RESs. Additionally, natural gas can serve as a fuel that integrates energy systems in CEEs through the expansion of cross-border transmission infrastructure and increased economic activity related to gas trade. Establishing stronger dependencies in the natural gas sector may translate into expanded international cooperation in other energy sectors.

4.7.3. Expansion of Interconnectors and Natural Gas Storage Facilities in CEEs (W3-O3)

Undoubtedly, the new infrastructure enabling the transmission of natural gas from deposits located in the Eastern Mediterranean to Europe can have a noticeable impact on the energy security of CEEs in the natural gas sector. However, for the effective utilisation of this new source of gas, it will be necessary to eliminate bottlenecks in the NSGC, including increasing the capacity of interconnectors and expanding national gas systems. Increasing the natural gas storage capacity in CEEs will also be crucial from the perspective of potential gas crises.

4.8. Weakness–Threat Strategies

4.8.1. Joint Strategy of CEEs towards the Eastern Mediterranean Countries (W1-T1)

Political disputes between countries in the Eastern Mediterranean over, among other things, the extraction of and trade in natural gas are all the more likely to strengthen the northern direction for gas supplies for Poland and other CEEs. Russia can exploit the conflicts, i.e., the Greek–Turkish conflict, Cypriot conflict, and Lebanese–Israeli conflict, for its own political and economic goals. Pressure on Turkey, which is significantly dependent on Russian gas, may be of particular importance in this context [

83]. Turkey can effectively block investment in gas transmission infrastructure from fields located around Cyprus and towards Greece. Thus, CEEs (with the EU) should pursue common political and economic objectives related to countries in the Eastern Mediterranean in terms of natural gas distribution. The main focus should be on stabilising the region and working to strengthen mutual trade relations at both the bilateral and EU level.

4.8.2. Gas as a Transition Fuel in the Decarbonisation Process of CEEs (W2-T2)

It is not only the highly conflictual nature of the Middle East and the permanent destabilisation of the region that speaks against investing in gas transmission infrastructure from the Eastern Mediterranean to Europe. An additional factor may be the EU’s tightened decarbonisation policy, which will aim to exclude natural gas from the electricity sector in the coming years. Admittedly, in many EU countries, gas is intended as a transition fuel towards a low-carbon economy, especially in countries that are reducing their coal consumption, i.e., Poland [

3]. Nevertheless, the Russian–Ukrainian conflict has complicated the situation on the gas markets in Europe and prompted more dynamic investment in alternative energy sources, i.e., RESs or nuclear power.

4.8.3. North–South Gas Corridor Co-Financed by EU Funds (W3-T3)

The development of CEEs’ national gas systems, interconnectors, gas storage facilities, LNG terminals, and other necessary gas infrastructure that would increase the importance of the NSGC requires large financial resources and coordinated action at the international level. Thus, any investment should be co-financed by EU funds. Action to include as many investments as possible in the PCI list will be important in this respect. Individual EU countries interested in expanding the NSGC should use the Just Transition Fund. Investors, meanwhile, have the opportunity to benefit from EU funding from, among others, the European Funds for Infrastructure, Climate, and Environment 2021–2027.

5. Conclusions

Considering the selected factors included in the SWOT analysis, it seems that the most connections can be identified within the strengths and threats. In light of this, it is advisable to embrace a conservative strategy. Given the current conditions marked by numerous threats, the key to implementing the transmission infrastructure from the Eastern Mediterranean to Central Europe will be the search for flexible solutions for both consumer and resource-rich countries.

The increased importance of the Eastern Mediterranean in terms of natural gas production and distribution has important implications for the regional natural gas trade. This issue primarily relates to the gas-intensive economies of European countries, which have recently been looking for alternative sources to Russia. Here, we refer to the countries of Central and Southeastern Europe, which were or still are significantly dependent on Russian gas. An example of a complete re-evaluation of the direction of gas supplies is Poland, which, in the wake of the war in Ukraine, abandoned hydrocarbons from Russian. As a result, the eastern direction (Russia), which was dominant in recent decades (up to 90%), has been replaced by the northern direction (via the Baltic Sea/U.S. LNG) [

84]. Nevertheless, in order to achieve a higher level of energy security, it is advisable to strengthen the other directions as well, especially the southern one. The situation in the natural gas sector is definitely more difficult for other CEEs, i.e., Hungary or Slovakia, which, due to their geographical location, do not have direct access to gas that is distributed by sea. It is in their interest to strengthen regional cooperation by, among other things, developing gas transmission infrastructure in directions other than that of Russia. Undoubtedly, the opening of the Eastern Mediterranean Gas Corridor (EastMed) creates new opportunities in this respect. Nevertheless, a number of doubts are being raised about the legitimacy and feasibility of distributing gas from the Middle East. First of all, it should be noted that this is a highly conflicted region, and, therefore, the location of investments, e.g., EastMed, is high-risk. Another issue relates to the potential production of resource states—specifically, whether it will be sufficient enough to meet the needs of consumer states in the short term. Going forward, it cannot be ignored that natural gas is a fossil fuel that is set to be excluded or significantly reduced in EU countries within two decades.

From Poland’s perspective, the development of natural gas transmission infrastructure in the Eastern Mediterranean and the emergence of new gas suppliers in the European market are desirable. This will create conditions for greater energy integration among CEEs and provide an opportunity to alleviate bottlenecks in the NSGC. Most importantly, it will increase the distribution capacity for more gas from the southern direction, which is currently of limited significance. This issue is particularly important in the context of ensuring energy security in the natural gas sector with the goal of achieving a diversified transmission system.

Consideration should be given to the projects that should be implemented to develop infrastructure for the transmission of natural gas from the Eastern Mediterranean. Israel, Egypt, and Cyprus should undoubtedly exploit their gas resources, systematically increase production, and engage in foreign trade. It is in the interest of the EU (especially the CEEs) to support the above measures, as their finalisation will mean greater diversification of gas sources and the possibility of replacing or reducing Russian supplies. The question of transmission technology, i.e., the choice between an offshore pipeline and LNG, remains an open question. Certainly, the commissioning of EastMed with a capacity of 10 bcm with the option to double this would have a significant impact on the regional gas market. There would also be a need to develop gas transmission infrastructure in Central and Southeastern Europe. EastMed could become a fundamental element for an integrated gas pipeline system from the Baltic Sea to the Mediterranean and the Black Sea. However, due to the geopolitical situation in the Middle East and a number of other factors, including economic and environmental factors, it is questionable whether it would be more flexible and efficient for the distribution of gas from the Eastern Mediterranean to expand LNG facilities. It should not be forgotten that following the Russian–Ukrainian dispute, liquefied natural gas has gained importance, especially in Europe. Furthermore, the expansion of LNG infrastructure does not present as many political and economic challenges as the construction of submarine pipelines. Of course, the choice of LNG technology by gas producers (Egypt, Israel, Cyprus) implies the need to significantly increase the capacity of LNG terminals located on the Adriatic and Aegean coasts. For Poland and other CEEs, the key would be the expansion of the terminal on the island of Krk or the commissioning of a new facility in Croatia.

Returning to the main goal of this article, which is to determine the role of the development of gas transmission infrastructure in the Eastern Mediterranean in the process of diversifying gas supply sources for Poland and CEEs, it should be emphasized that it has significant relevance. While it is an option fraught with many threats and is not the only solution for gas supplies, given the evolving geopolitical conditions in Central Europe, it could be an alternative that strengthens energy security in the natural gas sector.

The results that were analysed in this article are associated with certain limitations. They are the result of the research approach, which was consistently implemented. The limitations are related to, among other things, the subject or geographical scope of the research carried out. As for the subject, the research covered only the gas sector of Poland and, on a narrow scale, other CEEs. It must not be forgotten that the southern direction for gas distribution to CEEs involves not only gas from the Eastern Mediterranean countries but also from others. Therefore, the development of gas infrastructure in this part of the Mediterranean Basin is not decisive for the existence and expansion of the NSGC. The considerations focused on selected factors, which also translated into specific strategies. Of course, these issues could also be analysed from other perspectives, and the SWOT analysis can also be extended to include individual factors. It is worth noting that the obtained results are not universal, but they can certainly be used as material for comparative analyses.