Optimal Trading Volume of Electricity and Capacity of Energy Storage System for Electric Vehicle Charging Station Integrated with Photovoltaic Generator

Abstract

1. Introduction

- This paper presents a linear function to represent the daily cost of the EVCS by considering both the installation capacity of the ESS and the electricity trading volume with both the EV charging customers and the power supplier.

- This paper presents new constraints for optimizing the EVCS operating strategy in the case that the EVCS can sell the energy to the power supplier that has to manage the burden of power demand management at peak load hours.

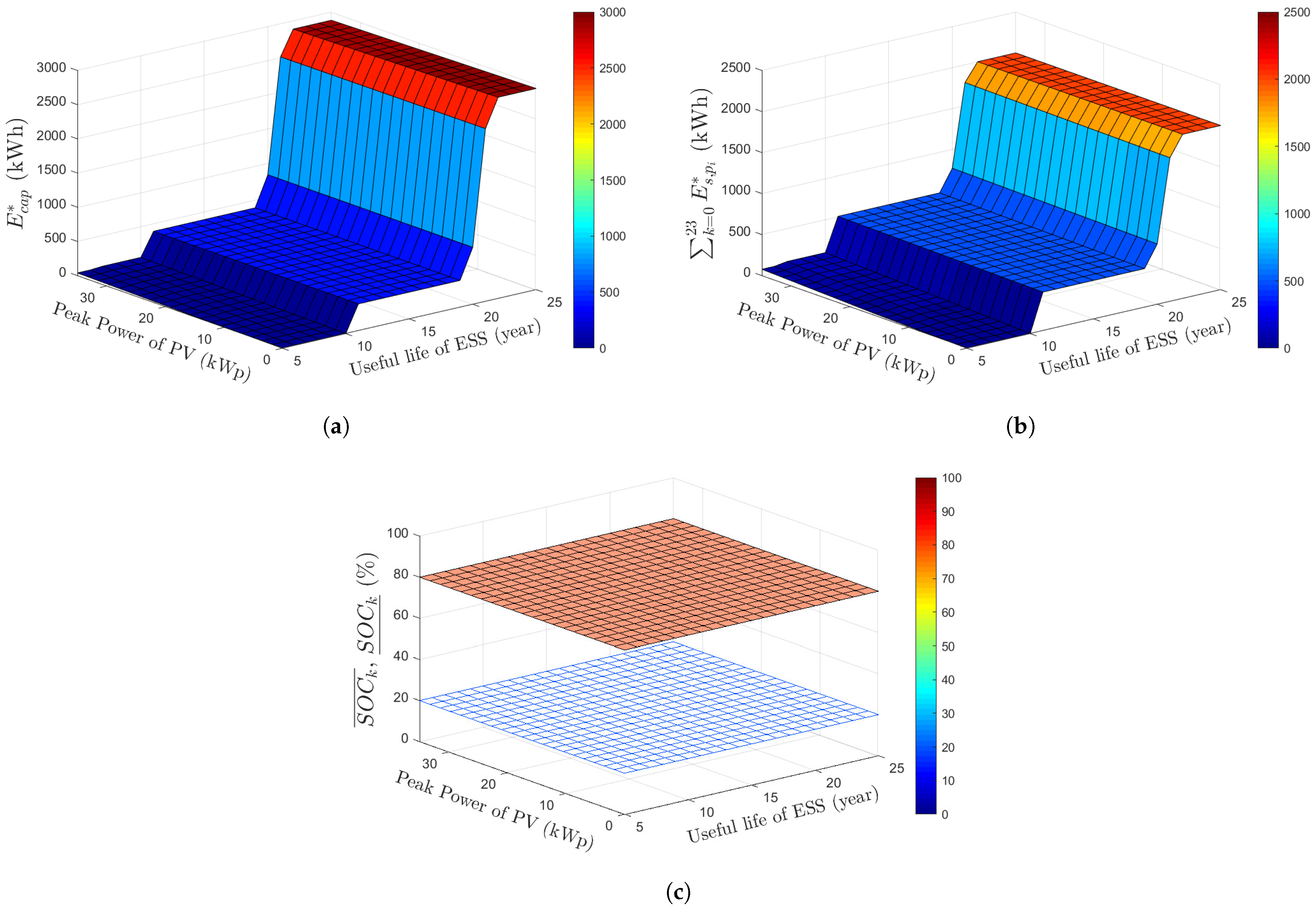

- This paper presents validation results of an optimized solution using linear programming that guarantees a global minimum of EVCS operating costs for various simulation conditions, such as different peak powers of the PV generator, the useful life of the ESS, weather conditions, and EVCS locations.

- This paper presents comparative studies of the daily profits of each EVCS operating strategy between the proposed method and the EVCS operating strategy that does not utilize the ESS and shows the proposed method’s qualitative outperformance.

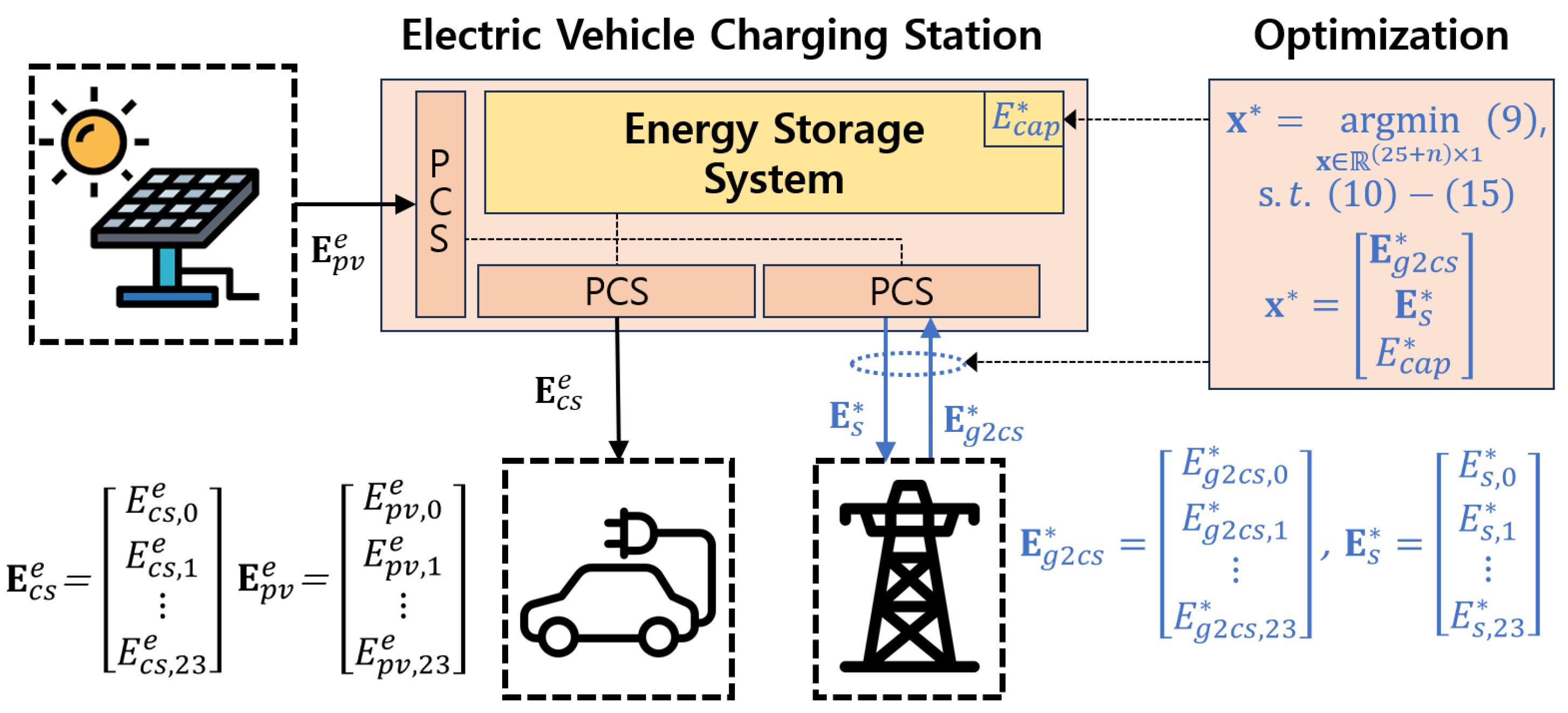

2. Optimization Problem of Electric Vehicle Charging Station

- Energy purchasing from a power supplier.

- Energy stored in the ESS.

- Energy selling to the power supplier.

- Energy saving to the ESS.

3. Validation Results

- Yangjae Solar Station on 9 March 2023, cloudy weather condition,

- Yangjae Solar Station on 21 March 2023, sunny weather condition,

- Suseo Station public parking lot on 9 March 2023, cloudy weather condition,

- Suseo Station public parking lot on 21 March 2023, sunny weather condition.

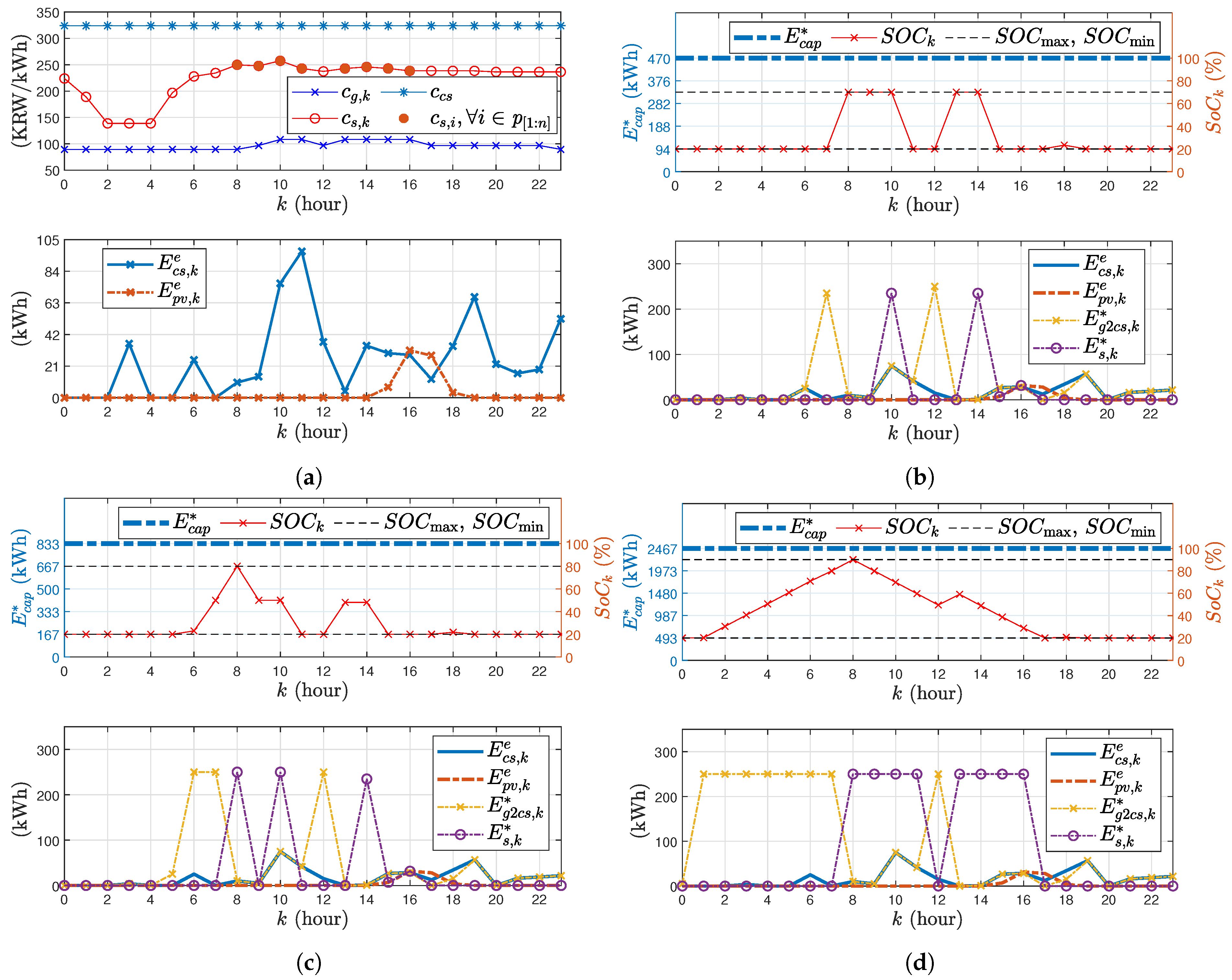

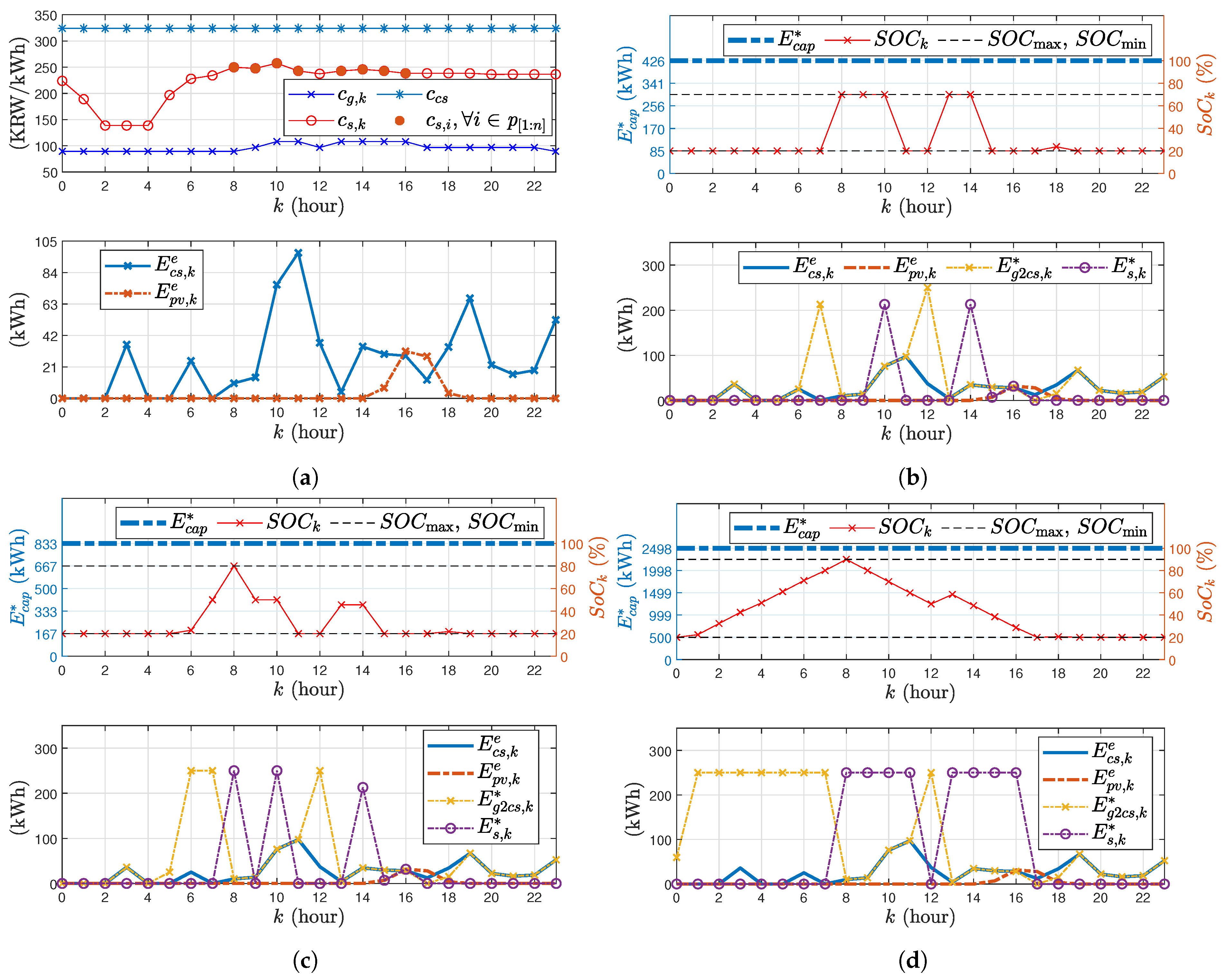

3.1. Validation Result at Yangjae Solar Station on 9 March 2023, Cloudy Weather Condition

3.2. Validation Result, Yangjae Solar Station, 21 March 2023, Sunny Weather Condition

3.3. Validation Result, Suseo Station Public Parking Lot, 9 March 2023, Cloudy Weather Condition

3.4. Validation Result, Suseo Solar Station, 21 March 2023, Sunny Weather Condition

3.5. Comparative Studies of the Proposed Optimized EVCS Operating Strategy with the Conventional EVCS Operation

- Daily profit of the conventional EVCS operating strategy:where is the selling price of EV charging (KRW/kWh).

- Daily profit of the proposed optimization-based EVCS operator:

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kwon, S.; Gil, H.; Baek, S.; Kim, H. Optimal Solution for a Renewable-Energy-Generation System at a Private Educational Institute in South Korea. Energies 2022, 15, 9430. [Google Scholar] [CrossRef]

- Bodansky, D. The Paris climate change agreement: A new hope? Am. J. Int. Law 2016, 110, 288–319. [Google Scholar] [CrossRef]

- Un-Noor, F.; Padmanaban, S.; Mihet-Popa, L.; Mollah, M.N.; Hossain, E. A comprehensive study of key electric vehicle (EV) components, technologies, challenges, impacts, and future direction of development. Energies 2017, 10, 1217. [Google Scholar] [CrossRef]

- Joint Ministries, The 4th Master Plan for Eco-Friendly Vehicles (2021–2025). Available online: https://eiec.kdi.re.kr/policy/callDownload.do?num=210895&filenum=3 (accessed on 2 February 2024).

- Global EV Outlook 2023, IEA, Paris. Available online: https://www.iea.org/reports/global-ev-outlook-2023 (accessed on 25 December 2023).

- Hall, D.; Lutsey, N. Emerging Best Practices for Electric Vehicle Charging Infrastructure; The International Council on Clean Transportation (ICCT): Washington, DC, USA, 2017; Volume 54. [Google Scholar]

- Ahmad, F.; Iqbal, A.; Ashraf, I.; Marzband, M.; Khan, I. Optimal location of electric vehicle charging station and its impact on distribution network: A review. Energy Rep. 2022, 8, 2314–2333. [Google Scholar] [CrossRef]

- Zhang, H.; Moura, S.J.; Hu, Z.; Song, Y. PEV fast-charging station siting and sizing on coupled transportation and power networks. IEEE Trans. Smart Grid 2016, 9, 2595–2605. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, J.; Cai, L.; Pan, J. Expanding EV charging networks considering transportation pattern and power supply limit. IEEE Trans. Smart Grid 2019, 10, 6332–6342. [Google Scholar] [CrossRef]

- Hashemian, S.N.; Latify, M.A.; Yousefi, G.R. PEV fast-charging station sizing and placement in coupled transportation-distribution networks considering power line conditioning capability. IEEE Trans. Smart Grid 2020, 11, 4773–4783. [Google Scholar] [CrossRef]

- Diaz-Londono, C.; Colangelo, L.; Ruiz, F.; Patino, D.; Novara, C.; Chicco, G. Optimal strategy to exploit the flexibility of an electric vehicle charging station. Energies 2019, 12, 3834. [Google Scholar] [CrossRef]

- Timpner, J.; Wolf, L. Design and Evaluation of Charging Station Scheduling Strategies for Electric Vehicles. IEEE Trans. Intell. Transp. Syst. 2014, 15, 579–588. [Google Scholar] [CrossRef]

- Shamsdin, S.H.; Seifi, A.; Rostami-Shahrbabaki, M.; Rahrovi, B. Plug-in Electric Vehicle Optimization and Management Charging in a Smart Parking Lot. In Proceedings of the 2019 IEEE Texas Power and Energy Conference (TPEC), College Station, TX, USA, 7–8 February 2019; pp. 1–7. [Google Scholar] [CrossRef]

- Kuran, M.Ş.; Viana, A.C.; Iannone, L.; Kofman, D.; Mermoud, G.; Vasseur, J.P. A smart parking lot management system for scheduling the recharging of electric vehicles. IEEE Trans. Smart Grid 2015, 6, 2942–2953. [Google Scholar] [CrossRef]

- Deb, S.; Kalita, K.; Mahanta, P. Review of impact of electric vehicle charging station on the power grid. In Proceedings of the 2017 International Conference on Technological Advancements in Power and Energy (TAP Energy), Kollam, India, 21–23 December 2017; pp. 1–6. [Google Scholar]

- Shuai, Z.; Sun, Y.; Shen, Z.J.; Tian, W.; Tu, C.; Li, Y.; Yin, X. Microgrid stability: Classification and a review. Renew. Sustain. Energy Rev. 2016, 58, 167–179. [Google Scholar] [CrossRef]

- Kaur, A.; Kaushal, J.; Basak, P. A review on microgrid central controller. Renew. Sustain. Energy Rev. 2016, 55, 338–345. [Google Scholar] [CrossRef]

- Bayram, I.S.; Michailidis, G.; Devetsikiotis, M.; Granelli, F. Electric power allocation in a network of fast charging stations. IEEE J. Sel. Areas Commun. 2013, 31, 1235–1246. [Google Scholar] [CrossRef]

- Sarker, M.R.; Pandžić, H.; Sun, K.; Ortega-Vazquez, M.A. Optimal operation of aggregated electric vehicle charging stations coupled with energy storage. IET Gener. Transm. Distrib. 2018, 12, 1127–1136. [Google Scholar] [CrossRef]

- Susowake, Y.; Yongyi, H.; Senjyu, T.; Howlader, A.M.; Mandal, P. Optimum operation plan for multiple existing EV charging stations. In Proceedings of the 2018 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Kota Kinabalu, Malaysia, 7–10 October 2018; pp. 611–615. [Google Scholar]

- Zahedmanesh, A.; Muttaqi, K.M.; Sutanto, D. A cooperative energy management in a virtual energy hub of an electric transportation system powered by PV generation and energy storage. IEEE Trans. Transp. Electrif. 2021, 7, 1123–1133. [Google Scholar] [CrossRef]

- Negarestani, S.; Fotuhi-Firuzabad, M.; Rastegar, M.; Rajabi-Ghahnavieh, A. Optimal sizing of storage system in a fast charging station for plug-in hybrid electric vehicles. IEEE Trans. Transp. Electrif. 2016, 2, 443–453. [Google Scholar] [CrossRef]

- Bryden, T.S.; Hilton, G.; Dimitrov, B.; de León, C.P.; Cruden, A. Rating a stationary energy storage system within a fast electric vehicle charging station considering user waiting times. IEEE Trans. Transp. Electrif. 2019, 5, 879–889. [Google Scholar] [CrossRef]

- Hussain, A.; Bui, V.H.; Kim, H.M. Optimal sizing of battery energy storage system in a fast EV charging station considering power outages. IEEE Trans. Transp. Electrif. 2020, 6, 453–463. [Google Scholar] [CrossRef]

- Ihm, J.; Amghar, B.; Chun, S.; Park, H. Optimum Design of an Electric Vehicle Charging Station Using a Renewable Power Generation System in South Korea. Sustainability 2023, 15, 9931. [Google Scholar] [CrossRef]

- Nishimwe, H.L.F.; Yoon, S.G. Combined optimal planning and operation of a fast EV-charging station integrated with solar PV and ESS. Energies 2021, 14, 3152. [Google Scholar] [CrossRef]

- Korea Power Exchange (KPX), Electricity Market Operation Rules. Available online: https://www.kpx.or.kr/board.es?mid=a11002010000&bid=0030&act=view&list_no=71450 (accessed on 2 February 2024).

- Korea Meteorological Administration Weather Data Service, Charging Capacity of Electric Vehicle Charging Stations. Available online: https://www.data.go.kr/data/15098661/fileData.do (accessed on 25 December 2023).

- Public Data Portal, Intensity of Sunlight. Available online: https://data.kma.go.kr/data/grnd/selectAsosRltmList.do?pgmNo=36 (accessed on 25 December 2023).

- Electric Power Statistics Information System, Hourly SMP. Available online: https://epsis.kpx.or.kr/epsisnew/selectEkmaSmpShdGrid.do?menuId=040202&locale=eng (accessed on 25 December 2023).

- Korea Electric Power Corperation, Electric Rates Table. Available online: https://cyber.kepco.co.kr/ckepco/front/jsp/CY/E/E/CYEEHP00203.jsp (accessed on 25 December 2023).

- Validation Results and Plotting Code. Available online: https://github.com/YongWooJeong/energies-17-00936.git (accessed on 25 December 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jeong, Y.W.; Lee, K.-C.; Kim, C.; Choi, W.Y. Optimal Trading Volume of Electricity and Capacity of Energy Storage System for Electric Vehicle Charging Station Integrated with Photovoltaic Generator. Energies 2024, 17, 936. https://doi.org/10.3390/en17040936

Jeong YW, Lee K-C, Kim C, Choi WY. Optimal Trading Volume of Electricity and Capacity of Energy Storage System for Electric Vehicle Charging Station Integrated with Photovoltaic Generator. Energies. 2024; 17(4):936. https://doi.org/10.3390/en17040936

Chicago/Turabian StyleJeong, Yong Woo, Kyung-Chang Lee, Chunghun Kim, and Woo Young Choi. 2024. "Optimal Trading Volume of Electricity and Capacity of Energy Storage System for Electric Vehicle Charging Station Integrated with Photovoltaic Generator" Energies 17, no. 4: 936. https://doi.org/10.3390/en17040936

APA StyleJeong, Y. W., Lee, K.-C., Kim, C., & Choi, W. Y. (2024). Optimal Trading Volume of Electricity and Capacity of Energy Storage System for Electric Vehicle Charging Station Integrated with Photovoltaic Generator. Energies, 17(4), 936. https://doi.org/10.3390/en17040936