Addressing the Renewable Energy Challenges through the Lens of Monetary Policy—Insights from the Literature

Abstract

1. Introduction

2. Materials and Methods

2.1. Research Methods

2.2. Data Sources and Selection

2.3. Visualization Tool

2.4. The Semi-Systematic Method for Content Analysis

3. Results

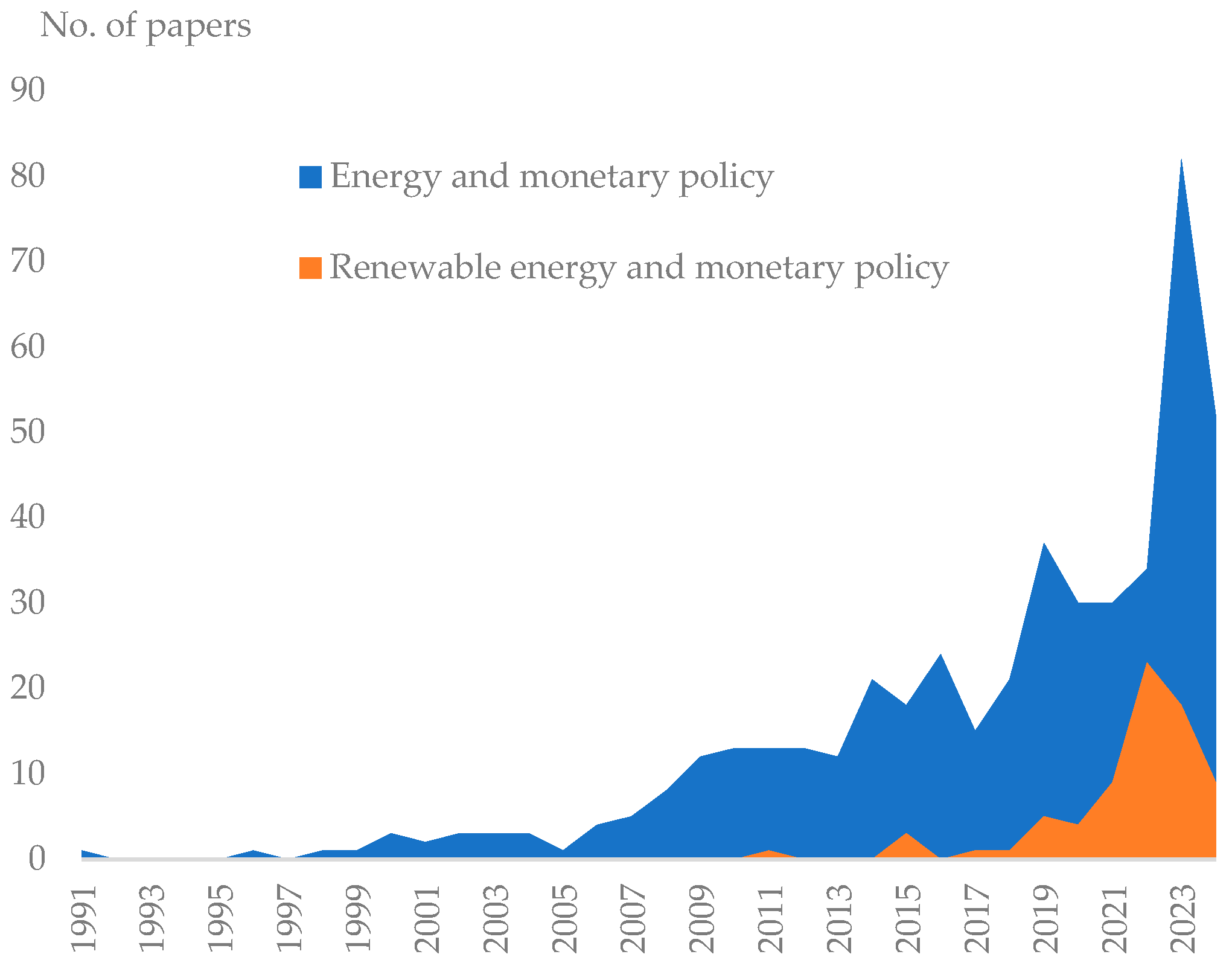

3.1. General Analysis

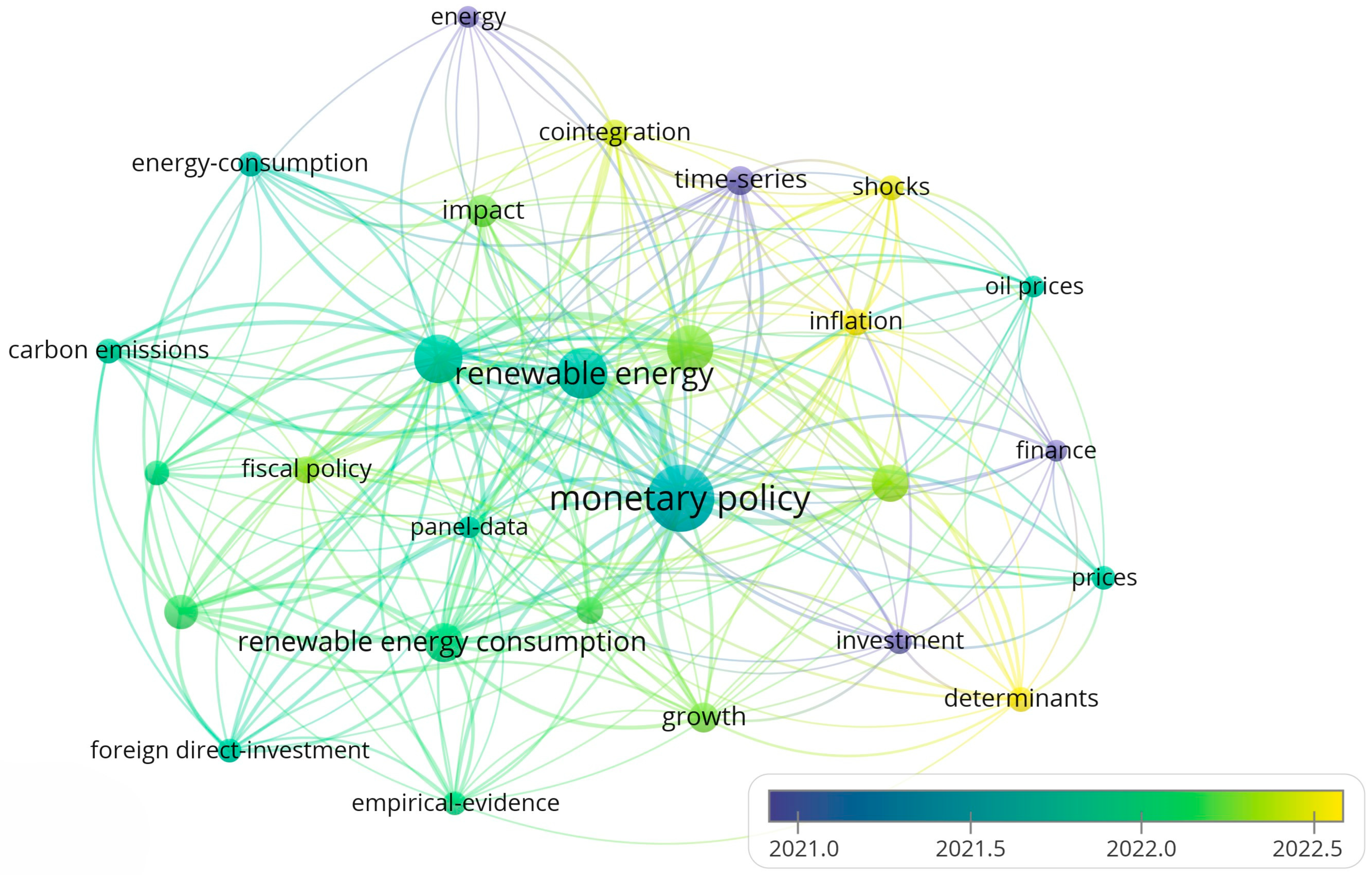

3.2. Keyword Co-Occurrence Analysis

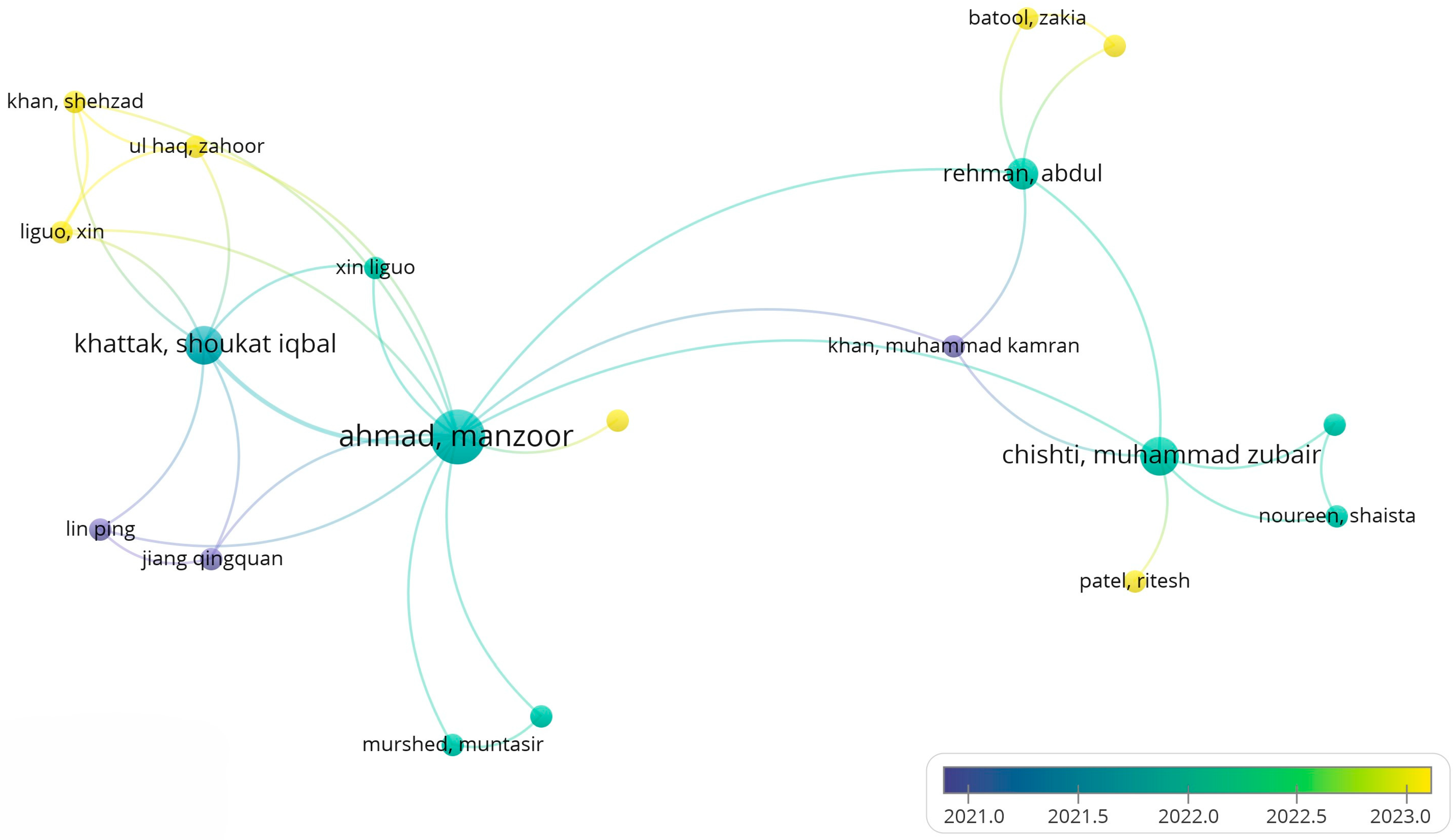

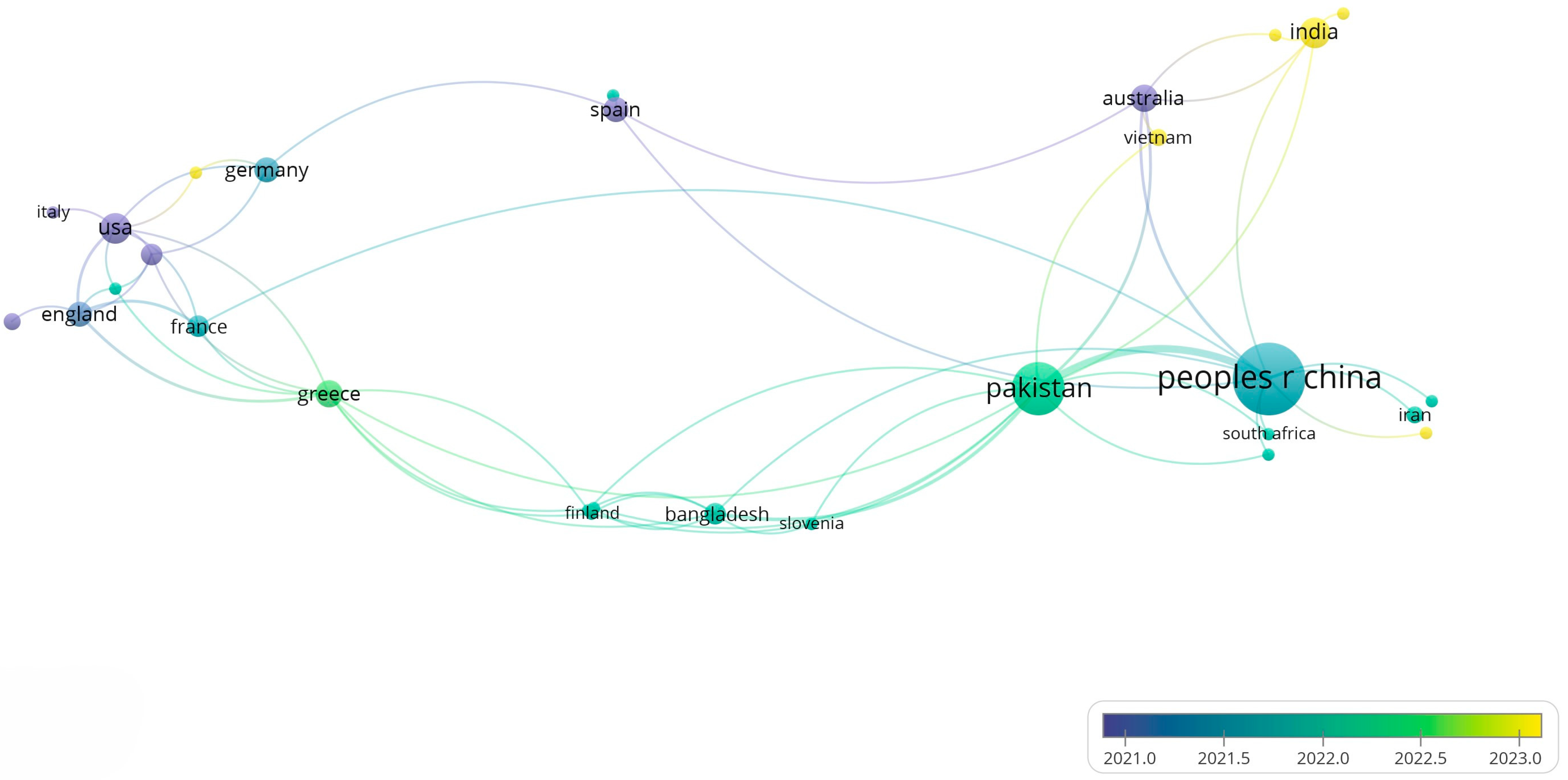

3.3. Collaboration Network Mapping

3.4. Scholarly Co-Citation and Citation Review

3.5. Methodology-Based Groupings for Research Articles

3.6. Insights Derived from Results Analysis

3.6.1. Monetary Policy Stance and the Environmental Quality

3.6.2. Monetary Policy and Renewable Energy Role in the Economy

3.6.3. Monetary Policy and Sustainable Investments

3.6.4. Inflation and the Environmental Quality

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Lupu, I.; Criste, A. Climate Change in the Discourse of Central Banks. Influence on Financial Stability at the European Level. Stud. Bus. Econ. 2023, 18, 235–246. [Google Scholar] [CrossRef]

- Monnin, P. Central Banks and the Transition to a Low-Carbon Economy; Discussion Notes 2018/1; Council on Economic Policies: Zurich, Switzerland, 2018. [Google Scholar]

- Lane, T. Thermometer Rising-Climate Change and Canada’s Economic Future. In Proceedings of the Finance and Sustainability Initiative, Montréal, QB, Canada, 2 March 2017. [Google Scholar]

- Dikau, S.; Volz, U. Central Banking, Climate Change and Green Finance; ADBI Working Paper 867; Asian Development Bank Institute: Tokyo, Japan, 2018. [Google Scholar]

- Dafermos, Y.; Nikolaidi, M.; Galanis, G. Climate Change, Financial Stability and Monetary Policy. Ecol. Econ. 2018, 152, 219–234. [Google Scholar] [CrossRef]

- Volz, U. On the Role of Central Banks in Enhancing Green Finance; Inquiry Working Paper 17/01; UN Environment Inquiry: Nairobi, Kenya, 2017. [Google Scholar]

- Ozili, P.K. Managing Climate Change Risk: The Policy Options for Central Banks. SSRN Electron. J. 2021, 1–12. [Google Scholar] [CrossRef]

- Campiglio, E. Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 2016, 121, 220–230. [Google Scholar] [CrossRef]

- Boneva, L.; Ferrucci, G.; Mongelli, F.P. To Be or Not to Be “Green”: How Can Monetary Policy React to Climate Change? ECB Occasional Paper No. 258; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar] [CrossRef]

- Matikainen, S.; Campiglio, E.; Zenghelis, D. The Climate Impact of Quantitative Easing; Policy Paper; Grantham Research Institute on Climate Change and the Environment: London, UK, 2017. [Google Scholar]

- Rusnok, J. The Changing World of Central Banking. In Proceedings of the Conference of the Czech Economic Society, Prague, Czech, 17 May 2021. [Google Scholar]

- Hansen, L.P. Central banking challenges posed by uncertain climate change and natural disasters. J. Monet. Econ. 2022, 125, 1–15. [Google Scholar] [CrossRef]

- Eames, N.; Barmes, D. The Green Central Banking Scorecard: 2022 Edition; Positive Money: London, UK, 2022. [Google Scholar]

- Lim, W.M.; Kumar, S. Guidelines for interpreting the results of bibliometric analysis: A sensemaking approach. Glob. Bus. Organ. Excell. 2024, 43, 17–26. [Google Scholar] [CrossRef]

- Donthu, N.; Kumar, S.; Mukherjee, D.; Pandey, N.; Lim, W.M. How to conduct a bibliometric analysis: An overview and guidelines. J. Bus. Res. 2021, 133, 285–296. [Google Scholar] [CrossRef]

- Öztürk, O.; Kocaman, R.; Kanbach, D.K. How to design bibliometric research: An overview and a framework proposal. Rev. Manag. Sci. 2024. [Google Scholar] [CrossRef]

- Krauskopf, E. A bibiliometric analysis of the Journal of Infection and Public Health: 2008–2016. J. Infect. Public Health 2018, 11, 224–229. [Google Scholar] [CrossRef]

- Yu, D.; Wang, W.; Zhang, W.; Zhang, S. A Bibliometric Analysis of Research on Multiple Criteria Decision Making. Curr. Sci. 2018, 114, 747. [Google Scholar] [CrossRef]

- Sweileh, W.M.; Al-Jabi, S.W.; Zyoud, S.H.; Sawalha, A.F.; Abu-Taha, A.S. Global research output in antimicrobial resistance among uropathogens: A bibliometric analysis (2002–2016). J. Glob. Antimicrob. Resist. 2018, 13, 104–114. [Google Scholar] [CrossRef] [PubMed]

- Egli, F.; Steffen, B.; Schmidt, T.S. A Dynamic Analysis of Financing Conditions for Renewable Energy Technologies. Nat. Energy 2018, 3, 1084–1092. [Google Scholar] [CrossRef]

- Qingquan, J.; Khattak, S.I.; Ahmad, M.; Ping, L. A New Approach to Environmental Sustainability: Assessing the Impact of Monetary Policy on CO2 Emissions in Asian Economies. Sustain. Dev. 2020, 28, 1331–1346. [Google Scholar] [CrossRef]

- Noureen, S.; Iqbal, J.; Chishti, M.Z. Exploring the Dynamic Effects of Shocks in Monetary and Fiscal Policies on the Environment of Developing Economies: Evidence from the CS-ARDL Approach. Environ. Sci. Pollut. Res. 2022, 29, 45665–45682. [Google Scholar] [CrossRef]

- Liguo, X.; Ahmad, M.; Khattak, S.I. Impact of Innovation in Marine Energy Generation, Distribution, or Transmission-Related Technologies on Carbon Dioxide Emissions in the United States. Renew. Sustain. Energy Rev. 2022, 159, 112225. [Google Scholar] [CrossRef]

- Liguo, X.; Ahmad, M.; Khan, S.; Haq, Z.U.; Khattak, S.I. Evaluating the Role of Innovation in Hybrid Electric Vehicle-Related Technologies to Promote Environmental Sustainability in Knowledge-Based Economies. Technol. Soc. 2023, 74, 102283. [Google Scholar] [CrossRef]

- Huang, W.; Saydaliev, H.B.; Iqbal, W.; Irfan, M. Measuring the Impact of Economic Policies on CO2 Emissions: Ways to Achieve Green Economic Recovery in the Post-COVID-19 Era. Clim. Chang. Econ. 2022, 13, 2240010. [Google Scholar] [CrossRef]

- Chishti, M.Z.; Ahmad, M.; Rehman, A.; Khan, M.K. Mitigations Pathways towards Sustainable Development: Assessing the Influence of Fiscal and Monetary Policies on Carbon Emissions in BRICS Economies. J. Clean. Prod. 2021, 292, 126035. [Google Scholar] [CrossRef]

- Chishti, M.Z.; Patel, R. Breaking the Climate Deadlock: Leveraging the Effects of Natural Resources on Climate Technologies to Achieve COP26 Targets. Resour. Policy 2023, 82, 103576. [Google Scholar] [CrossRef]

- Sohail, M.T.; Xiuyuan, Y.; Usman, A.; Majeed, M.T.; Ullah, S. Renewable Energy and Non-Renewable Energy Consumption: Assessing the Asymmetric Role of Monetary Policy Uncertainty in Energy Consumption. Environ. Sci. Pollut. Res. 2021, 28, 31575–31584. [Google Scholar] [CrossRef]

- Sun, C.; Khan, A.; Liu, Y.; Lei, N. An Analysis of the Impact of Fiscal and Monetary Policy Fluctuations on the Disaggregated Level Renewable Energy Generation in the G7 Countries. Renew. Energy 2022, 189, 1154–1165. [Google Scholar] [CrossRef]

- He, L.; Wu, M.; Zhong, Z.; Xia, Y.; Yu, J.; Jiang, Y. Can Monetary Policy Affect Renewable Energy Enterprises Investment Efficiency? A Case Study of 92 Listed Enterprises in China. J. Renew. Sustain. Energy 2019, 11. [Google Scholar] [CrossRef]

- Alola, A.A. The Trilemma of Trade, Monetary and Immigration Policies in the United States: Accounting for Environmental Sustainability. Sci. Total Environ. 2019, 658, 260–267. [Google Scholar] [CrossRef] [PubMed]

- Chen, S.-S.; Lin, T.-Y. Monetary policy and renewable energy production. Energy Econ. 2024, 132, 107495. [Google Scholar] [CrossRef]

- Razmi, S.F.; Moghadam, M.H.; Behname, M. Time-varying effects of monetary policy on Iranian renewable energy generation. Renew. Energy 2021, 177, 1161–1169. [Google Scholar] [CrossRef]

- Liu, D.; Meng, L.; Wang, Y. Oil price shocks and Chinese economy revisited: New evidence from SVAR model with sign restrictions. Int. Rev. Econ. Financ. 2020, 69, 20–32. [Google Scholar] [CrossRef]

- Cai, Y.; Wu, Y. Time-varying interactions between geopolitical risks and renewable energy consumption. Int. Rev. Econ. Financ. 2021, 74, 116–137. [Google Scholar] [CrossRef]

- Bhowmik, R.; Syed, Q.R.; Apergis, N.; Alola, A.A.; Gai, Z. Applying a dynamic ARDL approach to the Environmental Phillips Curve (EPC) hypothesis amid monetary, fiscal, and trade policy uncertainty in the USA. Environ. Sci. Pollut. Res. 2022, 29, 14914–14928. [Google Scholar] [CrossRef]

- Tufail, S.; Alvi, S.; Hoang, V.-N.; Wilson, C. The effects of conventional and unconventional monetary policies of the US, EU, and China on global green investment. Energy Econ. 2024, 134, 107549. [Google Scholar] [CrossRef]

- Samour, A.; Pata, U.K. The impact of the US interest rate and oil prices on renewable energy in Turkey: A bootstrap ARDL approach. Environ. Sci. Pollut. Res. 2022, 29, 50352–50361. [Google Scholar] [CrossRef]

- Khan, F.U.; Rafique, A.; Ullah, E.; Khan, F. Revisiting the relationship between remittances and CO2 emissions by applying a novel dynamic simulated ARDL: Empirical evidence from G-20 economies. Environ. Sci. Pollut. Res. 2022, 29, 71190–71207. [Google Scholar] [CrossRef] [PubMed]

- Altunöz, U. The nonlinear and asymetric pass-through effect of crude oil prices on inflation. OPEC Energy Rev. 2022, 46, 31–46. [Google Scholar] [CrossRef]

- Yang, J.; Fang, H.; Jing, F. Renewable energy pathways toward carbon neutrality in BRICS nations: A panel data analysis. Econ. Chang. Restruct. 2024, 57, 26. [Google Scholar] [CrossRef]

- Asif, M.; Sharma, V.; Chandniwala, V.J.; Khan, P.A.; Muneeb, S.M. Modelling the Dynamic Linkage Amidst Energy Prices and Twin Deficit in India: Empirical Investigation within Linear and Nonlinear Framework. Energies 2023, 16, 2712. [Google Scholar] [CrossRef]

- Nguyen, T.P.; Tran, T.N.; Dinh, T.T.H.; Hoang, T.M.; Duong Thi Thuy, T. Drivers of climate change in selected emerging countries: The ecological effects of monetary restrictions and expansions. Cogent Econ. Financ. 2022, 10, 2114658. [Google Scholar] [CrossRef]

- Feng, C. Does cyclical innovation in environmental-related technologies make knowledge-based economies carbon neutral? Environ. Sci. Pollut. Res. 2023, 30, 49605–49617. [Google Scholar] [CrossRef]

- Ni, J.; Ruan, J. Does negative interest rate policy impact carbon emissions? Evidence from a quasi-natural experiment. J. Clean. Prod. 2023, 422, 138624. [Google Scholar] [CrossRef]

- Lee, C.-C.; Yahya, F. Mitigating energy instability: The influence of trilemma choices, financial development, and technology advancements. Energy Econ. 2024, 133, 107517. [Google Scholar] [CrossRef]

- Deyshappriya, N.P.R.; Rukshan, I.a.D.D.W.; Padmakanthi, N.P.D. Impact of Oil Price on Economic Growth of OECD Countries: A Dynamic Panel Data Analysis. Sustainability 2023, 15, 4888. [Google Scholar] [CrossRef]

- Zhang, D.; Wang, Y.; Peng, X. Carbon Emissions and Clean Energy Investment: Global Evidence. Emerg. Mark. Financ. Trade 2023, 59, 312–323. [Google Scholar] [CrossRef]

- Jamil, M.; Ahmed, F.; Debnath, G.C.; Bojnec, Š. Transition to Renewable Energy Production in the United States: The Role of Monetary, Fiscal, and Trade Policy Uncertainty. Energies 2022, 15, 4527. [Google Scholar] [CrossRef]

- Agnese, P.; Rios, F. Spillover effects of energy transition metals in Chile. Energy Econ. 2024, 134, 107589. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Abakah, E.J.A.; Shao, X.; Le, T.-L.; Gyamfi, M.N. Financial technology stocks, green financial assets, and energy markets: A quantile causality and dependence analysis. Energy Econ. 2023, 118, 106498. [Google Scholar] [CrossRef]

- Xin, L.; Ahmad, M.; Murshed, M. Toward next-generation green solar cells and environmental sustainability: Impact of innovation in photovoltaic energy generation, distribution, or transmission-related technologies on environmental sustainability in the United States. Environ. Sci. Pollut. Res. 2022, 29, 89662–89680. [Google Scholar] [CrossRef]

- Fazal, R.; Rehman, S.A.U.; Bhatti, M.I. Graph theoretic approach to expose the energy-induced crisis in Pakistan. Energy Policy 2022, 169, 113174. [Google Scholar] [CrossRef]

- Spyromitros, E. Determinants of Green Innovation: The Role of Monetary Policy and Central Bank Characteristics. Sustainability 2023, 15, 7907. [Google Scholar] [CrossRef]

- Bildirici, M.; Çırpıcı, Y.A.; Ersin, Ö.Ö. Effects of Technology, Energy, Monetary, and Fiscal Policies on the Relationship between Renewable and Fossil Fuel Energies and Environmental Pollution: Novel NBARDL and Causality Analyses. Sustainability 2023, 15, 14887. [Google Scholar] [CrossRef]

- Frutos-Bencze, D.; Avdiu, K.; Unger, S. The effect of trade and monetary policy indicators on the development of renewable energy in Latin America. Crit. Perspect. Int. Bus. 2019, 16, 337–359. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Wen, X. Are China’s new energy stock prices driven by new energy policies? Renew. Sustain. Energy Rev. 2015, 45, 624–636. [Google Scholar] [CrossRef]

- Hashmi, S.M.; Syed, Q.R.; Inglesi-Lotz, R. Monetary and energy policy interlinkages: The case of renewable energy in the US. Renew. Energy 2022, 201, 141–147. [Google Scholar] [CrossRef]

- Bletsas, K.; Oikonomou, G.; Panagiotidis, M.; Spyromitros, E. Carbon Dioxide and Greenhouse Gas Emissions: The Role of Monetary Policy, Fiscal Policy, and Institutional Quality. Energies 2022, 15, 4733. [Google Scholar] [CrossRef]

- Bednář, O.; Čečrdlová, A.; Kadeřábková, B.; Řežábek, P. Energy Prices Impact on Inflationary Spiral. Energies 2022, 15, 3443. [Google Scholar] [CrossRef]

- Batool, Z.; Bhatti, A.A.; Rehman, A. Ensuring environmental inclusion in developing countries: The role of macroeconomic policies. Environ. Sci. Pollut. Res. 2023, 30, 33275–33286. [Google Scholar] [CrossRef] [PubMed]

- Guesmi, K.; Makrychoriti, P.; Spyrou, S. The relationship between climate risk, climate policy uncertainty, and CO2 emissions: Empirical evidence from the US. J. Econ. Behav. Organ. 2023, 212, 610–628. [Google Scholar] [CrossRef]

- Benavides, C.; Gonzales, L.; Diaz, M.; Fuentes, R.; García, G.; Palma-Behnke, R.; Ravizza, C. The Impact of a Carbon Tax on the Chilean Electricity Generation Sector. Energies 2015, 8, 2674–2700. [Google Scholar] [CrossRef]

- Arjun; Mishra, B.R. Asymmetric role of environmental policy stringency, fiscal, and monetary policy on environmental sustainability: Evidence from BRICS-T countries. Nat. Resour. Forum 2024. [Google Scholar] [CrossRef]

- Gawel, E.; Lehmann, P. Should renewable energy policy be ‘renewable’? Oxf. Rev. Econ. Policy 2019, 35, 218–243. [Google Scholar] [CrossRef]

- Castelló-Sirvent, F.; Meneses-Eraso, C. Research Agenda on Multiple-Criteria Decision-Making: New Academic Debates in Business and Management. Axioms 2022, 11, 515. [Google Scholar] [CrossRef]

- Dong, J.; Liu, D.; Dou, X.; Li, B.; Lv, S.; Jiang, Y.; Ma, T. Key Issues and Technical Applications in the Study of Power Markets as the System Adapts to the New Power System in China. Sustainability 2021, 13, 13409. [Google Scholar] [CrossRef]

- Qiao, H.; Qin, P.; Liu, Y.; Yang, Y. International energy trade and inflation dynamics: The role of invoicing currency use during the low carbon transition. Energy Econ. 2023, 128, 107178. [Google Scholar] [CrossRef]

- Chang, K.; Zeng, Y.; Wang, W.; Wu, X. The effects of credit policy and financial constraints on tangible and research & development investment: Firm-level evidence from China’s renewable energy industry. Energy Policy 2019, 130, 438–447. [Google Scholar] [CrossRef]

- Ye, X.; Rasoulinezhad, E. Assessment of impacts of green bonds on renewable energy utilization efficiency. Renew. Energy 2023, 202, 626–633. [Google Scholar] [CrossRef]

- Khan, I; Bilal; Tan, D.; Azam, X.; Ye, W.; Tauseef Hassan, S. Alternate energy sources and environmental quality: The impact of inflation dynamics. Gondwana Res. 2022, 106, 51–63. [Google Scholar] [CrossRef]

- Wang, K.; Wang, Y.-W.; Wang, Q.-J. Will monetary policy affect energy security? Evidence from Asian countries. J. Asian Econ. 2022, 81, 101506. [Google Scholar] [CrossRef]

- Musarat, M.A.; Alaloul, W.S.; Liew, M.S. Impact of inflation rate on construction projects budget: A review. Ain Shams Eng. J. 2021, 12, 407–414. [Google Scholar] [CrossRef]

- Andersson, F. Estimates of the Inflation Effect of a Global Carbon Price on Consumer, Investment, Export, and Import Prices; Working Paper 22; Department of Economics, School of Economics and Management, Lund University: Lund, Sweden, 2018. [Google Scholar]

| Keyword | Cluster | No. of Links | Total Link Strength | Occurrences | Avg. Pub. Year | Avg. Citations | Avg. Norm. Citations |

|---|---|---|---|---|---|---|---|

| empirical-evidence | 1 | 17 | 33 | 6 | 2022 | 57.6667 | 3.3701 |

| environmental kuznets curve | 1 | 17 | 42 | 7 | 2022 | 32.1429 | 1.0278 |

| financial development | 1 | 17 | 70 | 13 | 2022.077 | 33.7692 | 1.2502 |

| fiscal policy | 1 | 17 | 39 | 8 | 2022.25 | 30.125 | 0.9989 |

| foreign direct-investment | 1 | 14 | 39 | 6 | 2021.833 | 48.5 | 1.4512 |

| panel-data | 1 | 15 | 21 | 5 | 2021.8 | 66.6 | 1.876 |

| renewable energy consumption | 1 | 23 | 81 | 17 | 2022 | 35.4706 | 1.2621 |

| sustainable development | 1 | 20 | 47 | 8 | 2022.125 | 50.125 | 1.8853 |

| cointegration | 2 | 18 | 37 | 8 | 2022.375 | 11.25 | 0.5482 |

| economic-growth | 2 | 24 | 116 | 23 | 2022.217 | 18.7391 | 0.8457 |

| energy | 2 | 10 | 15 | 5 | 2018.2 | 25.6 | 0.5856 |

| inflation | 2 | 17 | 29 | 8 | 2022.5 | 16 | 0.7697 |

| oil prices | 2 | 14 | 22 | 5 | 2021.8 | 15.2 | 0.8121 |

| shocks | 2 | 15 | 26 | 7 | 2022.429 | 8.8571 | 0.5121 |

| time-series | 2 | 16 | 36 | 9 | 2021 | 43.5556 | 1.6658 |

| consumption | 3 | 19 | 59 | 15 | 2022.267 | 20.6667 | 1.1983 |

| determinants | 3 | 14 | 30 | 7 | 2023 | 9.1429 | 1.7886 |

| finance | 3 | 12 | 16 | 5 | 2020.8 | 37.6 | 0.5887 |

| growth | 3 | 20 | 43 | 10 | 2022.2 | 24.2 | 0.9545 |

| investment | 3 | 13 | 23 | 7 | 2020.571 | 45.2857 | 1.3357 |

| monetary policy | 3 | 26 | 182 | 49 | 2021.551 | 26.7143 | 0.9954 |

| prices | 3 | 11 | 20 | 6 | 2021.833 | 13.5 | 0.2989 |

| carbon emissions | 4 | 14 | 39 | 7 | 2021.857 | 28.2857 | 0.7864 |

| CO2 emissions | 4 | 26 | 126 | 25 | 2021.8 | 31.76 | 1.0955 |

| energy-consumption | 4 | 12 | 30 | 7 | 2021.714 | 29.1429 | 0.8608 |

| impact | 4 | 19 | 38 | 11 | 2022.182 | 15.3636 | 0.5126 |

| renewable energy | 4 | 26 | 121 | 28 | 2021.714 | 23.9286 | 1.1106 |

| Country | Documents | Citations | Total Link Strength |

|---|---|---|---|

| China | 34 | 1193 | 3464 |

| Pakistan | 18 | 578 | 3413 |

| Greece | 5 | 86 | 1018 |

| Bangladesh | 3 | 75 | 840 |

| India | 6 | 50 | 736 |

| England | 4 | 25 | 594 |

| USA | 6 | 109 | 503 |

| Australia | 5 | 107 | 494 |

| France | 3 | 115 | 489 |

| Switzerland | 3 | 236 | 422 |

| Spain | 4 | 37 | 299 |

| Germany | 4 | 64 | 246 |

| Turkey | 5 | 179 | 210 |

| Authors | Variables | Period | Countries | Main Results |

|---|---|---|---|---|

| Chen, S.S.; Lin, T.Y. [32] | Inflation Expectation, GDP Deflator, Real GDP, Effective Federal Funds Rate, Real Oil Price, Renewable Energy Production | 1990–2023 | United States | Renewable energy production declines due to monetary tightening, with solar energy experiencing the most notable impact. |

| Razmi, S.F.; Moghadam, M.H.; Behname, M. [33] | GDP, Oil Price, Consumer Price Index, Money Supply, Real Interest Rate, Renewable Energy Generation | 1984–2016 | Iran | A shock to the money supply is the only factor that can influence all three forms of renewable energy generation (total renewable energy generation, solid biomass and biogas, hydropower, solar, and wind). |

| Liu, D.H.; Meng, L.J.; Wang, Y.D. [34] | Industrial Added Value, Money Supply, Consumer Price Index, West Texas Intermediate Crude Oil Price | 1999–2018 | China | A surge in oil prices adversely affects both economic growth and the money supply. |

| Cai, Y.; Wu, Y. [35] | Geopolitical Risk, Renewable Energy Consumption, GDP, Real Crude Oil Price | 1985–2018 | United States | Renewable energy reduces geopolitical risks, and increasing geopolitical risks tends to boost renewable energy consumption. |

| Authors | Variables | Period | Countries | Main Results |

|---|---|---|---|---|

| Sohail, M.T.; Yu, X.Y.; Usman, A.; Majeed, M.T.; Ullah, S. [28] | Non-Renewable Energy and Renewable Energy Consumption, Monetary Policy Uncertainty Index, GDP, Consumer Price Index, Government Expenditures | 1985–2019 | United States | Renewable energy consumption is negatively influenced by monetary policy uncertainty in both the short and long run, according to the linear model. |

| Altunöz, U. [40] | Crude Oil Prices, Consumer Prices Index, Producer Prices Index, Output Gap | 2000–2021 | Turkey | The long-term effects of crude oil price volatility on Turkey’s consumer and producer price indices are asymmetrical, with price increases having a greater impact than decreases, which implies varied monetary policies to address these fluctuations. |

| Huang, W.J.; Saydaliev, H.B.; Iqbal, W.; Irfan, M. [25] | Total National Expenditure per Person, Traditional and Renewable Energy Use, CO2 Emissions, Monetary Policy | 1990–2016 | European Union countries | Growth-oriented monetary instruments worsened CO2 emissions, but tightening monetary policy mitigated these effects. |

| Alola, A.A. [31] | Uncertainty indices (monetary, trade, migration, financial regulation), Real GDP; CO2 Emissions | 1990–2018 | United States | The monetary policy uncertainty index significantly increases CO2 emissions in the long run. |

| Samour, A.; Pata, U.K. [38] | Renewable Energy Consumption as Share of Total Energy, GDP, Short-term Interest Rate in United States and Turkey, Brent Crude Oil Prices | 1985–2016 | United States, Turkey | US interest rates significantly affect Turkey’s renewable energy usage, driven by income and local interest rate changes. |

| Tufail, S.; Alvi, S.; Hoang, V.N.; Wilson, C. [37] | Green Bonds, Interest Rate, Growth Rate of Money Supply, Financial Development Index, Environment Policy Stringency Index, Climate Vulnerability Index, Energy Tax, Index of Real Global Economic Activity | 1985–2022 | United States, European Union, China | US monetary policy is not supportive of global green investment, with conventional policy ineffective in the long term and unconventional policy negatively affecting short-term investments. In contrast, China and the EU’s unconventional monetary easing policies positively influence green investments. |

| Yang, J.; Fang, H.; Jing, F. [41] | Green Energy Consumption, GDP, Environmental Tax Revenues, Green Finance Market Size, Trade Volume | 1995–2021 | BRICS | BRICS nations’ green fiscal and monetary policies are effective in promoting green energy deployment. However, other factors like trade liberalisation, economic growth, and increased FDI hinder green energy development due to their unsustainable nature. |

| Bhowmik, R.; Syed, Q.R.; Apergis, N.; Alola, A.A.; Gai, Z. [36] | CO2 Emissions, Industrial Production Index, Energy Consumption, Unemployment Rate, Monetary Policy Uncertainty Index, Fiscal Policy Uncertainty Index, Trade Policy Uncertainty Index | 1985–2018 | United States | Monetary policy uncertainty increases CO2 emissions, while fiscal policy uncertainty decreases them, both in the short and long term. Trade policy uncertainty does not appear to affect CO2 emissions. |

| Asif, M.; Sharma, V.; Chandniwala, V.J.; Khan, P.A.; Muneeb, S.M. [42] | Oil Prices, Electricity Prices, Fiscal Deficit, Current Account Deficit, Energy Consumption, Carbon Emissions, Urbanization | 1971–2021 | India | Estimates show a negative relationship between the twin deficit and energy inflation in a symmetric model. In the asymmetric model, energy inflation responds differently to expansionary and contractionary fiscal policies. NARDL estimates reveal distinct impacts of changes in the current account deficit on energy inflation. |

| Noureen, S.; Iqbal, J.; Chishti, M.Z. [22] | CO2 Emissions, N2O Emission, CH4 Emission, Renewable Energy Consumption, Fossil Fuel Consumption, GDP, Interest Rate, Tax Revenue | 1990–2017 | 16 Asian developing countries | Expansionary monetary and fiscal policies worsen environmental quality by increasing greenhouse gas emissions, while contractionary policies mitigate these effects. GDP and fossil fuels are positively associated with pollution, whereas renewable energy improves atmospheric quality. |

| Chishti, M. Z.; Ahmad, M.; Rehman, A.; Khan, M. K. [26] | CO2 Emissions, Real Interest Rates, Tax Revenues (% Of GDP), Fossil Fuels Energy Consumption, Renewable Energy Consumption, Aggregate Domestic Consumption Spending per Capita | 1985–2014 | BRICS | Expansionary fiscal policy exacerbates the harmful effects of CO2 emissions, while contractionary fiscal policy effectively mitigates them. Similarly, expansionary and contractionary monetary policies worsen and improve environmental quality, respectively. |

| Khan, F. U.; Rafique, A.; Ullah, E.; Khan, F. [39] | CO2 Emissions, Renewable Energy, Remittance, Financial Development, GDP | 1990–2019 | Australia, Mexico, Germany, India | Financial development is strongly associated with CO2 emissions in Mexico and India over the long term. Remittances and CO2 emissions in Australia, Germany, and India have a positive relationship, although this relationship is insignificant for Mexico. |

| Authors | Variables | Period | Countries | Main Results |

|---|---|---|---|---|

| Nguyen, T.P.; Tran, T.N.; Dinh, T.T.H.; Hoang, T.M.; Thuy, T.D.T. [36] | CO2 Emissions, Real Interest Rate, Financial Development, Trade Openness, GDP per Capita, Aggregate Domestic Consumption Spending Per Capita | 1998–2018 | 14 emerging economies | Monetary policy has a long-term impact on environmental pollution: raising interest rates reduces CO2 emissions while lowering interest rates increases them. These effects are especially evident at moderate and high levels of CO2 emissions. |

| Wang, K.; Wang, Y.W.; Wang, Q.J. [40] | Imports, Exports, Saving, Interest, Reserves, Price Diesel, Price Gasoline, GDP, Renewable Energy Consumption, Armed Forces Personal | 2000–2019 | 16 Asian countries | The relationship between monetary policy and energy security intensified after the 2008 financial crisis, with more developed economies being more susceptible to energy security challenges due to monetary policy changes. |

| Feng, C. [37] | Innovation in Environmental-Related Technologies, GDP per Capita, Real Interest Rate, Exports of Goods, Renewable Energy Consumption, Imports of Goods, Trade Openness, CO2 Emissions | 1990–2019 | 37 knowledge-based economies | The findings indicate that trade openness, expansionary trade policy, GDP per capita, and expansionary monetary policy lead to higher CO2 emissions, whereas contractionary trade policy and the use of renewable energy reduce CO2 emissions. |

| Lee, C.C.; Yahya, F. [39] | Energy Consumption Volatility, Energy Generation Volatility, Energy Price Volatility, Trilemma Policies, Foreign Direct Investment, GDP, Interest Rate, Total Reserves, Fiscal Procyclicality, Renewable Energy Consumption | 1969–2022 | 184 countries | Empirical findings show that financial openness significantly mitigates energy instability, especially at higher quantiles, outperforming monetary policy independence and exchange rate stability. A fully flexible exchange rate regime with financial openness and monetary policy independence provides comprehensive mitigation. Financial development increases energy volatility, while technology development reduces it, with varying effects from their interactions with monetary policy and other trilemma policies. |

| Ni, J.; Ruan, J.V. [38] | CO2 Emissions, Negative Interest Rate Policy (Dummy), Banks’ Domestic Credit to Private Sector, Renewable Energy Consumption, Income Per Capita, Manufacturing value Added, Urban Population Growth Rate, Share of Final Consumption Expenditure in GDP, R&D Expenditure | 2007–2019 | 45 countries | The results indicate that a negative interest rate policy significantly reduces CO2 emissions, confirmed by robustness tests. This reduction occurs through the exchange rate channel, with varying effectiveness across countries. |

| Deyshappriya, N.P.R.; Rukshan, I.A.D.D.W.; Padmakanthi, N.P.D. [47] | Oil Price, Interest Rate, Government Expenditure, Exchange Rate, Investment, Inflation, Openness, Growth | 2000–2020 | OECD countries | While higher oil prices positively affect growth through interest rates, they negatively impact it via exchange rates, government expenditure, and investment. Overall, the adverse effects outweigh the positive, resulting in a net negative impact on economic growth. |

| Authors | Variables | Period | Countries | Main Results |

|---|---|---|---|---|

| Jiang, Q.Q.; Khattak, S.I.; Ahmad, M.; Lin, P. [21] | CO2 Emissions, Monetary Policy, Income, Remittances, Urbanization, Fossil Fuels, Human Capital | 1990–2014 | Asian economies | Expansionary monetary policy significantly increases CO2 emissions in the long term, while contractionary monetary policy effectively mitigates CO2 emissions. |

| Jamil, M.; Ahmed, F.; Debnath, G.C.; Bojnec, Š. [49] | Total Renewable Energy Production, Industrial Production Index, Consumer Price Index, Monetary Policy Uncertainty Index, Fiscal Policy Uncertainty Index, Trade Policy Uncertainty Index | 1985–2020 | United States | Monetary policy uncertainty decreases renewable energy production in both the long and short run, while fiscal policy uncertainty increases it. Trade policy uncertainty has no effect on renewable energy production. |

| Zhang, D.; Wang, Y.; Peng, X. [48] | Installed Solar Energy Capacity, Real Interest Rate, Lending Interest Rate, Total Greenhouse Gas Emissions, CO2 Emissions, National Policy on Renewable Energy, Population, Total Natural Resource Rents, Real Gross Domestic Product, Trade, Renewable Energy Consumption | 1996–2018 | 9 Asian countries | There is long-term cointegration among solar investment, monetary policies, CO2, GDP, population, energy structure, natural resources, and environmental policy. The findings show that expansionary monetary policy boosts solar investment, which in turn is negatively related to CO2 emissions. |

| Sun, C.; Khan, A.; Liu, Y.; Lei, N. [29] | Total And Separate (Hydro, Wind, Solar) Renewable Energy Generation, GDP Per Capita, Population, Patent Application, Long-Term Interest Rate, Tax Revenue | 2000–2018 | G7 | Fiscal expansion significantly boosts renewable energy generation, while expansionary monetary policy negatively impacts renewable energy investment. This response pattern is consistent across different energy generation levels. Causality tests reveal a unidirectional causality from renewable energy towards fiscal and monetary policy indicators. |

| Liguo, X.; Ahmad, M.; Khattak, S.I. [23] | Import of Goods, GDP per Capita, Renewable Energy Consumption, Export of Goods, Trade Openness, GDP, Interest Rates, International Collaboration in Green Technology Development, Innovation in Marine Energy Generation, Distribution, or Transmission-Related Technologies, CO2 Emissions | 1990–2018 | United States | Trade openness, expansionary monetary policy, and GDP per capita are positively associated with carbon dioxide emissions. Additionally, there is one-way causality from marine energy innovation, GDP per capita, expansionary monetary policy, and trade openness to carbon dioxide emissions. |

| Xin, L.; Ahmad, M.; Murshed, M. [52] | 1990–2018 | United States | Expansionary monetary policy, GDP per capita, and trade openness contribute to increased CO2 emissions. There is a unidirectional causal link between expansionary monetary policy and GDP per capita to CO2 emissions. | |

| Fazal, R.; Rehman, S.A.U.; Bhatti, M.I. [53] | Inflation Rate, Oil Prices, Interest Rate, Money Supply, GDP, Exchange Rate, Unit Value of Import, Unit Value of Export and Output Shortfalls | 1990–2019 | Pakistan | Energy prices and interest rates drive inflation, affecting it from the cost side. Using high interest rates to curb energy-induced inflation can be counterproductive. |

| Spyromitros, E. [54] | Environmental and Total Patents, Broad Money, Real Interest Rate, Central Bank Independence and Transparency, Government Expenditure, GDP, Bureaucracy Index, Temperature Winter, CO2 Emissions, Power Purchasing Parity | 2010–2018 | 109 countries | Green innovation in developing nations is influenced by central bank independence and lower interest rates. In developed countries, expansionary monetary policy, central bank transparency, and energy factors promote green growth, while in Latin American, East Asian, and Pacific countries, they boost green innovation. High institutional quality, industrial concentration, and energy intensity enhance the effect of expansionary monetary policy on green innovation, while inflation and trade openness hinder it. |

| Bildirici, M.; Çırpıcı, Y.A.; Ersin, Ö.Ö. [55] | CO2 Emissions, Energy Consumption, Government Expenditure, Domestic Credits, Real GDP, Technology Patents, Energy Intensity, Renewable Energy and Fossil Fuel Energy Consumption | 1972–2022 | United States | Monetary and fiscal policies asymmetrically impact CO2 emissions. Both types of fiscal policies increase emissions, while contractionary monetary policy reduces them, and expansionary monetary policy worsens environmental degradation. |

| Agnese, P.; Rios, F. [50] | Dow Jones Commodity Index Brent Crude, S&P Global Clean Energy Index, S&P Kensho Electromobility Index, Federal Funds Composite Interest Rate, Bitcoin Price, Gold Price, S&P BVL Peru General Index, S&P ASX 200 Australia, Copper Price, Lithium Carbonate Price, Selective Stock Price Index, Chile’s Interest Rate | 2018; February–December 2020 | Chile | Oil shocks exert strong and significant immediate effects on the clean energy sector, US monetary policy, and Peru’s stock index but have a lesser impact on Bitcoin and Chile’s monetary policy. The global clean energy sector significantly affects all variables in the model except for US and Chilean monetary policies. |

| Tiwari, A.K.; Abakah, E.J.A.; Shao, X.; Le, TN-L.; Gyamfi, M.N. [51] | KBW NASDAQ Technology Index, S&P Green Bond Price Index, MSCI Global Environment Price Index, MSCI Global Alternative Energy Price Index, MSCI Global Pollution Prevention Price Index, MSCI Global Green Building Price Index, Dow Jones Sustainability Index World, S&P GSCI Biofuel Spot Price Index, Solactive Global Solar Price Index, Solactive Global Wind Price Index, S&P Global Clean Energy Price Index, S&P GSCI Natural Gas Spot Price Index, S&P GSCI Petroleum Spot Price Index, DS Coal Price Index | 2016–2020 | Global | Fluctuations in fintech markets impact the stability of renewable and non-renewable energy stocks, green bonds, green equities, and sustainable development, making their price levels more volatile. |

| Authors | Variables | Period | Countries | Method and Main Results |

|---|---|---|---|---|

| Frutos-Bencze, D.; Avdiu, K.; Unger, S. [56] | Current Account Balance, Foreign Direct Investment, Total Reserves, Reserves and Related Items, General Government Final Consumption, Final Consumption, Interest Payment on External Debt, Deposit Interest Rate, GDP, Renewable Energy Consumption, Energy Imports, Alternative Energy, Energy Use | 1992–2014 | Latin America | PCA Trade and monetary policies impact total energy usage and renewable energy consumption. Increasing interest rates, for instance, negatively affect renewable energy consumption, energy imports, and alternative energy usage. Renewable energy development is highly sensitive to these policies. |

| Reboredo, J.C.; Wen, X. [57] | New Energy Index, Subsector Indexes (Solar Energy, Wind Power, Nuclear Energy, Lithium Batteries), Data on Chinese New Energy Policies, interest rate and reserve rate announcements | 2007–2012 | China | GARCH Adjusting interest and reserve rates, along with binding targets and technology R&D, reduced new energy index returns and volatility. For solar energy stocks, these adjustments also decreased returns but increased volatility. |

| Authors | Variables | Period | Countries | Main Results |

|---|---|---|---|---|

| Batool, Z.; Bhatti, A.A.; Rehman, A. [61] | Environmental Inclusion Index, Money Supply, Government Expenditure | 1995–2019 | 51 developing countries | Fiscal and monetary policies can effectively promote a comprehensive clean environment in developing countries. |

| Lingyun He, Meng Wu, Zhangqi Zhong, Yufei Xia, Jiaru Yu, Yunying Jiang [30] | Growth Rate of M2, Monetary Policy Perception Index, Data for 92 Renewable Energy Listed Enterprises | 2007–2017 | China | The impact of monetary policy on investment efficiency varies by transmission channel, with the credit channel being the most significant. Easy monetary policy enhances investment opportunities for renewable energy enterprises and reduces their external financing constraints. |

| Hashmi, S.M.; Syed, Q.R.; Inglesi-Lotz, R. [58] | GDP per Capita, Crude Oil Prices, Real Interest Rate, Renewable Energy Consumption | 1960–2020 | United States | Expansionary monetary policy promotes renewable energy consumption in both the long and short run, with a more substantial impact in the short run. |

| Bletsas, K.; Oikonomou, G.; Panagiotidis, M.; Spyromitros, E. [59] | CO2 or GHG emissions, GDP, Government Expenses, Foreign Direct Investment, M3, Money Market Interest Rate, Central Bank Transparency, Central Bank Independence, Government Effectiveness | 1998–2019 | 95 countries | The main determinants of gas emissions in developing countries are economic growth, government spending, and central bank independence. In developed countries, these determinants include economic growth, government efficiency, and central bank transparency and independence. Improved institutional quality, effective government, expansionary fiscal policies, and central bank transparency help reduce emissions. |

| Bednář, O.; Čečrdlová, A.; Kadeřábková, B.; Řežábek, P. [60] | Share of Gas in Electricity Generation, Annual Inflation Rate, Non-Household Electricity Prices, Share of Renewable Sources on Electricity Consumption | 2009–2021 | European Union and other European countries | The research indicates that a larger share of renewable electricity sources is associated with lower inflation, highlighting the relationship between energy structure and inflationary pressures. Energy price shocks are not isolated incidents. |

| Authors | Variables | Period | Countries | Main Results |

|---|---|---|---|---|

| Guesmi, K.; Makrychoriti, P.; Spyrou, S. [62] | Climate Risk, Climate Policy Uncertainty, CO2 Emissions | 2000–2022 | United States | Natural disaster costs significantly influence CO2 emissions and renewable energy consumption variance in the US. Shocks to disaster costs decrease emissions and increase renewable energy use. Natural disasters increase political disagreement and climate policy uncertainty, highlighting the need for efficient policymaking and regulations. |

| Benavides, C.; Gonzales, L.; Diaz, M.; Fuentes, R.; García, G.; Palma-Behnke, R.; Ravizza, C. [63] | Carbon Tax Applied on the Chilean Electricity Generation Sector, Non-Conventional Renewable Energy Investment Cost Projections, Natural Gas Prices, Electricity Prices, GDP, GHG Emission | 2013–2030 | Chile | Various energy policies, such as non-conventional renewable energy sources and a sectorial cap, are compared with a carbon tax. The results show that while all policies achieve the same GHG emission reduction, the impact of alternative policies on electricity prices and GDP is lower compared to that of carbon taxes. |

| Arjun; Mishra, B.R. [64] | Environmental Policy Stringency Index, Ecological Footprint, Load Capacity Factor, Economic Growth, Renewable Energy Consumption, Government Expenditure, Money Supply | 1990–2022 | BRICS-T | Monetary policy mitigates pollution levels and improves environmental conditions, with significant bidirectional and unidirectional causality between monetary policy and environmental quality. |

| Authors | Countries | Main Results |

|---|---|---|

| Gawel, E.; Lehmann, P. [65] | Germany, United Kingdom, European Union | To maximise social welfare, renewable energy policies should be flexible to adapt to the dynamic development of RES technologies and uncertainties in their costs and benefits. |

| Castelló-Sirvent, F.; Meneses-Eraso, C. [66] | Global | A bibliometric analysis of academic publications on multiple-criteria decision-making. |

| Dong, J.; Liu, D.R.; Dou, X.H.; Li, B.; Lv, S.Y.; Jiang, Y.Z.; Ma, T.T. [67] | China | Propose a basic paradigm for the study of power market research; identifies key issues related to new power system adaptation and aims to promote safe, low-carbon, sustainable development in China’s power industry. |

| Qiao, H.; Qin, P.; Liu, Y.; Yang, Y. [68] | Global | Theoretical modelling shows that with all products priced in US dollars, imported inflation depends on exchange rates. The dominant issuer’s monetary policy has more significant spillover effects. Invoicing renewable energy in alternative currencies makes domestic monetary policy more effective and reduces foreign policy spillovers to domestic inflation. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lupu, I.; Criste, A.; Ciumara, T.; Milea, C.; Lupu, R. Addressing the Renewable Energy Challenges through the Lens of Monetary Policy—Insights from the Literature. Energies 2024, 17, 4820. https://doi.org/10.3390/en17194820

Lupu I, Criste A, Ciumara T, Milea C, Lupu R. Addressing the Renewable Energy Challenges through the Lens of Monetary Policy—Insights from the Literature. Energies. 2024; 17(19):4820. https://doi.org/10.3390/en17194820

Chicago/Turabian StyleLupu, Iulia, Adina Criste, Tudor Ciumara, Camelia Milea, and Radu Lupu. 2024. "Addressing the Renewable Energy Challenges through the Lens of Monetary Policy—Insights from the Literature" Energies 17, no. 19: 4820. https://doi.org/10.3390/en17194820

APA StyleLupu, I., Criste, A., Ciumara, T., Milea, C., & Lupu, R. (2024). Addressing the Renewable Energy Challenges through the Lens of Monetary Policy—Insights from the Literature. Energies, 17(19), 4820. https://doi.org/10.3390/en17194820