Abstract

The carbon emissions trading market is an essential tool for addressing climate change. The carbon emissions trading market has a relatively short history, and the research and management of risks in this market require further development. This paper takes as its research object 1272 pieces of English literature studies published by international scholars and featured on the Web of Science between 2002 and 2024. It uses CiteSpace software to categorize changes in the trends related to carbon market risk research based on time, space, and keyword clustering mapping. The results reveal the following: (1) In terms of the timeline, the risk evolution of the international carbon market is divided into an embryonic period (2002–2007), a developmental period (2008–2018), and a prosperous period (2019–2024); (2) from the perspective of spatial distribution, carbon market risk research institutions are multipolar, with China, the United States, and the United Kingdom, among other countries, issuing more studies on the topic; these studies mainly emerge from universities and research institutions; and (3) in terms of research hotspots, they revolve around four disciplinary issues, namely, primary research related to carbon market risk, carbon market risk categories, carbon market risk measurement, and response programs.

1. Introduction

The carbon emissions trading market is not only an essential tool for combating climate change but is also highly significant in terms of achieving efficient resource allocation and promoting the attainment of carbon neutrality. In 2002, the European Union established a carbon emissions trading system, providing ideas for other countries to reduce emissions. Then, the United States, Canada, and other developed countries set up carbon emissions trading markets (henceforth referred to as carbon markets). Carbon trading products, represented by the EU carbon emission allowances and certified emission reductions (CERs), occupy a significant position in the international carbon market, promoting the development of an efficient, low-carbon economy. The unanimous goal reached by countries at the United Nations Framework Convention on Climate Change in 2023, as agreed to in the Paris Agreement, is to limit the increase in global temperatures to 2 °C in the 21st century. However, according to the Global Inventory Technical Synthesis Report [1], by 2030, there will still be a global emission reduction gap of about 20 billion tons of carbon dioxide. This demonstrates the magnitude of the task of global carbon emissions reduction and the urgency of the situation, rendering it even more necessary to improve and develop the international carbon market. The carbon market as a platform for global emissions reduction also has certain risks; it is affected not only by the external environment but also by market mechanisms. The instability of the carbon market leads to large fluctuations in carbon prices, so there are widespread concerns regarding hotspots in carbon market risk and the evolution of these trends [2,3].

The existing literature on carbon market risk mainly explores the carbon market in terms of risk measurement and the risk relationship between the carbon market and the energy and stock markets [4,5]. However, the period covered in the relevant studies is short, the literature data are scarce, and the studies focus on a specific aspect of carbon market risk, without determining the overall evolutionary trend [6,7]. Other studies focus solely on the institutional dimension of the problem, fail to address the development trends in the research based on the evolutionary perspective, or fail to systematically and comprehensively review carbon market risk research. Based on our literature review, the following research gaps were identified: first, what is the development process of carbon market risk research? Second, what are the knowledge areas and knowledge base of carbon market risk research? Third, what are the most active areas of carbon market risk research at present? Fourth, what are the future research trends related to carbon market risk? In traditional review articles, it is also challenging to effectively collate, comprehensively summarize, and quantitatively analyze a particular field’s development trends and characteristics over a long period and in many studies. Carbon market research is an interdisciplinary field involving environmental science, energy, and economics. Therefore, there is an urgent need for a systematic study of the current status and development trends of carbon market risks. This study introduces the following innovations to answer these questions and fill the research gap. First, the existing literature mainly employs traditional manual reviews and lacks the use of intuitive visualization tools to reveal the characteristics of the literature, which makes it difficult to scientifically determine the evolution, linkages, and growth of carbon market risk research. In this study, CiteSpace analysis is introduced to clarify the development history of carbon market risk and classify the knowledge base and knowledge areas. As a combined visual and quantitative literature review method, CiteSpace analysis can minimize bias and overcome the problems associated with traditional literature reviews to ensure that the conclusions are scientific, objective, and authentic. Second, the existing literature is thematic and national in nature, but lacks a systematic overview of current research hotspots on carbon market risk and attention to research gaps. According to the results of our CiteSpace analysis, the hotspots of carbon market risk research mainly focus on four aspects: basic theory, risk classification, risk measurement, and risk defense schemes. Our analysis of the research hotspots can be used as a reference for subsequent carbon market risk research; meanwhile, it also provides a basis for carbon market regulators to improve risk management. This study explains the research gaps related to carbon market risk at four levels, namely, methodologies for carbon price calculations, carbon market operation mechanisms, carbon market risk management, and the risk spillover relationships between carbon and energy markets. This review can therefore assist scholars in understanding the frontiers of carbon market risk.

On this basis, we use the visualization software CiteSpace to analyze international carbon market risk research. We use scientific knowledge mapping to determine the current status of and development trends in international carbon market risk research. This study begins by describing the gathering of the relevant literature and conducting quantitative and qualitative analyses of these studies. The analysis identifies research gaps and provides guidance for future research directions. The second section of this article outlines the research methodology and data sources. In the third part, the literature is first quantitatively analyzed in terms of its temporal distribution, spatial distribution, keyword frequency, and centrality. Then, the critical scientific issues in the hotspots of carbon market risk are summarized via a qualitative analysis of the relevant literature, revealing the evolutionary trends in research into carbon market risk. Finally, we discuss the research outlook of international carbon market risk.

2. Materials and Methods

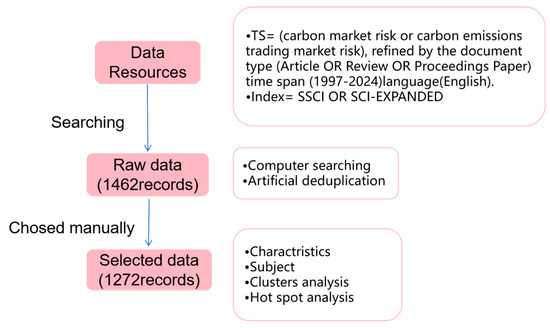

The textual data were obtained from the SCI and SCI–EXPANDED databases in the core database of Web of Science, and the types of literature selected were article, review, and proceeding papers. Because the Kyoto Protocol marked the birth of the international carbon trading model, the time of the adoption of the Kyoto Protocol in December 1997 was taken as the starting point, and the research period extended up to 31 March 2024. The keywords “carbon market risk” and “carbon emissions trading market risk” were used for screening. Finally, English was selected as the language. By removing duplicates and irrelevant articles, 1272 highly relevant articles were obtained, as shown in Figure 1.

Figure 1.

Literature search process.

This paper uses CiteSpace 6.1R6, which combines econometrics and visualization to summarize the knowledge contained in the database and provide a complete description of the structure, frequency, and distribution of the studies. It also generates a scientific visualization of research development, evolutionary trends, and internal logical relationships. Compared with traditional methods, it can effectively, systematically, and comprehensively sort out the development of the discipline and explore the research hotspots and changing trends in the field [8].

CiteSpace has four leading roles. The first is to summarize the existing domestic and international research from a big data perspective. Second, it identifies core research themes based on the authors’ perspective and keywords. Third, it provides insight into the process and patterns of the evolution of the academic discipline over time. Fourth, it determines the publication status of researchers and institutions in terms of their geospatial distribution.

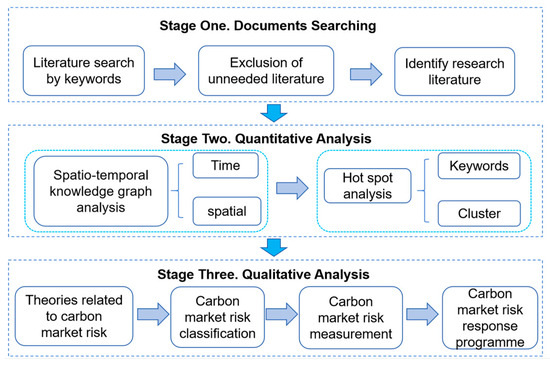

The research methodology of this paper is divided into three main steps, as shown in Figure 2. In the first step, the 1272 papers to be studied were extracted from the Web of Science through a literature search and screening. In the second step, quantitative analyses were conducted based on the results derived from CiteSpace 6.1R6. The quantitative analysis included the spatial and temporal distribution of studies related to carbon market risk, keywords, and hotspot trends. In the third step, detailed qualitative analyses were conducted with cluster analyses from the four carbon market risk research themes. These themes are theoretical studies related to carbon market risk, carbon market risk classification, carbon market risk measurement, and carbon market risk response options.

Figure 2.

Program.

3. Results and Analyses

3.1. Spatiotemporal Knowledge Mapping and Research Trend Analysis

3.1.1. Time Distribution

The literature related to carbon market risk varies widely in terms of its temporal distribution. The literature on carbon market risk was first published in 2002, so we count the number of publications and the cumulative number of publications in the relevant literature from 2002 to March 2024 (Table 1). As shown in Figure 3, the number of articles on the topic of carbon market risk exhibits a general upward trend, and the evolution of carbon market risk research can be divided into three stages in terms of time.

Table 1.

Distribution of annual publications and cumulative number of publications of carbon market risk research.

Figure 3.

National collaborative network for carbon market risk research.

The first stage was the embryonic stage, from 2002 to 2007, when the literature on carbon market risk showed a slow growth trend, but the number of publications was, at most, 10 per year. Since the industrial revolution, the rapid increase in the global population and the booming development of the industrial economy have accelerated the consumption of natural resources, and the conflict between economic development and resources and the environment has become increasingly acute; at this time, scholars began to pay attention to environmental problems, especially the problem of global warming. The 1992 Convention proposes that each State Party should control the emissions of greenhouse gases and maintain the concentration of greenhouse gases at a stable level in order to delay the effect of global warming. The 1992 UNCED Statement of Principles on Forests emphasized the important role that forests play in the global carbon cycle and the potential role of carbon sinks in mitigating greenhouse gas emissions. The Kyoto Protocol was adopted in Kyoto, Japan, in 1997, introducing three new compliance mechanisms: International Emission Trading (IET), Joint Implementation (JI), and the Clean Development Mechanism (CDM); it also set two compliance periods. The Kyoto Protocol marked the birth of the international carbon trading market. It promoted scholars’ research on the global carbon market, but the research was in its infancy during this stage, with few scholars and few publications.

The second stage was the development period, from 2008–2018, during which the publication of literature on carbon market risk grew exponentially; in 2018, the annual number of publications was close to 100. With the development of society, scholars have broadened their fields of research and started to look into carbon neutrality from different perspectives. In the area of energy fuels, as biofuels based on food crops have been widely criticized, scholars have turned their attention to second-generation biofuels based on wood and explored the nature of bioenergy and carbon emissions. Regarding power systems, the European Union proposed the use of renewable energy and the improvement of energy efficiency in 2008, and research on renewable energy, energy policy, energy security, and energy efficiency continued to develop. In terms of technology, some scholars began to study carbon capture utilization and storage (CCUS) technology and continued to explore the theory and feasibility of implementing CCUS technology. The entry into force of the Kyoto Protocol in 2005 inspired scholars to study the carbon market, and the 2009 Copenhagen Climate Conference upheld the principle of “common but differentiated responsibilities” and the mandate of the Bali Road Map. More countries and regions joined the climate governance team; at the same time, more scholars drew attention to carbon emissions and carbon neutrality. The 2030 Agenda for Sustainable Development, adopted at the seventeenth session of the United Nations in 2015, further emphasized the importance of environmental goals and global governance in global development. In the same year, the Paris Agreement, adopted in December, ceased distinguishing between the obligations of developed and developing countries and proposed limiting the increase in global temperature to less than two degrees Celsius in the twenty-first century, with successive countries and regions proposing emission reduction targets related to carbon neutrality or net-zero emissions. The number of scholars working in this field increased, the number of publications grew, and the research content became richer.

The third stage is a period of flourishing, spanning from 2019–2024, with a rapid rise in international publications, averaging over one hundred publications per year. The 2017 Carbon Neutral Alliance Statement set out a commitment to achieve zero carbon emissions by the middle of the 21st century, and, in November 2018, the European Commission published a policy paper on ‘Net Zero Emissions 2050’. The 2019 European Green Deal established that Europe would be the first region in the world to become carbon neutral by 2050, setting a good example for global climate governance. As of September 2023, 151 countries around the world have proposed carbon neutrality targets, covering 92 percent of GDP (PPP), 89 percent of the population, and 88 percent of emissions. The Paris Agreement, adopted in December 2015, no longer distinguishes between the obligations of developed and developing countries and limits global temperature rise to two degrees Celsius in the 21st century. Based on the development of the carbon market and the research cycle of scholars, the number of articles published by scholars did not increase significantly in the second phase, but there was a surge in the number of articles published in the third phase, and the research grew deeper.

3.1.2. Spatial Distribution

In this section, we analyze the spatial distribution of carbon market risk research in terms of the distribution of carbon market risk publications by country, institution, and journal.

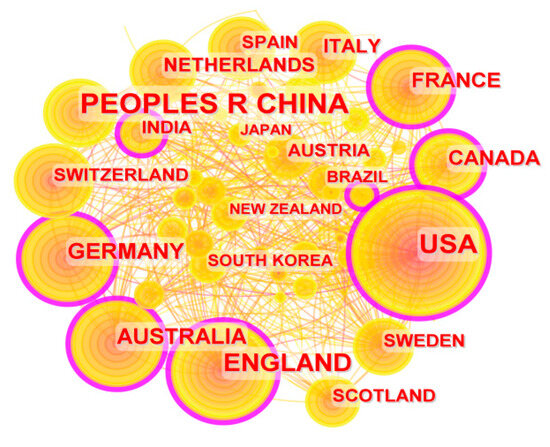

By exploring the regional distribution of carbon market risk research and the cooperation between countries, a map of national cooperation networks for carbon market risk research was generated, as shown in Figure 4. Figure 4 shows that the retrieved studies represent 89 countries or regions, and the overall density of the network is 0.1399, which represents a high level of inter-country cooperation. The node size shows the multi-polarization of the issuing regions, with China at the top of the list in terms of the number of articles issued (n = 391), followed by the US, England, Australia, and Germany, among others. According to the World Bank’s official website for 2020, the country with the highest carbon emissions is China, accounting for about 30 percent of the global total. China has pledged to achieve peak carbon dioxide emissions by 2030 and work towards carbon neutrality by 2060. In the face of the vast and urgent pressure to reduce emissions, Chinese scholars have been more active in researching the improvement of the carbon market and risk avoidance in their country, and they are at the top of the list in terms of the number of articles published. The shade of color of the outer ring of the node represents the degree of centrality. The UK has the highest centrality, with a centrality value of 0.19, followed by Australia, the USA, Malaysia, and Germany, among others. The centrality of these countries is shown by the fact that they play a “bridging” role in the study of carbon market risk. As a country that achieved industrialization earlier, the UK’s high energy consumption and pollution-intensive approach to economic growth has forced it to urgently seek a sustainable development path. The United Kingdom, in 2002, became the first country to implement a greenhouse gas trading mechanism. In 2008, the UK published the Climate Change Act, which proposed reducing greenhouse gas emissions by more than 80 percent from 1990 levels by 2050, well above the carbon reduction requirements set by the EU. Therefore, British scholars’ research on the carbon emissions trading market started earlier and they have published more papers, laying a strong foundation for other countries to study their carbon markets.

Figure 4.

Institutional collaboration network for carbon market risk research.

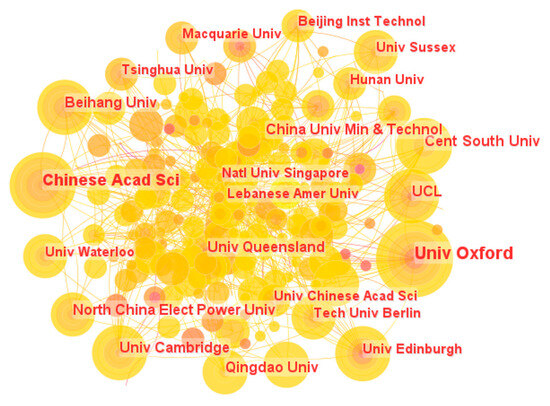

We then explored the institutional cooperation and distribution of carbon market risk and generated an institutional distribution cooperation network map, as shown in Figure 5. Figure 5 shows that a total of 619 institutions or organizations worldwide have published papers on carbon market risk. However, there needs to be more cooperation between institutional organizations, and the network density is only 0.005. The University of Oxford published the most articles (n = 26), followed by the University of the Chinese Academy of Sciences, Central South University, University College London, and Beijing University of Aeronautics and Astronautics, among others. However, the University of Edinburgh has the highest centrality, with a value of 0.12, followed by the University of Oxford, the University of the Chinese Academy of Sciences, and the University of Cambridge. These organizations play a crucial role in carbon market risk research.

Figure 5.

Keyword co-occurrence map of carbon market risk research.

In addition, journals on the theme of carbon market risk are ranked from highest to lowest in terms of number of articles published (Table 2). This table only lists the top ten journals in terms of the number of articles issued. Table 1 shows that the top three journals in terms of the number of articles issued are Energy Economics, Sustainability, and Energy Policy. The main research interests of the Energy Economics journal relate to the development, conversion, and use of energy, energy commodity and derivatives markets, and environment and climate. Sustainability covers climate change, urban planning, renewable energy, health, and other topics. Energy Policy’s topics include energy and environmental regulations, the security of the energy supply, the quality and efficiency of energy services, market-based approaches, and the effectiveness of government intervention. Regarding the thematic characteristics of the journals, most of the journals that publish on carbon-trading risks focus on the related fields of energy, climate, and environment.

Table 2.

Number of publications on carbon market risk research.

3.2. Content Knowledge Mapping and Research Trend Analysis

3.2.1. Keyword Co-Occurrence Analysis

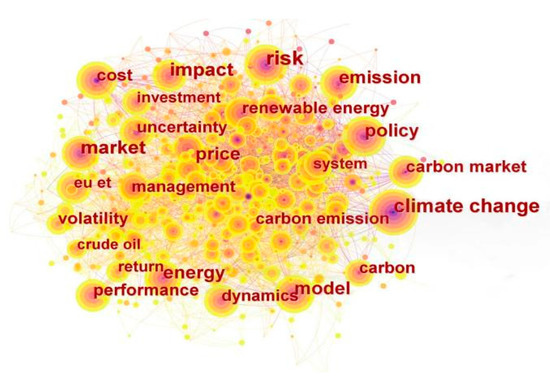

CiteSpace 6.1R6 software was used to map the co-occurrence of keywords (Figure 5). Excel software was used to count the 15 keywords with the highest frequency of occurrence and the 15 keywords with the highest degree of centrality (Table 3). As shown in Figure 5, there are 994 keywords for carbon market risk research, with a network density of 0.0107. Table 3 shows that, in terms of the number of keywords, RISK, CLIMATE CHANGE, IMPACT, and MARKET receive more attention from scholars. Regarding centrality, the words carbon market, carbon, dynamics, and mission are more centered and related to other words. Summarizing the keywords condensed them into three types of issues: basic carbon market research (including carbon market characteristics, carbon emission costs, carbon sink prices, climate change, etc.), applications and technologies (including risk measurement, clean energy technologies, carbon sequestration, etc.), and risk management options (including climate policy, energy markets, national governance, etc.).

Table 3.

Carbon market risk research keywords statistics.

The topic of carbon market fundamental research mainly includes keywords such as “carbon market volatility”, “carbon allowance price”, “carbon emission reduction cost”, “climate change”, “carbon dioxide emission”, “ emissions”, and “carbon dioxide emissions”. With the rapid development of industry, global climate change caused by carbon dioxide emissions is becoming increasingly more serious. Excessive CO2 emissions are having a catastrophic impact on global climate, ecosystems, and species. By 2022, the global atmospheric concentration of CO2 was close to 0.042 percent, far exceeding the requirement of “below 0.035 percent” set by the Paris Climate Conference in 2015; this will lead to an increase in global average temperature by more than 1.5 degrees Celsius compared with pre-industrial levels. At present, most countries still rely on thermal power generation, mainly due to the insufficient storage and peaking capacity of new energy power. Statistics show that about 47 percent of global CO2 emissions come from electricity and heat production, 25 percent from the transport sector, and 18 percent from chemical, petrochemical, iron and steel, cement, paper, and other industrial production areas. Climate change is the leading cause of the global demand for carbon emission reductions, and the carbon trading mechanism is mainly a national sector that sets a cap on corporate GHG emission allowances and penalizes emissions that exceed the quota [9,10]. The carbon emissions trading mechanism is a market-based means of reducing carbon emissions, and the allocation of carbon emission allowances is the basis and core of the smooth operation of the carbon market. Currently, there are two types of emissions trading: the total control and trading model (absolute control) and the baseline and credits model (relative control). The EU ETS constitutes total trading, and the key to the implementation of this program lies in the determination of the total amount and the allocation of the initial allowances. Meanwhile, the baseline and credits model is a project-based carbon emissions control model, in which the actual emissions are calculated, and if the actual emissions are lower than the baseline, they can be sold after certification. The initial quota methods in global carbon trading markets can be categorized into unpaid quota allocation (including historical and baseline methods) and paid quota allocation (including auction and pricing methods), with each of the different quota methods having its own advantages and disadvantages. An important way to reduce carbon emissions is to participate in carbon emissions trading, in which the individual carbon trading mechanism is an important means of cutting carbon emissions on the consumption side. The implementation of individual carbon trading results in a loss of welfare for high-income groups and an increase in the welfare of low-income groups, helping to promote social equity. The concept of individual carbon trading was proposed by Fleming under the framework of austerity and convergence, whereby government departments should set a carbon reduction target and allocate it to each consumer in a reasonable way, i.e., through a market trading mechanism that prompts consumers to take the initiative to reduce carbon emissions. Individual carbon trading mechanisms need to take into account factors such as individual carbon account management, market operations, regulation, permit allocation, and transaction costs. Enterprises need to manage the total amount of greenhouse gases they emit by reducing emissions independently or by buying allowances from the market to offset excess emissions. Establishing the carbon market mechanism guides enterprises in their transformation to low-carbon development methods, which is where the cost of carbon emission reduction lies. Investment has also tended to be more orientated towards low-carbon industries, which not only promotes the development of these industries, but also promotes low-carbon technological progress. The price of carbon allowances is the core issue in the carbon market, which is more volatile than other markets; this is because the price of carbon allowances is unstable, due to the influence of macroeconomics, policies, and the initial allocation of allowances, among other factors. Long-term price volatility affects investors’ enthusiasm for investment, which is not conducive to the long-term stable development of the carbon market. Continued low-carbon prices will not only impact investors’ motivation to update low-carbon technologies but will also result in a significant increase in production and emissions within a short period, leading the value of the carbon market to be better than nothing [11,12]. After two episodes of dramatic price volatility in the EU market, management introduced the Quantity Stabilization Mechanism for Carbon Prices (QSM) in 2021, a program that uses control of the stock of carbon market allowances to stabilize the carbon price.

Regarding techniques and applications, scholars have, on the one hand, continued to discover more accurate risk measurement methods based on their predecessors, such as the use of GARCH models and extreme value theory combined with VaR when measuring single-factor risks. When measuring multifactorial risk, the results obtained using Copula in combination with VaR are more accurate [13,14]. On the other hand, negative emission technologies, as key technologies in various emissions pathways, are highly significant to achieving carbon neutrality. Carbon capture and storage (CCS) technology, as a technology with large-scale emission reduction potential, is an indispensable and significant technology for achieving carbon neutrality that has received extensive attention. This technological project, first initiated by MIT in 1989, reduces greenhouse gas emissions by capturing CO2 from the burning of fossil fuels and storing it in natural underground formations over the long term. Current research on CCS technology includes the following aspects: public awareness of CCS technology, the simulation of CCS technology development, the operation and application of CCS projects, and barriers to the industrialization of CCS. Currently, CCS technology has not been subject to large-scale commercial operations, and there are many cost barriers to its development and application, including barriers to technological development, risks of carbon leakage, and imperfections in related policies, systems, laws, and regulations. Negative emission technologies also include terrestrial carbon removal and sequestration, blue carbon in coastal ecosystems, direct air capture (DAC), and biomass–CCS (i.e., technologies combining biomass and carbon capture and storage). Terrestrial carbon removal and sequestration involves the absorption and sequestration of carbon through afforestation, forest management, and increasing soil carbon storage. Blue carbon refers to increasing the amount of carbon absorbed and fixed by marine ecosystems such as mangrove forests, saltmarsh wetlands, and seagrass beds; this carbon is stored in the form of biogenic and sedimentary carbon, which has significant sequestration potential. DAC involves the direct capture of CO2 from the air and the compression of CO2 for injection into reservoirs; this process has high decarbonization potential.

In terms of risk management programs, unlike traditional commodity prices, carbon prices may change abruptly around international climate policy and convention processes. As such, enterprises and financial institutions need to carry out stress tests in advance, consider the long-term carbon pricing level for future investment and financing decisions, and explore risk management through carbon financial instruments. In addition, an increasing number of carbon markets are avoiding drastic fluctuations in carbon prices by establishing flexible trading mechanisms and price stabilization mechanisms. This study focuses on intertemporal trading, the supply-side adjustment of allowances, and price restrictions, which are already being used by mainstream carbon markets. First, intertemporal trading ensures flexibility in the timing of carbon allowances, allowing emission control enterprises to manage their carbon emissions in the most cost-effective manner over time. Through allowance storage, an enterprise can save carbon emission allowances issued in a certain period for use in a subsequent compliance period when they are needed. Allowance borrowing, on the other hand, allows emission control enterprises to borrow carbon emission allowances from a future compliance period for use in the current compliance period, thereby delaying the purchase of carbon allowances or postponing carbon emission reductions. Second, quota supply-side adjustments are a way of regulating carbon prices by adjusting the supply of quotas in the market. This method can be summarized as follows: when the market is short of quotas, quotas are supplied to the market according to certain conditions, so as to prevent the carbon price from being too high due to the shortage; when the market is loose, the supply of quotas in the market is reduced through certain means, so as to prevent the carbon price from being too low due to the oversupply of quotas. Third, price limits refer to the setting of upper or lower limits on the carbon price. Minimum auction prices, upward and downward limits, and price management reserves can all be categorized as price limits. For the carbon market, the auction of allowances can guide the pricing of allowances and is also conducive to the carbon market mechanism, which can stabilize the psychological expectations of market participants to a certain extent; this method plays a key role in optimizing the allocation of resources. The limit of the upward and downward movement of the carbon price is a direct control measure on the carbon price, and its advantage is that it narrows the range of price fluctuations, thus reducing the risk of the market [15].

3.2.2. Keyword Highlighting Analysis

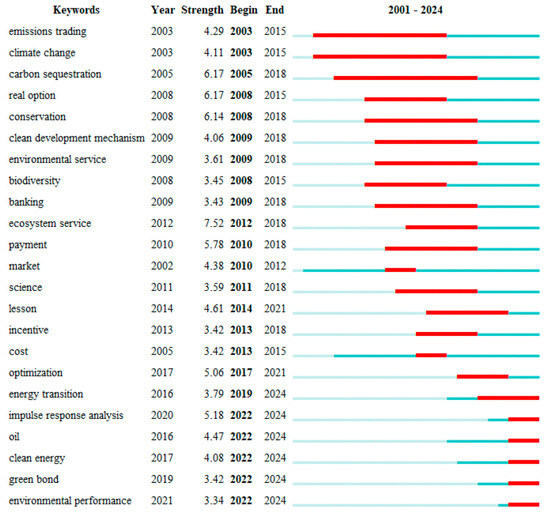

Highlighting analysis is used to analyze the latest research issues and changing trends in a particular research field. Keyword highlighting reflects the high-frequency keywords that appear at different stages in research hotspots and cutting-edge issues. In this study, CiteSpace was used to generate a mutation map of carbon market risk keywords from 2002 to 2024; Figure 6 shows the research hotspots of carbon market risk in different periods. The long colored bar in the figure represents the overall research year, the red part represents the part of the year in which the term is mutated, the light blue part indicates that the keyword had not yet begun to be researched in this period, and the dark blue part indicates that scholars have already started to research the term but it has not become a research hotspot; the degree of mutation refers to the frequency with which the keyword appears in a specific period of time. As shown in Figure 6, the carbon market risk research pathway is divided into two main phases, the first from 2002 to 2018 and the second from 2019 to 2024. In the first stage, the words with a prominence of 6 or more were ecosystem service (7.52), carbon sequestration (6.17), real option (6.17), and conservation (6.14). The four terms with the highest prominence in the first phase mainly fell into the categories of carbon market risk influencers and methods for analyzing the value of carbon sinks.

Figure 6.

Keywords in the field of carbon market risk and their salience.

Carbon price volatility is at the center of carbon market risk. The price of carbon market allowances depends on the marginal abatement cost curve and carbon reduction targets [16]. The short-term marginal cost of carbon reduction is determined by weather extremes, energy prices, and energy demand [17]. “Ecosystem services” is the most central. The concept of ecosystem services was first introduced in 1970, and its conceptual definition and classification became a research hotspot at the beginning of the 21st century. Ecosystem services can be classified into five categories based on their spatial flow characteristics, of which global non-proximity refers to the absence of a fixed service location for ecosystem services, specifically, climate regulation, carbon sequestration, and carbon storage in ecosystem services. Local proximity includes disturbance regulation or storm protection, waste disposal, biological control, etc. [18,19]. The existing literature empirically concludes that changes in weather affect carbon prices and credit allowances, and weather variables cause changes in CO2 prices [20,21]. Worse air quality means increased carbon dioxide emissions from energy consumption and increased demand for carbon credits to be allocated. Economic activity is the most obvious factor influencing carbon price volatility, as economic growth leads to increased energy consumption and increased industrial production, so that the carbon price responds not only to spreads in energy price valuations and weather extremes, but also to industrial output in the three sectors of fuels, iron and steel, and paper. The three weather variables of temperature, wind speed, and solar radiation indirectly impact carbon price volatility by influencing carbon emission allowances through their effect on the production and consumption of electricity [22,23]. Carbon sink project investments constitute climate finance, and one of the tasks of climate finance is to manage climate risks (both transition and physical risks). The fundamental work of managing transition risks is to guide long-term carbon pricing for investment and financing activities through internal carbon pricing under future climate policy scenarios. Carbon prices will rise as policy constraints to combat climate change strengthen [24,25]. Based on these conclusions, the climate regulation, extreme weather avoidance, and carbon sequestration functions of “ecosystem services” can reduce greenhouse gas emissions to varying degrees, and climate, extreme weather, and carbon sequestration are at the root of carbon market risk. Therefore, the study of “ecosystem services” has always been an essential connector of carbon market risk, which is not only the foundation of carbon market research, but also a keyword for later in-depth explorations of the factors affecting the price and risk of the carbon market.

“Carbon sequestration” is not only the second most central term, but it also falls under the category of ecosystem services. Theoretically, the higher the total amount of carbon emissions reduction (target), the more expensive the abatement technologies need to be, and the higher the carbon price is in allowances presented in the carbon market. Carbon sequestration is currently the fastest and most visible means of mitigating climate problems. By 2030, fossil fuels will still account for 70% of the global energy mix, making it particularly important to scale carbon sequestration technologies and determine how costs can be further reduced [26,27]. According to the IEA, carbon sequestration would reduce the cost to USD 35 from USD 60 by reducing emissions by one ton in 2030 and contributing 19 percent of emissions by 2050, making it the most significant single technology in terms of its share of emissions reduction. A balance will be struck with the price of carbon, which will rise as countries regulate their carbon emission policies more stringently. Based on the above factors, carbon sequestration can be seen to have a fundamental impact on carbon market risk, and it was used in the early stages of carbon market risk research through 2018.

“Real options” is the third most centered term. Afforestation and reforestation projects are essential means of addressing global climate change. According to data from the World Bank’s report “Carbon Pricing Mechanisms Development Status and Future Trends 2021”, the industries covered by different carbon offset mechanisms vary, with a total of 19 offset mechanisms comprising forestry carbon sinks, accounting for 73 percent of the global total and ranking first among all industries. Improving forest area and forest quality by way of forestry carbon sinks can effectively enhance the ecological value of forests and allow for the absorption of more carbon dioxide. The cost of forestry carbon sink technology is two to three times lower than that of industrial carbon capture and storage (CCS) technology, achieving a win–win situation in terms of both ecological and operational benefits [28]. However, long forestry production cycles perpetuate uncertainty about technical and natural conditions. Forestry carbon sink projects, therefore, have three typical optional characteristics: great uncertainty, management flexibility, and investment irreversibility. Fundamental options theory considers uncertainty investments to include decision elasticity, i.e., the use of flexible decision-making options. Some of the existing studies have introduced real options into forest carbon sink projects to obtain an additional premium by increasing the value of carbon sinks through possible uncertainty [29,30]. In addition, scholars have used this theory to value forestry carbon sink projects, quantifying them in the form of options, thus providing a practical framework for making investment decisions under uncertain conditions [31]. Research on forestry carbon sink project investment has made extensive use of real options theory, so fundamental options theory became a keyword with high centrality from 2005 to 2015.

“Conservation” usually refers to the protection of plants and animals, and it is often used in conjunction with “energy” to form the noun phrase “energy conservation”. The main ways to reduce greenhouse gas emissions include developing and using renewable energy, energy efficiency and conservation, and CCS technologies. Regarding plant and animal protection, the protection of forests is an integral part of developing and using renewable energy. On the one hand, according to the Global Forest Resources Assessment (FRA) 2020, forests currently cover a total of 4.06 billion hectares globally, or nearly 31 percent of the total land area. The forest ecosystem carbon pool is the largest in terrestrial ecosystems. On the other hand, trees absorb an average of 1.83 tons of carbon dioxide and release 1.62 tons of oxygen for every cubic meter of storage they grow. In terms of energy efficiency, two-thirds of global greenhouse gas emissions come from the energy sector, with the majority of these emissions coming from the use of fossil fuels. Scholars have conducted numerous studies on reducing emissions by focusing on three critical areas of energy use: industry, buildings, and transport. The main ways to reduce emissions are the development of low-carbon transport, energy saving and emissions reduction in buildings, and waste utilization [32].

The three keywords with the highest centrality in the second phase, 2019–2024, are impulse response analysis (5.18), oil (4.47), and clean energy (4.08). Impulse response analysis is essential in econometric analyses using vector autoregressive models. Its main objective is to describe the evolution of the model variables when one or more of them are subjected to shocks. This feature allows the propagation of a single shock to be traced through an otherwise noisy system of equations, making it a useful tool for evaluating economic policy. The existing literature primarily uses impulse responses to analyze the effects of environmental regulations, energy intensity and structure effects, and the impact of technological innovations on carbon emissions reduction. In the long term, environmental regulations can significantly reduce energy intensity and promote energy-saving technological innovation, leading to the transformation of enterprise development and a gradual decrease in the incremental impact on carbon emissions [33]. With 80 percent of global energy consumption coming from the three traditional fossil fuels of oil, coal, and natural gas, fossil fuels profoundly impact the carbon market. In terms of the structure of primary energy use, oil has the largest share, which accounts for more than 31 percent. The environmental pollution caused by fossil energy has attracted widespread global attention. The existing literature mostly takes the EU carbon market as an example. It uses the GARCH model and the Copula model to explore the risk spillover effect between the international oil market and the EU carbon market. The results show that there is a positive risk spillover effect between the oil market and the EU carbon market, i.e., the occurrence of risky events in the oil market causes an increase in risks in the carbon market, and the higher the confidence level, the stronger the spillover effect [34,35] [36,37].

The 28th United Nations Climate Conference aims to achieve global warming of 1.5 degrees Celsius or less from pre-industrial levels and increase climate finance for developing countries so that there is increased demand for creating and utilizing renewable and clean energy in all countries. Substitution between conventional and clean energy sources affects supply and demand, which, in turn, affects prices. The corresponding price volatility risk is also transmitted through substitution and aggregate demand effects, ultimately affecting risk spillovers across energy markets [38,39]. Risk benefits in energy markets have a positive spillover effect with carbon market risks, so risk spillovers between traditional and clean energy markets affect carbon market risks. In addition, the clean energy market brings about more frequent fluctuations in carbon market prices and turnover. The magnitude of fluctuations is also larger, and much higher than that of the traditional energy market, and the impact on the carbon market is more significant [40].

3.3. Cluster Mapping of Research Hotspots

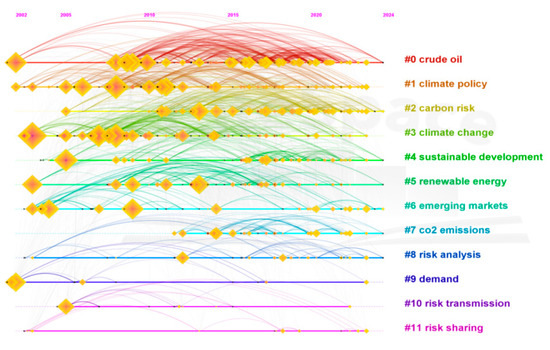

In our review, CiteSpace was used to cluster the keywords. The timeline view in the cluster analysis (Figure 7) shows the graphs included under the cluster labels as well as the period of the study, which is arranged according to size from top to bottom, with time from left to right indicating the year’s proximity. The Log-likelihood ratio algorithm is then used to assign a value to each keyword, and the keyword with the largest value is selected to be the tag word for the cluster. For further in-depth analysis, the first five keywords under each cluster were derived from Cluster Explorer, as shown in Table 4.

Figure 7.

Timeline view of international carbon market risk research keywords.

Table 4.

Keyword clusters of carbon market risk.

The table of clustering keywords shows that the clustering keywords related to carbon market risk are mainly the factors affecting the price of carbon emissions rights trading. The core issue of carbon market risk is the price at which carbon emissions rights are traded, which is subject to greater uncertainty and market volatility than other types of securities trading markets. The main factors affecting the price of carbon fall into four categories: macroeconomics, energy prices, substitute prices, and weather variability. First, the macroeconomic situation mainly affects the price of carbon trading by influencing the aggregate social supply and aggregate demand. Second, when the market demand for energy sources such as oil and natural gas increases, the increase in energy consumption leads to an increase in the total amount of carbon emissions, and countries must purchase a certain amount of carbon emissions rights in order to fulfil their own emission reduction obligations, which leads to an increase in the price of carbon trading. Third, from the perspective of the current international market for carbon trading, there are many varieties of carbon emissions rights products in circulation, including EUA, CER under the Clean Energy Mechanism (CEM), and AAU under the International Emission Mechanism (IEM). Analyzed from an economic point of view, all three commodities are typical substitutes for each other, and an increase in the price of any one of them triggers an increase in the demand for the other alternative commodity. Fourth, average temperatures have a small impact on carbon prices, but extreme weather has a larger impact on carbon prices.

The timeline view of the clusters shows that cluster #0, crude oil, has been the focus of research on spillover effects, carbon markets, carbon prices, and EU equivalence standards. As more in-depth studies of the carbon market financial market have been conducted, the research hotspot has shifted from exploring the impact of climate on carbon market risk to examining the risk spillover effects between the carbon market, the energy market, and the stock market, as well as exploring investment risks affecting carbon sink projects. As such, #1, climate policy, #3, climate change, #6, emerging markets, #9, demand, #10, risk transmission, and #11, risk sharing, have had less attention over the last decade. Studies related to #2, carbon risk, have examined the impact of carbon risk on share price returns, financing costs, and corporate decision-making, but no scholars have explored the impact of carbon risk on information efficiency. Analyzing the previous literature shows the possibility that carbon risk affects the information content of stock prices. In order to mitigate the negative impacts of carbon risk on firms, surplus management, disclosure, and other behaviors adopted by firms change the firm’s information environment, which, in turn, affects the extent to which firm-specific information enters the stock price. There are no studies that consider stock price information content as an economic consequence of carbon risk. Therefore, carbon risk has remained a hot research topic in recent years. Topic #4, sustainable development, was a research hotspot between 2002 and 2005 as a result of the World Summit on Sustainable Development in 2002, which discussed the implementation of sustainable development and set new goals and commitments to promote further global efforts on sustainable development. Scholars have begun to focus on the sustainable development paths of carbon-emission-related businesses, as well as on the sustainable development paths of regional economies, in light of the implementation of carbon-emission policies.

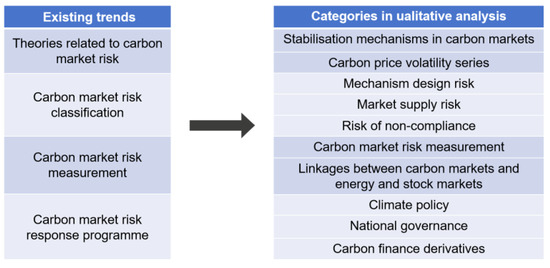

3.4. Analysis of Research Trends under the Distribution of Subject Headings

Based on the above research trends, we can summarize and discuss the development of carbon market risk from a macro perspective in relation to four areas: carbon-market-risk-related theories, carbon market risk classification, carbon market risk measurement, and carbon market risk response options. The reasons for choosing the above four aspects for further discussion are as follows: first, the study of carbon market risk requires an understanding of the relevant theories of carbon market risk, in order to lay a foundation for subsequent research. Second, compared with the general financial market, the carbon financial market is highly susceptible to the influence of policies, macroeconomics, energy markets, and climate conditions. Fluctuations in the carbon price will not only significantly impact the returns of emission-control enterprises and investors but will also affect the realization of emissions reduction targets. Therefore, correctly measuring risk in the carbon market has definitive practical significance for market participants. Finally, the carbon market is also subject to enormous risks, which are not only affected by the macroeconomic situation and market mechanism but are also closely related to the external environment, such as national quota allocation, energy prices, and policies. These risk factors are characterized by diversity and variability. Therefore, it is of great practical significance for the sustainable and healthy development of the carbon market to measure the value of carbon market risk and take the necessary risk management measures. Each aspect is then discussed in the context of carbon market risk clustering mapping and clustering labels from different perspectives, as shown in Figure 8.

Figure 8.

Qualitative analysis.

3.4.1. Theories Related to Carbon Market Risk

Theoretical studies related to carbon market risk mainly focus on the stabilization mechanism of the carbon market and the sequence of carbon price volatility. When the research field first emerged, scholars mostly took the mature EU carbon emissions trading system as the target and proposed that the carbon emissions trading system has a basic market mechanism, which can reduce costs and risks. In terms of stabilization mechanisms in the carbon market, carbon prices are heavily influenced by the total number of allowances and allocation policies, the economic cycle, and the quality of emissions data, and they are subject to greater uncertainty and market volatility than other markets. The EU carbon market saw a 50 percent drop in carbon prices within a week of the announcement of the total surplus of carbon allowances remaining in 2006. In the second phase, the price of carbon was affected by the economic crisis, dropping from EUR 30 to EUR 8 in the space of a few months. The EU established the Carbon Market Stabilization Reserve System, also known as the Quantity Stabilization Mechanism, in 2019, which maintains the smooth operation of the carbon market by intervening in the market’s stock of allowances. The existing literature on carbon market stabilization mechanisms focuses on the following aspects: first, the problem of oversupply under stabilization mechanisms [41]; second, comparisons between the quantity stabilization mechanism and the price stabilization mechanism, which show that the price stabilization mechanism is more effective than the quantity stabilization mechanism because of the high volatility of the carbon price, the existence of delays in regulation, and other stability-related issues. Adopting price–volume linkage stabilization mechanisms and price stabilization mechanisms can better preserve market rationality [42]. The third focus concerns hard versus soft prices, with studies showing that a hard price stabilization mechanism would be more effective [43]; the high volatility of carbon prices has a significant effect on the confidence of market participants and is detrimental to the long-term development of the carbon market.

The price volatility of financial products also characterizes carbon prices. Studies of carbon price volatility using different GARCH models have found that carbon futures in the EU market have structural breakpoints, and that carbon prices are heavily influenced by climate policy, the supply and demand of carbon emission allowances, and macroeconomic risks, including interest rates and crude oil prices [44]. Carbon finance is involved in most new energy and clean energy investors; capital operating within the market and the carbon trading market consisting of carbon-finance-related products is an essential part of the carbon trading market. These products contribute to rationalizing the carbon trading price, leading to a more active carbon market [45]. In addition to the GARCH family of models, scholars have widely used other econometric models to examine the volatility characteristics of carbon prices. For example, Chevallier first used a nonparametric model to study the characteristics of carbon prices in the EU, and the empirical results showed that this model can fit the characteristics of carbon price volatility very well and reduce the prediction error by 15 percent compared with a linear regression model [46].

3.4.2. Carbon Market Risk Classification

Carbon market risks can be categorized into mechanism design, market supply, and non-compliance risks [47].

Mechanism design risk can be further categorized into carbon quota supply risk, compliance target deviation risk, and market linkage risk [48]. In terms of the risk of the carbon quota supply, the oversupply of EU ETS Phase I quotas has led the value of quotas to approach zero, which has raised questions about the effectiveness and sustainability of the market; this indicates that an oversupply or shortage of carbon quotas will undermine the confidence of the carbon market [14,49,50]. In addition to this, market participants may also be concerned that the oversupply of quotas could adversely affect carbon financial derivatives. In terms of the risk of deviation from compliance targets, the carbon market is an essential tool for combating climate change and achieving emission reduction targets more efficiently [51]. The correlation between the development of the carbon market and the sum of carbon reduction targets is significant for key market participants such as companies and investors that need to control emissions. The long-term development of the carbon market is influenced by commentary on its micro-behaviors and macro-development concerning the overall goal of emission reductions, and contrary comments are detrimental to the sustainability of the carbon market. Regarding the risk of market linkages, the “bottom-up” carbon market inevitably suffers from a lack of connectivity between markets, which impedes further development. Establishing effective links between carbon markets and the realization of a broader range of registration links between regions and governments may improve the liquidity of the carbon market as a whole and effectively maintain its orderly operation [52].

Market supply risk can be categorized into participant risk, product supply risk, and liquidity risk. Regarding the risk of the participating entities, the carbon market has a relatively short development history, and a long period of monitoring data is required as a reference; the market regulatory system could be better and there is no need for more hedging tools [53]. There needs to be more accumulation of experience for designers involved in the carbon market and a need for a talent pool for market participants. All of these factors may cause errors or accidents in market operations, harming the interests of participating entities. In terms of product supply risk, the international carbon emissions trading mechanism under the Paris Agreement consists of two main mechanisms, namely, cooperative approaches and the sustainable development mechanism [54,55]. While different mechanisms have formed different products, on-exchange transactions completed on platforms such as exchanges and off-exchange transactions outside trading platforms have been formed, and products including forwards, swaps, futures, options, and other products have been derived, leading to a trend of the securitization of carbon currencies and their development into arbitrage trading products. Measuring the quality of these carbon financial products represents a methodological and valuation-related technical challenge, and this technical uncertainty will make carbon derivatives trading more opaque and more susceptible to the concealment and transmission of risks. In terms of liquidity risk, the market operates around exchanges with high liquidity [56,57]. This depends on the commoditization of the market itself, the number of participants, and whether the products are sufficiently rich so that a more significant number of participants seek risk management solutions for a wide range of products [58]. Confidence in the market can be undermined if market developments result in the low substitutability of trading instruments, leading to liquidity fragmentation [59]. Low liquidity prevents participants from trading freely and creates risks for the market and potential investors [60,61].

The main categories in terms of the risk of non-compliance are as follows. The first concerns offences that use the carbon market as a tool, such as fraud and money laundering. The second is criminal theft targeting the carbon market, such as hacking registration systems to steal allowances or emission reduction credits from accounts. This type of offence undermines the credibility of the carbon market but also the confidence of market participants. The third concerns market violations, including market manipulation and insider dealing. The behaviors of market manipulation and insider dealing artificially distort average prices in the market; they are the natural enemies of the market competition mechanism, and they violate the principles of market transparency and fairness. In the context of an expanding carbon market, such violations are likely to occur under the conditions of multi-party participation [62,63].

3.4.3. Carbon Market Risk Measurement

Due to the relative immaturity of the international carbon market, its uncertain life expectancy and high volatility, and the need for long-term quantitative data records due to the relatively short history of the development of the carbon market, the market offers few risk management tools for participants. Whether it is from the perspective of the sustainable development of the market, the sound development of the relevant economic sectors and markets, or the public interest, the appropriate governmental authorities in each country should identify the risks of the carbon financial market to ensure effective trading and pricing mechanisms, avoid fraud and price manipulation, and balance the transparency of information. In terms of measuring carbon market risk, the existing literature has mostly used value-at-risk (VaR) measurements and modelling methods such as Monte Carlo simulation to measure carbon market risk and provide a reference for investors to obtain hedging objectives.

One of the most widely used carbon market risk measures at present is the VaR method, which offers an estimate of the maximum loss in asset value that could be caused by an unfavorable market movement in a given time period, based on a defined confidence interval. The most important feature of the VaR method is that it draws on the probability distribution of a random variable to compute the potential VaR of a financial asset [64]. The mathematical representation of this is as follows:

where ΔValue is the amount of change in the value of the carbon financial product in the sample over the holding period t, and R is the value of the sample carbon financial product at risk at confidence level c. Due to the complexity of the fluctuation in the carbon price yield series, its tail characteristics are often inconsistent with the characteristics of the middle distribution, so the VaR method frequently needs to be supplemented by methods that can effectively describe the statistical characteristics of the tails of the changes in the value of the carbon asset; the most widely used of these methods is a combination with extreme value theory [65]. Extreme value theory is a theory that deals with situations that deviate significantly from the median of a probability distribution; it is often used to analyze probabilistically rare situations and is now widely used as a risk measure in the carbon market [66]. It assumes that the limiting distribution of extreme values is independent of its distribution. With the development of the carbon market, an increasing number of studies have been conducted to measure the risk in the carbon market based on extreme value theory. The study found that the downside risk of prices in the EU carbon market is higher than the upside risk, and that both the upside and downside risks of prices in the first phase of the carbon spot and carbon futures markets are higher than in the second phase. A risk measure of the EU carbon market based on the relevant theory effectively fits the volatility of the EU carbon market price return series. This proves that there is a significant asymmetry in the price volatility of the EU carbon market. Extreme value models can be classified into two categories based on the method of extreme value selection: the block maxima model (BMM) and peak over threshold (POT) [2].

Prob(ΔValue < −VaR) = 1 − c

While BMM is often used for extreme value problems with seasonal characteristics, POT is mainly used to model all the data in the series above a particular considerable value. POT is more suitable for analyzing carbon market risk. The specific model representation is as follows: let x be the sequence of returns on a carbon financial product, and the conditional distribution of the return r’s residuals over a threshold u converges to a generalized Pareto distribution for a relatively large value of u. There exists a such that satisfies:

where is the shape parameter of the carbon price yield distribution, which determines the rate of disappearance of its tail; the larger is, the thicker the tail is; and is the scale parameter of the carbon price yield distribution.

In extreme value modelling, a threshold u needs to be determined and then parameters and need to be estimated. The selection of the threshold is a critical step in the application of extreme value theory; a threshold that is too small will result in a biased estimation of the distribution of extreme values with large tails, while a threshold that is too large will result in too small a number of restrictions, producing too much variance in the estimated parameters [67].

The Monte Carlo method, also known as statistical simulation, is based on the principle that, when a particular problem can be abstracted as the expectation of a random variable and a directly relevant probability model is not available, a large amount of random data can be generated via simulation to obtain a numerical sequence of the probability distribution characteristics of the random variable to approximate the solution of the problem. The purpose of Monte Carlo prediction is to predict the state value [68,69]. It is in the form of the first visit MC method and the every visit MC method, with the formula:

The first visit method calculates only the reward value of the first occurrence of the state in each trial and averages it to obtain the return of the state; meanwhile, the every visit method sums up the rewards of the red solid points in each trial to obtain the average.

3.4.4. Carbon Market Risk Response Program

This theme covers topics including climate policy, energy markets, and national governance. The environment and climate nexus is a far-reaching and wide-ranging one, and global engagement is required to address the issue. Scholars have made some progress in this field, but the problems of ecological degradation and the unsustainable use of resources are still urgent. There is a need for concerted global governance among countries, regions, and organizations and institutions to build a standard mechanism for cooperation in the worldwide environment. Following the adoption of the Paris Agreement in 2015, 197 parties joined it to actively address climate issues and progressively strengthen their emissions reduction commitments. The same year, the United Nations Conference on Sustainable Development, known as Transforming Our World: the 2030 Agenda for Sustainable Development, elevated the climate issue to the same level as economic and social development, representing a key marker on the road to sustainable development. In 2019, 66 countries proposed “carbon-neutral” targets at the United Nations Climate Action Summit, forming the Climate Ambition Coalition. World Environment Day 2022, under the theme “There is only one Earth”, called on countries to change policies and choices to promote cleaner, greener, and more sustainable lifestyles and to live in harmony with nature. The participation of more than 150 countries and the involvement of governments, businesses, civil society, schools, celebrities, cities, and communities demonstrates the increased social focus on the environment and sustainable development.

Carbon financial hedging instruments are equally important tools for dealing with carbon market risks [70,71]. Carbon prices are price signals in the carbon market, which substantially impact the production decisions of emission-control enterprises and the low-carbon investment behaviors of investors [72]. Therefore, it is crucial to avoid drastic fluctuations in carbon prices in the carbon market. Financial derivatives are securities that correspond to one or more underlying assets, including forward, futures, and options contracts [73,74]. Accordingly, carbon financial derivatives include carbon futures and carbon options, etc. Carbon futures are relevant because they share the same kind of carbon asset futures price trend, spot price trend, and carbon futures contract expiry, as well as traders in the closed position or the delivery of carbon futures prices and the current period of carbon asset spot price convergence; holders can hedge risk through carbon futures and carbon spot reverse operations [75,76]. Carbon options are a more sophisticated risk management tool, usually based on a base price with several strike price contracts spaced above and below the strike price, so that investors can manage the risk of price fluctuations within several well-defined price bands based on changes in the spot market [77,78].

3.5. Review of the State of the Art

This paper combines quantitative and qualitative analyses to conduct a systematic study and review of carbon market risk, but the following aspects of carbon market risk need to be further studied.

First, theoretical and practical research on carbon emissions rights has made great progress in recent years, especially in relation to the initial allocation of carbon emissions rights, market trading, and the efficiency of carbon emissions regulation. However, there is still plenty of room for the development of quantitative research on the price of carbon emissions rights. There are fewer econometric modelling studies on the price of carbon emissions rights, and all of those that have been conducted follow the simulation of the price of other assets, a method that does not incorporate and portray the characteristics of the carbon emissions rights market. Research on the CDM market has mainly focused on methodology, the pricing of CER indicators, and how CDM operates in different countries, while less research has considered the systematic risk and expected returns of sCERs in the secondary market.

Second, the existing research shows that, with the gradual deepening of carbon market practice and academic research, most of the problems in the early stage of operation have been mitigated or even solved, and the carbon market operation mechanism is gradually approaching an ideal state. In this process, the transparency, openness, maturity, and liquidity of the carbon market have been significantly improved, and the flow of information, capital, and other factors between the carbon market and the energy market, to which it is most closely linked, has become smoother. The design of the operational mechanism is crucial to the carbon market, and the “improvement and refinement of the operational mechanism” will be a constant theme in the development of the carbon market. Research on this issue can start by using economic theories, such as game theory, to analyze the possible problems of the existing operating mechanism; or by using empirical methods, such as experimental economics, to explore the impact of the design of the operating mechanism on the carbon price or the liquidity of the carbon market. However, since 2009, the global financial crisis has been driven by macro-financial regulation and market failures, and the operational mechanism of carbon trading is very similar to that of the subprime debt that triggered the crisis. Although new financial regulations have gradually been introduced to deepen the regulation of the derivatives market in the wake of the subprime crisis, the cyclical and structural contradictions in the global economy have been exacerbated by the COVID-19 pandemic and the Russia–Ukraine conflict, which have resulted in an overall shock to both the supply and the demand sides, as well as causing a sharp rise in inflation in major economies, leading to a surge in the risk of economic recession. Under these circumstances, it remains questionable whether existing financial regulatory mechanisms can be adapted to the structure of the carbon emissions trading market and be effectively monitored.

Third, although the existing literature on carbon market risk management comprises a large number of fruitful studies, it still exhibits the following shortcomings: first, most of the existing research focuses on carbon market risk identification and assessment, and there is a lack of quantitative research on carbon market risk regulation. Moreover, a comprehensive theoretical methodology for carbon market risk management has not yet been developed, and there is a lack of effective theoretical guidance for the practice of carbon market risk regulation. Second, the existing risk analysis methods do not comprehensively consider the impact of internal and external risks and feedback loops on systemic risk in the carbon market. Third, the existing risk management literature focuses on qualitative analyses and lacks rigorous quantitative analyses, meaning that it cannot provide comprehensive and effective information support for carbon market risk management. Fourth, existing studies do not pay sufficient attention to the uncertainty that exists in the carbon financial market. In order to improve the ability of China’s financial institutions to identify and control the risks in the carbon financial market and to establish a more prudent risk identification system, it is important to take uncertainty into account when exploring the characteristics of the carbon price risk factor and the exchange rate risk factor. In terms of carbon financial hedging tools, research on carbon emissions right options has just started; regarding risk control and value investment, it basically follows the option pricing research methodology for general assets, especially for European options, and most of the existing studies remain at the level of applying the BS model proposed in the 1970s. In this sense, the research modelling should better reflect the characteristics of the carbon assets, but there are certain shortcomings, especially the failure to accurately reflect the unexpected impacts of the external market in a timely manner. In particular, they cannot accurately reflect the sudden impacts of external markets in a timely manner.

Fourth, there is a research gap regarding risk spillovers between carbon and energy markets. On the one hand, most of the existing studies focus on the linkages between carbon markets and a certain other type of financial market. The first requirement is to study the linkage between the carbon market and the energy market, because price fluctuations in the energy market will affect the price of carbon through the demand for carbon emissions by enterprises. The second requirement is to study the linkage between the carbon market and the financial market, because the financial market, as the “summer and winter tables” of macroeconomic operating conditions, will have price fluctuations that affect the carbon market through the real economy. However, the linkages between different financial markets are often not isolated and are coupled with the impact of negative events such as the COVID-19 pandemic; price volatility in financial markets has generally increased, and inter-market linkages have been further strengthened, so that a separate study of the linkages between the carbon market and a particular type of market would not be sufficient to reflect the true picture of correlations between financial markets. On the other hand, the risk contagion relationship of the energy market to the carbon market is a very complex and non-linear process. Comparative analyses have found that differences in operational mechanisms, levels of economic development, industrial structures, energy consumption structures, and other factors are important reasons for the occurrence of this risk contagion relationship. However, in the future, a systematic and rigorous approach is needed to provide an in-depth analysis of the mechanism of risk contagion caused by these factors.

4. Conclusions and Future Research Directions

4.1. Conclusions

This paper provides an econometric analysis of the literature in the field of carbon market risk to visualize the current status, evolution, and thematic distribution of carbon market risk research. The main innovations are as follows: first, CiteSpace is used to clarify the evolution of carbon market risk research based on temporal, spatial, and knowledge mapping. This method not only overcomes the many problems associated with traditional literature reviews and ensures the scientific validity of the conclusions, but also provides a reference for subsequent carbon market risk research. Second, using keyword highlighting and cluster analysis, we explore the research areas of carbon market risk research, identifying current research hotspots and research gaps, with a view to helping scholars to quickly understand cutting-edge issues in carbon market risk and enabling them to carry out more innovative research.

4.1.1. Quantitative Analysis of Conclusions

The overall publication volume of carbon market risk research exhibits an upward trend, and it can be divided into three phases in terms of the timeline: the budding period (2002–2007), the development period (2008–2018), and the flourishing period (2019–2024). In the past five years, carbon market risk research has grown quickly, and an increasing number of scholars are involved in carbon market risk research, showing that it is a promising area of study.

The spatial distribution of the research is developing in a multipolar way. China, the United States, and the United Kingdom are the leading countries studying this field. The key universities and research institutes are Oxford University, the University of the Chinese Academy of Sciences, and Central South University. Most of the issuing journals are concentrated around the themes of energy, sustainability, and environment, and the top three journals in terms of issuing volume are Energy Economics, Sustainability, and Energy Policy.

According to the clustering of keywords, research topics are diversified and multilevel. Research hotspots in the field of carbon market risk are gradually expanding and are mainly classified into the following three categories: the basis of carbon market research (including keywords such as carbon emissions trading, carbon price, and risk analysis), risk measurement (including keywords such as modelling, energy market, and stock market), and risk response (including keywords such as climate policy and energy policy).

4.1.2. Qualitative Analysis of Conclusions

The research hotspots related to carbon market risk are mainly divided into four aspects, namely, theories related to carbon market risk, carbon market risk classification, carbon market risk measurement, and carbon market risk response schemes. The theory of carbon market risk mainly focuses on the stability mechanism of the carbon market and the sequence of carbon price fluctuations. Carbon market risk classification is primarily divided into mechanism design risk, market supply risk, and irregular operation risk. Carbon market risk measurements are based on insured value measurements and the Monte Carlo simulation model. The carbon market risk response plan is based on the three aspects of climate policy, national governance, and carbon financial derivatives, which are used to reduce danger in the carbon market.

4.2. Future Research Directions

Since 66 countries proposed the carbon neutrality target at the 2019 UN Climate Conference, an increasing number of scholars have turned their attention to the carbon trading market. The research on carbon market risk has exploded in volume, which shows that it remains an important topic for future research on international social and economic development. International cooperation, the integration of disciplines, and carbon market stabilization mechanisms are three areas that still deserve our continued attention.

4.2.1. International Cooperation