Abstract

The carbon emissions of the power industry account for over 50% of China’s total carbon emissions, so achieving carbon peak and carbon neutrality in the power sector is crucial. This study aims to simulate the impacts of three energy policies—carbon constraints, the development of a high proportion of renewable energy, and carbon trading—on China’s energy transition, economic development, and the power sector’s energy mix. Through the construction of a dynamic computable general equilibrium (CGE) model for China and its integration with the SWITCH-China electricity model, the impact of diverse energy policies on China’s energy transition, economic progress, and the power mix within the electricity industry has been simulated. The integration of the SWITCH-China model can address the limitations of the CGE model in providing a detailed understanding of the specific intricacies of the electricity sector. The results indicate that increasing the stringency of carbon restrictions compels a reduction in fossil energy use, controlling the output of coal-fired power units, and thereby reducing carbon emissions. The development of a high proportion of renewable energy enhances the cleanliness of the power sector’s generation structure, further promoting the national energy transition. Implementing a carbon trading policy, where the entire industry shares the burden of carbon reduction costs, can effectively mitigate the economic losses of the power sector. Finally, the policies to further enhance the implementation of carbon trading policies, strengthen effective governmental regulation, and escalate the deployment of renewable energy sources are recommended.

1. Introduction

On 2 February 2023, the National Development and Reform Commission, in conjunction with the National Bureau of Statistics and the National Energy Administration, issued a formal notice titled “Strengthening the Integration of Green Electricity Certificates with Energy-Saving and Carbon-Reduction Policies to Bolster Non-Fossil Energy Consumption”. This notice serves as an extension of previous policies aimed at excluding newly added renewable energy consumption from total energy consumption control frameworks. The updated scope now encompasses not only renewable energy sources but also nuclear power, collectively referred to as “non-fossil energy”.

The power sector, accounting for over half of the energy industry’s carbon emissions [1], plays a pivotal role in achieving these goals. Therefore, achieving low-carbon or even zero-carbon emissions in the power sector will have a significant impact on the energy field. However, emission reductions in the power sector not only require a transition to clean energy but also need to consider the balance between cost and benefit to achieve high-quality emission reductions [2].

The key to achieving carbon peak and neutrality targets in China lies in the power sector, and the peak of carbon emissions in China’s power sector is expected to occur around 2030 [3,4]. Meanwhile, the demand for electricity is expected to increase by 58.6%, corresponding to a projected growth of approximately 27% in the proportion of non-fossil fuels compared to fossil fuels [5]. Therefore, the power sector should accelerate decarbonization. The types and capacities of installed units are correlated with the uncertainties of renewable energy. Thermal power units provide stable output but result in significant emissions. Under the constraints of the carbon peaking target, the reduction of fossil fuel units is accompanied by increased fluctuations in total load [6].If the government cannot coordinate the relationship between the two, it will undermine the power sector’s cost-minimizing decarbonization efforts. The types of renewable energy sources have an impact on the energy-saving transition of the power sector.

Among the various renewable energy sources, wind energy is considered as the most cost-effective renewable energy option for developing countries [7]. The type of capacity mechanism is closely related to the uncertainty of renewable energy. If the government fails to coordinate the relationship between the two, it can undermine the cost-minimization efforts of the electricity sector in reducing carbon emissions [8]. The types of renewable energy sources have an impact on the energy-saving transformation of the electricity sector. On one hand, government policies specifically targeting the renewable energy industry can also exert a certain influence on electricity generation [9]. On the other hand, the consumption of electricity generated from renewable energy sources is affected by the industrial structure and energy efficiency.

Adjusting renewable energy incentive policies can mitigate the impact of energy transition on the macroeconomy [10], which means that economic development can be ensured while meeting the demands of energy transition. A high proportion of renewable energy can ease the limitations on total energy consumption [11], providing ample room for the dynamic allocation of energy resources. This, in turn, enables the substitution of fossil fuels with non-fossil energy sources, affording greater flexibility in achieving carbon emission reduction targets, while maintaining overall energy consumption levels [12]. In addition, carbon emission reduction in the electricity sector faces challenges related to fairness and efficiency. While regional electricity markets outperform provincial electricity markets in terms of efficiency and profitability, provincial markets excel in terms of fairness [13]. Integrating the power sector into the carbon emissions trading system can promote carbon emissions reduction within the sector. Priority should be given to reducing the carbon emissions intensity of fossil fuel-based power generation, particularly coal- and natural gas-fired power generation, which would naturally lead to a corresponding decrease in their power outputs. [14,15]. Therefore, it is necessary to explore the impact of market mechanisms, such as the implementation of carbon trading policies, on emission reductions in the power sector.

Based on the above, achieving carbon emission reduction targets in China should primarily focus on the electricity sector. However, current research on emission reduction mechanisms in this sector remains inadequate, making it challenging to adapt to evolving energy consumption control indicators and dynamic top-down regulation targets for non-fossil energy use in the electricity sector. This challenge becomes apparent in several ways: numerous scholars have studied carbon constraints, carbon trading, and the significant role of renewable energy in the electricity sector, yet few have comprehensively analyzed the combined impact of these factors on economic development, energy transition, and carbon emission reduction. Furthermore, quantitative analysis methods are infrequently employed to simulate the offsetting effects of newly introduced non-fossil energy sources and to assess the precise impact on the achievement of “double control” targets.

To achieve the peak carbon emission target by 2030, China will invest more funds and human resources during the 14th and 15th Five-Year Plan periods to promote carbon emission reduction, especially in sectors like the power industry that consume a significant amount of energy and face greater challenges in transitioning. A quantitative analysis of the sector’s development prospects under multiple constraints and policy regulations plays a crucial role in precise policy formulation and implementation. This study, set against the backdrop of carbon reduction in the power sector, constructs a national dynamic energy–economic–environmental model (CGE model) and a high-spatiotemporal-resolution power optimization model (SWITCH-China model). By coupling these two models through three connection points—power load, carbon emission pathways, and installed capacity—we innovatively reflect the influence of macro policies in the CGE model of the power sector. This influence is then transmitted via data flow to the SWITCH-China model, which can finely simulate the power system. Combining macro and micro perspectives, a detailed comparative analysis is conducted to examine the impacts of carbon constraint intensity, the presence of carbon trading, and a high proportion of renewable energy on China’s economic development, energy transition, the completion of “dual control” intensity indicators, and other macro impacts on the power sector. Furthermore, we perform a cost-minimization optimization to derive the optimal future power structure and capacity combination. This in-depth exploration and quantitative analysis of various energy policies’ impacts on the power sector provides significant theoretical and practical insights for the selection of future carbon reduction policies in the power sector.

2. Methodology

2.1. CGE Model

The CGE model, short for the computable general equilibrium model, is commonly used to study the impacts of macroeconomic policies, tax policies, and other aspects. Its input data include basic information such as population, GDP, energy consumption, and labor employment.

Based on China’s 2020 input–output table [16], this paper combines data from the 2020 energy balance sheet [17] and China’s 2020 electric power installed capacity and generation [18], as well as energy prices, to construct an Integrated Assessment Model of Energy, the Economy, and the Environment for China.

The modeling framework comprises 33 sectors, including 5 energy-related and 28 non-energy sectors. Primarily, this model outlines the trajectories of economic growth, demographic shifts, energy demand and supply dynamics, investment patterns, and carbon emissions. Structurally, the model is organized into four integral modules: production, income generation, expenditure allocation, and trade interactions.

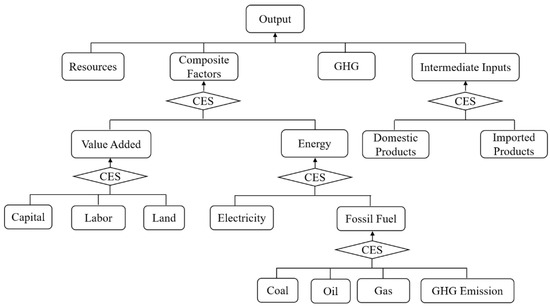

2.1.1. Production Module

The production module structure diagram is shown in Figure 1. It consists of four layers. The first layer’s output is synthesized by the Leontief production function, which includes resources, aggregated factors, greenhouse gases, and intermediate inputs. The second layer aggregates these factors using a CES function, primarily composed of value-added inputs and energy inputs. The intermediate inputs encompass both domestic and imported products. The third layer’s value-added inputs are synthesized through a CES function from capital, labor, and land, while the energy inputs comprise electricity and fossil fuels. The fourth layer represents fossil fuels, which are made up of four components through a CES function: coal, oil, natural gas, and greenhouse gas emissions.

Figure 1.

Production module.

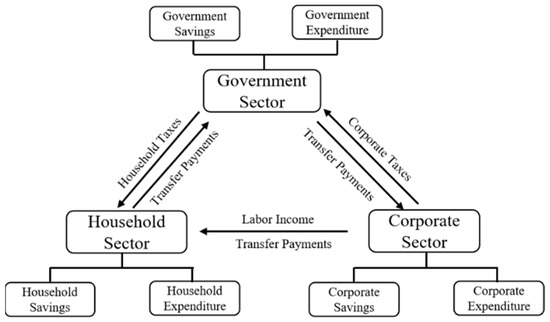

2.1.2. Income Module

The income module predominantly encompasses the circular relationship of financial flows between the government, residents, and enterprises, as depicted in Figure 2. Residents earn income from enterprises through their labor, allocating a portion of it towards personal savings and another towards consumption. Conversely, government revenue is primarily sourced from taxation, which encompasses both individual and corporate taxes. Lastly, corporate income comprises government transfers and capital income. This intricate financial web underscores the interconnectedness of these three entities within the broader economic ecosystem.

Figure 2.

Income module.

2.1.3. Expenditure Module

Residents earn income from enterprises, which they use for taxation, personal savings, and consumption. In the model, consumers maximize their utility through commodity prices and production functions. Business expenditures flow to residents and governments through transfer payments and taxes, respectively. The government establishes a cycle from residents to businesses through transfer payments.

2.1.4. Market Module

The market module connects the production module and the expenditure module. Through the CET (Constant Elasticity of Transformation) function, the total output is divided into export goods and domestic sales goods in different proportions. Then, using the Armington assumption, the CES (Constant Elasticity of Substitution) function is employed to combine imported goods and local goods into composite goods that can be used in demand allocation. The entire process represents the price changes and circulation of goods from the production module to the expenditure module in the market. The synthesis of various functions in the model aims to maximize profits.

2.1.5. Principles of Carbon Trading

In this study, carbon trading is primarily represented between departments and is achieved through the implementation of a total carbon emission allowance control and trading system. It is assumed that the revenue obtained from the sale of carbon emission quotas will be ultimately redistributed to the residential sector by the government through transfer payments. The CGE model undergoes a complex calculation process to identify a new market equilibrium point, where supply and demand in the carbon market are balanced. The determination of this equilibrium state relies on the calculation results obtained from Formulas (1) and (2).

In the formula:

—Sellers and buyers in the carbon trading market;

–Sector carbon trading volume;

–Demand function for carbon quotas in sectors;

–Marginal abatement cost of sectors;

, the revenue from government sales of carbon emission rights transferred to the household sector.

2.2. SWITCH-China

2.2.1. Model Framework

SWITCH is a loose acronym for solar, wind, hydro, and conventional technology investment. SWITCH-China is an optimization planning model for the power sector [19]. The objective function aims to minimize the cost of producing and delivering electricity through various construction and decommissioning scenarios for generation, storage, and transmission, based on forecasted demand in both the current year and future planning target years. Compared to traditional models, the SWITCH-China model has a high resolution in both the temporal (hourly scale) and spatial (provincial scale) dimensions, to simulate the impact of integrating variable renewable energy sources, particularly wind and solar photovoltaic, into the power grid.

SWITCH-China operates at the provincial level, using hourly data to simulate and optimize power system planning based on operational constraints. The model optimizes both long-term investments and short-term operations of the power grid. While optimizing, the model considers grid reliability, operational constraints, and resource availability, as well as current and potential climate policies and environmental regulations, particularly the impact of carbon peak and carbon neutrality goals.

Currently, the utilization of the SWITCH-China model for researching China’s power sector installation structure and energy storage is well-developed. By introducing cost minimization uncertainty improvements to the SWITCH-China model, in-depth research can be conducted on China’s power sector [20]. Combined with the JIMC model to evaluate employment issues faced by the coal industry during energy transition [21], studies have also found that cost reductions in renewable energy and energy storage can promote carbon emissions reduction in the power industry [22]. Larger balancing areas can enhance the flexibility of China’s power system [23].

2.2.2. Objective Function

SWITCH-China optimizes with the objective of minimizing costs, as expressed in Equation (3), which encompasses all model costs.

Total minimum cost:

In the formula:

represents the total cost.

denotes the construction costs of various units, both existing and new projects.

stands for the fixed operation and maintenance costs of all existing units.

refers to the variable costs incurred by each unit project, including variable operation and maintenance costs, fuel costs for electricity generation, and providing spinning reserves.

represents the costs associated with transmission lines, as well as the construction of new distribution facilities.

Specific calculations for each cost are detailed in Equations (4)–(7):

In the formula:

T represents generation technology; G denotes the generation project; i corresponds to a typical day’s time; t corresponds to the hour point at each time; a represents the load area.

2.2.3. Main Constraints

The model includes four sets of constraints:

(1) Constraints ensuring load satisfaction. For each load area a and at time point t, the sum of non-dispatched energy consumed by the load area, plus any distribution losses dl, must be less than or equal to the total generated energy within the hour for load area a, including the total power transferred from other load areas a’ to a, and the difference in charge and discharge from all energy storage projects in load area a over the hour t.

In the formula:

O: self-generated electricity; gp: generating unit; sp: energy storage unit; R: net discharge of energy storage.

(2) A constraint for maintaining operational reserves. In each hour t of load area ba, the spinning reserve provided by dispatchable power plants plus the operating reserve provided by energy storage projects , must be greater than or equal to the spinning reserve requirement of the balancing area ba during hour t.

(3) Constraints for achieving specific technological objectives, such as wind and solar energy development plans, nuclear energy development plans, non-fossil energy targets, and other technological goals. This primarily includes the following limitations:

The actual power output of intermittent generators (solar and wind) corresponds to their historical power input.

Baseload generators (nuclear) operate at their rated capacity.

Intermediate generators (gas) operate below their rated capacity.

Hydroelectric generators produce power equal to or greater than the historical average power for the day.

Storage facilities operate below their maximum storage capacity.

Transmission lines transmit electricity between any two load areas within the capacity limits set for the transmission lines.

(4) Constraints for implementing carbon emission limits. This ensures that during each period, the total carbon dioxide emissions from all operating generating units do not exceed predefined emission limits.

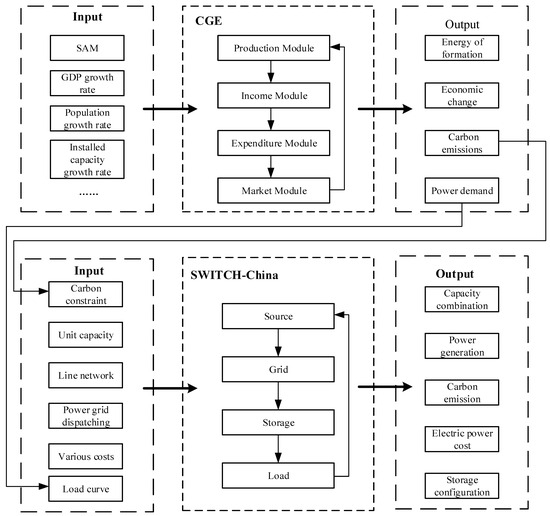

2.3. Mechanism of Model Coupling

The coupling of the CGE model and the SWITCH-China model is a soft linkage. Under a given electricity demand in both models, the output data from the CGE model is exported, processed, and then used as input data for the SWITCH-China model. As shown in Figure 3, when energy policies initially stimulate the equilibrium of the CGE model, this leads to changes in carbon emissions, energy consumption, and added value across various industries. The model then reaches a new equilibrium under the general equilibrium theory, resulting in new carbon emissions and installed capacity composition for the power sector. The carbon emissions obtained from the CGE model are used as the carbon emission constraint path for the SWITCH-China model, and the installed capacity requirements from the CGE model are used as various installation development constraints in the SWITCH-China model. These inputs are used in the power model to calculate changes in the power sector under different energy policy impacts.

Figure 3.

Coupled model framework of CGE model SWITCH-China.

The coupling of the two models makes policy research more specific, enabling the decomposition and transmission of emission reduction contributions from various factors to changes in installation structure and capacity. As an energy–economic model, the CGE model takes a holistic approach from a macro and market balance perspective [24], fully considering China’s economic and energy development [25,26], reconciling the contradictions between carbon emission reduction goals and energy transition [27]. Therefore, the data on the power sector calculated by the CGE model have a stronger reliability and authenticity. The SWITCH-China model provides a detailed depiction of the power system, accurate to the provincial unit level, and can optimize to obtain the power generation configuration that minimizes future power generation costs.

3. Data Source and Scenario Design

3.1. Database

The raw input–output table is insufficient for direct utilization in the model and necessitates further compilation into a more comprehensive format. This compilation process gives rise to the Social Accounting Matrix (SAM), which serves as the cornerstone data structure for the CGE model in economic analysis.

In our study, we leverage the latest 2020 Chinese competitive input–output table as the foundation for our research. Initially, this table encompassed 42 sectors; however, to enhance the granularity of our analysis, we have deliberately split the oil and gas extraction industry into two distinct sectors: one dedicated to oil extraction and the other to natural gas extraction. Subsequently, we have merged several other sectors, culminating in an initial accounting matrix that comprises 33 sectors.

To ensure the accuracy and reliability of our data, we employ the cross-entropy method to balance the matrix. This rigorous approach ensures that the final SAM, which is subsequently fed into our model, adheres to the highest standards of scientific rigor and precision. Ultimately, this meticulous compilation and balancing process enables us to derive robust and insightful conclusions from our CGE model analysis.

3.2. GDP and Population Growth Rate Settings

GDP and population growth rates are set as shown in the Table 1, based on relevant studies [28,29,30] and the results of China’s Seventh National Population Census. In this study, it is assumed that China’s population growth will peak in 2030 and then decline slowly.

Table 1.

GDP and population growth rate settings for 2021–2035.

3.3. Parameter Settings

In the context of comprehensive factors, the substitution elasticity parameter between energy and value-added is set at 0.4. Among the initial factor inputs, the substitution elasticity between capital and labor is designated as 0.6. Regarding energy inputs, the substitution elasticity between electricity and fossil fuels stands at 0.7. Within fossil fuel inputs, the substitution elasticity among solid, liquid, and gaseous fossil fuels is fixed at 1.5.

In the trade module, the substitution elasticity between exports destined for foreign markets and those intended for the domestic market, as a proportion of total output, is established at 2. Within the domestic market, the substitution elasticity between the local market and inter-provincial outflows is set at 3. In terms of domestic consumption, the substitution elasticity between the local market and inter-provincial inflows is adjusted to 4. Lastly, within local consumption, the substitution elasticity between domestic production and foreign imports is calibrated to 4.

3.4. Power Installation Setting

The installed capacity growth rate serves as input data for the CGE model and must be determined beforehand. According to the “14th Five-Year Plan for Modern Energy System” and the “14th Five-Year Plan for Renewable Energy Development”, the power generation from coal, natural gas, wind, nuclear, hydro, solar, biomass, and other sources in 2020 was 0.43 trillion kWh, 0.25 trillion kWh, 0.47 trillion kWh, 0.36 trillion kWh, 1.36 trillion kWh, 0.26 trillion kWh, and 0.14 trillion kWh, respectively. The goals of these plans are to achieve a 20% share of non-fossil energy consumption and 3.3 trillion kWh of annual renewable energy generation by 2025. Wind and solar power generation are expected to double, with hydro power capacity reaching 380 million kW and nuclear power capacity reaching 70 million kW. By 2025, coal power units are expected to undergo cumulative renovations totaling 200 million kW, and oil-fired power generation will be gradually phased out.

Based on future power generation and average generation hours, this study calculates the standard installation growth rates (as shown in Table 2). The standard installation growth rates are set according to the above plans to meet current installation development needs. High-proportion renewable energy installation growth rates are determined to meet the goal of non-fossil energy accounting for 30% by 2030, with average installation growth rates for each type of energy from 2021 to 2035. Coal power will start to retire during the 14th Five-Year Plan period, while the growth rates for natural gas, wind, nuclear, hydro, solar, biomass, and other energy sources will increase by approximately 2% above the standard installation growth rates. Adjustments are made to ensure the power generation levels meet the target for non-fossil energy, reaching a 30% share by 2030.

Table 2.

Average annual growth rate settings of electricity installed capacity in China from 2021 to 2035.

3.5. Input Data for the SWITCH-China Model

To simplify the computation process and reduce the calculation time in the SWITCH-China model, a typical year is selected to represent a consecutive five-year period. In this model, the base year is 2023, representing the period from 2023 to 2027. Other typical years include 2028, representing 2028–2032, and 2033, representing 2033–2037.

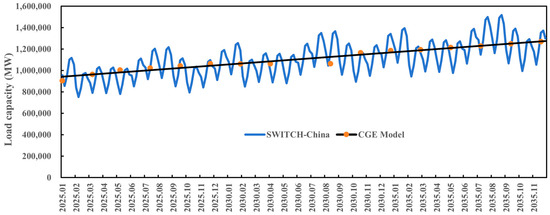

To ensure a closer and more accurate coupling between the two models, adjustments are made to the time-varying load data in the SWITCH-China model. This adjustment aims to align the load profile curve with the average load calculated from the electricity demand derived from the CGE model. As shown in Figure 4, which depicts the load curves for various time periods in China from 2025 to 2035, the load curves from both models exhibit a good alignment. It is important to note that the CGE model provides only discrete annual data, whereas the SWITCH-China model can simulate load at four-hour intervals daily, providing a more realistic representation of the actual situation.

Figure 4.

Matching graph of electricity load curve on demand side between CGE Model and SWITCH-China.

3.6. Scenario Settings

In this study, a baseline scenario (S0) and four emission reduction scenarios (S1–S4) have been established, as outlined in Table 3, to systematically investigate the diverse impacts of various policy factors on China’s energy consumption patterns and macroeconomic performance. Specifically, the scenarios take into account carbon emission constraints, the rate of expansion in renewable energy installations, and the implementation status of carbon trading mechanisms. Through a rigorous analysis of these scenarios, this study aims to provide insights into the optimal policy mix for achieving sustainable energy development in China.

Table 3.

Scenario settings.

Scenario S0 serves as the baseline, representing normal development in accordance with existing policies and goals. The emission reduction scenarios, denoted as S1, S2, and S3, impose progressively stricter carbon constraints when compared to the baseline S0. Distinctions exist between these emission reduction scenarios: scenarios S2 and S4 assume an identical and higher proportion of renewable energy installations compared to scenarios S0, S1, and S3, reflecting variations in renewable energy policies. Meanwhile, scenarios S3 and S4 incorporate carbon trading policies, which differentiate them from scenarios S0, S1, and S2, where no carbon trading across industries is assumed.

4. Results Discussion

4.1. Total Carbon Emissions of Whole Society

To ensure comparability across various factors and policies, this study establishes four emission reduction scenarios under a uniform total carbon constraint.

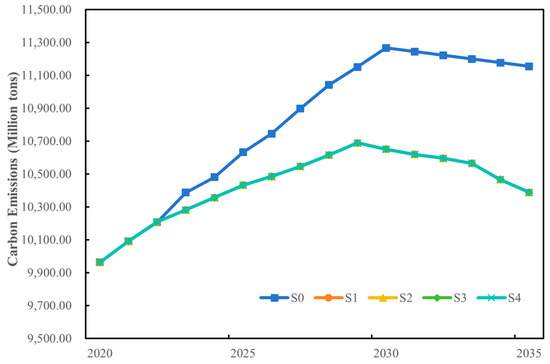

Within the entire model framework, the quantification of total carbon dioxide emissions excludes those emanating from industrial processes, and solely accounts for emissions stemming from energy consumption. As illustrated in Figure 5, the baseline scenario projects a peak in carbon emissions by 2030, attaining a peak value of 11,249 million tons. Conversely, the other four emission reduction scenarios, operating under identical carbon emission parameters, are anticipated to reach their emission peak by 2029, with a peak value of 10,688 million tons.

Figure 5.

Carbon emissions for various scenarios in China from 2020 to 2035.

4.2. Energy Consumption

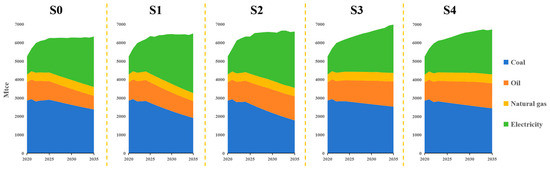

As shown in Figure 6, the total energy consumption in the baseline scenario S0 will continue to grow, peaking at 6258.84 Mtce by 2025. Thereafter, it enters a plateau phase where energy consumption growth levels off, ultimately attaining 6338.06 Mtce by 2035. In stark contrast, the growth in energy consumption is significantly more evident in the other four emission reduction scenarios.

Figure 6.

Primary energy consumption in China from 2020 to 2035.

In scenario S1, more stringent carbon constraints are imposed in comparison to scenario S0. These constraints restrict fossil fuel use by limiting carbon emissions from energy-intensive industries. Consequently, the proportion of coal in the energy mix declines from 37.49% to 32.12%, while the proportion of electricity increases from 43.26% to 45.27%.

Scenario S2 goes beyond scenario S1 by allocating a higher proportion of renewable energy installations. It aims to promote emission reductions by enhancing renewable energy generation, thus facilitating the use of green and low-carbon electricity. By 2035, scenario S2 results in a total energy consumption that is 943.58 Mtce higher than that of scenario S1, with a corresponding increase in the proportion of electricity by 5%.

Scenario S3 incorporates an additional element when compared to S1: carbon trading. Carbon trading lowers the cost of reducing carbon emissions, thereby attracting more investment, despite the same carbon constraints. Consequently, this leads to an increase in energy demand. By 2035, energy consumption in S3 is projected to be 1392 Mtce higher than in S1, with a notable rise of 373.73 Mtce in electricity consumption alone.

In contrast to S1, scenario S4 assumes a higher proportion of renewable energy but experiences a decline in overall energy consumption. Unlike in S2 and S1, where an increase in renewable energy installations typically drives up energy demand, the introduction of carbon trading in S4 yields a different result. Given that the cost of renewable energy generation is generally higher than that of fossil fuels, industries related to power generation undergo necessary industrial upgrading or elimination. This shift redirects some investments and subsequently reduces energy demand from other sectors. As a result, energy consumption in S4 is 316.07 Mtce lower than in S3.

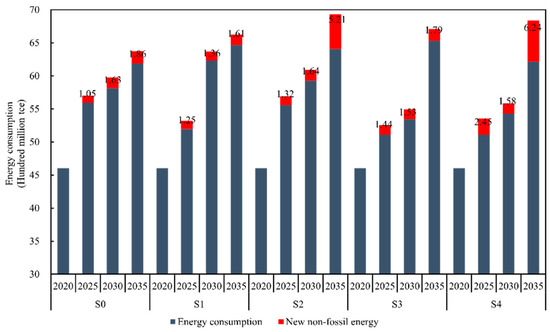

4.3. Offset of Non-Fossil Energy Policies

The exclusion of newly added non-fossil energy sources from the total energy consumption control underscores the emerging trend of non-fossil fuels dominating the energy mix. Utilizing a quantitative policy analysis, we employed the CGE model to calculate the incremental non-fossil energy volumes for distinct periods, benchmarking against 2020, 2025, 2030, and 2035. As illustrated in Figure 7, scenarios S2 and S4, both characterized by high renewable energy shares, are projected to introduce additional non-fossil energy capacities of 5.21 billion tce and 6.24 billion tce, respectively, by 2035. Furthermore, the influence of carbon trading mechanisms and tightened carbon constraints on the growth of non-fossil energy sources appears to be marginal.

Figure 7.

Increase in non-fossil energy in total energy consumption.

4.4. Energy Intensity and Carbon Emission Intensity

The reduction of energy consumption intensity stands as a pivotal and binding target specified in the “14th Five-Year Plan” outline, emphasizing the imperative to achieve predefined objectives. According to this plan, China aims for a cumulative decrease of 13.5% in energy consumption per unit of GDP and an 18% drop in carbon dioxide emissions per unit of GDP by the end of the five-year period.

Table 4 presents the reduction rates of energy intensity for the next two “Five-Year” periods under various scenarios. Among them, Scenario S2 has the largest reduction in energy intensity, with decreases of 15.81% and 14.73% during the 14th and 15th Five-Year Plan periods, respectively, which are significantly higher than the baseline scenario S0. Among the four emission reduction scenarios, imposing a carbon trading policy has the least effect on reducing energy intensity, while enhancing carbon constraints has the best effect. Increasing the proportion of renewable energy installations falls somewhere in between.

Table 4.

Reduction rates of energy intensity for different scenarios in the 14th and 15th Five-Year Plan.

As shown in Table 5, the most significant changes in carbon emission intensity reduction rates occur in Scenario S2, which combines enhanced carbon constraints with a high proportion of renewable energy. During the 14th and 15th Five-Year Plan periods, the reduction rates are 22.79% and 17.17%, respectively. Additionally, Scenario S3 also demonstrates good results in reducing carbon emissions, with reduction rates of 22.59% and 16.64% for the same periods. This indicates that the effectiveness of carbon trading in reducing emissions becomes more pronounced as the policy implementation deepens. Therefore, it is necessary to implement carbon trading in advance and expand its scope, as utilizing carbon market mechanisms is also an effective means of achieving emission reductions.

Table 5.

Reduction rates of carbon emission intensity for different scenarios in the 14th and 15th Five-Year Plan.

4.5. Installed Capacity Structure and Capacity Mix

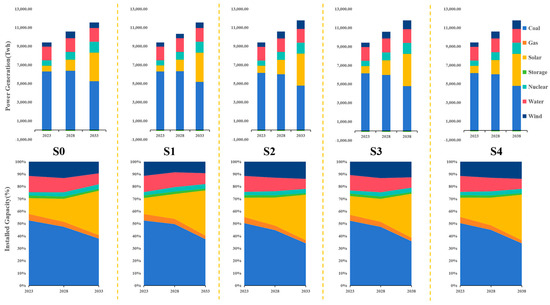

Carbon emissions and related power generation data from the electricity sector, calculated using the CGE model, are used as input for the SWITCH-China model. Through minimum cost optimization, a series of power generation data, including China’s power installed capacity and mix, are obtained.

As shown in Figure 8, under the baseline scenario S0, the total installed capacity in 2023, 2028, and 2033 is 2802.53 GW, 3220.89 GW, and 4156.49 GW, respectively. The proportion of fossil fuel-based coal-fired units decreases from 52.60% to 37.90% by 2033. Among non-fossil fuel sources, solar photovoltaic (PV) power generation experiences the most significant change, with installed capacities of 359.04 GW, 597.29 GW, and 1489.89 GW in the three representative years. Other scenarios also show significant increases in PV installed capacity. By 2033, scenarios S1, S2, S3, and S4 have additional PV capacities of 40.82 GW, 184.47 GW, 70.09 GW, and 185.80 GW, respectively, compared to S0. Under the same electricity demand, scenarios with a higher proportion of renewable energy require more non-fossil fuel installed capacity. Carbon trading policies play a catalytic role in energy transition. In 2033, scenario S3 has 1.75% more non-fossil fuel installed capacity than scenario S1.

Figure 8.

Electricity installed capacity structure and capacity combination for different scenarios.

In terms of total power generation, there is not much difference between the scenarios, because this study sets a consistent power generation demand for each scenario to optimize electricity generation. Under the minimum cost optimization framework, the main focus is on analyzing the national installed capacity structure considering carbon constraints, the installation costs of different energy sources, and transmission costs.

Under the baseline scenario S0, the power generation from photovoltaic, nuclear, hydropower, and wind energy in 2033 is 3.07 TWh, 1.17 TWh, 1.46 TWh, and 0.60 TWh, respectively, within the non-fossil energy sources. The installed capacity for energy storage is 60.34 GW, with a storage capacity of 38.01 GWh. At this point, the proportion of energy storage in the entire power system is still relatively small, and its utilization is limited. Therefore, while increasing the share of non-fossil energy sources, it is necessary to further expand the use of energy storage to achieve a coordinated development of “wind and solar power generation paired with energy storage”. This approach can help build a more stable and sustainable power system.

4.6. Economic Losses of Whole Society and Total Costs of Electric Power Sector

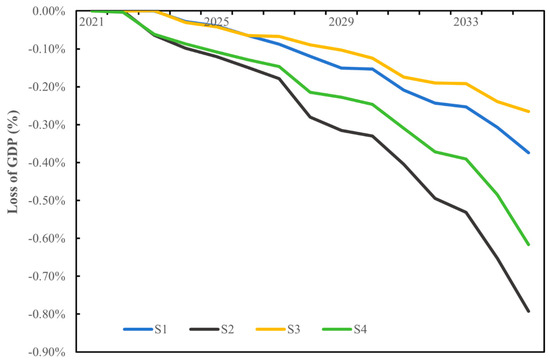

Figure 9 shows the economic losses of four emission reduction scenarios relative to the baseline scenario. Among them, Scenario S2 incurs the largest economic loss, followed by S4, and the smallest loss is in S3.

Figure 9.

Relative GDP loss rate for each scenario compared to baseline scenario.

When rigid carbon constraints are imposed, it can lead to a significant increase in the carbon emission reduction costs for high-energy-consuming industries. In Scenario S2, a high proportion of renewable energy is added, and the cost of developing renewable energy is currently more expensive than fossil fuels. Therefore, this results in further economic losses, reaching 0.79% by 2035.

Scenario S4 applies a carbon trading policy based on S2, which lowers the cost of carbon emission reduction across society and offsets some of the losses. As a result, the economic loss is reduced to 0.62% by 2035.

The economic losses in the other two scenarios, S1 and S3, are relatively smaller. However, the high proportion of renewable energy still has a significant impact on economic development. Therefore, it is necessary to increase investment and provide policy support for related new energy industries while developing renewable energy.

Compared to S1, the economic loss in S3 is 0.109% higher. This indicates that while carbon trading policies can have a positive impact on the economy, carbon constraints tend to result in greater economic losses.

The SWITCH-China model optimizes electricity generation through cost minimization. Table 6 shows the optimized cost values for the power sector under different scenarios. Among the emission reduction scenarios, S2 has the highest cost, followed by S4, and S1 has the lowest cost. This is similar to the GDP loss calculated by the CGE model.

Table 6.

Total costs of the electricity sector for each scenario.

From a macro perspective, under Scenario S2, the power sector requires more investment. This would shift investments from other industries to the power sector based on the balanced development of all industries in S0, leading to a new equilibrium state. As a result, there would be some loss in overall economic growth compared to the baseline scenario S0.

From a micro perspective, the power sector is constrained by carbon limits, which leads to a shift in the installed capacity structure towards non-fossil fuel power generation. However, fossil fuel power generation currently accounts for a significant proportion, and the cost of renewable energy sources such as wind and solar power is relatively high. When the SWITCH-China model performs a cost minimization optimization, it considers different costs to achieve the lowest overall cost.

Scenario S2 has the same carbon constraints and installed capacity as S4. However, S4 implements carbon trading, which reduces the cost of carbon emission reduction and lowers the cost of the power sector by 0.11 trillion yuan.

4.7. Sensitivity Analysis

In the CGE model, the substitution elasticity coefficient is often referenced from other studies or subjectively determined. Therefore, it is essential to perform a sensitivity analysis on such parameters to mitigate potential impacts on the simulation results. In this study, the substitution elasticity coefficient was adjusted by increasing or decreasing it by 5% to assess the significance of its effect on the current results. If the observed impact is minimal, it indicates the stability of the experimental outcomes.

Table 7 and Table 8 present the changes in GDP and carbon emissions that result from increasing or decreasing the substitution elasticity coefficient by 5% in 2030 and 2035, respectively. As can be observed from the tables, an increase in the elasticity coefficient brings about higher economic benefits, along with increased energy consumption, whereas a decrease in the elasticity coefficient suppresses energy consumption and further curtails economic growth. Hence, it can be concluded that the results obtained in this study exhibit a certain degree of robustness.

Table 7.

Sensitivity analysis of scenario parameters in 2030.

Table 8.

Sensitivity analysis of scenario parameters in 2035.

5. Main Conclusions and Policy Recommendations

5.1. Conclusions

This study aims to investigate the impact of energy policies on the decarbonization of the power sector and the overall nation, exploring the profound effects of China’s aggressive promotion of energy policies on both the macro-level of the national economy and the micro-level of the power sector from 2020 to 2035. By constructing a dynamic CGE model and coupling it with the SWITCH-China model, the research analyzes the influences of carbon constraints, varying proportions of renewable energy, and carbon trading policies on the national energy sector, economic performance, and the power generation mix within the electric power sector, all under consistent carbon constraints. The main conclusions drawn from this analysis are as follows:

(1) From the perspective of emission reduction, enhancing carbon constraints contributes the most significantly, followed by the development of a high proportion of renewable energy sources. In contrast, the implementation of carbon trading policies exhibits a relatively minor impact. Strengthening carbon constraints within sectors can effectively limit carbon emissions, thereby curbing the growth of emissions. Specifically, scenario S1, which involves increasing carbon constraints, achieves a 2.22% greater reduction in carbon emission intensity during the 14th Five-Year Plan period compared to the baseline scenario S0.The development of a high proportion of renewable energy sources reduces fossil fuel power generation and carbon emissions by increasing the installation of non-fossil energy sources at the source of power generation within the electricity sector. Under identical conditions, scenario S2, characterized by a high proportion of renewable energy installations, achieves a 0.67% reduction in carbon emission intensity compared to scenario S1, which features moderate renewable energy installations. Carbon trading policies aim to minimize economic losses by reducing the cost of carbon emission reduction, subsequently decreasing the carbon emission intensity indicator at the same level of emissions. Under comparable conditions, scenario S3, incorporating carbon trading policies, achieves a 0.47% greater reduction in carbon emission intensity compared to scenario S1, which lacks carbon trading mechanisms.

(2) From the perspective of energy transition, the development of a high proportion of renewable energy sources demonstrates a significant effectiveness in promoting the utilization of non-fossil energy. Conversely, enhancing carbon constraints and implementing carbon trading policies exhibit a more moderate impact on energy efficiency. Increasing the installation of non-fossil energy sources directly elevates the share of non-fossil energy, effectively transforming the energy mix. Specifically, under comparable conditions, scenario S2, characterized by a high proportion of renewable energy, achieves an approximately 5% higher electricity share compared to scenario S1.The intensification of carbon constraints serves as a catalyst for the transformation of high-emission industries, simultaneously modifying the energy consumption structure and capping total energy consumption. Carbon trading policies distribute the cost of carbon emission reduction across high-energy-consuming sectors, resulting in increased investment within these sectors relative to scenarios involving solely strengthened carbon constraints. Consequently, the proportion of non-fossil energy generation, which is currently associated with higher costs, is elevated in carbon trading scenarios when compared to carbon-constrained scenarios. Furthermore, overall energy consumption also experiences an increase.

(3) From an economic standpoint, the ranking of scenarios based on the magnitude of national GDP loss is as follows: enhanced carbon constraints, the promotion of a high proportion of renewable energy, and the adoption of carbon trading policies. Strengthening carbon constraints without complementary measures significantly increases the cost of carbon emission reduction for high-carbon industries, leading to an estimated loss of approximately 0.37% by 2035. Integrating the expansion of renewable energy with carbon constraints further escalates investment expenses, culminating in a loss of 0.79%. Nevertheless, carbon trading policies mitigate the financial impacts caused by both stringent carbon regulations and a substantial reliance on renewable energy. The estimated loss, when accounting for carbon trading policies, lies between the two extremes at approximately 0.62%. The overall investment trends in the electricity sector parallel those of societal economic losses. Specifically, carbon trading policies effectively reduce expenditures within the electricity sector under diverse scenarios, resulting in potential savings of approximately 1 billion yuan. This observation underscores the financial viability and long-term benefits of carbon trading policies in the context of energy transition and economic sustainability.

5.2. Policy Recommendations

Based on simulations of the aforementioned energy policies, which include strengthening carbon constraints, promoting a high proportion of renewable energy, and implementing carbon trading, it is apparent that the combined application of these policies yields more significant results than their individual implementation. Therefore, the following recommendations are proposed in light of the simulation findings, to enhance their effectiveness:

(1) Enhance the implementation of carbon trading policies and ensure effective government regulation. Expand the scope of the carbon market to include additional industries, promoting a collective and societal effort towards shouldering the responsibility for carbon emission reduction. At present, China’s carbon market only includes the power industry. Carbon trading significantly reduces the cost of carbon emission reductions and the economic losses based on the simulation results. An increase in the industries included in carbon trading can significantly reduce emission reduction costs and promote the achievement of emission reduction targets.

(2) Boosting the proportion of renewable energy installations and their penetration can effectively promote carbon peaking and carbon neutrality goals. Replacing fossil fuel-based energy installations with non-fossil alternatives can significantly reduce carbon emissions in the electricity sector, making the electricity structure cleaner.

6. Shortcomings and Improvement Directions

This study evaluates energy policies by integrating energy economic models with power optimization models, primarily analyzing the impact of policy transmission on power sector installations and generation. However, several limitations should be acknowledged. The CGE model relies on multiple assumptions and simplifications during the equilibrium simulation, which poses challenges in accurately reflecting real-world economic developments and the intricacies of policy implementation. Furthermore, the carbon constraints and carbon trading policies investigated in this study are theoretical, and their practical application often involves government intervention, rather than being purely market-driven, as assumed in the model.

Moreover, while the SWITCH-China model encompasses a wide range of installation types and power generation technologies, it cannot capture every detail of the actual power generation process. Additionally, provincial variations and yearly changes are not fully accounted for, leading to potential deviations in the simulated power generation process. When coupling the two models, temporal and spatial discrepancies arise. Specifically, enhancing the resolution of electricity demand data from the CGE model for integration into SWITCH-China may compromise data accuracy.

In conclusion, the incorporation of the SWITCH-China model in this study significantly improves the representation of the power sector. Nevertheless, there are still shortcomings in data integration. Future research should focus on refining the models’ ability to mirror real-world scenarios more closely and improving the precision of data linkage, thereby achieving a more realistic simulation.

Author Contributions

Conceptualization, L.T. and J.Z.; Methodology, L.T., G.H. (Guori Huang) and P.W.; Software, M.L., X.L., S.Y. and H.T.; Formal analysis, M.L., G.H. (Guori Huang), X.L. and S.R.; Investigation, G.H. (Gengsheng He) and N.S.; Resources, J.Z., S.Y. and N.S.; Data curation, G.H. (Gengsheng He) and H.T.; Writing—original draft, M.L. and L.T.; Writing—review & editing, X.L., S.Y., G.H. (Gengsheng He), N.S., H.T. and S.R.; Visualization, P.W.; Supervision, S.R.; Funding acquisition, P.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Innovation Project supported by China Southern Power Grid Corp (YNKJXM20230013).

Data Availability Statement

All data that support the findings of this study are included within this article. Other related data associated with this study could be made available upon request.

Conflicts of Interest

Authors Jincan Zeng, Guori Huang, LiuXi, Shangheng Yao, Gengsheng He and Nan Shang are employed by the China Southern Power Grid and Minwei Liu is employed by the company Yunnan Power Grid Corp. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- Cai, L.; Duan, J.; Lu, X.; Luo, J.; Yi, B.; Wang, Y.; Jin, D.; Lu, Y.; Qiu, L.; Chen, S.; et al. Pathways for electric power industry to achieve carbon emissions peak and carbon neutrality based on LEAP model: A case study of state-owned power generation enterprise in China. Comput. Ind. Eng. 2022, 170, 108334. [Google Scholar] [CrossRef]

- Li, M.; Gao, H.; Abdulla, A.; Shan, R.; Gao, S. Combined effects of carbon pricing and power market reform on CO2 emissions reduction in China’s electricity sector. Energy 2022, 257, 124739. [Google Scholar] [CrossRef]

- Fang, K.; Li, C.; Tang, Y.; He, J.; Song, J. China’s pathways to peak carbon emissions: New insights from various industrial sectors. Appl. Energy 2022, 306, 118039. [Google Scholar] [CrossRef]

- Tang, B.; Li, R.; Yu, B.; An, R.; Wei, Y.M. How to peak carbon emissions in China’s power sector: A regional perspective. Energy Policy 2018, 120, 365–381. [Google Scholar] [CrossRef]

- Mei, H.; Li, Y.P.; Suo, C.; Ma, Y.; Lv, J. Analyzing the impact of climate change on energy-economy-carbon nexus system in China. Appl. Energy 2020, 262, 114568. [Google Scholar] [CrossRef]

- Wang, W.; Yuan, B.; Sun, Q.; Wennersten, R. Application of energy storage in integrated energy systems—A solution to fluctuation and uncertainty of renewable energy. J. Energy Storage 2022, 52, 104812. [Google Scholar] [CrossRef]

- Baloch, Z.A.; Tan, Q.; Kamran, H.W.; Nawaz, M.A.; Albashar, G.; Hameed, J. A multi-perspective assessment approach of renewable energy production: Policy perspective analysis. Environ. Dev. Sustain. 2021, 24, 2164–2192. [Google Scholar] [CrossRef]

- Kozlova, M.; Overland, I. Combining capacity mechanisms and renewable energy support: A review of the international experience. Renew. Sustain. Energy Rev. 2022, 155, 111878. [Google Scholar] [CrossRef]

- Gang, Z.; Ying, Z. Can China’s renewable energy industry policy support the low-carbon energy transition effectively? Environ. Sci. Pollut. Res. 2023, 30, 29525–29549. [Google Scholar] [CrossRef]

- Pradhan, B.K.; Ghosh, J. A computable general equilibrium (CGE) assessment of technological progress and carbon pricing in India’s green energy transition via furthering its renewable capacity. Energy Econ. 2022, 106, 105788. [Google Scholar] [CrossRef]

- Kong, L.-S.; Tan, X.C.; Gu, B.H.; Yan, H.S. Significance of achieving carbon neutrality by 2060 on China’s energy transition pathway: A multi-model comparison analysis. Adv. Clim. Change Res. 2023, 14, 32–42. [Google Scholar] [CrossRef]

- Dasar, K.S.T.T.B. Decarbonizing the Global Electricity Sector through Demand-Side Management: A Systematic Critical Review of Policy Responses. J. Ekon. Malays. 2022, 56, 71–91. [Google Scholar]

- Chen, H.; Cui, J.; Song, F.; Jiang, Z. Evaluating the impacts of reforming and integrating China’s electricity sector. Energy Econ. 2022, 108, 105912. [Google Scholar] [CrossRef]

- Zhang, H.; Zhang, B. The unintended impact of carbon trading of China’s power sector. Energy Policy 2020, 147, 111876. [Google Scholar] [CrossRef]

- Yu, Z.; Geng, Y.; Calzadilla, A.; Bleischwitz, R. China’s unconventional carbon emissions trading market: The impact of a rate-based cap in the power generation sector. Energy 2022, 255, 124581. [Google Scholar] [CrossRef]

- National Bureau of Statistics. China Statistical Yearbook 2020; China Statistics Press: Beijing, China, 2020.

- National Bureau of Statistics, Energy Statistics Department. China Energy Statistical Yearbook 2021; China Statistics Press: Beijing, China, 2022.

- China Electricity Council. China Electric Power Statistical Yearbook 2021; China Statistics Press: Beijing, China, 2022. [Google Scholar]

- He, G.; Avrin, A.P.; Nelson, J.H.; Johnston, J.; Mileva, A.; Tian, J.; Kammen, D.M. SWITCH-China: A systems approach to decarbonizing China’s power system. Environ. Sci. Technol. 2016, 50, 5467–5473. [Google Scholar] [CrossRef]

- Avrin, A.P.; Moura, S.J.; Kammen, D.M. Minimizing cost uncertainty with a new methodology for use in policy making: China’s electricity pathways. In Proceedings of the 2016 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Xi’an, China, 25–28 October 2016; pp. 1–7. [Google Scholar]

- Zhang, X.; Cui, X.; Li, B.; Hidalgo-Gonzalez, P.; Kammen, D.M.; Zou, J.; Wang, K. Immediate actions on coal phaseout enable a just low-carbon transition in China’s power sector. Appl. Energy 2022, 308, 118401. [Google Scholar] [CrossRef]

- He, G.; Lin, J.; Sifuentes, F.; Liu, X.; Abhyankar, N.; Phadke, A. Rapid cost decrease of renewables and storage accelerates the decarbonization of China’s power system. Nat. Commun. 2020, 11, 2486. [Google Scholar] [CrossRef]

- Lin, J.; Abhyankar, N.; He, G.; Liu, X.; Yin, S. Large balancing areas and dispersed renewable investment enhance grid flexibility in a renewable-dominant power system in China. Iscience 2022, 25, 103749. [Google Scholar] [CrossRef]

- Ji, X.; Wu, G.; Zhang, J.; Su, P. Reconsider policy allocation strategies: A review of environmental policy instruments and application of the CGE model. J. Environ. Manag. 2022, 323, 116176. [Google Scholar] [CrossRef]

- Jiang, H.-D.; Pradhan, B.K.; Dong, K.; Yu, Y.Y.; Liang, Q.M. An economy-wide impacts of multiple mitigation pathways toward carbon neutrality in China: A CGE-based analysis. Energy Econ. 2024, 129, 107220. [Google Scholar] [CrossRef]

- Jia, Z. What kind of enterprises and residents bear more responsibilities in carbon trading? A step-by-step analysis based on the CGE model. Environ. Impact Assess. Rev. 2023, 98, 106950. [Google Scholar] [CrossRef]

- Jiang, H.-D.; Dong, K.; Qing, J.; Teng, Q. The role of technical change in low-carbon transformation and crises in the electricity market: A CGE analysis with R&D investment. Energy Econ. 2023, 125, 106897. [Google Scholar]

- Duan, L.; Liu, Z.; Yu, W.; Chen, W.; Jin, D.; Feng, Y.; Wang, Y.; Liu, J.; Zhou, H.; Sun, S.; et al. The provincial trend of population aging in China–based on population expansion forecast formula. J. Comput. Methods Sci. Eng. 2022, 22, 349–359. [Google Scholar] [CrossRef]

- Chen, L.; Mu, T.; Li, X.; Dong, J. Population prediction of Chinese prefecture-level cities based on multiple models. Sustainability 2022, 14, 4844. [Google Scholar] [CrossRef]

- Raftery, A.E.; Ševčíková, H. Probabilistic population forecasting: Short to very long-term. Int. J. Forecast. 2023, 39, 73–97. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).