1. Introduction

The overconsumption of natural resources frequently triggers severe environmental backlash, leading to widespread devastation for nature and society. Natural disasters are occurring more frequently all around the world as a result of the recent industrial activity that has accelerated the release of harmful gases into the atmosphere. For instance, a report by the United Nations suggests that, in the last fifty years, disasters linked to climate change have multiplied by five due to the unchecked exploitation of natural resources [

1]. The imbalance between the demand and supply of these resources has continued to stir chaos, contributing to a surge in global emissions. The Natural Resources Defense Council warns that emission levels are yet to peak, indicating that emission rates might not stabilize soon, thus posing a significant environmental threat. Research suggests that the Earth has already heated up by over 1.5 °C from pre-industrial levels [

2]. This trend could impose hefty environmental costs on countries, causing more ecological harm [

3]. Consequently, regions suffering the most will likely experience more frequent and severe environmental repercussions.

Within the domain of carbon footprint, which encompasses sociocultural, economic, and environmental dimensions, ecological issues are particularly salient and have been extensively examined by researchers and policymakers [

4,

5]. Renewable energy sources and green patents significantly predict a carbon footprint. Societies can substantially mitigate CO

2 emissions and diminish air and water pollution while enhancing energy security by transitioning from non-renewable fossil fuels to RE alternatives [

6]. The current theoretical framework posits that the extent of a nation’s fossil fuel reserves plays a pivotal role in determining its carbon intensity. In scenarios where other variables are constant, nations endowed with ample fossil fuel resources tend to adopt development trajectories more reliant on carbon emissions than those with scarce reserves. The Environmental Kuznets Curve (EKC) hypothesis is relevant here. It posits that environmental degradation initially increases with GDP but eventually decreases as economies mature and become wealthier, thus increasing investment in green technologies and stricter environmental regulations [

7]. Green technology and modern growth theories support this by emphasizing the role of technological advancements in reducing environmental impacts [

8]. These technologies include RE systems, energy-efficient processes, and sustainable practices, which are crucial for achieving long-term sustainability goals [

9].

Furthermore, it is noteworthy that oil-rich economies often demonstrate a lower dependency on renewable energy. For example, in countries rich in petroleum, such as Saudi Arabia, the renewable energy contribution (REC) to the primary energy mix is a mere 0.09%, with Algeria and Iran showing similarly low figures of 0.25% and 1.64%, respectively. In stark contrast, nations with limited oil resources, such as Morocco, Vietnam, Malaysia, and Thailand, exhibit higher renewable energy percentages in their energy mix, accounting for 8%, 17%, 7%, and 6.17%, respectively [

10].

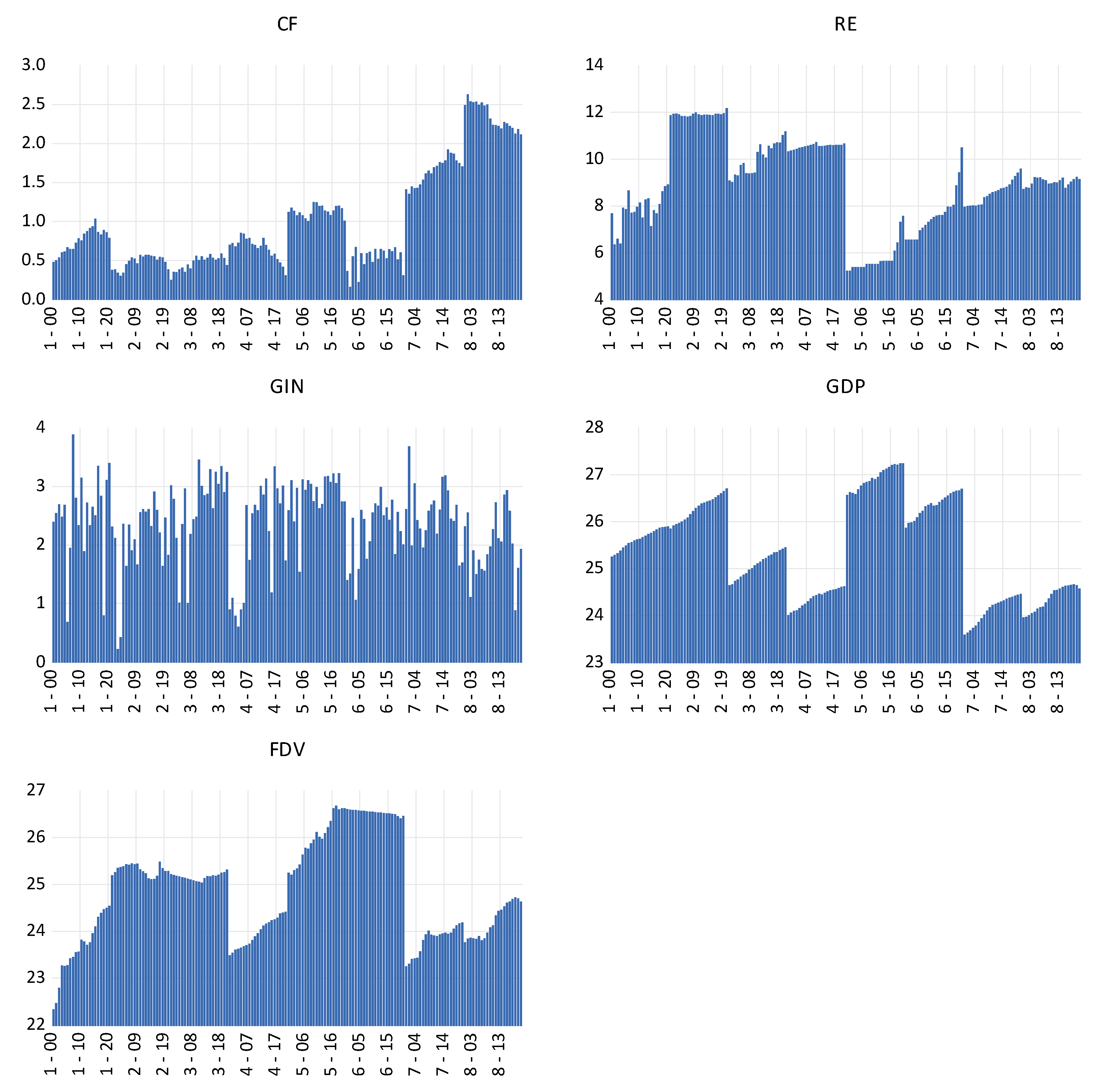

In this study, considering the growing importance of limiting emissions and the ecological footprint, we explore how green energy and technologies affect the carbon footprint in the MENA region from 2000 to 2021. Through this study, we address the following research questions: (1) Do energy policy interventions, such as encouraging green energy and technologies, help limit the carbon footprint in the MENA bloc? (2) How does technology focusing on ecological management affect the ecological footprint in the MENA bloc? To address these research queries, we deployed advanced panel data models and tests that can generate robust and consistent estimates. The motivation behind this study lies in the sharp contrasts that exist between MENA policies that are aimed at curbing emissions.

This research paper examines the impact of GDP, FDV, RE, and green innovation on the carbon footprint across eight MENA countries: Algeria, Egypt, Tunisia, Morocco, Saudi Arabia, the United Arab Emirates, Jordan, and Lebanon. A marked effort within the MENA region to enhance and diversify energy sources by promoting RE is noted as a strategic approach to reducing carbon emissions [

11]. The selection of the MENA region as the primary case study is attributed to the significant structural, economic, and societal changes it has undergone recently [

12], and this is characterized by rapid economic development and the evolution of financial systems. The choice of these specific countries is based on their robust commitment to boosting their renewable energy sector, which is pivotal considering the considerable environmental impact of their mining and quarrying sectors, particularly in oil and gas production. Comprehensive environmental evaluations that concentrate on mining operations have shown that these industries are important causes of air pollution-related health problems, as well as considerable contributors to environmental deterioration. This scenario underscores the urgent need for a strategic pivot toward RE in these oil-abundant nations as part of an initiative to mitigate the adverse environmental effects associated with their conventional energy sectors, which aligns them with the carbon curse hypothesis.

The second essential contribution of this work is in exploring how ecological governance and finance through market-based intervention affects the carbon footprint in the MENA region. Additionally, international commitments also compel regional policymakers, notably the obligation to meet the Sustainable Development Goals (SDGs) by 2030. Agriculture and water resources are critical in the MENA region, serving as principal employment sources and political stability pillars. Yet, prevailing climatic and demographic trends are provoking concerns regarding the region’s sustainable capacity to support its population and economic stability in the long term [

13].

The third contribution is using a dynamic panel quantile model to examine this field in MENA countries for the first time. Unlike previous studies that have employed static and traditional dynamic panel models, our research utilizes a non-parametric panel Q-ARDL model. This innovative approach allows us to capture the varying impacts of green innovation and renewable energy across different quantiles, thus providing a more nuanced and comprehensive analysis. We can gain a better understanding of the diverse impacts of numerous variables on environmental sustainability by utilizing this model as these effects are frequently obscured by traditional average-based approaches. This methodology also enables us to identify both immediate and long-term impacts, offering a clearer picture of how green innovation and renewable energy policies influence environmental outcomes over time. This contribution is particularly significant in the MENA region, where diverse economic and environmental conditions necessitate a more detailed and dynamic analytical framework.

Section 2 of the manuscript provides an analytical review of the recent literature;

Section 3 outlines the theoretical framework and primary methodologies;

Section 4 is devoted to a thorough presentation and discussion of the results; and

Section 5 concludes with policy recommendations.

2. Literature Review

An important factor in the impact of carbon footprint is the use of green technologies, which is mainly achieved through green patents. Ref. Javed et al. [

14] utilized a novel dynamic, simulated ARDL framework to analyze data from 1994–2019 in Italy. They found that ecological patents are instrumental in enhancing Italy’s environmental quality. Moreover, these patents demonstrate a more effective inhibition of ecological emissions when coupled with robust environmental governance. Expanding on their findings, Saqib et al. [

15] suggested that the strategic implementation of ecological patents limits carbon footprint impacts and catalyzes sustainable economic development in emerging economies. The aforementioned authors emphasized the pivotal role of government policies in fostering an environment that is conducive to innovation and the adoption of green technologies. They recommend that policymakers in these regions focus on creating incentives for research and development in eco-friendly technologies, which could significantly transform their environmental and economic landscapes, mainly by reducing the carbon footprint associated with traditional industrial practices. Similarly, Appiah et al. [

16] delved deeper into the mechanisms through which innovations influence ecological footprints. Their study highlights how crucial technical developments are in mitigating the negative effects of economic activity on the environment, including substantial reductions in carbon footprints. Applying the CS-ARDL approach provides empirical evidence showing that the proactive adoption of environmental patents diminishes the ecological footprint and sets a foundation for sustainable growth. This study calls for enhanced international collaboration to facilitate the transfer of green technologies, suggesting that such co-operation could be crucial for scaling the positive impacts of innovations across borders and achieving global sustainability goals. Abaas et al. [

17] explored the nexus between green patents, energy use, R&D expenditure, and CO

2 emissions in Chinese cities under the Low Carbon City Program from 2003–2020. Via employing CS-ARDL and Q-ARDL models in 118 cities, green tech investments have significantly boosted environmental sustainability across quantiles, thus validating the EKC hypothesis. In contrast, Sarabdeen et al. [

18] examined how digital revolution affects oil-exporting countries’ GDP, their contribution toward climate change, and their shift to sustainable energy. This study utilized panel data from the World Bank spanning from 2006 to 2020. This study found that digital technology improves environmental quality and mitigates climate change. However, internet and mobile access negatively impact ecological quality.

The interrelationship between RE and economic expansion constitutes a multifaceted and progressively pertinent study area, especially in terms of sustainable development and carbon footprint [

19,

20,

21,

22,

23]. The traditional economic growth paradigm is largely dependent on fossil fuels, which, while effective in driving industrialization and economic progress, has led to environmental degradation and an increased carbon footprint [

24,

25,

26]. This suggests that a greater adoption of renewable energy could enhance financial inclusion and decrease the risks associated with economic policy uncertainty. This study asserts that the intricate relationship between REC, GI, and GDP profoundly influences policymakers’ renewable energy frameworks. With adequate energy supply, a nation can benefit from increased productivity and other economic advantages such as enhanced competitiveness, fulfilling unmet needs, and creating new value [

27]. Additionally, innovative strategies for transitioning economies from traditional to greener energy sources are essential for achieving the objectives set for reducing carbon footprints by 2030 [

17,

28]. Usman et al. [

29] emphasized the indispensable role of renewable energy consumption in meeting these carbon footprint reduction goals.

Financial development (FDV) is critical in accelerating the transition toward renewable energy consumption and in reducing carbon footprint by facilitating investments, mitigating risks, and fostering technological innovations [

30]. Moreover, FDV influences policy decisions, as well as the potential for advocating for renewable-friendly policies and subsidies. FDV remains a significant barrier to the adoption of renewable energy in developing regions, such as African and Arab countries [

31]. FDV has been identified as a crucial driver of economic progress, and it has been highlighted that a consequent increase in production reduces carbon footprint and heightens energy consumption. According to the study of [

32], FDV is associated with advanced technologies that reduce energy consumption, but it is contingent on GDP growth. Shahbaz et al. [

33] observed that factors like reform methods, financial openness, structural changes, financial crises, energy costs, and inflation affect the financial sector and significantly influence carbon footprint and energy consumption levels. Danish [

34] argued that a more efficient financial system enables individuals, businesses, and governments to procure more energy products. The significance of renewables is increasingly acknowledged as they are pivotal to reducing carbon footprints and can enhance socio-economic aspects by satisfying energy demands, lessening pollution impacts, and improving population well-being. Dogan et al. [

35] focused on the function of research and development (R&D) in realizing SDG goals and CO

2 emissions in the USA during the period of 1990 to 2022 in the context of COP28. They confirmed a long-term cointegrating link between CO

2 emissions, GDP, human capital, R&D, eco-friendly technologies, and RE. In the short run, all of the variables except R&D expenditures showed significant effects. Moreover, rising income levels and human capital tend to worsen environmental problems by contributing to an increase in CO

2 emissions. Conversely, expenditures on the R&D, technological innovation, and the adoption of RE reduce carbon emissions and foster sustainability.

5. Conclusions

This study examined the impact of GDP growth, GIN, REC, and FDV on the carbon footprint using the panel data from eight MENA countries from 2000 to 2020. Our findings highlight the presence of CSD among the panel countries, indicating the potential influence of common unobserved factors. Additionally, the evidence is consistent with a long-term equilibrium relationship between the factors listed above. Given these findings, we estimated the underlying relationships using the QARDL and PMG ARDL methods. Following these estimates, the DH test was used to validate the selected model specification. We established a significant and positive effect of green innovation, greener energy, and financial development on the carbon footprint of MENA-selective nations.

The results suggest that the enterprises within these MENA countries have a strategic impetus to channel investments into renewable energy to sustain GDP growth and stabilize financial conditions, which is a paramount long-term objective. Moreover, it is imperative to safeguard the evolution of financial markets over the medium to long term. It is anticipated that there will be considerable transformations within the financial and industrial architectures propelled by socio-environmental consciousness and technological innovation. Economic growth (EG) and financial markets are projected to experience concomitant continued expansion with an escalation in demand for renewable energy consumption (REC) and green patents. The results also highlight the significant potential for RE to drive sustainable economic growth and to reduce carbon footprints, suggesting several key policy actions. Firstly, policymakers in the MENA region should prioritize developing and implementing supportive regulatory frameworks that encourage investment in RE. This includes setting clear targets for RE adoption, providing financial incentives such as subsidies and tax breaks, and simplifying administrative processes for RE projects. Secondly, the findings underscore the importance of investing in R&D to advance green technologies. Governments should allocate resources to R&D initiatives that focus on improving the efficiency and cost-effectiveness of RE technologies. Thirdly, to ensure a just transition to a green economy, it is crucial to develop training programs that equip workers with the necessary skills for jobs in the RE sector. Additionally, new energy laws and environmental technology patents must be created to promote the growth of the RE sector in this situation. Environmental stakeholders stress the importance of decoupling economic growth from dependence on petroleum-based hydrocarbons. This transition is especially critical for countries with high emissions intensities and traditional energy practices, such as the MENA region.

Our manuscript has a few limitations that can serve as a foundation for future research. The manuscript acknowledges several constraints that merit attention and could inform subsequent scholarly inquiries. Primarily, the analytical focus on the MENA region may limit the generalizability of the findings, particularly concerning the interplay between sustainability and global difficulties such as the pandemic, regional geopolitical tensions like the hostilities involving Russia and Ukraine, and conflicts in the Red Sea area. Such circumscription potentially narrows the scope of insights into the effects on developing countries within and beyond the MENA cohort. Secondarily, this study does not encompass critical macroeconomic variables like green productivity. Anticipated future scholarly contributions are expected to delve deeper into institutional and geopolitical indices via assessing whether adopting RE sources facilitated by energy policies and green productivity could substantially mitigate CO2 emissions. Thirdly, we recognize the several limitations of the methodologies. The Panel Quantile ARDL and PMG ARDL models are robust in capturing dynamic relationships across quantiles and heterogeneous panels. However, these models rely on certain assumptions that may affect the results. For instance, the PMG ARDL model assumes a homogeneity in the long-run coefficients across countries while allowing for short-run coefficients to vary. This assumption may not hold; thus, it could lead to potential biases in long-term estimates.

Future research in environmental sustainability and green energy in the MENA region can be directed toward technological innovations that also hold significant potential; research could investigate the applicability of advanced solar and wind technologies, energy storage solutions, smart grid systems, and AI use that is specific to the MENA region. We will also conduct a comparative analysis to complement our findings for the MENA region against other regions, as well as provide a more comprehensive understanding of the dynamics of renewable energy adoption and its implications for environmental sustainability.