Abstract

The challenges posed by climate change and global warming loom large, necessitating a critical initial step towards the long-term growth and the enhancement of both environmental and operational efficiency. Within the energy sector, renewable energy sources are gaining increasing prominence. Consequently, traditional oil and gas companies (OGC) are undergoing a gradual transformation into comprehensive energy corporations, aligning themselves with energy transition policies. This paper examines two types of efficiency measures—operational and environmental—for the 20 largest OGC during the period of 2010–2019. Secondly, this research aims to explore the effect of the global energy transition on both environmental and operational efficiency. Based on three estimation methods, two estimation steps are used in this research. In the first step, the True Fixed Effect (TFE) model and the Battese and coelli (1995) SFA model are applied to evaluate, measure and compare the environmental and operational efficiency scores. In the second step, the TFE model and GMM approach for the dynamic panel data model are used to explore, evaluate and verify the effect of global energy transition on the environmental and operational efficiency of the largest 20 OGC in the world. The results reveal that the average operational efficiency of major OGC measured using the BC.95 model and TFE model is 66% and 85%, respectively, and the overall average level of environmental efficiency for OGC over a 10-year period is 31% (based to B.C.95 model) and 13% (based to TFE model). Our findings reveal that biofuels, solar and hydropower contribute to promote the operational and environmental efficiency of the largest 20 OGC. However, the analysis suggests that while the global energy transition significantly influences and bolsters environmental efficiency, its effect on operational efficiency among these major OGC remains less pronounced and insufficient.

1. Introduction

In a contemporary society that strives for sustainable growth, concerns like energy economics and environmental preservation are crucial. Climate change and global warming raise many critical global issues addressing the evolution of the global energy grid in the future and require the emergence of a new global energy economy that changes the current fundamentals of energy production and consumption. Likewise, the demand for energy throughout the world is rising, driven by economic growth and population despite various regional turmoil, especially the COVID-19 pandemic. The energy sector is responsible for approximately 75% of the emissions that have driven the rise in average global temperatures, resulting in significant changes to weather and climate extremes [1]. Therefore, the energy sector must be at the heart of solving the problem of climate change.

The development of renewable energies must be at least six times faster if the world is to achieve the objectives defined in the Paris agreement (IRENA). The historic 2015 climate agreement aims, at a minimum, to reduce the average global temperature increase to “well below 2 °C”. Renewable energies, combined with a rapid improvement in energy efficiency, are key to tackling climate change. However, the global energy system must have structural changes and move from a system heavily reliant on fossil fuels to a system concerned with improving energy efficiency and based on renewable energies. This kind of global energy transition, at the heart of the “energy transition” already at work in many countries, can be the source of a more prosperous and more united world.

Government plans are still a long way from what is needed to reduce emissions. Under existing and projected policies, the world’s “carbon budget” would be depleted within twenty years to limit the global temperature increase to less than 2 °C, and global energy use will be dominated for decades to come by different types of fossil fuels [1]. Currently, over two-thirds of the world’s energy comes from the petroleum industry. It is under great pressure to make a transition to a more sustainable way of working by implementing energy transition policies to stem the effects of climate change and environmental problems. Accordingly, the new global energy system depends primarily on weather and a strategy for responding to emerging climate change and sustainability issues in the oil and natural gas industry.

According to the global energy review report [2], worldwide carbon emissions from energy combustion and industrial processes increased by 6% in 2021 to achieve their highest yearly level on record. The COVID-19 epidemic reduced worldwide CO2 emissions by 5.2% in 2020. However, because of the exceptional fiscal and monetary stimulus, as well as the quick vaccine deployment, the globe has witnessed an extraordinarily rapid economic rebound since then. The rebound in energy demand in 2021 has been hampered by unfavorable weather and energy market conditions, which have caused more coal to be burned with the strongest ever annual growth in coal production.

The global understanding of the necessity of environment protection is critical in light of current trends, particularly the energy sector firms, due to their large contribution to overall carbon dioxide emission. Moreover, the petroleum industries also directly release greenhouse gases into the atmosphere in addition to producing the basic energy necessary for economic expansion and the various petroleum products utilized as intermediary goods for several industries. Therefore, reducing CO2 emissions in the petroleum industry is something that governments, business leaders, and people who care about the environment should work toward. Even though they may have high levels of operational efficiency (OE), several oil and gas companies (OGC) were unwilling to implement such standards in order to reduce pollution or safeguard the environment. Therefore, assessing and comparing the environmental efficiency (EE) and operational efficiency (OE) of major OGC is a crucial first stage towards reducing carbon dioxide emissions and protecting the environment for sustainable economic growth.

Major OGC have boosted their investments in the transition to a low-carbon economy by setting carbon reduction goals. These investments include low-carbon projects, acquisitions, and emission reduction technology. British Petroleum (BP) has established a USD 500 million annual investment in low-carbon operations and a USD 100 million internal fund to implement new ideas [3]. Unprecedented investment in wireless fast-charging technology for automobiles, the declaration of support for a sizable gas-fired energy and carbon capture facility have been established in Teesside, UK, while USD 200 million has been invested in Lightsource BP [3]. Saudi Aramco is a member of the Oil and Gas Climate Initiative (OGCI) and will invest USD 1 billion in low-carbon technologies over the next decade [3].

Since the 2000s, Chevron has spent more than USD 8 million on the research and development of battery technologies and alternative energy. Chevron has also put more than USD 1 billion into investment in the Gorgon carbon dioxide injection project and the Quest project and has put more than USD 75 million into investment in carbon capture and storage research [3].

However, investment priorities vary among OGC. The major OGC have made a variety of investments in emerging energy areas, storage technologies and carbon capture. The major OGC invest heavily in carbon capture emerging energy areas and storage technology each year, and several OGC are interested in renewable energy initiatives. Shell and Total have made massive investments in the power system. Saudi Aramco intends to deploy solar photovoltaic remote facilities more frequently [3]. Furthermore, as a result of the heavy reliance on oil and gas in the transport sector, the major OGC are making investments in alternative energies and electric cars, thus expenditures in batteries and rapid charging technologies are rather considerable.

This paper examines and compares the OE and EE of the largest OGC over the 2010–2019 period using desirable (operational revenue) and undesirable (CO2 emission) outputs and assesses the effect of the global energy transition on the OE and EE. Three methods are adopted in this paper. In the first step, the True Fixed Effect (TFE) model and Stochastic Frontier Analysis (SFA) are applied to measure the OE and EE level. In the second step, the system GMM approach and the TFE model are used to study the effect of the global energy transition on the scores orientation of the two types of efficiency.

The remainder of this research is structured as follows. Section 2 provides an overview of the literature on EE and OE studies applied to energy challenges. Section 3 presents the methodology adopted in this research and discusses the used dataset. Section 4 discusses the findings of the OE scores and EE measures and the effect of global energy transition on the orientation of both efficiency scores. Section 5 presents the conclusion and makes recommendations for further research.

2. Literature Review

Several previous studies have evaluated the financial, operational, revenue or environmental efficiency of OGC [4,5,6,7]. Eller et al. [8] give empirical findings on the revenue efficiency of domestic OGC and private international OGC using the SFA method and the data envelopment analysis DEA Method for 78 OGC. They discover that home businesses are less effective than those operating abroad. The distinct structural and institutional aspects of the organizations, which may be explained by the firms studied various aims, can account for a sizable percentage of the inefficiency.

A crucial first step for organizations on the path to sustainable planning is an operational efficiency assessment approach. Atris and Goto [9] analyze the OE measures and also the EE measures for 34 U.S. OGC over 2011–2015 using non-radial DEA methods. The Kruskal–Wallis test is applied to see if there are any differences between integrated and independent companies as well as whether two types of unified efficiency indicators evolve over time. According to their findings, integrated enterprises are more environmentally efficient than independent ones. This is a result of integrated organizations increased environmental protection standards and their investment in a consumer-oriented strategy to increase revenues.

Lim and Lee [10] use the method of the two-step Markowitz portfolio optimization theory methodology to investigate the efficiency of oil refining industry between 2005 and 2016. They also analyze data from over 30 OECD nations. They claim that there is a direct correlation between oil product pricing and the efficiency of the refining sector. Additionally, their calculations demonstrate that while energy consumption and crude oil output in these nations reduce the efficiency of the refining sector, the consumption of renewable energy sources and research and development expenditures have the opposite effect. The oil industry can coexist with the renewable energy sector, according to the paper’s authors, in order to promote sustainable growth.

Sun et al. [7] examined the efficiency issues of CNPC and Sinopec, which are the largest Chinese OGC playing an important role in international competition. The authors adopt the SFA method and the TFE models to assess the efficiency of the 10 biggest oil firms in the world from 2003 to 2013. Their findings imply that compared to other oil and gas companies, CNPC and Sinopec Group’s efficiency has improved somewhat since the global financial crisis, and Chinese state-owned oil enterprises still need to be enhanced by foreign managerial expertise.

Jarboui [5] evaluates the OE and EE of 45 U.S. OGC during 2000–2018. Furthermore, the purpose of this study is to assess the impact of renewable energies on both forms of efficiency. In this study, the author employed two methods: the TFE model to calculate efficiency scores and identify causes of inefficiency, and the GMM to analyze the impact of US energy and environmental policies on both forms of efficiency. The findings show that OGC in the United States have begun to migrate to low CO2 emissions in recent years. Furthermore, biofuels, hydroelectric electricity, wind power, and solar power are contributing to the EE of U.S. OGC. Jia et al. [11] provide an overview of cutting-edge theory and technology in analytical chemistry and geochemistry as applied in the upstream oil and gas sector. They suggest enhancing high-resolution chemistry capabilities to promote efficient and sustainable energy development.

Recently, the SFA approach has been widely used to evaluate firms’ efficiency. The SFA model identifies the firm deviation from the optimal frontier of production function and distinguishes between individual heterogeneity and inefficiencies [12]. Some problems and restrictions may arise when conducting research using the SFA approach. The model proposed by Battese and Coelli [13,14,15] enables an overestimation of the inefficiency term, resulting in a mismatch between the projected efficiency outcomes and the actual conditions. However, Greene [16,17,18] concentrated on the effect of heterogeneity on the efficiency measure. Greene [16] examined the efficiency of health care services in 191 countries and showed that it is important to separate inefficiency from heterogeneity. The SFA cost technique for panel data was also used by Farsi et al. [19], and their ability to distinguish change in inefficiency from unobserved heterogeneity was contrasted. The importance of variability in efficiency assessment has been underlined by a growing body of research in recent literature. Wang and Ho [20] demonstrated that individual heterogeneity needs to be appropriately managed in this situation since otherwise, its influence will be recognized in both the inefficiency term and the efficiency estimation. Estimates of energy efficiency that disregard technology variety will be skewed [21,22]. A fixed-effects model evaluating the influence of environmental efficiency on rail transportation was created by Song et al. [23]. A True Fixed Effect model was presented by Greene [17] to separate between the time-varying and time-invariant component, thus distinguishing between inefficiency and heterogeneity. Heterogeneity presents the individual component in the TFE Model, which is assumed to be constant, while inefficiency is presented by the time-varying component.

3. Methodology

In order to assess the efficiency of the larger OGC, a two-step methodology is used in this research, and in each step, we used two methods. In the first step, it is necessary to measure the operational and environmental efficiency using two methods, namely the TFE model proposed by Wang and Ho [20] and the stochastic frontiers method developed by Batesse and Coeli [15]. In the second step, it is important to assess the effect of global energy transition policy on different types of efficiency. At this stage, the system GMM approach and TFE model are introduced as two methods to verify the effect of global energy transition on EE and OE scores.

3.1. Stochastic Approach: TFE and Heterogeneity

The SFA model for panel data is defined using the following equation [24]:

where, indicates the output of the firm i in the period t; indicates the inputs of company i for period t; β indicates the estimated coefficients; stands for the error component, which is broken down into two components: and ; denotes the random error, and denotes the error related to the technical inefficiency. Several research papers are interested in the distribution and the conditions of time-varying of after the study of Pitt and Lee [25]; the methods developed by Battese and Coelli, [14] (BC92), Battese and Coelli, [15] (BC95) are the most used to study the efficiency of an organization [26].

Greene [17] presents a thorough examination of the implications of heterogeneity. According to Greene [27], if every firm shared identical characteristics, disregarding random disturbance terms, they would be homogeneous; however, individual heterogeneity would persist. Due to the highly diverse manufacturing environment, numerous enterprises exhibit distinct traits influenced by various circumstances. Moreover, variations exist among nations in governmental policies, social norms, business reform strategies, and economic growth rates. These institutional traits or unobservable heterogeneities may impact a firm’s efficiency. Significantly, there are substantial differences among oil and gas companies concerning management strategies, organizational characteristics, investment objectives, and operational procedures. These factors undergo gradual changes and predominantly influence the goods firms produce rather than their production methods. Furthermore, these factors are unlikely to directly influence production [6].

Greene’s [16,17,18] True Fixed Effect model is used in this study to determine whether time-invariant heterogeneity influences inefficiency.

In this model, , and are independent. indicates the inefficiency score of firms, which can change over time and between firms. denotes the modelling of heterogeneity across several firms.

Comparing the current True Fixed Effect model with the Battese and Coelli [15] models reveals three significant distinctions. Firstly, in the True Fixed Effect model, heterogeneity remains consistent over time. This refers to the unique characteristics of individual companies, such as their operational approach, relevant policies, and variations in corporate assets. In contrast, the Battese and Coelli models do not maintain this consistency, potentially overlooking the influence of company-specific effects on efficiency scores. Secondly, the True Fixed Effect model addresses the issue of heterogeneity more effectively by ensuring that any removed elements are unrelated to each other, thereby minimizing the risk of erroneous values. In contrast, the Battese and Coelli models may not fully mitigate the impact of heterogeneity on efficiency scores, leading to less reliable results. Lastly, the efficiency scores in the True Fixed Effect model are dynamic and can change over time, making it suitable for analyzing panel data and reflecting the technical progress of firms.

The objective of this article is not just to compare EE and OE of the largest OGC, but also to evaluate the effect of global energy transition policy on the two types of efficiency. Indeed, we use the proposed model of Wang and Ho [20], Sun et al. [7] and Jarboui [5]. Their model is presented as follows:

3.2. Estimated Model

In this study, we utilize the translog production structure to estimate the true fixed effects model. Thus, the equation representing the model’s structure is provided below:

where indicates the output of firm i company at the t period; indicates the labor input; indicates the capital input; stands the factors explaining the inefficiency; , β and δ are the estimated coefficients; is the random error.

3.3. GMM Approach

This paper evaluates the effect of global transition energy on the efficiency of 20 largest OGC. For this purpose, the GMM approach for the dynamic panel data model is applied to panel data of 20 OGC over the period 2010–2019. Based on the efficiency scores already calculated using the stochastic frontier method, we aim to investigate the effect of the global energy transition on both types of efficiency (operational and environmental) of the companies. This study introduces the different measures reflecting the global energy transition, especially the production of different renewable energies, namely biofuels, solar energy, wind energy, hydropower and geothermal energy. Therefore, the dynamic panel model is presented via the following equation:

where stands the efficiency score of desirable or undesirable output (operational score or environmental score) of oil and gas companies measured through the True Fixed Effect model; represents the lagged efficiency score; stands the vector of the various variables of renewable energy reflecting global transition energy; measures company-specific fixed effects; stands for the random error shocks that are specific for each firm i and over time t. Finally, we introduce time dummy variables in the regression , because it would be more feasible that no association between individuals’ idiosyncratic disturbances exists [28].

4. Data

The dataset introduced in this study includes the twenty largest OGC by market capitalization (see Table 1). They were all listed in the Thomson Financial Database from 2010 to 2019. This paper will analyze the effect of the global energy transition on the environmental and operational efficiency of the twenty major OGC. In order to use the real fixed effect model, this study proposes two outputs: a desired and an undesired output, and also uses two inputs. The quantity of CO2 emissions from production and exploration is the undesired output. Therefore, this research evaluates the EE using CO2 emissions as the undesired output and operational revenue as the desired output to evaluate the OE; this study also aims to compare the two types of efficiency.

Table 1.

List of the largest oil and gas companies by market capitalization.

Operating expenses and the number of employees are used in this study as substitutes for capital and labor inputs, respectively. The operating income is employed as a measure of desired output, whereas CO2 emissions are a measure of undesired output [5,6,29]. The production of biofuels, solar energy, wind energy, hydropower, geothermal energy, and total renewable energy are employed as drivers of inefficiency term in order to assess the effects of the global energy transition, especially the effect of renewable energy on the OE and EE of the major OGC. These are the main sources of renewable energy. The chosen variables and data are described as follows:

- Desirable output

Operational revenue: Despite the fact that OGC have a variety of outputs, all sales would be converted to operational revenue, thus the appropriate measure for reflecting a company’s output is operating revenue. Higher revenue often indicates a company’s success in business and higher profitability. This variable also reveals the firms’ operating sizes. Additionally, even with a huge income stream, a firm may be inefficient if it has high expenditures.

- Undesirable output

CO2 emissions: This variable indicates the CO2 emissions from the company’s production and exploration. Depending on the extent of current emissions, there is scope for investment in prevention policies.

- Inputs

The number of employees: This factor shows the firm’s human capital investment. As a labor-intensive business, investing in human capital is crucial to determining the efficiency of OGC.

Total assets: This factor represents the sum of all current and non-current assets, including all balance-sheet components. This factor represents the capital investments of a firm. Therefore, in this paper, we use total assets as a proxy for the capital variable.

- Inefficiency determinants

The different types of renewable energies are introduced in this study as a factor reflecting the global energy transition that are proposed as determinants of the EE and OE of OGC. The main types of renewable energy sources are biofuels, solar energy, wind energy, hydropower and geothermal energy.

5. Results

5.1. TFE Model Results

Using data from the 20 largest OGC during 2010–2019, this research develops the TFE model (Model 1) to evaluate the efficiencies of the companies in the sample with reference to Equation (3). The estimated results of Model 1 are reported in Table 2. The estimated results of Model 1 indicate that the coefficients of t are not significant for the two types of outputs (desirable and undesirable); the coefficients of and are positively significant at the 1% level in the different models, which reflects the importance of these variables in this industry. The estimated coefficients of are positively significant at the 1% level in the different models; the estimated coefficients of are negatively significant at the 5% level for the two types of outputs (desirable and undesirable), and the estimated coefficients of are negatively significant at the 5% level only for the undesirable output estimation (undesirable model). The findings presented above are still inadequate to detect the effect of time on efficiency values. The estimated results indicate that is the standard deviation of the inefficient term ; is the standard deviation of the random error , while is the ratio of over , which assesses the accuracy of the estimation. Our results show that and are significant at the 1% level; the value of is 1.053 at the 1% level of significance, which indicates that for the purpose of assessing the efficiency of the 20 largest OGC, it is appropriate to use the SFA approach in combination with the TFE model.

Table 2.

Estimation results of TFE model.

The time-invariant country-specific impact and the inefficiency effect may be taken into account independently in the assessment of efficiencies according to the TFE model proposed by Greene [17], assuring the accuracy of these estimations. However, Wang and Ho [20] noted that the number of fixed effect parameters for a fixed effect model rises as does the sample size (N). As a result, the estimate of the TFE model would be challenging, since it takes into account both the inefficiency impact and the individual fixed effects. In addition, the incidental parameter problem would bias the TFE model. As a result, Wang and Ho [20] suggested an alternative stochastic panel frontier model that has the specification of the TFE model and enables model conversions while preserving the tractable likelihood function.

The TFE model was chosen for this research because, firstly, the sample size in this article is small; consequently, the problem of the random parameter would not bias the results of the estimation. Secondly, the TFE model is easy to use and has excellent performance in this research. Thirdly, in order to assess the robustness of the estimated results in this research, stability tests can be carried out.

Referring to the study of Sun et al. [7], we include the cross terms and the time square with time in Model 1 in order to evaluate the findings stability and examine the impact of the time variable. Our results confirm that Model 1 is mostly unaffected by the time variable, confirming the validity of the efficiency scores estimation.

5.2. Result of Battese and Coeli 95 Model

The model of Battese and Coelli [15] is among the most widely applied models in the literature to measure efficiency through stochastic approach. However, the Battese and Coelli [15] model does not include the effect of heterogeneity on measuring the efficiency of the sample, and considers heterogeneity as an inefficient element, which would lead to a distortion of the findings. The estimated findings of the Battese and Coelli [15] model (B.C.95) are presented in Table 3.

Table 3.

Estimation results of B.C.95 model.

Based on Battese and Coelli [15], the estimation method of the B.C.95 model is different from that of the TFE model. Based on the regression findings, / is the ratio of the variance parameters of the random errors and technical efficiency effects, where γ is used to determine if the regression model is plausible. The alternative hypothesis considers the impact of inefficient technology, whereas the null hypothesis assumes the complete effectiveness of technology for the stochastic frontier production function. If , then , which further allows us to obtain , reflecting that the firms’ technologies are efficient. If gets closer to 1, inefficiency would have a very important effect on oil and gas companies. Referring to Table 4, the estimation result of equals 0.946 for the desirable output and equals 0.976 for the undesirable output, which reveals that the inefficiency has a significant effect on the efficiency of the largest 20 OGC.

Table 4.

Estimation results of inefficiency effect using TFE model.

The estimation results in Table 3 show that the coefficients of t are insignificant for the two types of output (desirable and undesirable); the coefficients of are positively significant at the 1% level for all the estimated Models, which confirm the result of the estimation of TFE model. The estimated coefficients of and are positively significant at the 1% level for all the Models (desirable and undesirable output); the estimated coefficients of are positively significant at the 10% level for the two types of outputs (desirable and undesirable), and the estimated coefficients of are positively significant at the 1% and 5% level for the desirable output and undesirable output, respectively. The above results confirm the effect of the capital factor on OE and EE of the 20 largest OGC. This implies that the technology adopted by the OGC contributes significantly to the improvement of operational efficiency, but it is not environmentally friendly and contributes to the increase in CO2 emissions.

5.3. Inefficiencies Modelling Results

5.3.1. True Fixed Effect Model Results

In order to investigate the effects of the global energy transition on the EE and OE of the largest 20 OGC, this study incorporates the global production of different renewable energy sources into this analysis. These variables are introduced as factors affecting efficiency by referring to the model developed by Wang and Ho [20] presented in Equations (4) and (5). The estimation results of the Wang and Ho [20] model are presented in Table 4.

In order to explore the effect of the energy transition on the OE of the largest 20 oil and gas companies, this empirical study explores the effect of different renewable energy variables (biofuels, solar, wind, hydropower, geothermal, and total renewable energy) on the direction of efficiency scores. The estimation results are presented in Table 4 (Model 1 and 2). However, the estimated coefficients of biofuels () are negatively significant at the 5% level (Model 1), which indicates the negative correlation between the operational inefficiency of OGC and this variable. However, the estimated coefficients of hydropower () and total renewable energy production () are not significant. The estimation results of Model 2 shows that biofuels, solar and hydropower are negatively significant at the level of 1%, 5%, 10%, respectively. This involves that the biofuels, solar and hydropower contribute to promote the OE of the largest 20 OGC. Consequently, the global energy transition does not sufficiently and significantly affect the operational efficiency of the largest 20 oil and gas companies.

On the other hand, our research aims to explore the effect of global transition energy on EE. In this way, different renewable energy sources are introduced in this study. The estimation results are presented in Table 4 (Models 3 and 4). According to the estimated results, the estimated coefficients of biofuels () hydropower () and total renewable energy () are positively significant at the 1% level. This means there is a negative effect of these variables on the efficiency of undesirable output (CO2 emissions). This result is confirmed by the estimation result of Model 4. The estimated coefficient of solar (), wind (), and hydropower () are positively significant at the 1% level, and the estimated coefficient of biofuels () and geothermal () are positive and significant at the 5% level. This confirms the negative effect of these variables on the environmental inefficiency of OGC. Therefore, biofuels, solar energy, wind energy, hydropower and the total renewable energy contribute to improve the EE of the largest 20 OGC. Consequently, the global energy transition has a significant and important effect on the EE of the largest 20 OGC. This confirms the work of Scott, 2018, where some major OGC have concentrated on protecting the environment while concentrating on improving economic efficiency. They recognized earlier the significant importance of a low-carbon transition for OGC and thus they began to take action.

The effect of renewable energy demonstrated in this study is a further testament to the resilience of renewable energy. The remarkable performance demonstrated in this study allows governments and OGC to gain even more from the numerous economic and socioeconomic benefits of renewable energy. Despite this optimistic general trend, our analysis demonstrates that the energy transition is still far from being competitive with demand for fossil fuels and hence with OGC in order to avert the grave repercussions of climate change. This confirms the work of Morgunova and Shaton [30], who found that OGC have the capacity and motivation to contribute to the energy transition. According to the international organization, in order to achieve climate goals, renewable energy must expand at a faster rate than energy demand. Despite a huge growth in the usage of renewable energy for power generation, many nations are still far from reaching this level. Moreover, in many countries, energy demand is growing faster than green energy.

5.3.2. Dynamic Panel Data Model Results

In order to test the robustness of our results found using the TFE model, and to verify the effect of the global energy transition on the EE and OE of the 20 largest OGC, we use the dynamic panel data model by adopting the GMM estimator. The results of this estimation are presented in Table 5. In order to investigate the effect of energy transition on the OE of the 20 largest OGC, this study explores the effect of different renewable energy variables (biofuels, solar, wind, hydro, geothermal, and total renewable energy) on the direction of the efficiency scores. The estimation results are presented in Table 4 (Models 1 and 2). So, the estimated coefficients of the lagged efficiency scores, biofuels, solar energy, geothermal energy and total renewable energy are positively significant at 1% level (Table 4, Model 2), which indicates the positive effect of these variables on the OE scores of OGC, and thus they contribute to promoting OE. In addition, the estimated coefficient of wind energy is positively significant at the 1% level, which implies the positive effect that wind energy has on the OE. Therefore, the best solution for OGC in the transition to low-carbon emissions is renewable energy. While some OGC are still on the sidelines, others have long since started integrating renewables into their operations. For instance, several OGC generate steam for increased oil recovery using solar energy rather than natural gas [3]. In addition, OGC’ investment in renewable energy is principally focused on solar, geothermal, wind and bioenergy. Others seek risk capital that will create renewable energy solutions as well as improve energy use in the developing world.

Table 5.

The System GMM regression results.

On other hand, our research aims to investigate the effect of global transition energy on EE. Thus, different renewable energy sources are introduced in this study. The estimation results are presented in Table 4 (Models 3 and 4). According to the estimation results, the estimated coefficients of the lagged efficiency scores are positively significant at the 1% level, implying that the EE is affected by the lagged EE scores. However, the estimated coefficients of biofuels, solar energy, wind energy, geothermal energy and total renewable energy are negatively significant at the 1% level (Table 4, Model 2), which indicates the negative effect of these variables on the EE scores (undesirable output) of OGC, and so they contribute to promoting EE. In addition, the estimated coefficient of hydropower is negatively significant at the 5% level and therefore also contributes to promoting EE. Recently, major OGC have established carbon emission goals to halt the acceleration of global warming. In order to meet the low carbon objectives established by the 20 OGC, indirect carbon emission reductions can be accomplished by reducing methane intensity (e.g., BP) and flaring intensity (e.g., Chevron and Saudi Aramco), which have achieved certain results to varying degrees.

5.4. Operational an Environment Efficiency Scores

OE and EE scores of the largest OGC estimated using the BC95 model and TFE model are shown in Table 6. For a certain level of inputs, a firm lost income owing to operational inefficiencies, which resulted in a minus of the efficiency score from 2010 to 2019. The overall average OE of major OGC during the period 2010–2019 measured through the BC.95 model and TFE model is 66% and 85%, respectively (see Table 6); that is, without increasing the quantity of inputs, OGC enjoyed a 34% (B.C.95 model) and 15% (TFE model) improvement in efficiency. In addition, the overall average level of CO2 emissions efficiency (undesirable output) of the largest oil and gas companies measured using the B.C.95 model and TFE model is 69% and 87%, respectively, for a 10-year period. This indicates that OGC have reduced their CO2 emissions by 31% with this amount of investment (B.C.95 model) and 13% (TFE model). Otherwise, the overall average level of environmental efficiency for oil and gas companies over a 10-year period is 31% (based on the B.C.95 model) and 13% (based on the TFE model).

Table 6.

Average OE and EE scores of the largest OGC.

Generally, the OE found using the BC95 model is less than those found using the TFE model. The OE of PetroChina, ConocoPhillips, Gazprom, Petrobras, Duke Energy, Sinopec, and CNOOC, for example, are lower when assessed using the BC95 model than when tested through the TFE model, and the disparities are all more than 0.3, which confirms the work of Sun et al. [7]. Specifically, the disparities between the results of the TFE model and the BC95 model for the OE values of PetroChina, ConocoPhillips, and Sinopec are 0.3674, 0.3492 and 0.318, respectively. The discrepancies in OE values between the TFE model and the BC95 model for Gazprom and Petrobras are 0.4982 and 0.4692, respectively.

The results presented in Table 6 highlight that the difference is extremely heterogeneous and huge in some cases, such as PetroChina, Gazprom and Petrobras. This confirms the analysis of Greene [17], which shows that the methods proposed by Battese and Coelli [15] may overestimate the inefficiency term, resulting in estimated efficiency results that are lower than in real situations. This is why Greene [17] focused on the impact of heterogeneity between firms on the measurement of production efficiency.

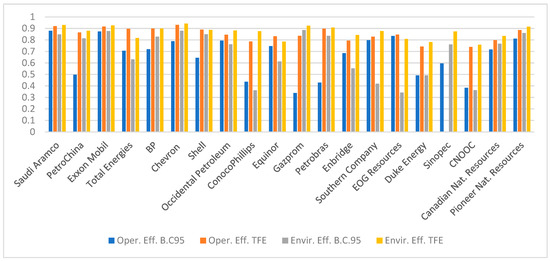

Referring to Table 6 and Figure 1, no company has achieved full efficiency equal to 1. Based on the estimation result of TFE model, CNOOC, Duke Energy, ConocoPhillips had the worst OE level, at 0.7392, 0.7425 and 0.7864, respectively, which is confirmed by the results of Model B.C.95. Furthermore, three companies have the highest OE scores for all ten years, namely Chevron, Saudi Aramco and ExxonMobil, with average OE scores of 0.9313, 0.9201 and 0.9166, respectively. Therefore, firms with the lowest OE values often had the lowest level of CO2 emissions, similar to CNOOC, Duke Energy, with average CO2 emission efficiency scores of 0.7583 and 0.7819, respectively. Furthermore, firms with the greatest OE values had the highest CO2 emissions scores, such as Chevron and Saudi Aramco with average CO2 emission efficiency scores of 0.9424 and 0.9302, respectively. This signifies that these firms are working to improve environmental protection; however, its environmental strategy may be out of sync with its operating efficiency, which verifies our findings in Section 5.3 on the negative link between renewable energy and OE.

Figure 1.

OE and EE scores of major OGC.

According to the International Energy Agency, global carbon dioxide emissions in 2021 were 36.3 gigatons, with natural gas and oil products accounting for almost 60% of total emissions [2,31]. Recently, the largest OGC have established equivalent carbon emission targets to prevent global warming from getting worse. It is evident that among the major oil and gas firms’ low carbon aims, regulating methane intensity (as undertaken by BP) and flaring intensity (such as Chevron and Saudi Aramco) can indirectly reduce carbon emissions, in addition to reducing carbon dioxide emissions.

The low-carbon transition, being gradual and long-term, necessitates reducing carbon emissions by improving energy efficiency, tapping high-quality reserves, enhancing product quality, and utilizing carbon capture and storage (CCS) technologies. ExxonMobil employs cogeneration and CCS to cut emissions, while Saudi Aramco, Chevron, and Total S.A. reduce flaring. Shell and Total S.A. utilize solar steam flooding to enhance oil recovery and curb emissions [3]. Such measures have yielded notable results. Transitioning to renewable energy represents the most comprehensive yet challenging approach. Major oil and gas firms have varying investment strategies in renewables, with Shell focusing on biofuels, hydrogen, and wind, and Total S.A. heavily investing in solar, wind, biofuels, and smart grids. Geothermal energy is particularly advantageous for these companies due to their expertise, foreseeing a shift towards integrated energy companies with a greater emphasis on electricity [3].

There has been improved investment by major OGC in the transition to a low-carbon economy, including projects, acquisitions and emissions-reducing technologies, in addition to setting low-carbon objectives. Members of the OGCI, including Saudi Aramco and PetroChina, will invest USD 1 billion in emission-reducing technologies in the next decade [3]. In recent years, Chevron’s investment in battery technology, research and development and alternative fuels is USD 8.5 million and USD 1.1 billion in the carbon dioxide injection project, and they have also spent over USD 75 million on carbon capture and storage research [3]. Major OGC have made various amounts of investments in emerging energy areas and carbon capture and storage technology. The electrical system has received significant funding from Shell and Total. Additionally, due to the transportation sector’s substantial reliance on oil and gas, major OGC are also invested in alternative energy vehicles including electric cars, which results in a relatively big investment in batteries and quick charging technologies.

6. Conclusions

A modern society that strives for sustainable growth must address concerns like energy conservation and environmental protection. Nations have worked together to minimize CO2 emissions in order to promote sustainable development. Two such accords and protocols include the Paris Agreement of 2015 and the Kyoto Protocol of 1997. So, in order to combat climate change and safeguard the environment, an energy shift is required. However, the current development model requires a decrease in oil production. Only 13% of the world’s known reserves of crude oil must be used up in order to fulfil the Paris Agreement. In addition, even if the global energy structure is changing significantly and the status of renewable energy is rising, oil and gas still account for 50% of the energy market. In the energy industry, renewable energy sources are becoming more and more significant. Oil and gas firms are increasingly converting into energy corporations by adhering to energy transition rules.

Firstly, this paper examines two types of efficiency measures—OE and EE—for 20 largest OGC during the period 2010–2019. Secondly, this research aims to explore the effect of the global energy transition on both EE and OE. Based on three estimation methods, two estimation steps are applied in this study. In the first step, the TFE model and B.C.95 model are applied to evaluate, measure and compare the EE and OE scores. In the second step, the TFE Model and GMM approach for the dynamic panel data model are used to explore, evaluate and verify the effect of the global energy transition on EE and OE of the largest 20 OGC in the world.

The empirical finding of this research reveals that the average OE of major OGC during the period 2010–2019 when measured using the BC.95 model and TFE model is 66% and 85%, respectively, which indicates that without modifying the volume of inputs, the OGC have a margin to improve their efficiency by 34% (B.C.95 model) and 15% (TFE model). In addition, the average EE (undesirable output) of the largest OGC measured using the B.C.95 model and TFE model is 69% and 87%, respectively, for a 10-year period, which indicates that without modifying the volume of inputs, OGC have controlled their CO2 emissions by 31% (B.C.95 model) and 13% (TFE model). Otherwise, the average EE for OGC over a 10-year period is 31% (based to B.C.95 model) and 13% (based to TFE model).

The empirical findings reveal that biofuels, solar and hydropower contribute to promote the OE of the largest 20 OGC. Therefore, the global energy transition is not sufficiently and significantly affecting the OE of the largest 20 OGC. On the other hand, biofuels, solar energy, wind energy, hydropower and the total renewable energy contribute to improve the EE of the largest 20 OGC. Therefore, the global energy transition has a significant and important effect on the EE of the largest 20 OGC.

The effect of renewable energy demonstrated in this study is a further testament to the resilience of renewable energy. The excellent performance verified in this research offers countries and oil companies the opportunity to benefit to an even greater extent from the many economic and socio-economic advantages of renewable energy. Despite this positive worldwide trend, our study demonstrates that the energy transition is far from being competitive enough with the oil industry to prevent the catastrophic effects of climate change from occurring. According to the worldwide organization, renewable energy must increase more quickly than energy consumption in order to meet climatic targets.

However, the global energy transition and the low-carbon transformation of the OGC will take a very long time and face several difficulties. OGC require political backing from a country or organization, in addition to continuing to be transparent and cooperative. Countries or regions can give matching subsidy programs in the early phases of OGC’ low-carbon transition, particularly for enterprises adopting renewable energy routes, and can subsequently reduce or discontinue subsidies when the development costs are lowered.

Author Contributions

Conceptualization, S.J. and H.A.; methodology, S.J.; software, S.J. and H.A.; validation, S.J.; formal analysis, S.J.; investigation, H.A.; resources, H.A.; data curation, H.A.; writing—original draft preparation, S.J. and H.A.; writing—review and editing, S.J. and H.A.; visualization, H.A.; supervision, S.J.; project administration, H.A.; funding acquisition, H.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by “Princess Nourah bint Abdulrahman University Researchers Supporting Project number (PNURSP2024R548), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia”.

Data Availability Statement

All data used in this study are available in the Thomson financial databases and the World Bank.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- IEA. World Energy Outlook: Executive Summary; IEA: Paris, France, 2021; Available online: https://www.iea.org/reports/world-energy-outlook-2021/executive-summary (accessed on 1 March 2022).

- International Energy Agency. Global Energy Review: CO2 Emissions in 2021. Available online: https://www.iea.org/reports/global-energy-review-co2-emissions-in-2021-2 (accessed on 1 March 2022).

- Lu, H.; Guo, L.; Zhang, Y. Oil and gas companies’ low-carbon emission transition to integrated energy companies. Sci. Total Environ. 2019, 686, 1202–1209. [Google Scholar] [CrossRef] [PubMed]

- Al-Mana, A.A.; Nawaz, W.; Kamal, A.; Koç, M. Financial and operational efficiencies of national and international oil companies: An empirical investigation. Resour. Policy 2020, 68, 101701. [Google Scholar] [CrossRef]

- Jarboui, S. Operational and environmental efficiency of U.S. oil and gas companies towards energy transition policies: A comparative empirical analysis. Aust. Econ. Pap. 2021, 61, 234–257. [Google Scholar] [CrossRef]

- Jarboui, S. Renewable energies and operational and environmental efficiencies of the US oil and gas companies: A True Fixed Effect model. Energy Rep. 2021, 7, 8667–8676. [Google Scholar] [CrossRef]

- Sun, C.; Luo, Y.; Huang, Y.; Ouyang, X. A comparative study on the production efficiencies of China’s oil companies: A true fixed effect model considering the unobserved heterogeneity. J. Clean. Prod. 2017, 154, 341–352. [Google Scholar] [CrossRef]

- Eller, L.; Hartley, R.; Medlock, K. Empirical evidence on the operational efficiency of national oil companies. Empir. Econ. 2010, 40, 623–643. [Google Scholar] [CrossRef]

- Atris, A.M.; Goto, M. Vertical structure and efficiency assessment of the US oil and gas companies. Resour. Policy 2019, 63, 101437. [Google Scholar] [CrossRef]

- Lim, C.; Lee, J. An analysis of the efficiency of the oil refining industry in the OECD countries. Energy Policy 2020, 142, 111491. [Google Scholar] [CrossRef]

- Jia, B.; Xian, C.; Tsau, J.S.; Zuo, X.; Jia, W. Status and Outlook of Oil Field Chemistry-Assisted Analysis during the Energy Transition Period. Energy Fuels 2022, 36, 12917–12945. [Google Scholar] [CrossRef]

- He, X. The intensive growth of industry and its engines. China Econ. Q. 2012, 11, 1287–1304. [Google Scholar]

- Battese, G.; Coelli, T. Prediction of firm level efficiencies with a generalized frontier production function and panel data. J. Econom. 1988, 38, 387–399. [Google Scholar] [CrossRef]

- Battese, G.; Coelli, T. Frontier production functions, technical efficiency and panel data: With application to paddy farmers in India. J. Product. Anal. 1992, 3, 153–169. [Google Scholar] [CrossRef]

- Battese, G.; Coelli, T. A model of technical inefficiency effects in stochastic frontier production for panel data. Empir. Econ. 1995, 20, 325–332. [Google Scholar] [CrossRef]

- Greene, W. Distinguishing between heterogeneity and inefficiency: Stochastic frontier analysis of the world health organization’s panel data on national health care systems. Health Econ. 2004, 13, 959–980. [Google Scholar] [CrossRef]

- Greene, W. Reconsidering heterogeneity in panel data estimators of the stochastic frontier model. J. Econom. 2005, 126, 269–303. [Google Scholar] [CrossRef]

- Greene, W. Fixed and random effects in stochastic frontier models. J. Product. Anal. 2005, 23, 7–32. [Google Scholar] [CrossRef]

- Farsi, M.; Filippini, M.; Kuenzle, M. Unobserved heterogeneity in stochastic cost frontier models: An application to Swiss nursing homes. Appl. Econ. 2005, 37, 2127–2141. [Google Scholar] [CrossRef]

- Wang, H.J.; Ho, C.W. Estimating fixed-effect panel stochastic frontier models by model transformation. J. Econom. 2010, 157, 286–296. [Google Scholar] [CrossRef]

- Lin, B.; Du, K. Measuring energy efficiency under heterogeneous technologies using a latent class stochastic frontier approach: An application to Chinese energy economy. Energy 2014, 76, 884–890. [Google Scholar] [CrossRef]

- Lin, J.; Long, Z.; Lin, K. Spatial panel stochastic frontier model and technical efficiency estimation. J. Bus. Econ. 2010, 5, 71–78. [Google Scholar]

- Song, M.; Zhang, G.; Zeng, W.; Liu, J.; Fang, K. Railway transportation and environmental efficiency in China. Transp. Res. Part D Transp. Environ. 2016, 48, 488–498. [Google Scholar] [CrossRef]

- Jondrow, J.; Materov, I.; Lovell, K.; Schmidt, P. On the estimation of technical inefficiency in the stochastic frontier production function model. J. Econom. 1982, 19, 233–238. [Google Scholar] [CrossRef]

- Pitt, M.; Lee, L. The measurement and sources of technical inefficiency in the Indonesian weaving industry. J. Dev. Econ. 1981, 9, 43–64. [Google Scholar] [CrossRef]

- Belotti, F.; Daidone, S.; Ilardi, G.; Atella, V. Stochastic frontier analysis using Stata. Stata J. 2013, 13, 719–758. [Google Scholar] [CrossRef]

- Greene, W. The Measurement of Productive Efficiency and Productivity Change; Oxford University Press: New York, NY, USA, 2008. [Google Scholar]

- Roodman, D.M. A note on the theme of too many instruments. Oxf. Bull. Econ. Stat. 2009, 71, 135–158. [Google Scholar] [CrossRef]

- Mrabet, A.; Jarboui, S. Do institutional factors affect the efficiency of GDP and CO2 emission? Evidence from Gulf and Maghreb countries. Int. J. Glob. Energy Issues 2017, 40, 259–276. [Google Scholar] [CrossRef]

- Morgunova, M.; Shaton, K. The role of incumbents in energy transitions: Investigating the perceptions and strategies of the oil and gas industry. Energy Res. Soc. Sci. 2022, 89, 102573. [Google Scholar] [CrossRef]

- International Energy Agency. Global Energy Review: Renewables. Available online: https://www.iea.org/reports/global-energy-review-2021/renewables (accessed on 1 March 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).