Abstract

Carbon accounting is primarily a process for measuring, reporting, and allocating greenhouse gas emissions from human activities, thus enabling informed decision-making to mitigate climate change and foster responsible resource management. There is a noticeable upsurge in the academia regarding carbon accounting, which engenders complexity due to the heterogeneity of practices that fall under the purview of carbon accounting. Such plurality has given rise to a situation where diverse interpretations of carbon accounting coexist, often bereft of uniformity in definition and application. Consequently, organisations need a standardised, comprehensive, and sequentially delineated carbon accounting framework amenable to seamless integration into end-to-end manufacturing systems. This research commences with the progressive evolution of the conceptual definition of carbon accounting. Then, it delves into the current state of carbon accounting in manufacturing systems and supply chains, revealing gaps and implementation issues warranting future scholarly exploration.

1. Introduction

The evolving interplay between corporate responsibility and environmental sustainability imperatives has propelled carbon accounting into sustainability discussions. As societies grapple with the profound effects of climate change, there is an elevated importance in comprehensively understanding and transparently measuring carbon emissions [1]. Manufacturing systems are central to these discussions of climate change and carbon emissions, which play a crucial role in the global economy. Such systems warrant a meticulous examination, especially concerning their greenhouse gas (GHG) emissions [2]. Manufacturing systems are complex conglomerations comprising products, machinery, personnel, information, control mechanisms, and support functions. All these elements are to be integrated to facilitate physical goods’ inception, production, distribution, and overall life cycle management. This intricate process caters to both market demands and societal needs [3]. A paramount goal within these manufacturing systems is the ambition of net-zero emissions. This entails striving towards a state where the GHG emissions produced by these systems are considerably reduced, looming at a near-zero level [4]. Diminishing emissions is pivotal for decelerating the progression of climate change and alleviating its consequent ramifications [5]. Regulatory adherence plays a significant role in this context; in a multitude of nations, legal frameworks mandate organisations to transparently disclose their GHG emissions [6].

Accounting is the systematic practice of recording and analysing financial data about businesses. This includes documenting financial transactions and producing financial statements that convey an organisation’s economic activities and health [7]. Financial accounting focuses on creating detailed financial reports for stakeholders, ensuring clarity and transparency in financial communication [8]. On another note, carbon accounting measures entities’ carbon dioxide equivalent emissions, including their supply chains, where there are inherent challenges in data collection, given it is outside the direct control of the organisation. This form of accounting covers a wide range of activities, such as measuring and reporting GHG emissions at various levels [9]. Both financial and carbon accounting are tools for organisations to monitor and report on essential operational facets. Carbon accounting is an instrumental process, facilitating organisations to comply with these statutory requirements, thereby circumventing potential financial penalties [10]. Despite their differences in focus and principles, as shown in Table 1, these accounting systems share certain similarities while serving unique purposes within the corporate landscape.

Table 1.

Difference between financial and carbon accounting.

The definition of carbon accounting has evolved over the years, as shown in Table 2 [12]. This happened due to several factors, including changing societal and environmental concerns, advances in the scientific understanding of climate change and GHG emissions, and developments in industry and policy [12,23]. As society has become more aware of the impacts of climate change, there has been an increasing demand for accurate and transparent reporting of GHG emissions. This has led to the development of new tools, standards, and guidelines to help organisations report and manage their emissions [24,25,26]. In addition, advances in the scientific understanding of climate change and GHG emissions have led to changes in how carbon accounting is conducted. For example, there is now greater recognition of the importance of measuring and reporting emissions from the entire supply chain, not just direct emissions from a single organisation [27,28]. Overall, the evolving definition of carbon accounting reflects the changing environmental, social, and economic context in which organisations operate and the need for accurate and transparent reporting of GHG emissions.

Table 2.

Carbon accounting concept evolution.

Analysing the definitions delineated in Table 2, Figure 1 summarises and showcases the evolution of the carbon accounting definitions over time.

Figure 1.

Carbon accounting definition evolution.

Within these definitions, the significance of carbon accounting across supply chains and product life cycles is emphasised as an essential practice for accurately quantifying and monitoring emissions. This research maps the current carbon accounting in the manufacturing and supply chain literature to specific research questions, providing a structured overview of how different aspects of carbon accounting are addressed. The discussion then delves into the challenges and opportunities within carbon accounting and outlines the future research direction, thereby answering the following research questions:

- What is the current understanding of the definition of carbon accounting in manufacturing systems and supply chains? (RQ1)

- What are the current gaps in carbon accounting in the manufacturing and supply chain systems literature? (RQ2)

- What is the future research agenda for carbon accounting in manufacturing systems and supply chains? (RQ3)

- What are the challenges of carbon accounting implementation in manufacturing systems and supply chains? (RQ4)

2. Methodology

PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) is a methodology for conducting and reporting systematic reviews and meta-analyses [44]. Utilising the PRISMA statement as a methodological framework [45], this study undertook a systematic examination of the domain under consideration, as explained further in this section. The search string combinations used to gather literature across two prominent academic databases—Scopus and Web of Science—are shown below in Table 3. Search string 1 was input for filtration only in the titles, whereas search string 2 was input for filtration across all the fields, including the title, abstract, and keywords.

Table 3.

Search results.

The preliminary stage encompassed a title-based filtration to identify and eliminate duplications, employing both intra-database (vertical duplicates) and inter-database (horizontal duplicates) methods. This stage resulted in 227 documents for evaluation. A further abstract-based relevance check was made of the 227 documents to maintain the scope of selected literature within the context of carbon accounting in manufacturing and supply chains, resulting in 47 documents. Out of these 47 documents, after in-text evaluation, 37 articles were selected. The summary of this PRISMA exercise is illustrated below in Figure 2.

Figure 2.

PRISMA statement summary.

3. Literature Findings

The quantitative findings that provide inputs to the discussion that follows in Section 4 are explained below. The final shortlisted literature mapped to the research questions it answers is shown below in Table 4 where X signifies lack of input from that document to the research question, while O signifies the presence of input to that specific research question.

Table 4.

Final shortlisted literature.

The term carbon accounting is used interchangeably with affiliated or constituent accounting approaches, as shown in Figure 3, in the literature in which it gets discussed. While the evolving definition and scope of carbon accounting is discussed in Section 4, there are some other more commonly used accounting concepts.

Figure 3.

Frequency of occurrence of carbon accounting and affiliated concepts [18,46,47,48,49,50,54,55,59,60,62,63,64,65,66,67,68,69,70].

Carbon footprinting is defined as an indicator tool to assess corporate environmental performance in physical terms, with carbon footprints measured as the greenhouse gases produced over a period [55]. Sustainability accounting quantifies and reports economic, social, and environmental impacts, often using a triple-bottom-line approach [62,66]. It aims to support internal decision-making and external disclosures related to sustainability performance [65]. Environmental accounting encompasses the practices that account for an organisation’s environmental costs, impacts, and strategies [49,50]. Environmental management accounting is a subset focused on providing environmental cost information to internal decision-makers [65].

4. Discussion

Carbon accounting has gained increasing attention as a means for companies to measure, manage, and reduce their GHG emissions and overall carbon footprint. This is especially relevant to emissions-intensive sectors like manufacturing, where carbon accounting can support emission reductions across production processes and broader supply chains [46,52,54,55,58].

Several studies have explored carbon accounting approaches tailored to the manufacturing sector. For the aerospace industry, a structured framework was proposed to facilitate consistent carbon measurement and reporting across complex extended supply chains [46]. This framework emphasised the need for complete supply chain visibility and senior leadership support. In the automotive industry, the researchers in [55] found that an environmental management accounting and eco-control approach helped Korean manufacturers align carbon management strategies with performance measurement. The study highlighted the need for quantitative carbon data to support decision-making. At a product level, researchers [52] developed a framework to compile supplier-specific life cycle GHG emissions data for liquified natural gas, from extraction through to distribution. The granular, supplier-specific data were intended to differentiate the emissions profiles of various supply chains amid growing policy interest in embedded carbon emissions. For manufactured goods like wooden furniture, GHG accounting methods were used to identify emissions hotspots across timber supply chains in China [59]. They found upstream production processes drove most emissions, urging sourcing and transport optimisation for footprint reductions. Multiple studies have also examined environmental or carbon management accounting as a tool to support emissions management internally. Across Chinese [59], Malaysian [74,75], Vietnamese [76], and Libyan [77] manufacturers, the research found environmental management accounting adoption levels were still developing. Key barriers were a lack of resources, knowledge, and regulatory incentives. The analyses underscored the need for management understanding and commitment to leverage these accounting systems towards sustainability [43]. Though carbon accounting techniques are advancing, it is noted that the complexity can still overwhelm practitioners, limiting organisational adoption and supply chain impacts [68]. They called for simplified tools and cross-disciplinary collaboration to increase connectedness. [66] also outlined research opportunities to address data reliability challenges in Indian supply chains through emerging technologies like blockchain and the Internet of Things.

Manufacturing organisations have not kept up with the best practices for comprehensively tracking and disclosing emissions sources. The authors in [81] discussed how current carbon accounting methods declare bioenergy to be carbon-neutral, failing to account for biogenic CO2 emissions at the point of combustion. This means emissions from industrial bioenergy processes often go unreported or are zeroed out in emissions reporting frameworks. Other analyses have shown how agricultural emissions receive much more scrutiny and mandatory reporting requirements compared to biogenic emissions from industry. The authors in [82] demonstrated that many countries with climate commitments do not include some industrial process emissions like waste/biomass incineration in their national reporting. This leads to under-reporting of substantial indirect emissions in developed countries. Specifically looking at differences by industry, the authors in [83] found that while agricultural methane emissions are comprehensively tracked and targeted for reduction by most countries, CO2 emissions from bioenergy are categorically excluded from reduction targets. They argue this imbalance hinders effective, holistic climate mitigation policy. In terms of territorial versus polluter-pays emissions accounting, the author in [84] discussed how under purely territorial accounting of emissions from traded biomass, substantial indirect emissions can go unreported. He advocated for improved emissions reconciliation and shared producer/consumer responsibility for bioenergy emissions. All these challenges add up to the need for manufacturing organisations to keep up with the carbon accounting practices that are evolving in other industries and sectors.

Overall, the literature reveals ongoing developments in carbon accounting. Still, a persistent need for standardisation, simplified tools, regulatory incentives, and skills development is needed to drive broader adoption across manufacturing supply chains. More empirical research into accounting techniques and digitisation opportunities can support the transition towards carbon transparency and emissions reductions in global manufacturing systems.

4.1. What Is the Current Understanding of the Definition of Carbon Accounting in Manufacturing Systems and Supply Chains? (RQ1)

The concept of carbon accounting is fundamental in the context of manufacturing and supply chain management. Still, it is essential to note that there is no single universally accepted definition of this term within the literature. Nevertheless, some common themes have emerged, shedding light on the various aspects and purposes of carbon accounting. One perspective on carbon accounting is that it serves to quantify an organisation’s GHG emissions, typically expressed in terms of carbon dioxide equivalent. For instance, ref. [46] describes carbon accounting as measuring the carbon dioxide equivalent emitted by any organisation. Similarly, ref. [59] defines a product’s carbon footprint as the total carbon dioxide emissions and other GHGs during a product’s life cycle. In this view, carbon accounting is primarily seen as a tool for assessing the environmental impact of an entity. Expanding on this, ref. [55] employs “carbon emissions data as a proxy for energy use and, hence, exposure to rising carbon risks”. This suggests that carbon accounting not only measures emissions but also serves as an indicator of an organisation’s vulnerability to the challenges posed by carbon emissions. In this sense, carbon accounting can be viewed as a tool to quantify climate-related risks. Another broad definition of carbon accounting comes from [68], which defines it as the “measures of greenhouse gases produced by activities”. This definition encompasses a wide range of applications, from organisational emissions to product life cycles, emphasising the role of carbon accounting in assessing the environmental impact of various activities. Moreover, some researchers conceptualise carbon accounting as a more holistic approach that extends beyond measurement and instead focuses on identifying, monitoring, and ultimately reducing emissions. As ref. [52] suggests, carbon accounting can “improve GHG emission estimates and differentiate supply chains,” informing business and policy decisions about transitioning to a low-carbon future. Similarly, ref. [55] argues that systematic carbon accounting and monitoring can help identify existing carbon exposure and serve as a starting point for developing strategies for carbon management. Here, carbon accounting plays a pivotal role in overall emissions management and sustainability efforts. Furthermore, carbon accounting is recognised for its significance in tracking emissions across complex supply chains. In [49], carbon accounting is used to estimate the variable environmental impacts of agricultural commodity supply chains, while ref. [48] applies it to quantify embodied emissions in global trade flows. In another example, ref. [60] calculates the carbon footprint across a seafood product supply chain. These cases demonstrate the practical relevance of carbon accounting in understanding and mitigating emissions within intricate production networks.

In summary, as shown in Figure 4, the literature aligns around carbon accounting’s purpose as quantifying GHG emissions, especially across complete product life cycles and supply chains. It is predominately viewed as an emissions measurement tool, though some note its broader role in informing carbon management strategies. More standardised terminology could support the further development of carbon accounting approaches, tools, and applications across the manufacturing sector.

Figure 4.

Various definitions of carbon accounting.

4.2. What Are the Current Gaps Identified in Carbon Accounting in the Manufacturing Systems and Supply Chain Systems Literature? (RQ2)

Numerous studies within the domain of carbon accounting in manufacturing supply chains have drawn attention to several critical gaps and challenges that need to be addressed for more effective and widespread adoption. One prominent theme that emerges from these studies is the need for standardisation and simplified tools in the field of carbon accounting. As pointed out by [46], the proliferation of various carbon calculators, reporting standards, and certification schemes has created a confusing landscape, lacking a unified and practical framework that enterprises can readily employ for carbon accounting. This fragmentation can deter organisations from engaging in comprehensive carbon accounting efforts. The researchers in [68] further underscore this concern by highlighting how the complexity of existing approaches can limit their adoption within organisations and hinder their impact throughout supply chains. To address this, they [68] suggest the importance of simplified tools and emphasise the need for transdisciplinary collaboration to enhance connectivity and coherence in carbon accounting practices.

Another challenge pertains to the reliability and availability of data required for carbon accounting. Ref. [66] identifies opportunities for leveraging emerging technologies such as blockchain and the Internet of Things to address data challenges in Indian supply chains. These technologies can enhance data transparency and accuracy, improving carbon accounting efforts’ quality. Similarly, ref. [52] tackles the issue of data gaps by developing a framework specifically designed to capture supplier-specific emissions data within LNG supply chains. Ref. [47] addresses the data limitations by creating a model that connects agricultural commodity supply chain data across different geographic scales, responding to the inadequacies of coarse national-level data. These examples underscore the need for more granular and transparent emissions data, which are crucial for informed decision-making.

Furthermore, studies have raised concerns about the narrow scope of carbon accounting efforts. For instance, ref. [55] highlights that widely recognised guidelines like the GHG Protocol predominantly focus on direct or first-tier suppliers, potentially overlooking the broader carbon footprint associated with global trade flows. Ref. [48] argues that addressing embodied emissions in global trade necessitates a more comprehensive approach to carbon management that spans across countries. Similarly, ref. [64] suggests that the current systems often have limited boundaries when it comes to implementing environmental management accounting systems within supply chains. These critiques underscore the need for a more holistic and expansive approach to carbon accounting that considers the full extent of emissions throughout supply chains.

Another challenge identified by researchers is the gap between carbon information and management decisions. Ref. [55] points out the lack of research on how managers collect and utilise carbon data, raising questions about the practical application of carbon accounting insights within organisations. Ref. [54] notes that the existing methods frequently overlook emissions related to labour and capital, indicating the need for a more comprehensive approach that encompasses all facets of emissions. Ref. [70] further highlights that even organisations committed to sustainability often struggle to translate sustainability data into meaningful and holistic business changes. This implies a need for more effective strategies to bridge the gap between carbon information and decision-making processes.

Finally, the studies indicate the lack of empirical evidence regarding the implementation of carbon accounting techniques. Both [55,68] advocate for expanding case studies and surveys to provide practical examples and insights into the effective use of carbon accounting methodologies. Ref. [64] cautions against overlooking the complex causal links between capabilities and environmental performance, emphasising the importance of empirical research to understand the dynamics of implementation. Ref. [52] also recognises the lack of bottom-up facility-level emissions data across supply chains and proposes innovative frameworks to address this gap.

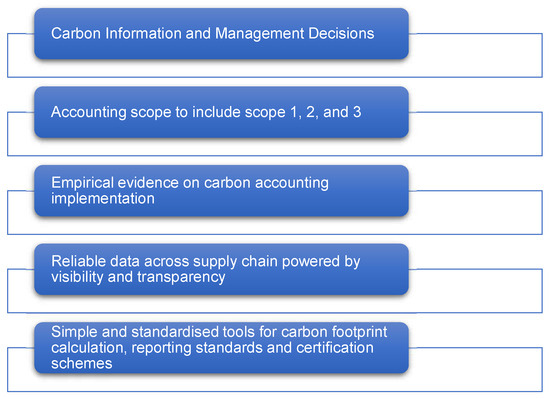

The literature highlights several challenges in the field of carbon accounting in manufacturing supply chains, including the need for standardisation and simplified tools, data reliability and availability, expanded accounting scopes, carbon information to be linked to management decisions, and the generation of empirical evidence on implementation. Addressing these gaps is crucial for advancing carbon accounting practices and fostering more sustainable supply chains to reach the ideal maturity level possible, as shown in Figure 5.

Figure 5.

Gaps crucial for advancing carbon accounting practices.

4.3. What Is the Future Research Agenda for Carbon Accounting in Manufacturing Systems and Supply Chains? (RQ3)

Carbon accounting in the context of manufacturing and supply chains presents a dynamic and evolving field, offering a promising avenue for future research and development. Several key themes emerge from the existing literature, which point towards the need for comprehensive and precise carbon accounting methods and tools to improve the accuracy of emissions estimation within complex global supply chains.

A recurring call in the literature, exemplified by studies such as [52,53,54,55], emphasises the necessity for more robust carbon accounting practices. These calls stem from the recognition that reliable tools are essential to bolster confidence in climate-driven policy decisions and to bridge gaps in emissions data at the facility level of specific suppliers. By enhancing granularity and transparency in emissions data across various tiers of supply chains, stakeholders and policymakers can make informed decisions and foster more sustainable practices [52,55].

Moreover, researchers advocate for the testing and refining of existing carbon accounting frameworks, tools, and implementation strategies through empirical research within the manufacturing sector. This area currently lacks substantial empirical evidence [55,59,64]. For instance, [55] suggests applying their carbon management framework to diverse industries to validate its effectiveness. At the same time, case studies and large-scale surveys are seen as valuable tools for gaining insights into successful carbon accounting practices [55,64].

The intersection of carbon accounting with emerging technologies is another promising avenue. Studies such as [48,62,66] highlight the potential of incorporating carbon accounting into technologies like Industry 4.0, the Internet of Things, and blockchain. Ref. [62] suggests utilising Industry 4.0 data flows for sustainability accounting. At the same time, ref. [48] argues that blockchain technology could enhance the reliability and traceability of emissions data in trade, providing a novel approach to improving the quality of carbon accounting efforts.

Furthermore, there is a need to explore the integration of carbon accounting into various organisational functions, including supply chain management, performance management, and broader sustainability practices [55,64,66]. Ref. [64], for instance, calls for investigating the integration of sustainability accounting into supply chain management within developing countries, such as Indonesia.

Geographically, researchers emphasise the importance of extending carbon accounting research into developing country contexts and emerging markets, where implementation can be particularly challenging [64,70]. Conducting research and testing frameworks in these settings can facilitate the adoption of carbon accounting practices [58] and contribute to a more comprehensive understanding of the global carbon footprint.

In conclusion, as shown in Figure 6, the future research direction for carbon accounting in manufacturing and supply chains encompasses efforts to refine the measurement approaches, integrate carbon accounting into cutting-edge technologies and organisational processes, validate implementations through empirical research, and expand applications into developing country settings. By striving for more granular, transparent, and integrated carbon accounting practices, the field can play a vital role in strengthening climate governance across global supply chains.

Figure 6.

Future research agenda for carbon accounting in manufacturing and supply chains.

4.4. What Are the Challenges of Carbon Accounting Implementation in Manufacturing Systems and Supply Chains? (RQ4)

Carbon accounting in manufacturing and supply chains is crucial in pursuing sustainability and reducing greenhouse gas emissions. However, as discussed further, it faces various challenges that impact its practical implementation.

4.4.1. Lack of Standardised Methodologies and Tools

One major hurdle in carbon accounting is the absence of standardised methodologies and tools [49,54,55,56]. Various approaches, such as the GHG Protocol, life cycle assessment, and product carbon footprinting, differ significantly in terms of their scope, boundary setting, emissions factors, and allocation methods [52]. This lack of standardisation creates difficulty in obtaining consistent and comparable carbon accounting data across different companies and supply chains [46,53]. As ref. [53] points out, the absence of standardised measures hampers the differentiation of emissions between different import routes and supply chains.

4.4.2. Lack of Quality Emissions Data

The challenge of obtaining quality emissions data is frequently highlighted [46,55,56]. Collecting accurate and complete data on energy use and emissions from suppliers proves to be challenging [46]. High monitoring costs and the absence of appropriate data are barriers to adopting green and sustainable supply chain management [55]. Many companies resort to secondary or proxy data sources due to suppliers’ lack of monitoring or the non-disclosure of primary emissions data [52].

4.4.3. Complexity of Supply Chains

Global multi-tiered supply chains are characterised by complexity, spanning multiple tiers of suppliers across different countries [56,68]. This intricacy makes emissions data collection, boundary setting, and allocation extremely challenging [56]. As ref. [68] highlights, the “lack of visibility of extended supply chain relationships” remains a significant concern for manufacturing company executives.

4.4.4. High Implementation Costs

Implementing carbon accounting across entire supply chains can be prohibitively expensive, especially for small and medium-sized enterprises (SMEs) [61,63]. Developing the necessary capabilities for carbon accounting demands investments in data collection systems, analytics tools, and personnel [61]. Resource limitations, particularly for SMEs, pose a significant barrier [63]. While outsourcing to consultants is an option, it can also be costly.

4.4.5. Organisational Culture and Commitment

A lack of organisational commitment and a culture that supports sustainability initiatives can hinder the adoption of carbon accounting [61,63]. Many companies are reluctant to integrate environmental strategies due to theperceived costs and low perceived benefits [63]. Top management commitment is essential to drive the organisational changes required for practical carbon accounting [61].

4.4.6. Lack of Regulation and Incentives

The absence of robust regulation, policy incentives, and stakeholder pressures can relegate carbon accounting to a low priority for many companies [61,63,66]. Voluntary carbon accounting initiatives may have limited uptake because the perceived costs often outweigh the benefits for individual companies [61]. Stronger regulation and policy incentives are required to motivate companies to prioritise carbon accounting [63,66].

4.4.7. Gaps in Capabilities and Understanding

Finally, gaps in carbon-related capabilities, skills, and understanding present adoption challenges [61,66]. There is a need to integrate environmental cost recording into financial reports, but organisations often lack the necessary capabilities [61]. Training and education are crucial to building organisational capacity for practical carbon accounting [66].

Addressing the challenges summarised in Figure 7 is essential for successfully implementing carbon accounting in manufacturing and supply chains. Standardisation, data quality improvement, supply chain transparency, cost-effective solutions, cultural change, regulatory support, and capacity building are all vital components in overcoming these hurdles and advancing the cause of sustainability in manufacturing and supply chains.

Figure 7.

Challenges to carbon accounting in manufacturing and supply chains.

5. Conclusions

This research work has explored the evolving landscape of carbon accounting in manufacturing systems and supply chains through a systematic literature review. It has given the current understanding of carbon accounting definitions (RQ1), identified gaps needing scholarly attention (RQ2), suggested future research directions (RQ3), and outlined implementation challenges (RQ4), as in Section 4.

However, some limitations provide avenues for further research. Comparative assessment of recurring methods and tools could enrich analytical insights, while investigating sectoral and regional differences may reveal additional nuances. Aligning the terminology across sectors could strengthen the possibility of detailed carbon accounting framework development.

Nevertheless, this review carries several implications for industry, which are listed below:

- Need for Standardised Approaches: The lack of standardised carbon accounting methodologies makes it difficult for companies to measure, report on, and compare emissions across different suppliers and facilities. Industry associations need to collaborate on developing sector-specific tools and protocols.

- Leveraging Emerging Technologies: Blockchain, IoT, and other digital innovations offer opportunities to enhance carbon data transparency, accuracy, and integration with operational decisions. Companies should actively explore technology adoption.

- Strengthening Organisational Commitment: Top management buy-in and internal capability development is crucial for the success of carbon management initiatives. Firms need to foster a culture that incentivises sustainability.

- Focus on Full Supply Chain Visibility: Complex global supply chains with multiple tiers of suppliers pose carbon accounting challenges. Businesses must invest in traceability systems that map emissions across entire product life cycles.

- Collaboration with Policymakers: Robust regulation and incentives are required to motivate industrial carbon management, especially given high abatement costs. Industries need to constructively engage with governments on pragmatic policy approaches.

This research relates directly to several of the United Nations Sustainable Development Goals (SDGs):

- SDG 12—Responsible Consumption and Production: The paper discusses how robust carbon accounting practices can help quantify and reduce greenhouse gas emissions across product life cycles and supply chains. This aligns with SDG 12’s emphasis on sustainable production and consumption patterns.

- SDG 13—Climate Action: By enhancing the transparency and management of carbon emissions, the approaches analysed in the paper can accelerate climate change mitigation efforts in line with SDG 13.

- SDG 9—Industry, Innovation and Infrastructure: The analysis touches on emerging technologies like blockchain and the Internet of Things, which have the potential to enhance carbon data management. Leveraging these innovative industrial technologies links to SDG 9.

- SDG 17—Partnerships for the Goals: The paper discusses the need for collaboration between stakeholders, policymakers, companies, and researchers to standardise and advance carbon accounting globally. Such cross-sectoral partnerships embody the spirit of SDG 17.

Additionally, the issues covered by the paper, including data reliability, transparency in emissions reporting, and integration of sustainability into business decisions, indirectly connect with principles underlying SDG 16 (Peace, Justice and Strong Institutions) and SDG 8 (Decent Work and Economic Growth).

By outlining how improved quantification, monitoring, and management of carbon emissions can facilitate the shift towards more sustainable manufacturing, the research work relates directly to key SDGs that are driving the climate change and sustainable production agenda globally. Its analysis has relevance for decision-makers and stakeholders seeking to align industry practices with urgent climate and development priorities.

Author Contributions

Conceptualisation, R.K. and K.S.; methodology, J.P. and Y.H. and K.S.; writing—original draft preparation, R.K.; writing—review and editing, K.S.; supervision, Y.H., J.P. and K.S.; funding acquisition, K.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the UKRI ATI programme, grant number 103040.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Schaltegger, S.; Csutora, M. Carbon accounting for sustainability and management. Status quo and challenges. J. Clean. Prod. 2012, 36, 1–16. [Google Scholar] [CrossRef]

- Marlowe, J.; Clarke, A.; Marlowe, J.; Clarke, A. Carbon Accounting: A Systematic Literature Review and Directions for Future Research. Green Financ. 2022, 1, 71–87. [Google Scholar] [CrossRef]

- Cohen, Y.; Faccio, M.; Galizia, F.G.; Mora, C.; Pilati, F. Assembly system configuration through Industry 4.0 principles: The expected change in the actual paradigms. IFAC-PapersOnLine 2017, 50, 14958–14963. [Google Scholar] [CrossRef]

- Bistline, J.E. Roadmaps to net-zero emissions systems: Emerging insights and modelling challenges. Joule 2021, 5, 2551–2563. [Google Scholar] [CrossRef]

- Anderson, K.; Broderick, J.; Stoddard, I. A factor of two: How the mitigation plans of ‘climate progressive’ nations fall far short of Paris-compliant pathways. Clim. Policy 2020, 20, 1290–1304. [Google Scholar] [CrossRef]

- Knox-Hayes, J.; Brown, M.A.; Sovacool, B.K.; Wang, Y. Understanding attitudes toward energy security: Results of a cross-national survey. Glob. Environ. Chang. 2013, 23, 609–622. [Google Scholar] [CrossRef]

- Carnegie, G.D.; Parker, L.D.; Tsahuridu, E.E. It’s 2020: What is Accounting Today? Aust. Account. Rev. 2020, 31, 65–73. [Google Scholar] [CrossRef]

- Maynard, J. Financial Accounting, Reporting, and Analysis; Oxford University Press: Oxford, UK, 2017; pp. 74–90. [Google Scholar]

- Carbon Might Be Your Company’s Biggest Financial Liability. Available online: https://hbr.org/2021/10/carbon-might-be-your-companys-biggest-financial-liability (accessed on 4 October 2023).

- Lodhia, S.; Hess, N. Sustainability accounting and reporting in the mining industry: Current literature and directions for future research. J. Clean. Prod. 2014, 84, 43–50. [Google Scholar] [CrossRef]

- Ascui, F.; Lovell, H. As frames collide making sense of carbon accounting. Account. Audit. Account. J. 2011, 24, 978–999. [Google Scholar] [CrossRef]

- Stechemesser, K.; Guenther, E. Carbon accounting: A systematic literature review. J. Clean. Prod. 2012, 36, 17–38. [Google Scholar] [CrossRef]

- Turzo, T.; Marzi, G.; Favino, C.; Terzani, S. Non-financial reporting research and practice: Lessons from the last decade. J. Clean. Prod. 2022, 345, 131154. [Google Scholar] [CrossRef]

- Izzo, M.F.; Ciaburri, M.; Tiscini, R. The Challenge of Sustainable Development Goal Reporting: The First Evidence from Italian Listed Companies. Sustainability 2020, 12, 3494. [Google Scholar] [CrossRef]

- Erin, O.; Bamigboye, O.A.; Oyewo, B. Sustainable development goals (SDG) reporting: An analysis of disclosure. J. Account. Emerg. Econ. 2022, 12, 761–789. [Google Scholar] [CrossRef]

- Adams, C.A. Handbook of Accounting and Sustainability; Edward Elgar Publishing: Cheltenham, UK, 2022; pp. 10–25. [Google Scholar]

- Fuzi, N.M.; Habidin, N.F.; Janudin, S.E.; Ong, S.Y.Y. Environmental management accounting practices, environmental management system and environmental performance for the Malaysian manufacturing industry. Int. J. Bus. Excell. 2019, 18, 120. [Google Scholar] [CrossRef]

- Fuzi, N.M.; Habidin, N.F.; Janudin, S.E.; Ong, S.Y.Y. Critical success factors of environmental management accounting practices: Findings from Malaysian manufacturing industry. Meas. Bus. Excell. 2019, 23, 1–14. [Google Scholar] [CrossRef]

- Laine, M.; Tregidga, H.; Unerman, J. Sustainability Accounting and Accountability; Routledge eBooks; Routledge: Abingdon, UK, 2021. [Google Scholar]

- Csutora, M.; Harangozó, G. Twenty years of carbon accounting and auditing—A review and outlook. Soc. Econ. 2017, 39, 459–480. [Google Scholar] [CrossRef]

- Andrew, J.; Cortese, C. Accounting for climate change and the self-regulation of carbon disclosures. Account. Forum 2011, 35, 130–138. [Google Scholar] [CrossRef]

- Flower, J. The International Integrated Reporting Council: A story of failure. Crit. Perspect. Account. 2015, 27, 1–17. [Google Scholar] [CrossRef]

- Lovell, H.; MacKenzie, D. Accounting for carbon: The role of accounting professional organisations in governing climate change. Antipode 2011, 43, 704–730. [Google Scholar] [CrossRef]

- Zhanga, C.; Zhang, C.; Zhou, M. Rethinking on the definition of carbon accounting. In Proceedings of the International Conference on Modern Economic Development and Environment Protection ICMED, Chengdu, China, 28–29 May 2016. [Google Scholar]

- DeFond, M.; Zhang, J. A review of archival auditing research. J. Account. Econ. 2014, 58, 275–326. [Google Scholar] [CrossRef]

- Esfahbodi, A.; Zhang, Y.; Watson, G. Sustainable supply chain management in emerging economies: Trade-offs between environmental and cost performance. Int. J. Prod. Econ. 2016, 181, 350–366. [Google Scholar] [CrossRef]

- Hertwich, E.G.; Wood, R. The growing importance of scope 3 greenhouse gas emissions from industry. Environ. Res. Lett. 2018, 13, 104013. [Google Scholar] [CrossRef]

- Downie, J.; Stubbs, W. Evaluation of Australian companies’ scope 3 greenhouse gas emissions assessments. J. Clean. Prod. 2013, 56, 156–163. [Google Scholar] [CrossRef]

- Cacho, O.J.; Hean, R.L.; Wise, R.M. Carbon-accounting methods and reforestation incentives. Aust. J. Agric. Resour. Econ. 2003, 47, 153–179. [Google Scholar] [CrossRef]

- Ravindranath, N.H.; Ostwald, M. Carbon Inventory Methods: Handbook for Greenhouse Gas Inventory, Carbon Mitigation and Roundwood Production Projects; Springer Science & Business Media: Dordrecht, The Netherlands, 2007; p. 158. [Google Scholar]

- Bebbington, J.; Larrinaga-González, C. Carbon trading: Accounting and reporting issues. Eur. Account. Rev. 2008, 17, 697–717. [Google Scholar] [CrossRef]

- Kolk, A.; Levy, D.L.; Pinkse, J. Corporate responses in an emerging climate regime: The institutionalization and commensuration of carbon disclosure. Eur. Account. Rev. 2008, 17, 719–745. [Google Scholar] [CrossRef]

- Molisa, P.; Wittneben, B. Sustainable development, the Clean Development Mechanism, and business accounting. In Economics and Management of Climate Change: Risks, Mitigation and Adaptation; Springer: New York, NY, USA, 2008; pp. 175–192. [Google Scholar]

- Schmidt, M. Carbon accounting and carbon footprint–more than just diced results? Int. J. Clim. Chang. Strateg. Manag. 2009, 1, 19–30. [Google Scholar] [CrossRef]

- Hespenheide, E.; Pavlovsky, K.; McElroy, M. Accounting for sustainability performance: Organizations that manage and measure sustainability effectively could see benefits to their brand and shareholder engagement and retention as well as to their financial bottom line. Financ. Exec. 2010, 26, 52–57. [Google Scholar]

- Bowen, F.; Wittneben, B. Carbon accounting. Account. Audit. Account. J. 2011, 24, 1022–1036. [Google Scholar] [CrossRef]

- Ascui, F.; Lovell, H. Carbon accounting and the construction of competence. J. Clean. Prod. 2012, 36, 48–59. [Google Scholar] [CrossRef]

- Ascui, F. A Review of Carbon Accounting in the Social and Environmental Accounting Literature: What Can it Contribute to the Debate? Soc. Environ. Account. J. 2014, 34, 6–28. [Google Scholar] [CrossRef]

- Ranganathan, J.; Corbier, L.; Schmitz, S.; Oren, K.; Dawson, B.; Spannagle, M.; Camobreco, V. GHG Protocol Initiative Team. Tech. Rep. 2015. Available online: https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf (accessed on 22 November 2023).

- San, O.T.; Kasbun, N.F.; Teh, B.H.; Muhammad, H.; Javeed, S.A. Carbon accounting system: The bridge between carbon governance and carbon performance in Malaysian Companies. Ecosyst. Health Sustain. 2021, 7, 1927851. [Google Scholar]

- Carton, W.; Lund, J.F.; Dooley, K. Undoing equivalence: Rethinking carbon accounting for just carbon removal. Front. Clim. 2021, 3, 664130. [Google Scholar] [CrossRef]

- Blumberg, G.; Sibilla, M. A Carbon Accounting and Trading Platform for the UK Construction Industry. Energies 2023, 16, 1566. [Google Scholar] [CrossRef]

- Mukwarami, S.; Nkwaira, C.; Van Der Poll, H.M. Environmental management accounting implementation challenges and supply chain management in emerging economies’ manufacturing sector. Sustainability 2023, 15, 1061. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G. Preferred reporting items for Systematic Reviews and Meta-Analyses: The PRISMA statement. PLoS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef] [PubMed]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.; Akl, E.A.; Brennan, S.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, n71. [Google Scholar] [CrossRef]

- Kaur, R.; Patsavellas, J.; Haddad, Y.; Salonitis, K. Carbon accounting management in complex manufacturing supply chains: A structured framework approach. Procedia CIRP 2022, 107, 869–875. [Google Scholar] [CrossRef]

- Smith, T.L.; Goodkind, A.L.; Kim, T.; Pelton, R.E.O.; Suh, K.; Schmitt, J. Subnational mobility and consumption-based environmental accounting of US corn in animal protein and ethanol supply chains. Proc. Natl. Acad. Sci. USA 2017, 114, E7891–E7899. [Google Scholar] [CrossRef]

- Tian, X.; Sarkis, J. Towards greener trade and global supply chain environmental accounting. An embodied environmental resources blockchain design. Int. J. Prod. Res. 2023, 1–20. [Google Scholar] [CrossRef]

- Tanç, A.; Gökoğlan, K. The Impact of Environmental Accounting on Strategic Management Accounting: A Research on Manufacturing companies. Int. J. Econ. Financ. Issues 2015, 5, 566–573. [Google Scholar]

- Hossain, M.M. Environmental Accounting Practices of Selected Manufacturing Enterprises. J. Pharmaceut. Negat. Results 2022, 13, 844–851. [Google Scholar]

- Roman-White, S.; Littlefield, J.; Fleury, K.G.; Allen, D.T.; Balcombe, P.; Konschnik, K.E.; Ewing, J.J.; Ross, G.B.; George, F. Response to comment on “LNG Supply Chains: A Supplier-Specific Life-Cycle Assessment for Improved Emission Accounting”. ACS Sustain. Chem. Eng. 2022, 10, 13552–13554. [Google Scholar] [CrossRef]

- Roman-White, S.; Littlefield, J.; Fleury, K.G.; Allen, D.T.; Balcombe, P.; Konschnik, K.E.; Ewing, J.J.; Ross, G.B.; George, F. LNG Supply Chains: A Supplier-Specific Life-Cycle Assessment for Improved Emission Accounting. ACS Sustain. Chem. Eng. 2021, 9, 10857–10867. [Google Scholar] [CrossRef]

- Donaghy, T.Q.; Stockman, L. Comment on “LNG Supply Chains: A Supplier-Specific Life-Cycle Assessment for Improved Emission Accounting”. ACS Sustain. Chem. Eng. 2022, 10, 13549–13551. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, W.M.; Xiao, Z.; Sun, J.; Li, D. Research on Extended Carbon Emissions Accounting Method and its application in Sustainable Manufacturing. Procedia Manuf. 2020, 43, 175–182. [Google Scholar]

- Lee, K.-H. Carbon accounting for supply chain management in the automobile industry. J. Clean. Prod. 2012, 36, 83–93. [Google Scholar] [CrossRef]

- Mózner, Z.V. Carbon accounting in long supply chain industries. In Corporate Carbon and Climate Accounting; Springer: Cham, Switzerland, 2016; pp. 143–162. [Google Scholar]

- Roozbeh Nia, A.; Awasthi, A.; Bhuiyan, N. Assessment of coal supply chain under carbon trade policy by ex-tended exergy accounting method. Flex. Serv. Manuf. J. 2023, 10, 1–69. [Google Scholar] [CrossRef]

- De Vries, G.J.; Ferrarini, B. What Accounts for the Growth of Carbon Dioxide Emissions in Advanced and Emerging Economies? The Role of Consumption, Technology and Global Supply Chain Participation. Ecol. Econ. 2017, 132, 213–223. [Google Scholar] [CrossRef]

- Tang, S.; Xu, Y. An Empirical Study on Environmental Accounting Information Disclosure of Manufacturing Enterprises in China. In Proceedings of the 2nd International Conference on Contemporary Education, Social Sciences and Humanities, Beijing, China, 9–11 June 2017. [Google Scholar]

- Aragão, G.M.; Saralegui-Díez, P.; Villasante, S.; López-López, L.; Aguilera, E.; Moranta, J. The carbon footprint of the hake supply chain in Spain: Accounting for fisheries, international transportation and domestic distribution. J. Clean. Prod. 2022, 360, 131979. [Google Scholar] [CrossRef]

- Nartey, S.N.; van der Poll, H.M. Innovative management accounting practices for sustainability of manufacturing small and medium enterprises. Environ. Dev. Sustain. 2021, 23, 18008–18039. [Google Scholar] [CrossRef]

- Klymenko, O.; Lillebrygfjeld Halse, L.; Jæger, B. The Enabling Role of Digital Technologies in Sustainability Accounting: Findings from Norwegian Manufacturing Companies. Systems 2021, 9, 33. [Google Scholar] [CrossRef]

- Pramono, A.J.; Suwarno; Amyar, F.; Friska, R. Sustainability Management Accounting in Achieving Sustainable Development Goals: The Role of Performance Auditing in the Manufacturing Sector. Sustainability 2023, 15, 10082. [Google Scholar] [CrossRef]

- Hoai, T.T.; Minh, N.N.; Van, H.V.; Nguyen, N.P. Accounting going green: The move toward environmental sustainability in Vietnamese manufacturing firms. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1928–1941. [Google Scholar] [CrossRef]

- Petcharat, N.; Mula, J.M. Identifying System Characteristics for Development of a Sustainability Management Accounting Information System: Towards a Conceptual Design for the Manufacturing Industry. In Proceedings of the 2009 Fourth International Conference on Cooperation and Promotion of Information Resources in Science and Technology, Beijing, China, 23–25 October 2009. [Google Scholar]

- Tiwari, K.; Khan, M.S.; Bharti, P.K. Sustainability Accounting and Reporting for supply chains in India-State-of-the-Art and Research challenges. IOP Conf. Ser. Mater. Sci. Eng. 2018, 404, 012022. [Google Scholar] [CrossRef]

- Bình, N.T.; Tuấn, V.A. Greenhouse Gas Emission from Freight Transport-Accounting for the Rice Supply Chain in Vietnam. Procedia CIRP 2016, 40, 46–49. [Google Scholar] [CrossRef][Green Version]

- Burritt, R.; Schaltegger, S. Accounting towards sustainability in production and supply chains. Br. Account. Rev. 2014, 46, 327–343. [Google Scholar] [CrossRef]

- Sadeghi, Z.; Saen, R.F.; Moradzadehfard, M. Developing a network data envelopment analysis model for ap-praising sustainable supply chains: A sustainability accounting approach. Oper. Manag. Res. 2022, 15, 809–824. [Google Scholar] [CrossRef]

- Spence, L.J.; Rinaldi, L. Governmentality in accounting and accountability: A case study of embedding sustainability in a supply chain. Account. Organ. Soc. 2014, 39, 433–452. [Google Scholar] [CrossRef]

- Tan, X.; Mu, Z.; Wang, S.; Zhuang, H.; Cheng, L.; Wang, Y.; Gu, B. Study on whole-life cycle automotive manufacturing industry CO2 emission accounting method and Application in Chongqing. In Proceedings of the International Environmental Modelling and Software Society (IEMSS) 5th Biennial Meeting, Ottawa, ON, Canada, 5–8 July 2010. [Google Scholar]

- Davies, J.C.; Dunk, R.M. Flying along the supply chain: Accounting for emissions from student air travel in the higher education sector. Carbon Manag. 2015, 6, 233–246. [Google Scholar] [CrossRef]

- Zrnić, A.; Starčević, D.P.; Mijoč, I. Evaluating environmental accounting and reporting: The case of croatian listed manufacturing companies. Prav. Vjes. 2020, 36, 47–63. [Google Scholar] [CrossRef]

- Jamil, C.Z.M.; Mohamed, R.; Muhammad, F.; Ali, A. Environmental Management accounting practices in small medium manufacturing firms. Procedia—Soc. Behav. Sci. 2015, 172, 619–626. [Google Scholar] [CrossRef]

- Mohamed, R.; Jamil, C.Z.M. The influence of environmental management accounting practices on environ-mental performance in small-medium manufacturing in Malaysia. Int. J. Environ. Sustain. Dev. 2020, 19, 378. [Google Scholar] [CrossRef]

- Nguyen, T.H. Factors affecting the implementation of environmental management accounting: A case study of pulp and paper manufacturing enterprises in Vietnam. Cogent Bus. Manag. 2022, 9, 2141089. [Google Scholar] [CrossRef]

- Elhossade, S.S.; Abdo, H.; Mas’ud, A. Impact of institutional and contingent factors on adopting environmental management accounting systems: The case of manufacturing companies in Libya. J. Financ. Report. Account. 2020, 19, 497–539. [Google Scholar]

- Javed, S. Environmental Management Accounting and Corporate Performance: The Mediating Role of Corporate Environmental Ethics: Evidence from the Manufacturing Sector. J. Environ. Account. Manag. 2023, 11, 41–52. [Google Scholar] [CrossRef]

- Jinga, G.; Dumitru, M.; Stoian, F.; Radu, G. An Environmental Management Accounting Case Study in a Manufacturing Company. In Proceedings of the Accounting and Management Information Systems Conference, Bucharest, Romania, 2–3 June 2014. [Google Scholar]

- Ashena, N.; Shahverdi, G.A. The effect of compliance with environmental standards on informational content of foundational figures of accounting. Rev. Direito Cidade 2020, 12, 1549–1568. [Google Scholar]

- Booth, M.S. Not carbon neutral: Assessing the net emissions impact of residues burned for bioenergy. Environ. Res. Let. 2018, 13, 035001. [Google Scholar] [CrossRef]

- Cowie, A.L.; Berndes, G.; Bentsen, N.S.; Brandão, M. Applying a science-based systems perspective to dispel misconceptions about climate effects of forest bioenergy. GCB Bioenergy 2021, 13, 1210–1231. [Google Scholar] [CrossRef]

- Balcombe, P.; Staffell, I.; Kerdan, I.G.; Speirs, J.F.; Brandon, N.P.; Hawkes, A.D. How can LNG-fuelled ships meet decarbonisation targets? An environmental and economic analysis. Energy 2021, 227, 120462. [Google Scholar] [CrossRef]

- Friedlingstein, P.; O’sullivan, M.; Jones, M.W.; Andrew, R.M.; Hauck, J.; Olsen, A. Global carbon budget 2020. Earth Sys. Sci. Data Dis. 2020, 12, 3269–3340. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).