Examining the Causality between Integrated Reporting and Stock Market Capitalization. The Case of the European Renewable Energy Equipment and Services Industry

Abstract

1. Introduction

2. Literature Review

3. Data and Research Methodology

- -

- Market capitalization (MC): an important indicator that reflects the size of a company and is used by investors to assess a company in the investment decision.

- -

- Financial performance indicators: the total asset (TA) owned by a company; total equity (TE) defining the residual interest of the shareholders; and total revenue (TR) expressing the selling capacity of the company.

- -

- Sustainability reporting: evaluated first by publishing a CSR report, human resource report, shareholders report, or a sustainability report; and second, by the ESG score according to the quality of the published environmental, social, and corporate governance information.

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- What is an Annual Report? Definitions, Requirements and Examples. Available online: https://venngage.com/blog/annual-report/ (accessed on 10 November 2022).

- Petera, P.; Wagner, J.; Paksiova, R.; Krehnacova, A. Sustainability information in annual reports of companies domiciled in the Czech Republic and the Slovak Republic. Inz. Ekon. Eng. Econ. 2019, 30, 483–495. [Google Scholar] [CrossRef]

- Filip, A.; Raffournier, B. The value relevance of earnings in a transition economy: The case of Romania. Int. J. Account. 2010, 45, 77–103. [Google Scholar] [CrossRef]

- International Accounting Standards Board—IASB. International Financial Reporting Standards (IFRSs); IFRS Foundation Publications Department: London, UK, 2013. [Google Scholar]

- Beaver, W.H. The behavior of security prices and its implications for accounting research (methods), Report of the Committee on Research Methodology in Accounting. Account. Rev. 1972, 47, 407–437. [Google Scholar]

- Casagrande, D. Information as verb: Re-conceptualizing information for cognitive and ecological models. J. Ecol. Anthropol. 1999, 3, 4–13. [Google Scholar] [CrossRef]

- Barth, M.E.; Landsman, W.R.; Lang, M.H. International accounting standards and accounting quality. J. Account. Res. 2008, 46, 467–498. [Google Scholar] [CrossRef]

- Robu, I.B.; Istrate, C.; Jaba, E. Statistical estimation of the information influence regarding employees on the Romanian firms market capitalization. Procedia Econ. Financ. Emerg. Mark. Queries Financ. Bus. 2015, 32, 208–215. [Google Scholar] [CrossRef]

- Bollen, N. Mutual fund attributes and investor behavior. J. Financ. Quant. Anal. 2007, 42, 683–708. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. Socially responsible investments: Institutional aspects, performance, and investor behaviour. J. Bank. Financ. 2008, 32, 1723–1742. [Google Scholar] [CrossRef]

- Integrated Reporting Framework. Available online: https://www.integratedreporting.org (accessed on 15 November 2022).

- Myskova, R.; Hajek, P. Sustainability and corporate social responsibility in the text of annual reports-the case of the IT services industry. Sustainability 2018, 10, 4119. [Google Scholar] [CrossRef]

- Tseng, T. Influences of Taiwan’s corporate social responsibility report management policy on the information transparency of its capital market. Borsa Istanb. Rev. 2022, 22, 487–497. [Google Scholar] [CrossRef]

- Champagne, C.; Coggins, F.; Sodjahin, A. Can extra-financial ratings serve as an indicator of ESG risk? Glob. Financ. J. 2022, 54, 100638. [Google Scholar] [CrossRef]

- Cai, L.; He, C. Corporate Environmental Responsibility and Equity Prices. J. Bus. Ethics 2014, 125, 617–635. [Google Scholar] [CrossRef]

- Mollet, J.C.; von Arx, U.; Ilic, D. Strategic sustainability and financial performance: Exploring abnormal returns. J. Bus. Econ. 2013, 83, 577–604. [Google Scholar] [CrossRef]

- Axjonow, A.; Ernstberger, J.; Pott, C. The impact of corporate social responsibility disclosure on corporate reputation: A non-professional stakeholder perspective. J. Bus. Ethics 2018, 151, 429–450. [Google Scholar] [CrossRef]

- Wang, Z.; Hsieh, T.S.; Sarkis, J. CSR performance and the readability of CSR reports: Too good to be true? Corp. Soc. Responsib. Environ. Manag. 2018, 25, 66–79. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG practices and the cost of debt: Evidence from EU countries. Crit. Perspect. Account. 2021, 79, 102097. [Google Scholar] [CrossRef]

- Al-Shaer, H.; Hussainey, K. Sustainability reporting beyond the business case and its impact on sustainability performance: UK evidence. J. Environ. Manag. 2022, 311, 114883. [Google Scholar] [CrossRef]

- Ramelli, S.; Ossola, E.; Rancan, M. Stock price effects of climate activism: Evidence from the first Global Climate Strike. J. Corp. Financ. 2021, 69, 102018. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Disagreement, tastes, and asset prices. J. Financ. Econ. 2007, 83, 667–689. [Google Scholar] [CrossRef]

- Ali, K.; Nadeem, M.; Pandey, R. Do capital markets reward corporate climate change actions? Evidence from the cost of debt. Bus. Strat. Enviuron. 2022, 1–15. [Google Scholar] [CrossRef]

- Luo, D. ESG, liquidity, and stock returns. Journal of International Financial Markets. Inst. Money 2022, 78, 101526. [Google Scholar] [CrossRef]

- Fatemi, A.; Fooladi, I.; Tehranian, H. Valuation effects of corporate social responsibility. J. Bank. Financ. 2015, 59, 182–192. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, social and governance (ESG) scores and financial performance of Multilatinas: Moderating effects of geographic international diversification and financial slack. J. Bus. Ethics 2019, 168, 315–334. [Google Scholar] [CrossRef]

- Huang, D.Z. Environmental, social and governance (ESG) activity and firm performance: A review and consolidation. Account. Financ. 2021, 61, 335–360. [Google Scholar] [CrossRef]

- Norhasimah, M.N.; Norhabibi, A.S.B.; Nor, A.A.; Sheh, M.Q.A.S.K.; Inaliah, M.A. The Effects of Environmental Disclosure on Financial Performance in Malaysia. Procedia Econ. Financ. 2016, 35, 117–126. [Google Scholar]

- Feng, J.; Goodell, J.W.; Shen, D. ESG rating and stock price crash risk: Evidence from China. Financ. Res. Lett. 2022, 46, 102476. [Google Scholar] [CrossRef]

- Minor, D.; Morgan, J. CSR as Reputation Insurance: Primum Non Nocere. Calif. Manag. Rev. 2011, 53, 40–59. [Google Scholar] [CrossRef]

- Kim, H.; Park, K.; Ryu, D. Corporate environmental responsibility: A legal origins perspective. J. Bus. Ethics 2017, 140, 381–402. [Google Scholar] [CrossRef]

- Marsat, S.; Pijourlet, G.; Ullah, M. Does environmental performance help firms to be more resilient against environmental controversies? International evidence. Financ. Res. Lett. 2022, 44, 102028. [Google Scholar] [CrossRef]

- Kanamura, T. Risk Mitigation and Return Resilience for High Yield Bond ETFs with ESG Components. Financ. Res. Lett. 2021, 41, 101866. [Google Scholar] [CrossRef]

- Díaz, V.; Ibrushi, D.; Zhao, J. Reconsidering systematic factors during the COVID-19 pandemic—The rising importance of ESG. Financ. Res. Lett. 2021, 38, 101870. [Google Scholar] [CrossRef] [PubMed]

- Eisenkopf, J.; Juranek, S.; Walz, U. Responsible Investment and Stock Market Shocks: Short-Term Insurance without Persistence. Br. J. Manag. 2022, 1–20. [Google Scholar] [CrossRef]

- Cerciello, M.; Busato, F.; Taddeo, S. The effect of sustainable business practices on profitability. Accounting for strategic disclosure. Discl. Corp. Soc Responsib. Environ. Manag. 2022, 1–18. [Google Scholar] [CrossRef]

- Saygili, E.; Arslan, S.; Birkan, A.O. ESG practices and corporate financial performance: Evidence from Borsa Istanbul. Borsa Istanb. Rev. 2022, 22, 525–533. [Google Scholar] [CrossRef]

- Du, S.; Yu, K. Do corporate social responsibility reports convey value relevant information? Evidence from report readability and tone. J. Bus. Ethics 2021, 172, 253–274. [Google Scholar] [CrossRef]

- Abdullah, M.; Hamzah, N.; Ali, M.H.; Tseng, M.-L.; Brander, M. The Southeast Asian haze: The quality of environmental disclosures and firm performance. J. Clean. Prod. 2020, 246, 118958. [Google Scholar] [CrossRef]

- Welbeck, E.E.; Owusu, G.M.Y.; Bekoe, R.A.; Kusi, J.A. Determinants of environmental disclosures of listed firms in Ghana. Int. J. Corpor. Soc. Respons. 2017, 2, 11. [Google Scholar] [CrossRef]

- Ng, T.; Lye, C.; Chan, K.; Lim, Y.; Lim, Y. Sustainability in Asia: The Roles of Financial Development in Environmental, Social and Governance (ESG) Performance. Soc. Indic. Res. 2020, 150, 17–44. [Google Scholar] [CrossRef]

- Pei-yi Yu, E.; Van Luu, B. International variations in ESG disclosure—Do cross-listed companies care more? Int. Rev. Financ. Anal. 2021, 75, 101731. [Google Scholar] [CrossRef]

- United Nations. Agenda 2030: A Window of Opportunity 1000+ CEOs, 100+ countries, 25+ industries call for greater local collaboration with national governments on SDG Action Plans. 2016. Available online: www.accenture.com/ungcceostudy (accessed on 20 November 2022).

- Nardo, M.; Ossola, E.; Papanagiotou, E. Financial integration in the EU28 equity markets: Measures and drivers. J. Financ. Mark. 2022, 57, 100633. [Google Scholar] [CrossRef]

- The Economist Intelligence Unit Limited. Energy Outlook 2023. Surviving the Energy Crisis; The Economist Intelligence Unit Limited: London, UK, 2022; Available online: https://www.eiu.com/n/campaigns/energy-in-2023/?utm_source=google&utm_medium=ppc&utm_campaign=industries-in-2023&gclid=CjwKCAiAwomeBhBWEiwAM43YIMq5I3SSzI1MRq0L5WzIYA32KvJGUPVkFQro4PcTTKVRCSnzg5bx0BoCq7YQAvD_BwE (accessed on 15 January 2022).

- Slusarczyk, B.; Zeglen, P.; Kluczek, A.; Niziol, A.; Gorka, M. The Impact of Renewable Energy Sources on the Economic Growth of Poland and Sweden Considering COVID-19 Times. Energies 2022, 15, 332. [Google Scholar] [CrossRef]

- Chomac-Pierzecka, E.; Kokiel, A.; Rogozinska-Mitrut, J.; Sobczak, A.; Sobon, D.; Stasiak, J. Analysis and Evaluation of the Photovoltaic Market in Poland and the Baltic States. Energies 2022, 15, 669. [Google Scholar] [CrossRef]

- Magor, R. Odnawialne ´zródła energii w gospodarce litewskiej, Polityka Energetyczna. Energy Policy J. 2017, 20, 140. [Google Scholar]

- Yang, L.; Wang, X.-C.; Dai, M.; Chen, B.; Qiao, Y.; Deng, H.; Zhang, D.; Zhang, Y.; Almeida, C.; Chou, A.; et al. Shifting from Fossil-Based Economy to Bio-Based Economy: Status Quo, Challenges, and Prospects. Energy 2021, 228, 120533. [Google Scholar] [CrossRef]

- Stroebel, J.; Wurgler, J. What do you think about climate finance? J. Financ. Econ. 2021, 142, 487–498. [Google Scholar] [CrossRef]

- Botosan, C.A. Disclosure and the cost of capital: What do we know? Account. Bus. Res. 2006, 36, 31–40. [Google Scholar] [CrossRef]

- Franc-Dabrowska, J.; Madra-Sawicka, M.; Milewska, A. Energy Sector Risk and Cost of Capital Assessment—Companies and Investors Perspective. Energies 2021, 14, 1613. [Google Scholar] [CrossRef]

- Galema, R.; Plantinga, A.; Scholtens, B. The stocks at stake: Return and risk in socially responsible investment. J. Bank. Financ. 2008, 32, 2646–2654. [Google Scholar] [CrossRef]

- Statman, M. Socially responsible indexes. JPM 2006, 32, 100–109. [Google Scholar] [CrossRef]

- Horvathova, E. Does environmental performance affect financial performance? A meta-analysis. Ecol. Econ. 2010, 70, 52–59. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Eriksson, J.; Asgodom, D. Perspectives of ESG Performance–A Study of ESG Performance Effect on Firm Value in the US; Lund University Libraries: Lund, Sweden, 2019. [Google Scholar]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustai. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Șerban, R.-A.; Mihaiu, D.M.; Țichindelean, M. Environment, Social, and Governance Score and Value Added Impacts on Market Capitalization: A Sectoral-Based Approach. Sustainability 2022, 14, 2069. [Google Scholar] [CrossRef]

| Variable | Description | Unit of Measure |

|---|---|---|

| Market Capitalization | The value of units of securities issued multiplied by the last price | Euro |

| Assets | Total assets of the company | Euro |

| Equity | The equity value of preferred shareholders, general and limited partners and common shareholders, without minority shareholders’ interest | Euro |

| Revenue | The revenue from all of a company’s operating activities after deducting any sales adjustments | Euro |

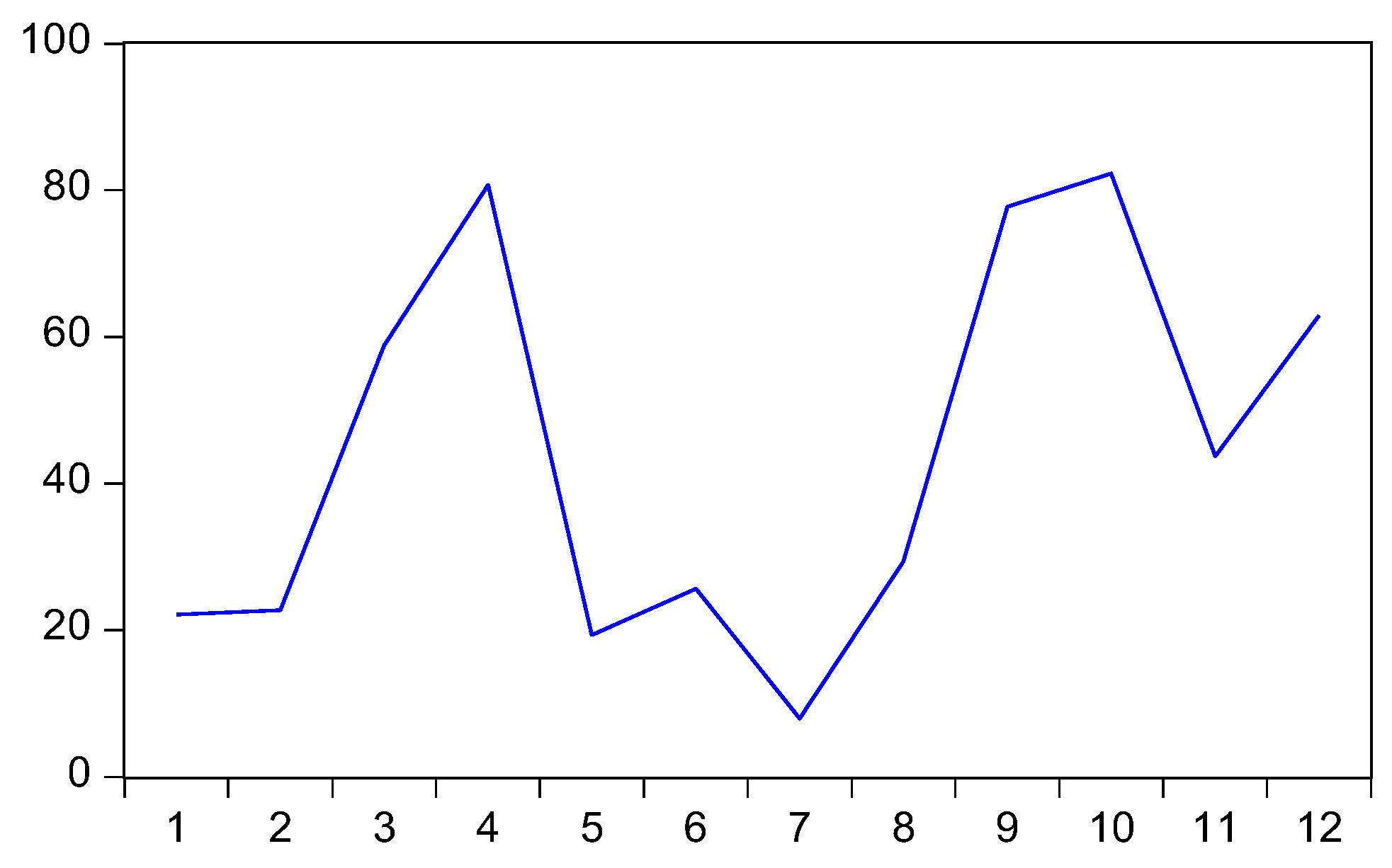

| ESG Score | The overall company score based on self-reported information in the environmental, social, and corporate governance pillars | The score ranges from 0 (no ESG information) to 100 (all information regarding environmental, social and corporate governance practices) |

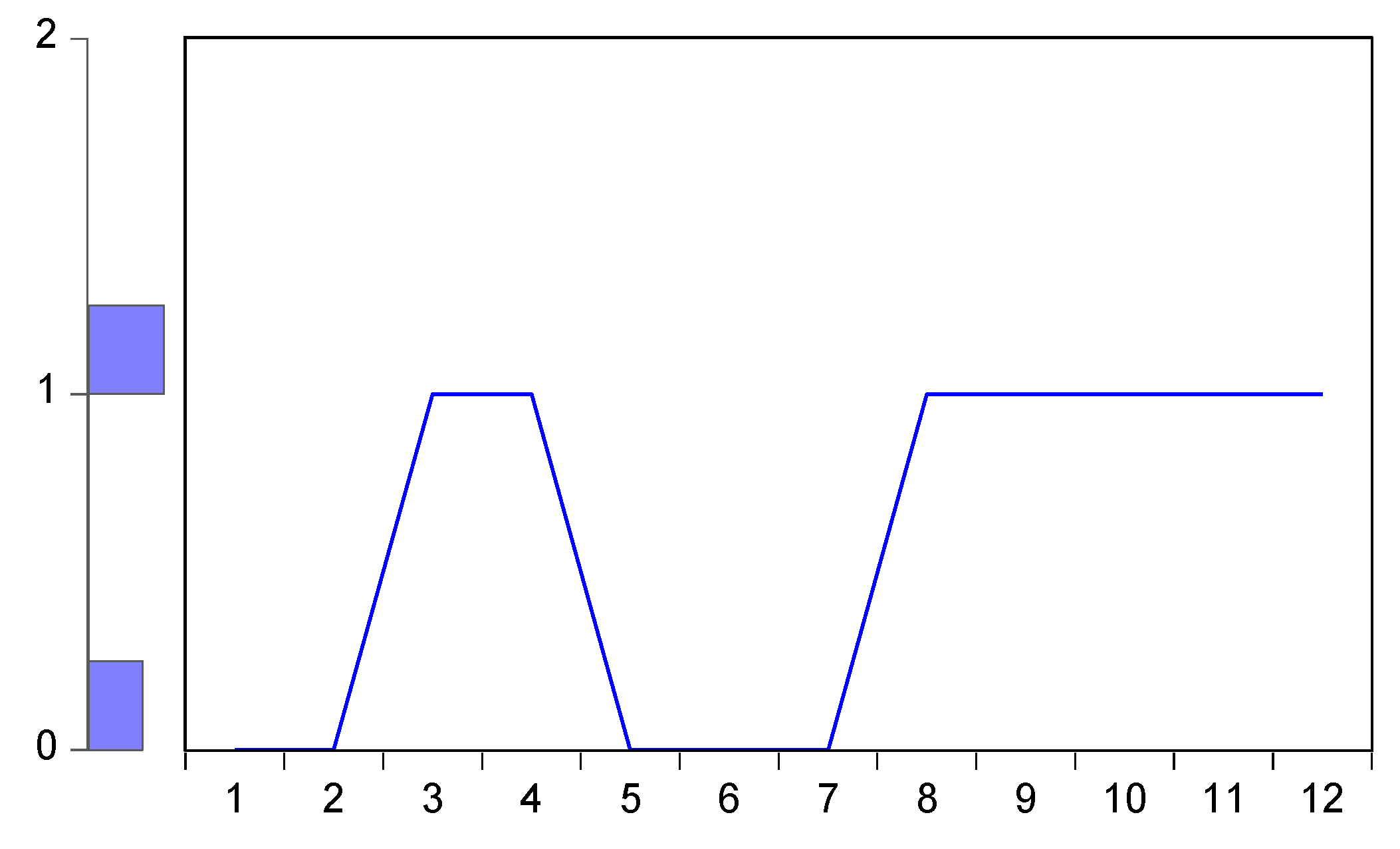

| CSR sustainability reporting | The company publishes a separate CSR/H&S/Sustainability report or publishes a section in its annual report on CSR/H&S/Sustainability. | Dummy variable: 1 for ‘True’, if it is reporting, and 0 for ‘False’, if it is not reporting |

| ESG | CSR | MC | TA | TE | TR | |

|---|---|---|---|---|---|---|

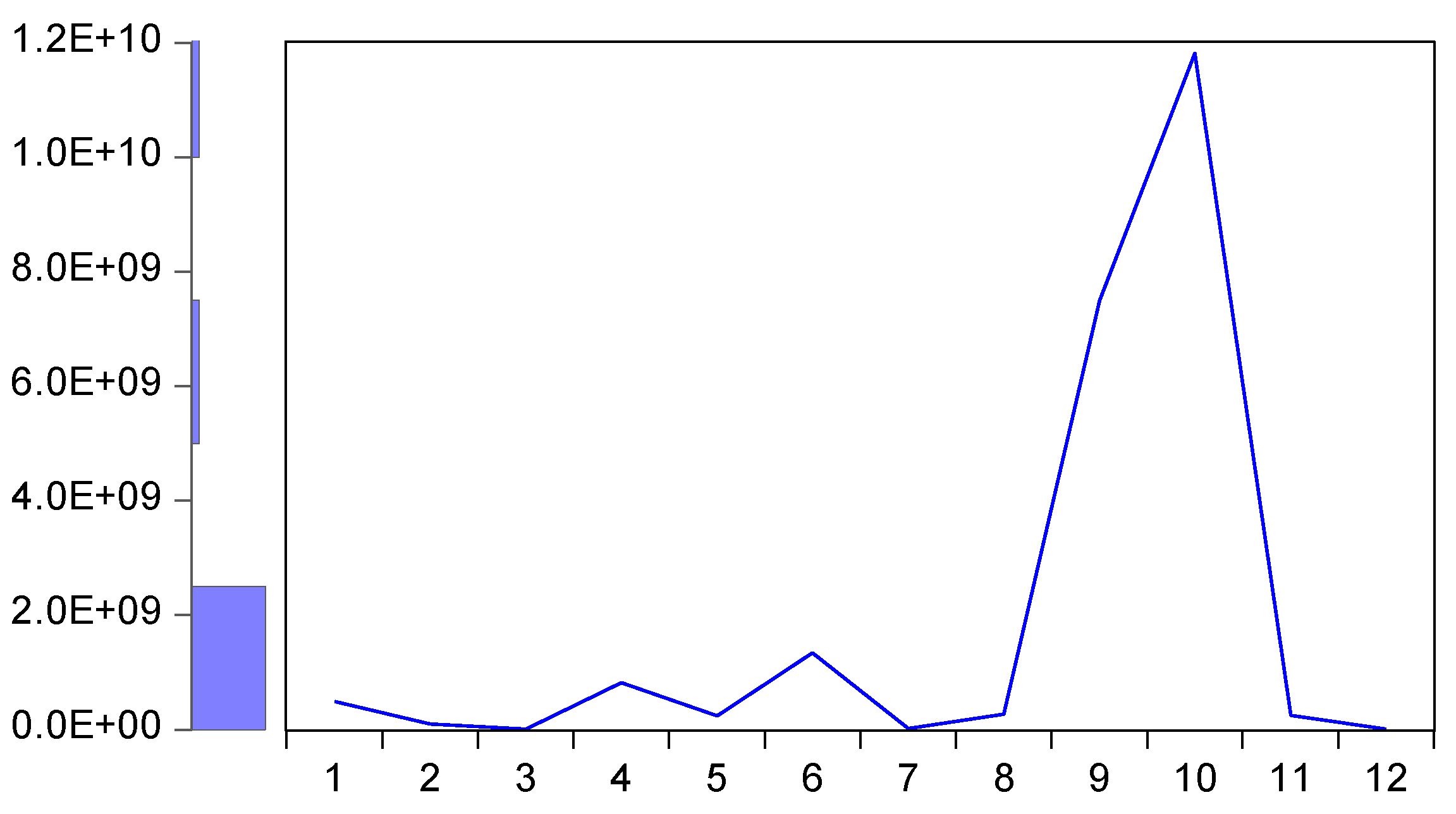

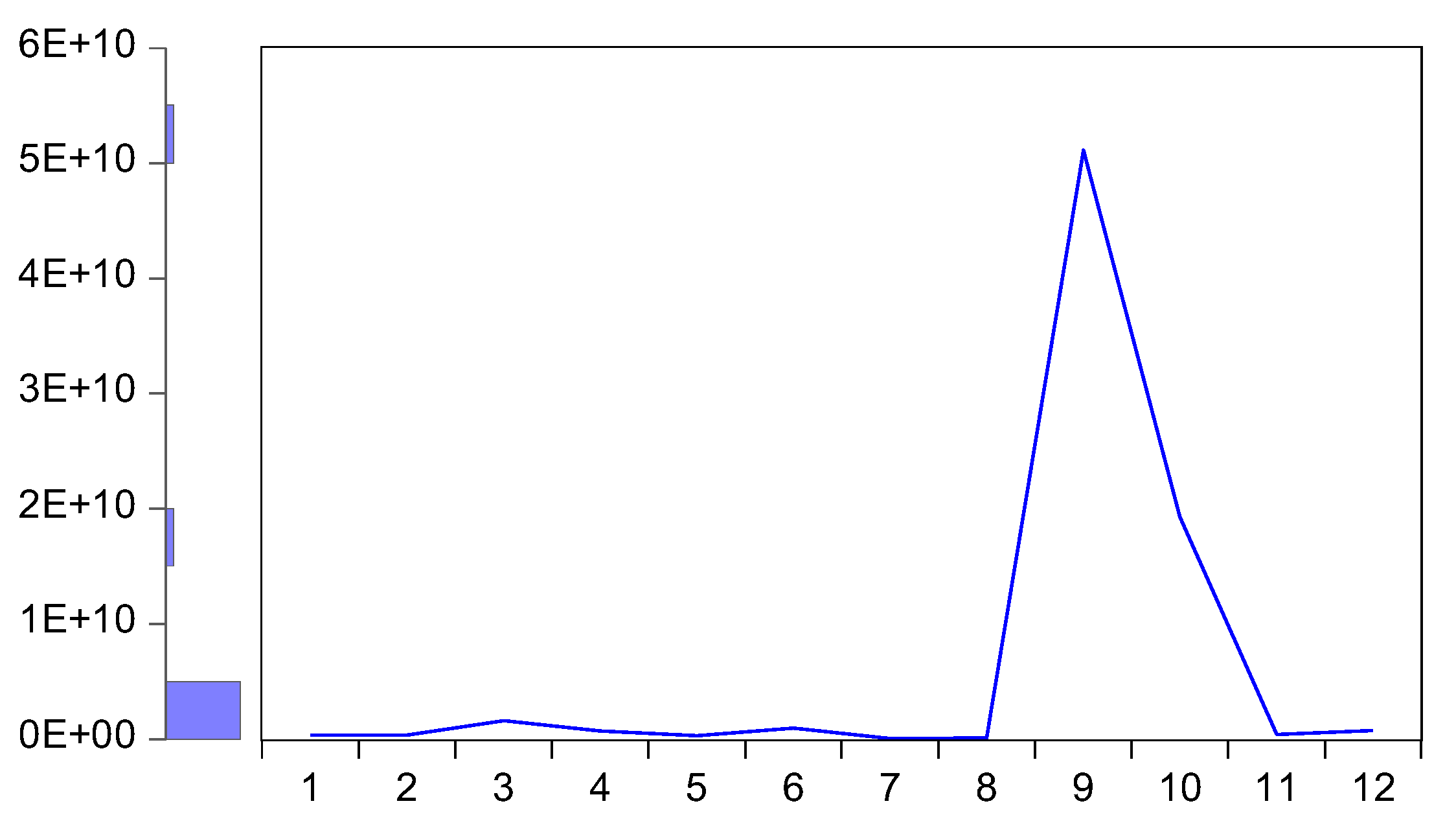

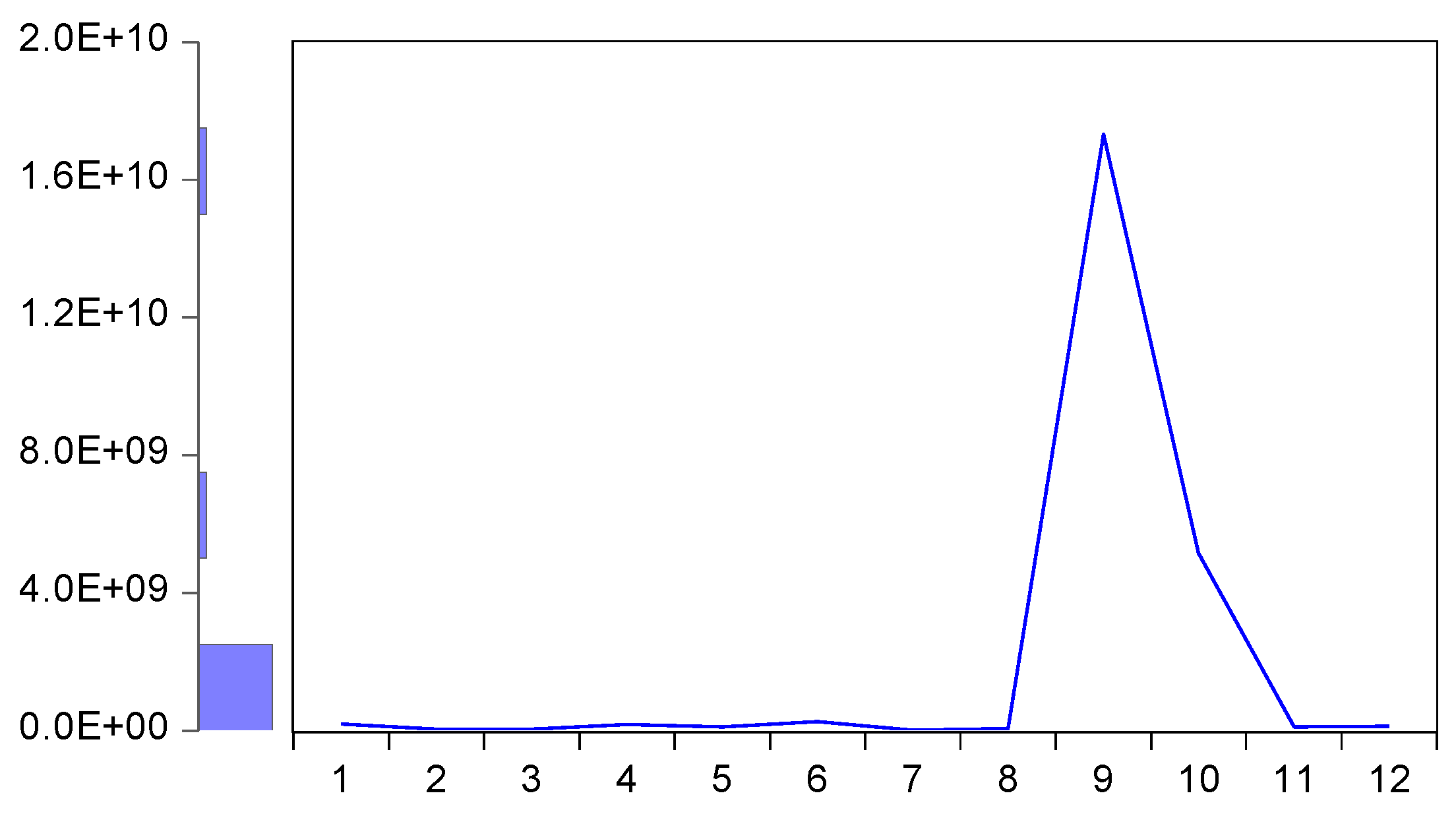

| Mean | 44.44667 | 0.583333 | 1.90E + 09 | 6.31E + 09 | 1.97E + 09 | 4.02E + 09 |

| Median | 36.54500 | 1.000000 | 2.58E + 08 | 5.26E + 08 | 1.22E + 08 | 1.72E + 08 |

| Maximum | 82.25000 | 1.000000 | 1.18E + 10 | 5.11E + 10 | 1.73E + 10 | 3.30E + 10 |

| Minimum | 7.950000 | 0.000000 | 1,916,377. | 9,297,911. | 7,392,629. | 2,838,597. |

| Std. Dev. | 26.82002 | 0.514929 | 3.76E + 09 | 1.51E + 10 | 5.05E + 09 | 9.71E + 09 |

| Skewness | 0.256611 | −0.338062 | 1.978641 | 2.482547 | 2.647250 | 2.517340 |

| Kurtosis | 1.529271 | 1.114286 | 5.332790 | 7.747136 | 8.516575 | 7.922246 |

| Jarque-Bera | 1.213219 | 2.006531 | 10.55100 | 23.59373 | 29.23216 | 24.78826 |

| Probability | 0.545196 | 0.366680 | 0.005115 | 0.000008 | 0.000000 | 0.000004 |

| Sum | 533.3600 | 7.000000 | 2.28E + 10 | 7.57E + 10 | 2.36E + 10 | 4.83E + 10 |

| Sum Sq. Dev. | 7912.450 | 2.916667 | 1.55E + 20 | 2.51E + 21 | 2.80E + 20 | 1.04E + 21 |

| Method | Statistic | Prob. |

|---|---|---|

| Levin–Lin–Chu | −5.11767 | 0.0000 |

| Im–Pesaran–Shin W-stat | −2.14786 | 0.0159 |

| ADF—Fisher Chi-square | 21.9918 | 0.0376 |

| ADF—Choi Z-stat | −2.42064 | 0.0077 |

| PP—Fisher Chi-square | 18.9247 | 0.0904 |

| Null Hypotheses | F-Statistic | Prob. |

|---|---|---|

| MC does not Granger Cause ESG | 0.63813 | 0.5665 |

| ESG does not Granger Cause MC | 0.32045 | 0.7397 |

| MC does not Granger Cause CSR | 1.32170 | 0.3461 |

| CSR does not Granger Cause MC | 0.71056 | 0.5351 |

| TA does not Granger Cause MC | 3.92381 | 0.0945 |

| MC does not Granger Cause TA | 0.05041 | 0.9513 |

| TE does not Granger Cause MC | 4.33034 | 0.0810 |

| MC does not Granger Cause TE | 0.12851 | 0.8822 |

| TR does not Granger Cause MC | 3.95436 | 0.0934 |

| MC does not Granger Cause TR | 0.05809 | 0.9442 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sahlian, D.N.; Popa, A.F.; Nicoară, Ș.A.; Bâtcă-Dumitru, C.G. Examining the Causality between Integrated Reporting and Stock Market Capitalization. The Case of the European Renewable Energy Equipment and Services Industry. Energies 2023, 16, 1398. https://doi.org/10.3390/en16031398

Sahlian DN, Popa AF, Nicoară ȘA, Bâtcă-Dumitru CG. Examining the Causality between Integrated Reporting and Stock Market Capitalization. The Case of the European Renewable Energy Equipment and Services Industry. Energies. 2023; 16(3):1398. https://doi.org/10.3390/en16031398

Chicago/Turabian StyleSahlian, Daniela Nicoleta, Adriana Florina Popa, Ștefania Amalia Nicoară, and Corina Graziella Bâtcă-Dumitru. 2023. "Examining the Causality between Integrated Reporting and Stock Market Capitalization. The Case of the European Renewable Energy Equipment and Services Industry" Energies 16, no. 3: 1398. https://doi.org/10.3390/en16031398

APA StyleSahlian, D. N., Popa, A. F., Nicoară, Ș. A., & Bâtcă-Dumitru, C. G. (2023). Examining the Causality between Integrated Reporting and Stock Market Capitalization. The Case of the European Renewable Energy Equipment and Services Industry. Energies, 16(3), 1398. https://doi.org/10.3390/en16031398